Cytonn 2025 Markets Outlook

By Research Team, Jan 12, 2025

Executive Summary

Global Markets Outlook

According to the World Bank’s Global Economic Prospects 2024, global economic growth is projected to rise marginally by 0.1% points to 2.7% in 2025, from 2.6% in 2024. The expected economic expansion is driven by the easing global inflation that has in turn necessitated easing of monetary policies in most major economies leading to an ease in credit conditions, normalization of supply and demand dynamics as labor markets stabilize due to the resilient labor markets. After peaking at 9.4% year over year in Q3’2022, headline inflation rates are now projected to reach 3.5% by the end of 2025, below the average level of 3.6% between 2000 and 2019, mainly attributable to declining commodity prices. Moreover, the growth in the Emerging Markets and Developing Economies (EMDEs) is expected to expand by 3.6% in 2024, a 0.3% points increase from the estimated growth of 3.3% in 2024;

Sub-Saharan Africa Regional Market Outlook

According to the World Bank’s Global Economic Prospects , growth in the Sub-Saharan Africa region is expected to rebound to 3.9% in 2024, from the estimated growth rate of 3.5% recorded in 2023 mainly attributable to the easing inflationary policies, reduction in prices of key imports such as fertilizers, metal and fuel, improved fiscal support and the expected increase in domestic demand. However, the projections remain subject to key downward risks such as high debt levels in the region as borrowing persists in the region due to the ever-present fiscal deficits in the region. Additionally, the increased debt servicing costs due to the sustained currency depreciation of the local currencies against the Dollar are expected to put more pressure on the region’s growth as most of the region’s debt is dollar-denominated;

Kenya Macro Economic Outlook

GDP Growth – Our outlook for 2025 is Neutral on GDP Growth. We are projecting the economy to register a growth within the range of 5.0%-5.4% in 2025 supported by continued recovery of business activity, expected strong growth in the agricultural sector, and robust performance in the services sector driven by growth in information and technology as well as accommodation and food services as a result of increased tourism. The key downside to this growth shall be the high risk of debt distress and a possible uptick in inflationary pressures;

Inflation - Our outlook for 2025 is Neutral on Inflation. We expect the annual average inflation rate to remain within the government’s target of 2.5%-7.5% coming in at an average of 5.3% as compared to 4.5% in 2024. We expect the inflation rate to remain relatively stable in the short term, but face upward pressure in the medium to long term during 2025, driven by the expansionary monetary policy stance, high electricity prices and potential depreciation of the Kenyan Shilling;

Currency - Our outlook for 2025 is Neutral on Currency. We project the Kenya Shilling to trade against the US dollar within a range of Kshs 120.9 and Kshs 140.5 by the end of 2025, with a bias of 4.6% depreciation against the USD in 2025. We expect the depreciation to be primarily driven by Kenya's persistent current account deficit, as the country remains a net importer, which will increase demand for dollars and strain the local currency. The anticipated continuous ease in the Central Bank Rate (CBR) is likely to make local-currency assets less attractive to investors, further increasing demand for foreign currencies and putting additional pressure on the Kenyan shilling. Additionally, the high debt servicing costs continue to put pressure on forex reserves given that 67.2% of Kenya’s external debt is US Dollar-denominated as of June 2024.;

Interest Rates – Our outlook for 2025 is Positive on Interest Rates. We expect the Central Bank to continue with the expansionary monetary policy stance in the short-to-medium term attributable to a stable currency and and the need to support the economic growth. Further, we expect the yield curve to normalize in the short to medium-term as the government turns to increase its external borrowing, hence alleviating pressure in the domestic market;

Government borrowing – Our outlook for 2025 is Negative on Government Borrowing. We expect the government to borrow aggressively from both the domestic and foreign markets to plug in the fiscal deficit, which is projected to come in at Kshs 768.6 bn, equivalent to 4.3% of the GDP. Furthermore, the government expects to receive more concessional financing from the IMF and the World Bank, in addition to commercial loans from loans from commercial lenders such as the Trade & Development Bank (TDB) and the African Development Bank. On revenue collection, we expect muted growth despite the raft of measures taken by the Kenya Revenue Authority to increase tax through the implementation of the Finance Act 2023 which revised a number of taxes upwards and widened the tax base to include the informal sector and digital services and proposals to broaden the tax base through the Tax Laws Amendment Bill 2024. The upward revision of taxes comes at a time when the amount of disposable income is decreasing which is weighing down on the projected revenue performance, with the total revenue collected as at the end of November 2024 amounting to Kshs 940.9 bn, equivalent to 35.8% of the revised estimates of Kshs 2,631.4 bn for FY’2024/2025 and is 85.8% of the prorated estimates of Kshs 1,096.4 bn.

The Tax Laws Amendment Bill 2024 introduced significant tax reforms including increasing tax-exempt limits for non-cash benefits, gratuity, and pension contributions, alongside deductions for contributions to the Affordable Housing Levy and other funds, exemptions for business transfers, locally assembled electric vehicles, and goods from AfCFTA countries from VAT or excise duty, could further reduce revenue collection from certain tax heads;

Investor Sentiment – Our outlook for 2025 is Positive on Investor Sentiment. We expect the high positive investor sentiments witnessed in 2024 to persist through the short to medium term of 2025, mainly due to anchored inflationary pressures driven by reduced fuel costs and stability of the Kenyan currency. Political noise and the high debt levels remains a key risk to the investors’ confidence.

Security and Political Environmnet– Our outlook for 2025 is Negative on Security. We expect security to remain a concern in 2025 due to an unstable political environment, driven by the frequent political tensions and continued opposition to the current regime;

Fixed Income

We expect interest rates to stabilize, especially for short-term papers as the yield curve adjusts to a normal yield curve supported by the improved liquidity in the money markets. This will allow cheaper borrowing for budgetary support, funding of infrastructure projects, and payment of domestic maturities which stand at Kshs 768.6 bn for the second half of the FY’2024/2025. Further, we expect the yield curve to normalize in the short to medium-term as the government turns to increased external borrowing alleviating pressure on the domestic market. Investors should be biased towards LONG-TERM FIXED INCOME INSTRUMENTS to lock in the high interest rates;

Equities

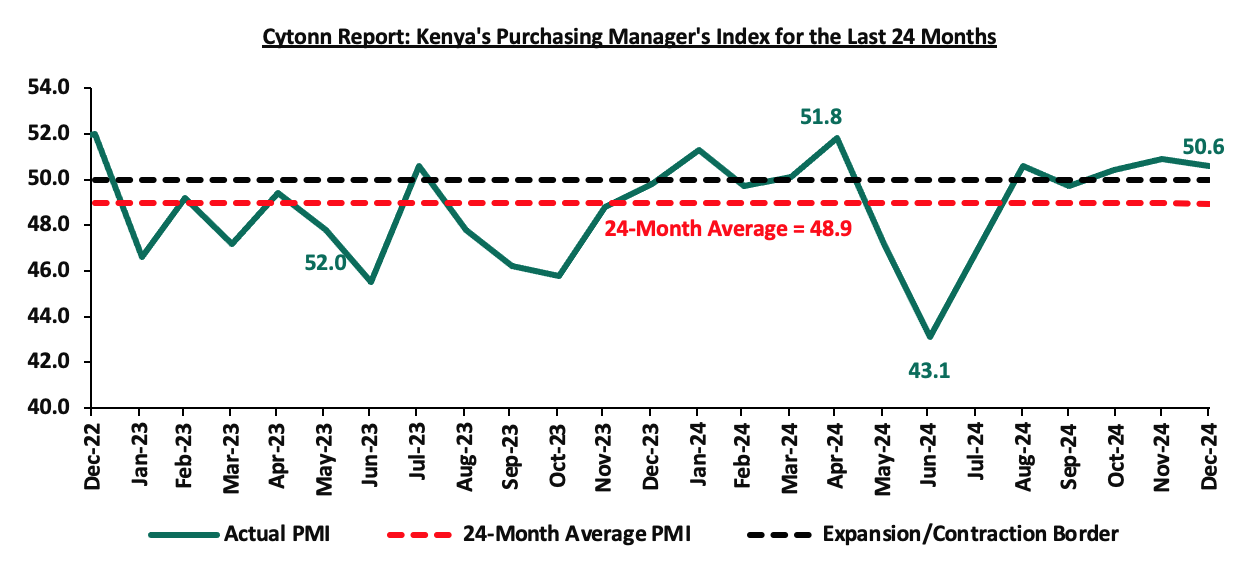

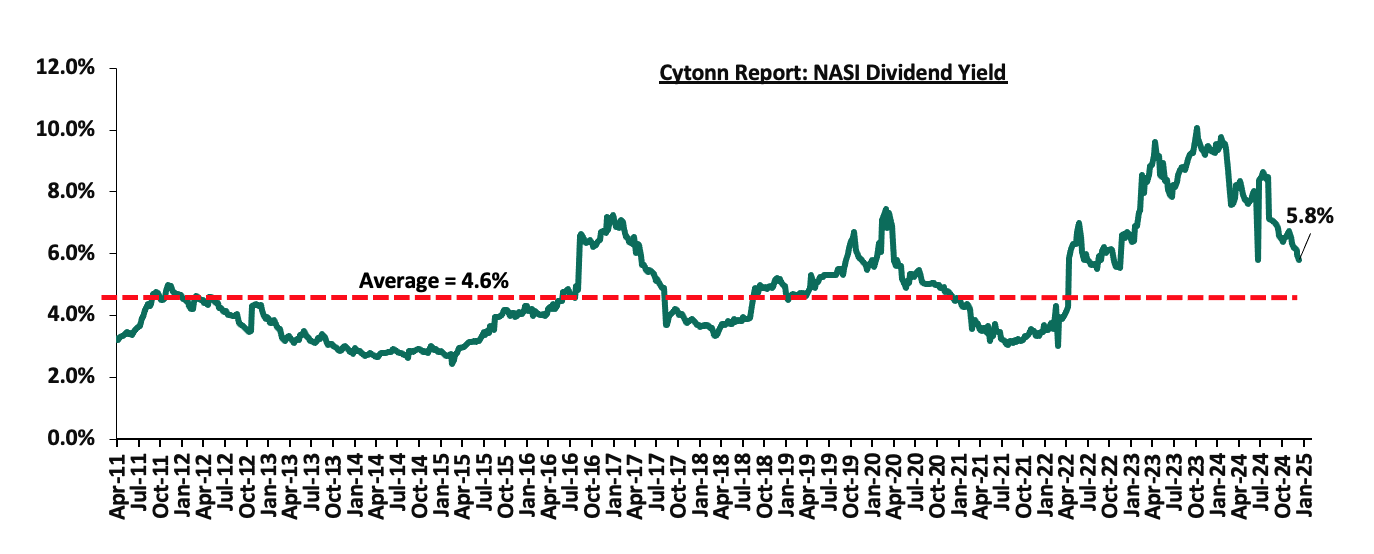

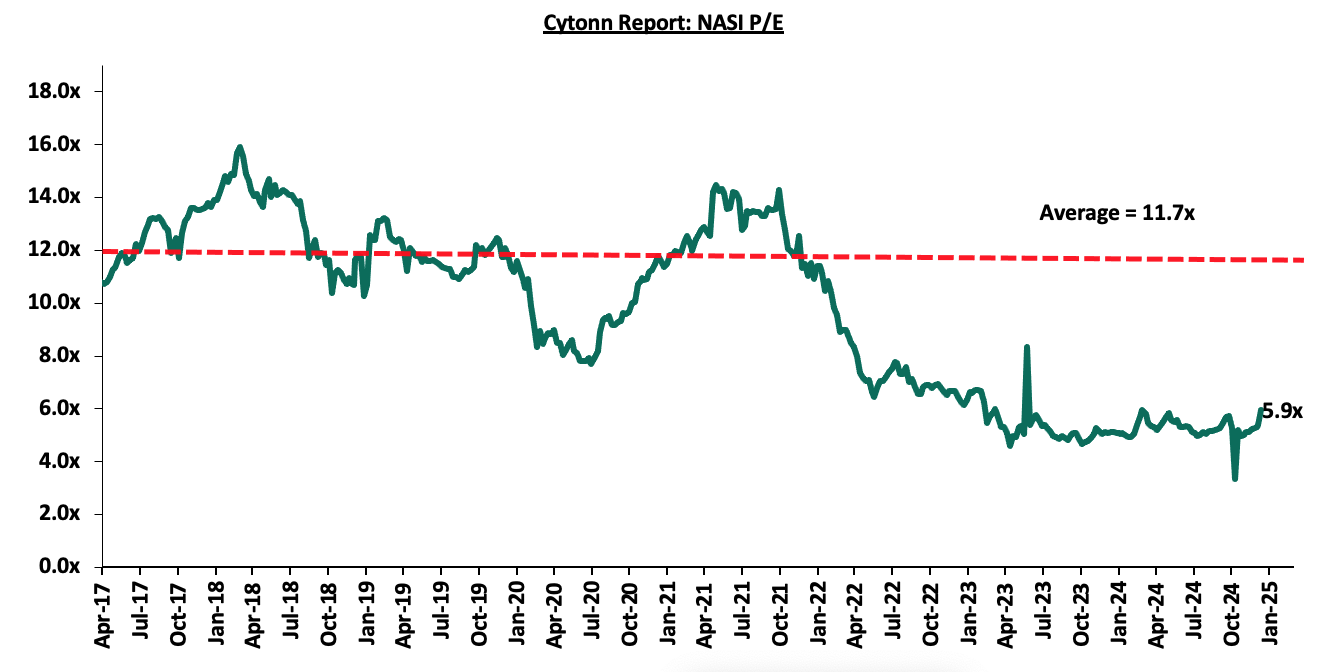

We have a BULLISH outlook on the Kenyan Equities market in the short term but “NEUTRAL” in the medium to long term. We expect a continued improvement in the listed sector’s earnings growth in 2025, largely driven by the expected 5.0%-5.4% GDP growth, decreased yields in the fixed income markets and the improvement of the country’s business environment. The business environment showed signs of improvement in the last quarter of 2024, with the Purchasing Manager’s Index (PMI) averaging at 50.6 in Q4’2024, higher than the year’s average of 49.6. Additionally, the Kenyan currency appreciated against the major select currencies, gaining 17.4% against the USD dollar in 2024 indicating a stable economy. The investor flight which has still persisted in the early weeks of the year may, however, inhibit the growth of the equities market in the short-term;

