Lifestyle Communities, & Cytonn Weekly #06.2021

By Research Team, Feb 14, 2021

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed but the overall subscription rate increased to 90.6%, from 70.0% recorded the previous week. The highest subscription rate was in the 364-day paper which increased to 160.8%, from 142.1% recorded the previous week. The subscription for the 182-day paper also increased to 47.0%, from 20.9% recorded the previous week, while the 91-day paper increased to 23.9% from 12.6% recorded the previous week. In the primary bond auction, the Central Bank of Kenya opened two tap sale bonds, FXD1/2013/15 and FXD1/2012/20, with effective tenors of 7.1 years and 11.8 years, and coupons of 11.3% and 12.0%, respectively following the undersubscription rate of 83.7%, mainly attributable to the short bidding period and tightened liquidity in the market. Additionally, during the week, the Kenya Revenue Authority (KRA) in a press release announced an improved January 2021 performance which came in at 102.6% to outdo its January revenue collection target by Kshs 3.5 bn. Additionally, the National Treasury released the Supplementary Budget Estimates I for the 2020/21 fiscal year, proposing an increase in the total expenditure by Kshs 120.8 bn to Kshs 3,036.5 bn from Kshs 2,915.7 bn in the June budget;

Equities

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 4.4%, 1.3% and 3.9% respectively, taking their YTD performance to gains of 7.9%, 0.9% and 5.9% for NASI, NSE 20 and NSE 25 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as EABL and Safaricom which both gained by 5.9%, coupled with gains recorded by banking stocks such as Co-operative Bank and ABSA Bank of 4.1% and 3.7%, respectively. The gains were however weighed down by losses recorded by other large cap stocks such as Bamburi, Standard Chartered Bank and NCBA Group which declined by 6.7%, 1.5% and 0.2%, respectively;

Real Estate

During the week, Knight Frank, a real estate developer released their Kenya Market Update H2’2020 Report and according to which prices and rents in prime markets continued to decline in H2’2020 attributed to the negative impacts of the COVID-19 pandemic on the real estate sector. In the infrastructure sector, the Kenya Urban Roads Authority (KURA) announced the construction of a Kshs 907.2 mn 8-Kilometre road in Nairobi’s Umoja-Innercore estate aimed at improving access into the area;

Focus of the Week

The real estate residential sector has witnessed numerous trends in line with changing times and customer preference among them being the growth of lifestyle communities. A lifestyle community is a residential development with several unique features aimed at enhancing the quality of life for its residents by offering convenience, comfort and all round luxury. The setting is mainly communal with large shared common spaces. The main unique features include but are not limited to fitness facilities such as gyms, walking and biking trails, swimming pools, golfing amenities and boating facilities with privacy and security being a top priority for most residents.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.57%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.53% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

- For recent news about the company, see our news section here.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained undersubscribed but the overall subscription rate increased to 90.6%, from 70.0% recorded the previous week. Investors preference remained on the 364-day paper which had the highest subscription rate increasing to 160.8%, from 142.1% recorded the previous week. This is mainly attributable to investor preference on medium-term papers (1-2 years) as they now believe that the pandemic has been contained but are still worried about possible effects of the current rising political temperatures preceding the elections in August 2022. The subscription for the 182-day paper also increased to 47.0%, from 20.9% recorded the previous week, while the 91-day paper increased to 23.9% from 12.6% recorded the previous week. The yields on 364-day, 182-day and 91-day papers rose by 10.8 bps, 5.0 bps and 3.2 bps to 8.8%, 7.7% and 6.9%, respectively. The government received bids worth Kshs 21.7 bn, accepting only Kshs 19.2 bn, translating to an acceptance rate of 88.5%.

The Central Bank of Kenya re- opened two bonds on tap sale, FXD1/2013/15 and FXD1/2012/20, with effective tenors of 7.1 years and 11.8 years, and coupons of 11.3% and 12.0%, respectively as the initial reopening had recorded an undersubscription with total subscription having come in at 83.7%, mainly attributable to the short bidding period and tight liquidity position in the market. The bonds are currently trading in the secondary market at a rate of 11.8% for FXD1/2013/15 and 12.6% for FXD1/2012/20. The period of sale runs from Tuesday, 9th February 2021 to Wednesday, 17th February 2021 or upon attainment of quantum, whichever comes first.

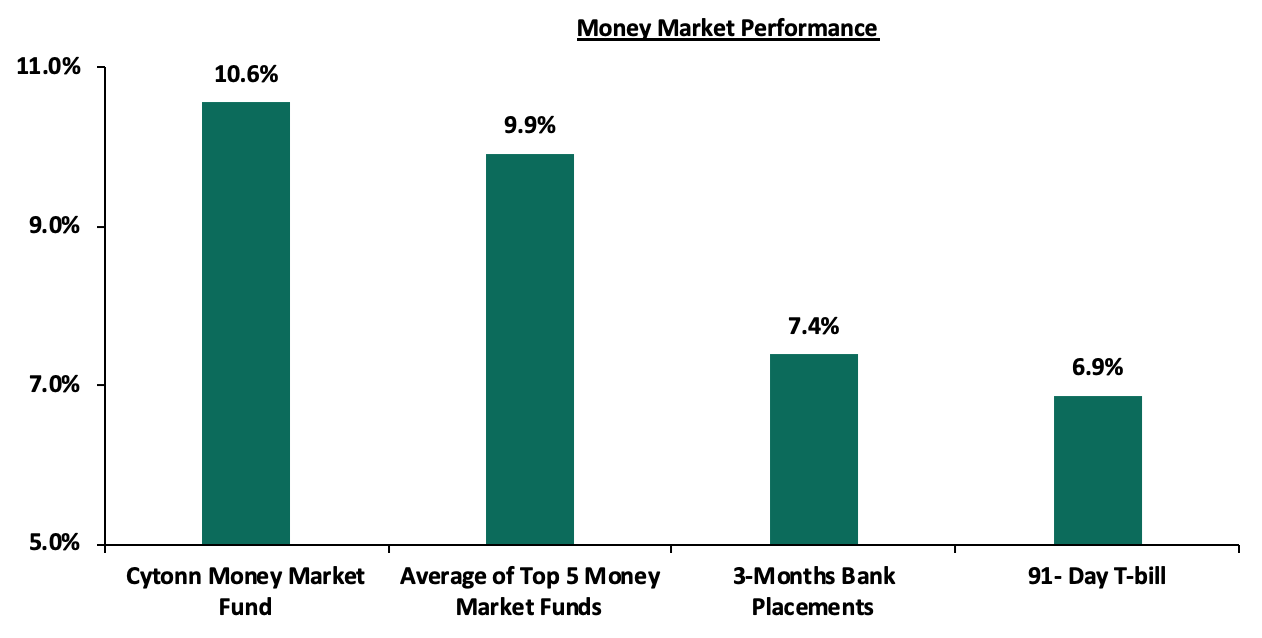

Money Market Performance

In the money markets, 3-month bank placements ended the week at 7.4% (based on what we have been offered by various banks), while the yield on the 91-day T-bill rose by 3.2 bps to 6.9%. The average yield of the Top 5 Money Market Funds declined by 0.1% points to 9.9% from the 10.0% recorded last week. The yield on the Cytonn Money Market declined by 30.0 bps to 10.6%, from the 10.9%, recorded the previous week.

