Review of the Interest Rate Cap, & Cytonn Weekly #25/2019

By Cytonn Research Team, Jun 23, 2019

Executive Summary

Fixed Income

T-bills remained oversubscribed during the week, with the overall subscription rate increasing to 236.7%, from 130.6% recorded the previous week. This continued oversubscription is attributable to favorable liquidity in the market supported by government payments. In the money markets, 3-month bank placements ended the week at 8.8% (based on what we have been offered by various banks), 91-day T-bill at 6.9%, average of Top 10 Money Market Funds at 8.4%, with the Cytonn Money Market Fund closing the week at 11.0%;

Equities

During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 declining by 1.7%, 2.2% and 2.2%, respectively, taking their YTD performance to gains of 5.0%, (6.6%), and 0.2% for NASI, NSE 20 and NSE 25, respectively. Safaricom and Equity Bank reached a financing deal which enables Safaricom’s suppliers, dealers and agents to access up to Kshs 200.0 mn unsecured short-term loans to manage cash flow positions ahead of payment. KCB Group served National Bank of Kenya (NBK) with take-over documents to acquire a 100% stake of ordinary shares of NBK upon conversion of the preference shares into ordinary shares;

Private Equity

During the week, there was private equity activity in fundraising, with Amethis, a Paris-based PE firm, announcing the close of its second Pan-African Fund, Amethis II. The fund raised EUR 375.0 mn (Kshs 43.4 bn), which was 25.0% higher than their initial target of EUR 300.0 mn (Kshs 34.7 bn). East Africa Private Equity & Venture Capital Association and KPMG released a report on private equity growth in East Africa;

Real Estate

During the week, Hon. Charles Hinga, Principal Secretary, State Department of Housing and Urban Development, announced plans to operationalize the Housing Fund through voluntary contributions, and seed funding from National Treasury, following the ongoing legal battle against mandatory contributions. In addition, Tatu City was declared a Special Planning Area, placing the 5,000-acre Master-planned city under control of the State, as opposed to County Authorities, which is expected to fast track the city’s development;

Focus of the Week

This week we revisit the interest rate cap topic following the proposal by the National Treasury Cabinet Secretary, Mr. Henry Rotich, in the Budget reading for 2019/20 fiscal year, to repeal Section 33B of the Banking Act. In this topical, we examine the recent developments regarding the interest rate cap law including the recent ruling suspending Section 33B by the High Court. We also scrutinize the interest rate regime in Zimbabwe and how it affected their banking industry. Further, we review the effects the rate cap law has had so far in the banking industry and subsequently, we examine recent calls by organizations and lobby groups to repeal the law. Lastly, we give our views and expectations regarding the interest rates controls in Kenya and the way forward.

- Interested in learning about real estate investments in a relaxing environment next weekend? Be sure to stop by our stand at Westgate Mall next weekend, on the 29th and 30th June 2019, from 9:00 am - 6:00 pm and start your investments journey,

- Ian Kagiri - Investments Analyst was on Metropol TV on “The Smart Investor” with Aly Khan Satchu to discuss the recently released Cytonn Q1’2019 Listed Banking Sector Report. Watch him here

- Ian Kagiri - Investments Analyst was on CNBC East Africa to discuss Market Movements. Watch him here

- David King’oo – Cytonn Manager was on Citizen TV to discuss the interest rate standoff. Watch him here

- Caleb Mugendi – Investments Associate was on KBC Channel 1 to discuss the current state of the economy and impact of the recently read budget. Watch him here

- Cytonn Asset Managers Ltd, our affiliate regulated by the Capital Markets Authority, CMA, and the Retirement Benefits Authority, RBA, has announced the launch of its individual pension plan product, Cytonn Individual Retirement Plan, CIRP. To register for CIRP, see here or just email pensions@cytonn.com;

- Phase 1 of The Alma achieved a milestone last week; it is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- Cytonn Money Market Fund closed the week at an average yield of 11.0% p.a. To subscribe, just dial *809#

- In line with increasing the product offering to our clients, we are happy to announce that Cytonn Asset Managers has received two more licenses to offer personal retirement benefits scheme with a monthly payment platform from the Retirement Benefits Authority (RBA). The licenses allow Cytonn Asset Managers to manage segregated funds, personal pension funds and the income drawdown fund. https://bit.ly/2K6xs6u. For more information on the pension products, email us at pensions@cytonn.com;

- Interested in learning about real estate investments in a relaxing environment this weekend? Be sure to stop by our stand at the Lavington Mall on the 21st and 22nd June 2019 from 9:00 am - 6:00 pm and start your investment journey;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor’s Tour and for more information, email us at sales@cytonn.com;

- Following the completion and handover of Amara Ridge in Karen, we have now launched our next Karen project, dubbed Applewood, a Kshs 2.5 bn residential development located in Miotoni, Karen. This signature development shall comprise luxury homes, each sitting on 1/2 acre. We invite you to the exhibition of Applewood which is ongoing at the Amara Ridge Clubhouse (Location pin: https://goo.gl/maps/B3GVnu8pHyn) or at the Applewood Sales Centre on Miotoni Road (Location pin: https://goo.gl/maps/ZfABuGjFo1z) from 9:00 am to 5:00 pm daily. Call 0709 101 000 or email resales@cytonn.com to reserve a villa! See Video here;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

T-bills remained oversubscribed during the week, with the overall subscription rate increasing to 236.7%, from 130.6% recorded the previous week. The continued oversubscription is attributable to favourable liquidity in the market supported by government payments, which more than offset the tax payments by banks. The yields on the 91-day and the 182-day T-bills declined by 0.1% points to 6.8% and 7.6%, respectively, while yields on the 364-day T-bills declined by 0.2% points to 9.1%, from 6.9%, 7.7% and 9.3% for the 91-day, 182-day and 364-day T-bills, respectively, recorded in the previous week. The acceptance rate declined to 17.4%, from 35.1% recorded the previous week, with the government accepting a total of Kshs 9.9 bn of the Kshs 56.8 bn worth of bids received, lower than the weekly quantum of Kshs 24.0 bn. Investors’ participation remained skewed towards the longer-dated paper, with the continued demand being attributable to the scarcity of newer short-term bonds in the primary market. The subscriptions for the 91-day, 182-day and 364-day T-bills rose to 161.2%, 64.0%, and 439.7% from 26.1%, 28.5%, and 274.2%, respectively.

In the money markets, 3-month bank placements ended the week at 8.8% (based on what we have been offered by various banks), 91-day T-bill at 6.8%, average of Top 10 Money Market Funds at 8.4%, with the Cytonn Money Market Fund closing the week at 11.0%.

Liquidity:

During the week, the average interbank rate declined to 2.8% from 3.2% recorded the previous week, pointing to improved liquidity conditions in the money market supported by government payments, which offset tax remittances by banks during the week. This saw commercial banks’ excess reserves coming in at Kshs 15.4 bn in relation to the 5.25% cash reserve requirement (CRR). The average volumes traded in the interbank market also increased by 226.2% to Kshs 14.3 bn, from Kshs 4.4bn the previous week.

Kenya Eurobonds:

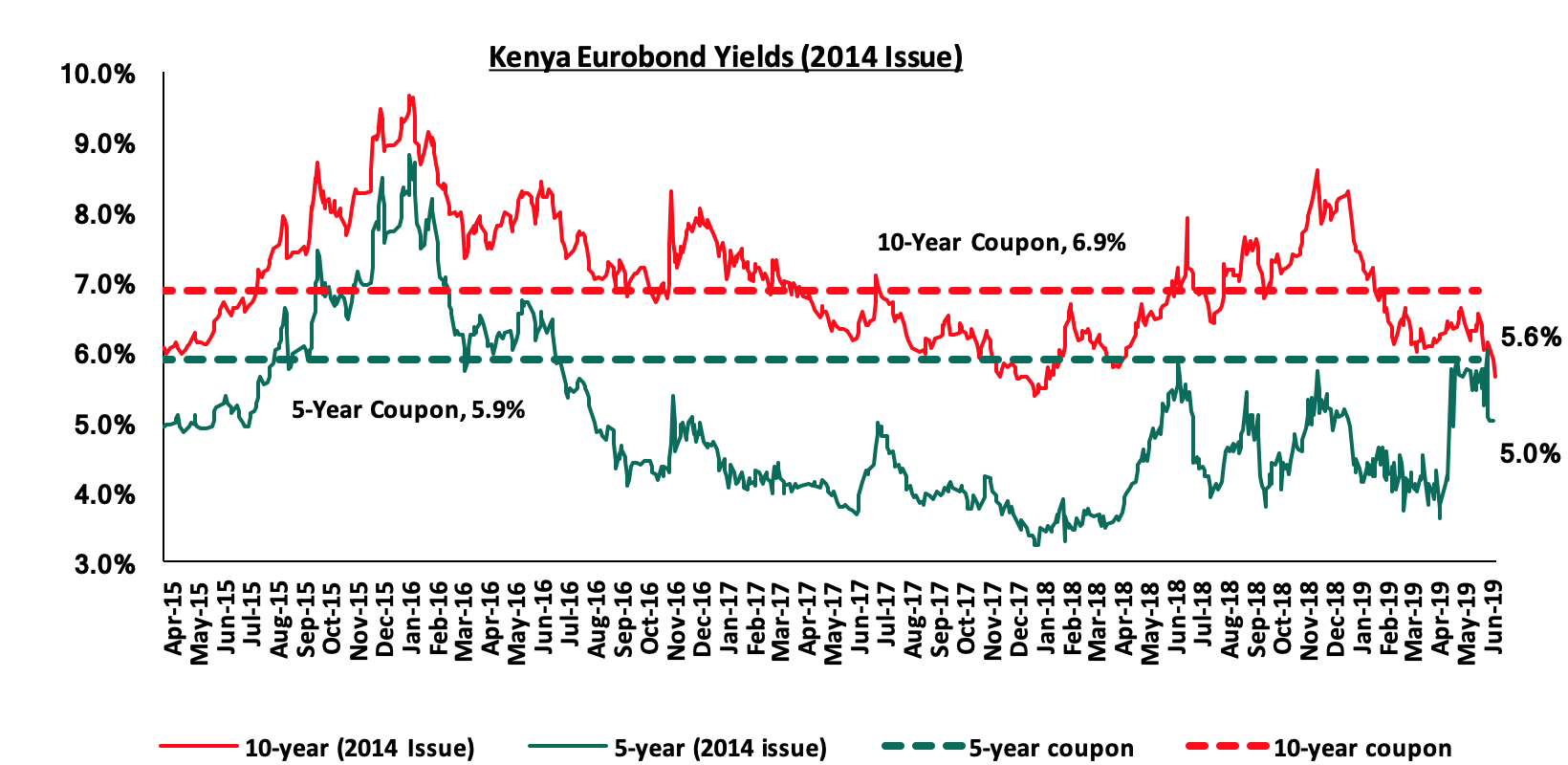

The yield on the 10-year Eurobond issued in 2014 declined by 0.5% points to 5.6%, from 6.1% recorded the previous week, while that of the 5-year remained unchanged at 5.0%. Key to note is that the 5-year bond is set to mature on 24th June 2019, while the 10-year bond currently has 5.0-years to maturity.

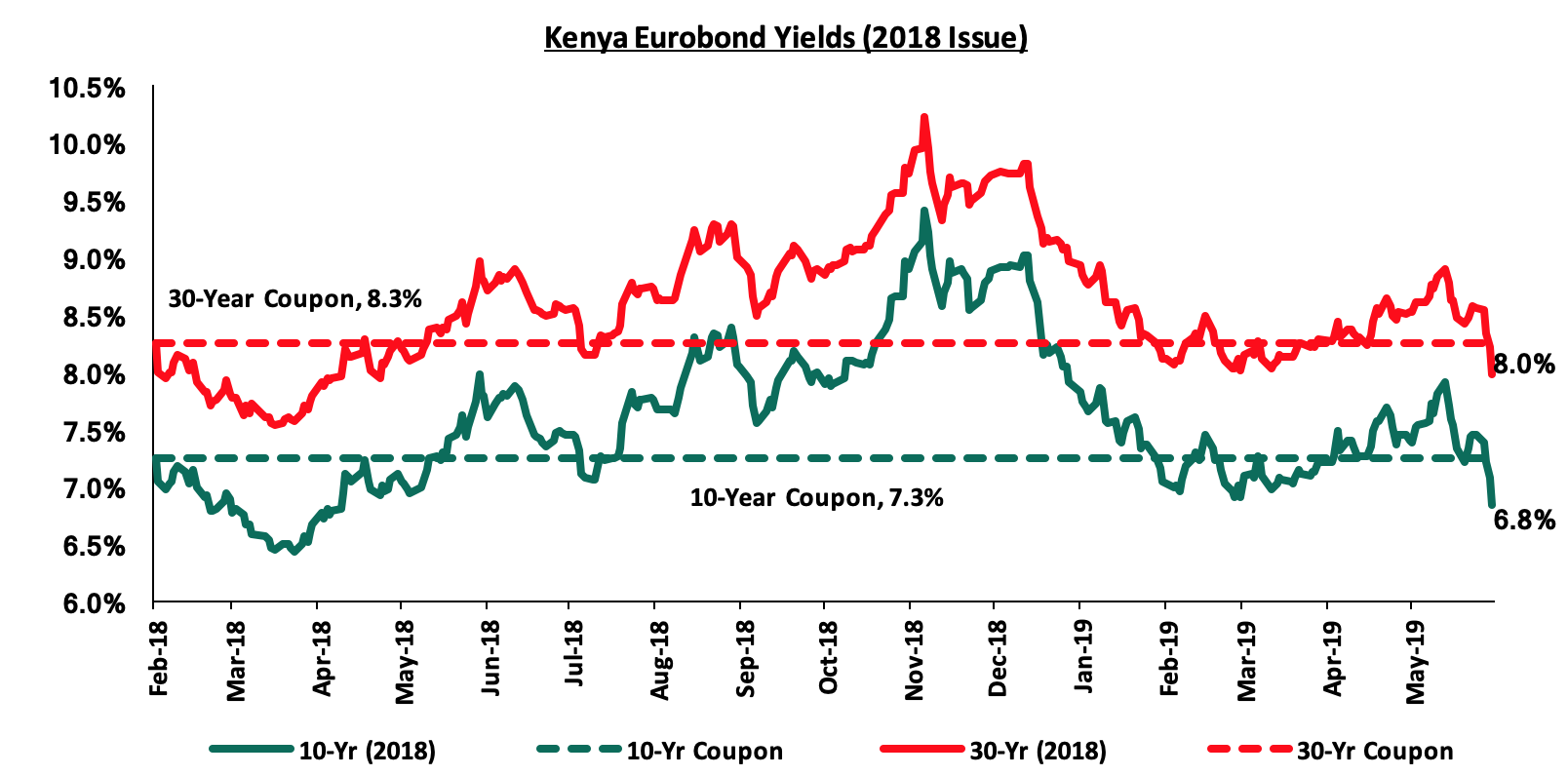

For the February 2018 Eurobond issue, yields on the 10-year Eurobond and 30-year Eurobond declined by 0.6% points to 6.8% and 8.0% from 7.4% and 8.6% recorded the previous week, respectively.

For the newly issued dual-tranche Eurobond with 7-years and 12-years tenor, priced at 7.0% for the 7-year tenor and 8.0% for the 12-year tenor, respectively; the yield on the 7-year bond declined by 0.4% points to 6.6% from 7.0% recorded in the previous week, while the 12-year bond declined by 0.7% points to 6.8% from 7.5% recorded in the previous week.

The Kenya Shilling:

During the week, the Kenya Shilling depreciated by 0.3% against the US Dollar to close at Kshs 101.9, from Kshs 101.5 the previous week, due to a spike in dollar demand from oil and merchandise importers resulting in the depreciation of the shilling. The Kenya Shilling has depreciated by 0.1% year to date; compared to the 1.3% appreciation in 2018, and in our view, the shilling should remain relatively stable to the dollar in the short term, supported by:

- The narrowing of the current account deficit with data on balance of payments indicating continued narrowing to 4.5% of GDP in the 12-months to April 2019, from 5.5% recorded in April 2018. The decline has been attributed to the resilient performance of exports particularly horticulture and coffee, strong diaspora remittances, and higher receipts from tourism and transport services. Growth of imports also slowed mainly due to lower imports of food,

- Improving diaspora remittances, which have increased cumulatively by 6.1% in April 2019 to USD 991.2 mn, from USD 858.6 mn recorded in a similar period of review in 2018. The rise is due to:

- Increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and,

- New partnerships between international money remittance providers and local commercial banks making the process more convenient,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 9.2 bn (equivalent to 5.8-months of import cover), above the statutory requirement of maintaining at least 4-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Highlights of the Week

The Federal Reserve Bank (Fed) of the U.S through its Federal Open Market Committee (FOMC), has maintained its benchmark policy rate within the band of 2.25% - 2.50%, during its 20th June Meeting, unchanged from its March projection. However, the FOMC left open the possibility for an interest rate cut depending on how macroeconomic conditions developed during the year. The decision was based on improved economic activity and reduced inflationary pressures. The Fed also highlighted that overall inflation on a 12-month basis for the month ending May 2019 was at 1.8%, which is slightly below the Fed’s target rate of 2.0%. We expect the Fed to reduce the policy rate by 25 bps to a band of 2.0%-2.25%, given uncertainties on the economic outlook.

Inflation projections

We are projecting the Y/Y inflation rate for the month of June to come in within the range of 5.8% - 6.2%, compared to 5.5% recorded in May. The Y/Y inflation for the month of June is expected to rise due to the base effect as well as:

- A rise in the transport index, which has a weight of 8.7%, with petrol prices having increased by 2.7% to Kshs 115.1, from Kshs 112.0 per liter previously, while diesel recorded a 0.4% rise to Kshs 104.8, from Kshs 104.4 per liter previously.

