Property Regulations in Kenya, & Cytonn Weekly #03/2021

By Research Team, Jan 24, 2021

Executive Summary

Fixed Income

During the week, T-bills subscription rate improved with the overall subscription rate coming in at 84.5%, from 65.7% recorded the previous week due to slight improvements in the liquidity of the money markets. In the primary bond market the government issued a 16-year bond, IFB1/2021/016 with a coupon rate of 12.3% and an amortized time to maturity of 12.5 year. The overall subscription rate of the bond came in at 250.7%, supported by the attractiveness of the bond due to its tax free benefits;

Equities

During the week, the equities market was on a downward trajectory with NASI, NSE 20 and NSE 25 shedding off 2.1%, 1.7% and 1.6%, respectively, taking their YTD performance to gains of 1.8%, 0.8% and 0.7%, respectively. The equities market performance was driven by losses recorded by large-cap stocks such as Diamond Trust Bank (DTB-K), Safaricom, KCB and Co-operative Bank which were down 5.2%, 2.7%, 2.4% and 2.3%, respectively. The declines were however mitigated by gains recorded by other large-cap stocks such as BAT and Bamburi which gained by 2.1% each. The Insurance Regulatory Authority (IRA), recently released the Q3’2020 Insurance Industry Report highlighting that the industry’s gross premium income increased by 2.6% to Kshs 179.4 bn, from Kshs 174.9 bn recorded in Q3’2019;

Real Estate

During the week, the British Foreign Secretary Dominic Raab announced that Kenya is expected to receive at least Kshs 8.0 bn from the United Kingdom government to finance the construction of approximately 10,000 affordable houses through Acorn Holdings, a local real estate developer. In the retail sector, Naivas Supermarket announced plans to open its 70th retail store in Kilifi taking up space previously occupied by troubled retailer Tuskys;

Focus of the Week

Land has consistently been ranked as one of the best investment assets in the real estate sector attributable to its resilience. For instance, in 2020, land asking prices recorded an average annual capital appreciation of 2.3% bringing the 9-year CAGR to 10.7%. To enhance land transactions, transparency and consolidation of land laws and to address the land ownership issues and use, the government of Kenya has continued to introduce several regulatory and policy reforms through most recently the Land Registration (Electronic Transactions) Regulations, 2020, Stamp Duty (Valuation of Immovable Property) Regulations, 2020 among others. However, more polishing of the land regulations needs to be done to address the missing links that bring about controversies;

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.85%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.41% p.a. To invest, email us at sales@cytonn.comand to withdraw the interest you just dial *809#;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We successfully handed over Phase 3 of the Alma project on the 22nd of December 2020. Please see attached photos of the happy homeowners;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

- For recent news about the company, see our news section here.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills subscription rate improved with the overall subscription rate coming in at 84.5%, from 65.7% recorded the previous week. The highest subscription rate was in the 364-day paper which rose to 172.2% from 133.1% recorded the previous week. The subscription for the 182-day and 91-day papers however declined to 9.2% and 53.7%, from 81.0% and 125.4% recorded the previous week, respectively. The yields on the 91-day and 364-day papers both rose by 10.0 bps and 6.0 bps to 7.0% and 8.5%, respectively, while the 182-day paper remained unchanged at 7.5%. The government continued to reject expensive bids with the acceptance rate declining to 86.4%, from 99.9% recorded the previous week, accepting bids worth Kshs 17.5 bn out of the Kshs 20.3 bn worth of bids received.

The Central Bank of Kenya issued a bond, IFB1/2021/016, with an effective tenor of 16 years and a coupon of 12.3%, which traded from 21st December 2020 to 19th January 2021. The issue recorded high demand, with the overall subscription rate coming in at 250.7%, supported by the attractive tax-free nature of the infrastructure bond. The government received bids worth Kshs 125.3 bn, higher than the Kshs 50.0 bn offered and accepted only Kshs 81.1 bn. The acceptance rate came in at 64.7%, with the weighted average rate of accepted bids being 12.4%.

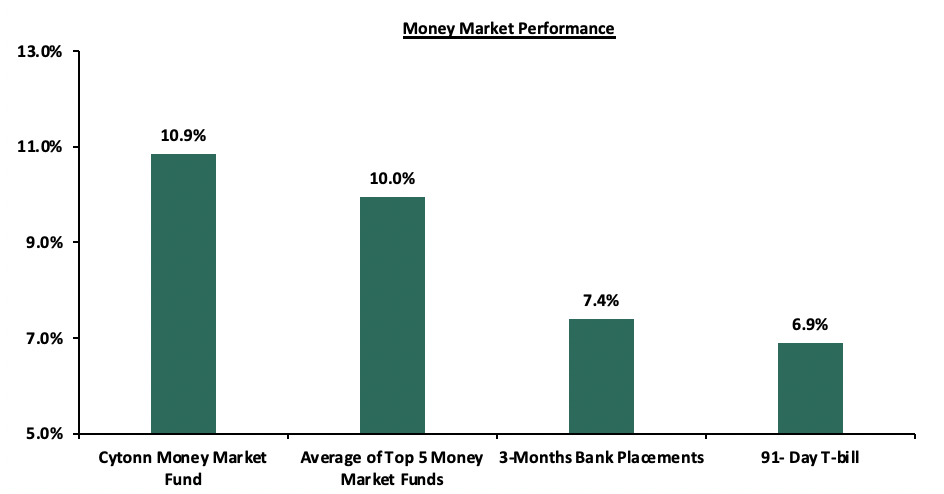

In the money markets, 3-month bank placements ended the week at 7.4% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased by 10.0 bps to 7.0%. The average yield of Top 5 Money Market Funds remained unchanged at 10.0%, as recorded the previous week. The yield on the Cytonn Money Market increased marginally by 10.0 bps to 10.9% from the 10.8%, recorded the previous week.