Real Estate

Residential sector: Our outlook remains NEUTRAL for the residential sector. On the supply side, our outlook is neutral as we expect the government to intensify its affordable housing activities country wide as it aims to deliver 200,000 units annually. We also expect the private sector to play a crucial rule in supplementing government efforts to bridge the housing deficit. In addition, infrastructural development will play a pivotal role in supporting the development of residential projects. On the demand side, our outlook remains neutral, owing to the tough macro-economic conditions currently being experienced in the country which has weakened buyers’ purchasing power. For detached units, investment opportunity lies in areas such as Kitengela, Ngong, and, South B&C, while for apartments, investment opportunity lies in Kahawa West, Westlands and Dagorreti, due to their remarkable returns driven by good demand for units;

Commercial Office Sector: Our overall outlook for the Nairobi Metropolitan Area commercial office sector is POSITIVE. We expect the sector to remain stable with a slight improvement by 0.2% in rental yields recorded in FY’2025, attributable to an expected increase in overall rental rates by 3.0% in FY’2025.The improved performance may be supported by; i) the increasing presence of multinational companies in Kenya is likely to drive up occupancy levels, ii) co-working spaces are gaining popularity in the region iii) the gradual return to “working from office” after the Covid-19 pandemic, iv) more start-ups are expected to drive demand for commercial spaces,. However, the sector continues to face challenges due to a significant oversupply of office space, currently standing at 5.8 mn SQFT. Despite these challenges, there are attractive investment opportunities in areas such as Gigiri, Westlands, and Kilimani, which offer rental yields of 8.8%,8.5% and 8.3%, compared to the market average of 7.8%;

Retail Sector: We maintain a NEUTRAL outlook on the retail sector’s performance for 2025, influenced by several factors; i) continued expansion by local and international retailers, driven by evolving consumer preferences and market trends, ii) infrastructure improvements, including ongoing road and railway projects, are set to increase accessibility to key retail zones, unlocking further investment opportunities, and iii) favorable demographic trends, such as a growing urban population, will sustain demand for retail goods and services. However, growth could face challenges from: i) oversupply issues, with around 3.6 n SQFT of retail space available in Nairobi and an additional 1.9 mn SQFT countrywide, leading to low occupancy rates and rental yields, ii) e-commerce adoption, increasingly shifting retail demand online, pushing brick-and-mortar outlets to adapt, and iii) limited financing options for retail developments, along with high costs, are likely to hinder investment, especially for small and medium-sized enterprises (SMEs) that need to adopt technology to stay competitive;

Hospitality Sector: We maintain a POSITIVE outlook for the hospitality sector, supported by several key drivers: i) aggressive marketing campaigns promoting Kenya’s tourism, expected to boost tourist arrivals and improve occupancy rates at hospitality venues, ii) continued international recognition of Kenya’s tourism industry, enhancing its status as a leading tourist destination and drawing more global visitors, iii) strategic partnerships within the tourism sector, fostering innovation and collaboration to capitalize on new opportunities, iv) events and initiatives aimed at increasing tourism activity and improving guest experiences. However, while the sector demonstrated resilience in its overall performance in 2024, the outlook remains cautiously optimistic due to i) Kenya continues to face significant competition from neighboring markets, such as Rwanda, which employs aggressive promotional strategies, alongside Zanzibar, Tanzania, and South Africa, these regions actively position themselves as attractive alternatives, challenging Kenya's market share in the region, ii) difficulty in accessing finance as lenders demand more collateral to cushion themselves owing to elevated credit risk, and iii) occasional release of cautionary statements by governments like China and United States to their citizens advising them against travelling to Kenya due to threats like terrorism and elevated crime rates;

Land Sector: We retain a POSITIVE outlook for the land sector in the Nairobi Metropolitan Area (NMA), considering it a dependable investment opportunity that has shown improving performance year on year. Going forward, we anticipate that land in the NMA will continue on an upward trajectory coming in at a sector average price of Kshs 131.2mn in FY’2025 a 3.0% increase, from Kshs 130.9 mn recorded in FY’2024. We expect the sector's performance to be driven by several factors: i) government efforts to streamline land transactions through innovative solutions such as Ardhi Sasa, ii) continued activities by players on both the demand and supply sides, iii) growing demand for land driven by positive demographics, iv) the launch of infrastructure development projects opening up satellite towns for investment opportunities, and v) the continued rollout of the Affordable Housing Program (AHP) by the government, driving further demand for land. The investment opportunity lies in Juja, Limuru and Utawala for unserviced land, which recorded annualized capital appreciations of 6.3%, 5.7% and 4.8% respectively compared to market average of 4.5%. For serviced land, Rongai and Athiriver recorded the highest annualized capital appreciations of 7.1% and 3.3%, respectively against the serviced average of 3.2%;

Infrastructure Sector: We maintain a NEUTRAL outlook in the infrastructural sector.We anticipate the government will continue with its aggressive efforts to; i) construct and rehabilitate roads, bridges, railways, airports, and affordable housing units, among others, ii) increase its diplomacy and partnerships in development among neighbouring nations, and, iii) step up on the competition for attracting regional and international investors against other countries in Eastern Africa like Tanzania through railway connections and ports infrastructure. However, this efforts may slow down due to the reduction in allocation to state department of roads by 7.6% in the supplementary budget FY’2024/25, to ksh 178.7 bn from the ksh 193.4 bn set in the FY’2024/25 budget. Consequently, going forward to 2025 we anticipate there will be a decline in the number of completed infrastructure projects and there could be an increase in stalled infrastructure projects. Although the government acknowledges the importance of Public-Private Partnerships (PPPs) in tackling financing challenges, we believe that prioritizing PPPs is fundamental in addressing funding shortfalls;

Industrial Sector: We maintain a NEUTRAL outlook on the industrial sector’s performance. We expect slight growth in the sector as investors continue to respond to the growing demand for industrial spaces both in Nairobi and around the country. Data centres, cold rooms, growth in e-commerce, and rising demand for fast-moving consumer goods will continue to foster growth in the industrial sector. In 2025, we expect a slight increase in development activities in the industrial sector through government support in line with its Bottom Up Economic Transformation Agenda (BETA) which aims to tap into the manufacturing sector to create wealth, employment and reduce poverty levels among Kenyan citizens. However, optimal performance in this sector may be weighed down by factors like high development costs for industrial facilities, low technological adoption and inadequate infrastructure to support operation of these facilities. Going forward, we expect the sector to continue on an upward trajectory driven by: i) the rising demand for data centers in the country, ii) an increasing demand for cold rooms, especially in the Nairobi Metropolitan Area, iii) demand for quality warehouses due to the growing e-commerce business in the country, iv) support from the government, as evidenced by the establishment of Special Economic Zones (SEZ) and Export Processing Zones (EPZ), v) increased development activities by industry players such as ALP Africa Logistics & Devki steel mills, vi) Kenya’s continued recognition as a regional hub, hence attracting international investors, and, vii) efforts by the government to support agricultural and horticultural products in the international market Viii) continued improvement in infrastructure through projects such as the Standard Gauge Railway (SGR), the Eastern and Northern Bypasses connecting Jomo Kenyatta International Airport (JKIA) and other regions in the Nairobi Metropolitan Area, among other key infrastructural improvements which we expect will increase the output of Special Economic Zones and Inland Container Depots (ICDs);

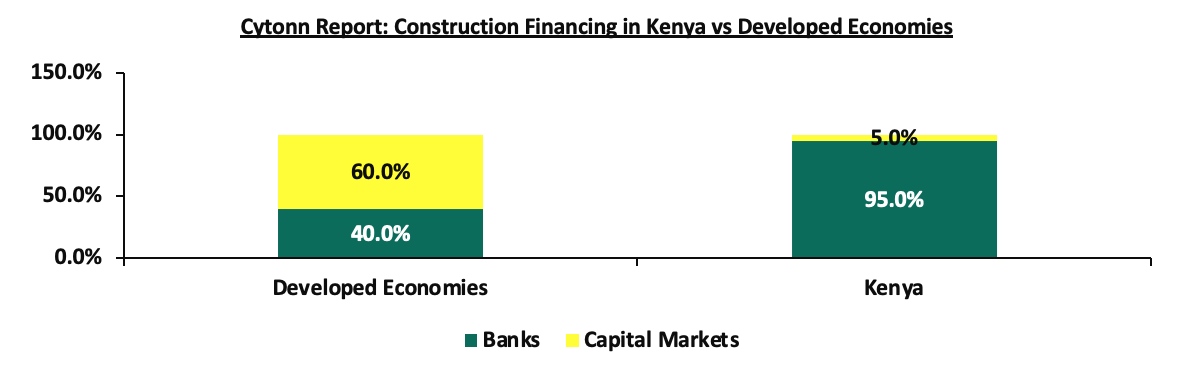

Real Estate Investment Trusts : We maintain NEUTRAL outlook for the REITs sector and we expect Kenya’s Real Estate sector to remain on a growth trend, supported by: i) demand for housing sustained by positive demographics, such as urbanization and population growth rates of 3.8% p.a and 2.0% p.a, respectively, against the global average of 1.7% p.a and 0.9% p.a, respectively, as at 2023, ii) activities by the government under the Affordable Housing Program (AHP) iii) heightened activities by private players in the residential sector. However, challenges such as rising construction costs, strain on infrastructure development (including drainage systems), high capital requirements for REITs, low investor knowledge on the asset class and existing oversupply in select Real Estate sectors will continue to hinder the sector’s optimal performance by limiting developments and investments.

Investment Updates:

- Weekly Rates: Cytonn Money Market Fund closed the week at a yield of 16.61% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Tuesdays, from 7:00 pm to 8:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Global Economic Growth:

According to the World Bank’s Global Economic Prospects 2024, global economic growth is projected to rise marginally by 0.1% points to 2.7% in 2025, from 2.6% in 2024. The expected economic expansion is driven by the easing global inflation that has in turn necessitated easing of monetary policies in most major economies leading to an ease in credit conditions, normalization of supply and demand dynamics as labor markets stabilize and resilient labor markets. After peaking at 9.4% year over year in Q3’2022, headline inflation rates are now projected to reach 3.5% by the end of 2025, below the average level of 3.6% between 2000 and 2019, mainly attributable to declining commodity prices. Moreover, the growth in the Emerging Markets and Developing Economies (EMDEs) is expected to expand by 3.6% in 2024 from the estimated growth of 3.3% in 2024.

Growth in 2024 shall be shaped by the following four key themes:

- Easing Inflation and Monetary Policies

In line with inflation-targeting strategies, central banks are expected to continue easing monetary policies in 2025, reducing interest rates to stimulate economic activity as inflationary pressures subside. This shift follows one of the most aggressive monetary tightening cycles in recent history, implemented to curb heightened inflation caused by persistent high fuel and food prices. Since June 2024, major central banks in advanced economies have started to cut their policy rates, moving their policy stance toward neutral. The change in global monetary conditions is easing the pressure on emerging market economies, with their currencies strengthening against the US dollar and financial conditions improving. This will help reduce imported inflation pressures, allowing these countries to pursue more easily their own disinflation path.

