Kenya’s FY'2021/2022 Budget Review, & Cytonn Weekly #24/2021

By Research Team, Jun 20, 2021

Executive Summary

Fixed Income

During the week, T-bills remained oversubscribed, with the overall subscription rate coming in at 152.9%, a decline from the 181.8% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 8.2 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 205.0%, a decline from the 209.7% recorded the previous week. The subscription rate for the 364-day paper declined to 172.3%, from 243.0% recorded the previous week, while that of the 182-day paper increased to 112.5%, from 109.3% recorded the previous week. The yields on all the three papers declined; with the 91-day, 182-day and 364-day paper declining by 10.4 bps, 19.5 bps and 54.3 bps, to 7.0%, 7.5% and 8.1%, respectively, with the decline in yields being mainly attributable to the government continuing to reject expensive bids as we approach the end of the current fiscal year. In the Primary Bond Market, there was an oversubscription for this month’s bond offers, FXD1/2019/20 and FXD1/2012/20, with the overall subscription rate coming in at 216.4%, attributable to the ample liquidity in the money market;

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum wholesale and retail prices for fuel prices in Kenya effective 15th June 2021 to 14th July 2021, highlighting that the price of Super Petrol increased by 0.6% to Kshs 127.1 per litre from Kshs 126.4 per litre previously, while the prices of Diesel and Kerosene remained unchanged at Kshs 107.7 per litre, and Kshs 97.9 per litre, respectively. Also, the National Treasury gazetted the revenue and net expenditures for the first eleven months of FY’2020/2021, closing 31st May 2021, highlighting that the total revenue collected as at the end of May 2021 amounted to Kshs 2.4 tn, equivalent to 80.1% of the revised target of Kshs 2.9 tn while total expenditure also amounted to Kshs 2.4 tn, equivalent to 80.1% of the revised target of Kshs 2.9 tn;

Equities

During the week, the equities market recorded mixed performance, with NSE 20 declining by 0.6%, while NASI and NSE 25 remained relatively unchanged increasing marginally by 0.03% and 0.1%, respectively. This week’s performance took their YTD performance to gains of 1.5%, 13.4% and 9.9% for NSE 20, NASI and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as BAT, NCBA Group and EABL of 3.1%, 2.7%, and 0.5%, respectively;

Real Estate

During the week, real estate developer Acorn Holdings through its subsidiary Spruce Properties Limited Liability Partnership (LLP), launched the construction of its Kshs 1.9 bn student accommodation hostels in Nairobi’s Karen under the Qwetu and Qejani brands. Absa Bank Kenya, partnered with Property developer Mi Vida Homes to provide mortgage finance to middle income earners seeking affordable housing within the Nairobi region. Additionally, International Finance Corporation (IFC), the World Bank’s private investment arm, signed a deal with Belco Realty a real estate development firm, to support the launch and development of Kongowea Villagea mixed-use affordable housing initiative consisting of 1,379 residential units and over 4,500 SQM of retail and commercial space in Kongowea, Mombasa County. In the retail sector, Optica Limited, a local eye-wear retailer, opened its 43rd Kenyan outlet in Gateway Mall along Mombasa Road as part of the retailer’s expansion strategy to the geographical outreach of its products and services. In the hospitality sector, Kenyan government through the Ministry of Foreign Affairs, lifted the ban on passenger flights between Nairobi and London, with flights expected to resume on June 26th 2021. Additionally, the United States of America (USA) lowered Kenya’s travel advisory from level 4 to level 2 citing moderate levels of Covid-19 in the country, having retained the highest level of advisory since April 2021;

Focus of the Week

Following the release of the Kenya’s FY’2021/2022 National Budget, this week we analyze the fiscal components of the budget including revenue expectation, expenditure and public debt. We shall also look at how Kenya’s Budget compares to Tanzania’s and Uganda’s FY’2021/2022 Budgets which were also presented on 10th June 2021.

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.27%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.54% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupancy. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

For recent news about the group, see our news section here.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained oversubscribed, with the overall subscription rate coming in at 152.9%, a decline from the 181.8% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 8.2 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 205.0%, a decline from the 209.7% recorded the previous week. The subscription rate for the 364-day paper declined to 172.3%, from 243.0% recorded the previous week, receiving bids worth Kshs 17.2 bn against the offered amounts of Kshs 10.0 bn, while the subscription rate for the 182-day paper increased to 112.5%, from 109.3% recorded the previous week, receiving bids worth Kshs 11.3 bn against the offered amounts of Kshs 10.0 bn. The yields on all the three papers declined; with the 91-day, 182-day and 364-day paper declining by 10.4 bps, 19.5 bps and 54.3 bps, to 7.0%, 7.5% and 8.1%, respectively. The government continued to reject expensive bids, accepting Kshs 17.3 bn out of the Kshs 36.7 bn worth of bids received, translating to an acceptance rate of 47.1%.

In the Primary Bond Market, there was an oversubscription for this month’s bond offers, with the overall subscription rate coming in at 216.4%, having received Kshs 64.9 bn compared to the Kshs 30.0 bn on offer. The government continued to reject expensive bids, accepting only Kshs 19.7 bn of the Kshs 64.9 bn received, translating to a 30.3% acceptance rate. The Central Bank of Kenya had re-opened 2 bonds, FXD1/2019/20 and FXD1/2012/20 with effective tenors of 17.9 years and 11.4 years, and coupons of 12.9% and 12.0%, respectively, in a bid to raise Kshs 30.0 bn for budgetary support. Investors preferred the longer-tenure issue i.e. FXD1/2019/20, which received bids worth Kshs 41.0 bn, representing 63.2% of the total bids received. The weighted average rate of accepted bids for the two bonds came in at 13.3% and 12.5%, for FXD1/2019/20 and FXD1/2012/20, respectively.

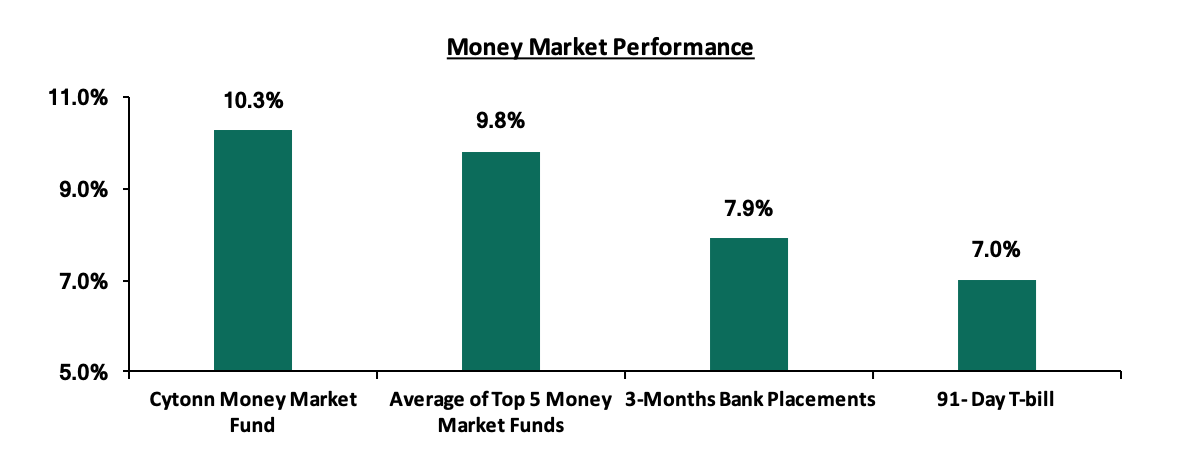

In the money markets, 3-month bank placements ended the week at 7.9% (based on what we have been offered by various banks), while the yield on the 91-day T-bill declined by 10.4 bps to 7.0%. The average yield of the Top 5 Money Market Funds declined to 9.8%, from the 9.9% recorded the previous week. The yield on the Cytonn Money Market Fund declined to 10.3%, from 10.4% recorded last week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 18th June 2021:

|

Money Market Fund Yield for Fund Managers as published on 18th June 2021 |

|||

|

Rank |

Fund Manager |

Daily Yield |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

9.78% |

10.27% |

|

2 |

Nabo Africa Money Market Fund |

9.59% |

10.02% |

|

3 |

Zimele Money Market Fund |

9.56% |

9.91% |

|

4 |

GenCapHela Imara Money Market Fund |

9.02% |

9.44% |

|

5 |

CIC Money Market Fund |

9.10% |

9.43% |

|

6 |

Alphafrica Kasha Money Market Fund |

8.94% |

9.31% |

|

7 |

Madison Money Market Fund |

8.92% |

9.30% |

|

8 |

Sanlam Money Market Fund |

8.82% |

9.22% |

|

9 |

Co-op Money Market Fund |

8.55% |

8.93% |

|

10 |

Dry Associates Money Market Fund |

8.33% |

8.65% |

|

11 |

Apollo Money Market Fund |

8.51% |

8.57% |

|

12 |

British-American Money Market Fund |

8.18% |

8.50% |

|

13 |

NCBA Money Market Fund |

8.02% |

8.33% |

|

14 |

ICEA Lion Money Market Fund |

8.00% |

8.33% |

|

15 |

Old Mutual Money Market Fund |

7.50% |

7.76% |

|

16 |

AA Kenya Shillings Fund |

6.16% |

6.34% |

Liquidity:

