Impact of COVID-19 on Real Estate Funds, & Cytonn Weekly #25/2020

By Cytonn Research, Jun 21, 2020

Executive Summary

Fixed Income

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 188.4%, down from 290.5% the previous week. The oversubscription is partly attributable to the continued favorable liquidity in the money markets, as well as the continued preference for shorter-dated papers by investors. The subscription rates for the 91-day paper increased to 334.4% from the 294.0% recorded the previous week, while subscription for the 182-day and 364-day papers declined to 130.6% and 187.8%, respectively, from 265.0% and 314.7%, recorded the previous week. During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum Retail Prices in Kenya for the period 15th June 2020 to 14th July 2020. Petrol prices increased by 6.9% to Kshs 89.1 per litre from Kshs 83.3 per litre previously, while diesel and kerosene prices have decreased by 4.8% and 21.7%, to Kshs 74.6 and Kshs 62.5 per litre, respectively, from Kshs 78.4 and Kshs 79.8 per litre. During the week, the Departmental Committee on Finance and National Planning tabled the Finance Bill 2020 in the National Assembly for its second reading in parliament. The bill was published on 5th May 2020 to make amendments to a raft of laws in the country, among them; the Income Tax Act, the Value Added Tax Act, the Tax Procedures Act and the Excise Duty Act among others;

Equities

During the week, the equities market recorded mixed performances, with NASI and NSE 25 gaining by 1.2% and 1.4%, respectively, while NSE 20 declining by 2.1%, taking their YTD performance to losses of 13.1%, 18.7%, and 25.8%, for NASI, NSE 25 and NSE 20, respectively. The YTD loss recorded by NSE 20 breaches the threshold of a bear market, which is a condition in which securities prices fall by 20.0% or more. The NASI performance was driven by gains recorded by large-cap stocks such as EABL, KCB Group, Equity Group, Cooperative Bank and Safaricom, which gained by 3.9%, 3.3%, 2.9%, 2.0% and 1.5%, respectively. During the week, ABSA Bank Kenya announced that they had restructured a total of Kshs 54.0 bn loans as at the end of May 2020, equivalent to 26.6% of its total loans, which stood at 203.0 bn in Q1’2020. During the week, Co-operative Bank of Kenya finalized a 100.0% buyout of Jamii Bora Bank (JBB). On 12th March 2020, JBB disclosed that its Board of Directors has approved the continued discussions between Co-operative Bank and JBB on the acquisition of the latter. JBB did not disclose the details of the acquisition and it remains unknown whether the lender will continue to operate as a standalone subsidiary of Co-operative bank or whether it will be fully absorbed by Co-operative Bank;

Real Estate

During the week, Unity Homes, a local residential developer, rolled out its first batch of 48 low-cost apartments in Tatu City. In the hospitality sector, Swiss-owned Planhotel Hospitality Group announced that it was offering pre-paid products in an offer that would see the group sell two-year holiday bonds for its three properties in Malindi, whereas hotel chain, Sarova Hotels, reopened its two Nairobi Hotels, Sarova Stanley and Sarova Panafric in a partial reopening that will see operations resume at the two hotels. In the infrastructure sector, Transport Secretary James Macharia announced that Kenya was set to open its first annuity road this year, a 91km road project in Kajiado County comprising of a 48km section through Ngong, Kiserian, and, Isinya townships.

Focus of the Week

The effects of the COVID-19 pandemic continues to increase as the number of cases and reported deaths continue to escalate, and with the impact being felt across various sectors of our economy, we discussed the Potential Effects of COVID-19 on Money Market Funds. We then wrote about Impact of COVID-19 on Kenya’s Real Estate Sector, where we discussed the impact of the pandemic in the residential, office, retail, and, hospitality sectors, which have been hit by lockdown measures. This week, we focus on the Impact of COVID-19 has had on Real Estate Funds.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.6% p.a. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.9% p.a. To invest, email us at sales@cytonn.com;

- Rodney Omukhulu, Assistant Investments Analyst at Cytonn Investments, was on CNBC Africa to discuss Kenya’s 2020/21 budget. Watch Rodney here;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running promotions:

- For Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit;

- For Phase 1: Get a 10% rent discount on units we manage for investors;

- For inquiries, please email us on clientservices@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The aim of the training is to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- For Pension Scheme Trustees and members, we shall be having different industry players talk about matters affecting Pension Schemes and the pensions industry at large. Join us every Wednesday from 9:00 am to 11:00 am for in-depth discussions on matters pension;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- For recent news about the company, see our news section here;

We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 188.4%, down from 290.5% the previous week. The oversubscription is partly attributable to the continued favorable liquidity in the money markets, as well as the continued preference for shorter-dated papers by investors. After the reduction of the both the CRR and the CBR rate was intended to increase liquidity in the market for onward lending to the private sector but due to the ongoing uncertainties in the financial markets, the lending is yet to pick and hence partly the reason for the high liquidity in the money market. The subscription rates for the 91-day paper increased to 334.4% from the 294.0% recorded the previous week, while subscription for the 182-day and 364-day papers declined to 130.6% and 187.8%, respectively, from 265.0% and 314.7%, recorded the previous week. The yields on the 91-day, 182-day and 364-day papers declined by 17.0 bps, 32.1 bps and 36.3 bps to 7.1%, 7.7% and 8.7%, respectively. The acceptance rate declined marginally to 32.6%, from 32.8% recorded the previous week, with the government accepting only Kshs 14.7 bn of the Kshs 45.2 bn worth of bids received.

On the primary bond auction, the period of sale for the reopened five-year and ten-year bonds, FXD3/2019/5 and FXD4/2019/10 closed on Tuesday, 16th June 2020. The issue was oversubscribed with the average subscription rate coming in at 262.8% as the government received bids worth Kshs 105.1 bn, higher than the Kshs 40.0 bn offered. Key to note, investor preference was biased towards the FXD3/2019/5, with a shorter tenor, receiving bids worth Kshs 60.9 bn compared to the FXD4/2019/10, which received Kshs 44.2 bn worth of bids. The preference towards the shorter tenor paper can be attributed to investors avoiding the duration risk associated with longer-dated papers. Yields on the bonds came in at 11.5% and 12.5%, for the five and ten-year bonds respectively, which was in-line with our expectations of a range between 11.4% - 11.6% for FXD3/2019/5 and 12.3% - 12.5% for FXD4/2019/10. The government rejected high bids only accepting Kshs 49.3 bn out of the Kshs 105.1 bn worth of bids received, translating to an acceptance rate of 46.9%.