M/M inflation is however expected to decline, with the rise in the transport index being mitigated by a decline in the food and non-alcoholic beverages index, which has a weighting of 36.0%, mainly driven by a decline in food prices such as tomatoes and maize flour, following the release of 2 million bags of maize from the strategic food reserves the previous month at a subsidized cost of Kshs 2,300 per 90 kg bag against Kshs 3,200 in the open market, to ease the grains shortage, hence curbing rising flour prices. We also expect a decline in the housing, water, electricity, gas and other fuels index, following the 0.3% decline in kerosene prices to Kshs 104.3, from Kshs 104.6 per litre previously. Going forward, we expect food inflation to be subdued, following the directive to open the duty free import window for maize from July to plug the grain shortage, which will allow traders to import up to 12.0 mn bags.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids as they are currently 3.6% ahead of their domestic borrowing target for the current financial year, having borrowed Kshs 332.5 bn against a pro-rated target of Kshs 321.0 bn. A budget deficit is likely to result from depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Despite this, we do not expect upward pressure on interest rates due to increased demand for government securities, driven by improved liquidity in the market owing to the relatively high debt maturities. Our view is that investors should be biased towards medium-term fixed income instruments to reduce duration risk associated with long-term debt, coupled with the relatively flat yield curve on the long-end due to saturation of long-term bonds.

During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 declining by 1.7%, 2.2% and 2.2%, respectively, taking their YTD performance to gains/(losses) of 5.0%, (6.6%), and 0.2% for NASI, NSE 20 and NSE 25, respectively. The performance in the NASI was driven by declines in EABL, NIC Group, and Bamburi that declined by 5.1%, 4.1%, and 2.5%, respectively.

Equities turnover decreased by 27.3% during the week to USD 26.9 mn, from USD 37.0 mn the previous week, taking the YTD turnover to USD 743.8 mn. Foreign investors remained net sellers for the week, with a net selling position of USD 0.7 mn, from USD 5.9 mn the previous week.

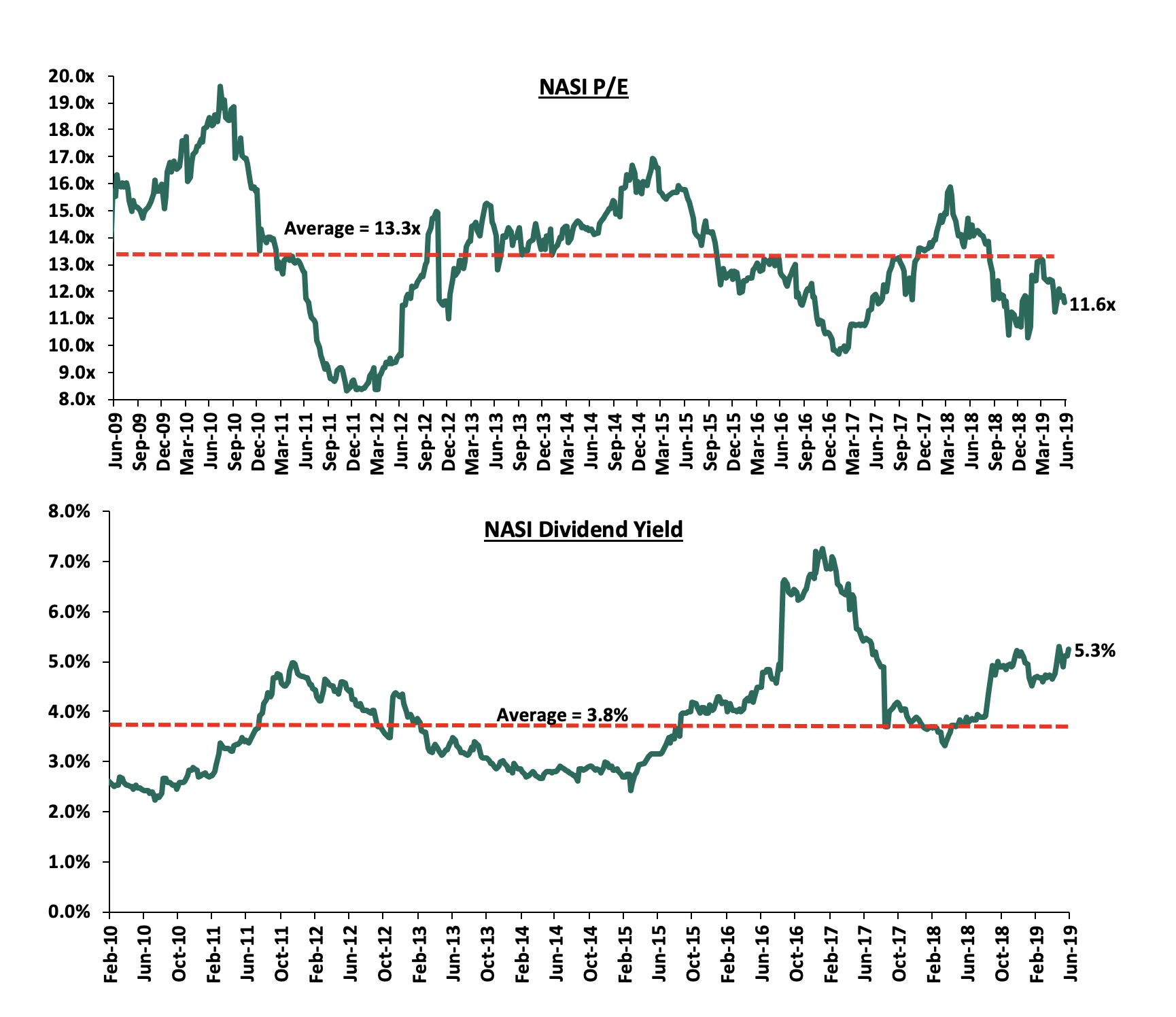

The market is currently trading at a price to earnings ratio (P/E) of 11.6x, 13.2% below the historical average of 13.3x, and a dividend yield of 5.3%, 1.5% points above the historical average of 3.8%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 11.6x is 19.4% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 39.4% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlights

During the week, Safaricom and Equity Bank reached a financing deal enabling Safaricom’s suppliers, dealers and agents to access up to Kshs 200.0 mn unsecured short-term loans to manage cash flow positions ahead of payment. Safaricom had 1,164 suppliers and 440 active dealers in the financial year ended March 2019 and 156,000 M-Pesa agents. The size of the loan to be accessed and terms will be subjected to individual firm’s credit grading. Suppliers, dealers and agents who provide information on local purchase orders or contractor financing, bid bonds, performance guarantees, advance payment guarantees and back-to-back letters of credit before they start supplying will access a maximum unsecured loan of Kshs 100,000. In our view, the financing deal will benefit Safaricom as the thousands of Safaricom suppliers, dealers and agents targeted will be able to provide the telco better services as a result of better cashflows and hence an increase in their operational efficiency. The financing deal will also be beneficial to Equity Bank as it will enable them to grow their loan book, which grew by 12.7% to Kshs 305.5 bn in Q1’2019, from Kshs 271.1 bn in Q1’2018, as well as grow their Non-Funded Income (NFI) which grew by 6.8% to Kshs 7.2 bn in Q1’2019, from Kshs 6.7 bn in Q1’2018. The financing deal is an indicator of Equity Bank’s aggressiveness evidenced by Equity Bank having the second highest NFI contribution to total operating income as reported in our Kenya Listed Banks Q1’2019 Report. We expect banks to continue focusing on revenue diversification in the current regime of compressed interest margins. Focus on Non-Funded Income (NFI) is likely to continue, as banks aim to grow transactional income via alternative channels such as agency banking, internet, and mobile technologies.

KCB Group served National Bank of Kenya (NBK) with take-over documents to acquire a 100% stake of ordinary shares of the Company upon conversion of the preference shares into ordinary shares. Under the take-over documents, KCB intends to satisfy the offer price consideration through a share swap of 1 ordinary share of KCB for every 10 ordinary shares of NBK, for more information see our Cytonn Weekly #16/2019. National Bank of Kenya (NBK) says it will negotiate to ensure that staff do not lose their jobs in the looming takeover by KCB. NBK currently has 1,356 staff. KCB said that part of the takeover will involve streamlining human resource in the post-acquisition period, raising fears of staff-layoffs of NBK employees. The exact number of staff who will be retained is yet to be determined as the takeover documents are yet to be filed with the Competition Authority of Kenya (CAK), who are mandated to consider public interest that includes jobs and substantial lessening of competition. There are instances when CAK has compelled firms to retain staff of target companies for a certain period. The regulator in May 2019 approved the Commercial Bank of Africa (CBA) and NIC Group Plc merger on condition that they retain their respective staff for at least a year. The agency in 2014 ordered Britam to retain at least 85 employees of its acquisition target Real Insurance’s 105 staff. In our view, the merger if it goes through, will result in closing of branches and staff layoffs as KCB restructures the business to achive operational efficiency. NBK’s staff costs increased by 5.3% to Kshs 1.0 bn in Q1’2019, from Kshs 0.9 bn in Q1’2018. We expect banks to continue focusing on operational efficiency with cost containment likely to continue being a focus area. We thus expect continued restructuring, possible leading to staff layoffs, as staff headcount demands reduce, on increased usage of mobile and internet channels.

