Cytonn Annual Markets Review - 2021

By Research Team, Jan 2, 2022

Executive Summary

Global Market Review

According to the October 2021 World Economic Outlook Report by the International Monetary Fund (IMF), the global economy is projected to expand by 5.9% in 2021, following a contraction of 4.4% in 2020. The growth is projected to be widespread across both the developed and the emerging markets. IMF projects that the new COVID-19 variants coupled with the slow vaccine distribution will continue to pose a risk on the recovery;

Sub-Saharan Africa Region Review

The World Bank and the International Monetary Fund, (IMF) project the Sub-Saharan region (SSA)’s economy to expand by 3.1% and 3.0%, respectively, in 2021, up from the 3.3% contraction recorded in 2020. The rebound projections come on the back of the increased rollout of vaccines in the region which has resulted to most countries re-opening their economies. The region has also seen recoveries in key sectors such as global trade, tourism and commodity driven sectors;

The select currencies recorded mixed performance against the US Dollar, with the Zambian Kwacha being the largest gainer in 2021, gaining by 21.0%, while the Mauritius Rupee was the largest decliner, depreciating by 9.3%. In 2021, Africa’s appetite for foreign-denominated debt continued to increase, with the region having raised a total of USD 11.8 bn in foreign-denominated debt issues;

Kenya Macro Economic Review

In 2021, the Kenyan economy rebounded, with the GDP for the first half of the year coming at an average of 5.4% , due to the 10.1% growth recorded in Q2’2021 and the 0.7% growth recorded in Q1’2021. The recovery was largely driven by growth in the transport and the accommodation and food sector which recorded growths of 16.9% and 9.1%, respectively, in Q2’2021, compared to the contraction of 16.8% and 56.6%, in Q2’2020. Business conditions in the Kenyan private sector recorded solid improvement during the year, with the average Stanbic Bank Monthly Purchasing Managers’ Index (PMI) for the first eleven months averaging 50.6, higher than the 48.0 recorded during a similar period in 2020. In 2021, inflation rate remained within the government’s set range of 2.5% - 7.5% but higher than the mid-range of 5.0% with the average inflation rate coming in at 6.1%;

Fixed Income

The yields on the government bonds remained relatively stable with the FTSE bond index registering a 2.2% decline. The yields on the, 91-day and 182-day T-bills increased to 7.0% and 7.6%, respectively while the yield on the 364-day T-bill declined to 8.5%, in 2021. There was a general increased interest on longer dated government securities with treasury receiving a 130.9% subscription translating to Kshs 834.2 bn raised compared to Kshs 728.0 bn on offer. The short-term papers were affected by the occasional liquidity strains with T-bills auction recording an undersubscription, with the average subscription rate coming in at 94.1%, down from the 130.9% oversubscription recorded in 2020;

Equities

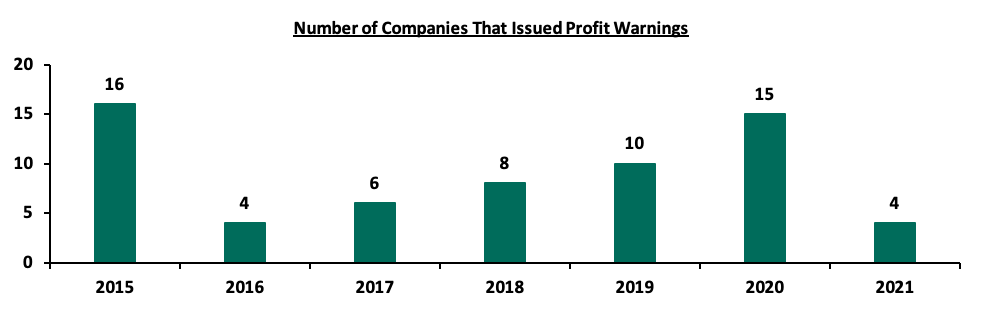

The Kenyan equities market was on an upward trend with all indices gaining: NASI, NSE 25 and NSE 20 were up by 9.5%, 9.8% and 1.6%, respectively. The equities market performance was driven by gains recorded by large cap stocks such as Equity Group, ABSA Bank Kenya, BAT Kenya, KCB Group and Safaricom of 45.5%, 24.5%, 22.3%, 18.4%, and 10.8%, respectively. The banking sector has seen recovery with the core earnings per share (EPS) of the listed banks growing by 102.0%, compared to a weighted decline of (32.4%) in Q3’2020. This year, 4 companies issued profit warnings, as compared to 15 companies in 2020, and 10 companies in 2019. These companies are Centum Investment Company PLC, Umeme Limited, Williamson Tea Kenya PLC and WPP ScanGroup PLC. Additionally, the Nairobi Securities Exchange (NSE) de-listed National Bank of Kenya (NBK) after the successful takeover of all the bank’s shares by KCB Group in September 2019;

During the week, the Central Bank of Kenya (CBK) released the Quarterly Economic Review for the period ending 30th June 2021, highlighting that the sector’s total assets increased by 7.8% to Kshs 5.7 tn, from Kshs 5.3 tn in June 2020 and Profit before Tax (PBT) increased by 132.7% to Kshs 50.5 bn, from Kshs 21.7 bn in Q2’2020. During the week, Equity Group disclosed that Britam Holdings PLC had agreed to sell its 6.7% stake in Equity Group to the International Finance Corporation (IFC) and IFC Financial Institutions Growth Fund (IFC FIG Fund);

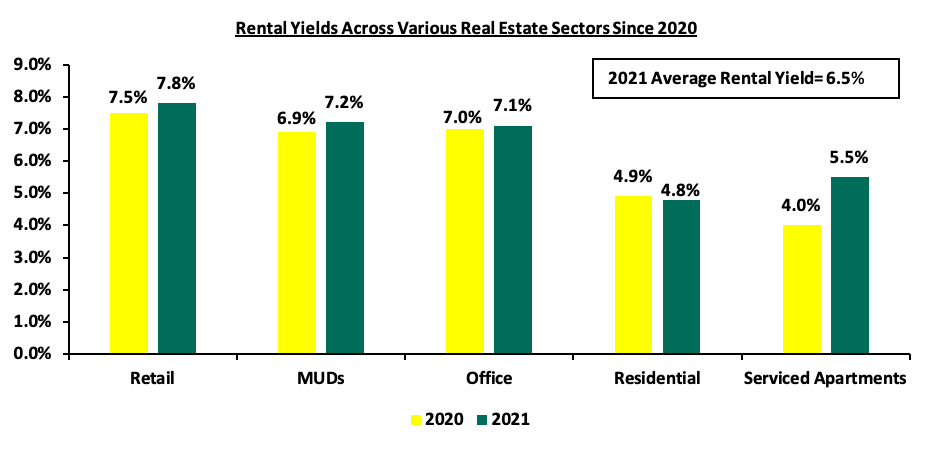

Real Estate

In 2021, the Kenyan Real Estate sector witnessed increased development activities with a general improvement in Real Estate transactions, attributed to the improved business environment. The reopening of the economy has also facilitated numerous expansion and construction activities by investors, in addition to various businesses also resuming full operations. In terms of performance; the residential, commercial office, retail, mixed-use developments and serviced apartments sectors realized average rental yields of 4.8%, 7.1%, 7.8%, 7.2%, and 5.5%, respectively. This resulted to an average rental yield for the Real Estate market at 6.5%, 0.4% points higher than the 6.1% recorded in 2020.

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.51%. To invest, dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.97% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809#;

- We shall resume our Wealth Management Training from Monday through Saturday, from 9:00 am to 11:00 am, through our Cytonn Foundation as from the New Year. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert is welcome to consider one of the five projects currently available for conversion, click here for the latest conversion term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s Real Estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation. To rent, please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

- Share a meal with a friend during the Sunday Brunch at The Hive Restaurant at Cysuites Hotel and Apartment. Every Sunday from 11.00 AM to 4.00 PM at a price of Kshs 2,500 for Adults and Kshs 1,500 for children under 12 years;

Global Economic Growth

According to the October 2021 World Economic Outlook Report by the International Monetary Fund (IMF), the global economy is projected to expand by 5.9% in 2021, from a contraction of 4.4% in 2020. IMF projects that the new COVID-19 variants coupled with the slow vaccine distribution as the big risk to the global economic recovery. Advanced Economies are projected to expand by 5.2%, while Developing and Emerging Markets are projected to expand by 6.4% in 2021. The recovery of the Advanced Economies has been revised down to 5.2% from 5.6%, partly attributable to the supply-chain disruptions brought about by the pandemic while that of the Developing and Emerging Markets has been revised up from 6.3% to 6.4% due to increased commodity prices that have boosted some of the commodity-exporting economies. Close to 60.0% of the population in advanced economies has been vaccinated, compared to approximately 4.0% of the low-income economies’ population. The global recovery shall largely be determined by how quickly and effectively governments vaccinate their populations.

Global Equities Markets Performance

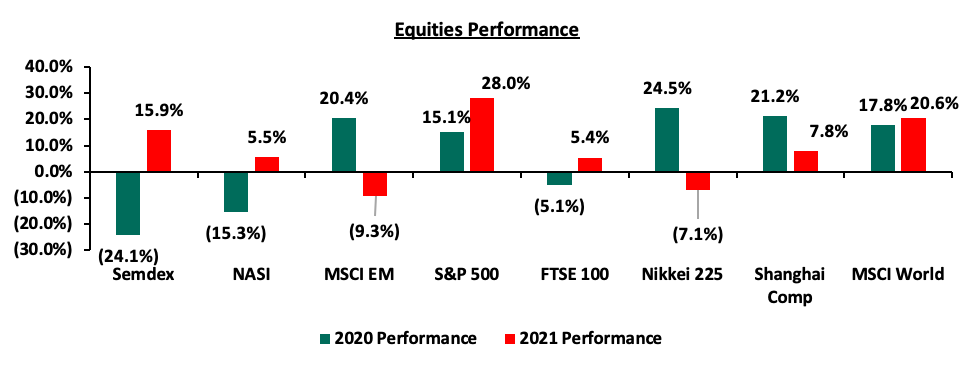

Global equity markets registered mixed performance during the year, with MSCI Emerging Markets and Nikkei 225 being the only losers among the major world indices. The losses recorded by MSCI EM and Nikkei 225 can be attributed to increased sell off of tech stocks following new strict regulations introduced in China which aimed to intensify the government’s influence over tech companies. The tech stocks had rallied during the third and fourth quarters of 2020, leading to the indices gaining at a period when most world indices were recording losses brought about by adverse effects of the pandemic. Growth in the global equities markets has been mainly driven by the economic recovery from the COVID-19 pandemic, accommodative monetary policies and increased rollout of vaccines which has improved the control of the pandemic. Below is a chart highlighting the performance of select stock indices;

Source: S&P Capital IQ

Global Commodities Market Performance

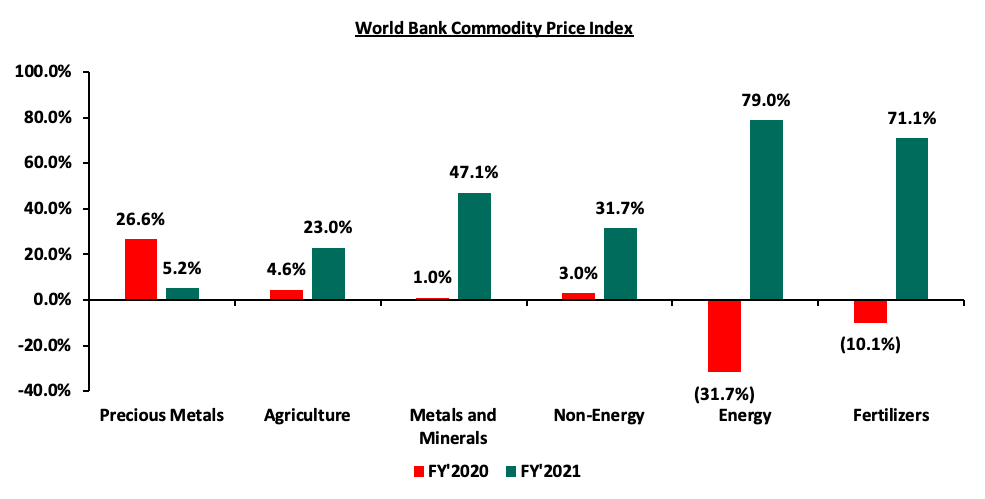

Global commodity prices registered positive performance in 2021, with energy prices showing the greatest increase of 79.0%, compared to the 31.7% decline experienced in 2020. The significant increase can be attributed to the recovery in global demand following the re-opening of major economies. Fertilizers, metals & minerals, non-energy commodities and agriculture, similarly registered gains of 71.1%, 47.1%, 31.7% and 23.0%, respectively, while precious metals registered a slower growth of 5.2% which was significantly lower than the 26.6% gain recorded in 2020. The slow gains by precious metals can be attributed to improved economic conditions from the pandemic, which have reduced investor demand for them as a primary store of value. Below is a summary performance of various commodities;

Economic Growth

The Sub-Saharan Africa economy is projected to expand by 3.1% in 2021 according to World Bank’s African Pulse issue and 3.0% according to the IMF, and is expected to grow further in 2022 by 3.5% and 3.8%, according to projections from the World Bank and IMF respectively. The growth will be driven by elevated commodity prices, relaxation of COVID-19 containments measures, increased vaccination and recovery in global trade. The SSA remains prone to threats such as emergence of new waves of the pandemic, coupled with slow vaccine roll out in some economies and concerns over debt sustainability. The region’s public debt to Gross domestic product is estimated at 71.0%, which is 30.0% points more than in 2013.

