Public-Private Partnerships (PPPs) in the Real Estate Industry in Kenya, & Cytonn Weekly #19/2021

By Research Team, May 16, 2021

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 110.7%, down from 131.0% recorded the previous week. The demand for the 364-day paper persisted, as it recorded the highest bids worth Kshs 22.3 bn against the offered Kshs 10.0 bn, translating to a subscription rate of 222.6%, a decline from the 253.2% recorded the previous week. In the Primary Bond Market, the government opened a tap sale on the two bonds issued in the month of May, FXD2/2019/15 and FXD1/2021/25. The tap sale issuance recorded an overall subscription rate of 104.7% with the investors preferring the shorter dated paper, FXD2/2019/15, which received bids worth Kshs 15.9 bn, of all the Ksh 20.9 bn subscriptions.

The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum wholesale and retail prices for fuel prices, highlighting that the prices of super petrol increased by 2.9% to Kshs 126.4 per litre from Kshs 122.8 per litre recorded in April, while the prices of diesel and kerosene remained unchanged at Kshs 107.7 and Kshs 97.9 per litre, respectively, as recorded on 15th April;

Equities

During the week, the equities market recorded mixed performance, with NSE 20 recording a marginal gain of 0.04% respectively, while NASI and NSE 25 declined by 3.1% and 3.7%. This week’s performance took their YTD performance to gains of 9.0% and 5.2%, for NASI and NSE 25, respectively, and a loss of 0.5% for NSE 20. The equities market performance was driven by gains recorded by stocks such as DTB-K and BAT which gained by 1.2% and 0.7%, respectively. The gains were however weighed down by losses recorded by stocks such as Safaricom and Co-operative Bank which declined by 3.4% and 1.2%, respectively. During the week, KCB Group disclosed that it had made an offer to the Banque Populaire du Rwanda Plc (BPR) shareholders to raise its acquisition stake in the bank from 62.1% to 100.0%;

Real Estate

During the week, Hass Consult, a local real estate company, released the House Price Index Q1’2021, indicating that house prices recorded a 0.7% drop q/q, and a 1.8% drop y/y. Hass Consult also released the Q1’2021 Land Price Index, indicating that land prices within the Nairobi suburbs recorded a price appreciation of 0.2% q/q. In the residential sector, the Nakuru County Governor, Lee Kinyanjui, announced that the construction of 600 affordable housing units in Nakuru has kicked off. In the commercial office sector, Insurance Regulatory Authority (IRA) and Capital Markets Authority (CMA) announced plans to jointly purchase office spaces within Nairobi, in a move that will see it take up at least 55,000 SQFT of office space in Upper Hill. In the retail sector, QuickMart supermarket, announced plans to open 4 stores concurrently by mid-July. For mixed used developments (MUD’s), the Kenya Commercial Bank (KCB) Group announced that it is seeking joint venture partners to finance and develop its 153.2 acres in Juja;

Focus of the Week

A Public-Private Partnership is an agreement between the public sector and the private sector for the purpose of designing, planning, financing, constructing and operating projects that would traditionally be regarded as falling within the remit of the public sector. With UK having come up with the first systematic program to encourage implementation of projects through PPPS since 1992, their model has been used as a benchmark by many countries in enhancing their PPP models and Kenya can borrow lessons to efficiently deliver development projects which have more often than not faced challenges in implementation. This is especially relevant to the President’s Big Four Agenda of Food Security, Manufacturing, Universal Health Coverage and Affordable Housing. The Government of Kenya stands to gain a lot with the use of PPPs which have a promising future if more efforts are made to solve the current challenges in order to provide a more conducive operating environment for PPPs. We believe that the government’s Housing Agenda can be accelerated if we had the appropriate PPP framework and incentives.

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.58%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.56% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, please get in touch with us through insuranceagency@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma by Cytonn is now ready for occupancy. To rent please email properties@cytonn.com;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

Hospitality Updates:

- CySuites Apartment Hotel is proud to receive the 2021 Travelers Choice Award after emerging in the top 10% best hotel destinations in the world. The ranking emanated from the great client reviews the luxurious serviced apartment hotel earned over the last 12 months for consistently delivering exemplary services and great experiences to its guests;

- We currently have promotions for Daycations and Staycations, visit cysuites.com/offers for details or email us at sales@cysuites.com;

For recent news about the group, see our news section here.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 110.7%, down from 131.0% recorded the previous week. The demand for the 364-day paper remained high, as it recorded the highest bids worth Kshs 22.3 bn against the Kshs 10.0 bn offered, translating to a subscription rate of 222.6%, a decline from the 253.2% recorded the previous week. Investors’ continued interest in the 364-day paper is mainly attributable to the expectations of continued progress in the containment of COVID-19 through the vaccine inoculation, as well as the papers attractive rate of 9.4% which is higher than the rate for most bank placements. The subscription rate for the 182-day paper declined to 28.9%, from 42.6% recorded the previous week, receiving bids worth Kshs 2.9 bn against the Kshs 10.0 bn offered. The subscription rate for the 91-day paper also declined to 35.7%, from 46.5% recorded the previous week, with the paper receiving bids worth Kshs 1.4 bn against the offered amounts of Kshs 4.0 bn. The yields on the 91-day and 182-day papers increased by 4.0 bps and 5.0 bps to 7.2% and 8.0%, respectively, while the yields on the 364-day paper declined by 5.9 bps to 9.4%. The government continued to reject expensive bids, accepting Kshs 20.5 bn out of the Kshs 26.6 bn worth of bids received, translating to an acceptance rate of 77.0%.

In the Primary Bond Market, the government opened a tap sale on the two bonds issued in the month of May, FXD2/2019/15 and FXD1/2021/25. The tap sale issuance recorded an overall subscription rate of 104.7% with investors preferring the shorter paper, FXD2/2019/15, which received bids worth Kshs 15.9 bn, of the Kshs 20.0 bn offered, translating to a subscription rate of 79.5%. On the other hand, FXD1/2021/25 received bids worth Kshs 5.0 bn against the Kshs 20.0 bn offered, translating to a subscription rate of 25.2%. The average yields on the two bonds were 13.0% and 13.9% for FXD2/2019/15 and FXD1/2021/25, respectively. The government accepted Kshs 20.7 bn of the Kshs 20.9 bn worth of bids received, translating to an acceptance rate of 98.9%.

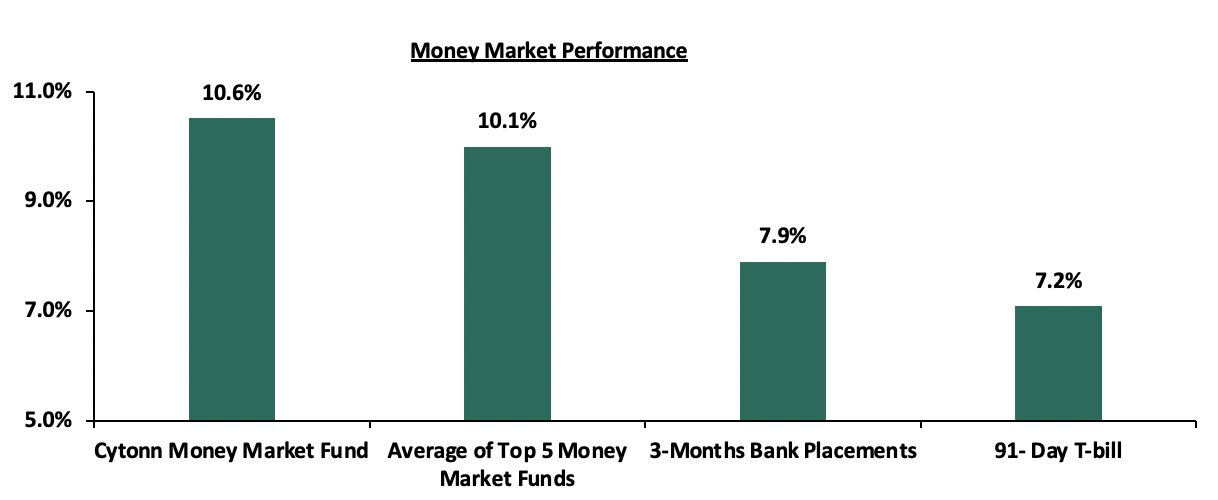

In the money markets, 3-month bank placements ended the week at 7.9% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased by 0.4 bps to 7.2%. The average yield of the Top 5 Money Market Funds increased to 10.1% from the 10.0% recorded the previous week. Similarly, the yield on the Cytonn Money Market Fund increased to 10.6% from the 10.5% recorded the previous week. The table below shows the Money Market Fund Yields for Kenyan fund managers as published on 14th May 2021:

