Nairobi Metropolitan Area Commercial Office Report 2023, & Cytonn Weekly #11/2023

By Research, Mar 19, 2023

Executive Summary

Fixed Income

During the week, T-bills remained oversubscribed, with the overall subscription rate coming in at 121.6%, albeit lower than the 148.5% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 7.3 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 182.3%, although significantly lower than the 501.0% recorded the previous week. Similarly, the 182-day paper recorded an oversubscription rate of 174.7%, a shift from the undersubscription rate of 79.1% recorded the previous week. On the other hand, the subscription rates for the 364-day paper declined to 44.3% from 76.8% recorded the previous week. The government accepted bids worth Kshs 28.8 bn out of the Kshs 29.2 bn total bids received, translating to an acceptance rate of 98.6%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day paper, 182-day and 91-day papers increasing by 3.0 bps, 6.9 bps and 3.8 bps to 10.8%, 10.3% and 9.8%, respectively;

In the primary market the government was seeking to raise an additional Kshs 20.0 bn for infrastructural development by offering a tap sale of bond issue no. IFB1/2023/017 with tenor to maturity of 17.0 years. The government received bids worth Kshs 12.7 bn translating to an undersubscription rate of 63.6% with the government accepting bids worth Kshs 12.7 bn translating to an acceptance rate of 100.0%. The average rate for the accepted bids and coupon rate for the bond is 14.4%;

Additionally, the government re-opened three bonds FXD2/2018/10, FXD1/2022/03 and FXD1/2019/15 seeking to raise additional Kshs 50.0 bn for budgetary support. The government seeks to raise Kshs 20.0 bn through the FXD2/2018/10, with closure date for bidding set on 4th April, 2023 and Kshs 30.0 bn through the FXD1/2022/03 and FXD1/2019/15, with closure date for bidding set on 18th April, 2023. The bonds have tenors to maturity of 2.1 years, 5.8 years and 10.9 years for the FXD1/2022/03, FXD2/2018/10 and FXD1/2019/15 respectively, and coupon rates of 11.8%, 12.5% and 12.9% for the FXD1/2022/03, FXD2/2018/10 and FXD1/2019/15 respectively. We anticipate the bonds to be undersubscribed as investors seek to avoid duration risk, as well as concerns on the government’s ability to sustain the current debt servicing costs. Our recommended bidding range for the bonds are; 12.6%-13.1% for FXD1/2022/03, 13.7%-14.2% for the FXD2/2018/10 and 13.9%-14.4% for the FXD1/2019/15 based on bonds of similar tenor trading range;

During the week, the National Treasury gazetted the revenue and net expenditures for the eight months of FY’2022/2023, ending 28th February 2023;

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya effective 15th March 2023 to 14th April 2023. Notably, prices of Super Petrol increased by Kshs 2.0 per litre to Kshs 179.3, while prices of Diesel and Kerosene remained unchanged for the fourth consecutive month at Kshs 162.0 and Kshs 145.9 per litres, respectively;

Equities

During the week, the equities market remained on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 12.3%, 4.9% and 9.7%, respectively, taking the YTD performance to losses of 18.8%, 8.7%, and 13.8% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large cap stocks such as Safaricom of 20.6%, whose market cap is 41.0% of the entire bourse, and banking stocks such as KCB Group, Equity Group and NCBA of 17.2%, 11.3%, and 7.5%, respectively. The equities market performance was mainly attributable to massive capital flight as foreign investors moved to developed markets with the European Central Bank raising the European Interest Base Rate (ECB) by 50.0 bps to 3.50% from 3.00% on 16th March 2023. Further, the U.S. Federal Reserve Board is expected to hike their interest from the range of 4.50%-4.75% in the next sitting scheduled for 22nd March 2023. The losses in the equities market were however marginally mitigated by gains recorded by other large cap stocks such as Stanbic Holdings and EABL of 1.6% and 0.4%, respectively;

During the week, four listed banks released their FY’2022 financial results all recording an increase in their Core earnings per share. ABSA Bank Kenya, Standard Chartered Bank Kenya, Co-operative Bank and KCB Group recorded an increase in their Core earnings per share of 34.2%, 34.0%, 33.2% and 19.5%, respectively;

Also, during the week, the Central Bank of Kenya (CBK) announced that Premier Bank Limited Somalia (PBLS) had completed acquisition of 62.5% shareholding of First Community Bank Limited (FCB) effective 27th March 2023;

Real Estate

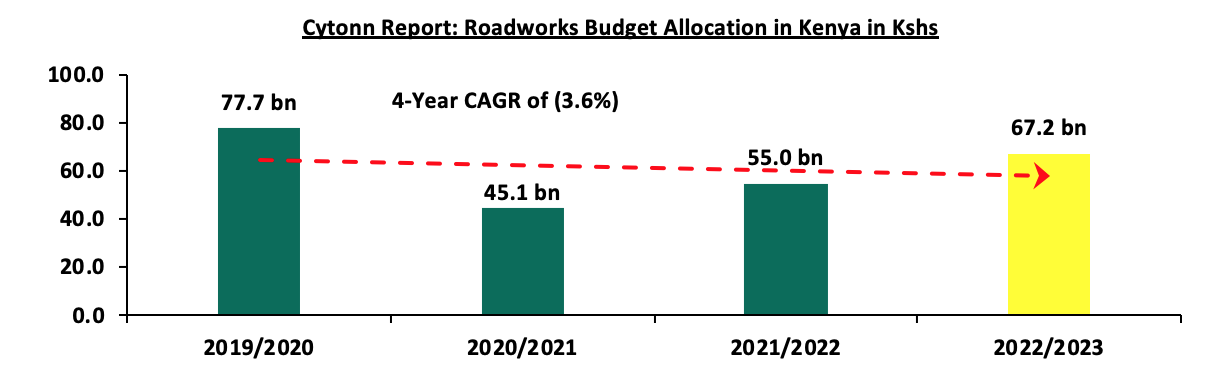

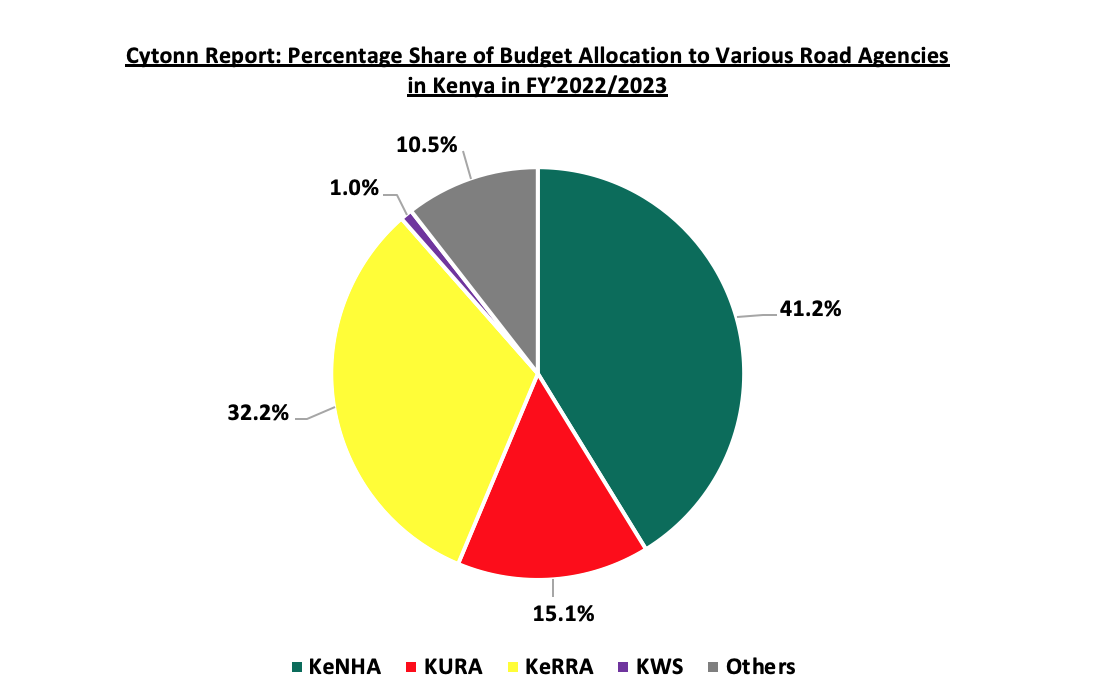

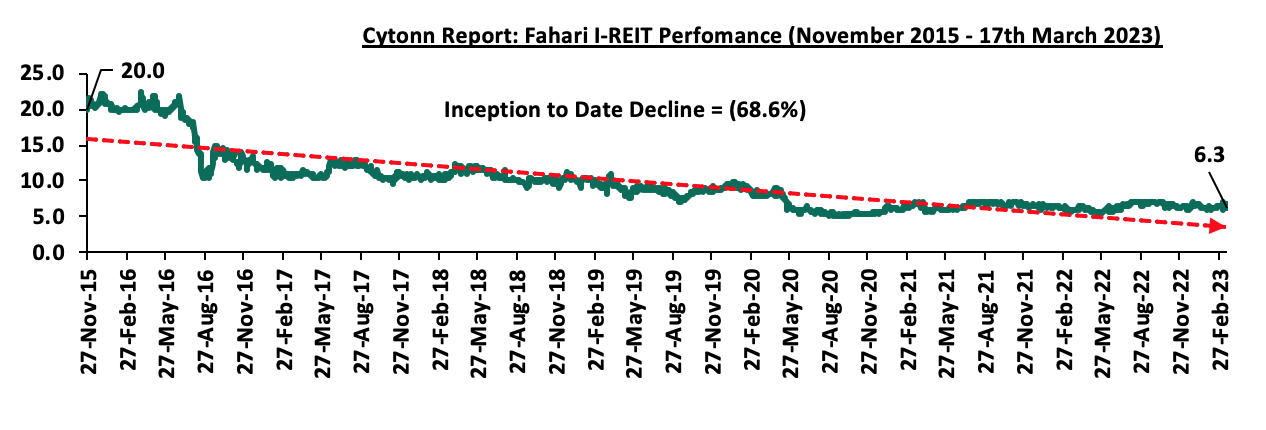

During the week, the Kenya Roads Board (KRB), released the Annual Public Roads Programme 2022/2023 report highlighting that Kshs 67.2 bn has been allocated in FY’2022/2023 to various road agencies. The amount represents a 22.2% increase in the funds allocated for the maintenance of roads from the Kshs 55.0 bn spent in the FY’2021/22, an indication that the government continued priority on improving road developments across the country. In the hospitality sector, Dusit International, a Bangkok based Thai Hotel and property development company announced plans to open a hotel-serviced apartment in Westlands Nairobi in 2023 dubbed ‘Dusit Princes Hotel Residences’, along Mimosa Lane off Church Road. The upper-middle class property will consist of a hybrid of 56 one bedroom and 30 studio apartments and 14 deluxe hotel rooms, an Italian inspire restaurant, a rooftop bar, heated swimming pool, rooftop gym, and a 150 guest capacity theatre-styled meeting room. In the Real Estate Investment Trusts (REITs) segment, Fahari I-REIT closed the week trading at an average price of Kshs 6.3 per share on the Nairobi Securities Exchange, a 3.6% gain from Kshs 6.1 per share recorded the previous week. On the Unquoted Securities Platform as at 17th March 2023, Acorn D-REIT and I-REIT closed the week trading at Kshs 23.9 and Kshs 20.9 per unit, respectively, a 19.4% and 4.4% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price;

