Cytonn 2020 Markets Outlook

By Cytonn Investments, Jan 12, 2020

Executive Summary

Global Markets Outlook

In 2020, global growth rate is expected to come in at 2.5% as per the World Bank data, higher than the estimated 2.4% in 2019, but lower than the 3.0% recorded in 2018. 2020 growth is expected to be driven by the recent policy actions, such as the Phase – One agreement between the US and China on trade, a gradual pick-up in global trade, and monetary policy easing in developed markets. Central Banks’ policy stance in advanced economies adjusted towards economic easing, with the US Federal Reserve cutting the Federal Funds Rate three times in 2019. The European Central Bank maintained the base lending rate at 0.0%, reduced its deposit rates by 10 bps to (0.5%) from (0.4%), and introduced a fresh stimulus package by restarting its bond purchases of EUR 20.0 bn a month from November;

Sub Saharan Africa Regional Market Outlook

In 2020, Sub Saharan Africa (SSA) is expected to register economic growth of 2.9%, higher than the estimated 2.4% in 2019 and 2.6% recorded in 2018, according to the World Bank in their Sub Saharan Economic Prospectus 2020. This is on the assumption that investor confidence improves in some large economies such as South Africa and Angola, a pickup in oil production and robust growth among agricultural commodity exporters such as Ethiopia. The forecast is lower than the initial 3.3% projection, mainly reflecting the expected softer demand from key trading partners such as China, and lower commodity prices;

Kenya Macro Economic Outlook:

GDP Growth – Our outlook for 2020 is NEUTRAL on GDP Growth. We project economic growth to come in at 5.6% - 5.8% in 2020, supported by the improved private sector credit growth, and expectations of a recovery of the agriculture sector. Risks to growth, however, lie in some of the major sectors which recorded subdued performance in 2019 such as the agricultural sector due to erratic weather patterns, manufacturing sector, and taxes on products,

Inflation - Our outlook for 2020 is POSITIVE on Inflation. We expect muted inflationary pressures and the inflation rate to average 5.2% over 2020, which is within the government target range of 2.5% - 7.5%,

Currency - Our outlook for 2020 is NEUTRAL on Currency. We project the Kenya Shilling will range between Kshs 101.0 and Kshs 104.0 against the USD in 2020, supported by the Central Bank of Kenya (CBK) in the short term through its sufficient reserves of USD 8.8 bn and an improving current account position,

Interest Rates - Our outlook for 2020 is NEUTRAL on Interest Rates. Despite our expectations of a bias towards expansionary monetary policy in 2020 in order to support economic activity, we still expect upward pressure on interest rates due to increased efforts by the Kenyan Government to meet its domestic borrowing target in order to plug in the fiscal deficit. This, in turn, might result in an upward readjustment of the yield curve in order to incentivize more uptake of government papers, with banks having shifted their focus to private sector lending in the tail end of 2019 as evidenced by reduced participation of banks in the primary auction market from an average of 125.4%, from January 2019 to November 7th 2019 before the repeal of the rate cap, to 48.4% for the post interest rate cap period between November 7th 2019 and 31st December 2019;

Fixed Income

Our view is that investors should be biased towards SHORT-TERM FIXED INCOME INSTRUMENTS to reduce duration risk. We expect upward pressure on interest rates following the repeal of the interest rate cap which in effect is expected to result in increased competition for bank funds from both the private and public sectors as the Government tries to raise funds to plug in the budget deficit;

Equities Outlook

We are POSITIVE for equities in 2020. We expect a stable macro-economic environment, a 12.4% growth in corporate earnings, and attractive valuations in many of the counters to support positive performance in the equities market in 2020.

Real Estate Outlook

Residential Sector: Our outlook on residential sector performance remains NEUTRAL. We expect that uptake as well as development activity will remain subdued as the negative effects of a sluggish economy persist into the year. Investment opportunity is in low to mid-end markets such as Athi River, Ruaka and Thindigua, for potential buyers, and upper mid-end markets such as Parklands for rental property;

Commercial Office Sector: Our outlook for the commercial sector is NEGATIVE as the sector’s performance continues to be constrained by oversupply of 5.6 mn SQFT as at 2019. The sector however has pockets of value in zones with low supply and high returns such as Gigiri, and in differentiated concepts such as serviced offices, which record relatively high rental yields of up to 13.4% p.a.;

Retail Sector: We have a NEUTRAL outlook for the sector with a bias towards negative due to existing oversupply of space estimated at 2.8 mn SQFT. We remain optimistic that the sector’s performance will be cushioned by the entry of international retailers and the expansion of local retailers such as Naivas and Tuskys. The investment opportunity is in Kenyan County headquarters in some markets such as Kiambu and Mt. Kenya that have an estimated retail space demand of 0.8 mn and 0.2 mn SQFT, respectively;

Hospitality Sector: Our outlook for serviced apartments is POSITIVE. Given the country’s political stability and the continued marketing of Kenya as an experience destination, we expect the number of international arrivals to grow annually by 6.7% to approximately 2.3 mn in 2020, from the estimated 2.2 mn in 2019. The investment opportunity is in (i) Westlands & Parklands, and (ii) Kilimani submarkets, which recorded relatively high rental yields of 10.8% and 9.5% in 2019, respectively;

Land Sector: We have a POSITIVE outlook for the land sector. We expect an annual capital appreciation of 3.9% in 2020, compared to 2.0% in 2019, fueled by the growing demand for development land especially in the satellite towns, and the improving infrastructure, for instance, the dualling of the Northern Bypass, which on completion is expected to open up areas such as Ruaka for development, and the dualling of Ngong Road Phase 2, which will enhance access to areas such as Lang’ata, Karen and Dagoretti. The investment opportunity within the Nairobi Metropolitan Area land sector lies in satellite towns (unserviced land) such as Utawala and Limuru, and suburbs such as Karen, Kitisuru, Runda and Kilimani supported by the relatively high annual capital appreciation of above 10.0%;

Infrastructure Sector: We have a POSITIVE outlook for the infrastructure sector, given the demonstrated government commitment towards transforming the country to middle-income status by 2030 through infrastructural upgrades. We expect execution of the planned infrastructure development such as sewer connection in Ruiru and Kitengela, water improvement program and the ongoing road and power projects, which will open these areas for real estate development;

Listed Real Estate Sector: We retain a NEGATIVE outlook for the REIT market due to the insufficient market structures and poor market sentiment. We expect real estate stakeholders such as the East Africa Forum for Alternative Investments and REITs Association of Kenya to continue working at improving the market sentiment on REITs, coupled by government efforts to improve the regulatory structures surrounding the REIT market.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.9% p.a. To subscribe, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.9% p.a. To subscribe, email us at sales@cytonn.com;

- Rodney Omukhulu, Assistant Investments Analyst attended a Skype Interview on CNBC to discuss the stock market opening. Watch Rodney here;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

The year 2019 was characterized by a slow-down in global growth, which was weighed down by the negative effects of the trade conflicts among the major economies. These include: (i) the on-going trade dispute between the US and China, (ii) uncertainty in Britain over its exit from the European Union (“Brexit”), (iii) geopolitical tension between the US and Iran, disrupting the mid-stream and down-stream oil supply channel, and (iv) overall slowing global trade, which, according to the World Trade Organization, is estimated to have grown by 1.2% in 2019. According to the World Bank, global GDP growth in 2020 is expected to come in at 2.5%, a marginal increase from the estimated 2.4% in 2019, driven by the expectations that policy actions put in place, in an effort to ease trade tensions, will lead to a reduction in policy uncertainty.

Following the economic growth experienced in 2019, we look at the three key themes that we believe will shape the global markets in 2020:

- Global Trade to Pick-Up…

A sharp slowdown in the manufacturing sector, majorly experienced in advanced economies, has continued to weigh down on global trade. The poor performance in the manufacturing sector can be attributed to weakening demand in Europe and Asia, particularly for trade-intensive automobiles and technology products. Similarly, trade tensions between the US and China have escalated for the most part of 2019, and have resulted in significant aggregate losses for world trade. Despite this, the recent negotiations have led to a Phase One agreement, signaling a notable de-escalation of trade tensions. This will ultimately reduce the cost of international trade.

Similarly, trade policies will be the drivers of global trade and help promote it in the year 2020. For example, the Africa Continental Free Trade Agreement which was ratified in 2019, will establish the largest free trade area in the world, according to the United Nations Conference on Trade and Development (UNCTAD). It will cover 1.2 billion people and over USD 3.0 trillion in GDP. The agreement seeks to increase intra-African trade by cutting tariffs by 90.0% and harmonizing trading rules at a regional and continental level. Our expectation is that global trade is set to pick up during the year, pegged on how well the policies put in place will be implemented.

- Monetary Policy Easing…

Monetary policy stances are expected to ease in advanced economies. The US Federal Open Market Committee (FOMC) is expected to continue on the path towards spurring growth through the easing of monetary policy, and expected to maintain the Federal Funds Rate at between 1.50% - 1.75% in 2020, despite elections in 2020. The European Central Bank (ECB) is expected to maintain its benchmark interest rates for the main refinancing operations, marginal lending facility and the deposit facility at 0.0%, 0.25% and -0.50%, respectively, through the year, having considered that the overall fiscal position of the Euro Area is expected to be roughly balanced amongst the member countries, and ultimately providing little additional support to activity.