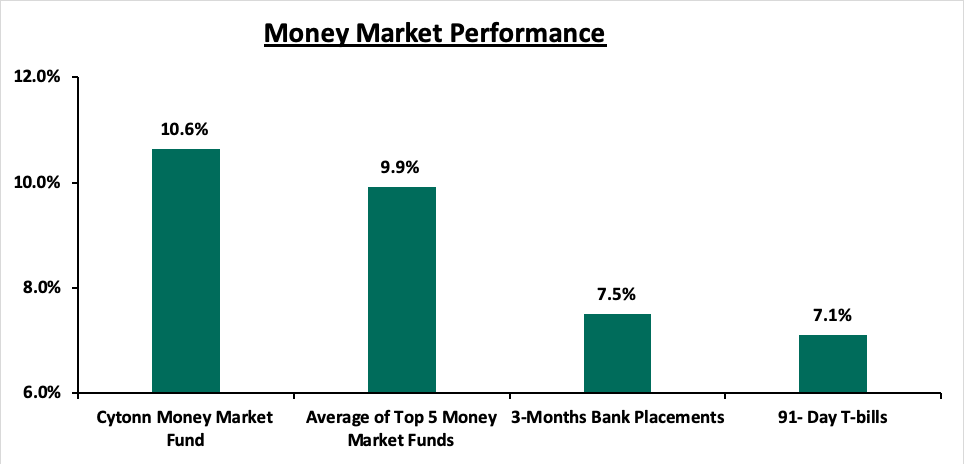

In the money markets, 3-month bank placements ended the week at 7.5% (based on what we have been offered by various banks), while the yield on the 91-day T-bill declined by 17.0 bps to close the week at 7.1%, from 7.3% recorded the previous week. The average yield of Top 5 Money Market Funds declined marginally to 9.9% from the 10.0%, recorded the previous week. The yield on the Cytonn Money Market remained unchanged at 10.6%, similar to what was recorded the previous week.

Liquidity:

During the week, the market remained relatively liquid with the average interbank rate increasing marginally to 2.9% from 2.6% recorded the previous week, but below the 2019 average of 4.3%, supported by government payments. The week also saw the average interbank volumes increase by 21.1% to Kshs 4.1 bn, from Kshs 3.4 bn recorded the previous week. As per the Central Bank of Kenya, commercial banks’ excess reserves came in at Kshs 39.1 bn in relation to the 4.25% cash CRR. The favourable liquidity in recent weeks has also partly been attributable to the reduction of the Cash Reserve Ratio (CRR) to 4.25%, from 5.25% previously, by the Monetary Policy Committee (MPC) during its March 2020 sitting, consequently freeing up additional liquidity to commercial banks for onward lending to distressed borrowers during the COVID-19 pandemic.

Kenya Eurobonds:

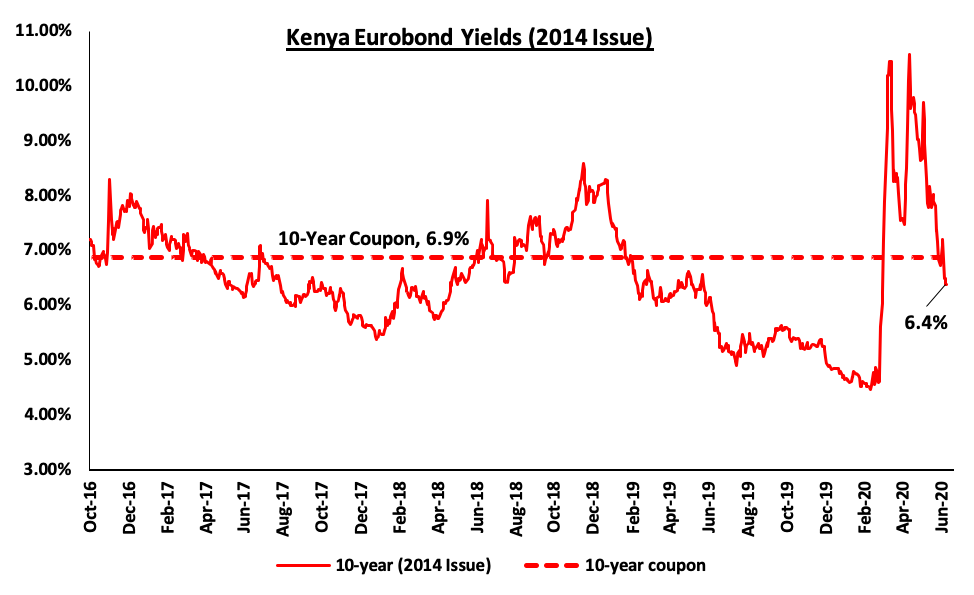

During the week, Kenyan Eurobonds were on a downward trend as all bonds saw a decline in yields. Since the jump we saw in March, the investor sentiments have been improving over the past two months. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 declined by 0.7% points to 6.4%, from 7.1% recorded the previous week.

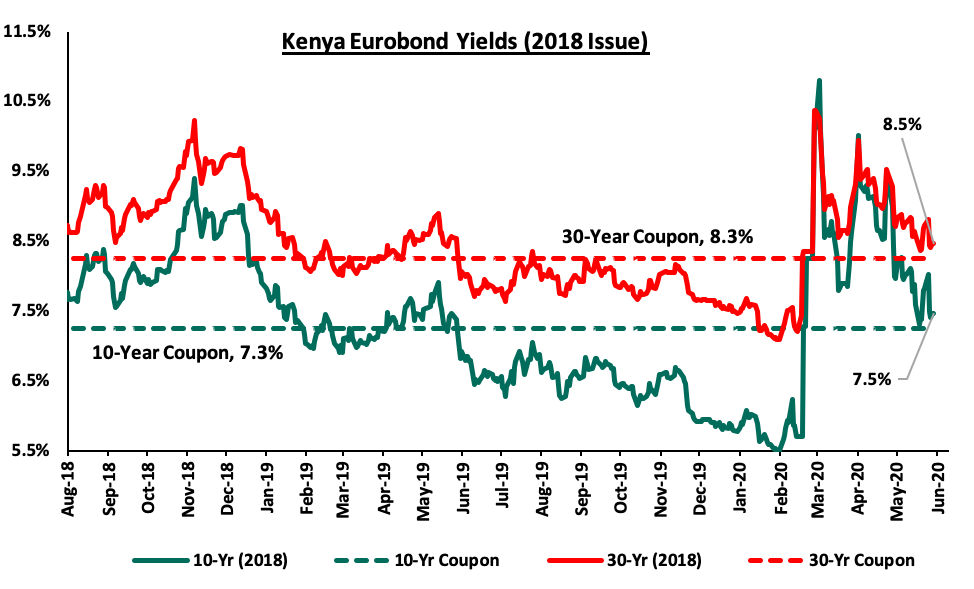

The yields on the 10-year and 30-year Eurobonds issued in 2018 declined by 0.3% points and 0.2% points to 7.5% and 8.5%, respectively, from 7.8% and 8.7% recorded the previous week, respectively.

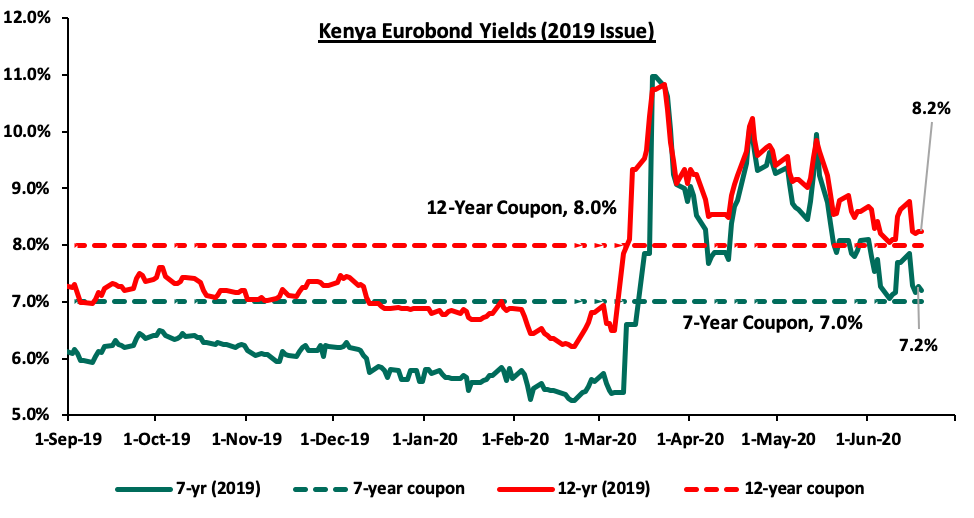

The yields on the 7-year and 12-year Eurobonds issued in 2019 also declined by 0.5% points and 0.4% points, to 7.2% and 8.2%, respectively, from 7.7% and 8.6% recorded the previous week, respectively.