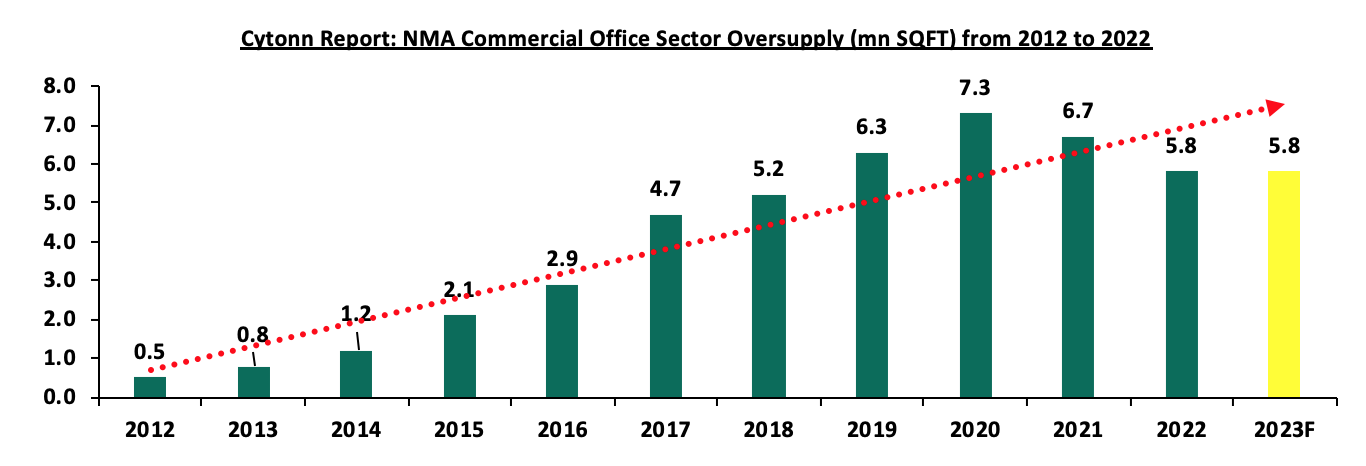

Focus of the Week

In 2022, we published the Nairobi Metropolitan Area Commercial Office Report 2022 themed ‘Changing Working Patterns Driving the Market’, in which we highlighted the performance of the sector in 2021, as well as giving insights on the outlook and areas best fit for investment opportunities. According to the report, the sector witnessed improved performance, with the average rental yields coming in at 7.3% in 2021, 0.3% points higher than the 7.0% recorded in 2020, attributed to continued post COVID-19 pandemic recovery, an improved business environment and expansion in activities by various firms. The average occupancy rates declined slightly by 0.1% points to 77.6% in 2021, from 77.7% recorded in 2020, this is as some firms still embraced a work from home policy. Asking rents and prices stabilized to an average of Kshs 94 and Kshs 12,108 per SQFT respectively in 2021, from Kshs 93 and Kshs 12,280 per SQFT, respectively, recorded in 2020. In addition, there was an oversupply of 6.7 mn SQFT in office spaces in the market, which continued to subdue the sector’s optimum performance. In 2023, we update our previous research with the Commercial Office Report 2023 themed ‘Persisting Tenant’s Market’, in order to determine the market’s performance and analyse the ongoing trends;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.03%. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 13.90% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Lee Mathenge, a Product Development, Service Design & Innovation Analyst at Cytonn Investments, was on a twitter space hosted by Sharp Daily, moderated by Fossie Adhiambo, a Product Development, Service Design & Innovation Assistant at Cytonn Investments. Listen to the conversation here;

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

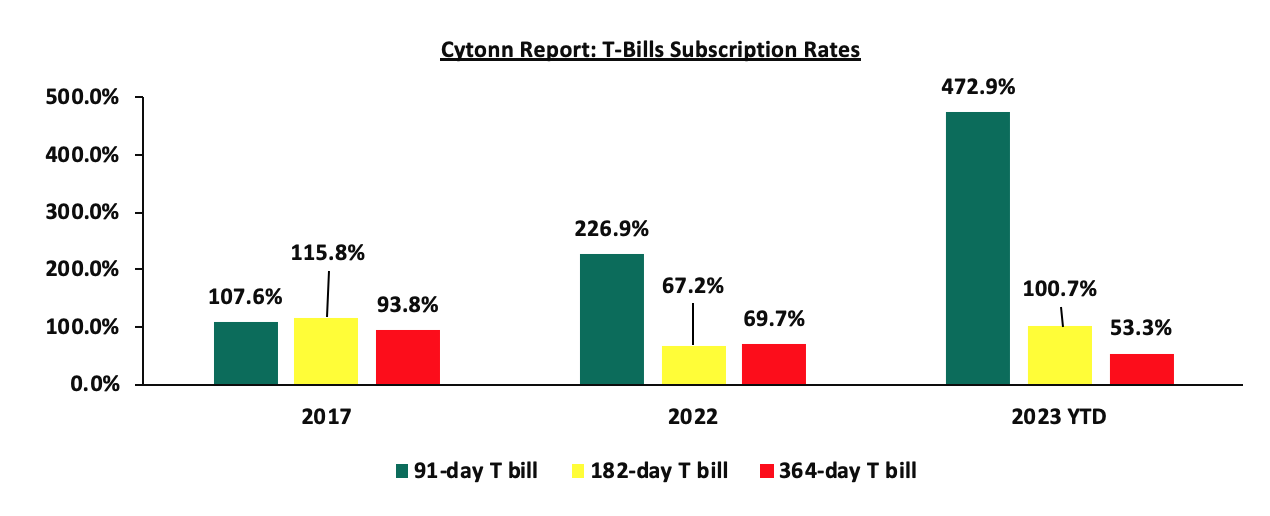

During the week, T-bills remained oversubscribed, with the overall subscription rate coming in at 121.6%, albeit lower than the 148.5% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 7.3 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 182.3%, although significantly lower than the 501.0% recorded the previous week. Similarly, the 182-day paper recorded an oversubscription rate of 174.7%, a shift from the undersubscription rate of 79.1% recorded the previous week. On the other hand, the subscription rates for the 364-day paper declined to 44.3% from 76.8% recorded the previous week. The government accepted bids worth Kshs 28.8 bn out of the Kshs 29.2 bn total bids received, translating to an acceptance rate of 98.6%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day paper, 182-day and 91-day papers increasing by 3.0 bps, 6.9 bps and 3.8 bps to 10.8%, 10.3% and 9.8%, respectively. The chart below compares the overall average T- bills subscription rates obtained in 2017, 2022 and 2023 Year to Date (YTD):

In the primary market the government was seeking to raise an additional Kshs 20.0 bn for infrastructural development by offering a tap sale of bond issue no. IFB1/2023/017 with tenor to maturity of 17.0 years. The bond received bids worth Kshs 12.7 bn translating to an undersubscription rate of 63.6% with the government accepting bids worth Kshs 12.7 bn translating to an acceptance rate of 100.0%. The average rate for the accepted bids and coupon rate for the bond is 14.4%. Additionally, the government re-opened three bonds FXD2/2018/10, FXD1/2022/03 and FXD1/2019/15 seeking to raise additional Kshs 50.0 bn for budgetary support. The government seeks to raise Kshs 20.0 bn through the FXD2/2018/10, with closure date for bidding set on 4th April, 2023 and Kshs 30.0 bn through the FXD1/2022/03 and FXD1/2019/15, with closure date for bidding set on 18th April, 2023. The bonds have tenors to maturity of 2.1 years, 5.8 years and 10.9 years for the FXD1/2022/03, FXD2/2018/10 and FXD1/2019/15 respectively, and coupon rates of 11.8%, 12.5% and 12.9% for the FXD1/2022/03, FXD2/2018/10 and FXD1/2019/15 respectively. We anticipate the bonds to be undersubscribed as investors seek to avoid duration risk, as well as concerns on the government’s ability to sustain the current debt servicing costs. Our recommended bidding range for the bonds are; 12.6%-13.1% for FXD1/2022/03, 13.7%-14.2% for the FXD2/2018/10 and 13.9%-14.4% for the FXD1/2019/15 based on bonds of similar tenor trading range.

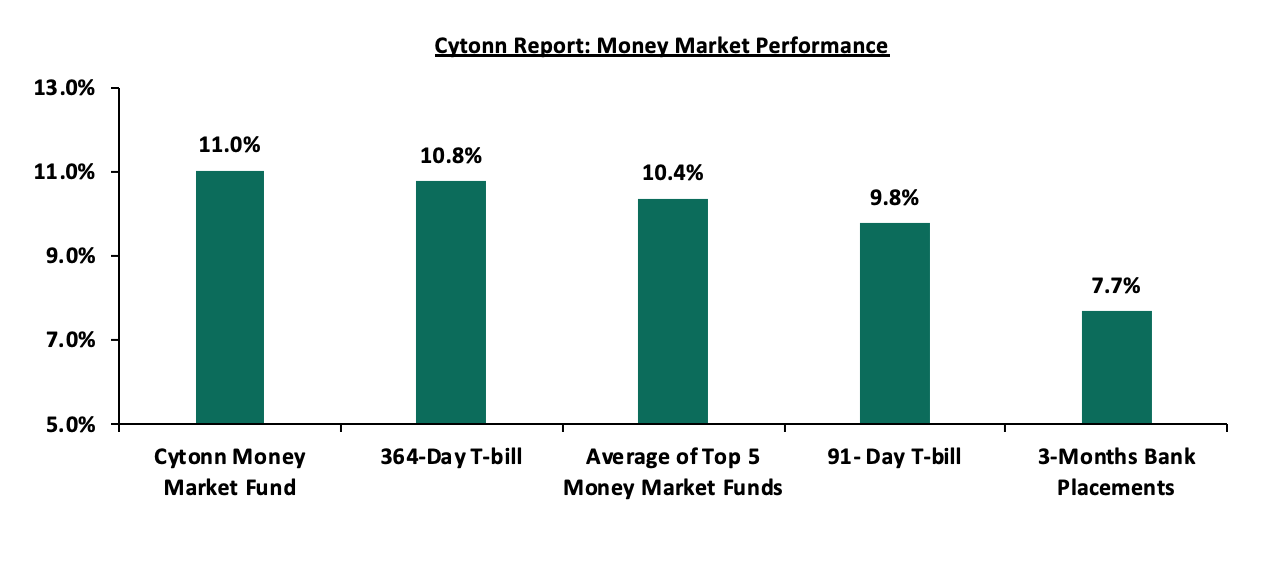

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 364-day and 91-day T-bill increased by 3.0 bps and 3.8 bps to 10.8% and 9.8% from 10.7% and 9.7% respectively, recorded the previous week. Similarly, the average yields of the Top 5 Money Market Funds increased by 5.4 bps to close the week at 10.4%, from 10.3% recorded the previous week. The yield on Cytonn Money Market Fund remained relatively unchanged at 11.0%, from what was recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 17th March 2023:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 17th March 2023 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (dial *809# or download Cytonn App) |

