Capital Markets Based Home Ownership Savings Plans, & Cytonn Weekly #03/2020

By Cytonn Research, Jan 19, 2020

Executive Summary

Fixed Income

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 118.1%, down from 178.3% recorded the previous week and lower than the YTD average of 124.9%. The oversubscription is partly attributable to improved liquidity in the market as evidenced by the decline in the average interbank rate to 3.8%, from 4.8% recorded the previous week. The yields on the 91-day, 182-day and 364-day papers increased by 3.2 bps, 2.5 bps and 0.9 bps to 7.2%, 8.2% and 9.8%, respectively. The acceptance rate declined to 80.1%, from 92.1% recorded the previous week, with the government accepting Kshs 22.7 bn of the Kshs 28.4 bn worth of bids received. During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum Retail Prices in Kenya for the period 15th January 2020 to 14th February 2020. During the week, Acorn Holdings, a real-estate developer, listed its Kshs 5.0 bn green bond on the Nairobi Securities Exchange, making it Kenya’s first listed green bond;

Equities

During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 recording declines of (3.0%), (1.2%) and (2.5%), respectively, taking their YTD performance to gains/(losses) of (0.1%), 0.6% and 0.04%, for the NASI, NSE 20 and NSE 25, respectively. During the week, the Central Bank of Kenya gave a go-ahead to Nigerian lender, Access Bank PLC, to acquire a 100% stake in Transnational Bank PLC for an undisclosed amount, with Access Bank PLC targeting to enhance its corporate and retail banking business in Kenya through the acquisition;

Real Estate

During the week, China State Construction handed over the 228 2-bedroom units of the first phase of the Park Road affordable housing project in Ngara to the Kenyan National Government. In the retail sector, Spur Corporation Ltd, a South African restaurant chain, announced plans to open two outlets in Kenya in 2020. Acorn Group, a Kenya-based real estate developer, listed its Kshs 4.3 billion green bond on the Nairobi Securities Exchange (NSE);

Focus of the Week

This week we revisit the Home Ownership Savings Plan, HOSP, topic in light of the Finance Act 2019, which expanded the scope of approved institutions that can hold savings towards HOSP to include Fund Managers and Investment Banks registered under the Capital Markets Act; the expansion was through the amendment of the Income Tax Act. Before the amendment, only banks savings qualified for HOSP. We review the prevailing housing market conditions that led up to the government’s declaration of affordable housing as part of the Big 4 Agenda and the effect of recent government incentives in promoting affordability. We also look at features of the Cytonn Affordable Housing Investment Plan, an investment plan that will enable Kenyans to build a deposit towards their affordable housing ownership.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.1% p.a. To subscribe, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.0% p.a. To subscribe, email us at sales@cytonn.com;

- Wacu Mbugua, Real Estate Analyst at Cytonn Investments was on CNBC to discuss the factors affecting housing in East Africa. Watch Wacu here;

- Beatrice Mwangi, Research Analyst at Cytonn Investments was on Metropol TV to discuss the 2020 real estate outlook. Watch Beatrice here;

- Rodney Omukhulu, Assistant Investment Analyst at Cytonn Investments was on CNBC where he gave his insights on KCB Group's offer to acquire 100% of the ordinary shares of the NBK Limited and the reduction of Tullow Oil's capital expenditure for its Kenyan operations this year. Watch Rodney here;

- David Gitau, Investment Analyst at Cytonn Investments was on Metropol TV where he talked matters investment and the 2020 economic outlook. Watch David here;

- Rodney Omukhulu, Assistant Investment Analyst at Cytonn Investments was on Metropol TV to discuss the equities outlook for the year 2020. Watch Rodney here;

- Shiv Arora, Chief Operating Officer at Cytonn Investments was on K24 to discuss the 2020 economic Outlook. Shiv said, “The Kenyan economy is expected to grow by 5.7%”. Watch Shiv here;

- Shiv Arora, Chief Operating Officer at Cytonn Investments was on Lolwe TV to discuss the current state of real-estate across the country. Watch Shiv here;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 118.1%, down from 178.3% recorded the previous week and lower than the YTD average of 124.9%. The oversubscription is partly attributable to improved liquidity in the market during the week as evidenced by the decline in the average interbank rate to 3.8%, from 4.8% recorded the previous week, supported by government payments and debt maturities. We note that the 364-day paper continued to receive the most interest from investors, having recorded the highest subscription rate of the 3 papers, at 169.9%. This is attributable to the market currently pricing that the government will be under pressure to meet its domestic target and as such a bias to shorter-dated papers in order to avoid duration risk, which has seen most investors still keen on the primary fixed income market, finding the 364-day T-bill more attractive on a risk-adjusted return basis. The yields on the 91-day, 182-day and 364-day papers increased by 3.2 bps, 2.5 bps and 0.9 bps to 7.2%, 8.2% and 9.8%, respectively. The acceptance rate declined to 80.1%, from 92.1% recorded the previous week, with the government accepting Kshs 22.7 bn of the Kshs 28.4 bn worth of bids received.

During the week, the Kenyan Government reopened two bonds namely, FXD1/2019/5 and FXD1/2019/10 with an effective tenor of 4.1 and 9.1 years, respectively, and coupon rates of 11.3% and 12.4%, respectively, in a bid to raise Kshs 50.0 bn for budgetary purposes. We expect the FXD1/2019/5 to attract more interest due to its relatively shorter tenor thus reduced duration risk, coupled with the high liquidity in the market. We expect the weighted average of accepted bids to come in at 11.3% - 11.5% for the FXD1/2019/5 and 12.1% - 12.3% for the FXD1/2019/10, given that they are currently trading at 11.3% and 12.1% on the yield curve, respectively.

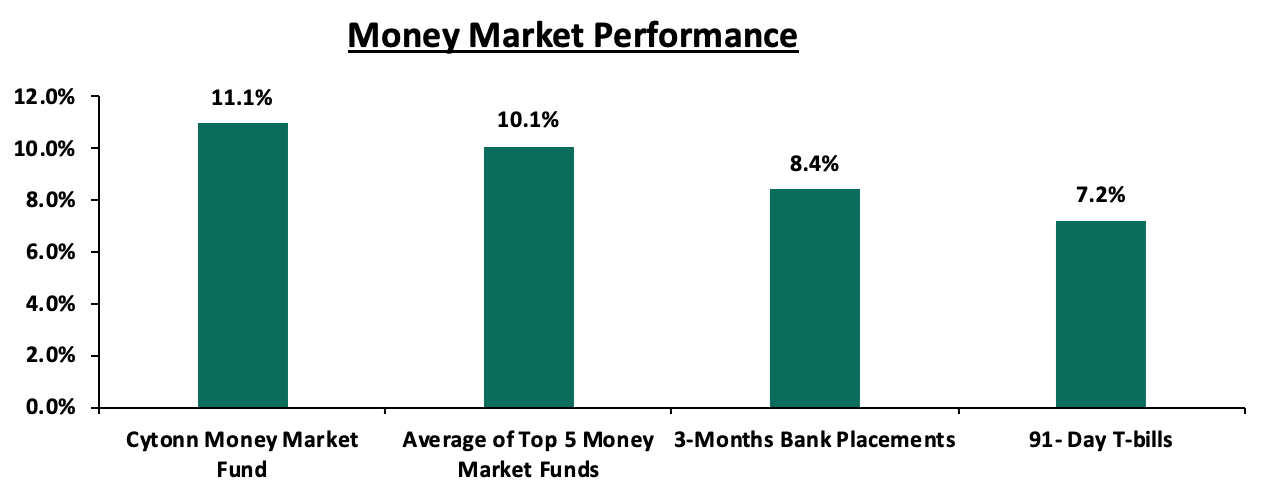

In the money markets, 3-month bank placements ended the week at 8.4% (based on what we have been offered by various banks), the 91-day T-bill came in at 7.2%, while the average of Top 5 Money Market Funds came in at 10.1%, unchanged from the previous week. The yield on the Cytonn Money Market increased by 0.6% points to close at 11.1%, from the 10.5% recorded the previous week.