Kenya Shilling:

During the week, the Kenya Shilling appreciated by 0.2% against the US Dollar to close the week at Kshs 106.3, from Kshs 106.5, recorded the previous week, which traders attributed to low dollar demand from merchandise importers, coupled with dollar inflows from horticulture exports. On an YTD basis, the shilling has depreciated by 4.9% against the dollar, in comparison to the 0.5% appreciation in 2019. We expect continued pressure on the shilling due to:

- Demand from merchandise and energy sector importers as they beef up their hard currency positions amid a slowdown in foreign dollar currency inflows, and,

- Subdued diaspora remittances evidenced by the 9.0% decline to USD 208.2 mn in April 2020, from USD 228.8 seen the previous month, mainly due to the decline in economic activities globally, coupled with increased prices of household items leading to lower disposable income. Key to note, the Central Bank of Kenya (CBK) expects a 12.0% decline in remittances in 2020.

The shilling is however expected to be supported by:

- High levels of forex reserves, currently at USD 9.2 bn (equivalent to 5.6-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Weekly Highlight:

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum Retail Prices in Kenya for the period 15th June 2020 to 14th July 2020. Below are the key take-outs from the statement:

- Petrol prices have increased by 6.9% to Kshs 89.1 per litre from Kshs 83.3 per litre previously, while diesel prices have declined by 4.8% to Kshs 74.6 per litre from Kshs 78.4 per litre.

- Kerosene prices, on the other hand, declined by 21.7% to Kshs 62.5 per litre from 79.8 per litre, previously,

- The changes in prices have been attributed to the increase in the average landing cost of imported super petrol by 31.5% to USD 248.1 per cubic meter in May 2020 from USD 188.7 per cubic meter in April 2020. Landing costs for diesel and kerosene however declined by 5.6% and 51.8% to USD 228.6 per cubic meter and USD 126.4 per cubic meters in May 2020, respectively, from USD 242.1 per cubic meter and USD 262.4 per cubic meter in April 2020, and,

- A 33.3%, increase in Free on Board (FOB) price of Murban crude oil lifted in May 2020 to USD 23.53 per barrel, from USD 17.6 per barrel in April 2020.

The increase will not only affect the transport index, which carries a weighting of 8.7% in the total consumer price index (CPI), but it will cut across as things like foodstuff might increase due to high transport costs.

During the week, the Departmental Committee on Finance and National Planning tabled the Finance Bill 2020 to the National Assembly for its second reading in parliament. The bill was published on 5th May 2020 to make amendments to a raft of laws in the country, among them; the Income Tax Act, the Value Added Tax Act, the Tax Procedures Act and the Excise Duty Act among others. The first reading of the bill took place on 6th May 2020. This is a departure from the status quo, where in previous years, the bill would be tabled after the reading of the national budget in June. This change was brought about by recent instruction from the court, which barred the government from collecting taxes before the relevant tax provisions were approved by the National Assembly. Normally, a bill is tabled in parliament where it undergoes the first, second and third reading. The bill is assigned to a committee for consideration, which occurs between the second and third readings before it is forwarded for presidential assent, after which it is passed into law. It is important to note that all the amendments relating to the income tax act have an effective date of 1st January 2021, while most of the other amendments will come into effect on the date of assent. Below are some of the earlier on major proposed amendments to the Finance Bill 2020:

- Under the Income Tax Act, the amendments included:

- The removal of certain existing tax incentives on income exempt from tax which includes: exception from income for the amounts contributed to a registered home ownership savings plan, income of National Social Security Fund (NSSF) and Bonus, overtime and retirement benefits not exceeding 10.0%,

- Extending the upper limit of the Residential Income Tax to Kshs 15.0 mn from Kshs 10.0 mn to allow landlords with rental income of between Kshs 10.0 mn and Kshs 15.0 mn to access the more concessional tax rate of 10% of gross income, and reduce administrative costs of ascertaining profit for such landlords which was aimed at raising an additional Kshs 200 mn to finance the FY’2020/21 fiscal deficit,

- Introduction of a minimum tax, to be introduced at a rate of 1% of the gross turnover. This new tax will apply to all persons whether they’re making profits or incurring losses. As highlighted in the budget the main reason for the introduction of the minimum tax was to ensure that all taxpayers contribute to the construction and maintenance of the country’s infrastructure, and

- Introduction of Digital Service Tax, to be introduced at a rate of 1.5% of the gross transaction value, to be charged on individuals who generate income from the provision of services through the digital market place. This tax targets non-residents without permanent establishments in the country since for any individuals with permanent establishment will have the same offset from their tax payable for the year of income, which was expected to yield Kshs 2.0 bn.

- Under the Value Added Tax Act, the amendments included:

- Removal of some items such as stoves and cookers from the VAT exemptions list,

- The exemption of maize seeds and ambulance services from VAT, and,

- The removal of some items from the VAT Zero Rated category, which include LPG gas and materials used in the manufacture of automotive and solar batteries.

- Under the Excise Duty Act, the amendments include:

- Reduction of the threshold for alcohol strength from over 10% to 8% for tax purposes. Consequently, the reduction of the threshold will mean that beverages with an alcoholic strength of over 8% will be subject to excise duty,

The Departmental Committee on Finance and National Planning, having considered the bill, recommended that the house approves the bill with some proposed amendments as highlighted below:

- Retain the income tax exemption of income from the National Social Security Fund to protect the benefits of members,

- Retaining the income tax exemption on the monthly pension granted to a person who is 65 years or more,

- Increasing the lower limit for the Residential Income Tax to Kshs 288,000.0, from Kshs 144,000.0 to make it consistent with changes in PAYE tax bands highlighted in the Tax Laws (Amendment) Act 2020,

- Zero-rate the supply of flour to make it cheaper and more affordable, by zero-rating taxes on the supply of flour, manufacturers will be able to sell at a lower cost and ultimately lower the price of flour in the market,

- For excise duty on alcoholic beverages, further lowering the threshold for alcoholic strength to 6% instead of 8% to enhance revenue collection. Consequently, the reduction of the threshold will mean that beverages with an alcoholic strength of over 6.0% will be subject to excise duty, lower than the 8.0% that was recommended in the Finance Bill 2020 on its first reading, and

- The removal of excise duty on betting which has had negative effects on the industry and led to the closure of Kenyan companies and the loss of hundreds of jobs, yet international companies continue to operate. The existing 20% excise duty charged on the stake had hurt the local gaming industry,

