Cytonn Weekly #21/2018

By Cytonn Investments Team, May 27, 2018

Executive Summary

Fixed Income

T-bills were oversubscribed during the week, with the subscription rate coming in at 184.2% up from 183.1%, the previous week. Yields on the 91 and 182-day papers declined by 10 bps each to 7.9% and 10.2% from 8.0% and 10.3%, respectively, the previous week, while the yield on the 364-day paper remained unchanged at 11.1%. The new 15-year Treasury bond for the month of May, FXD 1/2018/15, was undersubscribed at an overall subscription rate of 50.5%. The yield came in at 13.1%, in line with our expectations of 13.0% - 13.3%

Equities

During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 losing 2.2%, 3.7% and 2.8%, respectively. For the last twelve months (LTM), NASI and NSE 25 have gained 20.5% and 16.3%, respectively, while NSE 20 has lost 1.4%. Co-operative Bank and Diamond Trust Bank released Q1’2018 results, registering an increase in core earnings per share by 6.8% and 3.0%, respectively;

Private Equity

In the Financial services sector, AfricInvest, a private equity and venture capital firm based in Tunisia with a focus on agribusiness, financial services, healthcare, education and commercial sectors, acquired a 14.3% stake in Britam at Kshs 5.7 bn by acquiring 360.8 mn shares at a price of Kshs 15.9 per share;

Real Estate

During the week, the National Construction Authority (NCA) announced plans to release a draft Construction Industry Policy. The Ministry of Lands and the Law Society of Kenya (LSK) announced plans to form an all-inclusive task force that will provide guidelines on the implementation of the plan to digitize land registries in the country and facilitate online land transactions.

- Sharp Cents is a quarterly publication by Cytonn investments. We publish content on matters real estate, investments, finance, hospitality, education and entrepreneurship. We welcome contributions for articles to be featured in the next issue. To contribute articles please contact the editor. You can read previous editions here

- Our Senior Investment Analyst, Caleb Mugendi, discussed the offer by Seaboard to acquire a stake in Unga Group. Watch Caleb on CNBC here

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the trainings for their teams. The Wealth Management Trainings are run by the Cytonn Foundation under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- We continue to beef up the team with ongoing hires for: Quality Control and Assurance Manager & Associate, Sales & Marketing Manager, Procurement Manager, Relationship Manager – Corporate Affairs, Portfolio Manager and Investments Associate – Public Markets, among others. Visit the Careers section on our website to apply

T-bills were oversubscribed during the week, with the subscription rate coming in at 184.2% up from 183.1%, the previous week. The subscription rates for the 91, 182 and 364-day papers came in at 194.6%, 117.6%, and 246.7% compared to 82.7%, 78.6%, and 327.8%, respectively, the previous week. Yields on the 91 and 182-day papers declined by 10 bps each to 7.9% and 10.2% from 8.0% and 10.3%, respectively, the previous week, while the yield on the 364-day paper remained unchanged at 11.1%. We note that the 364-day paper continued to receive the most interest from investors, having recorded the highest subscription rate of the 3 papers this week, at 246.7% from 327.8% the previous week, as investors seek to lengthen duration. The acceptance rate for T-bills increased to 85.4% from 69.7%, the previous week, with the government accepting a total of Kshs 37.7 bn of the Kshs 44.2 bn worth of bids received, against the Kshs 24.0 bn on offer. The government is currently 39.1% ahead of its pro-rated domestic borrowing target for the current fiscal year, having borrowed Kshs 374.2 bn, against a target of Kshs 269.0 bn (assuming a pro-rated borrowing target throughout the financial year of Kshs 297.6 bn).

Last week, the Kenyan Government issued a new 15-year Treasury bond (FXD 1/2018/15) with the coupon set at 12.7%, in a bid to raise Kshs 40.0 bn for budgetary support. The overall subscription rate for the issue came in at 50.5%, with the market weighted average bid rate coming in at 13.2%, 10 bps above the average accepted rate of 13.1%, and in line with our expectations of 13.0% - 13.3%. The government accepted Kshs 12.9 bn out of the Kshs 20.2 bn worth of bids received, translating to an acceptance rate of 63.6%. The auction’s subscription was low compared to the year’s average of 101.5%, perhaps due to a decline in liquidity during the week as indicated by the increase in the average interbank rate to 5.7% from 4.4% recorded the previous week. Due to the undersubscription, we might see the government back in the market with a tap sale, despite being 39.1% ahead of their domestic borrowing target. The government is set to embark on a new borrowing cycle soon, with the budget for the fiscal year 2018/19 scheduled for release in June 2018. Estimates from the Budget Books by the National Treasury point to an expansionary budget, with the estimated increase in development expenditure being higher than that of recurrent expenditure. We expected a repeal or amendment of the law through a Bill by the Treasury, but they released the draft Financial Markets Conduct Bill, which does not point to a repeal or revision of the cap. This, in our view, will mean continued borrowing appetite by the government into the next fiscal year, and the retained ability to keep rates at low levels by rejecting bids deemed expensive in primary auctions with the interest rate cap still in place.

Liquidity levels declined in the money market as indicated by the increase in the average interbank rate to 5.7% from 4.4% recorded the previous week, and the reduction in the average volumes traded in the interbank market by 38.3% to Kshs 7.9 bn from Kshs 12.7 bn, the previous week. With the declining liquidity, small and medium banks traded at higher rates during the week, causing the average interbank rate to rise.