Liquidity:

During the week, the average interbank rate decreased to 3.8%, from 4.8% recorded the previous week, pointing to increased liquidity in the money markets. Commercial banks’ excess reserves came in at Kshs 16.8 bn in relation to the 5.25% cash reserves requirement (CRR). The average interbank volumes decreased by 38.1% to Kshs 11.2 bn, from Kshs 18.1 bn recorded the previous week.

Kenya Eurobonds:

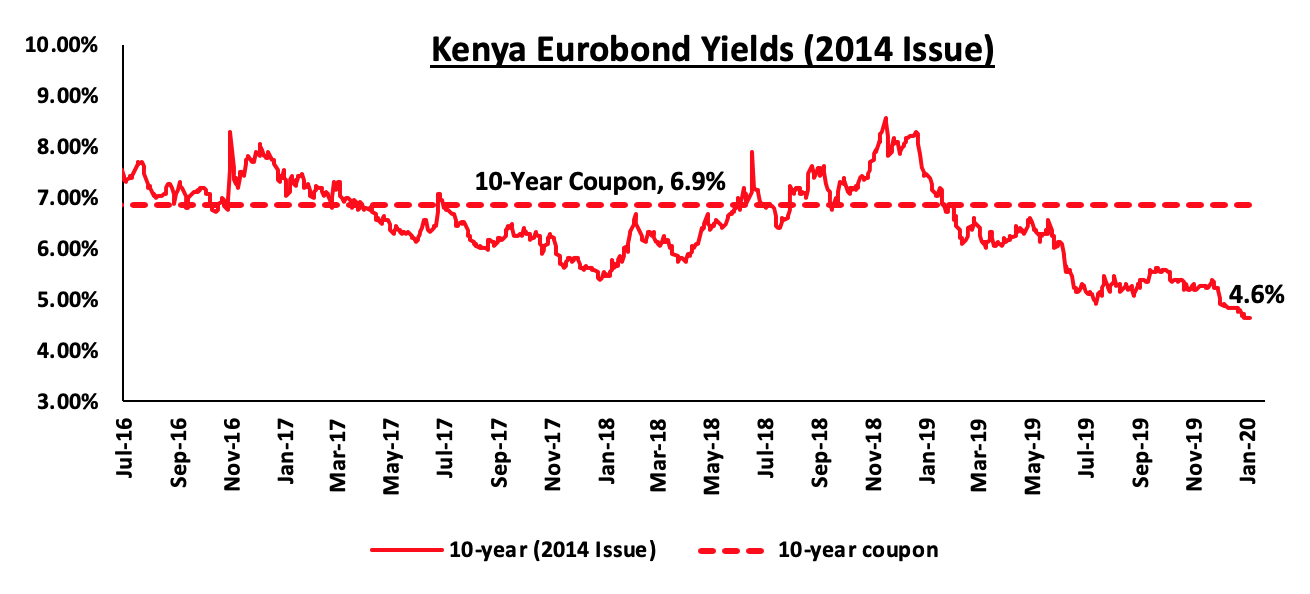

According to Reuters, the yield on the 10-year Eurobond issued in June 2014 remained unchanged at 4.6% similar to what was recorded the previous week. This is an indication that investors are not attaching a higher risk premium on the country, with Rating agencies Moody’s and Fitch Ratings having retained the country’s credit rating at “B2” and “B+”, respectively in 2019, highlighting the country’s stable outlook.

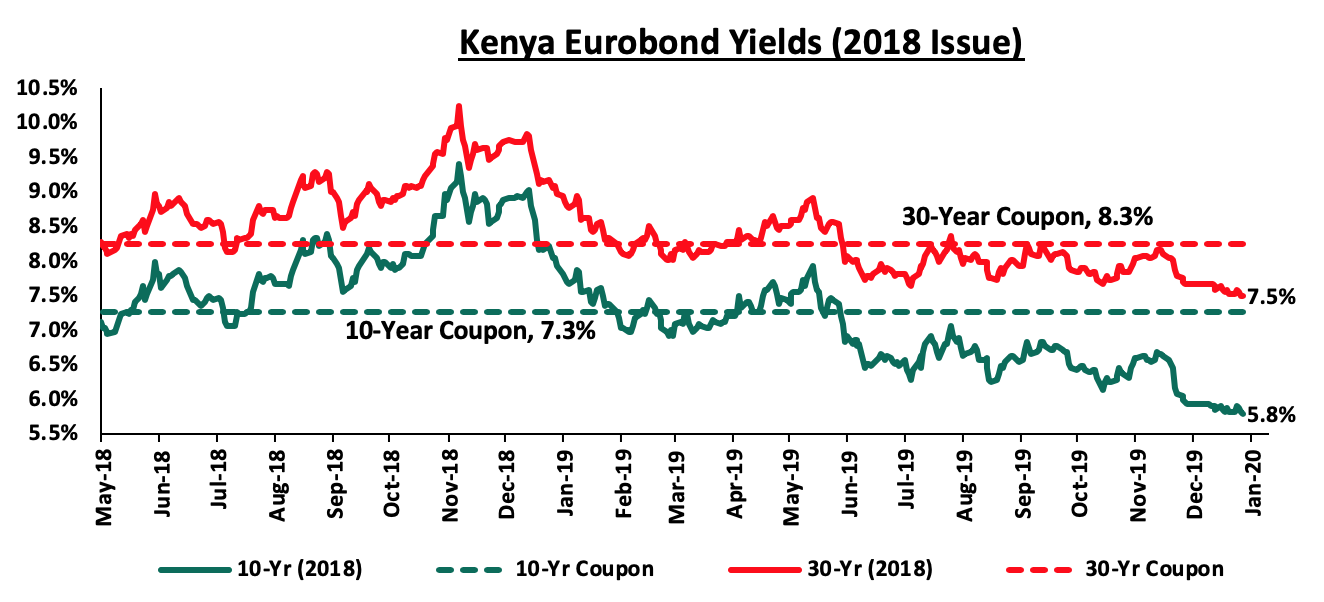

During the week, the yields on the 10-year Eurobond and the 30-year Eurobond issued in 2018 both remained unchanged at 5.8% and 7.5%, respectively.

