Financial Planning Amidst COVID-19, & Cytonn Weekly #26/2020

By Research Team, Jun 28, 2020

Executive Summary

Fixed Income

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 245.6% up from 188.4% the previous week. The oversubscription is partly attributable to the continued preference for shorter-dated papers by investors. The subscription rates for the 91-day, 182-day and 364-day papers increased to 412.0%, 140.3% and 284.4%, respectively, from 334.4%, 130.6% and 187.8%, recorded the previous week. The Monetary Policy Committee (MPC) met on 25th June 2020 to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). The MPC maintained the CBR at 7.00%, which in line with our expectations in our June 2020 MPC Note. We are projecting the y/y inflation rate for June 2020 to remain within the range of 5.4% - 5.7%, compared to 5.5% recorded in May;

Equities

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 recording declines of 4.7%, 1.6% and 3.0%, respectively, taking their YTD performance to losses of 17.2%, 27.0%, and 21.2%, for NASI, NSE 20 and NSE 25, respectively. The NASI performance was driven by losses recorded by large-cap stocks such as Bamburi, Safaricom, EABL, Equity Group, and NCBA, which lost by 20.3%, 7.8%, 2.9%, 2.2% and 1.6%, respectively. During the week, Equity Group announced it had mutually agreed with Atlas Mara to call off plans to acquire banking assets in four countries in exchange for shares in Equity Group. Equity Group also announced it would pay the final Kshs 2.1 bn for acquisition of a 66.5% controlling stake in Banque Commerciale du Congo (BCDC), over 2 years in a move aimed at protecting Equity Group against potential unforeseen liabilities in the target company. Jamii Bora Bank (JBB), disclosed Co-operative bank had offered an initial Kshs 1.0 bn for a 90.0% stake in Jamii Bora Bank, effectively valuing Jamii Bora Bank at Kshs 1.1 bn;

Real Estate

During the week, local developers, Ever Forgarden Company Limited and New Forhome Company, announced plans to develop 900 and 240 apartments, respectively, in Kilimani, Nairobi. In the retail sector, Quickmart, a local retailer, opened its latest outlet in Kilimani, along Kilimani Road, marking its 32nd outlet nationwide, whereas in the hospitality sector, W Hospitality Group, an African tourism Investment advisor, released their Hotel Chain Development Pipelines in Africa 2020 Report highlighting that Kenya has approximately 3,588 rooms in the pipeline, to be hosted within 23 hotels under brands; Radisson Hotel Group, Accor Hotels, Swiss International, and, Marriott International;

Focus of the Week

The novel COVID-19 has not only affected the global economy but has also affected our investments and long-term financial goals. Managing finances during this time is essential as most people are on a survival mode given the reduction in their income. Having a sound financial plan will help reduce and possibly eliminate the financial distress that may arise from various responsibilities and unexpected situations. Earlier in February 2020, we had discussed this topic on our Personal Financial Planning topical, however, in light of the ongoing Coronavirus pandemic that has wreaked havoc in individual’s businesses, savings and financial planning efforts, we found it timely to reiterate the topic keeping in mind the new operating environment;

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.6% p.a. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.5% p.a. To invest, email us at sales@cytonn.com;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running promotions:

- For Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit;

- For Phase 1: Get a 10% rent discount on units we manage for investors;

- For inquiries, please email us on clientservices@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The aim of the training is to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- For Pension Scheme Trustees and members, we shall be having different an industry players talk about matters affecting Pension Schemes and the pensions industry at large. Join us every Wednesday from 9:00 am to 11:00 am for in-depth discussions on matters pension;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 245.6% up from 188.4% the previous week. The oversubscription is partly attributable to the continued preference for shorter-dated papers by investors. The subscription rates for the 91-day, 182-day and 364-day papers increased to 412.0%, 140.3% and 284.4%, respectively, from 334.4%, 130.6% and 187.8%, recorded the previous week. The yields on the 91-day, 182-day, and 364-day papers declined by 39.0 bps, 34.9 bps, and 47.4 bps, respectively, to 6.7%, 7.4%, and 8.2%, respectively. The acceptance rate declined to 23.3%, from 32.6% recorded the previous week, with the government accepting only Kshs 13.8 bn of the Kshs 59.0 bn worth of bids received, due to reduced borrowing pressure, with the Government having met their FY’2019/2020 borrowing target of Kshs 409.0 as highlighted by the Governor of the Central Bank of Kenya in his post-monetary committee press conference on 26th June 2020.

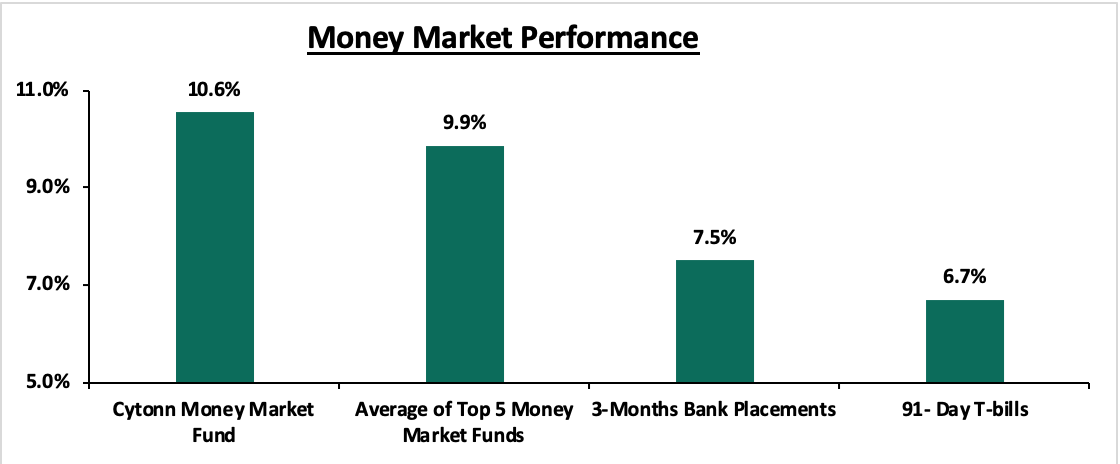

In the money markets, 3-month bank placements ended the week at 7.5% (based on what we have been offered by various banks), while the yield on the 91-day T-bill declined by 0.4% points to close the week at 6.7%, from 7.1% recorded the previous week. The average yield of Top 5 Money Market Funds remained unchanged at 9.9% similar to what was recorded the previous week. The yield on the Cytonn Money Market remained unchanged at 10.6%, similar to what was recorded the previous week.

Liquidity:

During the week, market liquidity tightened with the average interbank rate increasing to 3.9% from 3.2% recorded the previous week, attributable to tax remittances due on the 20th of every month. The week also saw the average interbank volumes increase by 132.6% to Kshs 8.9 bn, from Kshs 3.8 bn recorded the previous week. According to the Central Bank of Kenya, commercial banks’ excess reserves came in at Kshs 41.1 bn in relation to the 4.25% cash CRR. The favourable liquidity since March 2020 has also partly been attributable to the reduction of the Cash Reserve Ratio (CRR) to 4.25%, from 5.25% previously, by the Monetary Policy Committee (MPC) during its March 2020 sitting, consequently freeing up Kshs 35.3 bn of additional liquidity to commercial banks for onward lending to distressed borrowers during the COVID-19 pandemic. The Monetary Policy Committee in its meeting held on 25th June 2020 revealed that 87.6% of the funds have been used for onward lending especially to support the tourism, transport & communication, real estate, and manufacturing sectors.