Currency Performance

In 2021, SSA Currency markets recorded mixed performance, with most currencies depreciating against the dollar. This is attributable to increased dollar demand in the region following the reopening of major economies in 2021, coupled with a faster increase in imports as compared to exports. Below is a table showing the performance of select African currencies;

|

Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Dec-19 |

Dec-20 |

Dec-21 |

2020 y/y change (%) |

2021 y/y change (%) |

|

Zambian Kwacha |

14.1 |

21.1 |

16.7 |

(50.4%) |

21.0% |

|

Ugandan Shilling |

3,660.0 |

3,647.0 |

3,544.3 |

0.4% |

2.8% |

|

Tanzania Shilling |

2,293.0 |

2,314.0 |

2,297.8 |

(0.9%) |

0.7% |

|

Ghanaian Cedi |

5.7 |

5.8 |

6.0 |

(3.2%) |

(3.4%) |

|

Kenyan Shilling |

101.3 |

109.2 |

113.1 |

(7.7%) |

(3.6%) |

|

Malawian Kwacha |

729.1 |

763.2 |

817.3 |

(4.7%) |

(7.1%) |

|

Nigerian Naira |

306.0 |

380.7 |

410.9 |

(24.4%) |

(8.0%) |

|

South African Rand |

14.0 |

14.7 |

15.9 |

(5.0%) |

(8.1%) |

|

Botswana Pula |

10.6 |

10.8 |

11.7 |

(2.3%) |

(8.7%) |

|

Mauritius Rupee |

36.2 |

39.6 |

43.3 |

(9.3%) |

(9.3%) |

Key take outs from the table above are;

- The Mauritian Rupee was the worst performer, depreciating by 9.3% against the dollar, attributable to lower dollar inflows from export and tourism sectors as a result of strict lockdown measures to curb spread of the Delta variant of COVID-19.

- The Zambian kwacha registered significant recovery, appreciating by 0% compared to the 50.4% depreciation recorded in 2020. The strong performance of the Kwacha is mainly attributable to the strong recovery in global copper prices which led to improved foreign exchange flows from the mining sector.

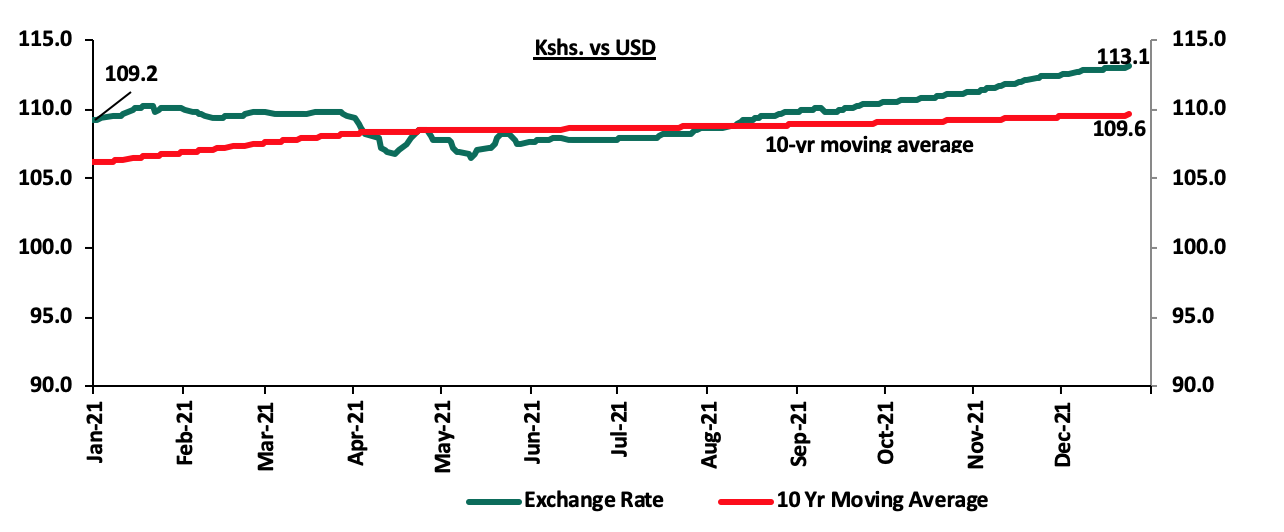

- The Kenya Shilling depreciated by 3.6% in 2021 to close at Kshs 113.1 against the US Dollar, compared to Kshs 109.2 recorded at the end of 2020, driven by the increased global crude oil prices that led to increased dollar demand from oil and energy importers who had to increase the amounts they pay for oil imports and hence depleting dollar supply in the market.

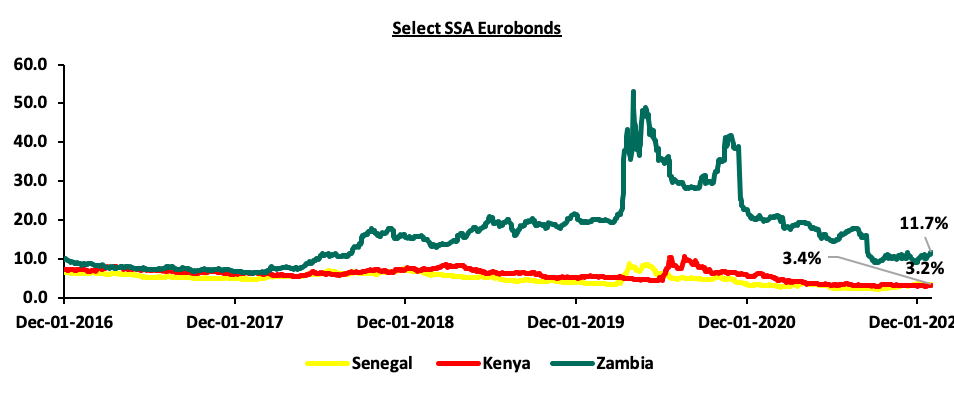

African Eurobonds

Africa’s appetite for foreign-denominated debt has continued to increase, with USD 11.8 bn worth of Eurobonds issued by African sovereigns in 2021. The latest issuer in 2021 was Nigeria, who raised a total of USD 4.0 bn in September 2021, after receiving bids worth USD 12.2 bn, translating to a subscription rate of 3.1x. The oversubscription is mainly driven by the yield hungry investors and also the positive outlook of Nigeria’s economic recovery. Other countries that issued Eurobonds include Kenya which raised USD 1.0 bn in June 2021, in an issue that was 5.0x oversubscribed. Similarly, Ghana raised USD 3.0 bn from a zero-coupon Eurobond issue that was 2.0x oversubscribed.

Below is a 5-year graph showing the Eurobond secondary market performance of select 10-year Eurobonds issued by the respective countries:

Source: S&P Capital IQ

There was a general decline in the yields of the various Eurobonds from different countries due to general improvement in investor sentiment as the economies recovered and demand for commodities increased. However, yields have slightly edged up in the tail end of Q4’2021, as investors attach a higher risk premium on the region, following the emergence of the new Omicron variant that continues to pose a risk to the region’s economic recovery.

Equities Market Performance

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in 2021, with most of the markets recording positive returns, attributable to the improved investor sentiments in the region. The Zambia Stock market (LASILZ) was the best performing with a 96.2% index gain, attributable to the recovery of copper prices. On the other hand, Rwanda’s RSEASI was the worst-performing index, recording losses of 5.5%, mainly attributable to a deterioration in the business environment following the sustained lockdowns put in place to curb the spread of COVID-19, hence lowering investor sentiments. Below is a summary of the performance of key indices:

|

Equities Market Performance (Dollarized*) |

||||||

|

Country |

Index |

Dec-19 |

Dec-20 |

Dec-21 |

2020 y/y change (%) |

2021 y/y change (%) |

|

Zambia |

LASILZ |

303.3 |

185.2 |

363.4 |

(39.0%) |

96.2% |

|

Ghana |

GGSECI |

405.5 |

332.5 |

464.4 |

(18.0%) |

39.7% |

|

South Africa |

JALSH |

4,079.3 |

4,069.0 |

4638.8 |

(0.3%) |

14.0% |

|

Kenya |

NASI |

1.6 |

1.4 |

1.5 |

(15.2%) |

4.4% |

|

Tanzania |

DARSDEI |

1.5 |

1.5 |

1.6 |

0.7% |

3.4% |

|

Uganda |

USEASI |

0.5 |

0.4 |

0.4 |

(26.8%) |

0.2% |

|

Nigeria |

NGEASI |

87.7 |

105.8 |

103.9 |

20.6% |

(1.8%) |

|

Rwanda |

RSEASI |

0.1 |

0.2 |

0.1 |

3.4% |

(5.5%) |

|

*The index values are dollarized for ease of comparison |

||||||

Source: S&P Capital IQ

Robust GDP growth in Sub-Saharan Africa region is expected to continue in 2022 in line with the rest of the global economy. The region still faces key challenges among them emergence of new COVID-19 waves coupled with slow pace of vaccine rollout. The region continues to suffer from high debt levels that will make them less attractive to foreign capital and high costs of debt service following expiry of Debt Service Suspension Initiative and weakening of local currencies.

Economic Growth:

During the first half of the year, the economy recorded an average growth of 5.4% growth, 10.1% growth recorded in Q2’2021 and the 0.7% growth recorded in Q1’2021, an increase from the 0.2% contraction recorded in H1’2020. The expansion was largely driven by growth in the transport and the accommodation and food sectors which recorded growth of 16.9% and 9.1%, respectively, in Q2’2021, compared to the contraction of 16.8% and 56.6%, recorded in Q2’2020. The growth in these sectors follow the ease of COVID-19 travel restrictions and lift of the dawn to dusk curfew that was put in place since March 2020. Notably, the agricultural sector recorded a decline of 0.9% in Q2’2021, compared to a 4.9% growth in Q2’2020 and a 0.1% contraction in Q1’2021. The contraction during the quarters is mainly attributable to unfavorable weather conditions witnessed during the period. For more information, see our Q2’2021 GDP Note.