During the week, liquidity in the money market eased, with the average interbank rate declining to 4.3% from 4.5% recorded the previous week, partly attributable to government securities maturities and redemptions worth Kshs 64.8 bn. The average interbank volumes declined by 27.1% to Kshs 7.5 bn, from Kshs 10.2 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on all the Eurobonds were on an upward trajectory, with the yields on the 10-year bond issued in 2014, 10-year bond issued in 2018, 30-year bond issued in 2018, 7-year bond issued in 2019 and the 12-year bond issued in 2019 increasing to 3.3%, 5.2%, 7.3%, 4.6% and 6.2%, respectively, from 3.0%, 5.1%, 7.2%, 4.5% and 6.1% recorded the previous week. Below is a summary of the performance:

|

Kenya Eurobond Performance |

|||||

|

|

2014 |

2018 |

2019 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

|

31-Dec-2020 |

3.9% |

5.2% |

7.0% |

4.9% |

5.9% |

|

31-May-21 |

3.1% |

5.3% |

7.3% |

4.7% |

6.2% |

|

11-Jun-21 |

3.0% |

5.1% |

7.2% |

4.5% |

6.1% |

|

14-Jun-21 |

3.0% |

5.1% |

7.2% |

4.5% |

6.1% |

|

15-Jun-21 |

3.1% |

5.3% |

7.3% |

4.7% |

6.2% |

|

16-Jun-21 |

3.4% |

5.2% |

7.3% |

4.8% |

6.3% |

|

17-Jun-21 |

3.4% |

5.3% |

7.4% |

4.6% |

6.3% |

|

18-Jun-21 |

3.3% |

5.2% |

7.3% |

4.6% |

6.2% |

|

Weekly Change |

0.3% |

0.1% |

0.1% |

0.1% |

0.1% |

|

MTD Change |

0.2% |

(0.1%) |

0.0% |

(0.1%) |

0.0% |

|

YTD Change |

(0.6%) |

0.0% |

0.3% |

(0.3%) |

0.3% |

Source: Reuters

During the week, the National Treasury disclosed that Kenya’s new 12-year Eurobond issue recorded an oversubscription of 5.4x, with the government receiving bids worth USD 5.4 bn (Kshs 582.1 bn) compared to the USD 1.0 bn (Kshs 107.8 bn) on offer. The Eurobond will be the fourth issued by the Government of Kenya and is the first new Eurobond issued in two years. The previous Eurobond, issued in 2019, recorded an oversubscription of 4.5x and raised USD 2.1 bn (Kshs 226.4 bn) in two tranches of USD 900.0 mn (Kshs 97.0 bn) for a seven-year paper and USD 1.2 bn (Kshs 129.4 bn) for a 12-year paper. The government exercised fiscal discipline during the issue, accepting only the targeted USD 1.0 bn despite the oversubscription and competitive pricing. The oversubscription reflects positive sentiment towards the Kenyan economy by global markets, fueled by the country’s Economic Recovery Programme supported by the IMF, coupled with the USD 750.0 mn concessional loan received from the World Bank last week. The issue was priced at 6.3%, 1.7% points lower than the 12-year 2019 issue which was priced at 8.0%. Citi Bank and JP Morgan acted as Joint Lead Managers for the issue, with NCBA Bank and I&M Bank acting as Co-Lead Managers.

In our view, the stance taken by treasury in only accepting the targeted USD 1.0 bn is commendable. The principal repayment of the issue will be done in equal instalments, on January 2033 and January 2034, to ease the burden of amassing huge amounts of dollars when the Eurobond falls due. Key to note is that the IMF set a limit of USD 5.0 bn that the government can tap into from the Eurobond market under the IMF programme and as such, the government still has leeway to borrow an additional USD 4.0 bn (Kshs 431.2 bn) under the IMF programme. However, with Kenya’s public debt standing at Kshs 7.3 tn as at March 2021, the government should exercise fiscal discipline and focus on fiscal consolidation measures to bridge the fiscal deficit, which is projected at 7.5% of the GDP in order to avoid debt distress in the medium to long-term.

Kenya Shilling:

During the week, the Kenyan shilling appreciated against the US dollar by 0.1%, closing the week at Kshs 107.8, from Kshs 107.9 recorded the previous week, mainly attributable to subdued demand for the dollar during the week and the positive news on the Eurobond issue. On a YTD basis, the shilling has appreciated by 1.3% against the dollar, in comparison to the 7.7% depreciation recorded in 2020. Despite the recent appreciation, we expect the shilling to remain under pressure in 2021 as a result of:

- Rising uncertainties in the global market due to the Coronavirus pandemic, which has seen investors continue to prefer holding their investments in dollars and other hard currencies and commodities, and,

- Demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally.

The shilling is however expected to be supported by:

- The Forex reserves, currently at USD 7.5 bn (equivalent to 4.6-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- The stable current account position which is estimated to remain at a deficit of 5.2% of GDP in 2021,

- Improving diaspora remittances evidenced by a 22.3% y/y increase to USD 315.8 mn in May 2021, from USD 258.2 mn recorded over the same period in 2020, which have cushioned the shilling against further depreciation, and,

- The dollar inflows from the IMF and World Bank loans in addition to the Eurobond issue.

Weekly Highlights:

I. Fuel Prices

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum wholesale and retail prices for fuel prices in Kenya effective 15th June 2021 to 14th July 2021. Below are the key take-outs from the statement:

- The price of Super Petrol increased by 0.6% to Kshs 127.1 per litre from Kshs 126.4 per litre previously, while the prices of Diesel and Kerosene remained unchanged at Kshs 107.7 per litre, and Kshs 97.9 per litre, respectively. Notably, this is the third consecutive month that the Diesel and Kerosene prices have remained unchanged.

- The mixed performance in fuel prices was attributable to:

- The increase in the average landed cost of imported Super Petrol by 1.5% to USD 496.1 per cubic meter in May 2021, from USD 488.7 per cubic meter in April 2021,

- The increase in the average landed costs for Diesel by 5.1% to USD 462.0 per cubic meter in May 2021, from USD 439.6 per cubic meter in April 2021,

- The increase in the average landed cost for kerosene, which increased by 4.4% to USD 449.4 per cubic meter in May 2021, from USD 430.4 per cubic meter in April 2021,

- The increase in the Free on Board (FOB) price of Murban crude oil in May 2021 by 5.9% to USD 67.7 per barrel, from USD 63.9 per barrel in April 2021, and,

- The Kenyan shilling appreciated by 0.2% against the dollar to close at Kshs 107.6 in May 2021, from Kshs 107.4 in April 2021.

Key to note, Diesel and Kerosene prices have remained unchanged for three consecutive months despite increases in the average landing costs of the products, attributable to a reduction in Oil Marketing Companies’ (OMCs) margins during the period. The margins for Diesel and Kerosene have reduced by 35.3% and 51.1% to Kshs 8.0 per litre and Kshs 6.0 per litre respectively in June 2021, from Kshs 12.4 per litre in March 2021 for both Diesel and Kerosene, with the margin for Super Petrol remaining unchanged at Kshs 12.4. The reduction in margins during the period is in line with the Ministry of Petroleum and Mining’s plan to protect consumers against rising global crude prices, with OMCs being compensated at a refund rate equivalent to the margin reduction per litre per product for pump prices.

We expect pressure on the inflation basket going forward given the projected increase in global fuel prices which have increased by 44.0% to USD 72.3 per barrel this week, from USD 50.2 in December 2020. These are the highest prices we have seen over the last two years. The rise in global prices is attributable to the rise in demand for oil in tandem with the reopening of global economies, with the rise in demand outpacing supply growth despite Organization of the Oil Exporting Countries (OPEC) agreeing to ease supply cuts.