Kenya Eurobonds:

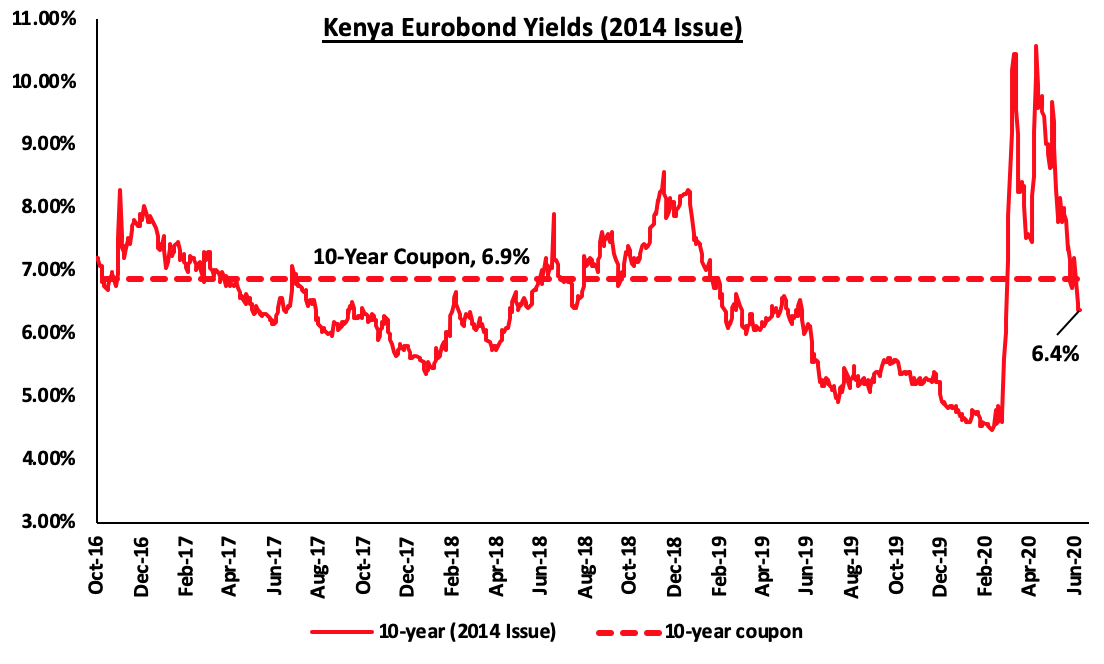

Since the jump we saw in March, investor sentiments have been improving over the past two months as the market reacted to the news by the World Bank having approved USD 1.0 bn funding to support the economy as well as the Rapid Credit Facility (RCF) which reaffirmed investors’ confidence despite the recent downgrade by Moody’s where Kenya’s sovereign credit outlook was changed to negative from stable. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 remained unchanged at 6.4% for the week.

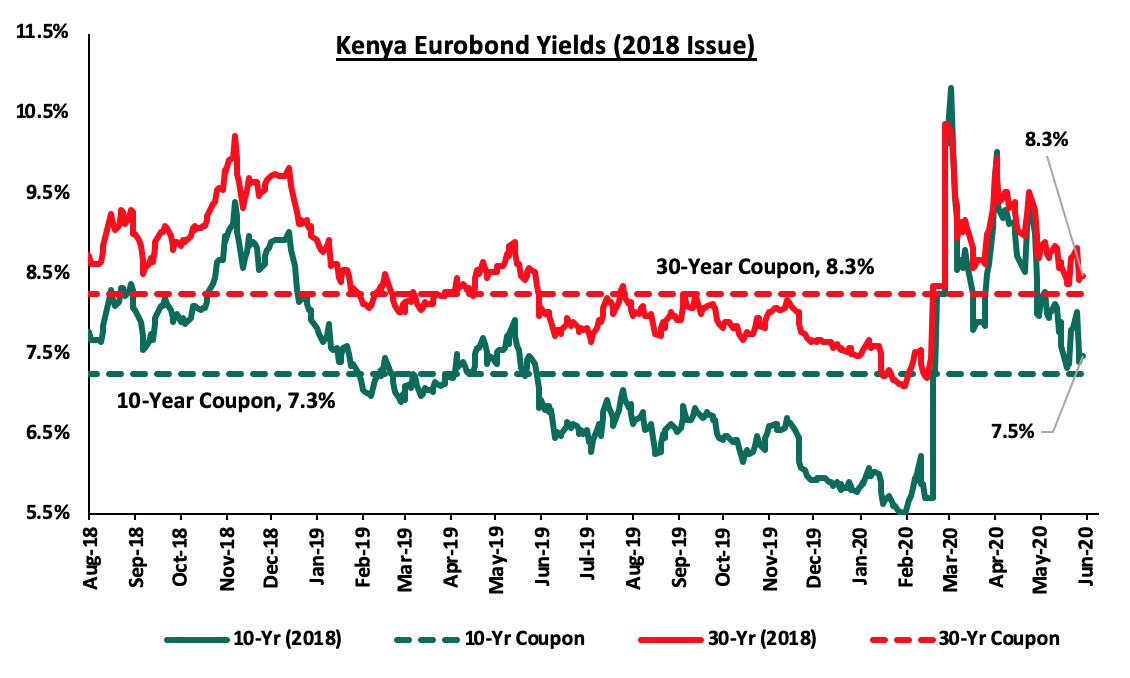

The yields on the 10-year Eurobond issued in 2018 remained unchanged at 7.5% similar to what was recorded the previous week. The yield on the 30-year Eurobonds issued in 2018 declined by 0.2% points to 8.3% from 8.5% recorded the previous week.

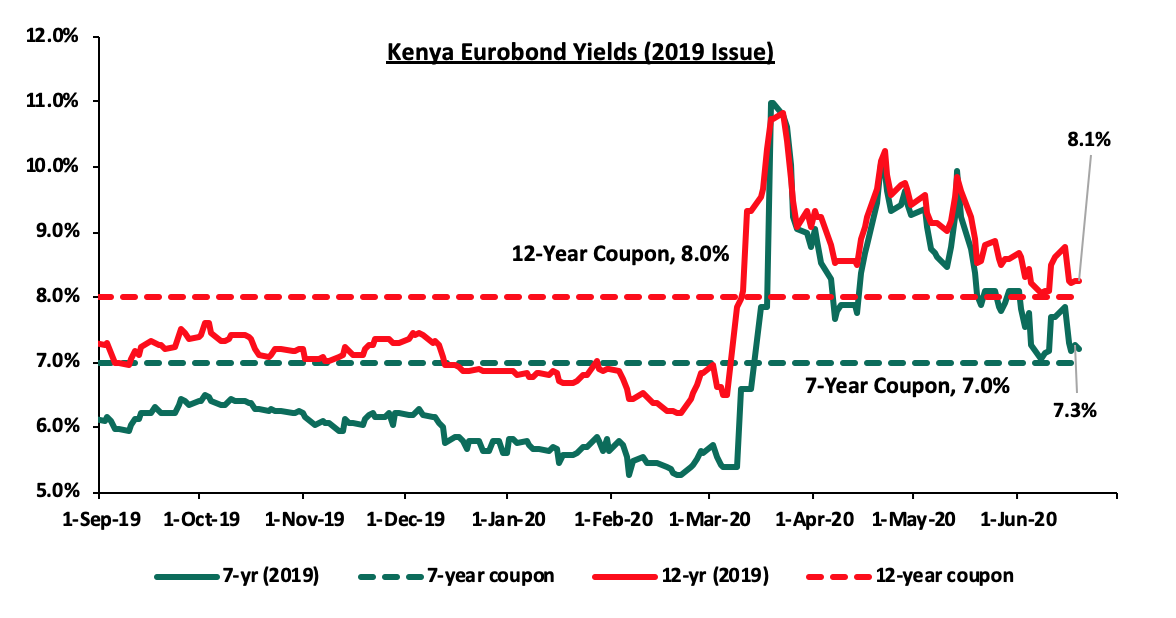

The yields on the 7-year Eurobond issued in 2019 increased by 0.1% points to 7.3% from 7.2% recorded the previous week. The yield on the 12-year Eurobonds issued in 2019 declined by 0.1% points to 8.1% from 8.2% recorded the previous week, respectively.