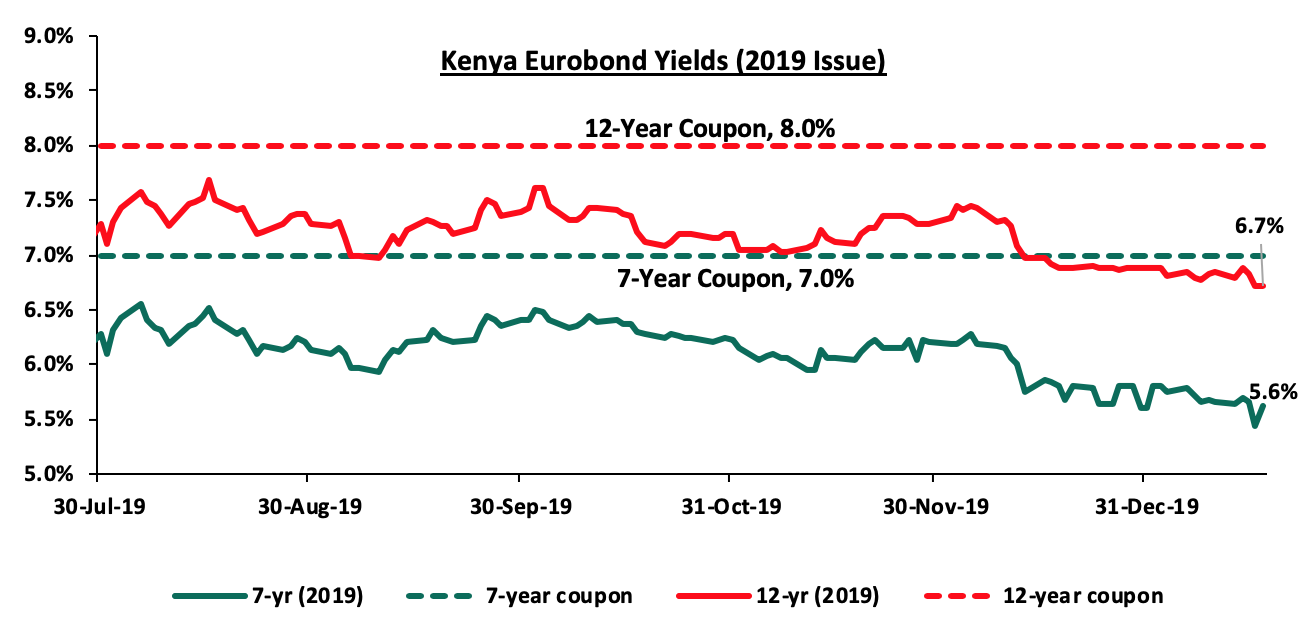

During the week, the yield on the 7-year Eurobond decreased by 0.1% points to 5.6%, from 5.7% recorded the previous week. The yield on the 12-year Eurobond also declined by 0.1% points to 6.7%, from 6.8% recorded the previous week.

Kenya Shilling:

During the week, the Kenya Shilling appreciated by 0.6% against the US Dollar to close at Kshs 101.0, from 101.6 recorded the previous week, mostly supported by inflows from tourism and diaspora remittances amid slow demand from importers. On an YTD basis, the shilling has appreciated by 0.4% against the dollar, in comparison to the 0.5% appreciation in 2019. In our view, the shilling should remain relatively stable against the dollar in the short term with a bias to a 2.4% depreciation by the end of 2020, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that Kenya’s current account deficit in Q3’2018 was equivalent to 8.2% of GDP, from 9.3% recorded in Q3’2018. This was mainly driven by the narrowing of the country’s merchandise trade deficit balance (a scenario where imports are greater than exports) by 6.7% and a rise in secondary income transfers (transfers recorded in the balance of payments whenever an economy provides or receives goods, services, income or financial items) by 4.3%,

- Foreign capital inflows, with investors looking to participate in the equities market,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars.

We, however, expect pressure on the Kenya Shilling to arise from:

- Increased oil imports bill, as a result of the U.S - Iran diplomatic row, which has seen average crude oil prices increase by 9.9% to an eight-month high to USD 72.0 a barrel, from USD 65.5 a barrel in December 2019, and,

- Subdued diaspora remittances growth following the close of the 10.0% tax amnesty window in July which has seen cumulative diaspora remittances increase by a marginal 5.0% in the 12-months to November 2019 to USD 2.8 bn, from USD 2.7 bn, which was slower than the 40.8% growth recorded in a similar period of review in 2018 and the ongoing spat between U.S and Iran which could lead to a slowdown in diaspora remittances.

Weekly Highlight:

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum Retail Prices in Kenya for the period 15th January 2020 to 14th February 2020. Below are the key take-outs from the statement:

- Petrol prices have increased by 1.6% to Kshs 111.2, from Kshs 109.5 per litre previously, while diesel and kerosene prices have increased by 0.5% and 1.7% to Kshs 102.3 and 104.0 per litre, respectively, from Kshs 101.8 and 102.3 per litre, previously,

- The changes in prices have been attributed to the increase in the average landing cost of imported super petrol by 2.2% to USD 471.0 per ton in December from USD 460.8 per ton in November. Landing costs for diesel and kerosene also increased by 1.7% and 5.8% to USD 493.7 per ton and USD 508.8 per ton in December, respectively, from USD 485.3 per ton and USD 481.1 per ton in November, and,

- A 4.0% increase in Free on Board (FOB) price of Murban crude oil lifted in December 2019 to USD 69.3 per barrel, from USD 66.6 per barrel in November 2019.

We expect an increase in the transport index, which carries a weighting of 8.7% in the total consumer price index (CPI), due to the increase in petrol and diesel prices. Consequently, the increase in the transport index will increase inflationary pressures.

During the week, Acorn Holdings, a real-estate developer, listed its Kshs 5.0 bn green bond on the Nairobi Securities Exchange making it Kenya’s first listed green bond, with plans to cross-list in London next week, which will also make it the first Kenyan Shilling bond to list on the London Stock Exchange. The 5-year bond was first issued in October 2019, by the company, in partnership with PE Fund Helios, attracting an 85.0% subscription rate, raising Kshs 4.3 bn of the targeted amount of Kshs 5.0 bn as highlighted in our Q3’2019 Markets Review. The bond will be listed in three tranches with the first tranche being floated at Kshs 786.0 mn. The local bond market has not witnessed any corporate bond issue since April 2017 when East African Breweries Ltd (EABL) listed its Kshs 6.0 bn bond expected to stimulate the dead bond market, which has witnessed defaults over the last five-years by issuers such as ARM Cement, Nakumatt and Imperial Bank leading to negative investor sentiments. The bond which attracts an interest of 12.5% annually will be used to finance sustainable and climate-resilient student accommodation with a combined capacity of 40,000 beds.

According to a report done by the IFC, a green bond is a fixed-income instrument whose distinguishing feature is that proceeds are earmarked exclusively for projects with environmental benefits. These include renewable energy, adaptation to climate change, waste management, pollution prevention, water management and green buildings, just to name a few. The green bond market was launched in Kenya in February 2019, through the Green Bonds Programme Kenya, which is a joint initiative between the Central Bank of Kenya, Nairobi Securities Exchange, Climate Bonds Initiative and Kenya Bankers Association, with several other organizations endorsing the program. In our view, the introduction of the green bond is a pro-active and good initiative by the Capital Markets Authority, which will benefit both investors and the stakeholders in the long-run considering its focus on environmental issues and a more sustainable economy.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 11.2% behind its domestic borrowing target, having borrowed Kshs 153.8 bn against a pro-rated target of Kshs 173.3 bn. We expect an improvement in private sector credit growth considering the repeal of the interest rate cap. This will result in increased competition for bank funds from both the private and public sectors, resulting in upward pressure on interest rates. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance

During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 recording declines of (3.0%), (1.2%) and (2.5%), respectively, taking their YTD performance to gains/(losses) of (0.1%), 0.6% and 0.04%, for the NASI, NSE 20 and NSE 25, respectively. The performance in NASI was driven by losses recorded by most large-cap stocks such as Equity Bank, KCB Group, BAT, Safaricom and Co-operative Bank of (6.4%), (5.9%), (4.0%), (4.0%) and (3.0%), respectively.

