Cytonn 2022 Markets Outlook

By Cytonn Research, Jan 23, 2022

Executive Summary

Global Markets Outlook

2021 saw the global economy rebound from the effects of the COVID-19 pandemic which impacted global trade by occasioning lock downs and restrictions aimed at curbing the spread of the virus. According to the World Bank’s Global Economic Prospects - 2022, the global economy is expected to rebound by 5.5% in 2021, supported by the increased vaccine inoculation, recovery of commodity prices and the accommodative monetary policies that most economies adopted in 2020. However, the World Bank projects the global economy to grow at a slower rate of 4.1% in 2022, with the key inhibitors being the rising global inflation due to high fuel and energy prices and persistent supply chain constraints, uneven vaccine distribution and inoculation, and the expected tightening of the accommodative monetary policies;

Sub Saharan Africa Regional Market Outlook

According to the World Bank’s Global Economic Prospectus - 2022, the Sub Saharan Africa region is expected to register an economic growth of 3.6% in 2022, 0.1% higher than the estimated 3.5% in 2021, supported by the elevated commodity prices as activities continue to rebound in the region’s main trading partners;

Kenya Macro Economic Outlook

GDP Growth – Our outlook for 2022 is Neutral on GDP Growth. We are projecting the economy to register a growth of within the range of 4.3% - 4.7% in 2022 supported by continued recovery of businesses from the adverse effects of the pandemic; this is on average 1.4% lower than the estimated 2021 growth of 5.9%. The key downside to this growth shall be the erratic weather affecting agricultural produce and the August 2022 general elections which risk destabilizing the Macro Economic environment,

Inflation - Our outlook for 2022 is Neutral on Inflation. We expect the inflation rate to remain within the government’s target of 2.5%-7.5% and come in at an average of 6.3%. The rising global crude oil prices, however, will continue putting pressure on the inflation rate,

Currency - Our outlook for 2022 is Neutral on Currency. We project the Kenya Shilling to trade within the range of between Kshs 112.0 and Kshs 117.0 against the USD in 2022, driven by the increased global crude oil prices that will lead to increased dollar demand from oil and energy importers who will have to increase the amounts they pay for oil imports and hence depleting dollar supply in the market,

Interest Rates – Our outlook for 2022 is Neutral on Interest Rates. In the short term, the Monetary Policy Committee (MPC) is projected to maintain the accommodative policy stance taken in 2020 to support the economy from the adverse effects of the pandemic. The MPC has maintained the CBR at 7.00% since April 2020 following a cumulative 125 bps cut, from 8.25% in January 2020. However, we expect some upward pressure on the interest rates as investors demand for a premium for the increased risk and uncertainty posed by the elections;

Government borrowing – Our outlook for 2022 is Negative on Government Borrowing. We expect the government to borrow aggressively from both the domestic and foreign markets as it aims to plug in the fiscal deficit, which is projected to come in at Kshs 1.4 tn in the FY’2021/22 equivalent to 11.4% of the GDP. On revenue collection, we expect continued improvement in 2022 due to the relatively more conducive business environment,

Investor Sentiment – Our outlook for 2022 is Negative on Investor Sentiment. We expect 2022 to register lower investor sentiments mainly due to investors taking a wait and see approach as they monitor the election proceedings, expected increase in Eurobond yields as concerns over Kenya’s high debt-to-GDP ratio persist, and, expected depreciation of the Kenyan currency as a result of increased oil prices globally and high debt servicing costs,

Security – Our outlook for 2022 is Neutral on Security. We expect security to be maintained, although the main concern is the political environment which we expect to heat up gradually as we edge closer to the August 2022 General Elections;

Fixed Income Outlook

We expect upward pressure on the interest rates market on the back of the government’s increased borrowing for budgetary support, debt repayments, funding of infrastructure projects and payment of domestic maturities which stand at Kshs 546.6 bn for H1’2022. Investors should be biased towards SHORT-TERM FIXED INCOME INSTRUMENTS to reduce duration risk;

Equities Outlook

We have a NEUTRAL outlook on the Kenyan Equities market in the short term but “BULLISH” in the medium to long term. We expect a slower growth in corporate earnings in 2022, attributable to the upcoming general elections coupled with the emergence of COVID-19 variants which are expected to weigh down growth prospects;

Real Estate Outlook

Residential sector: Our outlook for the residential sector is NEUTRAL. We expect the improved business environment to lead to increased Real Estate transactions. However, we expect investors to be conservative in the markets due to the upcoming general election. For detached units, investment opportunity lies in areas such as Ruiru, Ngong and Redhill while for apartments, investment opportunity lies in Rongai, Waiyaki Way, South C and Ruaka due to their remarkable returns driven by high demand for units in the areas, and, infrastructural developments enhancing accessibility and investments;

Commercial Office Sector: Our overall outlook for the commercial office sector is NEUTRAL following the lifting of the COVID-19 containment measures which led to increased business activities in the commercial office front, as well as some businesses resuming full operations thus boosting the occupancy rates. However, the existing oversupply at 7.3 mn SQFT in the Nairobi Metropolitan Area, the general elections uncertainties, and some businesses still embracing the working from home initiative and the hybrid model, are expected to weigh down performance of the sector. Investment opportunity lies in Gigiri, Westlands and Karen supported by relatively high returns with yields of 8.6%, 8.1% and 7.7%, respectively, compared to the market average of 7.1%, as at FY’2021 as a result of their superior locations characterized by serene environment attracting high-end clients and premium rental rates;

Retail Sector: We have a NEUTRAL outlook on the sector’s performance which is expected to be driven by the aggressive expansion by retailers taking up new and previously occupied retail spaces, infrastructural improvements which continues to promote accessibility, and positive demographics facilitating demand. However, the performance is expected to be impeded by; i) oversupply at 1.7 mn SQFT in the Kenyan retail sector and 3.0 mn SQFT in the NMA retail sector, ii) growing popularity of e-commerce which continues to affect occupier demand, and, iii) financial constraints hindering developments. Investment opportunity lies in Westlands, Karen and Kilimani which recorded high rental yields of 10.0%, 9.8% and 9.8%, respectively, compared to the market average of 7.8%, as at FY’2021 supported by adequate infrastructure, the presence of upper and middle income earners with capacity to acquire spaces and services, and, relatively low competition from small scale retailers making them competitive;

Hospitality Sector: Our outlook for the hospitality sector is NEUTRAL. The sector’s recovery is expected to be supported by the rebound of the tourism industry supported by; i) mass vaccination, and, ii) marketing of Kenya as a tourist destination, and, iii) increased international arrivals which have boosted occupancies in hotels and serviced apartments. However, performance will be constrained by travel advisories raised from key tourist markets such as the United States of America will have a down turn on the tourism and hospitality sectors. The investment opportunity lies in Westlands and Kileleshwa/Lavington which recorded average rental yields of 8.3% and 6.4%, respectively against a market average of 5.5% in 2021. This attributed to the availability of high quality serviced apartments, ease of accessibility, and proximity to most international organizations driving demand;

Land Sector: We retain a POSITIVE outlook for the land sector attributed to; i) positive demographics, ii) growing demand for land particularly in the satellite areas, iii) improving infrastructure thereby opening up areas for investment, iv) government’s efforts towards ensuring efficient and streamlined processes in land transactions, and, v) the continued focus on the affordable housing initiative driving demand for land. The investment opportunity lies in Kitisuru, Juja and Utawala for unserviced land, which recorded annualized capital appreciations of 8.2%, 7.6% and 7.5%, respectively, in FY’2021 compared to the market average of 2.5%. For site and service schemes, investment opportunity lies in Syokimau and Ruiru-Juja which recorded the highest annualized capital appreciations at 8.1% and 6.4%, respectively against the sites and serviced average of 3.8%;

Infrastructure Sector: We have a POSITIVE outlook for the infrastructure sector and we expect to continue seeing the launching, execution, and completion of more infrastructural developments in 2022 mainly supported by the government's aggressiveness to initiate and implement projects. In light of this, we expect an increase in the budget allocation for the infrastructure sector to Kshs 211.4 bn in FY’2022/23, 15.8% higher than the Kshs 182.5 bn allocation in FY’2021/22 according to the 2022 Draft Budget Policy Statement. Additionally, the expected project completions in 2022 will be driven by the efforts of the current government to FastTrack the accomplishment of key projects before the next regime takes over leadership. The investment opportunity lies in areas such as Nairobi County (Karen, Westlands, Kilimani, and Upper Hill), and Kiambu County (Ruiru, Kikuyu, Kahawa Sukari, and Thika) due to the presence of adequate infrastructure such as road networks, railway networks, water, and sewer connections;

Listed Real Estate: Our outlook for the REIT market is NEGATIVE due to the continued poor performance of the Fahari I-REIT which is the only listed instrument. We are still of the view that for the REIT market to pick, a supportive framework needs to be put in place to increase investor appetite in the REIT market.

