Kenya Mortgage Refinancing Company Update & Cytonn Weekly #17/2019

By Cytonn Research Team, Apr 28, 2019

Executive Summary

Fixed Income

T-bills were oversubscribed during the week, with the overall subscription rate increasing to 113.8% from 88.7% recorded the previous week. The yield on the 91-day and 182-day papers remained unchanged at 7.3% and 8.0%, respectively, while that of the 364-day paper declined to 9.3% from 9.4% recorded the previous week. During the week, the Kenya National Bureau of Statistics (KNBS) released the Economic Survey 2019 indicating that the economy had expanded by 6.3% in 2018 from 4.9% recorded in 2017. This was the fastest economic growth rate since the 8.4% recorded in 2010, and above the 5-year average GDP growth rate of 5.6%;

Equities

During the week, the equities market recorded mixed performance with NASI having gained by 0.3%, NSE 20 having recorded a 0.4% decline, and NSE 25 remained unchanged, taking their YTD performance to gains of 0.9%, 13.0% and 11.4%, for NSE 20, NASI and NSE 25, respectively. Co-operative Bank has launched the Co-op Bank Property Hub that will serve clients who have property to sell by connecting them to the Co-operative Bank clients who want to buy property, and also offering mortgages to the buyers of the property. Diamond Trust Bank Kenya has partnered with SWIFT, a leading provider of secure financial messaging services, in order to provide real time cross border payments to its clients;

Private Equity

During the week, in the hospitality sector, the International Finance Corporation (IFC), announced that it is considering a USD 9.0 mn (Kshs 0.9 bn) debt investment in a greenfield hotel project located in the outskirts of Lusaka, Zambia. The project which is a 249-room greenfield resort hotel with a multipurpose venue with a capacity of up to 2,500 and targeting the high-end hospitality market, will cost USD 29.6 mn (Kshs 3.0 bn) and is expected to be completed by early 2021. In the financial services sector, Nimai Capital, a Dubai-based financial institution that supports financial inclusion in South Asia and Africa, announced the launch of a USD 150.0 mn Nimai Emerging Financial Services Fund (NESF) in partnership with Victoria Commercial Bank (VCB), a mid-sized Kenyan financial institution that serves premier corporate clientele;

Real Estate

During the week, Kenya National Bureau of Statistics (KNBS) released the Economic Survey 2019, which highlighted the real estate sector’s contribution to GDP declined marginally to 7.0% from 7.1% in 2017, and recorded a slowdown in terms of growth rate, having grown by 4.1% compared to 6.1% in 2017. In listed real estate, real estate fund, Stanlib Fahari I-REIT announced plans to acquire more properties from pension firms and insurers who will be compensated in the form of units in the REIT;

Focus of the Week

In February this year, Central Bank of Kenya (CBK) published draft regulations intended to provide a clear framework for licensing, capital adequacy, liquidity management, corporate governance, risk management and reporting requirements of mortgage refinance companies. Once approved, the regulations will guide the launch and beginning of operations of the Kenya Mortgage Refinancing Company, KMRC. In light of this, we update our Kenya Mortgage Refinancing Company Note, first released in April 2018, where we introduced the facility and its main functions, highlighted the successes of other mortgage refinance companies in Africa, and emphasized on the conditions necessary for the KMRC to thrive. In this topical we will, therefore, focus on Mortgage Refinance Companies, reintroduce what they are, why they are needed, how they operate, what benefits are expected, finalizing with a case study of Tanzania, and key take-outs for KMRC.

- On Saturday 27th April 2019, Cytonn Investments held their Q1’2019 Market Outlook and company updates event at The Alma, Ruaka. See the event note,

- Faith Maina – Investments Analyst was on KTN to discuss about the rapid growth of Islamic financing in Africa. Watch Faith here;

- For an exclusive tour of the developments, visit: Sharp Investor’s Tour and for more information, email us at sales@cytonn.com;

- Following the completion and handover of Amara Ridge in Karen, we have now launched our next Karen project, dubbed Applewood, a Kshs 2.5 bn residential development located in Miotoni, Karen. This signature development shall comprise luxury homes, each sitting on 1/2 acre. We invite you to the exhibition of Applewood which is ongoing at the Amara Ridge Clubhouse (Location pin: https://goo.gl/maps/B3GVnu8pHyn) or at the Applewood Sales Centre on Miotoni Road (Location pin: https://goo.gl/maps/ZfABuGjFo1z) from 9:00 am to 5:00 pm daily. Call 0709 101 000 or email resales@cytonn.com to reserve a villa! See Video here;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects;

T-Bills & T-Bonds Primary Auction:

T-bills were oversubscribed during the week, with the overall subscription rate increasing to 113.8% from 88.7% recorded the previous week. The yield on the 91-day and 182-day papers remained unchanged at 7.3% and 8.0%, respectively, while that of the 364-day paper declined to 9.3% from 9.4% recorded the previous week. The acceptance rate improved to 95.3% from 87.1% recorded the previous week, with the government accepting a total of Kshs 26.0 bn of the Kshs 27.3 bn worth of bids received, higher than its weekly quantum of Kshs 24.0 bn. The subscription rate for the 91-day and the 182-day improved to 186.4% and 141.9%, from 104.0% and 46.8% recorded the previous week, while that of the 364-day paper declined to 56.6% from 124.4% recorded the previous week.

Liquidity:

The money market remained relatively tight during the week, with the average interbank rate increasing to 5.1% from 3.8% recorded the previous week. The average volumes traded in the interbank market rose by 23.9% to Kshs 26.7 bn, from Kshs 18.8 bn the previous week, as the markets recovered from tax payments coupled with banks propping up their reserves following the start of the new cash reserves requirement (CRR) cycle the previous week.

Kenya Eurobonds:

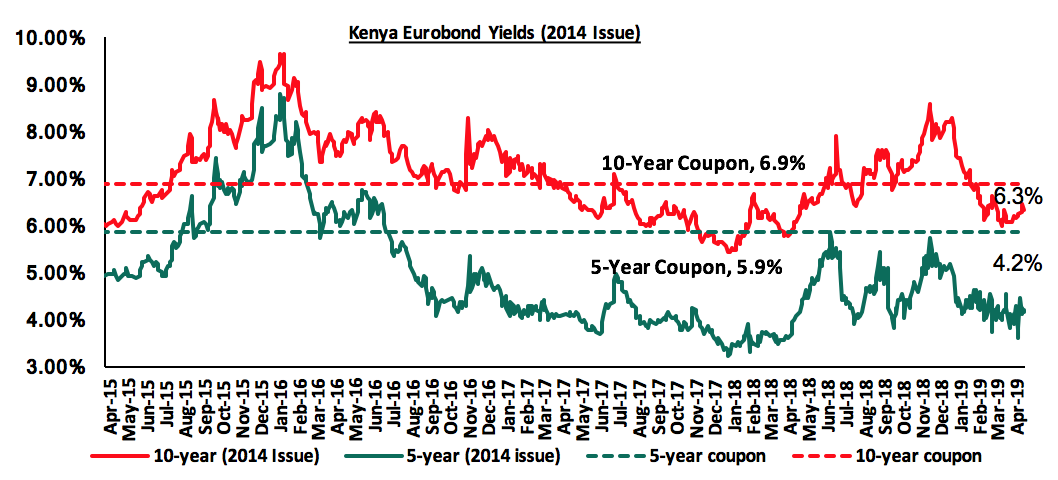

According to Bloomberg, the yield on the 10-year Eurobonds issued in 2014 rose by 0.1% points to 6.3% from 6.2%, while that of the 5-year declined by 0.1% points to 4.2% from 4.3% the previous week. Since the mid-January 2016 peak, yields on the Kenyan Eurobonds have declined by 4.4% points and 3.5% points for the 5-year and 10-year Eurobonds, respectively, an indication of the relatively stable macroeconomic conditions in the country. Key to note is that these bonds have 0.2-years and 5.2-years to maturity for the 5-year and 10-year, respectively.

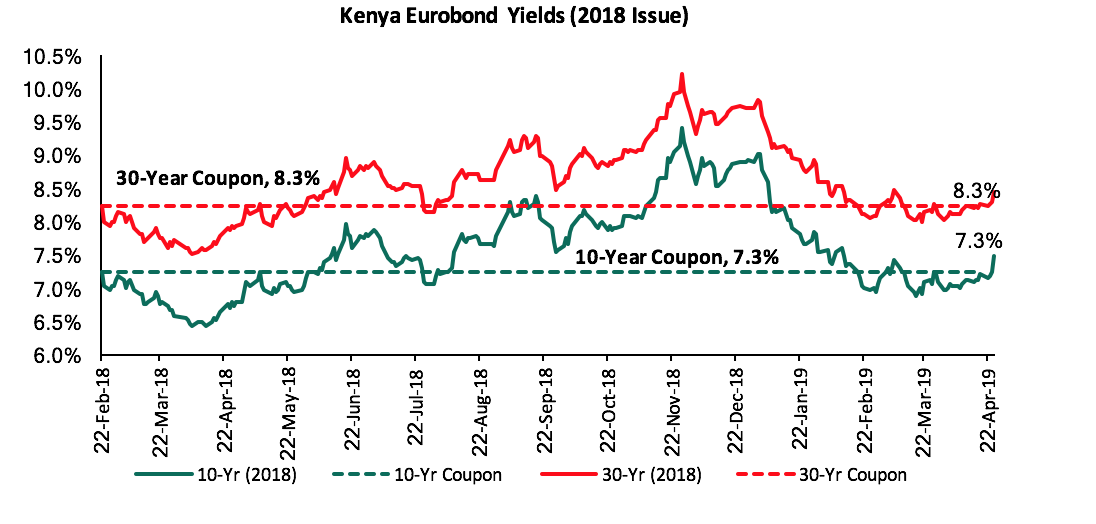

For the February 2018 Eurobond issue, during the week, the yields on 10-year Eurobond rose by 0.2% points to 7.3% from 7.1% the previous week, while the yield on the 30-year Eurobond rose by 0.1% points to 8.3% from 8.2% recorded the previous week. Since the issue date, the yields on the 10-year Eurobond have remained the same while those of the 30-year Eurobond have increased by 0.2% points.