In their latest meeting on 18th December 2024, the USA Federal Reserve cut their policy rates by 25 bps to a range 4.25%-4.50% from a range of 4.50%-4.75%. The Fed’s decision to lower rates was driven by the need to support a soft landing for the economy, as inflation showed signs of easing but remained above the 2.0% target. As of November 2024, the y/y inflation rate stood at 2.7%, up from 2.6% in October 2024. The Fed noted that while inflation has made progress toward its target, it remains somewhat elevated, and economic growth continues at a solid pace. Additionally, in their most recent sittings, other major economies such as Canada, and the Euro Area also cut their monetary policy rates. While lowering rates could stimulate domestic growth and ease financial conditions, they must balance this with the risk of inflationary pressures, currency devaluation, and capital outflows. In our view, we expect the coming rate cuts to be gradual as economies seek to adopt accommodative policies that will support the economy while avoiding an uptick in inflation rates.

The table below highlights the policy stance adopted by the Central Banks of major economies

|

Cytonn Report: Monetary Policy Stance Adopted by Central Banks in Select Economies |

||||||

|

No |

Country |

Central Bank |

Last meeting date |

Previous Rate |

Current Rate |

Margin |

|

1 |

Canada |

Bank of Canada |

11-Dec-24 |

3.75% |

3.25% |

(0.5%) |

|

3 |

USA |

Federal Reserve |

18-Dec-24 |

4.50%-4.75% |

4.25%-4.50% |

(0.25%) |

|

5 |

Euro Area |

European Central Bank |

18-Dec-24 |

3.40% |

3.15% |

(0.25%) |

|

2 |

China |

Bank of China |

20-Dec-24 |

3.1% |

3.1% |

Unchanged |

|

4 |

England |

Bank of England |

19-Dec-24 |

4.75% |

4.75% |

Unchanged |

|

6 |

Malaysia |

Bank Negara Malaysia |

6-Nov-24 |

3.00% |

3.00% |

Unchanged |

|

7 |

Australia |

Reserve Bank of Australia |

10-Dec-24 |

4.35% |

4.35% |

Unchanged |

Data Source: Cytonn Research

- Easing Commodity Prices

In 2024, commodity prices were on a downward trajectory and are projected to ease further in 2024. According to the World Bank’s Commodity Markets Outlook report, commodity prices are expected to decrease by 5.1% percent in 2025, after softening 2.7% in 2024. This would lead aggregate commodity prices to their lowest levels since 2020. The projected declines are led by oil prices but tempered by price increases for natural gas and a stable outlook for metals and agricultural raw materials. The table below shows select commodity price indices:

|

Cytonn Report: Average Commodity Prices (USD) |

||||||

|

Commodity Index |

2023 |

2024 |

Average y/y change |

Jun-24 |

Dec-24 |

Half-year Change |

|

Precious metals |

147.3 |

180.2 |

22.3% |

177.5 |

200.6 |

13.0% |

|

Agriculture |

110.9 |

114.8 |

3.5% |

116.4 |

118.0 |

1.4% |

|

Metals & Minerals |

104.0 |

106.7 |

2.6% |

112.6 |

107.9 |

(4.2%) |

|

Non-energy commodities |

110.2 |

112.4 |

1.9% |

115.1 |

115.0 |

(0.1%) |

|

Energy prices |

107.0 |

101.5 |

(5.1%) |

105.3 |

96.9 |

(8.0%) |

|

Fertilizers |

153.5 |

117.6 |

(23.4%) |

113.5 |

120.9 |

6.5% |

|

Aggregate index |

108.0 |

105.1 |

(2.7%) |

108.6 |

102.9 |

(5.2%) |

Data Source: World Bank

Oil prices have been under downward pressure declining by 2.6% in 2024, albeit lower than the 16.8% decrease which was recorded in 2023, as the post-pandemic demand recovery stalled, China's economy struggled, and the U.S. and other non-OPEC producers pumped more crude into a well-supplied global market. Oil prices are expected to decline further in 2025 but remain above the pre-pandemic levels as a result of weak demand from China in addition to rising global supplies which are expected to cast a shadow on OPEC+ led efforts to shore up the market. In 2025, fertilizer prices are projected to decline further by 2.0%, building on the 23.4% decrease recorded in 2024. This continued downward trend is attributed to increased global production and lower feedstock prices. Similarly, food prices, which represent the largest component of the World Bank Agriculture Commodity Index, are expected to fall by 4.8% in 2025. This decline is driven by record-high rice and maize production in the 2023-24 season and favorable crop expectations for 2025. These trends are likely to reduce agricultural input costs, easing inflationary pressures in food-dependent economies. However, risks such as unpredictable weather patterns or geopolitical disruptions could still impact price stability and agricultural output.

- Global Trade

The World Trade Organization (WTO) projects the global trade growth to improve to 3.0% in 2025 from the 2.7% growth rate in 2024 on the back of improved exports of manufactured goods from Asia and strong services trade. However, trade tensions, protectionist policies, and geopolitical uncertainties are significant risks to the outlook. The U.S.-China relationship remains a focal point, with American businesses growing more pessimistic about opportunities in China as its economic growth slows and local competitors, bolstered by state support, dominate key industries. Major U.S. companies are diversifying supply chains to countries such as Vietnam and India, reflecting diminished optimism about the Chinese market. Geopolitical uncertainties further exacerbate these challenges. The ongoing conflicts in the Middle East, for instance, could disrupt recovering global supply chains, thereby slowing down trade. Additionally, the potential for new tariffs and trade barriers, as indicated by recent policy discussions, may lead to increased market volatility and economic instability. In our view, global trade growth will remain constrained in the near term due to persistent structural challenges such as supply chain fragmentation, rising trade barriers, and labor market inefficiencies, despite a gradual easing of inflationary pressures.

- Public Debt

High debt levels especially in Emerging Markets and developing economies (EMDEs) are expected to persist in 2025 mainly on the back of widened current account deficits and surging debt service costs due to declining global trade and currency depreciation in most economies, coupled with tighter financial conditions undermining economic growth. According to the Global Debt Monitor by (IMF), the global public debt (public and non-financial private debt stocks) came in at 237.2% of the GDP, (USD 250.0 tn) in 2023, translating to 0.2% points decline from 238.0% of the GDP recorded in 2022. Conversely, public debt stock as a percentage of GDP increased by 2.0% points to 93.8% in 2023, from 91.8% recorded in 2022. However, given the perceived interest cuts in 2024, especially in developed economies such as the US, global debt levels may experience mixed impacts. While reduced borrowing costs could ease the debt servicing burden for some nations, the elevated refinancing costs for long-term debt and the persistent structural challenges, including fiscal deficits and weak revenue collection, are likely to counteract these benefits. Additionally, geopolitical risks and inflationary pressures, although moderating, remain key concerns that could strain fiscal positions, particularly in EMDEs. In our view, global debt is projected to remain elevated, with governments and corporations facing continued pressure to manage their liabilities amidst a challenging economic and financial landscape.

Below is a summary of the regional growth rates by country as per the World Bank:

|

Cytonn Report: World GDP Growth Rates |

||||||

|

Region |

2021 |

2022 |

2023 |

2024e |

2025f |

|

|

1. |

India |

9.7% |

7.0% |

8.2% |

6.6% |

6.7% |

|

2. |

Kenya |

7.6% |

4.9% |

5.6% |

5.0% |

5.3% |

|

3. |

Middle-East, North Africa |

6.2% |

5.9% |

1.5% |

2.8% |

4.2% |

|

4. |

China |

8.4% |

3.0% |

5.2% |

4.8% |

4.1% |

|

5. |

Sub-Saharan Africa |

4.4% |

3.8% |

3.0% |

3.5% |

3.9% |

|

6. |

Euro Area |

7.2% |

1.6% |

3.2% |

3.0% |

2.9% |

|

7. |

Brazil |

4.8% |

3.0% |

2.9% |

2.0% |

2.2% |

|

8. |

United States |

5.8% |

1.9% |

2.5% |

2.5% |

1.8% |

|

9. |

Japan |

2.6% |

1.0% |

1.9% |

0.7% |

1.4% |

|

10. |

South Africa |

4.7% |

1.9% |

0.6% |

1.2% |

1.3% |

|

|

Global growth rate |

6.3% |

3.0% |

2.6% |

2.6% |

2.7% |

Data Source: World Bank

According to the World Bank’s Global Economic Prospects , growth in the Sub-Saharan Africa region is expected to rebound to 3.9% in 2025, from the estimated growth rate of 3.5% recorded in 2024 mainly attributable to the easing inflationary policies, reduction in prices of key imports such as fertilizers, metal and fuel, improved fiscal support and the expected increase in domestic demand.

However, the projections remain subject to key downward risks such as:

- Persistent global inflationary pressures, which may lead to the deterioration of financial conditions in the region and high cost of living due to the high prices necessitating aggressive policy rate hikes in the region,

- The high debt levels in the region as borrowing persists in the region due to the ever-present fiscal deficits in the region. Additionally, the increased debt servicing costs due to the sustained currency depreciation of the local currencies against the Dollar are expected to put more pressure on the region’s growth as most of the region’s debt is dollar-denominated, and,

- Further rise in global or regional instability, such as the possible escalation of the conflict in the Middle East, which could drive up global energy and food prices which would in turn affect growth in the Sub-Saharan Africa region considering that most of the countries in the region are net importers.

In Nigeria, the region's largest economy, growth is projected to accelerate to 3.5% in 2025 from an estimated 3.3% in 2024. This improvement is attributed to increased non-oil sector activity, particularly in agriculture and services, supported by reforms to address structural economic challenges. Additionally, growth in South Africa is expected to increase slightly to 1.3% in 2025, from the estimated growth of 1.2% in 2024. The growth in South Africa is attributable to the energy sector reforms that are expected to improve energy supply in the medium term coupled with easing inflationary pressures which are expected to continue its gradual decline, easing cost-of-living pressures on households and supporting private consumption. However, growth in the region is expected to be hampered by the high debt levels, stifled demand, persistent depreciation of local currencies as well as the increased cases of corruption in the region as indicated by the Corruption Perceptions Index. Growth in the Eastern African region is expected to remain subdued due to the witnessed political clashes in Sudan, South Sudan and the Democratic Republic of Congo, coupled with persistent unfavourable weather conditions which continue to stifle agricultural production.

The table below highlights the real GDP forecasts of select Sub - Saharan Africa countries;

|

Cytonn Report: Real GDP Forecasts of Select Sub - Saharan Africa countries |

||

|

Country |

2024e |

2025f |

|

Senegal |

7.1% |

9.7% |

|

Rwanda |

7.6% |

7.8% |

|

Ethiopia |

7.0% |

7.0% |

|

Uganda |

6.0% |

6.2% |

|

Tanzania |

5.4% |

5.8% |

|

Kenya |

5.0% |

5.3% |

|

Ghana |

2.9% |

4.4% |

|

Mauritius |

5.0% |

4.1% |

|

Nigeria |

3.3% |

3.5% |

|

Angola |

2.9% |

2.6% |

|

South Africa |

1.2% |

1.3% |

|

Average |

4.9% |

5.2% |

Data Source: World Bank

- Economic Growth:

According to the Kenya National Bureau of Statistics (KNBS) Q3’2024 Gross Domestic Product Report, the Kenyan economy recorded a 4.0% growth in Q3’2024, a deterioration from the 6.0% expansion recorded in a similar period in 2023. The performance in Q3’2024 was mainly driven by the 4.2% growth in the agricultural sector due to favorable weather conditions, which led to a steady growth in agricultural output. Consequently, the economy recorded an average growth of 4.5% in the first three quarters of 2024, a decline from the 5.5% average growth recorded in a similar period in 2023. The average GDP growth rate for 2024 is expected to come in at a range of 4.8% - 5.0%, a decline from the 5.6% expansion witnessed in 2023.

In 2025, we expect the economy to continue its recovery trajectory with the projected GDP growth to come in at a range of 5.0% - 5.4%.