Universe of Coverage

Below is a summary of our SSA universe of coverage:

|

Banks |

Price as at 14/06/2019 |

Price as at 21/06/2019 |

w/w change |

YTD Change |

*Target Price |

Dividend Yield |

**Upside/Downside |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

120.0 |

116.0 |

(3.3%) |

(25.9%) |

228.4 |

2.2% |

99.1% |

0.6x |

Buy |

|

Zenith Bank |

20.1 |

20.0 |

(0.5%) |

(13.2%) |

33.3 |

13.5% |

80.1% |

0.9x |

Buy |

|

UBA Bank |

6.2 |

6.4 |

3.7% |

(16.5%) |

10.7 |

13.2% |

79.6% |

0.4x |

Buy |

|

CRDB |

115.0 |

120.0 |

4.3% |

(20.0%) |

207.7 |

0.0% |

73.1% |

0.4x |

Buy |

|

***KCB Group |

39.5 |

39.0 |

(1.3%) |

4.1% |

60.4 |

9.0% |

63.9% |

1.0x |

Buy |

|

GCB Bank |

4.6 |

5.0 |

8.7% |

8.7% |

7.7 |

7.6% |

62.0% |

1.2x |

Buy |

|

I&M Holdings |

55.0 |

54.3 |

(1.4%) |

27.6% |

81.5 |

6.5% |

56.7% |

1.0x |

Buy |

|

CAL Bank |

0.8 |

0.9 |

14.8% |

(5.1%) |

1.4 |

0.0% |

50.5% |

0.8x |

Buy |

|

Co-operative Bank |

12.3 |

12.1 |

(1.6%) |

(15.4%) |

17.1 |

8.3% |

49.2% |

1.0x |

Buy |

|

Access Bank |

6.4 |

6.9 |

7.3% |

1.0% |

9.5 |

5.8% |

44.1% |

0.4x |

Buy |

|

NIC Group |

31.8 |

30.5 |

(4.1%) |

9.7% |

42.5 |

3.3% |

42.6% |

0.6x |

Buy |

|

Equity Group |

40.0 |

39.3 |

(1.9%) |

12.6% |

53.7 |

5.1% |

41.8% |

1.7x |

Buy |

|

Ecobank |

10.0 |

7.8 |

(21.8%) |

4.3% |

10.7 |

0.0% |

37.2% |

1.7x |

Buy |

|

Barclays Bank |

10.3 |

10.4 |

1.0% |

(5.0%) |

12.8 |

10.6% |

33.6% |

1.3x |

Buy |

|

Guaranty Trust Bank |

30.9 |

31.2 |

1.1% |

(9.3%) |

37.1 |

7.7% |

26.5% |

2.0x |

Buy |

|

Stanbic Bank Uganda |

30.0 |

30.0 |

0.0% |

(3.2%) |

36.3 |

3.9% |

24.8% |

2.1x |

Buy |

|

SBM Holdings |

5.7 |

5.7 |

0.0% |

(4.4%) |

6.6 |

5.3% |

20.4% |

0.8x |

Buy |

|

Stanbic Holdings |

98.0 |

100.0 |

2.0% |

10.2% |

113.6 |

5.9% |

19.4% |

1.1x |

Accumulate |

|

Union Bank Plc |

6.9 |

7.0 |

0.7% |

24.1% |

8.2 |

0.0% |

17.3% |

0.7x |

Accumulate |

|

Bank of Kigali |

290.0 |

275.0 |

(5.2%) |

(8.3%) |

299.9 |

5.0% |

14.1% |

1.5x |

Accumulate |

|

Standard Chartered |

194.0 |

192.0 |

(1.0%) |

(1.3%) |

200.6 |

6.5% |

11.0% |

1.4x |

Accumulate |

|

Bank of Baroda |

128.0 |

129.0 |

0.8% |

(7.9%) |

130.6 |

1.9% |

3.2% |

1.1x |

Lighten |

|

FBN Holdings |

7.0 |

7.0 |

0.1% |

(12.5%) |

6.6 |

3.6% |

(1.1%) |

0.4x |

Sell |

|

National Bank |

4.4 |

4.0 |

(9.1%) |

(24.8%) |

3.9 |

0.0% |

(1.4%) |

0.2x |

Sell |

|

Standard Chartered |

21.6 |

20.5 |

(5.1%) |

(2.4%) |

19.5 |

0.0% |

(5.1%) |

2.6x |

Sell |

|

Stanbic IBTC Holdings |

42.0 |

39.9 |

(5.0%) |

(16.8%) |

37.0 |

1.5% |

(5.8%) |

2.1x |

Sell |

|

Ecobank Transnational |

10.0 |

11.4 |

13.5% |

(33.2%) |

9.3 |

0.0% |

(18.2%) |

0.4x |

Sell |

|

HF Group |

4.4 |

4.3 |

(3.4%) |

(23.3%) |

2.9 |

0.0% |

(31.8%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in ****Stock prices indicated in respective country currencies |

|||||||||

We are “Positive” on equities for investors as the sustained price declines has seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations to support the positive performance.

Earlier in the week, Amethis announced the close of its second Pan-African fund, which raised EUR 375.0 mn (Kshs 43.4 bn), which was 25.0% higher than their initial target of EUR 300.0 mn (Kshs 34.7 bn). The fund will invest in deals with an estimated ticket size of between EUR 10.0 mn (Kshs 1.2 bn) to EUR 30.0 mn (Kshs 3.5 bn) or more through co-investment. Among the more than 70 investors in the fund is; European Investment Bank who invested EUR 25.0 mn (Kshs 2.9 bn), International Finance Corporation (IFC), the French Public Investment Bank and Bpifrance.

Through its previous funds, Amethis has made a number of previous investments in the continent with its major focus on geographic and sector diversification. Below are the previous funds by the company;

Funds in Africa by Amethis

|

Fund |

Focus |

Amount |

|

Amethis Fund I |

Pan – African |

EUR 250.0 mn |

|

Amethis Fund II |

Pan – African |

EUR 375.0 mn |

|

Amethis Maghreb Fund I |

North African |

EUR 75.0 mn |

|

Amethis West Africa |

West African |

EUR 45.0 mn |

Amethis Fund II targets sectors that deliver goods and services to the middle class of African consumers; industry, distribution, consumer goods, financial services, telecommunications, health, and education. In the country, Amethis has invested in Kenafric Industries and Ramco group. We continue to see increased fundraising activity in the Pan-African region in private equity, owing to investor interest and the available opportunities for PE firms in the region. Some of the drivers supporting PE investment include; (i) economic growth, with the projected growth rate for Sub-Saharan Africa at 3.4% in 2019, higher than 2.7% in 2018 according to the World Bank, and (ii) attractive valuations in the private markets in the region compared to public markets.

East Africa Private Equity & Venture Capital Association and KPMG released a report on Private Equity in East Africa during the fifth annual PE conference held in Addis Ababa, Ethiopia on 13th June 2019. According to the report, PE deals increased by 15.5% to 97 in 2018 from 84 recorded the previous year, with an estimated value of USD 1.4 bn (Kshs 140.0 bn). The report attributed the increase to growth in both PE deals and value to the investment in private equity by pension funds. There was a 12.0% increase in the funds sourced from the domestic market, and this was driven mainly by the participation of pension funds in private equity investments. Despite this growth, the allocation to private equity by pension funds could be increased. As highlighted in our report, Retirement Benefits Schemes in Kenya, despite the regulation allowing for a 10% allocation to private equity in Kenya, as at June 2018, the total Retirement Benefits Assets allocated to private equity stood at 0.04% of managed assets.

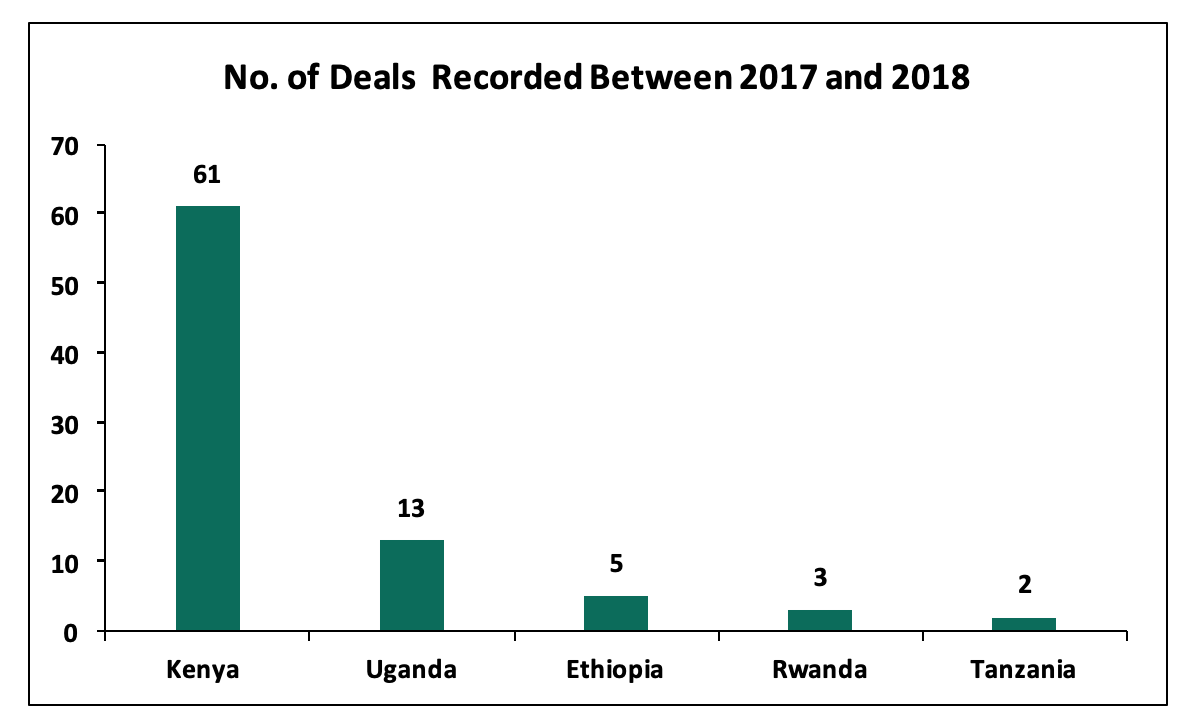

Kenya leads by a number of deals and volumes where between 2017 and 2018, it recorded 61 deals as per the below graph, accounting for 72.6% of all deals recorded in the 5 countries:

From the above graph, Kenya has the highest allocation of deals. This can be attributed to the conducive environment for doing business and the skilled workforce available.