The Kenya Shilling:

During the week, the Kenya Shilling lost by 0.2% against the US Dollar to close at Kshs 101.5, from Kshs 101.3 the previous week, attributable to increased dollar demand from the energy sector. The Kenya Shilling has appreciated by 0.3% year to date in addition to 1.3% in 2018. In our view, the shilling should remain relatively stable to the dollar in the short term, supported by:

- The narrowing of the current account deficit with preliminary data on balance of payments indicating continued narrowing to 4.7% of GDP in the 12-months to February 2019, from 5.5% recorded in February 2018. The decline has been attributed to improved agriculture exports, increased diaspora remittances, strong receipts from tourism, and lower food and SGR-related equipment relative to 2017,

- Improving diaspora remittances, which increased by 17.2% m/m in January 2018 to USD 244.8 mn from USD 208.9 mn recorded in a similar period of review in 2017. The rise is due to:

- Increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and,

- New partnerships between international money remittance providers and local commercial banks making the process more convenient,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 8.4 bn, equivalent to 5.4-months of import cover, above the statutory requirement of maintaining at least 4-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Highlight of the Week:

During the week, the Kenya National Bureau of Statistics (KNBS) released the Economic Survey 2019 indicating that the economy had expanded by 6.3% in 2018 from 4.9% recorded in 2017. This was the fastest economic growth since the 8.4% recorded in 2010, and above the 5-year average GDP growth rate of 5.6%.

Some of the key highlights from the survey were:

- There was a rebound recorded in the agriculture sector, which recorded a growth of 6.4% in 2018 from a revised growth of 1.9% in 2017 from the initial reported growth of 1.6%, with growth mainly driven by marked improvement in crops and animal production anchored by favourable weather conditions. Despite the rebound in growth, the sectors’ contribution remained unchanged at 21.3%;

- Growth in the manufacturing sector was robust in 2018 recording a 4.2% growth, up from the 0.5% growth recorded in 2017. Contribution of the sector to total GDP however declined slightly to 9.6% from 9.8% in 2017. Improved growth in the sector was driven by agro-processing activities that improved due to the increased agricultural production during the year. Under manufacturing of food and beverages, the highest growth was recorded in the manufacture of sugar at 30.3% and liquid milk at 18.5%;

- There was continued recovery of the tourism sector with accommodation and food service activities improving to 16.6% from 14.3% recorded in 2017, which can be attributed to enhanced security in the country, and a pick-up in the MICE tourism sector, with Kenya being one of the top Meetings, Incentive Group Travel, Conferences and Exhibitions destination in Africa. Growth was further boosted with the visits by heads of states and dignitaries, as well as various international conferences held during the year. These coupled with the withdrawal and relaxation of travel advisories, introduction of charter flights from key cities in Europe, increased flight frequency and routes, and the inauguration of the Nairobi-New York route in October 2018 saw international visitor arrivals rising by 14.0% to 2,027,700 from 1,778,400 in 2017;

- The real estate sector performance slowed down in 2018, having grown by 4.1% compared to 6.1% in 2017, owing to a decline in demand for property despite the growing supply, evidenced by the 3.0% decline in the residential sector occupancy rates, and the 4.8% increase in supply of retail space to 6.5 mn SQFT in 2018 from 6.2 mn SQFT in 2017, as per Cytonn’s research;

- The financial & insurance sector grew by 5.6% in 2018, up from the slow 2.8% growth recorded in 2017, which had been as a result of banks feeling the impact of the introduction of the capping of interest rates. 2018’s improved performance was driven by higher banking sector earnings growth, with interest income earned by commercial banks rising by 30.7% to Kshs 379.6 bn from Kshs 368.2 bn in 2017.

We expect the 2019 GDP growth to slow down to a range of 5.7%-5.9%, due to the delayed long rains with most parts of the country expected to experience depressed rainfall that is set to lead to a decline in agricultural production. Consequently, the manufacturing sector is also expected to decline, as the major growth driver in the sector is agro-processing. In addition, ongoing emergency intervention to address food shortages in several counties could impose fiscal pressure constraining capital spending, which has also been a major driver of economic growth especially in the construction sector.

Below is a table showing average projected GDP growth for Kenya in 2019 updated with the World Bank's and International Monetary Fund (IMF) downward revision to 5.7% and 5.8% from 5.8% and 6.1%, respectively; noteworthy being that the highest projection is by the Central Bank of Kenya at 6.3%, but recently the Central Bank of Kenya (CBK) Governor hinted on a possible downward revision by 1.0% points in the event that the country experiences a severe drought due to the delayed long rains.

|

No. |

Kenya 2019 Annual GDP Growth Outlook |

Q1'2019 |

Q2'2019 |

|

1 |

Central Bank of Kenya |

6.3% |

6.3% |

|

2 |

Citigroup Global Markets |

6.1% |

6.1% |

|

3 |

African Development Bank (AfDB) |

6.0% |

6.0% |

|

4 |

PNB Paribas |

6.0% |

6.0% |

|

5 |

UK HSBC |

6.0% |

6.0% |

|

6 |

Euromonitor International |

5.9% |

5.9% |

|

7 |

International Monetary Fund (IMF) |

6.1% |

5.8% |

|

8 |

Cytonn Investments Management Plc |

5.8% |

5.8% |

|

9 |

Focus Economics |

5.8% |

5.8% |

|

10 |

World Bank |

5.8% |

5.7% |

|

11 |

JPMorgan |

5.7% |

5.7% |

|

12 |

Euler Hermes |

5.7% |

5.7% |

|

13 |

Oxford Economics |

5.6% |

5.6% |

|

14 |

Standard Chartered |

5.6% |

5.6% |

|

15 |

Capital Economics |

5.5% |

5.5% |

|

16 |

Fitch Solutions |

5.2% |

5.2% |

|

Average |

5.8% |

5.8% |

For a more comprehensive analysis see the Kenya 2018 GDP Growth and Outlook note

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids, being currently 21.9% ahead of its domestic borrowing target for the current financial year, having borrowed Kshs 319.9 bn against a pro-rated target of Kshs 262.4 bn. A budget deficit is likely to result from depressed revenue collection, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Despite this, we do not expect upward pressure on interest rates due to increased demand for government securities, driven by improved liquidity in the market owing to the relatively high debt maturities. Our view is that investors should be biased towards medium-term fixed income instruments to reduce duration risk associated with long-term debt, coupled with the relatively flat yield curve on the long-end due to saturation of long-term bonds.

Market Performance:

During the week, the equities market recorded mixed performance with NASI having gained by 0.3%, NSE 20 having recorded a 0.4% decline, and NSE 25 remained unchanged, taking their YTD performance to gains of 0.9%, 13.0% and 11.4%, for NSE 20, NASI and NSE 25, respectively. The performance of NASI was driven by gains in large cap stocks such as Standard Chartered Bank and EABL, which gained by 3.2% and 2.7%, respectively.

Equities turnover declined by 25.5% during the week to USD 8.9 mn, from USD 12.0 mn the previous week, taking the YTD turnover to USD 518.0 mn. Foreign investors were net buyers for the week, with the net buying position coming in at USD 5.0 mn, from last week’s net selling position of USD 0.9 mn.

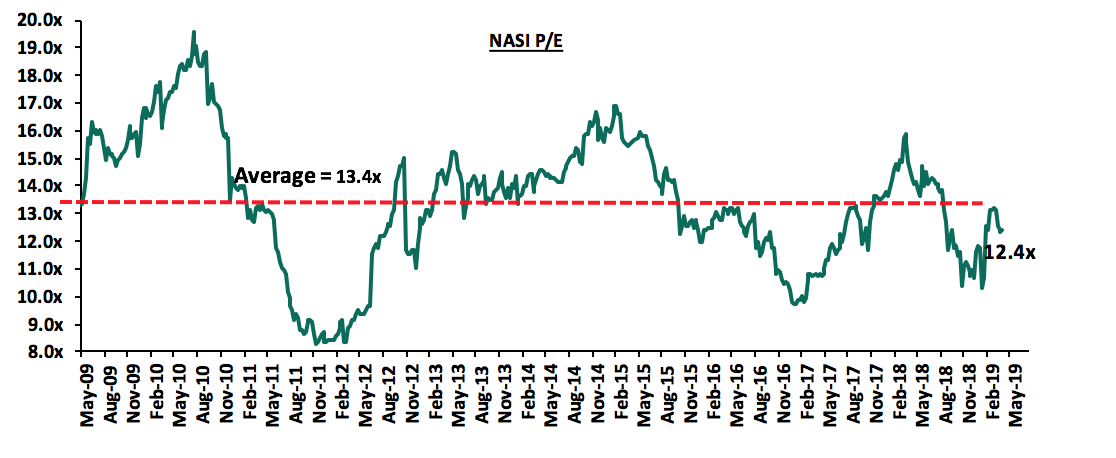

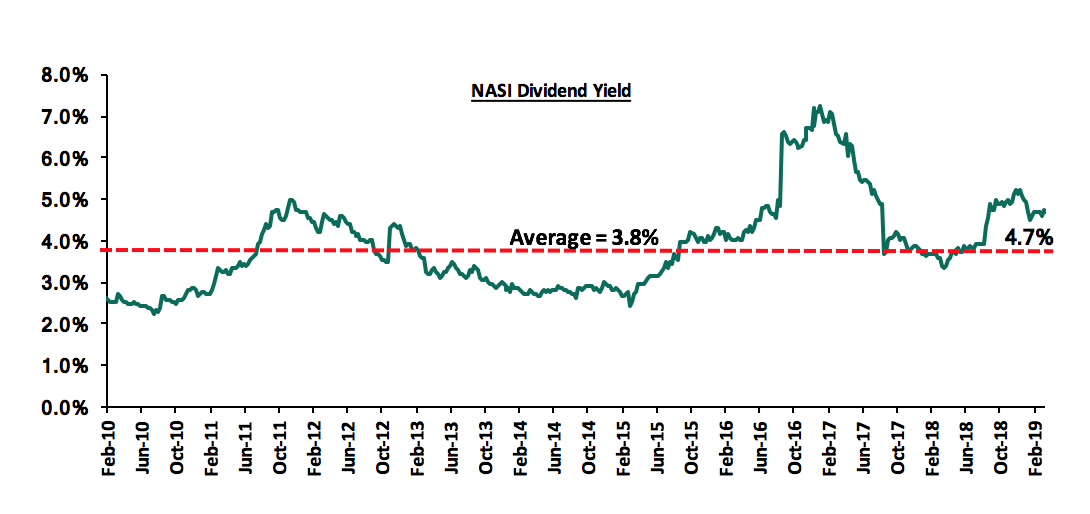

The market is currently trading at a price to earnings ratio (P/E) of 12.4x, 7.0% below the historical average of 13.4x, and a dividend yield of 4.7%, above the historical average of 3.8%. With the market trading at valuations below the historical average, we believe that there is still value in the market. The current P/E valuation of 12.4x is 28.1% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 49.8% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlights

Co-operative Bank of Kenya launched the Co-op Bank Property Hub under its mortgage division, which will offer property sales and mortgage origination to its clients. The Property Hub will serve the clients who have property to sell and connect them to the Co-operative Bank clients who want to buy property. The bank will also offer mortgages to the buyers of the property. The lender intends to leverage on its contacts with key institutions and the cooperative movements that largely own the bank to boost the property sales for its clients. The bank has been trying to diversify its revenue streams since the enactment of the Banking (Amendment) Act 2015 that capped interest rates chargeable on loans, and we expect the new product to increase the banks Non-Funded Income (NFI), as it eyes fee income from the sale of the property as well as the processing of mortgage loans, which should aid in increasing its NFI, with the contribution of NFI to total operating income coming in at 30.0% as at FY’2018, below the industry average of 33.2%. A recovery in NFI should buffer the bank’s profitability in the event of a decline in interest revenue, or a decline in specific NFI segments such as fees and commissions on loans due to reduced lending.

Diamond Trust Bank Kenya (DTBK) announced that it has partnered with SWIFT, a leading provider of secure financial messaging services, in order to provide real time cross border payments to its clients. DTBK will be the first East African Bank to go live on the SWIFT global payment innovation service, a service that is carrying out over USD 300 bn worth of transactions a day, in over 148 currencies. There has been increased demand for faster and cheaper cross border payment avenues, and we have seen strides by players in the Kenyan market to solve the challenges that arise with cross border money transfer, as evidenced by various partnerships such as;

- Family Bank and SimbaPay Partnership: Simba pay is a London-based financial technology, which in November 2018 partnered with Family Bank, a move which enabled Mpesa users to send money to over 1 bn active WeChat subscribers in China, and,

- Safaricom and PayPal Partnership: This April 2018 partnership made it possible for Mpesa users to move money to PayPal accounts in up to 25 currencies.

We view this as a strategic move by DTBK as it is likely to attract corporate and trade clients to the bank, given the convenience of SWIFT’s global presence. Given the increasing number and value of trade deals between the East Africa regional block and Asia, this would likely place the bank strategically to be a financial intermediary for clients who require cross border payments services. Thus, the bank will likely increase its fee and commission income from the increased transactions, consequently improving its Non-Funded Income currently at 21.0% of total operating income, which is below the industry average of 33.2% as at FY’2018.

Universe of Coverage:

Below is a summary of our SSA universe of coverage:

|

Banks |

Price as at 18/04/2019 |

Price as at 26/04/2019 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/Downside** |

P/TBv Multiple |

Recommendation |

|||||||||

|

GCB Bank |

4.0 |

4.0 |

1.0% |

(13.0%) |

4.6 |

7.7 |

9.5% |

102.5% |

0.9x |

Buy |

|||||||||

|

Diamond Trust Bank |

130.0 |

122.0 |

(6.2%) |

(22.0%) |

156.5 |

241.5 |

2.1% |

100.1% |

0.7x |

Buy |

|||||||||

|

Zenith Bank |

20.9 |

21.4 |

2.2% |

(7.4%) |

23.1 |

33.3 |

12.6% |

68.7% |

0.9x |

Buy |

|||||||||

|

UBA Bank |

6.7 |

6.9 |

3.0% |

(11.0%) |

7.7 |

10.7 |

12.4% |

68.6% |

0.4x |

Buy |

|||||||||

|

CRDB |

125.0 |

125.0 |

0.0% |

(16.7%) |

150.0 |

207.7 |

0.0% |

66.2% |

0.4x |

Buy |

|||||||||

|

NIC Group |

36.8 |

33.0 |

(10.5%) |

18.5% |

27.8 |

48.8 |

3.0% |

51.1% |

1.0x |

Buy |

|||||||||

|

Access Bank |

6.9 |

6.6 |

(3.6%) |

(2.9%) |

6.8 |

9.5 |

6.1% |

50.0% |

0.4x |

Buy |

|||||||||

|

I&M Holdings |

112.8 |

115.0 |

2.0% |

35.3% |

85.0 |

167.7 |

3.0% |

48.9% |

1.1x |

Buy |

|||||||||

|

Equity Group |

41.9 |

41.5 |

(1.0%) |

19.1% |

34.9 |

58.1 |

4.8% |

44.8% |

2.0x |

Buy |

|||||||||

|

CAL Bank |

1.0 |

1.0 |

(5.8%) |

(1.0%) |

1.0 |

1.4 |

0.0% |

44.3% |

0.9x |

Buy |

|||||||||

|

Co-operative Bank |

14.2 |

13.6 |

(4.2%) |

(5.2%) |

14.3 |

18.5 |

7.4% |

43.9% |

1.2x |

Buy |

|||||||||

|

KCB Group*** |

45.0 |

45.3 |

0.7% |

21.0% |

37.5 |

60.0 |

7.7% |

40.2% |

1.4x |

Buy |

|||||||||

|

Ecobank |

7.8 |

7.8 |

0.0% |

4.0% |

7.5 |

10.7 |

0.0% |

37.6% |

1.7x |

Buy |

|||||||||

|

Stanbic Bank Uganda |

29.0 |

29.0 |

0.0% |

(6.5%) |

31.0 |

36.3 |

4.0% |

29.1% |

2.1x |

Buy |

|||||||||

|

Stanbic Holdings |

99.0 |

96.3 |

(2.8%) |

6.1% |

90.8 |

115.6 |

6.1% |

26.2% |

1.0x |

Buy |

|||||||||

|

Union Bank Plc |

6.8 |

6.8 |

0.0% |

21.4% |

5.6 |

8.2 |

0.0% |

19.9% |

0.7x |

Accumulate |

|||||||||

|

Barclays Bank |

12.0 |

11.9 |

(0.4%) |

8.7% |

11.0 |

13.1 |

8.4% |

18.5% |

1.6x |

Accumulate |

|||||||||

|

SBM Holdings |

5.8 |

5.9 |

1.0% |

(1.3%) |

6.0 |

6.6 |

5.1% |

16.7% |

0.8x |

Accumulate |

|||||||||

|

Guaranty Trust Bank |

34.8 |

34.2 |

(1.7%) |

(0.7%) |

34.5 |

37.1 |

7.0% |

15.5% |

2.2x |

Accumulate |

|||||||||

|

Bank of Kigali |

265.0 |

274.0 |

3.4% |

(8.7%) |

300.0 |

299.9 |

5.1% |

14.5% |

1.5x |

Accumulate |

|||||||||

|

National Bank |

4.7 |

5.0 |

6.2% |

(6.0%) |

5.3 |

5.2 |

0.0% |

4.0% |

0.3x |

Lighten |

|||||||||

|

Standard Chartered |

206.0 |

208.0 |

1.0% |

6.9% |

194.5 |

203.8 |

6.0% |

4.0% |

1.7x |

Lighten |

|||||||||

|

Bank of Baroda |

130.0 |

129.0 |

(0.8%) |

(7.9%) |

140.0 |

130.6 |

1.9% |

3.2% |

1.1x |

Lighten |

|||||||||

|

Standard Chartered |

19.0 |

19.0 |

0.0% |

(9.5%) |

21.0 |

19.5 |

0.0% |

2.4% |

2.4x |

Lighten |

|||||||||

|

FBN Holdings |

7.7 |

7.3 |

(5.2%) |

(8.8%) |

8.0 |

6.6 |

3.4% |

(5.1%) |

0.4x |

Sell |

|||||||||

|

Ecobank Transnational |

10.8 |

10.8 |

0.5% |

(36.5%) |

17.0 |

9.3 |

0.0% |

(14.1%) |

0.4x |

Sell |

|||||||||

|

Stanbic IBTC Holdings |

46.2 |

47.0 |

1.7% |

(2.0%) |

48.0 |

37.0 |

1.3% |

(20.0%) |

2.4x |

Sell |

|||||||||

|

HF Group |

4.4 |

4.3 |

(1.1%) |

(22.4%) |

5.5 |

2.9 |

8.1% |

(24.4%) |

0.2x |

Sell |

|||||||||

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates holds a stake. ****Stock prices indicated in respective country currencies |

|||||||||||||||||||

We are “Positive” on equities since the sustained share price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

The International Finance Corporation (IFC), a member of the World Bank Group that offers investment, advisory and asset management services to private firms in less developed countries, announced the consideration of a USD 9.0 mn (Kshs. 0.9 bn) debt investment in a greenfield hotel project located in the Kasisi area, a rural outskirt of Lusaka, Zambia. The project, which is sponsored by Union Gold Zambia, the largest hospitality provider in Zambia, is a 249-room greenfield resort hotel with a multipurpose venue that will have a capacity of up to 2,500 persons. The upscale resort hotel will cost USD 29.6 mn (Kshs. 3.0 bn) and is expected to be completed by early 2021. The development that will be located within Bonanza Estate, a residence with an 18-hole golf course will be operated by Protea Hotel by Mariott, a hospitality firm owned by Union Gold Zambia, and that has 7-accommodation establishment across Africa. Apart from provision of financing, IFC is also expected to play a critical role in setting up of the development’s governance structure as well as provide industry expertise and advice. The investment by IFC is expected to promote the development of Zambia’s tourism sector through creation of employment and growth opportunities and the introduction of the concept of combining a hotel and multipurpose venues which is expected to foster competition and consequently better services offering within the market. The last decade has seen many global operators opening quality hotels in key markets in Sub-Saharan Africa like South Africa, Mauritius and Kenya with the supply of new hotels attributed to high occupancy rates. We expect the hospitality sector in Sub-Saharan Africa to continue performing well driven by;

- A growing population and expected strong economic growth where GDP is expected to grow by 2.7% in 2018, and 3.4% in 2019, from 2.6% in 2017,

- Growth in both international and domestic travelers to the market,

- An expected improvement in hotel standards as there is a shortage of quality hotels in Africa and as the middle class grows, there is higher demand for quality hotels, and,

- Increase in intra-African travel as the continent experiences better connectivity, access to low-cost airlines, and more countries embracing visa-free travel within Sub-Saharan Africa.

