Education Investment Plans in Kenya, & Cytonn Weekly #07/2020

By Cytonn Research, Feb 16, 2020

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed, with the subscription rate coming in at 195.8%, down from 217.4% the previous week. The oversubscription is partly attributable to favorable liquidity in the money market during the week due to the ongoing government payments. We note that the 364-day paper continued to receive the most interest from investors, having recorded the highest subscription rate of the 3 papers, at 379.0%. During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum Retail Prices in Kenya for the period 15th February 2020 to 14th March 2020. Petrol prices have increased by 2.4% to Kshs 113.9 per litre, from Kshs 111.2 per litre previously, while diesel prices have increased by 2.1% to Kshs 104.4 per litre, from Kshs 102.3 per litre previously. Kerosene prices, however, decreased by 1.2% to Kshs 102.7 per litre, from Kshs 104.0 per litre previously;

Equities

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 3.7%, 1.7% and 2.9%, respectively, taking their YTD performance to losses of 2.4%, 2.0% and 2.3%, for the NASI, NSE 20 and NSE 25, respectively. During the week, Barclays Bank of Kenya officially commenced trading on the Nairobi Securities Exchange (NSE) as ABSA Bank Kenya Plc, after the bourse temporarily suspended the trading of the lender’s shares to allow the settlement of outstanding obligations as well as change of its trading ticker code, as the lender finalized its brand transition. The rebranding brought an end to a process that began in 2018, following Barclays Plc’s reduction of its stake in Barclays Africa Group from 62.0% to 15.0%;

Real Estate

During the week, local microfinance company, Harambee Sacco, announced plans to facilitate construction of a thousand homes based on a loan facility from the Kenya Mortgage Refinancing Company (KMRC) amounting to Kshs 3.0 bn, while Housing Principal Secretary, Mr. Charles Hinga, announced plans to harmonize building approval processes across the counties amidst decline in activity owing to delays;

Focus of the Week

This week, we seek to enlighten the market on education investment plans, why one should invest in an education plan, some of the options available for investors and the various factors that come into play when selecting an education plan. We also focus on asset allocation strategies that fund managers employ when investing the funds in education investment plans;

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.1% p.a. To subscribe, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.5% p.a. To subscribe, email us at sales@cytonn.com;

- Rodney Omukhulu, Assistant Investments Analyst, Cytonn Investments was interviewed by CNBC as they discussed current matters affecting the economy. Watch Rodney here

- Michael Obaga, Senior Investments Consultant, Cytonn Investments was interviewed by CNBC. They talked about Kenya's rise in economic diversity survey. Watch Michael here

- Daniel Mainye, Senior Manager Technology and Innovation at Cytonn Investments was interviewed by KBC Channel 1 where they discussed the role of ICT in business development. Watch Daniel here

- Michael Obaga, Senior Investments Consultant, Cytonn Investments was interviewed by Metropol TV where they talked about fixed income investments. Watch Michael here

- Having completed and handed over Phase 1 of The Alma, and on track to hand over Phase 2, we have now turned our attention towards construction of The Ridge in Ridgeways. The Ridge is Cytonn’s 800-unit residential mixed-use development on the Northern Bypass. For more information please email us at sales@cytonn.com;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills were oversubscribed, with the subscription rate coming in at 195.8%, down from 217.4% the previous week. The oversubscription is partly attributable to favorable liquidity in the money market during the week due to the ongoing government payments. We note that the 364-day paper continued to receive the most interest from investors, having recorded the highest subscription rate of the 3 papers, at 379.0%. This is attributable to the market currently pricing that the government will be under pressure to meet its domestic target and as such a bias to shorter-dated papers in order to avoid duration risk, which has seen most investors still keen on the primary fixed income market, finding the 364-day T-bill more attractive on a risk-adjusted return basis. The yield on the 91-day, 182-day, and 364-day papers remained unchanged at 7.3%, 8.3% and 9.9%, respectively. The acceptance rate rose to 64.2%, from 53.6% recorded the previous week, with the government accepting Kshs 30.2 bn of the Kshs 47.0 bn bids received.

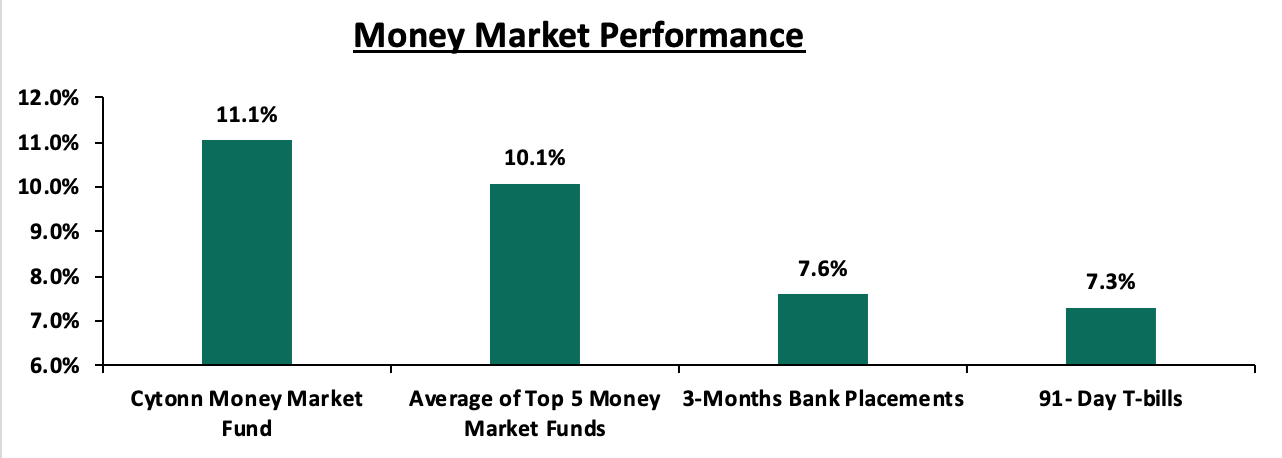

In the money markets, 3-month bank placements ended the week at 7.6% (based on what we have been offered by various banks), the 91-day T-bill came in at 7.3%, while the average of Top 5 Money Market Funds came in at 10.1%, unchanged from the previous week. The yield on the Cytonn Money Market came in at 11.1%, unchanged from the previous week.

During the week, the Capital Markets Authority, CMA, announced that it “has given a no-objection to a 28-day moratorium to enable the fund manager, Amana Capital Ltd (ACL), work with its Trustee to improve its liquidity position to meet redemption obligations to unit holders with investments in the Amana Shilling Fund.” This effectively means that unit holders cannot withdraw their funds. While the intention here is good, we think that closing of banks, financial institutions and investment funds facing challenges makes it even harder to find a resolution. It would have been better to seek solutions with the funds open because, once closed, reopening a fund becomes even more difficult, and should it reopen investors are likely to rush for the doors. The most optimal solution in our view would have been to oversee a very quick sale process of the troubled fund to a stronger fund manager take over the fund, write down the value of each Amana investor’s value to reflect the value of good assets, do a unit swap of Amana units with units of the new fund manager, and then allow them phased withdrawals after a lock in period.

Liquidity:

During the week, the average interbank rate decreased to 4.4%, from 5.0% recorded the previous week, pointing to increased liquidity in the money markets. Commercial banks’ excess reserves came in at Kshs 21.5 bn in relation to the 5.25% cash reserves requirement (CRR). The average interbank volumes decreased by 64.0% to Kshs 3.2 bn, from Kshs 8.9 bn recorded the previous week.

