Kenya Public Debt 2020 & Cytonn Weekly #29/2020

By Research Team, Jul 19, 2020

Executive Summary

Fixed Income

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 271.5% down from 358.2% the previous week. The oversubscription is partly attributable to increased liquidity in the money market with the average interbank rate coming in at 1.8% from 1.9% recorded the previous week. The yields on the 91-day, 182-day, and 364-day papers declined by 26.3 bps, 23.5 bps, and 23.6 bps respectively to 6.0%, 6.5%, and 7.5%, attributable to the high liquidity in the money market and increased investments in government securities from financial institutions as they shy away from lending,

Equities

During the week, the equities market recorded mixed performance, with NSE 20 and NSE 25 recording gains of 0.4% and 0.5%, respectively, while NASI recorded a decline of 0.1%, taking their YTD performance to losses of 20.5%, 28.1%, and 24.2%, for NASI, NSE 20 and NSE 25, respectively. The NASI performance was driven by losses recorded by large-cap stocks, with the highest declines being recorded in NCBA, Bamburi, ABSA and Safaricom, which lost by 4.5%, 3.9%, 3.4% and 1.8%, respectively. During the week, Equity Group disclosed it was seeking to raise up to Kshs 50.0 bn in long term debt from international financiers in the next three years as it seeks to boost its liquidity and capital positions. This is reflective of the trend by local banks, which are increasingly seeking loans from global financiers such as the International Finance Corporation (IFC) and European Investment Bank, which offer relatively favorable terms of debt in terms of lower interest rates and longer maturity profile;

Real Estate

During the week, Shelter Afrique, a Pan-African housing development financier, announced plans to issue a bond in the Nairobi Stock Exchange (NSE) aimed at raising funds to develop new real estate projects, while Stima Sacco, a local deposit-taking SACCO, announced that it had retracted plans to raise Kshs 5 bn through a corporate bond to finance its mortgage business. Instead, the SACCO will partner with Kenya Mortgage Refinancing Company (KMRC), a State-backed home loans financier, in its goal of acquiring long term financing for onward lending. In the retail sector, Artcaffe restaurant opened its third store in Nairobi’s Central Business District (CBD), located in Chester House, along Kimathi Street, whereas in the industrial sector, Cold Solutions Kenya Limited, a leading temperature-controlled warehouse and logistics service provider, announced that it will invest Kshs 7.5 bn in constructing a grade ‘A’ temperature-controlled cold storage warehouses in Tatu City Development special economic zone;

Focus of the Week

Over the past few years, Kenya’s Public Debt has been a point of discussion due to the continuous growth in the debt levels, a result of the government’s ambitious development agenda evident in the country’s budgets over the last ten years. Earlier in May, Moody’s Credit Agency released its rating outlook where it changed Kenya’s sovereign credit outlook to “negative”, from a previous outlook of “stable”, but affirmed the earlier on B2 credit rating. The agency highlighted that the negative outlook was a result of rising financial risks brought about by the country’s large borrowing requirements especially during this time where the fiscal outlook is deteriorating, given the erosion of the revenue base and the high debt and interest burden. Additionally, the global rating agency, Standard and Poor’s (S&P) also lowered its outlook on Kenya’s economy to “negative” from “stable” while affirming the country’s rating at ‘B+/B’, mainly due to the fallouts from the pandemic which have slowed down the country’s growth and weighed down on its already weak public finances.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.52%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.39% p.a. To invest, email us at sales@cytonn.com;

- Wacu Mbugua, Real Estate Research Analyst at Cytonn Investments, was on KBC Channel 1 to discuss the performance of the real estate industry in Kenya during the Covid-19 pandemic Watch Wacu here;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running promotions:

- For Phase 1: Get a 10% rent discount on units we manage for investors if you pay cash;

- For inquiries, please email us on clientservices@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- For Pension Scheme Trustees and members, we shall be having different industry players talk about matters affecting Pension Schemes and the pensions industry at large. Join us every Wednesday from 9:00 am to 11:00 am for in-depth discussions on matters pension;

- We continue to inform the market on the importance of retirement planning and issues affecting the pensions industry. In this week’s article, we focus on “Why you should still save for retirement during this pandemic period”

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 271.5% down from 358.2% the previous week. The highest subscription rate was on the 91-day paper which came in 746.9%, down from 948.1% recorded the previous week. The subscription for the 182-day paper also declined to 107.8% from 273.7% recorded the previous week, while the subscription of the 364-day paper increased to 245.1% from 206.7% recorded the previous week. The oversubscription is partly attributable to increased liquidity in the money market with the average interbank rate coming in at 1.8% from 1.9% recorded the previous week. We note that banks continue to prefer government securities as opposed to lending, with their holdings in Government domestic debt rising to 54.9% from 54.1% as at the start of the year. The yields on the 91-day, 182-day, and 364-day papers declined by 26.3 bps, 23.5 bps, and 23.6 bps respectively to 6.0%, 6.5%, and 7.5%, attributable to the high liquidity in the money market and increased investments in government securities from financial institutions as they shy away from lending. The acceptance rate increased to 69.8%, from 53.8% recorded the previous week, with the government accepting Kshs 45.2 bn of the Kshs 65.2 bn worth of bids received, higher than the weekly offered amount of Kshs 24.0 bn.

The National Treasury recently reopened 3 fixed coupon treasury bonds, FXD1/2020/05, FXD2/2018/10 and FXD1/2019/15 with effective tenors of 5 years, 10 years and 15 years respectively, for budgetary support purposes. The period of the sale is from 6th July 2020 to 21st July 2020. The coupon rates for the bonds are 11.7%, 12.5% and 12.9%, for the 5-year, 10-year and 15-year bonds, respectively. Our recommended bidding ranges are 10.5% - 10.6% for the 5-year bond, 11.7% - 11.8% for the 10-year bond and 12.3% - 12.4% for the 15 year bond, given that bonds with similar tenors are currently trading at 10.6%, 11.6% and 12.3%, respectively. As per the historic trend, we expect the market to maintain a bias towards the 5-year bond due to its short tenor.

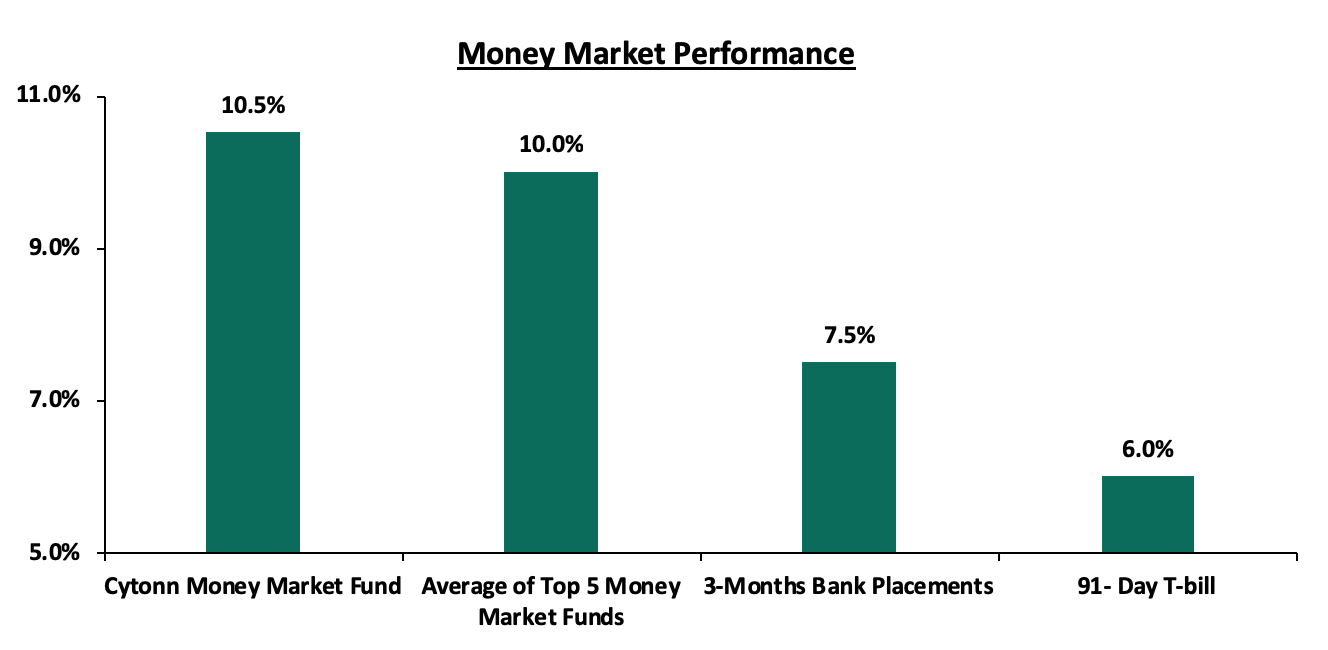

In the money markets, 3-month bank placements ended the week at 7.5% (based on what we have been offered by various banks), while the yield on the 91-day T-bill declined by 0.3% points to close the week at 6.0%, from 6.3% recorded the previous week. The average yield of Top 5 Money Market Funds recorded marginal gains to 10.0% from 9.9% recorded the previous week. The yield on the Cytonn Money Market remained unchanged at 10.5% similar to what was recorded the previous week.