11.0% |

|

2 |

Dry Associates Money Market Fund |

10.3% |

|

3 |

Apollo Money Market Fund |

10.2% |

|

4 |

Madison Money Market Fund |

10.2% |

|

5 |

NCBA Money Market Fund |

10.1% |

|

6 |

Kuza Money Market fund |

10.1% |

|

7 |

Nabo Africa Money Market Fund |

10.0% |

|

8 |

Zimele Money Market Fund |

9.9% |

|

9 |

Sanlam Money Market Fund |

9.9% |

|

10 |

Old Mutual Money Market Fund |

9.9% |

|

11 |

KCB Money Market Fund |

9.6% |

|

12 |

Co-op Money Market Fund |

9.6% |

|

13 |

AA Kenya Shillings Fund |

9.6% |

|

14 |

GenCap Hela Imara Money Market Fund |

9.5% |

|

15 |

Jubilee Money Market Fund |

9.4% |

|

16 |

CIC Money Market Fund |

9.3% |

|

17 |

GenAfrica Money Market Fund |

9.3% |

|

18 |

British-American Money Market Fund |

9.3% |

|

19 |

ICEA Lion Money Market Fund |

8.8% |

|

20 |

Orient Kasha Money Market Fund |

8.8% |

|

21 |

Absa Shilling Money Market Fund |

8.2% |

|

22 |

Mali Money Market Fund |

8.2% |

|

23 |

Equity Money Market Fund |

6.6% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets tightened, with the average interbank rate increasing to 6.9% from 6.7% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded declined by 17.6% to Kshs 17.5 bn from Kshs 21.3 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds were on an upward trajectory with the yield on the 7-year Eurobond issued in 2019 increasing the most, having gained by 2.3% points to 13.4% from 11.1% recorded the previous week. The rise in the country’s Eurobond yields is mainly on the back of increased concerns about the United States dollar shortages currently experienced in the economy, coupled with increased debt servicing concerns and S&P Global Ratings downgrading of Kenya’s outlook to negative from stable last month, citing a weakening liquidity position. The table below shows the summary of the performance of the Kenyan Eurobonds as of 16th March 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD bn) |

2.0 |

1.0 |

1.0 |

0.9 |

1.2 |

1.0 |

|

Years to Maturity |

1.3 |

5.0 |

25.0 |

4.2 |

9.2 |

11.3 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

2-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

1-Mar-23 |

12.1% |

10.7% |

11.0% |

10.9% |

10.8% |

10.2% |

|

9-Mar-23 |

11.8% |

11.2% |

11.3% |

11.1% |

11.3% |

10.5% |

|

10-Mar-23 |

11.9% |

11.4% |

11.4% |

11.5% |

11.4% |

10.6% |

|

13-Mar-23 |

12.4% |

11.5% |

11.5% |

11.8% |

11.6% |

10.9% |

|

14-Mar-23 |

12.9% |

11.9% |

11.7% |

12.5% |

11.8% |

11.1% |

|

15-Mar-23 |

13.2% |

12.2% |

11.9% |

12.8% |

12.1% |

11.3% |

|

16-Mar-23 |

14.0% |

12.8% |

12.3% |

13.4% |

12.5% |

11.6% |

|

Weekly Change |

2.2% |

1.6% |

1.0% |

2.3% |

1.2% |

1.1% |

|

MTD Change |

1.9% |

2.1% |

1.3% |

2.5% |

1.7% |

1.4% |

|

YTD Change |

1.1% |

2.3% |

1.4% |

2.5% |

1.7% |

1.7% |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling depreciated by 0.8% against the US dollar to close the week at Kshs 129.9, from Kshs 128.9 recorded the previous week, partly attributable to increased dollar demand from manufacturers and importers, especially oil and energy sectors against a slower supply of hard currency. On a year to date basis, the shilling has depreciated by 5.2% against the dollar, adding to the 9.0% depreciation recorded in 2022. We expect the shilling to remain under pressure in 2023 as a result of:

- High global crude oil prices on the back of persistent supply chain bottlenecks coupled with high demand. The high crude oil prices have inflated Kenya’s import bill and as a result, petroleum products imports have continued to weigh heavily on the country’s import bill, and accounted for 27.6% of the total import bill in Q3’2022, up from 25.6% in Q2’2022 and much higher than 15.2% recorded in Q3’2021,

- An ever-present current account deficit estimated at 4.9% of GDP in 2022, despite improving by 0.3% points from 5.2% recorded in 2021,

- The need for Government debt servicing which continues to put pressure on forex reserves given that 69.3% of Kenya’s External debt was US Dollar denominated as of October 2022, and,

The shilling is however expected to be supported by:

- Diaspora remittances standing at a cumulative USD 658.6 mn in 2023 as of February 2023, albeit 0.3% lower than the USD 660.3 mn recorded over the same period in 2022.

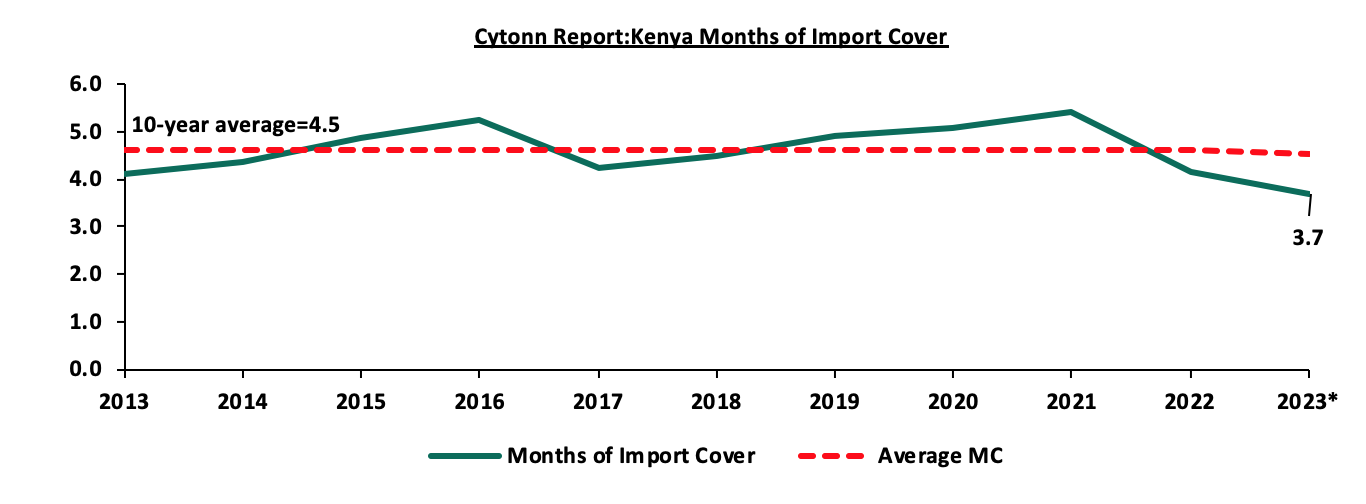

Key to note, Kenya’s forex reserves remained relatively unchanged at USD 6.6 bn as at 16th March 2023, similar to what was recorded the previous week. As such, the country’s months of import cover also remained unchanged at 3.7 months, similar to what was recorded the previous week, and below the statutory requirement of maintaining at least 4.0-months of import. The chart below summarizes the evolution of Kenya months of import cover over the last 10 years:

*Figure as at 16th March 2023

Weekly Highlights:

- Revenue and Net Exchequer for FY’2022/23

During the week, the National Treasury gazetted the revenue and net expenditures for the eight months of FY’2022/2023, ending 28th February 2023. Below is a summary of the performance:

|

Cytonn Report: FY'2022/2023 Budget Outturn - As at 28th February 2023 |

|||||

|

Amounts in Kshs billions unless stated otherwise |

|||||

|

Item |

12-months Original Estimates |

Actual Receipts/Release |

Percentage Achieved |

Prorated |

% achieved of prorated |

|

Opening Balance |

|

0.6 |

|

|

|

|

Tax Revenue |

2,071.9 |

1,236.2 |

59.7% |

1,381.3 |

89.5% |

|

Non-Tax Revenue |

69.7 |

44.5 |

63.9% |

46.4 |

95.9% |

|

Total Revenue |

2,141.6 |

1,281.3 |

59.8% |

1,427.7 |

89.7% |

|

External Loans & Grants |

349.3 |

201.0 |

57.5% |

232.9 |

86.3% |

|

Domestic Borrowings |

1,040.5 |

333.3 |

32.0% |

693.6 |

48.0% |

|

Other Domestic Financing |

13.2 |

15.5 |

117.4% |

8.8 |

176.1% |

|

Total Financing |

1,403.0 |

549.8 |

39.2% |

935.3 |

58.8% |

|

Recurrent Exchequer issues |

1,178.4 |

726.9 |

61.7% |

785.6 |

92.5% |

|

CFS Exchequer Issues |

1,571.8 |

756.5 |

48.1% |

1,047.9 |

72.2% |

|

Development Expenditure & Net Lending |

424.4 |

162.6 |

38.3% |

282.9 |

57.5% |

|

County Governments + Contingencies |

370.0 |

183.2 |

49.5% |

246.7 |

74.3% |

|

Total Expenditure |

3,544.6 |

1,829.1 |

51.6% |

2,363.1 |

77.4% |

|

Fiscal Deficit excluding Grants |

1,403.0 |

547.8 |

39.0% |

935.3 |

58.6% |

|

Total Borrowing |

1,389.8 |

534.3 |

38.4% |

926.5 |

57.7% |

Source: National Treasury and Kenya Gazette

Key takeouts from the release include;

- Total revenue collected as at the end of February 2023 amounted to Kshs 1,281.3 bn, equivalent to 59.8% of the original estimates of Kshs 2,141.6 bn for FY’2022/2023 and is 89.7% of the prorated estimates of Kshs 1,427.7 bn. We note that the government has not been able to meet its prorated revenue targets eight months into the FY’2022/2023 partly attributable to the tough macroeconomic environment in the country as a result of elevated inflationary pressures with February 2023 coming in at 9.2%, above the CBK ceiling of 7.5%. Cumulatively, tax revenues amounted to Kshs 1,236.2 bn, equivalent to 59.7% of the original estimates of Kshs 2,071.9 bn and 89.5% of the prorated estimates of Kshs 1,381.3 bn,

- Total financing amounted to Kshs 549.8 bn, equivalent to 39.2% of the original estimates of Kshs 1,403.0 bn and is equivalent to 58.8% of the prorated estimates of Kshs 935.3 bn. Additionally, domestic borrowing amounted to Kshs 333.3 bn, equivalent to 32.0% of the original estimates of Kshs 1,040.5 bn and is 48.0% of the prorated estimates of Kshs 693.6 bn,

- The total expenditure amounted to Kshs 1,829.1 bn, equivalent to 51.6% of the original estimates of Kshs 3,544.6 bn, and is 77.4% of the prorated target expenditure estimates of Kshs 2,363.1 bn. Additionally, the net disbursements to recurrent expenditure came in at Kshs 726.9 bn, equivalent to 61.7% of the original estimates of Kshs 1,178.4 bn and 92.5% of the prorated estimates of Kshs 785.6 bn,

- Consolidated Fund Services (CFS) Exchequer issues (refers to the Consolidated Fund established in the Kenya’s constitution into which development partners deposit funds before disbursing to the Exchequer accounts for projects such as servicing of public debt, payment of pensions and gratuities, salaries and allowances and subscription to International Organizations) came in at Kshs 756.5 bn, equivalent to 48.1% of the original estimates of Kshs 1,571.8 bn, and 72.2% of the prorated amount of Kshs 1,047.9 bn. The cumulative public debt servicing cost amounted to Kshs 694.0 bn which is 49.8% of the original estimates of Kshs 1,393.1 bn, and is 74.7% of the prorated estimates of Kshs 926.5 bn. Notably, the Kshs 694.0 bn debt servicing cost is equivalent to 54.2% of the actual revenues collected as at the end of February 2023, further emphasizing on how much public debt servicing weighs on the country’s expenditure. Additionally, Recurrent Exchequer issues came in at Kshs 726.9 bn equivalent to 61.7% of the original estimates of Kshs 1,178.4 bn and are 92.5% of the prorated estimates of Kshs 785.6, and,

- Total Borrowings as at the end of February 2023 amounted to Kshs 534.3 bn, equivalent to 38.4% of the original estimates of Kshs 1,389.8 bn for FY’2022/2023 and are 57.7% of the prorated estimates of Kshs 926.5 bn. The cumulative domestic borrowing target of Kshs 1,040.5 bn comprises of adjusted Net domestic borrowings of Kshs 579.1 bn and Internal Debt Redemptions (Roll-overs) of Kshs 461.4 bn.