Kenya Eurobonds:

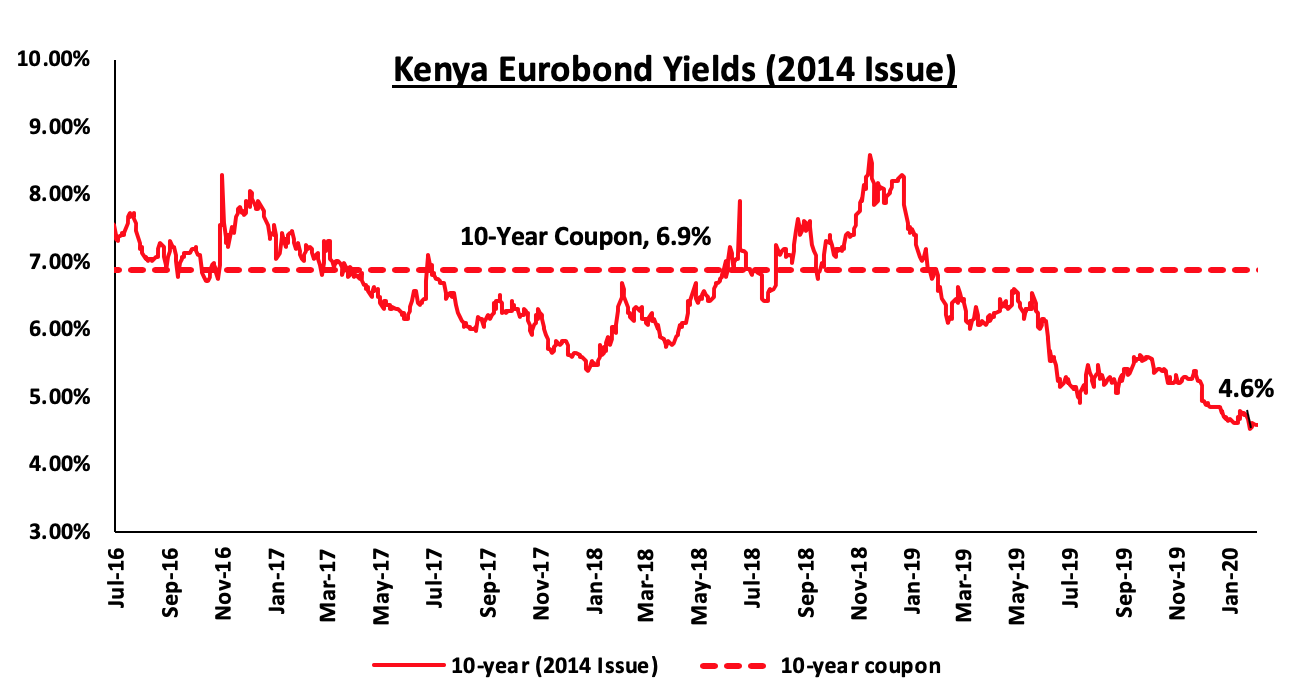

According to Reuters, the yield on the 10-year Eurobond issued in June 2014 increased marginally by 0.1% points to 4.6%, from 4.5% recorded the previous week. This is an indication that investors are not attaching a higher risk premium on the country.

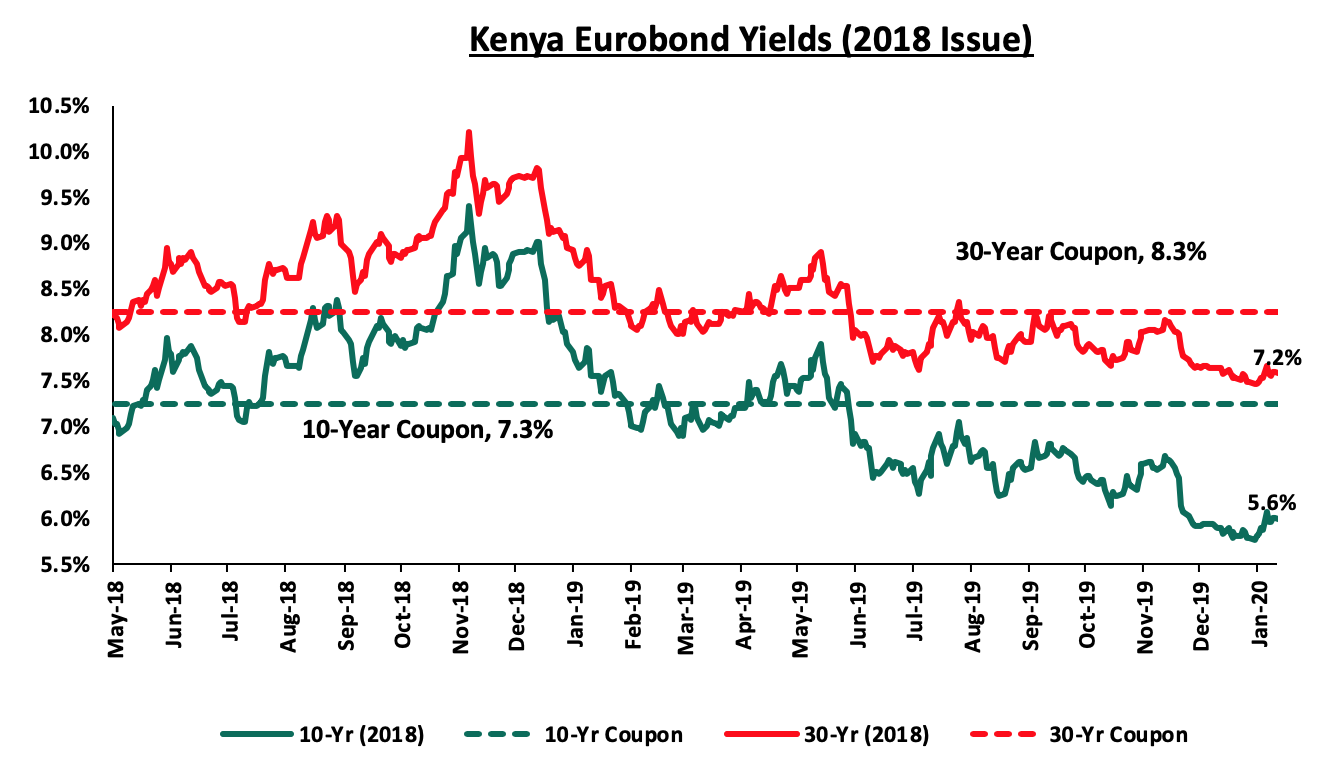

During the week, the yields on the 10-year Eurobond decreased by 0.1% points to 5.6%, from 5.7% seen the previous week, while that of the 30-year Eurobond remained unchanged at 7.2%, similar to what was recorded the previous week.

