Debt Restructuring, & Cytonn Weekly #25/2022

By Research Team, Jun 26, 2022

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed but the overall subscription rate increased to 88.3%, from 80.8% recorded the previous week. The undersubscription was partly attributable to the tightened liquidity in the money market with the average interbank rates rising to 5.2%, from the 5.1% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 8.1 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 201.4%, an increase from the 76.8% recorded the previous week. The oversubscription is partly attributable to investors’ preference for the shorter-dated paper as they seek to avoid duration risk. The subscription rate for the 364-day and 182-day papers declined to 82.9% and 48.5%, from 90.0% and 73.2%, respectively, recorded the previous week. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day and the 91-day papers increasing by 1.3 bps, 6.7 bps and 8.8 bps to 10.0%, 9.2% and 8.0%, respectively, partly attributable to investors attaching higher risk premium on the country due to perceived higher risks arising from increasing inflationary pressures and local currency depreciation. In the Primary Bond Market, the Central Bank of Kenya released results for the recently re-opened bonds on tap sale; FXD1/2022/03 and FXD1/2022/15. The tap sale recorded a subscription rate of 78.4% with the government receiving bids worth Kshs 19.6 bn against the offered Kshs 25.0 bn.

We are projecting the y/y inflation rate for June 2022 to fall within the range of 6.9% - 7.3%, compared to the 7.1% recorded in May 2022, mainly driven by increasing fuel and food prices;

Equities

During the week, the equities market was on a downward trajectory, with NASI and NSE 25 both declining by 3.8%, while NSE 20 declined by 3.3%. This week’s performance took the indices’ YTD performance to losses of 29.9%, 17.8% and 26.3% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by losses recorded by large cap stocks such as EABL, Absa Bank, Safaricom, Diamond Trust Bank (DTB-K), and KCB which declined by 7.4%, 5.6%, 4.9%, 3.4% and 3.2%, respectively. The losses were however mitigated by gains recorded by stocks such as Standard Chartered Bank Kenya (SCBK) of 1.0%;

During the week, the Central Bank of Kenya (CBK) released the Quarterly Economic Review January-March 2022, highlighting that the sector’s total assets increased by 1.6% to Kshs 6.1 tn, from Kshs 6.0 tn in December 2021. On a yearly basis, total assets increased by 10.4% to Kshs 6.1 tn, from Kshs 5.5 tn in Q1’2021. Profit before Tax (PBT) increased by 16.2% to Kshs 57.3 bn, from Kshs 49.3 bn in Q4’2021. On a yearly basis, PBT increased by 24.8%, to Kshs 57.3 bn, from Kshs 45.9 bn recorded in Q1’2021;

Real Estate

During the week, the Central Bank of Kenya (CBK) released the Quarterly Economic Review Q1’2022 highlighting that the gross loans advanced to the Real Estate sector increased by 0.9% to Kshs 460.0 bn in Q1’2022, from Kshs 456.0 bn in Q4’2021. Additionally, the Kenya Bankers Association (KBA) released the Housing Price Index Q4’2021 report which highlighted that house prices in Kenya contracted by 4.0% in Q4’2021 compared to a contraction of 3.7% in Q3’2021. In the retail sector, French private equity firm Amethis, and the International Finance Cooperation (IFC) consortium, sold an estimated 30.0% stake in Naivas supermarket to IBL Group of Mauritius and other investors, for an undisclosed amount. In the Hospitality sector, Kisumu Lakefront Development Corporation (KLDC), in partnership with Gad Works Projects Limited, announced plans to build a Kshs 539.0 mn beach apartments in Usoma, Kisumu County. For the listed Real Estate, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.0 per share;

Focus of the Week

Over the last two years, the corporate sector has faced unprecedented challenges as a result of the COVID-19 pandemic, which resulted in lost income, reduced profits, and a deterioration in the business environment. As such, it is important for business owners to understand the key options available to ensure that their companies stay afloat and grow in the long run. Companies facing significant financial challenges have several options to consider. These include bringing in new capital in the form of debt or equity, as well as requesting time to restructure their businesses. In this week’s topical, we shall cover debt restructuring amid the tough economic environment as we discuss the different ways businesses can restructure their debt;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.52%. To invest, dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.92% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809#;

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert are welcome to consider one of the five projects currently available for assignment, click here for the latest term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns; See further details here: Summary of Investment-ready Projects;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

During the week, T-bills were remained undersubscribed but the overall subscription rate increased to 88.3%, from 80.8% recorded the previous week. The undersubscription was partly attributable to the tightened liquidity in the money market with the average interbank rates rising to 5.2%, from the 5.1% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 8.1 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 201.4%, an increase from the 76.8% recorded the previous week. The oversubscription is partly attributable to investors’ preference for the shorter-dated paper as they seek to avoid duration risk. The subscription rate for the 364-day and 182-day papers declined to 82.9% and 48.5%, from 90.0% and 73.2%, respectively, recorded the previous week. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day and the 91-day papers increasing by 1.3 bps, 6.7 bps and 8.8 bps to 10.0%, 9.2% and 8.0%, respectively, partly attributable to investors attaching higher risk premium on the country due to perceived higher risks arising from increasing inflationary pressures and local currency depreciation. The government accepted a total of Kshs 20.3 bn worth of bids out of Kshs 21.2 bn received, translating to an acceptance rate of 95.7%.

In the Primary Bond Market, the Central Bank of Kenya released results for the recently re-opened bonds on tap sale; FXD1/2022/03 and FXD1/2022/15, with tenors to maturity of 3.0 years and 15.0 years, coupons of 11.8% and 13.9% respectively. The bonds recorded an undersubscription of 78.4%, partly attributable to the tightened liquidity in the money market with average interbank rates rising to 5.2%, from the 5.1% recorded the previous week. The government issued the bonds on tap-sale seeking to raise Kshs 25.0 bn for budgetary support, received bids worth Kshs 19.6 bn and accepted bids worth Kshs 19.6 bn, translating to a 99.9% acceptance rate. The weighted average yields for the two bonds were 13.9% for FXD1/2022/15 and 11.8% for FXD1/2022/03.

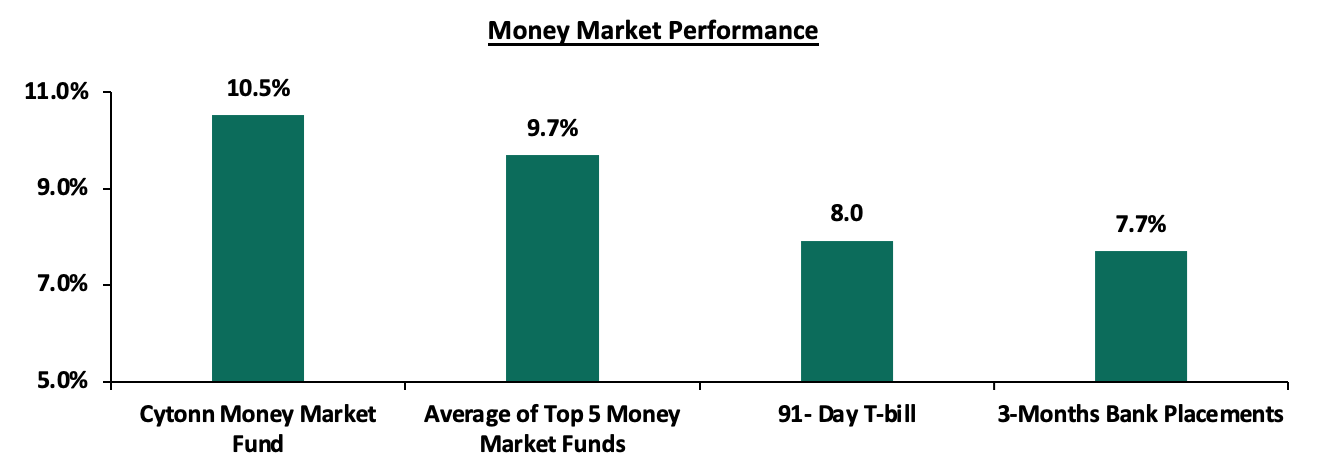

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased by 8.8 bps to 8.0%. The average yield of the Top 5 Money Market Funds and the Cytonn Money Market Fund remained relatively unchanged at 9.7% and 10.5% respectively, as was recorded last week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 24th June 2022:

|

Money Market Fund Yield for Fund Managers as published on 24th June 2022 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.5% |