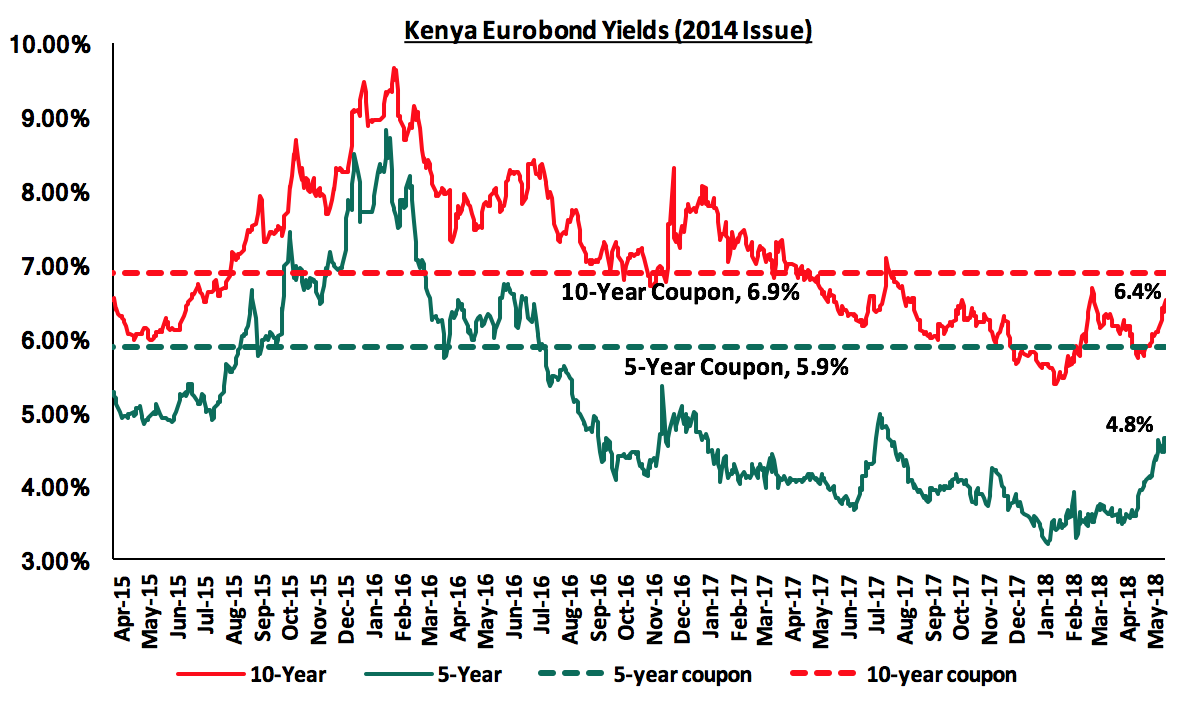

According to Bloomberg, the yield on the 5-year Eurobond issued in June 2014 remained unchanged at 4.8%, while the yield on the 10-year Eurobond declined by 10 bps to 6.4% from 6.5%, the previous week. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 4.0% points and 3.2% points for the 5-year and 10-year Eurobonds, respectively, due to the relatively stable macroeconomic conditions in the country.

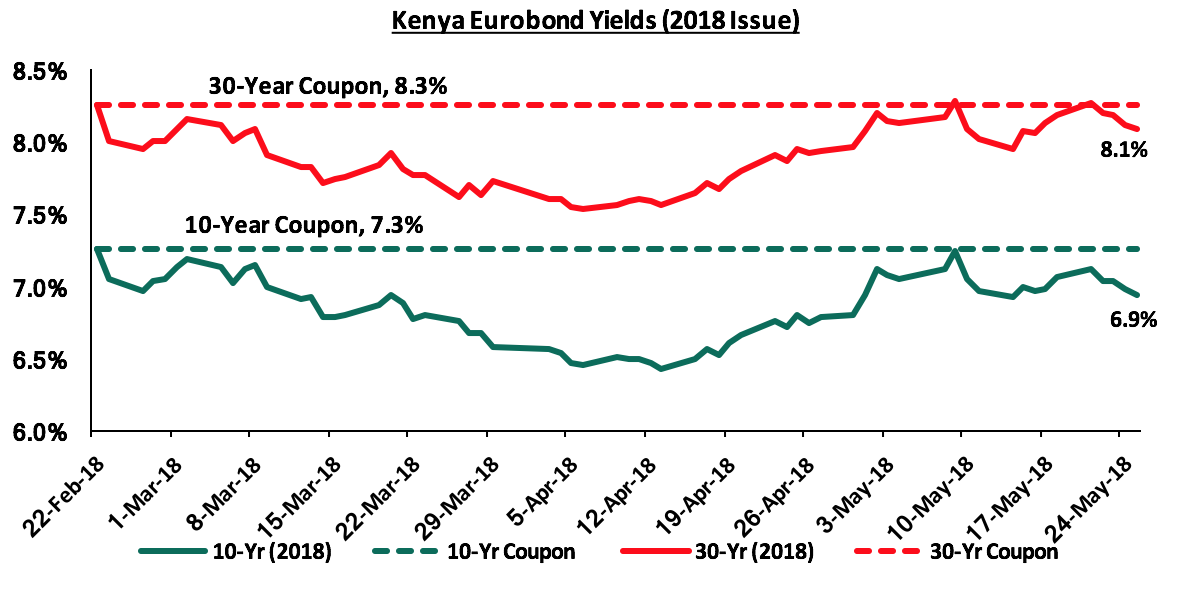

For the February 2018 Eurobond issue, during the week the yields on the 10-year and 30-year Eurobonds declined by 20 bps and 10 bps to 6.9% and 8.1% from 7.1% and 8.2%, respectively, the previous week. Since the issue date, yields on the 10-year and 30-year Eurobonds have both declined by 0.4% points and 0.2% points, respectively, indicating foreign investor confidence in Kenya’s macroeconomic prospects.

During the week, the Kenya Shilling declined by 0.6% against the US Dollar to close at Kshs 101.1 from Kshs 100.4, the previous week, due to increased end month dollar demand by multinationals and importers. On a YTD basis, the shilling has gained 2.0% against the USD. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- Stronger horticulture export inflows driven by increasing production and improving global prices,

- Improving diaspora remittances, which increased by 50.6% to USD 222.2 mn in March 2018 from USD 147.5 mn in March 2017, attributed to (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient, and,

- High forex reserves, currently at USD 9.1 bn (equivalent to 6.1 months of import cover) and the USD 1.5 bn stand-by credit and precautionary facility by the IMF, still available until September 2018, after which a new facility will be discussed.

We are projecting the inflation rate for the month of May to range between 3.8% - 4.1%, up from 3.7% in April. The inflation rate is expected to rise mainly due to a rise in the transport index driven by a rise in petrol and diesel prices by 0.3% and 0.8% to Kshs 107.2 and Kshs 98.6 per litre, respectively, during the month. The housing, water, electricity, gas & fuel index is also expected to rise but at a slower rate than last month due to a rise in the price of cooking fuels, with prices of kerosene and charcoal rising, being countered by a decline in electricity prices as the fuel and foreign exchange levy components of electricity decline by 7.5% and 15.3%, respectively, as detailed in our Cytonn Weekly #20/2018. Food inflation is expected to be up m/m attributed to the destruction of crops in some regions from the heavy flooding and impassable roads making accessibility to markets by farmers and traders difficult. However, on a y/y basis, food inflation will be much lower than it was last year, coming from a high base in May 2017 where inflation was at the year’s peak of 11.7%, due to adverse effects of the drought. As we approach the 2nd half of the year, we expect inflation to start rising gradually, mainly due to:

- Amendments to tax laws that will see fuel and select food item prices increase, despite optimism expressed by the Ministry of Agriculture regarding an increase in maize production driven by the healthy rains we have experienced this far, and,

- A lower base effect, given declining inflation in the 2nd half of 2017,

Going forward, we expect inflation to average 7.0% over the course of the year down from 8.0% in 2017, which is within the government target range of 2.5% - 7.5%.