Liquidity:

During the week, liquidity in the money market increased leading to a decline in the average interbank rate to 1.8% from 1.9% recorded the previous week while the average interbank volumes increased by 156.0% to Kshs 9.8 bn, from Kshs 3.8 bn recorded the previous week. Liquidity was mainly supported by government payments and maturing TADS of Kshs 162.2 mn. (TADs are used when the securities held by the CBK for Repo purposes are exhausted or when CBK considers it desirable to offer longer tenor options). As per the Central Bank of Kenya, commercial banks’ excess reserves came in at Kshs 10.9 bn in relation to the 4.25% Cash Reserve Ratio.

Kenya Eurobonds:

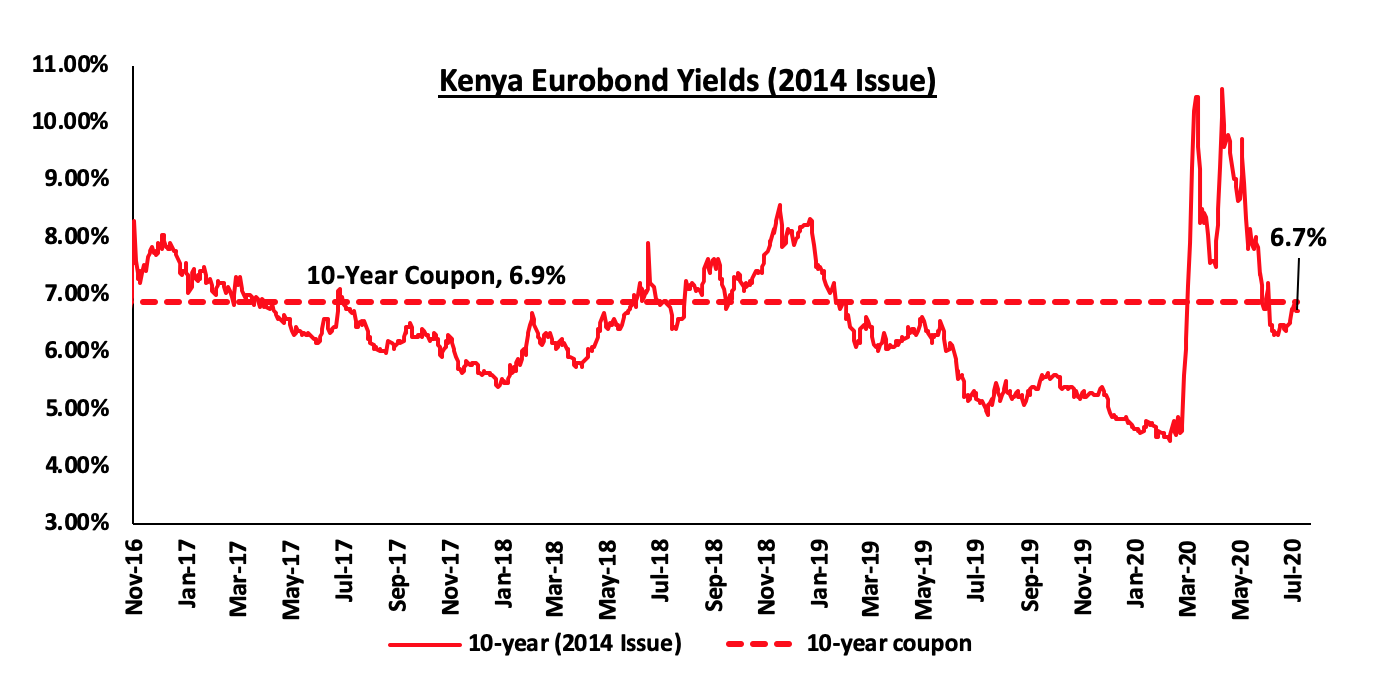

During the week, Eurobond yields were on a downward trend mainly attributable to the improved investor sentiments attributable to the recent easing of coronavirus restrictions. This is despite the continued surge in the coronavirus cases. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 declined by 0.1% points during the week to close at 6.7% from 6.8% recorded the previous week.

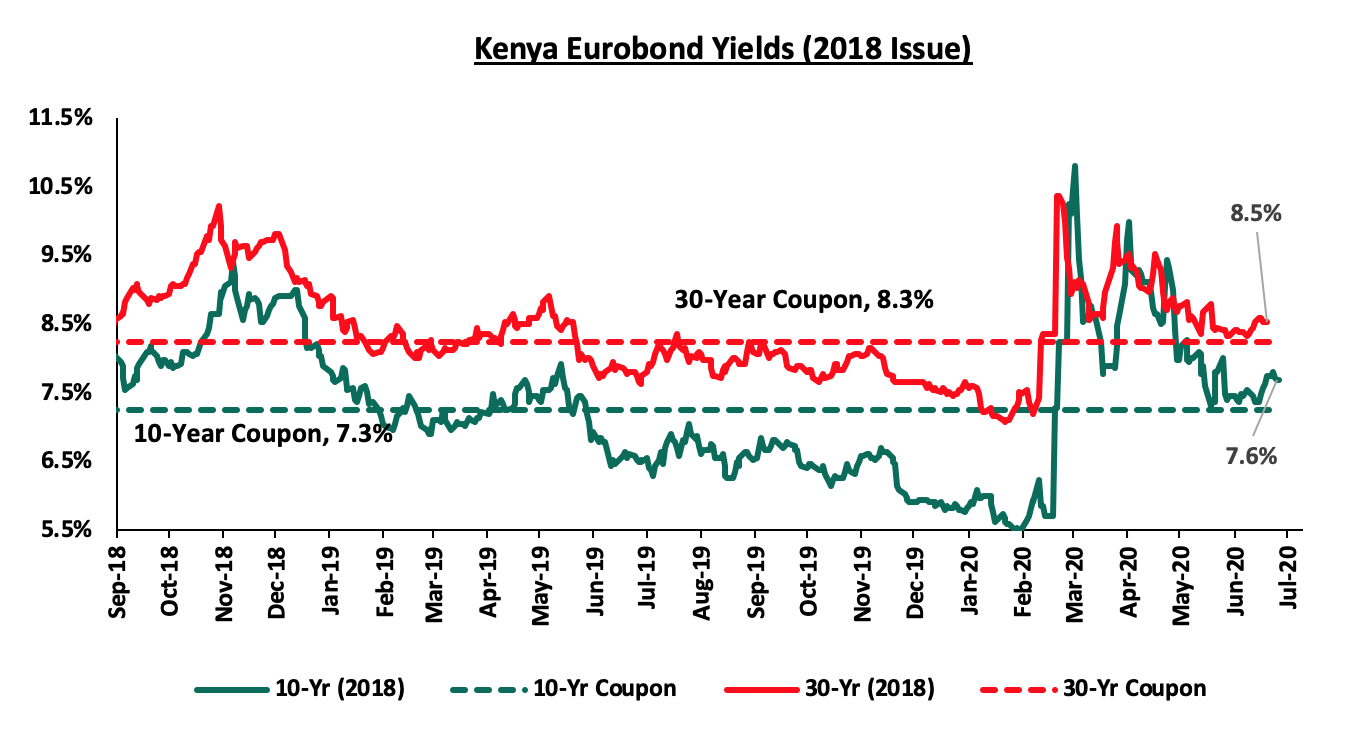

The yields on the 10-year Eurobond issued in 2018 declined marginally by 0.2% points to close at 7.6% from 7.8% recorded the previous week. The yield on the 30-year Eurobonds issued in 2018 remained unchanged at 8.5% similar to what was recorded the previous week.

