Impact of Proposed Budget Changes to Pensions Industry, & Cytonn Weekly #29/2019

By Research Team, Jul 21, 2019

Executive Summary

Fixed Income

T-bills remained oversubscribed during the week, however the overall subscription rate decreased to 108.4%, from 183.9% recorded the previous week. The continued oversubscription is attributable to favorable liquidity in the market supported by government payments. The Monetary Policy Committee (MPC) is set to meet on Wednesday, 24th July 2019, to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). We believe that the MPC will maintain the current policy stance, and the CBR at 9.0%, given the macroeconomic environment is still relatively stable. We are projecting the Y/Y inflation rate for the month of July to come in within the range of 6.2% - 6.6%, compared to 5.7% recorded in June. Going forward, we expect the inflation rate to remain within the Government target range of 2.5% - 7.5%. Inflationary pressures remain in the short term due to the expectations of food supply shocks, specifically in grain, which is expected to lead to a surge in prices;

Equities

During the week, the equities markets recorded mixed performance with the NASI and NSE 20 gaining by 0.5% and 0.1%, respectively while the NSE 25 declined by 0.2%, taking their YTD performance to gains/ (losses) of 6.6%, (5.1%) and 1.7%, for NASI, NSE 20 and NSE 25, respectively. During the week, Moody’s, a global credit rating agency, released a report indicating that Non-Performing Loans (NPLs) in Kenya’s banking sector were likely to decline in the near term;

Private Equity

During the week, Actis, a UK based private equity investor, took over the management rights of Abraaj Private Equity fund IV (APEF IV), and Abraaj Africa Fund III (AAF), a move that is expected to strengthen its footprint in Africa. In the education sector, Investisseurs & Partenaires (I&P), a Sub-Sharan impact investing firm based in France, announced plans to invest EUR 70.0 mn (Kshs 8.1 bn) in Africa’s education sector with the aim of addressing the challenges of access, equity, quality and adequacy of education in Africa;

Real Estate

During the week, County Government of Nairobi commenced on Pangani Affordable Housing Project construction plans, with an aim of delivering 1,434 units by 2020; Cytonn Real Estate, the development affiliate of Cytonn Investments, handed over Phase 1 of its Ruaka residential mixed-use project, The Alma. In the commercial office sector, Kenya Ports Authority announced plans to put up a 75,000 SQM ultra-modern office complex in Mombasa, which when developed, will be the largest office complex in Kenya;

Focus of the Week

In one way or another, all societies try to meet people’s needs as they age and can no longer provide for themselves. Increasing urbanization has led to the disintegration of the traditional system, that saw communities and families care for their aging relatives. It is therefore upon the government, through the regulators and players in the Retirement Benefits Industry, to establish retirement systems that enhance the attainment of a comfortable life on retirement. Over the years, Kenya’s Retirement Benefits Industry has continued to undertake reforms with the primary motivation being, (i) to strengthen the governance, management and effectiveness of the existing pension schemes, (ii) to enhance accountability and transparency by pension schemes with the aim of protecting members benefits, and (iii) continuously increase pension penetration. This focus will delve into the changes made to the Retirement Benefits Act and Regulations in the 2019/2020 Financial Budget and the effects that these changes will bring to the Retirement Benefits Industry.

- Cytonn Real Estate handed over Phase 1 of The Alma, its comprehensive development in Ruaka, in a ceremony attended by clients and top dignitaries – including The Rt. Hon. Raila Odinga, EGH, African Union High Representative For Infrastructure Development in Africa and Prime Minister of The Republic of Kenya (2008 – 2013), Hon. Charles Hinga the Principal Secretary for Housing and Urban Development, Governor of Kiambu County, Hon. Ferdinand Waititu, Kiambu County Commissioner, Mr. Wilson Wanyanga, and the Kiambaa Area Member of Parliament, Hon. Paul Koinange. Read the event note here;

- Wacu Mbugua, Real Estate Research Analyst was on Metropol TV to discuss the state of the real estate market in Kenya. Watch Wacu here;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- Cytonn Money Market Fund closed the week at an average yield of 10.8% p.a. To subscribe, just dial *809#

- In line with increasing the product offering to our clients, Cytonn Asset Managers officially launched its pensions business, and in addition to managing segregated funds, it has received licenses from the Retirement Benefits Authority (RBA) to offer other products including; (i) a Personal Retirement Benefits Scheme with a monthly payment platform, (ii) an Umbrella Retirement Benefits Scheme, and (iii) an Income Drawdown Fund. For more information on the pension products, email us at pensionsales@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor’s Tour and for more information, email us at sales@cytonn.com;

- Following the completion and handover of Amara Ridge in Karen, we have now launched our next Karen project, dubbed Applewood, a Kshs 2.5 bn residential development located in Miotoni, Karen. This signature development shall comprise luxury homes, each sitting on 1/2 acre. We invite you to the exhibition of Applewood which is ongoing at the Amara Ridge Clubhouse (Location pin: https://goo.gl/maps/B3GVnu8pHyn) or at the Applewood Sales Centre on Miotoni Road (Location pin: https://goo.gl/maps/ZfABuGjFo1z) from 9:00 am to 5:00 pm daily. Call 0709 101 000 or email resales@cytonn.com to reserve a villa! See Video here;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

T-bills remained oversubscribed during the week, however the overall subscription rate decreased to 108.4%, from 183.9% recorded the previous week. The continued oversubscription is attributable to favorable liquidity in the market supported by government payments. The yields on the 91-day paper and the 182-day paper fell by 0.1% points to 6.5% and 7.4%, from 6.6% and 7.5% recorded the previous week, respectively. The yields on the 365-day paper, however, rose by 0.2% points to 8.8%, from 8.6% recorded the previous week. The acceptance rate for all T-bills bid declined to 96.4%, from 100.0% the previous week, with the government accepting Kshs 25.1 bn of the Kshs 26.0 bn worth of bids received, higher than the weekly quantum of Kshs 24.0 bn. The 91-day paper registered improved subscription to 187.6%, from 81.1% recorded the previous week, while the 182-day and 365-day papers recorded a downturn in subscription to 69.7% and 115.6%, from 111.1% and 297.7% recorded the previous week, respectively.

For the month of July, the Kenyan Government has issued a 15-year bond issue number FXD 3/2019/15, which is set to be the first T-Bond for the 2019/2020 fiscal year and the third 15-year tenor bond in 2019, in a bid to raise Kshs 40.0 bn for budgetary support. The bond has a market-determined coupon rate and the value date set on 29th July 2019. In the market, bonds with 15-year maturity are currently trading at a yield of 12.2%. We expect bids for the FXD 3/2019/15 to come in at 12.2% - 12.4%, as well as at a significantly high subscription rate, driven by the current high liquidity in the money markets attributable to the government payments as well as effects emanating from the ongoing demonetization process.

