Kenya Retirement Benefits Scheme FY'2022 Review, & Cytonn Weekly #14/2023

By Cytonn Research, Apr 9, 2023

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed for the first time in two weeks, with the overall subscription rate coming in at 134.8%, up from an undersubscription of 34.4% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 25.7 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 643.3%, significantly higher than the 72.6% recorded the previous week. Notably, the 182-day and 364-day papers recorded continued undersubscriptions of 5.8% and 60.3%, from undersubscription rates of 35.5% and 18.1%, respectively, recorded the previous week. The government accepted bids worth Kshs 32.2 bn out of the total Kshs 32.3 bn bids received, translating to an acceptance rate of 99.8%. The yields on the government papers recorded mixed performances, with the yields on the 364-day paper and 91-day papers increasing by 5.7 bps and 9.7 bps to 10.9% and 10.0%, respectively while the yield of the 182-day paper declined by 3.1 bps to 10.4%;

In the primary market the Central Bank of Kenya released the bond auction results for the re-opened Treasury bond FXD2/2018/10 with effective tenor to maturity of 5.7 years. In line with our expectations, the bond was undersubscribed, receiving bid worth Kshs 3.6 bn, against the offered Kshs 20.0 bn, translating to an undersubscription rate of 17.9%. The undersubscription was attributable to tightened liquidity in the money market, with the average interbank rate increasing by 50.0 bps to 8.1%, from 7.6%, recorded the previous week;

During the week, Stanbic bank released its monthly Purchasing Manager’s Index (PMI), highlighting that the index for the month of March 2023 came in at 49.2, from 46.6 in recorded in February 2023, pointing towards continued deterioration in the business environment for the second consecutive month in 2023;

Equities

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 1.3%, 1.5% and 0.5%, respectively, taking the YTD performance to losses of 10.3%, 1.8% and 5.0% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by gains recorded by large cap stocks such as Bamburi, Diamond Trust Bank (DTB-K), Safaricom, and KCB Group of 7.0%, 3.4%, 2.8%, and 1.1%, respectively. The gains were however weighed down by losses recorded by stocks such as BAT and Stanbic Bank of 2.9% and 2.7%, respectively;

Real Estate

During the week, Naivas Supermarket opened a new outlet located at Brick Mall, Thindigua Kiambu County, bringing the total number of its operating outlets countrywide to 92. In the hospitality sector, JW Marriot, a subsidiary of the Marriot Bonvoy global portfolio of 30 extraordinary hotel brands officially opened a luxurious safari lodge in River Masai Mara, Talek, within Masai Mara National Reserve dubbed ‘JW Marriott Masai Mara’. The high-end property consists of a restaurant, lounge bar, spa, fitness centre, photographic studio, garden and outdoor pool. Additionally, the hotel entails 20 private tented rooms and suites which offers different kind of high-end amenities and at different rates. In the Real Estate Investment Trusts (REITs) segment, Fahari I-REIT closed the week trading at an average price of Kshs 6.84 per share in the Nairobi Securities Exchange, a 4.9% gain from Kshs 6.5 per share recorded the previous week. On the Unquoted Securities Platform as at 31st March 2023, Acorn D-REIT and I-REIT closed the week trading at Kshs 23.9 and Kshs 20.9 per unit, respectively, a 19.4% and 4.4% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price;

Focus of the Week

The Pension industry in Kenya has been negatively impacted by the various unprecedented economic occurrences such as the slow rebound of the financial markets after the adverse effects of COVID-19 as well as uncertainties around the general elections which slowed down economic activities in the country. Additionally, the high cost of living occasioned by elevated fuel and food prices as a result of sustained supply constraints have weighed down on the adequacy of disposable income available for saving for retirement as well as the sustainability of the pension industry in Kenya. This is evidenced by the Assets under Management (AUM) growing at a slower rate of 1.2% to Kshs 1.6 tn in 2022, from Kshs 1.5 tn in 2021, compared to 10.6% growth witnessed in 2021 to Kshs 1.5 tn from Kshs 1.4 tn. Further, Kenya is characterized by low saving culture with the Kenya National Bureau of Statistics (KNBS) in the FinAccess Household Survey Report 2021, highlighting that only 12.0% of the adult population in the labor force save for their retirement in Retirement Benefits Schemes (RBSs). This week, we shall focus on understanding Retirement Benefits Schemes and look into the historical and current state of retirement benefits schemes in Kenya with a key focus on 2022 and what can be done going forward;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.02%. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 13.74% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

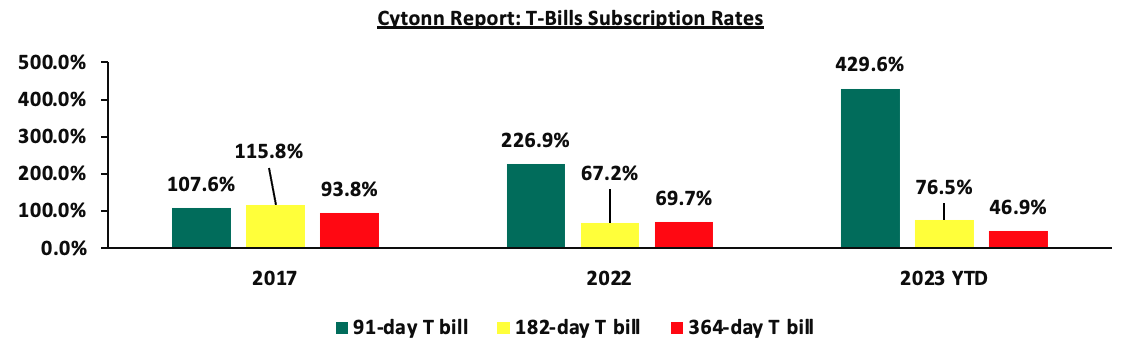

During the week, T-bills were oversubscribed for the first time in two weeks, with the overall subscription rate coming in at 134.8%, up from an undersubscription of 34.4% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 25.7 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 643.3%, significantly higher than the 72.6% recorded the previous week. Notably, the 182-day and 364-day papers recorded continued undersubscriptions of 5.8% and 60.3% from undersubscription rates of 35.5% and 18.1%, respectively, recorded the previous week. The government accepted bids worth Kshs 32.2 bn out of the total Kshs 32.3 bn bids received, translating to an acceptance rate of 99.8%. The yields on the government papers recorded mixed performances, with the yields on the 364-day paper and 91-day papers increasing by 5.7 bps and 9.7 bps to 10.9% and 10.0%, respectively while the yield of the 182-day paper declined by 3.1 bps to 10.4%. The chart below compares the overall average T- bills subscription rates obtained in 2017, 2022 and 2023 Year to Date (YTD):

In the primary market the Central Bank of Kenya released the bond auction results for the re-opened treasury bond FXD2/2018/10 with effective tenor to maturity of 5.7 years. In line with our expectations, the bond was undersubscribed, receiving bid worth Kshs 3.6 bn, against the offered Kshs 20.0 bn, translating to an undersubscription rate of 17.9%, on the back of tightened liquidity in the money market, with the average interbank rate increasing by 50.0 bps to 8.1%, from 7.6% recorded the previous week. The government continued to reject expensive bids, accepting bids worth Kshs 3.4 bn out of the Kshs 3.6 bn of total bids received, translating to an acceptance rate of 94.1%. The accepted weighted average yield for the bond came in at 14.4%, while the coupon rate was 12.5%.

Money Market Performance:

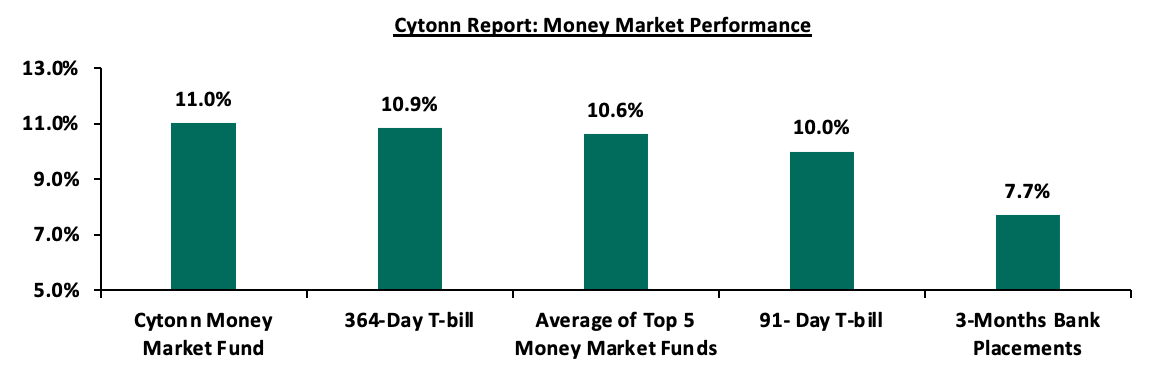

In the money market, the 3-month bank placements recorded 7.7%, similar to what was recorded the previous week (based on what we have been offered by various banks). The average yield on the 91-day T-bill and the 364-day T-bill increased by 0.1% points each to 10.0% and 10.9%, from 9.9% and 10.8%, respectively, recorded the previous week. On the other hand, yields of the average Top 5 Money Market Funds and Cytonn Money Market Fund (CMMF) declined by 0.2% points and 0.1% points to 10.6% and 11.0%, from 10.8% and 11.1%, respectively, recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 6th April 2023:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 6th April 2023 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (dial *809# or download the Cytonn App) |

11.0% |

|

2 |

Dry Associates Money Market Fund |

10.6% |

|

3 |

Apollo Money Market Fund |

10.6% |

|

4 |

Jubilee Money Market Fund |

10.5% |

|

5 |

Madison Money Market Fund |

10.5% |

|

6 |

Etica Money Market Fund |

10.3% |

|

7 |

NCBA Money Market Fund |

10.1% |

|

8 |

Nabo Africa Money Market Fund |

10.1% |

|

9 |

Kuza Money Market fund |

10.0% |

|

10 |

Old Mutual Money Market Fund |

10.0% |

|

11 |

Zimele Money Market Fund |

9.9% |

|

12 |

KCB Money Market Fund |

9.9% |

|

13 |

Enwealth Money Market Fund |

9.9% |

|

14 |

Co-op Money Market Fund |

9.8% |

|

15 |

Sanlam Money Market Fund |

9.8% |

|

16 |

AA Kenya Shillings Fund |

9.8% |

|

17 |

GenCap Hela Imara Money Market Fund |

9.5% |

|

18 |

CIC Money Market Fund |

9.4% |

|

19 |

British-American Money Market Fund |

9.3% |

|

20 |

GenAfrica Money Market Fund |

9.2% |

|

21 |

ICEA Lion Money Market Fund |

9.0% |

|

22 |

Orient Kasha Money Market Fund |

8.9% |

|

23 |

Absa Shilling Money Market Fund |

8.8% |

|

24 |

Mali Money Market Fund |

8.2% |

|

25 |

Equity Money Market Fund |

6.7% |

Source: Daily Nation, M-pesa app

Liquidity:

During the week, liquidity in the money markets continued to tighten, with the average interbank rate increasing to 8.1%, from 7.6% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volume traded, however, increased by 35.0% to Kshs 29.6 bn, from Kshs 22.0 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds were on a downward trajectory with the yields on the 10-year Eurobond and 30-year Eurobond both issued in 2018, declining the most, having declined by 0.2% points each to 12.2% and 11.4%, from 12.4% and 11.6% recorded the previous week. The decline followed an announcement by the Permanent Secretary (PS) of the National Treasury that the government is keen on prioritizing the payment of debt obligations and had settled all debt due in March amounting to Kshs 150.0 bn. The table below shows the summary of the performance of the Kenyan Eurobonds as of 5 April 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

2014 |

2018 |

2019 |

2021 |

|||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD bn) |

2.0 |

1.0 |

1.0 |

0.9 |

1.2 |

1.0 |

|

Years to Maturity |

1.3 |

5.0 |

25.0 |

4.2 |

9.2 |

11.3 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

02-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

30-Mar-23 |

13.7% |

12.4% |

11.6% |

13.3% |

11.8% |

11.2% |

|

31-Mar-23 |

14.2% |

12.3% |

11.6% |

13.4% |

11.7% |

11.3% |

|

03-Apr-23 |

13.7% |

12.2% |

11.4% |

13.2% |

11.6% |

11.2% |

|

04-Apr-23 |

13.4% |

12.0% |

11.4% |

13.1% |

11.6% |

11.1% |

|

05-Apr-23 |

13.6% |

12.2% |

11.4% |

13.2% |

11.7% |

11.2% |

|

Weekly Change |

(0.1%) |

(0.2%) |

(0.2%) |

(0.1%) |

(0.1%) |

(0.0%) |

|

MTD change |

(0.1%) |

0.1% |

0.0% |

0.0% |

0.1% |

0.0% |

|

YTD Change |

0.7% |

1.7% |

0.6% |

2.3% |

0.9% |

1.3% |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling depreciated by 0.7% against the US dollar to close the week at Kshs 133.3, from Kshs 132.3 recorded the previous week, partly attributable to increased dollar demand from manufacturers and importers, especially oil and energy sectors against a slower supply of hard currency. On a year to date basis, the shilling has depreciated by 8.0% against the dollar, adding to the 9.0% depreciation recorded in 2022. We expect the shilling to remain under pressure in 2023 as a result of:

- High global crude oil prices on the back of persistent supply chain constraints coupled with high demand. The high crude oil prices have inflated Kenya’s import bill and as a result, petroleum products imports have continued to weigh heavily on the country’s import bill, and accounted for 27.6% of the total import bill in Q3’2022, up from 25.6% in Q2’2022 and much higher than 15.2% recorded in Q3’2021,

- An ever-present current account deficit estimated at 4.9% of GDP in the 12 months to January 2023, from 5.6% recorded in a similar period last year,

- The need for Government debt servicing which continues to put pressure on forex reserves given that 68.1% of Kenya’s External debt was US Dollar denominated as of December 2022, and,

- A continued interest rate hikes in the USA and the Euro Area with the Fed and European Central Bank increasing their benchmark rates to 4.75%-5.00% and 3.50% respectively in March 2023, which has strengthened the dollar and sterling pound against other currencies following capital outflows from other global emerging markets.

The shilling is however expected to be supported by:

- Diaspora remittances standing at a cumulative USD 658.6 mn in 2023 as of February 2023, albeit 0.3% lower than the USD 660.3 mn recorded over the same period in 2022, and,

- The tourism inflow receipts that came in at USD 268.1 bn in 2022, a significant 82.9% increase from USD 146.5 bn inflow receipts recorded in 2021.

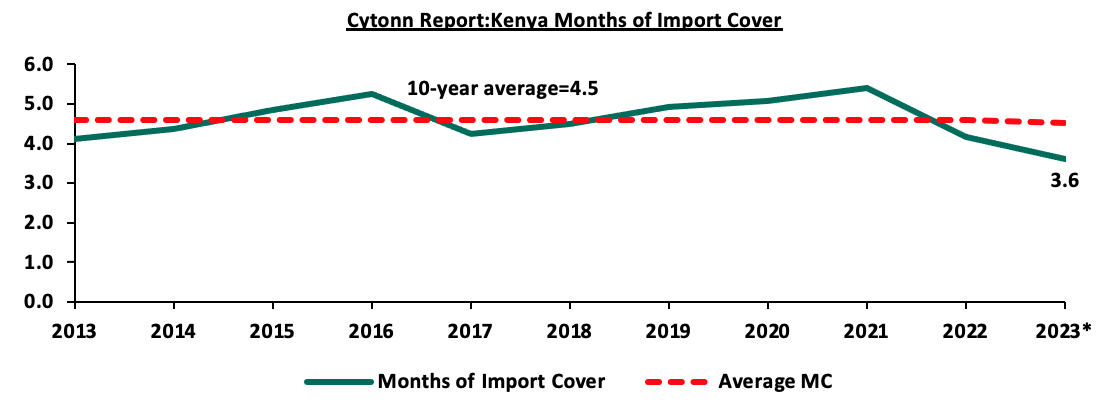

Key to note, Kenya’s forex reserves remained relatively unchanged at USD 6.4 bn as at 5 April 2023, similar to what was recorded the previous week. As such, the country’s months of import cover also remained unchanged at 3.6 months, similar to what was recorded the previous week, and below the statutory requirement of maintaining at least 4.0-months of import cover. The chart below summarizes the evolution of Kenya months of import cover over the last 10 years:

*Figure as of 5 April 2023

Weekly Highlight:

Stanbic Bank’s March 2023 Purchasing Manger’s Index (PMI)

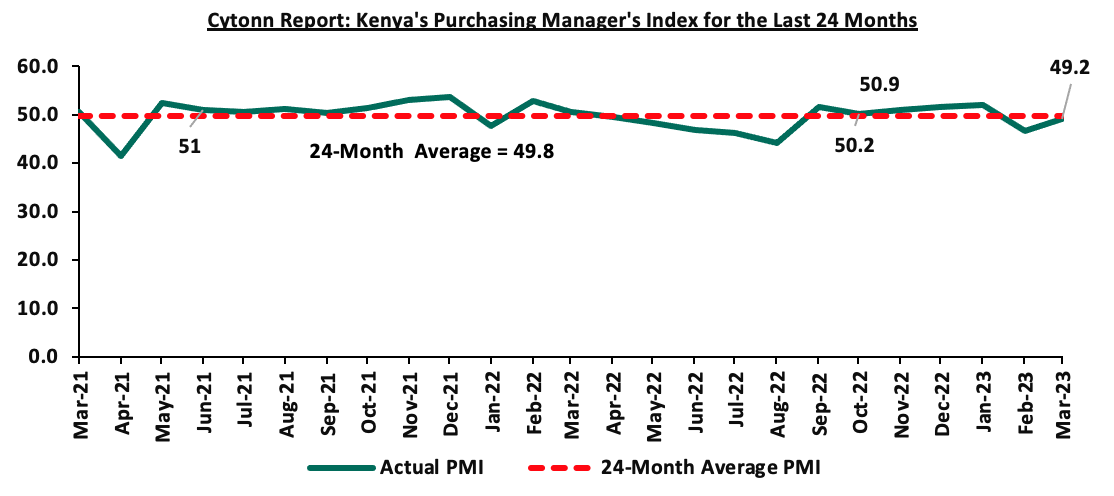

During the week, Stanbic bank released its monthly Purchasing Manager’s Index (PMI), highlighting that the index for the month of March 2023 came in at 49.2, from 46.6 in February 2023, pointing towards continued deterioration in the country’s business environment for the second consecutive month in 2023. The subdued business activity in the country is attributable to decline in new orders, driven by elevated prices of both inputs and commodity prices, low cash flow circulation evidenced by the tightened liquidity with the average interbank rate at 7.0% in March, up from average interbank rate of 6.4%, recorded in February 2023. Additionally, the interest hikes by both the Fed and the European Central Bank (ECB) against aggressive currency depreciation further increased the cost of petroleum products importation impeding production. However, the March PMI was an improvement from the 46.6 PMI recorded in February 2023, signalling lesser declines in business activities supported by marginal uplifts in employment and purchasing. On sectoral performances, there were variances, with sectors such as wholesale and retail recording decline in sales growth while construction, manufacturing, agriculture and services recorded slight increases in sales growth. The chart below summarizes the evolution of PMI over the last 24 months;

Despite the slowdown in business deterioration, we maintain a cautious outlook in the short-term owing to the elevated inflationary pressures with March 2023 inflation rate remaining unchanged at 9.2%, similar to what was recorded in February 2023. The high inflation rate, coupled with the aggressive depreciation of the Kenyan shilling continue drive high cost of production. Additionally, consumer demand is also of a major concern as the soaring prices of commodities continue to stifle consumer spending. Key to note, the improvement in the general business environment in the country is largely pegged on the stability in the global economy.

Rates in the Fixed Income market have remained relatively stable due to the relatively ample liquidity in the money market. The government is 14.4% ahead of its prorated borrowing target of Kshs 330.2n having borrowed Kshs 378.1 bn of the new domestic borrowing target of Kshs 425.1 bn as per the February 2023 revised domestic borrowing target for FY’2022/23. We believe that the projected budget deficit of 5.7% is relatively ambitious given the downside risks and deteriorating business environment occasioned by high inflationary pressures. Further, revenue collections are lagging behind, with total revenue as at February 2023 coming in at Kshs 1.3 tn in the FY’2022/2023, equivalent to 59.8% of its target of Kshs 2.1 tn and 89.7% of the prorated target of Kshs 1.4 tn. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to bridge the fiscal deficit through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 1.3%, 1.5% and 0.5%, respectively, taking the YTD performance to losses of 10.3%, 1.8% and 5.0% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by gains recorded by large cap stocks such as Bamburi, Diamond Trust Bank (DTB-K), Safaricom, and KCB Group of 7.0%, 3.4%, 2.8%, and 1.1%, respectively. The gains were however weighed down by losses recorded by stocks such as BAT and Stanbic Bank of 2.9% and 2.7%, respectively.

During the week, equities turnover increased by 13.4% to USD 11.5 mn from USD 13.2 mn recorded the previous week, taking the YTD turnover to USD 359.8 mn. Foreign investors remained net sellers, recording a net selling position of USD 1.3 mn, from a net selling position of USD 3.4 mn recorded the previous week, taking the YTD net selling position to USD 42.3 mn.