Liquidity:

During the week, liquidity in the money market improved, with the average interbank rate declining to 4.8% from the 5.5% recorded the previous week, as the government payments were offset by tax remittances. The average interbank volumes increased by 6.5% to Kshs 12.9 bn, from Kshs 12.2 bn recorded the previous week. According to the Central Bank of Kenya’s weekly bulletin released on 12th February 2021, commercial banks’ excess reserves came in at Kshs 11.0 bn in relation to the 4.25% Cash Reserve Ratio.

Eurobonds performance:

During the week, the yields on all Eurobonds remained unchanged from last week’s performance. According to Reuters, the yields on the 10-year Eurobond issued in June 2014 remained unchanged at 3.5%, as recorded the previous week. The yields on the 10-year and 30-year Eurobonds issued in 2018 remained unchanged at 5.0% and 7.0%, respectively. On the other hand, the yields on the 2019 dual-tranche Eurobonds remained unchanged at 4.5% and 5.8%, respectively as was recorded the previous week.

|

Kenya Eurobond Performance |

|||||

|

|

2014 |

2018 |

2019 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

|

31-Dec-2020 |

3.9% |

5.2% |

7.0% |

4.9% |

5.9% |

|

29-Jan-2021 |

3.6% |

5.3% |

7.2% |

4.8% |

6.1% |

|

08-Feb-2021 |

3.4% |

4.9% |

7.0% |

4.4% |

5.7% |

|

09-Feb-2021 |

3.4% |

4.9% |

7.0% |

4.4% |

5.8% |

|

10-Feb-2021 |

3.4% |

4.9% |

7.0% |

4.4% |

5.8% |

|

11-Feb-2021 |

3.5% |

5.0% |

7.0% |

4.5% |

5.8% |

|

12-Feb-2021 |

3.5% |

5.0% |

7.0% |

4.5% |

5.8% |

|

Weekly Change |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

|

YTD Change |

(0.4%) |

(0.2%) |

0.0% |

(0.4%) |

(0.1%) |

Source: Reuters

Kenya Shilling:

During the week, the Kenyan shilling appreciated by 0.4% against the US dollar to Kshs 109.5, from Kshs 109.8 recorded the previous week. This was mainly attributable to a subdued dollar demand, inflows from the agriculture sector and banks offloading their long dollar positions. On a YTD basis, the shilling has depreciated by 0.3% against the dollar, in comparison to the 7.7% depreciation recorded in 2020. We expect continued pressure on the Kenyan shilling due to:

- Demand from merchandise traders as they beef up their hard currency positions,

- A slowdown in foreign dollar currency inflows due to reduced dollar inflows from sectors such as tourism and horticulture, and,

- Continued uncertainty globally making people prefer holding dollars and other hard currencies.

However, in the short term, the shilling is expected to be supported by:

- The Forex reserves which are currently at USD 7.6 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- The improving current account position which narrowed to 4.8% of GDP in the 12 months to December 2020 compared to 5.8% of GDP during a similar period in 2019, and,

- Improving diaspora remittances evidenced by a 19.7% y/y increase to USD 299.6 mn in December 2020, from USD 250.3 mn recorded over the same period in 2019, has cushioned the shilling against further depreciation.

Weekly Highlights:

A: The Kenya Revenue Authority (KRA)

The Kenya Revenue Authority (KRA) has begun the financial year 2021 at a high note registering a 102.6% in revenue collections having collected Kshs 142.0 bn against a target of Kshs 138 bn. The above collection is 6.7% increase from the last year’s collection during a similar period. The positive performance is mainly attributable to:

- The economic resurgence following a 1.1% contraction in the third quarter of 2020, against a 5.5% contraction in the second quarter and partly due to the relaxation of the stiff Covid-19 control measures,

- The implementation of the post Covid-19 Economic Recovery strategy 2020-2022 by the government,

- The support from sustained implementation enhanced compliance efforts by KRA in the month of January, and,

- The reversal of the government fiscal measures that had been put in place to cushion individuals and businesses against Covid-19 related loses.

- For the month under review, the Customs & Boarder Control (C&BC) collection grew by 9.7% to Kshs 54.9 bn from Kshs 50.0 bn. However, the exemptions and remissions in customs declined by 4.8% positively impacting the revenue base by Kshs 283 mn.

- The domestic taxes as well registered an improved performance with KRA collecting 97.1% of target. This was a 5.0% improvement compared to the 10.4% decline in December 2020.

- Excise Domestic taxes recorded a 42.8% growth after collecting a surplus of Kshs 3.4 bn while withholding tax surpassed the target by Kshs 396.0 mn reflecting an 8.2% growth.

- Pay As You Earn (PAYE) recorded a 98.6% performance.

- Corporation taxes registered a performance rate of 119.4% an improvement from the 93.5% recorded in December 2020 reflecting a 44.4% growth.

- The Value Added Tax (VAT) remittance grew by 8.5%, an improvement from the 19.8% recorded at the close of 2020.

In our view, the performance rate will continue improving following further implementation of the post Covid-19, 2020-2022 Economic Recovery strategy, improved business performance as businesses continue reopening and the sustained daily average of non-oil revenue together with the reversal of the government fiscal measures which took effect on 1st January 2021

B: 2020/21 Kenya Supplementary Budget I

During the week, the National Treasury released the Supplementary Budget Estimates I for the 2020/21 fiscal year on the back of a challenging first half of the fiscal year 2020/21, with the challenges including the adverse effects of the COVID-19 pandemic on the economy. The proposed budget will be tabled to the National Assembly for debate and approval on a later date. The Treasury proposes an increase in the gross total supplementary budget by Kshs 120.8 bn to Kshs 3,036.5 bn from Kshs 2,915.7 bn previously. The proposed budget increment is attributable to COVID-19 related expenditure and efforts by the government to spur economic activity.