In the money markets, 3-month bank placements ended the week at 8.8% (based on what we have been offered by various banks), 91-day T-bill at 6.5%, the average of Top 5 Money Market Funds at 9.9%, with the Cytonn Money Market Fund closing the week at an average yield of 10.8% p.a.

Liquidity:

Liquidity in the market remained favorable during the week, with the interbank rate falling slightly to 2.1%, from 2.3% recorded the previous week. Commercial banks’ excess reserves stood at Kshs 9.0 bn in relation to the 5.25% cash reserves requirement (CRR). The average volumes traded in the interbank market declined by 3.7% to Kshs 8.7 bn, from Kshs 9.0 bn the previous week.

Kenya Eurobonds:

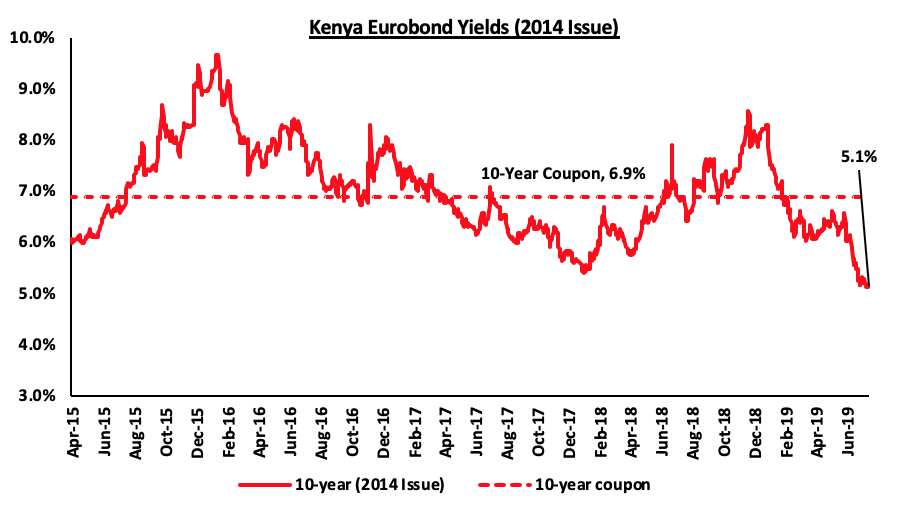

The yield on the 10-year Eurobond issued in 2014 dropped by 0.2% points to 5.1%, from 5.3% recorded the previous week. The decline in yields has been attributed to increased demand for emerging market fixed-income securities following the pause by the US Fed in raising the benchmark interest rate.

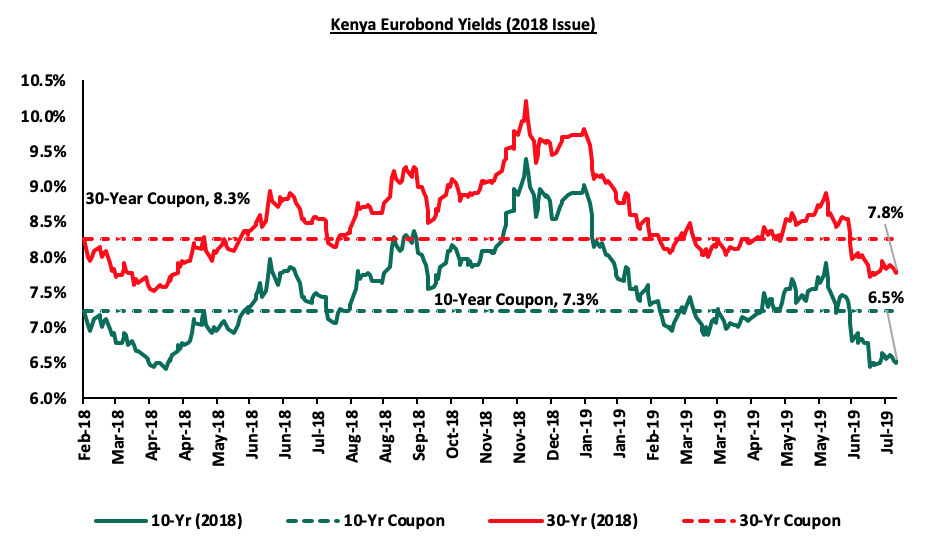

For the February 2018 Eurobond issue, yields on both the 10-year and 30-year Eurobonds dropped by 0.1% points to 6.5% and 7.8%, from 6.6% and 7.9% recorded the previous week, respectively.

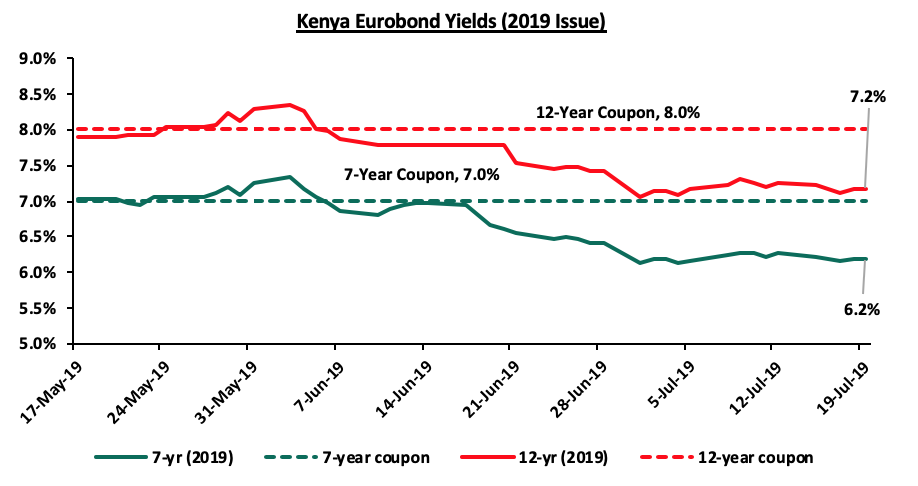

For the newly issued dual-tranche Eurobond with 7-years and 12-years tenor, priced at 7.0% for the 7-year tenor and 8.0% for the 12-year tenor, respectively, the yields on the 7-year bond and the 12-year bond dropped by 0.1% points to 6.2% and 7.2%, from 6.3% and 7.3% recorded the previous week, respectively.