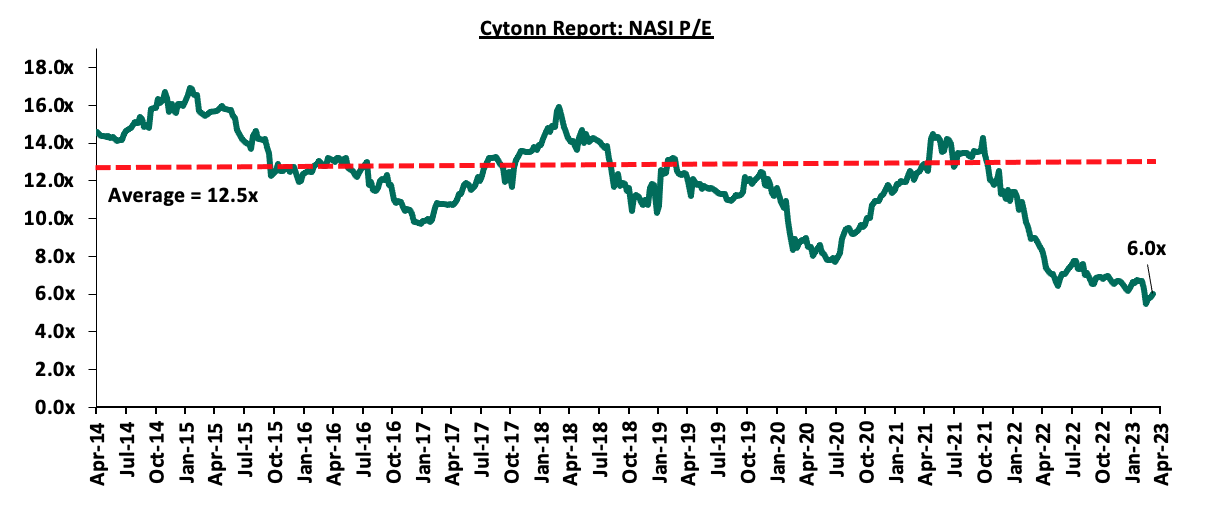

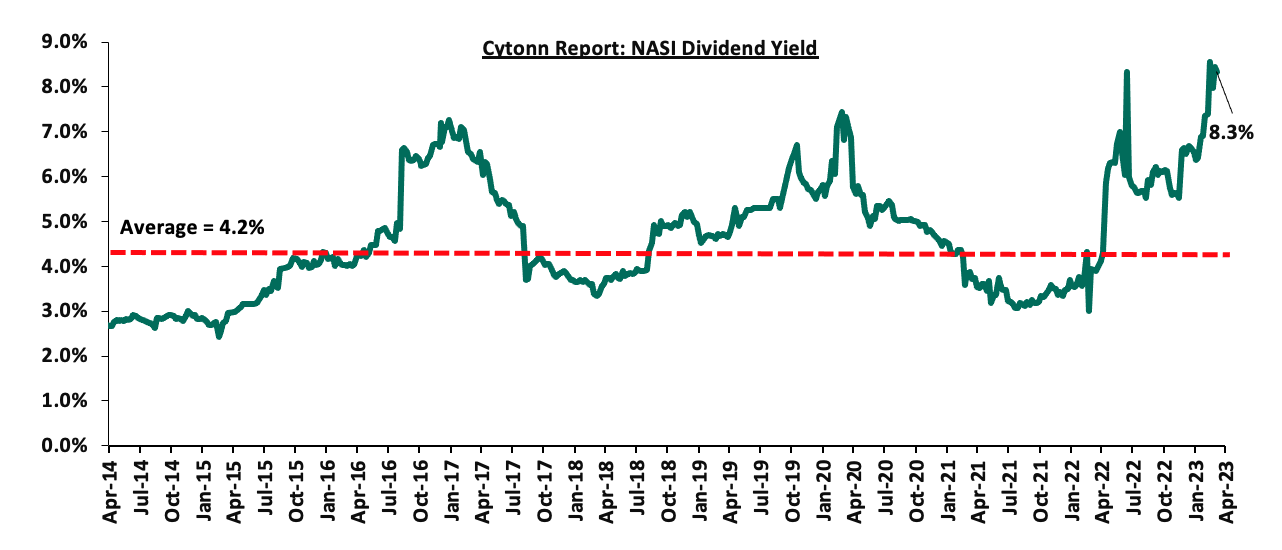

The market is currently trading at a price to earnings ratio (P/E) of 6.0x, 51.8% below the historical average of 12.5x. The dividend yield stands at 8.3%, 4.1% points above the historical average of 4.2%. Key to note, NASI’s PEG ratio currently stands at 0.8x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of coverage:

|

Company |

Price as at 31/03/2023 |

Price as at 06/04/2023 |

w/w change |

YTD Change |

Year Open 2023 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Jubilee Holdings |

177.0 |

168.8 |

(4.7%) |

(15.1%) |

198.8 |

305.9 |

8.3% |

89.6% |

0.3x |

Buy |

|

KCB Group*** |

35.5 |

35.9 |

1.1% |

(6.4%) |

38.4 |

52.5 |

5.6% |

51.8% |

0.6x |

Buy |

|

Britam |

4.7 |

4.7 |

1.1% |

(9.6%) |

5.2 |

7.1 |

0.0% |

51.5% |

0.8x |

Buy |

|

Sanlam |

8.2 |

8.6 |

4.4% |

(10.4%) |

9.6 |

11.9 |

0.0% |

38.8% |

0.9x |

Buy |

|

Liberty Holdings |

4.8 |

4.4 |

(7.7%) |

(11.9%) |

5.0 |

6.8 |

0.0% |

52.0% |

0.3x |

Buy |

|

Kenya Reinsurance |

1.9 |

2.0 |

5.8% |

7.0% |

1.9 |

2.5 |

10.0% |

35.5% |

0.2x |

Buy |

|

Equity Group*** |

45.5 |

45.5 |

0.0% |

1.0% |

45.1 |

58.4 |

8.8% |

37.0% |

1.1x |

Buy |

|

ABSA Bank*** |

12.8 |

12.9 |

0.4% |

5.3% |

12.2 |

15.5 |

10.5% |

30.7% |

1.1x |

Buy |

|

NCBA*** |

36.7 |

36.6 |

(0.4%) |

(6.2%) |

39.0 |

43.4 |

11.6% |

30.3% |

0.8x |

Buy |

|

Co-op Bank*** |

13.2 |

13.1 |

(0.8%) |

7.9% |

12.1 |

15.5 |

11.5% |

30.0% |

0.6x |

Buy |

|

CIC Group |

2.0 |

2.0 |

3.6% |

6.3% |

1.9 |

2.3 |

6.4% |

20.7% |

0.7x |

Buy |

|

Diamond Trust Bank*** |

51.3 |

53.0 |

3.4% |

6.3% |

49.9 |

57.1 |

9.4% |

17.2% |

0.2x |

Accumulate |

|

Stanbic Holdings |

110.0 |

107.0 |

(2.7%) |

4.9% |

102.0 |

112.0 |

11.8% |

16.4% |

0.9x |

Accumulate |

|

Standard Chartered*** |

170.0 |

169.0 |

(0.6%) |

16.6% |

145.0 |

166.3 |

13.0% |

11.4% |

1.1x |

Accumulate |

|

I&M Group*** |

20.9 |

20.9 |

0.2% |

22.6% |

17.1 |

20.8 |

10.8% |

10.4% |

0.5x |

Accumulate |

|

HF Group |

3.8 |

4.2 |

9.7% |

32.7% |

3.2 |

3.4 |

0.0% |

(17.9%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Neutral” on the Equities markets in the short term due to the current adverse operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently trading at a discount to its future growth (PEG Ratio at 0.8x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the equities outlook in the short term.

- Retail Sector

During the week, Naivas Supermarket opened a new outlet located at Brick Mall, Thindigua Kiambu County, bringing the total number of its operating outlets countrywide to 92. This decision by Naivas is part of the company's ambitious expansion strategy aimed at consolidating its market leadership position and gaining an edge over other major retailers in the region such as QuickMart, Cleanshelf, Chandarana Foodplus, and Carrefour. Previously, Thindigua was only served by Quickmart Supermarket as the only major retailer in the region since January 2019, and supplemented by other convenience stores and mini-marts. The entry of Naivas Supermarket in Thindigua and surrounding regions is a clear indication of the increasing demand for convenience by consumers with diverse preferences and interests, who want to be served at their close proximity by major retailers that have the necessary resources to facilitate such convenience. Furthermore, Naivas' expansion is coming at a time when several other retailers, including Nakumatt, Tuskys, Games Stores, Shoprite, Choppies, and Uchumi Supermarkets, have exited the market, widening the gap for investment in the formal retail sector. This development is happening at a time when formal retail penetration in Kenya remains low standing at 30.0% as of 2018. Naivas' decision to expand its footprint in Thindigua and surrounding areas will enable more consumers to access formal retail services and improve their shopping experiences.

The table below shows the number of stores operated by key local and international retail supermarket chains in Kenya;

|

Cytonn Report: Main Local and International Retail Supermarket Chains |

|||||||||||

|

Name of retailer |

Category |

Branches as at FY’2018 |

Branches as at FY’2019 |

Branches as at FY’2020 |

Branches as at FY’2021 |

Branches as at FY’2022 |

Branches opened in 2023 |

Closed branches |

Current branches |

Branches expected to be opened |

Projected branches FY’2023 |

|

Naivas |

Hybrid* |

46 |

61 |

69 |

79 |

91 |

1 |

0 |

92 |

0 |

92 |

|

Quick Mart |

Hybrid** |

10 |

29 |

37 |

48 |

55 |

2 |

0 |

57 |

0 |

57 |

|

Chandarana |

Local |

14 |

19 |

20 |

23 |

26 |

0 |

0 |

26 |

0 |

26 |

|

Carrefour |

International |

6 |

7 |

9 |

16 |

19 |

0 |

0 |

19 |

0 |

19 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

12 |

12 |

1 |

0 |

13 |

0 |

13 |

|

Tuskys |

Local |

53 |

64 |

64 |

6 |

6 |

0 |

59 |

5 |

0 |

5 |

|

Game Stores |

International |

2 |

2 |

3 |

3 |

0 |

0 |

3 |

0 |

0 |

0 |

|

Uchumi |

Local |

37 |

37 |

37 |

2 |

2 |

0 |

35 |

2 |

0 |

2 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

0 |

0 |

15 |

0 |

0 |

0 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

0 |

0 |

4 |

0 |

0 |

0 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

0 |

0 |

65 |

0 |

0 |

0 |

|

Total |

|

257 |

313 |

334 |

189 |

211 |

4 |

183 |

214 |

0 |

214 |

|

*40% owned by IBL Group (Mauritius), Proparco (France), and DEG (Germany), while 60% owned by Gakiwawa Family (Kenya) |

|||||||||||

|

**More than 50% owned by Adenia Partners (Mauritius), while Less than 50% owned by Kinuthia Family (Kenya) |

|||||||||||

Source: Cytonn Research

We continue to expect increased activities in the retail sector attributed to continuous growth and expansion by existing local and international retailers, increased infrastructural development enhancing accessibility in regions offering new opportunities for retail investment, and the growing demand for goods, services, and retail space driven by favourable demographics both within and beyond the Nairobi Metropolitan Area (NMA). Nevertheless, the retail sector in Kenya faces some challenges, including the oversupply of retail space in the NMA and Kenyan retail sectors (excluding NMA) at approximately 3.0 mn and 1.7 mn SQFT, respectively, the ongoing closure of the remaining retail spaces by exiting retailers, and the rapid growth of e-commerce, which could limit the optimal utilization of physical retail spaces. These negative factors may continue to hinder the optimum performance of the sector. For more information on the performance of retail sector in 2023, see Cytonn Q1’2023 Markets Review.