In 2021, the Kenyan economy is projected to grow at an average of 5.8% supported by continued recovery in the accommodation and food sector. The key challenge remains the Covid 19 pandemic and the fact that Kenya is having an election in2022. The table below shows the projections by various organizations:

|

No. |

Organization |

2021 Projections |

|

1 |

International Monetary Fund |

7.6% |

|

2 |

National Treasury |

6.4% |

|

3 |

Cytonn Investments Management PLC |

5.7% |

|

4 |

World Bank |

5.0% |

|

5 |

S&P Global |

4.4% |

|

Average |

5.8% |

|

|

Median of Growth Estimates |

5.7% |

|

Source: Cytonn Research, 2021

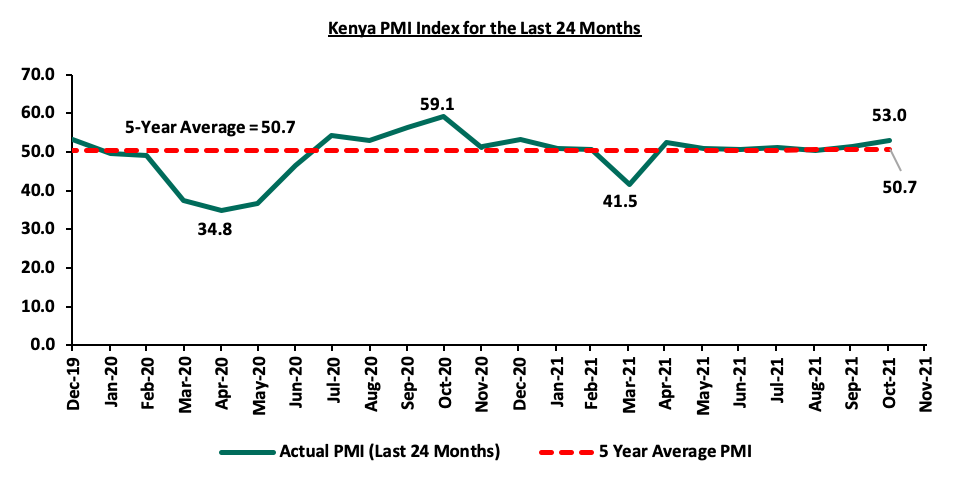

Business conditions in the Kenyan private sector recorded solid improvement during the year, with the average Stanbic Bank Monthly Purchasing Managers’ Index (PMI) for the first eleven months averaging 50.6, higher than the 48.0 recorded during a similar period in 2020. For the month of November 2021, the index increased to 53.0 from 51.4 recorded in October 2021.

The Kenya Shilling:

The Kenya Shilling depreciated by 3.6% against the US Dollar to close at Kshs 113.1 in 2021, compared to Kshs 109.2 at the end of 2020.

The performance of the Kenyan shilling in 2021 was driven by;

On the negative side we had

- Increased global crude oil prices that led to increased dollar demand from oil and energy importers who had to increase the amounts they pay for oil imports and hence depleting dollar supply in the market,

- Increased dollar demand as economies reopened leading to shortage of USD in the Kenyan market,

- Expansion of the current account deficit attributed to a robust increase in merchandise imports by 38.9% to Kshs 451.0 bn in Q2’2021, from Kshs 324.6 bn in Q1’2020 as compared to a 29.0% increase in merchandise exports to Kshs 179.7 bn, from Kshs 139.1 bn in Q2’2020, and,

- The aggressively growing government debt, with Kenya’s public debt having increased at a 10-year CAGR of 17.7% to Kshs 7.8 tn in July 2021, from Kshs 1.5 tn in July 2011 thus putting pressure on forex reserves to repay some of the public debt.

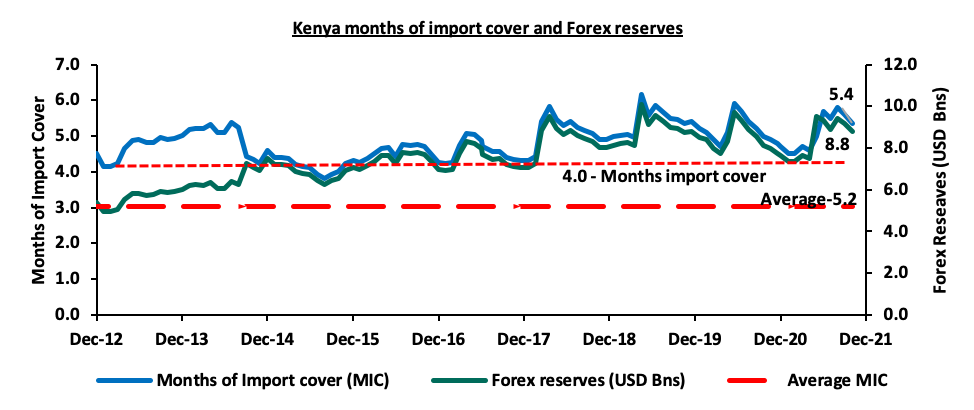

The shilling received some support driven by

- The forex reserve remains sufficient well above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. The following is a graph showing Kenya months of import cover and forex reserves since 2012;

- The government received USD 314.0 mn disbursement from the International Monetary Fund (IMF) earlier in April 2021 and the USD 407.0 mn approved by the IMF under the Extended Fund Facility and Extended Credit Facility in June 2021 which supported the reserves as they increased by 26.4% to Kshs 9.5 bn in June 2021 from Kshs 7.5 bn in May 2021. Additionally, in December 2021, the International Monetary Fund (IMF) completed the second review of the 38-month Extended Fund Facility (EFF) and Extended Credit Facility (ECF) allowing Kenya to access approximately USD 258.1 mn (Kshs 29.2 bn), bringing the total support from IMF to Kenya to USD 972.6 mn (Kshs 109.9 bn) in 2021. This debt relief is expected to support forex reserves,

- Diaspora remittances that has grown to USD 320.1 mn as at November 2021, compared to USD 257.7 mn recorded in the same period in 2020,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- Monetary policy support from CBK by maintaining the policy rate at the current 7.0%. Any additional rate cuts would lead to a further depreciation of the shilling.

In line with our expectations, the Kenyan shilling closed the year at Kshs 113.1. We expect the shilling to continue weakening in the medium term, within a range of Kshs 109.1 and Kshs 116.6 against the USD based on the Purchasing Power Parity (PPP) and Interest Rate Parity (IRP) approach. Read on our Review of Performance of Kenya Currency.

Inflation:

The inflation rate remained within the government’s set range of 2.5% - 7.5% but higher than the mid-range of 5.0% in 2021 with the average monthly inflation rate coming in at 6.1%. The relatively high inflation can be attributed to the high fuel prices experienced through most of the year, coupled with the erratic weather conditions experienced in the second half of the year which led to food commodity prices spiking. The December numbers were 5.7%, a decline from 5.8% recorded in November in line with our expectations of 5.7% - 6.1%, but higher than the December 2020 rate of 5.6%. On a m/m basis, the inflation rates increased by 0.9%, driven by a 1.7% increase in food & non-alcoholic beverages.

Going forward, we expect the inflation rate to remain within the government’s set range of 2.5% - 7.5% with the key risks being drought in the first quarter of the year, further depreciation of the currency and unsustainability of the fuel subsidy program by the National Treasury should the average landed costs of fuel keep rising, which could eventually lead to increase in fuel prices.

Monetary Policy:

During the year the Monetary Policy Committee(MPC) met 6 times and maintained the Central Bank Rate (CBR) at 7.00% and the Cash Reserve Ratio of 4.25% in all meetings, citing that the measures implemented since March 2020 were having the intended effect on the economy and as such, remained appropriate and effective. We expect the MPC to continue holding the rates at the same level as they try to balance between supporting the fragile economic recovery and maintain a stable price environment and at the same time protect the currency.

2021 Key Highlights:

- FY’2021/2022 Budget and Draft 2022 Budget Policy Statement;

- On 10thJune 2021, the National Treasury presented Kenya’s FY’2021/2022 National Budget to the National Assembly highlighting that the total budget estimate for the 2021/2022 fiscal year was Kshs 3.0 tn, a 4.8% increase from the Kshs 2.9 tn final FY’2020/21 budget. The government projects that total revenue will increase by 10.3% to Kshs 2.0 tn, from the Kshs 1.8 tn in FY’2020/2021, the increase largely being projected to come from ordinary revenue, which is to grow by 11.4% to Kshs 1.8 tn in FY’2021/22 from Kshs 1.6 tn in the FY’2020/21 budget. The projected revenues are mainly pegged on Kenya’s economic recovery, broadening the tax base and tax reforms. The expenditure is expected to increase by 4.8% to Kshs 3.0 tn, from Kshs 2.9 tn in the FY’2020/21 budget. For more information, see our Kenya’s FY’2021/2022 Budget Review, and,

- In the month of November, the National Treasury released the Draft 2022 Budget Policy Statement, projecting a 7.7% increase in the target Excise Duty for FY’2021/2022 to Kshs 259.6 bn, from Kshs 241.0 bn as highlighted in the original budget estimates. The increase in the Excise duty revenue collection target follows the publishing of the Legal Notice 217 of 2021, which allowed the Kenya Revenue Authority, (KRA) to adjust the specific rates of excise duty upwards by 5.0% in line with average annual inflation rate for the FY’2020/2021. For more information, see our Cytonn Weekly #46/2021.

- Credit Facilities extended to Kenya;

- In 2021, Kenya received a total of USD 130.0 mn (Kshs 14.0 bn) from the World Bank and USD 984.0 mn (Kshs 109.8 bn) from the IMF to help the country respond to the unprecedented shock of the COVID-19 pandemic as well as reduce Kenya’s debt levels. The funding from the World Bank would also enable Kenya to procure more vaccines through the African Vaccine Acquisition Task Team (Avatt) and the COVID-19 Vaccines Global Access (Covax) facilities in addition to supporting the deployment of the vaccines by boosting the country’s cold-storage capacity. For more information, see our Cytonn Weekly #26/2021, and,

- On 22nd December 2021, the Kenyan authorities and the IMF reached a staff level agreement on the second review of the 38-month Extended Fund Facility (EFF) and Extended Credit Facility (ECF) - funded program. IMF noted that subject to the completion of the review by the IMF Board, Kenya would access approximately USD 264.0 mn (Kshs 29.5 bn). For more information, see our Cytonn Weekly #07/2021, Cytonn Weekly #44/2021, and Cytonn Weekly #50/2021.

- Balance of Payments

The Kenya National Bureau of Statistics released the Q1’2021 Balance of Payments Report highlighting that Kenya’s balance of payments deteriorated in Q1’2021, coming in at a deficit of Kshs 59.4 bn, from a deficit of Kshs 47.4 bn in Q1’2020. The deterioration was due to the 16.6% increase in the Current Account deficit to Kshs 142.0 bn, from Kshs 121.7 bn in Q1’2020 due to merchandised trade deficit and lower inflows from the services sector. The current account deficit (value of goods and services imported exceeds the value of those exported) expanded by 16.6% to Kshs 142.0 bn, from Kshs 121.7 bn in Q1’2020, mainly attributable to widening of the Merchandise Trade Deficit by 26.9% to Kshs 287.3 bn from Kshs 226.4 bn recorded in Q1’2020. For more information, see our Q1’2021 BOP Note.