The key factors that shall support growth include:

- Continued growth in Services and Agricultural sectors: The steady performance in the agricultural sector witnessed in 2024 is expected to continue into 2025 following continued support by the government through fertilizer and seed subsidy programs, despite a marginal 3.7% cut in budget allocation under the Crop Development and Management Programme in the Supplementary Budget I for the Fiscal Year 2024/25. Additionally, the favorable weather conditions and sufficient rainfall experienced in the country is set to continue supporting the sector. The service sector is expected to register robust performance driven by growth in information and technology as internet connectivity increases, as well as accommodation and food services as a result of increased tourism,

- Eased Monetary Policy – In 2024, the Monetary Policy Committee (MPC) lowered the Central Bank Rate (CBR) by a total of 175.0 bps from 13.00% in February to 11.25% in December in a bid to support the economy, noting that its previous measures had successfully reduced overall inflation to below the mid-point of the target range of 2.5% - 7.5%, stabilized the exchange rate, and anchored inflationary pressures. We expect the MPC to continue lowering the rates gradually in the short to medium term therefore lowering borrowing costs, leading to increased spending and an uptick in the business environment. Further, this is expected to support the private sector credit growth, which has recorded record low credit growth rates in the recent months. The low CBR is expected to support economic growth, and,

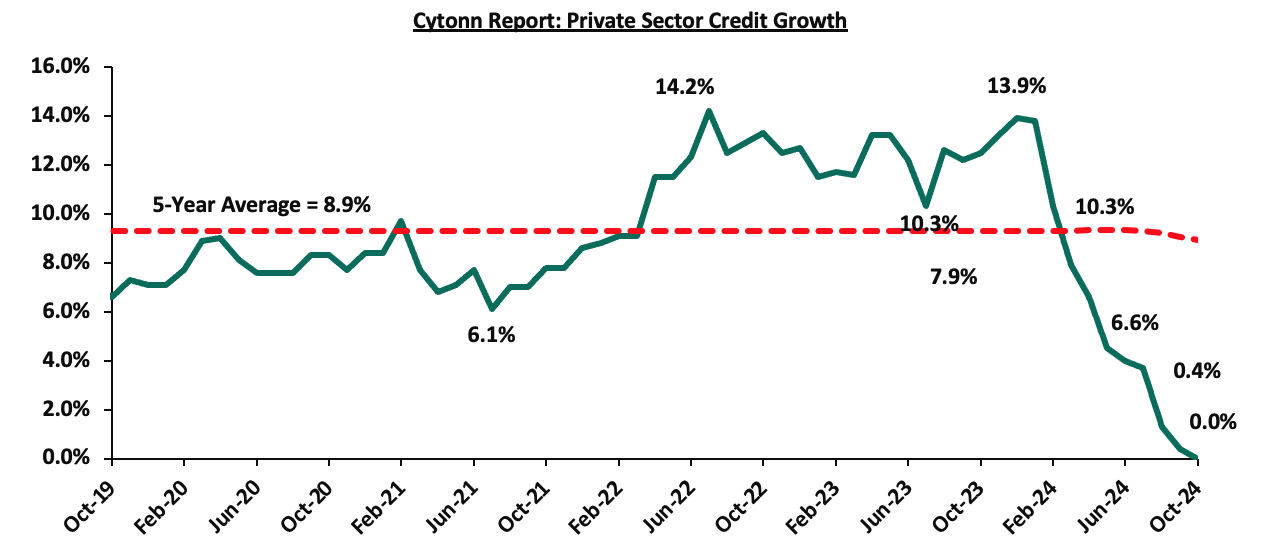

- Gradual Increase in Access to Credit: During the first 10 months of 2024, private sector credit growth rate averaged 5.3%, significantly lower than the 12.1% average growth rate recorded over the same period in 2023, mainly on the back of increased borrowing costs. Despite this decline, we anticipate an expansion of credit to the private sector driven by, the expansionary monetary policy stance by the Central Bank of Kenya, policy initiatives such as the MSMEs Credit Guarantee Scheme and the ongoing economic revival. Additionally, we expect the renewed focus on Public-private Partnerships (PPP) to finance commercially viable projects to spur growth in the private sector. Furthermore, the Hustler Fund has continued to inject affordable credit to the private sector having disbursed Kshs 52.9 bn as of December 2024, and is expected to continue to offer specific financial products such as the Hustler Fund by Vikundi. Furthermore, with the expected reduction in credit risk and a decline in yields in the short-term government papers, we expect the banking sector to increase its lending to the private sector in search of better yields following the adoption of risk-based lending. The chart below shows 5-year private sector credit growth;

Source: CBK

However, key risks threaten economic growth including:

- High Risk of Debt Distress: According to International Monetary Fund and the World Bank, Kenya is currently at risk of high debt distress with the country’s debt to GDP ratio coming in at 71.8% as at June 2024, 21.8% points above the recommended IMF threshold of 50.0% for developing countries. Additionally, Kenya’s debt stood at Kshs 10.8 tn as of September 2024, 1.9% higher than the Kshs 10.6 tn debt recorded over a similar period in 2023. Consequently, the government will face significant pressure to service the existing debt with the debt service to revenue ratio standing at 56.8% as of November 2024, 26.8% points above the 30.0% threshold recommended by the IMF. Economic growth potential diminishes when debt levels are high because a significant part of the revenue is allocated towards servicing the existing debt, leaving less for developmental spending, and,

- Rising Inflationary Pressures –The country’s inflation rate averaged 4.5% in 2024, remaining within and falling below the mid-point of the CBK’s target range of 2.5%-7.5%. Despite the improvement recorded in 2024, we expect the inflation rate to remain relatively stable in the short term, but face upward pressure in the medium to long term during 2025, weighing down the business environment.

- Currency:

The Kenya Shilling appreciated by 17.4% against the US Dollar to close at Kshs 129.3 in 2024, compared to Kshs 156.5 at the end of 2023, a contrast to the 26.8% depreciation recorded in 2023. The gain was majorly driven by the repayment of the USD 2.0 bn Eurobond that matured in June, through a buy-back in February 2024 that reduced credit risk on the country and pressure on the Shilling. Additionally, the cuts in the US Federal interest rates by a total of 100 bps in 2024 to a range of 4.25%-4.50%, from a range of 5.25%-5.50% in the beginning of 2024

Going forward, we expect the shilling to trade against the US dollar within a range of Kshs 120.9 and Kshs 140.5 by the end of 2025.

The Kenyan shilling will be supported by:

- Improving diaspora remittances standing at a cumulative USD 4,872.0 mn in the 12 months to November 2024, 16.7% higher than the USD 4,175.0 mn recorded over the same period in 2023. In the November 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 53.4% in the period. In 2025, diaspora remittances are set to improve further, mainly driven by the recovery of the global economy, increasing Kenyan population in the diaspora, and advancing technology that has facilitated easier transfer of money,

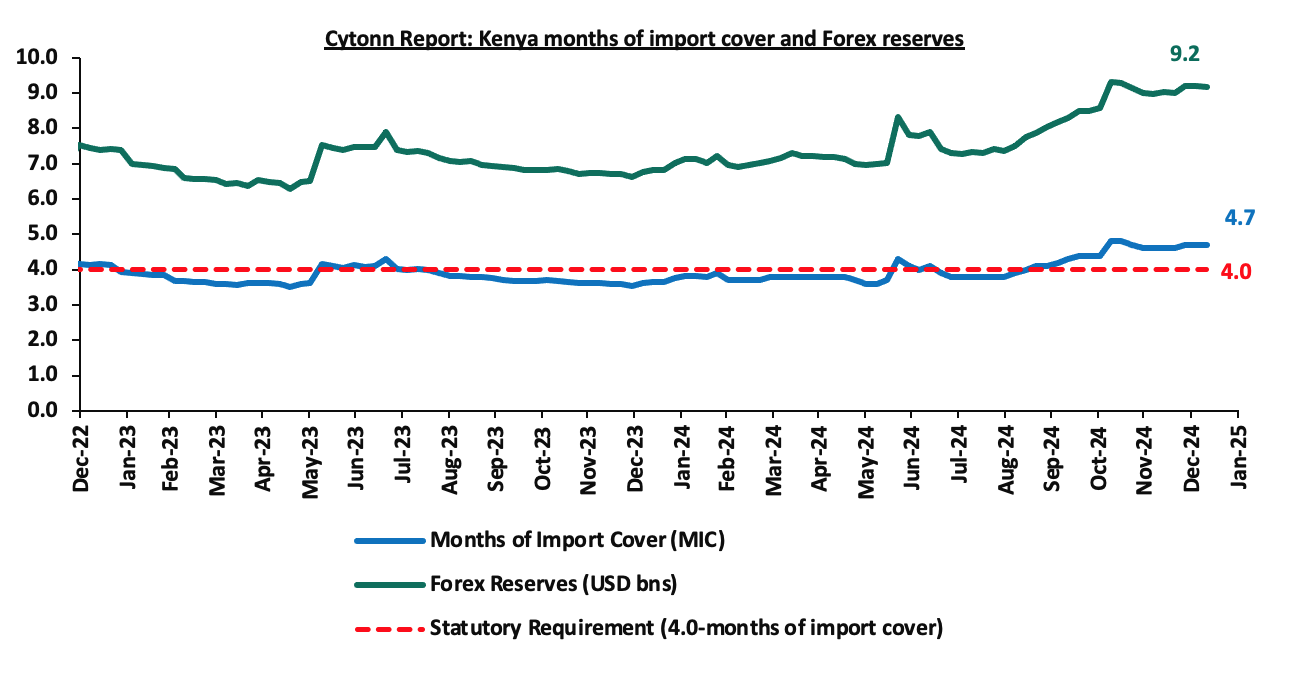

- Improving forex reserves currently at USD 9.2 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and the EAC region’s convergence criteria of 4.5-months of import cover. Forex reserves improved by a significant 39.1% to USD 9.2 bn (equivalent to 4.7 months of import cover) in December 2024, from USD 3.6 bn (equivalent to 4.0 months of import cover) in a similar period in 2023. The rise is largely attributed to reduced debt service obligations due to the stability of the Kenyan shilling and dollar inflows from concessional financing from International Monetary Fund (IMF) disbursements. Notably, the country successfully redeemed the 10-year USD 2.0 bn Eurobond that matured in June 2024, easing pressure on the country’s forex reserves,

- Expected dollar inflows from both commercial and concessional financing, boosting the country’s forex reserves. On 30th May 2024, The World Bank approved a new USD 1.2 bn funding under the Kenya Fiscal Sustainability and Resilient Growth Development Policy Operation (DPO), to be funded through a USD 850.0 mn loan from the International Bank for Reconstruction and Development (IBRD), a USD 300.0 mn credit from the International Development Association (IDA), and a USD 50.0 mn grant from the IDA's Window for Host Communities and Refugees. Additionally, in November 2024, Kenya secured a USD 606.1 mn from the International Monetary Fund (IMF), USD 485.8 mn under the Extended Fund Facility (EFF) and Extended Credit Facility (ECF) arrangements following the completion of the seventh and eighth reviews and USD 120.3 mn under the Resilience Sustainability Facility (RSF) arrangements, with the National Treasury expecting more financing from the IMF to fulfill the total financial commitment of USD 3.6 bn, and,

- The Government measures to stabilize the foreign exchange market which includes the Government-to-Government petroleum supply arrangement, revitalizing inter-bank forex bank trading and the revival and Commercialization of the National Oil Corporation of Kenya (NOCK). According to the Draft 2024 Budget policy, these arrangements are part of a broader strategy to enhance the stability of Kenya's foreign exchange market by addressing both supply and demand factors influencing currency valuation. Additionally, the Central Bank of Kenya (CBK) has been actively engaging in foreign exchange operations to manage the volatility of the Kenyan shilling against the U.S. dollar, shifting its strategy from selling to purchasing U.S. dollars from local banks, aiming to anchor its foreign exchange reserves and maintain the stability of the currency.

The Kenyan shilling will however face the following challenges:

- An ever-present current account deficit estimated at 3.9% of GDP in Q3’2024, a deterioration from the 3.5% deficit recorded in a similar period in 2023. The persistent current account deficit reflects the country’s reliance on imports which has resulted in increased demand for foreign currency which continues to put more strain on the local currency,

- The low interest rates, with the Monetary Policy Committee reducing the CBR to 11.25% in its last sitting, signalling an expansionary monetary policy stance, noting that its previous measures had successfully reduced overall inflation to below the mid-point of the target range of 2.5% - 7.5% and stabilized the exchange rate. The lower rates pose a challenge to the Kenyan Shilling, increasing pressure on the currency’s stability due to reduced attractiveness for foreign investors, especially in the face of sustained external borrowing needs and global market fluctuations.

- Elevated risk of increase in global crude oil prices as a result of supply chain constraints following the rising geopolitical tension in the Middle East. Consequently, the possible rise in global oil prices is set to increase demand for the US Dollar by oil and energy importers, as well as manufacturers against a low supply of US Dollar currency, and,

- The high debt servicing costs which continue to put pressure on forex reserves. Notably, the debt service to revenue ratio stood at 56.8% as of November 2024, 26.8% points above the 30.0% threshold recommended by the IMF, and 67.2% of Kenya’s external debt is US Dollar-denominated as of June 2024.

We expect the shilling to remain within a range of Kshs 120.9 and Kshs 140.5 against the USD by the end of 2025 with a bias towards a 4.6% depreciation by the end of the year.