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.41%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.02% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- Effie Otieno, Real Estate Research Coordinator, was on Metropol TV to talk about Financing Real Estate in Kenya. Watch Effie here;

- Justin Mwangi, Analyst, was on Metropol TV to talk about Kenya’s public and domestic debt. Watch Justin here:

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert are welcome to consider one of the five projects currently available for conversion, click here for the latest conversion term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns; See further details here: Summary of Investment-ready Projects;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

- Share a meal with a friend during the Sunday Brunch at The Hive Restaurant at Cysuites Hotel and Apartment. Every Sunday from 11.00 am to 4.00 pm at a price of Kshs 2,500 for Adults and Kshs 1,500 for children under 12 years;

2021 saw the global economy rebound from the effects of the COVID-19 pandemic which impacted global trade by occasioning lock downs and restrictions aimed at curbing the spread of the virus. According to the World Bank’s Global Economic Prospects - 2022, the global economy is expected to rebound by 5.5% in 2021, supported by the increased vaccine inoculation, recovery of commodity prices and the accommodative monetary policies that most economies adopted in 2020. However, the World Bank projects the global economy to grow at a slower rate of 4.1% in 2022, with the key inhibitors being the rising global inflation due to high fuel and energy prices and persistent supply chain constraints, uneven vaccine distribution and inoculation, and the expected tightening of the accommodative monetary policies.

Growth in 2022 shall be shaped by the following three key themes:

- Slowdown in Global Trade

According to the World Bank, global trade rebounded by 9.5% in 2021, driven by improved demand due to reduced pandemic restrictions, sustained economic stimulus packages and accommodative monetary policies. However, the emergence of new variants which have necessitated imposition of new COVID-19 restrictions in some economies, uneven vaccine rollout, and phasing out of economic stimulus packages in most nations as they seek to tame the rising inflation rates is expected to slow down global trade to a growth of 5.8% in 2022. Services trade is also expected to remain subdued, with key sectors such as tourism recording slow recovery due to the travel restrictions being imposed around the world to curb the spread of the Omicron COVID-19 variant, coupled with supply chain disruptions.

- Tightening Monetary Policies

In 2021, most Central’s banks maintained the accommodative monetary policies adopted in 2020 with the intention to spur economic growth. We expect most of these accommodative stances to be tightened, given the increasing global inflation as a result of high oil and energy prices, coupled with persisting supply chain constraints. Tightening of monetary policy will be driven by the need to control the surging inflation by reducing the monetary supply and easing upward cost pressures.

The USA Federal Reserve is poised to increase its benchmark rate in 2022 in a bid to curb the surging inflation that peaked at 7.0% in December 2021, the highest it has been since 1982. On the other hand, the Bank of China (BOC) has adopted a more accommodative policy, easing the benchmark lending rate to 3.70% in January 2022, from 3.80% in December 2021 in-order to support a slowing economy as a result of reintroduction of restrictions to curb the increasing COVID-19 infection rates. The table below highlights the policy stance adopted by the Central Banks of major economies;

|

No |

Country |

Central Bank |

Previous Rate |

Current Rate |

Margin |

|

1 |

USA |

Federal Reserve |

0.00% - 0.25% |

0.00% - 0.25% |

- |

|

2 |

Australia |

Reserve Bank of Australia |

0.10% |

0.10% |

- |

|

3 |

Malaysia |

Bank Negara Malaysia |

1.75% |

1.75% |

- |

|

4 |

China |

Bank of China |

3.80% |

3.70% |

(0.10%) points |

|

5 |

England |

Bank of England |

0.10% |

0.25% |

0.15% points |

- High Commodity Prices

Global commodity prices registered a positive performance in 2021, with energy prices recording the highest gain of 79.0%, compared to the 31.7% decline experienced in 2020. The significant increase can be attributed to the recovery in global demand following the re-opening of major economies, a mismatch between demand and supply, and high costs of shipping. Fertilizers, metals & minerals, non-energy commodities and agriculture, similarly registered gains of 71.1%, 47.1%, 31.7% and 23.0%, respectively, while precious metals registered a slower growth of 5.2% which was significantly lower than the 26.6% gain recorded in 2020. The slower gains by precious metals can be attributed to improved economic conditions from the pandemic, which have reduced investor demand for them as a primary store of value. Energy and Oil prices are expected to remain elevated, mainly attributable to higher demand which has continued to outweigh supply.

Below is a summary of the regional growth rates by country as per the World Bank:

|

World GDP Growth Rates |

||||||

|

Region |

2018 |

2019 |

2020 |

2021e |

2022f |

|

|

1. |

India |

6.5% |

4.0% |

(7.3%) |

8.3% |

8.7% |

|

2. |

China |

6.6% |

6.0% |

2.2% |

8.0% |

5.1% |

|

3. |

Kenya |

6.3% |

5.0% |

(0.3%) |

5.0% |

4.7% |

|

4. |

Middle East, North Africa |

0.8% |

0.9% |

(4.0%) |

3.1% |

4.4% |

|

5. |

Euro Area |

1.9% |

1.6% |

(6.4%) |

5.2% |

4.2% |

|

6. |

United States |

2.9% |

2.3% |

(3.4%) |

5.6% |

3.7% |

|

7. |

Sub-Saharan Africa* |

2.6% |

2.5% |

(2.2%) |

3.5% |

3.6% |

|

8. |

Japan |

0.8% |

(0.2%) |

(4.5%) |

1.7% |

2.9% |

|

9. |

South Africa |

0.8% |

0.1% |

(6.4%) |

4.6% |

2.1% |

|

10. |

Brazil |

1.3% |

1.2% |

(3.9%) |

4.9% |

1.4% |

|

|

Global Growth Rate |

3.0% |

3.1% |

(3.4%) |

5.5% |

4.1% |

|

|

*Including South Africa |

|||||

Source: World Bank

It is key to note that growth around the world in 2022 is expected to be slower as compared to the rebound recorded in 2021 mainly attributable to rising global inflation, high fuel and energy prices, persistent supply chain constraints, and the expected tightening of the accommodative monetary policies. Growth in the Emerging and developing markets is expected to weigh down the global economy mainly due to lower vaccination rates, tighter fiscal and monetary policies, and emergence of new variants of COVID-19.

According to the World Bank’s Global Economic Prospectus - 2022, the Sub Saharan Africa region is expected to register an economic growth of 3.6% in 2022, 0.1% higher than the estimated 3.5% in 2021, supported by elevated commodity prices as activities continue to rebound in the region’s main trading partners. The elevated commodity prices is attributable to higher oil prices which is expected to support growth in Nigeria and Angola while high coffee and cotton prices will support near-term recovery in Kenya, Tanzania and Ethiopia. Additionally, the ongoing inoculation of COVID-19 vaccines coupled with ease of travel restrictions across the region is expected to support the recovery of the tourism sector. However, possible emergence of COVID-19 variants such as Omicron and slow rollout of vaccines in the region is likely to weigh down on the pace of recovery. The forecast is higher than the initial 3.5% projected, mainly reflecting the expected growth as economies rebound, on the back of ease of restrictions supporting exports and tourism and as such propelling growth.

Despite the expected growth, risks to the regional outlook abound and they include:

- Slow COVID-19 vaccines rollout on the back of emergence of new and more transmissible variants,

- Increasing food prices attributable to supply bottlenecks and erratic weather conditions, leading to high cost of living and a surge in inflation rates,

- Insecurity, Social Unrest and Political Tensions in some countries causing uncertainty, slow structural reforms, slow vaccine inoculation and decline in private investments,

- High debt-levels leading to debt distress and high debt service costs,

- Decline in global investor sentiments and policy support owing to rising debt levels, and,

- Limited fiscal space on the back of declined government revenue.

- Economic Growth

According to Kenya National Bureau of Statistics (KNBS) Q3’2021 Gross Domestic Product Report, the Kenyan economy recorded a 9.9% growth in Q3’2021, up from the 2.1% contraction recorded in a similar period in 2020, pointing towards continued economic recovery. Consequently, the average GDP growth rate for the 3 quarters in 2021 is a growth of 6.9%, an increase from the 0.8% contraction recorded during a similar period of review in 2020. The average GDP growth rate for 2021 is expected to be 5.9%, a significant improvement from the 0.3% contraction witnessed in 2020.

In 2022, we expect the economy to continue its recovery trajectory with the projected GDP growth to come in at a range of 4.3% - 4.7%.

The key factors that shall support growth include:

- Improved Business Recovery: Continued recovery of businesses from the adverse effects of the pandemic owing partly to the continued reopening of the external trading partners,

- Growth in the Real Estate and Construction sectors: The government continues to implement select infrastructural projects in the country such as the Nairobi Expressway which is expected to be completed in March 2022, and the Western By-Pass. We expect to see the completion of most infrastructural projects in 2022 as the government continues to fast track the completion of key projects before the next regime takes over leadership after the August 2022 elections. Additionally, we expect an increase in the budget allocation for the infrastructure sector to Kshs 211.4 bn in FY’2022/23, a 15.8% increase from Kshs 182.5 bn allocation in FY’ 2021/22 according to the 2022 Draft Budget Policy Statement, and,