In our view, the amendments proposed in the finance bill are a good initiative, for instance, proposal to retain the income tax exemption on pension granted to persons at the age of 65 and above. Despite the recommendations, concerns still linger on the practicability of enforcing some of the measures in the Finance Bill 2020. A good example is the introduction of a digital tax on online transactions in the digital market space. Considering the amount of regulation already in place in term of online transacting, it will require a lot of background work for the proposal to work effectively. Some proposals, on the other hand, are counter-productive, case in point, the removal of tax incentives on the contribution to a registered home ownership savings plan, which will discourage savings towards homes and ultimately contradicts the affordable housing agenda that the government is pushing.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. We believe that the uncertainty affecting the global financial markets brought about by the novel Coronavirus will make it harder for the government to access foreign debt, and might result in investors attaching a high-risk premium on the country. As a result of depressed revenue collection with the revenue target for FY’2020/2021 at Kshs 1.9 tn, we expect a higher budget deficit, which the Treasury estimates at 7.5% of GDP, creating uncertainty in the interest rate environment as additional borrowing from the domestic market will be required to plug in the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term fixed income securities to reduce duration risk.

Markets Performance

During the week, the equities market recorded mixed performances, with NASI and NSE 25 gaining by 1.2% and 1.4%, respectively, while NSE 20 declined by 2.1%, taking their YTD performance to losses of 13.1%, 18.7%, and 25.8%, for NASI, NSE 25 and NSE 20, respectively. The YTD loss recorded by NSE 20 breaches the threshold of a bear market, which is a condition in which securities prices fall by 20.0% or more. The NASI performance was driven by gains recorded by large-cap stocks such as EABL, KCB Group, Equity Group, Cooperative Bank and Safaricom, which gained by 3.9%, 3.3%, 2.9%, 2.0% and 1.5%, respectively. The gains were however weighed down by losses recorded by other large-cap stocks such as Bamburi, Diamond Trust Bank (DTBK) and Standard Chartered Bank of 10.5%, 2.9% and 1.5%, respectively.

Equities turnover declined by 3.3% during the week to USD 30.3 mn, from USD 31.3 mn recorded the previous week, taking the YTD turnover to USD 777.0 mn. Foreign investors turned net sellers during the week, with a net selling position of USD 0.5 mn, from a net buying position of USD 4.7 mn recorded the previous week, taking the YTD net selling position to USD 201.4 mn.

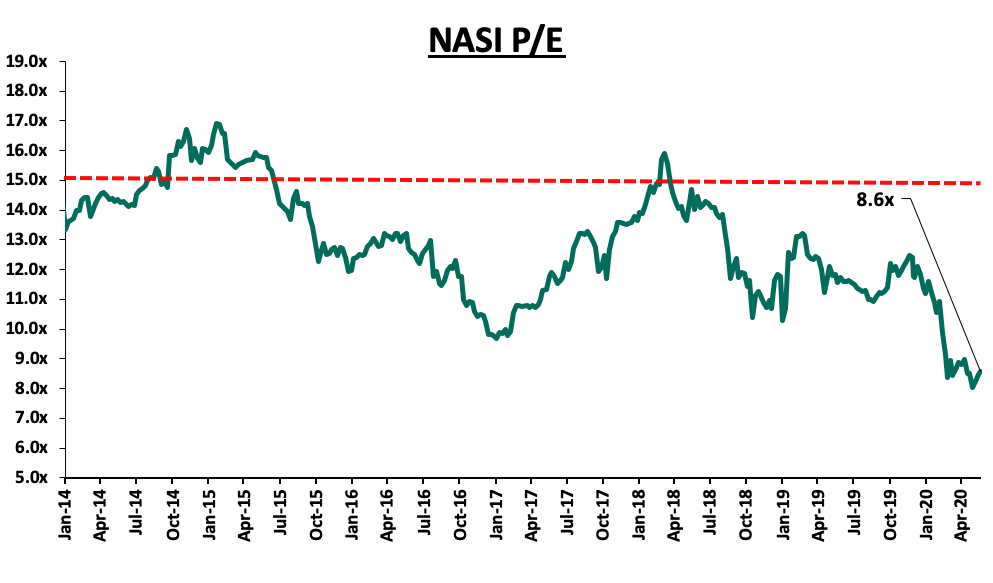

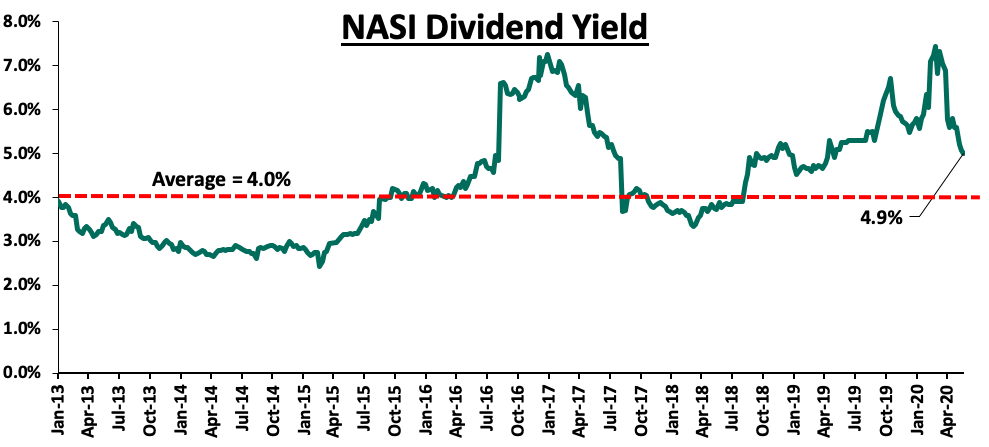

The market is currently trading at a price to earnings ratio (P/E) of 8.6x, 34.5% below the historical average of 13.1x. The average dividend yield is currently at 4.9%, a decline from the 5.1% recorded the previous week, but 0.9% points above the historical average of 4.0%. The decline of the dividend yield is mainly attributable to the price gains recorded by most stocks during the week. With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 8.6x is 6.8% above the most recent valuation trough of 8.0x experienced in the last week of May 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, ABSA Bank Kenya announced that they had restructured a total of Kshs 54.0 bn loans as at the end of May 2020, equivalent to 26.6% of its total loans book, which stood at 203.0 bn in Q1’2020. The loan restructuring by ABSA involves placing moratoriums on both interest and principal payments for three months, in effect giving a reprieve to its customers who found it difficult to repay their loans due to the impact caused by the pandemic. ABSA indicated that the beneficiaries of the loans are households and businesses whose disposable income have been affected by the COVID-19 pandemic. The lender indicated that with the restructuring, borrowers will not pay additional processing fees but will however pay the loan interest accrued during the repayment holiday period which will last for up to 3 months. The loan relief will apply to mortgages, personal loans, business loans etc., and will be determined on a case-by-case basis by the lender.