In Kenya, we expect further growth in the hospitality sector as a result of (i) restoration of political calm following the reconciliation of the Country’s two top political leaders last year, (ii) improved hotel standards as hotels rebrand while some embark on refurbishment and expansion, and (iii) improved flight operations and systems such as direct flights from the USA to Kenya, which commenced in October, 2018.

Nimai Capital, a Dubai-based financial institution that supports financial inclusion in South Asia and Africa, announced the launch of a USD 150.0 mn (Kshs 15.2 bn) Nimai Emerging Financial Services Fund (NESF) in partnership with Victoria Commercial Bank (VCB), a mid-sized Kenyan financial institution that serves premier corporate clientele. The fund aims to invest in financial services in African and South Asian countries such as Ghana, Tanzania, Kenya, Bangladesh, Sri Lanka, Nepal and India, and will be regulated by the Cayman Islands Monetary Authority. The partnership will leverage on VCB’s business experience and deep knowledge of the Kenyan financial services market, and Nimai’s deep operational capability in both African and Asian markets, as well as their resources. According to the announcement, the fund managers plan to deploy up to USD 45.0 mn (Kshs 4.6 bn) in the Ghanaian financial services sector as the first investment. Apart from bolstering the working capital of investee companies, the fund will also focus on creating access to diaspora financial services, advisory, fintech integration and linkage to international markets. VCB has over the years established itself as an important financier of small and medium enterprises and we expect the institution to leverage on the new partnership to increase lending to this segment, as well as improve its Non-Funded Income (NFI) that grew by 19.4% to Kshs 428.4 mn in 2018 from Kshs 358.7 mn the previous year.

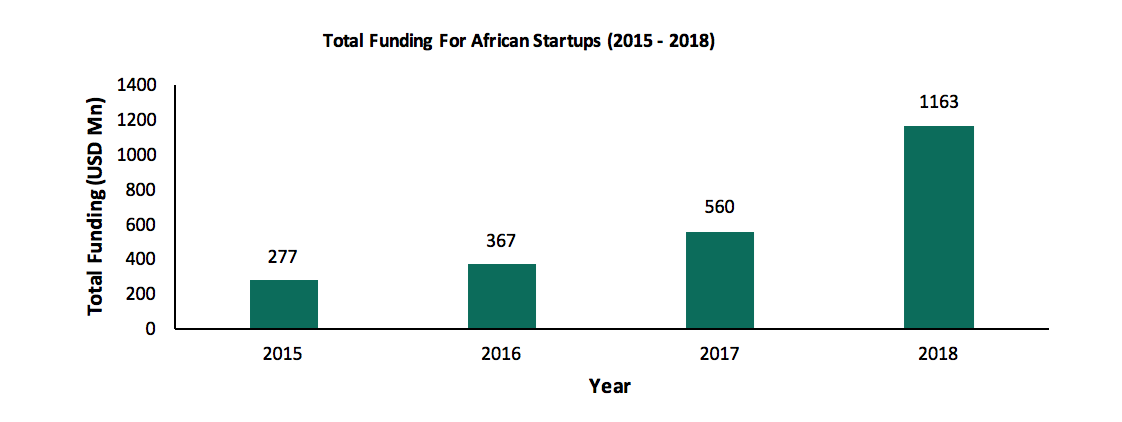

Partech Ventures, a global investment platform for tech and digital firms released a report on capital raising activity for African Tech Start-ups in 2018. According to the report, funding raised by a total of 146 African tech-startups grew by 108.0% to USD 1.2 bn in 2018 from USD 560.0 mn in 2017 driven by an increased number of series A & B startups attracting funding and increased appetite of global private equity investors to invest in African tech start-ups.

Source: Partech Ventures Report, 2018

Source: Partech Ventures Report, 2018

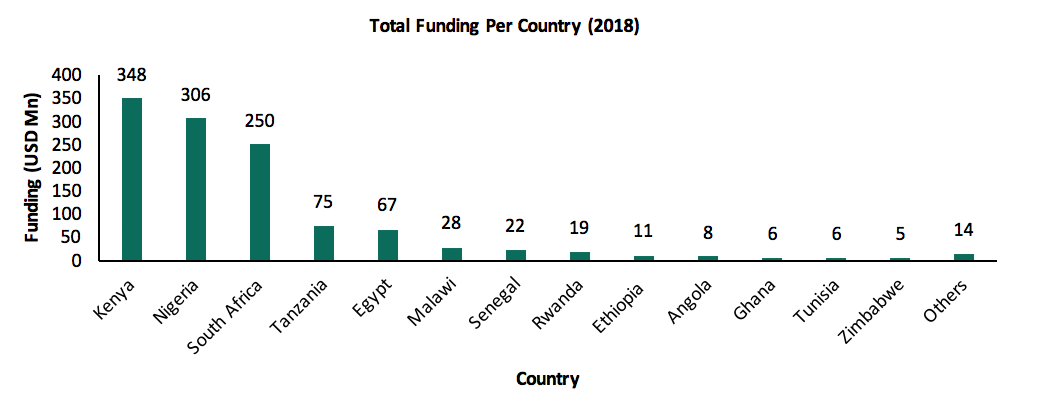

The report also highlighted that Kenya, Nigeria and South Africa are still the most attractive destinations for PE investors with the 3 countries absorbing 78.0% of the total funding in 2018. Kenya was the leading country in fundraising activity for tech startups beating traditional rivals, South Africa and Nigeria, to attract USD 348.0 mn in 44 funding deals. Nigeria attracted USD 306 mn in 26 funding transactions while South Africa attracted USD 250.0 mn in funding over 37 deals.

Source: Partech Ventures Report, 2018

Source: Partech Ventures Report, 2018

In terms of the sector break down, financial services remained the most attractive segment in the region for private equity investors, attracting 50.0% of the total funding. Fintech firms raised USD 379.0 mn (Kshs 38.5 bn) during the year, representing 33.0% of the total funding while off-grid tech and Insurtech firms attracted USD 194.0 mn (Kshs 19.7 bn) and USD 8.9 mn (Kshs 904.2 mn) during the year. Fundraising in business-to-business (B2B) and tech adoption also received significant funding with the segment receiving USD 353.0 mn (Kshs 35.9 bn) across 55 deals that accounted to 30.4% of the total fundraising activity. The increased deal activity in 2018 highlights growing investor confidence in African tech start-ups with Kenya gaining ground on Nigeria and South Africa, the two most developed African PE markets, a trend we expect to continue in 2019 driven by;

- High Returns - According to data collected by Crunchbase, since 2007, Fintech start-ups have raised an average of USD 41.0 mn (Kshs 4.2 bn) in Venture Capital and exited for an average value of USD 242.9 mn (Kshs 24.7 bn). This gives investors a better opportunity to invest in a sector that attracts a growing pool of new investors and in the end exit at a high price,

- Attractive Realization Periods - Private equity firms typically focus on investing for a short lead-time, often between three to five years. Many Fintech companies start showing profits by year three hence giving a chance for investors to realize their gains in time, and,

- Cheaper Running Costs - They are cheaper to run since a FinTech company is not weighed down by the same burden of costly regulation that governs traditional businesses. This makes PE firms to manage their FinTech portfolio with easy flexibility.

We maintain a positive outlook on private equity investments in Africa as evidenced by the increasing investor interest, which is attributed to; (i) economic growth, which is projected to improve in Africa’s most developed PE markets, (ii) attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, and (iii) attractive valuations in Sub Saharan Africa’s markets compared to global markets. Going forward, the increasing investor interest, stable macro-economic and political environment will continue to boost deal flow into African markets.