The Kenya Shilling:

During the week, the Kenya Shilling depreciated by 0.3% against the US Dollar to close at Kshs 103.1, from Kshs 102.9 the previous week, driven by a relatively liquid money market largely supported by government payments, which more than offset tax remittances during the week. The Kenya Shilling has depreciated by 1.2% year to date, in comparison to the 1.3% appreciation in 2018, and in our view, the shilling should remain relatively stable to the dollar in the short term, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that the current account deficit narrowed to 4.2% of GDP in the 12-months to May 2019, from 5.8% recorded in May 2018. The decline has been attributed to the resilient performance of exports particularly horticulture and coffee, strong diaspora remittances, and higher receipts from tourism and transport services. Growth of imports also slowed mainly due to lower imports of food,

- Improving diaspora remittances, which have increased cumulatively by 13.6% in the 12 months to June 2019 to USD 2.8 bn, from USD 2.4 bn recorded in a similar period of review in 2018. The rise is due to:

- Increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and,

- New partnerships between international money remittance providers and local commercial banks making the process more convenient,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 9.7 bn (equivalent to 6.2-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Weekly Highlights

The Monetary Policy Committee (MPC) is set to meet on Wednesday, 24th July 2019, to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). In their previous meeting held on 27th May 2019, the MPC maintained the CBR at 9.0%, citing that the economy was operating close to its potential and inflation expectations remained anchored within the target range, despite the possible spill-overs of the food and fuel price increases, thus the prevailing monetary policy stance remained appropriate. This was in line with our expectations as per our MPC Note, informed by the country’s macroeconomic fundamentals, which had remained stable as well as sustained optimism on the economic growth prospects, as evidenced by:

- Inflation expectations, which had remained within the target range of 2.5% - 7.5%, despite rising to a high of 6.6% in April from 4.4% in March, mainly driven by a flare in food inflation following the late onset of long rains coupled with a rise in fuel prices, and,

- Increased private sector optimism as per the MPC Private Sector Market Perception Survey conducted in May 2019, which indicated that the private sector was optimistic about local economic prospects. The private sector expects stronger economic growth in 2019, continued infrastructure development, growth in the tourism sector, a stable macroeconomic environment and investor confidence in the economy.

The Monetary Policy Committee also noted that the current account deficit had narrowed to 4.5% in the 12-months to April 2019, compared to 5.5% in April 2018, supported by strong growth of agricultural exports, particularly coffee and horticulture, improved diaspora remittances, and tourism receipts. The decline was also partly supported by the slower growth in imports due to lower imports of food.

We believe that the MPC will maintain the current policy stance, given the macroeconomic environment is still relatively stable. We therefore expect the MPC to hold the CBR at 9.0% with their decision being supported by:

- Considering the heavy domestic debt maturities, which currently stand at Kshs 949.2 bn for FY’2019/20, we believe the MPC will maintain the CBR at the current rate, in order for the Kenyan Government to continue accessing domestic debt at cheaper rates. This, however, might have adverse effects of further crowding out of the private sector, which is evidenced by private sector credit growth which as at April 2019 stood at 4.9%, below the 5-year average of 11.6%, and,

- Expectations of inflationary pressures remaining within the government set range of 2.5% - 7.5%. Risks are however present in the short term, due to the expectations of food supply shocks, specifically in grain, which is expected to lead to a surge in prices, with the Agriculture Ministry’s push for duty-free maize importation from the month of July to plug the grain deficit being blocked by the National Assembly’s Agriculture Committee.

We maintain our view that the key concern still lies in the weak private sector credit growth, despite improving to a 31-month high of 4.9% in the month of April 2019, from 4.2% recorded in March and higher than the 3.3% average in 2018. On this front, we have seen various measures being put in place to address the low private sector credit growth with the recent initiative being the launch of Stawi, a mobile loan product led by five commercial banks targeting micro, small and medium scale enterprises, with the loans having a repayment period of between 1 and 12-months and an interest rate of 9.0% per annum. Small business owners, youth and women are also expected to access loans from the state under the new Biashara Kenya Fund from rates of 6.0% on a monthly reducing balance as per the regulations tabled by the Treasury in parliament for approval.

The Cabinet Secretary, National Treasury and Planning, Mr. Henry Rotich during the Budget reading also proposed a repeal of the interest rate cap should be adopted in order to unlock credit, which would in effect boost the performance of the economy, and consequentially boost taxable income available. The Central Bank of Kenya has also continued to express concern over the effectiveness of monetary policy with the interest rate cap still in place. The Monetary Policy Committee through its assessment of the impacts of the interest rate cap noted that it has weakened the transmission of monetary policy. In particular, the transmission of changes in the CBR to growth and inflation takes longer compared to the period before implementation of the interest rate cap. Read our latest Interest Rate cap Topical here.

For our detailed MPC analysis, please see our MPC Note for the 24th July 2019 meeting here.

Inflation Projections:

We are projecting the Y/Y inflation rate for the month of July to come in within the range of 6.2% - 6.6%, compared to 5.7% recorded in June. The Y/Y inflation for the month of June is expected to rise due to the base effect as well as:

- A rise in the food and non-alcoholic beverages index, which has a weighting of 36.0%, mainly driven by a rise in food prices especially grain prices, with a 2 kg bag of maize currently retailing at Kshs 120 - Kshs 125,

- We also expect a marginal rise in the transport index following the 0.3% rise in petrol prices during the month, despite a 0.8% decline in diesel prices due to the higher 16.0% weighting of petrol in the CPI items under the transport index as compared to 1.9% diesel weighting.

Going forward, we expect the inflation rate to remain within the Government set range of 2.5% - 7.5%.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. A budget deficit is likely to result from depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Despite this, we do not expect upward pressure on interest rates due to increased demand for government securities, driven by improved liquidity in the market owing to the relatively high debt maturities. Our view is that investors should be biased towards medium-term fixed income instruments to reduce duration risk associated with long-term debt, coupled with the relatively flat yield curve on the long-end due to saturation of long-term bonds.

Market Performance

During the week, the equities markets recorded mixed performance with the NASI and NSE 20 gaining by 0.5% and 0.1%, respectively while the NSE 25 declined by 0.2%, taking their YTD performance to gains/ (losses) of 6.6%, (5.1%) and 1.7%, for NASI, NSE 20 and NSE 25, respectively. The performance in NASI was driven by gains made Equity Group, British American Tobacco (BAT) and Safaricom PLC, which recorded gains of 3.6%, 2.6% and 0.9%, respectively.

Equities turnover decreased by 9.9% during the week to USD 22.0 mn, from USD 24.4 mn the previous week, taking the YTD turnover to USD 838.1 mn. Foreign investors remained net sellers for the week, with the net selling position increasing by 13.2% to USD 7.2 mn, from USD 6.4 mn the previous week.