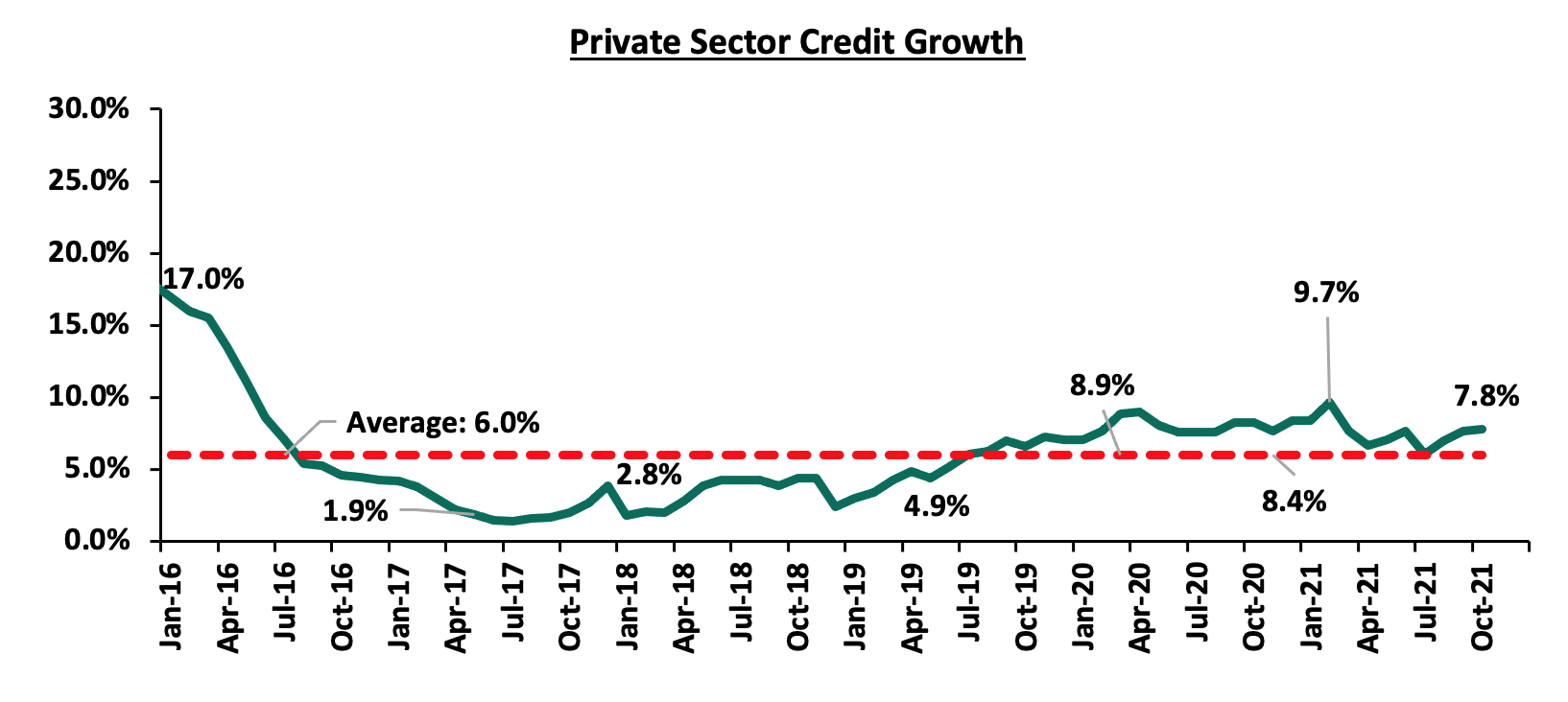

- Gradual Increase in Access to affordable Credit: As of October 2021, the private sector credit growth rate increased marginally to 7.8%, from 7.7% recorded in September 2021 according to the MPC’s October 2021 Report. Growth of credit to the private sector is expected to remain strong on the back of existing policy measures, including the MSMEs Credit Guarantee Scheme, and continued economic recovery. Given the improved Gross Non-Performing Loans Ratio in Q3’2021 to 12.0%, from 12.4% in Q3’2020, we expect to see banks gradually increase lending to the private sector on the back of an improved business environment but still remain cautious due to the elevated credit risk brought about by the emergence of new COVID-19 variants and compounded by the upcoming elections.

Key risks facing the economic growth however include:

- Ongoing concerns on the sustainability of the country’s debt levels: With the country’s debt to GDP ratio currently at 63.9%, 13.9% above the recommended IMF threshold of 50.0% for developing countries, it is expected that the government will have significant pressure to service the existing debt. A high level of debt reduces the prospects of economic growth as a large portion of revenues is used to service the existing debt as opposed to development expenditure,

- Emergence of new COVID-19 variants such as the Omicron variant: A resurgence of the COVID-19 cases especially due to the emergence of new variants could lead to reinstatement of restrictions hampering the country’s economic growth. Case in point, the Omicron variant’s quick spread globally has led to logistical bottlenecks thus exacerbating the ongoing supply chain disruptions and consequently contributing to the global inflationary pressures. The speed at which the vaccines shall reach the country and how fast they shall be distributed shall also determine how fast the economy can get back to full normalcy. The spread of COVID-19 variants in Kenya’s key trading partners has a direct effect on Kenya’s economy as they lead to lower demand for Kenya’s exports while border closures lead to less movement affecting sectors such as Transport and Hospitality,

- Elections: Elections generally pose the risk of destabilizing an economy should the resultant period be chaotic and unstable politically. This leads to a ripple effect whereby production decreases in the country due to decreased business activities. This also leads to low investor confidence in the country and consequently negative capital net flows. This was witnessed in 2008 when Kenya’s GDP growth declined to 0.2% from 6.5% in 2007 after the 2007/08 post-election violence, and,

- Expected subdued growth in the Agricultural sector due to erratic weather conditions: The Agricultural sector is the main driver of the economy’s GDP contributing 20.5% of the Kenya’s GDP as of Q3’2021. Erratic weather conditions, including drought, make it difficult for farmers to plan effectively leading to instances of under-supply of food products in the market. This leads to low production levels in the country and hamper the economic growth, as both exports and domestic sales decline.

- Currency:

The Kenyan Shilling depreciated by 3.6% against the USD during the year to close at Kshs 113.1, from Kshs 109.2 recorded at the end of 2020, driven by the increased global crude oil prices that led to increased dollar demand from oil and energy importers. Going forward, we expect the shilling to range between Kshs 112.0 and Kshs 117.0 supported by:

- Improving diaspora remittances evidenced by a 17.0% y/y increase to USD 350.6 mn in December 2021, from USD 299.6 mn recorded over the same period in 2020, which has continued to cushion the shilling against further depreciation. The improved remittances are attributable to financial innovations that have provided Kenyans in the diaspora more convenient channels to transact, and,

- Expected dollar inflows from foreign commercial loans. The National Treasury announced in December 2021 that it intends on issuing two Eurobonds by June 2022 to provide financing for the FY’2021/22 budget,

The Kenyan shilling will however face the following challenges:

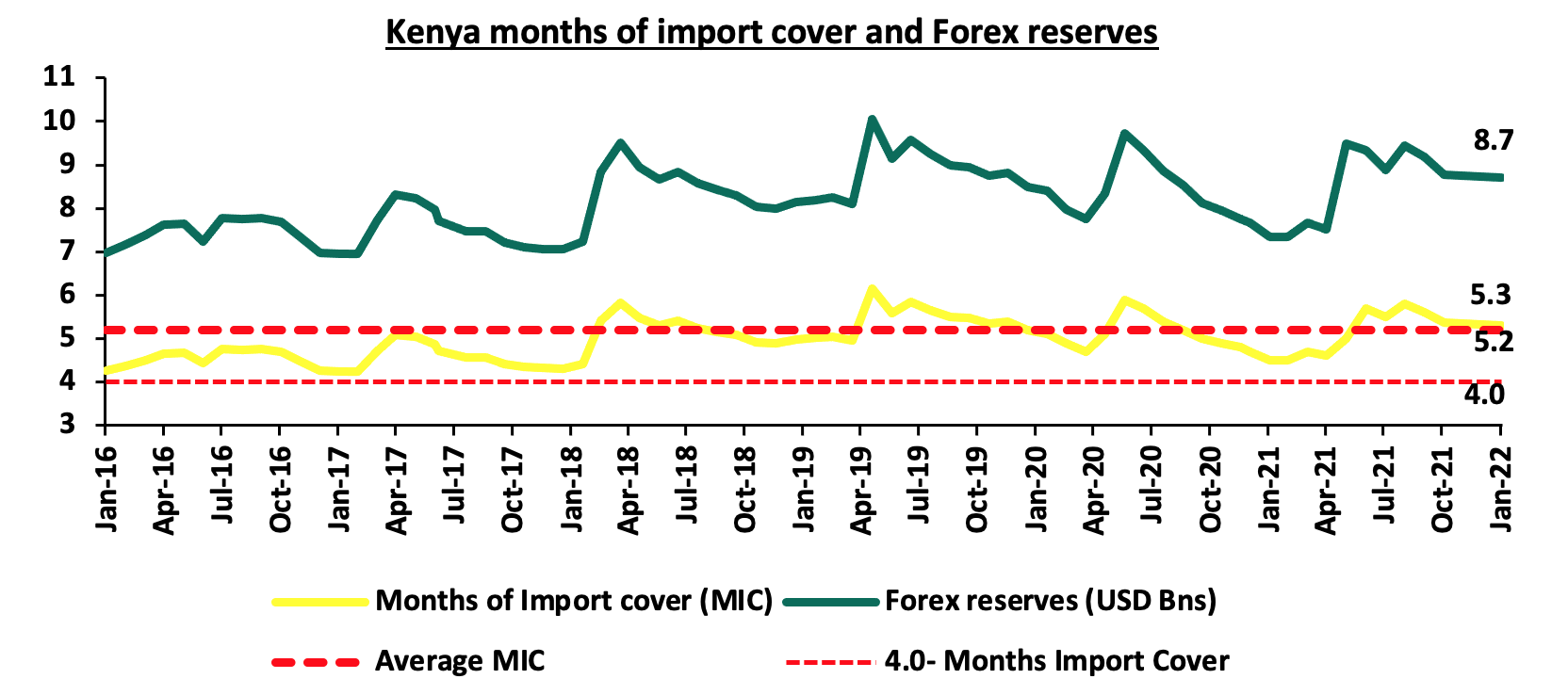

- Dwindling forex reserves which have been on a downward trend since September 2021 where we had reserves of USD 9.4 bn, compared to USD 8.7 bn recorded on 20th January 2022. Notably, at 5.3-months of import cover, we are still above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

The graph below shows Kenya’s amount of forex reserves and the reserves equivalents of months of import cover, in the last 5 years:

- Oil prices expected to increase on the back of limited supply, increased demand and political uncertainty in some oil producing regions, and,

- High debt servicing costs – with the Debt Service Suspension Initiative (DSSI) having expired in December 2021 meaning Kenya will have to begin servicing foreign loans. We approximate that Kshs 58.1 bn in debt payments were suspended through the initiative.