- Falling Commodity Prices…

Most global commodities registered declines in 2019, with agriculture, non-energy commodities, metals & minerals and Brent oil registering declines of 4.6%, 4.7%, 6.0%, and 11.8%, respectively, while energy was the biggest decliner falling by 14.9%, according to the World Bank Commodity Prices Index. Oil prices closed at USD 61.1 per barrel, having averaged USD 61.0 per barrel in 2019, and are projected to decline slightly to an average of USD 59.0 per barrel in 2020 and 2021, according to the World Bank. This performance was driven by production cuts by OPEC and its partners, coupled with constrained production in the Islamic Republic of Iran and Venezuela. These factors were however mitigated by the weakening oil demand. In 2020, the World Bank expects oil prices to decline slightly. Oil supply from the US is expected to continue increasing as a new pipeline capacity comes on stream, with the main downside risk being the further deterioration in growth and the geopolitical tensions between the US and Iran.

Having considered the two key factors that will drive Global Markets in 2020, we now look at specific economic regions and expectations for their GDP performance in 2020:

|

World GDP Growth Rates |

||||||

|

|

Region |

2016 |

2017 |

2018 |

2019e |

2020f |

|

1. |

China |

6.7% |

6.8% |

6.6% |

6.1% |

5.9% |

|

2. |

India |

7.1% |

7.2% |

6.8% |

5.0% |

5.8% |

|

3. |

Sub-Saharan Africa* |

1.3% |

2.7% |

2.6% |

2.4% |

2.9% |

|

4. |

Middle East, North Africa |

5.1% |

1.1% |

0.8% |

0.1% |

2.4% |

|

5. |

Brazil |

(3.3%) |

1.3% |

1.3% |

1.1% |

2.0% |

|

6. |

United States |

1.6% |

2.4% |

2.9% |

2.3% |

1.8% |

|

7. |

Euro Area |

1.9% |

2.5% |

1.9% |

1.1% |

1.0% |

|

8. |

South Africa (SA) |

0.6% |

1.4% |

0.8% |

0.4% |

0.9% |

|

9. |

Japan |

0.6% |

1.9% |

0.8% |

1.1% |

0.7% |

|

|

Global Growth Rate |

2.4% |

3.2% |

3.0% |

2.4% |

2.5% |

|

|

*including South Africa |

|

|

|

|

|

Source: World Bank

United States:

The US economy is expected to grow by 1.8% in 2020, 0.5% points slower than the estimated 2.3% growth in 2019. In mid-October 2019, the US Government started talks over the Phase One trade deal with China, which includes a partial rollback of tariffs which has since de-escalated trade tensions. Market expectations are for the Federal Reserve to maintain the Federal Funds Rate at the current banded range of 1.50% - 1.75%, a more accommodative policy given that 2020 is an electioneering year and the softening global economic prospects.

In 2020, the stock market is expected to be bearish, driven by the political uncertainty brought about by President Trump’s impeachment and the elections set for 2020. The recent agreement between the US and China, which has resulted in the de-escalation of trade tensions, will help mitigate this effect. According to Bloomberg, investors are set to earn much less in 2020 than they did in 2019, this they attribute to the downside risks associated with the electioneering period and fears of a global recession in 2020.

Eurozone:

The Eurozone is expected to grow by 1.0% in 2020, 0.1% points lower than the estimated 1.1% growth in 2019. This is mainly informed by weaknesses seen in several economies such as in Germany, where the industrial sector has been struggling with falling demand from Asia and disruptions in car production. The uncertainty around the Brexit also contributed to the slow growth. The ECB managed to restart quantitative easing by pushing its policy rate deeper into the negative territory, ultimately providing cheap credit to banks for onward lending.

The Stoxx 600 index gained by 24.6% in 2019. The P/E ratio currently at 15.0x, is 23.1% below the historical average of 19.5x, indicating markets are currently trading at relatively cheaper valuations. In 2020, the stock market is expected to be bullish, supported by reduced geopolitical tensions, following Britain’s General elections which have reduced uncertainty on Britain’s withdrawal from the EU (“Brexit”), coupled with the de-escalation of the US-China trade war achieved through the Phase One agreement.

China:

The Chinese economy is expected to grow by 5.9% in 2020, slower than the 6.1% expected growth in 2019, owing to cooling domestic demand and the existing trade tensions. Higher trade tariffs and trade policy uncertainty have weighed down on investor sentiment for the better part of 2019. Trade tensions between the US and China have escalated for the most part of 2019, and have resulted in significant aggregate losses for world trade. The recent negotiations have however resulted in a Phase One agreement signaling a notable de-escalation of trade tensions.

The Shanghai Composite index gained 25.2% during the year 2019. The gains were mainly supported by expectations of a positive outcome following the resumption of trade talks with the United States, coupled with increased capital injection by the government, which improved investor confidence. The P/E ratio currently at 14.7x, is 0.2% above the historical average of 14.5x, indicating that the market is currently trading at slightly more expensive valuations. In 2020, the stock market is expected to be bullishly supported by the renewed hope from the Phase One trade deal with the US, which had helped in de-escalating the trade tensions between the two countries.

In 2020, Sub Saharan Africa (SSA) is expected to register economic growth of 2.9%, higher than 2.4% expected in 2019 and 2.6% recorded in 2018, according to the World Bank in their Sub Saharan Economic Prospectus 2020. This is on the assumption that investor confidence improves in some large economies such as South Africa and Angola, a pickup in oil production and robust growth among agricultural commodity exporters such as Ethiopia. The forecast is lower than the initial 3.3% projection, mainly reflecting the expected softer demand from key trading partners such as China, and lower commodity prices. Nigeria’s economic growth is expected to come in at 2.1%, 0.1% points lower than the 2.2% expected in 2019. The slower growth will mainly be as a result of foreign exchange restrictions especially on the importation of food items and high persistent inflation which averaged 11.6% in 2019. South Africa’s GDP growth is expected to come in at 0.9% in 2020 from (2.6%) in 2019 assuming the new administration’s reform agenda gathers pace, policy uncertainty wanes, and investment gradually recovers. The slower pace of growth is mainly attributed to the infrastructure constraints majorly in electricity supply and weak export momentum hindered by weak external demand. Other countries expected to drive growth in 2020 are Rwanda, Ghana, Senegal and Kenya with expected economic growth rates of 8.1%, 6.8%, 6.8% and 6.0%, respectively, as per the World Bank Sub Saharan Economic Prospectus 2020. Despite the expected growth, the regional economic growth still faces downside risks, which include:

- Lower export revenues and investments mainly due to a sharp deceleration in major trading partners such as China, US, and the Eurozone countries,

- High levels of public debt in most economies in the region and sharp increases in interest burden, raising concerns about debt sustainability,

- Insecurity, conflicts, and insurgencies mainly in the Sahel region expected to weigh down economic activity in the affected region, and,

- Erratic weather patterns posing a significant downside risk to the agricultural sector, which is the backbone of many economies in the region

In 2019, the Kenyan economy recorded an average growth of 5.4% for the first three quarters of 2019, compared to an average of 6.0% in a similar period in 2018. The subdued growth was mainly as a result of (i) slowdown in agricultural activities due to delayed long rains, which curtailed agricultural production, and (ii) decreased output in transport and electricity activities, due to the rise in prices of fuel and insufficient long rains in the first and second quarters, respectively.

We project 2020 GDP growth to come in between 5.6% and 5.8%, supported by:

- Improvement in private sector credit growth, following the repeal of the interest rate cap, which is expected to improve market liquidity, coupled with improved access to credit by Micro, Small and Medium Enterprises (MSMEs). Banks will have sufficient margin to compensate for risks, and allocate funds away from the government towards lending,

- Stable growth of the agricultural sector, due to spillover effects from the heavy rains experienced in Q4’2019 and increased budgetary allocation to the sector for ongoing irrigation projects, strategic food reserves, cereal and crop enhancement and crop insurance schemes, in order to enhance food security and nutrition, which is a key pillar on the “Big 4 Agenda”, and,

- Public infrastructural investments are expected to be driven by the budgetary allocations in infrastructural projects, with the 2019/20 allocation increasing by 3.9% to Kshs 435.1 bn from Kshs 418.8 bn in 2018/19.

Risks abound to economic growth however include:

- Debt sustainability which continues to be a key concern, with the public debt to GDP ratio currently estimated at 62.0% and the Government having substituted the debt ceiling that was previously pegged at 50.0% of GDP to an absolute figure of Kshs 9.0 tn. One of the key elements of debt sustainability in any economy is the ability to service it, and this is usually measured by revenue collection to total outstanding payments required, both in principal and interest payments. In this Financial year, the Government had budgeted to pay Kshs 139.0 bn (USD 1.4 bn) in foreign interest coupled with the repayment of the principal loan extended to Kenya for the first phase of the mega railway project which will kick off this year after the expiry of a five-year grace period that Beijing had extended to Nairobi for the loans used to build the standard gauge railway (SGR) line. Pressure from debt repayment raises a concern of the Government funding the fiscal deficit in the FY’2019/20 budget, which might force a reduction in expenditure and in effect a decline in economic growth,

- The Kenyan Government has continued to stress out its fiscal consolidation strategy going forward in order to reduce country’s fiscal deficit, which is currently at 6.2% of GDP, from 7.7% in 2018/19, and against a target of 5.6% of GDP. This might adversely affect economic growth due to reduced government spending and in a bid to mitigate this, there are expectations of adoption of an accommodative monetary policy stance to support economic activity. We are of the view that accommodative monetary policy which is a strategy implemented by the Central bank in order to stimulate and encourage economic growth by lowering short term interest rates, however, cannot fully offset the impact of a fiscal tightening and as such this might lead to slower economic growth. We also believe that the Kenyan Government has limited fiscal space due to the continued underperformance of tax revenues, coupled with the pressure to plug in the fiscal deficit due to the expectations of reduced accessibility to local debt in the post rate cap era. This is in addition to pressure to meet the external borrowing with repayment of the principal loan extended to Kenya for the first phase of the mega railway project having kicked off this year after a five-year grace period that Beijing had extended to Nairobi for the loans used to build the standard gauge railway (SGR) line ended on 31st December 2019, and,

- Ongoing concerns on the sustainability of growth in some of the major sectors, which recorded subdued performance in 2019 such as the agricultural sector, manufacturing sector, taxes on products and tourism sector which recorded an average growth of 4.2%, 3.5%, 4.8%, 9.9% in the first 3 quarters of 2019, respectively down from 4.2%, 3.5%, 4.8% and 9.9% in a similar period of review in 2018.