- Credit Ratings;

The country saw its ratings revised downwards by Standard & Poor’s, a US based ratings agency, to 'B' from 'B+’, while Fitch Rating affirmed Kenya's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'B+' with a Negative Outlook. Fitch Rating pointed out that the rating reflected a track record of strong growth, relative macroeconomic stability and a favorable government debt structure which was balanced by negatives such as rising public debt levels and high net external indebtedness. On the other hand, the Negative Outlook on the ratings reflected the underlying weaknesses of the public finances and the uncertain pace of planned fiscal consolidation. For more information, see our Cytonn Q1’2021 Market Review. Below is a summary of the credit rating on Kenya so far:

|

Rating Agency |

Previous Rating |

Current Rating |

Current Outlook |

Date Released |

|

S&P Global |

B+ |

B |

Stable |

5th March 2021 |

|

Moody’s |

B1 |

B2 |

Negative |

19th June 2020 |

|

Fitch Ratings |

B+ |

B+ |

Negative |

26th March 2021 |

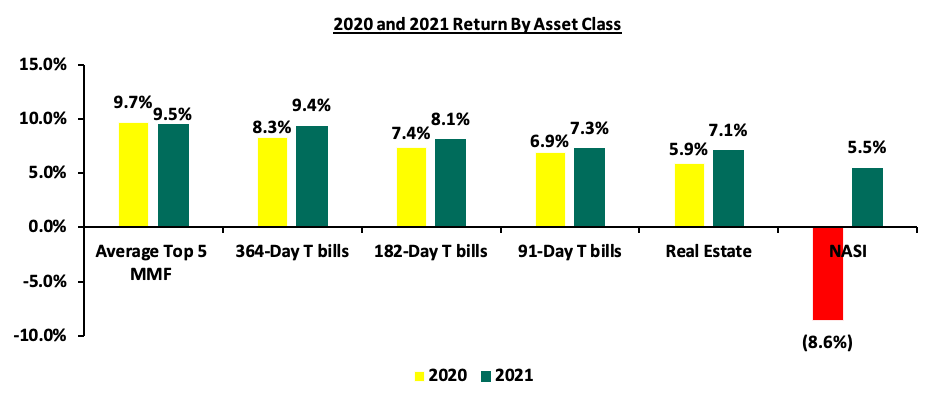

2021 returns by various Asset Classes

The returns by the various asset classes improved in 2021, with the 364-day, 182-day and 91-day Government papers recording yields of 9.4%, 8.1% and 7.3%, respectively, while Real estate yield and NASI recorded returns of 7.1% and 5.5% respectively. However, average returns of top five money market funds recorded a 0.2% points decline to 9.5% in December 2021, from 9.7% recorded in December 2020. The graph below shows the summary of returns by various asset classes (Average top 5 MMF, Fixed Income, Real Estate and Equities).

The table below shows the macro-economic indicators that we track, indicating our expectations for each variable at the beginning of 2021 versus the experience;

|

Macroeconomic Indicators 2021 Review |

||||

|

Macro-Economic Indicators |

2021 Expectations at Beginning of Year |

Outlook - Beginning of Year |

2021 Experience |

Effect |

|

Government Borrowing |

|

Negative |

|

Negative |

|

Exchange Rate |

|

Neutral |

|

Negative |

|

Interest Rates |

|

Neutral |

|

Neutral |

|

Inflation |

|

Positive |

|

Neutral |

|

GDP |

|

Neutral |

|

Neutral |

|

Investor Sentiment |

|

Positive |

|

Positive |

|

Security |

|

Neutral |

|

Neutral |

Since the beginning of the year, the notable changes we have seen out of the seven metrics that we track, fall under Exchange rates and Inflation. Exchange rates changed from neutral to negative while Inflation rate changed from positive to neutral. In conclusion, macroeconomic fundamentals showed mixed performances during the year but we expect a continued recovery in 2022 supported by the improving business conditions in the country. This will, however, be highly dependent on how well the government can handle the emerging COVID-19 Omicron variant and the upcoming national elections

T-Bills & T-Bonds Primary Auction:

During the year, T-bills auction recorded an undersubscription, with the average subscription rate coming in at 94.1% compared to an average of 130.9% in 2020, as investors shifted their interest to the bond market in search of higher yields. The yields on the 91-day and 182-day papers increased by 10 bps and 7.1 bps to 7.0% and 7.6%, respectively while the yield on the 364-day paper declined by 1.8 bps to 8.5% in 2021. Yields on government securities remained relatively stable, mainly due to the Central Bank of Kenya’s (CBK’s) efforts to keep rates low by rejecting expensive bids in the auction market.

Primary T-bond auctions in 2021 were oversubscribed, with the subscription rate averaging 147.6%, which was higher than the 130.6% average subscription rate recorded in 2020, partly attributable to the ample liquidity in the money market. The market preferred the medium-term bonds, owing to concerns that risks on the longer end of the yield curve may not be sufficiently priced. The average acceptance rate came in at 79.9% in 2021, an 11.4% points increase from the 68.5% recorded in 2020 as the market adjusted to the efforts of the CBK to maintain the rates at low levels.

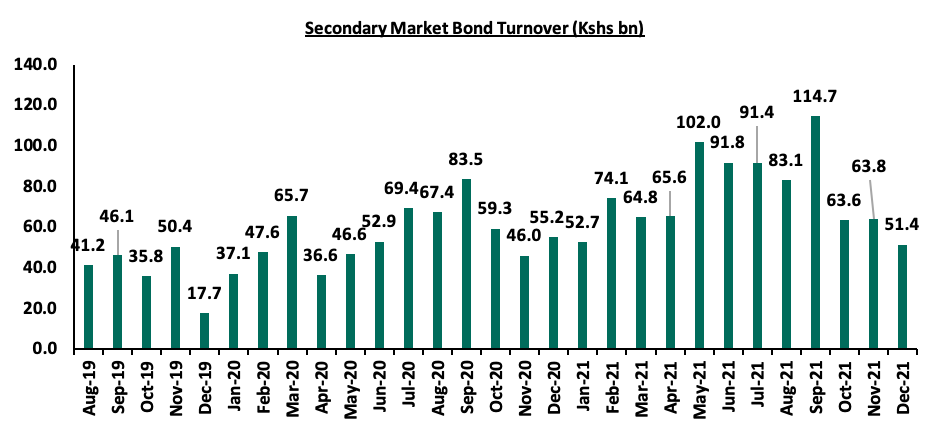

Secondary Bond Market Activity:

The secondary bond market recorded increased activity with the turnover having increased by 50.2% to Kshs 919.1 bn, from Kshs 667.3 bn in 2020. This is attributable to local institutional investors increasing their allocation to treasury bonds as they sort for higher returns offered by the asset class.

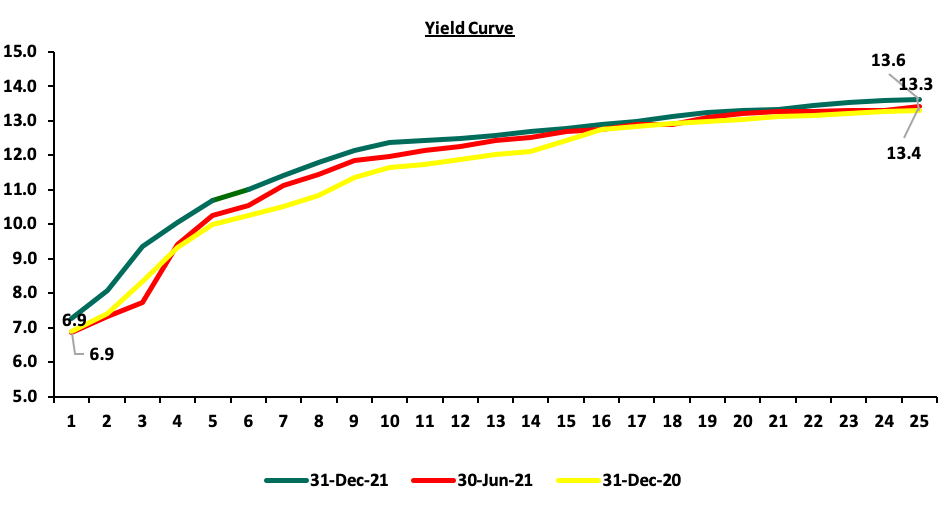

In 2021, the yield curve experienced upward pressure, partly attributable to the increased government borrowing and partly due to the increasing inflation seen in 2021 given that the higher the current rate of inflation and the higher the expected future rates of inflation, the higher the yields will rise across the yield curve, as investors will demand higher yield to compensate for inflation risk. The FTSE NSE bond index declined by 2.2% to close the year at 96.1, from 98.3 at the end of 2020. The chart below is the yield curve movement during the period;

Liquidity:

During the year, liquidity levels tightened as evidenced by the increase in the average interbank rate to 4.7% in 2021, from 3.7% in 2020. The tightened liquidity is partly due to government remittances which offset payments. The average volumes traded in the interbank market declined marginally by 0.3% to Kshs 10.65 bn in 2021 from Kshs 10.68 bn recorded in 2020.

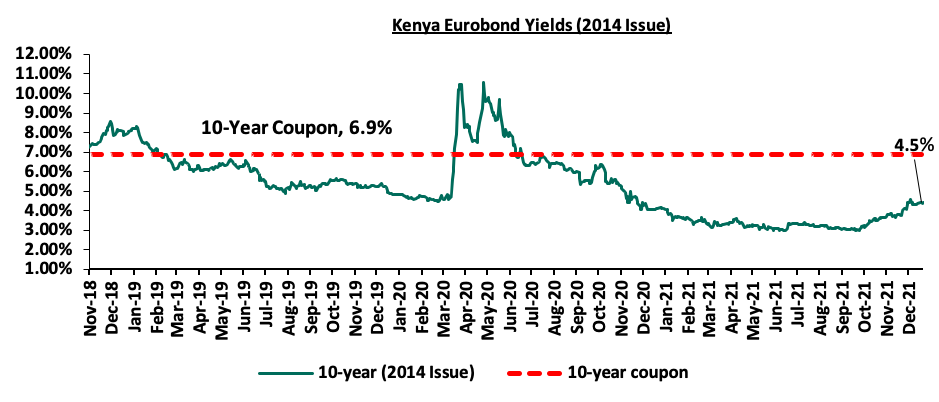

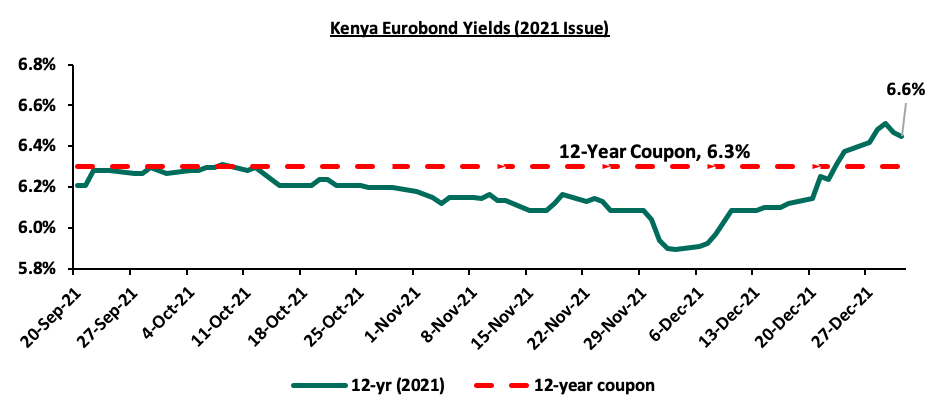

Kenya Eurobonds:

Yields on all Kenyan Eurobonds generally increased in 2021, pointing towards concerns by the investors on the economic status of the country. According to the CBK, the yields on the 10-Year Eurobond issued in 2014 increased by 0.6% points to 4.5%, from 3.9% recorded at the end of 2021.