We expect the shilling to remain within a range of Kshs 112.0 and Kshs 117.0 against the USD in 2022 with a bias towards a 2.0% depreciation by the end of the year.

- Inflation:

In 2021, the inflation rate remained within the government’s set range of 2.5% - 7.5% but higher than the mid-range of 5.0%, with the average monthly inflation rate coming in at 6.1%. The relatively high inflation can be attributed to the high fuel prices experienced through most of the year, coupled with the erratic weather conditions experienced in the second half of the year which led to food commodity prices spiking.

We expect inflation to average 6.3% in 2022, within the government target range of 2.5% - 7.5%. Key risks that abound are the erratic weather conditions that have reduced agricultural output, high fuel costs due to increased crude prices globally which could deplete the fuel subsidy program and further led to a depreciation of the local currency.

- Interest Rates:

The Central Bank Rate is expected to remain unchanged in the short term at 7.00% with a bias towards an increase in the medium term as the economy continues to improve. Additionally, we may see slight upward pressure on the interest rates especially in Q3’2022 as the government compensates investors for the increased risk and uncertainty posed by the elections

expect the government to borrow aggressively from both the domestic and foreign markets as it aims to plug in the fiscal deficit, which is projected to come in at Kshs 1.4 tn in the FY’2021/22 equivalent to 11.4% of the GDP. This increased borrowing will results in slight upwards pressures in the yield curve thus destabilizing the interest rate environment. Despite this, we expect the interest rate environment to remain relatively stable in the country owing to the support from concessional multilateral loans from IMF reducing the government’s cash crunch.

The table below summarizes the various macro-economic factors and the possible impact on the business environment in 2022. With five indicators being neutral and two negative, the general outlook for the macroeconomic environment in 2022 is NEUTRAL.

|

Macro-Economic & Business Environment Outlook |

||

|

Macro-Economic Indicators |

2022 Outlook |

Effect |

|

Government Borrowing |

|

Negative |

|

Exchange Rate |

|

Neutral |

|

Interest Rates |

|

Neutral |

|

Inflation |

|

Neutral |

|

GDP |

|

Neutral |

|

Investor Sentiment |

|

Negative |

|

Security |

|

Neutral |

The two changes from last year’s outlook are:

- Inflation Rate to Neutral from Positive necessitated by key risks such as erratic weather conditions that have reduced agricultural output, and, high fuel costs due to increased crude oil prices globally which could deplete the fuel subsidy program, and,

- Investor Sentiment to Negative from Positive necessitated by declining investor sentiments mainly due to; i) A cautious stance by investors as they monitor the election proceedings, ii) expected increase in Eurobond yields as concerns over Kenya’s high debt-to-GDP ratio persists, and, iii) Expected depreciation of the Kenyan currency as a result of increased oil prices globally and high debt servicing costs

Out of the seven metrics that we track, five have a neutral outlook and two have a negative outlook; from last year where two had a positive outlook, four had a neutral outlook and one had a negative outlook. Our general outlook for the macroeconomic environment remains NEUTRAL for 2022, unchanged from 2021.

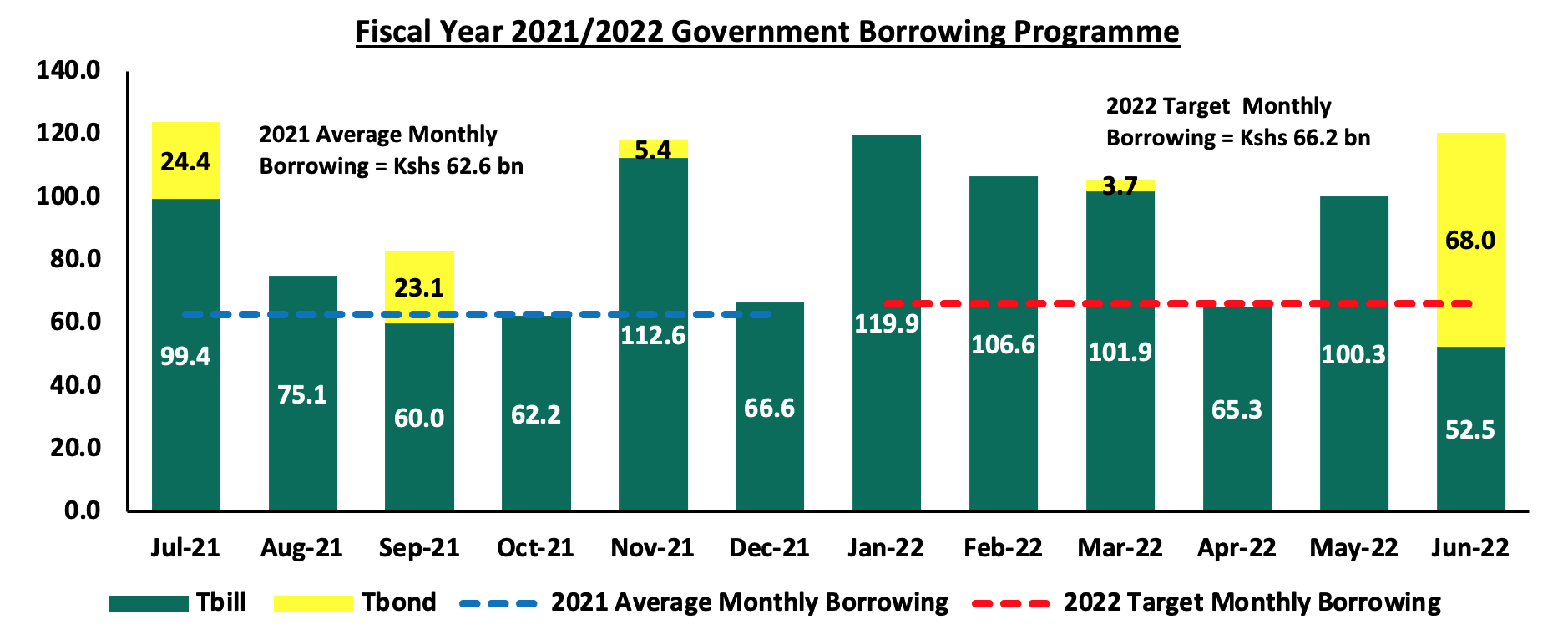

The government is currently 12.0% ahead of its prorated domestic borrowing target, having borrowed Kshs 425.5 bn domestically, against the pro-rated target of Kshs 379.9 bn, going by the government domestic borrowing target of Kshs 658.5 bn as per the Budget Review and Outlook Paper (BROP) 2021. In order to meet the domestic borrowing target, the government has to borrow an average of Kshs 66.2 bn on a monthly basis, in the 2nd half of the current fiscal year. We anticipate upward revision of government’s domestic borrowing target before end of the FY’2021/2022 on the back of the high financing needs to support government initiatives, repayment of debt and funding of the upcoming elections. We expect an upward pressure on the interest rates as the government will need to borrow aggressively from the local market to plug in the deficit projected at 11.4% of GDP.

Below is a summary of treasury bills and bonds maturities and the expected borrowings over the same period. The government will need to borrow Kshs 66.2 bn on average each month for the rest of the fiscal year to meet the domestic borrowing target of Kshs 658.5 bn for the FY’2021/2022, and cover T-bill and T-bond maturities, as illustrated in the graph below:

Fig: Schedule of Treasury bills and bonds maturities and the expected target borrowings in the 2021-2022 fiscal year to cater for the maturities and additional government borrowing.

Weekly Market Performance;

During the week, T-bills remained oversubscribed, albeit lower than the previous week, with the overall subscription rate coming in at 119.5%, from 156.4% recorded the previous week. The decline in the subscription rates is partly attributable to the tightened liquidity in the money market evidenced by average interbank rates increasing to 4.7%, from the 4.0% recorded the previous week. The 364-day paper recorded the highest subscription rate, receiving bids worth Kshs 14.4 bn against the offered Kshs 10.0 bn, translating to a subscription rate of 144.3%, a decline from the 194.0%, recorded the previous week. The subscription rate for the 91-day and 182-day papers declined as well to 48.1% and 123.1%, from 110.1% and 137.2%, respectively, recorded the previous week. The yields on the government papers record mixed performance, with the yields on the 91-day and 364-day papers increasing by 2.2 bps and 3.6 bps to 7.3% and 9.5%, respectively, while the yield on the 182-day paper declined by 1.2 bps to 8.1%. The government continued to reject expensive bids, accepting bids worth Kshs 27.9 bn bids out of the Kshs 28.7 bn worth of bids received, translating to an acceptance rate of 97.5%.