The Monetary Policy Committee (MPC) is set to meet on Monday 28th May 2018 to review the prevailing macroeconomic conditions and give direction on the Central Bank Rate (CBR). With (i) inflation having eased to 3.7% from 4.5% since the last meeting and an average of 8.0% in 2017, (ii) the government being under no pressure to borrow from the local markets since they are ahead of their domestic borrowing target, and (iii) the currency having appreciated by 0.8% since the last meeting on March 19th, 2018, the macroeconomic environment looks conducive for another rate cut. However, we see the MPC adopting a wait and see approach, as they monitor the effects of the previous rate cut. We therefore expect the MPC to hold the CBR at 9.5%. The key concern remains the low private sector credit growth, which declined slightly to 2.1% in February 2018 from 2.4% in December 2017, which is well below the 5-Year average of 14.0% as well as the government set annual target of 12.0% – 15.0%. For our comprehensive analysis on the same, see our MPC Note.

The National Treasury is proposing a credit guarantee scheme for loans advanced to small and medium size enterprises (SMEs) in a bid to unlock private sector credit growth. With the introduction of the rate cap in 2016, private sector credit growth has been on the decline due to banks adopting a more stringent credit risk assessment framework thus limiting lending to riskier borrowers and shifting focus to government securities, which they deemed less risky. The proposal is still at an early stage and the amounts and the inception date still not in place, as stakeholder consultations continue. The Treasury has also released a draft Financial Markets Conduct Bill that will see the establishment of the Financial Markets Conduct Authority that will (i) regulate the cost of credit with the aim of protecting consumers, (ii) promote a fair, non-discriminatory environment for credit access, and (iii) ensure uniformity in standards and practices in the issue of financial products and services. While the Bill seeks to promote access to credit while protecting consumers and regulating the cost of credit, we note that it does not point to a repeal or revision of the interest rate cap. If the scheme and the Bill is to be adopted, it will enable SME’s, that had difficulties in accessing debt financing, access credit more easily, with a guarantee in place and with improved terms and conditions, thus improving private sector credit growth and in turn, enhancing economic growth. However, with the cap still in place, the way forward for household borrowing in terms of access to credit remains uncertain.

Rates in the fixed income market have remained stable as the government rejects expensive bids. The government is under no pressure to borrow for the remaining part of the current fiscal year as: (i) they are currently ahead of their domestic borrowing target by 39.1%, (ii) they have met 79.1% of their total foreign borrowing target and 80.6% of their pro-rated target for the current fiscal year, and (iii) the KRA is not significantly behind target in revenue collection. Come the next fiscal year, the government is likely to remain behind target for the better part of the first half as per historical data, but we do not expect this to result in a rise in interest rates with the interest rate cap still in place. Therefore, we expect interest rates to remain stable. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium to long-term fixed income instruments.

During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 losing 2.2%, 3.7% and 2.8%, respectively. This takes the YTD performance of the NASI, NSE 20 and NSE 25 to 2.4%, (9.4%) and 5.5%, respectively. This week’s performance was driven by declines in large cap banking stocks, with KCB Group, Co-operative Bank and Diamond Trust Bank (DTB) declining by 7.0%, 6.1%, and 5.0%, respectively, owing to investors’ reaction to their recently released Q1’2018 results, and book closure on DTB for a dividend of Kshs 2.6 per share, translating to a dividend yield of 1.4%. For the last twelve months (LTM), NASI and NSE 25 have gained 20.5%, and 16.3%, respectively, while NSE 20 has declined by 1.4%.

Equities turnover increased by 1.5% this week to USD 33.5 mn from USD 33.1 mn, the previous week. Foreign investors remained net sellers of large cap stocks such as Safaricom, as an increase in political risks in the Eurozone, and uncertainty over the structure of a trade deal between the US and China dampened appetite for equities. We however expect the market to remain resilient this year supported by attractive stock valuations in select counters.

The market is currently trading at a price to earnings ratio (P/E) of 13.8x, which is above the historical average of 13.4x, and a dividend yield of 3.8%, slightly above the historical average of 3.7%. The current P/E valuation of 13.8x is 40.8% above the most recent trough valuation of 9.8x experienced in the first week of February 2017, and 66.3% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Cooperative Bank released Q1’2018 results during the week;

Cooperative Bank released Q1’2018 financial results, with its core earnings per share increasing by 6.8% to Kshs 2.4 from Kshs 2.2 in Q1’2017, in line with our expectation of a 5.9% increase to Kshs 2.3. Performance was driven by an 8.4% increase in total operating income, despite a 9.4% increase in the total operating expenses. Highlights of the performance from Q1’2017 to Q1’2018 include:

- Total operating income increased by 8.4% to Kshs 10.9 bn in Q1’2018 from Kshs 10.1 bn in Q1’2017. This was due to a 10.8% increase in Net Interest Income (NII) to Kshs 7.4 bn from Kshs 6.7 bn in Q1’2017, and a 3.8% increase in Non-Funded Income (NFI) to Kshs 3.5 bn from Kshs 3.4 bn in Q1’2017,

- Interest income increased by 9.1% to Kshs 10.4 bn from Kshs 9.5 bn in Q1’2017 bn. The interest income on loans and advances increased by 8.8% to Kshs 8.4 bn from Kshs 7.7 bn in Q1’2017. Interest income on government securities increased by 13.4% to Kshs 2.0 bn in Q1’2018 from Kshs 1.8 bn in Q1’2017. The yield on interest earning assets however declined to 12.3% in Q1’2018 from 14.1% in Q1’2017, due to a relatively faster increase in the interest earning assets to Kshs 347.0 bn from Kshs 323.0 bn in Q1’2017, with the increase mainly being government securities that have a lower yield than loans,

- Interest expense increased by 5.0% to Kshs 3.0 bn from Kshs 2.8 bn in Q1’2017, following a 6.3% increase in the interest expense on customer deposits to Kshs 2.7 bn from Kshs 2.5 bn in Q1’2017. Other interest expenses declined by 6.2% to Kshs 0.3 bn in Q1’2018 from Kshs 0.32 bn in Q1’2017. The cost of funds remained unchanged at 4.0%. Net Interest Margin declined to 8.6% from 10.1% in Q1’2017,

- Non-Funded Income increased by 3.8% to Kshs 3.5 bn from Kshs 3.4 bn in Q1’2017. The growth in NFI was driven by a 13.7% increase in other fees and commissions to Kshs 2.2 bn from Kshs 1.9 bn in Q1’2017, and a 34.4% increase in foreign exchange trading income to Kshs 0.8 bn from Kshs 0.6 bn in Q1’2017. Fees and commissions on loans however declined by 40.3% to Kshs 0.4 bn from Kshs 0.7 bn in Q1’2017. This was due to a growth in loans extended to corporates, which the bank did not charge any fees and commissions. The current revenue mix stands at 68:32 funded to non-funded income as compared to 66:34 in Q1’2017. The proportion of non-funded income to total revenue declined slightly owing to the faster growth in NII as compared to NFI,