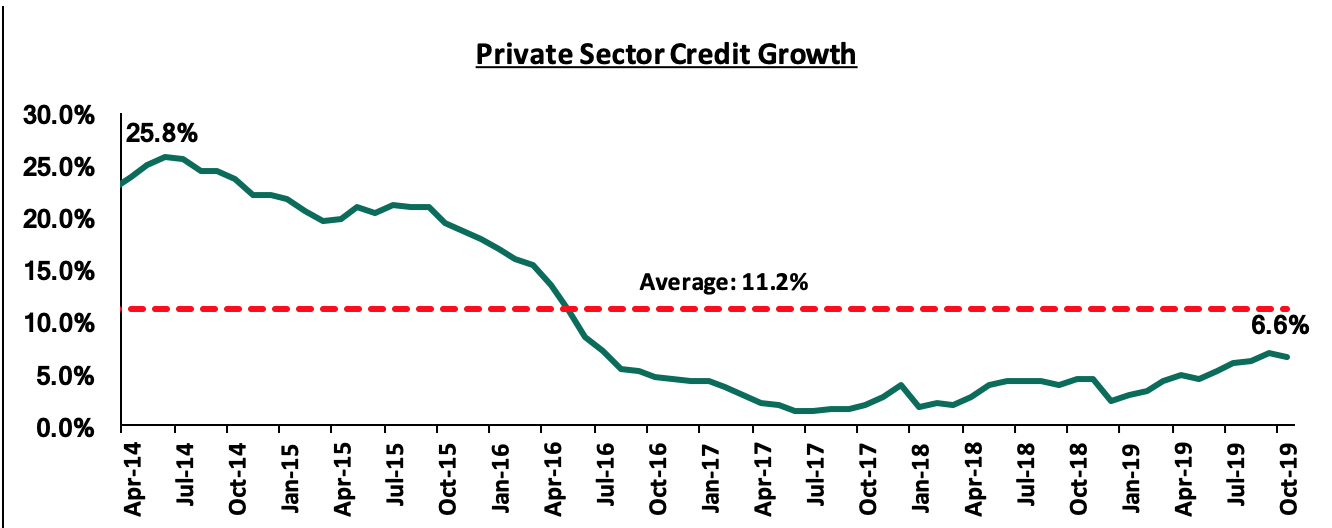

Private sector credit growth improved in 2019, averaging 4.2% in the 10-months to October, compared to 3.4% in a similar period in 2018, but remained below the 5-year average of 11.2%. The low credit growth had persisted since the enactment of the Banking (Amendment) Act, 2015, which made it difficult for banks to adequately price risk, prompting them to reassess their risk assessment framework, preferring to lend to the government where the returns were higher on a risk-adjusted basis, at the expense of the private sector. With the rate cap repeal and the ongoing reforms in the banking sector to strengthen the credit information sharing mechanism and promote transparency in pricing, we expect private sector credit growth to improve but remain well below the government target of 18.3%.

Currency:

The Kenyan Shilling remained resilient in 2019, appreciating by 0.5% against the USD during the year to close at Kshs 101.3, from Kshs 101.8 in 2018, mainly supported by inflows of hard currency from remittances by Kenyan workers abroad and offshore investors. On a YTD basis, the Kenyan Shilling has depreciated by 0.3% against the US Dollar.

We expect the shilling to remain stable within a range of Kshs 101.0 and Kshs 104.0 against the USD in 2020 with a bias to a 2.4% depreciation by the end of 2020.

We expect the pressure on the Kenyan shilling to arise from:

- Increased oil imports bill, as a result of the U.S - Iran diplomatic row, which has seen average crude oil prices increase by 9.9% to an eight-month high to USD 72.0 a barrel, from USD 65.5 a barrel in December 2019,

- Subdued diaspora remittances growth following the close of the 10.0% tax amnesty window in July which has seen cumulative diaspora remittances increase by a marginal 5.0% in the 12-months to November 2019 to USD 2.8 bn, from USD 2.7 bn, which was slower than the 40.8% growth recorded in a similar period of review in 2018 and the ongoing spat between U.S and Iran which could lead to a slowdown in diaspora remittances, and,

- Repayments of the principal loan extended to Kenya for the first phase of the mega railway project having kicked off this year which is expected to cause a decline in the country’s forex reserves with a good chunk of forex reserves in Kenya being from the issuance of debt.

Inflation:

In 2019, inflation averaged 5.2% compared to the 2018 average of 4.7%. Inflation rose towards the tail end of the year to 5.8% in December, mainly due to rising food prices.

We expect inflation to average 5.2% in 2020, within the government target range of 2.5% - 7.5% with inflationary pressure gradually easing off, due to improved agricultural production thus causing a decline in food prices following favorable weather conditions.

We expect inflationary pressure from an expected increase in fuel prices due to increased external uncertainties such as the current U.S-Iran diplomatic row.

Interest Rates:

Despite our expectations of a bias towards expansionary monetary policy in 2020 to support economic activity, we still expect upward pressure on interest rates due to increased pressure on the government to meet its domestic borrowing target to plug in the fiscal deficit, in the current post- interest rate cap era.

According to the 2019 Budget Review and Outlook Paper, total revenues for the FY’2019/20 are projected at Kshs 2.1 tn (equivalent to 20.2% of GDP), with ordinary revenues at Kshs 1.9 tn (equivalent to 17.9% of GDP).

The fiscal deficit is therefore projected at Kshs 640.2 bn (equivalent to 6.2% of GDP), which is expected to be financed by net external financing of Kshs 331.3 bn (equivalent to 3.2% of GDP), and Kshs 305.7 bn (3.0% of GDP) from domestic borrowing. Following the repeal of the interest rate cap repeal, which will now allow banks to price risk and thus admit riskier borrowers including SMEs and individuals, we expect to see a reduction in subscription rates for government securities as banks increase their focus on private sector lending. This was also recorded in the tail end of 2019 where T-bill subscription in the primary auction market declined from an average of 125.4%, from January 2019 to November 7th 2019 before the repeal of the rate cap, to 48.4% for the post interest rate cap period between November 7th 2019 and 31st December 2019.

Considering banks are the largest holders of domestic debt, we expect this to force an upward readjustment on the yield curve in order to incentivize more uptake.

The table below summarizes the various macro-economic factors and the possible impact on the business environment in 2020. With three indicators being positive, three at neutral and one negative, the general outlook for the macroeconomic environment in 2020 is NEUTRAL.

|

Macro-Economic & Business Environment Outlook |

||

|

Macro-Economic Indicators |

2020 Outlook |

Effect |

|

Government Borrowing |

• With the expectations of KRA not achieving the revenue targets, we expect this to result in further widening of the fiscal deficit which ought to be plugged • On the domestic front, due to the rate cap repeal, we expect banks to increase their credit accessibility and admit riskier borrowers including SMEs and individuals, which will see a reduction in subscription rates for government securities • On the foreign front repayment of the principal loan extended to Kenya for the first phase of the mega railway project kicks off this year after a five-year grace period that Beijing had extended to Nairobi for the loans used to build the standard gauge railway (SGR) line ended on 31st December 2019 which will see Loan repayments to China’s Exim Bank jump by 130.0% to Kshs 71.4 bn in the current financial year from the Kshs 31.0 bn paid in the last fiscal year putting more pressure on the Government in meeting the foreign debt target |

Negative |

|

Exchange Rate |

• We project that currency will range between Kshs 101.0 and Kshs 104.0 against the USD in 2019, with continued support from the CBK in the short term through its sufficient reserves currently at USD 8.8 bn (equivalent to 5.4-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover |

Neutral |

|

Interest Rates |

• Despite the expectations of a bias towards expansionary monetary policy in 2020, we expect slight pressure on interest rates following the repeal of the interest rate cap which in effect is expected to result in increased competition for bank funds from both the private and public sectors as the Government tries to raise funds to plug in the budget deficit |

Neutral |

|

Inflation |

• We expect inflation to average 5.2% and within the government target range of 2.5% - 7.5% |

Positive |

|

GDP |

• We project GDP growth for 2020 to come in at 5.7%, slightly higher than our 5.6% 2019 expectations, but similar to the 5-year historical average of 5.7% |

Neutral |

|

Investor Sentiment |

• We expect 2020 to register improved foreign, mainly supported by long term investors who enter the market looking to take advantage of the current low/cheap valuations in select sections of the market |

Positive |

|

Security |

• We expect security to be maintained in 2020, especially given that the political climate in the country has eased |

Positive |

The two changes from last year’s outlook are:

- GDP to neutral from positive in 2019 necessitated by the government’s fiscal consolidation strategy going forward in order to reduce country’s fiscal deficit, which might adversely affect economic growth due to reduced government spending and existing concerns on the sustainability of growth in some of the major sectors which recorded subdued performance in 2019 such as the agricultural sector, manufacturing sector, taxes on products and tourism sector, and,

- Investor sentiment also changed to positive from neutral in 2019, necessitated by the increased net foreign inflows in the equity markets as well as the reduced risk perception, which has seen the country’s credit rating by Fitch Ratings come in at B+ highlighting the country’s stable outlook.