The government has been unable to meet its revenue prorated targets for the eight months of the FY’2022/2023 on the back of the tough economic situation exacerbated by the elevated inflationary pressures that have remained above the CBK ceiling of 7.5%, with the year on year inflation rate in February 2023 coming in at 9.2%. Notably, the situation is further aggravated by the US dollar shortage that is currently experienced in the economy, resulting in high consumer prices as companies pass the high cost of import and production to consumers by hike in commodities prices. The February Purchasing Managers Index (PMI) also pointed towards a solid deterioration in operating condition with the index registering at 46.6, the first time in six months the index came below the 50.0 no change threshold. In a bid to expand its revenue base and seal tax leakage, the government through the Kenya Revenue Authority recently suspended all tax relief payments. The agency also disclosed that in the past five years it had granted total tax reliefs and incentives amounting to Kshs 610.0 bn, translating to an average of Kshs 122.0 per year which had continued to weigh down the government’s tax collections. We still hold the view that the government revenue targets are relatively ambitious, owing to the current tough economic situation which is expected to continue to impede revenue collection efforts as firms’ records low commodities demand as consumers cut back on spending.

- Fuel Prices

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya effective 15th March 2023 to 14th April 2023. Notably, prices of Super Petrol increased by Kshs 2.0 per litre to Kshs 179.3, while prices of Diesel and Kerosene remained unchanged for the fourth consecutive month at Kshs 162.0 and Kshs 145.9 per litres, respectively. Other key take-outs from the performance include;

- The average landed costs of super-petrol, diesel and kerosene by 0.1%, 2.5% and 1.5% to USD 659.5 per cubic metre, USD 759.9 per cubic metre and USD 763.3 per cubic metre in February 2023, from USD 659.9 per cubic metre, USD 779.5 per cubic metre and USD 775.0 per cubic metre in January 2023, respectively,

- The Free On Board (FOB) price of Murban crude oil declined by 11.9% to USD 80.1 per barrel in February 2023 from USD 90.9 per barrel recorded in January 2023,

- The Kenyan Shilling depreciated against the US Dollar by 2.6% to Kshs 134.0 in February 2023 from 130.6 in January 2023, and,

- The price of diesel has been cross subsidized with that of super-petrol, while maintaining a subsidy of Kshs 23.5 per litre on Kerosene in order to cushion consumers from the otherwise high prices.

Key to note, EPRA maintained the Kshs 12.4 per litre margin to Oil Marketing Companies for Super Petrol and increased Diesel margins by 16.0% to Kshs 2.9 per litre from 2.5 per litre, while Kerosene margins remained withheld. This is attributable to super-petrol recording a price stabilization surplus of Kshs 9.0 per litre, diesel remaining balanced, while kerosene recorded a deficit of Kshs 9.4 per litre.

Notably, despite the global fuel prices dropping by 37.3% to USD 73.8 per barrel as of 16th March 2023, from a peak of USD 117.7 per barrel recorded on 1st June 2022, and the average landed costs declining during the month, the prices of super-petrol in the country increased while prices of diesel and kerosene remain elevated based on historical levels. This is mainly attributable to the decision by the government to scale down fuel subsidies coupled with the US dollar shortage being experienced in the economy driven by elevated cost of fuel import. In a bid to alleviate the high demand of US dollar by petroleum importers which consequently leads to high cost of fuel importation, the government signed a deal with foreign government-owned fuel producers’ entities, the Saudi Aramco (ARAMCO), Abu Dhabi National Oil Company (ADNOC) and Emirates National Oil Company (ENOC) to supply Kenya with diesel and super petrol for the next six months on credit. In our view, it is only a temporary fix, and unless the government expedites measures to buffer foreign reserves and resuscitate the currently frail interbank forex market, the economy will once again be hit by elevated US dollar demand 6 months down the line. Furthermore, we still hold the view that, as a measure of fiscal consolidation, the government should eliminate the fuel subsidies, which continue to weigh on its expenditure.

Rates in the Fixed Income market have remained relatively stable due to the relatively ample liquidity in the money market. The government is 6.6% behind its prorated borrowing target of Kshs 418.7 bn having borrowed Kshs 391.2 bn of the Kshs 581.7 bn borrowing target for the FY’2022/2023. We believe that the projected budget deficit of 5.7% is relatively ambitious given the downside risks and deteriorating business environment occasioned by high inflationary pressures. Further, revenue collections are lagging behind, with total revenue as at February 2023 coming in at Kshs 1.3 tn in the FY’2022/2023, equivalent to 59.8% of its target of Kshs 2.1 tn and 89.7% of the prorated target of Kshs 1.4 tn. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to bridge the fiscal deficit through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the week, the equities market remained on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 12.3%, 4.9% and 9.7%, respectively, taking the YTD performance to losses of 18.8%, 8.7%, and 13.8% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large cap stocks such as Safaricom of 20.6%, whose market cap is 41.0% of the entire bourse, and banking stocks such as KCB Group, Equity Group and NCBA of 17.2%, 11.3%, and 7.5%, respectively. The equities market performance was mainly attributable to massive capital flight as foreign investors moved to developed markets with the European Central Bank raising the European Interest Base Rate (ECB) by 50.0 bps to 3.50% from 3.00% on 16th March 2023. Further, the U.S. Federal Reserve Board is expected to hike their interest from the range of 4.50%-4.75% in the next sitting scheduled for 22nd March 2023. The losses in the equities market were however marginally mitigated by gains recorded by other large cap stocks such as Stanbic Holdings and EABL of 1.6% and 0.4%, respectively.

During the week, equities turnover increased by 90.6% to USD 22.5 mn from USD 11.8 mn recorded the previous week taking the YTD turnover to USD 138.1 mn. Foreign investors remained net sellers, recording a significant net selling position of USD 8.0 mn, from a net selling position of USD 2.9 mn recorded the previous week, taking the YTD net selling position to USD 36.0 mn.

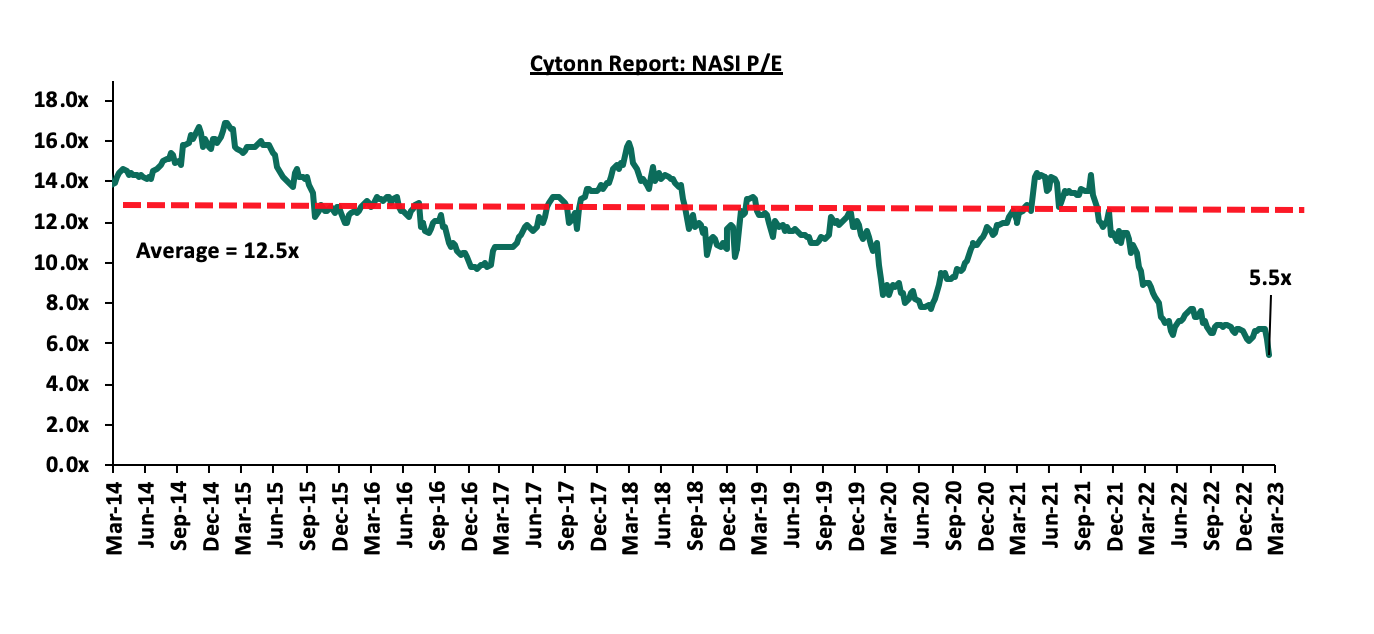

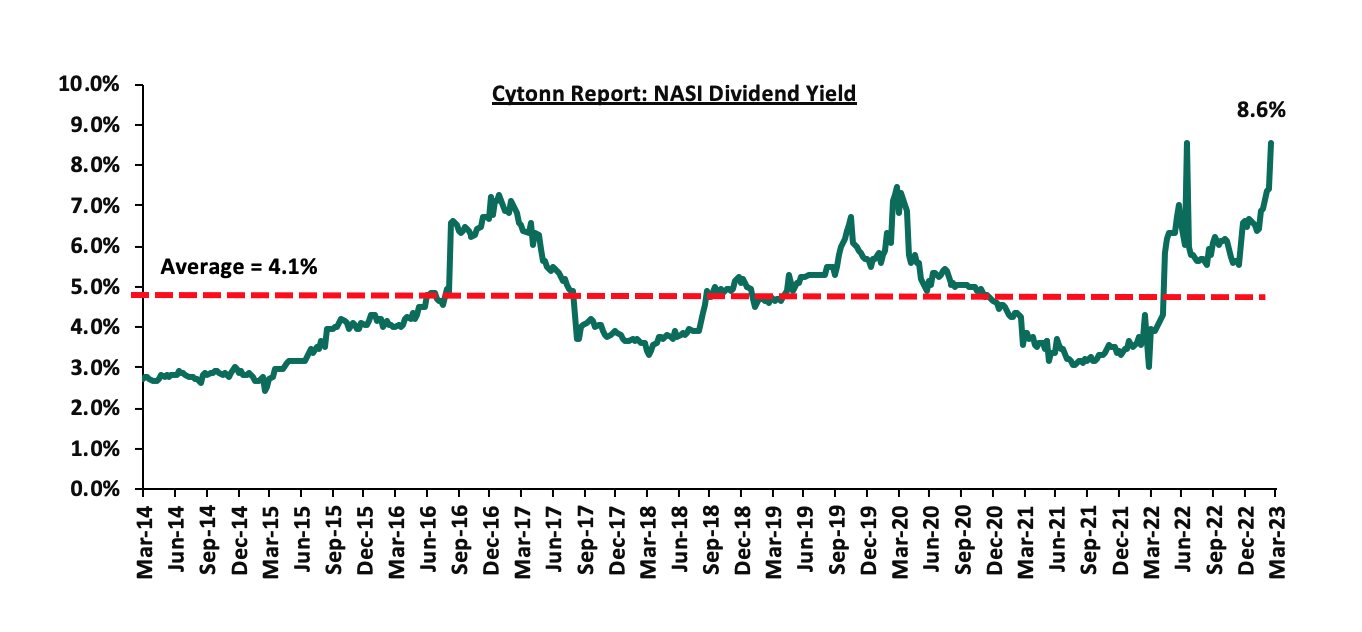

The market is currently trading at a price to earnings ratio (P/E) of 5.5x, 56.2% below the historical average of 12.5x and marks a new trough valuation. The dividend yield stands at 8.6%, 4.5% points above the historical average of 4.1%. Key to note, NASI’s PEG ratio currently stands at 0.8x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Weekly highlight

- First Community Bank Limited (FCB) Acquisition by Premier Bank Limited-Somalia (PBLS)

During the week, the Central Bank of Kenya (CBK) announced that Premier Bank Limited Somalia (PBLS) had completed acquisition of 62.5% shareholding of First Community Bank Limited (FCB) effective 27th March 2023. This comes after receiving regulatory approvals from the CBK and the Cabinet Secretary for the National Treasury. FCB, which has been in operation since June 2008, is classified as a tier 3 bank in Kenya with 18 branches and a market share of 0.3% as at December 2022. The acquisition by Premier Bank Limited Somalia (PBLS), comes at a time when FCB has been struggling to meet regulatory Capital adequacy requirements.