- Hospitality Sector

During the week, JW Marriot, a subsidiary of the Marriot Bonvoy global portfolio of 30 extraordinary hotel brands officially opened a luxurious safari lodge in River Masai Mara, Talek, within Masai Mara National Reserve dubbed ‘JW Marriott Masai Mara’. The high-end property consists of a restaurant, lounge bar, spa, fitness centre, photographic studio, garden, and outdoor pool. Additionally, the hotel entails 20 private tented rooms and suites which offer different kind of high-end amenities and at different rates. The rooms and suites are categorized into; Deluxe, Deluxe Sunset, Executive, and Ambassadorial. The opening of ‘JW Marriott Masai Mara’ was driven by; i) increased number of international visitors to the national reserve who are drawn to the spectacular natural beauty of the savannah, ii) the opportunity to observe the “Big Five” which includes lions, leopards, buffalos, rhinoceros, and elephants, and iii) the annual Great Wildebeest Migration, an event that happens between June and September. The opening also aligns with Marriott Bonvoy's global expansion plan to increase its presence in Kenya, with existing franchises such as Four Points Hotels, Autograph Collection Hotels, and W Hotel. This is at the back of increased competition from other local and international hospitality brands such as Dusit International, Hilton Hotels, PrideInn Hotels, Sarova Hotels, Serena Hotels and many more which are taking advantage of sustained recovery of the sector, with the performance in terms of bed occupancies and international arrivals tracking towards pre-COVID-19 levels. The table below shows breakdown of other Marriot Bonvoy hotels in Kenya;

|

Cytonn Report: Marriot Bonvoy Presence in Kenya |

||

|

Franchise |

Location |

Number of Rooms and Serviced Apartments |

|

Sankara Autograph Collection Hotel |

Westlands |

168 |

|

Four Points Sheraton Nairobi Airport |

Jomo Kenyatta International Airport (JKIA) |

172 |

|

Four Points Sheraton Nairobi Hurlingham |

Kilimani |

96 |

|

JW Marriott Global Trade Centre |

Westlands |

368 |

|

Total |

|

804 |

Source: Cytonn Research

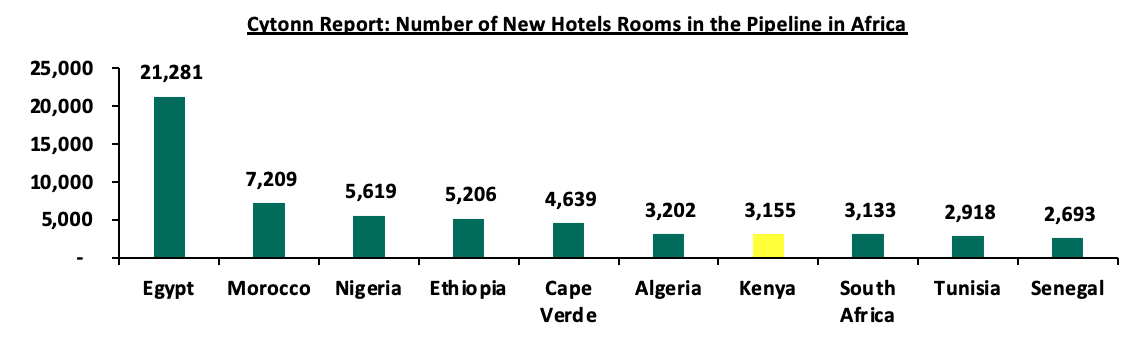

JW Marriott becoming part of the trend towards increased investment in Kenya's hospitality sector shows great signs of recovery and resilience of the sector in the wake of the pandemic. The W Hospitality Group's Hotel Chain Development Pipelines in Africa 2022 report reflects this optimistic trend, revealing that 24 global hotel brands are currently exploring opportunities to develop new hospitality facilities in Kenya. As a result, the country is set to see the addition of 3,155 new hotel rooms from 2023 to the coming years. This influx by global hotel brands will further cement Kenya's position as one of the top ten hotspot countries for new luxury hotels in Africa poising for growth and success of the sector. The graph below shows number of hotel rooms in the pipeline in several African countries;

Source: Hotel Chain Development Pipelines in Africa 2022

We expect continued resilience in the hospitality sector’s performance, fuelled by factors such as: i) continued recognition of Kenya’s hospitality industry by international hospitality agencies such as Henley and Partners Real Estate in their Africa Wealth Report 2023 and through positive accolades awarded to several local and foreign hotel brands based in Kenya such as the World Travel Awards 2022, MICE Awards, Fodor Finest Hotels, among others, which have boosted investors’ confidence in the sector, ii) increased international tourism arrivals into the country, and activities in the conference, leisure, and, sport sectors, following continuous reopening of the country in the post-COVID period with the sector’s performance gearing towards pre-COVID levels as highlighted by Kenya Tourism Research Institute in their Annual Tourism Sector Performance Report - 2022, iii) intensive marketing of Kenya’s tourism market through platforms such as the Magical Kenya and Kenya Tourism Board under the Ministry of Tourism Strategy 2021-2025, and, iv) continuous opening, expansions, and acquisitions and mergers by local and international hotel brands in the country. However, the recent issuance of travel advisories regarding insecurity in certain regions of the country by the United Kingdom (UK), United States of America (USA), Irish, and Canadian governments in February 2023 and the current government’s austerity measures to indefinitely suspend hotel meetings, conferences and trainings by Ministries, State Departments, Agencies (MDAs) will further weigh down the optimum performance of the hospitality sector.

- Regulated Real Estate Funds

- Real Estate Investment Trusts (REITs)

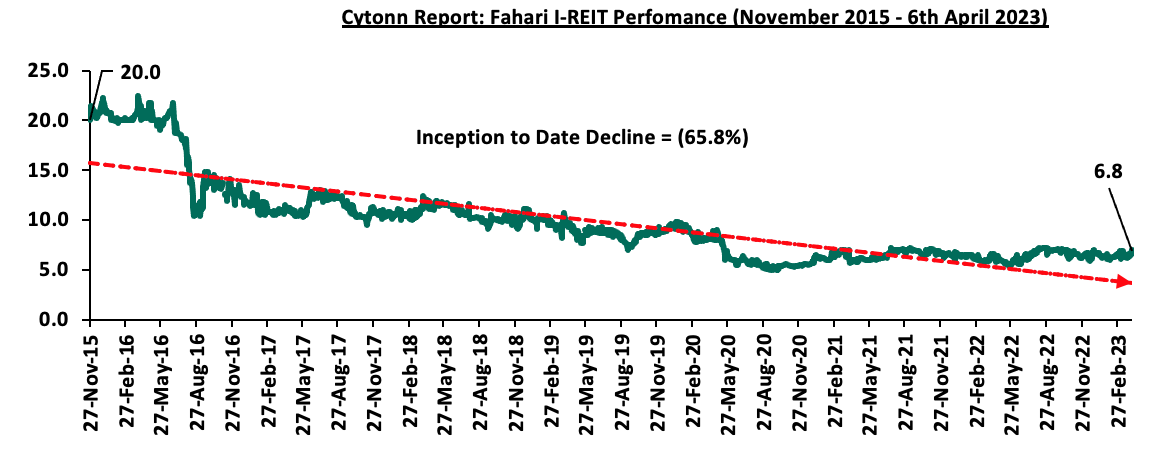

In the Nairobi Securities Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.84 per share. The performance represented a 4.9% gain from Kshs 6.5 per share recorded the previous week, taking it to a 0.9% Year-to-Date (YTD) increase from Kshs 6.78 per share recorded on 3rd January 2023. In addition, the performance represented a 65.8% Inception-to-Date (ITD) loss from the Kshs 20.0 price. The dividend yield currently stands at 9.5%. The graph below shows Fahari I-REIT’s performance from November 2015 to 6 April 2023;

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 23.9 and Kshs 20.9 per unit, respectively, as at 31 March 2023. The performance represented a 19.4% and 4.4% gain for the D-REIT and IREIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 29.6 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 603.2 mn, respectively, since inception in February 2021.

REITs provide numerous advantages, including tax exemptions, consistent and prolonged profits, and diversified portfolios. Despite these benefits, the performance of the Kenyan REITs market remains limited by several factors such as; i) insufficient investor understanding of the investment instrument, ii) time-consuming approval procedures for REIT creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and, iv) high minimum investment amounts set at Kshs 5.0 mn discouraging investments.