Out of the seven metrics that we track, three have a positive outlook while three have a neutral outlook and one has a negative outlook, unchanged from last year where three had a positive outlook, three had a neutral outlook and one had a negative outlook. However, the general outlook for macroeconomic environment changes to NEUTRAL for 2020, from POSITIVE in 2019.

Eurobond Yields:

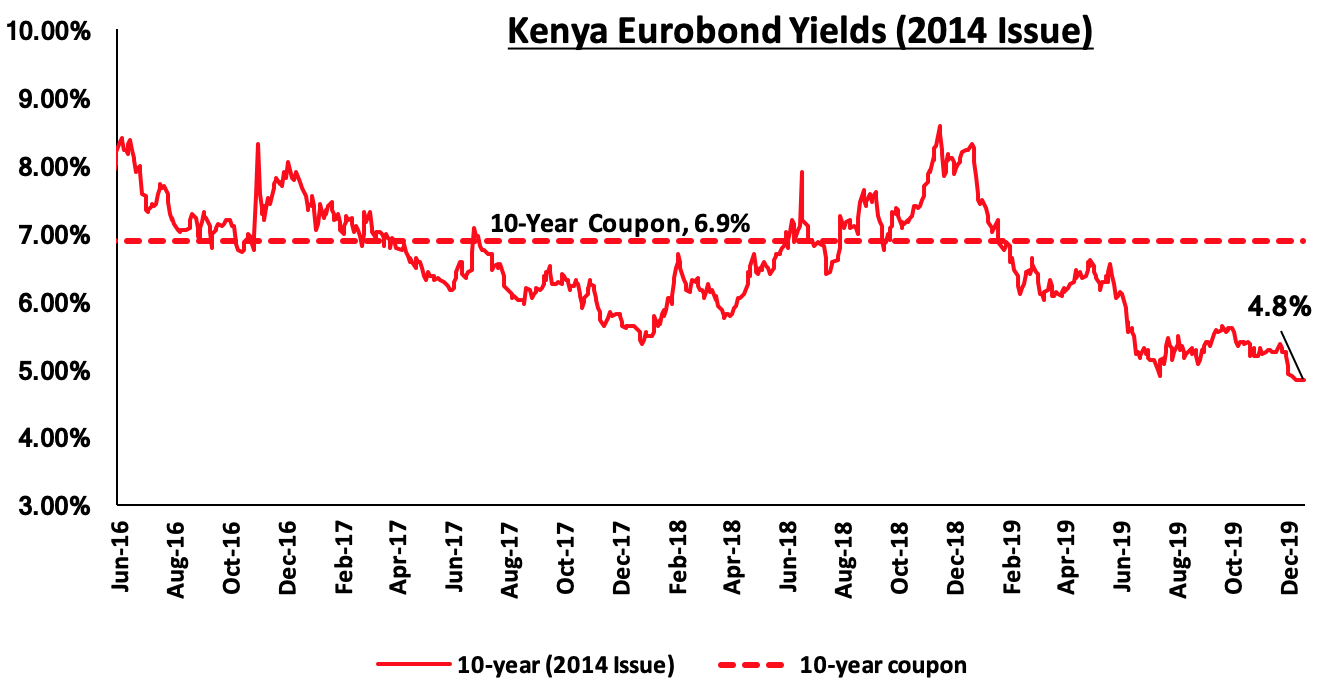

According to Reuters, yields on the 10-year Eurobond issued in 2014 decreased by 3.5% points to close at 4.8% at the end of 2019, from 8.3% at the end of 2018. With Rating agencies Moody’s and Fitch Ratings having retained the country’s credit at “B2” and “B+”, respectively, highlighting the country’s stable outlook, we do not expect investors to attach a higher risk premium on the country and as such the yields to remain stable. Risks are however abounded due to concerns on the country’s debt sustainability with the debt to GDP ratio in 2019 estimated at 62.0%. According to the IMF, the target debt to GDP for developing countries should be at or below 50.0%, meaning that the current debt level in the country has surpassed the standard set by the global lender, and this may pose fiscal challenges if mechanisms are not put in place to improve on Kenya’s fiscal and public finance management framework.

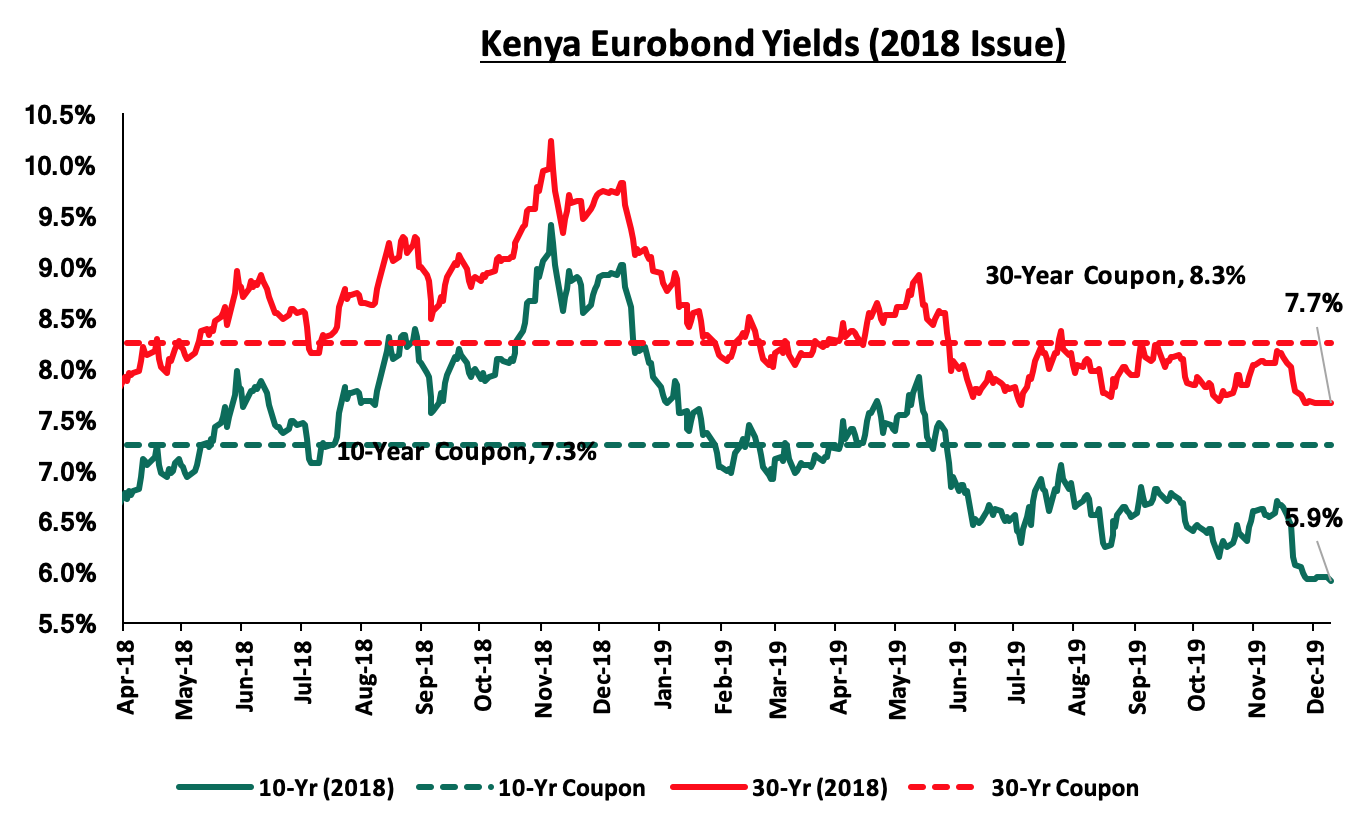

For the February 2018 Eurobond issue, the yields on the 10-year Eurobond and the 30-year Eurobond have declined by 3.1% points and 2.1% points to close the year at 5.9% and 7.7% from a yield of 9.0% and 9.8% at the close of 2018, respectively.

For the May 2019 dual-tranche Eurobond issue, the yields on the 7-year Eurobond and the 12-year Eurobond have declined by 1.2% points and 1.1% points to close the year at 5.8% and 6.9% from a yield of 7.0% and 8.0% when they were first issued in 2019, respectively.