We maintain a positive outlook on private equity investments in Africa as evidenced by the increasing investor interest, which is attributed to; (i) economic growth, which is projected to improve in Africa’s most developed PE markets, (ii) attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, and (iii) attractive valuations in Sub Saharan Africa’s markets compared to global markets. Going forward, the increasing investor interest, stable macro-economic and political environment will continue to boost deal flow into African markets.

- Residential

Following the pending legal case in regard to the Kenyan Government’s Housing Fund levy, Principal Secretary for the State Department of Housing and Urban Development, Hon. Charles Hinga announced that Kenyans can begin voluntary contributions, which according to the Housing Fund Act, shall not be less than Kshs 200 per month. This is to kick start contributions from willing individuals, especially the 225,000 Kenyans registered on the Boma Yangu portal, a symbol in itself of their interest in the Affordable Housing Scheme. Operationalization of the institution is, therefore, set to be backed by voluntary contributions and Kshs. 5.0 bn seed funding from the National Treasury as provided for in the National Budget 2019/2020. As it is, the Housing Fund levy is likely to have a long court process, which might delay delivery of the affordable homes especially considering the time sensitivity of the Kenyan Government’s plan to deliver 500,000 units by 2022. If approved, the government plans to use funds from the Housing Fund to bring on board private developers by providing offtake guarantees, with funds expected to be collected through public statutory contributions set at 3.0% of employees’ gross salary shared equally by employees and their employers. The government targets Kshs 55.0 bn in the first year from approximately 2.5 mn employees, and subsequent increases thereafter as the number of contributors continue to grow. However, the majority of the country’s population remain against the mandatory contribution, due to:

- The perceived burden on those who already own homes or are currently servicing a mortgage,

- The increased wage bill for employers,

- The imposition on the formal sector alone, and not the whole public, and,

- The ballot-based system meaning not all contributors will benefit from the scheme. The government aims to deliver 500,000 homes against at least 2.5 mn contributing Kenyans, therefore leaving 2.0 mn out of the affordable housing program. See our National Development Housing Fund Topical, for more information.

In our view, if the state does manage to obtain voluntary contributions, it will mobilize the rest of the population to partake in the housing fund, particularly the low-income earners who qualify for the affordable housing scheme. This is likely to be further facilitated by the government’s plan to hand over the first batch of affordable homes of 228 units from the ongoing Park Road Project, in September 2019, to low-income earners registered on the portal from across the country.

- Mixed-Use Developments (MUDs)

During the week, Kenya Power Pension Fund (KPPF) invited bids for a mixed-use residential development partner to undertake the development and funding of its 3.3-acres of land located along Naivasha Road, Lavington. The pension scheme’s goal is to put up a high-rise mixed-use residential and commercial building at an estimated cost of Kshs 1.4 bn, through its real estate trading company, Sakile Properties. The fund, which typically invests in high-end and upper mid-end properties in Nairobi, has completed projects such as Bogani Park in Karen, Loresho Ridge, and Runda Park. As the local real estate market peaks, we have witnessed increased supply of office space, retail space, and residential units, especially in the upper segment of the market, against shrinking demand, resulting in increased competition among developers and thus subdued returns. In order to differentiate their products, we are now seeing more developers undertaking Mixed-Use Developments (MUDs), which integrate various uses (residential, commercial, hospitality, retail, etc.) into one so as to maximize land use whilst increasing uptake through creation of a live, work, play and invest environment for building occupants. According to the Cytonn MUD Report 2018, office space and residential units in MUDs have higher rental yields at 8.2% and 5.6% compared to the market average at 7.9% and 5.0%, respectively, mainly attributed to higher rents and prices charged due to amenities and facilities provided.

(All values in Kshs unless stated otherwise)

|

Thematic Performance in MUDs in Comparison to Overall Market Performance in the Highlighted Nodes 2018 |

|||

|

Themes |

MUD Themes Average Rental Yield % |

Market Average Rental Yield % |

Rental Yield Difference |

|

Retail |

8.5% |

9.5% |

(1.0%) |

|

Offices |

8.2% |

7.9% |

0.3% |

|

Residential |

5.6% |

5.0% |

0.6% |

|

Average |

7.4% |

7.5% |

0.0% |

|

|||

Source: Cytonn Research

Local pension funds have been increasing their real estate investment portions owing to relatively high returns in the sector, which currently stand at a five-year average of 20.1%, in comparison to 8.7% for other traditional asset classes. As at December 2018, pension schemes in Kenya had total assets under management at Kshs 1.2 tn, an 8.0% increase from Kshs 1.1 tn in December 2017. However, real estate investments make up only 19.7% of their investments, 1.5% points decline from 21.2% in 2017, owing to an increase in assets and a marginal change in real estate investments. This is despite the Retirement Benefits Authority allowing the schemes to invest at most 30.0% of their assets in real estate.

- Master Planned Developments

During the week, the government declared Tatu City, through a Kenya Gazette Notice, a Special Planning Area (SPA), which means the master-planned city will be under state control rather than county authority. As per the Physical Planning Act, a Special Planning Area essentially means an area that cuts across boundaries of two or more local authorities and which has spatial or physical development problems. The national government’s intervention follows Tatu City’s brawls with the Kiambu County Government that has led to delays in construction approval processes for the 5,000-acre development, unnecessarily prolonging its development timelines. So far, completed projects developed within Tatu City since its commencement in 2015 includes Nova School, Crawford International School, various industrial parks, and residential projects such as Lifestyle Heights. Therefore, the move will fast track Tatu City’s materialization by allowing for fast planning and cutting construction approval bureaucracies for homeowners within the project while also paving way for the development of Tatu City’s Local Physical Development Plan whose key aim is to ensure coordinated and progressive development of the area in order to ensure health, safety, convenience, and the general welfare of its inhabitants. As per the gazette notice, Tatu City is also required to establish and operationalize a one-stop shop within the city to facilitate the processing and issuance of development and construction permits and certificates of occupancy as required by the Special Economic Zones Act. The SPA status, which is rare for private developments, indicates Tatu City’s unique potential for the overall country’s economy and is a step in the right direction towards protecting private developers from the often unfair government bureaucratic processes which tend to elongate development timelines, negatively affecting real estate investment returns.

Other Highlights

According to the National Treasury, revenues from stamp duty tax for the year ending June 2019 are expected to fall by 21.5% to Kshs 9.5 bn, from Kshs 12.1 bn collected in the year ending June 2018. In our view, this is mainly as a result of the exemption of first-time home buyers from the tax, which was effected in July 2018. The decline is also coupled by sluggish property uptake in the current year owing to tough economic conditions. As per the Cytonn Q1'2019 Markets Review, annual uptake for the Nairobi Metropolitan Area declined by 2.9% to an average of 20.8% from 23.7% in June 2018.

We expect increased real estate investments across all sectors driven by institutional investment into the sector, such as pension funds as they seek to diversify their portfolios and the government initiatives especially for affordable housing and provision of infrastructure aimed at enhancing real estate returns.

This week, we revisit the interest rate cap topic following the proposal by the National Treasury Cabinet Secretary, Mr. Henry Rotich, in the Budget reading for 2019/20 fiscal year, to repeal Section 33B of the Banking Act, which capped interest chargeable on loans at 4.0% above the CBR rate. As highlighted in the Finance Bill 2019, the proposition to repeal the interest rate cap stems from the adverse effects the law has had on credit access, especially by the Micro, Small and Medium Enterprises (MSMEs), which consequently has detrimental effects on economic growth.

In 2018, the Parliament rejected a similar repeal proposition made by the Cabinet in the Finance Bill 2018, electing to retain the lending rate cap ceiling but scrapping off the deposits rate floor, which was set at 70.0% of the Central Bank Rate. According to the Treasury, in order to spur business activity and improve access to credit to the private sector that is largely made of MSMEs, there is a need to repeal the rate cap law. The Central Bank of Kenya (CBK), and the International Monetary Fund (IMF), also support the repeal of the interest rate cap, citing that the law has not achieved its intended objectives.

We, therefore, revisit the issue of the interest rate cap, focusing on:

- Background of the Interest Rate Cap Legislation - What Led to Its Enactment?

- A Recap on Our Analysis on the Subject

- A Review of the Effects It Has Had So Far in Kenya

- Case Study of Interest Rate Cap Regime - Zimbabwe

- Recent Developments

- Our Views, Expectations, and Conclusion

Section I: Introduction

- Background of the Interest Rate Cap Legislation - What Led to Its Enactment?

Controls in the banking sector date back to the post-independence period where between 1963 and 1970, the government pursued a regime of interest rate capping and quantitative credit controls, with the aim of encouraging investment and spurring economic growth and development. The controls fixed minimum saving rates for all deposit-taking institutions and maximum lending rates for lending financial institutions, which resulted in fixed interest spreads for banks. This was largely aimed at improving the aggregate savings level, by incentivizing depositors using relatively higher deposit rates. Control of lending rates, on the other hand, resulted in the suppression of financial intermediation, which consequently changed banks’ operating models, and they became biased towards short-term credit to parastatals and major firms.