I. Industry Reports

During the week, Kenya National Bureau of Statistics released the Economic Survey 2019, which analyses the socio-economic environment in Kenya. The key take-outs in the real estate and construction industry from the report were;

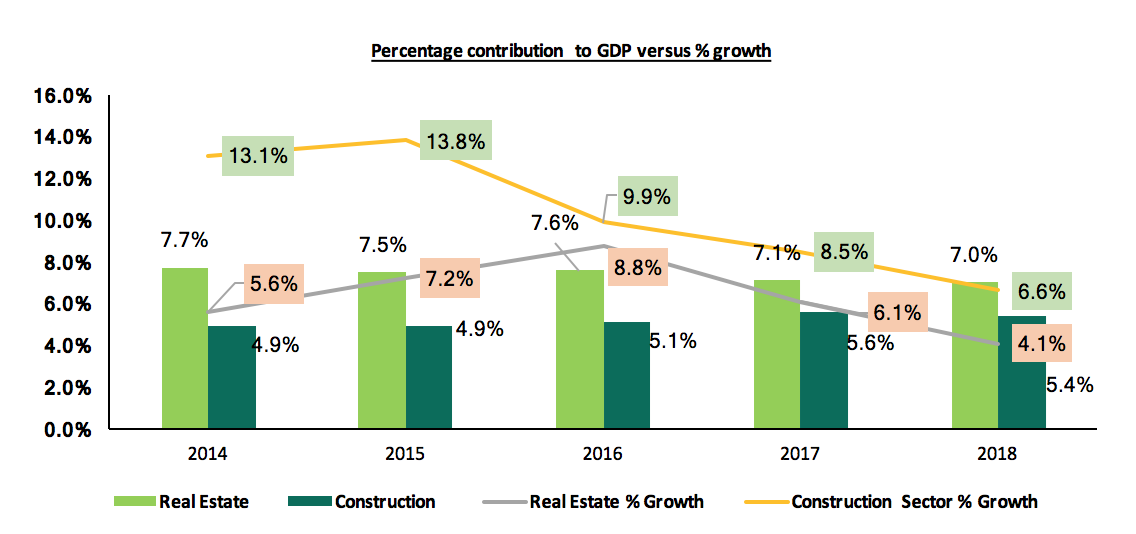

- The real estate sectors contribution to GDP declined marginally by 0.1% points to 7.0% in 2018, from 7.1% in 2017, and recorded a slowdown in terms of growth rate, having grown by 4.1% compared to 6.1% in 2017. We attribute the slower growth rate to inaccessibility and unaffordability of off-take financing, with the credit advanced to the sector recording a marginal decline of 0.5% to Kshs 368.7 bn as at end of 2018, from Kshs 370.7 bn as at the end of 2017,

- The construction sector grew by 6.6%, 1.9% points lower from 8.5% recorded in 2017. In line with the decline in growth rate, the sector’s contribution reduced slightly by 0.2% points to 5.4%, from 5.6% in 2017. The cement consumption recorded 1.6% increase from 5,856.6 mn tonnes in 2017 to 5,948.7 mn tonnes in 2018 supported by an increase in activities in the sector with the length of roads constructed increasing by 9.8% in 2018 to 18,655 km compared to 17,034 km in 2017, as shown below:

Source: Kenya National Bureau of Statistics

- In the infrastructural sector, the government expenditure on roads decreased by 7.4%, to Kshs 104.8 bn in 2017/18, from Kshs 113.2 bn in 2016/17. The key notable construction activities evident in 2018 were the ongoing construction of Phase Two of the Standard Gauge Railway (SGR) and other public investments in transportation infrastructure, with a 9.8% increase in the total length of bitumen roads in Kenya to 18,655 km in 2018, from 16,827 km in 2017. In addition, the expenditure on roads is expected to rise by 23.0% to Kshs 195.1 billion in 2018/19,

- The value of private building plans approved in Nairobi City County (NCC) decreased by 12.7% from Kshs 240.8 bn in 2017, to Kshs 210.3 bn in 2018, while the value of completed buildings issued with certificate of occupancy in NCC increased by 5.2% to Kshs 90.6 bn in 2018. We attribute the slowdown in building approvals to reduced activities in the real estate sector due to the space surplus in the sector, evidenced by the decline in the residential sector occupancy rates, and an oversupply in the commercial sector, currently at 2.0 mn SQFT and 4.7 mn SQFT for the retail and commercial office sector, respectively,

- Accommodation and food services retained a 0.7% contribution to GDP, similar to that of 2017, with the number of tourist arrivals increasing by 14.0%, from 1.8 mn recorded in 2017 to 2.0 mn in 2018. Consequently, hotel bed-nights occupied increased by 1.3% points, to 32.5% in 2018 compared to 31.2% in 2017, while the number of conferences increased by 7.8% to stand at 4,321 in 2018. The overall improvement in the sector’s performance was attributed to introduction of charter flights from key cities in Europe, increased flight frequency and routes, the inauguration of the Nairobi-New York route in October 2018, concerted marketing efforts such as branding of tourism products, digital marketing and global campaigns, a stable economic environment, improved security and thus improved investor confidence in the country.

Overall, the slowdown in the growth of the real estate sector is in line with the Cytonn Annual Market Review 2018 which highlighted that the sector recorded a decline in performance with the returns coming in 11.2% in 2018 compared to 14.1% in 2017, thus a 2.9% points decline, attributed to a decline in demand for property despite the growing supply, across the sectors. For 2019, as per Cytonn 2019 Market Outlook, we expect the slowdown in effective demand for property to persist amid increasing supply thus a neutral outlook. In terms of performance, we expect the sector’s performance to be shaped by focus on affordable housing, increased mortgage uptake and adoption of sustainable developments and technology.

II. Listed Real Estate

During the week, Stanlib Fahari I-REIT announced plans to acquire more properties from pension firms and insurers who will be compensated in the form of units in the REIT. The proposed structure eliminates the need for the firm to raise large sums of new capital to buy more buildings, in addition to expanding the pool of income-generating buildings owned by the REIT and raising earnings for the expanded investor base. According to the Stanlib Fahari FY'2018 Earnings Note, the firm’s total assets stood at Kshs 3.9 bn in 2018, and it has continued to diversify its real estate portfolio to the office and industrial sector, through their recent purchase of the 67 Gitanga Place office building in Lavington at Kshs 895.5 mn. Other properties owned by the REIT include; (i) Greenspan Mall in Donholm, (ii) Highway House in Industrial Area, and (iii) Bay Holdings Limited in Industrial Area. On the other hand, for the insurers and pension firms, the transactions will enhance liquidity, help them diversify their portfolio into the REITs sector and enable fund managers that are currently overweight with investment property to comply with regulations by the Retirement Benefits Authority (RBA) and Insurance Regulatory Authority (IRA) that allows up to 30.0% of pension schemes and insurers’ assets to be invested in real estate. The REIT’s performance is currently constrained by; i) opacity of the exact returns from the underlying assets, (ii) the negative sentiments currently engulfing the sector given the poor performance of Fahari I- REIT and Fusion D-REIT (FRED), (iii) inadequate investor knowledge, and (iv) lack of institutional support for REITs. Therefore we expect the move by the I-REIT to enhance institutional support and thus result in better uptake and performance.

Other highlights during the week:

- Transport, Infrastructure, Housing and Urban Development Cabinet Secretary, Hon. James Macharia, announced that the Kenya National Highway Authority (KeNHA) was set to sign-off on the contract initiating the construction of the Jomo Kenyatta International Airport (JKIA) - Westlands Expressway on 27th April 2019. The Kshs 51.0 bn project will be constructed and funded by the China Road and Bridge Corporation (CRBC), through a Private Public Partnership (PPP) framework that will see the firm fund the project and later recoup its investment from toll fees. According to the KNBS Economic Survey 2019, the government has continued to focus on infrastructure with a 9.8% increase in the total length of bitumen roads recorded in 2018 to 18,655 km from 16,827 km in 2017. According to the report, infrastructure spending is expected to increase by 23.0% to Kshs 195.1 bn in 2018-19 from Kshs 158.6 bn in 2017-18 attributed to the construction of phase 2A of the Standard Gauge Railway (SGR) from Nairobi to Naivasha and the construction of new roads including the Western Bypass and dualing of Ngong Road (Dagoretti Corner - Karen Roundabout Section). We expect the 18.6 km highway to ease traffic into the Nairobi CBD, access to JKIA and areas such as Westlands, thus drive the hospitality sector given that the airport is the main entrance of international arrivals and connects the same to Westlands which is one of the best performing serviced apartments node with and average rental yield of 10.6% according to Cytonn Research.

We expect growth in the real estate sector to be fueled by the continued improvement in infrastructure that will open up areas for development in addition to the improving socio-economic environment.

Following the announcement of the formation of the Kenya Mortgage Refinancing Company (KMRC) by the National Treasury Cabinet Secretary, Hon. Henry Rotich in April 2018, we released the Kenya Mortgage Refinancing Company Note, where we introduced the facility and its main functions, highlighted the successes of other mortgage refinance companies in Africa, and emphasized on the conditions necessary for the KMRC to thrive. To recapture the Note, the KMRC is an initiative of the National Treasury and the World Bank, whose main objective is to grow Kenya’s mortgage market by providing long-term funding to primary mortgage lenders. The initiative aims to support the affordable housing agenda by increasing the availability and affordability of housing finance, thus boosting home ownership.

Primarily, a mature mortgage market is made up of:

- Institutions that originate loans (primary mortgage market/lenders) such as banks and mortgage banking institutions,

- The markets in which they are transferred (secondary mortgage market), such as mortgage refinancing companies. The secondary markets’ main function is to get money to lenders in the primary market so they can loan it to consumers, thus facilitating the flow of funds for real estate financing, and,

- Investors, who are made up of institutional investors such as pension funds, insurance firms, and investment funds. They purchase the mortgage-backed securities, thus creating capital needed to make mortgage loans.

In February this year, Central Bank of Kenya (CBK) published draft regulations intended to provide a clear framework for licensing, capital adequacy, liquidity management, corporate governance, risk management and reporting requirements of mortgage refinance companies. Once approved, the regulations will guide the launch and beginning of operations of the KMRC. The MRC will complement other measures that the government has already undertaken to enable home ownership, such as;

- Exemption of first-time homebuyers from paying stamp duty tax,

- A 15.0% tax relief for first-time buyers up to a maximum of Kshs 108,000 p.a., and,

- Establishment of the National Housing Development Fund to manage funds set aside for the provision of social housing.

In this topical we will focus on Mortgage Refinancing Companies, reintroduce what they are, why they are needed, how they operate, what benefits are expected, finalizing with a case study review of Tanzania, and key take-outs for KMRC. As such, we shall cover the following:

- Introduction to Mortgage Refinance Companies

- The Need for Housing Finance in Kenya

- Formation & Operationalization of Mortgage Refinance Companies

- Expected Benefits & Challenges of MRCs

- Case Study: Tanzania MRC

- Lessons for Kenya MRC from Tanzania MRC

- Introduction to Mortgage Refinance Companies

A Mortgage Refinance Company (MRC) is a non-bank financial institution, incorporated as a limited liability company to provide affordable long-term funding and capital market access to primary mortgage lenders such as banks and financial co-operatives. The facility creates liquidity for primary mortgage lenders making it possible for mortgage originators to offer long-term mortgages, at relatively low interest rates and better terms and conditions. Acting as an intermediary between the primary mortgage lenders and the capital markets, the facility packages loan products into securities, which are collateralized by the underlying mortgage assets. This ensures a continuous flow of long-term financing to mortgage lenders and ultimately to borrowers, stimulating the real estate industry and the financial markets in general.