- Total operating expenses increased by 9.4% to Kshs 6.1 bn from Kshs 5.6 bn, largely driven by a 13.1% increase in staff costs to Kshs 2.6 bn in Q1’2018 from Kshs 2.3 bn in Q1’2017, coupled with a 9.4% increase in other operating expenses to Kshs 1.7 bn in Q1’2018 from Kshs 1.6 bn in Q1’2017. Staff costs rose due to specialized hires made by the bank in the IT department to be used for big data analytics, for credit pre-scoring purposes. The rise in staff costs could also be attributed to the bank’s restructuring by eliminating redundancies, which saw 84 employees leave the bank during the quarter. The Loan Loss Provisions (LLP) increased by 1.7% to Kshs 0.76 bn from Kshs 0.75 bn in Q1’2017, largely due to an increase in the non-performing loans by 152.5%, coupled with increased provisioning levels due to implementation of IFRS 9,

- The cost to income ratio deteriorated albeit marginally to 55.8% from 55.3% in Q1’2017. Without LLP, the Cost to income ratio also deteriorated to 48.8% from 47.9% in Q1’2017,

- Profit before tax increased by 8.6% to Kshs 4.9 bn, up from Kshs 4.5 bn in Q1’2017. Profit after tax increased 6.8% to Kshs 3.4 bn in Q1’2018 from Kshs 3.2 bn in Q1’2017,

- The balance sheet recorded an expansion as total assets increased by 5.1% to Kshs 397.8 bn from Kshs 378.5 bn in Q1’2017. This growth was largely driven by a 21.3% increase in government securities to Kshs 78.1 bn from Kshs 64.4 bn in Q1’2017,

- The loan book increased by 2.8% to Kshs 252.8 bn in Q1’2018 from Kshs 245.9 bn in Q1’2017,

- Total liabilities rose by 4.5% to Kshs 329.1 bn from Kshs 314.8 bn in Q1’2017, driven by a 5.7% increase in total deposits to Kshs 295.9 bn from Kshs 279.9 bn in Q1’2017. Deposits per branch increased by 2.3% to Kshs 1.93 bn from Kshs 1.89 bn in Q1’2017

- The faster growth in deposits as compared to loans led to a decline in the loan to deposit ratio to 85.4% from 87.9% in Q1’2017,

- Gross non-performing loans increased by 152.5% to Kshs 28.4 bn in Q1’2018 from Kshs 11.2 bn in Q1’2017. As a consequence, the NPL ratio deteriorated to 10.8% in Q1’2018 from 4.5% in Q1’2017. Loan loss provisions increased by 124.3% to Kshs 7.9 bn from Kshs 3.5 bn in Q1’2017. NPL coverage decreased to 30.6% in Q1’2018 from 40% in Q1’2017, due to the relatively faster increase in the gross non-performing loans. The increase in the non-performing loans could be attributed to major clients in the real estate and manufacturing sector, whose activities were affected by the economic slump occasioned by a prolonged electioneering period coupled with the drought witnessed in 2017,

- Shareholders’ funds increased by 6.5% to Kshs 68.0 bn in Q1’2018 from Kshs 63.8 bn in Q1’2017, mainly due to a 6.6% increase in the retained earnings to Kshs 55.9 bn from Kshs 52.4 bn in Q1’2017,

- Cooperative Bank Holdings is currently sufficiently capitalized with a core capital to risk weighted assets ratio of 16.3%, 5.8% above the statutory requirement. In addition, the total capital to risk weighted assets ratio was 16.4%, exceeding the statutory requirement by 1.9%. Adjusting for IFRS 9, the core capital to risk weighted assets stood at 17.2%, while total capital to risk weighted assets came in at 17.3%, indicating that the bank’s total capital relative to its risk-weighted assets declined by 0.9% due to implementation of IFRS 9,

- Cooperative Bank currently has a return on average assets of 3.0% and a return on average equity of 17.6%.

Going forward, we expect the bank’s growth to be propelled by:

- Non-Funded Income Growth Initiatives- Co-operative Bank’s NFI is below the industry average, coming in at 32.0%, which is lower than the industry average of 33.6%. The bank needs to focus on increasing fee income and transactional income. To this effect, the bank is taking advantage of its alternative channels such as the mobile wallet platform, MCoop Cash mobile app, and agency banking to increase its transactional income, as more customers increase the usage of these platforms. For instance, MCoop cash has had the number of loan customers increase by 86.9% to 867,000 customers from 464,000 in Q1’2017. This brings the total number of customers subscribed to MCoop cash to 3.7 million customers. This consequently increased commission income from the app by 28.1% to Kshs 367.9 mn in Q1’2018 from Kshs 287.1 mn in Q1’2017,

- Increased adoption of alternative channels by the customers will improve operational efficiency in addition to increasing the bank’s transactional income. The bank is planning to aggressively grow its number of agents to 20,000 agents from the current 10,000. Agency outlets will be transformed such that basic banking services such as account opening will be done by agents in a bid to migrate transactions from the bank’s branches. For instance, the bank had 87.0% of total transactions carried out using alternative sources, while 13.0% of transactions were handled at the branches in Q1’2018. Such initiatives will see the bank’s cost-to-income ratio improve significantly from the current 55.8%, and,

- Addressing the deteriorating asset quality - the bank has adopted increased measures to improve its asset quality. This include (i) Utilization of an E-collect system, which has seen collections increase by 83% y/y (ii) Launch of a collaborative curing between businesses and the remedial department, (iii) outsourcing of collection of lower ticket micro-credit loans. These initiatives will aid to improve the asset quality of the bank, and consequently reduce the loan-loss provision expense.

For a comprehensive analysis, see our Co-operative Bank Q1’2018 Earnings Note.

Diamond Trust Bank released Q1’2018 results;

Diamond Trust Bank released Q1’2018 financial results, with its core earnings per share increasing by 3.0% to Kshs 6.0 from Kshs 5.9 in Q1’2017, which was slightly below our expectation of a 4.3% increase to Kshs 6.5. Performance was driven by a 5.2% increase in total operating income, despite a 6.3% increase in total operating expenses. Highlights of the performance from Q1’2017 to Q1’2018 include:

- Core earnings per share increased by 3.0% to Kshs 6.0 from Kshs 5.9 in Q1’2017, which was slightly below our expectation of a 4.3% increase to Kshs 6.5. Performance was driven by a 5.2% increase in total operating income, despite a 6.3% increase in the total operating expenses,

- Total operating income increased by 5.2% to Kshs 6.2 bn in Q1’2018 from Kshs 5.9 bn in Q1’2017. This was due to a 5.4% increase in Net Interest Income (NII) to Kshs 4.9 bn from Kshs 4.6 bn in Q1’2017, coupled with a 4.4% increase in Non-Funded Income (NFI) to Kshs 1.4 bn from Kshs 1.3 bn in Q1’2017,