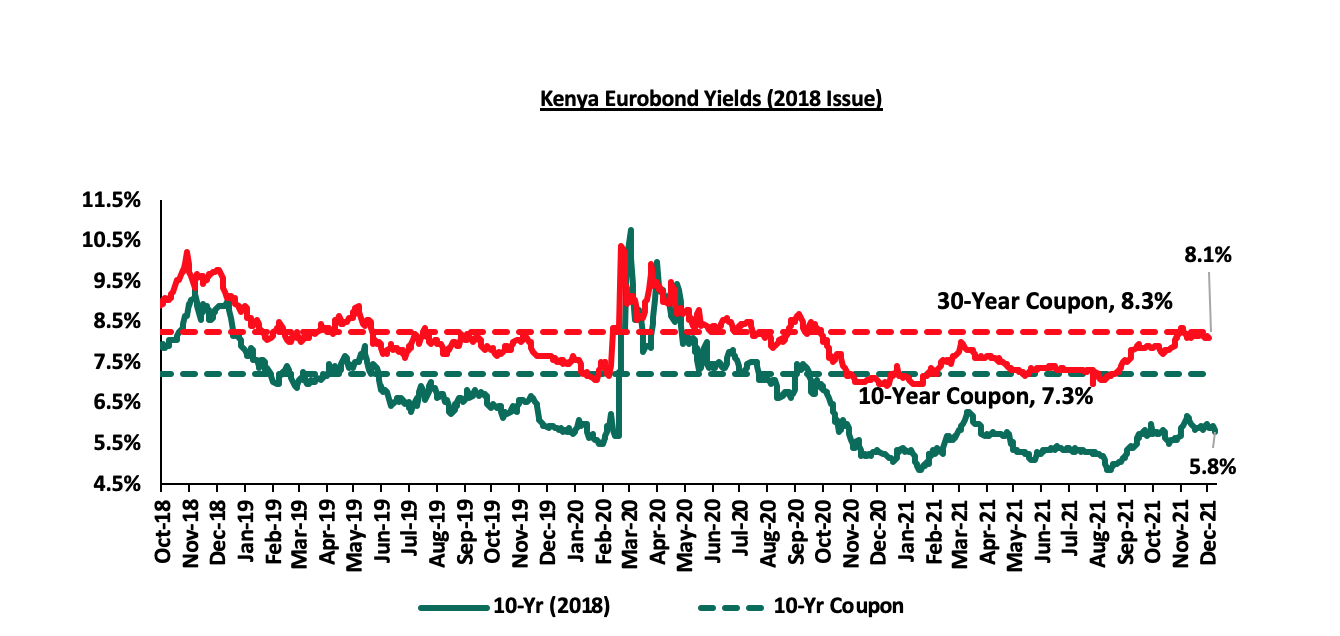

For the 2018 Eurobond issue, the yields on the 10-year Eurobond and the 30-year Eurobond both increased by 0.6% points and 1.1% points to close the year at 5.8% and 8.1%, from yields of 5.0% and 7.0% at the close of 2020 respectively.

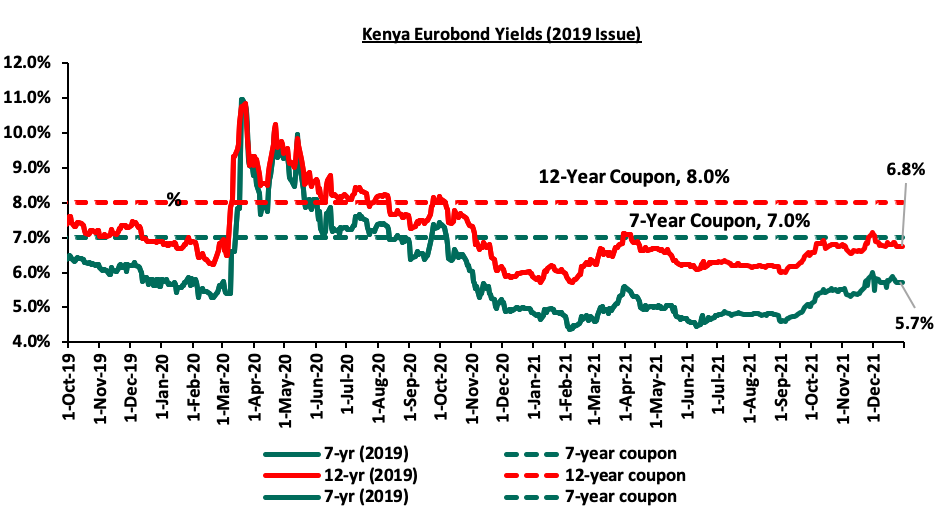

For the 2019 Dual-tranche Eurobond issue, the yields on the 7-year Eurobond and the 12-year Eurobond increased by 0.8% points and 0.9% points to close the year at 5.7% and 6.8%, from 4.9% and 5.9% at the close of 2020, respectively.

For the 13-Year Eurobond issued in 2021 closed the year at a yield of 6.6%.

Rates in the fixed income market have remained relatively stable with an upward bias due to the tightened but sufficient levels of liquidity in the money markets and the high appetite for debt by the government. The government is 5.9% ahead of its prorated borrowing target of Kshs 341.9 bn having borrowed Kshs 362.1 bn of the Kshs 658.5 bn borrowing target for the FY’2021/2022. We expect a gradual economic recovery going into FY’2021/2022 as evidenced by KRAs collection of Kshs 740.0 bn in revenues during the first five months of the current fiscal year, which is equivalent to 100.0% of the prorated revenue collection target. However, despite the projected high budget deficit of 7.5% and the lower credit rating from S&P Global to 'B' from 'B+', we believe that the support from the IMF and World Bank will mean that the interest rate environment will remain stable since the government is not desperate for cash.

Market Performance

During the year, the Kenyan equities market was on an upward trajectory, with NASI, NSE 25 and NSE 20 increasing by 9.5%, 9.8% and 1.6%, respectively. Below is a summary of the 2021 performance of the some of the large cap stocks in the Kenyan stock market:

|

Kenyan Equities Performance – Large Cap Gainers and Losers 2021 |

||

|

No |

Company Name |

Share Price Performance 2021 |

|

1 |

Equity Group |

45.5% |

|

2 |

ABSA Bank Kenya |

24.5% |

|

3 |

BAT Kenya |

22.3% |

|

4 |

KCB Group |

18.4% |

|

5 |

Safaricom |

10.8% |

|

6 |

East African Breweries Limited (EABL) |

7.1% |

|

7 |

Co-operative Bank Kenya |

3.2% |

|

8 |

Bamburi Cement |

(4.9%) |

|

9 |

NCBA Bank Kenya |

(5.3%) |

|

10 |

Standard Chartered Bank Kenya |

(11.2%) |

|

11 |

Diamond Trust Bank Kenya (DTB-K) |

(22.5%) |

Equity turnover during the year declined by 11.2% to USD 1.3 bn, from USD 1.4 bn in FY’2020. Foreign investors remained net sellers, with a net outflow of USD 91.9 mn, compared to net outflows of USD 280.9 mn recorded in FY’2020. The foreign-investor outflows during the year can be attributed mainly to profit taking activities as most large cap stocks recorded significant gains during the year, compared to 2020.

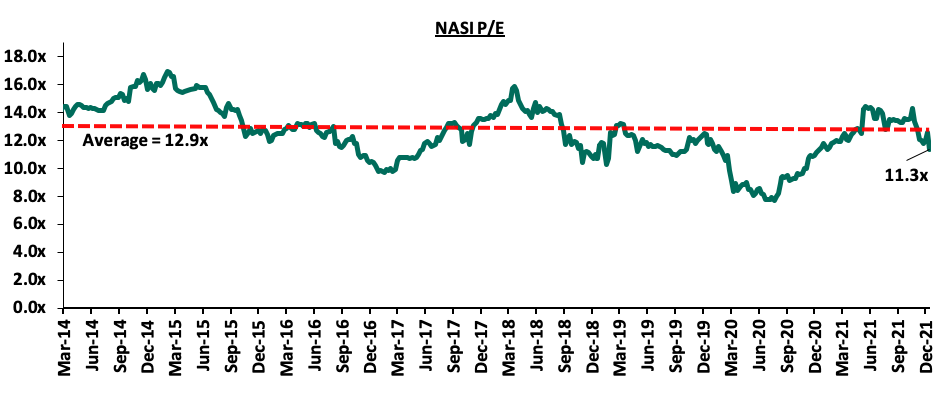

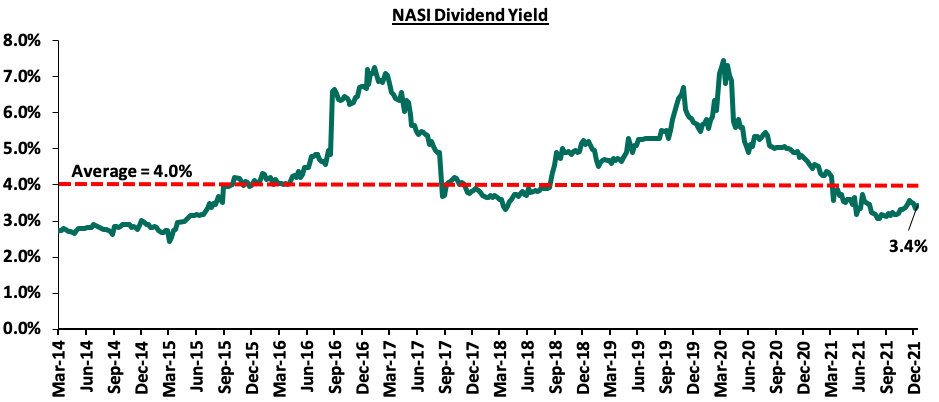

The market is currently trading at a price to earnings ratio (P/E) of 11.3x, similar to what was recorded at the end of 2020, and is 12.4% below the 12-year historical average of 12.9x. NASI’s P/E ratio has remained high for most of the year, mainly attributable to price rallies on most stocks such as Safaricom whose price increased by 10.8% during the year, while its EPS decline by 6.8%. Safaricom continues to be a key part of Kenyan equities portfolios, accounting for 59.5% of Nairobi Stock Exchange (NSE’s) market capitalization, and has dominated both the market turnover and determining the direction of the market given its weight and liquidity in the Nairobi Securities Exchange. On the other hand, the average dividend yield is currently at 3.4%, 0.6% points below the historical average of 4.0%.

Key to note, NASI’s PEG ratio currently stands at 1.3x, an indication that the market is trading at a premium to its future earnings growth. The current P/E valuation of 11.3x is 47.1% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the market’s historical P/E and dividend yield:

Weekly Highlights:

- Q2’2021 Quarterly Economic Review

During the week, the Central Bank of Kenya (CBK) released the Quarterly Economic Review for the period ending 30th June 2021, highlighting that the banking sector remained stable and resilient during the period. According to the report, the sector’s total assets increased by 2.7% to Kshs 5.7 tn in June 2021, from Kshs 5.5 tn in March 2021. The increase was mainly attributable to a 2.7% increase in loans and advances during the quarter. On a yearly basis, total assets increased by 7.8% to Kshs 5.7 tn, from Kshs 5.3 tn in June 2020. Notably, loans and advances accounted for 49.3% of total assets in Q2’2021, which was a 0.5% points decrease from 49.8% of total assets in Q1’2021 and a 1.6% points decrease from 50.9% of the total assets in Q2’2020.

Other key take-outs from the report include:

- The banking sector recorded a 10.1% increase in Profit before Tax (PBT) to Kshs 50.5 bn in Q2’2021, from Kshs 45.9 bn in Q1’2021, with the increase in profitability mainly attributable to a higher 6.3% increase in income to Kshs 154.0 bn, from Kshs 144.9 bn in Q1’2021, compared to the 4.5% increase in expenses to Kshs 103.5 bn, from Kshs 99.1 bn in Q1’2021. On a yearly basis, PBT increased by 132.7%, to Kshs 50.5 bn, from Kshs 21.7 bn recorded in Q2’2020. Consequently, the sector’s Return on Assets (ROA) recorded a 0.1% point increase to come in at 2.7% in Q2’2021, from 2.6% recorded in Q1’2021, and, a 2.2% points increase from 0.5% recorded in Q2’2020. Additionally, Return On Equity (ROE) recorded an 0.7% points increase to 22.7% in June 2021, from 22.0% in March 2021, and, an 11.4% points increase from 11.3% recorded in June 2020,

- Lending increased by 2.3% to Kshs 3.1 tn in Q2’2021, from Kshs 3.0 tn in Q1’2021, attributable to an increase in loans and advances to Manufacturing, and Personal and Household, and Financial Services sectors. On a yearly basis, lending was up by 6.9% to Kshs 3.1 tn, from Kshs 2.9 tn in Q2’2020,

- Deposits recorded a 2.8% increase to Kshs 4.2 tn in June 2021, from Kshs 4.1 tn in March 2021, attributable to a 3.4% increase in local currency deposits which increased to Kshs 3.2 tn in June 2021, from Kshs 3.1 tn in March 2021. Compared to last year, deposits increased by 8.9% to Kshs 4.2 tn in Q2’2021, from Kshs 3.9 tn in Q2’2020. Key to note, customer deposits remain the main source of funding for banks, accounting for 74.8% of the sector’s total liabilities and shareholders’ funds as at Q2’2021, same as recorded in Q1’2021 but slightly lower than the 75.0% recorded in Q2’2020,