As highlighted in our previous topical on Affordable Housing in Kenya, one of the main limitations to home ownership in Kenya is limited access to debt funding for home purchases due to (i) relatively low incomes that cannot service a mortgage, (ii) high property prices, (iii) high interest rates and deposit requirements, which lock out many borrowers, and (iv) lack of capital markets funding towards real estate purchases for end-buyers. The MRC will help to alleviate the housing shortage by supporting the activities of mortgage lenders, enabling them to lower the cost of mortgage rates as well as extending their maturity. In addition, the provision of long-term financing to mortgage lenders irrespective of their size is likely to lead to increased competition amongst the lenders resulting in a higher bargaining power for borrowers, and as a result the Primary Mortgage Lenders (PMLs) are likely to charge affordable rates. This means more people will qualify for mortgage finance, boosting home-ownership.

- The Need for Housing Finance in Kenya

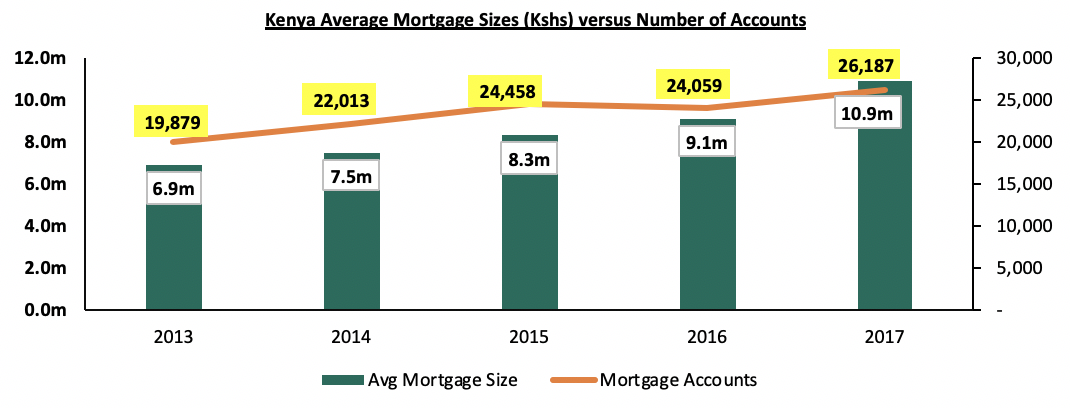

Affordability is a major constraint to the growth of the housing and mortgage markets, and a key challenge to accessing decent housing in Kenya. According to the 2015/16 Kenya Integrated Household Budget Survey (KIHBS), only 26.1% of Kenyans living in urban areas own the homes they live in, with the main factor causing this being the unaffordability of housing units in the market. Those who own homes rely mainly on savings and other sources of financing including mortgage loans, commercial bank loans, local investment groups commonly referred to as chamas, and Savings & Credit Co-operative Societies (SACCOs). Out of an adult population of about 23 mn, there were only 26,187 mortgage loans as at December 2017, according to the CBK Bank Sector Annual Report 2017. While the number of mortgage loans has been growing by an annual CAGR of 5.7% since 2013, the average mortgage size in Kenya has been growing at a higher CAGR of 9.6%, from Kshs 6.9 mn in 2013 to Kshs 10.9 mn in 2017, as shown below:

Mortgage Accounts 5-Year CAGR – 5.7%

Average Mortgage Size 5-Year CAGR – 9.6%

Source: Central Bank of Kenya (CBK)

According to Kenya National Bureau of Statistics (KNBS), approximately 74.5% of the formal working population in Kenya earns Kshs 50,000, and below, per month. With the average mortgage size in Kenya at Kshs 10.9 mn, interest rates at 13.6% and an average tenor of 12-years, therefore, an average Kenyan household earning Kshs 100,000 per month (assuming it has two persons each earning Kshs 50,000) is required monthly repayments of Kshs 153,905, which is unaffordable to this income class. However, using 40% of their gross income on monthly mortgage payments under similar market conditions, the household can afford a Kshs 2.8 mn home.

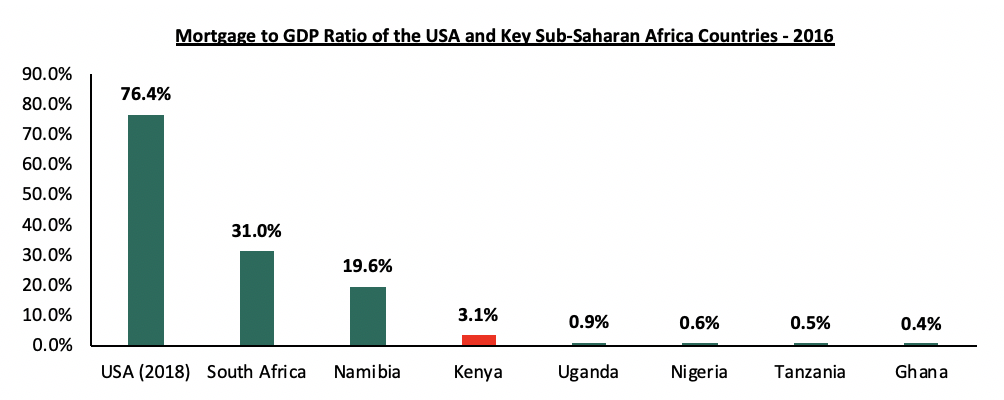

As a result, the Kenyan mortgage market still lags behind, with a mortgage to GDP ratio of 3.1% in 2016, significantly lower than more mature markets like South Africa, and the United States of America as shown below according to World Bank:

Source: World Bank

The Banking Sector

In Kenya, banks are the main providers of mortgage financing. According to Bank Supervision Annual Report 2017, 77.5% of all mortgage lending was originated by 6 banks, out of a total of 44 banks in the country, showing the reluctance of financial institutions to expand their mortgage portfolios. The main barriers to mortgage issuance include;

- Asset-liability mismatch by tenor due to the relatively long-term nature of mortgage loans and short-term nature of bank deposits,

- Limited access to capital markets funding for mortgages thus low supply of long- term capital,

- A complex legal and regulatory framework as well as collateral requirements making mortgages exceedingly expensive,

- Insufficient credit risk information, particularly on the informal sector, despite the sector making up a significant 83.4% of the total employment, according to KNBS Leading Economic Indicators 2018, and,

- An inefficient land and property registration process, which affects mortgage credibility for home-buyers.

To help bridge the funding gap in the housing finance market, there is need for better systems encompassing alternative sources of long-term financing, improved land and property registration, an expansive credit bureau coverage and an efficient legal system.

Mortgage Refinancing Companies address the liquidity issue, by (i) using the capital markets to raise large amounts of funds to support the lending activities of PMLs in a sustainable manner, and (ii) increased liquidity also helps to reduce risk premiums on mortgages for borrowers.

Some of the capital market products that could be considered include Housing Bonds, Asset-Backed Securities, and Real Estate Investment Trusts (REITS), targeting both retail and institutional investors. Institutions such as pension funds and insurance firms offer a viable market for these securities, especially given their rapidly growing pool of long-term funds. In Nigeria, for instance, pension funds account for 70.0% of the total subscriptions for mortgage-backed securities in 2018. In Kenya, data from the Retirement Benefits Authority (RBA) showed that the retirement benefits assets under management grew by 8.0% from Kshs. 1,080.1 billion in December 2017 to Kshs. 1,166.6 billion in June 2018. While the Retirement Benefits Authority (RBA) allows up to 30.0% of pension scheme’s assets to be invested in real estate, the current allocation stands at 19.8%, thus, there is still room for more real estate-based investments.

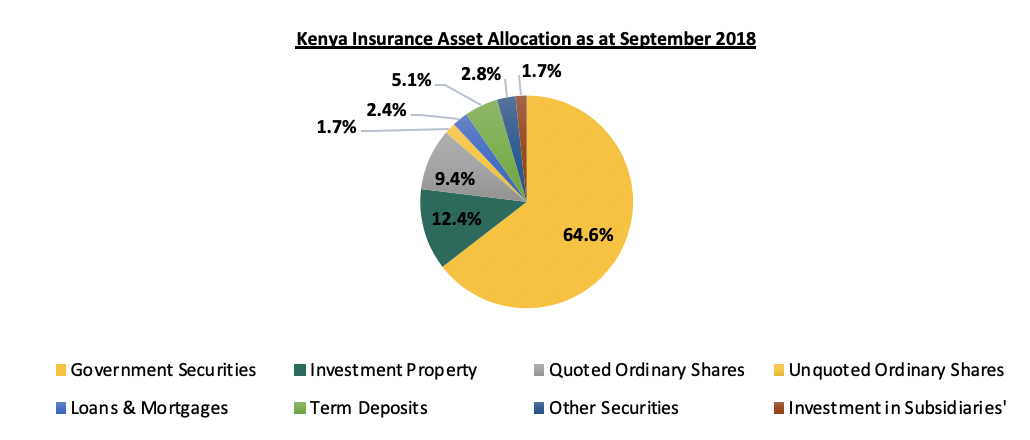

Insurance companies are also potential investors, holding 2.4% of their portfolios in loans and mortgages as at September 2018. Below is the allocation of the long-term insurance business investments as at September 2018:

Source: Insurance Regulatory Authority

Increased allocation of pension and insurance funds to alternative assets will not only diversify their pension funds’ portfolios and generate stable returns, but also provide the much-needed home financing.

- Formation & Operationalization of Mortgage Refinance Companies

Having looked at what MRCs are, and why we need them, in this section we will look at how MRCs are formed, operated and governed.