The table below shows the Banks that have disclosed their restructured loans so far:

|

# |

Bank |

Amount Restructured (Kshs bn) |

% of Restructured Loans to Total Loans |

y/y Change in Loan Loss provision |

|

1 |

Kenya Commercial Bank |

120.2 |

21.7% |

149.1% |

|

2 |

ABSA Bank Kenya |

54.0 |

26.6% |

75.2% |

|

3 |

Standard Chartered Bank of Kenya |

22.0 |

17.5% |

3.1% |

|

4 |

Diamond Trust Bank |

40.7 |

18.3% |

52.0% |

|

5 |

Co-operative Bank of Kenya |

15.3 |

5.5% |

79.5% |

|

6 |

Equity Group Holdings |

92.0 |

24.3% |

660.4% |

|

Average |

57.4 |

19.0% |

169.8% |

|

|

Total |

344.2 |

|

||

With banks restructuring loans on account of the strained cash flows for businesses as well as disposable income to individuals due to the pandemic, we expect to see a rise in the Non-Performing Loans (NPL) ratio as seen in Q1’2020, where the Gross NPL ratio stood at 11.3%, from 10.4% recorded in Q1’2019, and much higher than the 5-year average of 8.3%. The deteriorating asset quality remains a concern as most businesses struggle to keep afloat due to subdued revenues, we believe that they may not be able to meet their repayment requirements further elevating credit risks.

During the week, Co-operative Bank of Kenya finalized a 100.0% buyout of Jamii Bora Bank (JBB). On 12th March 2020, JBB disclosed that its Board of Directors has approved the continued discussions between Co-operative Bank and JBB on the acquisition of the latter. JBB did not disclose the details of the acquisition and it remains unknown whether the lender will continue to operate as a standalone subsidiary of Co-operative bank or whether it will be fully absorbed by Co-operative Bank. Additionally, JBB did not disclose the trading multiples of the deal with Co-operative Bank. Commercial Bank of Africa (CBA), had earlier shown interest in acquiring the Tier III bank (JBB), and instead, dropped its acquisition bid to merge with NIC Bank, to form NCBA Group. As highlighted in our Cytonn Weekly #11/2020, the acquisition will be the second bank acquisition in 2020, following the green light given by the Central Bank of Kenya (CBK) to Access Bank Plc, a Nigerian lender, on acquiring 100.0% of Transnational Bank Plc. Following the consolidation, Co-operative Bank will expand its branches to 176, from the current 159 branches. The table below highlights Jamii Bora’s performance indicators as of Q1’2018:

|

Performance Indicators |

Q1’2017 (Kshs mn) |

Q1’2018* (Kshs mn) |

Y/Y Change |

|

Customer Deposits |

6,530.0 |

5,030.1 |

(23.1%) |

|

Net Loans |

9,377.5 |

7,934.8 |

(16.0%) |

|

Non-Performing Loans |

1,413.5 |

1,073.8 |

(21.4%) |

|

Profit after Tax |

(96.8) |

(51.3) |

(47.0%) |

|

Loan Coverage Ratio |

61.3% |

79.9% |

18.6% |

|

Capital Adequacy Ratios |

Q1’2017 |

Q1’2018* |

% Point Change |

|

Liquidity Ratio |

6.5% |

(11.1%) |

(17.6%) |

|

Minimum Statutory requirements |

20.0% |

20.0% |

- |

|

Excess/Deficit |

(13.5%) |

(31.1%) |

(17.6%) |

|

Core Capital /Total Liabilities |

36.0% |

44.1% |

8.1% |

|

Minimum Statutory requirements |

8.0% |

8.0% |

- |

|

Excess/Deficit |

28.0% |

36.1% |

8.1% |

|

Core Capital/ Total Risk Weighted Assets |

16.3% |

18.8% |

2.5% |

|

Minimum Statutory requirements |

10.5% |

10.5% |

- |

|

Excess/Deficit |

5.8% |

8.3% |

2.5% |

|

Total Capital / Total Risk Weighted Assets |

17.0% |

19.3% |

2.3% |

|

Minimum Statutory requirements |

14.5% |

14.5% |

- |

|

Excess/Deficit |

2.5% |

4.8% |

2.3% |

|

*Last Financial results released by Jamii Bora Bank |

|||

Given Jamii Bora Bank’s financial performance, having recorded losses of Kshs 51.3 mn in Q1’2018, and Kshs 96.8 mn in Q1’2017, coupled with the Bank’s capital position, we believe that the acquisition would only be strategic and plausible if Co-operative Bank acquired the struggling lender at very discounted trading multiples. The acquisition will, however, have little impact on increasing Co-operative Bank’s market share.

The table below highlights the various transactions in the banking sector in the last 5-years that have either happened, been announced or expected to be concluded:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs. Bns) |

Transaction Stake |

Transaction Value |

P/Bv Multiple |

Date |

|

Co-operative Bank |

Jamii Bora Bank |

3.4 |

100.0% |

Undisclosed |

N/A |

Mar-20* |

|

Commercial International Bank |

Mayfair Bank Limited |

1.0 |

51.0% |

Undisclosed |

N/A |

May-20* |

|

Access Bank PLC (Nigeria) |

Transnational Bank PLC |

1.9 |

100.0% |

Undisclosed |

N/A |

Jan-20** |

|

Oiko Credit |

Credit Bank |

3.0 |

22.8% |

1.0 |

1.5x |

Aug-19 |

|

KCB Group |

National Bank of Kenya |

7.0 |

100.0% |

6.6 |

0.9x |

Sep-19 |

|

CBA Group |

NIC Group |

33.5 |

53%:47% |

23.0 |

0.7x |

Sep-19 |

|

CBA Group** |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

Jan-19 |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

Jan-19 |

|

KCB Group |

Imperial Bank |

3.2 |

Undisclosed |

Undisclosed |

N/A |

Dec-18 |

|

SBM Bank Kenya |

Chase Bank Ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

3.0 |

100.0% |

5.0 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov-13 |

|

Average |

|

|

75.7% |

|

1.4x |

|

|

*Announcement date ** Deals that were dropped |

||||||

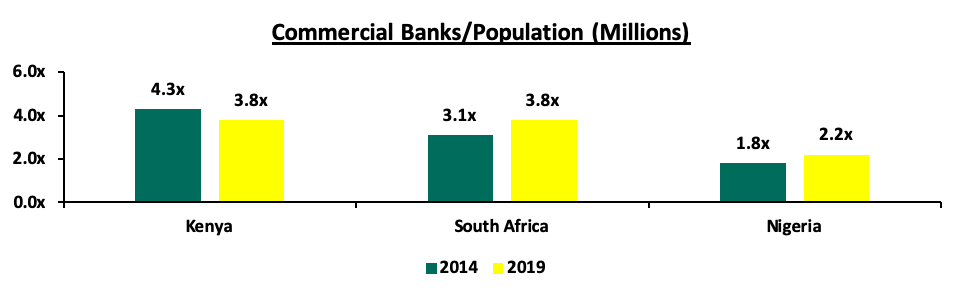

Following the acquisition, the number of banks in Kenya will be 38, compared to 43 banks from 5-years ago. The ratio of the number of banks per 10.0 million people in Kenya now stands at 3.8x, compared with a ratio of 4.3x, 5 years ago. However, despite the ratio improving, Kenya remains overbanked as the number of banks remains relatively high compared to the population. The chart below highlights the ratio of the number of banks per 10.0 mn people in Kenya, South Africa and Nigeria

We believe that continued bank consolidation efforts in Kenya, as highlighted in our Q1’2020 Banking Report, will lead to a stable banking sector, as consolidation continues to eliminate weaker banks. In our view, banks will continue to consolidate to form strategic partnerships and well-capitalized entities capable of navigating the relatively tough operating environment induced by stiff competition.