Equities turnover increased by 52.8% during the week to USD 40.2 mn, from USD 26.3 mn recorded the previous week, taking the YTD turnover to USD 69.0 mn. Foreign investors remained net buyers for the week, with a net buying position of USD 6.6 mn, a 726.4% increase from a net buying position of USD 0.8 mn recorded the previous week.

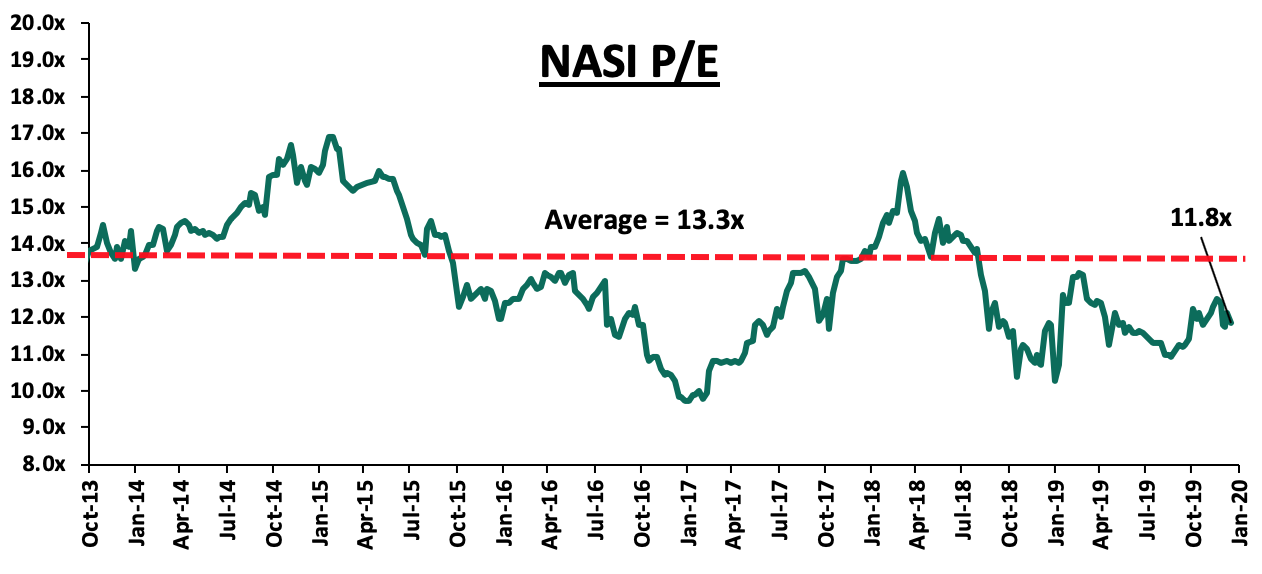

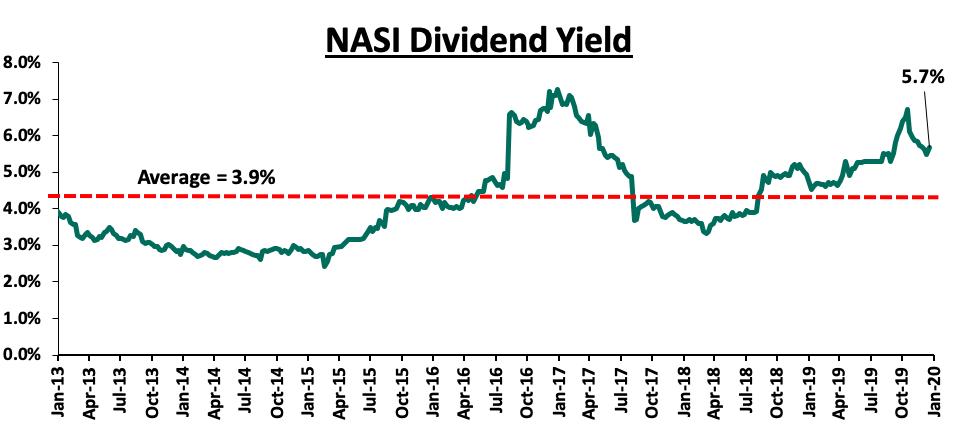

The market is currently trading at a price to earnings ratio (P/E) of 11.8x, 10.8% below the historical average of 13.3x, and a dividend yield of 5.7%, 1.8% points above the historical average of 3.9%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 11.8x is 21.9% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 42.4% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, the Central Bank of Kenya gave a go-ahead to Nigerian lender, Access Bank PLC to acquire a 100% stake in Transnational Bank PLC for an undisclosed amount, with Access Bank PLC targeting to enhance its corporate and retail banking business in Kenya through the acquisition. Access Bank is Nigeria’s largest lender by assets with an asset base of USD 16.1 bn (equivalent to Kshs 1.6 tn). Once completed, this will be the first bank acquisition in 2020, with the deal expected to be completed in February 2020, and will be in line with our expectation of consolidation in the Kenyan banking sector as players with depleted capital positions become acquired by their larger counterparts or merge together to form well-capitalized entities capable of navigating the relatively tough operating environment induced by stiff competition, as highlighted in our Q3’2019 Banking Sector Report. Transnational Bank, a mid-tier lender, recorded a loss after tax of Kshs 23.3 mn in Q3’2019 with an asset base of Kshs 9.6 bn as at Q3’2019. The bank's shareholders’ funds stood at Kshs 1.9 bn in Q3’2019. The deal will see Nigerian banks deepen their presence in Kenya with the United Bank of Africa (UBA) and Guarantee Trust Bank already in the market. Below is a summary of the deals in the last 5-years that have either happened, been announced or expected to be concluded. Transactions have been carried out at an average P/BV of 1.4x, compared to the current listed banking sector average of 1.5x:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs. Bns) |