Liquidity:

During the week, liquidity eased in the market with the average interbank rate decreasing to 4.3% from the 5.1% recorded the previous week, mainly supported by government payments which partly offset tax remittances. The average interbank volumes declined by 11.0% to Kshs 9.6 bn, from Kshs 10.8 bn recorded the previous week. According to the Central Bank of Kenya’s weekly bulletin, released on 15th January 2021, commercial banks’ excess reserves came in at Kshs 13.0 bn in relation to the 4.25% Cash Reserve Ratio.

Eurobonds performance:

During the week, the yields on Eurobonds recorded mixed performance with the yields on the 10-year Eurobond issued in June 2014, the 30-year bond issued in 2018 and the 12-year bond issued in 2019 remaining unchanged at 3.7%, 7.2% and 6.1%, respectively while the yields on the 10-year bond issued in 2018 and the 7-year bond issued in 2019 declining by 0.1% points, The 10-year bond issued in 2018 declined to 5.3% from 5.4%, while the 7-year bond issued in 2019 declined to 4.8% from 4.9%, recorded last week.

|

Kenya Eurobond Performance |

|||||

|

|

2014 |

2018 |

2019 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

|

31-Dec-2020 |

3.9% |

5.2% |

7.0% |

4.9% |

5.9% |

|

15-Jan 2021 |

3.7% |

5.4% |

7.2% |

4.9% |

6.1% |

|

18-Jan-2021 |

3.7% |

5.4% |

7.4% |

5.0% |

6.2% |

|

19-Jan-2021 |

3.7% |

5.4% |

7.3% |

4.9% |

6.2% |

|

20-Jan-2021 |

3.7% |

5.4% |

7.3% |

4.9% |

6.2% |

|

21-Jan-2021 |

3.6% |

5.3% |

7.2% |

4.9% |

6.1% |

|

22-Jan-2021 |

3.7% |

5.3% |

7.2% |

4.8% |

6.1% |

|

Weekly Change |

0.0% |

(0.1%) |

0.0% |

(0.1%) |

0.0% |

|

YTD Change |

(0.2%) |

0.1% |

0.2% |

(0.1%) |

0.2% |

Source: Reuters

Kenya Shilling:

During the week, the Kenyan shilling appreciated marginally against the US dollar by 0.1% to Kshs 109.8 from Kshs 110.1 recorded the previous week, buoyed by higher dollar inflows from offshore investors into the local debt market due to the improved investor sentiment for so-called frontier assets. On a YTD basis, the shilling has depreciated by 0.6% against the dollar. We expect continued pressure on the Kenyan shilling due to:

- Demand from merchandise traders as they beef up their hard currency positions as businesses reopen following the festive season, amid a slowdown in foreign dollar currency inflows, and,

- Continued uncertainty globally making people prefer holding dollars and other hard currencies.

However, in the short term, the shilling is expected to be supported by:

- The Forex reserves which are currently at USD 7.8 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- The improving current account position which narrowed to 4.7% of GDP in the 12 months to November 2020 compared to 5.4% a similar period in 2019, and,

- Improving diaspora remittances evidenced by a 19.7% y/y increase to USD 299.6 mn in December 2020, from USD 250.3 mn recorded over the same period in 2019, has cushioned the shilling against further depreciation.

Weekly Highlights

The Monetary Policy Committee (MPC) is set to meet on Wednesday, 27th January 2021, to review the performance of the previous policy decisions undertaken in 2020 and what the next steps would be on matters monetary policy. We expect the MPC to maintain the Central Bank Rate (CBR) at 7.00%, supported by:

- Projection of stable Inflation which is projected to remain within the 2.5%- 7.5% on account of stable; food and fuel prices,

- Support for the shilling as the fundamentals supports a more stable shilling i.e. the current account position has been improving despite the decline in the forex reserve,

- The most recent reprieve from the debt servicing is meant to support the shilling, and,

- The need to support the economy by continuously pumping money into the economy. The current macro and business environment fundamentals might constrain the transmission of further accommodative cuts, despite the need to stimulate economic growth. Therefore, we believe that any additional rate cuts will not lead to a rise in Private sector credit growth as elevated credit risks still persist in the current environment.

For more information, see our note on the 27th January 2021 Monetary Policy Committee (MPC) Meeting.

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the Central Bank as they reject expensive bids. The government is 22.9% ahead of its prorated borrowing target of Kshs 252.5 bn having borrowed Kshs 321.8 bn. In our view, due to the current subdued economic performance brought about by the effects of the COVID-19 pandemic, the government will record a shortfall in revenue collection with the target having been set at Kshs 1.9 tn for FY’2020/2021 thus leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug the deficit.

Market Performance

During the week, the equities market was on a downward trajectory with NASI, NSE 20 and NSE 25 shedding off 2.1%, 1.7% and 1.6%, respectively, taking their YTD performance to gains of 1.8%, 0.8% and 0.7%, respectively. The equities market performance was driven by losses recorded by large-cap stocks such as Diamond Trust Bank (DTB-K), Safaricom, KCB and Co-operative Bank of 5.2%, 2.7%, 2.4% and 2.3%, respectively. The declines were however mitigated by gains recorded by other large-cap stocks such as BAT and Bamburi which gained by 2.1% each.