In the Primary Bond Market, the government released the auction results for the recently issued 10-year and 20-year treasury bonds namely; FXD2/2018/10 and FXD1/2021/20. The bonds recorded an oversubscription of 128.0%, attributable to the investor’s appetite for higher yields. The government sought to raise Kshs 30.0 bn for budgetary support, received bids worth Kshs 38.4 bn and accepted bids worth Kshs 34.9 bn, translating to a 90.9% acceptance rate. Investors preferred the longer-tenure issue i.e. FXD1/2021/20, which received bids worth Kshs 28.0 bn, representing 93.3% of the total bids received owing to its higher yields of 13.8% compared to 12.7% yield on the FXD2/2018/10. The coupons for the two bonds were; 12.5% and 13.4%, and the weighted average yield for the issues were; 12.7% and 13.8%, for FXD2/2018/10 and FXD1/2021/20, respectively.

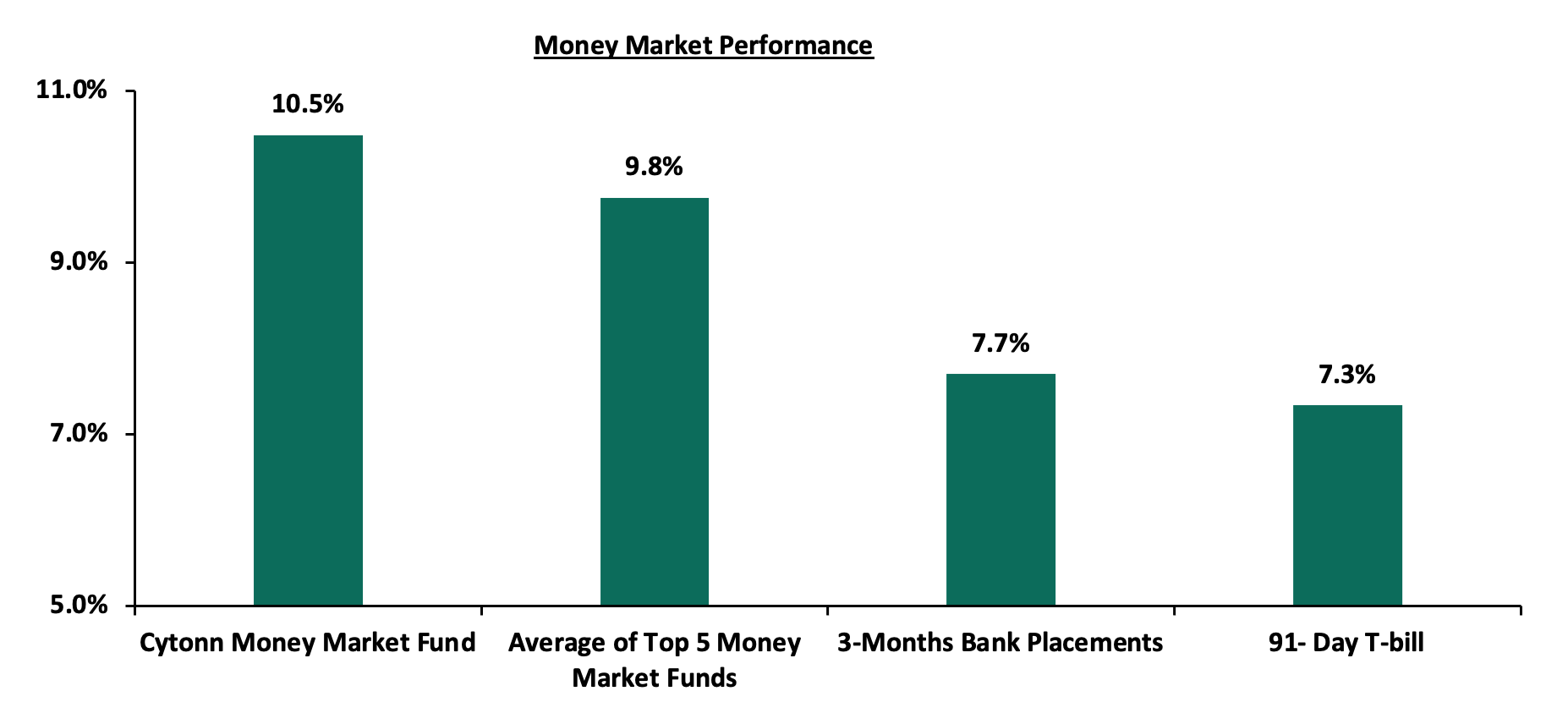

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increasing by 2.2 bps to 7.3%. The average yield of the Top 5 Money Market Funds remained relatively unchanged at 9.8% as was recorded the previous week while the yield on the Cytonn Money Market Fund increased marginally by 0.1% point to 10.5%, from 10.4% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 21st January 2022:

|

|

Money Market Fund Yield for Fund Managers as published on 21st January 2022 |

|

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.5% |

|

2 |

Zimele Money Market Fund |

9.9% |

|

3 |

Nabo Africa Money Market Fund |

9.7% |

|

4 |

Sanlam Money Market Fund |

9.4% |

|

5 |

CIC Money Market Fund |

9.3% |

|

6 |

Madison Money Market Fund |

9.0% |

|

7 |

Apollo Money Market Fund |

9.0% |

|

8 |

GenCapHela Imara Money Market Fund |

8.9% |

|

9 |

Dry Associates Money Market Fund |

8.8% |

|

10 |

Orient Kasha Money Market Fund |

8.6% |

|

11 |

British-American Money Market Fund |

8.5% |

|

12 |

Co-op Money Market Fund |

8.5% |

|

13 |

NCBA Money Market Fund |

8.4% |

|

14 |

ICEA Lion Money Market Fund |

8.3% |

|

15 |

AA Kenya Shillings Fund |

7.6% |

|

16 |

Old Mutual Money Market Fund |

7.5% |

Source: Business Daily

Weekly Highlight:

- September MPC Meeting

The Monetary Policy Committee (MPC) is set to meet on Wednesday, 26th January 2022, to review the outcome of its previous policy decisions and recent economic developments, and to decide on the direction of the Central Bank Rate (CBR). We expect the MPC to maintain the Central Bank Rate (CBR) at 7.00% with their decision mainly being supported by;

- We foresee the MPC taking a wait and see approach as they continue to monitor the country’s economic recovery, with an emphasis on the need to spur economic growth and not curtail the post pandemic recovery. Kenya’s economy recorded a 9.3% growth in Q3’2021, up from the 2.1% contraction recorded in Q3’2020 but slightly lower than the 10.1% growth recorded in Q2’2021. We believe that despite this recovery, risks that abound the economic recovery are the emergence of the new variants and 2022 being an election year. Historically, election years have seen slower economic growth due to political instability. As such, we believe that the MPC will keep monitoring the macro-economic indicators before pursuing any additional policy measures, and,

- Inflation is expected to remain stable and within the government’s target range of 2.5% -7.5% on account of the stable fuel prices. December inflation eased to 5.7%, from 5.8% recorded in November, supported by the stability in fuel which have remained unchanged since October 2021 due to the fuel subsidies under the Petroleum Development fund. However, Global fuel prices have continued to increase, hitting seven year highs on the back of increased demand and persisting supply chain constraints. We believe that the fuel subsidy program by the National Treasury stands at risk of being depleted and is unsustainable, due to the continuous increase in the average landed costs of fuel. We anticipate inflation pressures to remain elevated in the short term driven by the rising food prices and the rise in global fuel prices.

For a more detailed analysis, please see our January 2022 MPC note.

Rates in the fixed income market have remained relatively stable due to the ample liquidity in the money markets, coupled with the discipline by the Central Bank as they reject expensive bids. Government borrowing is expected to increase in 2022 for budgetary support, debt repayments, funding infrastructure projects and payment of domestic maturities which stand at Kshs 546.6 bn for H1’2022. This will consequently create uncertainties in the interest rate environment as additional domestic borrowing may be required to plug in the deficit projected at 11.4% of GDP.

OUR VIEW IS THAT INVESTORS SHOULD BE BIASED TOWARDS SHORT-TERM FIXED-INCOME SECURITIES TO REDUCE DURATION RISK ASSOCIATED WITH THE LONG-TERM DEBT COUPLED WITH THE RELATIVELY FLAT YIELD CURVE ON THE LONG-END DUE TO SATURATION OF LONG-TERM BONDS.

In 2021, the Kenyan equities market was on an upward trajectory, with NASI, NSE 25 and NSE 20 increasing by 9.5%, 9.8% and 1.6%, respectively. Large-cap gainers in 2021 included Equity Group, ABSA Bank, BAT, KCB Group and Safaricom which gained by 45.5%, 24.5%, 22.3%, 18.4%, and 10.8%, respectively.