Transaction Stake |

Transaction Value |

P/BV Multiple |

Date |

|

Access Bank PLC (Nigeria) |

Transnational Bank PLC |

1.9 |

100.0% |

Undisclosed |

N/A |

Feb-20* |

|

Oiko Credit |

Credit Bank |

3.0 |

22.8% |

1.0 |

1.5x |

Aug-19 |

|

KCB Group |

National Bank of Kenya |

7.0 |

100.0% |

6.6 |

0.9x |

Sep-19 |

|

CBA Group |

NIC Group |

33.5 |

53%:47% |

23.0 |

0.7x |

Sep-19 |

|

CBA Group |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

Jan-19 |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

Jan-19 |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

Dec-18 |

|

SBM Bank Kenya |

Chase Bank Ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

3.0 |

100.0% |

5.0 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov-13 |

|

Average |

|

|

75.7% |

|

1.4x |

|

|

* Completion date |

||||||

Universe of Coverage

|

Banks |

Price at 10/01/2020 |

Price at 17/01/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

3.0 |

3.0 |

0.7% |

(1.0%) |

3.0 |

4.8 |

15.0% |

75.0% |

0.3x |

Buy |

|

Diamond Trust Bank |

120.3 |

117.0 |

(2.7%) |

7.3% |

109.0 |

189.0 |

2.2% |

63.8% |

0.6x |

Buy |

|

I&M Holdings*** |

58.0 |

58.3 |

0.4% |

7.9% |

54.0 |

75.2 |

6.7% |

35.8% |

1.0x |

Buy |

|

KCB Group*** |

55.0 |

51.8 |

(5.9%) |

(4.2%) |

54.0 |

64.2 |

6.8% |

30.8% |

1.4x |

Buy |

|

Jubilee Holdings |

360.0 |

360.0 |

0.0% |

2.6% |

351.0 |

453.4 |

2.5% |

28.4% |

1.2x |

Buy |

|

Sanlam |

17.1 |

17.5 |

2.6% |

1.7% |

17.2 |

21.7 |

0.0% |

24.0% |

0.7x |

Buy |

|

Co-op Bank*** |

16.5 |

16.0 |

(3.0%) |

(2.1%) |

16.4 |

18.1 |

6.3% |

19.4% |

1.4x |

Accumulate |

|

Equity Group*** |

54.8 |

51.3 |

(6.4%) |

(4.2%) |

53.5 |

56.7 |

3.9% |

14.5% |

1.9x |

Accumulate |

|

Standard Chartered |

206.0 |

204.5 |

(0.7%) |

1.0% |

202.5 |

211.6 |

9.3% |

12.8% |

1.5x |

Accumulate |

|

NCBA |

36.5 |

36.3 |

(0.7%) |

(1.6%) |

36.9 |

37.0 |

4.1% |

6.2% |

0.8x |

Hold |

|

Barclays Bank*** |

13.3 |

13.5 |

1.5% |

1.1% |

13.4 |

13.0 |

8.1% |

4.4% |

1.8x |

Lighten |

|

Liberty Holdings |

10.5 |

10.4 |

(0.5%) |

0.5% |

10.4 |

10.1 |

4.8% |

1.6% |

0.9x |

Lighten |

|

CIC Group |

3.0 |

2.9 |

(4.3%) |

7.5% |

2.7 |

2.6 |

4.5% |

(3.9%) |

1.0x |

Sell |

|

Stanbic Holdings |

107.8 |

112.8 |

4.6% |

3.2% |

109.3 |

103.1 |

4.3% |

(4.3%) |

1.2x |

Sell |

|

Britam |

9.5 |

9.2 |

(3.4%) |

2.2% |

9.0 |

6.8 |

0.0% |

(26.6%) |

0.9x |

Sell |

|

HF Group |

5.7 |

6.1 |

7.4% |

(5.3%) |

6.5 |

4.2 |

0.0% |

(31.4%) |

0.3x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

- Residential Sector

During the week, China State Construction handed over the 228 2-bedroom units of the first phase of Park Road affordable housing project in Ngara to the Kenyan National Government. The 1,370-unit project sits on a 7.9-acre parcel of land in Ngara, Nairobi, with Phase 2 expected to be completed by June 2020. Once complete, the project will comprise of 30 SQM 1-bed, 40 SQM 2-bed and 60 SQM 3-bed social housing units selling at Kshs 1.5 mn, Kshs 2.0 mn and Kshs 3.6mn, respectively, which translates to Kshs 53,056 per SQM, in addition to 60 SQM 2-bed and 80 SQM 3-bed affordable housing units selling at Kshs 3.0 mn and 4.0 mn, respectively, which translates to Kshs 50,000 per SQM.

According to the dailies, approximately 300 homeowners have so far paid the mandatory 12.5% deposit and are awaiting allocation which will be done through the running of a lottery (timelines not disclosed). In December 2019, the government published guidelines that would be used in allocating residential units at the Park Road affordable housing project in Ngara. The units will be allocated through the Boma Yangu Portal upon paying of 12.5% of the house value as a deposit with the main modes of purchase as follows;

- Outright Sale – requires 12.5% of the house value as a deposit with the balance paid within 90-days,

- Mortgage Loan- financed under the Civil Servants mortgage scheme or partner banks, and,

- Tenant Purchase Scheme (TPS) - 12.5% of the house value as a deposit with monthly payments at an interest of 7.0% p.a for a period of 25-years. However in our view, the rate may not be sustainable as it may result in a high cost of debt for the KMRC facility as investors of the mortgage-backed bonds are likely to demand a relatively high rental yield of approximately 13.5%, assuming a 1.0%-point margin above the minimum of the risk-free rate for a 15-year bond, which currently stands at 12.5%, yet KMRC’s target is providing mortgages at 9.0% interest. For more details, see our KMRC Topical.

To drive the affordable housing initiative, the government has already put in place various policies and strategies to support developers and first-time homebuyers, which include:

For Home Buyers:

- 15.0% tax relief up to a maximum of Kshs 108,000 p.a.,

- Exemption from stamp duty tax for first time home buyers,

- Enabling homeowners to make savings for the purchase of a home through Collective Investment Schemes, through the expansion of approved institutions that can hold savings towards HOSP to include Fund Managers and Investment Banks registered under the Capital Markets Act.

For Developers:

- 50% corporate tax break from 30% to 15% for investors who put up 100 and above affordable housing units,

- Scrapping off, of the NEMA and NCA levies, which used to be 0.1% and 0.05% of the construction costs, respectively,

- Exemption of goods supplied through import or purchase for the direct and exclusive use in the construction of affordable houses by licensed Special Economic Zones(SEZ) from Value Added Tax (VAT),

- Exemption of companies implementing projects under the affordable housing scheme from the application of thin capitalization rules,

- Exemption of the transfer of a house constructed under the affordable housing scheme from the developer to the National Housing Corporation from Stamp Duty, and,

- Reduction of Import Declaration Fee (IDF) on inputs for the construction of houses under the affordable housing scheme approved by the CS Finance from 2.0% to 1.5%.

We except continued activities in the affordable housing sphere fueled by the continued government focus to achieve the target of developing 500,000 housing units by 2022 and this is evidenced by the significant budget allocation of Kshs 10.5 bn in the 2019/2020 budget, in addition to the introduction of incentives for both developers and home buyers. In 2020, we expect the initiative to continue to gain traction with a significant number of potential home buyers registering for the affordable housing units in addition to the implementation of several projects in the pipeline, among them being; 1,142 units Park Road Phase 2, a 3,500 unit project in Starehe, 5,300 units in Shauri Moyo and 2,720 units River Estate in Ngara.

- Retail Sector

During the week, Spur Corporation Ltd, a South African restaurant chain, announced plans to open two additional outlets in Kenya in 2020, as part of its expansion strategy. The restaurant chain currently has 7 outlets in Kenya which comprise of 5 steak houses, a restaurant and a pizzeria. This is an indication of the continued expansion efforts by international retailers aimed at increasing their local foothold in the country. The continued entry and expansion of international retail in Kenya has continued to boost the retail real estate sector through space uptake thus boosting the investors’ returns. However, according to Cytonn Annual Markets Review – 2019, the sector has an existing oversupply of 2.8 mn SQFT of space, which has continued to cripple its performance. According to the report, the sector recorded a decline in rents and occupancies by 1.5% and 4.0%, respectively, to Kshs 175.5 and 75.9% in 2019 from Kshs 178.2 and 79.8%, respectively, in 2018, attributed to the oversupply which has created a bargaining chip for retailers forcing developers to reduce or maintain their rents in order to remain competitive and attract occupants to their retail spaces.