Equities turnover increased by 26.8% during the week to USD 24.1 mn, from USD 19.0 mn recorded the previous week, taking the YTD turnover to USD 57.6 mn. Foreign investors remained net buyers, with a net buying position of USD 0.2 mn, from a net buying position of USD 6.6 mn recorded the previous week, taking the YTD net buying position to USD 4.9 mn.

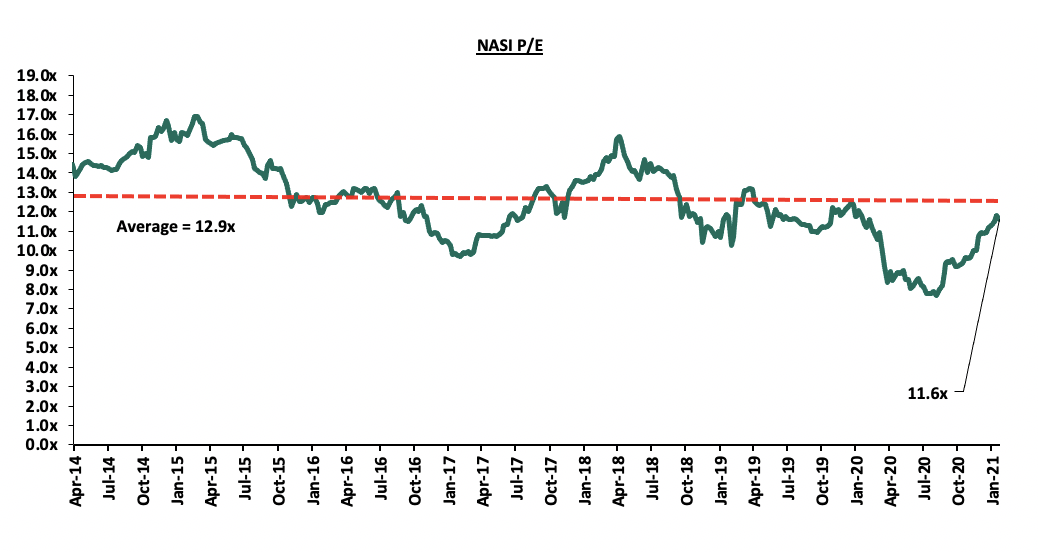

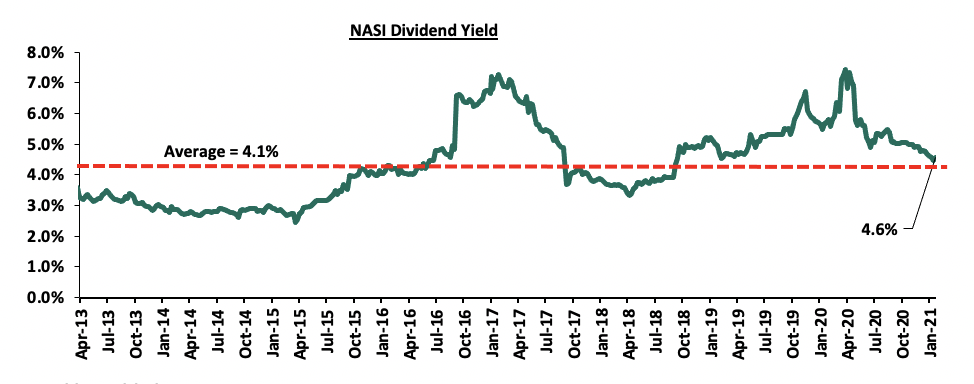

The market is currently trading at a price to earnings ratio (P/E) of 11.6x, 10.3% below the 11-year historical average of 12.9x. The average dividend yield is currently at 4.6%, 0.1% points above what was recorded the previous week and 0.5% points above the historical average of 4.1%.

With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with a higher risk tolerance. The current P/E valuation of 11.6x is 50.6% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the market’s historical P/E and dividend yield.

Weekly Highlight:

The Insurance Regulatory Authority (IRA), recently released the Q3’2020 Insurance Industry Report highlighting that the industry’s gross premium rose by 2.6% to Kshs 179.4 bn, from Kshs 174.9 bn recorded in Q3’2019, with the general insurance business contributing to 58.6% of the industry’s premium income, a 1.6% points decline from the 60.2% contribution witnessed in Q3’2019. The regulator noted that the COVID-19 pandemic had impacted the insurance sector mainly through reduced returns from the capital markets and a rise in insurance claims in the long term insurance business class.

Other key take-outs from the report include:

- Investment income declined by 22.2% to Kshs 25.4 bn in Q3’2020, from Kshs 32.7 bn recorded in Q3’2019 for long term insurance businesses, and declined by 15.5% for general insurance businesses to Kshs 7.3 bn, from Kshs 8.6 bn recorded in Q3’2019. The declines can be attributed to increased investments in lower-yielding fixed income securities and the fair value losses in equity investments,

- The net claims for the long term insurance business increased by 15.2% to Kshs 48.4 bn, from Kshs 42.0 bn in Q3’2019, mainly driven by increased requests from individuals wishing to access their pension benefits given the reduction in their disposable income. This saw the loss ratio for the long term business rise to 69.7%, from 64.3% recorded in Q3’2019,

- For the general insurance businesses, the loss ratio declined to 63.3% in Q3’2020, from 65.3% in Q3’2019 owing to the faster 3.3% decline in claims against a 0.3% decline in the net premium income. The decline in claims was mainly driven by the 6.6% decline in motor claims to Kshs 22.3 bn, from Kshs 23.8 bn in Q3’2019. Key to note, the incurred loss ratio during the quarter was the lowest in the last 3 years, with the average loss ratio at 64.2%, and,

- In the period ending H1’2020, insurance surrenders (the full cancellation of an insurance policy) in the long-term business increased by 26.2% to Kshs 5.3 bn, from Kshs 4.2 bn recorded in H1’2019. The pension business recorded the highest value of cancelled policies where Kshs 3.6 bn was withdrawn, in comparison to the Kshs 2.4 bn in H1’2019 as people lost jobs and could not keep up with the contributions.