|

Money Market Fund Yield for Fund Managers as published on 14th May 2021 |

|||

|

Rank |

Fund Manager |

Daily Yield |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.05% |

10.58% |

|

2 |

Nabo Africa Money Market Fund |

10.00% |

10.47% |

|

3 |

Zimele Money Market Fund |

9.56% |

9.91% |

|

4 |

GenCapHela Imara Money Market Fund |

9.23% |

9.67% |

|

5 |

Alphafrica Kaisha Money Market Fund |

9.22% |

9.62% |

|

6 |

Madison Money Market Fund |

8.94% |

9.35% |

|

7 |

CIC Money Market Fund |

8.98% |

9.30% |

|

8 |

Sanlam Money Market Fund |

8.80% |

9.21% |

|

9 |

Dry Associates Money Market Fund |

8.62% |

8.97% |

|

10 |

Co-op Money Market Fund |

8.38% |

8.74% |

|

11 |

British-American Money Market Fund |

8.23% |

8.55% |

|

12 |

Apollo Money Market Fund |

8.43% |

8.50% |

|

13 |

NCBA Money Market Fund |

8.02% |

8.34% |

|

14 |

Old Mutual Money Market Fund |

7.74% |

8.02% |

|

15 |

ICEA Lion Money Market Fund |

7.13% |

7.39% |

|

16 |

AA Kenya Shillings Fund |

6.11% |

6.29% |

Liquidity:

During the week, liquidity in the money market improved, with the average interbank rate declining to 3.7%, from 4.6% recorded the previous week, partly attributable to Kshs 44.5 bn of government securities maturities. The average interbank volumes increased by 22.8% to Kshs 9.8 bn, from Kshs 8.0 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds recorded mixed performance, with the yields on the 10-year Eurobond issued in June 2014, 10-year bond issued in 2018, 30-year bond issued in 2018 and 7-year bond issued in 2019 increasing to 3.6%, 6.0%, 7.1% and 5.1%, from 3.1%, 5.7%, 7.6% and 5.0%, respectively. The increase was partly attributable to dwindling investor confidence, following reports of a possibility of delayed vaccination and rising COVID-19 infections in the Sub-Saharan Region. On the other hand, the yields on the 12-year bond issued in 2019 remained unchanged at 6.6%.

|

Kenya Eurobond Performance |

|||||

|

2014 |

2018 |

2019 |

|||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

|

31-Dec-2020 |

3.9% |

5.2% |

7.0% |

4.9% |

5.9% |

|

30-April-2021 |

3.2% |

5.7% |

7.7% |

5.0% |

6.7% |

|

07-May-2021 |

3.1% |

5.7% |

7.6% |

5.0% |

6.6% |

|

10-May-2021 |

3.1% |

5.7% |

7.6% |

5.0% |

6.6% |

|

11-May-2021 |

3.1% |

5.7% |

7.5% |

5.0% |

6.6% |

|

12-May-2021 |

3.1% |

5.7% |

7.5% |

5.0% |

6.6% |

|

13-May-2021 |

3.6% |

6.0% |

7.7% |

5.1% |

6.6% |

|

Weekly Change |

0.5% |

0.3% |

0.1% |

0.1% |

0.0% |

|

MTD Change |

0.4% |

0.3% |

0.0% |

0.1% |

0.1% |

|

YTD Change |

(0.3%) |

0.8% |

0.7% |

0.2% |

0.7% |

Source: Reuters

Kenya Shilling:

During the week, the Kenyan shilling depreciated against the US dollar by 0.2% to Kshs 107.0, from Kshs 106.9 recorded the previous week, attributable to increased dollar demand from energy and general merchant importers. On a YTD basis, the shilling has appreciated by 2.0% against the dollar, in comparison to the 7.7% depreciation recorded in 2020. We expect the shilling to remain under pressure in 2021 as a result of:

- Rising uncertainties in the global market due to the Coronavirus pandemic, which has seen investors continue to prefer holding their investments in dollars and other hard currencies and commodities, and,

- Demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally,

The shilling is however expected to be supported by:

- The Forex reserves, currently at USD 7.6 bn (equivalent to 4.6-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- The improving current account position which narrowed to 4.8% of GDP in the 12 months to December 2020 compared to 5.8% of GDP during a similar period in 2019, and,

- Improving diaspora remittances evidenced by a 43.8% y/y increase to USD 299.3 mn in April 2021, from USD 208.2 mn recorded over the same period in 2020, has cushioned the shilling against further depreciation.

Weekly Highlights:

May Fuel Prices

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum wholesale and retail prices for fuel prices in Kenya effective 15th May 2021 to 14th June 2021. Below are the key take-outs from the statement:

- Super Petrol prices increased by 2.9% to Kshs 126.4 per litre from Kshs 122.8 per litre recorded in April, while the prices of diesel and kerosene remained unchanged at Kshs 107.7 and 97.9 per litre, respectively. Notably, this is the second consecutive month that the diesel and kerosene prices have remained unchanged.

- The mixed performance in fuel prices was attributable to:

- The average landed cost of imported super petrol declined by 0.6% to USD 488.7 per cubic meter in April 2021, from USD 491.5 per cubic meter in March 2021,

- The average landed costs for diesel declined by 1.0% to USD 439.6 per cubic meter in April 2021, from USD 444.2 per cubic meter in March 2021,

- The average landed cost for kerosene increased by 2.0% to USD 430.4 per cubic meter in April 2021, from USD 421.9 per cubic meter in March 2021,

- The Free on Board (FOB) price of Murban crude oil lifted in April 2021 declined by 1.9% to USD 63.9 per barrel, from USD 65.2 per barrel in March 2021, and,

- The Kenyan shilling appreciated by 1.6% against the dollar to close at Kshs 107.8 in April 2021, from Kshs 109.6 in March 2021.

We expect an increase in the transport and fuel index which carries a weighting of 8.7% in the total consumer price index (CPI) as a result of the increase in petrol prices. However, the increase may not be felt in other components of the inflation index like food as the kerosene prices have remained unchanged.

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the Central Bank as they reject expensive bids. The government is 1.6% ahead of its prorated borrowing target of Kshs 484.6 bn having borrowed Kshs 492.1 bn. In our view, due to the current subdued economic performance brought about by the effects of the COVID-19 pandemic, the government will record a shortfall in revenue collection having collected Kshs. 1,337.4 bn as at 10 months to April 2021, compared to Kshs 1,383.7 bn prorated target collection for FY’2020/2021, thus leading to a larger budget deficit than the projected 7.5% of GDP. The high deficit and the lower credit rating from S&P Global to 'B' from 'B+' will mean that the government might be forced to borrow more from the domestic market which will ultimately create uncertainty in the interest rate environment. In our view, investors should be biased towards short-term fixed income securities to reduce duration risk.