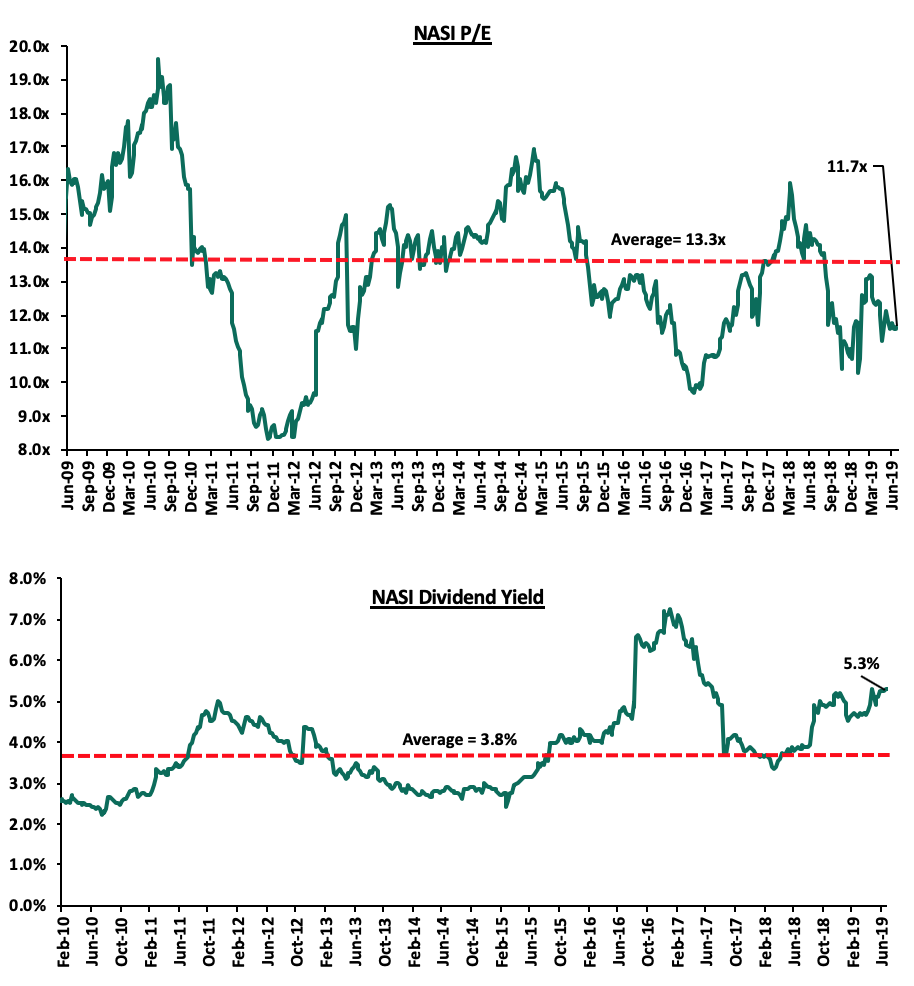

The market is currently trading at a price to earnings ratio (P/E) of 11.7x, 12.6% below the historical average of 13.3x, and a dividend yield of 5.3%, 1.5% points above the historical average of 3.8%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 11.7x is 20.6% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 39.4% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlights

During the week, Moody’s, a global credit rating agency, released a report highlighting that Kenya faces rising liquidity pressures driven by a rise in the government’s arrears to domestic goods and service providers, which has also led to high NPL’s among local banks. The report also highlighted that the Kenyan banking sector is likely to improve its asset quality in the near term, driven by lenders stepping up debt recovery, a gradual recovery in corporate earnings and improved liquidity as the government moves to settle contractors’ pending bills. Kenyan banking sector has seen its asset quality deteriorate since 2016 with the gross Non-Performing Loans (NPLs) rising to 12.0% and 12.3% in 2018 and 2017, respectively, from 9.4% recorded in 2016. The rise in NPLs has mainly been driven by the tough operating environment in the country occasioned the volatile political environment experienced in 2017, drought, and delayed payments by the government, as the effects spilled over to 2018 and 2019. We note that the interest rate cap imposed by the Central Bank of Kenya, coupled with the raising NPL’s has led to the adoption of tight credit standards by banks, resulting to reduced lending, and thus, we are also of the view that the denominator effect is at play given the relative slow growth in the sector’s loan book. We however expect that a possible resolution of the delayed payments by the government will likely aid in reducing the level of NPLs in the Micro, Small and Medium Enterprises (MSMEs), operating in the trade, manufacturing and retail sectors.

During the week, Standard Chartered Bank Kenya (SCBK) announced its plans to enter the mobile lending sector in the near future highlighting its popularity in the country, partly driven by the reduced unsecured personal lending by banks after the implementation of the interest rate cap law, under the Banking (Amendment) Act 2015.The bank is set to join the sector in which some of its peers are already players as highlighted in the below schedule:

|

|

Bank |

Mobile Lending Platform |

|

1. |

KCB Group |

KCB – Mpesa |

|

2. |

Commercial Bank of Africa |

M – Shwari |

|

3. |

Equity Group Holdings |

Equitel |

|

4. |

Co-operative Bank of Kenya |

M-Co-op Cash |

|

5. |

Barclays Bank of Kenya |

Timiza |

|

6. |

HF Group |

HF Whizz |

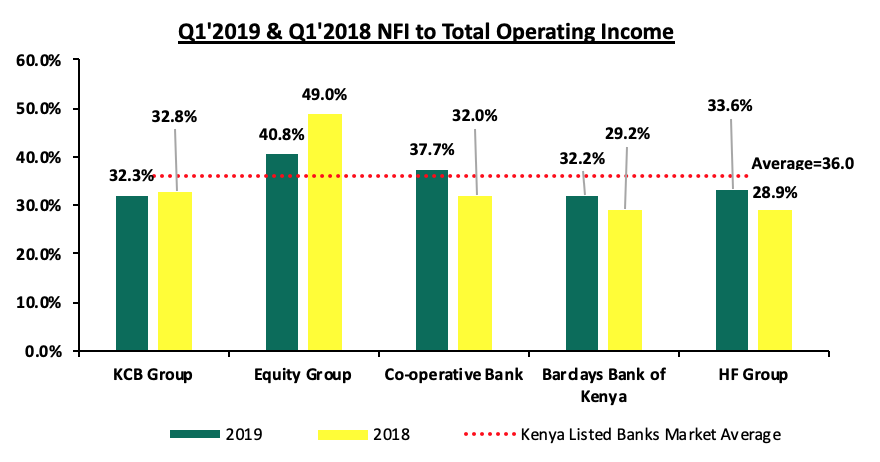

We note that banks have continued to source for alternative revenue sources, as interest margins remain compressed under the current interest rate-capped regime. These channels have contributed to the improved performance of the Non-funded Income (NFI) segment, which grew by 10.7% y/y, faster than 9.5% recorded in Q1’2018, and has enabled banks to maintain a relatively stable growth, in the current tough operating environment.