- Revenue and Net Exchequer for FY’2020/2021

During the week, the National Treasury gazetted the revenue and net expenditures for the first eleven months of FY’2020/2021, ending 31st May 2021. Total revenue collected as at the end of May 2021 amounted to Kshs 2.4 tn, equivalent to 80.1% of the revised target of Kshs 2.9 tn and is 83.3% of the prorated estimates. Cumulatively, Tax revenues amounted to Kshs 1.3 tn, equivalent to 89.3% of the target of Kshs 1.5 tn. The total expenditure amounted to Kshs 2.4 tn, equivalent to 80.1% of the revised budget of Kshs 2.9 tn and is 83.2% of the prorated expenditure estimates. Below is a summary of the performance:

|

FY'2020/2021 Budget Outturn - As at 31st May 2021 |

|||

|

Amounts in Kshs billions unless stated otherwise |

|||

|

Item |

12-months Revised Estimates |

11-months Actual |

Percentage Achieved |

|

Opening Balance |

48.0 |

48.0 |

100.0% |

|

Tax Revenue |

1,469.7 |

1,313.1 |

89.3% |

|

Non-Tax Revenue |

124.3 |

80.6 |

64.8% |

|

External Loans & Grants |

418.8 |

124.4 |

29.7% |

|

Domestic Borrowings |

853.8 |

770.6 |

90.3% |

|

Other Domestic Financing |

28.5 |

21.8 |

76.5% |

|

Total Revenue |

2,943.2 |

2,358.5 |

80.1% |

|

Recurrent Exchequer issues |

1,084.4 |

907.0 |

83.6% |

|

CFS Exchequer Issues |

1,073.7 |

899.6 |

83.8% |

|

Development Expenditure & Net Lending |

401.4 |

286.0 |

71.3% |

|

County Governments + Contingencies |

383.6 |

263.5 |

68.7% |

|

Total Expenditure |

2,943.2 |

2,356.1 |

80.1% |

|

Fiscal Deficit excluding Grants |

(418.8) |

(122.0) |

29.1% |

|

Total Borrowing |

1,272.6 |

895.0 |

70.3% |

The revenue underperformance for FY’2020/2021 was expected given the ravaging effects of the COVID-19 pandemic on the economy for most parts of 2020. In our view, we expect the government to fall short of its revenue target as it currently has Kshs 122.0 bn in deficits. With less than a month before the end of the current fiscal year, we believe that the government will continue to borrow aggressively to bridge the Kshs 122.0 bn deficit. For an in-depth analysis on the FY'2020/2021 Budget Outturn, see our topical.

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the government as they reject expensive bids. The government is 5.3% behind its prorated borrowing target of Kshs 539.7 bn having borrowed Kshs 511.1 bn. In our view, due to the current subdued economic performance brought about by the effects of the COVID-19 pandemic, the government will record a shortfall in revenue collection having collected Kshs 1,313.1 bn in the first 11 months to May 2021, compared to Kshs 1,469.7 bn prorated target collection for FY’2020/2021, thus leading to a budget deficit of 10.6%, larger than the projected 7.5% of GDP. Despite the high deficit and the lower credit rating from S&P Global to 'B' from 'B+', the monetary support from the IMF and World Bank will mean that the interest rate environment may stabilize since the government will not be desperate for cash.

Markets Performance

During the week, the equities market recorded mixed performance, with NSE 20 declining by 0.6%, while NASI and NSE 25 remained relatively unchanged increasing marginally by 0.03% and 0.1%, respectively. This week’s performance took their YTD performance to gains of 1.5%, 13.4% and 9.9% for NSE 20, NASI and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as BAT, NCBA Group and EABL of 3.1%, 2.7%, and 0.5%, respectively.

During the week, equities turnover declined by 50.9% to USD 21.9 mn, from USD 44.7 mn recorded the previous week, taking the YTD turnover to USD 597.4 mn. Foreign investors remained net sellers, with a net selling position of USD 2.7 mn, from a net selling position of USD 7.2 mn recorded the previous week, taking the YTD net selling position to USD 27.4 mn.

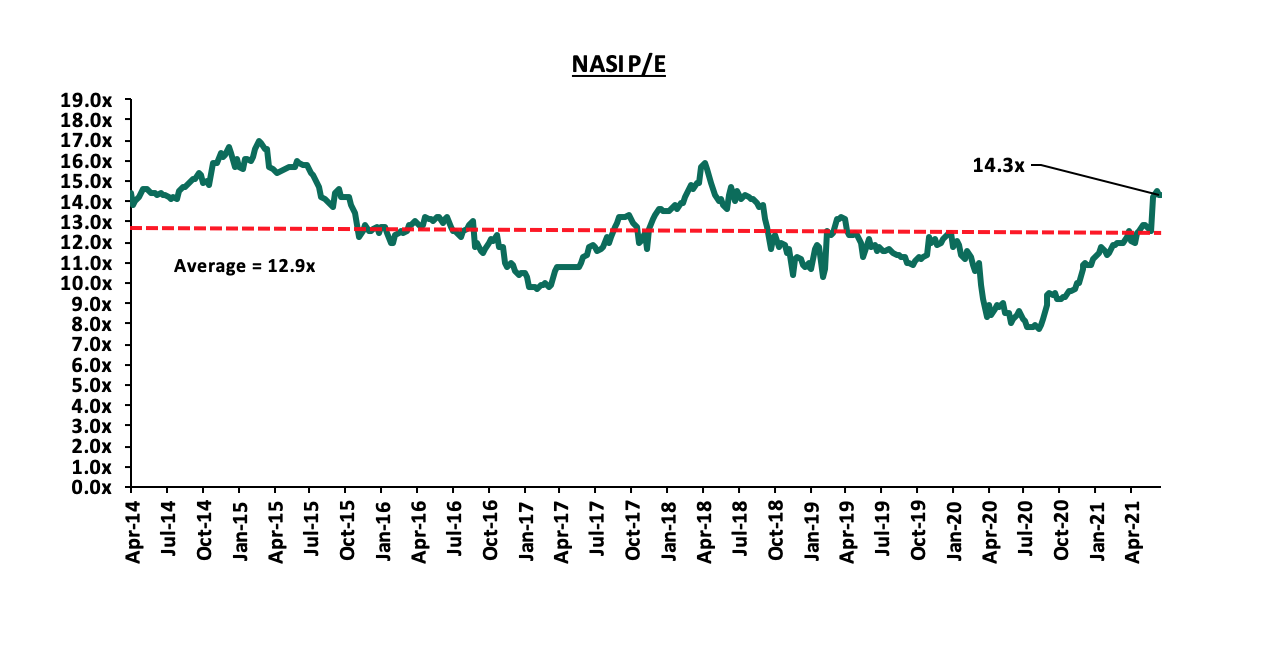

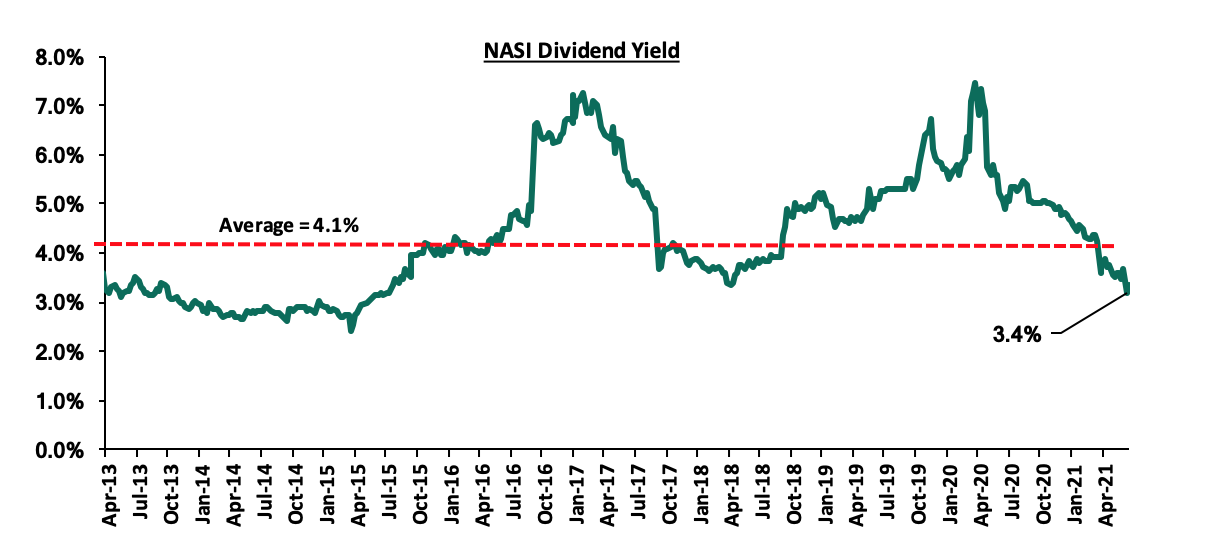

The market is currently trading at a price to earnings ratio (P/E) of 14.3x, 10.4% above the historical average of 12.9x, and a dividend yield of 3.4%, 0.7% points below the historical average of 4.1%. Key to note, NASI’s PEG ratio currently stands at 1.6x, an indication that the market is trading at a premium to its future earnings growth. Basically, a PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. Excluding Safaricom, the market is trading at a P/E ratio of 10.2x and a PEG ratio of 1.1x. The current P/E valuation of 14.3x is 86.2% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Universe of Coverage