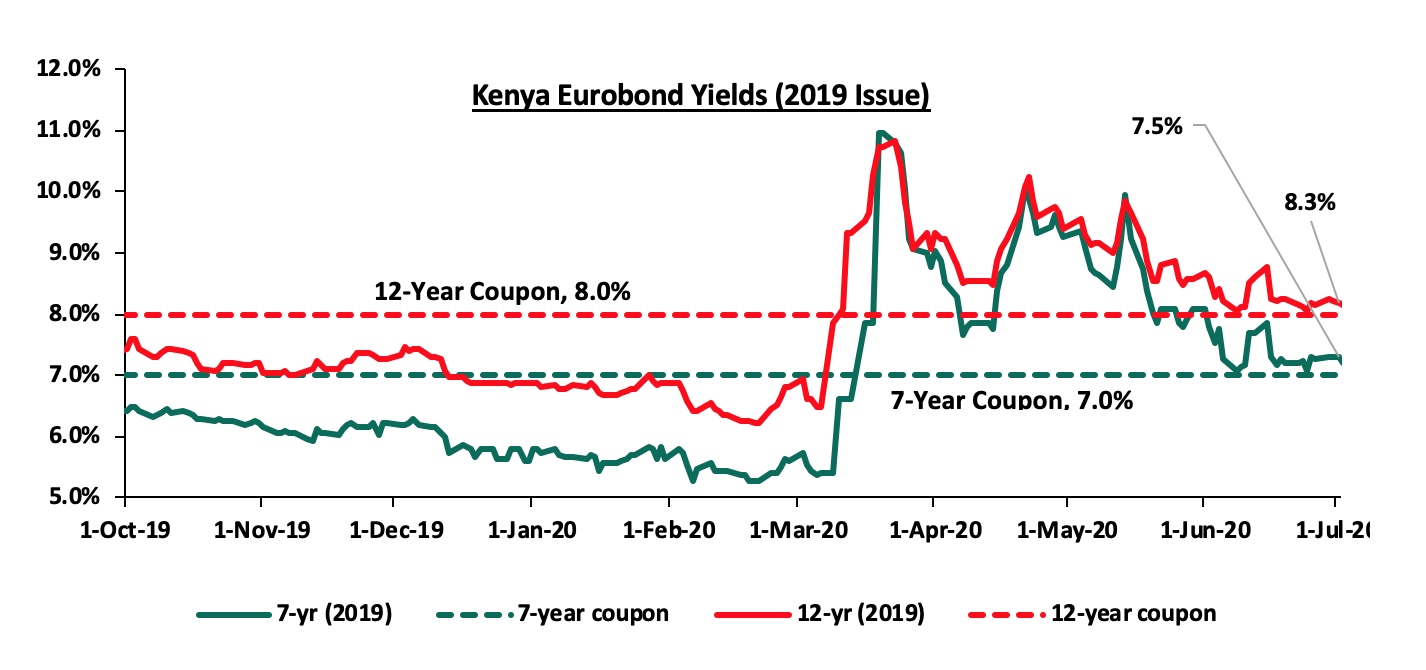

The yields on the 7-year Eurobond and 12-year Eurobond issued in 2019 both declined by 0.1% points, respectively to 7.5% and 8.3% from 7.6% and 8.4% recorded the previous week, respectively.

Kenya Shilling:

During the week, the Kenya Shilling depreciated by 0.5% against the US Dollar to close the week at Kshs 107.5, from Kshs 106.9, recorded the previous week, attributable to increased dollar demands from importers as global economies continued easing movement restrictions. On a YTD basis, the shilling has depreciated by 6.0% against the dollar, in comparison to the 0.5% appreciation in 2019. We expect continued pressure on the shilling due to:

- Demand from merchandise and energy sector importers as they beef up their hard currency positions amid a slowdown in foreign dollar currency inflows,

- A deteriorating current account position, with the current account deficit deteriorating by 10.2% during Q1’2020, to Kshs 110.9 bn, from Kshs 100.6 bn recorded in Q1’2019 attributable to;

- 3.0% decline in the secondary income (transfers recorded in the balance of payments whenever an economy provides or receives goods, services, income or financial items) balance, to Kshs 124.1 bn, from Kshs 128.0 bn in Q1’2019, and,

- A 67.0% decline in the services trade balance (the difference between the imports and exports of services) to Kshs 20.4 bn, from Kshs 61.9 bn.

The shilling is however expected to be supported by:

- High levels of forex reserves, currently at USD 9.7 bn (equivalent to 5.9-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover, and,

- Improving diaspora remittances evidenced by the 24.0% increase to USD 258.2 mn in May 2020, from USD 208.2 seen the previous month, mainly due to the improvements in economic activities globally, as countries abroad eased their coronavirus restrictions. In terms of y/y performance, diaspora remittances increased by 6.2% to USD 258.2 mn in May 2020, from USD 243.2 mn recorded in May 2019.

Weekly Highlight

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum Retail Prices in Kenya for the period 15th July 2020 to 14th August 2020. Below are the key take-outs from the statement:

- Petrol prices have increased by 12.8% to Kshs 100.5 per litre from Kshs 89.1 per litre previously, while diesel prices have increased by 23.2% to Kshs 91.9 per litre from Kshs 74.6 per litre. Kerosene prices also increased by 4.8% to Kshs 65.5 per litre from 62.5 per litre, previously,

- The changes in prices have been attributed to the increase in the average landing cost of imported super petrol by 12.6% to USD 279.6 per cubic meter in June 2020 from USD 248.2 per cubic meter in May 2020. Landing costs for diesel increased by 32.2% to USD 302.2 per cubic meter in June 2020, from USD 228.6 per cubic meter in May 2020. Landing costs for Kerosene, on the other hand, remained unchanged at USD 126.4 per cubic meter in June 2020,

- A 54.5%, increase in Free on Board (FOB) price of Murban crude oil lifted in June 2020 to USD 36.3 per barrel, from USD 23.5 per barrel in April 2020, and,

- The Kenya shilling appreciated by 0.2% against the dollar to close at Kshs 106.5 in June 2020, from Kshs 106.7 recorded in May 2020,

The increase will not only affect the transport index, which carries a weighting of 8.7% in the total consumer price index (CPI), but will have a trickle-down effect on the prices of other commodity baskets food prices due to higher transport costs.

During the week, S&P Global lowered Kenya’s outlook from stable to negative and affirmed the B+ long term and B short-term credit rating. Key to note, Moody’s credit rating agency changed Kenya’s sovereign credit outlook to “negative”, from a previous outlook of “stable” and affirmed the B2 credit rating. The agency pointed out that the negative outlook was as a result of rising financial risks brought about by the country’s high debt and interest burden. Below is a summary of the credit rating and outlook revisions on Kenya so far;

|

Rating Agency |

Rating as at January 2020 |

Outlook as at January 2020 |

Current Rating |

Current Outlook |

|

Moody’s |

B2 |

Stable |

B2 |

Negative |

|

S&P Global |

B+ ‘short term’, B ‘Long Term’ |

Stable |

B+ ‘short term’, B ‘Long Term’ |

Negative |

|

Fitch Ratings |

B+ |

Stable |

B+ |

Negative |

The agency cited that the ongoing COVID-19 pandemic will not only slow the country’s GDP growth rate but also increase Kenya’s debt distress. The agency noted that despite the external financial support from IMF to fund Kenya’s fiscal deficits, the country’s external debt will reach high levels and remain high in 2020-2023. Given the economic fallout from COVID-19, S&P Global projects that Kenya will record a slow GDP growth rate of 1.0% in 2020 and rebound thereafter to 4.0% in 2021. The table below shows GDP projections from 8 firms with the consensus GDP growth expected to come in at 1.7%.

|

Kenya 2020 Annual GDP Growth Outlook |

|||

|

No. |

Organization |

2020 Projections* |

Revised Projections** |

|

1. |

International Monetary Fund |

6.0% |

1.0% |

|

2. |

S&P Global |

6.0% |

1.0% |

|

3. |

Cytonn Investments Management PLC |

5.7% |

1.6% |

|

4. |

McKinsey & Company |

5.2% |

1.9% |

|

5.

|

Central Bank of Kenya |

6.2% |

2.3% |

|

6.

|

National Treasury |

6.0% |

2.5% |

|

7. |

World Bank |

6.0% |

1.5% |

|

8. |

African Development Bank (AfDB) |

6.0% |

1.4% |

|

|

Average |

5.9% |

1.7% |

|

|

Median of Revised Growth Estimates |

|

1.6% |

|

*As at the beginning of the year ** Revised GDP Growth |

|||

Further to the sluggish growth rate and the expected widening of Kenya’s fiscal deficit, the agency highlighted that the country’s deficit will widen to 8.7% of GDP in FY’2020 and fall slightly to a deficit of 7.9% of GDP in FY’2021. As such, the financing of these deficits will increase Kenya’s debt levels as well as increase the country’s external vulnerabilities. On a positive note, the agency notes that Kenya’s strong Agricultural and service sectors, as well as Kenya’s flexible monetary setting, will help cushion the economy from the effects of the COVID-19 pandemic. However, the agency is biased towards a negative outlook given the country’s high current account deficits, high fiscal deficits as well as high debt levels.

In our view, given the negative impact on revenue collection from the pandemic, Kenya’s fiscal consolidation will remain elusive. The FY’2020/2021 budget saw a high uptake of semi-concessional loans worth Kshs 124.1 bn and as such, we believe that Kenya will continue to face high debt repayment challenges. We believe that should the government’s efforts towards the control of the spread of the virus bear fruit, Kenya will be on a sluggish but steady growth towards economic recovery.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. We believe that the uncertainty affecting the global financial markets brought about by the novel Coronavirus will make it harder for the government to access foreign debt, and might result in investors attaching a high-risk premium on the country. As a result of depressed revenue collection with the revenue target for FY’2020/2021 at Kshs 1.9 tn, we expect a higher budget deficit, which the Treasury estimates at 7.5% of GDP, creating uncertainty in the interest rate environment as additional borrowing from the domestic market will be required to plug in the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term fixed income securities to reduce duration risk.

Market Performance

During the week, the equities market recorded mixed performance, with NSE 20 and NSE 25 recording gains of 0.4% and 0.5%, respectively, while NASI recorded a decline of 0.1%, taking their YTD performance to losses of 20.5%, 28.1%, and 24.2%, for NASI, NSE 20 and NSE 25, respectively. The NASI performance was driven by losses recorded by large-cap stocks, with the highest declines being recorded in NCBA, Bamburi, ABSA and Safaricom, which lost by 4.5%, 3.9%, 3.4% and 1.8%, respectively. However, the decline was slowed down by gains recorded by other large-cap stocks, with the highest gains being recorded in Equity Group, KCB and EABL, which gained by 6.8%, 3.5% and 1.3%, respectively.