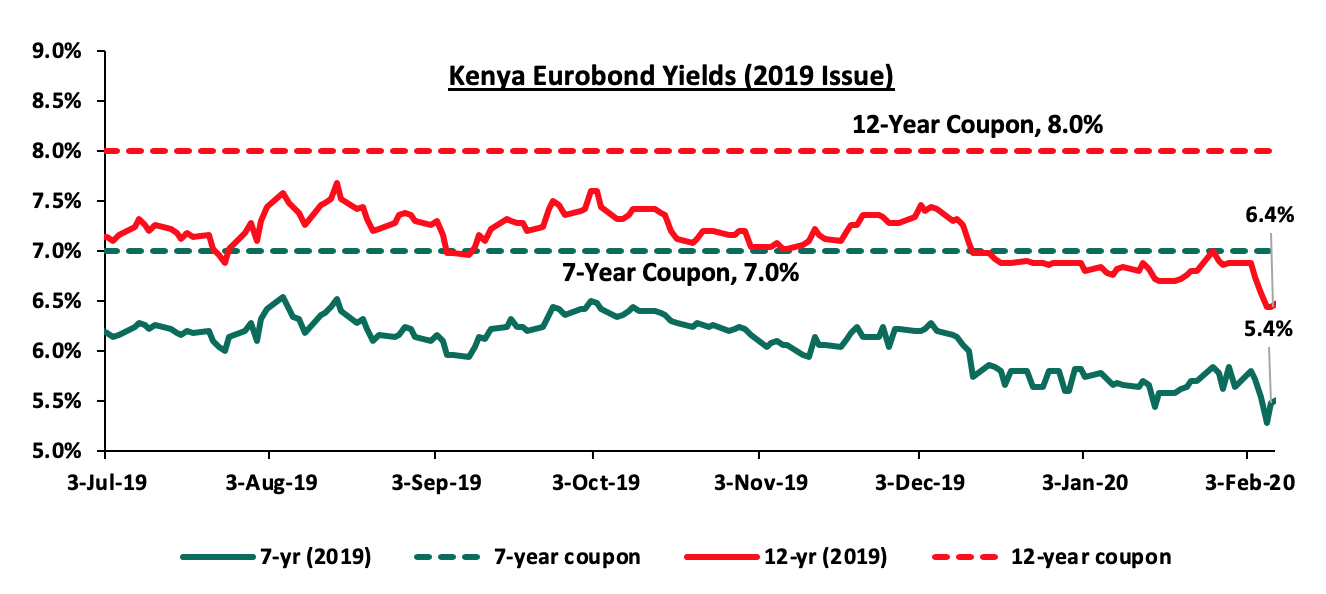

During the week, the yield on the 7-year Eurobond decreased by 0.1% points to 5.4%, from 5.5% recorded the previous week. The yield on the 12-year Eurobond remained unchanged at 6.4% similar to what was recorded the previous week.

Kenya Shilling:

The Kenya Shilling depreciated by 0.1% against the US Dollar during the week to Kshs 100.6, from Kshs 100.4 recorded last week, mostly supported by increased dollar demand by merchandise and corporate importers as well as increased liquidity in the money market. On a YTD basis, the shilling has appreciated by 0.7% against the dollar, in comparison to the 0.5% appreciation in 2019. In our view, the shilling should remain relatively stable against the dollar in the short term with a bias to a 2.4% depreciation by the end of 2020, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that Kenya’s current account deficit was equivalent to 4.6% of GDP in 2019, from 5.0% recorded in 2018. This was mainly driven by lower imports of SGR-related equipment, resilient diaspora remittances which cumulatively stood at USD 2.8 bn in December 2019, a 3.7% increase from the USD 2.7 bn recorded in December 2018, and strong receipts from transport and tourism services with preliminary data indicating that the number of tourists landing in the country stood at 132,019 in month of December 2019, which was a 9.0% increase, compared to the 121,070 recorded in November 2019,

- High levels of forex reserves, currently at USD 8.5 bn (equivalent to 5.2-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- Foreign capital inflows, with investors looking to participate in the domestic equities market, and,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars. During the week, the CBK had to mop up Kshs 15.0 bn through repurchase agreements to ease liquidity in the market.

We, however, expect pressure on the shilling to arise from:

- Subdued diaspora remittances growth following the close of the 10.0% tax amnesty window in July 2019, which has seen cumulative diaspora remittances increase by a 3.7% in the 12-months to December 2019 to USD 2.8 bn, from USD 2.7 bn in 2018.

Weekly Highlight:

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum Retail Prices in Kenya for the period 15th February 2020 to 14th March 2020. Below are the key take-outs from the statement:

- Petrol prices have increased by 2.4% to Kshs 113.9 per litre from Kshs 111.2 per litre previously, while diesel prices have increased by 2.1% to Kshs 104.4 per litre from Kshs 102.3 per litre. Kerosene prices have however decreased by 1.2% to Kshs 102.7 per litre from 104.0 per litre, previously,

- The changes in prices have been attributed to the increase in the average landing cost of imported super petrol by 3.9% to USD 489.4 per ton in January 2020 from USD 471.0 per ton in December 2019. Landing costs for diesel and kerosene also increased by 2.7% and 2.6% to USD 506.9 per ton and USD 495.3 per ton in January 2020, respectively, from USD 493.7 per ton and USD 508.8 per ton in December 2019, and,

- A 2.1%, decrease in Free on Board (FOB) price of Murban crude oil lifted in January 2020 to USD 67.8 per barrel, from USD 69.3 per barrel in December 2019.

We expect an increase in the transport index, which carries a weighting of 8.7% in the total consumer price index (CPI), due to the increase in petrol and diesel prices. Consequently, the increase in the transport index will increase inflationary pressures.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 23.3% ahead of its domestic borrowing target, having borrowed Kshs 244.0 bn against a pro-rated target of Kshs 196.4 bn. We expect an improvement in private sector credit growth considering the repeal of the interest rate cap. This will result in increased competition for bank funds from both the private and public sectors, resulting in upward pressure on interest rates. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 3.7%, 1.7% and 2.9%, respectively, taking their YTD performance to losses of 2.4%, 2.0% and 2.3%, for the NASI, NSE 20 and NSE 25, respectively. The performance in NASI was driven by losses recorded by large-cap stocks such as Bamburi, Safaricom, DTBK, and Equity of 6.9%, 5.8%, 5.5% and 3.9%, respectively.

Equities turnover decreased by 8.3% during the week to USD 32.6 mn, from USD 35.6 mn recorded the previous week, taking the YTD turnover to USD 190.1 mn. Foreign investors turned net sellers for the week, with a net selling position of USD 9.6 mn from a net buying position of USD 1.1 mn recorded the previous week.