Below is a summary of our universe of coverage and the recommendations:

|

Company |

Price as at 11/06/2021 |

Price as at 18/06/2021 |

w/w change |

YTD Change |

Year Open 2021 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

I&M Holdings*** |

21.5 |

21.8 |

1.4% |

(51.4%) |

44.9 |

29.8 |

10.3% |

47.0% |

0.3x |

Buy |

|

Kenya Reinsurance |

2.5 |

2.4 |

(2.8%) |

4.8% |

2.3 |

3.1 |

4.1% |

32.2% |

0.3x |

Buy |

|

Sanlam |

9.3 |

9.7 |

4.7% |

(25.1%) |

13.0 |

12.4 |

0.0% |

27.3% |

0.8x |

Buy |

|

NCBA*** |

26.3 |

25.6 |

(2.7%) |

(3.8%) |

26.6 |

29.5 |

5.9% |

21.1% |

0.7x |

Buy |

|

Co-op Bank*** |

12.3 |

12.3 |

(0.4%) |

(2.4%) |

12.6 |

13.8 |

8.2% |

20.8% |

0.9x |

Buy |

|

Diamond Trust Bank*** |

59.0 |

59.0 |

0.0% |

(23.1%) |

76.8 |

70.0 |

0.0% |

18.6% |

0.3x |

Accumulate |

|

Stanbic Holdings |

80.0 |

80.0 |

0.0% |

(5.9%) |

85.0 |

90.5 |

4.8% |

17.9% |

0.8x |

Accumulate |

|

KCB Group*** |

42.6 |

42.6 |

(0.1%) |

10.8% |

38.4 |

48.6 |

2.4% |

16.6% |

1.0x |

Accumulate |

|

Liberty Holdings |

6.8 |

7.2 |

6.2% |

(6.0%) |

7.7 |

8.4 |

0.0% |

16.0% |

0.5x |

Accumulate |

|

Equity Group*** |

44.1 |

44.8 |

1.6% |

23.4% |

36.3 |

51.2 |

0.0% |

14.4% |

1.3x |

Accumulate |

|

Standard Chartered*** |

130.0 |

130.0 |

0.0% |

(10.0%) |

144.5 |

134.5 |

8.1% |

11.5% |

0.9x |

Accumulate |

|

Jubilee Holdings |

306.3 |

309.5 |

1.1% |

12.2% |

275.8 |

330.9 |

2.9% |

9.8% |

0.6x |

Hold |

|

ABSA Bank*** |

10.1 |

10.1 |

0.0% |

6.1% |

9.5 |

10.7 |

0.0% |

5.9% |

1.1x |

Hold |

|

Britam |

7.3 |

7.3 |

0.8% |

4.6% |

7.0 |

6.7 |

0.0% |

(8.5%) |

1.3x |

Sell |

|

HF Group |

3.8 |

3.6 |

(3.5%) |

15.6% |

3.1 |

3.2 |

0.0% |

(11.8%) |

0.2x |

Sell |

|

CIC Group |

2.1 |

2.1 |

0.0% |

0.5% |

2.1 |

1.8 |

0.0% |

(15.1%) |

0.7x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in Key to note, I&M Holdings YTD share price change is mainly attributable to counter trading ex-bonus issue. |

||||||||||

We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.6x), we believe that investors should reposition towards companies with a strong earnings growth and are trading at discounts to their intrinsic value. Additionally, we expect the recent discovery of new strains of COVID-19 coupled with the introduction of strict lockdown measures in major economies to continue dampening the economic outlook.

I. Residential Sector

During the week, real estate developer Acorn Holdings through its subsidiary Spruce Properties Limited Liability Partnership (LLP), launched the construction of its Kshs 1.9 bn student accommodation hostels in Nairobi’s Karen under the Qwetu and Qejani brands. The 3,591 room-hostels will sit on a 5-acre plot, comprising of nine residential blocks, which are expected to be completed by the end of 2022. The development is expected to serve about 10,000 students from JKUAT Karen Campus, Catholic University of East Africa, Cooperative University, Kenya School of Law and other institutions around the area. The hostels aim to provide safe, secure and affordable accommodation to students, with charges expected to range between Kshs 15,000 and Kshs 16,500 for a room on the premium Qwetu Brand and between Kshs 7,500 to Kshs 12,500 for the Qejani brand. Other upcoming projects by the developer include the Kshs 810.0 mn Nairobi West Qwetu hostels targeting Strathmore University, the Kshs 880.0 mn Qwetu 3 and Kshs 740.0 mn Qwetu 4 developments targeting United States International University Africa (USIU Africa), all set for completion this year.

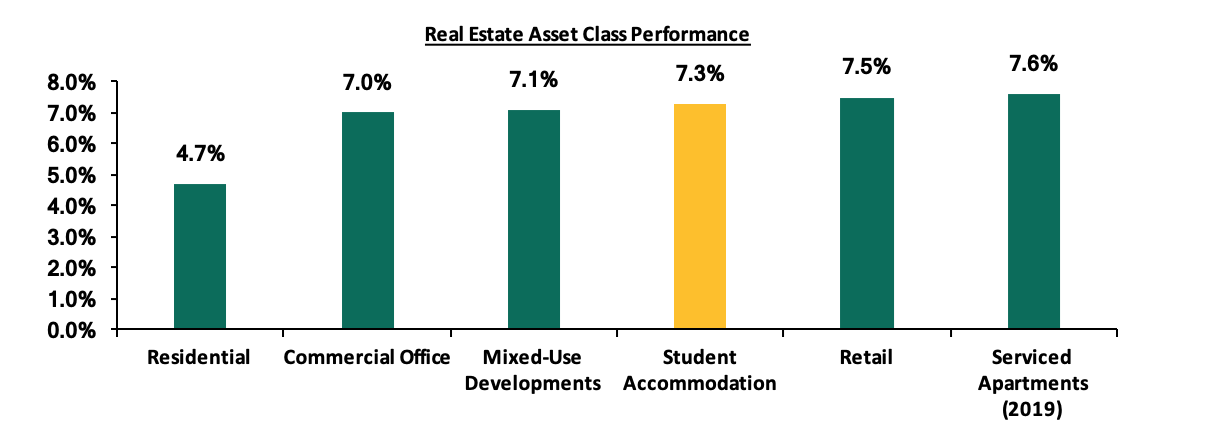

Modern student housing continues to gain momentum due to; i) high returns recorded at 7.3% in 2020, compared to other real estate classes such as residential, commercial office and mixed-use developments at 4.7%, 7.0% and 7.1% respectively, ii) rising demand for student housing supported by the increasing student population with Kenya National Bureau of Statistics data indicating that the number of available student housing was at 300,000 in 2020 against a university enrolment of 509,473, with exclusion of technical colleges, iii) inability of tertiary institutions to offer full accommodation within premises hence creating a high demand for accommodation elsewhere due to limited hostel capacity, and, iv) the need to solve the rising insecurity challenges in the areas surrounding learning institutions by offering safe, secure and affordable accommodation for students. Student housing is therefore expected to keep attracting more investors seeking high returns on their investment and a rebound in performance following the increase in student enrolment to tertiary institutions with the demand for affordable student accommodation yet to be met.

The graph below shows the performance of rental yields in student housing compared to the different real estate asset classes in Q1’2021;

Source: Cytonn Research

Also during the week, Absa Bank Kenya partnered with Property developer Mi Vida Homes to provide mortgage finance to middle income earners seeking affordable houses within the Nairobi region at a rate of 12.5% annually compared to Absa Bank’s market rate of 14.0% with up to 90.0% financing and a 25-year repayment plan, for both employed and self-employed Kenyans. Mi Vida Homes had partnered with NCBA Bank in late March to provide mortgage finance for the purchase of apartment units at their Garden City project.

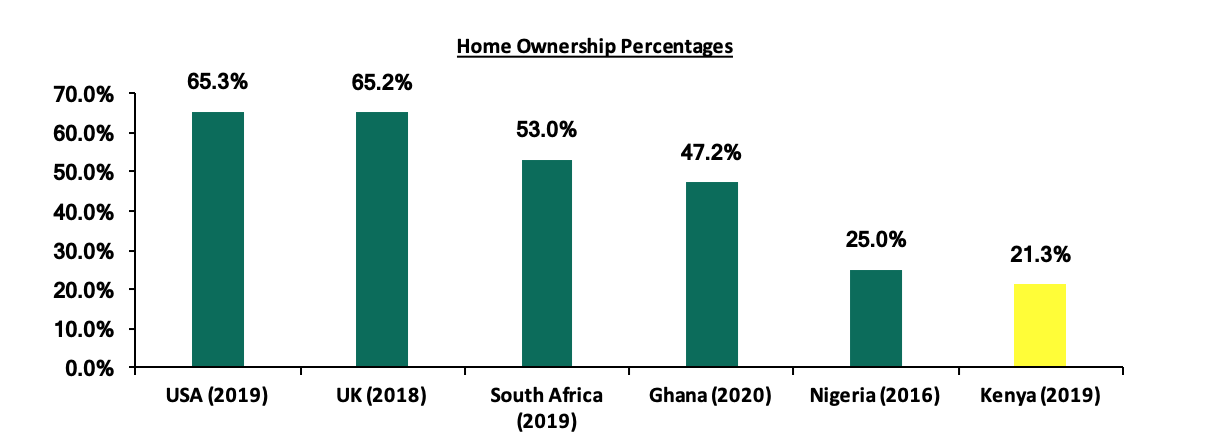

The move by Absa Bank is a step in the right direction towards increasing the number of mortgage accounts which registered a 3.7% decline to 26,971 accounts in 2020 from 27,993 accounts in 2019 according to Central Bank of Kenya’s Bank Supervision Annual Report 2020, while home ownership in the country continues remaining relatively low at 21.3%, compared to other countries such as USA and UK at 65.3% and 65.2%, respectively as at 2020.