The table below illustrates the allocation of the Supplementary Budget 2020/21, showing the components of the estimated expenditure:

|

Supplementary Gross Budget 2020/2021 (Kshs billions) |

|

|||

|

|

Approved Estimates |

Supplementary I Estimates |

Change |

% Change |

|

State Department of Basic Education |

100.8 |

99.5 |

(1.3) |

(1.3%) |

|

State Department of Vocational & Technical Training |

24.9 |

24.6 |

(0.3) |

(1.2%) |

|

Ministry of Health |

111.7 |

111.5 |

(0.2) |

(0.2%) |

|

State Department of Infrastructure |

189.5 |

190.3 |

0.8 |

0.4% |

|

State Department of Interior |

132.1 |

133.2 |

1.1 |

0.8% |

|

State Department of Water Services |

77.2 |

82.0 |

4.8 |

6.2% |

|

Other Ministries & State Departments |

-0,686.9 |

-0,698.0 |

(11.1) |

1.6% |

|

State Department of ICT |

20.0 |

21.7 |

1.7 |

8.5% |

|

Ministry of Energy |

72.5 |

84.8 |

12.3 |

17.0% |

|

State Department of Agricultural Research |

41.8 |

49.6 |

7.8 |

18.7% |

|

Total Expenditure |

1,887.70 |

1,962.80 |

75.1 |

4.0% |

|

Consolidated Fund Services |

1,028.0 |

1,073.7 |

45.7 |

4.4% |

|

Grand Total Supplementary Budget |

2,915.70 |

3,036.50 |

120.8 |

4.1% |

Key highlights in the supplementary budget include;

- The State Department for Early Learning and Basic Education has seen its budgetary allocation reduce by Kshs 1.3 bn to Kshs 99.5 bn from the earlier revised allocation of Kshs 100.8 bn. The 1.3% decline was on account of a 27.9% decrease in the allocation to Quality Assurance and Standards to Kshs 3.1 bn from the previously approved estimate of Kshs 4.3 bn, attributable to a 78.6% decrease in allocation for Curriculum Development to Kshs 0.3 bn from the earlier approved estimate of Kshs 1.4 bn,

- The Ministry of Health has seen its budgetary allocation decline to Kshs 111.5 bn from the earlier approved estimate of Kshs 111.7 bn. The 0.2% decline was on account of a 30.1% decline in allocation for Health Policy, Standards and Regulations to Kshs 27.4 bn from the previously approved estimate of Kshs 39.2 bn. This was due to the Health Policy, Planning and Financing department’s allocation declining by 43.9% to Kshs 12.9 bn from the earlier approved estimate of Kshs 23.0 bn,

- The State Department of ICT’s budget has increased by Kshs 1.7 bn to Kshs 21.7 bn, from Kshs 20.0 bn on account of a shortfall in personal emolument, ICT shared services, budget provision for the newly created office of Data Protection Commissioner and increased donor commitments. The creation of the Data Protection Commissioner office is partly attributable to the 29.5% increase in general administration planning and support services for the docket to Kshs 299.1 mn from Kshs 230.9 mn. The E-Government services docket also received a 4.2% increase to Kshs 2.5 bn from Kshs 2.4 bn on account of increased use of online services during the pandemic,

- The Ministry of Energy’s docket has seen its budget record the highest rise, increasing by Kshs 12.3 bn to Kshs 84.8 bn from the approved estimate of Kshs 72.5 bn on account of increased donor commitments and additional funding for flagship transmission lines. This is in line with the government’s last-mile connectivity initiative which aims to provide electric connectivity to individuals in marginalized areas. It is key to note that the 17.0% increased allocation for the Ministry of Energy means that special approval will be needed for the expenditure adjustment in the docket since it is beyond the 10.0% threshold in accordance with the Public Finance Management Regulations. Allocation to power generation and power transmission and distribution are the notable gainers, increasing by 43.3% and 15.8% respectively to improve availability and access to electricity,

- In a bid to enhance food security, the State Department for Crop Development and Agricultural Research has seen its allocation increase by Kshs 7.8 bn to Kshs 49.6 bn from the approved estimate of Kshs 41.8 bn. The 18.7% increase, which is the highest percentage increase, is on account of the 29.4% increase in allocation to Crop Development and Management, coupled with settlement of pending bills under the Maize Subsidy Programme, implementation of Emergency Locust Response Project, Pyrethrum Industry Recovery, Miraa Industry Revitalization Project and Embryo Transfer Project, which are aimed at increasing agricultural output and creating employment. The 18.7% increase in the agricultural docket will also need special approval since it exceeds the 10.0% threshold in accordance with the Public Finance Management Regulations, and,

- Consolidated fund services have seen a 4.4% increase to Kshs 1,037.7 bn from the earlier approved estimate of Kshs 1,028.0 bn. Interest and redemptions increased by Kshs 53.7 bn to Kshs 958.4 bn from the previously approved estimate of Kshs 904.7 bn while pension have seen a Kshs 8.1 bn decline to Kshs 111.1 bn from the earlier approved estimate of Kshs 119.2 bn. External interest payments declined by Kshs 31.6 bn to Kshs 340.0 bn from the earlier approved estimate of Kshs 308.4 bn, attributable to suspended interest payments for bilateral debt lenders from the Paris Club, which was partly attributable to the 1.0% decline in total interest payments to Kshs 458.7 bn from the earlier approved estimate of Kshs 463.1 bn. Total interest and redemption, however, recorded a 5.9% increase to Kshs 958.4 bn from an the earlier approved estimate of Kshs 904.7 bn. Key to note, interest on external debt declined by 23.3% to Kshs 118.7 bn from Kshs 154.7 bn, with a notable decline of 28.4% in interest payments owed to Exim Bank of China to Kshs 21.4 bn from the earlier approved estimate of Kshs 29.9 bn.

In our view, the fiscal deficit will continue widening in FY’2020/21 considering that the approval of the 2020/21 supplementary budget will increase the fiscal deficit to an estimated 8.9% of GDP from the earlier estimated deficit of 7.5% of GDP for FY’2020/21. On the other hand, improved revenue collection provides hope that revenue collection could recover during the calendar year 2021. Moving forward, the government should take measures such as freezing nominal expenditure growth, rationalization of expenditure for State Corporations and suspend launching of new projects so as to consolidate its financial position. With four months remaining before the debt suspension initiative expires, we believe that the government should exercise fiscal discipline or risk further distress in the near future due to increasing debt service obligations and a further widening of the fiscal deficit

Rates in the fixed income market have remained relatively stable due to the discipline by the Central Bank as they reject expensive bids but we have seen some upward pressure lately due to the tight liquidity. The government is 13.8% behind its prorated borrowing target of Kshs 527.7 bn having borrowed Kshs 341.4 bn. In our view, due to the current subdued economic performance brought about by the effects of the COVID-19 pandemic, the government will record a shortfall in revenue collection with the target having been set at Kshs 1.9 tn for FY’2020/2021, thus leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term to medium-term fixed income securities to reduce duration risk.

Market Performance:

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 4.4%, 1.3% and 3.9% respectively, taking their YTD performance to gains of 7.9%, 0.9% and 5.9% for NASI, NSE 20 and NSE 25 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as EABL and Safaricom which both gained by 5.9%, coupled with gains recorded by banking stocks such as Co-operative Bank and ABSA Bank of 4.1% and 3.7%, respectively. The gains were however weighed down by losses recorded by other large cap stocks such as Bamburi, Standard Chartered Bank and NCBA Group which declined by 6.7%, 1.5% and 0.2%, respectively. Key to note, Safaricom recorded an all-time high of Kshs 38.4, mainly attributable to the announcement of an interim dividend of Kshs 0.45 per ordinary share. The interim dividend book closure is on 5th March 2021 and will be paid on 31st March 2021.