Universe of Coverage:

|

Company |

Price at 12/06/2020 |

Price at 19/06/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

70.0 |

68.0 |

(2.9%) |

(35.8%) |

109.0 |

175.0 |

3.9% |

161.2% |

0.4x |

Buy |

|

Kenya Reinsurance |

2.2 |

2.2 |

0.0% |

(27.4%) |

3.0 |

4.6 |

5.0% |

114.1% |

0.2x |

Buy |

|

KCB Group*** |

35.0 |

36.2 |

3.3% |

(35.2%) |

54.0 |

56.2 |

10.0% |

65.5% |

0.9x |

Buy |

|

I&M Holdings*** |

50.0 |

48.3 |

(3.5%) |

(7.4%) |

54.0 |

76.3 |

5.1% |

63.2% |

0.7x |

Buy |

|

Co-op Bank*** |

12.2 |

12.5 |

2.9% |

(25.7%) |

16.4 |

18.0 |

8.2% |

52.2% |

1.0x |

Buy |

|

ABSA Bank*** |

9.9 |

9.9 |

(0.6%) |

(25.7%) |

13.4 |

13.2 |

11.1% |

45.0% |

1.2x |

Buy |

|

Stanbic Holdings |

77.0 |

82.0 |

6.5% |

(29.5%) |

109.3 |

111.2 |

9.2% |

44.8% |

1.0x |

Buy |

|

Equity Group*** |

34.9 |

35.9 |

2.9% |

(34.9%) |

53.5 |

50.7 |

0.0% |

41.4% |

1.2x |

Buy |

|

Jubilee Holdings |

255.0 |

250.0 |

(2.0%) |

(27.4%) |

351.0 |

334.8 |

3.5% |

37.4% |

0.9x |

Buy |

|

Sanlam |

15.0 |

13.6 |

(9.4%) |

(13.1%) |

17.2 |

18.4 |

0.0% |

35.8% |

1.3x |

Buy |

|

NCBA |

27.1 |

27.5 |

1.7% |

(26.6%) |

36.9 |

35.6 |

0.9% |

30.4% |

0.7x |

Buy |

|

Standard Chartered |

170.0 |

167.5 |

(1.5%) |

(16.0%) |

202.5 |

202.7 |

7.1% |

28.1% |

1.4x |

Buy |

|

Liberty Holdings |

8.0 |

7.9 |

(1.3%) |

(22.7%) |

10.4 |

9.8 |

0.0% |

24.5% |

0.7x |

Buy |

|

HF Group |

3.9 |

4.0 |

2.3% |

(39.5%) |

6.5 |

4.0 |

0.0% |

0.0% |

0.2x |

Lighten |

|

CIC Group |

2.3 |

2.3 |

(2.2%) |

(14.2%) |

2.7 |

2.1 |

0.0% |

(6.7%) |

0.8x |

Sell |

|

Britam |

9.7 |

8.5 |

(13.0%) |

8.0% |

9.0 |

7.6 |

2.6% |

(7.6%) |

0.7x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Companies in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Neutral” on equities for investors because, despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim.

- Residential Sector

During the week, Unity Homes, a local residential developer, rolled out its first batch of low-cost residential housing apartments in Tatu City, comprising of 48 two-bedroom apartments each with a plinth area of 58 SQM and selling at Kshs 4.25mn, which translates to Kshs 73,310 per SQM, 18.0% lower than Ruiru apartments’ average price of Kshs 89,421 in 2019 according to our Nairobi Metropolitan Area Residential Report 2019. This is the first phase of the 1,200-unit residential development that is located within a 23-acre community, inside Tatu City. This is the second affordable housing project by the developer locally, after the completion of Unity Gardens in 2018, a 250-unit development in Kapseret, Eldoret, which comprised of 3-bedroom villas each with a plinth area of 95 SQM. The project indicates investor focus on the affordable housing sector as part of the ongoing efforts by the private sector to support the National Government’s goal of increasing homeownership in the country. Kenya’s Affordable Housing agenda is facing various headwinds such as reduced budgetary allocation towards the programme to Kshs 6.9 bn for FY’2020/21, a 34.3% reduction from the Kshs 10.5 bn allocated in 2019/2020, and the proposed Financial Bill 2020 amendment of the Income Tax Act to do away with Home Ownership Savings Plan (HOSP) tax incentives. Nonetheless, we expect more private developers to continue tapping into the sector to address the ongoing demand for affordable housing which, according to the Government’s Boma Yangu website, is currently at 298,193 against the measly 228 units completed in Ngara. Incentives by the government that are expected to draw in the private sector include; (i) a reduction in corporate tax by 50.0% from 30.0% to 15.0% for developers of over 100 affordable housing units annually, (ii) exemption from Value Added Tax for supplies imported or purchased for direct and exclusive use in the construction of affordable houses by licensed Special Economic Zones (SEZ), (iii) reduced customs tariffs such as Import Declaration Fee (IDF) which was reduced from 2.0% to 1.5%, in addition to the scrapping of NEMA and NCA levies of 0.1% and 0.05%, respectively, of the cost of construction, and, (iv) the waiving of building approval fees for all affordable housing projects in Nairobi, under the Nairobi City County Sessional Paper Number 1 of 2018. In light of this, we expect to see more private sector developers undertaking affordable housing projects targeting the low and middle-income earners as the segment presents an investment opportunity supported by the growing demand, which is estimated to be growing at 200,000 units per annum as per National Housing Corporation (NHC). Moreover, for private developers, satellite towns such as Ruiru continue to be attractive for low-cost housing due to the availability of relatively cheaper development land as well as the growth of infrastructure.

- Hospitality Sector

During the week, Swiss-owned Planhotel Hospitality Group announced that it was offering holiday bonds, where prospective guests would be required to pay half the cost to reserve a room, for two years for its three properties in Malindi; Diamonds Dream of Africa, Sandies Malindi Dream Garden, and, Sandies Tropical Village. Under this concept, a one-holiday bond represents one all-inclusive night at any of the 3 resorts where regular room rates range between Kshs 19,000 to Kshs 30,000 per night. However, with the bond, the rooms will be priced at half the regular rates. For example, regular rates at the Sandies Tropical Village Resort are Kshs 19,000 per night, but if a guest buys one-holiday bond, that would be equivalent to 1 night and will go for Kshs 9,500, a 50% discount. Bonds purchased will be valid up to June 2022 and guests can buy as many hospitality bonds as they want which can also be liquidated after buying anytime between now and June 2022. The move signals a shift by the hospitality group towards innovative strategies designed to boost reservations and cash flow at a time when the hospitality sector continues to grapple with the effects of the Coronavirus pandemic, mainly due to its reliance on tourism, as travel restrictions and social distancing rules continue to result in reduced demand for hospitality services. We expect revenues raised through the initiative to help foot operational costs as well as keep the facilities open during downtime caused by the COVID-19 pandemic.