The graph below shows the percentage of home ownership in different countries compared to Kenya;

Source: Center for Affordable Housing Africa

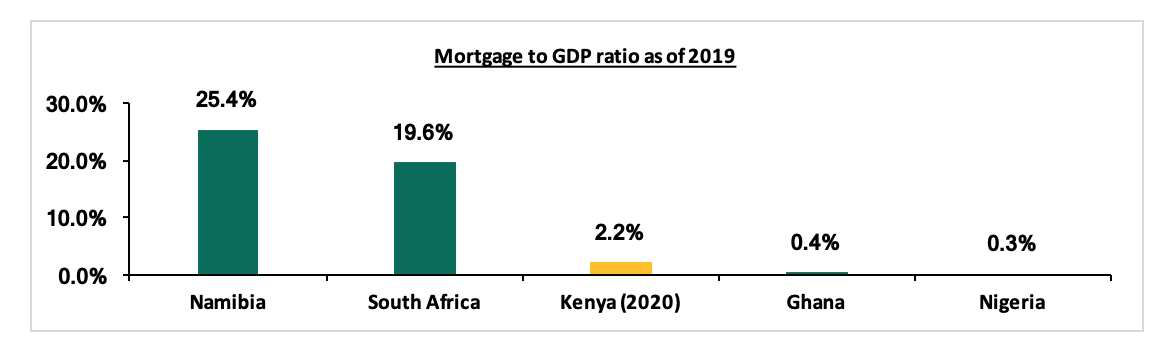

In terms of mortgage penetration, Kenya has continued to record a relatively low mortgage to GDP ratio which stands at 2.2% as at 2020, compared to other African countries such as Namibia at 25.4%. The low mortgage uptake has been low due to; i) the high interest rates and high deposit requirements, ii) soaring of property prices, iii) low-income levels making it hard to service loans, and, iv) lack of credit risk information for those in the informal sector leading to their exclusion. However, the Kenyan government is working on improving this through the Kenya Mortgage and Refinance Company which advances credit to mortgage lenders at a rate of 5.0% for onward lending at rate of 7.0%, 3.9% lower than the average market lending rate of 10.9% as at 2020.

The graph below shows the mortgage to GDP ratio for Kenya compared to other countries as at 2019;

Source: Centre for Affordable Housing Finance in Africa

International Finance Corporation (IFC), the World Bank’s private investment arm, signed a deal with Belco Realty a real estate development firm, to support the launch and development of Kongowea Villagea mixed-use affordable housing initiative consisting of 1,379 residential units and over 4,500 SQM of retail and commercial space in Kongowea, Mombasa County. The development will sit on an eight-acre piece of land and is expected to be completed in 2024. IFC is seeking to identify international strategic investors to invest equity of up to USD 12.0 mn (Kshs 1.3 bn) as well as providing Belco Realty with the necessary technical support to develop the project which is expected to meet the International Finance Corporation Excellence in Design for Greater Efficiencies (IFC EDGE) certification, and will incorporate latest technologies in passive cooling, energy efficiency, and water conservation to support sustainable urbanization. IFCs partnership with Belco Realty is expected to help Kenya meet its affordable housing demand, with the country’s housing deficit currently standing at above 2.0 mn units and growing annually by 200,000.

The private sector continues to complement government efforts in realizing its affordable housing initiative of delivering approximately 50,000 units every year, by accelerating funding to affordable housing projects. Some of the ways the government can enhance private sector engagement to spur development include; i) offering guarantees for offtake of developments, this will be an incentive to private developers as they will be assured of exit from projects, ii) reducing bureaucracies and slow approval processes to encourage initiation of projects, iii) urban planning to allow best use of land in a sustainable manner and reduce construction costs for developers, and, iv) removing the numerous road blocks to mobilization of capital markets funds targeted at housing funds.

The residential sector is expected to register increased activities following focus on student housing, and affordable housing with market players seeking to avail relatively affordable mortgage facilities thus improving home ownership in Kenya.

- Retail Sector

During the week, Optica Limited, a local eye-wear retailer, opened its 43rd Kenyan outlet in Gateway Mall along Mombasa Road as part of the retailer expansion strategy to expand the geographical outreach of its products and services, having opened a 42nd Branch in Thika Road Mall in October 2020. The entry of the retailer to Gateway Mall is supported by i) strategic positioning of the mall along Mombasa Road, ii) infrastructural developments such as the Nairobi Express Way expected to increase footfall in the mall, iii) availability of prime space in the mall, and, iv) demand of eye wear as the public is also adopting prescription sunglasses for vision correction and protection from UV rays. According to our Cytonn Q1’2021 Markets Review, Mombasa Road registered an average retail rental price of Kshs 139, 16.2% lower than the average market price of Kshs 166 thus offering a relatively affordable retail space for Optica Limited hence suitability for uptake.

The table below shows the performance of the retail spaces in the Nairobi Metropolitan Area in Q1’2021;

|

Nairobi Metropolitan Area Retail Market Performance |

|||

|

Area |

Rent Kshs/SQFT Q1’ 2021 |

Occupancy (%) Q1’ 2021 |

Rental Yield Q1’ 2021 |

|

Westlands |

205 |

84.5% |

10.1% |

|

Karen |

219 |

82.6% |

10.1% |

|

Kilimani |

173 |

83.8% |

8.7% |

|

Ngong Road |

178 |

75.0% |

7.6% |

|

Kiambu road |

163 |

70.8% |

6.7% |

|

Mombasa road |

139 |

73.0% |

6.0% |

|

Satelite towns |

138 |

72.4% |

6.0% |

|

Thika Road |

148 |

66.8% |

5.6% |

|

Eastlands |

132 |

66.0% |

5.5% |

|

Average |

166 |

75.0% |

7.4% |

Cytonn Research 2021

- Hospitality Sector

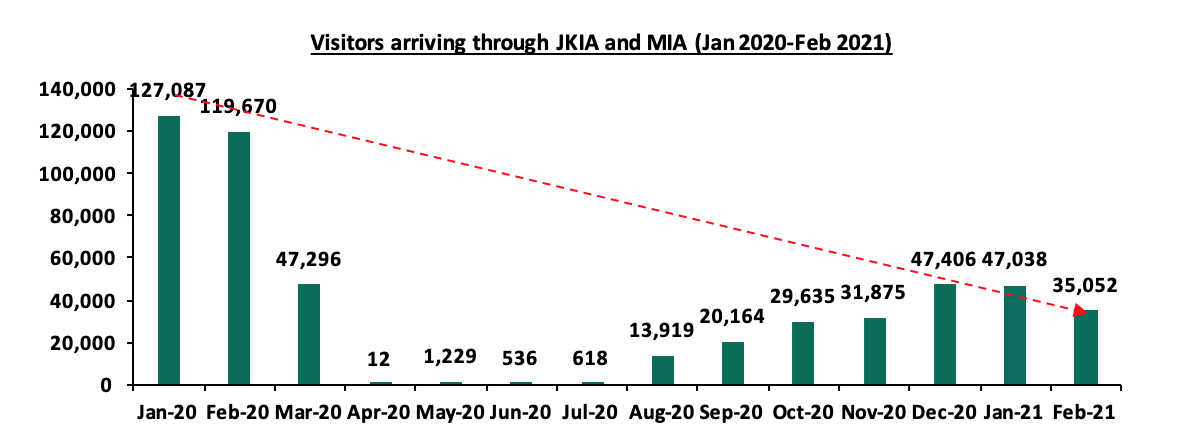

During the week, the Kenyan government through the Ministry of Foreign Affairs, lifted the ban on passenger flights between Nairobi and London, with flights expected to resume on June 26th 2021. Additionally, the United States of America (USA) lowered Kenya’s travel advisory from level 4 to level 2 citing moderate levels of Covid-19 in the country, having issued the highest level of advisory since April 2021. Lifting of the ban is expected to boost performance of the hospitality sector due to the anticipated increase in international arrivals. The tourism sector is also expected to register increased activities between July and September as a result of a favorable climate that supports increased wildlife and tourism activities. Data from the Tourism Research Institute, indicates that the US and the UK ranked 2nd and 4th highest source market for tourists in Kenya from January to October 2020 with 53,444 and 42,341 tourists respectively and hence the high expectations for performance improvement following relaxation of the travel advisories. We expect bookings for hotels and serviced apartments to register improvements with the expected rise in numbers of tourist arrivals hence a boost to the performance of the hospitality sector.

The graph below shows the number of international arrivals in Kenya from January 2020 to February 2021;

Source: Kenya National Bureau of Statistics

The real estate sector is expected to record improved performance supported by focus on affordable housing and student housing, easier access to relatively affordable mortgages, expansion by local retailers, and, improvement in the hospitality sector following the relaxation of travel bans and advisories.