|

2 |

Zimele Money Market Fund |

9.9% |

|

3 |

Sanlam Money Market Fund |

9.4% |

|

4 |

Madison Money Market Fund |

9.4% |

|

5 |

Apollo Money Market Fund |

9.4% |

|

6 |

Nabo Africa Money Market Fund |

9.2% |

|

7 |

Dry Associates Money Market Fund |

9.0% |

|

8 |

Co-op Money Market Fund |

9.0% |

|

9 |

CIC Money Market Fund |

9.0% |

|

10 |

GenCap Hela Imara Money Market Fund |

8.9% |

|

11 |

ICEA Lion Money Market Fund |

8.8% |

|

12 |

Orient Kasha Money Market Fund |

8.6% |

|

13 |

NCBA Money Market Fund |

8.4% |

|

14 |

Old Mutual Money Market Fund |

8.2% |

|

15 |

AA Kenya Shillings Fund |

7.8% |

|

16 |

British-American Money Market Fund |

7.5% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets tightened, with the average interbank rate rising to 5.2% from 5.1% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded increased by 62.2% to Kshs 17.1 bn from Kshs 10.5 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds recorded mixed performance, with increase in the yields partly attributable to investors attaching higher risk premium on the country due to perceived higher risks arising from increasing inflationary pressures and local currency depreciation. Yields on the 7-year Eurobond issued in 2019 recorded the highest increase, of 0.5% points to 15.0% from 14.5%, recorded the previous week. Yields on the 10-year Eurobond issued in 2014 recorded a decline of 0.1% points to 15.1% from 15.2%, recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 23rd June 2022;

|

Kenya Eurobond Performance |

||||||

|

2014 |

2018 |

2019 |

2021 |

|||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

03-Jan-22 |

4.4% |

8.1% |

8.1% |

5.6% |

6.7% |

6.6% |

|

31-May-22 |

8.7% |

10.0% |

11.0% |

10.5% |

10.4% |

10.0% |

|

17-Jun-22 |

15.2% |

13.4% |

12.7% |

14.5% |

12.8% |

11.9% |

|

20-Jun-22 |

15.2% |

13.5% |

12.7% |

14.6% |

12.9% |

11.8% |

|

21-Jun-22 |

15.1% |

13.4% |

12.6% |

14.4% |

12.7% |

11.7% |

|

22-Jun-22 |

15.2% |

13.6% |

12.8% |

14.5% |

12.8% |

12.0% |

|

23-Jun-22 |

15.1% |

13.6% |

12.8% |

15.0% |

13.0% |

12.0% |

|

Weekly Change |

(0.1%) |

0.2% |

0.1% |

0.5% |

0.2% |

0.1% |

|

MTD Change |

6.4% |

3.6% |

1.8% |

4.5% |

2.6% |

2.0% |

|

YTD Change |

10.7% |

5.6% |

4.7% |

9.4% |

6.3% |

5.4% |

Source: Central Bank of Kenya (CBK)

Kenya Shilling:

During the week, the Kenyan shilling depreciated by 0.3% against the US dollar to close the week at Kshs 117.7, from Kshs 117.3 recorded the previous week, partly attributable to increased dollar demand from the oil and energy sectors. Key to note, this is the lowest the Kenyan shilling has ever depreciated against the dollar. On a year to date basis, the shilling has depreciated by 4.0% against the dollar, in comparison to the 3.6% depreciation recorded in 2021. We expect the shilling to remain under pressure in 2022 as a result of:

- Rising global crude oil prices on the back of supply constraints and geopolitical pressures at a time when demand is picking up with the easing of COVID-19 restrictions and as economies reopen. Key to note, risks abound the recovery following the emergence of the new COVID-19 variants,

- Increased demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally,

- An ever-present current account deficit due to an imbalance between imports and exports, with Kenya’s current account deficit estimated to come in at 5.1% of GDP in the 12 months to April 2022 compared to the 4.8% for a similar period in 2021. The wider deficit reflects a higher import bill, particularly for oil, which more than offset increased receipts from agricultural and services exports, and remittances, and,

- The aggressively growing government debt, with Kenya’s public debt having increased at a 10-year CAGR of 18.6% to Kshs 8.2 tn in December 2021, from Kshs 1.5 tn in December 2011 thus putting pressure on forex reserves to service some of the public debt. It is worth noting that the average GDP growth over the same period has been 3.9%, an indicator that the increase in debt is not translating into GDP growth.

The shilling is however expected to be supported by:

- High Forex reserves currently at USD 8.2 bn (equivalent to 4.9-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. In addition, the reserves were boosted by the USD 750.0 mn World Bank loan facility received in March 2022 and are expected to be boosted further by the expected USD 244.0 mn from the International Monetary Fund (IMF), and,

- Improving diaspora remittances evidenced by an 7.6% y/y increase to USD 339.7 mn as of May 2022, from USD 315.8 mn recorded over the same period in 2021 which has continued to cushion the shilling against further depreciation. In the recently released May 2022 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 59.9% in the period, followed by Europe at 17.8% while the rest of the world accounted for 22.3% of the total.

Weekly Highlight:

June 2022 inflation projections

We are projecting the y/y inflation rate for June 2022 to fall within the range of 6.9%-7.3%. The key drivers include:

- Increasing fuel prices - Fuel prices for the period 15th June 2022 to 14th July 2022 increased by 6.0% to Kshs 159.1 per litre for Super Petrol, 6.9% to Kshs 140.0 per litre for Diesel and 7.6% to Kshs 127.9 per litre for Kerosene. With fuel being a major contributor to Kenya's headline inflation, we expect the increasing fuel prices to continue to exerting upward pressure on the inflation basket,

- Increasing food prices - This was evidenced by the 12.4% y/y increase in the prices food & non-alcoholic beverages as of May 2022 due to increased costs of production. Food prices increased by 1.3% m/m from April 2022 mainly due to increases in the prices of maize flour, cooking fat and cooking oil (salad) among other food items occasioned by adverse weather conditions in most parts of the country coupled with high fertilizer prices, and,

- The price of electricity which reduced by 15.7% in January 2022 marking the first phase of compliance with President Uhuru Kenyatta’s directive to cut the cost of electricity by 30.0% in order to reduce the cost of living. The reduction in electricity costs helped prices of goods remain stable during the month of May 2022 due to lower production costs.

Going forward, we expect the inflation rate to remain within the government’s set range of 2.5% - 7.5%. The move by the Monetary Policy Committee (MPC) to increase the Central Bank Rate (CBR) by 50.0 bps to 7.5%, from the previous 7.0% is expected to anchor inflation expectations as well as help prop the shilling given the current YTD depreciation of 4.0%. However, concerns remain high on the inflated import bill and widening trade deficit as global fuel prices continue to rise due to supply bottlenecks worsened by the geopolitical tensions arising from the Russia-Ukraine invasion. We expect increased inflationary pressure mainly due to the rising global fuel prices as fuel prices are a substantial input cost in the bulk of Kenya’s sectors such as manufacturing, transport and energy.

Rates in the Fixed Income market have remained relatively stable due to the relatively ample liquidity in the money market. The government is 5.9% ahead of its Kshs 664.0 bn borrowing target for the FY’2021/2022 having borrowed a total of Kshs 703.2 bn. We expect a gradual economic recovery as evidenced by the revenue collections of Kshs 1.7 tn during the first eleven months of the current fiscal year, which was equivalent to 103.7% of the prorated revenue collection target. However, despite the projected high budget deficit of 8.1% and the affirmation of the `B+’ rating with negative outlook by Fitch Ratings, we believe that the support from the IMF and World Bank will mean that the interest rate environment will remain stable since the government is not desperate for cash. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Markets Performance

During the week, the equities market was on a downward trajectory, with NASI and NSE 25 both declining by 3.8%, while NSE 20 declined by 3.3%. This week’s performance took the indices’ YTD performance to losses of 29.9%, 17.8% and 26.3% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by losses recorded by large cap stocks such as EABL, Absa Bank, Safaricom, Diamond Trust Bank (DTB-K), and KCB which declined by 7.4%, 5.6%, 4.9%, 3.4% and 3.2%, respectively. The losses were however mitigated by gains recorded by stocks such as Standard Chartered Bank Kenya (SCBK) of 1.0%;

During the week, equities turnover increased by 24.3% to USD 22.5 mn, from USD 18.1 mn recorded the previous week, taking the YTD turnover to USD 453.4 mn. Foreign investors remained net sellers, with a net selling position of USD 13.6 mn, from a net selling position of USD 11.9 mn recorded the previous week, taking the YTD net selling position to USD 101.5 mn.