Markets Performance

During the week, the equities market recorded mixed performance, with NSE 20 recording a marginal gain of 0.04% respectively, while NASI and NSE 25 declined by 3.1% and 3.7%. This week’s performance took their YTD performance to gains of 9.0% and 5.2%, for NASI and NSE 25, respectively, and a loss of 0.5% for NSE 20. The equities market performance was driven by gains recorded by stocks such as DTB-K and BAT which gained by 1.2% and 0.7%, respectively. The gains were however weighed down by losses recorded by stocks such as Safaricom and Co-operative Bank which declined by 3.4% and 1.2%, respectively.

Equities turnover increased by 14.7% to USD 28.6 mn, from USD 24.9 mn recorded the previous week, taking the YTD turnover to USD 433.5 mn. Foreign investors turned net sellers during the week, with a net selling position of USD 5.4 mn, from a net buying position of USD 6.8 mn recorded the previous week, taking the YTD net selling position to USD 7.9 mn.

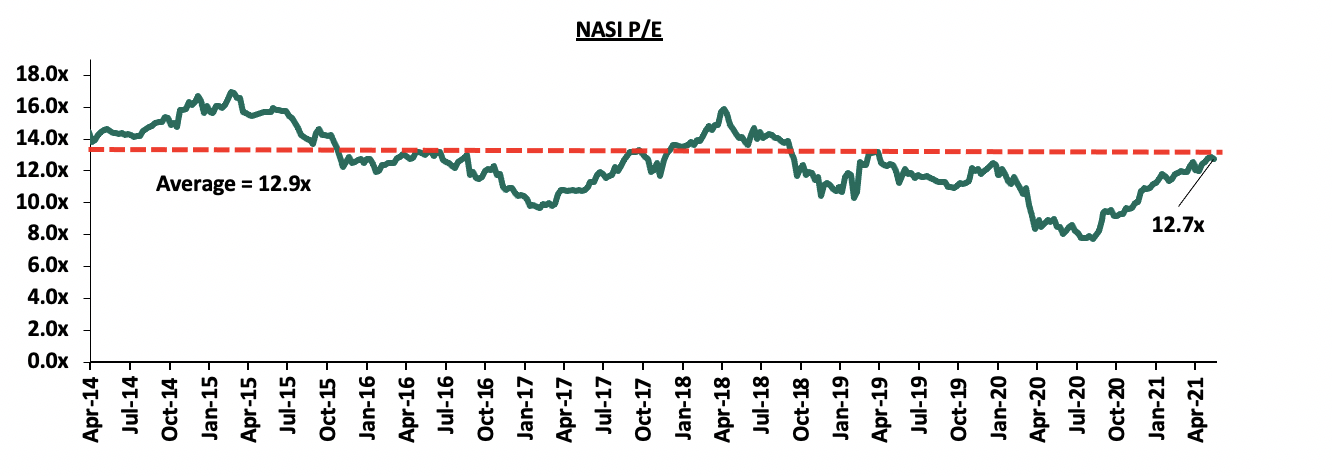

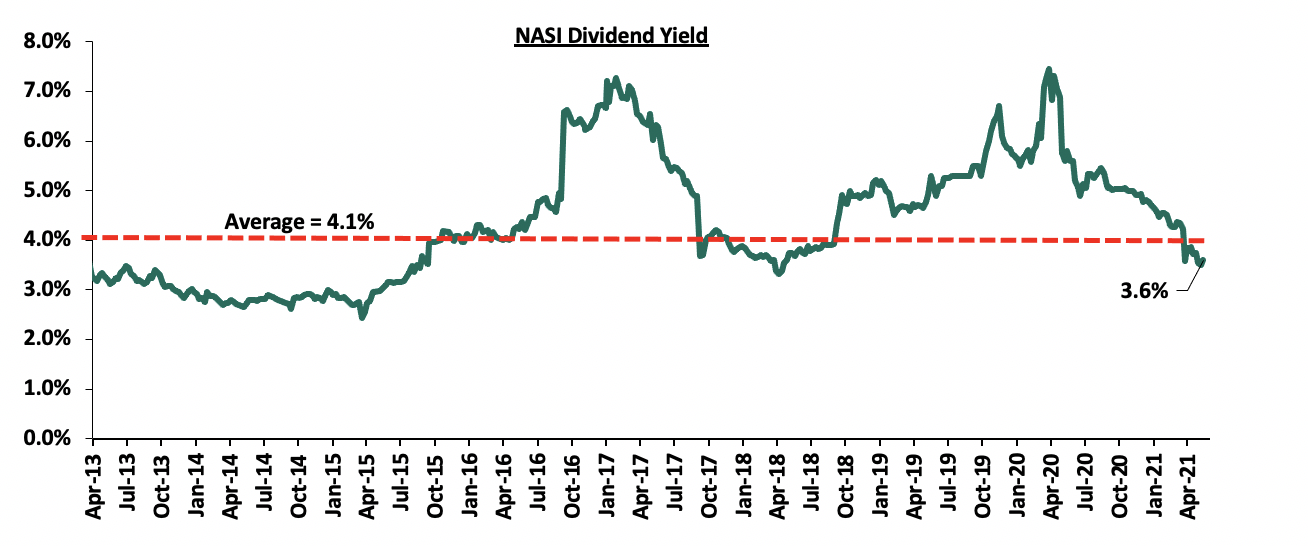

The market is currently trading at a price to earnings ratio (P/E) of 12.7x, which is 1.5% below the historical average of 12.9x, and a dividend yield of 3.6%, 0.5% points below the historical average of 4.1%. Key to note, NASI’s PEG ratio currently stands at 1.4x, an indication that the market is trading at a premium to its future earnings growth. Basically, a PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The current P/E valuation of 12.7x is 65.2% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight:

During the week, KCB Group disclosed that it had made an offer to the Banque Populaire du Rwanda Plc (BPR) shareholders to raise its acquisition stake in the bank from 62.1% to 100.0%. This deal comes months after KCB disclosed that it had entered into a binding agreement with Atlas Mara to acquire 62.1% stake in Banque Populaire du Rwanda Plc (BPR) in Rwanda and 100.0% stake in African Banking Corporation (ABC) Tanzania Limited. As highlighted in our Cytonn Weekly #48/2020, the 62.1% BPR acquisition would see KCB pay a cash consideration based on the net asset value of the BPR at completion of the transaction using a price to book multiple of 1.1x. According to the latest BPR financials, the bank had a book value of Rwf 47.3 bn (Kshs 5.1 bn), and thus at the trading multiple of 1.1x, we expect KCB Group to spend Kshs 5.6 bn to acquire BPR Rwanda. Collectively, KCB will spend a total of USD 56.9 mn (Kshs 6.1 bn) in the acquisition of Banque Populaire du Rwanda Plc (BPR) Rwanda and African Banking Corporation (ABC) Tanzania. Once complete, the move is expected to increase KCB Group’s total assets to Kshs 1.02 tn, from Kshs 0.99 tn recorded in FY’2020, and increase its total branches to 552 from 359 as of FY’2020. The deal is subject to shareholders’ approval and the regulatory approvals from authorities in the three countries; Kenya, Rwanda and Tanzania. BPR Rwanda is the third largest bank in Rwanda by assets with a market share of 9.4%. Given that KCB Group already has a Rwandan subsidiary, KCB Bank Rwanda, the acquisition of BPR will increase its market share in Rwandan banking sector to 14.9% from 5.5%, thereby becoming the second largest bank in the country by assets.