Kenya Shilling:

During the week, the Kenya Shilling depreciated by 0.2% against the US Dollar to close the week at Kshs 106.5, from Kshs 106.3, recorded the previous week, which traders attributed to high, end month, dollar demand from multinational companies and manufacturers importing goods. The demand was, however, offset by the inflows from the horticulture exports as well as diaspora remittances. On an YTD basis, the shilling has depreciated by 5.1% against the dollar, in comparison to the 0.5% appreciation in 2019. We expect continued pressure on the shilling due to:

- Demand from merchandise and energy sector importers as they beef up their hard currency positions amid a slowdown in foreign dollar currency inflows, and,

- Subdued diaspora remittances evidenced by the 9.0% decline to USD 208.2 mn in April 2020, from USD 228.8 seen the previous month, mainly due to the decline in economic activities globally, coupled with increased prices of household items leading to lower disposable income. Key to note, the Central Bank of Kenya (CBK) expects a 12.0% decline in remittances in 2020.

The shilling is however expected to be supported by:

- High levels of forex reserves, currently at USD 9.2 bn (equivalent to 5.6-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Weekly Highlight:

- Monetary Policy

The Monetary Policy Committee (MPC) met on 25th June 2020 to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). The MPC maintained the CBR at 7.00%, which was in line with our expectations in our June 2020 MPC Note. The MPC indicated that the previous cuts in the CBR rate in March and April 2020 to the current 7.00%, was having the intended outcome. The key highlights from the meeting:

- Inflation is expected to remain within the Government’s target of between 2.5% - 7.5%, largely supported by the improving food supply due to favourable weather conditions, lower international oil prices, reduced VAT rate on some commodities and muted demand pressures,

- The most recent economic indicators points that growth in Q1’2020 was strong, an indication that impact of the COVID-19 virus was majorly pronounced in April 2020. There was a notable recovery in the economy in May 2020 driven by increased agricultural output and exports. The revenues from the services sector likes tourism and aviation remained low,

- Taking into consideration the impact of COVID-19, the current account deficit is expected to remain at 5.8% of GDP in 2020, suported by an increase in exports of tea and horticulture. The service sector, and in particular air travel and tourism, continue to be adversely affected by the COVID-19 pandemic,

- The banking sector recorded an improvement in asset quality with the gross non-performing loans ratio coming in at 13.0% in May 2020 as compared to 13.1% in April 2020. The performance was attributable to repayments and recoveries in the manufacturing and real estate sectors,

- In line with the measures announced by the Central Bank in March 2020 regarding loan restructuring, total loans worth Kshs 679.6 bn had been restructured representing 23.4% of the total banking sector loan book which amounts to Kshs 2.9 tn. A total of Kshs 199.1 bn (25.0% of total personal loans) have been restructured. Other major sectors where loan restructuring has taken place include trade (23.7%), real estate (20.6%), tourism (12.5%), and transport and communication sector (11.2%), and,

- There was an Improvement in private sector credit growth, with the growth at 1% in the 12-months to May 2020, above the 5-Year historical average, of 8.0%. Strong credit growth was observed in the Manufacturing sector (18.6%), consumer durables (16.7%), trade (8.2%), and finance and insurance (7.2%).

The committee noted that the policy measures put in place in March and April were having the intended effect on the economy and are still being transmitted. They concluded that the current accommodative stance is appropriate. The Governor of the Central Bank of Kenya noted that measures put in place to cushion the economy such as waiving transaction charges for transfer of money between banks as well as waiving fees for any mobile transactions below Kshs 1,000.0 were having the intended effect on the economy. The governor also noted that other tools of monetary policy such as Cash Reserve Ratio (CRR) and Repos continue to remain efficient in stimulating the economy.

- Inflation Projection

We are projecting the y/y inflation rate for June 2020 to remain stable within the range of 5.4% - 5.7%, compared to 5.5% recorded in May. The key drivers include:

- Petrol prices increased by 6.9% while kerosene and diesel prices declined by 21.7% and 4.8%, respectively. The increase in petrol prices, together with travel restrictions by government in the wake of COVID-19 are likely to have upward pressure on the transport index which holds a weighting of 8.7%,

- Food prices have remained relatively stable during the month given the favourable weather and an improvement in agricultural output, and,

- The reclassification of the Food Index in the Consumer Price Index from 36.0% to 32.9%, which is expected to have an impact on the final inflation figures.

We expect inflation to remain stable despite supply side disruption due to COVID-19 as low demand for commodities compensates for the cost-push inflation. The recent reopening of majority of the global markets will also address supply chain disruptions leading to stable import prices.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. We believe that the uncertainty affecting the global financial markets brought about by the novel Coronavirus will make it harder for the government to access foreign debt, and might result in investors attaching a high-risk premium on the country. As a result of depressed revenue collection with the revenue target for FY’2020/2021 at Kshs 1.9 tn, we expect a higher budget deficit, which the Treasury estimates at 7.5% of GDP, creating uncertainty in the interest rate environment as additional borrowing from the domestic market will be required to plug in the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term fixed income securities to reduce duration risk.

Markets Performance

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 recording declines of 4.7%, 1.6% and 3.0%, respectively, taking their YTD performance to losses of 17.2%, 27.0%, and 21.2%, for NASI, NSE 20 and NSE 25, respectively. The NASI performance was driven by losses recorded by large-cap stocks such as Bamburi, Safaricom, EABL, Equity Group, and NCBA, which lost by 20.3%, 7.8%, 2.9%, 2.2% and 1.6%, respectively. The loss was however slowed down by gains recorded by other large-cap stocks such as DTBK, ABSA and BAT of 2.9%, 2.4% and 1.3%, respectively.

Equities turnover declined by 14.0% during the week to USD 26.1 mn, from USD 30.3 mn recorded the previous week, taking the YTD turnover to USD 803.0 mn. Foreign investors remained net sellers during the week, with a net selling position of USD 12.3 mn, from a net selling position of USD 0.5 mn recorded the previous week, taking the YTD net selling position to USD 213.7 mn.