Equities turnover declined by 34.8% during the week to USD 18.6 mn, from USD 28.5 mn recorded the previous week, taking the YTD turnover to USD 127.5 mn. Foreign investors turned net buyers, with a net buying position of USD 1.3 mn, from a net selling position of USD 4.5 mn recorded the previous week, taking the YTD net buying position to USD 2.4 mn.

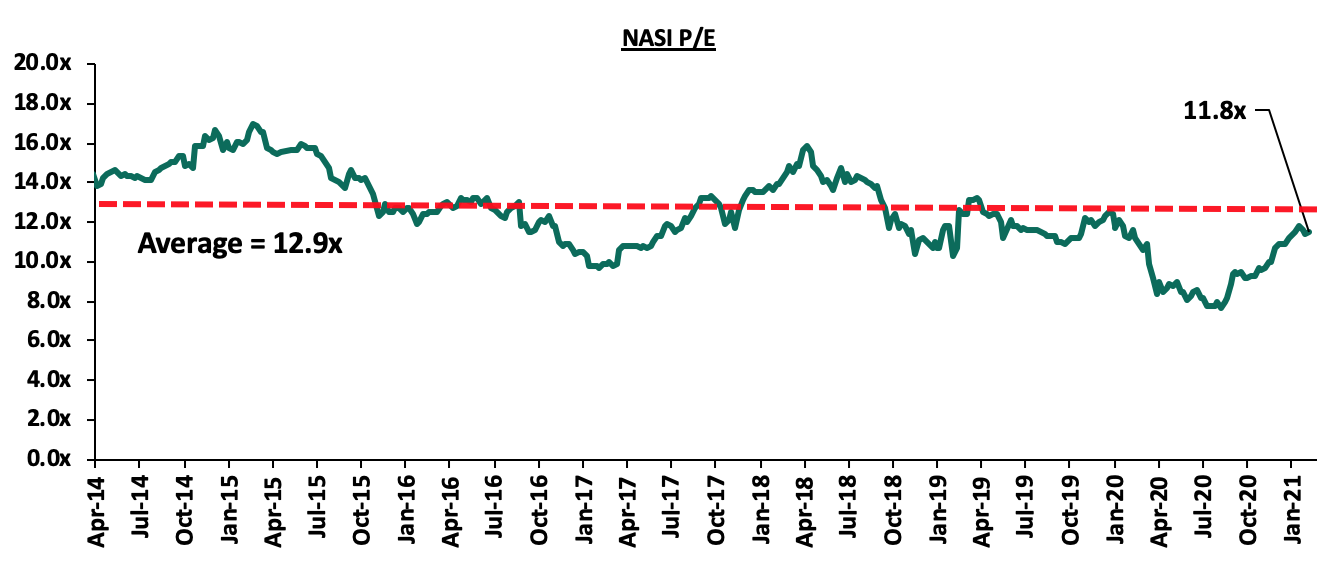

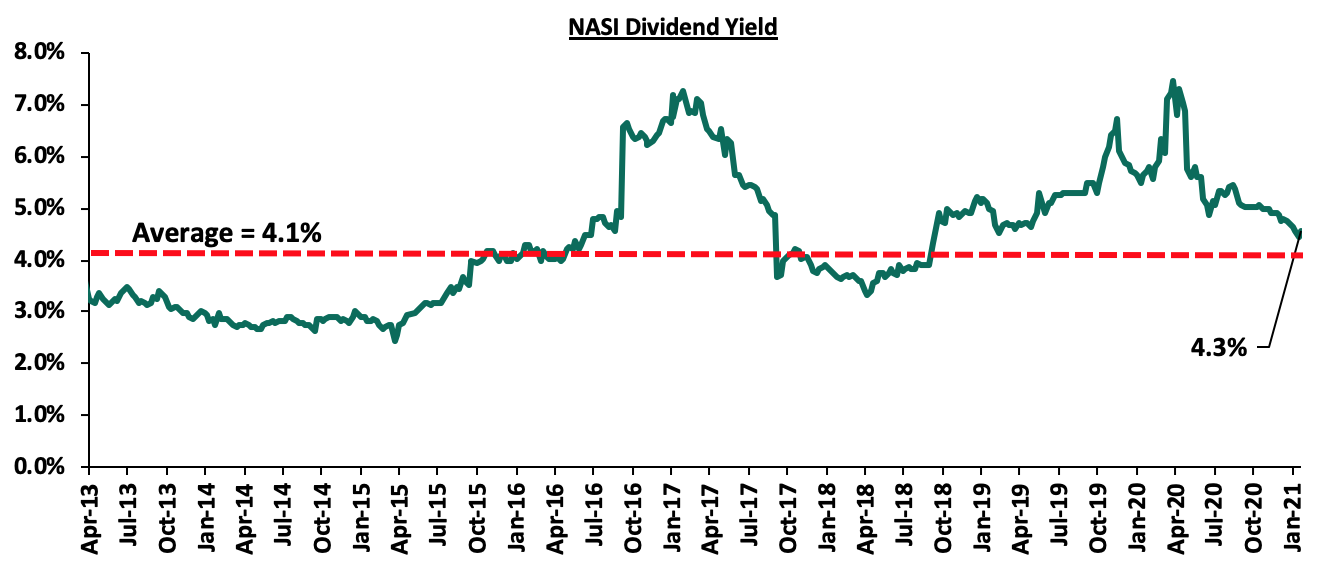

The market is currently trading at a price to earnings ratio (P/E) of 11.8x, 8.6% below the 11-year historical average of 12.9x. The average dividend yield is currently at 4.3%, 0.2% points below the 4.5% recorded the previous week, and 0.2% points above the historical average of 4.1%.

With the market trading at valuations below the historical average, we believe that there are pockets of value in the market for investors with a higher risk tolerance. The current P/E valuation of 11.8x is 53.4% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the market’s historical P/E and dividend yield.

Universe of Coverage:

|

Banks |

Price at 05/02/2021 |

Price at 12/02/2021 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank*** |