The table below shows the Nairobi Metropolitan Area (NMA) retail performance between 2018 and 2019:

(All values in Kshs unless stated otherwise)

|

Retail Sector Performance 2018-2019 |

|||

|

Item |

2018 |

2019 |

∆ Y/Y 2019 |

|

Average Asking Rents (Kshs/SQFT) |

178.2 |

175.5 |

(1.5%) |

|

Average Occupancy (%) |

79.8% |

75.9% |

(4.0%) points |

|

Average Rental Yields |

9.0% |

7.8% |

(1.2%) points |

|

|||

Source: Cytonn Research 2019

We expect international retailers to continue expanding their local footprint in the Kenya retail market supported by positive economic growth, rise in disposable incomes, change in consumer tastes & preferences, and improved infrastructural developments. This will fuel continued uptake of space and thus cushion the sector’s performance, in the wake of the existing oversupply.

Other highlights during the week included:

- Acorn Group, a real estate developer, listed its Kshs 4.3 billion green bond on the Nairobi Securities Exchange (NSE). The five-year bond will be listed in three tranches, with the newly listed first tranche floated at Kshs 786 million. The green bond is intended to finance the developer’s sustainable and climate-resilient student accommodation in Kenya. Acorn Group has already put up approximately 1,000 hostel units located in Parklands, Jogoo Road and Ruaraka under the Qwetu brand. According to Cytonn Research, modern student hostels have potentially high yields of between 7.2% - 9.6% compared to the conventional real estate sectors i.e., commercial office, retail, and residential, whose average yields were 7.0% as at 2019. The green bond listing is a step in the right direction towards enabling the real estate sector to raise funds from the capital markets to finance their investment. For more information, see our Cytonn Q3’2019 Markets Review.

We expect increased activities in the real estate sector mainly in the residential and retail themes, supported by the increased focus on the provision of affordable housing by the National Government, and the continued entry and expansion of international retailers in the country.

This week we revisit the Home Ownership Savings Plan, HOSP, topic in light of the Finance Act 2019, which expanded the scope of approved institutions that can hold savings towards HOSP to include Fund Managers and Investment Banks registered under the Capital Markets Act; the expansion was through the amendment of the Income Tax Act. Before the amendment, only banks savings qualified for HOSP. We review the prevailing housing market conditions that led up to the government’s declaration of affordable housing as part of the Big 4 Agenda and the effect of recent government incentives in promoting affordability. We also look at features of the Cytonn Affordable Housing Investment Plan, an investment plan that will enable Kenyans to build a deposit towards their affordable housing ownership; CAHIP is a collaboration between Cytonn Investment, as the structuring agent, and Cytonn Asset Managers Limited, as the Fund Manager eligible to take HOSP savings.

As such, we shall look at the following:

- Government’s Affordable Housing Agenda,

- A Recap of Our Analysis of Home Ownership Savings Plans and Recent Developments,

- Benefits of Home Ownership Savings,

- Structural Impediments to Capital Markets Based Home Ownership Savings Programs, and,

- The Cytonn Affordable Housing Investment Plan, CAHIP.

Section I: Government’s Affordable Housing Agenda

Kenya’s housing sector is largely characterized by deteriorating housing conditions countrywide arising from a demand that far outpaces supply, particularly in urban areas. According to the National Housing Corporation (NHC), Kenya has a cumulative housing deficit of 2.0 mn units growing by 200,000 units per year driven mainly by; i) rapid population growth of 2.2% p.a. compared to the global average of 0.9%, and ii) a high urbanization rate of 4.3% against global and Sub-Saharan averages of 2.1% and 4.1%, respectively. Supply, on the other hand, has been constrained mainly by the high construction costs, high costs of land in urban areas as well as high cost of capital, with the Ministry of Housing in Kenya estimating the total annual supply to be at 50,000 units.

Notably, the Ministry indicates that 83.0% of the existing housing supply is for the high income and upper-middle-income segments, with only 15.0% for the lower-middle and 2.0% for the low-income population. In short, while 74.4% of Kenya’s working population requires affordable housing, only 17.0% of housing supply goes into serving the low to lower-middle-income segment. This shortage in housing has manifested itself through the proliferation of slums and informal settlements in urban areas and poor quality housing in rural areas.

It is in this regard that the President of Kenya declared the Affordable Housing Initiative under the Big Four Agenda in 2017 aiming to deliver 500,000 homes by 2022 with a price range of Kshs 0.6 mn and Kshs 3.0 mn.

|

Affordable Housing - Income Classes |

||

|

Type of Housing |

Income Range (Kshs) |

% of Kenyan Population |

|

Social Housing |

0-19,999 |

2.6% |

|

Low Cost Housing |

20,000-49,999 |

71.8% |

|

Mortgage Gap |

50,000-149,999 |

22.6% |

|

Middle to High Income |

>150,000 |

2.9% |

Source: Ministry of Housing

The target beneficiaries for the units are Kenyans who are unable to access long-term housing finance. This is as most local banks have products for households that earn above Kshs 150,000 per month.

As a low middle-income country, Kenya’s largest challenge has been access to finance. As a result, previous government regimes had introduced some measures aimed at alleviating the housing finance crisis, namely:

- Mortgage Relief: Introduced in the 1995 Income Tax Act cap 470, borrowers of mortgages from a registered financial institution to purchase a home or to improve a home guarantees them tax relief on interests paid to the registered financial institution of up to a maximum of Kshs 300,000 p.a.,

- Home Ownership Savings Plan: Introduced in 1995 in the Income Tax Act and amended in 2018, savings with a Registered Home Ownership Savings Plan for a maximum of ten-years allows the subscribers tax exemption on income to a maximum of Kshs 8,000 per month or Kshs 96,000 annually and on interest income earned by a depositor on savings of up to a maximum of Kshs 3.0 mn.

However, since the declaration of Affordable Housing Agenda, the current regime has gone ahead and passed a host of more legislations meant to enable the affordable housing initiative. These include:

- Affordable Housing Relief: The Income Tax Act was amended in 2018 to allow 15.0% tax relief up to a maximum of Kshs 108,000 p.a., or Kshs 9,000 p.m., to affordable home buyers,

- Stamp Duty Act: Amended in 2018, the Act allows for the exemption of first-time homebuyers under the affordable housing scheme from paying the Stamp Duty Tax, which is normally set at 2.0% - 4.0% of the property value depending on location, and,

- Kenya Mortgage Refinancing Company: The facility was set up with the intention of enhancing mortgage affordability in Kenya by enabling long-term loans at attractive market rates through the provision of affordable long-term funding and capital market access to primary mortgage lenders such as banks and financial co-operatives.

The government has over the past three years also introduced a host of other measures to help ease construction costs for developers of affordable housing, key among them being:

- 50% corporate tax break from 30% to 15% for investors who put up 100 and above affordable housing units,

- Scrapping off, of the NEMA and NCA levies, which used to be 0.1% and 0.05% of the project costs, respectively,

- Exemption of VAT for supplies imported or purchased for direct and exclusive use in the construction of affordable houses by licensed Special Economic Zones (SEZ). Developers will also need (i) a recommendation from the Cabinet Secretary for Housing, and (ii) a minimum of 5,000 units to qualify,

- Exemption of companies implementing projects under the affordable housing scheme from the application of thin capitalization rules,

- Exemption of the transfer of a house constructed under the affordable housing scheme from the developer to the National Housing Corporation from Stamp Duty,

- Reduction of Import Declaration Fee (IDF) on inputs for the construction of houses under the affordable housing scheme approved by the CS Finance from 2% to 1.5%, and,

- Under the Nairobi City County Sessional Paper Number 1 of 2018, waiving of building fees for all affordable housing projects in Nairobi.