- Cytonn High Yield Fund (CHYF)

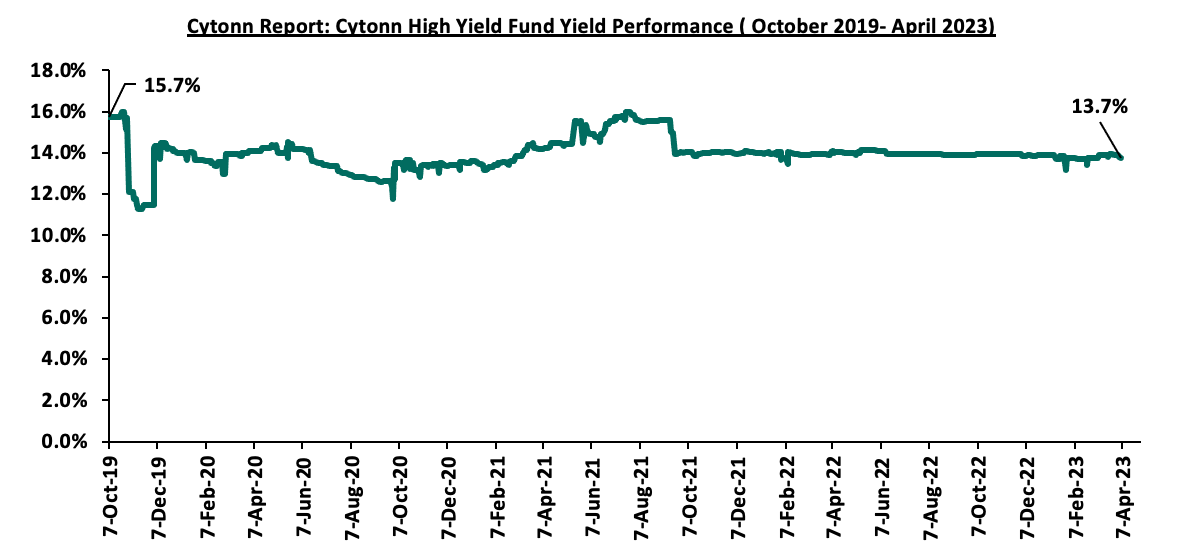

Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 13.7%, 0.2% points decline from 13.9%, recorded the previous week. The performance also represented a 0.2% points Year-to-Date (YTD) decline from 13.9% yield recorded on 1 January 2023 and 2.0% points Inception-to-Date (ITD) loss from the 15.7% yield. The graph below shows Cytonn High Yield Fund’s performance from November 2015 to 6 April 2023;

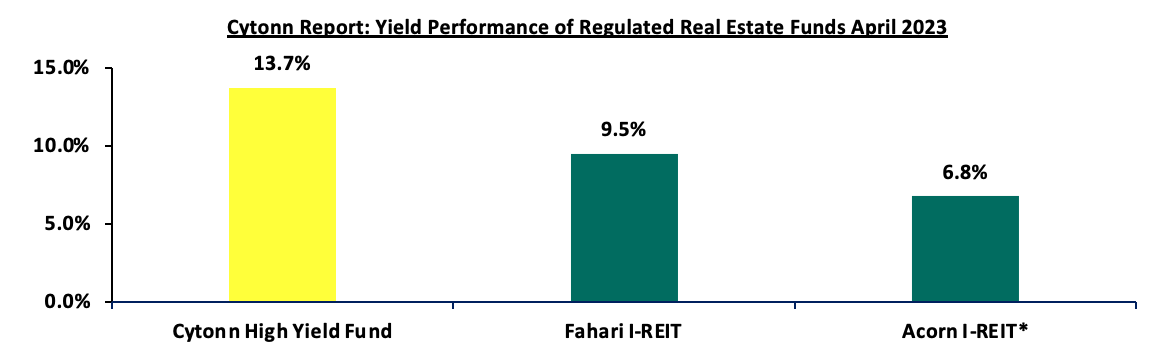

Notably, the CHYF has outperformed other regulated Real Estate funds with an annualized yield of 13.7%, as compared to Fahari I-REIT and Acorn I-REIT with yields of 9.5%, and 6.8% respectively. As such, the higher yields offered by the CHYF makes the fund one of the best alternative investment resource in the Real Estate sector. The graph below shows the yield performance of the Regulated Real Estate Funds;

*FY’2022

Source: Cytonn Research

We expect the performance of Kenya’s Real Estate sector to remain on an upward trajectory, supported by factors such as; i) continuous growth and expansion exhibited by local and international retailers, ii) increased investment in road infrastructural developments by the government which will open up more areas for more opportunities in Real Estate across the country, and, iii) increased activities in the hospitality sector as the economy continues on its recovery path. However, the oversupply of spaces in select sectors, and low investor appetite for REITs are expected to continue optimal performance of the general real estate sector.

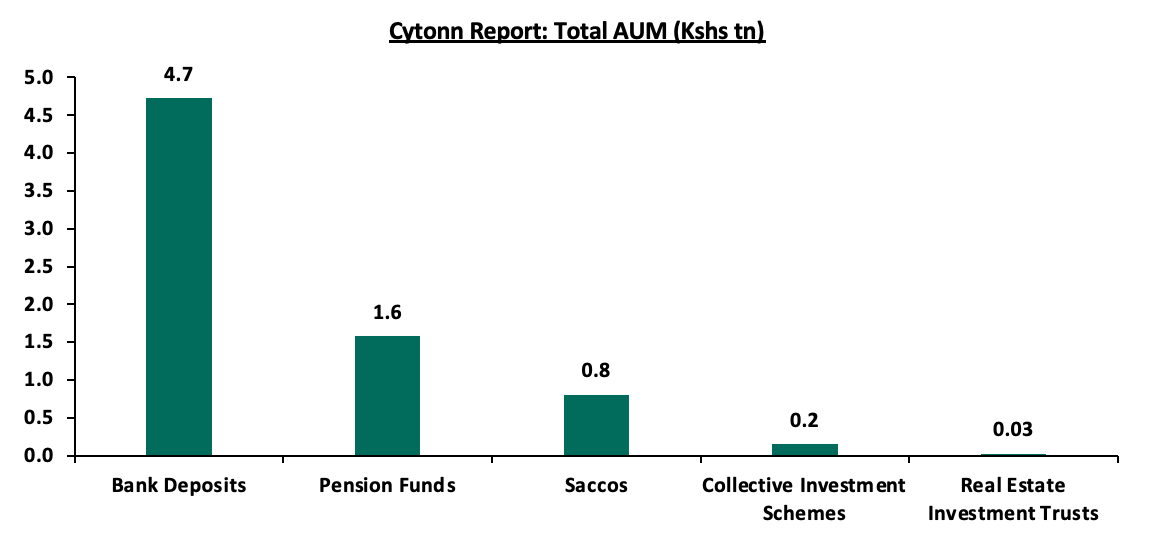

The Pension industry in Kenya has been negatively impacted by the various unprecedented economic occurrences such as the slow rebound of the financial markets after the adverse effects of COVID-19 as well as uncertainties around the general elections which slowed down economic activities in the country. Additionally, the high cost of living occasioned by elevated fuel and food prices as a result of sustained supply constraints have weighed down on the adequacy of disposable income available for saving for retirement as well as the sustainability of the pension industry in Kenya. This is evidenced by the Assets under Management (AUM) growing at a slower rate of 1.2% to Kshs 1.6 tn in 2022, from Kshs 1.5 tn in 2021, compared to 10.6% growth witnessed in 2021 to Kshs 1.5 tn from Kshs 1.4 tn. Further, Kenya is characterized by low saving culture with the Kenya National Bureau of Statistics (KNBS) in the FinAccess Household Survey Report 2021, highlighting that only 12.0% of the adult population in the labor force save for their retirement in Retirement Benefits Schemes (RBSs). Notably, in 2022, Kenyan Court of Appeal gave the nod on the implementation of the National Social Security Fund Act, 2013 to enhance Social Security Protection paid out by National Social Security Fund (NSSF). The new act replaced the NSSF Act Cap 258 of 1965, which only covered workers in the formal employment, with new act requiring employers to contribute 6.0% of employees’ gross earnings to NSSF while the employers matches the contribution, with the maximum contribution capped at Kshs 2,160.0, an increase from the Kshs 400.0 contribution in the previous act. This new regulation is expected to boost the growth of the pension industry both in membership and AUM. Additionally, members will be able to access a bigger retirement package upon retirement.

We have been tracking the performance of Kenya’s Pension schemes with the most recent topicals being Progress of Kenya’s Pension Schemes-2022 done on August 2022 and Kenya Retirement Benefits Schemes FY’2021 Performance done on March 2022. This week, we shall focus on understanding Retirement Benefits Schemes and look into the historical and current state of retirement benefits schemes in Kenya with a key focus on 2022. We shall also analyze other asset classes such as offshore investments that the schemes can tap into to achieve higher returns. Additionally, we shall look into factors and challenges influencing the growth of the RBSs in Kenya as well as the actionable steps that can be taken to improve the pension industry. We shall do this by looking into the following:

- Introduction to Retirement Benefits Schemes in Kenya,

- Historical and Current State of Retirement Benefits Schemes in Kenya,

- Factors and Challenges Influencing the Growth of Retirement Benefits Scheme in Kenya, and,

- Recommendations on Enhancing the Performance of Retirement Benefit Schemes in Kenya;

Section 1. Introduction to Retirement Benefits Schemes in Kenya

Retirement benefits scheme refers to a savings platforms allowing individuals to make regular contributions during their working years where the contributed funds are invested in order to generate returns. The various schemes allow members to make regular contributions during their working years and once a member retires either after attaining the retirement age or earlier due to other factors, mainly ill-health, these contributions plus accrued interest are utilized to provide retirement income to the member. Further, a retirement plan is essential in cushioning retirees from reduced income and ensures decent living after retirement thus reducing old age dependency. According to Retirement Benefits Authority (RBA), retirement schemes in Kenya are categorized based on contributions, mode of payment at retirement, membership and mode of investment. The categories are explained as follows:

- Based on Contributions:

- Defined Benefits Schemes – Defined benefit plans are funded either exclusively by employer contributions or sometimes require employee contributions. The cost of the promises being earned each year are calculated in advance, to advice on the required amount that needs to be contributed each year to keep the scheme healthy, and,

- Defined Contribution Scheme – Here, member’s and employer’s contributions are fixed either as a percentage of pensionable earnings or as a shilling amount. However, members have the freedom to contribute more than the defined rate (Additional Voluntary Contribution). The scheme’s benefits are usually not known and the level of retirement income will depend on level of contributions made over the period, fees by the service provider, investment returns and the cost of buying benefits.

- Based on Mode of Payment at Retirement:

- Pension Scheme – At retirement, a member of a pension scheme may access up to a third of their contributions and contributions made on their behalf plus accrued interest as a lump sum and then the remainder is used to purchase an annuity (pension) that pays a periodic income to the pensioner in their retirement years, usually monthly, and,

- Provident Fund – The scheme offers members payments of lump sums and other accrued benefits to employees upon retirement or to their dependents upon death.

- Type of Membership:

- Occupational Retirement Benefits Scheme - These are schemes that are set up by an employer where only members of their staff are eligible to join. The employees contribute to the scheme and automatically leave once their contract with the employer is over,

- Umbrella Retirement Benefits Scheme – Here, retirement scheme pools the retirement contributions of multiple employers on behalf of their employees. It is a cost-effective scheme reducing the average cost per member and enhancing the overall returns of both the employer and the employees’ contributions, and,

- Individual Retirement Benefits Scheme – Are schemes run by independent financial institutions and individuals contribute directly towards saving for their retirement. The contributions are flexible to accommodate individuals with varying financial capabilities.

- Mode of Investment:

- Segregated Funds – Refers to schemes where contributions by members are invested directly by the Trustees through an appointed Fund Manager. Notably, the Trustees establishes an appropriate Investment Policy which is then implemented by the Fund Manager. The scheme directly holds the investments and the returns are fully accrued to the scheme to earn interest for the members,

- Guaranteed Funds - Are funds offered by insurance companies where the members’ contributions are pooled together and the insurance company guarantees a minimum rate of return. However, should the actual return surpass the minimum guaranteed rate, the insurance company may either top up the minimum rate with a bonus rate of return or reserve the extra return.