68.5 |

69.0 |

0.7% |

(10.1%) |

76.8 |

105.1 |

3.9% |

56.2% |

0.3x |

Buy |

|

Sanlam |

11.8 |

11.3 |

(3.8%) |

(13.1%) |

13.0 |

16.4 |

0.0% |

45.1% |

1.1x |

Buy |

|

I&M Holdings*** |

44.2 |

45.0 |

1.9% |

0.3% |

44.9 |

60.1 |

5.7% |

39.2% |

0.7x |

Buy |

|

Kenya Reinsurance |

2.4 |

2.5 |

1.2% |

6.5% |

2.3 |

3.3 |

4.5% |

38.6% |

0.3x |

Buy |

|

Liberty Holdings |

7.9 |

7.5 |

(5.3%) |

(2.9%) |

7.7 |

9.8 |

0.0% |

31.0% |

0.6x |

Buy |

|

KCB Group*** |

37.1 |

38.0 |

2.6% |

(1.0%) |

38.4 |

46.0 |

9.2% |

30.3% |

1.0x |

Buy |

|

Standard Chartered*** |

137.0 |

135.0 |

(1.5%) |

(6.6%) |

144.5 |

153.2 |

9.3% |

22.7% |

1.1x |

Buy |

|

Co-op Bank*** |

12.2 |

12.7 |

4.1% |

1.2% |

12.6 |

14.5 |

7.9% |

22.0% |

1.0x |

Buy |

|

Britam |

7.5 |

7.3 |

(3.2%) |

4.3% |

7.0 |

8.6 |

3.4% |

21.2% |

0.8x |

Buy |

|

ABSA Bank*** |

9.3 |

9.6 |

3.7% |

0.8% |

9.5 |

10.5 |

11.5% |

20.8% |

1.2x |

Buy |

|

Equity Group*** |

37.3 |

37.9 |

1.6% |

4.4% |

36.3 |

43.0 |

5.3% |

18.9% |

1.1x |

Accumulate |

|

Jubilee Holdings |

272.0 |

276.0 |

1.5% |

0.1% |

275.8 |

313.8 |

3.3% |

16.9% |

0.7x |

Accumulate |

|

Stanbic Holdings |

79.5 |

85.0 |

6.9% |

0.0% |

85.0 |

84.9 |

8.3% |

8.2% |

0.8x |

Hold |

|

NCBA*** |

24.5 |

24.5 |

(0.2%) |

(8.1%) |

26.6 |

25.4 |

1.0% |

4.9% |

0.7x |

Lighten |

|

CIC Group |

2.1 |

2.1 |

1.0% |

0.5% |

2.1 |

2.1 |

0.0% |

(0.9%) |

0.8x |

Sell |

|

HF Group |

3.6 |

3.5 |

(3.3%) |

11.5% |

3.1 |

3.0 |

0.0% |

(14.3%) |

0.1x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/ or its affiliates are invested in |

||||||||||

We are “Neutral” on the Equities markets in the short term. We expect the recent discovery of a new strain of COVID-19 coupled with the introduction of strict lockdown measures in major economies to continue dampening the economic outlook. However, we maintain our bias towards a “Bullish” equities markets in the medium to long term. We believe there exist pockets of value in the market, with a bias on financial services stocks given the resilience exhibited in the sector. The sector is currently trading at historically cheaper valuations and as such, presents attractive opportunities for investors.

I. Industry Reports

During the week, Knight Frank, a real estate developer released their Kenya Market Update H2’2020 Report. The report tracks the status and trends in various economic sectors in Kenya including prime real estate. Some of the key highlights from the report were;

- Prime monthly retail rent prices remained unchanged over the review period at Kshs 459 per SQM (4.2 USD per SQFT) similar to H1’2020. The stagnation was mainly attributed to an oversupply of retail centres, economic slowdown, restrictions on mobility due to the nationwide curfew, unfavourable business climate, landlords adopting a range of concessions and less disposable income which all resulted in reduced consumer spending. According to the report, retail centres recorded average occupancy rates of between 70.0%-80.0% with more established malls having an average occupancy levels of 90.0%,

- Prime commercial office monthly rental charges recorded a 12.7% decline to Kshs 142 per SQFT from Kshs 124 per SQFT in H1’2020. Absorption of Grade A and B office space decreased by 50.0% during the review period compared to a similar period in 2019, with overall absorption for the year 2020 declining by 47.0%. The declines in the uptake and rental rates of offices is attributed to oversupply in the commercial spaces in some submarkets, the tough economic times which has resulted to businesses scaling down their operations, the adaptation of the working from home amid the COVID-19 pandemic, and,

- Prime residential sale prices in Nairobi declined by 3.9% in 2020, compared to a decline of 4.0% in 2019. This was mainly attributed to developers and sellers being more flexible and willing to negotiate lower prices with potential buyers amid a tough economic environment. Prime residential rents experienced a sharp decline of 10.3% in 2020, compared to a decline of 2.8% in 2019 attributed to the continued oversupply of rental properties, less disposable income due to the unfavourable economic climate, budget cuts from multinationals and fewer expatriates in the country as a significant number relocated back to their home countries in H1’2020 due to the pandemic.

The findings of the above report are in line with our views on the Cytonn Annual Markets Review-2020 which stated that the average rental yields on the residential, commercial office and retail sectors softened coming in at 4.7%, 7.0%, and, 7.5% in FY’2020 from 5.0%, 7.5% and 7.8% respectively in FY’2019. The declines in performance is attributed to the overall declines in rental charges, occupancies and uptake as a result of the negative impacts of the COVID-19 pandemic on the real estate sector. The sectors performance is expected to improve in the long run as economic activities continues to regain momentum amid the discovery of the COVID-19 vaccine.