Equities turnover declined by 20.3% during the week to USD 31.9 mn, from USD 40.1 mn recorded the previous week, taking the YTD turnover to USD 889.4 mn. Foreign investors remained net sellers during the week, with the net selling position decreasing by 12.3% to USD 16.5 mn, from a net selling position of USD 18.8 mn recorded the previous week, taking the YTD net selling position to USD 253.4 mn.

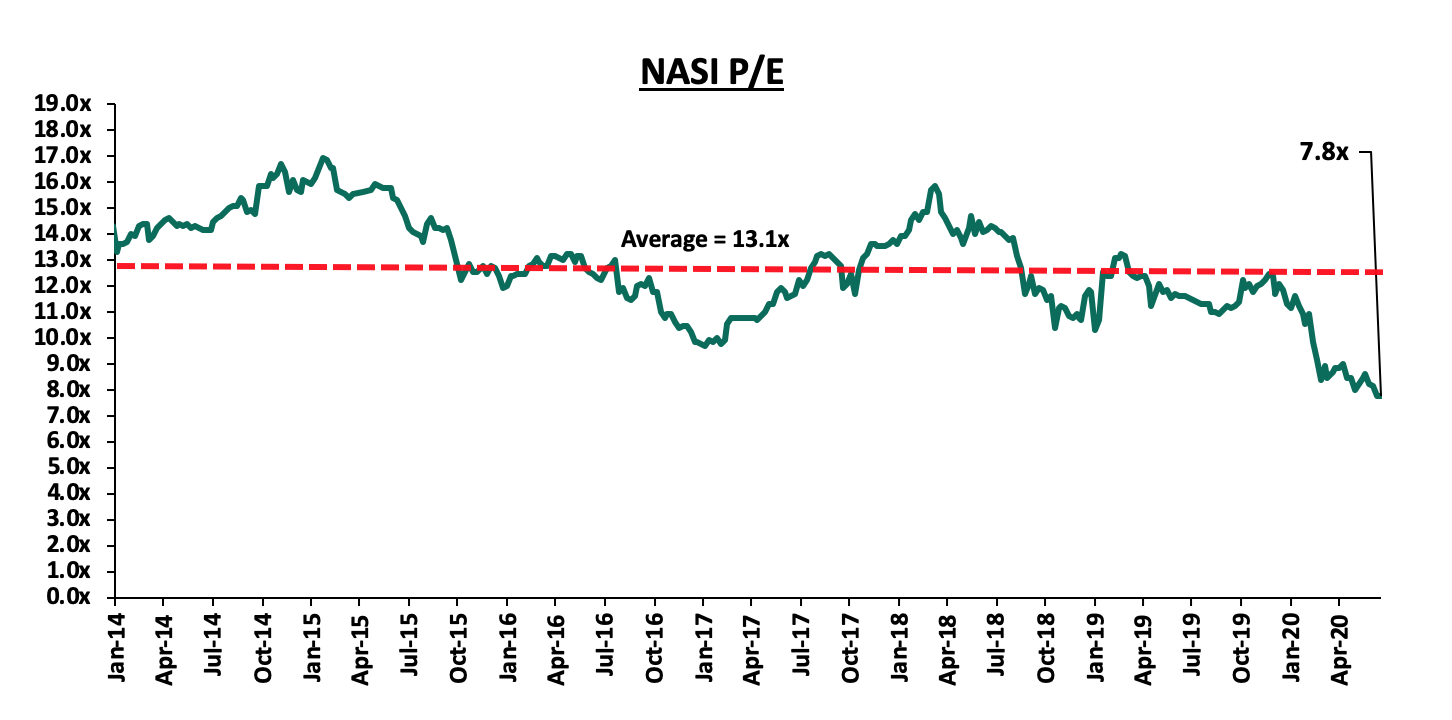

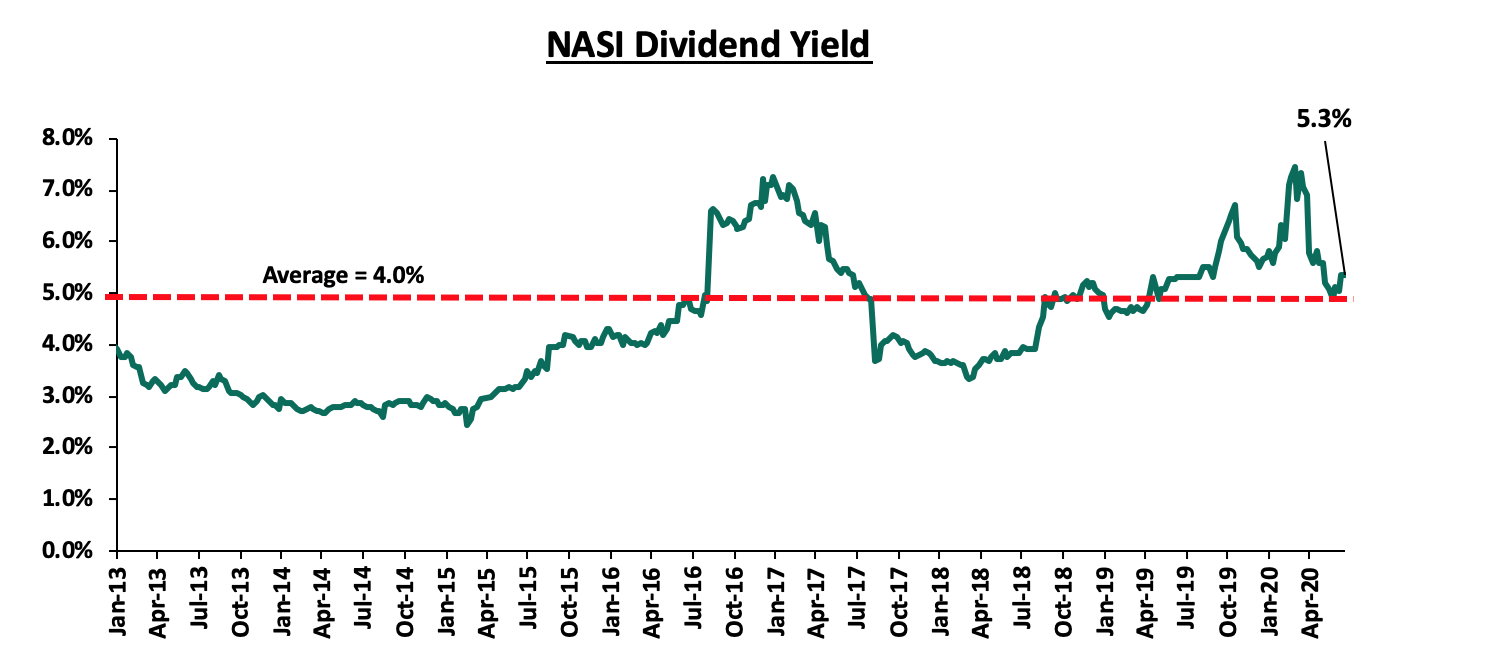

The market is currently trading at a price to earnings ratio (P/E) of 7.8x, 40.4% below the historical average of 13.1x. The average dividend yield is currently at 5.3%, unchanged from the previous week, and 1.3% points above the historical average of 4.0%. With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 7.8x is at par with the most recent valuation trough of 7.8x experienced in the second week of July 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, Equity Group disclosed it was seeking to raise up to Kshs 50.0 bn in long term debt from international financiers in the next three years as it seeks to boost its liquidity and capital positions. This is reflective of the trend by local banks, which are increasingly seeking loans from global financiers such as the International Finance Corporation (IFC) and European Investment Bank, which offer relatively favorable terms of debt including lower interest rates and longer maturities. As highlighted in our Cytonn Weekly #28/2020, mortgage financier HF Group is also seeking to raise Kshs 1.0 bn additional tier II capital from global financiers. In Q1’2020 Equity group’s borrowing stood at Kshs 52.6 bn, with the Kenyan subsidiary receiving an additional Kshs 5.3 bn from the International Finance Corporation (IFC) to be used for onward lending to Small and Medium Enterprises (SMEs) impacted by the pandemic. The group anticipates the impact of the pandemic to last for at least 18 months and with Kshs 22.9bn (43.5%) of the Kshs 52.6 bn of long- term borrowing expected to mature in March 2023, it is our view that the additional liquidity injection will boost the group’s liquidity and capital position in both the short and long term as it tries to mitigate effects of the pandemic. The lender has already taken a proactive strategy in preserving its capital and liquidity to enable it to respond appropriately to the ongoing pandemic through suspending its FY’2019 dividend payment, as well as abandoning its regional expansion deal with Atlas Mara as highlighted in our Cytonn Weekly #26/2020.