Despite the measures taken by the government to cushion individuals against the effects emanating from the pandemic, we believe that the industry’s loss ratio is set to increase in FY’2020 as more people file for claims while others use their contributions as collateral for loans. Additionally, given the declines recorded in the Equities Market in 2020, with the NASI and NSE 20 declining by 8.6% and 29.6%, respectively, and the decline in yields during the period, we believe that the sector’s investments income will decline further, and as such, affect the sectors bottom line.

Universe of Coverage

|

Banks |

Price at 15/01/2021 |

Price at 22/01/2021 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank*** |

77.0 |

73.0 |

(5.2%) |

(4.9%) |

76.8 |

105.1 |

3.7% |

47.7% |

0.3x |

Buy |

|

KCB Group*** |

36.9 |

36.0 |

(2.4%) |

(6.3%) |

38.4 |

46.0 |

9.7% |

37.5% |

1.0x |

Buy |

|

I&M Holdings*** |

45.9 |

46.0 |

0.3% |

2.6% |

44.9 |

60.1 |

5.5% |

36.2% |

0.7x |

Buy |

|

Kenya Reinsurance |

2.6 |

2.5 |

(4.9%) |

8.7% |

2.3 |

3.3 |

4.4% |

35.9% |

0.3x |

Buy |

|

Liberty Holdings |

8.0 |

7.4 |

(7.3%) |

(3.6%) |

7.7 |

9.8 |

0.0% |

32.1% |

0.6x |

Buy |

|

Co-op Bank*** |

12.9 |

12.6 |

(2.3%) |

0.4% |

12.6 |

14.5 |

7.9% |

23.0% |

1.0x |

Buy |

|

ABSA Bank*** |

9.5 |

9.5 |

(0.4%) |

(0.6%) |

9.5 |

10.5 |

11.6% |

22.6% |

1.2x |

Buy |

|

Equity Group*** |

36.9 |

37.2 |

0.8% |

2.6% |

36.3 |

43.0 |

5.4% |

21.0% |

1.1x |

Buy |

|

Standard Chartered*** |

139.8 |

138.8 |

(0.7%) |

(4.0%) |

144.5 |

153.2 |

9.0% |

19.4% |

1.1x |

Accumulate |

|

Stanbic Holdings |

80.5 |

77.8 |

(3.4%) |

(8.5%) |

85.0 |

84.9 |

9.1% |

18.3% |

0.8x |

Accumulate |

|

Britam |

7.5 |

7.5 |

0.8% |

7.4% |

7.0 |

8.6 |

3.3% |

17.7% |

0.8x |

Accumulate |

|

Sanlam |

13.2 |

14.0 |

6.1% |

7.7% |

13.0 |

16.4 |

0.0% |

17.1% |

1.1x |

Accumulate |

|

Jubilee Holdings |

290.0 |

280.0 |

(3.4%) |

1.5% |

275.8 |

313.8 |

3.2% |

15.3% |

0.7x |

Accumulate |

|

NCBA*** |

25.5 |

25.4 |

(0.4%) |

(4.5%) |

26.6 |

25.4 |

1.0% |

1.0% |

0.7x |

Lighten |

|

CIC Group |

2.2 |

2.2 |

0.0% |

1.9% |

2.1 |

2.1 |

0.0% |

(2.3%) |

0.8x |

Sell |

|

HF Group |

3.6 |

3.9 |

6.9% |

23.9% |

3.1 |

3.0 |

0.0% |

(22.9%) |

0.1x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/ or its affiliates are invested in |

||||||||||

We are “Neutral” on the Equities markets in the short term. We expect the recent discovery of a new strain of COVID-19 coupled with the introduction of strict lockdown measures in major economies to continue dampening the economic outlook. However, we maintain our bias towards a “Bullish” equities markets in the medium to long term. We believe there exist pockets of value in the market, with a bias on financial services stocks given the resilience exhibited in the sector. The sector is currently trading at historically cheaper valuations and as such, presents attractive opportunities for investors.

- Residential Sector

During the week, British Foreign Secretary Dominic Raab announced that Kenya is expected to receive at least Kshs 8.0 bn from the United Kingdom to finance the construction of approximately 10,000 affordable houses through Acorn Holdings, a local real estate developer. The funds which will be released in tranches will consist of Kshs 1.0 bn from UK funded InfraCo and another Kshs 7.0 bn from private investors. The investment affirms UK’s government’s support for the Big Four Agenda on affordable housing that is aimed at delivering affordable homes for Kenyans. Kenya government has continued to push for the delivery of the targeted 0.5 mn units but the implementation of the projects has continued to lag behind with less than 1,000 units delivered so far mainly through the Park Road Project and Pangani Estate, while other projects such as Shauri Moyo, Makongeni and Starehe houses are still in the pipeline. The main challenges facing the delivery have included; (i) unavailability of affordable financing to developers, (ii) bureaucracy and slow project approval processes, (iii) the pending operationalization of the Integrated Project Delivery Unit (IPDU) which was tasked with being a single point of regulatory approval for developments, infrastructure provision and developer incentives, (iv) failure to fast track incentives provided in support of the affordable housing initiative, (v) ineffectiveness of Public-Private Partnerships, (vi) obstacles in our capital markets regulatory framework, which make it difficult to raise capital for real estate development, and, (vii) the current economic slowdown due to the ongoing pandemic. We therefore expect the provision of funding from the UK government will positively drive the initiative by facilitating implementation of projects through Acorn. In spite of the above, the implementation of approximately 10,000 housing units is still a drop in the ocean given the relatively high demand evidenced by more than 300,000 individuals who have registered to purchase affordable homes through the Boma Yangu initiative. Additionally, the 2022 target of 500,000 units remains a pipers dream as there is still no clear path to achieving that. In our view, despite the milestones achieved by the government in driving the affordable housing initiative, the above stated challenges still need to be addressed to fast track the supply of affordable housing units. In addition, there is need for vigorous raising of funds for the initiative especially in the wake of reduced budget allocation towards the same for FY 2020/21 at Kshs 6.9 bn 34.3% lower than the Kshs 10.5 bn allocated in FY 2019/2020.