FCB’s asset base stood at Kshs 22.1 bn in Q3’2022 with net loans coming in at Kshs 18.2 bn. Customer deposits came in at Kshs 18.2 bn as well, translating to a loan to deposit ratio of 100.0% reflecting the bank’s current inability to amass deposits. Profits after tax came in at Kshs 205.7 mn in Q3’2022, a 8.2% y/y decline from Kshs 224.1 mn in Q3’2021, driven by a faster 15.9% increase in operating expenses to Kshs 1.1 bn from Kshs 1.0 bn in Q3’2021 which outpaced the 6.9% increase in operating income to Kshs 1.4 bn from Kshs 1.3 bn in Q3’2021. Key capital ratios such as the Core capital to deposit liabilities ratio came in at 9.1% in Q3’2022, only 1.1% points above the regulatory limit of 8.0%. The core capital to risk weighted assets came in at 7.1% in Q3’2022, 3.4% points below the regulatory limit of 10.5%. Similarly, the Capital adequacy ratio came in at 11.0% in Q3’2022, 3.5% points below the regulatory requirement of 14.5%, and 8.0% below the sector average of 19.0% in Q3’2022. The liquidity ratio came in 14.5%, 5.5% points below the regulatory requirement of 20.0%. Further, other ratios have also been adverse, such as the asset quality, with the bank’s Non-Performing loan (NPL) ratio coming in at 26.1% in Q3’2022, 12.4% points above the banking sector average of 13.7% during the same period. The table below summarizes FCB’s financials and ratios;

|

Cytonn report: Summary of First Community Bank (FCB) Financials |

|||||

|

FY’2018 |

FY’2019 |

FY’2020 |

FY’2021 |

Q3'2022 |

|

|

Balance Sheet Summary (Kshs bn) |

|||||

|

Net Loans |

9.0 |

9.9 |

12.6 |

17.2 |

18.2 |

|

Total Assets |

17.9 |

18.8 |

21.9 |

24.7 |

22.1 |

|

Customer Deposits |

14.6 |

16.1 |

18.8 |

21.5 |

18.2 |

|

Total Liabilities |

16.6 |

17.3 |

19.9 |

22.2 |

18.9 |

|

Shareholders' Funds |

1.3 |

1.5 |

2.1 |

2.5 |

3.2 |

|

Income Statement Summary (Kshs bn) |

|||||

|

Total Operating income |

1.2 |

1.2 |

1.3 |

2.2 |

1.4 |

|

Total Operating expenses |

(1.5) |

(1.0) |

(1.1) |

(1.6) |

(1.1) |

|

Profit After Tax (PAT) |

(0.3) |

0.2 |

0.2 |

0.6 |

0.3 |

|

Balance Sheet Ratios |

|||||

|

Loan to Deposit |

61.8% |

61.5% |

67.1% |

80.1% |

99.9% |

|

ROaE |

(14.2%) |

14.0% |

10.6% |

17.1% |

13.5% |

|

ROaA |

(1.2%) |

1.0% |

0.9% |

1.7% |

1.7% |

|

Income Statement Ratios: |

|||||

|

Yield on Interest Earning Assets |

7.2% |

7.4% |

6.5% |

9.1% |

10.9% |

|

Net Interest Margin |

5.2% |

5.6% |

5.6% |

8.7% |

10.2% |

|

Cost to Income Ratio |

98.1% |

55.6% |

79.0% |

49.1% |

75.2% |

|

Capital Adequacy Ratios: |

|||||

|

Core Capital liabilities ratio |

5.3% |

3.8% |

4.4% |

5.2% |

9.1% |

|

Minimum Statutory requirement |

8.0% |

8.0% |

8.0% |

8.0% |

8.0% |

|

Excess/Deficit |

(2.7%) |

(4.2%) |

(3.6%) |

(2.8%) |

1.1% |

|

Core Capital risk weighted assets ratio |

6.5% |

4.4% |

4.8% |

5.2% |

7.1% |

|

Minimum Statutory requirement |

10.5% |

10.5% |

10.5% |

10.5% |

10.5% |

|

Excess/Deficit |

(4.0%) |

(6.1%) |

(5.7%) |

(5.3%) |

(3.4%) |

|

Total Capital risk weighted ratio |

9.1% |

8.1% |

9.3% |

8.9% |

11.0% |

|

Minimum Statutory requirement |

14.5% |

14.5% |

14.5% |

14.5% |

14.5% |

|

Excess/Deficit |

(5.4%) |

(6.4%) |

(5.2%) |

(5.6%) |

(3.5%) |

|

Liquidity ratios: |

|||||

|

Cash Reserve Ratio |

15.5% |

19.5% |

8.6% |

7.1% |

6.6% |

|

Minimum Statutory requirement |

5.3% |

5.3% |

4.3% |

4.3% |

4.3% |

|

Excess/Deficit |

10.2% |

14.2% |

4.3% |

3.8% |

2.3% |

|

Liquidity ratio |

41.1% |

42.3% |

37.2% |

21.0% |

14.5% |

|

Minimum Statutory requirement |

20.0% |

20.0% |

20.0% |

20.0% |

20.0% |

|

Excess/Deficit |

21.1% |

22.3% |

17.2% |

1.0% |

(5.5%) |

|

Asset quality ratios: |

|||||

|

Gross Non-Performing Loan Ratio |

46.2% |

39.7% |

34.8% |

27.4% |

26.1% |

|

NPL Coverage Ratio |

33.7% |

40.9% |

47.5% |

51.7% |

55.0% |

We expect the completed acquisition to boost FCB’s capital adequacy and liquidity ratios to above the minimum statutory requirements and positively impact the bank’s operations. The acquisition is also a welcome move as it ensures that the bank’s customer deposits are protected and will bring stability to the bank. Going forward, we expect to see more consolidation activities in the Kenya’s banking sector as larger banks with a sufficient capital base take over smaller and weaker banks.

Below is a summary of the deals in the last 10 years that have either happened, been announced or expected to be concluded:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs bn) |

Transaction Stake |

Transaction Value (Kshs bn) |

P/Bv Multiple |

Date |

|

Premier Bank Limited |

First Community Bank Limited |

3.2 |

62.5% |

Undisclosed |

N/A |

Mar-23 |

|

Commercial International Bank |

Mayfair Bank Limited |

4.3 |

49.0% |

5.0 |

2.3x |

Jan-23 |

|

Equity Group |

Spire Bank |

0.01 |

Undisclosed |

Undisclosed |

N/A |

Sep-22 |

|

KCB Group |

Trust Merchant Bank |

12.4 |

85.0% |

15.7 |

1.5x |

Aug-22 |

|

Access Bank PLC |

Sidian Bank |

4.1 |

83.4% |

4.3 |

1.1x |

June-22* |

|

KCB Group |

Banque Populaire du Rwanda |

5.3 |

100.0% |

5.6 |

1.1x |

Aug-21 |

|

I&M Holdings PLC |

Orient Bank Limited Uganda |

3.3 |

90.0% |

3.6 |

1.1x |

Apr-21 |

|

KCB Group** |

ABC Tanzania |

Unknown |

100.0% |

0.8 |

0.4x |

Nov-20* |

|

Co-operative Bank |

Jamii Bora Bank |

3.4 |

90.0% |

1 |

0.3x |

Aug-20 |

|

Commercial International Bank |

Mayfair Bank Limited |

1.0 |

51.0% |

3.8 |

7.1x |

Apr-20 |

|

Access Bank PLC (Nigeria) |

Transnational Bank PLC. |

1.9 |

100.0% |

1.4 |

0.7x |

Feb-20* |

|

Equity Group ** |

Banque Commerciale Du Congo |

8.9 |

66.5% |

10.3 |

1.2x |

Nov-19* |

|

KCB Group |

National Bank of Kenya |

7.0 |

100.0% |

6.6 |

0.9x |

Sep-19 |

|

CBA Group |

NIC Group |

33.5 |

53% : 47% |

23 |

0.7x |

Sep-19 |

|

Oiko Credit |

Credit Bank |

3.0 |

22.8% |

1 |

1.5x |

Aug-19 |

|

CBA Group** |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

Jan-19 |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

Jan-18 |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

Dec-18 |

|

SBM Bank Kenya |

Chase Bank Ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

3.0 |

100.0% |

5 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov-13 |

|

Average |

|

|

77.2% |

|

1.6x |

|

|

* Announcement Date ** Deals that were dropped |

||||||

- Earnings Release

- Co-operative Bank of Kenya FY’2022 Performance

During the week, Co-operative Bank of Kenya released their FY’2022 financial results. Below is a summary of the performance:

|

Balance Sheet Items (Kshs bn) |

FY’2021 |

FY’2022 |

y/y change |

|

Government Securities |

184.1 |

173.3 |

(5.9%) |

|

Net Loans and Advances |

310.2 |

339.4 |

9.4% |

|

Total Assets |

579.8 |

607.2 |

4.7% |

|

Customer Deposits |

407.7 |

423.8 |

3.9% |

|

Deposits per Branch |

2.29 |

2.34 |

2.2% |

|

Total Liabilities |

479.0 |

499.3 |

4.2% |

|

Shareholders’ Funds |

100.2 |

107.7 |

7.4% |

|

Balance Sheet Ratios |

FY’2021 |

FY’2022 |

y/y change |

|

Loan to Deposit Ratio |

76.1% |

80.1% |

4.0% |

|

Return on average equity |

17.3% |

21.2% |

3.9% |

|

Return on average assets |

3.0% |

3.7% |

0.7% |

|

Income Statement (Kshs bn) |

FY’2021 |

FY’2022 |

y/y change |

|

Net Interest Income |

41.0 |

45.5 |

10.9% |

|

Non-Interest Income |

19.4 |

25.7 |

32.7% |

|

Total Operating income |

60.4 |

71.3 |

17.9% |

|

Loan Loss provision |

(7.9) |

(8.7) |

9.4% |

|

Total Operating expenses |

(38.1) |

(42.2) |

10.9% |

|

Profit before tax |

22.6 |

29.4 |

29.9% |

|

Profit after tax |

16.5 |

22.0 |

33.2% |

|

Earnings per share (Kshs) |

2.4 |

3.2 |

33.2% |

|

Income Statement Ratios |

FY’2021 |

FY’2022 |

Y/Y Change |

|

Yield from interest-earning assets |

11.5% |

12.0% |

0.5% |

|

Cost of funding |

3.3% |

3.5% |

0.2% |

|

Net Interest Spread |

8.2% |

8.5% |

0.3% |

|

Net Interest Income as % of Total Income |

67.9% |

63.9% |

(4.0%) |

|

Non-Funded Income as a % of Total Income |

32.1% |

36.1% |

4.0% |

|

Cost to Income |

63.0% |

59.3% |

(3.7%) |

|

Cost to Income Ratio without provisions |

49.9% |

47.1% |

(2.8%) |

|

Cost to Assets |

5.2% |

5.5% |

0.3% |

|

Net Interest Margin |

8.5% |

8.9% |

0.4% |

|

Capital Adequacy Ratios |

FY’2021 |

FY’2022 |

% points change |

|

Core Capital/Total deposit Liabilities |

19.6% |

21.9% |

2.3% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

|

|

Excess |

11.6% |

13.9% |

2.3% |

|

Core Capital/Total Risk Weighted Assets |

15.6% |

16.9% |

1.3% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

|

|

Excess |

5.1% |

6.4% |

1.3% |

|

Total Capital/Total Risk Weighted Assets |

17.2% |

18.0% |

0.8% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

|

|

Excess |

2.7% |

3.5% |

0.8% |

|

Liquidity Ratio |

53.8% |

48.3% |

(5.5%) |

|

Minimum Statutory ratio |

20.0% |

20.0% |

|

|

Excess |

33.8% |

28.3% |

(5.5%) |

|

Adjusted Core Capital/Total Deposit Liabilities |

16.0% |

21.9% |

5.9% |

|

Adjusted Core Capital/Total Risk Weighted Assets |

12.8% |

16.9% |

4.1% |

|

Adjusted Total Capital/Total Risk Weighted Assets |

14.3% |

18.0% |

3.7% |

Key Take outs

Earnings Growth- Core earnings per share rose by 33.2% to Kshs 3.2 from Kshs 2.4 in FY’2021, higher than our expectations of a 19.0% increase to Kshs 2.9, with the variance stemming from the 17.9% increase in total operating income, which was higher than our projection of an 11.5% increase. The performance was driven by a 17.9% increase in total operating income to Kshs 71.3 bn in FY’2022, from Kshs 60.4 bn in FY’2021, which outpaced the 10.9% increase in the total operating expenses to Kshs 42.2 bn in FY’2022, from Kshs 38.1 bn in FY’2021,