In brief, the MRC operates in four key steps, as shown below:

- Borrowers cede their property to a primary mortgage lender (PML) as security for a long-term mortgage loan,

- The MRC will lend its funds to PMLs with the mortgages as collateral,

- The MRC provides a bond to private institutions and investors, with the mortgages as collateral. Institutions with medium to long-term liabilities buy the bonds at a margin above the usual government securities,

- The MRC obtains the minimum core capital to enable its launch. KMRC is expected to obtain at least Kshs 1.0 bn as the minimum core capital, from the seed investors such as World Bank, the national treasury and commercial banks and SACCOs each pledging to contribute Kshs. 16.0 bn, Kshs. 1.5 bn and Kshs. 200 mn, respectively to facilitate its launch.

According to the World Bank, mortgage-refinancing companies operate under four key features;

- Taking Loans as Security – The MRC facility takes the underlying mortgage portfolios from the PML as security. This is done by either (i) extending wholesale loans to the mortgage lenders collateralized by the lenders’ mortgage portfolios, or (ii) directly buying mortgage portfolios “with recourse” from the PML. This means that the PML is bound to replace any loans, which go into default with performing credits.

MRC’s have the following lending requirements:

- The refinanced PML, must meet safety and soundness criteria to be eligible to the facility, and are subject to concentration limits, and,

- Good quality of underlying assets based on mortgage rank, Loan-to-Value ratio, credit scores, residential purposes etc.

MRC’s must be protected against a fall in the value of the security/collateral due to market fluctuations or if the replacement of defaulting loans in the cover pool does not happen continuously. This is usually addressed by over-collateralisation levels of up to 120% of refinance loans by underlying mortgages.

- Issuance of Bonds - The mortgage refinancing company issues a bond to the bond market targeting private institutions and investors who buy bonds at a margin above the usual government securities. Given the low risk nature of MRCs and their specialization in assessing the credit risk of the mortgage portfolio, their bonds need not be collateralized, however, mostly MRC use the mortgages portfolio as collateral on its bond issuance.

- Balance Sheet Management – This involves the way assets (mortgages) and liabilities (bonds) are matched. Generally, in emerging markets, the duration of the bonds is shorter than the mortgages they refinance resulting in balance sheet mismatches for the lenders or the MRC, and a need to manage the mismatches and the interest rate risk. The popular balance sheet management approach is for the MRC to turnover its debt by extending medium term refinance loans. In this case, the PMLs would typically reset the interest rates on their mortgages in line with the new funding rate following each change. This means PMLs do not incur interest risks in this They would only face a minimal liquidity risk in the case of the MRC being unable to refinance the loans if it was unable to roll over its debt. For example, in Malaysia, the rate resetting on the mortgage loans is disconnected from the refinancing, which creates at the minimum a basis risk for the lenders, but the gap between bonds – generally with a bullet repayment profile – and mortgage loans – amortizable on long periods- can stay open. This approach is however viable in mature markets where hedging instruments are available. In emerging markets such as Kenya, the two possible solutions are to either (i) keep the mismatch at the PML level, or (ii) transfer it onto the MRC’s balance sheet.

- Pricing - The intermediation role carries a price which varies from one country to another, depending on; i) the size of the balance sheet, ii) the risks transferred to the MRC, and iii) its corporate structure. Facilities that manage large assets and do not incur financial risks do not charge fees on the loans, so they transfer funds to the banks at the same rate that the bonds are issued at, such as CRH France. The only profit it makes is from the investment income derived from its capital, to which users must subscribe. Younger facilities without large-scale benefits charge up to 1.0% over their cost of fund. The Tanzanian Mortgage Refinance Company currently charges 0.5%-0.75% above the government risk free rate government bonds dependent on tenure ranging from 5 – 25 years. KMRC falling under younger facilities is likely to charge a fee of approximately 1.0% above the minimum of the risk-free rate for a 20-year bond, which currently stands at 12.8%, or 13.1% for a 25-year bond, thus is likely to trade at a yield between 13.8% to 14.1%, this compared to the current mortgage price of about 13.6%, which indicates that KMRC is likely to (i) improve accessibility of mortgages by increasing the amounts available to lend and (ii) also increase the tenors from the current 12 years to say 20 years, therefore reducing the monthly payment; KMRC in its current proposal may not improve the price / cost of mortgages, unless it’s able to get Development Finance Institutions to offer below market price debt financing.

In summary, MRC operates under the above four steps with an aim to fund primary mortgage lenders (PML) and provide relatively low interest rates and long tenure to mortgage borrowers at minimum possible risks, translating to increased mortgage uptake, thus addressing the key challenge to accessing decent housing in Kenya.

Governance, Monitoring & Evaluation

The governance of the MRC is structured in the following two ways;

- Cooperative Approach – This involves joint ownership between the government and the private sector and given the extensive government involvement in the creation of MRC, and the initial start-up risk, the main equity holder in the initial phase of an MRC is often the government owned institution,

- Government Support – The government does not participate as a shareholder, however, takes a lead role in the creation of the MRC. The objectives of the government involve improving affordability through lowering of mortgage interest rates translating to increase in the level of home-ownership and implementing of the social agenda for housing. Therefore, generally government provides support at least during a ramp-up phase of MRCs independently, by holding a stake in their capital and guaranteeing the bond issuance of the MRC.

The KMRC is established under the Companies Act, licensed by the CBK to conduct mortgage refinance business according to CBK (Mortgage Refinance Companies) Regulations 2019, which are intended to provide a clear framework for licensing, capital adequacy, liquidity management, corporate governance, risk management as well as reporting requirements of MRCs. The draft regulations for MRCs are almost similar to those of commercial banks. According to the draft, which was subjected to public comments:

- Minimum core capital of MRCs will be at least Kshs 1.0 bn, which is the same level as that of commercial banks and will need to be availed before the launch,

- The MRCs will be required to have a master servicing and refinancing agreement governing the lending operations between the mortgage refinance company and the participating primary mortgage lenders, and,

- CBK proposes that no MRC shall grant direct finance to any primary mortgage lender of amounts exceeding 25.0% of core capital.

Generally, KMRC will be subject to regulation and supervision of the Central Bank of Kenya (CBK), with Capital Markets Authority (CMA) providing oversight over its bond issuance in the capital market.

- Expected Benefits & Challenges of MRCs

Once operational, the expected benefits of MRCs will include;

- Increased home ownership

The sole aim of KMRC is to increase the number of people eligible to take up mortgages thus increasing home ownership among Kenyans. The facility is expected to enable the lenders to offer longer mortgage tenures of 20-years on average, and at relatively cheaper rates, to be capped at 10% per annum according to current proposals. However, it is not yet clear how the market will achieve such low rates without any special government subsidies, because even a risk free 20-year government bond rate is 12.8%. We therefore assume the rates will be maintained at 13.3%-13.8%, which is 0.5%-1.0% points above the 20-year bond rate of 12.8%.

The table below shows the monthly payments for a standard 3-bedroomed affordable housing unit going for Kshs 3.0 mn. At the prevailing market conditions with average interest rates at 13.6% and tenure of 12-years, the required monthly payments are Kshs 42,359. Assuming this accounts for 40.0% of the household’s monthly income, this means the household earns a gross income of Kshs 106,000. If the facility maintains the current average mortgage interest rates but prolongs average tenure to 20 years, the monthly payments reduce by 14.0% to Kshs 36,437, which is affordable to households earning Kshs 92,000 per month.

All figures in Kshs unless stated otherwise

|

Mortgage Affordability |

||||||

|

Market Rates |

Amount Borrowed |

Interest Rate |

Tenure (Years) |

Total Interest |

Monthly Payments |

Affordability (Gross Income by 2 persons) |

|

Current Rates |

3.0m |

13.6% |

12 |

3.1m |

42,359 |

106,000 |

|

KMRC |

3.0m |

13.6% |

20 |

5.7m |

36,437 |

92,000 |

|

KMRC |

3.0m |

13.8% |

20 |

5.8m |

36,870 |

93,000 |

- Growth of the Kenyan Mortgage Market

Despite the progress in recent years, the Kenyan mortgage market still lags behind more mature markets like South Africa and Morocco. The KRMC is expected to improve the primary and secondary mortgage markets, by providing secure, long-term funding to the mortgage lenders, thus increasing the number and financial muscle of mortgage lending financial institutions in the country.

- Increased Liquidity for Banks

The KMRC will provide the needed long-term funding to mortgage lenders, thus, creating liquidity for the institutions. This will increase the lenders’ ability to advance mortgages to applicants therefore increasing the vibrancy of the mortgage market and lead to a rise in the number of mortgages issued in the market.

- Standardization, Improved Lending Practices, and Increased Inclusivity

As a non-bank financial institution, KMRC will be partly owned by financial institutions, World Bank and the Government of Kenya while being regulated by the CBK, and overall oversight being provided by the Capital Markets Authority (CMA). SACCOs, which primarily represent the low-income masses, will also be brought on-board, leading to increased inclusivity. Once operational, KMRC targets 50,000 mortgages within 5-years. This is expected to increase competitiveness in the mortgage market, leading to improved lending practices among the mortgage lenders in terms of rates, tenures and processing fees, thus resulting in a more streamlined, standardized and cost-efficient market.

- Expansion of the Bond Market

KMRC will create more opportunities for investors by introducing new investment products such as mortgage-backed securities to the local capital market. This will provide an extra market for investors willing to subscribe to bonds, thus increasing their options and ultimately leading to a more competitive market.

The main challenges that are likely to face KMRC include:

- High Cost of Debt

In order to raise funds, the KMRC will issue mortgage-backed bonds, where investors are likely to demand high yields of between 13.5% - 13.8%, assuming a 1.0%-point margin above the minimum of the risk-free rate for a 15-year bond, which currently stands at 12.5%, or 12.8% for a 20-year bond. This, in our view, is still high for financing end user mortgages as it might mean high costs of debt, and will thus pose a challenge to the KMRC’s target of providing mortgages at 9% interest, potentially locking out low-income earners from accessing mortgages.