- Retail Sector

During the week, Naivas Supermarket announced plans to open its 70th retail store at Kilifi Complex Centre in Kilifi towards the end of January taking up the 25,000 SQFT space previously occupied by troubled retailer Tuskys. This follows the opening of other outlets such as Ananas Mall in Thika, Hazina Towers, and Prestige Plaza among others. The rapid expansion by Naivas is supported by availability of funds having raise approximately Kshs 6.0 bn in August 2020 from the sale of a 30.0% stake to a group of investors, including the International Finance Corporation.

The decision to invest in Kilifi is supported by; i) positive demographics with Kilifi having a population of 1,453,787 as of 2019 which was a 23.7% growth from the 1,109,735 recorded in 2009, ii) a growing middle class with increased consumer purchasing power, and, iii) the area’s recognition as a major tourist destination in Kenya, due to its rich cultural heritage and proximity to the Indian Ocean.

The table below shows the summary of the number of stores of the key local and international retail supermarket chains in Kenya;

|

Main Local and International Retail Supermarket Chains |

||||||

|

Name of Retailer |

Initial number of branches |

Number of branches opened in 2021 |

Closed branches |

Current number of Branches |

Branches expected to be opened / closed |

Projected total number of branches |

|

Naivas Supermarket |

69 |

0 |

0 |

69 |

1 |

70 |

|

Tuskys |

52 |

0 |

14 |

52 |

27 |

25 |

|

QuickMart |

35 |

0 |

0 |

35 |

0 |

35 |

|

Chandarana Foodplus |

20 |

0 |

0 |

20 |

0 |

20 |

|

Carrefour |

8 |

0 |

0 |

8 |

3 |

11 |

|

Uchumi |

37 |

0 |

33 |

4 |

0 |

4 |

|

Game Stores |

3 |

0 |

0 |

3 |

0 |

3 |

|

Choppies |

15 |

0 |

13 |

2 |

0 |

2 |

|

Shoprite |

4 |

0 |

2 |

2 |

0 |

2 |

|

Nakumatt |

65 |

0 |

65 |

0 |

0 |

0 |

|

Total |

308 |

0 |

127 |

195 |

31 |

172 |

Source: Online Research

The continued expansion of local retailers such as Naivas, has significantly cushioned the real estate retail sector whose performance has been dwindling attributable to; i) reduced demand for retail space as some retailers halt operations to cushion themselves from the effects of the pandemic, ii) reduced revenues amid reduced disposable income among consumers, iii) the shift to e-commerce, and, iv) the existing oversupply in the retail sector of 2.0 mn SQFT in the Kenya retail as at 2020 thus resulting in pressure on landlords to provide concessions and other incentives to attract new clientele or retain existing tenants. According to the Cytonn’s Kenya Retail Report 2020, the retail sector on overall recorded a decline in the average rental yield by 0.3% points to 6.7% in 2020 from 7.0% in 2019, while the occupancy rates also recorded a 0.7% points drop to 76.6% in 2020 from 77.3% in 2021.

The performance of the key urban centers in Kenya is as summarized below;

(All values in Kshs unless stated otherwise)

|

Summary of Retail Performance in Key Urban Cities in Kenya |

|||

|

Region |

Rent/SQFT 2020 |

Occupancy % 2020 |

Rental Yield 2020 |

|

Mount Kenya |

125.0 |

78.0% |

7.7% |

|

Nairobi |

168.5 |

74.5% |

7.5% |

|

Mombasa |

114.4 |

76.3% |

6.6% |

|

Kisumu |

97.2 |

74.0% |

6.3% |

|

Eldoret |

130.0 |

80.2% |

5.9% |

|

Nakuru |

55.7 |

76.6% |

5.9% |

|

Average |

115.1 |

76.6% |

6.7% |

Source: Cytonn Research

Despite declines in performance, some of the factors expected to continue supporting the growth of the retail sector in Kenya include; i) continued improvement of infrastructure opening up areas for investment, ii) rapid urbanization and population growth rates of around 4.0% and 2.2%, respectively against a global average of 1.9% and 1.1%, iii) investor confidence due to the ease of doing business in Kenya, having been ranked position #56 by World Bank in the ease of doing business, and, iv) the growing middle class with increased purchasing power.

The real estate sector is expected to continue recording increased activities supported by the continued focus on the affordable housing initiative and the constant expansion by local retailers taking up prime spaces vacated by struggling retailers.