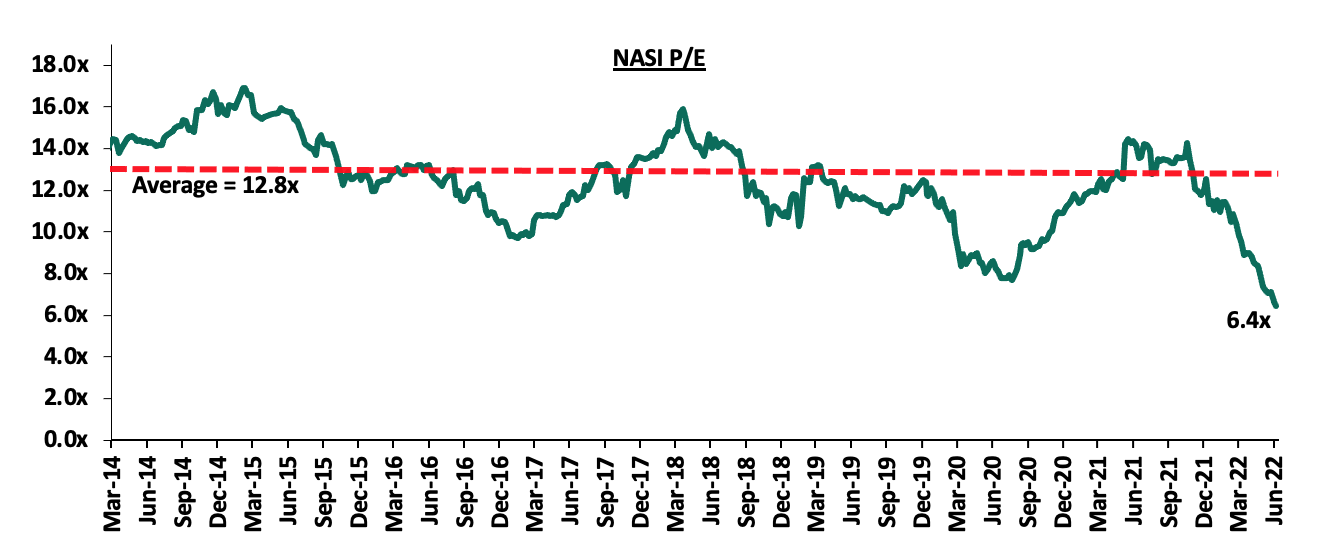

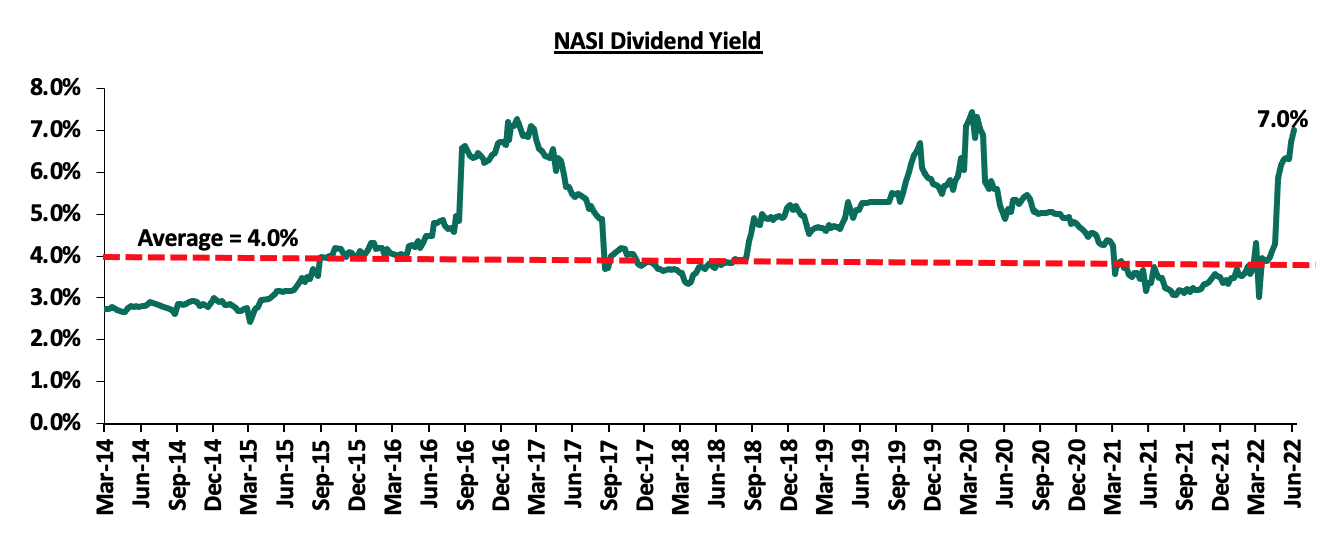

The market is currently trading at a price to earnings ratio (P/E) of 6.4x, 49.7% below the historical average of 12.8x, and a dividend yield of 7.0%, 3.0% points above the historical average of 4.0%. Key to note, NASI’s PEG ratio currently stands at 0.8x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued.

The charts below indicate the historical P/E and dividend yields of the market;

Weekly Highlights:

Q1’2022 Quarterly Economic Review

During the week, the Central Bank of Kenya (CBK) released the Quarterly Economic Review for the period ending 31st March 2022, highlighting that the banking sector remained stable and resilient during the period. According to the report, the sector’s total assets increased by 1.6% to Kshs 6.1 tn in March 2022, from Kshs 6.0 tn in December 2021. The increase was mainly attributable to a 4.1% increase in loans and advances to Kshs 3.4 tn as well as a 2.6% increase in government securities to Kshs 2.0 tn. On a yearly basis, total assets increased by 10.4% to Kshs 6.1 tn, from Kshs 5.5 tn in Q1’2021. Notably, loans and advances accounted for 50.2% of total assets in Q1’2022, which was an increase from 48.8% of total assets recorded in the Q4’2021.

Other key take-outs from the report include:

- The banking sector recorded a 16.2% increase in Profit before Tax (PBT) to Kshs 57.3 bn in Q1’2022, from Kshs 49.3 bn in Q4’2021, with the increase in profitability mainly attributable to a faster decrease in quarterly expenses by 9.8% as compared to decrease in quarterly income by 1.4% between Q4’2021 and Q1’2022. On a yearly basis, PBT increased by 24.8%, to Kshs 57.3 bn, from Kshs 45.9 bn recorded in Q1’2021,

- The sector’s Return on Assets (ROA) recorded a 0.4% points increase to come in at 3.0% in Q1’2022, from 2.6% recorded in Q4’2021. Year on year, ROA increased by 0.4% to 3.0% in Q1’2022 from 2.6% I Q1’2021. Additionally, Return On Equity (ROE) recorded a 3.5% points increase to 25.1% in March 2022, from 21.6% in December 2021, and, a 3.1% points increase from 22.0% recorded in Q1’2021,

- Lending increased by 4.1% to Kshs 3.4 tn in Q1’2022, from Kshs 3.2 tn in Q4’2021, attributable to an increase in credit granted for working capital purposes, and loans granted to individual borrowers. On a yearly basis, lending was up by 11.2% to Kshs 3.4 tn, from Kshs 3.0 tn in Q1’2021,

- Deposits recorded a 0.6% increase to Kshs 4.5 tn in March 2022, from Kshs 4.4 tn in December 2021, attributable to a 0.8% increase in local currency deposits which increased to Kshs 3.38 tn in March 2022, from Kshs 3.35 tn in December 2021. Compared to last year, deposits increased by 8.1% to Kshs 4.7 tn in Q1’2022, from Kshs 4.1 tn in Q1’2021. Key to note, customer deposits remain the main source of funding for banks, accounting for 73.2% of the sector’s total liabilities and shareholders’ funds as at Q1’2022, 0.7% lower than the 73.9% recorded in Q4’2021 and 1.6% lower than the 74.8% recorded in Q1’2021,

- Credit risk remained elevated in the sector since the gross NPLs to gross loans ratio increased to 14.0% in Q1’2022 from 13.1% in Q4’2021. The gross Non-Performing Loans (NPLs) also increased by 11.0% in Q1’2022 to Kshs 473.7 bn, from 426.8 bn in Q4’2021. Building and construction sector registered the highest increase in NPLs by 38.0% (Kshs 11.1 bn) as a result of delayed payments in Q1’2022. The asset quality, however, improved compared with last year as the gross NPL ratio decreased by 0.6% points to 14.0% in Q1’2022, from 14.6% in Q1’2021.