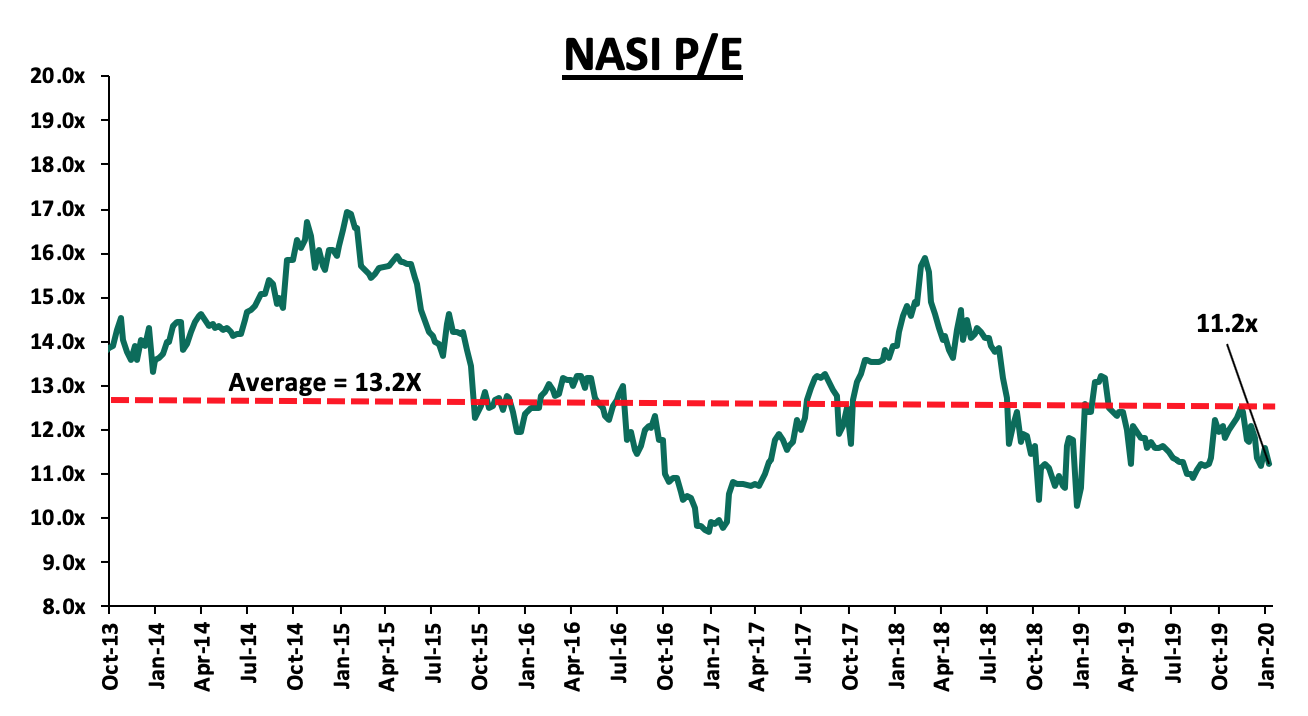

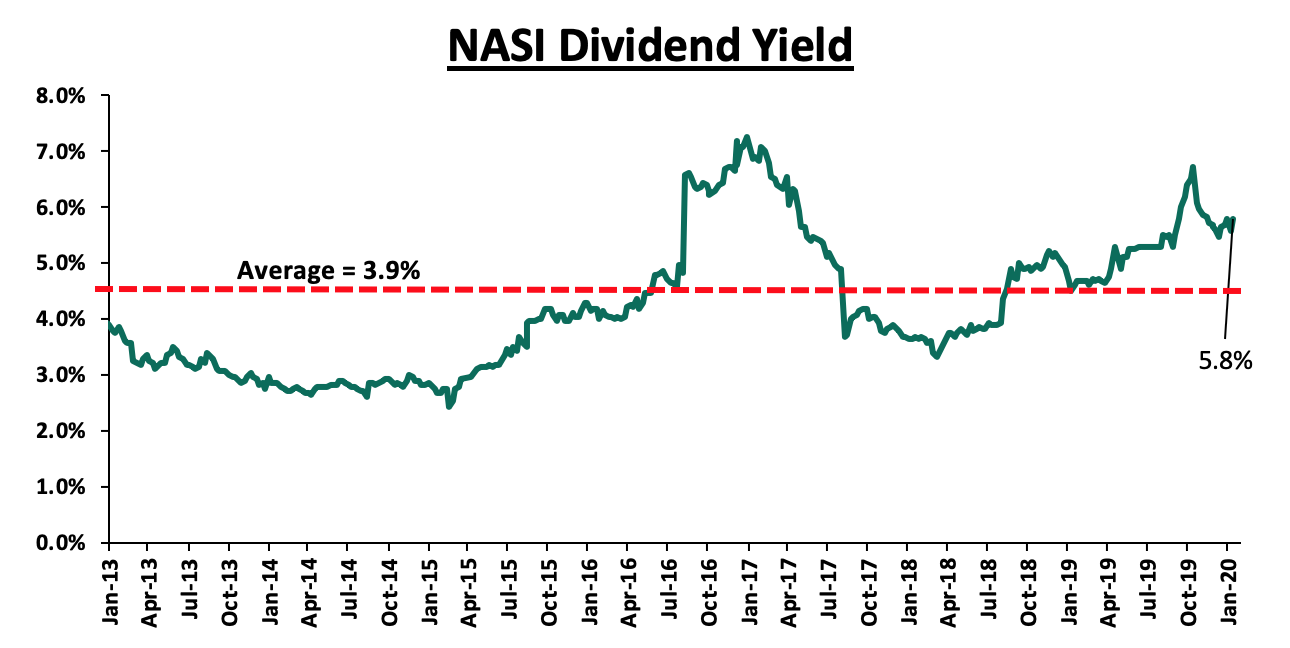

The market is currently trading at a price to earnings ratio (P/E) of 11.2x, 15.1% below the historical average of 13.2x, and a dividend yield of 5.8%, 1.9% points above the historical average of 3.9%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 11.2x is 15.9% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 35.4% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, Barclays Bank of Kenya officially commenced trading on the Nairobi Securities Exchange (NSE) as ABSA Bank Kenya Plc, after the bourse temporarily suspended the trading of the lender’s shares to allow the settlement of outstanding obligations as well as change of its trading ticker code, as the lender finalized its brand transition. The rebranding brought an end to a process that began in 2018, following Barclays Plc’s reduction of its stake in Barclays Africa Group from 62.0% to 15.0%. As at Q3’2019, Barclays disclosed that it had spent Kshs 910.0 mn in rebranding expenses in the nine months to September 2019. Additionally, in December 2019, Barclays Kenya hired an additional 463 employees on permanent contracts and 700 workers on contract basis, as the company sought to fast track its growth in the market following the removal of interest rate caps. Currently, most of the bank’s branches around the country have adopted the new corporate identity, logo and brand name, beating its initial rebranding deadline set for June 2020. We expect the exercise to positively impact the bank’s image, as the lender takes advantage of the transition to refocus its strategy. However, we expect that its bottom-line performance will take a hit as a result of rebranding costs incurred.