- Introduction

- Overview of the Land Sector in Kenya

Land plays a significant role in the socio-economic and political development of the country. Therefore, its ownership, allocation, distribution and utilization is of great concern to most Kenyans thus making it one of the contentious issues that requires a lasting solution in effective legal and institutional framework. Land is either public, private or community land, with ownership being either on a freehold tenure which gives the holder absolute ownership of the land for life, or leasehold tenure in which the interest in land for a specific period is subject to payment of a fee, rate or rent to the grantor. The National Land Policy in Kenya recommends leases of not more than 99 years with a possibility of extension when the lessee applies for an extension of term before the existing term has expired. During the period of ownership, an individual or entity is required to pay land rates and rent which is currently based on the 1980 valuation roll. In terms of Stamp Duty payment before transfer of land, current stamp duty rates are 4.0% of the valuation amount for land in urban areas and 2.0% for land in rural areas.

- Performance of the Land Sector in Kenya

Land has also consistently been ranked as one of the best investment assets in the real estate sector attributable to its performance resilience. According to the Cytonn Annual Markets Review 2020, land asking prices recorded an average annual capital appreciation of 2.3% in 2019 bringing the 9-year CAGR to 10.7%. The satellite towns have continued to gain popularity outperforming the Nairobi suburbs recording an average annual capital appreciation of 5.4% compared to the market average of 2.3%, attributable to affordability of land in the satellite towns. However, for site and service the prices are lower due to the fewer list of sub markets unlike unserviced land which in includes market areas such as Ruaka whose prices are relatively high yet there is absence of site and service schemes. The commercial suburbs in the Nairobi area recorded reduced transaction volumes and resultant subdued performance attributable to the existing oversupply of commercial office and retail space estimated at approximately 6.3 mn and 3.1 mn SQFT, respectively.

The table below shows the summary of the Nairobi Metropolitan Area land performance;

(All values in Kshs Unless Stated Otherwise)

|

Nairobi Metropolitan Area Land Performance Trend |

|||||||

|

Location |

*Price in 2011 |

*Price in 2017 |

*Price in 2018 |

*Price in 2019 |

*Price in 2020 |

9 Year CAGR |

Annual Capital Appreciation 2019/'20 |

|

Unserviced land- Satellite Towns |

9.0 mn |

20.4 mn |

22.7 mn |

24.9 mn |

26.8 mn |

12.9% |

7.1% |

|

Serviced land- Satellite Towns |

6.0 mn |

14.4 mn |

14.3 mn |

14.3 mn |

14.8 mn |

10.6% |

3.8% |

|

Nairobi Suburbs - Low Rise Residential Areas |

56.0 mn |

82.4 mn |

89.4 mn |

91.6 mn |

93.8 mn |

5.9% |

3.2% |

|

Nairobi Suburbs - High Rise residential Areas |

46.0 mn |

134.6 mn |

135.0 mn |

137.5 mn |

135.7 mn |

12.8% |

1.2% |

|

Nairobi Suburbs - Commercial Areas |

156.0 mn |

429.8 mn |

447.3 mn |

428.5 mn |

413.0 mn |

11.4% |

(3.8%) |

|

Average |

54.6 mn |

144.5 mn |

155.4 mn |

139.4 mn |

136.8 mn |

10.7% |

2.3% |

Source: Cytonn Research

- Factors driving Land Transactions

Some of the recent factors driving land transactions include;

- Focus on Affordable Housing: The continued focus on the provision of affordable housing by both the government and private sector developers has continued to result in sustained demand for development land especially in the satellite towns where land is available in bulk and at affordable prices,

- Mortgage Availability: Access to mortgage facilities especially through the KMRC which is committed to offering affordable loans through the Primary Mortgage Lenders (PMLs) at an interest rate of 5.0% enabling them to write off loans at an interest rate of 7.0% compared to the average interest rate of 12.0%, has been driving the uptake of land mainly due to the availability of affordable loans to finance the development and purchase of property,

- Infrastructure Development: Development of infrastructure has continued to open up areas for development and thus increased demand for development land, and,

- Positive Demographics: Kenya has a high population and urbanization growth rate of 2.3% and 4.0% against a global average of 1.1% and 1.9% respectively according to the World Bank, driving the demand for development land mainly to cater for the housing need.

- Challenges facing Land Transactions

Despite the above, the factors negatively affecting land transactions include;

- Tough Economic Environment: The tough economic environment brought about by the COVID-19 pandemic has resulted to reduced disposable income which has limited the capacity of individuals to purchase land. Additionally, the reduced real estate development activities have also resulted to reduced uptake of land as investors adopt a wait and see attitude amid market uncertainty,

- High cost of land: The high cost of land especially within the Nairobi suburbs has crippled the purchasing of land thus resulting in stagnated performance. According to Cytonn research, the average asking price of land within the Nairobi suburbs averaged at approximately Kshs 216.2 mn per acre, and,

- Inaccessibility of financing: Funding for both developers and end users have remained low due to the perceived liquidity risk and despite the operationalization of KMRC, the mortgage market continues to grow sluggishly attributable to low-income levels that cannot service the loans, the high interest rates and deposit requirements which lock out many borrower and resulting to reduced demand for property including land.