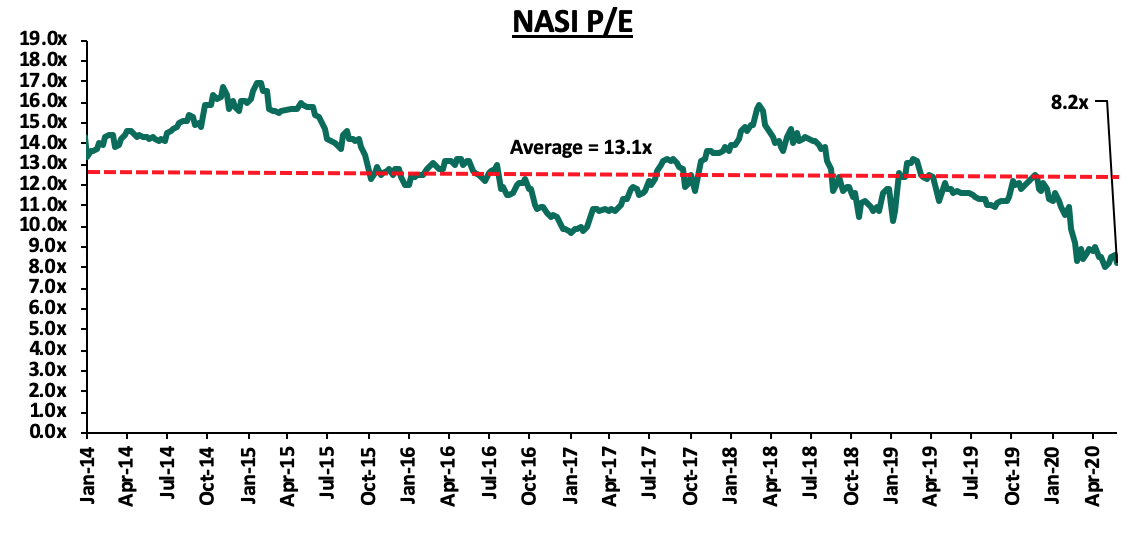

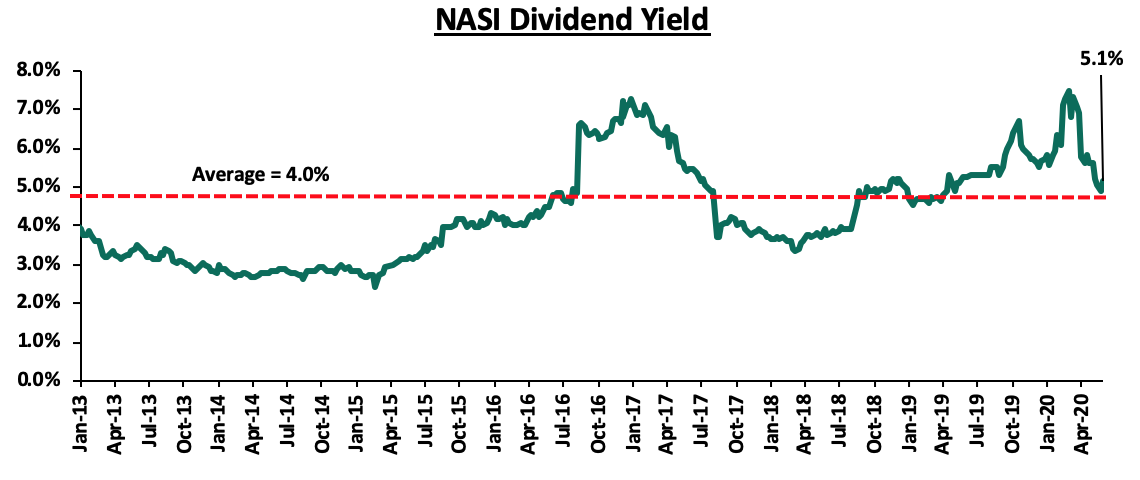

The market is currently trading at a price to earnings ratio (P/E) of 8.2x, 37.5% below the historical average of 13.1x. The average dividend yield is currently at 5.1%, an increase from the 4.9% recorded the previous week, and 1.1% points above the historical average of 4.0%. The increase in dividend yield is mainly attributable to price declines recorded by most stocks during the week. With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 8.2x is 2.0% above the most recent valuation trough of 8.0x experienced in the last week of May 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, Equity Group announced it had mutually agreed with Atlas Mara to call off plans to acquire banking assets in four countries in exchange for shares in Equity Group. This follows a January announcement by the board of Equity Group announcing the extension of discussions between the Group and Atlas Mara after the expiry of the transaction period before the two parties could sign a detailed transaction agreement. During the extended period, the two parties were to continue further discussions to try to reach mutually acceptable commercial terms with respect to the proposed transaction or a variant of it. The lender had entered into a binding term sheet in 2019 with Atlas Mara Limited to acquire:

- 62.0% of the share capital of Banque Populaire du Rwanda (BPR);

- 100.0% of the share capital of Africa Banking Corporation Zambia (ABCZam) Ltd.;

- 100.0% of the share capital of Africa Banking Corporation Tanzania (ABCTz); and,

- 100.0% of the share capital of Africa Banking Corporation Mozambique Ltd (ABCMoz).

The transaction was to be funded by a share swap whereby Atlas Mara would be allotted 252.5 mn shares of Equity Group, equivalent to a 6.7% stake valued at about Kshs 8.9 bn using the closing price of Kshs 35.1 on 26thJune 2020 and effectively valuing Equity Group at Kshs 132.3 bn. As part of its growth strategy, Equity Group had undertaken to expand its regional footprint by leveraging on its strong retail banking expertise as well as its strong digital banking capability via its subsidiary-Finserve.

In our view, the bank’s geographical diversification strategy has continued to emerge as a net positive, with the bank’s various subsidiaries in Uganda, DRC, Rwanda, and South Sudan cumulatively contributing 25.0% of the bank’s total profitability and 28.0% of the group’s total asset base in Q1’2020. However, the completion of the Atlas Mara deal would have caused a strain on the balance sheet of Equity Group given the current tough operating environment and the poor performance of some of its subsidiaries especially the Tanzanian subsidiary, which recorded a loss of Kshs 0.07 bn in Q1’2020 from Kshs 0.10 bn in Q1’2019. We are of the view that the drop off plan is commendable and in line with the Group’s strategy of exercising prudence, aimed at preserving capital in the wake of the COVID-19 pandemic. Key to note, according to Atlas Mara’s Banking components results for the year ended 31 December 2019, of the four banks Equity Group was to acquire, there was an improvement in performance in Rwanda, and underperformance in Mozambique, Tanzania, and Zambia, attributable to challenging macroeconomic and market environment, thus underpinning the major concerns in Equity’s regional expansion to those countries.

During the week, Equity Group also announced it would pay the final Kshs 2.1 bn for acquisition of a 66.5% controlling stake in Banque Commerciale du Congo (BCDC), over 2 years. In a move aimed at protecting Equity Group against potential unforeseen liabilities in the target company, the Kshs 2.1 bn will be kept in an escrow account (an account where funds are held in trust while two or more parties complete a transaction), with part of the funds being released to the George Arthur Forest family, a year after the completion date of the deal, provided Equity does not encounter new liabilities in BCDC, while the remaining balance will be released after 2 years. In a circular to its shareholders, Equity Group also disclosed the agreement provides for a claims mechanism that enables the Group to seek compensation in certain circumstances post-completion. In our view, the approach by Equity Group will ensure its investors are able to get value from the acquisition and ensure Equity’s expansion into DRC continues to contribute positively to the Group.