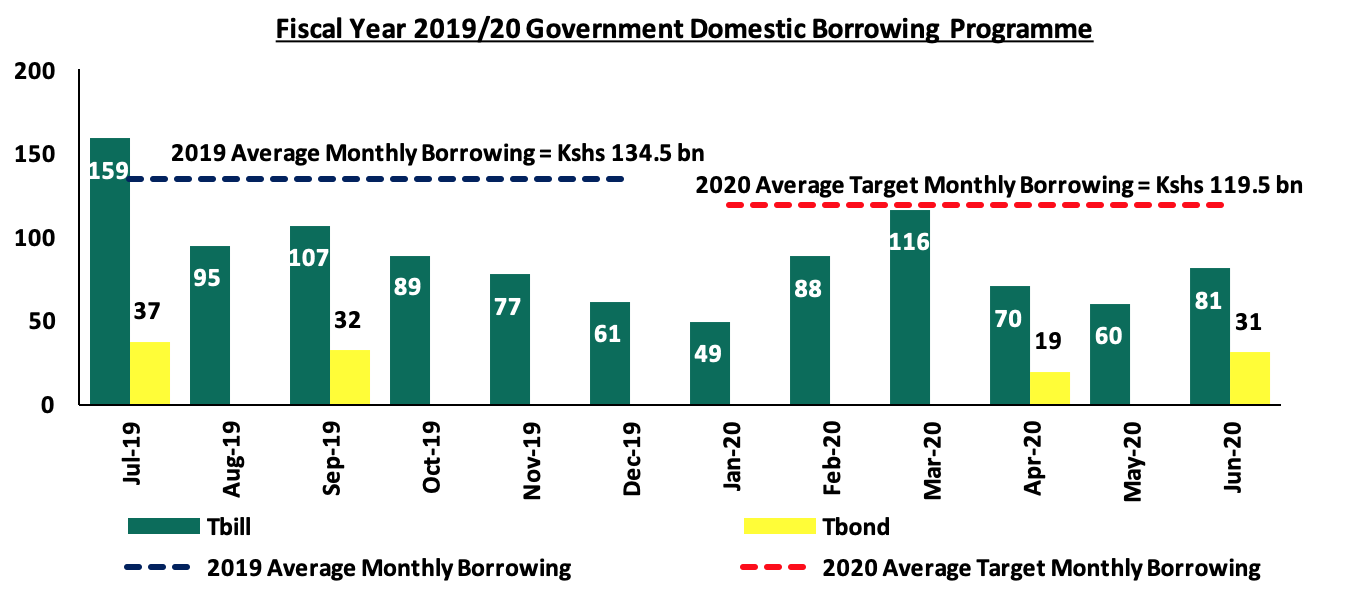

The government is currently 8.6% behind its prorated domestic borrowing target, currently having borrowed Kshs 153.1 bn domestically, against the pro-rated target of Kshs 167.5 bn, going by the revised government domestic borrowing target of Kshs 300.3 bn as per the Budget Review and Outlook Paper (BROP) 2019. In order to meet the domestic borrowing target, the government has to borrow an average of Kshs 119.5 bn on a monthly basis, in the 2nd half of the current fiscal year. We expect upward pressure on interest rates following the repeal of the interest rate cap, which in effect is expected to result in increased competition for bank funds from both the private and public sectors as it will allow banks to price risk appropriately and thus admit riskier borrowers including SMEs and individuals. Since its repeal, T-bill subscription in the primary auction market has declined from an average of 125.4%, from January 2019 to November 7th 2019 before the repeal of the rate cap, to 48.4% in the post interest rate cap period between November 7th 2019 and 31st December 2019. Considering Banks are the largest holders of domestic debt, we expect this to force an upward readjustment on the yield curve to incentivize more uptake.

Below is a summary of treasury bills and bonds maturities and the expected borrowings over the same period. The government will need to borrow Kshs 119.5 bn on average each month for the rest of the fiscal year to meet the revised domestic borrowing target of Kshs 300.3 bn, and cover T-bill and T-bond maturities, as illustrated in the graph below:

Fig: Schedule of Treasury bills and bonds maturities and the expected target borrowings in the 2019-2020 fiscal year to cater for the maturities and additional government borrowing.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 8.6% behind its domestic borrowing target, having borrowed Kshs 153.1 bn against a pro-rated target of Kshs 167.5 bn. We expect an improvement in private sector credit growth considering the repeal of the interest rate cap. This will result in increased competition for bank funds from both the private and public sectors, resulting in upward pressure on interest rates.

OUR VIEW IS THAT INVESTORS SHOULD BE BIASED TOWARDS SHORT-TERM FIXED-INCOME SECURITIES TO REDUCE DURATION RISK.

In 2019, the Kenyan equities market recorded mixed performance, with NASI and NSE 25 gaining by 18.5% and 15.5%, respectively, while NSE 20 declined by 6.3%. Since the peak in February 2015, NASI and NSE 20 are down 20.9% and 48.4%, respectively. Large-cap gainers in 2019 included Equity Group, KCB Group, Safaricom, NCBA, Barclays, Co-operative Bank and EABL, which gained by 53.5%, 44.2%, 41.9%, 32.6%, 21.9%, 14.3% and 13.6%, respectively, while the largest losers were Bamburi, BAT and, DTBK which lost (39.6%), (31.0%), and (30.4%) in 2019, respectively.

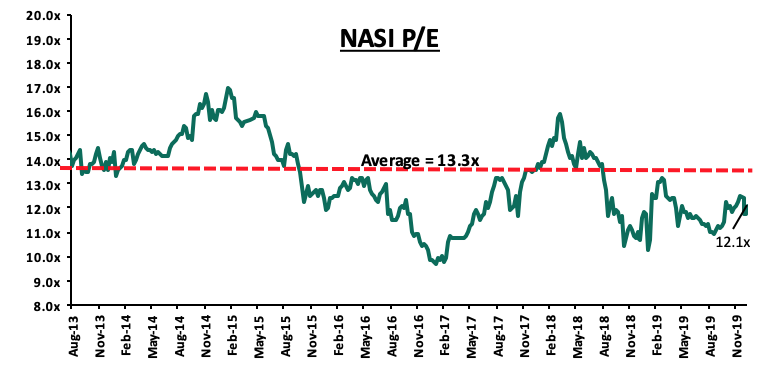

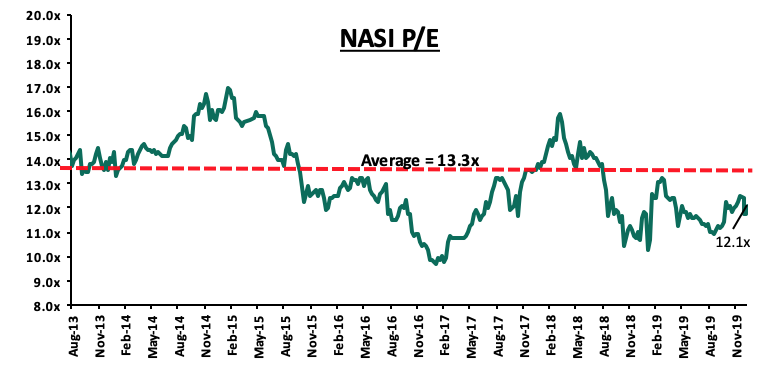

Following poor performance in the equities market in the first half of 2019, the market valuation declined to below its historical average with NASI price to earnings ratio (P/E) currently at 12.1x, 9.1% below the historical average of 13.3x, and a dividend yield of 5.5%, 1.6% points above the historical average of 3.9%. Equity turnover in 2019 declined by 12.9% to USD 1.5 bn, from USD 1.7 bn in FY’2018. Foreign investors turned net buyers, with a net inflow of USD 18.5 mn, compared to net outflows of USD 425.6 mn recorded in FY’2018. The foreign investor inflows during the year can be attributed mainly to the improved financial performance of listed commercial banks in the country, coupled with the repeal of the rate cap law in the last quarter of the year, which led to increased foreign activity in the local bourse.

In 2019, 10 companies issued profit warnings to investors compared to 8 companies in 2018, attributable to the tough macro-economic environment during the year. Companies are required to issue profit warnings if they project a more than 25% decline in profits year-on-year. They include Nairobi Stock Exchange (NSE), BOC Kenya, UAP Holdings Limited, KPLC, Eaagads, Williamson Tea, Standard Group, CIC Insurance, Kenya Airways, and Kapchorua Tea. Kenya Power and Lighting Company issuing consecutive warnings over the last 2-years. The table below shows companies that have issued profit warnings in 2019 and those that issued profit warnings in 2018;

|

Comparison: Companies that Issued Profit Warnings 2019 vs 2018 |

|||

|

No |

2019 |

No |

2018 |

|

1 |

Nairobi Stock Exchange |

1 |

Bamburi Cement |

|

2 |

BOC Kenya Plc |

2 |

Britam Holdings |

|

3 |

UAP Holdings Limited |

3 |

HF Group |

|

4 |

Kenya Power and Lighting Company |

4 |

Deacons East Africa Plc |

|

5 |

Eaagads |

5 |

Kenya Power and Lighting Company |

|

6 |

Williamson Tea Kenya |

6 |

Sanlam |

|

7 |

Standard Group Plc |

7 |

UAP-Old Mutual |

|

8 |

CIC Insurance |

8 |

Sameer Africa |

|

9 |

Kenya Airways |

|

|

|

10 |

Kapchorua Tea Company |

|

|

Market Performance

During the week, the equities market recorded mixed performance with NASI, and NSE 25 recording gains of 2.4% and 1.7%, respectively, and NSE 20 declining by 0.3%, taking their YTD performance to gains of 3.0%, 1.8% and 2.6%, for the NASI, NSE 20 and NSE 25, respectively. The performance in NASI was driven by gains recorded by large-cap stocks such as Diamond Trust Bank Kenya, Safaricom and EABL of 10.3%, 4.1%, and 3.3%, respectively.