The move by KCB Group continues the trend seen by Kenyan banks of acquiring banks in the East African region in a bid to grow their assets and expand their regional reach; case in point, I&M Holdings which recently announced that it had completed the acquisition of 90.0% of Oriental Bank Uganda’s share capital. We believe that KCB’s expansion into Rwanda and Tanzania will present significant growth opportunities for the lender as the percentage of adults with bank accounts in Rwanda and Tanzania stood at 36.7% and 21.0%, compared to Kenya’s 55.7%, according to the Global Findex Report 2017. Additionally, Rwandan banking sector’s asset quality is superior to Kenya’s having registered an average NPL ratio of 6.2% over the last 5 years and in FY’2020, the ratio stood at 4.5% compared to the average NPL ratio of 14.1% recorded by Kenya’s banking sector and 14.8% recorded by KCB Group in FY’2020. As loans typically comprise the majority of a bank’s assets, the superior asset quality in Rwanda can help KCB Group reduce the level of risk exposure to its loan book and increase profits as there will be more performing loans. Further, according to data by the World Bank, Rwanda and Tanzania recorded interest rate spreads of 8.9% and 9.9% in 2019, respectively, both higher than Kenya’s 4.8% and KCB Group's 7.8% net interest spread over the same period; which means that the acquisitions could help boost the Group's funded income.

Below is a summary of the deals in the last 7 years that have either happened, been announced or expected to be concluded:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs bn) |

Transaction Stake |

Transaction Value (Kshs bn) |

P/Bv Multiple |

Date |

|

I&M Holdings PLC |

Orient Bank Limited Uganda |

3.3 |

90.0% |

3.6 |

1.1x |

April-21 |

|

KCB Group |

Banque Populaire du Rwanda, and, ABC Tanzania |

4.5 (Banque Populaire du Rwanda, only. ABC Tanzania financials unknown) |

100.0% |

6.1 |

N/D |

Nov-20* |

|

Co-operative Bank |

Jamii Bora Bank |

3.4 |

90.0% |

1 |

0.3x |

Aug-20 |

|

Commercial International Bank |

Mayfair Bank Limited |

1 |

51.0% |

Undisclosed |

N/D |

May-20* |

|

Access Bank PLC (Nigeria) |

Transnational Bank PLC. |

1.9 |

100.0% |

1.4 |

0.7x |

Feb-20* |

|

Equity Group ** |

Banque Commerciale Du Congo |

8.9 |

66.5% |

10.3 |

1.2x |

Nov-19* |

|

KCB Group |

National Bank of Kenya |

7 |

100.0% |

6.6 |

0.9x |

Sep-19 |

|

CBA Group |

NIC Group |

33.5 |

53%:47% |

23 |

0.7x |

Sep-19 |

|

Oiko Credit |

Credit Bank |

3 |

22.8% |

1 |

1.5x |

Aug-19 |

|

CBA Group** |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

Jan-19 |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

Jan-18 |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

Dec-18 |

|

SBM Bank Kenya |

Chase Bank Ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

3 |

100.0% |

5 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov-13 |

|

Average |

|

|

76.7% |

|

1.2x |

|

|

* Announcement Date ** Deals that were dropped |

||||||

Universe of Coverage

Below is a summary of our universe of coverage and the recommendations:

|

Company |

Price at 07/5/2021 |

Price at 13/5/2021 |

w/w change |

YTD Change |

Year Open 2021 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Standard Chartered*** |

131.8 |

132.0 |

0.2% |

(8.7%) |

144.5 |

164.4 |

8.0% |

32.5% |

0.9x |

Buy |

|

I&M Holdings*** |

42.6 |

24.3 |

(43.0%) |

(45.8%) |

44.9 |

29.9 |

9.3% |

32.3% |

0.3x |

Buy |

|

Diamond Trust Bank*** |

64.3 |

65.0 |

1.2% |

(15.3%) |

76.8 |

84.3 |

0.0% |

29.7% |

0.3x |

Buy |

|

Stanbic Holdings |

81.0 |

83.0 |

2.5% |

(2.4%) |

85.0 |

99.4 |

4.6% |

24.3% |

0.8x |

Buy |

|

NCBA*** |

24.6 |

24.7 |

0.2% |

(7.3%) |

26.6 |

28.4 |

6.1% |

21.3% |

0.6x |

Buy |

|

KCB Group*** |

42.0 |

42.0 |

0.0% |

9.2% |

38.4 |

49.8 |

2.4% |

21.1% |

1.0x |

Buy |

|

Equity Group*** |

40.8 |

41.0 |

0.5% |

13.0% |

36.3 |

49.5 |

0.0% |

20.9% |

1.3x |

Buy |

|

Co-op Bank*** |

12.6 |

12.5 |

(1.2%) |

(0.8%) |

12.6 |

13.6 |

8.0% |

17.3% |

0.9x |

Accumulate |

|

ABSA Bank*** |

8.8 |

8.8 |

0.5% |

(7.6%) |

9.5 |

10.2 |

0.0% |

15.9% |

1.0x |

Accumulate |

|

HF Group |

3.7 |

4.0 |

8.7% |

27.4% |

3.1 |

3.8 |

0.0% |

(5.0%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in. Key to note, the I&M Holdings share price change is mainly attributable to counter trading ex-bonus issue. |

||||||||||

We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.4x), we believe that investors should reposition towards companies with a strong earnings growth and are trading at discounts to their intrinsic value. Additionally, we expect the recent discovery of new strains of COVID-19 coupled with the introduction of strict lockdown measures in major economies to continue dampening the economic outlook.

- Industry Reports

During the week, Hass Consult, a local real estate company, released the House Price Index Q1’2021, a report that highlights the performance of residential buildings within the Nairobi Metropolitan Area. Some of the key take outs from the report include;

- House prices recorded a 0.7% drop q/q, and a 1.8% drop y/y, attributed to the reduced consumer purchasing power of individuals which has affected uptake of properties,

- Apartments in Lang’ata recorded the highest price appreciation of 2.9% q/q, and 1.6% y/y attributed to increased demand due to their affordability, on the other hand, Westlands apartments recorded the highest q/q drop with prices declining by 3.3%,

- Ruiru recorded the highest q/q price appreciation of 2.7% for satellite towns while Ngong recorded the highest y/y increase at 8.4%. Juja had the highest q/q and y/y price depreciation of 4.2% and 10.8% respectively, and,

- Overall, rental prices increased by 1.2% q/q and 5.1% y/y with Donholm recording the highest rental appreciation of 2.2% q/q while Muthaiga recorded the highest y/y rental appreciation of 7.8%. The general appreciation in the rental rates is attributed to growing demand for rental housing as people relocated due to reduced disposable income brought about by the tough economic environment.

The findings of this report are not in line with the Cytonn Q1’2021 Markets Review which indicated that the residential sector posted a price appreciation of 0.5% q/q in Q1’2021 with average Y/Y total returns to investors coming in at 5.1%, up from 4.7% attributed to increased market activities at the start of the first quarter of the year. We expect the returns to investors to record slight improvements supported by the expected improvement in market activities due to the reopening of the economy. As per our report investment opportunity for apartments lies in areas such as South C, Ruaka and Thindigua which continued to post high returns of 6.5%, 6.2% and 6.0% respectively while for detached units, opportunity lies in submarkets such as Rosslyn, Ruiru and Kitisuru which posted returns of 6.7%, 6.3%, and 5.9 % respectively.

Hass Consult also released the Q1’2021 Land Price Index, and the key take outs are;

- Land prices within the Nairobi suburbs recorded a price appreciation of 0.2% q/q, indicating that people still consider land as a good investment asset class despite the pandemic. Satellite towns on the other hand recorded a 1.5% appreciation q/q and 0.6% price appreciation y/y, attributable to increased demand for affordable land available in satellite towns.

- Nyari registered the highest q/q increase in land prices at 2.2% and a 2.1% price appreciation y/y while Riverside posted the biggest q/q drop of 1.7%, with an annual price correction of 7.1% within the Nairobi suburbs, and,

- Ngong recorded the highest appreciation among satellite towns at 6.1% q/q, and 16.0% y/y, supported by the affordability of land and improving infrastructure. On the other hand, Kiambu recorded the highest q/q and y/y price correction of 2.0% and 12.6%, respectively, attributed to relatively high land prices compared to other satellite towns with the average price per acre at Kshs 37.8 mn.