Universe of Coverage:

|

Company |

Price at 10/07/2020 |

Price at 17/07/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank*** |

70.0 |

69.0 |

(1.4%) |

(36.7%) |

109.0 |

175.0 |

3.9% |

157.5% |

0.4x |

Buy |

|

Kenya Reinsurance |

2.0 |

2.4 |

20.0% |

(20.8%) |

3.0 |

4.6 |

4.6% |

96.3% |

0.2x |

Buy |

|

KCB Group*** |

34.1 |

35.3 |

3.5% |

(34.7%) |

54.0 |

56.2 |

9.9% |

69.4% |

0.9x |

Buy |

|

Co-op Bank*** |

11.9 |

11.9 |

0.0% |

(27.5%) |

16.4 |

18.0 |

8.4% |

60.3% |

1.0x |

Buy |

|

I&M Holdings*** |

49.0 |

49.9 |

1.7% |

(7.7%) |

54.0 |

76.3 |

5.1% |

58.2% |

0.8x |

Buy |

|

ABSA Bank*** |

9.5 |

9.2 |

(3.4%) |

(31.2%) |

13.4 |

13.2 |

12.0% |

55.8% |

1.3x |

Buy |

|

Stanbic Holdings |

79.0 |

78.5 |

(0.6%) |

(28.1%) |

109.3 |

111.2 |

9.0% |

50.6% |

1.0x |

Buy |

|

Equity Group*** |

31.9 |

34.0 |

6.8% |

(36.4%) |

53.5 |

50.7 |

0.0% |

49.1% |

1.2x |

Buy |

|

NCBA*** |

26.4 |

25.2 |

(4.5%) |

(31.6%) |

36.9 |

35.6 |

1.0% |

42.3% |

0.8x |

Buy |

|

Jubilee Holdings |

229.0 |

250.0 |

9.2% |

(28.8%) |

351.0 |

334.8 |

3.6% |

37.5% |

0.9x |

Buy |

|

Standard Chartered*** |

161.5 |

160.0 |

(0.9%) |

(21.0%) |

202.5 |

202.7 |

7.8% |

34.5% |

1.5x |

Buy |

|

Sanlam |

13.5 |

14.0 |

3.7% |

(18.6%) |

17.2 |

18.4 |

0.0% |

31.4% |

1.3x |

Buy |

|

Liberty Holdings |

7.9 |

7.9 |

0.5% |

(23.7%) |

10.4 |

9.8 |

0.0% |

24.5% |

0.7x |

Buy |

|

Britam |

7.0 |

7.5 |

7.1% |

(16.7%) |

9.0 |

7.6 |

3.3% |

4.7% |

0.7x |

Lighten |

|

HF Group |

4.5 |

4.0 |

(11.1%) |

(38.1%) |

6.5 |

4.0 |

0.0% |

0.0% |

0.2x |

Sell |

|

CIC Group |

2.3 |

2.4 |

4.4% |

(12.3%) |

2.7 |

2.1 |

0.0% |

(10.7%) |

0.8x |

Sell |

|

*Target Prices as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Companies in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Neutral” on equities for investors because, despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim.

- Residential Sector

During the week, Shelter Afrique, a Pan-African housing development financier, announced plans to issue a bond in the Nairobi Stock Exchange (NSE) aimed at raising funds to develop new real estate projects. The company’s plans to return to the bond market as it turns profitable. The firm reduced its full-year loss by 93.7% for the year ended December 2019 to Kshs 59.0 mn loss, down from the Kshs 940.8 mn reported in 2018, attributed to significant cost reductions. With private sector credit remaining relatively low coupled with the high cost of borrowing, local development firms are bound to continue looking to the capital markets as an alternative way to fund projects such as capital market instruments.

|

Some of the Locally Issued Bonds Aimed Towards Real Estate |

||||||

|

Issuer |

Amount |

Issue Tenor |

Subscription Rate |

Year |

Aim |

|

|

Acorn Holdings |

5.0 bn |

5 |

85% |

2020 |

Financing sustainable and climate-resilient student accommodation in Kenya |

|

|

Shelter Afrique |

3.5 bn |

5 |

143% |

2013 |

Funding low-cost urban housing projects across Kenya |

|

|

Shelter Afrique |

2.5 bn |

3 |

100% |

2011 |

Funding low-cost urban housing projects across Kenya |

|

In our view, alternative sources of funding will facilitate the supply of additional housing units through long term funds raised from the bond market in Kenya and are critical to help meet the housing demand and real estate needs for the country. However, Kenya’s capital market faces various challenges such as;

- There is a limited number of companies listed in the Nairobi Stock Exchange (NSE) compared to well-established stock markets in developed countries, presenting an investor with limited options,

- Investors have little confidence in the Kenyan capital markets due to losses that have been experienced in the past, and,

- The lack of investor education for retail investors as some SMEs have a poor understanding of the capital markets and are unaware of ways in which they can use them to raise funds thus investor education/ awareness campaigns are important to educate SMEs on how they can use the stock exchange better and build their confidence in the financial system of the capital markets.

Also during the week, Stima Sacco, a local deposit-taking SACCO, announced that it had retracted its plans to raise Kshs 5 bn through a corporate bond to finance its mortgage business. Instead, the SACCO will partner with Kenya Mortgage Refinancing Company (KMRC), a State-backed home loans financier, in its goal of acquiring long term financing for onward lending. The SACCO has been developing residential properties for its members with the new plan meant to finance buyers by issuing long term mortgages of between 20-25 years. KMRC is expected to advance cash to financial institutions at an annual interest of 5% for onward lending to homebuyers at 7%, nearly half the current market rates. Once operational, we expect KMRC to partner with local primary lenders to create liquidity making it possible for mortgage originators to offer long-term mortgages, at relatively low-interest rates and better terms and conditions.

- Retail sector

During the week, Artcaffe restaurant opened its third store in Nairobi’s Central Business District (CBD), located in Chester House, along Kimathi Street. This is the restaurant’s 30th branch in Kenya (according to online sources) and is part of its expansion plan to further strengthen their share in Kenya’s rapidly growing fast-food sector. Artcaffe first opened shop in Kenya in 2009 and has expanded rapidly with new openings in Nairobi’s high-end shopping malls. The Artcaffe Group is owned by US private equity firm Emerging Capital Partners (ECP) who acquired a majority stake in the group in 2018 for Kshs 3.5 bn, an acquisition which also gave it control over Artcaffe’s business that consists of bakeries, coffee houses, and, eatery brands such as Dormans, Tapas Ceviche Bar, Urban Gourmet, and, Oh Cha Noodle Bar. The continued expansion by the retailer in Nairobi despite the COVID-19 pandemic which has especially slowed down operations in the foodservice sector signals investor confidence in Kenya’s fast food retail sector which is among the fastest-growing industries in the country driven by the growth of Kenya’s middle class and changes in household consumer behaviours. This has seen recent investments worth millions of dollars by global and local restaurant chains such as Java House, Café Espresso, Café Arabika, Dominos, Subway, and, Café Deli. In our opinion, Nairobi presents a viable opportunity for the fast-food industry as it hosts high to middle-income earners with high purchasing power, which will sustain demand from the restaurant’s target market. The continued expansion of Artcaffe and other restaurants such as Java in Nairobi is also expected to result in increased uptake of retail real estate developments thus improving the overall performance of the sector.

- Industrial Sector

During the week, Cold Solutions Kenya Limited, a leading temperature-controlled warehouse and logistics service provider, announced that it will invest Kshs 7.5 bn in constructing, grade ‘A’ temperature-controlled cold storage warehouses in Tatu City Development special economic zone. Cold Solutions Kenya Limited is a portfolio company of ARCH Cold Chain Solutions East Africa Fund, a private equity fund who will be backed by the African Development Bank (AfDB) for the project. The 15,000 SQM cold storage complex is set to be developed on 6 acres at Tatu City and is expected to be commissioned in 12 months, where it will provide storage for fresh fruits, vegetables, perishable goods, pharmaceuticals, and, vaccines. The facility will be the second grade ’A’ warehouse facility in Tatu City after Africa Logistics Properties’ (ALP) ALP North warehouse, a 50,000-SQM warehousing facility developed on 22 acres. We continue to see increased interest in Grade A warehouses especially in areas such as Ruiru, Machakos and Limuru, driven by; (i) availability of development land in bulk and at relatively affordable prices, (ii) improved infrastructure such as the Eastern and Northern Bypass and the ongoing expansion of Mombasa Rd, and, (iii) government support with regards to tax rebates offered in Special Economic Zones (SEZ) such as Tatu City. We expect to see an increase in demand for modern industrial park space fueled by improved business conditions which are expected to draw in more industrial firms both local and international, increased port throughput after the completion of the Naivasha Inland Port, and, various emerging trends during the COVID-19 pandemic which are expected to lead to higher demand for warehousing such as increased online shopping and increased near sourcing of inputs by local industries and retailers due to the current disruption in global supply chains.

Other Highlights:

During the week, Nairobi Metropolitan Services (NMS) Director-General, Mohammed Badi, announced the formation of the Railway City Development Authority (RCDA), a special purpose vehicle created under the State Corporations Act and under the Companies Act, which is expected to lead the implementation of the Nairobi Railway City, a 425-acre urban development on the area between Haile Sellasie Avenue, Uhuru Highway and Bunyala Road that is part of the Nairobi integrated urban development plan. The project is estimated to take 20 years (2020 to 2040) and will be implemented in 3 phases at an estimated cost of Kshs 27.9 bn. The city will comprise of commercial and residential buildings expected to accommodate approximately 28,000 residents. According to the World Bank’s Kenya Urbanization Review 2016 report, urban services provided in Nairobi are unable to keep up with the rate of urbanisation in the city and other urban centres in the country due to congestion, with the Nairobi hosting 4.4 mn people. Once completed, we expect the city to transform the CBD and help solve persistent issues such as traffic congestion, lack of affordable housing, congestion, and, water supply problems, with the implementation of new infrastructure.