- Interest income increased by 4.9% to Kshs 8.6 bn from Kshs 8.2 bn in Q1’2017. This was due to a 17.9% increase in interest income on government securities to Kshs 3.1 bn from Kshs 2.6 bn in Q1’2017. Interest income on loans and advances declined marginally by 0.3% to Kshs 5,459.8 mn in Q1’2018 from Kshs 5,474.7 mn in Q1’2017. The yield on interest earning assets however declined to 11.3% in Q1’2018 from 12.5% in Q1’2017, due to the relatively faster increase in the interest earning assets by 12.0% to Kshs 327.0 bn from Kshs 292.0 bn in Q1’2017, with the increase mainly being government securities that have a lower yield than loans,

- Interest expense increased by 4.2% to Kshs 3.7 bn from Kshs 3.6 bn in Q1’2017, as interest expense on customer deposits increased 2.7% to Kshs 3.3 bn from Kshs 3.2 bn in Q1’2017. Interest expense on deposits from other banking institutions rose 117.2% to Kshs 0.2 bn from Kshs 0.1 bn in Q1’2017. Other interest expenses declined by 18.0% to Kshs 0.2 bn in Q1’2018 from Kshs 0.3 bn in Q1’2017. The cost of funds declined to 5.1% from 5.5% in Q1’2017. The Net Interest Margin declined to 6.4% from 7.2% in Q1’2017,

- Non-Funded Income increased by 4.4% to Kshs 1.4 bn from Kshs 1.3 bn in Q1’2017. The growth in NFI was driven by an 8.3% increase in total fees and commissions income to Kshs 0.9 bn from Kshs 0.8 bn in Q1’2017, and a 131.0% increase in other income to Kshs 93.8 mn from Kshs 40.6 mn in Q1’2017. Forex trading income however declined by 14.7% to Kshs 365.8 mn from Kshs 429.1 mn in Q1’2017. The revenue mix remained unchanged at 78:22 funded to non-funded income, similar to Q1’2017,

- Total operating expenses increased by 6.3% to Kshs 3.5 bn from Kshs 3.3 bn, largely driven by a 28.7% increase in rental charges to Kshs 238.3 mn in Q1’2018 from Kshs 185.2 mn in Q1’2017, coupled with an 11.3% increase in other operating expenses to Kshs 1.2 bn in Q1’2018 from Kshs 1.1 bn in Q1’2017. The Loan Loss Provisions (LLP) increased by 9.7% to Kshs 0.7 bn from Kshs 0.6 bn in Q1’2017, largely due to an increase in the non-performing loans by 82.4%, coupled with increased provisioning levels due to implementation of IFRS 9. Staff costs remained relatively unchanged at Kshs 1.0 bn, same as in Q1’2017,

- The cost to income ratio deteriorated to 56.3% from 55.7% in Q1’2017. Without LLP, the Cost to income ratio also worsened marginally to 45.0% from 44.9% in Q1’2017,

- Profit before tax increased by 3.9% to Kshs 2.7 bn, up from Kshs 2.6 bn in Q1’2017. Profit after tax increased 3.0% to Kshs 1.80 bn in Q1’2018 from Kshs 1.75 bn in Q1’2017,

- The balance sheet recorded an expansion with total assets increasing by 9.6% to Kshs 367.7 bn from Kshs 335.3 bn in Q1’2017. This growth was driven by a 16.0% increase in government securities to Kshs 89.4 bn from Kshs 77.2 bn in Q1’2017,

- The loan book increased by 3.0% to Kshs 194.1 bn in Q1’2018 from Kshs 188.4 bn in Q1’2017,

- Total liabilities rose by 8.7% to Kshs 312.8 bn from Kshs 287.8 bn in Q1’2017, driven by an 8.1% increase in customer deposits to Kshs 271.9 bn from Kshs 251.4 bn in Q1’2017. Deposits per branch increased by 11.6% to Kshs 2.1 bn from Kshs 1.9 bn in Q1’2017

- The faster growth in deposits as compared to loans led to a decline in the loan to deposit ratio to 71.4% from 76.5% in Q1’2017,

- Gross non-performing loans increased by 82.4% to Kshs 15.4 bn in Q1’2018 from Kshs 8.4 bn in Q1’2017. Consequently, the NPL ratio deteriorated to 7.1% in Q1’2018 from 4.1% in Q1’2017. Loan loss provisions increased by 52.0% to Kshs 8.3 bn from Kshs 5.5 bn in Q1’2017. Consequently, the NPL coverage decreased to 68.0% in Q1’2018 from 87.0% in Q1’2017, due to the relatively faster increase in the gross non-performing loans. The increase in the non-performing loans could be attributed to loan defaults by Nakumatt Holdings, where DTB had extended a credit line of Kshs 3.7 bn,

- Shareholders’ funds increased by 16.7% to Kshs 49.7 bn in Q1’2018 from Kshs 42.6 bn in Q1’2017.

- Diamond Trust Bank is currently sufficiently capitalized with a core capital to risk weighted assets ratio of 17.5%, 7.0% above the statutory requirement. In addition, the total capital to risk weighted assets ratio was 19.1%, exceeding the statutory requirement by 4.6%. Adjusting for IFRS 9, the core capital to risk weighted assets stood at 19.1%, while total capital to risk weighted assets came in at 20.7%, indicating that the bank’s total capital relative to its risk-weighted assets declined by 1.6% due to implementation of IFRS 9,

- Diamond Trust Bank currently has a return on average assets of 1.8% and a return on average equity of 13.8%.

Going forward, we expect the bank’s growth to be propelled by:

- Non-Funded Income Growth Initiatives- DTB’s NFI is way below the industry average, coming in at 22.0%, while the industry average is at 33.6%. The bank needs to put more focus on growing its agency banking network and expansion of its digital channels to improve efficiencies while increasing transactions. This will enable DTB to acquire higher transactional income, thereby increasing its NFI growth and contribution to total income. In addition, DTB is currently venturing into bancassurance with Defender insurance policy that targets motorists, with the aim to increase the bank’s fee income businesses,

- DTB experienced a deterioration in asset quality, with gross non-performing loans (NPLs) rising by 82.4%, to Kshs 15.4 bn from Kshs 8.4 bn in Q1’2017. This was largely due to major clients such as Nakumatt defaulting on a Kshs 3.7 bn loan issued to the retailer by the bank. However, provisioning levels failed to rise in tandem, increasing by 9.7%, leading to a decline in the NPL coverage to 68.0% in Q1’2018 from 87.0% in Q1’2017. The bank needs to adopt initiatives that will aid to improve the asset quality of the bank, and consequently reduce the loan-loss provision expense.

For a comprehensive analysis, see our Diamond Trust Bank Q1’2018 Earnings Note.