Universe of Coverage

Below is a summary of our SSA universe of coverage:

|

|

Price as at 12/07/2019 |

Price as at 19/07/2019 |

w/w change |

YTD Change |

Target Price |

Dividend Yield |

Upside/ Downside |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

116.0 |

115.0 |

(0.9%) |

(26.5%) |

228.36 |

2.3% |

96.2% |

0.6x |

Buy |

|

CRDB |

105.0 |

105.0 |

0.0% |

(30.0%) |

207.70 |

0.0% |

88.8% |

0.4x |

Buy |

|

UBA Bank |

5.9 |

5.5 |

(6.8%) |

(28.6%) |

10.70 |

15.5% |

88.0% |

0.4x |

Buy |

|

Zenith Bank |

19.0 |

18.5 |

(2.6%) |

(19.7%) |

33.32 |

14.6% |

82.9% |

0.8x |

Buy |

|

KCB Group*** |

39.3 |

39.6 |

0.8% |

5.6% |

60.41 |

8.8% |

66.8% |

1.0x |

Buy |

|

GCB Bank |

5.0 |

5.0 |

0.0% |

7.6% |

7.72 |

7.7% |

64.3% |

1.2x |

Buy |

|

I&M Holdings |

55.0 |

52.0 |

(5.5%) |

22.4% |

81.50 |

6.7% |

54.9% |

1.0x |

Buy |

|

Access Bank |

6.7 |

6.4 |

(4.5%) |

(5.9%) |

9.50 |

6.3% |

52.4% |

0.4x |

Buy |

|

Co-operative Bank |

12.1 |

12.1 |

0.0% |

(15.4%) |

17.05 |

8.3% |

50.4% |

1.0x |

Buy |

|

Equity Group |

40.6 |

42.0 |

3.6% |

20.4% |

53.66 |

4.8% |

42.5% |

1.8x |

Buy |

|

NIC Group |

30.5 |

30.2 |

(1.1%) |

8.5% |

42.50 |

3.3% |

42.2% |

0.6x |

Buy |

|

CAL Bank |

1.0 |

1.0 |

4.2% |

1.0% |

1.40 |

0.0% |

40.0% |

0.8x |

Buy |

|

Barclays Bank |

10.3 |

10.3 |

0.0% |

(5.9%) |

12.79 |

10.7% |

33.1% |

1.2x |

Buy |

|

Stanbic Bank Uganda |

28.8 |

29.0 |

0.6% |

(6.5%) |

36.27 |

4.0% |

29.1% |

2.1x |

Buy |

|

SBM Holdings |

5.6 |

5.5 |

(1.4%) |

(8.1%) |

6.56 |

5.5% |

23.0% |

0.8x |

Buy |

|

Guaranty Trust Bank |

29.9 |

29.3 |

(2.0%) |

(14.9%) |

37.10 |

8.2% |

21.0% |

1.8x |

Buy |

|

Stanbic Holdings |

100.0 |

96.0 |

(4.0%) |

5.8% |

113.56 |

6.1% |

20.8% |

1.1x |

Buy |

|

Ecobank |

7.5 |

8.1 |

7.3% |

7.3% |

10.73 |

0.0% |

19.2% |

1.8x |

Accumulate |

|

Union Bank Plc |

7.5 |

6.5 |

(13.3%) |

16.1% |

8.15 |

0.0% |

16.4% |

0.7x |

Accumulate |

|

Standard Chartered |

198.0 |

195.3 |

(1.4%) |

0.4% |

200.64 |

6.4% |

9.6% |

1.4x |

Hold |

|

Bank of Kigali |

275.0 |

275.0 |

0.0% |

(8.3%) |

299.93 |

5.0% |

8.5% |

1.5x |

Hold |

|

FBN Holdings |

6.0 |

5.7 |

(5.0%) |

(28.3%) |

6.63 |

4.4% |

5.6% |

0.3x |

Hold |

|

Bank of Baroda |

128.0 |

128.0 |

0.0% |

(8.6%) |

130.61 |

2.0% |

3.4% |

1.1x |

Lighten |

|

Standard Chartered |

19.3 |

19.0 |

(1.3%) |

(9.5%) |

19.46 |

0.0% |

2.3% |

2.4x |

Lighten |

|

National Bank |

4.1 |

4.0 |

(2.2%) |

(24.8%) |

3.94 |

0.0% |

(4.8%) |

0.2x |

Sell |

|

Stanbic IBTC Holdings |

40.0 |

36.6 |

(8.5%) |

(23.7%) |

37.00 |

1.6% |

(6.4%) |

1.9x |

Sell |

|

Ecobank Transnational |

10.0 |

9.0 |

(9.5%) |

(47.1%) |

9.28 |

0.0% |

(15.6%) |

0.3x |

Sell |

|

HF Group |

4.3 |

4.3 |

(0.9%) |

(23.3%) |

2.90 |

0.0% |

(27.7%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in ****Stock prices indicated in respective country currencies |

|||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations to support the positive performance.

During the week, Actis, a UK based private equity investor, took over the management rights of the Abraaj Private Equity Fund IV (APEF IV), a global buyout fund, and Abraaj Africa Fund III (AAF III), a Sub-Saharan investment fund. APEF IV has made investments worth USD 1.6 bn (Kshs 165.2 bn) in the Middle East and Africa while AAF III has a portfolio of investments in Africa, which include:

All values stated in Kshs unless stated otherwise

|

Year |

Company |

Contry |

Amount |

Sector |

|

2007 |

Mouka Limited |

Nigeria |

Undisclosed |

Manufacturing |

|

2011 |

Libstar |

South Africa |

Undisclosed |

Consumer services |

|

2012 |

Nairobi Java House |

Kenya |

10.3 bn |

Consumer services |

|

2013 |

Indorama Eleme Fertilizer & Chemicals Limited |

Nigeria |

14.4 bn |

Manufacturing |

|

2016 |

Ghana Home loans |

Ghana |

Undisclosed |

Financial services |

This transaction follows the collapse of Abraaj group, a global private equity firm based in the United Arab Emirates (UAE), following the liquidation case the firm currently faces. This transaction will strengthen Actis’ footprint in the Sub-Saharan region, whose portfolio currently consists of the following notable investments;