Universe of Coverage

|

Banks |

Price at 07/02/2020 |

Price at 14/02/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

114.5 |

108.3 |

(5.5%) |

(0.7%) |

109.0 |

189.0 |

2.4% |

77.0% |

0.5x |

Buy |

|

Kenya Reinsurance |

3.0 |

3.0 |

0.0% |

(1.3%) |

3.0 |

4.8 |

15.1% |

75.6% |

0.3x |

Buy |

|

I&M Holdings*** |

55.5 |

53.3 |

(4.1%) |

(1.4%) |

54.0 |

75.2 |

7.3% |

48.5% |

0.9x |

Buy |

|

KCB Group*** |

51.3 |

50.5 |

(1.5%) |

(6.5%) |

54.0 |

64.2 |

6.9% |

34.1% |

1.4x |

Buy |

|

Jubilee Holdings |

352.0 |

355.8 |

1.1% |

1.4% |

351.0 |

453.4 |

2.5% |

30.0% |

1.2x |

Buy |

|

Co-op Bank*** |

14.9 |

15.0 |

1.0% |

(8.3%) |

16.4 |

18.1 |

6.7% |

27.3% |

1.3x |

Buy |

|

Sanlam |

17.7 |

18.0 |

1.7% |

4.7% |

17.2 |

21.7 |

0.0% |

20.6% |

0.7x |

Buy |

|

Equity Group*** |

52.0 |

50.0 |

(3.9%) |

(6.6%) |

53.5 |

56.7 |

4.0% |

17.5% |

1.9x |

Accumulate |

|

Standard Chartered |

206.0 |

200.0 |

(2.9%) |

(1.2%) |

202.5 |

211.6 |

9.5% |

15.3% |

1.5x |

Accumulate |

|

Liberty Holdings |

9.5 |

9.5 |

0.2% |

(8.0%) |

10.4 |

10.1 |

5.3% |

11.0% |

0.8x |

Accumulate |

|

CIC Group |

2.6 |

2.6 |

(1.9%) |

(4.1%) |

2.7 |

2.6 |

5.1% |

7.7% |

0.9x |

Hold |

|

NCBA |

36.4 |

35.9 |

(1.5%) |

(2.7%) |

36.9 |

37.0 |

4.2% |

7.4% |

0.8x |

Hold |

|

ABSA Bank*** |

13.4 |

13.4 |

0.0% |

0.0% |

13.4 |

13.0 |

8.2% |

5.6% |

1.7x |

Hold |

|

Stanbic Holdings |

105.3 |

105.3 |

0.0% |

(3.7%) |

109.3 |

103.1 |

4.6% |

2.5% |

1.1x |

Lighten |

|

Britam |

8.7 |

8.7 |

0.5% |

(3.3%) |

9.0 |

6.8 |

0.0% |

(22.4%) |

0.9x |

Sell |

|

HF Group |

5.8 |

5.8 |

0.0% |

(10.8%) |

6.5 |

4.2 |

0.0% |

(27.1%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

During the week, Housing Principal Secretary, Mr. Charles Hinga, announced the Kenyan Government’s plans to streamline building approval processes and fees across the 47 counties. This follows lobbying from real estate stakeholders in a bid to improve processes in the construction environment. The harmonization of building approval processes would enhance the developer experience across different counties and we expect this will encourage investment in different regions as well as efficiency of the e-permit system, which according to Architectural Association of Kenya (AAK), remained down for a prolonged period in 2019 across various counties, resulting to a slowdown in the construction sector’s growth which came in at 6.6% as at Q3’2019 in comparison to 7.0% growth in the same period in 2018 whereas cement consumption decreased to 1.4 mn tons in 2019 from 1.5 mn tons in 2018, demonstrating the continued decline of activity in the construction sector. Notable affected projects include Lordship Africa’s 88 Apartments in Upperhill and Mida Vida apartments in Garden City, along Thika Road, whose construction permits have been in delay for at least eight months. Such massive delays often lead to cost increments and loss of revenue while also leading to some developers flouting the approval requirements, thus contributing to the construction of illegal structures. In addition, the tedious process, which also tends to be ambiguous, creates a barrier for potential investors, thus discouraging investment. However, we continue to see stakeholders working towards improving the system such as the recently launched Buildhub Portal, by Architectural Association of Kenya, which seeks to create an efficient system with consolidated information regarding approvals and permits such as the processes followed, fees, and requirements, for the public and also for developers to track their applications. With such strides being made by both private and public sector stakeholders, we therefore, expect the built environment to continue picking up coupled by (i) continued foreign investments, (ii) improved infrastructure, and (iii) expanding middle class, which is expected to grow by a 4-year CAGR of 5.6%, in Nairobi alone, according to research firm, Sagaci.

Nairobi County Government continues to gain momentum in the development of its affordable housing projects. According to the Housing Ministry, construction of Jevanjee Estate is set to start soon (dates undisclosed), marking the third of the seven flagship projects under the Nairobi Urban Renewal Project. The project will have a total of 1,800 units at an estimated cost of Kshs 9.1 bn, with the contract having been awarded to Jabavu Limited, a Ugandan-based real estate developer, in 2016. Upon completion, the eighty initial tenants are guaranteed allocation priority while the rest 1,720 units will be acquired through a tenant purchase scheme at approximately Kshs 8,000 per month for a period of 30 years. This follows the completion of Phase I of the New Ngara Project and the Pangani project, whose first phase is set for completion in 45 weeks. Other upcoming projects include Old Ngara, Ngong Road Phase I and II, Uhuru Estate, and Suna Road. Upon completion, the urban renewal programme will deliver 100,000 units in the county with the projects designed to bridge the gap between demand and supply for housing in the county where less than 35,000 new homes are constructed annually, barely meeting the demand estimated to grow at 120,000 every year, thereby causing a rapid rise in informal settlements.

Also during the week, local microfinance institution, Harambee Sacco, announced plans to facilitate the construction of a 1,000 affordable housing units following the extension of a Kshs 3.0 bn loan facility from the Kenya Mortgage Refinancing Company (KMRC), marking the secondary mortgage company’s first portfolio. The loan will be used for on-lending to the Sacco’s members, at interest rates of below 10.0% and repayment periods of 15 to 20-years. According to our KMRC Topical, extending loan repayment period from the current average of 12-years, as reported by Central Bank of Kenya, to 20-years will reduce the monthly mortgage repayments by approximately 14.0%, making mortgages more affordable. Overall, KMRC is expected to provide a major boost for the state’s Affordable Housing agenda by helping lending institutions to offer affordable mortgages to low-income populations. So far, the institution has mobilized capital from local institutions and multinational institutions such as the World Bank and African Development Bank (AfDB) and it’s expected that the company will stimulate the local mortgage market by 4,000 new mortgages, directly impacting 24,000 beneficiaries.

We expect affordable housing to continue shaping the real estate sector in the short-term as demand continues to grow supported by a rapidly growing population amidst prevailing low incomes for majority of Kenyans. To this end, we expect to continue seeing the government make efforts to streamline the construction environment processes in a bid to encourage engagement from the private sector in realizing the affordable housing initiative.

This week, we seek to analyze education investment plans, why one should invest in an education plan, some of the options available for investors and the various factors that come into play when selecting an education plan. We also focus on asset allocation strategies that fund managers employ when investing the funds in education investment plans. We do this in six sections as follows:

- Background of Education Sector and Laying of Context,

- Enrolment and Literacy Statistics Globally and in Kenya,

- Constitution of Education Investment Plans,

- Key Things to Consider before Joining an Education Investment Plan,

- Alternatives to Education Investment Plans, and

- Conclusion

Section 1: Background of Education Sector and Laying of Context

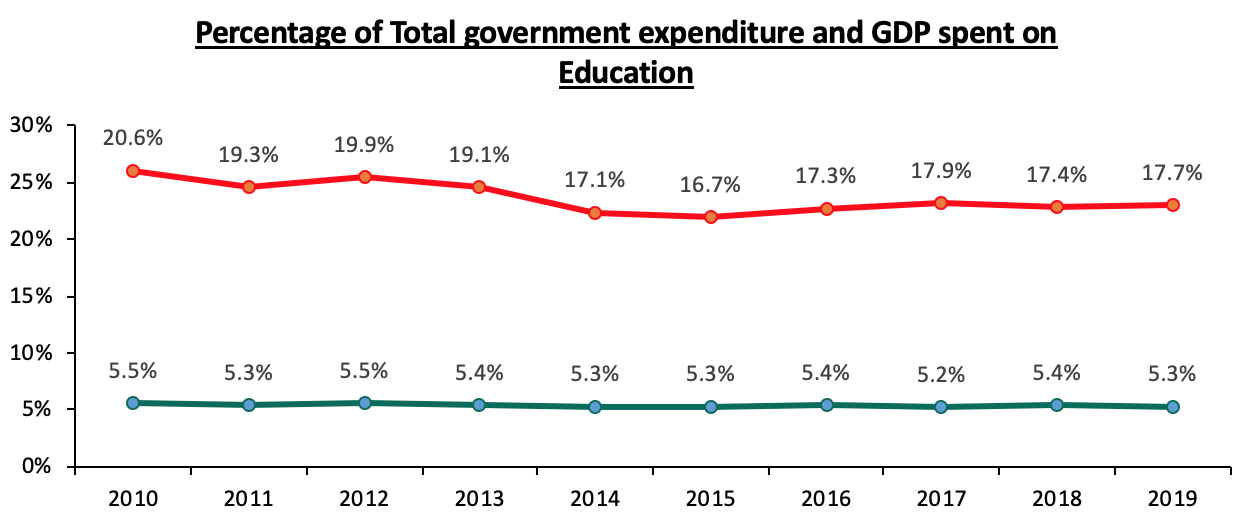

Education is a key aspect in any economy, with the Kenyan government making significant allocations towards education expenditure in every fiscal year. Over the last 10-years, the budgetary allocation towards education expenditure as a percentage of GDP has been averaging over 5.3%. According to the FY’2019/20 budget reading, the education sector received a significant share of government spending at Kshs 494.8 bn, out of the total budget of Kshs 2.8 tn, (equivalent to 17.7%). According to the 2020 Budget Policy Statement, this is expected to increase to Kshs 497.8 bn in FY’2020/21, Kshs 528.4 bn in FY’2021/22 and to Kshs 544.2 bn in FY’2022/23.