Equities turnover increased by 342.1% during the week to USD 26.3 mn, from USD 6.0 mn the previous week, taking the YTD turnover to USD 28.7 mn. Foreign investors became net buyers for the week, with a net buying position of USD 0.8 mn, an improvement from a net selling position of USD 0.2 mn recorded the previous week.

The market is currently trading at a price to earnings ratio (P/E) of 12.1x, 9.1% below the historical average of 13.3x, and a dividend yield of 5.5%, 1.6% points above the historical average of 3.9%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 12.1x is 24.6% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 45.7% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

Following the acquisition of National Bank of Kenya (NBK) by KCB Group in 2019, this week, KCB further injected Kshs 5.0 bn into the subsidiary, which was in breach of various capital adequacy ratios. According to NBK’s Q3’2019 financial results, its core capital liabilities ratios, core capital risk-weighted assets ratio and total capital risk-weighted ratio were 6.8%, 9.0% and 11.6% below the minimum statutory requirements of 8.0%, 11.0% and 15.0%, respectively. Prior to the capital injection, with a Non-Performing Loan (NPL) ratio of 47.9% in Q3’2019, NBK’s bad debts stood at Kshs 31.4 bn. Hence, before capitalization, KCB Group had indicated that it will employ aggressive strategies to recover as well as write down key NPLs and consequently, set up effective loan portfolio management measures to maintain a favorable loan portfolio quality. We expect that with the injection, NBK will be well-capitalized to continue its operations separately. KCB Group’s profitability, on the hand, will be affected as it cleans up NBK’s books. However, we expect the rate cap repeal will help it absorb the restructuring costs that will arise.

Kenya Equities Outlook

In 2020, the factors that will affect the direction of the Kenyan equities market include:

- Corporate Earnings: On average, we expect earnings growth for the year 2020 to come in at 12.4%, higher than our 2019 expectation of 8.1%. The expectation of higher earnings growth for 2020 is mainly due to the anticipation of improved earnings from commercial banks buoyed by increased lending and asset growth, due to the repeal of the rate cap law. Going forward, banks will be able to price loans based on the credit risk of borrowers and thus, benefit from higher Net Interest Margins (NIM). Further, the repeal of the rate cap law is expected to increase credit flow that will aid the recovery of various sectors such as manufacturing and commercial;

- Valuations: The market is currently trading at a P/E of 12.1x, with an expected earnings growth of 12.4%, the market is currently trading at a Forward P/E of 10.8x, representing a potential upside of 23.0% compared to historical levels;

- Capital Markets Investor Sentiment: We expect the equities market to register increased foreign inflows in 2020, mainly supported by:

- Existence of value to be derived from stocks, with the market, and various counters trading at cheaper valuations relative to historical levels, which provide attractive entry opportunities for medium and long-term investors,

- With the uncertainty in the global economy on account of the unresolved U.S-China trade war and the recent tensions between the U.S and Iran, we expect increased capital flight to frontier and emerging economies from developed economies, and,

- Generally, Kenya remains more attractive compared to other frontier markets boosted by stronger economic growth compared to other economies in the region such as Nigeria. Furthermore, Kenya’s rank at position 56 globally and 4th in Sub-Saharan Africa in the 2020 Ease of Doing Business report, higher than regional peers Uganda and Tanzania, will attract investors seeking the high growth in frontier markets;

- Diversification of Capital Markets and New Listings: We expect several activities to be undertaken by NSE in 2020 including; (i) increasing the number of Single Stock Futures traded on the derivatives market. Currently, the bourse offers 6 Single Stock Futures namely Safaricom Plc, Kenya Commercial Bank Group Plc, Equity Group Holdings Plc, East African Breweries Ltd, Barclays Bank of Kenya and British American Tobacco Plc, and (ii) possible listing of companies currently engaged in the Ibuka program, which aims to enhance the visibility of private companies with high growth prospects, with the NSE aiming to list at least one firm from the program by the end of Q1’2020;

It is our view that these initiatives would result in; (i) increased liquidity in the market by increasing the volume of securities available for trading, and (ii) improved depth in the capital market by increasing product offerings at the exchange, consequently attracting investors. However, there are key challenges the local capital market faces; (i) reluctance to identify and implement innovative measures to attract potential issuers, (ii) increased popularity of private equity firms that provides easily accessible capital to SMEs, (iii) a capital markets infrastructure, governance and culture that favors banking products rather than capital markets is not conducive to markets growth, and (iv) low uptake of the new products introduced in the exchange attributable to increased competition from other investment vehicles that provide better short-term returns such as gambling. We maintain our view that there remains the need for increased focus towards extensive investor education and public awareness initiatives, and engagement before rolling out new products;

- Monetary Policy Direction: Following the repeal of the interest rate caps in November 2019, in 2020, we expect monetary policy to remain relatively stable in the short term, and a slight upward pressure later in the year due to efforts by the Government to meet its domestic borrowing target in order to plug in the fiscal deficit. The inflation rate is expected to average 5.2% in 2020, within the government target range of 2.5% - 7.5% with inflationary pressure gradually easing off, due to improved agricultural production thus causing a decline in food prices following favorable weather conditions, while the currency is expected to remain stable supported by CBK’s intervention activities, improving diaspora remittances, continued narrowing current account deficit, and foreign capital inflows with investors looking to participate in the equities market.

As can be seen in the table below, we expect equities market activity in 2020 to be driven by; (i) a stable macro-economic environment, with the GDP growth rate for the year projected to come in at 5.7%, slightly higher than our 5.6% 2019 expectations, supported by increased productivity from 2019 spillovers, following the heavy rains experienced in Q4’2019. 2019 saw the delayed onset of the traditional long rains which adversely affected the performance of the Agricultural sector, (ii) a 12.4% growth in corporate earnings, (iii) attractive valuations in a majority of the counters, with the market currently trading at P/E of 12.1x, 9.1% below the historical average of 13.3x, thereby providing attractive entry point, and possibly a higher capital appreciation gain potential, and (iv) strong foreign inflows following the repeal of the rate cap law.

|

Equities Market Indicators |

Outlook for 2020 |

Current View |

|

Macro-Economic Environment |

· We expect growth to remain stable in 2020, with the GDP growth rate projected to come in at 5.7%, slightly higher than our 5.6% 2019 expectations, supported by increased productivity from 2019 spill overs, following the heavy rains experienced in Q4’2019. 2019 saw the delayed onset of the traditional long rains which adversely affected the performance of the Agricultural sector |

Positive |

|

Corporate Earnings Growth |

· We expect corporate earnings growth to average 12.4% in 2020, higher than the expected 8.1% growth for 2019 driven by the repeal of the interest rate cap law which is expected to improve credit flow that will aid the recovery of various sectors such as manufacturing and commercial. Increased lending will positively affect the performance of commercial banks |

Positive |

|

Valuations |

· With the market currently trading at a P/E of 12.1x, and expected earnings growth of 12.4%, the market is currently trading at a Forward P/E of 10.8x, representing a potential upside of 23.0% compared to historical levels |

Positive |

|

Investor Sentiment and Security |

· We expect 2020 to register strong foreign interest with the repeal of the interest rate cap law · We believe pockets of value still exist in the equities market, more so, following a poor performance in the first half of 2019 which saw the market valuation declining below its historical average, with NASI price to earnings ratio (P/E) currently at 12.1x, 9.1% below the historical average of 13.3x · We expect security to be maintained in 2020, especially given that the political climate in the country has eased |

Positive |

Out of the four metrics that we track, all have a positive outlook. Compared to 2019, we have maintained our positive outlook on the macroeconomic, corporate earnings growth, valuations of the market and investor sentiment and security. As such in consideration of the above, we have a “POSITIVE” outlook on Kenyan equities going into 2020.