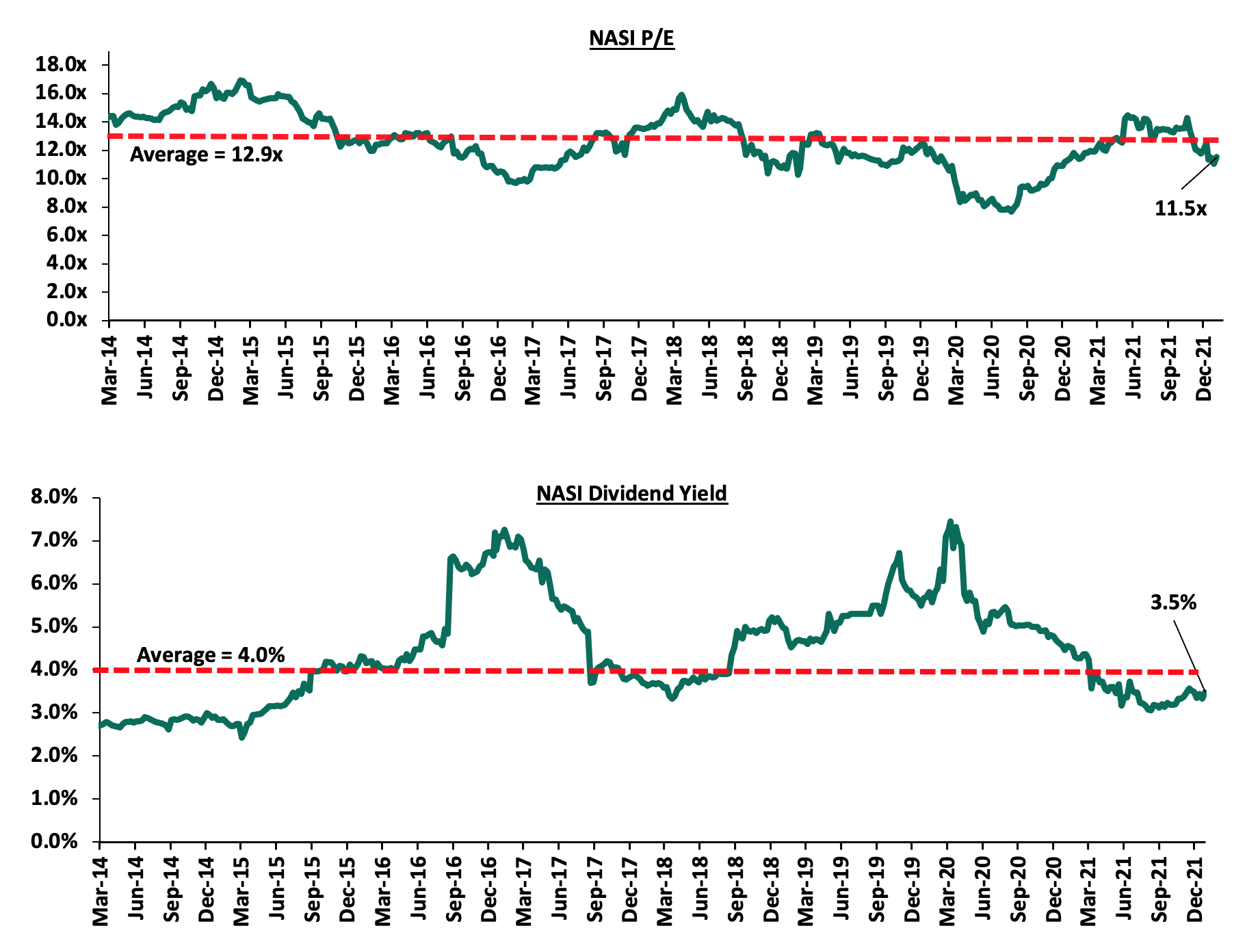

Despite the positive performance in the equities market in 2021, the market valuation remained below the historical average with NASI closing the year at a price to earnings ratio (P/E) of 11.3x, 12.4% below the 12-year historical average of 12.9x, and a dividend yield of 3.4%, 0.6% points below the historical average of 4.0%. Equity turnover, on the other hand declined by 11.2% to USD 1.3 bn, from USD 1.4 bn in FY’2020. Foreign investors remained net sellers, with a net outflow of USD 91.9 mn, compared to net outflows of USD 280.9 mn recorded in FY’2020. The year also saw 4 companies issuing profit warnings, with a further 3 companies issuing profit warnings in January 2022, coming in to a total of 7, a decrease from 15 companies in 2020, with the decline attributable to the improved business environment following the lifting of COVID-related restrictions during the year. Key to note, companies are required to issue profit warnings if they project a more than 25.0% decline in profits year-on-year. For more information, see our Cytonn Annual Markets Review - 2021.

Kenyan 2022 Equities Outlook

In 2022, we project the following factors to affect the direction of the Kenyan equities market:

- Corporate Earnings Growth: We expect a slower growth in earnings in 2022, attributable to the uncertainty surrounding the general elections during the year coupled with the emergence of COVID-19 variants which are expected to weigh down growth prospects. The growth in Corporate Earnings is further weighed down by the political instability in Ethiopia following Safaricom’s expansion into the country. Key to note, Safaricom controlled 59.3% of the Nairobi All Share Index (NASI) as of 21st January 2022. Ethiopia is currently under a 6-month State of Emergency which began on 2nd November 2021. The uncertain macro-economic environment is expected to delay the launch of operations in the country, which could in turn lengthen Safaricom’s break-even period for the venture. The banking sector is also expected to register muted growth in 2022 following the significant earnings growth recorded in 2021. The sector’s expected muted growth in 2022 is attributable to the perceived higher credit risk associated with the uncertainty surrounding the general elections in 2022 which is expected to weigh down lending and in turn earnings growth;

- Attractive valuations: The market valuations remained below the historical average, with NASI closing the year at a price to earnings ratio (P/E) of 11.3x, 12.4% below the 12-year historical average of 12.9x, and a dividend yield of 3.4%, 0.6% points below the historical average of 4.0%. Given these low valuations, we expect investors to take advantage of this and buy into the market;

- Capital Markets Investor Sentiment: We expect the equities market to register muted foreign interest in 2022, attributable to the uncertainty surrounding general elections. We expect the security situation to be uncertain in 2022 due to the rising political temperatures ahead of the upcoming general elections. On the flipside, we believe pockets of value still exist in the equities market due to the attractive valuations, with NASI trading 12.4% below its historical average;

- Diversification of Capital Markets and New Listings: We expect a number of activities to be undertaken by NSE in 2022 such as increasing the number of Single Stock Futures traded on the derivatives market. Currently, the bourse offers 6 Single Stock Futures namely Safaricom Plc, Kenya Commercial Bank Group Plc, Equity Group Holdings Plc, East African Breweries Ltd, ABSA Bank Kenya and British American Tobacco Plc. Additionally, we expect increased activity in the Unquoted Securities Platform (USP). The USP was launched on 12th May 2021 with Acorn’s two Real Estate Investments Trusts (REITs) as the first entities to tap into the unquoted companies trading infrastructure.

It is our view that these initiatives would result in; (i) increased liquidity in the market by increasing the volume of securities available for trading, and, (ii) improved depth in the capital market by increasing product offerings at the exchange, consequently attracting investors;

- Monetary Policy Direction: In 2021 the CBR remained unchanged at 7.00%, with the Monetary Policy Committee (MPC) citing that the measures implemented since March 2020 were having the intended effect on the economy and as such, remained appropriate and effective. We expect the CBR rate to remain unchanged at 7.00% in the short term with a bias towards an increase in the medium term as the economy continues to improve. An increase in the CBR will result in higher yields in the fixed income market, which will in turn make government bonds more attractive compared to equities. An increase in the CBR will also result in lower liquidity in the market, leaving investors with less disposable income to invest.

Below, we summarize the metrics used in coming up with our 2022 Equities Outlook;

|

Equities Market Indicators |

Outlook for 2022 |

Current View |

|

Macro-Economic Environment |

|

Neutral |

|

Corporate Earnings Growth |

|

Neutral |

|

Valuations |

|

Positive |

|

Investor Sentiment and Security |

|

Neutral |

Out of the four metrics that we track, three have a “neutral” outlook while one has a “positive” outlook. Compared to 2021, we have maintained our positive outlook on the valuations of the market. In consideration of the above, we have a ‘’NEUTRAL” outlook on the Kenyan Equities market in the short term. However, we maintain our bias towards a “BULLISH” equities markets in the medium to long term, with the expectations of a gradual recovery in corporate earnings and the cheaper valuations currently in the market.

Weekly Market Performance

During the week, the equities market recorded a mixed performance, with NASI and NSE 20 declining by 0.3% and 0.4%, respectively, while NSE 25 gained by 0.3%, taking their YTD performance to losses of 1.5%, 1.1% and 1.6% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by losses recorded by large cap stocks such as Diamond Trust Bank (DTB-K) and Safaricom, of 1.7% and 1.1%, respectively. The losses were however mitigated by gains recorded by stocks such as Equity Group of 4.0% while BAT and Bamburi both gained by 2.0%.

Equities turnover declined by 1.5% to USD 13.7 mn, from USD 13.9 mn recorded the previous week, taking the YTD turnover to USD 44.5 mn. Foreign investors remained net sellers, with a net selling position of USD 3.64 mn, from a net selling position of USD 3.65 mn recorded the previous week, taking the YTD net selling position to USD 4.0 mn.