- The sector’s NPL coverage ratio decreased to 49.6% in Q1’2022, from 54.1% in Q4’2021, despite the increase in Non-Performing Loans. We expect provisioning levels to increase in during Q2 and Q3’2022 due to the increasing credit risk remains brought by the tough operating environment and the upcoming elections,

- The banking sector remained adequately capitalized, with the aggregate Core Capital to Total Risk Weighted Assets ratio decreasing marginally to 16.2% in Q2’2022 from 16.7 in Q4’2021, and 0.3% lower than the 16.5% recorded in Q1’2021. The Core Capital to Total Risk-Weighted Assets ratio was 5.7% points above the CBK’s minimum statutory ratio of 10.5%. On the other hand, Total Capital to Total Risk-Weighted Assets ratio, decreased slightly by 0.7% points to 18.9% in Q1’2022, from 19.6% in Q4’2021, and, up 0.1% points from 18.8% recorded in Q1’2021. The Q2’2021 Total Capital to Total Risk-Weighted Assets ratio was 4.4% points above the CBK’s minimum statutory ratio of 14.5%, and,

- The sector remained sufficiently liquid during the period under review, despite the liquidity ratio decreasing to 55.0% in Q1’2022, from 56.2% in Q4’2021. Year on year, the ratio increased by 1.3% points from 56.3% recorded in Q1’2021. This was 35.0% points above the minimum statutory level of 20.0%. The decrease in the banking sector’s liquidity is attributable to a 1.1% increase in short term liabilities, as compared to a 1.1% decrease in total liquid assets between the periods under review.

The increasing profitability in Q1’2022 indicates that the banking sector remains resilient and profitable. The sector remains sufficiently capitalized and with adequate liquidity levels above the minimum statutory requirement, evidenced by the capital adequacy and liquidity ratios remaining above the minimum statutory ratios. However, credit level remained elevated with Gross NPLs increasing in Q1’2022 compared to Q4’2021 attributable to increased cost of living, persistent supply constraint due to Ukraine-Russian conflict, and resurgence of COVID-19 infections. Overall, we expect the banking sector to remain resilient boosted by the CBK’s efforts to improve their liquidity positions by maintaining the Cash Reserve Ratio at 4.25%, proactive monitoring of the loan book by commercial banks and improved capital adequacy across the sector

Cytonn coverage:

|

Company |

Price as at 17/06/2022 |

Price as at 24/06/2022 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

2.0 |

2.0 |

(1.5%) |

(12.7%) |

3.2 |

5.0% |

63.9% |

0.2x |

Buy |

|

Jubilee Holdings |

265.0 |

260.0 |

(1.9%) |

(17.9%) |

379.4 |

5.4% |

51.3% |

0.5x |

Buy |

|

KCB Group*** |

37.9 |

36.7 |

(3.2%) |

(19.4%) |

52.2 |

8.2% |

50.4% |

0.7x |

Buy |

|

Equity Group*** |

39.9 |

39.0 |

(2.1%) |

(26.1%) |

54.4 |

7.7% |

47.2% |

1.0x |

Buy |

|

ABSA Bank*** |

10.8 |

10.2 |

(5.6%) |

(13.2%) |

13.6 |

10.8% |

44.1% |

1.0x |

Buy |

|

Liberty Holdings |

5.1 |

5.5 |

7.0% |

(22.1%) |

7.8 |

0.0% |

41.8% |

0.4x |

Buy |

|

I&M Group*** |

16.7 |

17.0 |

1.8% |

(20.6%) |

22.3 |

8.8% |

40.0% |

0.5x |

Buy |

|

Co-op Bank*** |

11.0 |

10.9 |

(1.4%) |

(16.5%) |

14.1 |

9.2% |

39.2% |

0.8x |

Buy |

|

NCBA*** |

24.5 |

23.9 |

(2.5%) |

(6.3%) |

29.1 |

12.6% |

34.6% |

0.6x |

Buy |

|

Diamond Trust Bank*** |

52.0 |

50.3 |

(3.4%) |

(15.5%) |

62.4 |

6.0% |

30.1% |

0.2x |

Buy |

|

Stanbic Holdings |

100.3 |

91.5 |

(8.7%) |

5.2% |

109.8 |

9.8% |

29.8% |

0.8x |

Buy |

|

Britam |

5.6 |

6.1 |

9.7% |

(19.0%) |

7.7 |

0.0% |

25.8% |

1.0x |

Buy |

|

Sanlam |

13.0 |

13.0 |

0.0% |

12.6% |

15.9 |

0.0% |

22.3% |

1.4x |

Buy |

|

Standard Chartered*** |

123.8 |

125.0 |

1.0% |

(3.8%) |

137.0 |

11.2% |

20.8% |

1.0x |

Buy |

|

CIC Group |

1.9 |

2.0 |

3.7% |

(9.7%) |

2.1 |

0.0% |

7.1% |

0.7x |

Hold |

|

HF Group |

3.0 |

3.0 |

0.3% |

(20.8%) |

2.8 |

0.0% |

(7.0%) |

0.2x |

Sell |

|

Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

|||||||||

We are “Neutral” on the Equities markets in the short term due to the current adverse operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently trading at a discount to its future growth (PEG Ratio at 0.8x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs, the upcoming Kenyan general elections and the slow vaccine rollout to continue weighing down the economic outlook in the short term.

- Industry Report

During the week, the Central Bank of Kenya (CBK) released the Quarterly Economic Review Q1’2022, a report highlighting the status and performance of Kenya’s economy. The following were the key take outs from the report, with regards to the Real Estate and related sectors;

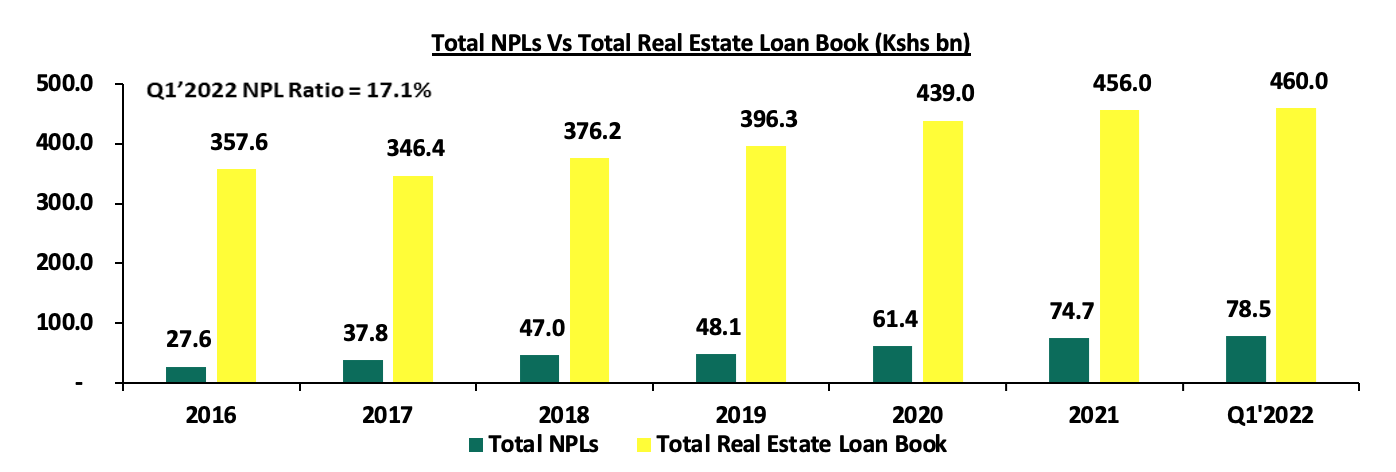

- The gross loans advanced to the Real Estate sector increased by 0.9% to Kshs 460.0 bn in Q1’2022, from Kshs 456.0 bn in Q4’2021. On a YoY basis, this was a 3.6% increase of from the Kshs 444.0 bn realized in Q1’2021, driven by the increased construction and development activities in the property sector that demanded more capital,

- Gross loans advanced to the Tourism sector also increased by 3.7% to Kshs 111.0 bn in Q1’2022, from Kshs 107.0 bn in Q4’2021, in order to support the sector’s activities such as marketing, sports, and leisure activities, thus in turn boost its overall performance,

- Gross loans advanced to the Building and Construction sector increased by 7.8% to Kshs 138.0 bn in Q1’2022, from Kshs 128.0 bn in Q4’2021. This was mainly attributed to increased construction activities in select Real Estate sectors such as residential and infrastructure sectors, and,

- The Gross Non-Performing Loans in the Real Estate sector increased by 5.6% to Kshs 78.5 bn in Q1’2022, from Kshs 74.7 bn recorded in Q4’2021. On a YoY basis, the performance represented a 11.3% increase from Kshs 70.5 bn realized in Q1’2021, attributed to increased Real Estate loan default rates amidst a tough economic environment.