The findings of the report are in tandem with the Cytonn Q1’2021 Markets Review, which indicated that the land sector posted an annualized appreciation of 2.8% in Q’1 2021 indicating that people still consider land as a good investment asset in the long term. According to the report, land in satellite towns recorded an average annual price appreciation of 7.2% while land within Nairobi suburbs recorded an average annual price appreciation of 1.0%. The investment opportunity lies in sub markets such as Kitisuru, Runda, and Kasarani, which recorded relatively high annualized capital appreciation of 8.2%, 6.5% and 5.2%, respectively. For satellite towns, Juja recorded the highest annualized price appreciation of 10.5% for unserviced land whereas Thika recorded the highest annualized appreciation for site and serviced land at 10.5%.

- Residential Sector

During the week, the Nakuru County Governor, Lee Kinyanjui, announced that the construction of 600 affordable housing units in Nakuru has kicked off. The project which is expected to be completed within 18 months is a joint venture between the National Government and the World Bank. The project will complement the on-going construction of 2,400 houses in Naivasha, targeting workers earning between Kshs 15,000 and Kshs 150,000. The affordable housing units will be built on a 10-acre piece of land in Bondeni Estate within Nakuru Town East Sub-County while those within Naivasha are being constructed on a 55-acre parcel of land along the Nairobi-Nakuru Highway near GK Prisons. The continued focus on the development of affordable homes in Nakuru county is attributed to the increasing demand for housing in Nakuru due to population growth with Nakuru recording a 34.9% increase in population from 1.6 mn in 2009 to 2.2 mn in 2019 creating the need for housing.

The affordable housing projects continues to take shape in Kenya with other developments being the recently launched Buxton Project in Mombasa, Shauri Moyo, Makongeni, and Starehe houses in the Nairobi Metropolitan Area which are still underway. Despite the growing demand for affordable housing units, evidenced by the relatively high number of individuals who have registered through the Boma Yangu portal currently at 316,632; the implementation of affordable housing projects has been sluggish and the initiative under the Big Four agenda by the government is expected to fall short of its target of delivering 500,000 housing units by the end of 2022. This is likely to accelerate the current housing deficit of 2.0 mn units that continues to grow at 200,000 units per annum. We expect the housing deficit to expand even further driven by the relatively high population growth of 2.2% per annum, compared to the global average of 1.9% according to World Bank. Some of the challenges that have been facing the implementation of the projects include i) bureaucracy and slow project approval processes, ii) the pending operationalization of the Integrated Project Delivery Unit which was tasked with being a single point of regulatory approval for developments, infrastructure provision and developer incentives, iii) failure to fast track incentives provided in support of the affordable housing initiative, iv) ineffectiveness of Public-Private Partnerships, and, v) the current economic slowdown due to the ongoing pandemic. The government must embark on resolving these challenges to accelerate the supply of housing units within the country in addition to investing in urban planning and infrastructure to open up areas for development.

In our view, if the project is successfully delivered within the target timelines, it will help enhance the confidence of Kenyans in the affordable housing programmes particularly projects that involves the government and other agencies such as the World Bank.

- Commercial Sector

During the week, Insurance Regulatory Authority (IRA) and Capital Markets Authority (CMA) announced plans to jointly purchase office spaces within Nairobi, in a move that will see it take up at least 55,000 SQFT of office space in the Upper Hill area with a minimum of 100 parking bays. Currently both IRA and CMA offices are located in Zep-Re building and Embankment Plaza respectively. The decision by the authorities to buy office spaces maintaining Upperhill as their preferred location is supported by; i) concentration of government offices within alluring environment of Upper Hill, ii) favourable infrastructure with the area served by roads such as the Valley Road, Elgon Road, and Upper Hill Road etc, iii) proximity to the Nairobi’s CBD, and, iv) favourable zoning regulations supporting densification. In terms of performance, according to the Cytonn Q1’2021 Markets Review, Upper Hill recorded relatively high rental prices of Kshs 95 against the average market price of Kshs 92 thus supporting the move by the authorities to venture into buying of office space instead of renting to cut down on costs.

The table below shows summary of Nairobi Metropolitan Area commercial office sub market performance;

All Values in Kshs Unless Stated Otherwise

|

Nairobi Metropolitan Area Commercial Office Submarket Performance Q1’2021 |

||||

|

Area |

Price per SQFT |

Rent per SQFT |

Occupancy (%) |

Rental Yield (%) |

|

Gigiri |

13,400 |

116 |

81.0% |

8.3% |

|

Karen |

13,511 |

107 |

83.8% |

8.0% |

|

Westlands |

11,974 |

101 |

74.0% |

7.6% |

|

Parklands |

10,763 |

92 |

77.2% |

7.4% |

|

Kilimani |

12,187 |

92 |

78.6% |

6.7% |

|

Upper Hill |

12,524 |

95 |

74.8% |

6.8% |

|

Nairobi CBD |

12,110 |

81 |

80.9% |

6.6% |

|

Thika Road |

12,417 |

76 |

74.4% |

5.3% |

|

Mombasa Road |

11,167 |

72 |

61.6% |

4.7% |

|

Average |

12,228 |

92 |

76.3% |

6.8% |

Source: Cytonn Research 2021

- Retail Sector

During the week, QuickMart supermarket, a local retail chain, announced plans to open 4 stores concurrently by mid-July, in an expansion drive that will see it take up spaces at i) Chania Mall in Thika (previously occupied by Tuskys, ii) OTC within Nairobi’s Central Business District, iii) Mtwapa Mall in Kilifi, and, iv) Kitale Town in Trans-Nzoia County. This will bring the retailer’s operational outlets to 45, having opened 4 outlets so far this year. The decision to open the stores is supported by; i) a rising middle class with increased disposable income, ii) the exit of retailers such as Tuskys from the market leaving prime retail space to let, iii) stiff market share competition with closest rival Naivas and Carrefour having 71 and 13 stores respectively, and, iv) improved infrastructure such as roads creating easier and faster access to the retail outlets.

In terms of performance, according to our Kenya Retail Sector Report 2020, Nairobi recorded an average rental yield of 7.5% against the market average rental yield of 6.7% implying that Nairobi continues to offer an attractive investment opportunity for retail chains. Mount Kenya where Thika is categorized recorded the best performance for the Kenyan retail market with an average rental yield of 7.7% against a market average of 6.7% attributed to increased demand evidenced by an occupancy of 78.0% against a market average of 76.6%. The table below shows a summary of the performance of the retail sector in key urban cities in Kenya.

|

Summary Performance of Key Urban Cities in Kenya |

|||

|

Region |

Rent/SQFT 2020 |

Occupancy% 2020 |

Rental Yield |

|

Mount Kenya |

125 |

78.0% |

7.7% |

|

Nairobi |

168.5 |

74.5% |

7.5% |

|

Mombasa |

114.4 |

76.3% |

6.6% |

|

Kisumu |

97.2 |

74.0% |

6.3% |

|

Eldoret |

130 |

80.2% |

5.9% |

|

Nakuru |

55.7 |

76.6% |

5.9% |

|

Average |

115.1 |

76.6% |

6.7% |

Source: Cytonn Research 2020

The table below shows the summary of the number of stores of the key local and international retail supermarket chains in Kenya;