The Group’s directors recommended a first and final dividend per share of Kshs 1.5 in FY’2022, representing a dividend yield of 12.2% as of 17th March, 2023. This is a 50.0% increase from the dividend per share of Kshs 1.0 issued in FY’2021. Similarly, the dividend payout ratio increased to 39.9% in FY’2022, from 35.5% in FY’2021,

Increased Lending compared to a decline in Government Security – The Group’s net loans and advances increased by 9.4% to Kshs 339.4 bn in FY’2022, from Kshs 310.2 bn in FY’2021. On the other hand, government securities declined by 5.9% to Kshs 173.3 bn, from Kshs 184.1 bn recorded in FY’2021, indicating a management shift to increased lending as compared to allocation to government securities following the improvement in business environment towards the end of the year,

Improvement in Asset Quality – The group’s asset quality improved, with the NPL ratio reducing to 14.0% in FY’2022, from 14.6% in FY’2021, owing to the 9.4% growth in gross loans to Kshs 373.5 bn, from Kshs 341.3 bn in FY’2021, which outpaced the 5.2% increase in gross non-performing loans. The improved asset quality was attributable to the proactive credit management strategies that have seen increased loan repayments as well as the robust increase in lending, and,

Improved Efficiency - The group enhanced their efficiency levels evidenced by an improvement in Cost to Income Ratio (CIR) improving to 59.3% in FY’2022, from 63.0% in FY’2021 owing to the 17.9% increase in the total operating income which outpaced the 10.9% increase in the total operating expenses. Without LLP, the Cost to Income ratio improved as well to 47.1%, from 49.9% in FY’2021.

For a comprehensive analysis, please see our Co-operative Bank of Kenya FY’2022 Earnings Note

- ABSA Bank Kenya’s FY’2022 Performance

During the week, ABSA Bank Kenya released their FY’2022 financial results. Below is a summary of the performance;

|

Balance Sheet Items |

FY’2021 |

FY’2022 |

y/y change |

|

Government Securities |

132.6 |

133.5 |

0.7% |

|

Net Loans and Advances |

234.2 |

283.6 |

21.1% |

|

Total Assets |

428.7 |

477.2 |

11.3% |

|

Customer Deposits |

268.7 |

303.8 |

13.0% |

|

Deposits per Branch |

3.2 |

3.7 |

14.4% |

|

Total Liabilities |

372.2 |

413.6 |

11.1% |

|

Shareholder's Funds |

56.4 |

63.6 |

12.7% |

|

Balance sheet ratios |

FY’2021 |

FY’2022 |

% point change |

|

Loan to Deposit Ratio |

87.2% |

93.4% |

6.2% |

|

Return on average equity |

21.1% |

24.3% |

3.2% |

|

Return on average assets |

2.7% |

3.2% |

0.5% |

|

Income Statement Items |

FY’2021 |

FY’2022 |

y/y change |

|

Net Interest Income |

25.3 |

32.3 |

27.9% |

|

Net non-Interest Income |

11.7 |

13.7 |

17.2% |

|

Total Operating income |

36.9 |

46.0 |

24.6% |

|

Loan Loss provision |

(4.7) |

(6.5) |

37.6% |

|

Total Operating expenses |

(21.4) |

(25.1) |

17.6% |

|

Profit before tax |

15.5 |

20.8 |

34.1% |

|

Profit after tax |

10.9 |

14.6 |

34.2% |

|

Core EPS |

2.0 |

2.7 |

34.2% |

|

Income statement ratios |

FY’2021 |

FY’2022 |

% point change |

|

Yield from interest-earning assets |

9.0% |

10.3% |

1.3% |

|

Cost of funding |

2.6% |

2.9% |

0.3% |

|

Net Interest Spread |

2.5% |

2.8% |

0.3% |

|

Cost of risk |

12.8% |

14.1% |

1.3% |

|

Net Interest Margin |

7.1% |

8.2% |

1.1% |

|

Cost to Income |

57.9% |

54.7% |

(3.2%) |

|

Cost to income (Without LLPs) |

45.1% |

40.6% |

(4.5%) |

|

Cost to Assets |

3.9% |

3.9% |

0.0% |

|

Net Interest Income as % of operating income |

68.4% |

70.3% |

1.9% |

|

Non-Funded Income as a % of operating income |

31.6% |

29.7% |

(1.9%) |

|

Capital Adequacy Ratios |

FY’2021 |

FY’2022 |

% Points change |

|

Core Capital/Total Liabilities |

17.9% |

18.4% |

0.5% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

- |

|

Excess |

9.9% |

10.4% |

0.5% |

|

Core Capital/Total Risk Weighted Assets |

14.6% |

14.6% |

0.0% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

- |

|

Excess |

4.1% |

4.1% |

0.0% |

|

Total Capital/Total Risk Weighted Assets |

17.1% |

18.6% |

1.5% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

- |

|

Excess |

2.6% |

4.1% |

1.5% |

|

Liquidity Ratio |

38.3% |

33.6% |

(4.7%) |

|

Minimum Statutory ratio |

20.0% |

20.0% |

- |

|

Excess |

18.3% |

13.6% |

(4.7%) |

|

Adjusted Core Capital/Total Liabilities |

18.0% |

18.4% |

0.4% |

|

Adjusted Core Capital/Total RWA |

14.7% |

14.6% |

(0.1%) |

|

Adjusted Total Capital/Total RWA |

17.2% |

18.6% |

1.4% |

Key Take-Outs:

Earnings Growth- Core earnings per share increased by 34.2% to Kshs 2.7 in FY’2022, from Kshs 2.0 in FY’2021, slightly higher than our projections of a 28.7% growth to Kshs 2.6. The performance was driven by a 24.6% increase in total operating income to Kshs 46.0 bn, from Kshs 36.9 bn recorded in FY’2021. However, the growth was weighed down by the 17.6% increase in total operating expenses, to Kshs 25.1 bn, from Kshs 21.4 bn recorded in FY’2021,

The Group’s directors recommended a final dividend per share of Kshs 1.15 in FY’2022, adding to the interim dividend per share of Kshs 0.20 issued in Q3’2022. The total dividend of Kshs 1.35 per share represents a dividend yield of 11.3% as of 17th March, 2023. This is a 22.7% increase from the dividend per share of Kshs 1.10 issued in FY’2021. Notably, the dividend payout ratio declined to 50.3% in FY’2022, from 55.0% in FY’2021,

Improved deposit gathering capacity – The Bank recorded double digit growth in deposits at 13.0% y/y growth in FY’2022 as compared to the 5.9% growth recorded in FY’2021. Consequently, the increased deposits have helped to bring down the loan to deposit to 93.4% in FY’2022, from a high of 103.0% in Q3’2022,

Improved Lending – The Bank increased its lending in FY’2022 with Loans and advances recording a 21.1% growth, highlighting the Bank’s aggressive lending despite the tough operating business environment,

Improvement in Asset Quality - The bank’s asset quality improved, with the NPL ratio declining by 0.4% points to 7.5% in FY’2022, from 7.9% in FY’2021, owing to the faster 20.9% growth in Gross Loans, as compared to the 13.6% increase in Gross Non-Performing Loans (NPLs). However, on q/q, the asset quality deteriorated as evidenced by the NPL ratio which rose by 0.9% points from 6.6% recorded in Q3’2022, mainly attributable to 12.4% increase in Gross Non-Performing Loans, coupled with 1.2% decline in Gross Loans,

Improved efficiency levels – The Banks’s cost to income ratio without LLP improved, declining by 4.5% to 40.6%, from 45.1% in FY’2021, an indication of improved efficiency.

For a comprehensive analysis, please see our ABSA Bank Kenya FY’2022 Earnings Note

- KCB Group’s FY’2022 Performance

During the Week, KCB Group released their FY’2022 financial results. Below is a summary of the performance:

|

Balance Sheet Items |

FY’2021 |

FY’2022 |

y/y change |

|

Net Loans and Advances |

675.5 |

863.3 |

27.8% |

|

Government Securities |

270.8 |

278.0 |

2.7% |

|

Total Assets |

1,139.7 |

1,554.0 |

36.4% |

|

Customer Deposits |

837.1 |

1,135.4 |

35.6% |

|

Deposits per branch |

2.36 |

2.29 |

(3.0%) |

|

Total Liabilities |

966.2 |

1,347.8 |

39.5% |

|

Shareholders’ Funds |

171.7 |

200.2 |

16.6% |

|

Balance Sheet Ratios |

FY’2021 |

FY’2022 |

% y/y change |

|

Loan to Deposit Ratio |

80.7% |

81.3% |

0.6% |

|

Return on average equity |

21.8% |

22.0% |

0.2% |

|

Return on average assets |

3.2% |

3.0% |

(0.2%) |

|

Income Statement |

FY’2021 |

FY’2022 |

y/y change |

|

Net Interest Income |

77.7 |

86.7 |

11.5% |

|

Net non-Interest Income |

30.9 |

43.3 |

39.8% |

|

Total Operating income |

108.6 |

129.9 |

19.6% |

|

Loan Loss provision |

(13.0) |

(13.2) |

1.7% |

|

Total Operating expenses |

(60.8) |

(72.6) |

19.3% |

|

Profit before tax |

47.8 |

57.3 |

19.9% |

|

Profit after tax |

34.2 |

40.8 |

19.5% |

|

Core EPS |

10.63 |

12.7 |

19.5% |

|

Income Statement Ratios |

FY’2021 |

FY’2022 |

y/y change |

|

Yield from interest-earning assets |

11.1% |

10.1% |

(1.0%) |

|

Cost of funding |

2.8% |

2.9% |

0.1% |

|

Net Interest Spread |

8.3% |

7.3% |

(1.0%) |

|

Net Interest Margin |

8.4% |

7.5% |

(0.9%) |

|

Cost of Risk |

12.0% |

10.2% |

(1.8%) |

|

Net Interest Income as % of operating income |

71.5% |

66.7% |

(4.8%) |

|

Non-Funded Income as a % of operating income |

28.5% |

33.3% |

4.8% |

|

Cost to Income Ratio |

56.0% |

55.9% |

(0.1%) |

|

Capital Adequacy Ratios |

FY’2021 |

FY’2022 |

% points change |

|

Core Capital/Total Liabilities |

18.7% |

15.3% |

(3.4%) |

|

Minimum Statutory ratio |

8.0% |

8.0% |

|

|

Excess |

10.7% |

7.3% |

(3.4%) |

|

Core Capital/Total Risk Weighted Assets |

18.0% |

13.9% |

(4.1%) |

|

Minimum Statutory ratio |

10.5% |

10.5% |

|

|

Excess |

7.5% |

3.4% |

(4.1%) |

|

Total Capital/Total Risk Weighted Assets |

21.7% |

17.1% |

(4.6%) |

|

Minimum Statutory ratio |

14.5% |

14.5% |

|

|

Excess |

7.2% |

2.6% |

(4.6%) |

|

Liquidity Ratio |

39.1% |

40.9% |

1.8% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

|

|

Excess |

19.1% |

20.9% |

1.8% |

Key Take-Outs

Earnings Growth – Core earnings per share rose by 19.5% to Kshs 12.7 from Kshs 10.6 in FY’2021, higher than our expectations of a 16.2% increase to Kshs 12.4, with the variance stemming from the 19.6% increase in total operating income, which was slightly higher than our projection of a 17.7% increase. The performance was driven by the 19.6% growth in total operating income to Kshs 129.9 bn, from Kshs 108.6 bn in FY’2021, which outpaced the 19.3% growth in total operating expenses to Kshs 72.6 bn, from Kshs 60.8 bn in FY’2021,