- Inflation:

In 2024, the average inflation rate in the country was 4.5%, marking 3.2% points decrease from the average inflation rate of 7.7% witnessed in 2023. However, the y/y inflation rate increased slightly by 0.2% points to 3.0%, in December 2024 from the 2.8% recorded in November 2024. Key to note, the overall inflation rates throughout 2024, remained within the Central Bank’s target range of 2.5% and 7.5%, hitting its lowest in October 2024 at 2.7%, the lowest since 2010. Despite the improvement recorded in 2024, we expect the inflation rate to remain relatively stable in the short term, but face upward pressure in the medium to long term during 2025, given that the current fiscal measures do not address the cost-driven inflation, in addition to a ripple effect of the current expansionary monetary stance.

We expect inflation to average 5.3% in 2025, within the government target range of 2.5% - 7.5%. Key risks driving inflationary pressure are the high electricity prices, fuel costs, and exchange rate fluctuations on the Kenyan shilling.

- Interest Rates:

The Central Bank of Kenya (CBK) is expected to continue with the expansionary monetary policy stance in the short-to-medium term attributable to a stronger and stable currency and the eased inflation currently below the mid-point of the CBK’s preferred target of a range of 2.5% - 7.5%. The 11.25% Central Bank Rate (CBR) set in December 2024 marks the lowest level since December 2023. In the short term, we anticipate the Central Bank of Kenya (CBK) will adopt a more cautious approach to rate adjustments as it evaluates the performance of the local currency and inflation trends. However, in the medium term, there is potential for further reductions in the CBR to stimulate private sector credit growth, which experienced a decline in 2024 due to elevated interest rates.

Despite the projected decline in borrowing by 8.7% to Kshs 768.6 bn in FY’2024/25 from Kshs 835.1 bn in FY’2023/24, Kenya still has an ever-present fiscal deficit, projected at 4.3% in FY’2024/25. As such, we expect the government to continue borrowing aggressively from both the domestic and foreign markets, given that the government is already ahead of its total net domestic borrowing target of Kshs 408.4 bn in FY’2024/25. The escalating debt service due to further borrowing will persistently burden the government, compelling it to borrow more to cover the maturing debts. However, the interest rate environment is expected to stabilize in the medium term as the government receives a boost from concessional loans from the IMF and the World Bank, improving the country’s credit outlook.

The table below summarizes the various macroeconomic factors and the possible impact on the business environment in 2025. With two indicators being negative, three being neutral and two being positive, the general outlook for the macroeconomic environment in 2025 is NEUTRAL.

|

|

Cytonn Report: Macro-Economic & Business Environment Outlook |

|

|

|

Macro-Economic Indicators |

|

2025 Outlook |

Effect |

|

Government Borrowing |

|

On the domestic front, we expect the government to borrow aggressively from the domestic market as it aims to plug in the fiscal deficit, which is projected to come in at Kshs 768.6 bn in the FY’2024/25 Supplementary Budget Estimates I, 4.3% of the GDP. The government intends to plug this fiscal deficit through Kshs 356.4 bn in external financing and Kshs 412.2 bn in domestic borrowing. Borrowing domestically is less costly for the government than acquiring debt denominated in foreign currencies, which not only carry higher interest rates but also come with the added risk of currency fluctuations. Currently the government has borrowed Kshs 502.2 bn from the domestic market

In our view, the level of foreign borrowing will also increase in 2025 due to the following reasons; (i) Disbursement of concessional loans from the IMF under the Extended Credit Facility arrangement (EFF/ECF) and the Resilience Sustainability Facility (RSF) programme, coupled with funding from the World Bank under the Development Policy Operation (DPO) arrangement, and (ii) Disbursement of commercial loans from commercial lenders such as the Trade & Development Bank (TDB) and the African Development Bank.

On revenue collection, we expect continued improvement in 2025 due to the raft of measures the new administration has put in place to boost tax collection such implementation of the Finance Act 2023 which revised a number of taxes upwards and widened the tax base to include the informal sector and digital services. The tax regime has also taken measures to strengthen tax administration by leveraging on technology to seal leakages, rolling out a Tax Invoice Management System (e-TIMS), and enhancing both the iTax platform and the Integrated Customs Management System (iCMS). However, the upward revision of taxes comes at a time when the disposable income is reducing leading to a lot of opposition weighing down on the projected revenue performance. Notably, the withdrawal of the Finance Bill 2024 which sought to raise Kshs 344.3 bn in additional revenue to fund the FY’2024/25 Budget has constrained the government revenue collection efforts, with the total revenue collected as at the end of November 2024 amounting to Kshs 940.9 bn, equivalent to 35.8% of the revised estimates of Kshs 2,631.4 bn for FY’2024/2025 and is 85.8% of the prorated estimates of Kshs 1,096.4 bn.

The government is also employing a raft of measures to boost revenue collection through non-tax channels by streamlining its services to the public e.g. Citizen services, the Ministry of Lands and Immigration services and proposals to broaden the tax base through the Tax Laws Amendment Bill 2024. However, the upward revision of taxes comes at a time when the business environment remains subdued, underpinned by the increased taxation that has suppressed business production levels weighing down on the projected revenue performance. Additionally, the Tax Laws Amendment Bill 2024 that introduced significant tax reforms including increased tax-exempt limits for non-cash benefits, gratuity, and pension contributions, alongside deductions for contributions to the Affordable Housing Levy and other funds, exemptions for business transfers, locally assembled electric vehicles, and goods from AfCFTA countries from VAT or excise duty, could further reduce revenue collection from certain tax heads; |

Negative |

|

Exchange Rate |

• |

We expect the shilling to remain within a range of Kshs 120.9 and Kshs 140.5 against the USD by the end of 2025 with a bias towards a 4.6% depreciation by the end of the year. In 2025, the shilling is likely to face continued pressure due to: i) Persistent current account deficit resulting in increased demand for foreign currency hence putting more strain on the local currency, ii) The high debt servicing costs which continue to put pressure on forex, and, iii) Elevated risk of increase in global crude oil prices as a result of supply chain constraints following the rising geopolitical tension in the Middle East. However, we expect Improved diaspora remittances to support the shilling coupled with expected dollar inflows from both commercial and concessional financing, boosting the country’s forex reserves. |

Neutral |

|

Interest Rates |

• |

Given the expansionary policy stance utilized towards the end of in 2024, we expect the same to continue in 2025 as the Monetary Policy Committee evaluates the effect of the lower CBR on the country’s inflation rate and local currency performance in a bid to support private sector credit and lower borrowing costs for the government leading to a spur in economic growth. However, we expect the yield curve to normalize in the short to medium-term as the government turns to increased external borrowing alleviating pressure on the domestic market;

|

Positive |

|

Inflation |

• |

We expect inflation to average 5.3% in 2025, within the government target range of 2.5% - 7.5% due to inflationary pressure arising from high electricity prices, elevated fuel costs and potential exchange rate fluctuations on the Kenyan shilling. |

Neutral |

|

GDP |

• |

We anticipate the economic growth to continue on its recovery trajectory in 2025, with the GDP growth rate ranging between 5.0% - 5.4%. We expect the GDP growth to be supported by the continued recovery of the agricultural sector and a robust performance in the services sector driven by growth in information and technology as well as accommodation and food services as a result of increased tourism. However, there are several risks could potentially hinder this growth such as the high risk of debt distress, elevated inflationary pressures and currency depreciation. |

Neutral

|

|

Investor Sentiment |

• |

We expect the high positive investor sentiments witnessed in 2024 to persist through the short to medium term of 2025, mainly due to; i) Anchored inflationary pressures driven by reduced fuel costs, ii) Stability of the Kenyan currency as a result of decreased dollar demand from importers, especially for oil and energy sectors, and iii) Recovery of the private sector as the low interest rate environment reduces borrowing costs leading to an uptick in the business environment. |

Positive |

|

Security |

• |

We expect security to remain a concern in 2025 due to an unstable political environment, driven by ongoing political tensions and continued opposition to the current regime. |

Negative |

The change from last year’s outlook is:

- Interest Rate to Positive from Neutral necessitated by the expansionary monetary policy which is expected to be maintained in the short to medium term of 2025 to support private sector credit given the anchored inflation and stable shilling.

- Security to Negative from Positive attributable to the political instability and opposition against the current regime.

- Exchange rate to Neutral from Negative attributable to the stable Kenya shilling. We however expect the Shilling to face fluctuation pressures given the continued rate cuts by the CBK and the ever-present current account deficit and increasing debt service costs which continue to put pressure on the forex reserves.

Out of the seven metrics that we track, three have a neutral outlook, two have a negative outlook and two have a positive outlook; from last year where four had a neutral outlook, two had a negative outlook and one had a positive outlook. Our general outlook for the macroeconomic environment remains NEUTRAL for 2025, unchanged from 2024.

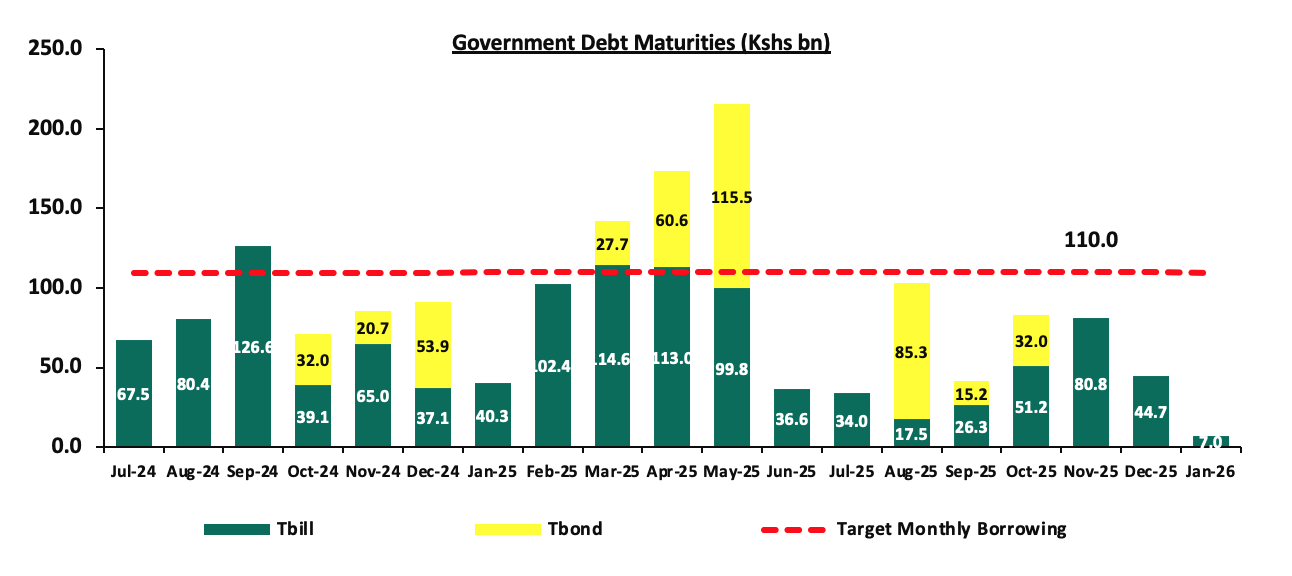

The government is currently 128.3% ahead its prorated domestic borrowing target, having a net borrowing of Kshs 502.2 bn domestically, against the pro-rated target of Kshs 219.9 bn, and 23.0% ahead of the total net domestic borrowing target of Kshs 408.4 bn for FY’2024/25, suggesting aggressive borrowing from the local market mainly on the back of the high debt maturities. We expect a moderate downward pressure on the interest rates, supported by the Central Bank of Kenya’s accommodative monetary policy stance and general economic improvement. While the international capital markets remain challenging, the reduced inflationary environment, easing global interest rates is expected to alleviate investor demands for high yields, though elevated debt servicing costs could still weigh on fiscal sustainability.

Below is a summary of treasury bills and bond maturities and the expected borrowings over the same period. The government will need to borrow Kshs 110.0 bn on average each month for the rest of the fiscal year to meet the domestic borrowing target of Kshs 408.4 bn for the FY’2024/2025, and cover T-bill and T-bond maturities, as illustrated in the graph below:

Fig: Schedule of Treasury bills and bonds maturities and the expected target borrowings in the 2024-2025 fiscal year to cater for the maturities and additional government borrowing.