The enactment of the Banking (Amendment) Act 2015 in September 2016, that capped lending rates at 4.0% above the Central Bank Rate (CBR), and deposit rates at 70.0% of the CBR, came against a backdrop of low trust in the Kenyan banking sector due to various reasons:

- The period was marred with several failures of banks such as Chase Bank Limited, Imperial Bank Limited and Dubai Bank, due to failures in corporate governance. The failure of these banks rendered depositors helpless and unable to access their deposits in these banks,

- The total cost of credit was high at approximately 21.0% per annum, yet on the other hand, the interest earned on deposits placed in banks was low, at approximately 5.0% per annum, and

- Calls for capping interest rates were based on the high profitability in the banking sector because of high spreads between lending rates and deposits rates, which in 2016 was at a high of 9.5%. As a result, in 2016, the Return on Equity of Kenyan banks stood at 24.5% above the 5-year SSA average of 15.4%. The Return on Assets, on the other hand, stood at 3.1% above the 5-year SSA average of 1.5%.

Section II. A Recap on Our Analysis on the Subject

Our view has always been that the interest rate cap regime would have an adverse effect on the economy and by extension to Kenyans. We have previously written about this in six focus notes, namely:

- Interest Rate Cap is Kenya's Brexit- Popular But Unwise, dated 21st August 2016, highlighted our view that the interest rate cap would have a clear negative impact on the economy. We noted that free markets tend to be strongly correlated with stronger economic growth, emphasized by the lack of compelling evidence of an economy where interest rate capping was successful, as evidenced by the World Bank report on the capping of interest rates in 76 countries around the world. In Zambia, for example, interest rate caps were introduced in December 2012 and repealed 3-years later, in November 2015, after the impact was found to be detrimental to the economy. We called for the implementation of a strong consumer protection agency and framework, coupled with the promotion of initiatives for competing alternative products and channels.

- Our second topical, Impact of the Interest Rate Cap, dated 28th August 2016, four days after the interest rate cap bill was signed into law, highlighted the immediate effects of the interest rate cap, as banking stocks lost 15.6% in 2-days. Here, we re-iterated our stance on the negative effects of the interest rate cap, while identifying the winners and losers of the Banking (Amendment) Act, 2015.

- The State of Interest Rate Cap, dated 14th May 2017, 9-months after the interest rate cap was signed into law. We assessed the interest rate cap and its effects on private sector credit growth, the banking sector, and the economy in general, following concerns raised by the IMF. We noted that the law had the effect of (i) inhibiting access to credit by SMEs and other “small borrowers” whom banks cited as being “risky”, and were unable to be fitted within the 4.0% margin imposed by the Law, and (ii) contributed to subduing of private sector credit growth, which was recorded at 4.0% in March 2017. We suggested that policymakers review the legislation, highlighting that there existed, and continues to exist, opportunities for structured financial products and private equity players to come in and provide capital for SMEs and other businesses to grow, and consequently improve private sector credit growth.

- In the Update of Effect on Interest Rate Caps on Credit Growth and Cost of Credit, dated 23rd July 2017, approximately 1-year after the Banking (Amendment) Act 2015 was signed into law, we analyzed, on the back of the rate cap, the decline in private sector credit growth and lending by commercial banks, coupled with the elevated total cost of credit, which was higher than the legislated 14.0%, as banks loaded excessive additional charges, while noting that the large banks, which control a substantial amount of the banking sector loan portfolio, were the most expensive. We suggested (i) a repeal or modification of the interest rate cap, (ii) increased transparency on credit pricing, (iii) improved and more accommodating regulation, (iv) consumer education, and (v) diversification of funding sources into alternatives.

- In our note titled The Total Cost of Credit Post Rate Cap, dated 14th January 2018, we analyzed the true cost of credit, the initiatives put in place to make credit cheaper and more accessible, the impact of the interest rate cap on private sector credit growth, and we gave our view on what more can be done to remedy the effects of the interest rate cap.

- In Rate Cap Review Should Focus More on Stimulating Capital Markets, dated 13th May 2018, we revisited the interest rate cap following an announcement by the Treasury that they were in the process of completing a draft proposal that will address credit management in the economy, where we gave our views on how promoting competing sources of financing would lead to a self-pricing regulatory structure, which would effectively reduce credit prices, as opposed to relying on bank funding.

- In our note on the Status of the Rate Cap Review in Finance Bill 2018, 26th August 2018, we revisited the interest rate cap topic following the proposed amendments to the Finance Bill, 2018, tabled by the Parliamentary Committee on Finance and Planning in the National Assembly during its second reading.

Section III: A Review of the Effects It Has Had So Far in Kenya

The interest rate cap has had the following four key effects to Kenya’s Economy since its enactment:

- Private Sector Credit Crunch

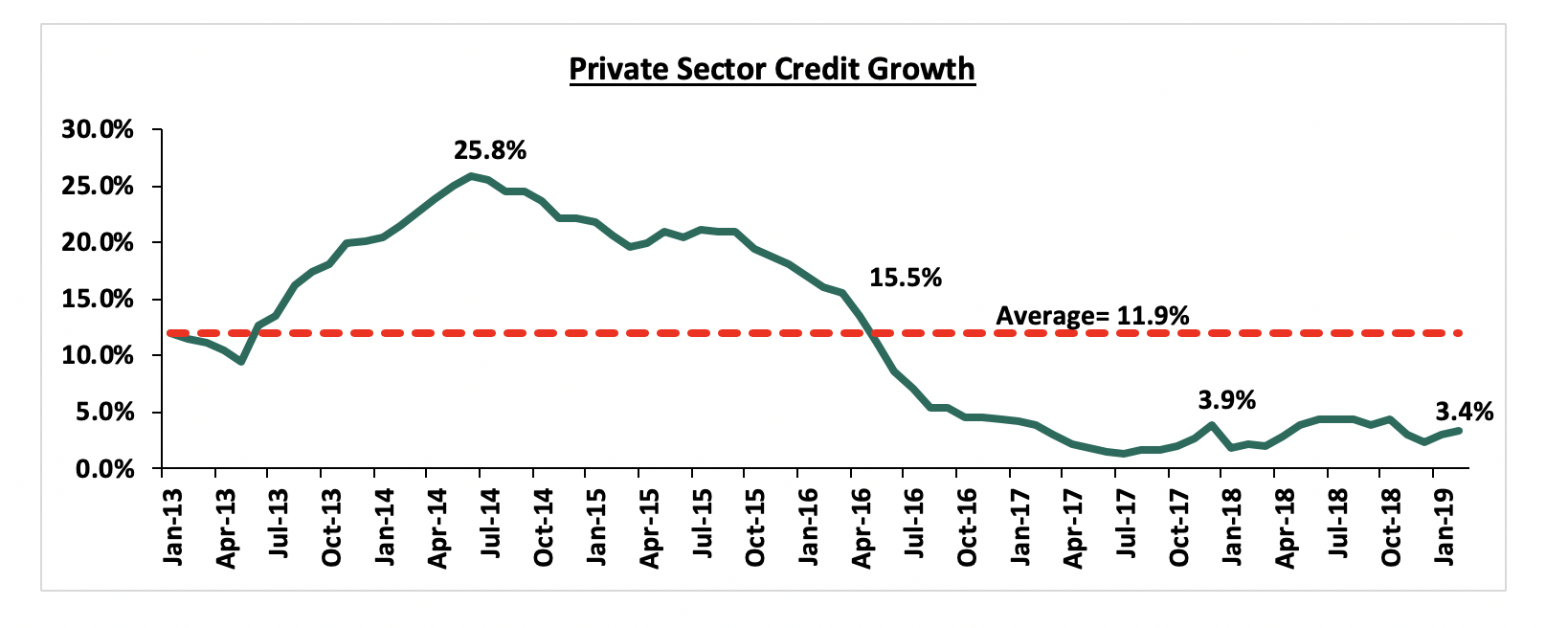

Private sector credit growth in Kenya has been declining, and the enactment of the Banking (Amendment) Act (2015), had the adverse effect of further subduing credit growth. The stock of credit to SMEs declined sharply by 10% y/y in October 2017 from a similar period in 2016 on account of difficulty for banks to price the SMEs within the set margins, as they were perceived “risky borrowers”. Banks thus invested in asset classes with higher returns on a risk-adjusted basis, such as government securities. Lending to the public sector increased sharply with a growth of over 25% y/y over the same period. Private sector credit growth touched a high of 25.8% in June 2014, and averaged 11.8% over the last five years, but dropped to below 5.0% after the implementation of interest rates controls, rising slightly to 3.4% in February 2019. The chart below highlights the trend in private sector credit growth.

- Loan Accessibility Reduced

Following the enactment of the Banking (Amendment) Act, 2015, banks recorded a rise in demand for loans, as did the number of loan applications, which increased by 20.0% in Q4’2016, according to the CBK Credit Officer Survey of October-December 2016. This was on account of borrowers attempting to access cheaper credit. However, the supply of loans by banks did not meet this rise in demand as evidenced by:

- Reduced Loan Growth: According to the Bank Supervision Annual Report 2017, the Net Loan growth declined since the implementation of the interest rate cap law, having come from a growth of 11.2% in 2015 to a decline of 7.7% as at December 2017.