The graph below shows the number of Real Estate non-performing loans compared to the total Real Estate loan book from 2016-Q1’2022;

Source: Central Bank of Kenya (CBK)

Additionally, during the week the Kenya Bankers Association (KBA) released the Housing Price Index Q4’2021, a report highlighting the performance of the Real Estate housing sector in Kenya. The following were the key take outs from the report:

- The house prices contracted by 4.0% in Q4’2021 compared to a contraction of 3.7% in Q3’2021, mainly attributable to economic downturn in the country which led to reduced investment in the Real Estate sector leading to limited supply of new Real Estate properties,

- Apartments continued to dominate the housing market with 56.8% completed sale transactions in Q4’2021. The performance represented 9.8% points increase from the 47.0% completed sale transactions that were recorded in Q3’2021, attributed to the increasing demand for rental apartments, as well as their affordability when compared to bungalows and maisonettes. On the other hand, bungalows and maisonettes accounted for 13.3% and 29.2% sale transactions, respectively, in the period of focus as a result of the high prices, and,

- Apartments in the low-end sub markets, which consist of areas such as Athi River, Ruaka, Thika Road, Embakasi and Mlolongo recorded the highest sale transactions in Q4’2021 at 58.8%, compared to the high end and mid end submarkets whose transactions came in at 14.4% and 26.8%, respectively. This signified a higher demand for the housing units in the areas resulting from their affordability.

The findings of the report are not in tandem with our Cytonn Annual Markets Review 2021 which highlighted that the average selling prices for houses within the Nairobi Metropolitan Area (NMA) appreciated by 1.6% points in Q4’2021. The overall improvement in performance was attributed to a general improvement in Real Estate transactions fueled by increased demand, coupled with improved investor confidence in the residential market.

Additionally, KBA’s report is not in tandem with Hass Consult’s House Price Index Q4’2021 report which highlighted that the average selling prices for properties within the NMA recorded an increase of 3.0% and 3.1% q/q and y/y, respectively. This was mainly driven by increased performance of the detached units which realized a 4.9% q/q and 5.9% y/y increase in their selling prices.

We expect Kenya’s property market to continue realizing improvements in its performance driven by high development activities, and demand for residential units boosting property prices. However, setbacks such as financial constraints to continue weighing down the optimum performance of the sector.

- Retail Sector

During the week, French private equity firm Amethis, and the International Finance Cooperation (IFC) consortium, sold an estimated 30.0% stake in Naivas supermarket to IBL Group and other investors, for an undisclosed amount. The other investors who also partnered with IBL to purchase the shares included Proparco Group, and DEG, a subsidiary of German KfW Group. This comes two years after the consortium consisting of IFC, Amethis, MCB Equity Fund, and German sovereign wealth fund DEG, acquired the 30.0% stake worth Kshs 6.0 bn in April 2020, with Naivas having been valued at Kshs 20.0 bn. From the 30.0% sale transaction by IFC and Amethis, IBL Group which is the largest investment Consortium in Mauritius, purchased the largest the stake thus becoming its largest investment worldwide, and the first in East Africa. This signifies the investors’ high appetite for Kenya’s retail sector, particularly Naivas which continues to outshine other retailers in the country. Currently, Naivas operates a total of 84 outlets in the country, with 5 branches having been opened so far this year in Nairobi, Machakos, and Naivasha, among other areas. IBL and the other investors’ decision to invest in Kenya’s retail market is driven by;

- Naivas’ impressive performance as it has grown to be one of Kenya’s largest companies,

- Kenya’s recognition as a regional hub thus enhancing investments,

- IBL’s expertise in the retail sector as it runs the Winners supermarket chain in Mauritius, thus Naivas being a good investment opportunity,

- Positive demographics promoting retail investments, and,

- IBL’s expansion drive into East Africa, as part of its plans to increase their regional expansion and investments.

The table below shows a summary of the number of stores of the key local and international retailer supermarket chains in Kenya;

|

Main Local and International Retail Supermarket Chains |

||||||||||

|

Name of retailer |

Category |

Highest number of branches that have existed as at FY’ 2018 |

Highest number of branches that have existed as at FY’ 2019 |

Highest number of branches that have existed as at FY’ 2020 |

Highest number of branches that have existed as at FY’ 2021 |

Number of branches opened in 2022 |

Closed branches |

Current number of branches |

Number of branches expected to be opened |

Projected number of branches FY’2022 |

|

Naivas |

Local |

46 |

61 |

69 |

79 |

5 |

0 |

84 |

1 |

85 |

|

QuickMart |

Local |

10 |

29 |

37 |

48 |

3 |

0 |

51 |

0 |

51 |

|

Chandarana |

Local |

14 |

19 |

20 |

23 |

1 |

1 |

24 |

4 |

28 |

|

Carrefour |

International |

6 |

7 |

9 |

16 |

0 |

0 |

16 |

0 |

16 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

12 |

0 |

0 |

12 |

0 |

12 |

|

Tuskys |

Local |

53 |

64 |

64 |

3 |

0 |

61 |

3 |

0 |

3 |

|

Game Stores |

International |

2 |

2 |

3 |

3 |

0 |

0 |

3 |

0 |

3 |

|

Uchumi |

Local |

37 |

37 |

37 |

2 |

0 |

35 |

2 |

0 |

2 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

0 |

13 |

0 |

0 |

0 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

0 |

4 |

0 |

0 |

0 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

0 |

65 |

0 |

0 |

0 |

|

Total |

|

257 |

313 |

334 |

186 |

9 |

179 |

195 |

5 |

200 |

Source: Cytonn Research

We expect Kenya’s retail sector to continue recording development activities geared towards boosting its performance. However, the existing oversupply of retail space at 1.7 mn SQFT in Kenya and 3.0 mn SQFT in Nairobi Metropolitan Area (NMA), is expected to weigh down the optimum performance of the sector

- Hospitality Sector

During the week, Kisumu Lakefront Development Corporation (KLDC), in partnership with Gad Works Projects Limited, announced plans to build beach apartments worth Kshs 539.0 mn in Usoma, Kisumu County. The project will have 119 units, a restaurant, a floating swimming pool in the lake and an aqua park. The developer’s decision to invest in Kisumu is driven by;

- Strategic location of the project off Nkrumah Road, on the shores of Lake Victoria,

- Increasing modernization of Kisumu city thus boosting tourism activities in the area, and,

- Presence of the rehabilitated Kisumu International Airport facilitating access to the city by air.

Upon completion, the project will; i) provide modern housing and recreation facilities for tourists, ii) create employment opportunities for the residents, and, iii) expand revenue generation for the County Government of Kisumu.

The hospitality sector continues to record expansion developments driven by activities such as tourism, conferences, sports and leisure activities. This signifies the increasing investor confidence in the sector which has shown improved performance, after having been one of the worst hit sectors by the onset of the pandemic. We expect a similar trend to continue being witnessed in the sector thus continue driving its overall performance, with some of the driving factors being: i) continuous roll out of COVID-19 vaccine which in turn boost tourism confidence and arrival into the country, ii) annual world rally championship program boosting hotel and serviced apartments occupancies, iii) Positive accolades such as the 28th World Travel Awards winners, where Nairobi was voted as Africa’s leading business travel destination, and, iv) the aggressive marketing of Kenya’s tourism sector via the Magical Kenya Platform, and, Kenya Tourism Board.