- Land Regimes in Kenya

The 2010 Constitution of Kenya enhanced previous land reform efforts by establishing a legal framework for the administration, use, and management of land in Kenya. Article 61 of the Constitution classifies land as either public land, private land or community land, i.e;

- Public land: this is land held and administered by the National Lands Commission which has been reserved for public use or environmental protection such as forests and game reserves, rivers and lakes, roads provided by the Act of Parliament, etc,

- Community land: this is land held by communities on basis of ethnicity, culture or similar community interest and is held in trust by the county governments for the community if unregistered, and,

- Private land: this is land held by any person and companies under any freehold tenure or under leasehold tenure or land that is declared private by an Act of Parliament

There has been a number of land regulations that have been established without constitutional backing such as The Land Titles Act, The Registration of Titles Act, The Land Acquisition Act , The Government Land Act and therefore they had to be repealed . There are others that remain in force such as The Land Control Act, The Landlord and Tenant Act, and The Distress for Rent Act. The Parliament of Kenya in 2012 enacted new land laws with the aim of revising, consolidating and rationalizing land laws; and also providing for the sustainable administration and management of land and land-based resources on matters concerning land.

The new land regulations include:

- The Land Act 2012: This law was enacted in order to revise, consolidate and rationalize land laws, to provide for the sustainable administration and management of land and land-based resources,

- The Land Registration Act 2012: This was enacted to revise, consolidate and rationalize the registration of titles, to give effect to the principles and objects of devolved government in land registration,

- The National Land Commission Act 2012: This was enacted to make further provision as to the functions and powers of the National Land Commission, qualifications and procedures for appointments to the Commission; to give effect to the objects and principles of devolved government in land management and administration, and,

- Community Land Act of 2016: This was enacted to provide for the recognition, protection and registration of community land rights; management and administration of community land; to provide for the role of county governments in relation to unregistered community land.

The main provisions that came under the above Acts of Parliament included;

- The National Land Commission was granted more power in management and administration of public, private and community land having been required to be the link between the county governments and other institutions dealing with land and land related resources,

- All land in Kenya had and still has to be registered and any land available for allocation has to be Gazetted and notices published in at least two local dailies, prior to commencement of the allocation process,

- Title deeds were examined and registered afresh in order to be issued in the new prescribed form,

- Foreigners who held freehold titles or leasehold titles that were for a term exceeding 99 years, had their titles reduced to 99-year leasehold titles while Kenyan Citizens who held a leasehold title were granted the right to re-acquire the land upon expiry of the term provided the land is not required for public purposes,

- Provision of a certificate of lease where a person is registered as the owner of a long term lease over apartments, flats, maisonettes, townhouses or offices,

- Spouses being deemed owners of land though not through title,

- For the transfer of a portion of land, a new title deed for the subdivision will have to be obtained prior to completing the transfer of a portion of land,

- Corporate bodies or associations effecting dispositions of land, such as agreements for sale, transfers and charges, were required to execute documents in the presence of an advocate of the High Court of Kenya, a magistrate, judge or notary,

- Title deeds to be issued over long term leases exceeding 21 years as opposed to the old rules that required leases exceeding 25 years,

- Regulations on charges relating to private land including variation of interest rates requiring a notice with simple explanation to the borrower, forced sale valuation must be undertaken before exercising the statutory power of sale, among others,

- Any land acquired through a process tainted with corruption be forfeited to the Government,

- New offences and penalties relating to land transactions, i.e.;

- Offences related to the giving of false information and other fraudulent practices being punishable by a fine of up Kshs 5.0 mn and imprisonment of up to 5 years or both, under the Land Registration Act,

- Unlawful occupation of public land being deemed an offence which will attract fines of up to Kshs 500,000 and if a continuous offence, a sum not exceeding Kshs 10,000 for every day the offence is continued,

- Wrongful obstruction of a public right of way being deemed an offence and will attract a fine of up to Kshs 10.0 and if a continuous offence, a sum of up to Kshs 100,000 for every day the offence is continued, and,

- Any rights over land that were obtained by virtue or on account of an offence may be cancelled or revoked.

- The Commission and the Cabinet Secretary were granted powers to make regulations to better carry into effect the provisions of the Land Act and Land Registration Act, in matters with respect to squatters, regulations that "facilitate negotiations between private owners and squatters" and also those that deal with the " transfer of unutilized land and land belonging to absentee land owners to squatters".

Despite these laws having been comprehensive enough to address loopholes in legal framework, land transactions have over the years continued to face challenges which further led to other recent reforms which have come into play to facilitate easier land and property transactions, bringing order to records and reducing court cases relating to the transactions;

- The Physical and Land Use Panning Act 2019: The law repealed the Physical Planning Act of 1996 and now governs matters relating to the planning, use, regulation and development of land. It requires integration of national, county, inter-county and local physical and land use plans, development control by county governments in their respective counties, and, developers seeking development permission prior to undertaking any development. The significant changes that the Act brought about are;

- Increased public participation in land matters e.g. the suitability of the national and county plans,

- Classification of developments that require development permission, i.e, developments such as subdivision, amalgamation, change of user, extension of user, extension of lease and approval of building plans will still require development permission to be issued by the relevant county government,

- Additional developments requiring approvals with processing of easements (making use of land for a limited purpose) and wayleaves (right of way) requiring express development permission, as well as sitting educational institutions, base transmission stations, petrol stations, eco lodges, campsites, power generation plants and factories,

- Clear definition of what constitutes commercial and industrial use to guide applicants in selecting the correct land use, depending on the nature of the project they wish to undertake, and,

- Development permission in respect of commercial and industrial use being a pre-requisite for other licensing authorities granting a license for a commercial or industrial use, or occupation of land.