Weekly Market Performance;

Money Markets, T-Bills Primary Auction:

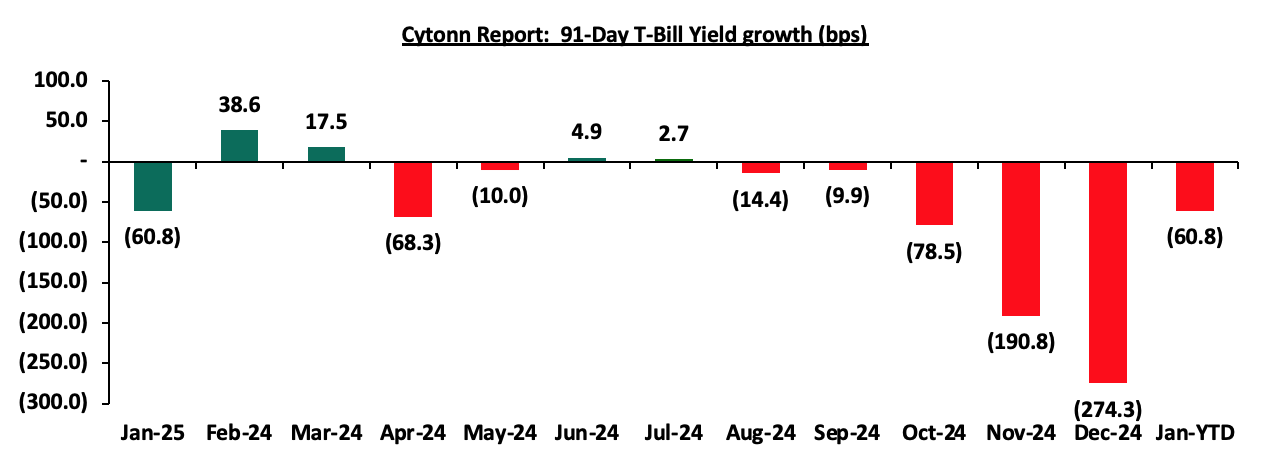

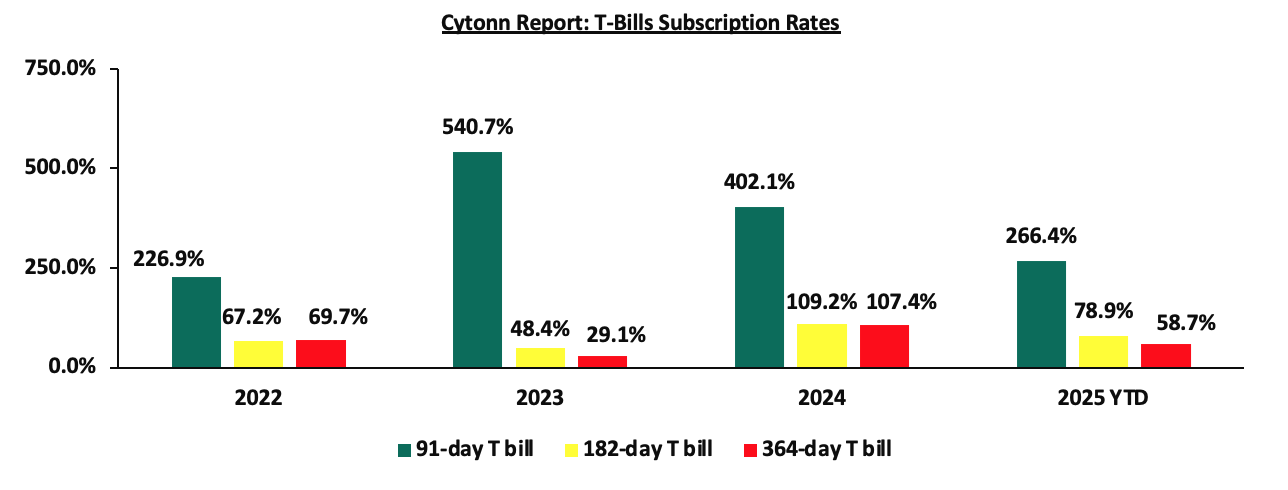

During the week, T-bills were oversubscribed for the first time in five weeks, with the overall oversubscription rate coming in at 138.1%, higher than the undersubscription rate of 65.4% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 13.3 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 333.1%, significantly higher than the oversubscription rate of 199.7% recorded the previous week. The subscription rates for the 182-day and 364-day papers increased to 97.1% and 101.1% respectively from 60.8% and 16.3% respectively recorded the previous week. The government accepted a total of Kshs 24.5 bn worth of bids out of Kshs 33.1 bn bids received, translating to an acceptance rate of 73.8%. The yields on the government papers were on a downward trajectory, with the yields on the 91-day papers declining the most by 23.2 bps to 9.6% from 9.8%, while the yields on the 182-day paper declined by 0.1 bps to remain relatively unchanged at 10.0% % and the yields on the 364-day paper declined by 3.7 bps to 11.3% from the 11.4% recorded the previous week. The chart below shows the yield growth rate for the 91-day paper over the period:

The chart below compares the overall average T-bill subscription rates obtained in 2022, 2023, 2024 and 2025 Year-to-date (YTD);

Money Market Performance:

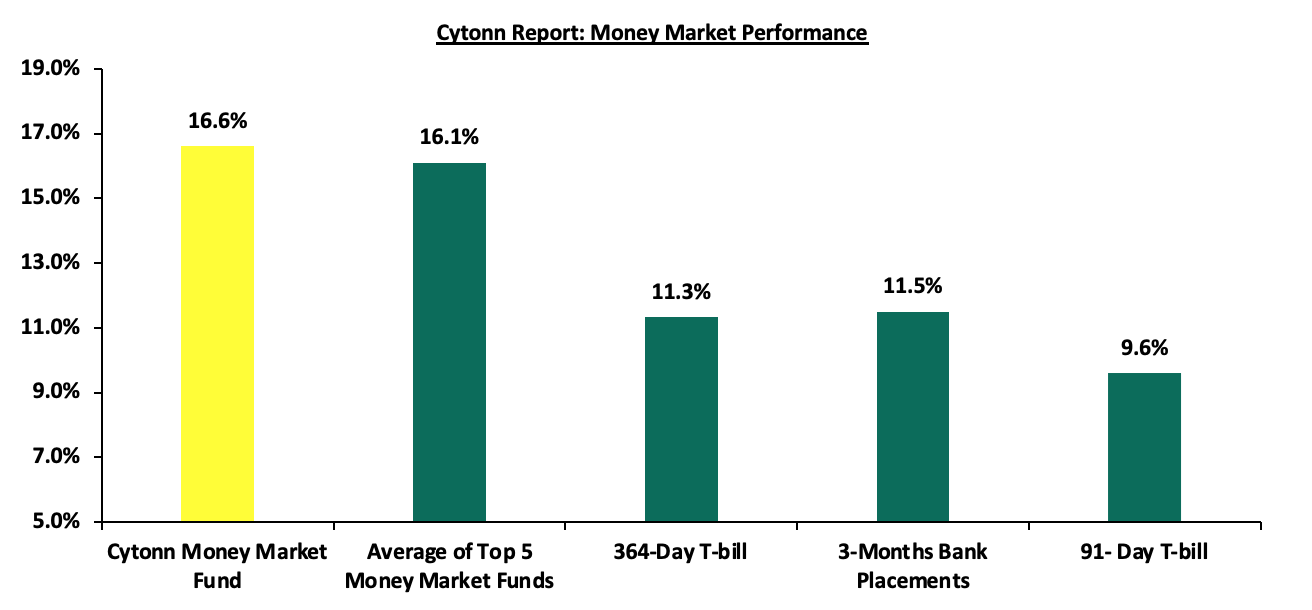

In the money markets, 3-month bank placements ended the week at 11.5% (based on what we have been offered by various banks), and yields on the government papers decreased, with the yields on the 364-day and 91-day papers decreasing by 3.7 bps and 23.2 bps to 11.3% and 9.6% respectively, from 11.4% and 9.8% respectively recorded the previous week. The yield on the Cytonn Money Market Fund declined by 23.0 bps to 16.6% from the 16.8% recorded the previous week, while the average yields on the Top 5 Money Market Funds decreased by 11.0 bps to close the week at 16.1%, from 16.2% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 10th January 2025:

|

Money Market Fund Yield for Fund Managers as published on 10th January 2025 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund USD (Dial *809# or download the Cytonn app) |

16.6% |

|

2 |

Lofty-Corban Money Market Fund |

16.3% |

|

3 |

Gulfcap Money Market Fund |

16.3% |

|

4 |

Etica Money Market Fund |

15.9% |

|

5 |

Ndovu Money Market Fund |

15.5% |

|

6 |

Kuza Money Market fund |

15.4% |

|

7 |

Mali Money Market Fund |

15.2% |

|

8 |

Arvocap Money Market Fund |

15.1% |

|

9 |

Orient Kasha Money Market Fund |

14.2% |

|

10 |

Dry Associates Money Market Fund |

13.7% |

|

11 |

Sanlam Money Market Fund |

13.7% |

|

12 |

Madison Money Market Fund |

13.6% |

|

13 |

Faulu Money Market Fund |

13.6% |

|

14 |

Co-op Money Market Fund |

13.3% |

|

15 |

KCB Money Market Fund |

13.3% |

|

16 |

Nabo Africa Money Market Fund |

13.1% |

|

17 |

British-American Money Market Fund |

13.1% |

|

18 |

Genghis Money Market Fund |

13.0% |

|

19 |

Jubilee Money Market Fund |

12.9% |

|

20 |

Enwealth Money Market Fund |

12.9% |

|

21 |

Apollo Money Market Fund |

12.9% |

|

22 |

GenAfrica Money Market Fund |

12.8% |

|

23 |

Ziidi Money Market Fund |

12.8% |

|

24 |

Absa Shilling Money Market Fund |

12.7% |

|

25 |

CIC Money Market Fund |

12.7% |

|

26 |

Old Mutual Money Market Fund |

12.6% |

|

27 |

ICEA Lion Money Market Fund |

12.5% |

|

28 |

Mayfair Money Market Fund |

12.1% |

|

29 |

AA Kenya Shillings Fund |

11.7% |

|

30 |

Stanbic Money Market Fund |

11.1% |

|

31 |

Equity Money Market Fund |

7.0% |

Source: Business Daily

Liquidity:

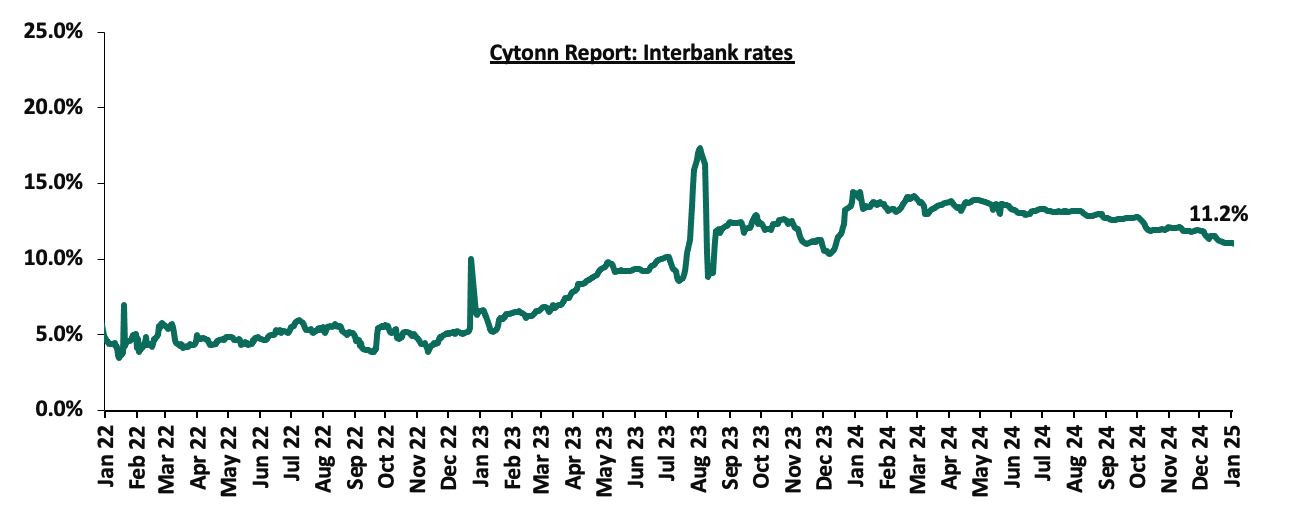

During the week, liquidity in the money markets marginally tightened, with the average interbank rate increasing by 3.9 bps remaining relatively unchanged at 11.1% recorded the previous week, partly attributable to the tax remittances that offset government payments. The average interbank volumes traded increased by 52.3% to Kshs 34.6 bn from Kshs 22.7 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Eurobonds were on a downward trajectory, with the yields on the 13-year Eurobond issued in 2021 decreasing the most by 32.6 bps, to 9.8% from 10.1% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 9th January 2025:

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2018 |

2019 |

2021 |

2024 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

|

Years to Maturity |

3.1 |

23.1 |

2.4 |

7.4 |

9.5 |

6.1 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

|

02-Jan-25 |

9.1% |

10.3% |

8.5% |

10.1% |

10.1% |

10.1% |

|

03-Jan-25 |

8.9% |

10.1% |

8.5% |

9.9% |

9.9% |

9.9% |

|

06-Jan-25 |

8.9% |

10.0% |

8.3% |

9.8% |

9.8% |

9.8% |

|

07-Jan-25 |

8.8% |

10.0% |

8.3% |

9.7% |

9.7% |

9.7% |

|

08-Jan-25 |

8.8% |

10.0% |

8.4% |

9.8% |

9.8% |

9.8% |

|

09-Jan-25 |

8.8% |

10.0% |

8.3% |

9.7% |

9.8% |

9.8% |

|

Weekly Change |

(0.3%) |

(0.3%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.3%) |

|

MTD Change |

(0.3%) |

(0.3%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.3%) |

|

YTD Change |

(0.3%) |

(0.3%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.3%) |

Source: Central Bank of Kenya (CBK)

Debt sustainability concerns continue to persist in the Sub-Saharan Africa (SSA) region in 2025 amid a slow post-pandemic recovery and elevated inflationary pressures. In 2024, several Sub-Saharan African (SSA) countries re-entered the Eurobond market after a period of inactivity. In January 2024, Côte d'Ivoire issued Eurobonds totaling USD 2.6 bn with maturities of nine and thirteen years, offering a coupon rate of 8.5%. In February 2024, Benin entered the market with a 14-year, dollar-denominated Eurobond worth USD 750.0 mn at a coupon rate of 8.375%. This marked Benin's first dollar-denominated bond issuance and Kenya issued a seven-year Eurobond, raising USD 1.5 bn at a rate of 10.375%. Lastly, in June 2024, Senegal became the fourth SSA nation to issue a Eurobond, raising USD 750.0 mn with a maturity in 2031 at a coupon rate of 7.75%. These issuances highlight a cautious reopening of international capital markets to SSA countries, despite prevailing global financial challenges. In 2025, Sub-Saharan Africa's Eurobond market is projected to experience a cautious yet optimistic outlook. The region's economic recovery is expected to continue, with growth IMF projections reaching 4.0% in 2025. Several countries are anticipated to re-enter the Eurobond market to address fiscal deficits and refinance maturing debts. The table below shows the SSA countries that have issued Eurobonds and their respective risk of debt distress;

|

Cytonn Report: Sub-Saharan Africa Eurobond Countries |

|||||

|

Country |

Debt to GDP Ratio (2022, IMF) |

Debt to GDP Ratio (2023, IMF Projected) |

Debt Service to Revenue Ratio |

Risk of overall debt distress (Joint IMF & Word bank DSA) |

Current Situation |

|

Zambia |

98.5% |

98.3% |

61.0% |

In debt distress |

External Debt Restructuring Ongoing |

|

Ghana |

92.4% |

84.9% |

97.1% |

In debt distress |

External and domestic debt restructuring ongoing |

|

Angola |

66.7% |

84.9% |

19.5% |

High risk of debt distress |

No debt restructuring ongoing |

|

Senegal |

76.6% |

81.0% |

21.7% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

South Africa |

71.1% |

73.7% |

36.2% |

High risk of debt distress |

No debt restructuring ongoing |

|

Kenya |

66.7% |

70.1% |

56.8% |

High risk of debt distress |

No debt restructuring ongoing |

|

Namibia |

69.8% |

67.6% |

13.8% |

High risk of debt distress |

No debt restructuring ongoing |

|

Gabon |

57.7% |

64.9% |

48.9% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Rwanda |

61.1% |

63.3% |

30.1% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Seychelles |

61.5% |

60.8% |

- |

High risk of debt distress |

No debt restructuring ongoing |

|

Ivory Coast |

56.8% |

56.8% |

34.0% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Benin |

54.2% |

53.0% |

64.7% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Tanzania |

42.3% |

42.6% |

14.2% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Cameroon |

45.5% |

41.9% |

51.6% |

High risk of debt distress |

No debt restructuring ongoing |

|

Nigeria |

39.6% |

38.8% |

57.1% |

Moderate risk of debt distress |

Domestic Debt Restructuring |

|

Ethiopia |

46.4% |

37.9% |

16.8% |

In debt distress |

External Debt Restructuring Ongoing |

|

Average |

62.9% |

63.8% |

41.4% |

|

|

Sources: International Monetary Fund (IMF) 2023 economic outlook & Joint Debt Sustainability Analysis (DSA), World Bank

Key take-outs in the table include

- Three countries already defaulted on their debt: Ghana, Zambia and Ethiopia are already in debt distress, and have already initiated different forms of debt restructuring, especially at the G20,

- The average debt servicing consumes above 41.4% of the total revenue collected, translating to less allocation for development purposes, and,

- Although Kenya’s debt to GDP ratio is projected to increase to 70.1% in 2023 from 66.7% in 2022, the government’s debt appetite might push the ratio higher, having recorded a debt to GDP ratio of 71.8% as of June 2024, despite the current administration’s initiatives towards fiscal consolidation

Kenya Shilling:

During the week, the Kenya Shilling depreciated marginally against the US Dollar by 15.2 bps, to close the week at Kshs 129.5, from the Kshs 129.3 recorded the previous week. On a year-to-date basis, the shilling has depreciated marginally by 0.1% against the dollar, compared to the 17.4% appreciation recorded in 2024.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,872.0 mn in the 12 months to November 2024, 16.7% higher than the USD 4,175.0 mn recorded over the same period in 2023. In the November 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 53.4% in the period, and,

- The tourism inflow receipts which came in at USD 352.5 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 14.9% in the 12 months to October 2024, compared to a similar period in 2023.

- Improved forex reserves currently at USD 9.2 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2025 as a result of:

- An ever-present current account deficit which came at 3.5% of GDP in Q3’2024 from 3.9% recorded in Q3’2023, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.2% of Kenya’s external debt is US Dollar-denominated as of June 2024.

Key to note, Kenya’s forex reserves decreased marginally by 0.2% during the week, to remain relatively unchanged at USD 9.2 bn recorded in the previous week, equivalent to 4.7 months of import cover, unchanged from last week, and above the statutory requirement of maintaining at least 4.0-months of import cover. The chart below summarizes the evolution of Kenya's m`15678uionths of import cover over the years:

Weekly Highlights:

- Kenya Q3’2024 GDP Growth

The Kenya National Bureau of Statistics (KNBS) released the Q3’2024 Quarterly Gross Domestic Product Report, highlighting that the Kenyan economy recorded a 4.0% growth in Q3’2024, slower than the 6.0% growth recorded in Q3’2023. The main contributor to Kenyan GDP remains to be the Agriculture, fishing and forestry sector which grew by 4.2% in Q3’2024, lower than the 5.1% expansion recorded in Q3’2023. All sectors in Q3’2024, except Mining and Quarrying and Construction recorded positive growths, with varying magnitudes across activities. Most sectors recorded declining growth rates compared to Q3’2023 with Accommodation and Food Services, Mining & Quarrying and Financial & Insurance Sectors recording the highest declines of 20.8%, 11.9% and 10.8% points, respectively. Other sectors that recorded a contraction in growth rate, from what was recorded in Q3’2023 were Construction, Electricity and Water Supply and Real Estate of 6.0%, 2.4% and 2.2% points respectively.

The key take-outs from the report include;