The market is currently trading at a price to earnings ratio (P/E) of 11.5x, 10.9% below the 12-year historical average of 12.9x. The average dividend yield is currently at 3.5%, 0.5% points above the historical average of 4.0%. Key to note, NASI’s PEG ratio currently stands at 1.5x, an indication that the market is trading at a premium to its future earnings growth. Basically, a PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The current P/E valuation of 11.5x is 49.5% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Universe of coverage:

|

Company |

Price as at 14/01/2022 |

Price as at 21/01/2022 |

w/w change |

YTD Change |

Year Open 2022 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

2.3 |

2.2 |

(1.8%) |

(2.6%) |

2.3 |

3.3 |

9.0% |

57.7% |

0.2x |

Buy |

|

I&M Group*** |

21.1 |

21.3 |

1.2% |

(0.5%) |

21.4 |

24.4 |

10.6% |

25.0% |

0.6x |

Buy |

|

Jubilee Holdings |

310.0 |

309.8 |

(0.1%) |

(2.2%) |

316.8 |

371.5 |

2.9% |

22.8% |

0.6x |

Buy |

|

KCB Group*** |

45.2 |

44.9 |

(0.6%) |

(1.4%) |

45.6 |

51.4 |

2.2% |

16.6% |

0.9x |

Accumulate |

|

Sanlam |

10.5 |

10.6 |

0.5% |

(8.7%) |

11.6 |

12.1 |

0.0% |

14.8% |

1.1x |

Accumulate |

|

Britam |

7.4 |

7.3 |

(1.4%) |

(3.4%) |

7.6 |

8.3 |

0.0% |

14.3% |

1.2x |

Accumulate |

|

Standard Chartered*** |

129.5 |

130.8 |

1.0% |

0.6% |

130.0 |

137.7 |

8.0% |

13.3% |

1.0x |

Accumulate |

|

Stanbic Holdings |

87.3 |

87.3 |

0.0% |

0.3% |

87.0 |

94.7 |

4.4% |

12.9% |

0.8x |

Accumulate |

|

Liberty Holdings |

7.0 |

7.0 |

0.3% |

(1.1%) |

7.1 |

7.8 |

0.0% |

11.4% |

0.5x |

Accumulate |

|

Equity Group*** |

49.5 |

51.5 |

4.0% |

(2.4%) |

52.8 |

56.6 |

0.0% |

9.9% |

1.3x |

Hold |

|

Co-op Bank*** |

13.0 |

13.0 |

0.4% |

0.0% |

13.0 |

13.1 |

7.7% |

8.2% |

1.0x |

Hold |

|

NCBA*** |

26.0 |

25.8 |

(0.8%) |

1.4% |

25.5 |

26.4 |

5.8% |

8.1% |

0.6x |

Hold |

|

Diamond Trust Bank*** |

59.0 |

58.0 |

(1.7%) |

(2.5%) |

59.5 |

61.8 |

0.0% |

6.5% |

0.3x |

Hold |

|

ABSA Bank*** |

11.9 |

11.8 |

(0.4%) |

0.4% |

11.8 |

11.9 |

0.0% |

0.9% |

1.2x |

Lighten |

|

CIC Group |

2.2 |

2.2 |

(0.5%) |

0.9% |

2.2 |

2.0 |

0.0% |

(6.7%) |

0.8x |

Sell |

|

HF Group |

3.6 |

3.5 |

(3.0%) |

(7.9%) |

3.8 |

3.0 |

0.0% |

(15.6%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.5x), we believe that investors should reposition towards value stocks with a strong earnings growth and are trading at discounts to their intrinsic value. We expect the discovery of new COVID-19 variants coupled with slow vaccine rollout in developing economies to continue weighing down the economic outlook. On the upside, we believe that the relaxation of lockdown measures in the country will lead to improved investor sentiments in the economy.

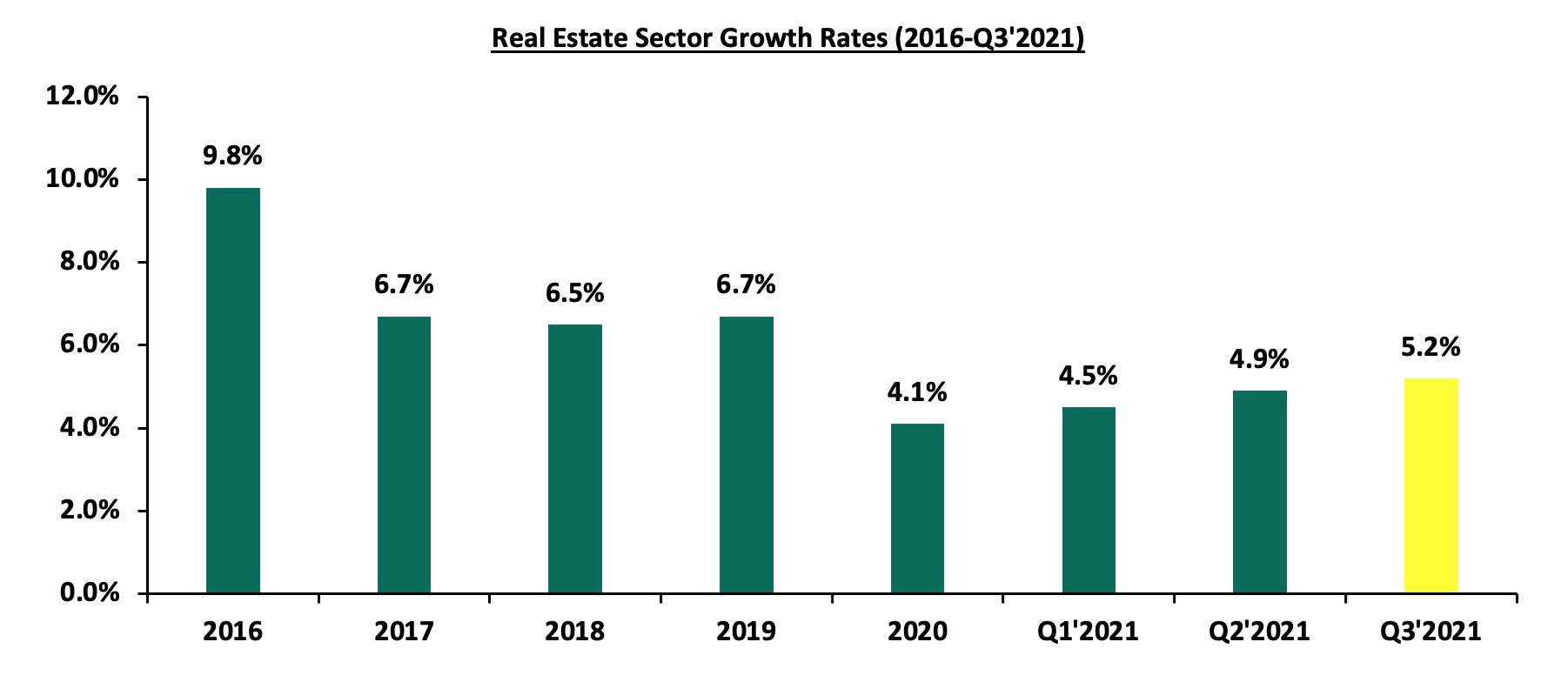

In 2021, the Kenyan Real Estate sector witnessed increased development activities with a general improvement in Real Estate transactions, attributed to the improved business environment. The reopening of the economy also facilitated numerous expansion and construction activities by investors, in addition to various businesses also resuming full operations. The Real Estate Sector in Q3’2021 grew by 5.2%, 0.3% points higher than the 4.9% growth recorded in Q2’2021, according to the Quarterly GDP Report Q3’2021 by the Kenya National Bureau of Statistics’ (KNBS).

The graph below shows Real Estate sector growth rates from 2016-Q3’2021;

Source: Kenya National Bureau of Statistics

In terms of performance, residential, commercial office, retail, mixed-use developments, and, serviced apartments sectors realized average rental yields of 4.8%, 7.1%, 7.8%, 7.2%, and 5.5%, respectively. This resulted to an average rental yield for the Real Estate market at 6.5%, 0.4% points higher than the 6.1% recorded in 2020. The table below is a summary of thematic performance of average rental yields in FY’2021 compared to FY’2020;

|

Real Estate Thematic Performance- Average Rental Yields |

|||

|

Theme |

Rental Yield FY’2020 |

Rental Yield FY’2021 |

Y/Y Change (% Points) |

|

Residential |

4.9% |

4.8% |

(0.1%) |

|

Commercial Office |

7.0% |

7.1% |

0.1% |

|

Retail |

7.5% |

7.8% |

0.3% |

|

Mixed-use Developments (MUDs) |

7.1% |

7.2% |

0.1% |

|

Serviced Apartments |

4.0% |

5.5% |

1.5% |

|

Grand Average |

6.1% |

6.5% |

0.4% |

Source: Cytonn Research

We had a NEUTRAL outlook for the Real Estate sector in 2021 supported by factors such as; i) government’s focus on implementing affordable housing projects coupled with improved investor confidence in the country’s housing market, ii) increased demand for office spaces, iii) rapid expansion by local and international retailers, iv) increased visitor arrivals into the country hence boosting the performance of hospitality sector, v) government’s aggressiveness on implementing infrastructural projects, and, vi) positive demographics. However, factors such as i) financial constraints, ii) oversupply in the commercial office and retail sectors, and iii) low of investor appetite in Real Estate Investments Trusts (REITs) are expected to continue impeding performance of the sector. For a detailed review of 2021 performance, see our Real Estate Annual Markets Review 2021 Note.