- Stamp Duty (Valuation of Immovable Property) Regulations, 2020: The Valuation Regulations outline the procedure for determining the market value of immovable property, mainly land, for purposes of assessment of applicable stamp duty to be borne by the buyer with the aim of simplifying transactions. Provisions under the regulations include;

- Permits for valuations may either be done by a Government Valuer or a Private Valuer appointed by the Chief Government Valuer thus speeding up the land and building transfer processes,

- The appointed registered Private Property Valuer will be expected to submit a valuation report to the Chief Government Valuer immediately a payment has been made by a transferee while the Government Valuer has a limit of 21 days to submit the valuation report from the date a transferee chooses to have valuations done,

- The person liable to pay the Stamp Duty and who is aggravated by the valuation of property may lodge objection in writing to the Chief Government Valuer within 21 days of receipt of the notice of valuation on limited grounds including; i) value assigned for the immovable property, ii) the apportionment of the area, dimensions or description of the immovable property, iii) in the case where the immovable property that should have been included in the valuation has been valued separately, iv) that the immovable property that should have been valued separately has been included in the valuation, and, v) the person named in the report is not the true transferee of the immovable property, and,

- In case of professional malpractice in the course of rendering services under the Stamp Duty Act, the person alleging the malpractice may report the matter to the Valuers Registration Board and if proven relevant sanctions in the valuers act will apply.

- The Stamp Duty (Amendment) Regulations, 2020: A legal notice was published under these regulations to amend matters of electronic transmission of documents. Provisions under the regulations are;

- Allowing electronic stamping of documents by franking machines or by electronic means,

- Allowing payment of stamp duty under the direction of a collector to be done electronically,

- Electronic submission of documents through the National Land Information System,

- Allowing modification of forms for electronic transactions, and,

- Serving of notices authorized to be done electronically.

- Land Registration (Electronic Transactions) Regulations, 2020: These regulations seek to effect the development and implementation of a National Land Information System and the maintenance of a land register and land documents in a secure, accessible and reliable format. As per the proposed Regulations;

- The mandate to keep and maintain a data base of all public land in electronic form was given to the National Lands Commission (NLC),

- Public institutions vested with the control, care and management of public land are required by the NLC to submit an inventory of all land under their control and actual occupation in electronic form,

- Various fees prescribed under the Regulations may be paid through authorized electronic means as may be advised by the Cabinet Secretary from time to time, and,

- The decision to grant or not grant an extension of lease by the County Government be communicated to the Cabinet Secretary of the Ministry of Lands for implementation and not the NLC as it was earlier.

- The Sectional Properties Act 2020: This Act provides for the division of buildings into units to be owned by individual proprietors and common property to be owned by proprietors of the units as tenants in common and to provide for the use and management of the units and common property. The provisions under the Act are;

- Giving property developers and apartment owners greater transaction ability in financing and disposal of properties in the market as it will allow apartment buyers to have title deeds as proof of ownership,

- Independent and complete ownership of properties will give banks greater incentive to lend to apartment owners since charges can be placed directly on individual titles,

- The owners of a unit shall only be liable in respect of an interest endorsed on the sectional plan in proportion to the unit factor for his unit,

- Developers can subdivide buildings into two or more units by the registration of a sectional plan prepared, by a surveyor, from a building plan that has been approved by a county government,

- Common property comprised in a registered sectional plan, shall be held by the owners, and,

- Landlords or owners of existing units are allowed to convert their properties into units under the Act if they want to sell them as units. This implies developers will no longer be allowed to sell units without sectional plans to enable individual ownership.

- Effects of Recent Land Regulations

Some of the expected effects of the recent land Regulations are;

- Digitization of Land Records: The digitization of land records will facilitate easy, fast and efficient processing of transactions of land property by eradicating fraud and putting a stop to further deterioration of paper records, improve access, storage and retrieval of land records thus leading to efficient, timely and cost-effective land management processes, as well as promoting public confidence in the integrity and reliability of electronic records and electronic transactions,

- Enhanced Ease of Doing Business: This will be achieved by the reduced period of application and registration of property from nearly three months to under two weeks, as well as the effort of devolved planning, standardization, and, streamlining of the processes of approval of strategic national and inter-county projects that require land,

- Enhanced Revenue Collection from Land Transactions: The National Land Information Management System (NLIMS), will eliminate revenue leakages with the establishment of an electronic payment system. Rolling out a new Land Valuation Index to guide land valuations for investment and land compensation decisions, as well as the plans to draft a national property rating legislation to determine new land rates will ensure increased revenue as all properties will be captured within the valuation roll, and land rates based on improved property values,

- Mitigation of Land Valuation Issues: The new valuation regulations will enable shortening of the lengthy process of acquiring land and buildings due the current delays at the Lands Ministry attributed to the shortage of government valuers, and,

- Easier Access to financing and Loans: Provisions under the Sectional Properties Act such as property developers and apartment owners having greater transaction ability in financing and disposal of properties in the market with apartment buyers having title deeds as proof of ownership, as well as independent and complete ownership of properties, giving banks greater incentive to lend to apartment owners since charges can be placed directly on individual titles.

- Conclusion

Land reforms in Kenya have over the years been a continuous process aimed at bringing about positive change in land management and administration. With land being one of the key enablers of the Big Four Agenda, the Ministry of Lands and Physical Planning has been implementing several strategic policies and administrative interventions, as well as administrative and legal reforms to streamline land administration and to address the issues of land ownership and use. We expect the new land laws to bring about change, consistency and consolidation of land laws in Kenya. However, more polishing of the regimes needs to be done to address the missing links that bring about controversies. In addition, to enhance the effectiveness of the regimes we recommend, i) consolidation of the land law into a few Acts to take care of the substantive land law, registration of land, planning and survey, ii) creation of public awareness on the land laws, and, iii) eradicating historical injustices such as irregularly allocated public land by the commission.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.