Also during the week, hotel chain, Sarova Hotels, reopened its two Nairobi Hotels, Sarova Stanley and Sarova Panafric. The partial reopening will see operations resume at Sarova Stanley’s Thorn Tree restaurant and Sarova Panafric’s eatery wing after the hotel chain suspended operations in all its 7 hotels and resorts in March this year, namely; Sarova Stanley, Sarova Woodlands, Sarova Whitesands, Sarova Mara, Sarova Shaba, Sarova Lion Hill, and, Sarova Panafric, in addition to an announcement that it would stop managing the Sarova Taita Hills Game Lodge and Sarova Salt Lick Game Lodge effective July this year. The closures were as a result of strained revenues attributed to the ongoing COVID-19 pandemic. The reopening signals the hospitality sector’s gradual recovery backed by various conducive measures by the National Government such as the extension of working hours for hotels and restaurants from the previous closing time of 5.00 p.m. to 7.30 p.m. daily, a move that is expected to see hotels and restaurants raking in more revenues attributed to the increase in operating hours. We expect the hospitality sector’s recovery to commence in the near term on the back of government policies aimed at cushioning the sector such as the gradual easing of movement restrictions coupled with monetary allocations through bodies such as TFC aimed at enhancing liquidity.

- Infrastructure Sector

During the week, Transport Secretary, James Macharia, announced that Kenya was set to open its first annuity road this year under the Annuity programme where contractors design, finance, construct and maintain roads based on agreed periodical payments by the government. The 91km road project in Kajiado County comprises of a 48km section through Ngong, Kiserian and Isinya townships, and will join the 43km Kajiado-Imaroro road. The roads annuity programme dubbed, Roads 10,000 Programme, was approved by the Cabinet in March 2015 as an alternative financing method in response to the government’s huge funding gap for its infrastructure investment plans and was to be implemented under the Ministry of Transport and Infrastructure through the roads authorities; Kenya National Highways Authority (KeNHA), Kenya Rural Roads Authority (KeRRA), and, Kenya Urban Roads Authority (KURA). The financing model consists of a variation of PPPs involving private contractors and the government each meeting agreed portions of the total construction cost then thereafter, the government repays the contractor its portion in equal instalments over a set period from the time after a road is completed. Other key road projects to be constructed and maintained through the PPP model include; the ongoing dualling and upgrade of the Nairobi-Mombasa highway, the ongoing construction of the Nairobi-Nakuru-Mau Summit highway, and, the construction of the 2nd Nyali Bridge in Mombasa which is expected to kick off in June this year. We expect the government to continue rolling out such innovative financing models in a bid to bridge Kenya’s significant infrastructure funding deficit especially at a time when the government is experiencing revenue shortfalls in the wake of an economic slowdown caused by the COVID-19 pandemic, which saw the infrastructure sector get an allocation of Kshs 172.4 bn in the 2020/2021 budget, 60.4% lower than the 435.1 bn allocated in the 2019/2020 budget, the lowest allocation in the last 10 financial years. Improved road connectivity opens up previously inaccessible areas thus making areas more attractive for investment and results in increased demand for property, which then causes an increase in property prices.

We retain a neutral outlook on the performance of the real estate sector. We expect the sector to continue being supported by increased demand for low-cost housing, increased infrastructural improvements, and, the hospitality sector’s expected recovery in the near term on the back of favourable government policies.

The COVID-19 pandemic started more as a global health crisis and has now triggered severe economic recessions as the impact of the pandemic continues to be significant. The Organization for Economic Co-operation and Development (OECD) in their OECD Economic Outlook, June 2020, expect global growth for 2020 to contract by 7.6% if there is a second wave of infections before end of the year and a 6.0% contraction if a second wave is avoided. There has not been any particular country or region that has been spared due to the lockdowns, which have significantly impacted trade and supply chains leading to declines in investments across the board since the beginning of the pandemic, with the S & P 500 having declined by 4.1% on a Year to Date (YTD) basis. Commodity prices have also been on a decline, with Oil recording consistent price declines resulting from low demand due to the lockdown measure. The Real estate sector, which has been considered a safe haven over time, has also been hit by massive illiquidity affecting the performance of the sector.

Closer home we have seen the Nairobi Stock Market register significant declines with the NASI declining by 13.1% on a YTD basis. The Fahari I-REIT, Kenya’s only listed Real Estate fund has also not been spared having declined 41.4% YTD. In Q1’2020 Kenya’s Listed Banks recorded a 0.9% points increase in gross Non Performing Loans (NPLs) to 11.3% from 10.4% in Q1’2019. This was high compared to the 5-year average of 8.5% as banks allow their clients to restructure their loan portfolios as a result of the tough operating environment. We have been analysing the impact of the pandemic on various sectors, where we looked at the Potential Effects of COVID-19 on Money Market Funds. We then wrote about the Impact of COVID-19 on Kenya’s Real Estate Sector, focussing on the impact of the pandemic in the residential, office, retail, and, hospitality sectors and this week, we focus on the Impact of COVID-19 has had on Real Estate Funds and therefore we shall cover the following;

- Introduction to Real Estate Funds,

- Types of Real Estate Funds,

- How COVID-19 Has Impacted Funds in the Global Market and Measures Being Undertaken to Assist,

- What Support Mechanisms Can Be Employed to Assist Real Estate Funds

- Conclusion

- What are Real Estate Funds?

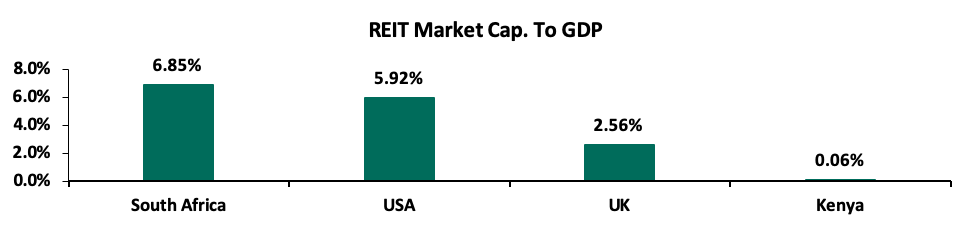

A Real Estate Fund is an investment vehicle that enables investors to pool their funds together and invest largely in Real Estate. The funds can either be privately offered, publicly offered or traded in a listed Stock Exchange. Kenya in comparison to the rest of the world has a less developed formal real estate funds market, but a lot of effort has been going towards developing the sector. Using Real Estate Investment Trusts (REITs) as an example, Kenya has only one listed REIT, Fahari I-REIT, and accounts for less than 0.1% of REIT market cap to GDP, compared to South Africa, USA and UK at 6.9%, 5.9% and 2.6%, respectively as illustrated below;

Source: JSE, NSE, NAREIT

The governance structures of real estate funds largely mirror the governance structures of other funds, in that, if it is publicly listed then it should be under a trustee structure, but if not publicly traded the governance structure can be diverse, including the selection of a Board of Directors. At its basic form, even a group of investors who come together to collect funds for investment in real estate can be deemed a real estate fund i.e. the investment groups or the “Chama”. Gaining exposure in real estate through real estate funds has various advantages among them being;

- Lower capital requirements compared to traditional brick and mortar real estate investment,

- Access to a diversified portfolio- The fund can invest in real estate across a variety of property sectors and various asset classes, therefore reducing the risk of a drop in the investment value,

- Time-saving- Fund managers undertake the day to day activities of managing the investments saving the investors time and headache of doing it themselves,

- Access to Professional management. The funds are managed by professionals who can choose the right balance between risks and rewards, therefore eliminating the burden on the investor,

- High transparency compared to brick and mortar since the prices of the units are observable, and,

- Tax benefits, as the government seeks to grow the REITs market there are a couple of tax incentives for investing in the real estate funds as highlighted in our note on Tax Incentives for REITs as an Investment Alternative.