The Group’s directors recommended a final dividend per share of Kshs 1.0 in FY’2022, adding to the interim dividend per share of Kshs 1.0 issued in Q3’2022. The total dividend of Kshs 2.0 per share represents a dividend yield of 6.5% as of 17th March, 2023. This is a 33.3% decline from the dividend per share of Kshs 3.0 issued in FY’2021. Additionally, the dividend payout ratio declined to 15.7% in FY’2022, from 28.2% in FY’2021,

Key to note, the decline in recommended dividends for FY’2022 drove a decline in KCB’s share price to Kshs 31.0 per share as at 17th March 2023, a 17.2% from Kshs 37.5 per share the previous week,

Increased Customer Deposit – KCB Group’s customer deposits base increased significantly by 35.6% to Kshs 1,135.4 bn from Kshs 837.1 bn in FY’2021 and is the second banking group in Kenya after Equity Group to cross the Kshs 1.0 tn mark, mainly attributable to the completion of the acquisition of TMB Bank and the organic growth in the existing business,

Deteriorated Asset Quality – KCB group’s asset quality deteriorated y/y to 17.0% from 16.6% in FY’2021 driven by a 31.2% increase in gross non-performing loans to Kshs 161.2 bn, from Kshs 122.9 bn in FY’2021, which outpaced the 28.0% growth in gross loans. The increase in gross non-performing loans was driven by a 40.0% increase in KCB-Kenya’s gross NPLs to Kshs 129.1 bn from Kshs 92.2 bn in FY’2021 following an increase in NPL stock and reclassifications in sectors such as building and construction, manufacturing, and Transport and communication during the year. As such KCB-Kenya’s NPL ratio deteriorated to 19.1% in FY’2022 from 16.0% in FY’2021, 5.8% points higher than the Kenya’s banking sector NPL ratio which came in at 13.3% in FY’2022. Similarly, National Bank of Kenya’s NPL ratio continued to weigh down the group, coming in at 22.1%, despite being an improvement from 31.9% from FY’2021. However, on a q/q basis, the asset quality improved, with the NPL ratio improving to 17.0% in FY’2022 from 17.8% in Q3’2022,

Impaired Yield on Interest Earning Assets ratio – The group recorded a 1.0% decline in its Yield on Interest Earning Ratio to 10.1% from 11.1% driven by the faster 26.3% growth in Average Interest Earning Assets (AIEA) following the acquisition of TMB Bank in DRC which outpaced the 15.1% growth in trailing interest income with the group yet to optimize the TMB Balance sheet to generate interest income.

For a comprehensive analysis, please see our KCB Group FY’2022 Earnings Note

- Standard Chartered Bank Kenya FY’2022 Performance

Below is a summary of Standard Chartered Bank Kenya FY’2022 performance:

|

Balance Sheet Items |

FY'2021 |

FY'2022 |

y/y change |

|

Net loans |

126.0 |

139.4 |

10.7% |

|

Government Securities |

95.6 |

105.7 |

10.6% |

|

Total Assets |

334.9 |

381.3 |

13.9% |

|

Customer Deposits |

265.5 |

278.9 |

5.1% |

|

Deposits per Branch |

7.4 |

8.7 |

18.2% |

|

Total Liabilities |

281.7 |

325.1 |

15.4% |

|

Balance Sheet Ratios |

FY'2021 |

FY'2022 |

y/y change |

|

Loan to deposit ratio |

47.5% |

50.0% |

2.5% |

|

Return on Average Equity |

17.4% |

22.1% |

4.7% |

|

Return on Average Assets |

2.7% |

3.4% |

0.6% |

|

Income Statement |

FY'2021 |

FY'2022 |

y/y change |

|

Net Interest Income |

18.8 |

22.2 |

18.1% |

|

Net non-Interest Income |

10.4 |

11.8 |

13.5% |

|

Total Operating income |

29.2 |

34.0 |

16.5% |

|

Loan Loss provision |

2.1 |

1.3 |

(36.2%) |

|

Total Operating expenses |

16.6 |

16.9 |

1.9% |

|

Profit before tax |

12.6 |

17.1 |

35.8% |

|

Profit after tax |

9.0 |

12.1 |

33.3% |

|

Core EPS |

23.5 |

31.5 |

34.0% |

|

Income Statement Ratios |

FY'2021 |

FY'2022 |

y/y change |

|

Yield from interest-earning assets |

7.6% |

8.0% |

0.4% |

|

Cost of funding |

1.3% |

1.2% |

(0.1%) |

|

Net Interest Spread |

6.2% |

6.8% |

0.6% |

|

Net Interest Margin |

6.4% |

7.0% |

0.6% |

|

Cost of Risk |

7.1% |

3.9% |

(3.2%) |

|

Net Interest Income as % of operating income |

64.5% |

65.4% |

0.9% |

|

Non-Funded Income as a % of operating income |

35.5% |

34.6% |

(0.9%) |

|

Cost to Income Ratio |

56.8% |

49.7% |

(7.1%) |

|

Cost to Income Ratio without LLP |

49.7% |

45.8% |

(3.9%) |

|

Cost to Assets |

4.4% |

4.3% |

(0.1%) |

|

Capital Adequacy Ratios |

FY'2021 |

FY'2022 |

% Change |

|

Core Capital/Total Liabilities |

15.4% |

15.1% |

(0.3%) |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess |

7.4% |

7.1% |

(0.3%) |

|

Core Capital/Total Risk Weighted Assets |

15.5% |

15.4% |

(0.2%) |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess |

5.0% |

4.9% |

(0.2%) |

|

Total Capital/Total Risk Weighted Assets |

17.8% |

17.3% |

(0.5%) |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess |

3.3% |

2.8% |

(0.5%) |

|

Liquidity Ratio |

70.7% |

73.0% |

2.3% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

0.0% |

|

Excess |

50.7% |

53.0% |

2.3% |

|

Adjusted core capital/ total deposit liabilities |

15.4% |

15.1% |

(0.3%) |

|

Adjusted core capital/ total risk weighted assets |

15.6% |

15.4% |

(0.2%) |

|

Adjusted total capital/ total risk weighted assets |

17.8% |

17.3% |

(0.5%) |

Key Take-Outs

Earnings Growth - Core earnings per share rose by 34.0% to Kshs 31.5, from Kshs 23.5 registered in FY’2021, higher than our expectations of a 20.9% increase to Kshs 28.4, with the variance stemming from the 1.9% decline in total operating expense to Kshs 16.9, which was lower than our projection of a 19.1% increase to Kshs 19.7 bn in FY2022. The performance was driven by the 16.5% growth in total operating income to Kshs 34.0 bn, from Kshs 29.2 bn in FY’2021, against the relatively lower 1.9% growth in total operating expenses to Kshs 16.9 bn from Kshs 16.6 bn in FY’2021,

The Group’s directors recommended a final dividend per share of Kshs 16.0 in FY’2022, adding to the interim dividend per share of Kshs 6.0 issued in Q3’2022. The total dividend of Kshs 22.0 per share represents a dividend yield of 13.2% as of 17th March, 2023. This is a 15.8% increase from the dividend per share of Kshs 19.0 issued in FY’2021. Key to note, the dividend payout ratio declined to 69.9% in FY’2022, from 80.9% in FY’2021,

Improvement in Asset Quality - The group’s asset quality improved significantly, with the NPL ratio improving to 14.2% in FY’2022, from 16.0% recorded in FY’2021. The improvement in asset quality was attributable to the 3.0% decline in gross non-performing loans, coupled with a 9.2% increase in gross loans. Key to note, on a q/q basis, Standard Chartered Bank’s Asset quality improved by 1.2% points to 14.2% as end of FY’2022, from 15.4% recorded in Q3’2022,

Sustained operating efficiency levels – The bank’s operating efficiency has recorded sustained improvement with cost to income ratio without LLP improving to 45.8% from 49.7% in FY’2021, similar to the trend witnessed in Q3’2022 financial performance where cost to income LLP improved by 0.6% points to 47.4% in Q3’2022 from 48.0% in Q3’2021, and,

Cautious Lending – FY’2022 was characterized by cautious lending to the public attributable to the high credit risks brought about by the deteriorated business environment mainly as a result of the elevated inflationary pressures during the year. As such, the bank turned to lending to the government resulting in government securities registering a 10.6% growth to Kshs 105.7 bn, from 95.6 bn in FY’2021.

For a comprehensive analysis, please see our Standard Chartered Bank Kenya FY’2022 Earnings Note

Asset Quality

The table below is a summary of the listed banks that have released their FY’2022 results:

|

|

FY'2022 NPL Ratio* |

FY'2021 NPL Ratio** |

% point change in NPL Ratio |

FY'2022 NPL Coverage* |

FY'2021 NPL Coverage** |

% point change in NPL Coverage |

|

ABSA Bank Kenya |

7.5% |

7.9% |

(0.4%) |

80.5% |

77.7% |

2.8% |

|

Stanbic Holdings |

10.0% |

9.3% |

0.7% |

63.1% |

58.1% |

5.0% |

|

Co-operative Bank |

14.0% |

14.6% |

(0.6%) |

69.3% |

62.6% |

6.7% |

|

SCBK |

14.2% |

16.0% |

(1.8%) |

87.1% |

84.4% |

2.7% |

|

KCB Group |

17.0% |

16.6% |

0.4% |

52.4% |

52.9% |

(0.5%) |

|

Mkt Weighted Average |

13.2% |

12.3% |

0.9% |

69.0% |

65.5% |

3.5% |

|

*Market cap weighted as at 17/03/2023 |

||||||

|

**Market cap weighted as at 14/04/2022 |

||||||

Key take-outs from the table include;

- Asset quality for the listed banks that have released deteriorated during the year, with market weighted average NPL increasing by 0.9% points to 13.2%, from a 12.3% in FY’2021. The deterioration was driven by a deterioration in Stanbic holdings’ and KCB Group’s asset quality with their NPL ratios increasing by 0.7% and 0.4% points to 10.0% and 17.0%, respectively in FY’2022, and,

- Market weighted average NPL Coverage for the listed banks increased by 3.5% points to 69.0% in FY’2022, from 65.5% recorded in FY’2021. However, KCB Group’s NPL coverage declined by 0.5% points to 52.4% in FY’2022 from 52.9% in FY’2021, attributable to a 31.2% increase in gross non-performing loans to Kshs 161.2 bn, from Kshs 122.9 bn in FY’2021, despite a 35.0% increase in provision to Kshs 70.6 bn from Kshs 52.3 bn in FY’2021, coupled with a marginal growth in interest suspense to Kshs 14.0 bn, up from Kshs 13.0 bn in Fy’2021.