|

Main Local and International Retail Supermarket Chains |

|||||||||

|

Name of Retailer |

Category |

Highest number of branches that have ever existed as at FY’2018 |

Highest number of branches that have ever existed as at FY’2019 |

Highest number of branches that have ever existed as at FY’2020 |

Number of branches opened in 2021 |

Closed branches |

Current number of Branches |

Number of branches expected to be opened |

Projected number of branches FY’2020 |

|

Naivas |

Local |

46 |

61 |

69 |

2 |

0 |

71 |

3 |

74 |

|

QuickMart |

Local |

10 |

29 |

37 |

4 |

0 |

41 |

4 |

45 |

|

Chandarana Foodplus |

Local |

14 |

19 |

20 |

0 |

0 |

20 |

0 |

20 |

|

Carrefour |

International |

6 |

7 |

9 |

4 |

0 |

13 |

0 |

13 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

1 |

0 |

12 |

0 |

12 |

|

Tuskys |

Local |

53 |

64 |

64 |

0 |

61 |

3 |

0 |

3 |

|

Game Stores |

International |

2 |

2 |

3 |

0 |

0 |

3 |

0 |

3 |

|

Uchumi |

Local |

37 |

37 |

37 |

0 |

35 |

2 |

0 |

2 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

13 |

2 |

0 |

2 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

3 |

1 |

0 |

1 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

65 |

0 |

0 |

0 |

|

Total |

257 |

313 |

334 |

11 |

177 |

168 |

7 |

175 |

|

Source: Online Research

Generally, the performance of the Kenya retail sector is expected to be affected by factors such as (i) constrained spending power among consumers resulting from a tough financial environment, and, (ii) an oversupply of retail space in certain locations which has resulted in pressure on landlords to provide concessions and other incentives to attract new or retain existing tenants. The performance of the sector is however expected to be cushioned by factors such as i) positive demographics, iii) continued expansion of local and international retailers taking up retail spaces left by struggling retailers, and, improving infrastructure.

- Mixed Use Developments (MUDs)

During the week, Kenya Commercial Bank (KCB) Group announced that it is seeking joint venture partners to finance and develop its 153.2 acres in Juja. The firm seeks to develop a Kshs 6.0 bn mixed-use development project comprising of 5,786 residential and commercial buildings in Juja near Thika. KCB’s contribution towards the venture will therefore be its prime land worth Kshs 2.3bn whereas the JV partner will provide the cash and meet other construction related costs translating to a 38.0 % and 61.0 % shareholding respectively on the successful completion of the project. The decision by the group to seek joint venture partnership to develop its land is supported by; i) sluggish land purchase deals owed to the Covid-19 pandemic thus sourcing for development, ii) Juja’s ease of accessibility to Nairobi’s CBD, iii) population growth of 31.4% to 156,041 in 2019 from 118,793 in 2009 supporting the increased demand for housing, iv) a rising middle class with increased disposable income, and, v) improved infrastructure such as roads with the area being served by Thika Road creating easier and faster access to developments.

In terms of performance, according to the Cytonn Annual Markets Review-2020, Thika road recorded a 22.5% average uptake for residential units against the market average of 20.3% signalling demand, and an average commercial office rental price of Kshs 105 against the average market price of Kshs 112 thus providing investment opportunity due to affordability.

Table below shows summary of Nairobi Metropolitan Area mixed-use developments market performance;

All Values in Kshs Unless Stated Otherwise

|

Nairobi Metropolitan Area Mixed Use Developments Market Performance by Nodes 2020 |

|||||||||||||

|

Retail Performance |

Office Performance |

Residential Performance |

|||||||||||

|

Location |

Price/SQFT |

Rent/SQFT |

Occupancy |

Rental Yield (%) |

Price/SQFT |

Rent/SQFT |

Occupancy |

Rental Yield (%) |

Price/SQM |

Rent/SQM |

Annual Uptake (%) |

Rental Yield (%) |

Average MUD Yield |

|

Westlands |

15,833 |

178 |

70.8% |

9.8% |

12,667 |

117 |

73.3% |

8.2% |

211,525 |

1,226 |

24.5% |

7.0% |

8.5% |

|

Limuru Rd |

23,900 |

223 |

85.0% |

9.5% |

13,500 |

130 |

65.0% |

7.5% |

147,496 |

1,166 |

20.0% |

7.3% |

|

|

Karen |

23,333 |

143 |

88.5% |

6.7% |

13,200 |

123 |

80.0% |

9.0% |

7.3% |

||||

|

Kilimani |

17,400 |

143 |

75.0% |

7.5% |

13,250 |

108 |

68.8% |

6.6% |

7.2% |

||||

|

Upper Hill |

15,485 |

120 |

65.0% |

6.0% |

12,500 |

107 |

65.0% |

6.7% |

6.6% |

||||

|

Msa Rd |

20,000 |

150 |

70.0% |

6.3% |

13,000 |

100 |

70.0% |

6.5% |

157,440 |

874 |

14.3% |

6.7% |

6.5% |

|

Thika Rd |

26,250 |

200 |

85.0% |

8.5% |

13,750 |

105 |

64.0% |

5.9% |

143,803 |

705 |

22.5% |

5.9% |

6.4% |

|

Eastlands |

20,000 |

110 |

80.0% |

5.3% |

12,000 |

100 |

55.0% |

5.5% |

72,072 |

333 |

18.0% |

5.6% |

5.5% |

|

Average |

18,857 |

157 |

75.7% |

7.8% |

12,957 |

112 |

69.9% |

7.3% |

146,023 |

835 |

20.3% |

6.2% |

7.1% |

Source: Cytonn Research 2020

The real estate sector is expected to be on an upward trajectory supported by the continuous focus on the affordable housing initiative, uptake of prime commercial office spaces, and, the continued expansion of local retailers taking up prime retail spaces left by struggling retailers.

Kenya’s Vision 2030 Agenda seeks to make the country an industrialized middle income economy by 2030. The government and the private sector have therefore been working on providing the right environment for implementation of Public Private Partnerships (PPPs) since 1996, to deliver projects in sectors such as infrastructure, housing and student hostels, health care facilities, and agriculture. Additionally, there has been some effort in establishing sound legal and regulatory framework to promote and encourage PPPs. This week, we shall therefore cover PPPs in the real estate sector in Kenya with the aim of giving recommendations on what can be done to make them more efficient, and therefore accelerate the government Big Four Housing Agenda. The report will cover the following:

- Overview of Public-Private Partnerships (PPPs)

- Public- Private Partnerships (PPPs) in Kenya

- Benefits of PPPs and Challenges facing PPPs

- Case Study: United Kingdom(UK) Real Estate PPPs

- Recommendations for Successful PPPs for Housing

- Conclusion

Section I: Overview of Public-Private Partnerships (PPPs)

A Public Private Partnership is an agreement between the public sector and the private sector for the purpose of designing, planning, financing, constructing, and/or operating projects that would traditionally be regarded as falling within the remit of the public sector. PPP projects can either be solicited or unsolicited (Privately Initiated Investment Proposals). Solicited PPPs involves a private party making a proposal to undertake a PPP project in response to a request from the government while an unsolicited PPP is where the private party makes a proposal to undertake a PPP project at their own initiative by submitting the proposal to the government. PPP contracts are usually long-term and legally binding with the private sector taking up the financial burden and risks involved in development and operation of the project. There are different types of PPP arrangements which include:

- Build Operate Transfer (BOT): the private sector institution finances, builds, maintains and operates a facility for a given period of time and recoups its investment by collecting tolls during the concession period,

- Build Own Operate (BOO): the private entity will finance, build and operate the project but there will be no transfer back to the government,

- Build Own Operate Transfer (BOOT): the private sector builds, owns, operates and eventually transfers the PPP project to the public sector after an agreed period of time,

- Build Transfer Operate (BTO): the private organization finances, builds and upon completion, transfers the ownership to the public sector agency. The public sector agency then leases the facility back to the private developer under a long term lease. During the lease, the private developer operates the facility and earns a return from user charges, and,

- Design Build Finance Operate (DBFO): the private sector is responsible for financing, designing, construction and operation of the project and is compensated by service payments from the government during the life of the project.

Section II: Public Private Partnerships (PPPs) in Kenya

- The Structure and Framework of PPPs

PPPs in Kenya were established under PPP policy statement, 2011 and later revised in Act. 15 of 2013 of the Kenya Constitution titled as the Public Private Partnership Act, which stipulates that; i) the government retains total strategic control on the service, ii) the government is mandated to secure new infrastructure which will become the government’s assets at the end of the contract period, and, iii) allocation of project and performance risks is to the party best able to manage or mitigate.