II. Infrastructure

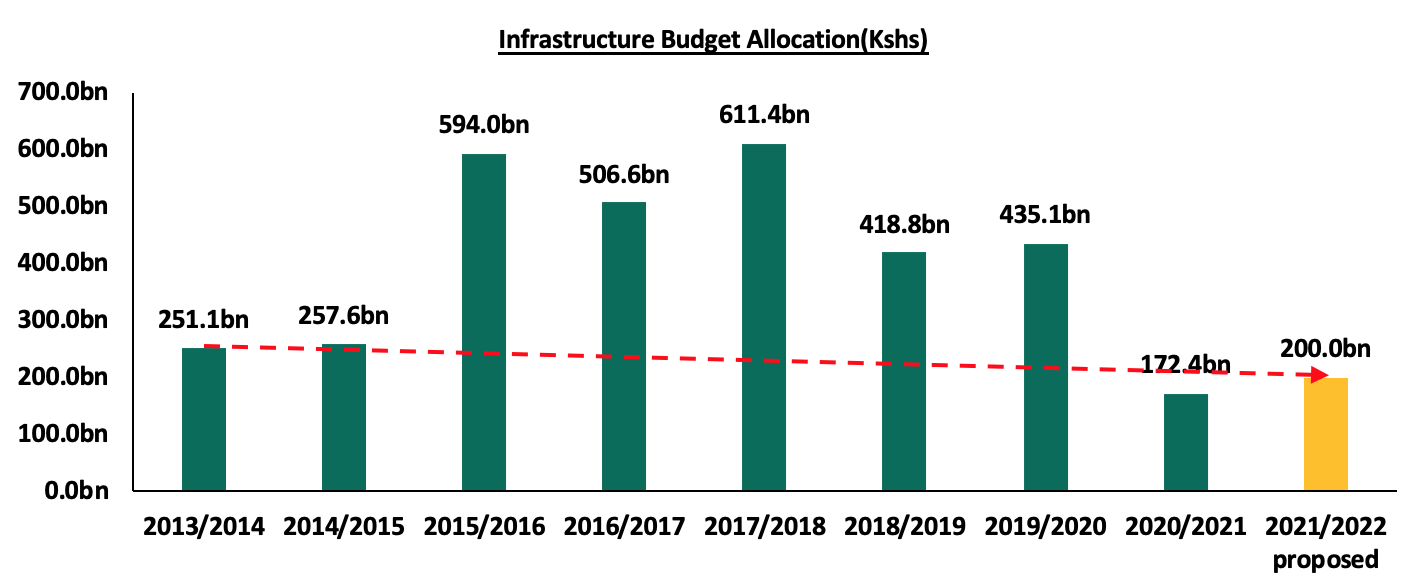

During the week, the Kenya Urban Roads Authority (KURA) announced the construction of a Kshs 907.2 mn 8-Kilometre road in Nairobi’s Umoja-Innercore aimed at improving access into the area. The project is expected to include a 7-meter wide two lane carriageway, a foot path, bus bays, drainage facilities, road markings and street lighting. The Umoja-Innercore project consists of several roads namely; Ruaraka Crescent Road, Kangundo Moi Drive link and Malewa-Mwangaza Road. The continued implementation of select infrastructural projects in Kenya has been occasioned by the reduced budget allocation through the National Budget, where the sector was allocated Kshs 172.4 bn for financial year 2020/2021 budget, the lowest allocation in the last 10 financial years, and 60.4% lower than the Kshs 435.1 bn allocated in the 2019/2020 budget, attributed to diversion of funds towards the mitigation of the spread of the COVID-19 pandemic. However, the National Treasury proposed an allocation of Kshs 200.0 bn to the State Department of Infrastructure, which is in charge of the development of roads, railways and other infrastructure. The proposal is expected to increase the budget allocation to the infrastructure sector by 16.0% from Kshs 172.4 bn allocated for financial year 2020/2021.

The graph below shows the budget allocation to the infrastructure sector over the years;

Source: National Treasury

The expected increase in the infrastructure budget allocation is expected to boost the implementation of select infrastructural projects thus opening up areas for development hence boosting the real estate sector. This will be in line with the country’s economic expansion goals to make Kenya the African hub for transportation, industrial, and services sectors. Despite the reduced budget allocation to the sector some of the other ongoing infrastructural projects include; i) the Nairobi Express way, ii) Nairobi Western Bypass, iii) Lamu Port Access Road, and, iv) the Mombasa Port Development Project among others.

The real estate sector is expected to continue recording sluggish growth amid the tough economic environment. However, the continued implementation of infrastructural projects opening areas for development is expected to boost the sector.

The real estate residential sector has witnessed numerous trends that are gradually being embraced with changing times and customer preference, with individuals looking for developments with unique features that help improve their quality of life. Lifestyle communities aim at offering a comprehensive and luxurious work, live and play environment and are differentiated by their location, unit size and designs, quality of finishes, array of amenities and facilities and thus have an associated feel of prestige. This week we shall focus on the lifestyle community concept with the aim of explaining what they are, highlighting their performance within the Nairobi Metropolitan Area and providing recommendations on their viability as a real estate investment. We shall look into;

- Introduction to Lifestyle Communities,

- Lifestyle Communities in the Nairobi Metropolitan Area and Factors Driving Them,

- Challenges facing Development of Lifestyle Communities,

- Performance of Lifestyle Communities within the Nairobi Metropolitan Area,

- Pros and Cons of Lifestyle Communities, and,

- Future of Lifestyle Communities in Kenya & Conclusion.

I. Introduction to Lifestyle Communities

A lifestyle community, also known as a common-interest community, is a residential neighbourhood with one or more unique features aimed at enhancing the quality of life for its residents by offering convenience, comfort and all-round luxury. The setting is mainly communal with large shared common spaces. The main unique features include but are not limited to fitness facilities such as; gyms, walking and biking trails, swimming pools, golfing amenities and boating facilities etc, and for these communities privacy and security are a top priority for most residents.

II. Lifestyle Communities in the Nairobi Metropolitan Area and Factors Driving Them

Development of lifestyle communities offering salient features has been on an upward trajectory as the need for convenient modern lifestyle by Kenya’s growing middle class creates a ready market. The developments provide prestige and exclusivity sought by affluent individuals in the context of high rise residential units in targeted markets such as; Westlands, Kilimani, Limuru Road, Thika Road and Upperhill. Some of the key lifestyle communities include;

- The Alma: The project is located in Ruaka encompassing 477 modern apartments. It comprises of one, two and three bedroom apartments (standard and premium) priced at Kshs 7.9 mn, Kshs 12.4 mn, Kshs 16.4 mn and Kshs 17.5 mn, respectively. Amenities within the development include; swimming pool, roof-top gardens, children’s playing fields, day care and nursery, clubhouse with a glass walled gym, aerobics and lounge area, a commercial hub that features a mini market, restaurant/café, beauty spa and pharmacy among others;

- Enaki Residences: The project is located in Rosslyn and sits on a 22.0-acre piece of land with the residential resort occupying 9.6 acres. Residential units comprise of one, two, three and four bedroom units priced at approximately Kshs 12.5 mn, Kshs 16.4 mn, Kshs 29.1 mn and Kshs 49.0 mn respectively. There are also studios priced between Kshs 6.5 mn and Kshs 8.9 mn and duplexes priced at Kshs 34.4 mn, Kshs 49.2 mn, Kshs 54.5 mn and Kshs 60.2 mn depending on size and the location of the unit within the building. Amenities at Enaki include; a grand reception lobby, concierge, fully walkable site, golf cart route, designated guest parking, staff lounge & facilities, caretakers flat, resident stores, gym and juice bar;

- Mi Vida Homes: Mi Vida, located at Garden City, along Thika Road, sits on 4.5 acres overlooking the Garden City Mall. The development, which is set for completion in 2021 will have a total of 208 units. It consists of one, two and three bedroom units priced at Kshs 8.4 mn, Kshs 12.0 mn and Kshs 15.7 mn, respectively. Mi Vida Homes’ amenities include; an indoor gym with yoga and fitness studio, a multipurpose sports court, barbeque deck, swimming pool, integrated intercom system and a 300 metre outdoor jogging track among others;

- Riverbank: The Riverbank development is located in Ruaka and sits on 11.0 acres at Two Rivers MallIt consists of 160 units of one, two and three bedroom apartments, priced at Kshs 16.0 mn, Kshs 20.0 mn and Kshs 26.5 mn, respectively. Amenities at Riverbank include; sports club with fully equipped gym, seven-a-side soccer pitch, tennis courts, a basketball court, and swimming pools among others;

- Le Mac: Le Mac is a 27 storeys development located off Old Waiyaki Way in Westlands on a 1.3-acre plot., consisting of 170 units. The development is a mixture of 81 SQM one bedroom, 114 SQM two bedroom and 146 SQM three bedroom apartments, priced at Kshs 17.0 mn, Kshs 25.0 mn and Kshs 30.0 mn, respectively. Amenities at Le Mac include; ground floor lounge café, gym, sauna, panoramic sky restaurant and infinite heated swimming pool;

- Purple Haze: The project is located along Kitale lane, off Dennis Pritt Road in Kilimani. It sits on a 2.0-acre plot, with differentiated two, three and four bedroom units. The two bedroom units range from 140 SQM- 169 SQM and are priced between Kshs 23.5 mn to Kshs 27.5 mn, while the three-bedroom unit sizes range between 169 SQM- 175 SQM and are priced between Kshs 27.5 mn - Kshs 29.5 mn. The 416 SQM and 492 SQM four bedroom units are priced at Kshs 78.0 and Kshs 80.0 mn, respectively. Amenities at Purple Haze include; a swimming pool, club house, gym, sauna and a roof garden among others;