- Credit risk remained elevated in the sector, despite the gross Non-Performing Loans (NPLs) ratio reducing to 14.0% in Q2’2021, from 14.6% in Q1’2021. The Transport and Communication sector registered the highest increase in NPLs by 15.3% in Q2’2021 as a result of the disruptions caused by the COVID-19 pandemic. The asset quality, however, deteriorated compared with last year as the NPL ratio increased by 0.9% points to 14.0% in Q2’2021, from 13.1% in Q2’2020. The sector’s NPL coverage ratio decreased slightly to 53.0% in Q2’2021, from 53.1% in Q1’2021, an indication that the banks maintained the current relatively high provisioning levels to manage risks given the tough economic conditions. The NPL coverage as of Q2’2020 stood at 44.4%,

- The banking sector remained adequately capitalized, with the aggregate Core Capital to Total Risk-Weighted Assets ratio coming in at 16.5% in Q2’2021, similar to what was recorded in Q1’2021 and 0.1% higher than the 16.4% recorded in Q2’2020. The Core Capital to Total Risk-Weighted Assets ratio was 6.0% points above the CBK’s minimum statutory ratio of 10.5%. On the other hand, Total Capital to Total Risk-Weighted Assets ratio, increased slightly by 0.1% points to 18.9% in Q2’2021, from 18.8% in Q1’2021, and, up 0.4% points from 18.5% recorded in Q2’2020. The Q2’2021 Total Capital to Total Risk-Weighted Assets ratio was 4.4% points above the CBK’s minimum statutory ratio of 14.5%, and,

- The sector remained liquid during the period under review, with the liquidity ratio rising to 56.8% in Q2’2021, from 56.3% in Q1’2021 and 52.8% record in Q2’2020. This was 36.8% points above the minimum statutory level of 20.0%. The increase in the banking sector’s liquidity is attributable to a 3.3% increase in total liquid assets, which outpaced the 2.4% increase in short term liabilities during the quarter.

The increasing profitability in Q2’2021 indicates that the banking sector remains on the path to recovery in 2021. The sector remains sufficiently capitalized and with adequate liquidity levels, evidenced by the capital adequacy and liquidity ratios remaining above the minimum statutory ratios. Overall, we expect the banking sector to remain resilient boosted by the CBK’s efforts to improve their liquidity positions by maintaining the Cash Reserve Ratio at 4.25%, proactive monitoring of the loan book by commercial banks and improved capital adequacy across the sector.

- Britam Shares Sale in Equity Group

During the week, Equity Group disclosed that Britam Holdings PLC and Britam Life Assurance Company (Kenya) Limited had entered into a share purchase and sale agreement of Equity Group Shares with International Finance Corporation (IFC) and IFC Financial Institutions Growth Fund (IFC FIG Fund). The agreement will see IFC acquire 164,521,735 shares, 4.4% of the total Equity Group shares, and IFC FIG Fund would acquire 88,588,626 shares, 2.3% of the total Equity Group shares, from Britam in total. Britam Life is a subsidiary of Britam Holdings PLC. IFC and IFC FIG Fund are expected to acquire the shares at Kshs 55.0 per share, which represents a 4.3% premium on Equity Group’s current market price of Kshs 52.8 per share as of 31st December 2021. Britam will receive a total of Kshs 13.9 bn from the transaction. The split between Britam Holdings and Britam Life, and, the use of proceeds, have not been specified. However, we estimate that Kshs 3.3 bn will go towards paying the holding company’s bank loan that was secured with quoted ordinary shares, and, Kshs 5.2 bn will go towards supporting the Britam Wealth Management Fund. Britam Holdings had made a provision for investment losses of Kshs 5.2 bn in their FY’2020 financials, to provide financial support to the Wealth Management Fund, a fund managed by Britam Asset Managers.

The move to sell the shares will help reduce the effect that the volatile equity investment has had on Britam’s profit levels in the past. According to their FY’2020 annual report, its shareholding in Equity Group alone led to a fair value loss of Kshs 4.2 bn, representing 46.9% of the total Kshs 9.1 bn loss recorded during the year, due to a 33.5% share price decline in Equity Group’s share price in 2020. We expect that this portfolio optimization will help Britam stabilize its performance going forward and enable it to focus on its core and profitable offerings.

2021 Key highlights;

- Banking Sector Earnings

As per the Q3’2021 results, the listed banks recorded a weighted average increase in their core earnings per share of 102.0%, compared to a weighted decline of (32.4%) in Q3’2020. The table below highlights the performance of the banking sector, showing the performance using several metrics, and the key take-outs of the performance.

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

ABSA |

328.3% |

1.3% |

(19.1%) |

8.6% |

7.0% |

5.2% |

32.0% |

11.9% |

9.0% |

(5.6%) |

85.2% |

9.5% |

21.1% |

|

NCBA |

159.0% |

16.2% |

10.8% |

17.9% |

8.4% |

10.3% |

29.4% |

1.2% |

11.2% |

6.9% |

75.9% |

12.9% |

22.7% |

|

KCB |

131.4% |

28.7% |

45.0% |

23.3% |

7.0% |

28.8% |

39.7% |

34.2% |

26.6% |

25.8% |

63.9% |

23.2% |

22.2% |

|

Equity |

78.6% |

9.8% |

(1.3%) |

19.1% |

6.2% |

(0.2%) |

44.3% |

(4.3%) |

11.2% |

(14.1%) |

53.2% |

(4.6%) |

11.8% |

|

Stanbic |

43.2% |

(2.5%) |

(23.3%) |

2.8% |

6.7% |

19.1% |

33.9% |

17.9% |

6.4% |

(6.8%) |

51.0% |

0.1% |

14.5% |

|

SCBK |

33.7% |

0.5% |

(7.3%) |

12.2% |

6.2% |

4.2% |

42.6% |

(8.5%) |

(5.8%) |

(17.4%) |

83.0% |

11.2% |

14.0% |

|

I&M |

25.1% |

15.7% |

(5.2%) |

34.5% |

6.0% |

(3.5%) |

30.7% |

12.8% |

14.2% |

28.6% |

71.9% |

11.8% |

14.3% |

|

DTBK |

20.1% |

6.0% |

6.2% |

5.9% |

5.4% |

(4.9%) |

24.5% |

0.3% |

12.3% |

(2.7%) |

63.5% |

0.0% |

6.8% |

|

Co-op |

18.0% |

21.6% |

22.4% |

21.3% |

8.5% |

15.6% |

35.4% |

9.4% |

12.0% |

35.9% |

72.9% |

7.8% |

14.2% |

|

HF Group |

(22.0%) |

(18.4%) |

(21.2%) |

(14.8%) |

3.9% |

12.2% |

24.7% |

27.5% |

(1.3%) |

(9.5%) |

92.2% |

(7.9%) |

(19.0%) |

|

Q3'21 Mkt Weighted Average* |

102.0% |

15.9% |

14.9% |

16.9% |

7.3% |

14.3% |

35.2% |

13.8% |

14.3% |

11.7% |

69.7% |

12.4% |

18.7% |

|

Q3'20 Mkt Weighted Average** |

(32.4%) |

10.8% |

8.2% |

11.7% |

7.0% |

2.1% |

35.9% |

(7.9%) |

23.1% |

47.4% |

65.6% |

15.0% |

13.0% |

|

*Market cap weighted as at 10/12/2021 **Market cap weighted as at 01/12/2020 |

|||||||||||||

Key takeaways from the table above include:

- For the third quarter of 2021, core Earnings per Share (EPS) recorded a weighted average growth of 102.0%, compared to a weighted average decline of 32.4% in Q3’2020 for the listed banking sector. The performance is however largely skewed by the strong performance from ABSA, NCBA and KCB Group of 3%, 159.0% and 131.4%, respectively,

- The Banks have recorded a weighted average deposit growth of 14.3%, a decline from the 23.1% recorded in Q3’2020,

- Interest expense grew at a faster pace, by 14.9%, compared to the 8.2% growth in Q3’2020 while cost of funds declined, coming in at a weighted average of 2.7% in Q3’2021, from 2.9% in Q3’2020, owing to the faster growth in average interest-bearing liabilities, an indication that the listed banks were able to mobilize cheaper deposits,

- Average loan growth came in at 12.4%, lower than the 15.0% growth recorded in Q3’2020. Notably, the loan growth outpaced the 11.7% growth in government securities, an indication that the banks’ have increased their lending to private sectors due to decrease in credit risk on the back of economic recovery,

- Interest income grew by 15.9%, compared to a growth of 10.8% recorded in Q3’2020. Notably, the weighted average Yield on Interest Earning Assets (YIEA) for the listed banks increased to 9.8%, from the 9.5% recorded in Q3’2020, an indication of the increased allocation to higher-yielding government securities by the sector during the period. Consequently, the Net Interest Margin (NIM) now stands at 7.3%, a 0.3% points increase from the 7.0% recorded in Q3’2020 for the listed banking sector, and,

- Non-Funded Income grew by 14.3%, compared to the 2.1% increase recorded in Q3’2020. This can be attributable to the faster growth in the fees and commission which grew by 13.8% compared to a decline of 7.9% in Q3’2020, and points to the diversification of income in the banking sector.

For more information, see our Kenya Listed Banks Q3’2021 Report.

- Insurance Sector Earnings:

During the year, Kenyan listed insurers released their H1’2021 results, recording a weighted average increase in core earnings per share of 127.6%, an improvement, compared to an average decline of (280.5%) in H1’2020. The table below highlights the performance of the listed insurance sector, showing the performance using several metrics, and the key take-outs of the performance:

|

Listed Insurance Companies H1'2021 Earnings and Growth Metrics |

||||||||

|

Insurance |

Core EPS Growth |

Net Premium growth |

Claims growth |

Loss Ratio |

Expense Ratio |

Combined Ratio |

ROaE |

ROaA |

|

CIC Group |

177.3% |

0.5% |

7.0% |

81.3% |

50.8% |

132.1% |

3.4% |

0.6% |

|

Jubilee Holdings |

146.2% |

10.0% |

42.1% |

109.6% |

30.4% |

140.0% |

12.5% |

3.1% |

|

Britam Holdings |

123.0% |

2.4% |

15.8% |

78.5% |

79.4% |

157.8% |

1.7% |

0.3% |

|

Sanlam Kenya |

68.8% |

45.9% |

64.9% |

92.8% |

47.1% |

140.0% |

(19.3%) |

(0.9%) |

|

Liberty Holdings |

(20.4%) |

(5.7%) |

32.5% |

75.0% |

84.3% |

159.3% |

3.1% |

0.7% |

|

*H1'2021 Weighted Average |

127.6% |

6.3% |

29.1% |

92.8% |

53.8% |

146.6% |

6.2% |

1.6% |

|

**H1'2020 Weighted Average |

(280.5%) |

5.1% |

6.5% |

75.0% |

48.8% |

123.8% |

2.0% |

0.6% |

|

*Market cap weighted as at 11/11/2021 **Market cap weighted as at 30/09/2020 |

||||||||

The key take-outs from the above table include;

- Core EPS growth recorded a weighted growth of 127.6%, compared to a weighted decline of 280.5% in H1’2020. The increase in earnings was attributable to increased premiums during the period following robust recovery by the sector from the COVID-19 pandemic, coupled with gains recorded in the equities markets and higher yields from government papers,

- The premiums grew at a faster pace of 6.3% in H1’2021, compared to a growth of 5.1% in H1’2020, while claims grew at an aggressive faster rate of 29.1% in H1’2021, from the 6.5% recorded in H1’2020 on a weighted average basis,

- The loss ratio across the sector increased to 92.8% in H1’2021, from 75.0% in H1’2020, owing to increased claims in insurance sub sectors such as motor and medical and perennial challenges facing the industry such as fictitious claims and increased benefit payments from the life business owing to job layoffs,

- The expense ratio increased to 53.8% in H1’2021, from 48.8% in H1’2020, owing to an increase in operating expenses,

- The insurance core business still remains unprofitable, with a combined ratio of 146.6% as at H1’2021, compared to 123.8% in H1’2020, and,

- On average, the insurance sector delivered a Return on Average Equity (ROaE) of 6.2%, an increase from a weighted Return on Average Equity of 2.0% in H1’2020.