Summary performance

The table below highlights the performance listed banks, showing the performance using several metrics:

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

ABSA |

34.2% |

27.5% |

25.9% |

27.9% |

8.2% |

17.2% |

29.7% |

0.3% |

13.0% |

0.7% |

93.4% |

21.1% |

24.3% |

|

SCBK |

34.0% |

14.3% |

6.5% |

18.1% |

7.0% |

13.5% |

34.6% |

(17.7%) |

5.1% |

10.6% |

50.0% |

10.7% |

22.1% |

|

Co-op |

33.2% |

11.0% |

11.0% |

10.9% |

8.9% |

32.7% |

36.1% |

31.8% |

3.9% |

(5.9%) |

80.1% |

9.4% |

21.2% |

|

Stanbic |

25.7% |

31.8% |

15.2% |

31.8% |

5.9% |

23.7% |

40.9% |

(0.5%) |

19.5% |

42.9% |

87.8% |

16.4% |

15.3% |

|

KCB |

19.5% |

15.3% |

27.1% |

11.5% |

7.5% |

11.5% |

33.3% |

18.6% |

35.6% |

2.7% |

81.3% |

27.8% |

22.0% |

|

FY'22 Mkt Weighted Average* |

28.5% |

18.9% |

18.4% |

18.5% |

7.6% |

18.5% |

34.4% |

8.2% |

17.5% |

7.5% |

78.4% |

18.4% |

21.4% |

|

FY'21 Mkt Weighted Average** |

82.9% |

13.8% |

11.5% |

15.2% |

7.1% |

10.9% |

34.7% |

16.6% |

13.5% |

18.1% |

69.7% |

13.5% |

20.2% |

|

*Market cap weighted as at 17/03/2023 |

|||||||||||||

|

**Market cap weighted as at 14/04/2022 |

|||||||||||||

Key take-outs from the table include;

- The listed banks recorded a 28.5% growth in core Earnings per Share (EPS) in FY’2022, compared to the weighted average growth of 82.9% in FY’2021, an indication of sustained performance despite the tough operating environment experienced in FY’2022,

- The listed Banks’ Interest income grew by 18.9% compared to the market weighted average growth of 13.8% in FY’2021. The growth in interest income is attributable to the 18.4% weighted average growth in the loan book in FY’2022 which was higher than the 13.5% growth in FY’2021. The higher loan book growth took the loan to deposit ratio to 78.4% from the 69.7% market weighted average loan to deposit ratio in FY’2021.

- Non-Funded Income grew by 18.5% compared to market weighted average growth of 10.9% in FY’2021, pointing to increased revenue diversification efforts by the banking sector, and,

- The Banks recorded a deposit growth of 17.5%, higher than the market weighted average deposit growth of 13.5% in FY’2021, highlighting increased investment risk in the business environment.

Universe of coverage:

|

Company |

Price as at 10/03/2024 |

Price as at 17/03/2024 |

w/w change |

YTD Change |

Year Open 2023 |

Target Price* |

Current Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Jubilee Holdings |

175.8 |

151.5 |

(13.8%) |

(23.8%) |

198.8 |

305.9 |

9.2% |

111.2% |

0.3x |

Buy |

|

KCB Group*** |

37.5 |

31.0 |

(17.2%) |

(19.2%) |

38.4 |

52.5 |

6.5% |

75.8% |

0.5x |

Buy |

|

Kenya Reinsurance |

1.7 |

1.6 |

(6.5%) |

(15.0%) |

1.9 |

2.5 |

6.3% |

64.2% |

0.1x |

Buy |

|

Equity Group*** |

43.0 |

38.2 |

(11.3%) |

(15.3%) |

45.1 |

58.4 |

7.9% |

60.8% |

0.9x |

Buy |

|

Britam |

4.9 |

4.6 |

(7.5%) |

(12.5%) |

5.2 |

7.1 |

0.0% |

56.5% |

0.8x |

Buy |

|

Liberty Holdings |

4.5 |

4.8 |

6.4% |

(4.8%) |

5.0 |

6.8 |

0.0% |

40.6% |

0.4x |

Buy |

|

ABSA Bank*** |

12.6 |

12.0 |

(4.4%) |

(1.6%) |

12.2 |

15.5 |

11.3% |

40.0% |

1.0x |

Buy |

|

Co-op Bank*** |

12.5 |

12.3 |

(1.6%) |

1.7% |

12.1 |

15.5 |

12.2% |

38.0% |

0.6x |

Buy |

|

Sanlam |

8.7 |

8.7 |

0.0% |

(9.0%) |

9.6 |

11.9 |

0.0% |

36.6% |

0.9x |

Buy |

|

NCBA*** |

36.8 |

34.1 |

(7.5%) |

(12.6%) |

39.0 |

43.4 |

8.8% |

36.2% |

0.8x |

Buy |

|

I&M Group*** |

18.0 |

17.1 |

(5.3%) |

0.0% |

17.1 |

20.8 |

8.8% |

30.9% |

0.4x |

Buy |

|

Diamond Trust Bank*** |

49.7 |

48.5 |

(2.5%) |

(2.8%) |

49.9 |

57.1 |

6.2% |

24.1% |

0.2x |

Buy |

|

CIC Group |

2.0 |

1.9 |

(3.6%) |

(0.5%) |

1.9 |

2.3 |

0.0% |

22.1% |

0.7x |

Buy |

|

Stanbic Holdings |

108.8 |

110.5 |

1.6% |

8.3% |

102.0 |

112.0 |

11.4% |

12.8% |

1.0x |

Accumulate |

|

Standard Chartered*** |

167.0 |

167.0 |

0.0% |

15.2% |

145.0 |

166.3 |

13.2% |

12.7% |

1.1x |

Accumulate |

|

HF Group |

3.5 |

3.5 |

(0.3%) |

10.8% |

3.2 |

3.4 |

0.0% |

(1.7%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

||||||||||

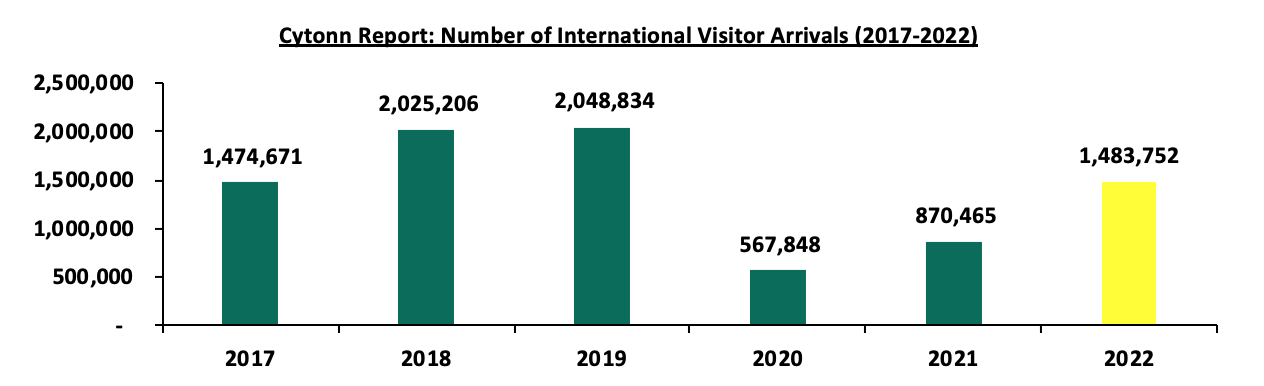

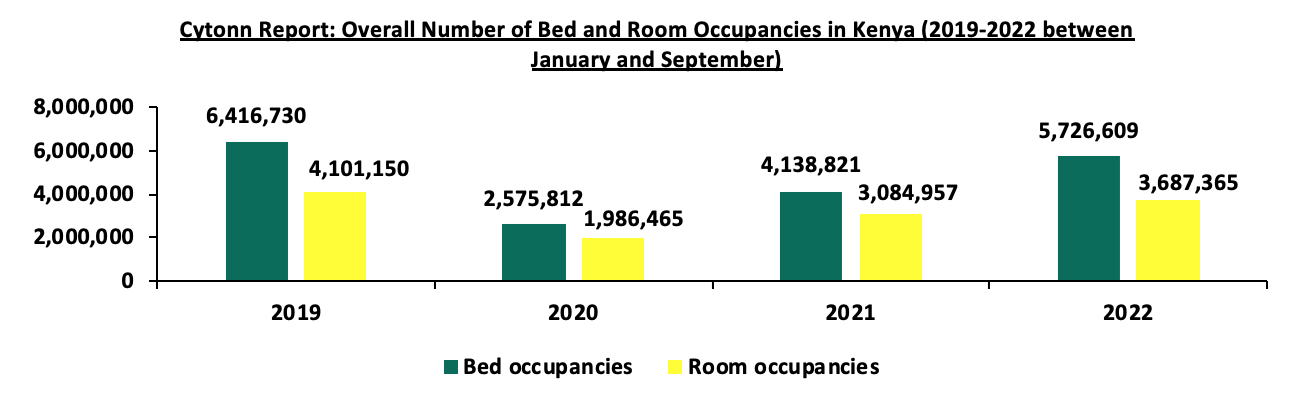

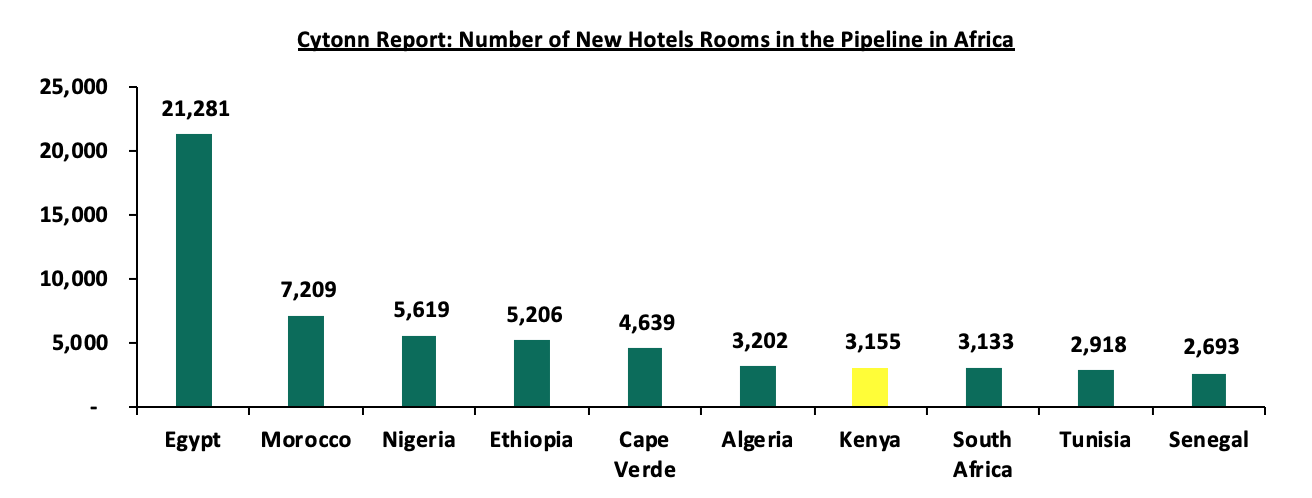

We are “Neutral” on the Equities markets in the short term due to the current adverse operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.