During the week, Jamii Bora Bank (JBB), disclosed Co-operative bank had offered an initial Kshs 1.0 bn for a 90.0% stake in Jamii Bora Bank, effectively valuing Jamii Bora Bank at Kshs 1.1 bn. The offer from Co-operative bank is a variation of the earlier discussion of a 100.0% buyout as highlighted in our Cytonn Weekly #25/2020. Details of the implied transaction are as follows;

- The transaction will involve the issuance of additional 224.1 mn new Class A shares to Co-operative bank, subject to Co-operative Bank paying the aggregate subscription price of Kshs 1.0 bn, effectively valuing the new shares at Kshs 4.46 per share,

- The existing issued 24.9 mn shares in JBB of Kshs 66.0 per share will be reclassified to Class B and will retain their existing rights. This will increase JBB’s total shares outstanding to 249.0 mn shares from the current 24.9 mn shares, and current shareholders will be diluted to 10.0%,

- As at Q1’2018 (last time JBB released its financial results), JBB had a book value of Kshs 3.4 bn. As such the implied transaction is being carried out at a price-to-book value (P/Bv) of 0.3x, which is a 70.0% discount to the current listed banks trading book value of 1.0x, and 78.6% below the historical average P/Bv of 1.4x for the Kenyan Bank transactions in the last 5 years.

The acquisition of the bank at a discount is reflective of Jamii Bora Bank’s financial performance, having recorded losses of Kshs 51.3 mn in Q1’2018, and Kshs 96.8 mn in Q1’2017, coupled with the Bank’s capital position. In our view, the acquisition will have little impact on increasing Co-operative bank’s market share and is more likely a rescue deal. The table below highlights the various transactions in the banking sector in the last 5-years that have either happened, been announced or expected to be concluded:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs. Bns) |

Transaction Stake |

Transaction Value |

P/Bv Multiple |

Date |

|

Co-operative Bank |

Jamii Bora Bank |

3.4 |

90.0% |

1.0 |

0.3x |

Mar-20** |

|

Commercial International Bank |

Mayfair Bank Limited |

1.0 |

51.0% |

Undisclosed |

N/A |

May-20* |

|

Access Bank PLC (Nigeria) |

Transnational Bank PLC. |

1.9 |

100.0% |

Undisclosed |

N/A |

Feb-20* |

|

Oiko Credit |

Credit Bank |

3.0 |

22.8% |

1.0 |

1.5x |

Aug-19 |

|

KCB Group |

National Bank of Kenya |

7.0 |

100.0% |

6.6 |

0.9x |

Sep-19 |

|

CBA Group |

NIC Group |

33.5 |

53%:47% |

23.0 |

0.7x |

Sep-19 |

|

CBA Group*** |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

Jan-19 |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

Jan-19 |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

Dec-18 |

|

SBM Bank Kenya |

Chase Bank Ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

3.0 |

100.0% |

5.0 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov-13 |

|

Average |

|

|

75.7% |

|

1.4x |

|

|

*Announcement date **Deals that were dropped |

||||||

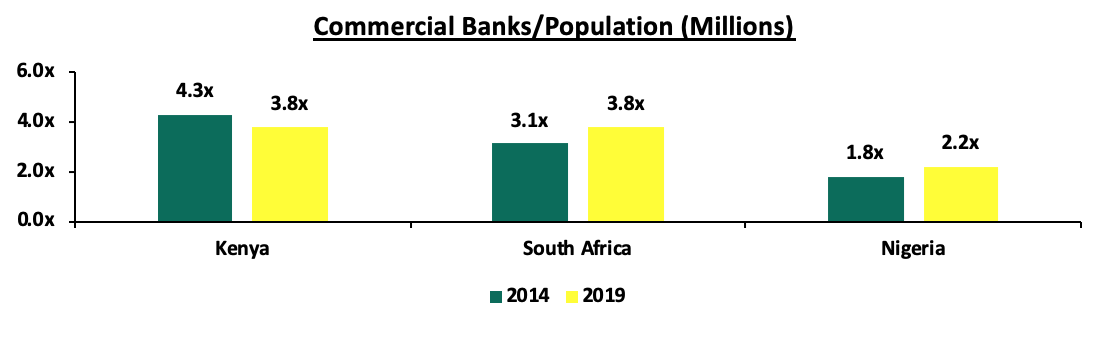

The number of commercial banks in Kenya will be 38, compared to 43 banks from 5-years ago. The ratio of the number of banks per 10.0 million people in Kenya now stands at 3.8x, compared with a ratio of 4.3x, 5 years ago. However, despite the ratio improving, Kenya still remains overbanked as the number of banks remains relatively high compared to the population. The chart below highlights the ratio of the number of banks per 10.0 mn people in Kenya, South Africa and Nigeria

We believe that continued bank consolidation efforts in Kenya, as highlighted in our Q1’2020 Banking Report, will lead to a stable banking sector, as consolidation continues to eliminate weaker banks. In our view, banks will continue to consolidate to form strategic partnerships and well-capitalized entities capable of navigating the relatively tough operating environment induced by stiff competition.

Universe of Coverage:

|

Company |

Price at 19/06/2020 |

Price at 26/06/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank*** |

68.0 |

70.0 |

2.9% |

(35.8%) |

109.0 |

175.0 |

3.9% |

153.9% |

0.4x |

Buy |

|

Kenya Reinsurance |

2.2 |

2.2 |

0.9% |

(26.7%) |

3.0 |

4.6 |

5.0% |

112.2% |

0.2x |

Buy |

|

KCB Group*** |

36.2 |

36.4 |

0.7% |

(32.6%) |

54.0 |

56.2 |

10.0% |

64.4% |

0.9x |

Buy |

|

I&M Holdings*** |

48.3 |

50.0 |

3.6% |

(7.4%) |

54.0 |

76.3 |

5.1% |

57.7% |

0.8x |

Buy |

|

Co-op Bank*** |

12.5 |

12.5 |

0.0% |

(23.5%) |

16.4 |

18.0 |

8.2% |

52.2% |

1.0x |

Buy |

|

Stanbic Holdings |

82.0 |

82.0 |

0.0% |

(24.9%) |

109.3 |

111.2 |

9.2% |

44.8% |

1.0x |

Buy |

|

Equity Group*** |

35.9 |

35.1 |

(2.2%) |

(34.5%) |

53.5 |

50.7 |

0.0% |

44.7% |

1.2x |

Buy |

|

ABSA Bank*** |

9.9 |

10.1 |

2.4% |

(24.3%) |

13.4 |

13.2 |

11.1% |

41.8% |

1.3x |

Buy |

|

Jubilee Holdings |

250.0 |

250.0 |

0.0% |

(28.8%) |

351.0 |

334.8 |

3.5% |

37.4% |

0.9x |

Buy |

|

Liberty Holdings |

7.9 |

7.2 |

(8.6%) |

(30.2%) |

10.4 |

9.8 |

0.0% |

36.2% |

0.7x |

Buy |

|

Sanlam |

13.6 |

13.7 |

0.7% |

(20.6%) |

17.2 |

18.4 |

0.0% |

34.8% |

1.3x |

Buy |

|

NCBA*** |

27.5 |

27.1 |

(1.6%) |

(26.6%) |

36.9 |

35.6 |

0.9% |

32.5% |

0.8x |

Buy |

|

Standard Chartered*** |

167.5 |

167.0 |

(0.3%) |

(17.5%) |

202.5 |

202.7 |

7.4% |

28.7% |

1.5x |

Buy |

|

Britam |

8.5 |

7.8 |

(7.8%) |

(13.3%) |

9.0 |

7.6 |

2.6% |

0.0% |

0.7x |

Sell |

|

CIC Group |

2.3 |

2.3 |

2.2% |

(14.2%) |

2.7 |

2.1 |

0.0% |

(8.7%) |

0.8x |

Sell |

|

HF Group |

4.0 |

4.5 |

13.3% |

(29.9%) |

6.5 |

4.0 |

0.0% |

(11.7%) |

0.2x |

Sell |

|

*Target Prices as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Companies in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Neutral” on equities for investors because, despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim.