The Act was passed to enable the participation of the private sector in financing, construction, development, operation and maintenance of infrastructure projects of the government through concessions or other contractual arrangements. The Act also establishes institutions that will regulate, monitor and supervise the implementation of project agreements, i.e;

- Public Private Partnership Committee: its functions include; i) to formulate and oversee the implementation of policies, ii) monitor development and progress of projects, and, iii) take custody of a project agreements made under this Act by monitoring compliance with the terms and conditions of the agreement,

- Public Private Partnership Unit: the unit serves as a secretariat and technical arm of the committee and its roles are; i) to provide technical, financial and legal expertise to the committee and any node established under this Act, ii) to serve as a resource centre on matters relating to PPPs in Kenya by maintaining a record of all project documentation, and, iii) to provide other government departments with assistance during procurement processes

- Public Private Partnership Nodes: they carry out their functions on behalf of the contracting authorities which include; i)to identify, screen and prioritize projects based on guidelines issued by the Committee, ii) ensure compliance with provisions of the Act by the parties of a project agreement, iii) liaise with all key project stakeholders during the project cycle, and, iv) ensure transfer of assets at the expiry of early termination of project agreement is consistent with the terms and conditions of the agreement.

Recently the government came up with the Public Private Partnership Bill 2021 intended to present a solution to current institutional and governance hurdles that have plagued the successful implementation of PPPs in Kenya over the last 8 years, however the Bill is yet to be enacted.

- Projects in the Pipeline in Kenya

Owing to the substantial framework which is supportive of PPP projects in Kenya, the government of Kenya through Kenya PPP Platform has reported a total of 64 PPP projects currently in the pipeline. In the housing sector, the Kenyan government has PPP projects in affordable housing and student housing, i.e;

|

Housing Public-Private Partnership Projects in Kenya |

|||||

|

Theme |

Project |

Partnership |

Project Start Date |

Project Status |

Expected Date of Completion |

|

Affordable Housing |

River Estate, Ngara (2,720 units) |

National Government and Edderman Property Limited |

March 2019 |

Ongoing |

December 2021 |

|

Pangani Housing Project (1,562 units) |

National Government and Tecnofin Kenya Limited |

May 2020 |

Ongoing |

May 2022 |

|

|

Hydro City, Kamiti (30,489 units) |

National Government and Hydro Developers Limited |

||||

|

Student Housing |

Kenyatta University Hostels (10,000 beds) |

Africa Integras (Kenya LLC), EPCO Contractors, Triad Architects and Broll Kenya Facility Managers |

2015 |

2035 |

Ongoing |

|

University of Embu Hostels (4,000 beds) |

Meridiam, JV Unicamp and PDM-Roko-CBA Capital and JV Unicamp |

2018 |

2038 |

Pre-Qualification |

|

|

Moi University Hostels (15,000 beds) |

Kesa, Meridiam, JV Unicamp and PDM-Roko-CBA Capital and Chinese Overseas |

2018 |

2038 |

Pre-Qualification |

|

|

South Eastern Kenya University Hostels (5,400 beds) |

Kesa and PDM Roko-CBA Capital |

2018 |

2038 |

Pre-Qualification |

|

Section III: Benefits and Challenges facing Real Estate PPPs in Kenya

- Benefits

The Kenyan government’s consideration to use PPPs to deliver development projects has proven to be beneficial as they capitalize on the private sector’s capacities and the public sector’s ability to incentivise private sector investments. Some of the major benefits experienced by the government include;

- Access to Finance for Projects: PPPs have granted the government access to private capital to carry out various development projects that would otherwise have taken a long time to implement. Ideally financing for national projects in Kenya comes from debt and this sets back economic development by diverting funds to debt servicing at the expense of economic development. The private financing therefore allows public resources to be used for other projects and enables the government concentrate on important matters such as regulation, policy and planning,

- Risk Transfer to Private Sector: PPPs have allowed a substantial transfer of risk to the private sector, for example construction risks such as budget overruns, project completion times and other risks such as operational and maintenance risk. These are risks that are best mitigated by professionals contracted in the PPPs thus reducing inefficiencies in completion and delivery of projects, contrary to which the cost is fully borne by the private sector,

- Government Access to Private Sector Efficiencies: The government has been able to acquire new and improved technology as well as skilled labour through PPPs as a result of undertaking projects by contracting foreign expatriates from countries such as China and Japan who have vast experience and are more organised as they have worked on similar construction projects in their countries,

- Large Scale Investment and/or Development: PPPs have facilitated large scale development projects that would cause financial strain to taxpayers if implemented by the government. The aim of these large scale developments is to make Kenya an industrialized middle-income country in order to provide a high quality of life to its citizens hence the government has provided incentives such as coming up with the Public Private Partnership Bill to address hurdles since the government’s vision cannot be achieved without private sector engagement, and,

- Enhancement in Ease of Doing Business: PPPs have promoted passing of regulations that have improved the ease of doing business in Kenya due to the establishment of regulatory guidelines that despite having gaps have given a roadmap on procedures to be followed thus boosting foreign investor confidence in undertaking Kenyan projects.

- Challenges

Despite the benefits PPPs have fallen short in achievement of development initiatives attributed to:

- Inadequate Planning for PPP Projects: There is a challenge in identifying suitable projects and gauging the risks involved, as well as testing the likelihood of success. In addition, selecting the most qualified project developer for a specific project has always been a tricky task when the pool of investors with capacity for PPPs is limited. PPP projects without sound plans have therefore led to lack of value for money due to ineffective implementation,

- Insufficient Regulatory Framework to Handle Complex PPP Transactions: Kenya’s laws and regulations set up to conduct business with the private sector are severely lacking and some entirely absent or requiring change. Such gaps in the regulatory framework include;

- lack of a clear guideline on what happens if the timelines required for evaluation of technical bids, normally 7 days is exceeded.

- no timelines at all for the evaluation of a Privately Initiated Investment Proposal (PIIP) which is a stumbling block for potential investors who may opt to withdraw when their patience runs out,

- no law on concessional element of PPPs, i.e, where a franchise has been granted the right to finance, build, own, operate and maintain public infrastructure for a given period while charging users for that service

- Irregular Procurement Processes due to Corruption: The public sector has been marred with a myriad of accusations of irregular procurement such as irregular awarding of tenders through corruption, raising speculation with some even being raised in parliamentary debates, hence causing loss of public confidence in the contracted parties thus delayed delivery of PPP projects,

- Insufficient Bulk Infrastructure Required to Support Development: Kenya has limited supporting bulk infrastructure, e.g, the insufficient sewer lines and drainage systems and poor road networks in areas the development projects are being undertaken, meaning that developers often have to incur costs to develop the infrastructure themselves and this discourages the private sector due to the huge amount required,

- Differing Goals Between the Private and Public Sector: While the private sector mainly focuses on obtaining a return on investment, the public sector’s main interest is on protecting the interests of its citizens by enacting regulations and engaging in projects that benefit the public such as affordable housing PPPs, for example, the price ceilings on affordable housing units discourage the private sector from investing as total returns may be relatively too low compared to the normal market rates for residential units,

- Bureaucracy and Lengthy Approval Processes: Bureaucracy in government systems has led to delays in approvals as applications require to go through different channels, some taking up to 6 months, in order to be granted a green light. Furthermore, some delays in responding to bidders are blamed on the failure to achieve quorum at the various levels required to provide approval, which hampers expeditious decision making,

- Inadequate Risk Mitigation Strategies: There is no specific project implementation team tasked with handling PPP projects from start to finish hence the ineffective monitoring and auditing of finances in PPP projects in Kenya has led to lack of accountability for allocated funds and imprudent utilization of finances as funds end up being spent without consideration of the budgetary allocations, and,

- High Transaction Costs: In the case of unsolicited PPPs, there are high costs involved in retaining consultants to assess the environmental, social and financial implications of a project given the time, data and analytical expertise required for this, with there being no guarantee that the proposal shall be approved and this can discourage them.