We expect the real estate sector to continue on an upward trajectory with activity driven by demand for affordable housing and differentiated concepts coupled with the expansion of local retail stores and the continued development of high-quality warehousing.

Introduction

Over the past few years, Kenya’s Public Debt has been on the rise as a result of the government’s ambitious development agenda evident in the country’s budgets over the last ten years. We have seen a couple of rating agencies relook at the country’s Sovereign Credit Outlook and change them to a more negative outlook. Below is a summary of those:

- In May, Moody’s Credit Agency released its rating outlook where it changed Kenya’s sovereign credit outlook to “negative”, from a previous outlook of “stable”, but affirmed the earlier on B2 credit rating. The agency highlighted that the negative outlook was a result of rising financial risks brought about by the country’s large borrowing requirements especially during this time where the fiscal outlook is deteriorating, given the erosion of the revenue base and the high debt and increased interest burden. According to Moody’s, the large borrowing needs, the negative fiscal outlook, will and continues to expose Kenya to exchange and interest rate shocks thus threatening any fiscal consolidation measures that had been set by the government.

- In July, the global rating agency, Standard and Poor’s (S&P) also lowered its outlook on Kenya’s economy to “negative” from “stable” while affirming the country’s rating at ‘B+/B’, mainly due to the fallouts from the pandemic which have slowed down the country’s growth and weighed down on its already weak public finances. The negative outlook reflects the worsening fiscal position of the country amidst the pandemic and the disruptions to revenue collection.

- Fitch Ratings similarly revised the outlook on Kenya’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to negative from stable, affirmed the Issuer Default Rating at ‘B+’, and downgraded the country’s ceiling to ‘B+’ from ‘BB-‘. The agency expects a sharp economic slowdown and deterioration in the budget deficit and the ratio of government debt to GDP on the back of weak fiscal consolidation. They forecast government debt to reach 70% of GDP in FY 2022, as a result of delays in fiscal consolidation brought about by the pandemic and weak revenue growth. Despite the above, the ‘B+’ IDR reflects favourable growth potential and relatively stable macroeconomic conditions.

Essentially, the rating downgrades may influence the country’s cost of borrowing in the international financial markets and make it harder for the country to borrow from the international market.

Below are the previous topicals we have done on Kenya’s debt:

- Kenya’s Debt Levels: Are we on a Sustainable Path?– In May 2016, we wrote about the rising debt levels in the country and concluded that they were within the safer bounds in terms of debt levels but needed to look into risks associated with the changing funding patterns that could see the debt levels rise,

- Kenyan Debt Sustainability– In December 2016, we wrote about Kenya’s debt level, questioning its sustainability, and concluded that the government needed to reduce the amount of public debt, giving suggestions as to how this could be achieved, and,

- Kenya’s Public Debt, Should We be concerned? – In February 2018, we wrote about the concerns surrounding the debt level’s the country and concluded that we should be concerned about the country’s debt levels unless decisive policies were implemented,

In this week’s topical, we focus on the current state of affairs regarding the country’s public debt profile and levels and discuss how sustainable the same is. Under this, we shall cover:

- Kenya’s Evolution of Debt,

- Is Kenya’s Debt Sustainable?

- Debt Composition,

- Debt Service to Revenue ratios, and,

- Debt to GDP ratios,

- Conclusion and Recommendations.

Section I: Kenya’s Evolution of Debt

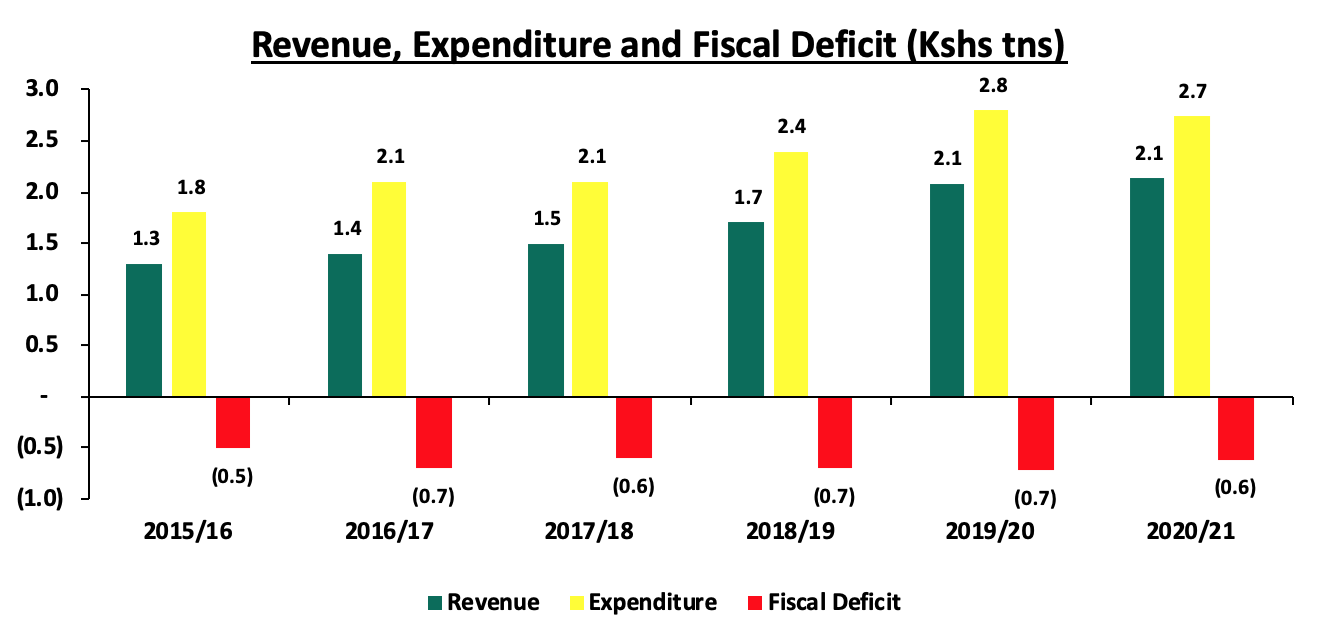

The national budget has continued to grow, with total expenditure growing at a 6-year CAGR of 7.3% to an estimated Kshs 2.7 tn in FY’2020/21 according to the 2020 Budget statement, from Kshs 1.8 tn as at the end of FY’2015/16. Revenue growth, on the other hand, has grown at a faster 6-year CAGR of 8.6% to an estimated Kshs 2.1 tn in FY’2020/21, from Kshs 1.3 tn as at the end of FY’2015/16. The fiscal deficit came in at Kshs 0.6 tn (equivalent to 5.2% of GDP) in FY’2020/21 as highlighted in the chart below,

Source: National Treasury

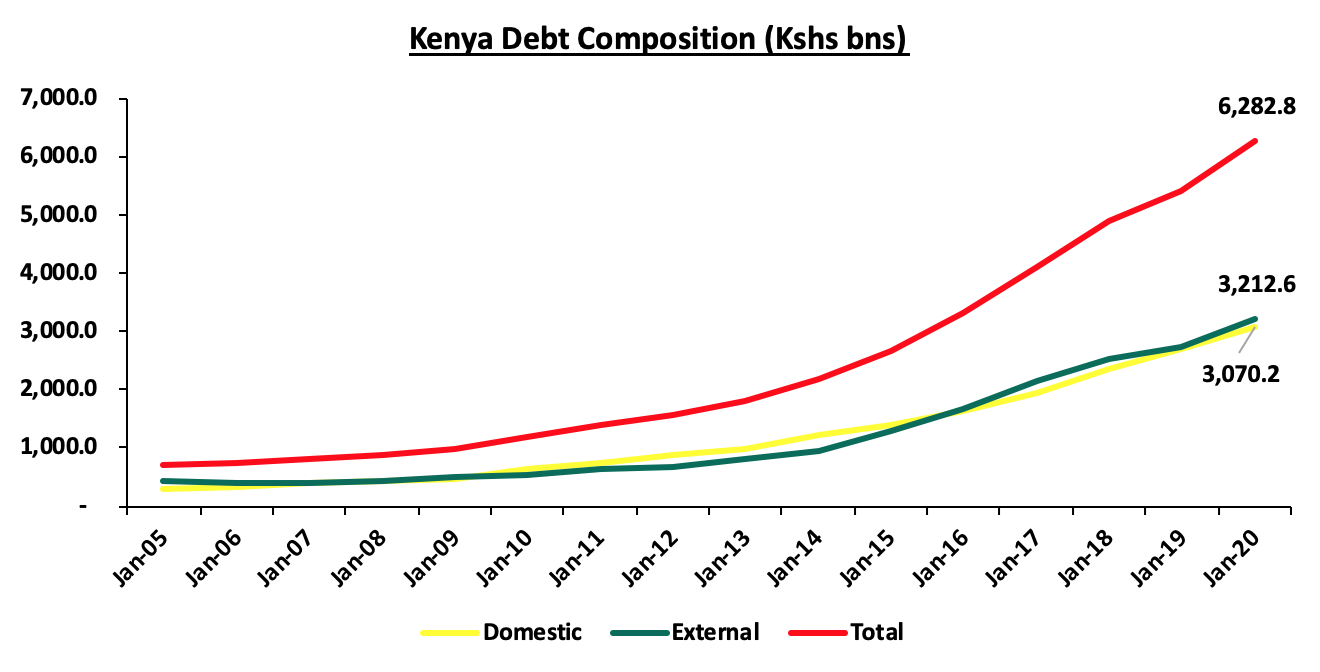

The country’s total public debt as at March 2020 stood at Kshs 6.3 tn, with the country having raised the debt ceiling to the absolute figure of Kshs 9.0 tn from the initial 50% of GDP in October 2019, this means that the government has headroom to borrow an additional Kshs 2.7 tn before the current debt ceiling is exceeded. The debt mix stands at 51:49 external and domestic debt, respectively, meaning foreign borrowing is currently at Kshs 3.2 tn while domestic borrowing came in at Kshs 3.1 tn. Below is a table highlighting the trend in debt composition over the last 15 years;