Universe of Coverage

|

Banks |

Price at 03/01/2020 |

Price at 10/01/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

3.1 |

3.0 |

(2.3%) |

(1.7%) |

3.0 |

4.8 |

15.1% |

76.2% |

0.3x |

Buy |

|

Diamond Trust Bank |

110.0 |

120.3 |

9.3% |

10.3% |

109.0 |

189.0 |

2.2% |

59.3% |

0.6x |

Buy |

|

I&M Holdings*** |

55.8 |

58.0 |

4.0% |

7.4% |

54.0 |

75.2 |

6.7% |

36.4% |

1.0x |

Buy |

|

Jubilee Holdings |

350.0 |

360.0 |

2.9% |

2.6% |

351.0 |

453.4 |

2.5% |

28.4% |

1.2x |

Buy |

|

Sanlam |

18.0 |

17.1 |

(5.3%) |

(0.9%) |

17.2 |

21.7 |

0.0% |

27.3% |

0.7x |

Buy |

|

KCB Group*** |

55.0 |

55.0 |

0.0% |

1.9% |

54.0 |

64.2 |

6.4% |

23.1% |

1.5x |

Buy |

|

Co-op Bank*** |

16.6 |

16.5 |

(0.3%) |

0.9% |

16.4 |

18.1 |

6.1% |

15.8% |

1.4x |

Accumulate |

|

Standard Chartered |

204.3 |

206.0 |

0.9% |

1.7% |

202.5 |

211.6 |

9.2% |

11.9% |

1.6x |

Accumulate |

|

Equity Group*** |

55.0 |

54.8 |

(0.5%) |

2.3% |

53.5 |

56.7 |

3.7% |

7.2% |

2.1x |

Hold |

|

Barclays Bank*** |

13.4 |

13.3 |

(0.4%) |

(0.4%) |

13.4 |

13.0 |

8.3% |

6.0% |

1.7x |

Hold |

|

NCBA |

37.3 |

36.5 |

(2.1%) |

(0.9%) |

36.9 |

37.0 |

4.1% |

5.5% |

0.8x |

Hold |

|

Liberty Holdings |

10.5 |

10.5 |

(0.5%) |

1.0% |

10.4 |

10.1 |

4.8% |

1.1% |

0.9x |

Lighten |

|

Stanbic Holdings |

103.8 |

107.8 |

3.9% |

(1.4%) |

109.3 |

103.1 |

4.5% |

0.1% |

1.1x |

Lighten |

|

CIC Group |

3.0 |

3.0 |

0.3% |

12.3% |

2.7 |

2.6 |

4.3% |

(8.0%) |

1.1x |

Sell |

|

HF Group |

6.6 |

5.7 |

(13.1%) |

(11.8%) |

6.5 |

4.2 |

0.0% |

(26.3%) |

0.2x |

Sell |

|

Britam |

9.4 |

9.5 |

1.1% |

5.8% |

9.0 |

6.8 |

0.0% |

(29.1%) |

1.0x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/ or its affiliates are invested in |

||||||||||

We are “Positive” on equities for investors with a medium-term to long-term investment horizon as the sustained price declines have seen the market P/E decline below its historical average. With the repeal of the rate cap, we expect increased market activity, and increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

In 2019, the real estate sector grew by 4.8% on average from Q1’2019 to Q3’2019, 0.3% points higher than the growth rate recorded over the same period in 2018, according to Kenya National Bureau of Statistics (KNBS) Quarterly Gross Domestic Product Report Q3'2019. The growth was supported by:

- Continued National Government support for the affordable housing initiative,

- Increased entry of multinational corporations and retailers into the country,

- Infrastructural improvements, boosting Nairobi’s positioning as a regional hub,

- Rapid population growth, creating demand for more properties, especially housing, and,

- Improving macroeconomic environment, with the country’s GDP growing by 6.3% in 2018, 1.4% points higher than the 4.9% recorded in 2017 and is expected to come in at 5.6% in 2019 according to Cytonn Research.

In terms of performance, commercial office, retail, residential, mixed-use developments and serviced apartments sectors registered average rental yields of 7.5%, 7.8%, 5.0%, 7.3%, and 7.6%, respectively, resulting to an average rental yield for the real estate market of 7.0%, 0.4% points lower compared to 7.4% recorded in 2018. Therefore, with a capital appreciation for existing properties at 2.0%, average total returns came in at 9.0%, 2.2% points decline from 11.2% recorded in 2018. For a detailed review of 2019 performance, see Cytonn Annual Real Estate Markets Review Note 2019.

In 2020, we expect the key drivers of real estate to be as follows:

- Improving Macroeconomic Environment - The country’s GDP grew by 6.3% in 2018, 1.4% points higher than the 4.9% recorded in 2017 and is expected to come in at 5.6% and 5.7% in 2019 and 2020, respectively, according to Cytonn Research. We expect that the improvement will enhance the growth of business and thus increased real estate activities,

- Attractive Demographic Profile – Demographic trends such as (i) rapid urbanization, currently at 4.3% p.a. in Kenya, against global and Sub-Saharan averages of 2.0% and 4.1%, respectively, (ii) an expanding middle class evidenced by growth in net disposable income, which increased to Kshs 7.1 tn in 2017 from Kshs 6.6 tn in 2016, and (iii) rapid population growth rates currently at 2.2%, 1.3% points higher than global averages of 0.9%, will continue to support demand in the real estate sector, and,

- Sustained Infrastructural Development – The government increased the 2019/2020 budget allocation towards infrastructural development to Kshs 435.1 bn, 3.9% higher than 418.8 bn allocated for FY 2018/19, which shows the government’s efforts aimed at transforming the country to middle-income status by 2030 through infrastructural upgrades, which we expect will continue opening up new areas for real estate development and boosting performance in upcoming markets, especially satellite towns in Kenya.

Despite the above drivers, the sector is expected to be constrained by the following factors in 2020;

- Delay in Processing of Construction Permits - Continued delays in the processing of construction permits by some Kenyan County Governments, namely, Nairobi, Kisumu, Kiambu, and Mombasa, was a major setback for private developers in 2019 as it resulted in prolonged project implementation timelines. Given that the issue is yet to be resolved, we expect this to continue crippling the sector in 2020,

- Oversupply in Select Sectors - The real estate sector has witnessed increased space supply over the last 5-years;

- Increased supply in the middle and high-end residential sector (houses with prices above Kshs. 119,535 per SQM) with a decreasing effective demand, hence recording 3.4% points decline in annual uptake from 22.8% in 2018 to 19.4% in 2019,

- The commercial office sector has an oversupply of 5.2 mn SQFT and this is expected to grow to 5.6 mn SQFT in 2020, with completion of buildings such as Kenya Institute of Supplies Management (KISM) headquarters along Ngong Road and Parliament Tower in the CBD, and,

- The retail sector, which has an existing oversupply of 2.8 mn SQFT.

- Inaccessibility and Unaffordability of Off-take financing - Access to mortgages in Kenya remains low mainly due to; (i) low-income levels that cannot service a mortgage, (ii) relatively high property prices, (iii) high interest rates and deposit requirements which lock out many borrowers, (iv) exclusion of the informal sector due to insufficient credit risk information, and (v) lack of capital markets funding towards real estate purchases for end buyers. According to Central Bank of Kenya, there were only 26,504 active mortgage accounts in Kenya as at December 2018 against a total adult population of approximately 23 mn persons, leading to low real estate uptake,

- Ineffectiveness of Public-Private Partnerships (PPPs) for Housing Development - The government has previously enlisted the help of the private sector for financing and development of affordable housing. This has however not achieved the optimal intended objective this far as a result of; (i) regulatory hindrances such as lack of a mechanism to transfer public land to a Special Purpose Vehicle (SPV) to facilitate access to private capital through the use of the land as security, (ii) lack of clarity on returns and revenue-sharing, (iii) the extended time-frame of PPPs while private developers prefer to exit projects within 3-5 years, and (iv) bureaucracy and slow approval processes,

- Despite being successfully launched in 2019, we expect the KMRC to face challenges such; (i) difficulty in raising funds through issuing of bonds, due to competition from government instruments such as treasury bills and government stocks, (ii) prolonged due diligence processes due to bureaucracy in departments offering critical services such as registration of properties, (iii) lack of access to long term funding, and (iv) a high cost of debt as the investors of the mortgage-backed bonds are likely to demand a relatively high rental yield of approximately 13.5%%, assuming a 1.0%-point margin above the minimum of the risk-free rate for a 15-year bond, which currently stands at 12.5%, yet KMRC’s target is providing mortgages at 9.0% interest. For more details, see our KMRC Topical,

- The unavailability of proper guidelines on the way forward for the newly approved institutions that can hold Home Ownership Savings Plan (HOSP) deposits. These include; (i) the general framework for business principles and general contract terms with respect to institutions that offer HOSPs, (ii) rules on permissible business activities by the Fund Managers, (iii) approved methods of investing the savings whether in the stock market or government securities, and (iv) guidelines on granting of loans after the ten years have elapsed and the appropriate loan-to-value ratio. For more details, see HOSP Update Topical, and

- Restrictive Capital Markets Structure: The current capital markets structure is restrictive for market players looking to raise capital and deploying it towards real estate. The primary reason for the same is that Kenyan businesses currently face challenges raising capital due to dominance by the banking sector, and a framework that favors banking products. Some of the challenges include:

- Conflicts of interest as only banks are currently licensees to be Trustees of Collective Investment Schemes (CIS’s) in Kenya, and this can lead to frustration of market players,

- There are players in the banking sector that are firmly in control of the capital markets. Similar to the way the banking sector has undergone reforms and in recent times been liberalized, there need to be similar reforms in the capital markets,

- A lot of capital raised towards real estate comes in the form of private offers. However, there is still not a lot of clarity on private offers and private equity for raising capital towards real estate, which needs to be provided, as not every offer needs to be regulated. This will ultimately lead to more private sector players raising and deploying capital to real estate, and,

- In order to spur deployment of capital towards growing home ownership, the Finance Bill of 2019 had a number of key measures. One of which was Inclusion of Unit Trust Fund Managers as Registered Home Ownership Savings Plan in the Finance Bill 2019. However, unless operationalized and specialized funds approved by CMA, there will be no benefit towards the Affordable Housing Big 4 Agenda. The effective date was January 1, 2020 and there has been no movement at all.