Below is a chart showing a percentage of education expenditure against total government expenditure (red line) and against GDP (green line):

Education enables citizens to get better jobs in the market and empower those who do not get employed to start their own businesses. The skills equipped by secondary and university education especially are enough to make one self-sufficient. Employment on the other hand empowers Kenyans to improve their standards of living and collectively that of the nation... There is no limit to the potential that education holds hence why the government continually spends on the sector. This has increased access to quality basic education and improved the outcomes of our public schools as seen in high literacy levels ranking among peer nations. In particular, Kenya has the highest rate of primary-to-secondary school transition, which is currently close to 100.0%. Education however has a huge cost implication that needs addressing. With primary education being mostly free, it is post-primary education that many guardians need to save for to enable their children gain quality education, hence the need for education investment plans.

Section 2: Enrolment and Literacy Statistics Globally and in Kenya

Literacy level refers to the total number of people in a country or region who are able to read and write. Kenya has had a high literacy level from the beginning of century to date currently estimated at 82.0%. This may be attributed to the free primary introduction and the importance that its citizens place on education.

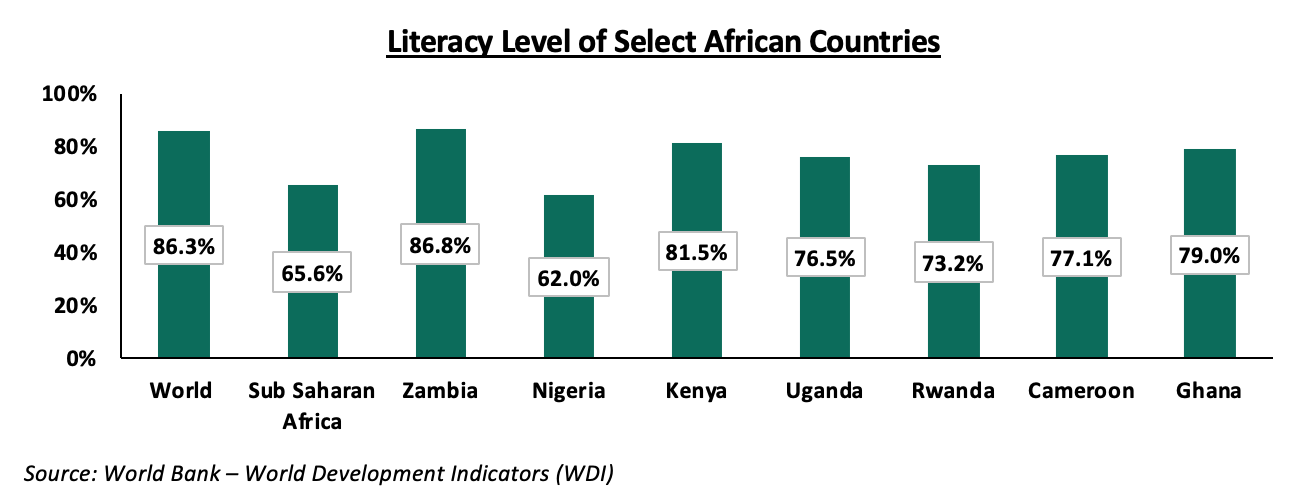

The graph below shows the literacy level of select African countries and the Sub-Saharan and the world averages.

Kenya has a literacy level of 81.5%, which is higher than the other select African countries except for Zambia, which has about 86.8%. The world average is 86.3% while the Sub Saharan average is 65.6%.

The biggest constraint to quality education, however, has been the cost implication on guardians. The introduction of free compulsory primary school education during the previous regime has offered some reprieve to guardians, albeit minor. They still had to contend with costs such as purchase of books and reading material, exam fees, boarding fees and others. On top of it, this waiver of tuition fees drove an influx of students to public schools, causing an issue of overcrowding and in effect deterioration of the quality of education. Most guardians opted to go the private school route, despite being costly, to ensure their children get the best education.

Recently, there has been a stagnation and further decline in the number of students joining universities from secondary schools. This has put pressure on public universities’ cash flows causing various public universities to start focusing more on parallel programs in order to avoid revenue shortfalls. This raises fear that the cost of university education may become significantly higher in the next five to ten years. On top of that, the alternative, parallel programs, is more expensive than government-sponsored courses.

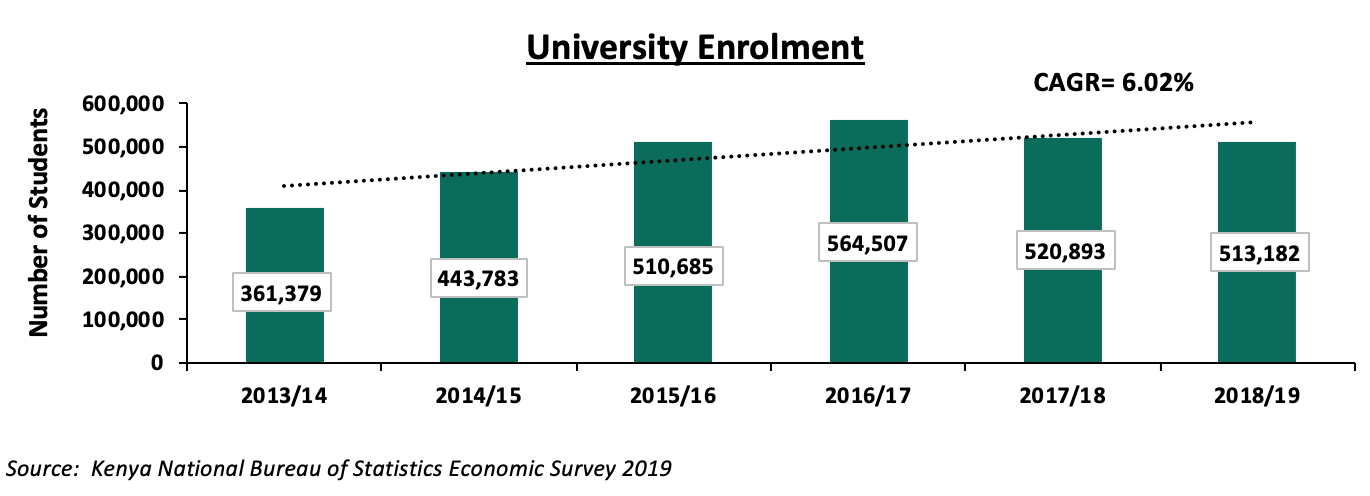

Below is graph showing university enrolment numbers in the last 6 years as researched by Kenya National Bureau of Statistics:

Companies in the financial services sector have taken the opportunity to address these issues by tailoring products (Education Investment Plans), aimed at helping parents save and invest with the goal of securing their children’s education.

Section 3: Constitution of Education Investment Plans

Education Investment Plans are medium to long-term mutual funds promoted by a financial institution, usually an insurance company or an asset manager. In terms of structures, Education Investment Plans are easily distinguishable in that they often have a lock-in period of investment whereby the guardian is required to make periodic contributions, usually monthly. These funds then gain interest and help the contributor attain their financial goals. The beneficiary of the funds could be a dependent or one may save for their own education.