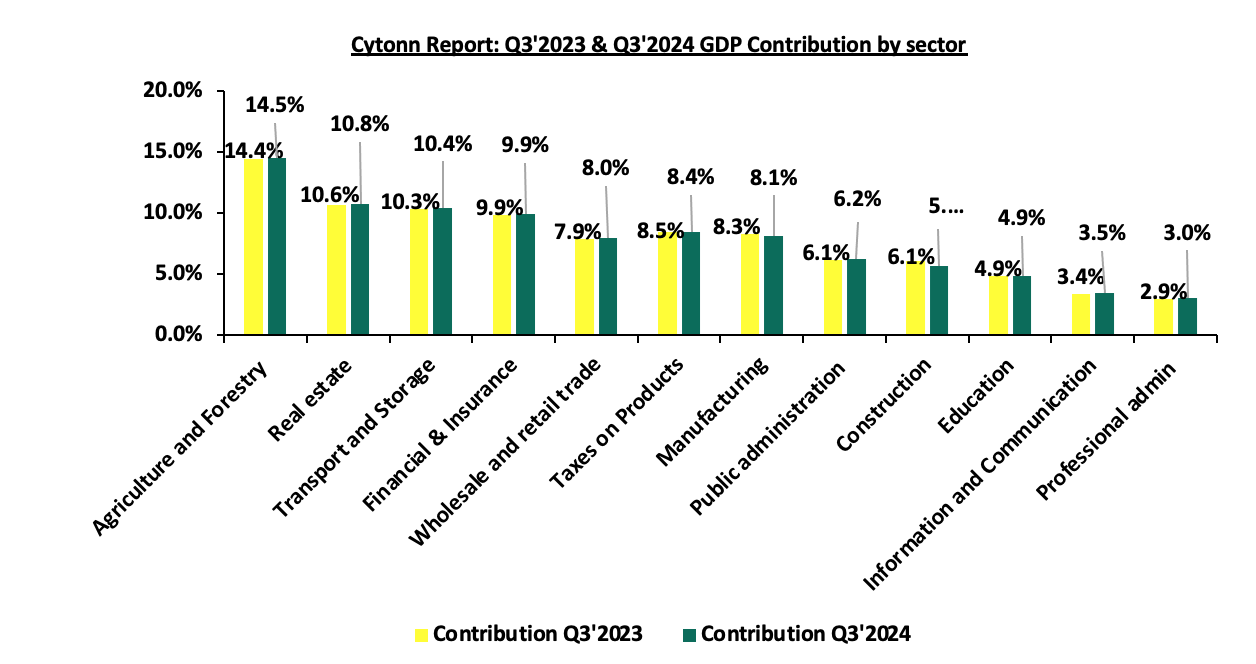

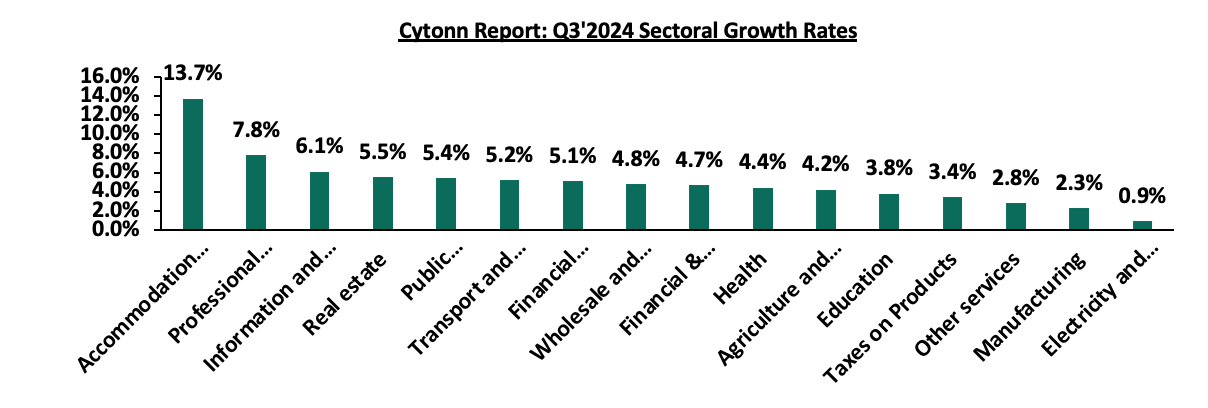

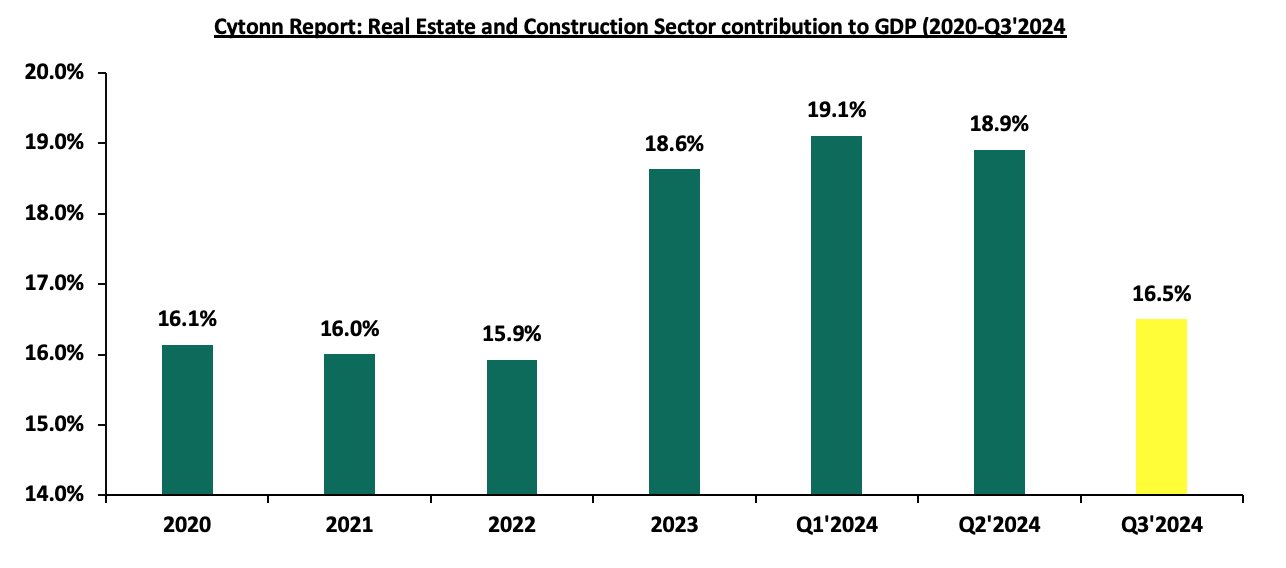

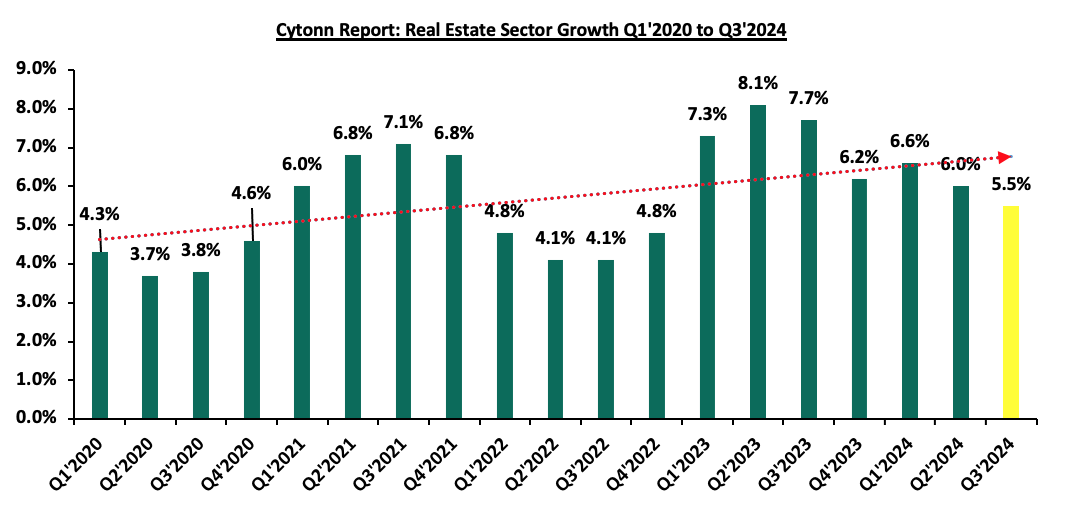

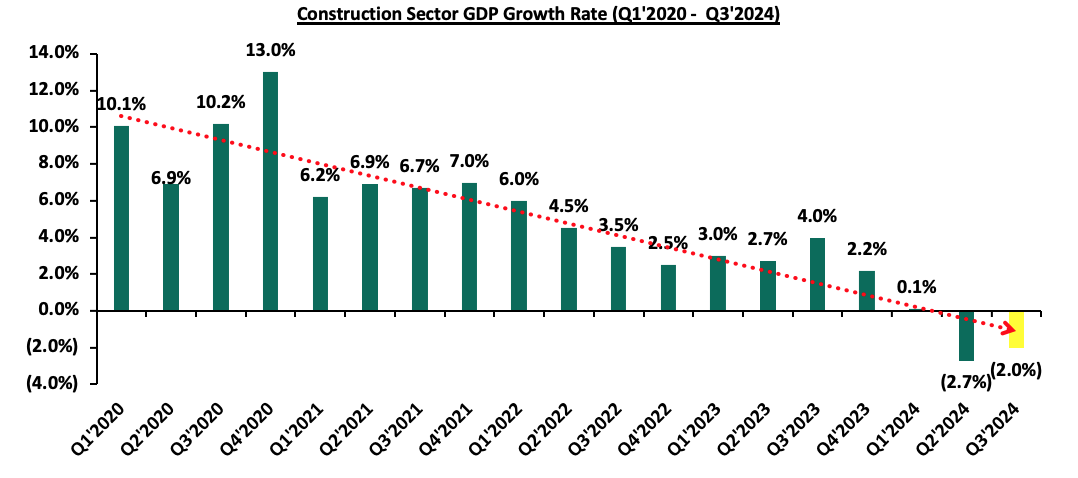

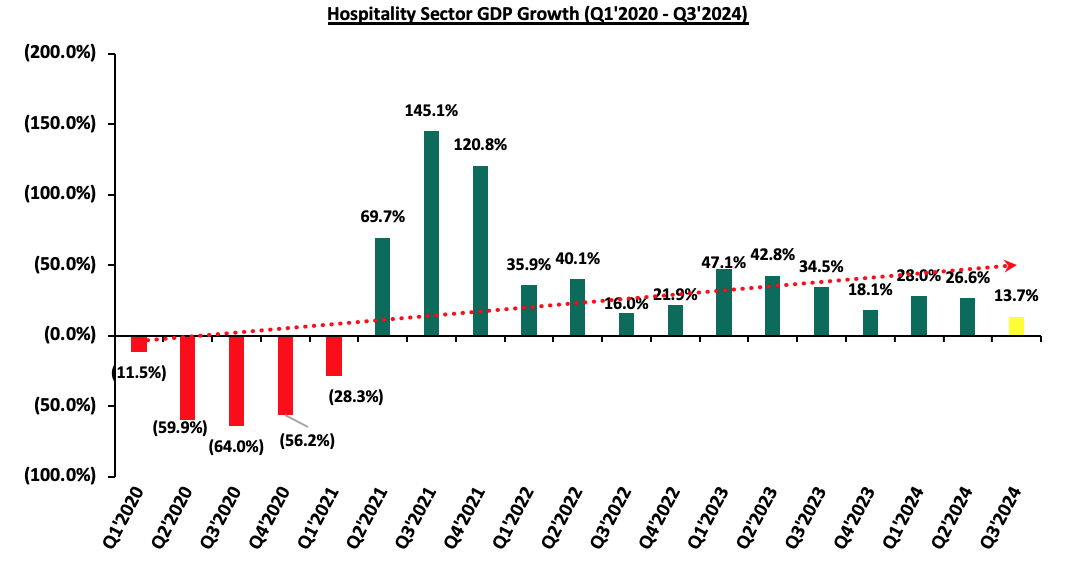

- Sectoral Contribution to Growth - The biggest gainer in terms of sectoral contribution to GDP was the Real Estate sector, increasing by 0.2% points to 10.8% in Q3’2024 from 10.6% in Q3’2023, while the Construction was the biggest loser, declining by 0.4% points to 5.7% in Q3’2024, from 6.1% in Q3’2023. Real Estate was the second largest contributor to GDP at 10.8% in Q3’2024, up from 10.6% recorded in Q3’2023, indicating sustained growth. The Accommodation and Food Services sector recorded the highest growth rate in Q3’2024 growing by 13.7%, albeit slower than the 34.5% growth recorded in Q3’2023.

The chart below shows the top contributors to GDP by sector in Q3’2023 and Q3’2024:

Source: KNBS Q3’2023 and Q3’2024 GDP Report

- Slowed growth in the Agricultural Sector – Agriculture and Forestry recorded a growth of 4.2% in Q3’2024. The performance was a decrease of 0.9% points, from the expansion of 5.1% recorded in Q3’2023. Additionally, the sector remains the major contributor to GDP, with the sectoral contribution to GDP marginally increasing by 0.1% to 14.5% in Q3’2024, from 14.4% recorded in Q3’2023.The positive growth recorded during the quarter was mainly attributable to favorable weather conditions that characterized the first three quarters of 2024. Notably, during the quarter, production of key food crops and cash crops increased with a significant increase in the production of sugarcane and volume of milk during the quarter under review. However, the performance was weighed down by decline in the production of tea.

- Reduced growth in the Financial and Insurance Services Sector: The Financial and Insurance sector growth rate slowed down by 10.8% points to 4.7% in Q3’2024 compared to the 15.5% in Q3’2023, attributable to the rise in cost of credit during the period. Additionally, the contribution to GDP increased by 0.07% points to remain relatively unchanged from the 9.9% recorded in Q3’2023. Some of the notable improvements include:

-

- Broad money supply (M3) grew by 2.6% to KSh 6.0 trillion as at end of September 2024, from Ksh 5.8 trillion recorded as at the end of September 2023.

- The NSE 20 Share Index rose by 17.8% to 1,776.0 points in September 2024 from 1,508.0 points in September 2023, signaling improved performance in the equity market.

However, growth in this sector was weighed down by;

-

- The number of shares traded in the Nairobi Securities Exchange decreased by 21.2% to 334.0 mn in September 2024 from 424.0 million in September 2023. Similarly, the total value of traded shares decreased by 3.8% in September 2024 to 5.0 billion from 5.2 billion in September 2023

- Decelerated growth in the electricity supply sector - The Electricity and Water Supply sector recorded a slowed growth of 0.9% in Q3’2024 compared to a 3.3% growth in a similar period of review in 2023, with the sectoral contribution to GDP marginally decreasing to 2.5% points in Q3’2024, from 2.6% recorded in Q3’2023.

- Sustained growth in the Accommodation and Food Service sector: Accommodation and Food Services sector is the only sector that recorded double digit growth in Q3’2024, having expanded by 13.7%, albeit slower than the 34.5% recorded in Q3’2023. Additionally, the contribution to GDP increased by 0.1% points, to 1.4% in Q3’2024, from1.3% recorded in Q3’2023.

The chart below shows the different sectoral GDP growth rates for Q4’2024:

Source: KNBS Q3’2024 GDP Report

In 2025, we expect the economy to grow at a faster pace in the range of 5.2%-5.5% due to the improved business activity on the back of stronger and stable Shilling, reduced borrowing costs and eased inflation rate. We however expect the growth to be subdued by the challenging business environment, driven by increasing taxes and elevated costs of living. However, recent economic developments, including the Central Bank of Kenya's (CBK) decision to lower the Central Bank Rate (CBR) in its December 2024 meeting by 75.0 bps to 11.25% and the anticipated further reduction in the subsequent meetings, have provided a more accommodative monetary policy stance. This shift, combined with the significant easing of inflation, currently at 3.0% as of December 2024, is expected to alleviate some pressure on the cost of credit, thereby improving access to affordable borrowing. The lower CBR is likely to support investment spending by both individuals and businesses, contributing positively to economic activity. Inflation remains well within the CBK's target range of 2.5%-7.5%, and while risks of rising fuel prices persist due to global geopolitical tensions, the overall inflation outlook is more favorable. Despite this, consumer purchasing power remains somewhat constrained due to increased taxation and high cost of living, which may limit demand for goods and services, moderating economic growth. On a positive note, the agricultural sector, Kenya's largest contributor to GDP, is expected to continue supporting growth due to favorable rainfall, while easing inflationary pressures and a strengthening Shilling provide further optimism for the economic outlook.

- Kenya Q3’2024 Balance of Payments

Kenya’s balance of payment (BoP) position improved significantly by 113.5% in Q3’2024, to a surplus of Kshs 17.8 bn, from a deficit of Kshs 131.5 bn in Q3’2023, and a 78.9% decline from the Kshs 84.1 bn surplus recorded in Q2’2024. The y/y positive performance in BoP was mainly driven by a significant 5,756.4% improvement in the financial account balance to a surplus of Kshs 62.9 bn in Q3’2024, from a deficit of Kshs 1.1 bn in Q3’2023. The performance was however weighed down by a 60.4% deterioration in the capital account balance to a surplus of Kshs 1.4 bn from a surplus of Kshs 3.4 bn in Q3’2023. The table below shows the breakdown of the various balance of payments components, comparing Q3’2023 and Q3’2024:

|

Item |

Q3'2023 |

Q3'2024 |

Y/Y % Change |

|

Current Account Balance |

(139.8) |

(139.2) |

0.4% |

|

Capital Account Balance |

3.4 |

1.4 |

(60.4%) |

|

Financial Account Balance |

(1.1) |

62.9 |

5,756.4% |

|

Net Errors and Omissions |

6.0 |

92.7 |

1442.5% |

|

Balance of Payments |

(131.5) |

17.8 |

113.5% |

All values in Kshs bns

Key take-outs from the table include;