On 10th June 2021, the National Treasury presented Kenya’s FY’2021/2022 National Budget to the National Assembly highlighting that the total budget estimate is Kshs 3.0 tn, a 4.8% increase from the Kshs 2.9 tn final FY’2020/21 budget. The government projects that total revenue will increase by 10.3% to Kshs 2.0 tn, from the Kshs 1.8 tn in FY’2020/2021, the increase largely being projected to come from ordinary revenue, which is to grow by 11.4% to Kshs 1.8 tn in FY’2021/22 from Kshs 1.6 tn in the FY’2020/21 budget. The projected revenues are mainly pegged on Kenya’s economic recovery, broadening the tax base and tax reforms.

Uganda and Tanzania also released their FY’2021/2022 budgets with the Tanzanian budget expanding by 20.9%, mainly due to higher allocation in both recurrent and development expenditure, and the Ugandan Budget declining by 5.6%, mainly attributable to the Ugandan government’s fiscal consolidation efforts which will see a reduction in projected development expenditure by 4.5% in FY’2021/22. Kenya’s budget focuses mainly on economic recovery following the effects of the COVID-19 pandemic, tax reforms and reducing the fiscal deficit to 7.5% of GDP in the FY’2021/22, from 8.7% of GDP in the current Budget, while the Ugandan and Tanzania budgets focused on inclusive and sustainable economic empowerment of its citizens. The different budgets also include several proposals that will require approval from the respective countries Parliaments. As such, this week, we shall discuss the recently released budgets with a key focus on Kenya’s fiscal components. We shall do this in five sections, namely:

- FY’2020/2021 Budget Outturn as at May 2021

- Comparison between FY'2020/2021 and FY'2021/2022 Budgets,

- Analysis and House-view on Key Aspects of the 2021 Budget,

- Comparison between the East African FY'2021/2022 budgets, and,

- Conclusion

Section I: FY’2020/2021 Budget Outturn as at May 2021

The National Treasury recently gazetted the revenue and net expenditures for the first eleven months of FY’2020/2021, ending 31st May 2021. Below is a summary of the performance:

|

FY'2020/2021 Budget Outturn - As at 31st May 2021 |

|||

|

Amounts in Kshs billions unless stated otherwise |

|||

|

Item |

12-months Revised Estimates |

11-months Actual |

Percentage Achieved |

|

Opening Balance |

48.0 |

48.0 |

100.0% |

|

Tax Revenue |

1,469.7 |

1,313.1 |

89.3% |

|

Non-Tax Revenue |

124.3 |

80.6 |

64.8% |

|

External Loans & Grants |

418.8 |

124.4 |

29.7% |

|

Domestic Borrowings |

853.8 |

770.6 |

90.3% |

|

Other Domestic Financing |

28.5 |

21.8 |

76.5% |

|

Total Revenue |

2,943.2 |

2,358.5 |

80.1% |

|

Recurrent Exchequer issues |

1,084.4 |

907.0 |

83.6% |

|

CFS Exchequer Issues |

1,073.7 |

899.6 |

83.8% |

|

Development Expenditure & Net Lending |

401.4 |

286.0 |

71.3% |

|

County Governments + Contingencies |

383.6 |

263.5 |

68.7% |

|

Total Expenditure |

2,943.2 |

2,356.1 |

80.1% |

|

Fiscal Deficit excluding Grants |

(418.8) |

(122.0) |

29.1% |

|

Total Borrowing |

1,272.6 |

895.0 |

70.3% |

The key take-outs from the report include:

- Total revenue collected as at the end of May 2021 amounted to Kshs 2.4 tn, equivalent to 80.1% of the revised target of Kshs 2.9 tn and is 83.3% of the prorated estimates. Cumulatively, Tax revenues amounted to Kshs 1.3 tn, equivalent to 89.3% of the target of Kshs 1.5 tn,

- The revenue from the Consolidated Fund Services (CFS) Exchequer came in at 83.8% of target coming in at Kshs 0.9 tn compared to Kshs 1.1 tn target,

- The cumulative public debt servicing cost amounted to Kshs 820.9 bn which is 85.7% of the revised estimates of Kshs 958.4 bn,

- The total expenditure amounted to Kshs 2.4 tn, equivalent to 80.1% of the revised budget of Kshs 2.9 tn and is 83.2% of the prorated expenditure estimates. Additionally, the net disbursements to recurrent and development expenditures came in at Kshs 907.0 bn and Kshs 286.0 bn, which is 83.8% and 71.3% of their respective FY’2020/2021 targets, respectively, and,

- Total Borrowings stood at Kshs 0.9 tn, equivalent to 70.3% of the revised target of Kshs 1.3 tn. The cumulative domestic borrowing amounted to Kshs 853.8 bn comprising of adjusted Net domestic borrowings of Kshs 491.9 bn and Internal Debt Redemptions (Roll-overs) of Kshs 362.0 bn. On the other hand, external loans and grants amounted to Kshs 124.4 tn, which is 29.7% behind its target of Kshs 418.8 tn.

The revenue underperformance was expected given the ravaging effects of the COVID-19 pandemic on the economy for most parts of 2020. However, the recent reversal of the tax incentives introduced earlier in 2020 has helped improve tax revenue collections, as seen by reported revenue out-performances in the first five months of 2021. Additionally, the Government received USD 410.0 mn (Kshs 44.4 bn) from the recently announced IMF credit facility in May 2021 to help in stabilizing Kenya’s economy and create a sustainable growth path. Looking at tax revenue, we expect revenue collection to pick up in the remaining month owing to the recovering business environment. In our view, however, we expect the government to fall short of its revenue target as it currently has Kshs 122.0 bn in deficits. With less than a month before the end of the current fiscal year, we believe that the government will continue to borrow aggressively to bridge the Kshs 122.0 bn deficit.

Section II: Comparison between FY’2020/2021 and FY’2021/2022 Budgets

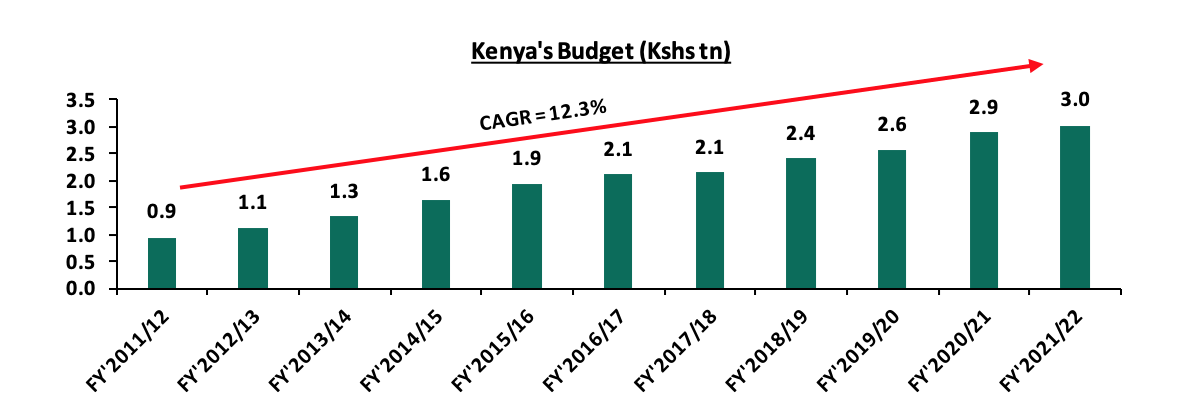

The Kenyan Government budget has been on the rise over the years as can be seen from the chart below:

For the coming financial year, the budget increased by 4.8% to Kshs 3.0 tn in FY’2021/22, from Kshs 2.9 tn in FY’2020/21 driven by an 8.4% growth in the Recurrent expenditure to Kshs 2.0 bn from Kshs 1.8 bn and a 6.9% increase in the country transfers to Kshs 370.0 bn from Kshs 346.2 bn but the Development expenditure is expected to decline by 5.9% to Kshs 655.9 bn from Kshs 696.6 bn in the FY’2020/21 budget. To fund this expenditure, increases shall be funded by an 11.4% growth projection in ordinary revenue to Kshs 1.8 tn in FY’2021/22 from Kshs 1.6 tn in the FY’2020/21 budget and 21.1% increase in the domestic borrowings. Overall, total revenues are expected to increase by 10.3% y/y to 2.0 tn, from Kshs 1.8 tn in FY’2020/21.