Saving for retirement is important since it allows individuals to access income from their savings upon retirements enabling them to sustain the lifestyle they had before retirement. Below are some of the reasons why an individual should join an appropriate Retirement Benefits Scheme:

- Compounded and Tax-free Interest – Savings in a retirement benefits schemes earn compounded interest. This means that your money grows faster as even the interest earned is reinvested and grows. Additionally, investment income of retirement schemes is tax exempt meaning that the schemes have more to reinvest,

- Tax-exemptions on Contributions – Members of Retirement Benefits Scheme enjoy a monthly tax relief on their contributions of up to Kshs 20,000.0 per month, Kshs 240,000 per annum or 30.0% of their monthly salary, whichever is less. As such, this lessens the total income tax deducted from one’s earnings and ensure more capital preservation,

- Use of Pensions Benefit as Mortgage Security – When applying for a mortgage, one can use his savings in the various schemes as security. This is essential as it will enable individuals to own homes without the need to look for security,

- Financial Independence upon Retirement – Old age poverty and dependency is currently a scourge where most parents depend on their children and relatives for survival. According to World Bank, Kenya’s age dependency ratio was at 70.0% in 2021, as slight decline from 72.0% in 2022 indicating that most of the working population have to support more non-working population which are individuals below the age of 15 and old people above 64 years. However, having a concrete retirement plan ensures that an individual remains financially independent upon retirement and avoid being a burden to relatives and other family members ensuring a dignified life, and,

- Ascertaining Income Security – Saving in a Retirement benefits schemes allow individuals to be financially secure by accessing funds in case of job loss, retirement or contract termination as a result of ill-health. Savings will ascertain continued income stream even if you stop working hence protecting you from being dependent and enable you to live comfortably.

Section 2. Historical and the Current State of Retirement Benefits Schemes in Kenya

- Growth of Retirement Benefits Schemes

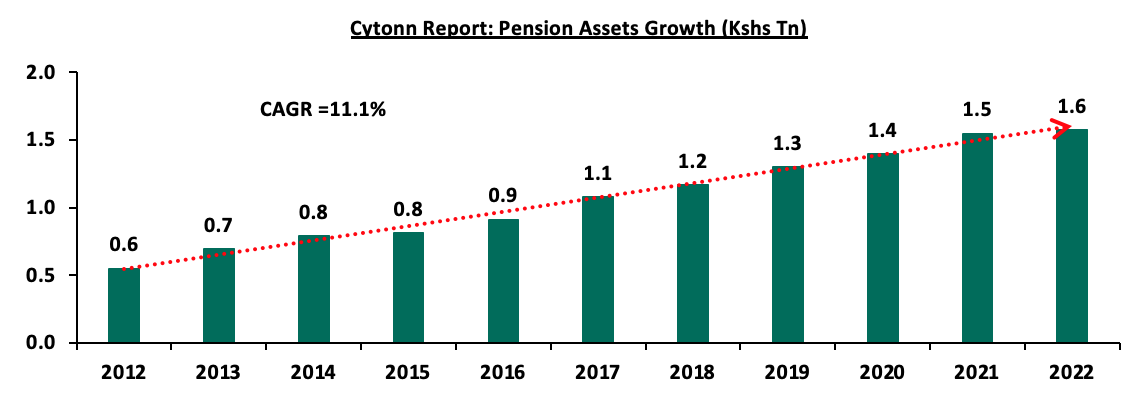

According to the Retirement Benefits Authority (RBA), the retirement benefits schemes industry has registered a significant growth with Assets under Management (AUM) growing at a 10-year CAGR of 11.1% to Kshs 1.6 tn in 2022, from Kshs 0.6 tn in 2012. However, assets grew at a slower rate of 1.2% in 2022 to Kshs 1.6 tn, from Kshs 1.5 tn compared to 10.6% growth in 2021. The diminished growth was partly attributable to the increased cost of living in the country as a result of high inflationary pressures which led to reduced disposable income among the working population. Additionally, the slow rebound of the financial markets after the adverse effects of COVID-19 as well uncertainties around the general elections held in 2022 disrupted business activities in the country negatively impacting the number of people making regular payments to various schemes. The graph below shows the growth of Assets under Management of the retirement benefits schemes over the last 10 years:

Source: Retirement Benefits Authority (RBA)

The graph below shows the Assets under Management of Pensions against other Capital Markets products and bank deposits:

Sources: CMA, RBA, SASRA and REIT Financial Statements

- Retirement Benefits Schemes Allocations and Various Investment Opportunities

Retirement Benefits Schemes allocate the members in various available assets in the markets aimed at preservation of the member’s contributions as well as earn attractive returns. There are various investment opportunities that Retirement Benefits Schemes can invest in such as the traditional asset classes including equities and fixed income as well as alternative investment options such as Real Estate. As such, the performance of Retirement Benefits Schemes on Kenya depends on a number of factors such as;

- Asset allocation,

- Selection of the best performing security within a particular asset class,

- Size of the scheme,

- Risk appetite of members and investors, and,

- Investment horizon.

The Retirement Benefits (Forms and Fees) Regulations, 2000 offers investment guidelines for retirement benefit schemes in Kenya in terms of the asset classes to invest in and the limits of exposure to ensure good returns and that members’ funds are hedged against losses. According to RBA’s Regulations, the various schemes through their Trustees can formulate their own Investment Policy Statements (IPS) to act as a guideline on how much to invest in the asset option and assist the trustees in monitoring and evaluating the performance of the Fund. However, IPSs often vary depending on risk return profile and expectations mainly determined by factors such as scheme’s demography and the economic outlook. The table below represents how the retirement benefits schemes have invested their funds in the past:

|

Cytonn Report: Kenyan Pension Funds’ Assets Allocation |

|||||||||||||

|

Asset Class |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

Average |

Limit |

|

|

Government Securities |

33.8% |

31.0% |

29.8% |

38.3% |

36.5% |

39.4% |

42.0% |

44.7% |

45.7% |

45.8% |

39.2% |

90.0% |

|

|

Quoted Equities |

25.5% |

26.0% |

23.0% |

17.4% |

19.5% |

17.3% |

17.6% |

15.6% |

16.5% |

13.7% |

19.0% |

70.0% |

|

|

Immovable Property |

17.2% |

17.0% |

18.5% |

19.5% |

21.0% |

19.7% |

18.5% |

18.0% |

16.5% |

15.8% |

18.0% |

30.0% |

|

|

Guaranteed Funds |

10.3% |

11.0% |

12.2% |

14.2% |

13.2% |

14.4% |

15.5% |

16.5% |

16.8% |

18.9% |

14.5% |

100.0% |

|

|

Listed Corporate Bonds |

4.4% |

6.0% |

5.9% |

5.1% |

3.9% |

3.5% |

1.4% |

0.4% |

0.4% |

0.5% |

3.1% |

20.0% |

|

|

Fixed Deposits |

4.9% |

5.0% |

6.8% |

2.7% |

3.0% |

3.1% |

3.0% |

2.8% |

1.8% |

2.7% |

3.3% |

30.0% |

|

|

Offshore |

2.2% |

2.0% |

0.9% |

0.8% |

1.2% |

1.1% |

0.5% |

0.8% |

1.3% |

0.9% |

1.2% |

15.0% |

|

|

Cash |

1.3% |

1.0% |

1.4% |

1.4% |

1.2% |

1.1% |

1.2% |

0.9% |

0.6% |

1.1% |

1.1% |

5.0% |

|

|

Unquoted Equities |

0.6% |

0.0% |

0.4% |

0.4% |

0.4% |

0.3% |

0.3% |

0.2% |

0.2% |

0.3% |

0.4% |

5.0% |

|

|

Private Equity |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

0.1% |

0.1% |

0.2% |

0.2% |

0.1% |

10.0% |

|

|

REITs |

0.0% |

0.0% |

0.0% |

0.1% |

0.1% |

0.1% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

30.0% |

|

|

Commercial Paper, non-listed bonds by private companies |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

10.0% |

|

|

Others e.g. unlisted commercial papers |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

0.2% |

0.0% |

10.0% |

|

|

|

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

||

Source: Retirement Benefits Authority

Key Take-outs from the table above are;

- Schemes in Kenya allocated an average of 58.2% of their members’ funds towards government securities and Quoted Equities between the period of 2013 and 2022. The 39.2% average allocation to government securities is the highest among the asset classes attributable to safety assurances of members’ funds because of low risk investments and the increasing yields in the country,

- The allocation towards quoted equities declined to 13.7% in 2022, from 16.5% in 2021 on the back of increased capital flight as foreign investors sold off their investments in the Kenyan equities market due to macroeconomic uncertainties in the country as well a series of interest rate hikes in the developed economies, and,

- Retirement Benefits Schemes investments in offshore markets declined by 0.4% points to 0.9% in 2022, from 1.3% in 2021 as a result of the geopolitical tensions and elevated global inflation consequently reducing the attractiveness of the investments owing to the high risks attached.

Further, we now shift our focus to the performance of the aforementioned asset classes, classified into three broad categories: Fixed Income, Equity, Offshore and Overall Return. Below is a table showing the performances over the period 2013-2022:

|

Cytonn Report: Performance of Different Asset Classes |

|||||||||||

|

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

Average |

|

Fixed Income |

10.7% |

13.3% |

7.4% |

14.8% |

14.5% |

13.8% |

12.8% |

12.8% |

9.6% |

8.0% |

11.8% |

|

Equity |

43.0% |

17.7% |

(11.3%) |

(10.2%) |

28.7% |

(11.0%) |

32.5% |

(10.4%) |

16.9% |

(14.0%) |

8.2% |

|

Offshore |

14.9% |

6.6% |

11.6% |

1.2% |

23.9% |

(11.6%) |

25.7% |

31.7% |

18.5% |

(19.8%) |

10.3% |

|

Overall Return |

20.3% |

14.6% |

1.4% |

6.5% |

18.7% |

5.0% |

17.0% |

7.0% |

11.6% |

1.7% |

10.4% |

Source: ACTSERV Surveys

Key take-outs from the table above include;

- Returns from Equity investments recorded a decline by 30.9% points to 14.0% in 2022, from a 16.9% gain recorded in 2021. The performance was partly attributable to increased sell offs by foreign investors as they exited the market on the back of uncertainties in the country’s macroeconomic performance. Additionally, the interest rate hikes in developed economies such as United States and European Union caused dollar investments to be more attractive and thus lowering their appetite for risky investments in emerging markets such as Kenya. The performance of the equities markets was further evidenced in the Kenyan equities market which was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 23.7%, 12.4% and 16.6%, respectively in 2022. Notably, the allocation towards the asset class also declined to 13.7% in 2022, from 16.5% in 2021 as a result of the sustained poor performance and uncertainty in the bourse,

- Fixed income has continued to offer stable returns with little volatility over the years, recording the highest return in 2022 as compared to the other asset classes that recorded declines during the year, partially attributable increased yields as result of elevated inflationary pressures and continued currency depreciation. However, there has been a continuous decline of the returns over the last 6 years to 8.0%, from 14.5% recorded in 2017. This is mainly attributable to the Central Bank of Kenya (CBK) and other stakeholders’ efforts over the years to maintain a stable interest rate environment. Despite stable returns, fixed income performance recorded a 1.6% points decline to 8.0% in 2022, from 9.6% in 2021 due to tight liquidity in 2022 evidenced by the average interbank rate increasing to 4.9% in 2022, from 4.7% in 2021. Fixed income investments have also outperformed the other asset classes such as equity and offshore investments averaging 11.8% in the period 2013 to 2022 while investments made in offshore and equity asset categories averaged 10.3% and 8.2%, respectively during the same period, and,

- Returns from the Offshore investments recorded the highest decline of 19.8% in 2022, 38.3% points lower than 18.5% gain recorded in 2021. The performance was partly attributable to heightened global economic performance uncertainties on the back of the high global inflationary pressures and sustained geopolitical tensions arising from the ongoing Russia-Ukraine war.