In 2020, some of the key factors expected to shape the real estate sector include;

- The Affordable Housing Initiative - The Kenyan Government’s affordable housing initiative focused on delivering 500,000 units by end of 2022, is expected to push developers’ effort towards provision of more housing for the lower middle- and low-income earners’ segment. In support of the initiative, several tax incentives through the Financial Act of 2019, which include:

For developers:

- A reduction in the Import Declaration Fee (IDF) on inputs for the construction of houses under the affordable housing scheme approved by the CS Finance from 2.0% to 1.5%,

- Exemption of companies implementing projects under the affordable housing scheme from the application of thin capitalization rules, and,

- Exemption of goods supplied for the direct and exclusive use houses under the affordable housing scheme approved by the Cabinet Secretary (CS) for Finance from Value Added Tax (VAT).

For home buyers:

- An exemption of stamp duty for the transfer of a house constructed under the affordable housing scheme,

- Exemption from income tax of withdrawals from the NHDF to purchase a house by a first-time home owner, and,

- Exemption of the National Housing Development Fund from income Tax.

With the above tax and policy reforms, we expect more potential homeowners to join the affordable housing program in 2020, given the significantly reduced financial burden in the strive towards home ownership, and developers and other private sector players taking up affordable housing projects as they are bound to maximize on the reduced costs.

In addition, the government allocated Kshs 10.5 bn of the Kenya National Budget 2019/20 in support of the initiative.

- Improved Mortgage Market – Following the National Treasury’s launch of the Kenya Mortgage Refinancing Company (KMRC) in 2019 and its successful mobilization of capital, we expect the institution to become fully operational in 2020, stimulating the mortgage market by enabling lenders to offer long-term mortgages. In addition, we expect the recent interest rate cap repealing will result in borrowers being able to access housing finance as banks increase credit advancement to the private sector,

- Devolution - Devolution has led to increased population at County Government headquarters and neighboring towns through the relocation of County Government officials and businesses creating demand for commercial office and retail spaces as well as residential units. In addition, counties were allocated Kshs 371.6 bn in the 2019/2020, and we expect this to support infrastructural development,

- Government Partnerships – In 2020, the government is expected to enter into various partnerships such as Public-Private Partnerships (PPPs), County Government & National Government partnerships and government & government partnerships, which we expect will support development and financing for the real estate sector, especially affordable housing and infrastructure.

Some of the challenges likely to face the sector include;

- Ineffectiveness of Public-Private Partnerships (PPPs) for Housing Development - The government has previously enlisted the help of the private sector for financing and development of affordable housing. This has however not achieved the optimal intended objective this far as a result of; (i) regulatory hindrances such as lack of a mechanism to transfer public land to a Special Purpose Vehicle (SPV) to facilitate access to private capital through the use of the land as security, (ii) lack of clarity on returns and revenue-sharing, (iii) the extended time-frame of PPPs while private developers prefer to exit projects within 3-5 years, and (iv) bureaucracy and slow approval processes,

- Despite being successfully launched in 2019, we expect the KMRC to face challenges such; (i) difficulty in raising funds through issuing of bonds, due to competition from government instruments such as treasury bills and government stocks, (ii) prolonged due diligence processes due to bureaucracy in departments offering critical services such as registration of properties, (iii) lack of access to long term funding, and (iv) a high cost of debt as the investors of the mortgage-backed bonds are likely to demand a relatively high rental yield of approximately 13.5%%, assuming a 1.0%-point margin above the minimum of the risk-free rate for a 15-year bond, which currently stands at 12.5%, yet KMRC’s target is providing mortgages at 9.0% interest. For more details, see our KMRC Topical,

- The unavailability of proper guidelines on the way forward for the newly approved institutions that can hold Home Ownership Savings Plan (HOSP) deposits. These include; (i) the general framework for business principles and general contract terms with respect to institutions that offer HOSPs, (ii) rules on permissible business activities by the Fund Managers, (iii) approved methods of investing the savings whether in the stock market or government securities, and (iv) guidelines on granting of loans after the ten years have elapsed and the appropriate loan-to-value ratio. For more details, see HOSP Update Topical.

The table below summarizes our outlook on the various real estate themes and the possible impact on the business environment in 2020:

Real Estate Thematic Performance Review and Outlook

|

Thematic Performance Review and Outlook |

|||

|

Theme |

2019 Performance |

2020 Outlook |

Effect |

|

Residential |

|

|

Neutral |

|

Commercial Office |

|

|

Negative |

|

Retail Sector |

|

|

Neutral |

|

Hospitality Sector |

|

|

Positive |

|

Land Sector |

|

|

Positive |

|

Infrastructure |

|

|

Positive |

|

Listed Real Estate |

|

|

Negative |

Our outlook is positive for three themes, neutral for two and negative for two, thus, the general outlook for the sector in 2020 is NEUTRAL. This is similar to our outlook that we presented for 2019. The sector will be supported by; (i) the National Government’s support for the affordable housing initiative, (ii) continued entry and expansion of international retailers into the country, (iii) improving infrastructure, and (iv) the improving macroeconomic environment. The real estate sector has pockets of value in themes such as housing for lower-middle to low-income earners in the residential sector, land in satellite towns and differentiated concepts such as serviced apartments and serviced offices.

THE KEY AREAS OF OPPORTUNITIES BY THEME IN REAL ESTATE SECTOR

Based on returns, factors such as supply, demand, infrastructure, land prices and availability of social amenities the following are the ideal areas for investment;

|

The Key Areas of Opportunities by Theme in Real Estate Sector |

|||

|

Sector |

Themes |

Locations |

Reasons |

|

Residential Sector |

High End- (Detached) |

Runda, Karen |

Annual returns at 6.4% and 5.5%, respectively, against the high-end market average of 5.0% For speculative buyers, Karen and Kitisuru recorded the highest annual uptake in this segment with 21.0% and 21.8%, respectively, against the high-end market average of 19.9% |

|

Upper- Mid End (Detached) |

Runda Mumwe, Ridgeways/Garden Estate |

Relatively high uptake at 22.7% and 25.0%, respectively. The areas also have relatively low supply coupled by availability of development land in comparison to other upper mid-end areas such as Lavington and Lang’ata |

|

|

Upper Mid- End (Apartments) |

Parklands, Kileleshwa |

Relatively high annual returns of 7.5% and 7.1%, respectively, against upper mid-end market average of 6.1% |

|

|

Low End (Detached) |

Athi River, Kitengela |

Relatively high returns averaging 7.1% and 7.0%, respectively, in comparison to the respective market average of 6.6% |

|

|

Low End (Apartments) |

Thindigua, Athi River |

Relatively high annual returns at 8.2% and 7.6%, respectively, against lower mid-end market average of 6.5% |

|

|

Commercial Office Sector |

Grade A Offices |

Gigiri, Karen |

Relatively low supply, proximity to commercial hubs and high yields of 9.2% and 8.3%, respectively |

|

Serviced Offices |

Westlands |

Prime commercial hubs with high occupancy of 85.5% and yields of 15.8% |

|

|

Retail Sector |

Suburban Malls |

Counties such as Mt. Kenya Regions and Kiambu |

Mt. Kenya Regions and Kiambu with attractive yields at 8.6% and 8.0% and occupancy rates at 82.3% and 79.4%, respectively |

|

Mixed Use Developments (MUDs) |

MUD |

Kilimani, Limuru Road |

Affluent neighborhoods with high rental yield return of 9.1% and 8.0%, respectively |

|

Hospitality Sector |

Serviced Apartments |

Westlands & Parklands, Kilimani |

Relatively high rental yields of above 10.8% and 9.5%, respectively, compared to the market average of 7.6% |

|

Land Sector |

Satellite Towns |

Utawala and Limuru |

Relatively high capital appreciation of above 10.0% y/y, the provision of trunk infrastructure such as road networks and the growing demand for development land |

|

Suburbs |

Karen, Runda, Kitisuru and Kilimani |

Relatively high capital appreciation of above 10.0% y/y and proximity to amenities |

|

Source: Cytonn Research

For the detailed real estate market outlook report, see our Real Estate Sector 2020 Market Outlook Note.

Outlook Summary

Our outlook for Fixed Income is “neutral”, and our view is investors should be bias towards short-term fixed income securities, in a bid to reduce duration risk. Our outlook for equities is “positive”, while our outlook for real estate is “neutral”. In summary, our Outlook for 2020 Asset Classes is Neutral.

Key: Green – POSITIVE, Grey – NEUTRAL, Red – NEGATIVE

|

|

Fixed Income & Equities Outlook for 2020 |

|

Fixed Income |

Our view is that investors should be biased towards SHORT-TERM FIXED INCOME INSTRUMENTS in a bid to reduce duration risk. We expect upward pressure on interest rates following the repeal of the interest rate cap which in effect is expected to result in increased competition for bank funds from both the private and public sectors as the Government tries to raise funds to plug in the budget deficit

|

|

Kenya Equities |

We are POSITIVE for equities in 2020. We market activity in 2020 to be driven by; (i) a stable macro-economic environment, with the GDP growth rate for the year projected to come in at 5.7%, slightly higher than our 5.6%, 2019 expectations, (ii) a 12.4% growth in corporate earnings, (iii) attractive valuations in a majority of the counters, with the market currently trading at P/E of 12.1x, 9.1% below the historical average of 13.3x, and, (iv) strong foreign inflows following the repeal of the interest rate cap. |

|

Real Estate Outlook Summary |

|

|

Real Estate Sector |

We have a NEUTRAL outlook for the real estate sector in 2020, with positive performance expected in the hospitality and land sectors, negative performance in the listed real estate and commercial office sectors, while the residential and retail sectors’ performance stagnate. |

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.