The table below summarizes the key buckets and the projected changes:

|

Item |

FY'2020/21 Revised Estimates I |

FY'2021/22 Estimates |

Change y/y (%) |

|

Total revenue |

1,848.0 |

2,038.7 |

10.3% |

|

Total grants |

73.0 |

62.0 |

(15.1%) |

|

Total revenue & grants |

1,921.0 |

2,100.7 |

9.3% |

|

Recurrent expenditure |

1,849.2 |

2,004.9 |

8.4% |

|

Development expenditure & Net Lending |

696.6 |

655.4 |

(5.9%) |

|

County Transfer & Contingencies |

346.2 |

370.0 |

6.9% |

|

Total expenditure |

2,892.0 |

3,030.3 |

4.8% |

|

Fiscal deficit inclusive of grants |

(970.9) |

(929.7) |

(4.2%) |

|

Deficit as % of GDP |

8.7% |

7.5% |

(1.2%) pts |

|

Net foreign borrowing |

427.0 |

271.2 |

(36.5%) |

|

Net domestic borrowing |

543.9 |

658.5 |

21.1% |

|

Total borrowing |

970.9 |

929.7 |

(4.2%) |

|

Source: Financial Statements for the fiscal year 2021/2022 – National Treasury of Kenya |

|||

Some of the key take-outs include;

- The FY’2021/22 Budget estimates point to a 4.8% increase of the budget, to Kshs 3.0 tn from Kshs 2.9 tn in the FY’2020/21 budget,

- Recurrent expenditure is set to increase by 8.4% to Kshs 2.0 tn in FY’2021/22, from Kshs 1.8 tn in FY’2020/21 budget, while development expenditure is projected to decline by 5.9% to Kshs 655.4 bn in FY’2021/22, from Kshs 696.6.0 bn as per the FY’2020/21 budget. Under recurrent expenditures, ministerial recurrent expenditure is set to increase by 0.9% y/y to Kshs 1,286.6 bn, from Kshs 1,275.1 bn, while interest payment and pension increased by 25.1% to Kshs 718.3 in the FY’2021/22 budget from Kshs 574.1 bn in the FY’2020/21 budget. The 25.1% growth in the Recurrent Consolidated Fund Services (CFS) is mainly attributable to the 22.1% rise in debt servicing expenses to Kshs 560.3 bn, from Kshs 458.7 bn in the FY’2020/21 budget,

- The budget deficit is projected to decline to Kshs 929.7 bn (7.5% of GDP) from the projected Kshs 970.9 bn (8.7% of GDP) in the FY’2020/21 budget; in line with the International Monetary Fund’s (IMF’s) recommendation, in a bid to reduce Kenya’s public debt requirements. Kenya plans in the current Budget to 7.5% of GDP in the FY’2021/22 and further decline to 3.6% of GDP in the FY’2024/25, to help reduce the growth in public debt. The average fiscal deficit level over the last 10 years to FY’2021/2022 has been 7.9%,

- Revenue is projected to increase by 9.3% to Kshs 2.1 tn, from Kshs 1.9 tn in the FY’2020/21 budget, with measures already in place to work towards increasing the amount of revenue collected in the next fiscal year,

- Total borrowing is expected to reduce by 4.2% to Kshs 929.7 bn in the FY’2021/22 from Kshs 970.9 bn as per the FY’2020/21 budget, in a bid to reduce Kenya’s public debt burden which is estimated to be at 69.6% of GDP putting it 19.6% points above the recommended threshold of 50.0%, and,

- Debt financing is projected to reduce the reliance on foreign debt for the financial year 2021/2022 to 29.2% from 44.0% this current financial year.

Section III: Analysis and House-view on Key Aspects of the FY’2021/2022 Budget

Below we give our analysis and view on various aspects of the 2021 Budget Estimates:

- Revenue

Revenue is projected to increase by 10.3% to Kshs 2.0 tn in FY’2021/22, from Kshs 1.8 tn in the FY’2020/21 budget on the back of the expected economic recovery. The increased revenue projections in the FY’2021/22 are mainly attributable to the projected 11.4% growth in ordinary revenue to Kshs 1.8 tn in FY’2021/22, from Kshs 1.6 tn in the FY’2020/21 budget. Value Added Tax (VAT) is projected to increase by 19.7% to Kshs 0.5 tn in FY’2021/22 budget from Kshs 0.4 tn in the FY’2020/21 budget. Income Tax is expected to remain the highest contributor to government revenue, contributing 40.9% of the total revenue projections of Kshs 2.0 tn.

To meet its revenue target for the, the government shall rely on an expanded tax base and increase in some taxes. Some of the suggested changes shall be include growing the digital base, increasing VAT for some products like bread and motorcycles and also increasing the excise tax.

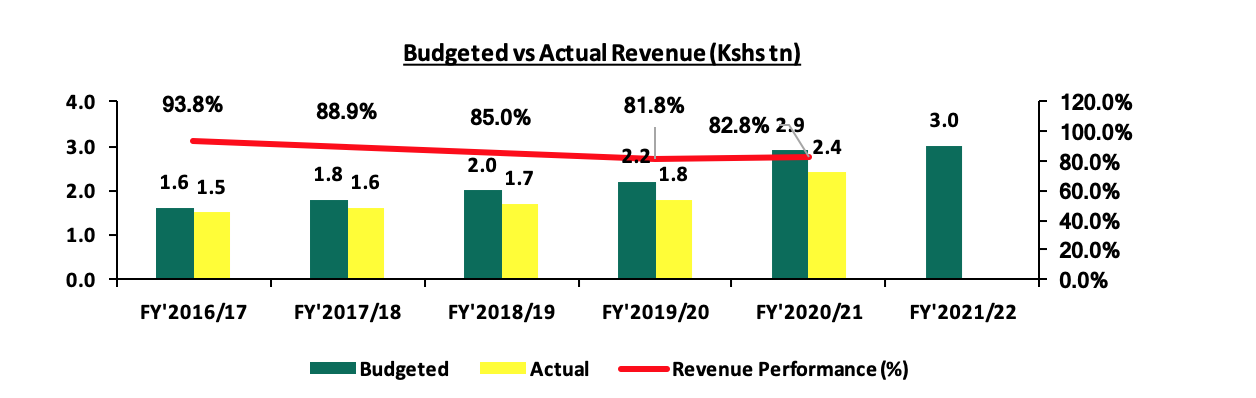

The government has been in the past struggled to raise the taxes and we think that with the ongoing pandemic these could be repeated this year. The chart below shows the revenue performance previously:

Source: National Treasury of Kenya

- Expenditure

The expenditure is expected to increase by 4.8% to Kshs 3.0 tn, from Kshs 2.9 tn in the FY’2020/21 budget. The higher expenditure level is attributable to the 8.4% increase in recurrent expenditure to Kshs 2.0 tn from Kshs 1.8 tn in FY’2020/21 and the 6.9% increase in County Transfers & Contingencies to Kshs 370.0 mn in FY’2021/22 Budget from Kshs 346.2 mn in FY’2020/21. However, Development Expenditure is expected to decline by 5.9% in FY’2021/22 to Kshs 655.4 bn from Kshs 696.6 bn in FY’2020/21, the first decline since FY’2017/18. The decline in development expenditure is in line with the government’s fiscal consolidation efforts where it intends to cut down on expenditure to help reduce the need to take on debt. The main concern from this budget is the growth of the recurrent expenditure by 8,4% increasing the proportion of recurrent expenditure to development spending at 75.4% from 72.6%, meaning that we are not investing much for the future.

In our view, the Government should increase its efforts in minimizing the recurrent expenditure growth in order to achieve its fiscal deficit of 3.6% in FY’2024/25. Development projects need to be prioritized and better planning incorporated to match fund availability to project execution, and measures taken to improve the public procurement process.

- Public Debt

The total public debt requirement for the FY’2021/22 is set to reduce by 4.2% to Kshs 929.7 bn, from Kshs 970.9 bn, in FY’2020/21, as per the revised budget. The public debt mix is projected to comprise of 29.2% foreign debt and 70.8% domestic debt, from 44.0% foreign and 56.0% domestic as per the FY’2020/21 budget. The debt servicing costs are set to rise by 22.1% to Kshs 560.3 bn in FY’2021/22, from Kshs 458.7 bn in the FY’2020/21 budget. The rise in debt servicing expenses may be partly attributable to the Debt Service Suspension (DSSI) agreement that Kenya entered into which temporarily suspended debt servicing costs, totaling Kshs 32.9 bn, in the last half of FY’2020/21. The increase in domestic debt mix to 70.8% from 56.0%, may lead to slow growth in the private sector lending as banks end up prefer lending in the government securities issued which are viewed to be low risk.

The higher domestic debt composition could have the following two results:

- A decline in Kenya’s exposure to external shocks, as the more we owe in foreign currency, the more exposed we are to any shocks in the foreign markets. The recent appreciation of the shilling against the dollar, at 1.3% YTD, is a noteworthy positive as this reduces the amount owed in foreign debt interest payments, and,

- Increase the crowding out of the private sector because the lower the government’s local debt appetite, the more banks have to lend to the private sector. Notably, appetite for domestic debt has been on a rise, concurrently, interruptions from the Covid-19 pandemic saw banks shy away from lending due to elevated credit risk on the borrowers and thus opting to lend to the government.