- The decline in the number of loan accounts: The number of loan accounts in large banks (Tier I) declined by 27.8%, the largest among the three tiers, followed by Tier II banks with a decline of 11.1% between October 2016 and June 2017,

- Increase in average loan size: Despite a 26.1% decline in the industry’s number of loan accounts between October 2016 and June 2017, the average loan size increased by 36.0% to Kshs 548,000 from Kshs 402,000 between October 2016 and June 2017. This points to lower credit access by smaller borrowers, while also demonstrating that credit was extended to larger and more “secure” borrowers, and,

- Decrease in average loan tenures: The average loan tenure declined by 50.0% to 18-24 months compared to 36-48 months prior to the introduction of the interest rate cap. This is due to bank’s increasing their sensitivity to risk, thereby opting to extend only short-term and secured lending facilities to borrowers, rather than longer-term loans to be used for investments, according to the latest survey by the Kenya Bankers Association (KBA) on the effects of the Banking (Amendment) Act, 2015.

- Banks’ Changed their Operating Models to Mitigate the Effects of the Rate Cap Legislation

The enactment of the Banking (Amendment) Act, 2015, saw banks changing their business and operating models to compensate for reduced interest income (their major source of income) as a result of the capped interest rates. Thus, banks adapted to this tough operating environment by adopting new operating models through:

- Increased focus on Non-Funded Income (NFI): This is evidenced by the fact that the proportion of non-interest income to total income stood at 28.4% in September 2016, and has risen to the current average of 36.0%, for listed commercial banks that have released their Q1’2019 financial results,

- Increased lending to the government rather than individuals and the private sector: This is evidenced by the faster growth in allocations to government securities by 16.1% as at Q1’2019, faster than the 7.7% growth in loan allocations, given the higher risk-adjusted returns offered by government debt.

- Cost rationalization: Banks also stepped up their cost rationalization efforts by increasing the use of alternative channels by mainly leveraging on technology such as mobile money and digital banking to improve efficiency and consequently reduce costs associated with the traditional brick and mortar approach. This led to the closure of branches and staff layoffs in a bid to retain the profit margins in the tough operating environment, due to depressed interest income, and,

- Focus on niche segments: The implementation of the law saw the larger banks venture into the small banks’ niche markets such as Small and Medium Enterprises (SMEs) banking, and consequently, most of the tier II and tier III banks have struggled to operate. The smaller banks have witnessed declining top-line revenue, leading to increased operational inefficiency, and operating losses; this has led to depleted capital, spurring an increase in the consolidation activity in the banking sector, which has seen smaller banks struggling to operate being acquired, merging or forming strategic relationships with larger banks in order to leverage on the synergies created.

- The Proliferation of Alternative Credit Markets

As a result of the private sector credit crunch, there was a rapid rise in the alternative credit markets as evidenced by the Mobile Financial Services (MFS) rising to become the preferred method to access financial services in 2019, with 79.4% of the adult population using the channels up from 71.4% in 2016. According to Global Digital, in 2018, there were about 6.1 mn digital borrowers in the country coupled with 28.3 mn unique mobile users. Players in this segment charge exorbitant interest rates, e.g. M-Shwari charges a facilitation fee of 7.5%, while Tala and Branch offer varying rates depending on the repayment period with a month’s loans offered at a rate of 15.0%, which are very expensive when annualized.

- Reduced Effectiveness of the Monetary Policy

The introduction of interest rate controls has made it difficult for the CBK to adjust the monetary policy rates in response to economic developments. Before the interest rates were capped, the CBK was able to adjust the CBR in relation to changes in inflation and growth. This is mainly because any alteration to the CBR would directly affect credit conditions. Expansionary monetary policy is difficult to implement since lowering the CBR has the effect of lowering the lending rates and as a consequence, banks find it even more difficult to price for risk at the lower interest rates, leading to pricing out of even more risky borrowers, and hence further reducing access to credit. On the other hand, if the CBK was to employ a contractionary monetary policy, so as to reduce inflation and credit growth for example, then raising the CBR would have the reverse effect of increasing the supply of credit in the economy since banks would be able to admit riskier borrowers.

Section IV: Case Study of Interest Rate Cap Regime in Zimbabwe

- Background

Between 1980 and 1999, the financial sector of Zimbabwe was characterized by administrative controls on deposit and lending rates that were frequently adjusted to take into account rising inflation rates. During this period, the average annual economic growth rate was 2.7%, below the population growth rate of 3.0%.

In 2015, an interest rate ceiling was introduced which was effected on 1st October the same year, where the Reserve Bank of Zimbabwe directed that commercial banks cap interest rates at 18.0%, for both existing and new borrowers, as part of measures to deal with the prohibitive cost of finance following dollarization. Prior to the rate cap, local commercial banks were charging interest rates as high as 35.0% similar to what Kenyan commercial banks were charging before the rate cap. The model of the rate charged under the ceiling depended on the risk profiles of customers where prime borrowers with low credit risk were to be charged between 6.0% and 10.0% per annum, borrowers with moderate risk were to be charged between 10.0% and 12.0% per annum and lastly, borrowers with high credit risk were to be charged between 12.0% and 18.0% per annum, respectively. Further, housing finance loans attracted annual interest rates of between 8.0% and 16.0% per annum while loans for consumptive purposes were quoted at between 10.0% and 18.0%. Defaulters, on the other hand, were charged a penalty from 3.0% to 8.0% over and above the interest rates they would have been charged for the loans obtained.

In 2017, effective from April 1st, the interest rate ceiling dropped to a maximum of 12.0% and ranged between 6.0% and 12.0%, respectively, depending on the risk profile of each customer. Further, the charges including application, facility and administration fees were capped at 3.0%. The decline in the interest rate cap was attributed to a move by the Reserve Bank of Zimbabwe to reduce the lending rates to a level that was comparable with the rest of the region. This was driven by aims to improve credit consumption for the purpose of driving production across sectors and other auxiliary activities. The Central Bank also engaged the Banker’s Association of Zimbabwe to reduce interest rates on loans for productive purposes to make lending cheaper for producers with the goal of exporting products.

In February 2019, the Governor of the Reserve Bank of Zimbabwe, John Mangudya, indicated that the Central Bank was in the process of introducing a bank rate which is expected to guide interest rates in the market. The bank rate will be used as a monetary policy instrument to control liquidity in the market. The move comes after the outcry of local commercial banks who complain that the set interest rate of 12.0% had been overtaken by inflation, which was at a high of 56.9% in the month of February, making it difficult for them to lend.

- Performance of Commercial Banks since 2015

In 2015, bank lending to individuals and manufacturing accounted for 22.0% and 19.8% total loans, respectively. In 2017, however, the distribution of loans to individuals and manufacturing sectors declined to 18.6% and 17.3%, respectively. Total banking sector gross loans & advances decreased by 2.6% from USD 3.9 bn in 2015 to USD 3.8 bn in 2017 on account of reduced lending rates. On the other hand, fees and commission income in the banking industry rose by 51.2% to USD 512.5 mn in 2018 from USD 339.0 mn recorded in 2015, owing to hidden loan charges, despite the 3.0% cap on application, facility and administration fees charged by banks in 2017.