All figures in Kshs unless stated otherwise

|

Year |

Project/Company |

Country |

Amount |

Sector |

|

2010 |

Laurus Develoopment Partners |

Ghana, Nigeria |

Undisclosed |

Real estate |

|

2011 |

Heritage place |

Nigeria |

Undisclosed |

Real estate |

|

2011 |

Garden City |

Kenya |

55.7 bn |

Real esatte |

|

2015 |

Sigma Pensions Fund |

Nigeria |

6.4 bn |

Financial services |

In the education sector, Investisseurs & Partenaires (I&P), a Sub-Saharan impact investing firm based in Paris, France, has announced plans to invest EUR 70.0 mn (Kshs 8.1 bn) in Africa’s education sector with the aim of addressing the challenges of access, equity, quality and adequacy of education in Africa. I&P currently has the following investments in the educational sector:

|

Year |

Company |

Country |

Investment value |

Status |

|

2016 |

Enko Education |

Pan-African |

Undisclosed |

Investment Phase |

|

2018 |

Vallese Editions |

Ivory Coast |

Undisclosed |

Investment Phase |

|

2018 |

Centre d’Appui à l’Initiative Féminine (CAIF) |

Senegal |

Undisclosed |

Investment Phase |

|

2018 |

African Management Initiative |

Kenya |

Undisclosed |

Investment Phase |

|

2018 |

Etudesk |

Ivory Coast |

Undisclosed |

Investment Phase |

|

2018 |

Studio Ka |

Ivory Coast |

Undisclosed |

Investment Phase |

|

2019 |

Vatel |

Madagascar |

Undisclosed |

Investment Phase |

We have seen continued investment by international organizations in different sectors in Africa, and we expect that:

- Investments in early stage business and entrepreneurs to continue owing to the continued need for capital and technical support, coupled with the potential for the segment to generate high returns on investment for private equity firms; and

- Investment in the education sector to continue owing to the need for quality education across Africa.

Private equity investments in Africa remains robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and a stable macroeconomic environment will continue to boost deal flow into African markets.

- Residential Sector

During the week, the County Government of Nairobi commenced works on the Pangani Regeneration Project, one of the 7 flagship projects earmarked for Nairobi County as part of the Kenyan Government’s Affordable Housing Initiative. The project, which is set on 12.5-acres in Pangani Estate, is to be undertaken by Technofin as the main contractor and Stima Sacco as the sales agent, and will see the development of approximately 1,434 units in a span of one year at an estimated cost of Kshs 4.0 bn. This will mark the second public-private affordable housing project to commence construction since the Park Road Project, which is currently under construction and scheduled to hand over 228 units of Phase One in September this year to Kenyans registered on the Boma Yangu portal. Since the launch of the Big Four Agenda, the initiative has recorded notable progress, with (i) growing aggregate demand as Kenyans continue to register for the units, (ii) financial backing from various international and private institutions towards support of homebuyer financing, and (iii) government incentives such as scrapping of stamp duty for first-time homebuyers and 15.0% affordable housing income tax relief, meant to boost offtake. Despite the said positive factors the affordable housing initiative has, however, continued to face delays with regards to operationalization of (i) the KMRC due to lack of licensing from the CBK despite having drafted the facility’s regulations in February 2019, which is key to end-buyers, and (ii) the National Development Housing Fund due to legal oppositions, which is key for supply side financing. With the government targeting to construct 200,000 units annually, at least 500 units have to be delivered daily, thus, necessitating the need to engage more local private developers, which in our view will be facilitated by incentives such as financial backing, fast and efficient building approval processes, as well as actual provision of land and sufficient infrastructure.

During the week, Cytonn Real Estate, the development affiliate of Cytonn Investments, handed over the first phase of its Ruaka project, The Alma, after full uptake of the 16 one-bedrooms, 70 two-bedroom and 27 three-bedroom units selling at Kshs 6.3 mn, Kshs 9.9 mn and Kshs 12.9 mn, respectively. With initial investors realizing capital gains of up to 55.0%, Ruaka Satellite Town has been an attractive real estate investment opportunity owing to (i) relatively good transport network – with the Northern Bypass set for expansion whereas the Western Bypass connecting the Southern Bypass and the Northern Bypass is ongoing, (ii) close proximity to shopping facilities, namely Two Rivers, and others along Limuru Road such as the Village Market and Rosslyn Riviera, (iii) proximity to a UN blue zoned area and foreign organizations, thus, promoting its security, and (iv) relatively high returns and uptake.

II. Commercial Office Sector

Kenya Ports Authority (KPA) announced plans to put up an office building, to be located in Mombasa. According to the state agency, the building will have a total built up area of 75,000 SQM making it the largest office building in Kenya after Britam and UAP Towers with 32,716 SQM and 29,000 SQM, respectively. The KPA Office Tower Complex, which is currently at tendering process, is set to have 1,000 parking bays covering 18,000 SQM, 12,000 SQM of conference facilities, 15,000 SQM of commercial spaces, 12,000 SQM lettable office space while KPA will occupy 9,000 SQM. Also, according to the state agency, the provided area allocation is subject to change as the project gains traction.

As a real estate investment opportunity, Mombasa County is boosted by stable economic growth evidenced by the fast infrastructural development such as the Standard Gauge Railway, Dongo Kundu Bypass, Moi International Airport upgrade, as well as growth of maritime trade, growth of the tourism sector, and as per the KNBS Gross County Product data 2018, the county ranked 4th in contribution to national GDP per capita, accounting for 4.7% after Nairobi, Nakuru and Kiambu Counties with 21.7%, 6.1%, and 5.5%, respectively, hence attracting more of developers to the coastal region. According to the Cytonn 2018 Mombasa Research Report, the office sector recorded average rental yields of 5.1%, with office mixed-use buildings registering an average of 7.4%, as shown below:

(all values in Kenya Shillings unless stated otherwise)

|

Mombasa Office Market Performance Summary August 2018 |

|||||

|

Class |

Current Price/SQFT (Kshs) |

Asking Rent Per SQFT per Month (Kshs) |

Service Charge (Kshs) |

Occupancy Rate |

Rental Yield 2018 |

|

Grade B |

15,000.0 |

79.6 |

20.0 |

71.7% |

5.9% |

|

Grade C |

|

61.3 |

19.0 |

59.1% |

3.2% |

|

Office MUD |

11,750.0 |

108.5 |

14.7 |

64.4% |

7.4% |

|

Average |

12,833.3 |

75.7 |

18.6 |

65.8% |

5.1% |

|

· Mixed-use developments recorded better returns with average rental yields of 7.4% compared to the market average of 5.1%, attributable to their relatively high rental rates with an average of Kshs 108 per SQFT compared to the market average of Kshs 75.7 per SQFT, as they are mostly located in exclusive high end or upper mid-end residential areas thus target high-end clientele |

|||||

Source: Cytonn Research

We expect the commercial real estate sector in Mombasa to continue picking up, boosted by ongoing infrastructural developments in the region, the government’s emphasis on investment in sectors such as manufacturing and the maritime business, and the national economic expansion, which has a spill-over effect as companies expand to the nation’s largest cities including Mombasa, increasing demand for commercial real estate.