- Competition from Government Instruments

The KMRC may face challenges in its efforts to raise funds through issuing of bonds, due to competition from government instruments such as treasury bills, treasury bonds and government stocks. The KMRC will primarily focus on reducing cost of mortgages, thus may issue bonds at lower rates than the government instruments in order to maintain affordability of the mortgages offered. This will lead investors to shy away from the KMRC issued bonds, and instead subscribe to government instruments.

- Maturity Mismatch/Lack of Access to Secure Long-Term Funding

Maturity mismatch arise when the tenure of the mortgage-backed bonds is shorter than the mortgages they refinance. Typically, lenders in emerging markets tend to shy away from issuing long-term mortgages with tenures of 20-years for instance, backed by relatively shorter bonds of 10 years on average. According to the World Bank, the main challenge for the Tanzanian Mortgage Refinance Company was lack of access to long-term funds among lenders in Tanzania. This is a challenge that is also likely to face the Kenya Mortgage Refinancing Company, thus negatively affecting its operations because of inadequate funding.

- Bureaucracy and Inefficiencies in State Departments

Prolonged due diligence processes due to bureaucracy in departments offering critical services such as registration of properties and title deeds is likely to slow down operations of the KMRC. Inefficiencies also reduce the number of people eligible for mortgages thus negatively affecting the KMRC’s effort to increase mortgage uptake.

- Case Study: Tanzania MRC

In Africa, the average mortgage to GDP ratio is estimated to be at 5.0% with South Africa, Namibia, Morocco and Tunisia leading with 31%, 20%, 15%, and 13%, respectively, as at 2018. With the intensified focus on the affordable housing deficit in Africa, various countries have attempted to improve the mortgage markets, which are key impediments to the success of filling in the housing deficit gaps. To this end, we have seen countries such as Tanzania, Egypt and Nigeria establish mortgage refinancing facilities ultimately leading to increased mortgage products that are affordable to mid and low-income earners in the respective countries. We selected Tanzania as our case study due to comparability to the Kenyan market in terms of financial markets structuring as well as prevailing market conditions.

Introduction

With an estimated population of 56.9 mn as at 2018, according to the World Bank, Tanzania has a fast-growing housing demand which is also bolstered by the strong and sustained economic growth with GDP growth averaging at 6.0%-7.0% over the past decade. Furthermore, with majority of the population falling under low- and mid-income class, the country has a huge affordable housing deficit estimated at 3.0 mn units and growing annually by 200,000 units, as per the Tanzania National Housing Corporation. The deficit has been attributed to high property prices that are out of reach for majority of Tanzanians coupled by relatively high costs of finance. The fast-growing Tanzanian population is expected to more than double by 2050 with 50.0% living in urban areas, calling for efforts by the government to meet the growing demand of affordable housing. Consequently, TMRC, a non-banking institution owned by Tanzanian banks, was launched in 2011 with the sole purpose of financing mortgage lending banks’ portfolios in order to grow the mortgage market and increase home ownership rates in Tanzania.

Initially, TMRC began operations by using World Bank’s loan of USD 30.0 mn (Kshs 3.0bn) as well as the equity funds by the shareholders, whose requirement was a minimum subscription of Kshs 21.8 mn each, to finance primary lenders’ mortgage portfolios.

Bond Issuance

In 2017, TMRC managed to place bonds worth Kshs 174.4 mn with three pension funds; Government Employees Provident Fund (GEPF), Parastatal Pensions Fund (PPF), and Workers Compensation Fund (WCF). In 2018, TMRC offered the public its first issue of a corporate five-year bond worth Kshs 523.4 mn, which managed to raise Kshs 545.3 mn, a 4.3% oversubscription (Bank of Tanzania). The TMRC bond fixed-interest rate was 11.79%, set at 0.5% points above the 5-year Treasury bond whose interest rate was 11.29%.

TMRC Achievements

As at 2018, Mortgage to GDP ratio in Tanzania was at 0.3% from virtually zero 8-10 years ago, and as at December 2017, total mortgage loans by banks in Tanzania amounted to Kshs 15.0 bn, a 34% 5-Year CAGR, from Kshs 4.9 bn as at December 2012. The growth of Tanzania’s mortgage market is attributable to (i) favorable interest rates, (ii) increased awareness on mortgage loans among borrowers due to public awareness campaigns by major banks, (iii) extended tenor of mortgages, and (iv) increased competition due to continued entry of new lenders in the market.

The key achievements by TMRC are as indicated below:

- Mortgage refinance and pre-finance loans grew by a 5-Year CAGR of 64% from Kshs 187.6 mn in 2012 to Kshs 3.6 bn in 2017, bolstered by increased uptake by the primary mortgage market,

- Number of banks offering mortgage loans grew by 933.3% from 3 in 2011 to 31 by 2017,

- Mortgage repayment periods increased from a maximum of 5-7 years to 15-25 years. Initially, demand for the TMRC did not materialize as a result of banks’ reluctance to take on any maturity mismatches ahead of refinancing. Therefore, TMRC was redesigned to offer a pre-financing mechanism, through loans collateralized by government treasury bonds to the primary lenders, who then develop mortgage portfolios. The chance of banks misusing the funds is overseen through strict policies and penalties,

- Typical mortgage interest rates in Tanzania currently stand at 15%-19% on average, compared to 22%-24% in 2011. The interest rates were largely brought down as a result of growing competition from increasing number of lenders.

Key Challenges Facing TMRC

Demand for housing in Tanzania continues to be extremely high as a result of limited affordable units further constrained by relatively high interest rates that lock out the average Tanzanians. The key challenges to the maturity of Tanzania’s mortgage market include:

- Insufficient housing stock that can qualify for mortgages,

- High cost of land for development which is passed through to end-buyers,

- Low income levels leading to low mortgage affordability, and

- Bureaucratic processes with regards to issuance of titles, which negatively affects mortgage eligibility for homebuyers

As a result, the Government of Tanzania through institutions such as the National Housing Corporation, the Tanzania Building Authority and pension bodies such as NSSF are actively involved in development, selling and renting of houses for the Tanzania residents in order to address the housing shortage. NHC’s major ongoing projects in Dar es Salaam include the 711 Kawe, Morocco Square, and Victoria Place. Completed projects include Mwongozo and Kigamboni Housing Projects whose price points of Kshs 2.4 mn - Kshs 6.9 mn and Kshs 2.4 mn – Kshs 2.8 mn respectively, saw the projects achieve annual uptake of 84.0% and 100.0%, respectively. Upcoming projects include 559.4 acres SafariCity in Arusha and Iyumbu Satellite Town in Dodoma, both targeting low- and mid-income earners. See Cytonn Research Report on Dar

- Lessons for Kenya MRC from Tanzania MRC

TMRC has been fairly successful in improving its mortgage market as seen through the longer mortgage repayment periods and lower interest rates. The key takes for Kenya from Tanzania’s case are:

- Financial Capacity is Key: TMRC’s initial goal of tapping the capital markets was hampered by high treasury bond interest rates and inflation rates. At this stage, the facility received its financing from International Development Association through the Bank of Tanzania at 10.0% and loaning this to mortgage lenders at 11.5%, allowing the facility to create interest income as its own funds. KMRC’s goal to raise funds through the capital markets is also likely to experience its own challenge as the current interest rates for 15 and 20 year bonds stand at 12.5% and 12.8%, respectively. Therefore, assuming a 1.0% risk premium, KMRC bond interest rates would be 13.5%-13.8% which would mean refinancing lenders at higher rates and ultimately raising the mortgage interest rates to the borrower. Therefore, if the KMRC refinances at the market clearing levels, its financing costs may surpass the current average mortgage interest rates of 13.6%, leaving no spread for the facility or the lenders while also defying the intended purpose of reducing or maintaining current mortgage interest rates. To this end, the KMRC would either:

- Refinance at cost which would mean no spread for the facility, as well as competition from treasury bonds, possibly leading to undersubscription,

- Opt for medium-term bonds, say five-year, which would have lower interest rates. Currently, interest rates for a five-year treasury bond stands at 10.8%, or

- Refinance lenders’ mortgage portfolios using finance from the World Bank and other shareholders’ equity as they build up on entry to capital market

- Affordable Housing: Improving home affordability to the average-income homebuyers is a key component as seen in Tanzania’s NHC subsidized homes. Additionally, in Tanzania, the affordability project entailed the transformation of NHC into a master developer whose main role is to prepare land, devise an overall plan and create a conducive investment environment for private real estate developers. This has seen the corporation deliver affordable units on land belonging to the Government of Tanzania with units going for as low as Kshs 2.4 mn for a three-bedroom bungalow. Therefore, the Government of Kenya should channel its efforts towards ensuring the operationalization of KMRC goes hand in hand with realization of the affordable housing initiative,

- Awareness Campaign: Initially, TMRC failed at creating demand from primary lenders largely due to lack of sufficient knowledge amongst lenders and borrowers. KMRC, therefore, should create awareness among investors and lending institutions in order to ensure it begins operations on a firm ground. In addition to this, KMRC should be designed in such a way that it offers incentives to its various stakeholders to enable it to raise its own funds,

- Complementary Solutions: Tanzania, and other countries such as Nigeria and India, supplement their housing efforts with microfinance markets, to enable even the informal workers to access housing finance. Therefore, the government should strengthen the microfinance and housing cooperatives market in order to provide long-term housing microfinance/ cooperatives to low income earners who may not access the conventional mortgage finance.

In summary, we expect the KMRC to:

- Increase the amounts of monies available for mortgage lending, and

- Lengthen typical mortgage tenures in Kenya from the current average of 12 years to 20 years, bringing down monthly payments by 14%, assuming current average interest rates of 13.6%,

- Maintain the current market interest rates of 13.6% - 13.8%, (noting mortgages are fairly priced at just 100 bps above 15-year and 20-year government bonds at 12.5% and 12.8%, respectively. There has been talk of KMRC bringing down cost of mortgages to 10%, but not clear how that would be achieved as even the government has to pay 12.5%).

With the above impacts, we expect that the facility will help in addressing Kenya’s housing deficit by extending the range of qualifying mortgage borrowers, resulting in growth of home ownership rate and a vibrant mortgage market.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.