- One West Park: One West Park is located off Mpaka road in Westlands. The development consists of 145 apartments and 380 parking spaces on 0.8 acres. The units are 190 SQM for a two bedroom, 209 SQM for a type (A) three bedroom and 227 SQM for a type (B) three bedroom, 255 SQM for a four-bedroom unit and 311 SQM for a penthouse, and are priced at Kshs 24.0 mn, Kshs 30.0 mn, Kshs 34.0 mn, Kshs 45.0 mn and Kshs 72.0 mn, respectively. Amenities include; two heated swimming pools, two heated generators, a jogging track, social hall, games room and a fully equipped gym;

- The Ridge: Located in Ridgeways, the Ridge sits on a 9.9-acre piece of land fronting the Northern Bypass. The residential development consists of 54 SQM one bedroom, 99 SQM two bedroom, 124 SQM three bedroom and 225 SQM four bedroom apartments, priced at Kshs 9.6 mn, Kshs 18.1 mn, Kshs 24.1 mn and Kshs 30.5 mn, respectively. Amenities at the Ridge include; a swimming pool, children’s playgrounds, landscaped courtyards, a health club, retail and office space consisting of a mini-mart, convenience stores, salon and laundry among others;

|

Nairobi Metropolitan Area Lifestyle Communities Developments Summary |

|||||

|

Name of development |

Location |

Residential Typology & Unit Sizes (SQM) |

Size (SQM) |

Residential Unit Price (Kshs) |

Price per SQM (Kshs) |

|

Enaki Residences |

Rosslyn |

1 bedroom(Townside) |

59 |

10.9 mn |

184,158 |

|

1 bedroom (Parkside) |

62 |

12.5 mn |

|||

|

2 bedroom (Townside) |

89 |

21.6 mn |

|||

|

2 bedroom (Parkside) |

94 |

16.4 mn |

|||

|

3 bedroom |

218 |

29.1 mn |

|||

|

4 bedroom |

291 |

49.0 mn |

|||

|

Mi Vida Homes |

Thika Road |

1 bedroom(A) |

56 |

8.4 mn |

141,227 |

|

1 bedroom(B) |

58 |

8.9 mn |

|||

|

2 bedroom |

86 |

12.0 mn |

|||

|

2 bedroom (DSQ) |

94 |

13.1 mn |

|||

|

2 bedroom (DSQ) |

99 |

14.0 mn |

|||

|

3 bedroom |

123 |

15.7 mn |

|||

|

Riverbank |

Ruaka |

1 bedroom |

87 |

14.0 mn |

152,670 |

|

2 bedroom |

130 |

20.0 mn |

|||

|

3 bedroom |

185 |

26.5 mn |

|||

|

Le Mac

|

Westlands |

1 bedroom |

81 |

17.0 mn |

221,551 |

|

2 bedroom |

114 |

25.0 mn |

|||

|

3 bedroom |

146 |

30.0 mn |

|||

|

Purple Haze

|

Kilimani |

2 bedroom (A) |

140 |

23.5 mn |

169,152 |

|

2 bedroom (B) |

169 |

27.5 mn |

|||

|

3 bedroom (A) |

169 |

27.5 mn |

|||

|

3 bedroom (B) |

172 |

29.5 mn |

|||

|

4 bedroom (A) |

416 |

78.0 mn |

|||

|

4 bedroom (B) |

492 |

80.0 mn |

|||

|

One West Park

|

Westlands |

2 bedroom |

190 |

24.0 mn |

158,044 |

|

3 bedroom (A) |

209 |

28.0 mn |

|||

|

3bedroom (B) |

227 |

32.0 mn |

|||

|

4 bedroom (A) |

255 |

45.0 mn |

|||

|

4 bedroom (B) |

311 |

72.0 mn |

|||

|

The Ridge |

Ridgeways |

1 bedroom |

54 |

9.6 mn |

172,740 |

|

2 bedroom |

99 |

18.1 mn |

|||

|

3 bedroom |

124 |

24.1 mn |

|||

|

4 bedroom |

225 |

30.5 mn |

|||

|

The Alma

|

Ruaka |

1 bedroom |

51 |

7.9 mn |

133,471 |

|

2 bedroom |

87 |

12.4 mn |

|||

|

3 bedroom (Standard) |

117 |

16.4 mn |

|||

|

3 bedroom( Premium) |

117 |

17.5 mn |

|||

Source: Online Research

Some of the major factors supporting the growth of lifestyle communities include;

- Demographic Growth: Kenya’s urbanization and population growth rates have remained relatively high at 4.0% and 2.3%, compared to the global average of 1.9% and 1.1%, respectively. This rising population presents an ideal market for lifestyle communities in urban areas and opportunities for real estate solutions to meet the growing demand while presenting comprehensive living conditions,

- Growth of the Middle Class: Kenya’s growing middle class demands for comprehensive and ideal living conditions given the increased disposable income. The middle class prefers solutions that are comprehensive and offer great convenience thus the growing preference for lifestyle communities,

- Presence of Salient Amenities: Lifestyle communities boast of top-notch amenities such as gyms, walking and biking trails, swimming pools, golfing amenities, reliable supply of water, sauna and security which offer convenience and a prestigious feel to the residents,

- Benefits of Economies of Scale: Due to the relatively large scale of amenities for many occupiers in the units, developers are able to offer amenities and services at a relatively lower unit cost, therefore benefiting both the developer and the buyer, and,

- Improved infrastructure: The continuous improvement of road networks such as the recent dualling of Ngong Road, the ongoing construction of Nairobi expressway and upgrading of Waiyaki way and construction of the Northern Bypass, opens up areas for development of investment grade real estate which encourages developers to explore lifestyle communities as an option, as they offer relatively high returns.

III. Challenges facing Development of Lifestyle Communities

Despite the numerous factors that have supported the growth of lifestyle communities, their development has been constrained by a number of factors, key among them being;

- Lack of Development Funding: Developers face barriers to adequate financial access which more often leads to project delays as they mostly rely on traditional sources of funding such as bank funding which is hard to secure due to the risk of defaults, while structured financing for real estate developments such as Real Estate Structured Notes and Real Estate Investment Trusts face slow uptake due to lack of sufficient market knowledge on the products,

- Inaccessibility to Mortgage Funding: Limited access to mortgage funding due to stringent requirements for borrowers to meet eligibility criteria coupled with inflexible mortgage maturity for buyers hinders uptake of units within lifestyle developments,

- Poor Urban Planning: Infrastructure remaining underdeveloped such as inadequate sewerage systems and water supply systems discourages development of lifestyle communities due to the high development costs accrued trying to ensure the environment is aesthetically appealing in order to attract clientele hence limiting developers, and,

- High Development Costs: Lifestyle communities are mostly located in prime areas with high land costs. This coupled by the need to deliver high quality designs and finishing leads to high development costs, thus a key hindrance to some developers.