Education Investment Plans have a relatively longer lock-in period, which help to promote investor discipline. Ideally, an investment plan that caters for a long-time goal should have low liquidity. In Kenya, most market players have set the minimum tenor at 5years. This serves the logic that most parents and guardians save for secondary and university education and they often start saving early on. The plans require a minimum monthly investment amount ranging from Kshs 1,500 to Kshs 7,000. However, the payments are flexible in that one may pay monthly, quarterly, semiannually or annually.

Below is a list of some of the existing education plans in Kenya:

|

Education Plan |

Minimum Investment Period |

Minimum Investment Amount |

Interest Rate per annum |

Minimum Sum Assured |

Life Cover Benefits |

|||||

|

Jubilee Career Life Plan |

5 Years |

Kshs 5,000 |

5.6% |

Kshs 350,000 |

|

|||||

|

Liberty Scholar Plan |

15 Years |

Kshs 1,500 |

No interest rate. Bonuses payable |

Kshs 200,000 |

|

|||||

|

Liberty Educator Plan |

10 – 20 Years |

Kshs 1.000 |

No interest rate. Bonuses payable |

Kshs 200,000 |

|

|||||

|

Britam Elimu Bora Education Policy |

7 – 18 Years |

Kshs 1,500 |

10% |

Varies according to contributions |

|

|||||

|

Madison Bima Ya Karo |

10 – 18 Years |

Kshs 2,500 |

2% (Guaranteed) |

Kshs 119,000 (May vary according to Age) |

|

|||||

|

Madison Uniplan |

5 – 15 Years |

Kshs 5,000* |

5% (Guaranteed) |

Kshs 394,000 |

|

|||||

|

Capex Masomo Cover |

5 – 20 years |

Kshs 2,000 |

6% |

Kshs 120,000 |

|

|||||

|

CIC Academia Policy |

5 Years |

Kshs 2,000 |

5.8% |

Vary according to age |

|

|||||

|

Wanafunzi Trust by Nabo |

4 Years |

Kshs |

8.4% |

No life cover |

N/A |

|||||

|

Cytonn Sharp Education Investment Plan (SEIP) |

3 – 10 Years |

Kshs 100,000** |

15% |

No life cover |

N/A |

|||||

|

*Kshs 5,000 minimum investment comes with a term condition of minimum of 6-years (Madison Uniplan) ** This is a privately offered and distributed product, hence the higher minimum amount to comply with Reg. 21 |

||||||||||

From the above table, the below are the key take-outs:

- Insurance companies all provide life insurance together with their education policies. The sum assured in this case refers to the amount that is paid out to a client’s next of kin should they die. This amount varies with the monthly contribution amount and the tenor of investment. These insurance companies incorporate life insurance premiums into the monthly payments in order to avoid clients making two separate payments,

- Insurance Companies however, offer less returns than education products by investment managers. This is mainly because education policies in insurance companies are taken as more of a savings plan rather than an investment plan,

- The minimum investment amounts vary from Kshs 1,500 to Kshs 5,000

Life cover does not refer to a lump sum paid upon death (sum assured); Instead, the life cover comes with extra benefits called riders. The riders include:

- Last Expense – Upon death, the surviving beneficiaries are paid an amount, usually about Kshs. 100,000, within three days to help cater for funeral expenses,

- Permanent and Total Disability (PTD) – This benefit accrues to when the client suffers a disability hence affecting their ability to continue contributing to the education policy. The client is offered a lump sum and given their funds plus accumulated interest,

- Accidental Life Cover – This refers to when a client passes away in a purely accidental manner. The beneficiaries are paid a lump sum on top of the funds already saved,

- Natural Death – Natural death life cover refers to when a client dies form natural causes such a disease. The difference between natural death and accidental life cover is that in natural death the beneficiaries have to produce a death certificate and other documents confirming cause of death. The processing of these documents may take two months or longer, and,

- Family Income Benefit –This rider provides a monthly income for the family after the client passes away until the policy matures.

Education policies offer flexibility in that a client may choose to contribute monthly, quarterly, semiannually or annually. If a client is able to, it is advisable to pay annually in arrears, as the interest accrued for the year will be higher.

Lastly, Kenya also has a tax incentive for Education Plans but with the condition that one must save for a minimum of 10-years. The tax incentive allows for tax-deductible contributions of up to Kshs. 5,000 per month.

Recently, we have seen the monopoly set by insurance firms challenged with new entrants into the market. In 2019, Nabo Capital launched Wanafunzi Investment Unit Trust Fund, which allowed students to save for their own education. Unlike the other education policies that are offered by insurance companies, Nabo Capital is an investment firm. Cytonn also provides its own education plan, Cytonn Sharp Education Investment Plan that offers a return of 15% per annum with a lock-in period of 3 years, but the product is a privately placed product.

Section 4: Key Things to Consider before Joining an Education Investment Plan

According to research done by Cytonn on priorities accorded to various household expenditures, food is the first ranked priority at 81.9%, followed by rent with 67.3%, then school fees with 29.6%, transport at 27.1% and the least prioritized is entertainment with 3.9%. School fees herein represent expenditure on education; add to it the costs of student accommodation and reading materials and the total expenditure rises even further. Bearing in mind these costs, a guardian has to choose an education plan that can provide safety, preservation and growth. The following are key factors to consider:

- Financial Profile of Investor: This refers to the different and unique characteristics each investor has. Age is an important factor to consider before making any investment decisions as it affects both the time horizon of an investment that an investor is willing to take and their risk appetite. A young couple with a young child can choose to invest in a longer education plan, while an older couple with more mature children does not have the need for saving for such a long time. A longer tenor also affords the younger couple the opportunity to have a more aggressive portfolio as they have more time to recover any lost potential returns. It is also key for guardians to profile themselves based on the financial goals they hope to achieve with the investment plan. If they want to invest for a short period they should consider other investment vehicles whereas if they would like a longer-term investment then education investment plans are the best option for them,

- Issuer: It is especially crucial when seeking a financial partner to do a background check with a keen focus on returns offered. Education plans are often long-term investments that are hard to get out of. One should think about whether to buy an insurance based product or an investment manager based product,

- Inflation: The value of money now is higher than a similar amount in the future due to the effect of inflation; to ensure that you preserve the strength of your education savings, it is important that you save in a plan that offers above-inflation interest rates. Inflation refers to the continuous rise in prices of commodities and services. This means that if you were saving towards university fees, say Kshs 1 mn, then the fees in 10 years would be higher for the same service. It is recommendable to have a financial goal higher than the current market conditions. Guardians should also save their money with an issuer who offers interest rates significantly higher than inflation rates to cushion inflationary effects,

- What to Do With Funds When The Kid is In School: When the term of the education plan comes to an end and the dependent is going to his or her desired college, it is highly probable that the matured funds will be more than enough to cater for the college fees. The guardian can either choose to pay the school a lump sum or alternatively pay the fees for the current year or invest the rest in a liquid investment product,

- Additional Benefits: Most education plan are provided by insurance companies. The insurance companies offer their education policies clients with the additional benefits of life cover which is sometimes subject to payment of an additional premium. Life insurance serves to provide financial protection to the loved ones left behind and it is important to consider before saving in a plan. The guardian may also choose to have the education plan and the life cover separately with different firms,

- Early Withdrawal: One key area that an education policy client should be able to appreciate is the fact that as a medium-long term investment, it is difficult to have early access to all of your funds anytime as one wishes. In education policies offered by insurance companies, there is a term known as surrender value. This is the amount that one stands to be paid should they wish to withdraw early on in their policy before maturity and this value is usually significantly less than the aggregate contributions. However, there is an option called ‘Paid up’ which allows the client to no longer contribute monthly payments without penalties. To better understand, we shall take an example of plan offered by a market player, ABCD education policy: For this policy the minimum tenor is 5 years; however, for a client who has faithfully contributed every month (or quarterly, semiannually or annually) for 3 years they are offered the Paid Up option. Should they choose this option, for the remaining 2 years, their money will continue earning interest but they will not be required to contribute.