- Listed Real Estate

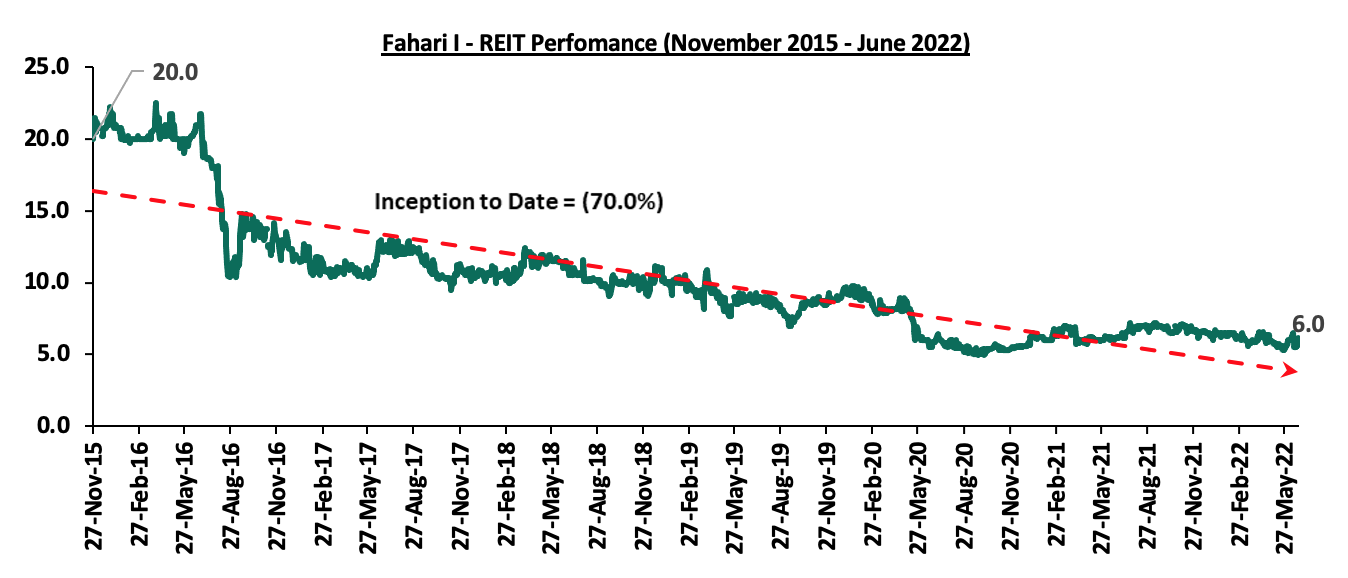

In the Nairobi Stock Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.0 per share. The performance represented a 9.1% Week-to-Date (WTD) increase, from Kshs 5.5 per share recorded last week. However, on a Year-to-Date (YTD) and Inception-to-Date (ITD) basis, the REIT’s performance continues to be weighed down having realized a 6.3% and 70.0% decline, respectively, from Kshs 6.4 and Kshs 20.0, respectively. The graph below shows Fahari I-REIT’s performance from November 2015 to 24th June 2022:

We expect Kenya’s property market to continue being shaped by; increased construction activities, increasing investor confidence in Kenya’s housing and retail market, and, increasing expansion drive in the hospitality sector. However, setbacks such as the increasing NPLs in the property market, and, investor’s minimal appetite for the REIT instrument is expected to continue weighing down the overall investments in REITs.

Over the last two years, the corporate sector has faced unprecedented challenges as a result of the COVID-19 pandemic, which resulted in lost income, reduced profits, and a deterioration in the business environment. As such, it is important for business owners to understand the key options available to ensure that their companies stay afloat and grow in the long run. Companies facing significant financial challenges have several options to consider. These include bringing in new capital in the form of debt or equity, as well as going the extra mile and requesting time to restructure their businesses.

We have previously covered a topical on “Business Restructuring Options” in 2020 and concluded that business owners should fully understand the Insolvency Act as it helps in offering struggling businesses a second chance to reorganize themselves and come out stronger and viable businesses, as well as encouraging entrepreneurship by providing a path to redemption in the case of a viable venture that has run into turbulence and just needs room to restructure. In this week’s topical, we shall cover debt restructuring amid the tough economic environment. We shall do this by taking a look into the following;

- Introduction,

- The Process of Restructuring Debt,

- Types of Debt Restructuring,

- Examples of Debt Restructuring in Kenya,

- Advantages and Disadvantages of Debt Restructuring, and,

- Conclusion

Section 1: Introduction

All businesses, be it start-ups or established companies, require funding in order to meet their operating expenses, purchase inventory and acquire machinery among other expenses. To meet these expenses, businesses seek funds through a variety of channels, including i) borrowing from banks or retail and institutional investors, ii) equity - where investors provide funds for a company in exchange for a stake in the company, iii) venture capital, v) personal financing, vi) shareholder capital injection, and vii) reinvesting profits, among others. Debt and equity are the most common methods of raising funds for a business.

In this topical, we shall focus on Debt and Debt restructuring. Debt restructuring is the process by which a business or entity that is experiencing financial difficulties and liquidity distress, renegotiates with lenders and enters into an agreement with the lender with more favorable terms that will save the business from insolvency or severe cash flow issues. For instance, Company A owes Bank X an outstanding debt of Kshs 10.0 mn that is due on 31st July 2022 but Company A is facing severe liquidity constraints. In this case, the Company may negotiate a one-year extension to July 2023, with installment payments in between.

Debt restructuring is also pursued by countries as well, not just companies. A recent example of this is the G20 Debt Service Suspension Initiative (DSSI) which ran from May 2020 to December 2021 with the G20 countries suspending debt repayments totaling USD 12.9 bn. According to the World Bank, Kenya joined the initiative in January 2021 and saved a total of USD 1.2 bn (Kshs 140.0 bn) in 2021 which significantly helped Kenya reduce its level of debt distress. Additionally, debt restructuring could take place between an individual and a lender as was seen in 2020 in Kenya, when banks restructured loans by extending maturities and interest repayment dates, and, accepting lower loan installment amounts.

Some of the common reasons that have led firms to pursue the debt restructuring process include:

- Reduction in cash flows – A cash flow shortage happens when more money is flowing out of a business than is flowing into the business which means that, a business might not have enough money to cover its operating expenses. If the outflows are largely debt repayments, then business can consider the option of debt restructuring,

- Failure or delay in payments by customers – when the rate at which money goes out is faster than the rate at which money comes in, the cash flows of a business especially one that does not have reserves is highly affected. This trickles down to a reduction in cash flows,

- Management failures – Lack of proper debt servicing plans, poor risk governance and lack of financial planning could lead to excessive borrowing stemming from activities such as over-expansion of the business or high operating costs,

- High competition – Despite the advantages competitive markets provide, risks abide for firms that are unable to keep up with trends in the market. A company might deteriorate in performance due to stiff competition from new entrants or current sector competitors, and,

- Tough operating environment – unprecedented occurrences such as the COVID-19 pandemics, significant sectoral changes or huge change in consumer behaviors and patterns occasioned by key macro-economic factors, such as inflation may significantly affect a firm’s cash flows and disrupt its obligations.

Section 2: The Process of Restructuring Debt

The debt restructuring process involves heavy negotiations from both the borrower and the lenders, and as such it is important that both parties are satisfied with the outcome. To achieve this, many firms that pursue debt restructuring call on independent financial analysts and legal experts to guide the process. Debt restructuring can either be done through;

- Voluntary negotiations between the parties – Refers to when the borrower and lender enter into negotiations without seeking court processes that may affect the borrower’s status as an ongoing concern, and,

- Restructuring of the Business through a court process - As highlighted in our Business Restructuring Options topical, Kenyan laws provide alternatives on how a technically insolvent business can be assisted to get back to its feet and be able to service its creditors’ obligations and protect the interests of the other stakeholders. The available options include: (i) Administration, (ii) Company Voluntary arrangements, and, (iii) Liquidation. The process of administration is headed by an Administrator, a certified Insolvency Practitioner, who may be appointed by an administration order of the court, unsecured creditors, or a company or its directors. An administrator of a company is required to perform the administrator’s functions in the interests of the company’s creditors as a whole. The Administrator endeavors to achieve a better outcome for the company’s creditors than liquidation would offer – a process that often involves restructuring the debt obligations of the firm.