Source: Central Bank of Kenya

In the current budget, FY2020/21, the government intends to borrow a total of Kshs 569.4 bn comprising of Kshs 247.3 bn from external lenders, a 30.0% decline from the Kshs 353.5 bn seen in FY2019/20 and Kshs 318.9 bn as domestic debt from the projected 300.7 bn in the FY’2019/2020. Consequently, the ratio of domestic to foreign debt will come in at 56:44.

Section II: Is Kenya’s Debt Sustainable?

- Debt composition

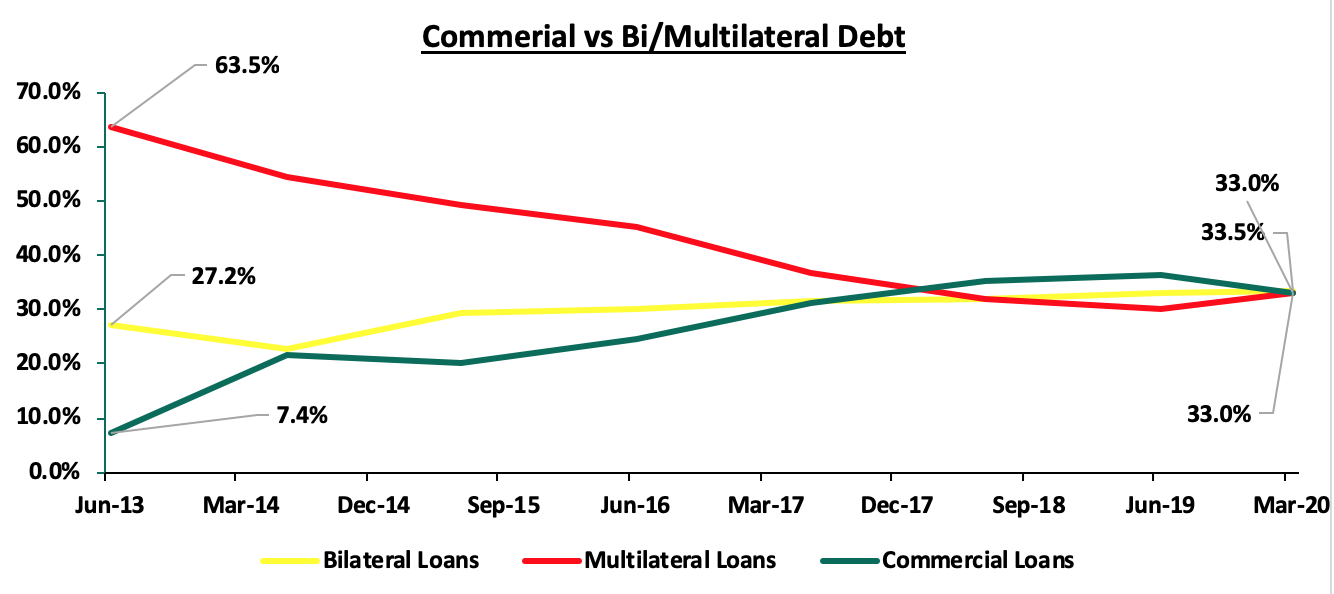

The country’s debt composition has evolved with the exposure to bilateral and multilateral development institutions declining, to a much more commercial funding structure comprising of Eurobonds and syndicated loans. This has seen the proportion of concessional loans (Bilateral and Multilateral debt) which stood at 90.7% of total external debt as at June 2013, decline to approximately 66.5% as of March 2020. This has seen commercial loans, deemed more expensive because of their high-interest costs, grow from a low of Kshs 58.9 bn (equivalent to 7.4% of total external debt) as at June 2013, to Kshs 1.0 tn (equivalent to 33.0% of total external debt) as at March 2020, with suppliers credit accounting for the remaining 0.5% of the total foreign debt. It is key to note that:

- Contribution from both Bilateral foreign debt and Commercial banks’ loans decreased marginally from 33.7% and 34.6%, respectively in March 2019, to 33.5% and 33.0% in March 2020, and,

- Multilateral foreign debt, which is largely composed of concessional facilities from organizations such as the International Development Association (IDA) and the ADB & ADF, increased from 31.1% to 33.0% over the same periods.

This is illustrated in the chart below:

Source: Central Bank of Kenya & National Treasury

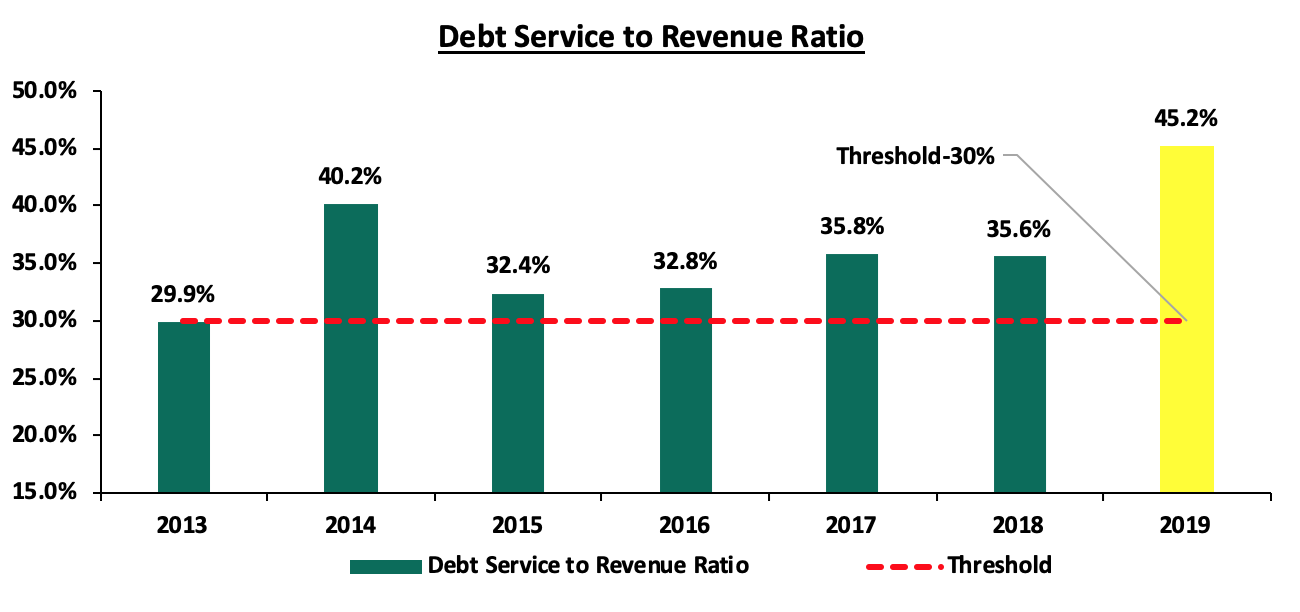

- Debt Service to Revenue Ratio:

This is a measure of how much of the government’s revenue is used to service debt. For the first half of 2020, revenue collection activities of the government have been affected due to the ongoing pandemic with major economic sectors such as tourism, manufacturing and agriculture feeling the brunt effects of the pandemic following supply-side shocks. According to the National Treasury, the debt to service revenue ratio is estimated at 45.2% at the end of 2019, higher than the recommended threshold of 30.0% and as such elevating the risks of repayment following shocks arising from the ongoing pandemic and low revenue collection. For this financial year, a total of Kshs 904.7 bn has been set aside for debt servicing from the Kshs 2.1 tn projected revenue collection. Below is a chart showing the debt service to revenue ratio;

Source: IMF Country Report & National Treasury Annual Public Debt Report

Further to the above, we expect the country’s cost of debt servicing to rise driven by currency depreciation with the shilling having depreciated by 6.0% year to date to close the week at Kshs/USD107.5. Additionally, the debt service to revenue ratio is expected to increase mainly driven by the expected decline in revenue.