We expect to see increased real estate developments in counties other than Nairobi, facilitated by the ongoing infrastructural improvements, growth of GDP per capita. In Nairobi Metropolitan Area, pockets of value remain in themes such as housing for lower-middle to low-income earners in the residential sector and in differentiated concepts such as serviced offices and offices in mixed-use developments (MUDs) that attract average rental yields of upto 13.4% and 8.2%, respectively

A report done by the World Bank in 2018 shows that Kenya’s population is aging and the number of the elderly as a percentage of the population is expected to hit 7% by 2050, from the current 3%. This is as a result of an improvement in life expectancy from an average of 49 years in 2006, to 59 years in 2016, and 64 years in 2018. The reducing birthrate has not helped as we have seen the average number of children per family fall sharply, from 8.1 children in 1978 to 4.6 children in 2008, and it is projected to possibly reach 2.4 children by 2050. These changing demographic trends reinforce the need to ensure that some form of old age protection is provided to the elderly and ensure security against destitution during old age. This note will review the regulatory changes that the Retirement Benefits Authority has enforced over the years to ensure continuous improvement in the Retirement Benefits Industry; as such, we will cover;

- Role of the Retirement Benefits Authority in Regulating the Retirement Benefits Industry

- Challenges facing the Retirement Benefits Industry that Regulations Have Not Been Able to Solve

- 2019/2020 Budget Changes Affecting the Retirement Benefits Industry

- Conclusion

Section I. Role of the Retirement Benefits Authority in Regulating the Retirement Benefits Industry

Prior to the formation of the Retirement Benefits Authority (RBA), the Retirement Benefits Industry did not have effective regulation and supervision, and the interests of members were not sufficiently protected. This era was characterized by poor administration, mismanagement of scheme funds as well as outright misappropriation of funds. Consequently, confidence in the sector was low. This necessitated the enactment of the Retirement Benefits Act in 1997 and a comprehensive framework of regulations that was implemented three-years later, in 2000. The Retirement Benefits Authority was formed in 2000, to strengthen the governance, management and effective running of the Retirement Benefits Industry. This marked the beginning of a regulated, organized and more responsible Retirement Benefits Sector in Kenya, which led to;

- Improvement in Protection of Member’s Benefits. The legislation required that existing schemes be registered by the RBA and a transition period given for the schemes to comply with the regulations. The new regulations included the separation of the roles of scheme sponsors, trustees and service providers. In addition, in-house investments and custody of schemes funds was no longer allowed and the RBA required that each scheme appoint a professional fund manager and an external custodian approved by the RBA. The RBA also imposed investment limits for various asset classes to ensure diversification and protection of funds.

- Improved Governance of Schemes. The legislations provided guidelines on the election and appointment of trustees as the legal owners of the scheme. It also made explicit requirement for schemes to perform annual audits and service providers to submit various documentations regularly to the RBA for inspection and to track the compliance levels with legislation and exposure to risk. This resulted in better governed schemes.

Section II. Challenges Facing the Retirement Benefits Industry that Regulations Have Not Been Able to Solve

It is quite clear that our Retirement Benefits Industry is growing, having hit Kshs 1.2 trillion as of December 2018, from Kshs 0.6 trillion in December 2013, representing a compounded annual growth rate of 13.0% in the last 5 years. In comparison, the unit trust market has grown by a compounded annual growth rate of 11.8% over the same period, indicating the strong growth in pensions. Even with this growth, there are still some challenges that regulations have not been able to effectively handle and these include coverage and adequacy of pensions. These challenges are not unique to Kenya but are faced by most Retirement Benefits Industries globally.

- Low Penetration Rate. Despite RBA’s initiatives to boost pensions coverage, penetration by retirement benefits schemes is still low at 20% of the labour force, and poses the biggest challenge in the Kenya’s pension system, with the Authority having a target of increasing this to 30% by 2024 according to their strategic plan. One of the causes of this is the structure of the industry as it is highly biased towards formal employment where employees generally contribute from source at the salary level and employees adhere to legislations issued compared to those in the informal employment sector, where there are no regulations requiring contributions to a pension scheme. However, this gap is slowly narrowing, with the formation of individual schemes such as the Mbao Pension Plan targeting the informal sector. The RBA has also continued to invest in member education and to demystify pension schemes and making them an ordinary service that is not a preserve of the privileged few. The RBA has also continued to challenge service providers in the industry to come up with innovative products that will tap into the large population in informal employment whose coverage is under 1%, by leveraging on technology to provide them with flexible and efficient modes of saving for retirement, and,

- Pension’s Adequacy. Even for those who are in a pension, pension adequacy exacerbates the already low penetration, with studies showing that currently, the income replacement ratio for retirees in Kenya is at 34% compared to the desired target of 75%, according to research done by Zamara. This means that for Kenyans earning Kshs 100,000 per month they are only saving to earn Kshs 34,000 per month during their retirement years as opposed to Kshs 75,000, which is recommended. This low adequacy has been attributed to, (i) lack of legislation that prescribe minimum contribution or benefit levels for retirement schemes, and (ii) frequent access to the benefits before retirement by members. Studies show that 95% of members who leave employment withdraw the maximum allowable benefits every time they change employers. It was therefore imperative that the RBA comes up with checks and balances that would enhance benefits preservation and reduce old age poverty.

Section III. 2019/2020 Budget Changes Affecting the Retirement Benefits Industry

Various trends and changes in the operating environment necessitate that the Retirement Benefits Authority continuously reviews its regulatory framework to keep pace with the emerging developments in the sector. Amendments to the Retirement Benefits Act and Regulations go through a rigorous review process to ensure that the changes being made will result in an improved industry and ultimately benefit the members. The process involves;

- Proposals for amendments are originated by players in the industry, through their umbrella bodies such as the Fund Managers Association, Association for Retirement Benefit Schemes and the Association of Pension Administrators,

- The proposals are then submitted to the Retirement Benefits Authority for review and consideration,

- The RBA then forwards the final proposals to the National Treasury for consideration, and to be included in the Budget, and,

- The Budget, including all the proposed changes, is then tabled in parliament for approval. Once approved, the regulations are amended and the same are gazetted with the effective dates for each change stipulated.