Section 5: Alternatives to Education Investment Plans

Education Investment Plans are versatile investment avenues that cater for clients of varying risk appetites. However, to save for education one does not have to use a purely education-oriented product.

Other ways of saving for education other than Education Investment Plans include:

- Money Market Fund: A money market fund is a short-term investment vehicle that offers high liquidity as the lock-in period is usually short and withdrawal is easy (most money market funds typically allow redemption within four working days). However, there is no tax benefits associated with money market funds, however the higher rates of returns more than compensate for the lack of tax benefits. Additionally, money market funds offer easy withdrawal that allow you to redeem regularly say, every term or semester or to cover educational emergencies that may arise in the course of the investment period. However, a specialized education based unit trust fund would likely limit withdrawals,

- Banks: Many banks in Kenya offer targeted savings account for saving for various goals including education. These accounts have seen a high uptake as many Kenyans consider banks to be safe options and fail to pay enough attention to the returns they get.

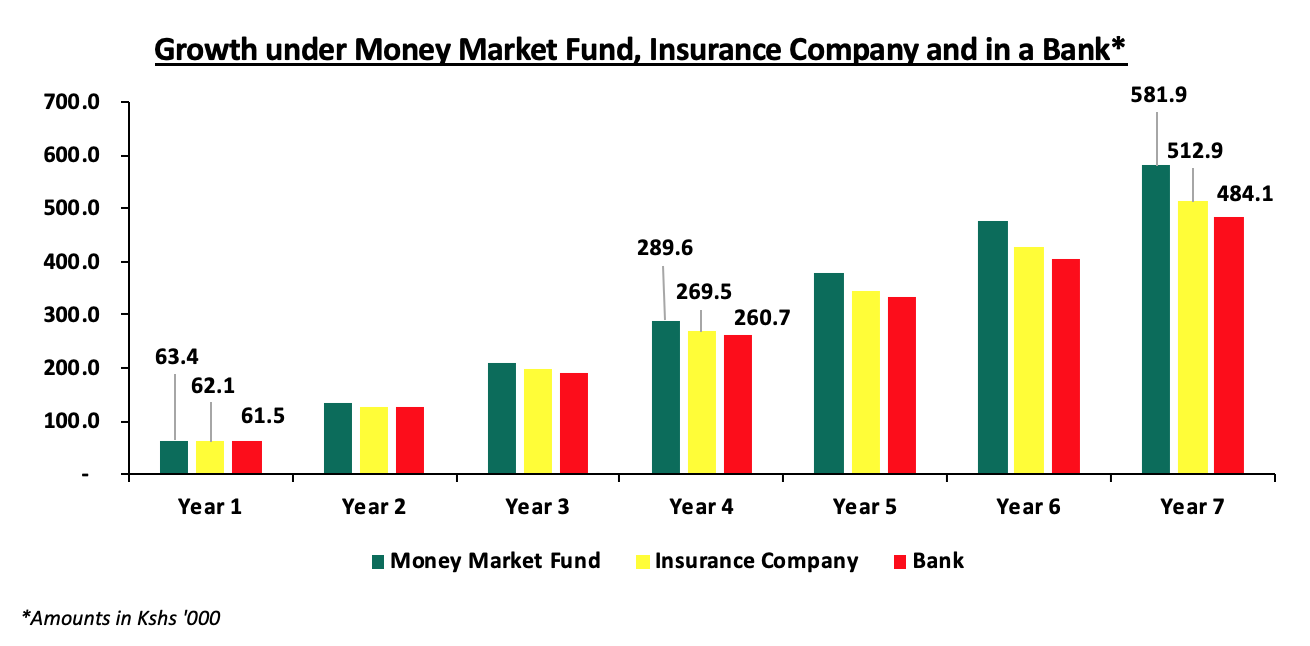

To illustrate the different returns one would get under various alternatives we have assumed a person who starts with an initial investment of Kshs 10,000 and makes monthly top-ups of Kshs 5,000 saves in a money market fund, with an insurance company and in a bank savings account. Below are the amounts at maturity they would get:

|

Analysis of Education Investment Plans |

||||||||||

|

|

Money Market Fund |

Insurance Company |

Bank |

|||||||

|

Initial Amount (Kshs) |

10,000 |

10,000 |

10,000 |

|||||||

|

Monthly Top-ups (Kshs) |

5,000 |

5,000 |

5,000 |

|||||||

|

Tenor (Years) |

7 |

7 |

7 |

|||||||

|

Rate of Return |

10.09% |

6.29% |

4.5% |

|||||||

|

Amount after Maturity (Kshs) |

581,877 |

512,893 |

484,066 |

|||||||

|

Sources: Money Market Fund Interest Rates – Effective annual interest rates of the top 5 money market funds i.e Cytonn, Zimele, Nabo Africa, Sanlam and AlphaAfrica Kaisha money market funds Insurance Company Interest Rates – Average rates of Jubilee, CIC, Madison, Capex and Britam education investment plans as provided in the table in Section 3 Bank Savings Rate – Central Bank of Kenya release, November 2019 More information: The figures at maturity are gross and no taxes have been applied, and the interest rates are compound interests. |

||||||||||

Evidently, the returns from saving in a money market fund are the highest. At the end of 7 years, saving in a money market fund will give returns of Kshs 581,877 compared to Kshs 512,893 and Kshs 484,066 when saving in an insurance education policy and in a bank savings account. A savings account should not just preserve your capital but it should grow with you and your needs.

It is essential that before making any investment decision to consult a financial advisor in order to better understand what you are getting into, before signing any binding agreement.

Section 6: Conclusion

Despite the economic uncertainties, guardians are still certain that they have to spend on their children’s education to secure them a brighter future. In order to do this, they have to plan their finances accordingly and one of the best avenues for this is in an Educational Investment Plans. Education Investment Plans are not used to safeguard a child’s education only but also, to save for one’s own further education like Masters.

Prominent benefits that an Education Investment Plan include:

- Shield Against Capital Erosion and Inflation Pressures - Investing in a plan that offers high yield (higher than yearly inflation rates) enables one to protect their savings from erosion, i.e. what happens when the interest rate your money is earning is less than inflation rate for a given year,

- Debt Management - An education investment plan may enable you order to avoid future loans that your children or dependent will have to pay as they start working such as Higher Education Loans Board (HELB) loans. Upon reaching university, the student will not find himself or herself in a situation where they have to take a loan for their studies, as the education investment plan would cater of that. This avails more cash to the students when they start working as the monthly HELB loan repayment amount may be saved or even invested,

- Serves as a Contingency Measure - With tough economic times affecting your business or job security not assured, a parent can rest assured that they will be able to provide for their dependent’s education should their source of income be affected, and

- Compound Interest Benefit – Most Education Investment Plans provided by fund managers earn compound interest. Compound Interest will make invested funds grow at a faster rate than simple interest, which is interest calculated only on the principal amount. Assuming an investment with an interest rate of 10%, for 5 years and an initial investment amount of Kshs 100,000 with no top ups, with simple interest the amount at maturity would be Kshs 150,000 while with compound interest the amount would be Kshs 164,861.

Most education savings plans are insurance-based, we suggest that guardians consider all options available in the market.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.