- Residential Sector

During the week, Ever Forgarden Company Limited, a local developer, announced plans to develop 900 apartments hosted within four 15-storey blocks along Kindaruma Road in Kilimani, Nairobi. The proposed development, dubbed ‘Heartland Home’ will comprise of 240- 40 SQM studio apartments and 660- 70 SQM one-bedroom apartments selling at Kshs 3.8mn and Kshs 6.8 mn, respectively, which translates to Kshs 96,363 per SQM, 16.9% lower than Kilimani’s market average of Kshs 115,985 according to our Cytonn Q1'2020 Markets Review. This marks the developer’s second development in Kilimani after Denis Garden along Denis Pritt Road. The project, which started in 2018, comprises of 30 SQM studio apartments, 40 SQM one-bedroom apartments, 70 SQM one bedroom (inclusive of a servant quarter) apartments, 100 SQM two-bedroom apartments, 120 SQM three-bedroom apartments, and, 150 SQM three bedroom (inclusive of a servant quarter) apartments selling at Kshs 3.8 mn, Kshs 4.8 mn, Kshs 6.8 mn, Kshs 8.8 mn, Kshs 10.8 mn, and Kshs 12.8 mn, respectively, which translates to Kshs 93,725 per sqm on average. In addition, New Forhome Company, also a local developer, has also announced plans to put up 240 apartments in the Kilimani area. The project will consist of 60 Studio apartments, 120 one-bedroom apartments, and, 60 two-bedroom apartments (the sizes and prices are yet to be disclosed). The move by the developers are an indication of the continued investor interest in Kilimani submarket, supported by the relatively high returns on investment. According to Cytonn Q1'2020 Markets Review, Kilimani was the best performing node in the upper mid-end market within the Nairobi Metropolitan Area, recording an average rental yield of 6.7%, compared to the market average rental yield of 5.3% and an average annual uptake of 25.7%, compared to the market average of 20.0%. The relatively high performance within Kilimani is supported by an existing demand for residential units by Nairobi’s young and working population driven by the proximity to key business nodes such as Upperhill, availability of good infrastructure, security, coupled with availability of amenities.

(All Values in Kshs Unless Stated Otherwise)

|

Upper Mid-End Apartments Performance Q1'2020 |

|||||||

|

Node |

Average Price per SQM Q1'2020 |

Average Rent Per SQM Q1'2020 |

Average Occupancy Q1'2020 |

Average Annual Uptake 2020 |

Average Rental Yield Q1'2020 |

Average Annual Price Appreciation Q1'2020 |

Total Returns Q1’2020 |

|

Kilimani |

115,985 |

650 |

94.5% |

25.7% |

6.6% |

0.1% |

6.7% |

|

Parklands |

113,703 |

637 |

94.1% |

16.7% |

6.2% |

(0.8%) |

5.4% |

|

Loresho |

111,277 |

563 |

90.8% |

17.9% |

5.5% |

(0.6%) |

4.9% |

|

Westlands |

129,199 |

687 |

77.6% |

21.5% |

5.2% |

(0.4%) |

4.8% |

|

Kileleshwa |

113,736 |

442 |

71.4% |

18.3% |

5.9% |

(1.6%) |

4.3% |

|

Average |

116,780 |

596 |

85.7% |

20.0% |

5.9% |

(0.6%) |

5.3% |

Source: Cytonn Research 2020

- Retail Sector

During the week, Quickmart, a local retailer, opened its latest outlet in Kilimani, along Kilimani Road, marking its 32nd store nationwide, following recent openings in Nairobi’s Central Business District (CBD), along Tom Mboya Street, Ongata Rongai, Roysambu, and, along Waiyaki Way. The retailer has continued to expand its foothold in the Kenyan retail market with plans to open another store in Nyayo Estate, Embakasi next month. The retailer’s continued expansion is mainly supported by; (i) adequate funding from Adenia Partners, a private equity fund management company based in Mauritius, which acquired majority stake in Quickmart for an undisclosed amount in September last year, (ii) availability of prime locations vacated by struggling supermarket chains such as Choppies, (iii) shifting consumer habits as Kenyans increasingly shop in formal retail centres, and, (iv) Kenya’s expanding middle-class population.

The move by Quickmart comes just two months after Naivas Supermarket unveiled its 64th outlet in the Kilimani suburb, indicating that the Kilimani market appeals to a number of retailers supported by; (i) availability of relatively good infrastructure such as the upgraded Ngong Road, and, (ii) presence of individuals with a high purchasing power, since the area is an upper middle-income neighbourhood. We expect the continued expansion of the retailers will cushion the sector’s performance in the wake of growing vacancy rates driven by some retailers shutting down their operations to cushion themselves against the impact of the Coronavirus pandemic and the fall of struggling retailers such as Botswana’s Choppies. According to Cytonn Q1’2020 Market Review, in terms of performance, Kilimani retail market recorded an average occupancy rate of 85.5%, compared to the market average of 76.3%.

The table below shows the performance of the retail sector:

(All Values in Kshs Unless Stated Otherwise)

|

Nairobi Metropolitan Area (NMA) Retail Submarket Performance Q1'2020 |

|||

|

Location |

Rent/SQFT Q1’ 2020 |

Occupancy Q1’ 2020 |

Rental Yield |

|

Westlands |

210.3 |

82.2% |

10.0% |

|

Karen |

220.0 |

81.9% |

9.6% |

|

Ngong Road |

186.3 |

80.5% |

8.5% |

|

Kilimani |

164.2 |

85.5% |

8.5% |

|

Kiambu Road |

175.4 |

70.3% |

7.3% |

|

Thika Road |

170.4 |

73.0% |

7.0% |

|

Eastlands |

148.2 |

71.8% |

6.8% |

|

Mombasa Road |

152.5 |

69.3% |

6.4% |

|

Satellite town |

135.0 |

74.5% |

6.0% |

|

Average |

172.7 |

76.3% |

7.7% |

Source: Cytonn Research 2020

- Hospitality Sector

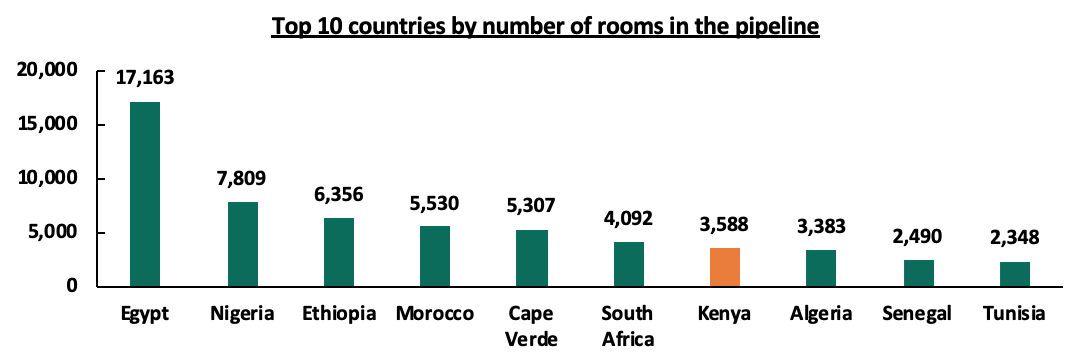

During the week, W Hospitality Group, an African tourism investment advisor, released their Hotel Chain Development Pipelines in Africa 2020 Report, which aims at providing the hospitality industry with insight into the various upcoming hotel facilities by the major hotel players in Africa at a country, regional, and, city level. According to the report, Kenya ranked 7th in Africa with 3,588 rooms in the pipeline, within 23 hotels under brands such as; Radisson Hotel Group, Accor Hotels, Swiss International, and, Marriott International. This accounts for 25.3% of total rooms in the pipeline in the East African region whose total amounted to 13,850 keys. At the city level, Nairobi stood out as the key investment destination for global hoteliers targeting Kenya, with 3,298 rooms in the pipeline, representing 91.2% of Kenya’s total expected rooms, while ranking 4th in Africa after Cairo, Addis Ababa and Lagos with 6,257, 4,865 and 3,690 hotel rooms, respectively, within their pipeline.