IV. Performance of Lifestyle Communities within The Nairobi Metropolitan Area

We sampled lifestyle developments in key neighbourhoods among them; Westlands, Kilimani, Limuru Road, and Thika Road. These areas have continued to record growth of lifestyle communities supported by; i) relatively good transport networks, ii) proximity to social amenities, i.e, presence of malls such as Garden City Mall and Two Rivers Mall, iii) proximity to commercial nodes offering convenience for the working population, and, iv) hosting expatriates and majority of the growing Kenyan middle-class with increased disposable income thus demand for convenient and comprehensive lifestyles.

According to our analysis, lifestyle communities’ average total returns stood at 7.7%, 3.0% points higher than the residential market average of 4.7% according to Cytonn Annual Markets Review 2020. The average price per SQM came in at Kshs 157,952 while the average occupancy stood at 80.2%. In terms of total returns, one-bedrooms apartments were the best performing with an average returns of 10.1%, followed closely by two-bedroom apartments at 9.4%, while three and four-bedroom apartments came in at 6.6% and 4.7%, respectively. The good performance of one and two bedroom apartments is supported by their high demand as rental units. The performance of three-bedroom apartments was affected by 0.9% price correction attributable to the slowdown in demand amid reduced disposable income and thus focus on more affordable options. Four bedroom apartments recorded low rental yields averaging 4.2% respectively, attributed to relatively low occupancy rates at 77.0%, compared to the market average at 80.2%. Nevertheless, four-bedroom apartments had the highest average annualized uptake which stood at 21.7% while three, two, and one bedrooms recorded average annualized uptakes averaging 21.3%, 21.2% and 19.1%, respectively. The concept remained resilient recording an average price appreciation of 0.1% despite the tough economic environment.

The table below shows the performance of lifestyle communities in the Nairobi Metropolitan Area in 2021;

(All values in Kshs unless stated otherwise)

|

Nairobi Metropolitan Area Market Performance of Lifestyle Communities 2021 |

||||||||||

|

Typology |

Average Price |

Average Monthly Rent |

Average Price per SQM |

Average Rent per SQM |

Average Occupancy |

Average Annualized Uptake |

Average Rental Yield |

Average Price Appreciation |

Average Total Returns |

|

|

1 bed |

10.6 mn |

92,500 |

161,212 |

1,393 |

78.3% |

19.1% |

9.7% |

0.4% |

10.1% |

|

|

2 bed |

17.5 mn |

139,883 |

154,532 |

1,072 |

82.4% |

21.2% |

9.0% |

0.4% |

9.4% |

|

|

3 bed |

25.7 mn |

176,154 |

144,422 |

974 |

82.9% |

21.3% |

7.4% |

(0.9%) |

6.6% |

|

|

4 bed |

66.8 mn |

295,000 |

171,641 |

720 |

77.0% |

21.7% |

4.2% |

0.5% |

4.7% |

|

|

Grand Average |

|

175,782 |

157,952 |

1,040 |

80.2% |

20.8% |

7.6% |

0.1% |

7.7% |

|

|

· The average total returns came in at 7.7% with an average rental yield of 7.6% and an average price appreciation of 0.1% · One bedroom units recorded the highest rental yield at 9.7%, followed by two bedroom units at 9.0% · The average occupancy stood at 80.2% while the average price per SQM came in at Kshs 157,952 |

||||||||||

Source: Cytonn Research

The table below shows the comparison between performance of lifestyle communities in 2021 and the general residential market in the Nairobi Metropolitan Area in 2020;

(All values in Kshs unless stated otherwise)

|

Nairobi Metropolitan Area Market Performance Summary |

|||

|

Metric |

Lifestyle Communities |

FY’20 Residential Market |

Difference |

|

Average Price Per SQM |

157,952 |

116,774 |

32.8% |

|

Average Rent Per SQM |

1,040 |

543 |

91.3% |

|

Average Rental Yield |

7.6% |

4.9% |

2.7% points |

|

Average Y/Y Price Appreciation |

0.1% |

(0.2%) |

0.3% points |

|

Average Total Returns |

7.7% |

4.7% |

3.0% points |

|

· Lifestyle communities performed better in terms of total returns averaging 7.7%, 3.0% points higher than the residential market average of 4.7% · Lifestyle communities’ average price per SQM and rent per SQM came in at Kshs 157,952 and Kshs1,040, which are 36.1% points and 80.4% points higher than the residential market averages of Kshs 116,774 and Kshs 543, respectively |

|||

Source: Cytonn Research

V. Pros and Cons of Lifestyle Communities

Some of the advantages of lifestyle communities include:

- Security: Lifestyle communities provide a safe environment for residents owing to tightly guarded gates and perimeter walls. Residents with children are assured of the security and safety of their kids as they play within the neighbourhood,

- Cost Reduction due to Shared Facilities and Programs: Lifestyle communities provide shared facilities such as swimming pools, fitness centres, kids’ play areas and golf grounds which make them convenient and relatively affordable to home owners. In addition, the sharing creates familiarity and oneness within a particular community,

- Convenience: Lifestyle communities are developed with or around facilities that make life easier and better for its residents. Basic amenities such as shopping malls, schools, hospitals, churches and social services can be easily accessed at residents’ discretion,

- Maintenance is a Management Responsibility: These communities have a dedicated maintenance team which is available round the clock and given the pooled resources, the cost of services reduces significantly, and,

- Full Capital Gains on Re-sale: Investors are guaranteed of relatively high returns on re- sale of the property boosted by the proper maintenance and comprehensive amenities.

Despite the above benefits, there are a few disadvantages associated with lifestyle communities and they include;

- Less Freedom for Decorating and Design- For some communities, guidelines regarding home’s exteriors, landscaping, and maintenance present too much control and some homeowners feel they are being deprived of their right to freedom of expression, and,

- Restricted privacy: Residents live too close together and this limits their privacy compared to standalones in which on has their own compound and space.

VI. Future of lifestyle communities in Kenya & Conclusion

The lifestyle community concept has continued to gain popularity in Kenya supported by the growing demand for developments offering a comprehensive lifestyle that incorporates live, work and play, in addition to the relatively good returns to investors compared to the overall residential market. On the residential part, the best typologies to invest in would be one-bedrooms followed by two-bedrooms owing to their high returns supported by their high rental returns and resilient unit prices amid reduced transaction volumes in the market. With benefits outweighing shortcomings, we expect the real estate sector to continue recording increased development of lifestyle communities supported by; i) relaxed zoning regulations that enable development of high density building which allow for the provision of an array of amenities, ii) Kenya’s growing middle class thus demand for convenient, social and modern lifestyles, iii) improvement of infrastructure opening up more areas for development, iv) increased foreign investments supporting development with Kenya’s ranking by the World Bank in the ease of doing business having improved by 5 positions to #56 in 2020, and, iv) investors aiming to cash in on the high returns achievable from the developments. However, we expect the tough economic environment, market uncertainty, and the reduced disposable income to affect uptake of units within the lifestyle communities in the short term.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.