- Other Asset Classes that Retirement Benefit Schemes can Leverage on

Retirement benefits schemes have for a long time skewed their investments towards traditional assets, mostly, government securities and equities market, averaging 54.2% as of 2022, leaving only 45.8% for the other asset classes. In the asset allocation, alternative investments that include immovable property, private equity as well as Real Estate Investments Trusts (REITs) account for an average of only 18.1% against the total allowable limit of 70.0%. This is despite the fact that these asset classes such as REITs offer benefits such as low cost exposure to Real Estate and tax incentives hence potential for better returns. Below, we focus on the asset classes which we believe would play a big role in improving the performance of retirement benefits schemes;

- Offshore Investments

Offshore investments are investments made outside the jurisdiction or country in which the investor resides such as Venture Capital, Mutual Funds, private equity and purchase of precious metals. The investor may be an individual, corporation or a fund looking to take advantage of the tax incentives offered in other countries, or to diversify their portfolio.

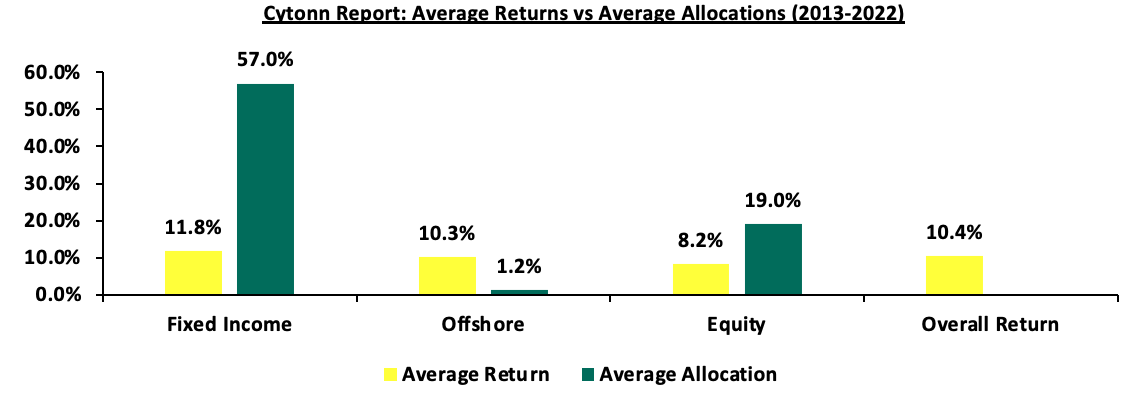

According to RBA regulations, schemes can invest up to 15.0% of their assets in offshore investments in bank deposits, government securities, listed equities, rated corporate bonds and offshore collective investment schemes. However, the allocation between 2013 and 2021 has averaged 1.2% as compared to an average allocation of 39.2% in government securities and 19.0% in equities. This is despite the fact that offshore investments returns have averaged 10.3% since 2013, outperforming the equity asset class which averaged 8.2% during the same period. The chart below shows the average allocations against performance of offshore, fixed income and equities investments since 2013:

Source: ACTSERV Survey

Despite better returns offered by offshore investments, their allocation has remained significantly low as compared to other asset classes. The low allocation in the offshore investments may be due to low financial awareness among trustees, associated high and various bureaucracies involved in decision making. However, the asset category performed poorly in 2022 as a result of high risks associated with offshore investments owing to the ongoing global uncertainties. Despite perceived risks and challenges, we believe diversifying into offshore investments can still help schemes by cushioning against exchange rate risks, inflation and lower returns. Such investments can also protect scheme’s asset when made in countries with laws that prevent against seizure of assets and also prevent adverse losses of member’s funds by cushioning against losses on local investments.

- Alternative Investments (Immovable Property, Private Equity and REITs)

Refers to investments that are supplemental strategies to traditional long-only positions in equities, bonds, and cash. They differ from the traditional investments on the basis of complexity, liquidity, and regulations and can invest in immovable property, private equity and Real Estate Investment Trusts (REITs) to a limit of 70.0% exposure. The schemes allocation has averaged only 18.1% in the period 2013 to 2022, with the vast allocation to immovable property at an average of 18.0% during the period. The low allocation is partly attributable to bureaucracies and insufficient expertise and experience with these asset classes as investing in them requires adequate research and expertise.

Additionally, asset classes such as listed REITs have performed poorly over time. However, the listed Real Estate, ILAM Fahari I-REIT gained by 0.9% Year-to-Date (YTD) to Kshs 6.84, from Kshs 6.78 per share recorded at the beginning of the year. This represents a 65.8% Inception-to-Date (ITD) loss from the Kshs 20.0 price during 2015. Further, schemes can also take advantage of regulated funds that invest in Real Estate such as Cytonn High Yield Fund (CHYF) which has continued to offer higher returns at 13.7% on Year-to-Date (YTD). Additionally, we believe that there is value in the alternative markets that schemes can take advantage of. Some of the key advantages of alternatives investments include:

- Diversification: Investing in a variety of asset classes such as REITs, fixed income securities and equities helps to reduce risk when incorporated into a single investment, as it spreads the investments across diverse locations, sectors, platforms and classes. REIT institutions typically own physical assets such as land and buildings, and frequently enter into lengthy leases with their tenants. This makes REITs some of the most dependable investments on the market. This diversification creates the opportunity for blended portfolio to earn higher returns while reducing the potential for negative or low returns, and,

- Competitive Long-Term Returns: REITs provide robust and long-term yields. This makes them an ideal component of a successful and efficient portfolio.

- Performance of the Retirement Benefit Schemes

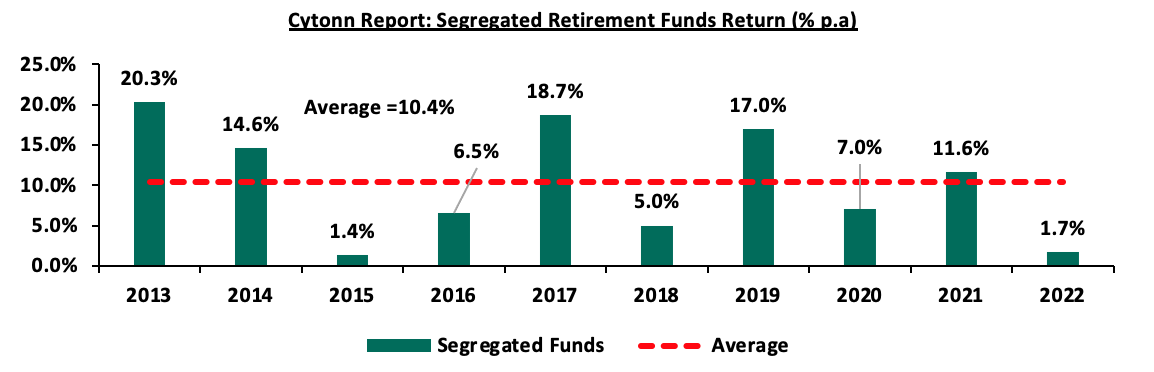

According to the ACTSERV Q4’2022 Pension Schemes Investments Performance Survey, the ten-year average return for segregated schemes over the period 2013 to 2022 was 10.4% with the performance fluctuating over the years to a high of 20.3% in 2013 and a low of 1.4% in 2015 reflective of the markets performance. Notably, segregated retirement benefits schemes returns significantly declined by 9.9% points to 1.7% in 2022, from the 11.6% recorded in 2021. The performance was largely attributable to the 14.0% decline recorded in the equities portfolio in 2022, from the 16.9% gain recorded in 2021. The equities portfolio performance in 2022 was mainly on the back of increased capital flight as foreign investors sold off their investments in the Kenyan equities market due to macroeconomic uncertainties in the country as well a series of interest rate hikes in the developed economies. Additionally, offshore portfolio recorded a decline of 19.8% recorded in 2022 from 18.5% growth recorded in 2021, partly attributable to heightened global economic performance uncertainties as a result of geopolitical tensions arising from the ongoing Russia-Ukraine war. However, the performance was supported by fixed income investments held in the scheme which increased to 8.0% in 2022 despite declining from 9.6% in 2021. The chart below highlights the performance of the segregated pension schemes over a 10-year period:

Source: ACTSERV Surveys

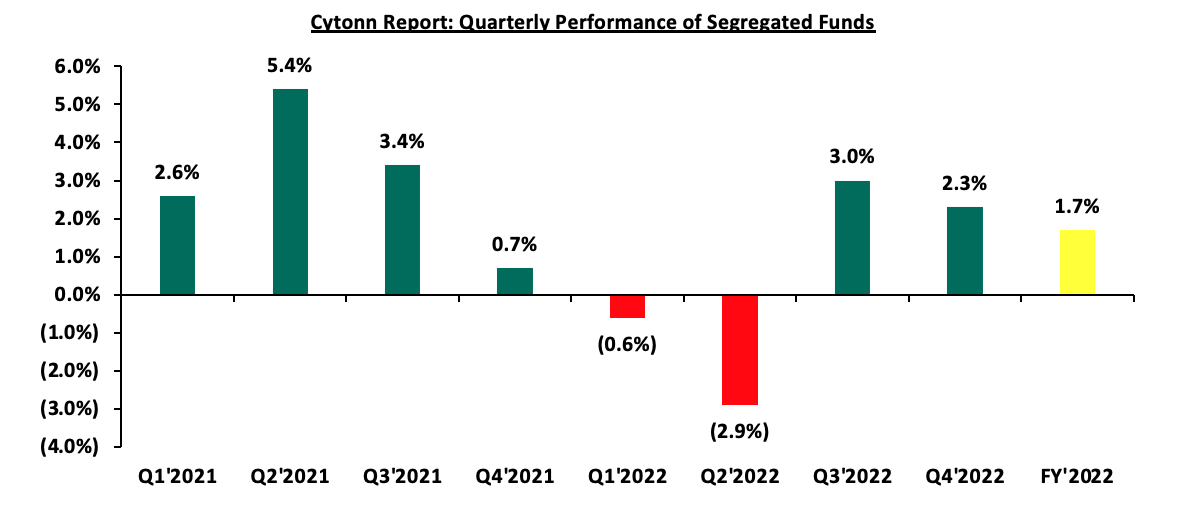

The chart below shows the quarterly performance of segregated pension schemes since 2021:

Source: ACTSERV Survey Reports (Segregated Schemes)

The key take-outs from the graph include:

- Schemes recorded a 3.0% gain in Q3’2022, representing a 0.4% decline from the 3.4% recorded in Q3’2021. The performance was largely driven by a 6.3% gain in equities in comparison to the 5.2% gain recorded in Q3’2021, largely attributable to improved investor sentiment following a peaceful election ending the long electioneering period. The gain was however weighed down by the slower growth in fixed income and offshore investments which gained by 2.3% and declined by 2.8% in Q3’2022 in comparison to the 2.9% and 1.9% growths recorded in Q3’2021, respectively,

- Overall returns for Q4’2022 increased by 1.6% points to 2.3%, from 0.7% in Q4’2021 largely due to the gains recorded in the fixed income portfolio which increased to 2.9% in Q4’2022 from 2.2% in Q4’2021. The performance was further supported by the equity portfolio returns improving to negative 0.1% in Q4’2022, from a decline of 4.4% in Q4’2021. The improved performance of the fixed income was mainly on the back of easing liquidity in the money market with the interbank rate declining to 5.1% in Q4’2022, from 5.2% in Q1’2022. Further, equity portfolio performance was partly due to the improved investor sentiments arising from the easing inflation, favourable weather conditions and steady fuel prices hence improved business environment, and,

- In Q2’2022, schemes recorded the worst performance, declining by 8.3% points to a negative of 2.9% compared to a gain of 5.4% in Q2’2021. This was largely due to the negative returns of 15.4% by equities, compared to the 11.9% gain recorded in Q2’2021 amidst rising inflation and diminished demand as a result of geopolitical tensions.

Going forward, we expect the schemes’ performance to remain subdued given the current macroeconomic performance such as high inflation, currency depreciation and expected slowdown in economic growth amongst others. Additionally, we expect the scheme’s performance to be weighed down by the equities market has been on a downward trajectory with NASI, NSE 20 and NSE 25 declining by 11.5%, 3.2% and 5.4%, respectively, in Q1’2023, similar to the declining trend in 2022. The poor equities performance is mainly on the back of capital flight as investors move to developed markets because of the continued hike in the interest rates. Risks also lie on the downside given the uncertainties arising from global tensions, unpredictable weather patterns, currency depreciation and elevated inflation. However, we expect the performance to be supported by the continued economic recovery albeit at a slower rate.

Section 3. Factors Influencing the Growth of Retirement Benefit Schemes

The retirement benefit scheme industry in Kenya has registered significant growth in the past 10 years with assets under management growing at a CAGR of 11.1% to Kshs 1,576.2 bn in 2022 from Kshs 550.0 bn in 2012. The growth is attributable to:

- Increased Pension Awareness – More people are becoming increasingly aware of the importance of pension schemes and as such, they are joining schemes to grow their retirement pot which they will use during their golden years. According to the Retirement Benefit Statistical Digest 2021, the total contributions increased by a 5-CAGR of 13.8% to Kshs 135.5 bn in 2021 from Kshs 70.9 bn in 2015,

- Legislation – The Retirement Benefit Authority introduced the Retirement Benefits (Good Governance Practices) Guidelines, 2018 and Retirement Benefits (Treating Customers Fairly) Guidelines, 2019, with the intention of ensuring that pension schemes are well anchored on practices that ensure effective and efficient service delivery of the pension schemes. This has raised standards in the way retirement schemes conduct their day to day businesses and increase the confidence in the pension industry. Additionally, the implementation of the National Social Security Fund Act, 2013 is expected to foster the growth of the pension industry by allowing both the employees in the formal and informal sector to save towards their retirement, as opposed to the previous NSSF act cap 258 of 1965, which was only targeting the employees in the formal sector,

- Tax Incentives - Members of Retirement Benefit Schemes are entitled to maximum tax-free contribution of Kshs 20,000 monthly or 30.0% of their monthly salary, whichever is less. Consequently, pension scheme members enjoy a reduction in their taxable income and pay lesser tax. This incentive has motivated more people to not only register but also increase their regular contributions to pension schemes,

- Relevant Product Development – Pension schemes are not only targeting people in formal employment but also those in the informal employment through the individual pension schemes, with the main aim of improving the pension coverage in Kenya. To achieve this, most Individual schemes have come up with flexible plans that fits various individuals in terms of affordability and convenience. Additionally, the National Social Security Fund Act, 2013 contains a provision for self-employed members to register as members of the fund, with the minimum aggregate contribution in a year being Kshs 4,800 with the flexibility of making the contribution by paying directly to their designated offices or through mobile money or any other electronics transfers specified by the board,

- Demographics - Kenya’s rising population has played a big role in supporting the pensions industry in Kenya. The young population aged 15-24, currently at a population of 10.4 mn approximately 19.6% of the total population, has grown rapidly with the United Nations’ projecting that the corresponding population of youth in Kenya aged 15-24 years and ready to join the workforce will increase to 18.0 mn, from 9.5 mn over the period 2015 to 2065. This will support the continuous increase in people entering joining the workforce and saving for retirement. Which will consequently increase scheme membership significantly, and,

- Technological Advancement – The adoption of technology into pension schemes has improved the efficiency and management of pension schemes. Additionally, the improvement of mobile penetration rate and internet connectivity has enabled members to make contributions and track their benefits from the convenience of their mobile phones.

Challenges that Have Hindered the Growth of Retirement Benefit Schemes

Despite the growth of the Retirement Benefit industry, the industry still faces a number of challenges that impedes its growth. Some of the factors that hinder growth include:

- Market Volatility – For segregated schemes, the investment returns are not guaranteed and vary depending on the market volatility. In 2022, the market volatility, witnessed in the in the Equities and Offshore investments which recorded declines of 14.0% and 19.8% respectively led the schemes to record a 1-year return of 1.7% in 2022, a decline from the 11.6% return recorded in 2022, according to the ACTSERV Pension Schemes Investment Performance Survey (Quarter 4, 2022) report,

- High Unemployment Rate – According the Kenya National Bureau of Statistics Q4’2022 labour report, 6% of the Kenya’s 29.1 mn of the working age population aged between 15-64 years are unemployed. Such status makes it extremely difficult for them to commit to pension contributions towards their retirement,

- Access of Savings before Retirement - In retirement benefit schemes, members of Individual pension schemes can be able to access 100.0% of their contributions, provided that those contributions do not consist of the contributions made by former employer when transferring into the scheme. As for umbrella and occupation schemes, employees can only access 50.0% of their total benefits. This gives employees access to their savings before actually retiring because of losing a job or leaving a particular employer. However, such actions can always prove to be shortsighted since it significantly depletes the value of savings upon retirement and will reduce the growth of the sector,

- Low Pension Coverage in the Informal Sector – According to the Retirement Benefit Statistical Digest 2021, there are 266,764 members registered in the individual pension schemes. This is significantly low considering that according to the Kenya National Bureau of Statistics Economic Survey report 2022 , there are 15.2 million people engaged in the informal sector,

- Unremitted Contributions – Umbrella schemes and occupational schemes have over the years grappled with the issue unremitted contribution from employers due to financial challenge and this has led to some pension scheme being underfunded. Consequently, according to the Retirement Benefit Statistical Digest 2021, this has resulted in total unremitted contribution to increase to Kshs 42.8 bn in 2021, from Kshs 34.7 bn in 2020, and,

- Delayed Processing and Payment of Benefits - Payments of members benefits undergo a number of process from determination of total accrued benefits by the pension scheme administrator to approval of payment by the Trustees of pensions schemes and in the case of Occupational or umbrella schemes, the employer has to give approval, before the benefits finally reaches the members. Delays may occur as the benefits files moves form one service provider to there. This is quite disadvantageous especially for those members who have reached the age of retirement. These delays, consequently, discourages those not in pensions schemes to shy away from joining.

Section 4. Recommendation on Enhancing the Performance of Retirement Benefit Schemes in Kenya

Despite the challenges facing the Retirement Benefit schemes, the RBA in collaboration with the service providers can work together to address these challenges. Some of the actionable steps that can be taken to address the aforementioned challenges include:

- Diversification of Investments – Currently, the allocation to traditional assets such as Government securities and Equities constitute 59.5% of the total Asset under Management as at 31st December 2022. Fund managers of pension schemes should consider investing in alternative investments such as structured products, Real estate notes, private equities and Commercial papers to diversify their portfolio. There are numerous benefits to investing in alternative investments with key ones being high returns and low correlation of returns as they have their own value that is not dependent on factors that affect traditional investments such as dwindling investor interest occasioned by volatility, and are thus able to provide real return to the investor,

- Mass Education – The Retirement Benefit Authority and the service providers in the retirement benefit industry can adopt initiatives such as media campaigns and strategic collaboration with county governments, professional associations, religious institutions, SACCOs, as well as welfare associations that are closer to the masses to educate citizens on the importance of saving for retirement. This will help demystify that pensions schemes are not just for those in formal employment,

- Registration of More Service Providers – By having many diverse players in the pensions industry, it will lead to a more competitive environment that will ultimately lead to more innovations in terms of product development and better service delivery in the pensions market,

- Extending the limits on withdrawal to voluntary benefits in individual schemes - The RBA has provided withdrawal limits on benefits before retirement age mostly to umbrella, occupational pension schemes and personal schemes for savings transferred from occupational or umbrella schemes. As such, members of individual pension schemes are able to withdraw their benefits for which the trustees have given approval at any time before retirement. We believe that extending the withdrawal limits to the individual schemes will go a long way in ensuring that individuals have enough money at retirement and the pensions industry continues growing as scheme managers will have more funds and enough time to make long term investments, and,

- Proper Governance – The RBA has outlined the investment guidelines which caps the maximum allocation of the AUM to the various allowed asset classes that pension schemes can invest. At the same time, pension schemes are required by law to have Investment Policy Statement (IPS), which is a document prepared by the schemes investment advisor/ actuary that outlines the general investment guidelines, uniquely tailored towards a particular scheme based on the schemes profile. The Trustees should strive to ensure that Schemes are compliant with both the RBA guidelines and the IPS to prevent the schemes from taking extremes risk that might potentially lead to members losing their benefits.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.