In the 2019/2020 Budget, we saw several changes effected to the Retirement Benefits Industry, these include;

- Access to Employers Portion of your Retirement Benefits before Retirement:

Change: The Umbrella Regulations and Occupational Regulations have been amended to limit access to retirement benefits by members of defined contribution schemes, who have not attained the retirement age, to only 100% of their member contributions, with the employers’ contributions being inaccessible and locked in until the member attains the retirement age, or on early retirement or on immigration. Previously, members leaving the service of an employer could access 100% of their contributions and 50% of the employers’ contributions. The challenge with this was that it eroded the amount one would finally have at retirement as whenever one changes employment there was a tendency to access these benefits and start afresh reducing the funds that one will have at the point of retirement.

Implications: We are of the opinion that this amendment will be instrumental in increasing pension’s adequacy and improving the income replacement ratio for retirees and thus reducing old age poverty. For the industry, this will translate to; (i) faster growth of assets, and (ii) trustees through their Fund Managers will have more room to make long-term investments and hence to translate to better returns to the schemes.

- Transfer of Funds from Guaranteed Schemes:

Change: The transfer period of Schemes that invest in Guaranteed Schemes and wish to withdraw their funds and transfer them to another Scheme, (Guaranteed or Segregated) has been reduced from three-years to one-year, effective January 2020.

Implications: We are of the opinion that this change is favorable to Trustees of Schemes who are dissatisfied with their current Approved Issuer/Insurance Company, as it will mean the assets starting to earn the more favorable returns of the new Approved Issuer/Insurance Company or Fund Manager earlier than having to wait for three years. For Approved Issuers/Insurance Companies offering Guaranteed Schemes, this would mean that they have to be more prudent in their investment decisions and make provisions for this shorter period allowed for liquidation of part of their Guaranteed Fund.

- Reserve Funds:

In regards to reserve funds, we saw two amendments incorporated;

a. Distribution of Reserves

Change: Occupational Retirement Benefits Regulations and the Retirement Benefits Act make provisions for creation of reserve funds by defined contribution schemes. The main reason why schemes maintain a reserve is to help smoothen the returns in times of bad investment performance due to challenging economic environment. The Schemes are however not required to distribute these reserve funds on the exit of a Member from the Scheme. This in effect means that departing Members exit without accessing their total entitlement from the Scheme. The amendment of the regulations is to ensure that Members receive their appropriate share of the reserves on leaving the Scheme.

Implications: We are of the opinion that this change will make the Retirement Benefits Schemes more attractive as it increases the members’ confidence that the regulations are protecting their interests and it makes it fair for people leaving the scheme as they have access to the entirety of their savings and investment returns.

b. Maximum Allowable Size of Reserve Fund:

Change: The Occupational Retirement Benefits Schemes Regulations have been amended to limit the amount of funds held in reserve to a maximum of 5% of the schemes assets. Initially, there was no limit of reserve funds stipulated by law and this was left to the discretion of the trustees to determine the level of reserves to keep.

Implications: This move will see enhanced member protection by increasing member benefits as it limits the returns that can be directed to reserves by trustees, and thus fund managers have to attribute the rest of the income to members. The members will therefore have better returns.

4. Post-Retirement Medical Fund:

Change: The amendment made is to allow members of Umbrella Schemes to make additional voluntary contributions towards funding a post-retirement medical fund. Initially this provision was available for members of Occupational Schemes and Individual Schemes. The amendments have also made a provision that allows members to transfer a portion of their retirement saving, up to a maximum of 10%, into the medical fund to achieve the desired level of medical funds.

Implications: Studies done by the RBA show that medical expenses constituted the biggest expenditure for retired people, and in addition, most insurance companies often decline to cover elderly persons, above 65 years old, as they are considered high risk. This change will play a major role towards the achievement of universal health coverage and allow members to fund their medical needs after retirement. For the members this shall play apart in lengthening the life expectancy.

5. Income Drawdown Option at Retirement:

Change: The amendment has made it mandatory for schemes’ rules to provide for income drawdown, as an alternative to an annuity or a Lump Sum, as a channel for members to access their retirement benefits at the point of retirement. Initially, it was at the discretion of the founder to include income drawdown as an option at retirement in their trust deeds and rules, and this meant that if the trust deeds and rules of your scheme do not have this provision, you could not transfer your retirement benefits into an income drawdown fund.

Implications: This amendment increases flexibility and gives retirees more options in which they can access their benefits at retirement as opposed to the traditional annuities. This will also allow retirees to benefit from income generated from investing their lump sum benefits and thus translating to higher regular payout to the retirees. For the industry, we expect this to result in increased registration of income drawdown funds, currently we only have five registered income drawdown funds, consequently beefing up competition and thus better service to members. (The five registered Income Drawdown Funds are; (i) Cytonn Income Drawdown Fund, (ii) Enwealth Kesho Hela Income Drawdown Fund, (iii) Octagon Income Drawdown Fund, (iv) Platinum Drawdown by Britam, and (v) Milele Income Drawdown by GenAfrica.

Section IV. Conclusion

Of the six changes in the 2019/2020 budget covered above, we are of the opinion that all are positive and will go a long way in promoting the Retirement Benefits Industry and protecting members’ interests, with the primary goal being to secure their retirement years. With the Retirement Benefits Industry growing, we expect the RBA to continue amending the regulations to accommodate the changes that might come by. When comparing our Retirement Benefits Industry with those around the world, there are similar challenges. Global coverage and adequacy of pensions is a challenge even in advanced economies, and there is need for regulators to continuously enforce reforms and regulations that enhance the Retirement Benefits Industry by smoothing the distribution of consumption spending over an individuals’ life, i.e. in both productive years and least productive years. The Retirement Benefits Authority in Kenya has evidently improved the industry immeasurably and it continues to come up with ways to drive the industry to higher heights through investment in member education and constantly amending the regulations. This will continue increasing the public’s confidence in the industry and attract more people to save for retirement and consequently protecting their golden years.

It is important for people to note that the government can provide the right legislative framework to help secure their lives but it is an individual’s responsibility to ensure that they are taking care of their lives. There are a number of products in the markets that one can take advantage, within the Retirement Benefits Industry as well as outside the industry. We shall be doing a note on possible investment options available in the market.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.