Source: W Hospitality Group Report

The report affirms the attractiveness of Kenya’s hospitality sector to investors and this we attribute to; (i) Nairobi’s recognition as East and Central Africa’s leading business and investment hub which has led to an increase in conference tourism, and, (ii) increased foreign investor confidence in the Kenyan hospitality industry supported by an existing demand for hospitality facilities and services. According to the World Travel and Tourism Council (WTTC), domestic travel spending in Kenya generated 59.0% of direct travel and tourism GDP in 2015. This figure is expected to increase at an average annual rate of 5.4%, reaching USD 4.2 bn in 2026. Nevertheless, development activities within the sector are expected to slow down considerably in the short and medium term, attributed to effects of the current COVID-19 pandemic among them; (i) a decline in project financing as investors adopt a wait and see attitude in the wake of a slowdown in the economy globally, (ii) delays in project completion due to disruption of supply chains and reduced labor force, and, (iii) reduced tourism activities owing to local and international travel restrictions. However, we expect the sector to recover gradually supported by various National Government measures among them; (i) the gradual easing of movement restrictions, (ii) extension of working hours for hotels and restaurants, and, (iii) various fiscal response measures such as the restructuring of loans worth Kshs 634 mn to hospitality facilities through the Tourism Finance Corporation (TFC) coupled with the allocation of Kshs 3 bn in support of the post COVID-19 tourism marketing and hotel refurbishment under the 8-point stimulus programme.

We expect the real estate sector to record activities as the economy cautiously reopens following the COVID-19 closures, supported by the continued investor focus on high return residential submarkets such as Kilimani and the hospitality sector, and, continued expansion of local retailers such as Quickmart backed by investor funding.

Introduction

Financial planning is the systematic approach towards managing one’s finances by allocating resources in a systematic and disciplined manner in order to achieve one’s financial goals and objectives. A sound financial plan is important as it helps reduce and possibly eliminate financial distress that may arise from various responsibilities and unexpected situations. Earlier in February 2020, we had discussed this topic on our Personal Financial Planning topical, however, in light of the ongoing Coronavirus pandemic that has wreaked havoc in individual’s businesses, savings and financial planning efforts, we found it timely to reiterate the topic keeping in mind the new operating environment. The novel COVID-19 has greatly affected the global economy with the International Monetary Fund projecting the global economy to contract by 3.0% in 2020, a worse outlook than the one seen during the 2008-2009 financial crisis, where growth contracted by 0.8%. Due to these effects in the economy, livelihoods have been affected in one way or another and as such, people have had to adjust financially to the new environment. We shall cover the following in this topical;

- Financial Planning Process

- Effects of Coronavirus on financial planning

- Financial planning opportunities in the coronavirus environment

- Factors to consider when making an Investment Decision

- Conclusion

Section I: Financial Planning Process

As discussed above, a sound financial plan will go a long way in mitigating unexpected situations such the Coronavirus Pandemic. Financial planning is a process consisting of the following steps:

- Assessment: In this step, one determines their current financial situation by identifying various factors that may affect his/her financial plan. In this step, one may ask themselves questions such as; is my salary enough for me to pursue my financial objective? What are my spending habits? etc. One’s financial plan is likely to be informed by their risk profile, age, income or number of dependents. In most cases, people with fewer dependants have more freedom to make riskier investment decisions while those with a lower risk appetite tend to avoid riskier investment decisions and as such, they will be geared towards safer investment plans,

- Goal Setting: In this step, one outlines the financial goals they want to achieve in the long run. These goals ultimately provide a clear roadmap towards the achievement of their financial objectives. However, the goals should be measurable and achievable by one or a combination of the following four practices:

- Savings is defined as keeping money for emergencies in a fund without the intention of generating wealth. Savings requires discipline and as such, one should treat it as a necessary expense and have a plan. It has always been stated that one should have at least 6 months of living expenses saved up but with the pandemic, there is now need to look at a larger time frame than the 6 months,

- Not to be confused with saving, investing is an asset or item acquired with the goal of generating income or appreciation. The main differences between saving and investing is the risk and return involved. In investing, investors take risk by investing in certain investments assets such as Equities, Private Equity, Real Estate or the Fixed Income asset class, that have the possibility of making losses while in savings, there is no risk involved and as such, the return is lower,

- Budgeting – A budget is a plan that estimates the expenses and revenues over a specific period. A simple budget can help in tracking all sources of income, the expenditures as well as track all the savings such as retirement savings or what is portioned out for an emergency fund. Through a budget, one is able to know their financial flexibility for the month. Key to note is that, no one budget strategy will work for everyone, however, a budget gives one a good starting point towards financial planning, and,

- Debt and Debt Management. One should always know when to get into debt and ensure that they are taking on good debt. However, not all debt is bad. Good debt is an investment that has the potential to grow in value and yield future financial gains such as business, education or property.

- Creation of a plan and execution. A financial plan is developed at this step based on the goals identified in the step above. The financial plan will detail how the goals will be achieved, the time factor as well as the next actionable steps to takes towards achieving the goal. A well laid out plan should highlight the following:

- Suitable channels and investment instruments that will assist you in achieving your goals. This may be through saving, budgeting, cutting on expenses, and through investing, and,

- Timelines: This will indicate how long you are willing to invest in a given investment instrument. Long-term investments may be most suitable for long-term goals. This is because, long-term investments offer higher returns, and long-term goals often have higher cash requirements.

- Monitoring and Reassessment. This is the final step in financial planning. Given that goals and priorities change over time, it is important to monitor the financial plan created and readjust it when necessary. Before reassessing or adjusting the financial plan, it is important to consider the following;

- Status of the goals earlier set. A financial plan should be revised once a goal has been achieved. For the goals not yet achieved, one should determine whether they can still be achieved, given the present circumstances,

- Change in income levels. When income levels change, your financial plan is directly impacted given that it may require a change in priorities. It may also lead to delay of set goals therefore affecting the laid out timelines,

- Changes in risk appetite and risk tolerance. As one progresses in life, their risk appetite is set to change and as such, the financial plan ought to be adjusted to cater for this, and,

- Number of dependants – When the number of dependants increases, the disposable income put towards an investments decreases, and vice versa.

Section II: Effects of Coronavirus on Financial Planning

The Novel COVID-19 which started as a global health crisis, has brought an economic downturn with most firms scaling down their operations. Consequently, this has affected individuals disposable income due to salary pay-cuts, unpaid leaves and employment termination, consequently disrupting their investments and savings plans. As economic contraction continues, most individuals have been forced to take a more conservative stance in their investments plans in order to minimize the losses incurred, maintain adequate liquidity as well as re-evaluating their short term and long-term financial goals.