Below is a summary of the Q1’2018 results for the six listed banks that have released,

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Cost of Funds |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income (NFI) Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Loan Growth |

Growth in Govt. Securities |

IFRS 9 Capital Ratios Effect |

|

Stanbic |

79.0% |

17.7% |

17.4% |

3.3% |

17.9% |

7.0% |

55.4% |

49.0% |

73.7% |

13.2% |

11.4% |

83.5% |

(0.6%) |

|

Equity Group |

21.7% |

10.5% |

10.5% |

2.7% |

10.5% |

8.4% |

6.3% |

41.0% |

7.2% |

10.0% |

3.5% |

32.9% |

(0.5%) |

|

KCB Group |

14.1% |

11.0% |

13.0% |

3.1% |

10.0% |

8.2% |

(0.4%) |

32.8% |

(2.3%) |

8.7% |

5.8% |

(10.7%) |

(0.8%) |

|

Co-op Bank |

6.8% |

9.1% |

5.0% |

4.0% |

10.8% |

8.6% |

3.8% |

32.0% |

9.6% |

5.7% |

2.8% |

21.3% |

(0.9%) |

|

DTB |

3.0% |

4.9% |

4.2% |

5.1% |

5.4% |

6.4% |

4.4% |

21.5% |

8.3% |

8.1% |

3.0% |

16.0% |

(1.6%) |

|

NIC Group |

2.2% |

8.2% |

35.9% |

5.2% |

(8.3%) |

6.3% |

(5.5%) |

29.6% |

1.8% |

22.1% |

(0.4%) |

81.2% |

(0.8%) |

|

Weighted Average Q1’ 2018 |

17.6% |

10.1% |

11.0% |

3.4% |

9.5% |

8.0% |

6.7% |

37.6% |

9.1% |

9.4% |

4.3% |

26.6% |

(0.8%) |

|

Weighted Average Q1’2017 |

(8.6%) |

(11.6%) |

(10.3%) |

3.0% |

(10.1%) |

9.2% |

18.6% |

37.8% |

8.7% |

11.7% |

7.1% |

43.1% |

- |

Weighted Average* is market cap weighted

Key takeaways from the table include:

- All listed banks recorded an increase in core EPS growth, with the average increase coming in at 17.6% compared to a decrease of 8.6% for the same period last year. Growth is driven by an increase in the Net Interest Income (NII), which came in at 9.5%, compared to a decrease of 10.1% last year. This indicates that the banking industry has adjusted to the new operating environment;

- Average deposit growth came in at 9.4%. Interest expense paid on deposits recorded a faster growth of 11.0% on average, indicating that more interest earning accounts have been opened, which increased the cost of funds to 3.4% from 3.0% in Q1’2017;

- Average loan growth came in at 4.3%, while investment in government securities has grown by 26.6%, outpacing the loan growth, showing increased lending to the government by banks as they avoid the risky borrowers;

- The average Net Interest Margin in the banking sector currently stands at 8.0%, a decline from the 9.2% recorded in Q1’2017, and,

- Non-funded income has grown by 6.7%, which included a Fee and Commissions growth of 9.1%. This shows that banks are charging more fee income to improve their income on loans above the rate cap maximum, but the growth is much lower than the 18.6% experienced last year, indicating that opportunities for fee income have largely been maxed out.

Standard Chartered Bank Kenya terminated 285 employees in FY’2017 at a cost of Kshs 173.1 mn, bringing down the total headcount to 1,587 from 1,872 staff members. The downsizing marks the third consecutive staff cut for the lender in the last 3 years, with some 100 employees retrenched in 2016 and 167 in 2015; bringing the total number of employees laid off to 552 over the previous 3 years. The bank disclosed the job cuts in its latest annual report, emphasizing its strategy of leveraging the use of technology to boost efficiency across its operations. As a result, the group’s staff costs declined by 2.3% to Kshs 7.0 bn in FY’2017 from Kshs 7.2 bn in FY’2016. In addition, Standard Chartered closed four branches in Bungoma, Kisii, Kitengela and Warwick (Nairobi) during the last financial year, as it reviewed its brick-and-mortar network and intensified its drive to digital banking channels; bringing down its branch count to 36. The bank aims to migrate 80.0% of transactions to non-branch channels by the year 2020, according to the bank’s digitization strategy formulated in 2016. It has since invested heavily in internet, mobile and video banking, coupled with the roll out of cash deposit machines. The bank’s disclosure brings the number of staff laid off in the Kenya banking sector to 1,605 last year, owing to bank restructuring efforts aimed at improving efficiency.

|

Kenya Banking Sector Restructuring |

|||

|

No. |

Bank |

Staff Retrenchment |

Branches Closed |

|

1. |

Bank of Africa |

- |

12 |

|

2. |

Barclays Bank |

301 |

7 |

|

3. |

Ecobank |

- |

9 |

|

4. |

Equity Group |

400 |

7 |

|

5. |

Family Bank |

Unspecified |

- |

|

6. |

First Community Bank |

106 |

- |

|

7. |

KCB Group |

223 |

Unspecified |

|

8. |

National Bank |

150 |

- |

|

9. |

NIC |

32 |

Unspecified |

|

10. |

Sidian Bank |

108 |

- |

|

11. |

I&M Holdings |

- |

Unspecified |

|

12. |

Standard Chartered |

285 |

4 |

|

Total |

1,605 |

39 |

|

Below is our Equities Universe of Coverage:

|

all prices in Kshs unless stated otherwise |

||||||||||||

|

Banks |

Price as at 18/05/2018 |

Price as at 25/05/2018 |

w/w change |

YTD Change |

LTM Change |

Target Price* |

Dividend Yield |

Upside/(Downside)** |

P/TBv Multiple |

|||

|

NIC Bank*** |

36.0 |

34.8 |

(3.5%) |

(4.1%) |

29.6% |

56.0 |

2.9% |

64.0% |

0.9x |

|||

|

Diamond Trust Bank |

202.0 |

192.0 |

(5.0%) |

0.0% |

37.1% |

272.9 |

1.4% |

43.5% |

1.1x |

|||

|

KCB Group |

49.8 |

46.3 |

(7.0%) |

8.2% |

15.6% |

63.7 |

4.3% |

42.0% |

1.6x |

|||

|

I&M Holdings |

118.0 |

112.0 |

(5.1%) |

(11.8%) |

23.1% |

151.2 |

3.1% |

38.1% |

1.2x |

|||

|

Zenith Bank |

28.0 |

26.7 |

(4.8%) |

3.9% |

46.3% |

33.3 |

10.1% |

35.2% |

1.1x |

|||

|

Union Bank Plc |

6.1 |

6.1 |

0.0% |

(21.8%) |

40.6% |

8.2 |

0.0% |

33.6% |

0.7x |

|||

|

National Bank |

6.5 |

6.6 |

1.6% |

(29.9%) |

(2.2%) |

8.6 |

0.0% |

31.2% |

0.4x |

|||

|

CRDB |

160.0 |

160.0 |

0.0% |

0.0% |

(20.0%) |

207.7 |

0.0% |

29.8% |

0.6x |

|||

|

Ghana Commercial |

6.5 |

6.4 |

(1.5%) |

26.7% |

22.6% |

7.7 |

5.9% |

26.6% |

1.5x |

|||

|

Barclays |

11.8 |

11.8 |

0.0% |

22.4% |

34.3% |

13.7 |

8.5% |

25.1% |

1.7x |

|||

|

Co-operative Bank |

18.7 |

17.6 |

(6.1%) |

9.7% |

21.0% |

20.5 |

4.6% |

21.5% |

1.6x |

|||

|

Stanbic Bank Uganda |

31.0 |

31.3 |

0.8% |

14.7% |

15.7% |

36.3 |

3.7% |

19.8% |

2.5x |

|||

|

Equity Group |

49.8 |

48.3 |

(3.0%) |

21.4% |

27.8% |

54.3 |

4.1% |

16.8% |

2.5x |

|||

|

UBA Bank |

11.5 |

10.6 |

(7.4%) |

2.9% |

45.2% |

10.7 |

14.2% |

15.1% |

0.8x |

|||

|

HF Group *** |

9.7 |

9.4 |

(2.6%) |

(9.6%) |

(1.1%) |

10.0 |

3.4% |

9.6% |

0.4x |

|||

|

Bank of Kigali |

290.0 |

290.0 |

0.0% |

(3.3%) |

18.4% |

299.9 |

4.8% |

8.2% |

1.6x |

|||

|

Stanbic Holdings |

92.0 |

92.5 |

0.5% |

14.2% |

30.3% |

87.1 |

5.7% |

(0.1%) |

1.6x |

|||

|

Standard Chartered KE |

209.0 |

210.0 |

0.5% |

1.0% |

5.5% |

192.6 |

6.0% |

(2.4%) |

1.7x |

|||

|

Guaranty Trust Bank |

44.0 |

42.0 |

(4.7%) |

2.9% |

24.9% |

37.2 |

5.7% |

(5.6%) |

2.5x |

|||

|

Access Bank |

10.9 |

10.7 |

(1.8%) |

2.4% |

46.6% |

9.5 |

3.7% |

(7.5%) |

0.6x |

|||

|

Ecobank |

11.7 |

11.7 |

0.0% |

53.3% |

60.7% |

10.7 |

0.0% |

(7.9%) |

3.3x |

|||

|

CAL Bank |

1.7 |

1.5 |

(9.4%) |

42.6% |

100.0% |

1.4 |

0.0% |

(9.1%) |

1.7x |

|||

|

SBM Holdings |

7.9 |

7.9 |

(0.3%) |

4.8% |

3.7% |

6.6 |

3.8% |

(12.7%) |

1.1x |

|||

|

Bank of Baroda |

150.0 |

158.0 |

5.3% |

39.8% |

43.6% |

130.6 |

1.6% |

(15.8%) |

1.2x |

|||

|

Stanbic IBTC Holdings |

49.0 |

47.5 |

(3.0%) |

14.5% |

82.7% |

37.0 |

1.3% |

(20.8%) |

2.7x |

|||

|

FBN Holdings |

11.1 |

9.7 |

(12.2%) |

10.2% |

118.5% |

6.6 |

2.6% |

(29.1%) |

0.7x |

|||

|

Standard Chartered GH |

32.5 |

30.0 |

(7.6%) |

18.8% |

87.5% |

19.5 |

0.0% |

(35.1%) |

4.4x |

|||

|

Ecobank Transnational |

20.6 |

20.5 |

(0.5%) |

20.6% |

109.2% |

9.3 |

0.0% |

(54.7%) |

0.7x |

|||

|

|

*Target Price as per Cytonn Analyst estimates |

|

|

|||||||||

|

|

**Upside / (Downside) is adjusted for Dividend Yield |

|

|

|||||||||

|

|

***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 5th largest shareholder |

|

|

|||||||||

|

|

|

|

||||||||||

We are “NEUTRAL” on equities for investors with a short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for long-term investors, and with expectations of higher corporate earnings this year, we are “POSITIVE” for investors with a long-term investment horizon.

AfricInvest, a private equity and venture capital firm with a focus on agribusiness, financial services, healthcare, education and commercial sectors, has completed a transaction to buy a 14.3% stake in Britam for Kshs 5.7 bn. The transaction involved the creation of 360.8 mn new shares, which AfricInvest bought at a price of Kshs 15.9 per share, as at September 2017 when the deal was agreed upon, subject to regulatory approval. Britam’s shares closed the week at Kshs 14.0, which is 11.9% below the transaction price. Britam will use the capital to accelerate property development, inject fresh investments into its subsidiaries, and to revamp its technology to enable it deliver its products via digital channels like mobile phones, with an eye on Micro-insurance. AfricInvest is now the second largest investor in Britam, after Plum LLP acquired a 23.3% stake in 2016. The transaction indicates the company’s confidence in the long-term growth and management of Britam, and highlights the opportunity in Kenya’s financial services sector. Britam, which has offices in Kenya, Uganda, Tanzania, Rwanda, South Sudan, Mozambique and Malawi, offers a wide range of financial products and services. The acquisition was carried out at a P/B multiple of 1.4x, which is a 50.0% discount from the average insurance sector transaction P/B multiple of 2.1x over the last seven years, hence a relatively cheaper transaction valuation. The table below highlights the transaction multiples in Kenya’s insurance sector over the last seven years;