For more information, see our Kenya H1’2021 Listed Insurance Report.

Other Key Results

Safaricom Limited released the H1’2022 results, recording core earnings per share increase of 12.1% to Kshs 0.9, from Kshs 0.8 in H1’2021. The increase in the earnings growth was attributable to the 45.8% increase in M-PESA revenue to Kshs 52.3 bn, from Kshs 35.9 bn in H1’2021, following the lifting of the waiver by the Central Bank of Kenya on all charges for transactions below Kshs 1,000.

This year, 4 companies issued profit warnings to investors compared to 15 companies in 2020, and 10 companies in 2019, as a results of the improved business environment following the lifting of COVID-related restrictions. Companies are required to issue profit warnings if they project a more than 25.0% decline in profits year-on-year. Below is the summary of the said companies:

|

Companies that issued profit warnings |

|||

|

No |

2021 |

2020 |

2019 |

|

1 |

Centum Investment Company PLC |

ABSA Kenya |

Nairobi Stock Exchange |

|

2 |

Umeme Limited |

Diamond Trust Bank |

BOC Kenya Plc |

|

3 |

Williamson Tea Kenya PLC |

Standard Chartered |

UAP Holdings Limited |

|

4 |

WPP ScanGroup PLC |

I&M Holdings |

Kenya Power and Lightning Company |

|

5 |

|

NCBA Group |

Eaagads |

|

6 |

|

Britam Holdings |

Williamson Tea Kenya |

|

7 |

|

East African Breweries Limited |

Standard Group Plc |

|

8 |

|

Nation Media Group |

CIC Insurance |

|

9 |

|

Longhorn Publishers |

Kenya Airways |

|

10 |

|

Kenya Power |

Kapchorua Tea Company |

|

11 |

|

Unga Group |

|

|

12 |

|

East Africa Cables |

|

|

13 |

|

Kenya Orchards |

|

|

14 |

|

TPS East African |

|

|

15 |

|

Nairobi Business Ventures |

|

The key take-outs from the table above include:

- Centum Investment Company Limited attributed the shortfall in profits to the impact of COVID-19 on their Private Equity portfolio businesses and the lack of gains on disposal of investments in the financial year ending 31st March 2021. Centum had registered significant gains on disposal of investments totalling Kshs 12.5 bn in the previous financial year ending 31st March 2020. Additionally, Centum pointed to the revenue recognition of sales in the Real Estate business as another reason for the depressed profit level, as sales revenues are only recognized once ownership of the real estate residential units are transferred to the new owners,

- Umeme Limited issued a profit warning statement attributing dismal performance to the attributed to (i) the effects of the Covid-19 pandemic as restrictions put in place which led to a 9.0% decline in Commercial, medium-industrial and large industrial electricity demand, (ii) regulatory lag, and, (iii) suspension of the Government’s free connections policy,

- Williamson Tea Kenya PLC also issued a profit warning citing that the pandemic adversely affected the property market leading to a loss on revaluation of the firm’s investment properties. Williamson Tea also cited rising production costs and lower global market prices as contributing factors to their depressed bottom-line in the financial year ending 31st March 2021, and,

- WPP ScanGroup cited that the impact of discontinued operations in 2020, when the company disposed of its interest in Millward Brown East Africa Limited, Millward Brown West Africa Limited, Millward Brown Nigeria and Research and Marketing Group Limited, on 30th June 2020, as the reason for the firm’s lower earnings.

Below is a summary of the number of companies that issued profit warnings over the last 7 years:

Source: Cytonn Research, NSE

- Listings and Suspensions

During the year, the Nairobi Securities Exchange (NSE) delisted National Bank of Kenya (NBK), effective 25th November 2021. This came after the successful takeover by KCB of 100.0% of all the ordinary shares of National Bank of Kenya (NBK) through a share swap of 1 ordinary share of KCB for every 10 NBK shares, after the Capital Markets Authority (CMA) approved the acquisition in September 2019. The de-listing was approved by both the CMA and the shareholders of NBK. NBK became the 13th firm since 2001 to be de-listed in the NSE with Kenol/Kobil being the most recent exit in August 2019. The table below shows the delisted companies and the year they were delisted in:

|

No. |

Company Name |

Year of De-listing |

|

1. |

East African Packaging Industries |

2001 |

|

2. |

Africa Online Holding Ltd |

2003 |

|

3. |

Unilever Tea Kenya |

2008 |

|

4. |

Access Kenya |

2013 |

|

5. |

City Trust Ltd |

2013 |

|

6. |

Rea Vipingo Plantations Limited |

2015 |

|

7. |

CMC Holdings |

2015 |

|

8. |

Atlas Development and Support Services |

2017 |

|

9. |

Marshall East Africa Limited |

2017 |

|

10. |

Hutchings Biemer |

2018 |

|

11. |

A. Baumann & Co. Limited |

2018 |

|

12. |

Kenol/Kobil |

2019 |

|

13. |

National Bank of Kenya |

2021 |

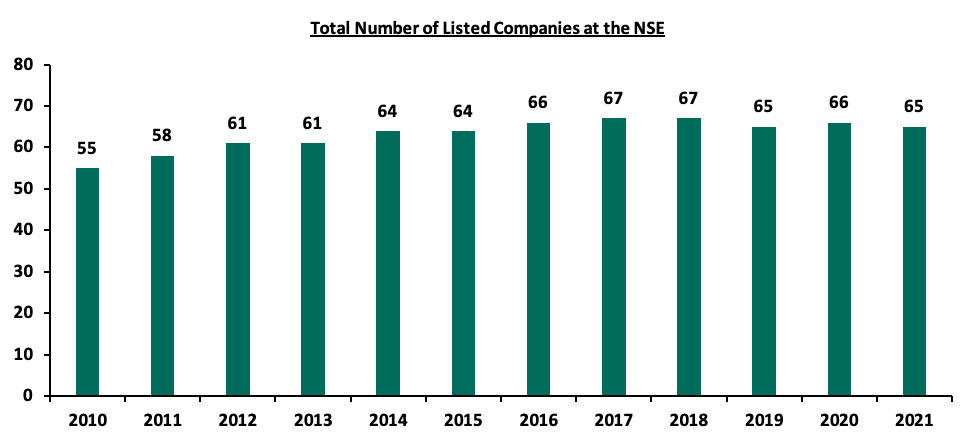

The chart below shows the number of listed companies in the Nairobi Securities Exchange (NSE) for the period 2010 - 2021:

Source: CMA Quarterly Statistical Bulletins

- Liquidations

During the year, the Central Bank of Kenya (CBK) approved the liquidation of three banks; namely, Chase Bank Limited (In Receivership), Imperial Bank Limited (In Receivership) and Charterhouse Bank Limited. Charterhouse Bank had been under statutory management since 23rd June, 2006 over severe violations of the Banking Act relating to lending, accuracy of returns submitted to CBK, and failure to obtain account opening documentation for a number of customers. The bank’s liquidation was announced on 7th May 2021, with the Kenya Deposit Insurance Corporation (KDIC) being appointed as the liquidator in order to protect the interest of the bank’s depositors, its creditors, and other stakeholders. Charterhouse Bank had assets totalling Kshs 4.0 bn and deposits totalling Kshs 2.9 bn, as of 2006.

For both Chase Bank and Imperial Bank, KDIC acted as the receiver and liquidation approvals came after recommendation by KDIC that liquidation was the only feasible option going forward. Chase Bank Limited (In Receivership) (CBLIR)’s liquidation announcement was made in 16th April 2021, and came five years after CBK appointed KDIC as the receiver for Chase Bank Limited on April 7, 2016. Please see our Note on the Liquidation of Chase Bank Limited, In Receivership (CBLIR) for a detailed analysis. We expect total recoveries of Kshs 59.6 bn out of the total Kshs 76.1 bn in deposits held by Chase Bank Limited In Receivership; resulting in a potential loss of Kshs 16.5 bn. This represents a 78.3% recovery rate. Out of the Kshs 59.6 bn recoveries, Kshs 57.1 bn is the deposits amount transferred to SBM Bank (K) and expected to be fully recovered while Kshs 2.5 bn is the maximum amount to be paid by KDIC after liquidation.

Additionally, CBK announced on 9th December 2021, that it had approved the liquidation of Imperial Bank Limited In Receivership (IBLIR), in order to pave way for the sale of IBLIR’s remaining assets to settle any existing debts to depositors and creditors. Imperial Bank Limited was put under receivership by CBK on 13th October 2015 due to irregularities and malpractices in the bank which exposed depositors, creditors and the banking sector to financial risk. At the time of receivership, IBLIR had 32 branches, Kshs 70.3 bn (as of 30th June 2015) worth of assets, and Kshs 58.1 bn worth of deposits, owed to 50,000 depositors. According to CBK, 37.3% of the total deposits will be recovered, totalling Kshs 21.7 bn. Out of the 50,000 depositors, 45,700 will be paid fully representing 91.4% of the total depositors. For more information on the liquidation of Imperial Bank Limited In Receivership (IBLIR), please see our Cytonn Weekly #49/2021.

- Legislations and other Developments

The year 2021 saw a number of legislative changes and other developments that affected the equities market and investor sentiment, namely:

- Guidance on Loan Restructuring: The Central Bank of Kenya announced that the emergency measures on restructuring of loans for bank borrowers put in place in March 2020, expired on 2nd March 2021. The circular, intended to cushion the borrowers from the adverse effects of the pandemic, provided commercial banks and mortgage finance companies with guidelines on loan reclassification, and provisioning of extended and restructured loans as per the Banking Circular No 3 of 2020. According to the Central Bank, the measures were highly effective, giving borrowers restructuring options which included moratorium on principle or interest and waivers on interest fees. The measures gave borrowers room to readjust their businesses and operations to the ‘new normal’ in addition to helping mitigate job losses. The banking sector also benefitted from the measures, presenting banks with the opportunity to re-evaluate their loan books, build additional capital and liquidity buffers and minimizing the effect of the pandemic on their Non-Performing Loan book,

- Draft CMA Investments Regulations: In August 2021, the Cabinet Secretary for the National Treasury and Planning, through the Capital Markets Authority (CMA), published two draft regulations; the Capital Markets (Collective Investment Schemes) Regulations 2021 and the Capital Markets (Collective Investment Schemes) (Alternative Investment Funds) Regulations 2021. The proposed CIS regulations seek to update the current Collective Investment Scheme regulations given the changes in the market dynamics since the last published Regulations in 2001, as well as address emerging issues. Additionally, the draft Alternative Investment Funds’ (AIFs) regulations seek to create a regulatory environment for privately pooled funds whose investors seek higher returns by investing in specified alternative asset classes including Debt funds, Equity and equity linked investments, Hedge funds, or infrastructure. For a detailed analysis of the draft regulations, please see our Cytonn Weekly#37/2021. However, we still await the release of the Regulatory Impact Assessment by the regulator and a revised draft taking into account market commentaries,

- Integration of Climate-Related Risk Management: In October 2021, the Central Bank of Kenya (CBK) released Guidance on Climate-Related Risk Management, highlighting that all banks and mortgage finance companies ought to integrate the risks and opportunities arising from climate change in their risk management, strategy and governance structure. Opportunities expected to arise from climate change include financing activities such as the transition to renewable energy, appropriate housing, resilient infrastructure and innovative agricultural practices. On the other hand, banks are expected to build their capacity going forward to identify and mitigate the risks arising from climate change,

- Guidelines on Buybacks for Listed Companies - In November 2021, the Capital Market Authority (CMA) released guidelines on share buybacks for listed companies, following the issuance of proposed guidelines on share buy-backs, in June 2020, which have been in the process of revision following public participation. The guidelines are in line with Part XVI, Section 447 of the Companies Act, 2015, that introduced a share buyback option for publicly traded companies and aims to enhance investor protection, promote liquidity and ensure transparency in share buyback transactions.The new guidelines came after Nation Media Group (NMG) became the first listed company in the Nairobi Stock Exchange (NSE) to conduct a share buyback which ran from 28th June 2021 to 24th September 2021, which saw NMG acquire 17.1 mn ordinary shares out of the targeted 20.7 mn ordinary shares, representing an 82.5% success rate. For more information on the guidelines, please see our Cytonn Weekly #46/2021,

- Suspension of the Listing of Borrower’s Negative Credit Information: On 8th November 2021, the Central Bank of Kenya (CBK) announced a 12 months suspension of listing of negative credit information for borrowers with loans below Kshs 5.0 mn, whose loans were performing previously, but have become non-performing from 1st October, 2021. The move by the CBK is an intervention measure aiming to cushion Micro Small and Medium Enterprises from adverse effects of the COVID-19 pandemic,

- Central Bank of Kenya Amendment Act, 2021 - In December 2021, President Uhuru Kenyatta signed into law the Central Bank of Kenya (CBK) Amendment Act, 2021 which confers the CBK powers to regulate the digital lending services sector and aims to amend the Central Bank of Kenya Act Chapter 491 to provide and allow for the licensing of digital credit service providers, who are currently not regulated. The act also defines relevant terms for the business of digital credit lending where a digital credit provider is a person licensed by the CBK to carry on digital credit business while a digital credit business is one of providing credit facilities or loan services through a digital channel. Further, the act aims to provide for a fair and non-discriminatory marketplace for access to credit.