The reduction in income levels for individuals who have lost their jobs, taken paycuts or unpaid leave, has set a stage for loan defaults. Given than debt management is among the goals of financial planning as discussed in the above section, the reduced income levels has put a strain on people’s ability to make their monthly financial obligations to their banks. Additionally, despite the income levels declining, most monthly expenses such as rent, transport etc. have not come down putting a strain on the individual’s finances. In the section below, we shall discuss the financial planning opportunities in the current operating environment.

Section III: Financial Planning Opportunities in the Coronavirus environment

Maintaining ones finances at manageable levels during this time is essential as most people are on a survival mode given the reduction in their income. In this section, we shall focus on some of the key considerations one can make in this operating environment:

- Scale back on spending - Due to the financial stress arising from the effects of Coronavirus, it is important to be true to oneself and scale back on spending and minimize all unnecessary expenses. Some of the tips to attain this include:

- Prioritize your expenditure- It is advisable to only spend on the needs such as food, rent etc. as opposed to the wants such as upgrading your old phone etc. Focus your efforts on recurring and necessary bills such as electricity bills and maybe relook your entertainment budget.

- Seek for alternatives – There are plenty of alternatives you can take advantage of that will give you the same level of happiness but will cost much less. Individuals should look out for cheaper ways to achieve the same needs, and,

- Look out for bargain purchases: you can take advantage of any offers in the market as it helps save some money

- Loan Restructuring: In March 2020, Central Bank of Kenya Governor Patrick Njoroge announced that banks would provide personal reliefs on loan repayments for up-to one year to individuals affected by the effects of the Coronavirus. One can choose to restructuring there loans in:

- Seeking personal relief- this involves placing moratoriums on both interest and principal payments for three months or longer, in effect giving a reprieve to customers who find it difficult to repay their loans due to the impact caused by the pandemic, and,

- Loan consolidation – for people with more than one loan facility, they can seek to consolidate this and even request for a longer loan repayment period as it reduces the cash outflow from them.

Key to note, the loan relief is determined at your bank’s discretion.

- Reformulating a budget – Budgeting is usually described as the first step towards financial freedom. It tells you as an individual where your money is going rather than wondering where it went. Given the reduced disposable income, a budget will ensure that you determine whether the available resources are sufficient to cater for your monthly expenses and if not, it provides a clear picture on where you can scale back in order to live within your means. It is also through a budget that one is able to know their financial health and identify any disposable income available for investing. Key to note, sticking to a laid out budget requires discipline and the truth of making a really good budget more so in this economic downturn is, you have to be honest about where your weaknesses are, most especially in areas you can be saving more money,

- Review and update your Investment Plan – Based on your current financial situation, it is important to review and update your investments plan to ensure you are comfortable with your investment allocation in the various investments asset classes. Individuals whose income levels has been affected should revaluate their investment strategies to a low risk plan. Given that liquidity is the most important goals at the moment, investors should focus on short-term investments such as Unit Trusts as opposed to investing in long term illiquid assets such as the Real Estate Sector. The economic downturn has seen most investors recorded losses in their portfolios and as such, rebalancing your financial plan will help in minimise the loses in your portfolio as well as assist you in staying the course of your short-term financial goals, and,

- Re-evaluate the Emergency fund – It is important to have an emergency fund that is easily accessible and can cover at least three months of your living costs. With the slow economic growth anticipated globally, emergency funds will come in handy during this time. With companies scaling back their operations and cutting costs, most people have found themselves either taking paycuts, being laid off or taking unpaid leave. If you are lucky enough to not have lost your job or if you took a paycut, given the scaling back of expenses, your residual income can be directed towards an emergency fund. Think of it as your SOS fund should anything go wrong.

Section IV: Factors to consider when making an Investment decision

Even in the middle of the pandemic, it is important to ensure that we continue investing in a bid to ensure we are growing wealth or at least preserving value. It is important to ensure that investors are getting at least a return above inflation in the long term. A lot has changed due to the ongoing Pandemic with various assets classes being impacted differently. We have covered some of the effects on this on the various weekly reports such; Impact of COVID-19 on Kenya’s money market funds, Impact of COVID-19 on Kenya’s Real Estate Sector, Impact of COVID-19 on Kenya’s Real Estate funds. Now it is more important than ever for investors to ensure that they are making the right investment decisions. Below are some of the factors to consider while making an investment:

- Return: This are the profits made from an investment. A rational investor seeks out a venture that would provide maximum return for a given level of risk. The choice of investment depends on the returns available and the preference of the investor towards generating a stream of income or capital appreciation in their portfolio,

- Risk Tolerance – One of the general rules in investments is, the higher the risk, the higher the return. It is important that before investing, know your risk tolerance. Not everyone is comfortable in investing in risky assets classes such as the Equities market. It is therefore important to take on calculated risks and stick to a risk/reward ratio suitable for your risk appetite,

- Liquidity: This refers to how quickly one can convert an asset to cash. Key to note, liquidity varies from one asset to another. For individuals looking for liquidity amid the pandemic, it is important to consider investing in short-term liquid assets,

- Time Horizon: What an investor hopes to achieve will determine the type of investment they venture into. Before investing, an individual must evaluate the target for the investment chosen and the length of time for which they require illiquid assets. The investment horizon determines the investor’s income requirements and desired risk exposure, which then helps in choosing the appropriate investment product, and,

- Investments Capital – The amount of investment capital one has often affects their choice of investment given that some investments require higher capital, thus making it harder for investors with lower capital to invest. In the current market, one can invest in the equities market either directly on their own or via Collective Investment Schemes such as Equity funds (which buy ownership in businesses most often in the form of publicly traded common stock), with as little as Kshs 1,000 or invest in government papers using Collective Investment Schemes such as Money Market Funds with as little as Kshs 100 in select Money Market Funds,

When one has decided what they want to invest in, the next step is to determine how they would like to invest. One can choose to invest directly or through a collective scheme. Collective Investment schemes (CIS) are pools of funds that are managed on behalf of investors by fund managers. The amounts invested in the CIS are pooled and utilized by fund managers to buy stocks, bonds or other securities that are in accordance with the funds objective, with the aim of generating returns for their investors. Direct investors on the other hand, own particular investment assets on their own and are responsible for the management of their portfolio/ investments. Direct investors reap all the rewards and assumes all risk as opposed to investing in a CIS.

Below is a summary of some of the pros and cons of investing through each type;

|

|

Advantages |

Disadvantages |

|

Collective Investment Schemes |

|

|

|

Direct Investment |

|

|

In light of the current economic conditions, with CIS, investors with low levels of income are able to access various investment avenues such as the Money Market Fund. Money Market Funds for instance, have continued to record higher returns as compared to bank deposits and saving accounts during this economic downturn.

Conclusion

As the global market continues to show signs of distress and fluctuation, financial planning will provide a clear path on navigating the stressful situation caused by the pandemic. Investing in the right assets to fit ones objectives is of paramount importance. It is therefore important to ensure that you are constantly updated on what is happening in the market given that this will enable you to make the right investment decisions that are in line with your goals. Getting the right investment partner is paramount and as such, an investor should ensure that they vet their investment partners in order to gain the maximum insights in regards to their investments. One should also continuously assess if their financial circumstances have changed and readjust their financial plans accordingly.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.