It is important to understand the main considerations before pursuing a debt restructuring proposal. Some of the considerations include:

- Type of Debt – Funds may be raised by businesses either from financial institutions such as banks, or from individual and institutional investors through products such as commercial papers and corporate bonds,

- Terms of Debt – The terms of debt are critical in any restructuring process as they will be the main components that will be affected when the restructuring process commences. These terms include the type of interest payable –whether fixed or floating, the interest rate, the repayment structure including frequency of installments and the tenor of the debt,

- Affected Personnel – Some debt restructuring processes are coupled with organizational restructuring with the aim of reducing operational costs, including staff costs. In such instances, it is important to outline all affected processes and personnel beforehand and ensure all parties are sufficiently engaged during the restructuring process,

- Restructuring costs – The restructuring process involves hiring the services of financial and legal experts which means additional expenses incurred by the borrower. Other costs include; severance packages, acquisition of new production materials, legal costs incurred when selling assets and payments due to regulatory bodies if the restructuring process requires regulatory approvals, and,

- Source of new financing – In order to save a firm from insolvency and increase its debt repaying capabilities, additional capital is often required. This calls for fundraising activities from the borrower engaging prospective business partners.

Below we highlight the key steps in a typical corporate Debt Restructuring Process:

|

Steps |

Action |

More Details |

|

Step I |

Identify the sources of the liquidity challenges |

|

|

Step II |

Draft proposed solutions on how to resolve liquidity challenges clearly outlining what is required from the lenders and how both parties will be affected |

|

|

Step III |

Open negotiations with the lender(s) |

|

|

Step IV |

Acceptance of Restructuring Terms |

|

|

Step V |

Engage all other parties to be affected by the Restructuring |

|

|

Step VI |

Implementation of the Restructuring Plan |

a) Fundraising activities, b) Regulatory approvals, and, c) Organizational restructuring. |

The debt restructuring process’ chances of success are high with sufficient commitment and follow-through from the borrower on repayments and an optimal business operating environment.

Section 3: Types of Debt Restructuring

There are several ways in which a company can restructure its debt. It is important to note that not all companies that use debt restructuring strategies are seriously indebted, the strategies can also be used to gain a competitive advantage and generate more revenue. Debt restructuring can also be used to ensure the presence of a timely and transparent mechanism to assist companies in financial distress as well as reduce the losses incurred by lenders and shareholders as a result of the procedure. While some methods change very little about a company, others may completely transform it, and the best method depends on the company in question and the circumstances in which it finds itself. Some of the ways that a company can restructure its debt include;

- Debt-to-Equity Swap - A debt to equity swap is a type of financial restructuring in which a debt is exchanged for a predetermined amount of equity in a company. A debt-to-equity swap is frequently used when a company is in financial difficulty and cannot repay its creditors without going bankrupt. The number of shares of stock awarded is determined by the outstanding debt and the value of the stock. A debt to equity swap, allows a company to deal with creditors proactively before creditors take steps to recover debts and, in the case of secured creditors, enforce its security or appoint an external administrator. On the other hand, a debt for equity swap may be a way for a creditor to avoid the costs of initiating debt recovery processes which may not be fully recoverable in most instances and may provide a way to participate in the company's future growth.

In a debt to equity swap, creditors recover their funds through dividends payable by the company to shareholders as well as share price appreciation which is crystallized when the creditors choose to sell their shares,

- Debt to Assets – This refers to a debt restructuring in which the debtor transfers receivables from third parties, real estate, or other assets to the creditor to fully or partially satisfy a debt. The transfer may result from foreclosure or repossession. The fair value of assets transferred to the creditor in full satisfaction of the debt must at least equal the creditor's recorded investment in receivables or the carrying amount of the debtor's payables.

In a debt to asset conversion process, the creditors recover their funds through sale of the property or asset into which the debt has been restructured into,

- Recapitalization - This refers to a company altering the proportions of its debt and equity or the composition of its share capital structure in order to reduce its outstanding debt burden, raise new equity, or reflect the risk levels associated with various types of equity. In this type, creditors are required to provide additional funding to the firm in order to support its growth prospects and provide much needed financial respite. This may be an appealing solution where it is believed that the business is fundamentally viable but is temporarily hampered by poor trading conditions and constrained cash flow. Existing equity holders who do not participate in the new round risk end up having their stake diluted,

- Informal Debt Repayment Agreements - In the process of reducing debt payments or lengthening the debt schedule, a company may be able to have its interest rates reduced so that it can afford to pay its loan instalments, or it may agree to reduce the principal amount so that the debtor can afford its payments. Furthermore, a company may agree to have the debt repaid over a longer period of time, making it easier for the debtor to meet its payment obligations on time. Similarly, if a company cannot afford to repay its loan in full, a lender may allow it to pay in instalments, effectively lengthening the debt schedule, and,

- Transfer to a New Company – Alternatively, all debt and equity stakeholders can agree on a plan to transfer the borrower's good or performing assets or business to a newly formed company. Financial creditors may accept debt in the new company, equity in the new company or both in exchange for reducing or cancelling their debt claims against the borrower. In the long run, it allows creditors to share in the profits generated by the new company after a restructuring as equity holders are entitled to dividends once there are sufficient distributable reserves or on any subsequent sale.

As companies look at the options of restructuring, it is important that the various stakeholders approach it from a Win-Win mind-set and be open to getting help as they redesign their businesses.

Section 4: Examples of Debt Restructurings in Kenya

As earlier mentioned, the two most common methods of financing a business are debt and equity. This is also reflected in majority of debt restructurings in Kenya – whereby the most prevalent type in the public domain is a debt to equity swap. The table below includes some of the debt restructurings known in Kenya:

|

No. |

Institution / Fund (Borrower) |

Lender |

Year |

Amount of Debt Restructured (Kshs) |

Type of restructuring and more details |

|

1 |

TPS Eastern Africa Plc (Serena Hotel) |

Aga Khan Fund for Economic Development (AKFED) |

2022 |

Kshs 1.7bn |

Debt to Equity (100% conversion)

TPS Eastern Africa wants to convert Kshs 1.7 bn it owes Aga Khan Fund for Economic Development (AKFED) to a 19.4% stake. If approved, the Aga Khan Fund's ownership in TPS Eastern Africa will increase to 64.4% from 45.0% |

|

2 |

National Bank of Kenya |

KCB Bank |

2021 |

3.5 bn |

Debt to equity (100% conversion)

KCB Group acquired 100% stake in National Bank of Kenya in 2019 |

|

3 |

Two Rivers Lifestyle Centre (TRLC) |

Undisclosed |

2021 |

4.5 bn |

Debt to equity (100% conversion) |

|

4 |

Real People |

Noteholders of a corporate bond issued by the firm |

2021 |

1.3 bn |

70% waived; Remaining 30% to be paid over 4 years |

|

5 |

Amana Shilling Fund |

Unit holders in the Fund |

2020 |

0.3 bn |

Debt to equity conversion (into 30% stake in Amana Capital) |

|

6 |

Housing Finance (HF) Group |

Crescent Finco LLP |

2019 |

1.6 bn |

Debt to assets (land and housing units) plus 12% return |

|

7 |

TransCentury Limited |

Kuramo Capital |

2017 |

2.3 bn |

Debt to equity (100% conversion into 25.0% stake in TransCentury Ltd) |

|

8 |

Kenya Airways |

The Government and several Banks |

2017 |

59.0 bn |

Debt to equity 100% of the debt was converted |

Source: Annual Reports, Public Cautionary Statements, Company Press Releases, Online Research

We have included the highlights from the eight debt restructuring examples below:

- TPS Eastern Africa Plc (Serena Hotel) - In June 2022, TPS Eastern Africa Plc (Serena Hotel) and Aga Khan Fund for Economic Development (AKFED) agreed to convert the Kshs 1.7 bn debt owed to the later into equity. The transaction, if approved by regulators, will increase AKFED’s direct shareholding in TPS Eastern Africa to 64.4% from the current 45.0%,

- KCB Bank Debt to National Bank of Kenya (NBK) - National Bank converted the subordinated debt it owes KCB, of Kshs 3.5 bn, to equity in December 2021. This increased KCB’s equity in National Bank of Kenya to Kshs 8.5 bn in 2021 from Kshs 5.0 bn in 2019 when it completed it’s 100% acquisition of NBK,

- Two Rivers Lifestyle Centre (TRLC) - The total debt amount was Kshs 10.9 bn out of which Kshs 4.5 bn was converted to zero-interest equity-linked instrument in December 2021. Key to note Two Rivers Lifestyle Centre is partially owned by Centum Investment Company which has an effective stake of 29.0% in Two Rivers. TRLC is owned by Two Rivers Development Limited (TRDL) and Old Mutual Properties, who both own 50%. Further, Two Rivers Development Limited ownership structure is as follows; i) Centum – 58.0%, ii) AVIC International – 39.0%, and, iii) Kenya Development Corporation (KDC) – 3.0%,

- Real People - Total restructured debt was Kshs 1.3 bn unsecured notes out of the total Kshs 5.0 bn Medium Term Note. In December 2021, the Kshs 1.3 bn was restructured as follows: 70% of the principal amount was waived, while the remaining 30% was to be paid in three instalments February 2023, February 2024 and February 2025.