Section IV: Case Study; United Kingdom (UK) Real Estate PPPs

The UK came up with the first systematic program aimed at encouraging implementing projects through PPPs which was introduced in 1992 through the Private Finance Initiative (PFI), a procurement policy where private firms were contracted to complete and manage public projects. Since then PPPs have been increasingly used to deliver real estate projects in housing and infrastructure as a key way to transforming the country in an efficient and cost effective way. Moreover, UK’s PPP model has been used as a benchmark by other countries such as Japan, Sweden, Australia and Canada in enhancing their PPP models.

- Success Factors for PPPs in the UK

- Effective Procurement Processes

There is substantial legislation on procurement policies and contract management. Selection criteria for private firms is strictly based on the company’s suitability to pursue a professional activity, economic and financial standing, technical ability and certain mandatory exclusions to ensure that only suitable parties participate, with the government required by law to publish successful bidders, tender amounts and the reasons against other bidders in order to augment transparency and accountability of the process. This ensures that successful bidders’ ability to implement a project is unquestionable and that there is an enabling environment for conclusion of projects. Contractual challenges occurring through the life of the project are pursued through an arbiter to ensure continuity of the projects as conflict resolution is on going

- Incentives to the Private Sector

The UK government is committed to use public-private partnerships to deliver value for the tax payer by emphasizing no shortage of finances for well-structured projects, through offering incentives to the private sector to encourage their engagement, i.e;

- The UK Guarantee Scheme which operates on a commercial basis but allows private projects to benefit from Government’s support at lower rates when they experience funding shortfall,

- Housing Guarantees to support development of residential housing in target areas, and

- Co-investment Funds, which deals with charging fees for use of developed infrastructure then co-invests in other projects to accelerate roll out of such projects while gaining commercial return as an investor.

- Diverse Market of Project Finance:

There exists a diversified pool of finance for PPP projects in the UK with key among them being;

- Through banks and Non-Banking Financial Institutions where repayment is based on projects cash flows on completion with projects assets, rights and interests held as collateral,

- Co-Financing with the Government where the government decides to provide part of the project financing through equity, contingent products such as guarantees, indemnities and hedging, investments and/or debt. Most UK PPPs have utilized government support to ensure that government bears some risks which it can manage better than private investors as well as supporting projects financially, and

- Joint Ventures where the private company enters into a joint venture partnership especially in the cases involving land where land owners receive pre agreed rates of returns.

- Separate PPP Policy and PPP Project Development Agencies

The UK has separate PPP policy and project development agencies. The project development agency, Partnerships UK, advises government agencies on PPP projects and finances itself by charging fees to the public sector while the policy taskforce sits within treasury and sets guidance on procurement, deal structuring, and evaluation. Individual line ministries also typically have their own project development teams. These distinctions help eliminate conflicts of interests in projects as well as ensuring that development agencies work independently in execution of their mandate.

- Flexibility in Undertaking PPP Projects

The UK has no specific PPP legislation but there is sufficient flexibility and certainty in the common law framework to permit and govern PPPs. For instance, local authorities can enter into a contract with another person for the provision of assets and services in connection with the projects and there are provisions to ensure PPPs are not adversely affected by general changes in the law, for instance subcontractors being paid immediately after a project is certified, to avoid bankrupting the project-financed Special Purpose vehicle (SPV) that would undermine the PPP.

- Barriers to PPP Projects in the UK

- High Project Costs

Infrastructural developments in the UK have always been faced with challenges of inflated costs from the initial bid budget estimates to the developmental costs of the projects. The use of bonds from the private sector as opposed to the government borrowing increases interest payments that could otherwise have been lowered, thus increasing overrun costs and the subsequent total project costs with more debts attracting more interest payments. High returns by the private firms undertaking these PPP projects has also increased costs to the government which are then shouldered by the taxpayer.

- Poor Risk Evaluations

Public-Private Partnerships have been shown to be over optimistic and underestimating risks at inception of the projects with shareholders retaining an economic interest in the projects while avoiding the full financial consequences of their failure, necessitating the public sector to chip in despite the private sector getting a return to take risks, hence leaving financial burden on the taxpayer.

Section V: Recommendations for PPPs Success in Kenya

Public Private Partnerships have enabled the United Kingdom to deliver numerous development projects that have industrialized the country, and Kenya can emulate UK’s success in delivery of PPP projects in the following ways:

- Regulatory Framework: The government still has a long way to go in improving gaps in regulation. Despite the efforts in coming up with the Public-Private Partnership Bill 2021 which aims to address the matters regarding implementation of PPPs by the County governments, institutional framework and Unsolicited Proposals, the element of concessional agreements is still lacking. The government should provide a clear framework on issues relating to them such as risks, approval processes and mechanisms for servicing long term debt to avoid losing investor confidence,

- Procurement Policy: The government should consider establishing a specific procurement framework just like UK’s that is open, restricted and competitive with negotiation and competitive dialogue done with prior publication, and once publicized there is need to come up with ways to visibly track approvals digitally, as well as information displayed to the general public, to ensure competent and capable contractors who have been thoroughly scrutinized are chosen to procure and manage PPPs efficiently,

- Incentives for Private Sector Engagement: The government should strive to provide incentives to the private sector that will encourage uptake of projects, for example,

- Tax incentives including; exemption from registration tax on acquisition of real estate, reduction of exemption from various appropriation charges, and recognition of a certain percentage of investment as a reserve for servicing corporation tax and protection against reduction of tariffs,

- PPP laws harmonized to provide for acquisition of private land by the contracting authority on behalf of the investor

- Encouraging of Swiss challenge in the bidding process, where an unsolicited bid for a public project is published to invite third parties to match or better it thus fostering public-private sector trust, support and confidence in the PPP projects thus gain significant traction.

- Financing for Projects: The government should incorporate provisions for enabling other forms of financial support to make projects commercially viable for private investors for example joint ventures by private companies to finance PPP projects as is the case for UK. Additionally, they can offer operational and maintenance support grants to the private entities to show their commitment to the projects,

- Institutional framework: The government should institute bodies tasked with specific urgent responsibilities and directly answerable to the different arms of the government, for example a dispute resolution body that can listen to PPP cases to hasten dispute resolution as opposed to going directly through the court, and separate Project Policy Implementation and Project Development Agencies to ensure there in sufficiency in carrying out duties under their mandate for proper implementation of PPP projects, and

- Housing Related Recommendation: Given Housing as a Big Four Agenda item, we have the following recommendations

- The government should focus on enabling the private sector to build houses rather than government getting involved in the construction; since announcing the Big Four agenda about 4 years ago, the government has delivered less than 1000 houses so far thus falling short of the annual 500,000 target. Private sector players with the right incentive will accelerate delivery,

- There is no shortage of land, as there is a lot of private land looking for Joint Venture partners, hence the government should not look at land as an important ingredient but focus on financing and infrastructure incentives for private developers,

- Focus on financing incentives for developers and incentives for end users, primarily through tax incentives,

- Provide housing infrastructure incentives in areas such as roads, sewer, water and power, either through delivering them or some rebates for developers who put them up, and,

- Expedited statutory approvals for developments that registered as part of the Housing Agenda.

Section VI: Conclusion

Public-Private Partnerships (PPPs) in the real estate industry in Kenya have not been promising owing to the numerous challenges in regulatory framework involving procurement, private sector engagement, financing and institutional framework. However, with the government’s effort to revitalizing the PPP Program, there is hope for sustainable development through them to fast track achievement of industrialization. The real estate sector stands to benefit from developments through the PPPs Initiative, if the recommendations aforementioned are taken into consideration, for the government to facilitate timely and successful implementation and delivery of PPP projects thus improving the country’s economy through this model.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.