The above measures are aimed at lowering construction costs by approximately 30.0%, from the average market rate of Kshs 44,754 per SQM to Kshs 31,328 per SQM, thereby fostering the development of affordable homes. The table below shows the anticipated impact of the above incentives in promoting affordability.

|

Affordable Housing Initiatives |

||

|

Initiative |

Expected Impact on Reducing Property Prices |

Impact on Buyers |

|

Reduction of Import Declaration Fee (IDF) from 2.0% to 1.5% |

0.5% |

Indirect |

|

Zero rate VAT for affordable construction supplies |

16.0% |

Indirect |

|

Corporate tax reduction from 30% to 15% for developers of over 100 units |

8.0% |

Indirect |

|

The scrapping of 2.0% and 4.0% Stamp Duty for First-time Homebuyers |

3.0% |

Direct |

|

Total Impact on Affordability |

27.5% |

|

Source: Cytonn

We estimate that measures such as zero-rating VAT, reducing IDF Fee, and the 50.0% corporate tax reduction for developers will indirectly reduce home prices by at least 16.0%, 0.5%, and 8.0%, respectively, while the scrapped off stamp duty outright saves the homebuyer 2.0% or 4.0% of the home value. Thus, on average, the incentives will help increase affordability by up to 27.5%. Taking, for instance, an average two-bedroom unit priced at Kshs 7.0 mn in the prevailing market values; with the government incentives applied, the unit price, therefore, will cost Kshs 5.1 mn. We also expect that other measures such as the incorporation of The Kenya Mortgage Refinancing Company will also ease the cost of buying in the long run, particularly for mortgage borrowers. In our KMRC Topical, we estimated that the facility would help reduce monthly repayments for a mortgage by at least 14.0%, comparing a mortgage loan of 12 and 20 years offered at an interest rate of 13.6%.

Section II: A Recap of Our Analysis of Home Ownership Savings Plans (HOSP) and Recent Developments

It has been our view that linking housing finance systems to the capital market, which is capable of offering attractive rates to Kenyans saving for homeownership will enhance financial liberalization and assist low-income earners to efficiently save towards homeownership as part of the overall government’s development strategy.

To reiterate our Home Ownership Savings Plans (HOSP) topical pieces dated September 15, 2019, and December 22, 2019, the Income Tax Act cap 470 defines a Home Ownership Savings Plan (HOSP) as a savings plan established by an ‘approved institution’ and registered with the commissioner for Income Tax for receiving and holding funds in trust for depositors. It is a tax-sheltered savings plan whose main objective was to enable individual depositors to save for home acquisition or development and was introduced in Kenya in 1995. The regulation allows depositors tax rebates of Kshs 8,000 per month maximum or Kshs 96,000 per annum, effectively reducing an individual’s taxable income by the amount of their monthly contribution) with the condition that it is with a Registered Home Ownership Savings Plan. As per the Income Tax Act, any interest earned on the deposits up to Kshs 3.0mn is also tax-exempt. It is also important to note that Registered Home Ownership Savings accounts in Kenya are restricted to first time home buyers. The accumulated funds are withdrawn tax-free to strictly purchase or construct a house. Thus, if the depositor utilizes the funds for any other purpose other than to acquire a house, they become taxable in the year of withdrawal.

In the topical, we also noted how Home Ownership Savings Plan in Kenya has not been very successful in its overall objective, which was to avail housing finance and promote a culture of savings for aspiring homeowners. This has been evidenced by the fact that only one institution, Housing Finance, explicitly offers the product to the public; the low homeownership rates in the country which as per the Kenya Integrated Household Budget Survey of 2016 stood at 26.5%; and the relatively low mortgage uptake with 26,504 mortgage accounts recorded as at 2018 against an adult population of 23.0 mn and the existing housing deficit estimated at 2.0 mn by the National Housing Corporation.

As at the time of our first topical, the Income Tax Act restricted the product to a few approved institutions, which were; banks or financial institutions registered under the Banking Act, insurance companies licensed under the Insurance Act or building societies registered under the Building Societies Act.

It is in this regard that real estate and capital market players lobbied for the passing of Registered Home Ownership Saving Plans to include Fund Managers and Investment Banks under the Capital Markets Act. This is also because, a well-developed capital market that is in sync with the housing finance system is a prerequisite for a sustainable, low-cost capital raising mechanism for affordable housing in Kenya for both developers and potential homeowners. As such, we lobbied stakeholders and recommended that Fund Managers and Investment Banks should qualify as HOSP approved institutions, under Section 22 C (8) Income Tax Act 2018.

We commend the government for heeding this call. The Finance Act of 2019, passed in November 2019, expanded the scope of approved Institutions which can hold deposits of a HOSP to include Fund Managers and Investment Banks registered under the Capital Markets Act.

Section III: Benefits of Home Ownership Savings

The current attractiveness of HOSP schemes to stakeholders stems in part from the financial and housing market conditions that prevail today in the Kenyan market characterized by lack of long-term savings, the huge housing shortage, affordability problems as evidenced by extremely high price-to-income ratios, relatively high and volatile inflation, as well as reduced wage incomes. For the government, HOSP schemes alleviate the housing problem by enabling homebuyers to have the required funding to acquire a home. As it is, there exists a direct correlation between the existing housing finance system and the level of informal settlements in the country, which the World Bank estimated to be 61.0% of urban dwellers as at 2017. For financial institutions, HOSP schemes can offer effective screening and monitoring as well as establishing the reputation of steady savers as future borrowers, thus lowering credit risks. Savers, on the other hand, stand to benefit in the following ways:

- Tax Rebates: According to Income Tax Act, individuals in a Registered Home Ownership Savings Plan are guaranteed tax exemption on income of up to Kshs 8,000 per month or Kshs 96,000 per annum, while the interest income of up to Kshs 3.0 mn is tax-exempt upon withdrawal. With this, assuming a median income of Kshs 50,000, an individual depositing Kshs 8,000 per month with a registered HOSP account pays 28.1% less PAYE (Pay as You Earn) than one without a HOSP account, as shown below:

(All Values in Kshs Unless Stated Otherwise)

|

PAYE Remittances Scenario |

||

|

|

HOSP Subscriber |

Without HOSP |

|

Monthly Gross Salary (Kshs) |

50,000 |

50,000 |

|

HOSP Remittance (Kshs) |

8,000 |

- |

|

PAYE (Kshs) |

5,459 |

7,596 |

|

Taxable Income (Kshs) |

42,000 |

50,000 |

- Credit Profile: In a country like Kenya, the provision of loans for private households is rather restricted, which also implies exorbitant interest rates and very short repayment timelines. This is mainly because lending institutions are not in a position to evaluate the creditworthiness of potential customers as the majority of people do not have bank accounts or have very irregular incomes with 83.4% of the working population being within the informal sector. Having an active HOSP sector can help customers establish their creditworthiness through their regular saving. Those who can save a small portion of their income regularly will be identified as reliable borrowers, and,

- Household Savings: Saving in a HOSP fund facilitates the accumulation of equity for households or the depositors by establishing a savings discipline, which can be non-existent in many emerging economies like Kenya. As such, the schemes provide a concrete goal for homebuyers and offer prospects of a well-priced loan, which ultimately makes it easier for an individual to acquire a home by efficiently raising a deposit for a future house loan. According to the World Bank, inability to raise deposits required to access mortgage has been proven as one of the reasons behind the small number of home loans, necessitating the need for tax incentives to boost savings for property acquisition.