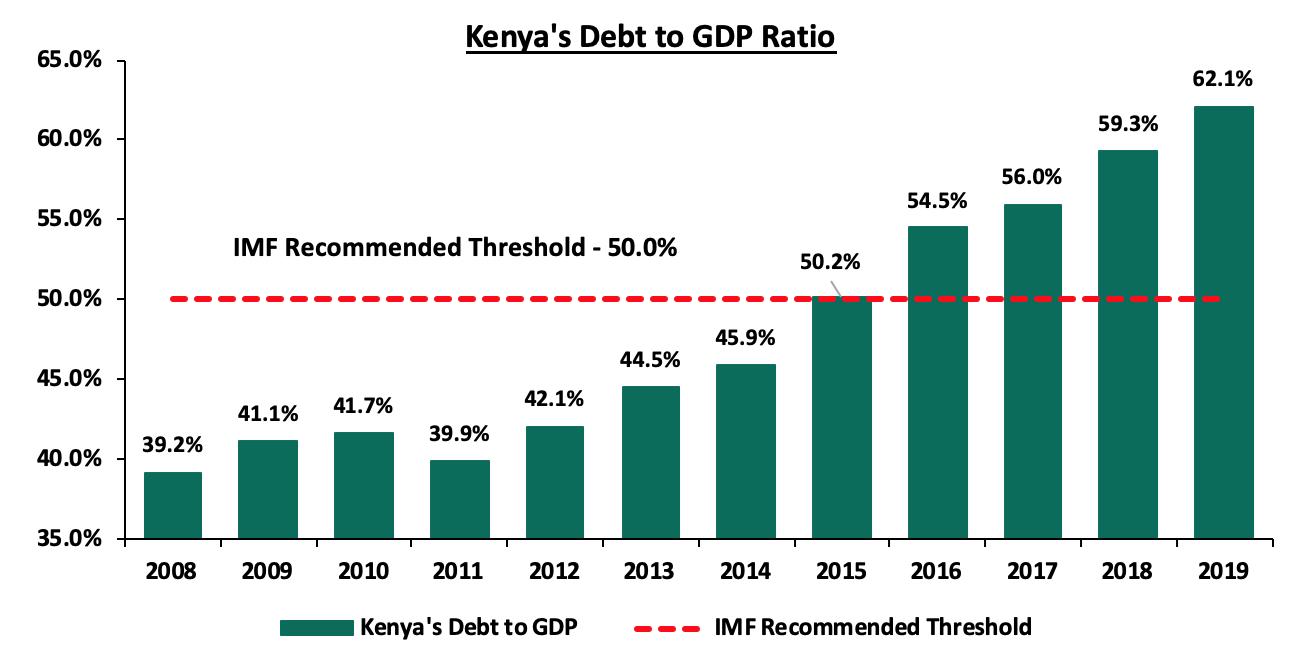

- Debt to GDP Ratio

On the other hand, Kenya’s debt to GDP ratio came in at an estimated 62.1% in 2019, 12.1% above the IMF recommended threshold of 50.0%. Late last year, the treasury amended the Public Finance Management (PFM) regulations to substitute the debt ceiling which was previously set at 50.0% of GDP to an absolute figure of Kshs 9.0 tn to plug the budget shortfalls without hurting the economy since there was no more scope to raise taxes. According to Fitch Ratings, the shocks from COVID-19 are expected to delay the narrowing of the fiscal deficit. Government debt is forecasted to 70.0% of GDP in 2021 on the back of rising debt levels and weak revenue growth. Below is a graph highlighting the trend in the country’s debt to GDP ratio;

Source: World Bank

Some might argue that the additional debt is being directed towards development projects which will, in turn, lead to faster economic growth but this has not been the case. A significant amount of government spending has gone towards development projects whose expected economic return might not be able to finance the cost of financing. For example, the Exim Bank of China is set to receive Kshs 43.2 bn in debt payments for the SGR in the current fiscal year despite the project facing a variety of challenges such as low cargo volumes.

According to the IMF, the Kenyan economy is expected to grow at 1.0% in 2020, while the National Treasury expects the same to come in at 2.5%. The expected decline in growth is already being seen through the suppressed business activity experienced during the second quarter of the year, evidenced by the country’s Purchasing Manager’s Index which dipped to 34.8 in April 2020, the second-lowest level since the index was set up. The GDP growth for the year is expected to be slower than debt financing meaning the debt to GDP ratio will increase significantly since the denominator - GDP Growth - will grow at a much slower pace.

Below are some of the risks that the high debt levels open the economy to:

- Possible depreciation of the local currency as other governments demand hard currency to service the debt increases,

- The higher cost of debt servicing may lead to higher taxation as the local government tries to keep up with its debt obligations,

- The increased cost of further borrowing since lenders will price the new debt considering the possible increased risks,

- Crowding out of the private sector by the government which largely leads to lower projected economic growth which even impacts collections much further,

- Decreased ability to effectively respond to problems since governments often borrow to address unexpected events. Having a high debt level means there will be fewer options,

To determine whether the current debt is sustainable, we have put together a table of metrics indicating the level of concern based on the current and projected situation

|

No. |

Metric |

Narrative |

Level of Concern |

|

1. |

Total Government Debt to GDP |

The 2019 Ratio is estimated to come in at 62.1%, up from 45.9% in 2014; and well above the IMF threshold of 50.0%. Fitch projects that the ratio will reach 70.0% by June 2021 unless decisive policies are implemented by the government. Despite being above the IMF threshold, the government raised the debt ceiling to the absolute figure of Kshs 9.0 tn, meaning that the government still has room for additional borrowing, |

High |

|

2. |

Total Debt Service to Revenue |

The figure for 2019 is estimated at 45.2% up from 35.6% in 2018 and above the 30.0% IMF threshold. In the year 2019/20, the government had a revenue target of Kshs 2.1 tn which it did not meet due to poor revenue collection in the last quarter of the 2019/20 fiscal year. Going forward we are pessimistic on the government’s ability to meet its revenue collection targets given the current environment, |

High |

|

3. |

Total Public Debt Mix – Domestic vs. External |

The external to domestic debt ratio came in at 51:49 in March 2020, compared to 52:48 in March 2015. Given the marginal difference in the current ratio, the government has the option of being prudent in reducing the amount borrowed externally. |

Medium |

|

4. |

Debt Mix – Commercial vs. Concessional Loans |

The increase in contribution of commercial loans to 33.0% of total external debt in March 2020, from 20.1% in June 2015, has resulted to a higher debt service to revenue ratio for the country since commercial loans attract higher interest rates when compared to a concessional loan. Concessional loans’ contribution has decreased from 78.7% in June 2015 to 66.5% in March 2020 |

High |

|

5. |

Current Account Balance |

The current account balance worsened to 10.2% of GDP in Q1’2020, mainly attributable a 67.0% in the services trade balance to Kshs 20.4 bn from Kshs 61.9 bn in Q1’2019. This was mitigated by the 9.1% narrowing in the merchandise trade deficit mainly supported by a 14.0% increase in exports, outweighing the 0.1% increase in imports. The Kenyan shilling depreciated by 5.1% against the US Dollar during the first half of 2020. Despite this, we expect the shilling to be supported by the CBK’s sufficient reserves, currently at USD 9.7 bn (equivalent to 5.8 months of import cover), above the statutory requirement of 4.5 months import cover. |

High |

Of the 5 metrics we have taken into account, 4 suggest High concern while 1 suggest Medium concern, as such we are of the opinion that the current debt levels are not sustainable and the government should be pro-active in alleviating the pressures on the country’s debt

Section III: Conclusion and Recommendation

The high debt levels in the country have become a point of concern with both the debt to GDP ratio as well as the debt service to revenue ratio having exceeded the recommended threshold. We expect the economy to face fiscal challenges arising from the global pandemic. This sentiment has been echoed by various authoritative bodies, pointing to a possible further downgrading of Kenya’s creditworthiness. Despite this, some investors are optimistic with regards to the country’ outlook evidenced by the decline in Eurobond yields over the month of May, pointing to the perception of lower risk in the country going forward coupled with the additional funding received from both the World Bank and the IMF. Locally, the Central Bank through the Monetary Policy Committee has continued to support the economy through the policy rate and the Cash Reserve Ratio and is confident that the measures put in place are having the desired effect. Similarly, the government has also made some tax amendments to help boost revenue collection and at the same time cushion the economy from the adverse effects of the coronavirus. Below are some actionable steps the government can take towards debt sustainability;

- Restructuring the debt mix: the government should go for more concessional borrowing to reduce the amounts paid in debt service. Additionally, commercial borrowing should be limited to development projects with high financial and economic returns, to ensure that more expensive debt is invested in projects that yield more than the market rate charged,

- The government can carry out capital expenditure cuts during the current period of distress and direct the funds to areas that have a higher economic return such as supporting the manufacturing sector. By scaling down on the funding of new projects and focusing on completing those that are pending the economic benefits will be transmitted into the economy and support overall economic growth,

- The government can focus on developing certain sectors to build an export-driven economy. Encouraging growth in the manufacturing sector will help increase the value of our exports leading to an improved current account. Additionally, they can encourage private sector involvement in such development projects to reduce the strain on government expenditure, and,

- The government should take a more proactive stance in enforcing the recent tax policy changes to prevent tax avoidance and evasion, recent policies such as the introduction of digital tax which are geared towards widening the tax base.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.