- Amana Shilling Fund - Amana Capital through its regulated fund, Amana Shilling Fund (ASF) impaired Kshs 255.0 mn (about 59.0% of the total unit share value of Kshs 434.0 mn), following the collapse of the retail giant, Nakumatt after which the retailer defaulted on its Commercial Paper – eventually being into put under voluntary administration. The investors’ funds were converted into shares at the Amana Capital Ltd (ACL), with a cumulative stake of 30.0%. Each investor’s fund will be slashed by 59.0%. The 30.0% equity shares were issued proportionally to individual holdings of funds lost in the Amana UTS Shilling Fund Class B. For a detailed analysis of the Amana Shilling Fund restructuring, please our Cytonn Monthly February 2020 and Cytonn Monthly August 2020,

- Housing Finance (HF) Group – As per its 2019 annual report, HF Group owed Kshs 1.6 bn in Crescent Finco LLP which was transferred to a joint investment fund that primarily invests in property (Kshs 2.4 bn fund; with Kshs 1.8 bn in housing units, Kshs 0.6 bn in land and Kshs 0.06 bn in cash). The arrangement amounted to a debt to assets conversion of the Kshs 1.6 bn owed to Crescent Finco LLP. In the arrangement, the creditor, Crescent Finco, would be paid all its investments through cash conversion plus a 12.0% return over an undisclosed time period

- TransCentury Limited - TransCentury entered into a convertible loan arrangement with Kuramo Capital, a private equity fund, wherein Kuramo Capital lent TransCentury USD 20.0 mn (Kshs 2.3 bn). In April 2017, the loan was converted to equity – Kuramo Capital gained 25.0% in TransCentury consisting of 93.8 mn shares worth USD 13.0 mn (Kshs 1.5 bn) and preference shares worth USD 7.0 mn (Kshs 0.8 bn). The preference shares are redeemable after 7 years at 4.9% coupon and 1.75x the par value, and,

- Kenya Airways Plc - Kenya Airways restructured Kshs 59.0 bn debt owed to the Government and several banks. The debt was converted to equity – shares in the company and some key elements of the transaction include:

- Kshs 24.0 bn was owed to the government – after the debt-to-equity conversion, government’s shareholding in Kenya Airways increased to 48.9% from 29.8%;

- Kshs 35.0 bn owed to several banks – a consortium with the banks’ representatives was formed and jointly saw them receive a 35.7% stake in Kenya Airways in lieu of the debt.

It is important to note that in the case of Real People, Noteholders who were the lenders to the firm, accepted to waive 70.0% of their debt highlighting that during the debt restructuring process, the lenders may in some instances take a haircut which is necessary in order to help the borrower repay fully the remaining debt. However, on the other hand, the majority of the debt to equity conversions have been fairly successful. Debt to equity swaps are often an equivalent of a long term investment wherein the creditors believe in the company’s recovery and future good financial performance.

Section 5: Advantages and Disadvantages of Debt Restructuring

In order to make an informed decision with regards to corporate debt restructuring, it is also important for firms to understand the advantages and disadvantages that come along with debt restructuring. Some of the advantages and disadvantages of debt restructuring include:

Advantages

- Low Interest Rates – Existing loans may be at a higher interest rate and high interest rates are likely to put a strain on the repayment schedule of a debtor especially during times of economic distress. As such, one of the key consideration when restructuring debt is usually lower interest rates. In an informal debt repayment agreement, the creditor and debtor have the option of initially lowering interest rates until the debtor is back on their feet, after which they can use whatever interest rate they deem appropriate. The benefit of a lower interest rate is that it has a cascading effect in that you pay less than before, which means you have more money to run your business and make it grow and consequently pay out the existing debts,

- Business Sustainability - The COVID-19 economic shocks have had a negative impact on business cash flows, with many businesses going into debt to stay afloat. If the current economic climate persists for an extended period of time, several businesses may fail due to a lack of funds to operate effectively and efficiently. As a result of the debt overhangs, firms have been forced to settle for more favourable terms in loan repayment plans, making room for finance planning to ensure that the businesses remain afloat,

- Greater Satisfaction of the creditor as opposed to Bankruptcy – As opposed to bankruptcy, the creditor involved in debt restructuring are assured of getting their principal back or at least something equivalent to the debt. In most cases, creditors lower the interest rates or prolong the repayment period but eventually get compensated,

- Supervision by the administrator over the process of restructuring – The administrator ensures that the company meets its obligations and identifies effective recovery strategies. In the event that the company does not perform its obligations, the administrator has the right to declare the company’s bankruptcy, and,

- Protection of Company Assets which would otherwise have been pursued by the creditors. With debt restructuring, such an eventuality is unlikely to happen. With minimum payments and lower interest rates, a business is in a better position to repay debts, thus protecting the business assets. If you take up debt restructuring fast enough, creditors are unable to proceed with the execution of the liability, as legal proceedings are suspended and then terminated.

Disadvantages

- Prolonged Repayment Period – Despite the flexibility that comes along with an extended repayment period, duration risks are bound to increase and consequently the chances of incurring higher costs. The longer the repayment period, the higher the interest paid. Additionally, it will take a company much longer to become debt free and also limit the choices of who the company can borrow from,

- Cost of Restructuring - The greatest cost of corporate debt restructuring is the time, effort, and money spent negotiating the terms with all the required stakeholders including creditors and the authorities. The process can take several months and entail multiple meetings,

- Partial Waiver of the debt – Depending on a company’s capability and financial prospects, occasionally creditors may be required to waive part of the debt amount in the process of restructuring. This may lead to loss of investment sums from the creditor sums of varying proportions,

- Negative effects on the Company’s credit score – Debt restructuring being one of the best ways to help a business remain afloat, could have a negative effect on a company’s credit score driven by the modification of the original repayment agreement. However, the extent of the negativity will largely depend on several factors such as the size of the debt, the current conditions, reporting practices of the creditor as well as how much of the principal is already paid, and,

- In case the restructuring plan is not approved, the company is declared bankrupt – Debt restructuring lacks guarantee and the company may continue to suffer financially even after restructuring. A court order could be used to replace a group's disapproval of the restructuring plan and declare the company bankrupt. Once this happens, the business’ assets will be sold off and the liquidation proceeds used to pay creditors

Key to note, during the restructuring process, a company operates in the same manner as before the restructuring. However, some actions require the approval of the restructuring administrator, who oversees the debtor's actions during the restructuring, and he/she is required to act with professional care so that the value of the debtor's assets does not fall and that the restructuring process is completed successfully. As a result, it is important that businesses understand the benefits of debt restructuring and leverage on the advantages, in the current economic environment.

Section 6: Conclusion

Credit risk has remained elevated in the present economic environment, and banks have kept access to credit tight even as firms need more financing, driving more businesses into financial difficulties. As such, we are of the view that business owners and companies should look for the ideal balance and trade-off depending on the specific circumstances of their business. Additionally, businesses need also be aware of all that debt restructuring entails, in order to select the best solutions in light of their objectives. For instance, entering into administration to halt or cancel a compulsory liquidation order should be data driven and done cautiously, as a company with little to no projected profitable future in its market sector may be better off liquidated and subsequently shut down instead. As businesses gradually recover, we expect the government to come up with ways of supporting enterprises as its role is to ensure that they provide the requisite operational environment for businesses and individuals to thrive. Some of our recommendations include:

- Creating an enabling environment for restructuring - The legal and regulatory environment can both encourage and discourage restructuring. To encourage restructuring, special debt restructuring frameworks can include incentives for debtors and creditors. The government can ensure presence of a functional debt enforcement regime, which forces debtors to negotiate and come up with taxation rules that do not penalize debt restructurings and debt reductions for debtors and creditors. This will also reduce the costs associated with administration as companies would consider out of court settlements, and,

- Support for SME restructuring - The government can also consider implementing support programs including legal, business, and financial advice in the development of restructuring plans for businesses, as well as financial support for the restructuring.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.