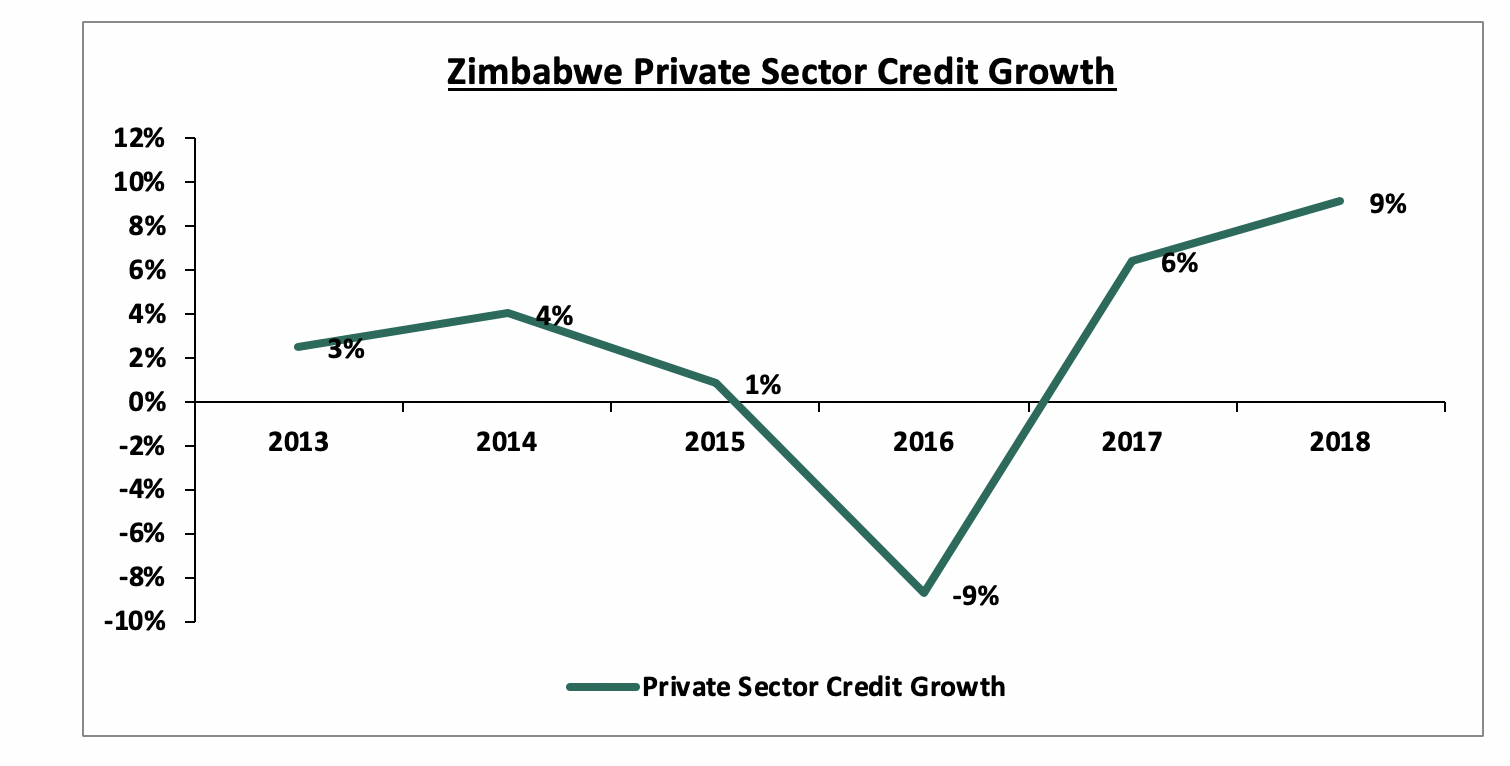

Zimbabwe’s lending rates ceiling generally aimed to target predatory lending that arose when the economy was dollarized in 2009 and banks took advantage of the different currencies in the economy to price their loans based on Zimbabwean dollar and not US dollar based as required. This reduced transparency resulted in local commercial banks charging interest rates as high as 35.0%. The lending cap has impacted the banking industry as evidenced by a credit crunch towards the private sector, similarly observed in Kenya. The private sector credit growth in Zimbabwe was at 4% in 2014 before the rate ceiling, which then slumped to negative 9% in 2016 at the height of the interest rate cap as shown below.

As highlighted, bank lending to individuals and manufacturing in 2017 recorded declines to 18.6% and 17.3%, respectively from 22.0% and 19.8% in 2015 when the rate ceiling was implemented. Specifically, the cap affected the manufacturing sector, with a bias to producers of chemicals and petroleum products, wood and furniture, metal and metal products, clothing and footwear, and non-metallic mineral products, among others.

Section V: Recent Developments

- Removal of the floor in the Finance Act 2018

The Finance Bill 2018 was tabled by the Parliamentary Committee on Finance and Planning in the National Assembly during its first reading with proposed amendments to repeal Section 33B of the Banking Act which would result in the elimination of the Central Bank’s powers to enforce an interest rate cap in banks and other financial institutions. During the second reading of the bill in parliament, however, the committee was of the view that:

- The upper limit on the interest rate charged on borrowers, which is capped at 400 basis points above the CBR, should be maintained, stating that there is no justification for the repeal of the cap, as banks have not shown efforts to address the issue of high credit risk pricing, and,

- The floor set for deposit rates paid to depositors at 70% of the CBR should be repealed. The proposition to remove the floor was ratified by the National Assembly and consequently signed into law as part of the Finance Act 2018.

- High Court Ruling on Interest Rate Capping

On 18th March 2019, the High Court suspended the Interest Rate Cap law in a ruling that declared Section 33B (1) and (2) of the Banking Act unconstitutional and gave the National Assembly one year to amend the anomalies, failure to which will mean a reversion to a free-floating interest rates regime. A three-Judge bench determined that the wordings the Parliament used to define the terms ‘credit facility’ and the ‘Central Bank Rate’ as vague and open to multiple interpretations. The anomalies and ambiguity arise in Section 33B (1) of the Banking Act which states that, “a bank or a financial institution shall set the maximum interest rate chargeable for a credit facility in Kenya at no more than four percent, the Central Bank Rate set and published by the Central Bank of Kenya (now at 9.0%)”.

- Proposal to Repeal the Cap by the National Treasury Cabinet Secretary

The National Treasury Cabinet Secretary, Henry Rotich, stated that in this year’s Finance Bill, another proposal would be tabled to seek the repeal of Section 33B of the Banking Act 2016, as the interest rates cap has had the opposite effect of reducing credit access by MSMEs, in addition to contributing to the shrinking of small banks’ loan books. The Cabinet Secretary maintains its view that in order to spur business activity and improve access to credit by MSMEs and the private sector in general, there is a need to repeal the rate cap law.

- Calls by various organizations to repeal the Rate Cap Law

- IMF

The International Monetary Fund backed the National Treasury and CBK’s call for the repeal of the interest rates cap law. The IMF working paper released in March 2019 termed the interest rate controls Kenya introduced in September 2016 as the most drastic measures ever imposed. According to the paper, the reduction of the interest rate spreads, which initially was intended to increase access to bank credit and boost the return on savings, seems to have the opposite effect evidenced by;

- A sharp decline in bank credit to SMEs, particularly in trade and agriculture,

- A disproportional hit on lending activity and the profitability of small banks; and

- Reduced financial intermediation, with commercial bank credit shifting away from the private sector and towards the public sector.

The paper also points out the reduced signaling effect of the policy rate as an indicator of the monetary policy stance due to the increased divergence of interbank rates from policy rates following the implementation of the interest rates cap. The paper proposed that consideration should be given to using other policy instruments, instead of interest rate controls, to increase financial access and address equity concerns related to the high profits of the banking sector.

- Kenya National Chamber of Commerce and Industry

The Kenya National Chamber of Commerce and Industry (KNCCI) has backed the proposal to repeal the commercial lending rate caps law with the view that that the removal of the cap will provide an added incentive to banks to loosen risk considerations before extending credit to SMEs, thus improving credit access by small businesses.

Section VI: Our Views, Expectations, and Conclusion

The proposal to repeal Section 33B of the Banking Act (2016) by the Cabinet Secretary will be tabled in the form of Bills before it is introduced to the National Assembly, thereafter it will be assigned to a committee where it will be read for the first time. The bill will go through the Second and Third Reading stages before final approval or rejection is given by Parliament. Thereafter, the President will give assent to the Act of Parliament, which subsequently will be gazetted to become law. If the proposal to repeal the rate cap law is successful, we expect to see the following benefits accrue to the economy:

- Growth in private sector credit: As of April 2019, the private sector credit growth rate stood at 4.9% according to the MPC market perception survey. With the repeal of the rate cap law, we expect that access to credit by Micro, Small and Medium Enterprises (MSMEs) will increase as banks will have sufficient margin to compensate for risks,

- GDP growth: Credit and economic growth are positively correlated and we expect that with increased access to credit by MSMEs, the economy is bound to expand as MSMEs make a significant contribution to the economy. According to data from the KNBS Micro, Small and Medium Enterprises (MSMEs) 2016 survey, MSMEs account for approximately 28.4% of Kenya’s GDP, and,

- Increased monetary policy effectiveness: With the repeal of the rate cap law, the Central Bank of Kenya will be free to adjust the monetary policy rate in response to economic developments such as inflation and growth.

In conclusion, we continue to emphasize the need to urgently repeal or at least significantly review the Banking (Amendment) Act, 2015, given the current regulatory framework, as it has hampered credit growth, evidenced by the continued decline of private sector credit growth, which is at 4.9% as at April 2019, below the 5-year average of 14.0%. Some policy measures, other than interest rate caps, that can both protect borrowers from excessive interest rates and limit the negative consequences of interest rate caps include:

- The adoption of structured and centralized credit scoring and rating methodology: This would go a long way to eliminate any biases and inconsistencies associated with accessing credit. Through a centralized Credit Reference Bureau (CRB), risk pricing is more transparent, and lenders and borrowers have more information regarding credit histories and scores, thus enabling banks price customers appropriately, spurring increased access to credit,

- Consumer education: Educate borrowers on how to be able to access credit, the use of collateral, and the importance of establishing a strong credit history,

- Increased transparency: This can be achieved through a reduction of the opacity in debt pricing. This will spur competitiveness in the banking sector and bring a halt to excessive fees and costs. Recent initiatives by the CBK and Kenya Bankers Association (KBA), such as the stringent new laws and cost of credit website being commendable initiatives,

- Greater emphasis on strengthening consumer protection measures: The implementation of strong consumer protection, education agency, and framework, to include robust disclosures on cost of credit, free and accessible consumer education, enforcement of disclosures on borrowings and interest rates, while also handling issues of contention and concerns from consumers, and

- Promote capital markets infrastructure: in both regulated and private markets. The Capital Markets Authority (CMA) could aid in enhancing the capital markets’ depth by making it easier for new and structurally unique products to be introduced in the capital and financial markets. This may then enhance returns, with the benefits of reduced risk compared to the traditional conventional investment securities. This would enable the diversion of the funds from banks into other investment vehicles that yield returns that far eclipse those obtained from deposits in banks, thereby leading to a faster capital formation in the economy, hence reducing overreliance on bank funding and thereby spurring competition in the credit market, which would eventually lead to cheaper debt costs for borrowers.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.