Section IV: Structural Impediments to Capital Markets Based Home Ownership Savings Programs

While the government has done a lot to stimulate HOSP, we still have 3 key structural impediments to the Capital Markets Based Home Ownership Program that require urgent review, in any case, the biggest financier to sustainable affordable housing is going to capital markets funding. We request the government and the Capital Markets Authority, CMA, to look into these three issues with due speed since they are huge impediments to capital formation towards affordable housing:

- Allow Specialist Funds: Our archaic capital market rules currently do not allow investors to form a specialized fund, such as an affordable housing real estate fund, because the Collective Investment Schemes regulations allow only 25% of a fund to be invested in one sector; so even if you form a real estate fund, only 25% can go into real estate, the rest has to go to other sectors,

- Remove Conflict of Interest by Banks: The regulations currently require that the overseer / Trustee of a collective investment scheme must be a bank, and indeed only 5 banks are registered as Trustees. Obviously, commercial banks are good in deposit gathering and lending, not capital markets instruments, but more importantly, they will be more comfortable with allocating investor savings back into the banking sector rather than into the housing sector,

- Reduce the Minimums for Investors Wishing to Put Money Together to Invest in Affordable Housing: Our CMA rules essentially require that an investor must have at least Kshs 1.0 mn in the case of a real estate high yield fund, or Kshs 5.0 mn in the case of Real Estate Investment Trust, in order to come together as investors to invest in real estate. These amounts are too high for a regular Kenyan and seem designed to lock out the regular Kenyan, leaving them with no option but to join informal schemes such as Ekeza, where they end up risking their savings.

Affordable housing agenda will not move fast or far without capital markets funding, and capital formation will not happen without reviewing the above structural impediments; it is crucial that we review the above 3 with a sense of urgency.

Section V: The Cytonn Affordable Housing Investment Plan (CAHIP)

Majority of Kenyans desire to own a home and this has seen many duped by unscrupulous organizations purporting to help them achieve that objective. Having been a key player in lobbying for expanding of HOSP to include Fund Managers, and in an effort to provide a credible home savings platform, Cytonn Investments will on Tuesday, 21st January 2020, launch the Cytonn Affordable Housing Investment Plan (CAHIP) with the main objective being to offer a solution to members of the public, the common mwananchi, who are keen on saving towards homeownership.

CAHIP will provide those saving towards home purchase an attractive investment proposition, compared to those currently available in the market. To achieve this, CAHIP, which is structured by Cytonn Investments, has partnered with the Cytonn Money Market Fund, which not only has tax advantages for those saving towards homeownership but provides high levels of returns while protecting investor's capital. The key features are as indicated below:

- The minimum initial investments into the Fund shall be Kenya Shillings One Thousand (Kshs. 1,000), with individuals and then making monthly contributions to a minimum of Kshs 1,000,

- The savings made shall attract an attractive interest of approximately 10.0% - 11.0% p.a., in line with the target return of the Cytonn Market Money Fund,

- Unit holders will be entitled to a tax exemption on savings made under the Fund subject to a maximum of Kshs 8,000 per month or Kshs 96,000 per year for 10-years, in line with the Income Tax Act Section 22,

- Any interest income on savings, up to a maximum of Kshs 3.0 mn of savings, earned by the unit holder on investment into the Fund shall be exempt from tax. However, any excess amount of the withdrawal shall be subject to tax, and,

- Individuals can save up for as long as they wish and/or until they have a property (residential house or land) into which they would like to direct the savings, upon which evidence must be provided. However, if the depositor utilizes the funds for any other purpose other than the above mentioned, the savings become taxable in the year of withdrawal.

Below we illustrate an individual savings plan through: (i) a HOSP scheme, which is likely to offer a 5.0% return per annum, based on the rates we received in the market, and (ii) a Fund Manager’s Unit Trust Fund such as the Cytonn Affordable Housing Investment Plan, offering a 11.0% yield per annum; the purpose of the example is to show how much a depositor would have after the ten-year period:

(All Values in Kshs Unless Stated Otherwise)

|

|

CAHIP |

HOSP (Current Market Rate) |

|

Monthly Deposits |

2,000 |

2,000 |

|

Rate of Return |

11.0% |

5.0% |

|

Tenor (Years) |

10 |

10 |

|

Future Value |

432,249 |

310,565 |

|

||

Assuming (i) an 11.0% yield on savings, (ii) goal is to build a 10% towards a house costing Kshs 4.0 mn, hence saving at least 400,000, this is how long it would take you (assuming an initial investment of Kshs 5,000). The below table also shows different levels of monthly savings needed to achieve the Kshs 400,000:

All values in Kshs unless stated otherwise

|

Monthly Investment after Initial 5000 |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Year 6 |

Year 7 |

Year 8 |

Year 9 |

Year 10 |

|

1,000 |

17,139 |

31,716 |

47,890 |

65,835 |

85,746 |

107,837 |

132,347 |

159,542 |

189,715 |

223,192 |

|

2,000 |

28,730 |

57,277 |

88,951 |

124,094 |

163,085 |

206,346 |

254,346 |

307,602 |

366,690 |

432,249 |

|

3,000 |

40,321 |

82,838 |

130,012 |

182,352 |

240,424 |

304,856 |

376,344 |

455,661 |

543,665 |

641,306 |

|

4,000 |

51,912 |

108,399 |

171,073 |

240,610 |

317,763 |

403,365 |

498,342 |

603,721 |

720,640 |

850,363 |

|

5,000 |

63,503 |

133,960 |

212,134 |

298,868 |

395,102 |

501,874 |

620,340 |

751,780 |

897,615 |

1,059,420 |

|

6,000 |

75,094 |

159,521 |

253,194 |

357,127 |

472,441 |

600,384 |

742,339 |

899,840 |

1,074,590 |

1,268,477 |

|

7,000 |

86,685 |

185,082 |

294,255 |

415,385 |

549,780 |

698,893 |

864,337 |

1,047,899 |

1,251,564 |

1,477,534 |

|

8,000 |

98,276 |

210,643 |

335,316 |

473,643 |

627,119 |

797,403 |

986,335 |

1,195,959 |

1,428,539 |

1,686,591 |

|

9,000 |

109,867 |

236,204 |

376,377 |

531,901 |

704,458 |

895,912 |

1,108,333 |

1,344,018 |

1,605,514 |

1,895,648 |

|

10,000 |

121,458 |

261,765 |

417,438 |

590,159 |

781,797 |

994,421 |

1,230,332 |

1,492,078 |

1,782,489 |

2,104,705 |

In conclusion, being part of a risk-averse homeownership savings plans that offers an attractive return on your homeownership savings will enable savers to purchase a home more easily and more efficiently in comparison to other savings vehicles and for ardent savers; a high rate of return also means high-interest income and capital stability.

For more information on CAHIP, email us at housing@cytonn.com.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.