- Consolidation: Consolidation activity remained one of the key highlights witnessed in 2021, as players in the sector were either acquired or merged, leading to the formation of relatively larger, well capitalized, and possibly more stable entities. The following were some of the major M&A’s activities witnessed during the year:

-

- In May 2021, Equity Group disclosed that it had had acquired an additional 7.7% stake valued at Kshs 996.0 mn, in Equity bank Congo (EBC) from the German Sovereign wealth Fund (KfW). The acquisition raised the total ownership in EBC to 94.3%, indicating that they are currently valuing the company at Kshs 14.2 bn. This followed the recent acquisition of 66.5% stake in Banque Commerciale Du Congo (BCDC) by Equity Group at a cost of Kshs 10.2 bn in August 2020. The BCDC subsidiary is already the second largest most profitable regional subsidiary, having contributed Kshs 1.3 bn to the Group’s Profit After Tax of Kshs 20.1 bn in 2020. Read more information on the transaction here,

- In May 2021, I&M Holdings PLC announced that it has completed the 90.0% acquisition of Orient Bank Limited Uganda (OBL) share capital, after receiving all the required regulatory approvals. As highlighted in our Cytonn Weekly #50/2020, I&M Holdings was set to pay Kshs 3.6 bn for the deal; which translated to a Price to Book Value (P/Bv) of 1.1x. The valuation of 1.1x P/Bv is 0.1x lower than the 7-year average which is at 1.2x P/Bv, but higher than the last one-year average, which is at 0.7x P/Bv and the average P/Bv in the listed banking stocks of 0.8x. Additionally, I&M Holdings will take over 14 branches from OBL, taking its total branches to 80, from 66 branches as at the end of 2020. Read more on the same here,

- On 25th August 2021, KCB Group announced that it had completed the 62.1% acquisition of Banque Populaire du Rwanda Plc (BPR), after receiving all the required regulatory approvals. KCB Group had agreed to purchase 62.1% stake in BPR from Atlas Mara Limited using a Price to Book Value (P/Bv) of 1.1x. According to the latest BPR financials released as of June 2021, the bank had a book value of Rwf 52.9 bn (Kshs 5.8 bn), and thus at the trading multiple of 1.1x, we expect KCB Group to have spent an estimated Kshs 6.3 bn to acquire BPR Rwanda. The valuation of 1.1x P/Bv is lower than the 7-year average which is at 1.3x P/Bv, but higher than the last one-year average, which is at 0.7x P/Bv and the average P/Bv in the listed banking stocks of 1.0x as of Q1’2021. Additionally, KCB Group will take over 135 branches from BPR, taking its total branches to 489, from 354 branches as of June 2021. Read more information on the transaction here,

- On 14th September 2021, Liberty Holdings Limited (Liberty), a financial services and property holding company completed the acquisition of 84.2 mn shares in Liberty Kenya Holdings Plc (Liberty Kenya), which represents 15.7% of the company’s issued share capital. This followed the June 2021 announcement of Liberty Holdings intention to buy 49.5 mn ordinary shares from the Conrad N. Hilton Foundation, Kimberlite Frontier Africa Master Fund, L.P. and Vanderbilt University (the KFAMF Acquisition), and a further 34.7 mn ordinary shares from Coronation Africa Frontiers Fund and Coronation All Africa Fund (the Coronation Acquisition), which represented 9.3% and 6.5% of the company’s shareholding, respectively. The completed acquisition has increased Liberty Holding’s stake to 73.5% (393.6 mn ordinary shares), from the current 57.7% (309.3 mn ordinary shares), retaining Liberty Holding’s status as the largest shareholder of Liberty Kenya. Read more information on the transaction here, and,

- In November 2021, HF Group announced the invitation of strategic investors to acquire a stake in the Company following a Proposed Transaction disclosure in their published FY’2020 Financial Statements. The Proposed Transaction aims to inject capital to the company so as to increase its liquidity and enable expansion into mainstream banking including retail and SME lending, while also reducing reliance on the Real Estate market segment. This comes after the Kshs 1.0 bn capital injection the group received from its top shareholder, Britam Holdings Plc, in January this year, which aimed at growing the firm’s full-service banking offering. The price at which an investor will buy a stake in the company is expected to be based on negotiations with the issuer. Read more on the same here.

Below is a summary of the deals in the last 7-years that have either happened, been announced or expected to be concluded:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs bn) |

Transaction Stake |

Transaction Value (Kshs bn) |

P/Bv Multiple |

Date |

|

I&M Holdings PLC |

Orient Bank Limited Uganda |

3.3 |

90.0% |

3.6 |

1.1x |

April-21 |

|

KCB Group |

Banque Populaire du Rwanda |

5.3 |

100.0% |

5.6 |

1.1x |

August 2021 |

|

KCB Group** |

ABC Tanzania |

Unknown |

100% |

0.8 |

0.4x |

Nov-20* |

|

Co-operative Bank |

Jamii Bora Bank |

3.4 |

90.0% |

1 |

0.3x |

Aug-20 |

|

Commercial International Bank |

Mayfair Bank Limited |

1 |

51.0% |

Undisclosed |

N/D |

May-20* |

|

Access Bank PLC (Nigeria) |

Transnational Bank PLC. |

1.9 |

100.0% |

1.4 |

0.7x |

Feb-20* |

|

Equity Group ** |

Banque Commerciale Du Congo |

8.9 |

66.5% |

10.3 |

1.2x |

Nov-19* |

|

KCB Group |

National Bank of Kenya |

7 |

100.0% |

6.6 |

0.9x |

Sep-19 |

|

CBA Group |

NIC Group |

33.5 |

53%:47% |

23 |

0.7x |

Sep-19 |

|

Oiko Credit |

Credit Bank |

3 |

22.8% |

1 |

1.5x |

Aug-19 |

|

CBA Group** |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

Jan-19 |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

Jan-18 |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

Dec-18 |

|

SBM Bank Kenya |

Chase Bank Ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

3 |

100.0% |

5 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov-13 |

|

Average |

|

|

76.7% |

|

1.3x |

|

|

* Announcement Date ** Deals that were dropped |

||||||

In 2021, Kenya’s operating environment was characterized by a relatively improved macro-economic environment owing to the easing of the COVID-19 restrictions in the country coupled with the gradual recovery in various sectors of the economy. In 2021, the market remained slumped with NASI’s P/E of 11.3x trading below its’ historical average of 12.9x, and below the most recent peak of 15.9x in April 2018, showing that pockets of value still exist. We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.3x), we believe that investors should reposition towards companies with a strong earnings growth and are trading at discounts to their intrinsic value. We expect the discovery of new COVID-19 variants coupled with slow vaccine rollout in developing economies to continue weighing down the economic outlook. On the upside, we believe that the recent relaxation of lockdown measures in the country will lead to improved investor sentiments in the economy.

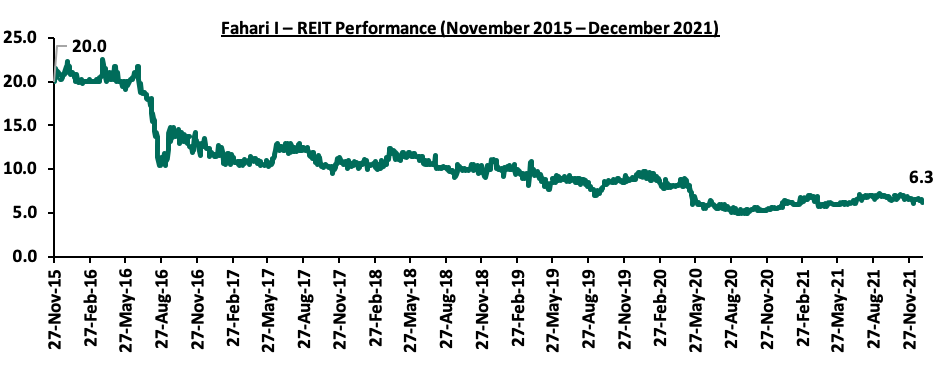

In 2021, the Kenyan Real Estate sector witnessed increased development activities with a general improvement in Real Estate transactions, attributed to the improved business environment. The reopening of the economy has also facilitated numerous expansion and construction activities by investors, in addition to various businesses also resuming full operations. Consequently, the Real Estate sector grew by 4.9% in Q2’2021, 0.3% points higher than the 4.6% growth recorded in Q2’2020, according to the Quarterly GDP Report by the Kenya National Bureau of Statistics’ (KNBS). Some of the factors that supported the improved performance of the sector included:

- Government’s continued focus on initiating and implementing affordable housing projects, coupled with improved investor confidence in the country’s housing market. In November 2021, the Capital Markets Authority (CMA) approved the issuance of a Kshs 3.9 bn Medium Term Note (MTN) programme which will be used to finance the construction of the ongoing Pangani Affordable Housing Project,

- Aggressive expansion by local and international retailers in the country such as Naivas, QuickMart, and Carrefour supermarket chains taking up spaces previously occupied by troubled retailers such as Tuskys, Uchumi and Nakumatt,

- Lifting of flight travel bans that led to increased number of visitor arrivals into the country, evidenced by KNBS’ October 2021 Leading Economic Indicators Report which highlighted that number of visitor arrivals came in at 72,809 in October 2021, compared to the 28,982 visitors recorded in October 2020. This in turn led to performance of serviced apartments increasing as well, and hotels also resuming full operations,

- Government’s aggressiveness in implementing infrastructure projects especially road projects such as the Nairobi Expressway, and Nairobi Western Bypass projects, among many others, which in turn continues to boost Nairobi’s positioning as a regional hub thereby supporting Real Estate investments,

- Kenya Mortgage Refinance Company efforts to make loans available to home buyers. In support of this, the average mortgage loan size increased to Kshs 8.6 mn in 2020, from Kshs 8.5 mn in 2019, according to Central Bank of Kenya’s (CBK) Bank Supervision Annual Report 2020. However, the number of mortgages reduced to 26,971 in December 2020 from 27,993 in December 2019 due to the effect of the Covid 19 depressed economy,

- Positive demographics evidenced by Kenya’s relatively high urbanization and population growth rates of 4.0% p.a and 2.3% p.a, respectively, against the global average of 1.8% p.a and 1.0% p.a, respectively, as at 2020, driving increased demand for developments, and,

- Establishment of statutory laws by the government aimed at aligning Kenya with international standards in an attempt to address the shortcomings of previous Acts. The laws are also expected to streamline Real Estate investments and transactions.