In 2022 we expect the key drivers of Real Estate to be as follows:

- Infrastructural Development: The Kenyan Government has been aggressively supporting and implementing various infrastructural development projects, with a major focus on the transport sector with the key beneficiaries being road construction. This is evident in the country’s road network coverage currently at 161,451 Km and valued at over Kshs 3.5 tn as at 2021, signifying heavy investment towards the sector, according to the Kenya Roads Board’s Annual Public Roads Programme 2021/2022. In general, infrastructure development continues to be a factor supporting the growth of the Real Estate sector through opening up areas for Real Estate investments,

- Positive Demographics: Kenya has a relatively high urbanization and population growth rates of 4.0% p.a and 2.3% p.a, respectively, against the global average of 1.8% p.a and 1.0% p.a, respectively, as at 2020 according to the World Bank, driving increased demand for Real Estate developments,

- Expansion by local and International Retailers: Aggressive expansion by local and international retailers such as Naivas, QuickMart, and, Carrefour, taking up new and previously occupied retail spaces by troubled retailers such as Tuskys and Shoprite continues to support the retail sector,

- Hotel and Serviced Apartments Operations: Lifting of flight travel bans in the second half of 2021 led to increased number of visitor arrivals into the country. This in turn led to improved performance of serviced apartments, and hotels also resuming full operations. We expect this to continue driving the performance of serviced apartments in 2022,

- Focus on Affordable Mortgages: Lending financial institutions such as banks and SACCOs such as Gulf African Bank, NCBA Bank Kenya, Co-op Bank and Stima SACCO have continued to demonstrate efforts in supporting home ownership through offering affordable mortgage schemes with bespoke terms to clients in bid to increase mortgage uptake. KMRC also announced a 143.5% increase in mortgage loans to primary lenders to Kshs 7.0 bn from Kshs 2.8 bn. These initiatives demonstrate continued focus on increasing mortgage accessibility and uptake to individuals, and,

- Statutory Reforms Supporting the Real Estate Sector: Establishment of statutory laws by the government aimed at aligning Kenya with international standards in an attempt to address the shortcomings of previous Acts is expected to streamline Real Estate investments and transactions, e.g. the Public Private Partnership bill-2021.

Despite the above drivers, the sector is expected to be constrained by the following factors in 2022:

- Oversupply in Select Sectors - The existing oversupply in the Nairobi Metropolitan Area (NMA) office and retail market of 7.3 mn SQFT and 3.0 mn SQFT, respectively, coupled with an oversupply of 1.7 mn SQFT in the Kenya retail market continues to be a challenge for the Real Estate sector in the respective themes,

- Constrained Financing for Developers: Financial constraints continues to be a challenge for Real Estate developers as it results in stalling of projects as banks limit lending due to the increasing non-performing loans. This is evidenced by the 1.5% increase in the gross non-performing loans advanced to the Real Estate sector to Kshs 69.2 bn in Q3’2021, from Kshs 68.2 bn recorded in Q2’2020, accounting for 14.9% of the total Real Estate loan book, according to Central Bank of Kenya’s (CBK) Quarterly Economic Review Report July-September 2021.

- COVID-19 Uncertainties: COVID-19 uncertainties are a challenge for the Real Estate sector as the virus continues to mutate with the most current emerging variant being Omicron. This might lead to most tourists halting their travel plans with other countries imposing strict measures to limit the spread of the virus,

- Travel Restrictions: Travel bans and restrictions from key tourist markets continues to be a factor affecting the Real Estate sector particularly the hospitality industry due to the reduced number of tourism arrivals. Kenya currently has travel alerts from countries such as USA and UAE (Dubai),

- Underdeveloped capital markets: Under-developed capital markets continue to make it hard to develop pools of capital focused on projects particularly in the private markets, to complement efforts by the government. In Kenya, the main source of funding for Real Estate developers is banks which provide close to 95.0% of funding as compared to 40.0% in developed countries. This implies that capital markets contribute a mere 5.0% of Real Estate funding, compared to 60.0% in developed countries,

- Finance Bill 2021: The signing of the Finance Bill, 2021 into law brought the re-introduction of a 20.0% excise duty on fees and other commissions earned on loans by financial institutions making credit costly for home owners and developers as lenders will transfer the burden to borrowers, and,

- Shift towards e-commerce: The shift towards online shopping and financial setbacks continues to affect the performance of the Kenyan retail market. This shift continues to reduce demand for physical retail spaces.

The table below summarizes our outlook on the various Real Estate themes and the possible impact on the business environment in 2021;

Thematic Performance Review and Outlook

|

Thematic Performance Review and Outlook |

|||

|

Theme |

2021 Performance |

2022 Outlook |

Effect |

|

Residential Sector |

|

|

Neutral |

|

Commercial Office Sector |

|

|

Neutral |

|

Retail Sector |

|

|

Neutral |

|

Hospitality Sector |

|

|

Neutral |

|

Land Sector |

|

|

Positive |

|

Infrastructure Sector |

|

|

Positive |

|

Listed Real Estate |

|

|

Negative |

With 2 themes having a positive outlook, 4 neutral and 1 being negative, the general outlook for the sector therefore remains NEUTRAL. The sector’s performance will be supported by; i) government’s focus to implement affordable housing projects coupled with improved investor confidence in the country’s housing market, ii) increased demand for office spaces, iii) aggressive expansion by local and international retailers taking up new and previously occupied spaces, iv) increased visitor arrivals into the country hence boosting the performance of hospitality sector, v) government’s aggressiveness towards infrastructure roads development thus boosting investments through accessibility, and, vi) positive demographics. However, factors such as financial constraints, oversupply in the commercial office and retail sectors, and low of investor appetite in Real Estate Investments Trusts (REITs) are expected to continue impeding performance of the sector.

For the detailed real estate market outlook report, see our Real Estate Sector 2022 Market Outlook Note.

Key Highlights during the Week:

- Mr Charles Hinga, the Principle Secretary for the State Department of Housing and Urban Development, signed a Memorandum of Understanding (MoU) with Seascan Development Limited, a Real Estate developer, to construct 4900 affordable housing units in the project dubbed Mowlem Estate in Nairobi’s Dandora area, at a cost of Kshs 18.0 bn. The project will be the first-ever Transit-Oriented Development (TOD) Housing Programme in Kenya (a type of urban development that maximizes the amount of residential, business and leisure space within walking distance of public transport), whose ground-breaking is set for April 2022. The project will comprise of three phases of 1200, 2000, and, 1700 units, respectively. The table below is a summary of the expected unit types and prices;

|

Mowlem Estate Project |

||

|

Typology |

No. of Units |

Prices |

|

Studios |

880 |

1.8 mn |

|

1 bed |

660 |

3.0 mn |

|

2 bed |

1680 |

3.7mn |

|

3 bed |

1680 |

5.4 mn |

The continued focus on affordable housing initiative is expected to support increased home ownership in the county especially in the low and middle class segments whose demand for housing is high yet remains undersupplied,

- The United Arab Emirate (UAE) retained Kenya in its ‘Red List’ of countries barred from visiting UAE, with other countries such as Ghana, Angola, Uganda, Guinea and Cote d’Ivoire allowed admission to the middle-eastern state in its latest review. UAE had issued a ban on all inbound and transit passengers from Kenya in December 2021, citing fake COVID-19 certificates from Kenyan travellers, a move that saw the Kenyan government retaliate by suspending all inbound and transit passenger flights from the UAE for seven days effective 10th January 2022 and has further extended the ban to 24th January 2022. The continued travel bans and advisories are expected to weigh down the performance of the tourism and hospitality sectors in general as its tourists will cancel or postpone their travel plans to cushion themselves against the emerging Covid-19 variants, and,

- The government of Kenya through the Kenya Rural Roads Authority (KERRA) announced that it has begun upgrading to Bitumen Standards the Mago-Mululu - Wangulu (E240) & Lusui - Vokoli (E293) Roads. The two projects are approximately 20 Kms and are estimated to cost Kshs 1.1 bn. Upon completion, the road projects are expected to i) spur the growth of Real Estate through opening up the surrounding areas for development and promoting accessibility, ii)promote the property values, and, iii) reduce the development costs since infrastructural costs in Kenya account for approximately 14.0% of construction costs, according to the Centre for Affordable Housing Finance in Africa through relieving the cost burden that would otherwise be incurred by the developer.

Outlook Summary

Our outlook for Fixed Income is “neutral”, and our view is investors should be bias towards short-term fixed-income securities, in a bid to reduce duration risk. Our outlook for equities is “neutral”, while our outlook for real estate is “neutral”. In summary, our Outlook for 2022 Asset Classes and the investment environment is Neutral.

Key: Green – POSITIVE, Grey – NEUTRAL, Red – NEGATIVE

|

|

Fixed Income & Equities Outlook for 2022 |

|

Fixed Income |

Our view is that investors should be biased towards SHORT-TERM FIXED-INCOME SECURITIES to reduce duration risk. The political climate is expected to heat up gradually as we edge closer to the 2022 General Election with the investors expected to retrieve to “Safer” asset classes i.e Fixed income securities, as they closely monitor the political situation. We expect the interest rate environment to remain relatively stable in the country owing to the support from concessional multilateral loans from IMF reducing the government’s cash crunch

|

|

Equities |

We have a NEUTRAL outlook on the Kenyan Equities market in the short term. However, we maintain our bias towards a “BULLISH” equities markets in the medium to long term, with the expectations of a gradual recovery in corporate earnings, the cheaper valuations currently in the market, and the improving investor sentiment. |

|

Real Estate Outlook Summary |

|

|

Real Estate Sector |

The overall outlook for the real estate sector is NEUTRAL, supported by; improved business environment, the aggressive expansion by retailers taking up new and previously occupied retail spaces, infrastructural improvements which continues to promote accessibility, positive demographics facilitating demand and rebound of the tourism industry. However, factors such as financial constraints, oversupply in the commercial office and retail sectors, and low of investor appetite in Real Estate Investments Trusts (REITs) are expected to continue impeding performance of the sector |

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.