|

Insurance Sector Transaction Multiples over the last Seven Years |

|||||||

|

No. |

Acquirer |

Insurance Acquired |

Book Value (bn Kshs) |

Transaction Stake |

Transaction Value (bn Kshs) |

P/B |

Date |

|

1. |

Africa Development Corporation |

Resolution Health E. Africa |

N/A |

25.1% |

0.2 |

N/A |

Dec-10 |

|

2. |

Leapfrog Investments |

Apollo Investments |

0.3 |

26.9% |

1.1 |

15.6x |

Dec-11 |

|

3. |

Saham Finances |

Mercantile Insurance |

0.5 |

66.0% |

Undisclosed |

N/A |

Jan-13 |

|

4. |

Swedfund |

AAR |

0.4 |

20.0% |

0.4 |

5.4x |

May-13 |

|

5. |

BAAM |

Continental Re Kenya |

0.7 |

30.0% |

0.3 |

1.4x |

Apr-14 |

|

6. |

Union Insurance of Mauritius |

Phoenix of East Africa |

1.8 |

66.0% |

2 |

1.6x |

May-14 |

|

7. |

UK Prudential |

Shield Assurance |

0.1 |

100.0% |

1.5 |

10.2x |

Sep-14 |

|

8. |

Swiss Re |

Apollo Investments |

0.6 |

26.9% |

Undisclosed |

N/A |

Oct-14 |

|

9. |

Britam |

Real Insurance Company |

0.7 |

99.0% |

1.4 |

2.1x |

Nov-14 |

|

10. |

Leap Frog Investments |

Resolution Insurance |

0.2 |

61.2% |

1.6 |

11.7x |

Nov-14 |

|

11. |

Old Mutual Plc |

UAP Holdings |

9.6 |

60.7% |

11.1 |

1.9x* |

Jan-15 |

|

12. |

MMI Holdings |

Cannon Assurance |

1.7 |

75.0% |

2.4 |

1.9x |

Jan-15 |

|

13. |

Pan Africa Insurance Holdings |

Gateway Insurance Co. Ltd |

1.0 |

51.0% |

0.6 |

1.1x |

Mar-15 |

|

14. |

Barclays Africa |

First Assurance |

2.0 |

63.3% |

2.9 |

2.2x |

Jun-15 |

|

15. |

IFC |

Britam |

22.5 |

10.4% |

3.6 |

1.5x |

Mar-17 |

|

16. |

Africinvest III |

Britam |

28.5 |

14.3% |

5.7 |

1.4x |

Sep-17 |

|

|

Average |

|

4.7 |

49.7% |

2.5 |

2.1x |

|

*- Proforma Transaction Multiple

Following the new shares issued, existing shareholders will have their stake further diluted by 14.3% following the previous 10.4% dilution through the International Finance Corporation’s (IFC’s) Kshs 3.6 bn investment in March 2017. For AfricInvest they have picked a compelling asset, with a solid regional presence, a strong distribution network and a diversified business strategy at a very attractive valuation of 1.4x P/B compared to a seven-year average of 2.1x, while positioning themselves within the capital markets for easier exit once they realize value. For Britam, they get a sound business partner as a significant shareholder, which will help boost their growth strategies. The lower valuations, coupled with increased capital requirements across the sector and regulatory demand for more discipline in the financial services sector, will most likely lead to more merger and acquisition (M&A) transactions over the coming years.

Private equity investments in Africa remain robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub-Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub-Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub-Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets.

During the week, the National Construction Authority (NCA) announced that it was drafting a construction industry policy that will streamline operations in the construction and real estate sectors in the country. The NCA is a statutory body established in 2011 by the National Construction Authority Act (2011) of parliament and it is mandated to provide a supervisory role in the construction industry in Kenya. Its key objectives are;

- To promote and coordinate training programmes within the construction sector by accrediting both private and public training institutions,

- Manage research in the construction sector and institute an information system for the construction industry,

- Regulate and register performance of both foreign and local contractors and accredit skilled supervisors and construction personnel, and,

- Develop the construction industry code of conduct and promote quality assurance.

Since its inception, the NCA has made progress, including development and publishing of the construction industry code of conduct, accreditation of approximately 150,000 site supervisors and construction workers, and establishment of a register of contractors, with more than 18,300 construction firms registered in four categories. However, the construction sector in Kenya still faces several challenges such as quality of construction, with poor workmanship leading to the collapse of buildings in the country, and developer disregard for zoning regulations. The NCA has had challenges due to; (i) inadequate support from other government bodies and stakeholders, (ii) inadequate staffing and funding, that limits the authority’s capacity to undertake building audits, and (iii) limited mandate, as other than earmarking the buildings for demolishing and demolishing them, it has no capacity to arrest or prosecute rogue contractors and developers. The construction industry policy thus targets to aide in achieving the NCA’s objectives through;

- Providing a road map for operations,

- Strengthening existing interventions in a concise and accurate manner,

- Laying out structures that indicate performance as well as standards for industry players, and,

- Facilitate coordination among the various regulatory bodies in the construction sector, including the National Environmental Management Authority (NEMA) and county governments.

The construction industry policy should address and subsequently implement the issues raised, and this will streamline the operations of the NCA and improve coordination among the various players. Over the last 7 years, the combined contribution of real estate and construction sectors to GDP has been on an upward trend growing by 1.5% points from 12.6%, in 2007 to 14.1% in 2017. Execution of the policy, as well as provision of adequate support and resources to the NCA will be key to facilitating its success, and thus establishing a dynamic and a healthy construction and real estate industry, which is key to the country’s economic growth.

In a bid to resolve the standoff over the implementation of the automation of the country’s lands registries, the Cabinet Secretary of the Ministry of Lands and the Law Society of Kenya (LSK), have agreed to form a 15 person, all-inclusive task force to address issues raised by the LSK on the shortcomings of the Land Information Management Systems (LIMS). The task force will comprise representatives from Kenya Property Developers, the Law Society of Kenya, the Kenya Bankers Association, the Governance Institute of Kenya, the Institute of Surveyors of Kenya, the Kenya Private Sector Alliance, and the Attorney General’s Office, among other bodies. The main deliverable of the task force will be to recommend guidelines on how the implementation of the electronic registration and conveyancing system will be undertaken, in compliance with Regulation 90 of the Land Registration (General Regulations, 2017) that states that the register as well as documents required under the Electronic Registration and Conveyancing Act, shall be maintained in an electronic format. The Ministry of Lands had started the automation of the lands registries in a bid to ease lands transactions, starting with processes such as rent payment and land searches in 2016. In March 2018, the land registries were shut down to facilitate the moving of land transfers from a manual system to an online system, a move opposed by the LSK, who cited it as illegal due to;

- Parliament had not yet passed a law supporting online land transactions,

- It fell contrary to section 34 of the Advocates Act, which states that, “no unqualified person shall, either directly or indirectly, take instructions or draw or prepare any document or instrument relating to the conveyancing of property”,

- Kenyans without access to internet and the online portal would risk losing their land, and,

- Online processing of land transactions would make property owners susceptible to fraud and loss of property through acts such as hacking.

While some of the concerns raised by the LSK are valid, digitisation of the lands ministry has several advantages including; (i) enhanced efficiency and transparent land dealings through improved ownership transfers and payment systems, (ii) reduction of costs related to conveyancing processes, and (iii) proper coordination of land records and data sets. We therefore hope the taskforce will address the issues raised and pave way for the digitisation of the lands registries.

Saint-Gobain, a French multinational corporation that manufactures, designs and distributes materials in the construction and building material industry, launched its first showroom in Nairobi. This follows the launch of it office in the country in June 2014. The centre is set to be a networking hub for professionals, and aims to ensure stakeholders gain knowledge on building materials including Alternative Building Technology. The company joins other multinationals including Bechtel from USA, Power China from China, and Britain’s Royal Institution of Chartered Surveyors (RICS), which have set up operations in the country attracted by a conducive operating environment and heavy government expenditure on infrastructure, which is expected to be higher in 2018. While the companies facilitate knowledge transfer to the country and create employment, as well as demand for the real estate sector themes such as offices and residential developments, they outcompete the local contractors from getting lucrative tenders due to stronger financial muscle and experience. For Instance, Bechtel, won the Kshs 230.0 bn tender to construct the Nairobi Mombasa Expressway. The Government therefore needs to set up quotas for local contractors and provide financial support to prevent them from running out of business.

We expect the real estate sector to remain vibrant in the coming months driven by (i) favourable policies set to be implemented including; digitization of the lands ministry and development of a national construction policy by the NCA, and (ii) entry of international players attracted by the conducive environment and increased infrastructure expenditure.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.