Debt sustainability continues to be a key concern, with the country’s public debt–to-GDP ratio having increased considerably over the past five years to 69.6% as at December 2020, from 44.3% as at the end of 2013 with half of the debt being external. The ballooning levels of public debt in the pandemic environment elevated the risk of debt sustainability, where in FY2020/21 the government received debt servicing suspension from ten Paris club members totaling to Kshs 32.9 bn which is 0.9% of the Kshs 3,769.9 bn of total external debt as at December 2020. The debt suspension helped in providing the much-needed relief as it reduced pressure on payments falling due from 1st January 2021 to 30th June 2021, as well as, a five-year repayment period with a grace period of one year.

Some of the actionable steps the government can take towards debt sustainability include (i) Restructuring the debt mix where the government should go for more concessional borrowing to reduce the amounts paid in debt service. Additionally, commercial borrowing should be limited to development projects with high financial and economic returns, to ensure that more expensive debt is invested in projects that yield more than the market rate charged, and (ii) The setting up of the Public Debt Management Authority (PDMA) – to monitor all public debt-related transactions, is a step in the right direction. However, Kenya’s debt problems have been more of a lack of fiscal discipline coupled with the inadequate political will to fight corruption so as to avoid pilferage. The authority should also be given the mandate to monitor expenditure and funds allocation to specific projects.

Section IV: Comparison between the East African FY’2021/2022 Budget

In line with the EAC, Uganda and Tanzania also presented their FY’2021/2022 Budgets for approval in their respective National Assemblies. Below we compare the two countries’ Budgets against Kenya’s proposed budget:

|

EAST AFRICA BUDGET COMPARISONS (Kshs Bn) |

||||||||||||||

|

|

Kenya |

Uganda |

Tanzania |

|||||||||||

|

Item |

FY'2020/21 |

FY'2021/22 |

Change y/y (%) |

% to GDP FY'2021/22 |

FY'2020/21 |

FY'2021/22 |

Change y/y (%) |

% to GDP FY'2021/22 |

FY'2020/21 |

FY'2021/22 |

Change y/y (%) |

% to GDP FY'2021/22 |

|

|

|

Total revenue |

1,848.0 |

2,038.7 |

10.3% |

16.7% |

593.1 |

684.4 |

15.4% |

13.8% |

962.1 |

1,169.9 |

21.6% |

15.0% |

|

|

|

External grants |

73.0 |

62.0 |

(15.1%) |

0.5% |

67.3 |

43.5 |

(35.4%) |

0.9% |

26.4 |

52.9 |

100.7% |

0.7% |

|

|

|

Total revenue & external grants |

1921.0 |

2100.7 |

9.3% |

17.2% |

660.4 |

727.9 |

10.2% |

14.7% |

988.5 |

1222.8 |

23.7% |

15.7% |

|

|

|

Recurrent expenditure |

1,849.2 |

2,004.9 |

8.4% |

16.4% |

579.4 |

578.9 |

(0.1%) |

11.7% |

981.5 |

1,069.3 |

8.9% |

13.8% |

|

|

|

Development expenditure & Net Lending |

696.6 |

655.4 |

(5.9%) |

5.4% |

471.4 |

450.3 |

(4.5%) |

9.1% |

415.8 |

619.5 |

49.0% |

8.0% |

|

|

|

Others Expenditures |

346.2 |

370.0 |

6.9% |

3.0% |

56.2 |

15.6 |

(72.2%) |

0.3% |

0.0 |

0.0 |

- |

0.0% |

|

|

|

Total expenditure |

2,892.0 |

3,030.3 |

4.8% |

24.8% |

1,106.9 |

1,044.8 |

(5.6%) |

21.1% |

1,397.3 |

1,688.8 |

20.9% |

21.7% |

|

|

|

Fiscal deficit |

(970.9) |

(929.7) |

(4.2%) |

(7.5%) |

(446.6) |

(316.9) |

(29.0%) |

(6.4%) |

(408.8) |

(465.9) |

14.0% |

(6.0%) |

|

|

|

Deficit as % of GDP |

8.7% |

7.5% |

(1.2%) |

(7.5%) |

9.9% |

6.4% |

(3.5%) |

(6.4%) |

5.7% |

6.0% |

0.3% |

(6.0%) |

|

|

|

Net foreign borrowing |

427.0 |

271.2 |

(36.5%) |

2.2% |

271.5 |

221.0 |

(18.6%) |

4.5% |

230.6 |

193.8 |

(15.9%) |

2.5% |

|

|

|

Net domestic borrowing |

543.9 |

658.5 |

21.1% |

5.4% |

175.1 |

95.9 |

(45.2%) |

1.9% |

228.0 |

231.9 |

1.7% |

3.0% |

|

|

|

Total borrowing |

970.9 |

929.7 |

(4.2%) |

7.6% |

446.6 |

316.9 |

(29.0%) |

6.4% |

458.6 |

425.8 |

(7.2%) |

5.5% |

|

|

|

GDP Estimate |

11,484.3 |

12,242.3 |

6.6% |

|

4,510.8 |

4,951.9 |

9.8% |

|

7,205.3 |

7,776.2 |

7.9% |

|

|

|

Some of the key take outs from the table above include:

- Kenya’s GDP is estimated to grow at a rate of 6.6% in 2021, while Uganda’s economy is expected to grow at a rate of 4.3% and Tanzania, 7.9%. The higher increase in Kenya’s GDP growth is attributed to its lower base as it grew by 0.6% in 2020, which was lower than Uganda’s growth of 3.3% in the same time period. Tanzania’s GDP is set to increase by 7.9% to Kshs 7.8 tn, from Kshs 7.2 tn in FY’2020/21, building on its impressive growth of 8.2% in FY’2020/21. Key to note, Tanzania did not impose COVID-related restrictions on its economy in 2020 and the nation’s government let business activities continue unhampered while urging observation of health safety measures,

- The three economies expect significant recovery from COVID-19-related negative effects, to boost their revenue. Kenya projects its total revenues plus grants to grow by 9.3% in FY’2021/22, while Uganda projects a 10.2% growth to Kshs 727.9 bn, from Kshs 660.4 bn in FY’2020/21. Tanzania’s revenue levels are also expected to increase by 21.6% to Kshs 1.2 tn, from Kshs 1.0 tn in FY’2020/21 mainly attributable to an expected 20.6% increase in tax revenue collections on the back of improved business activities especially as Tanzania’s trading partners recover and open up their economies,

- In terms of debt servicing, Tanzania’s debt service costs to total borrowing ranks highest at 96.8% compared to Kenya’s 60.3% and Uganda’s 45.2%. This indicates that Tanzania borrows relatively more expensive loans, and,

- In terms of borrowing, Kenya’s new borrowing is set to reduce by 4.2% to Kshs 929.7 bn in the FY’2021/22, from Kshs 970.9 bn as per the FY’2020/21 budget, in a bid to reduce Kenya’s public debt burden. Uganda has projected a 29.0% decline in its borrowings in the FY’2021/22 to Kshs 316.9 bn, from Kshs 446.6 bn as Uganda aims to prioritize borrowing from concessional sources which offer more generous terms, only borrow to fund economically viable projects and increase the maturity of its debt profile. This is a concern as Kenya’s public debt burden is 19.6% points above the East African Community (EAC) Monetary Union Protocol, the World Bank Country Policy and Institutional Assessment Index, and the IMF threshold of 50.0%. Key to note, as of December 2020, Kenya’s public debt burden stood at 69.6% compared to Uganda’s 49.8% and Tanzania’s 27.1%.

While Kenya’s total GDP remains significantly higher than Uganda’s, Kshs 12.0 tn against Uganda’s Kshs 5.0 tn and Tanzania’s 7.8 tn in the FY’2021/22 budget, Kenya’s increased borrowing levels and increasing recurrent expenditure are likely to slow down the country’s medium term growth.

Section IV: Conclusion

Kenya’s GDP is expected to rebound growing at a rate of 6.6% in 2021 from 0.6% growth in 2020. The performance in 2020 was mostly attributed to the effects of the COVID-19 pandemic, as movement restrictions adversely affected the demand in both the Kenyan and global economy. With this rebound in economic activity, the government projects increased revenue collections, which shall be supported by tax reforms as well. On the other hand, the Kenyan budget is expansionary as the government intends on spending more in the coming financial years to steer the country out of the pandemic driven economic. Kenya’s borrowing remains a major concern going forward with its current public debt burden at 69.6% compared to Uganda’s 49.8% and Tanzania’s 27.1%. Additionally, Kenya’s fiscal deficit is projected to stand at 7.5% in FY’2021/22, higher than both Uganda’s 6.4% and Tanzania’s 6.0%. The government of Kenya needs to seek more sustainable ways of minimizing their expenditure levels to help reduce the need for borrowing and leverage on the revenue generating bases to help service the existing debts. Kenya’s public debt mix is projected to comprise of 29.2% foreign debt and 70.8% domestic debt, from 44.0% foreign and 56.0% domestic as per the FY’2020/21 budget. The higher allocation to domestic borrowing may lead to slow growth in the private sector lending as banks end up prefer investing in the government securities issued which are viewed to be low risk and a stable source of returns.

It therefore remains a tough balance for the government and the emphasis should be on stimulating the economy and increasing tax collection efficiencies to reduce the debt burden.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.