There are however certain risks that come with investment in Real Estate Funds among them;

- Lack of control as investors delegate the decision making roles to the manager of the fund and therefore they have limited control over where the fund invests,

- Illiquidity risk- although the assets are relatively liquid compared to brick and mortar investments, the underlying asset remains real estate, consequently, there are times liquidity is not guaranteed, and,

- It is difficult to value real estate funds during periods of extreme economic uncertainty

- Types of Real Estate Funds

Investors can venture into real estate through either Real Estate Funds or directly investing in real estate, which involves the purchase or leasing of property. The following are the main types of Real Estate Funds:

- REITs- These are regulated investment vehicles that enable collective investment in real estate, where investors pool their funds and invest in a trust to earn profits or income from real estate, as beneficiaries of the trust. REITs source funds to build or acquire real estate assets, which they sell or rent to generate income. The income generated is then distributed to the shareholders at the end of a financial year. There exist three types of REITs namely;

-

- Income REITs (I-REITs) - This is a form of REITs in which investors pool their resources for purposes of acquiring long-term income-generating real estate including residential, commercial and other themes. Investors gain through capital appreciation and rental income. Dividends are usually distributed to unit-holders at the agreed duration, with the appreciation realized upon the sale of the units at a higher value,

- Development REITs (D-REITs) – A D-REIT is a type of REIT in which resources are pooled together for purposes of running development and construction projects. This may include residential or commercial projects. A D-REIT can be converted to an I-REIT once the development is complete where the investors in a D-REIT can choose to sell, reinvest or lease their shares or convert their shares into an I-REIT, and,

- Islamic REITs - An Islamic REIT is a unique type of REIT that invests primarily in income-producing, sharia-compliant real estate. A fund manager is required to conduct a compliance test before investing in real estate to ensure it is Sharia compliant and that non-permissible activities are not conducted in the estate.

- Structured Products- These are products that are highly customized/tailor-made investment products that are packaged by investment professionals, to enable the investor to access returns that are not accessible in the conventional market. There are publicly placed structured products, however, the majority are privately placed. Examples of privately placed structured solutions include structured notes, which are backed by high yielding assets such as real estate and commercial papers.

- How COVID-19 has Impacted Funds in the Global Market and Measures Being Undertaken to Assist

According to rating agency Fitch, approximately 80 funds were suspended in Europe in March 2020, resulting from the high cash outflow and large drops in asset prices as investors prioritize liquidity and became more selective in the investment opportunities they considered, while those with existing investments looked to cash out to enhance their liquidity. The real estate sector in which real estate funds have significant exposure has seen a reduction of the labour force and a disruption in the supply chain resulting in a slowdown in construction activities hence reducing revenues significantly thus making it difficult for funds to meet the liquidity need of investors. Some of the measure taken by various economies to mitigate the impact of the pandemic on both real estate and real estate funds and to manage liquidity include;

|

Country |

Response Measure |

|

UK |

|

|

US |

|

|

India |

|

|

UAE |

|

|

Abu Dhabi |

|

Case Study: United Kingdom (UK) Real Estate Funds

The UK economy, like the rest of other global economies, has been impacted by the ongoing pandemic making it difficult to value property owned by funds prompting the suspension of various funds. The suspension of funds is in line with the Financial Conduct Authority (FCA) guidelines, which stipulates property funds should suspend dealings if there is material uncertainty over the value of 20.0% of their assets. Previously in the UK, property funds have blocked withdrawals due to liquidity issues resulting from the 2008 financial crisis and the Brexit vote. The Bank of England in its Financial Stability Report 2019, cited that there exists a mismatch between redemption terms and the liquidity of some open-ended funds, particularly in stress conditions and as such, to enhance consistency between liquidity and redemption terms, the bank proposed a combination of;

- Longer redemption periods, and,

- A system to force those leaving the fund in times of market stress to accept a discounted price for their units.

Fund managers in the UK have taken various mitigation measures, such as suspension of funds, in light of the current tough operating environment to manage liquidity as few can fulfil redemption requests immediately and others forced to suspend operations. The table below highlights real estate funds that have been suspended in the UK so far;

|

No |

Name of Fund/ Company |

Size |

|

1 |

St James’s Place (SJP) Gates Property Unit Trust |

GBP 3.6 bn (Kshs 460.0 bn) |

|

2 |

All funds for Standard Life Aberdeen |

GBP 3.3 bn (Kshs 422.0 bn) |

|

3 |

Legal & General Property Fund |

GBP 2.9 bn (Kshs 371.0 bn) |

|

4 |

M & G Property Portfolio for M & G Investments |

GBP 2.4 bn (Kshs 307.0 bn) |

|

5 |

Janus Henderson UK Property Fund |

GBP 2.0 bn (Kshs 249.0 bn) |

|

6 |

Thread needle UK Property Authorized Investment Fund (PAIF) |

GBP 1.4 bn (Kshs 179.0 bn) |

|

7 |

Kames Property Income Fund |

GBP 0.7 bn (Kshs 92.0 bn) |

|

|

Total |

GBP 16.3 bn ( Kshs 2.1 tn) |

Key to note for investors, as long as the investments have been done in quality real estate projects, it is important to ensure the fund managers are preserving value so that once the time of illiquidity passes they can be able to get value for their investments.

- What Support Mechanisms Can Be Employed to Assist Real Estate Funds

Real Estate funds have been hit by temporal liquidity challenges especially where the funds are open-ended, what the funds can do is borrow from what the other organizations are doing to preserve the value of the funds such as reducing cash payout to investors and seeking capital restructuring from investors. Below are some of the suggestions of what can be done to preserve value;

- Suspension of withdrawals from funds- In Europe, it is estimated that over 80 funds were suspended to preserve value and liquidity,

- Reduced development activity to ensure the cash requirements are lower,

- Suspension of fees related to real estate by the government - Some governments like Abu Dhabi have suspended registration fees for real estate as they seek to support the real estate sector,

- Asset buying programs- Various governments have set aside cash to help struggling businesses,

- Direct Investments into Funds- In India the government directly infused cash into the funds to help with liquidity,

- Developers can seek different financiers such as Private Equity firms to finance their projects, and,

- Disposal of Assets but within the prevailing market rates.

- Conclusion

In conclusion, we believe that real estate funds will remain attractive as on the longer end they provide higher returns well above inflation and are good for diversification away from traditional asset classes such as Equities and Fixed Income. Property prices have avoided a slump and remained relatively stable in the Kenyan markets and therefore it is key for investors to ensure that the underlying assets remain attractive. The managers of real estate funds should ensure that they do everything possible to mitigate the impact of the pandemic and to protect the underlying investments. On the other hand, investors in real estate funds need to appreciate that illiquidity during times of stress, such as the pandemic, is normal in real estate hence work together with managers to navigate the environment.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.