Real Estate Investment Trusts (REITs) in Kenya, & Cytonn Weekly #11/2021

By Research Team, Mar 21, 2021

Executive Summary

Fixed Income

During the week, T-bills recorded an oversubscription, with the overall subscription rate coming in at 115.0%, an increase from the undersubscription of 94.3% recorded last week as a result of improved liquidity in the money markets due to government payments. The interbank rate however increased during the week to 5.4%, from 5.0% last week. The highest subscription rate was in the 364-day paper of 150.8%, an increase from 121.9% recorded the previous week. The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on fuel prices, the maximum wholesale and retail prices, indicating a 6.6%, 5.9% and 5.6% increase in petrol, kerosene and diesel, to Kshs 122.8, Kshs 97.9 and Kshs 107.7 per litre, from Kshs 115.2, Kshs 92.4 and Kshs 101.9, respectively, recorded in 15th February 2021;

Equities

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 3.0%, 0.5% and 2.6%, respectively, taking their YTD performance to gains of 9.8%, 3.3% and 8.8% for NASI, NSE 20 and NSE 25 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Co-operative Bank, Equity Group, Safaricom and KCB Group, which gained by 7.3%, 4.1%, 4.0% and 3.5%, respectively. The gains were however weighed down by losses recorded by stocks such as EABL, Diamond Trust Bank (DTB-K) and Standard Chartered Bank, which declined by 3.0%, 2.0% and 1.1%, respectively. KCB Group and Co-operative Bank released their FY’2020 financial results which indicated a profit decline of 22.1% and 24.4% respectively;

Real Estate

During the week, the Kenya Mortgage and Refinance Company (KMRC), a treasury-backed lender, announced that it has so far advanced Kshs 2.8 bn in credit to mortgage lenders accounting for approximately 7.5% of the Kshs 37.2 bn they had planned to lend from September 2020. Student Factory Africa, a consortium of architects, partnered with Betonbouw B, a Dutch-based private equity firm to launch a 4,500-bed student accommodation hostel to be located next to Catholic University of Eastern Africa in Karen, at a cost of Kshs 5.0 bn. In the retail sector Kentucky Fried Chicken (KFC), a US fast food chain, opened a new branch in Mombasa County, in an expansion drive that saw it take up approximately 2200 SQFT of space in Mombasa Trade Centre. In Statutory Reviews, the Landlord and Tenant Bill of 2021 was tabled in Parliament with the aim of consolidating the laws relating to the renting of business and residential premises and regulating the relationship between the landlord and tenant in order to promote stability of rental transactions;

Focus of the Week

Real Estate Investments Trusts (REITs) are regulated collective Investment Schemes that largely invest in real estate. REITs managers source funds to build or acquire real estate assets, which they sell or rent to generate income. The income generated is then distributed to the investors. The property is held by a trustee on behalf of unit holders and professionally managed by a REIT manager.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.77%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.16% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

For recent news about the company, see our news section here.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills recorded an oversubscription, with the overall subscription rate coming in at 115.0%, an increase from the undersubscription of 94.3% recorded last week as a result of improved liquidity in the money markets due to government payments. The interbank rate however increased during the week to 5.4%, from 5.0% last week. The highest subscription rate was in the 364-day paper of 150.8%, an increase from 121.9% recorded the previous week. The subscription rate for the 91-day and 182-day papers also increased to 135.6% and 71.0%, from 108.8% and 60.8% respectively from the previous week. The yields on all three papers rose; with the 364-day, 182-day and 91-day papers increasing by 6.9 bps, 5.2 bps and 4.7 bps to 9.2%, 7.9% and 7.1%, respectively. The government continued to reject expensive bids by accepting only Kshs 23.3 bn of the Kshs 27.6 bn offered, translating to an acceptance rate of 84.4%.

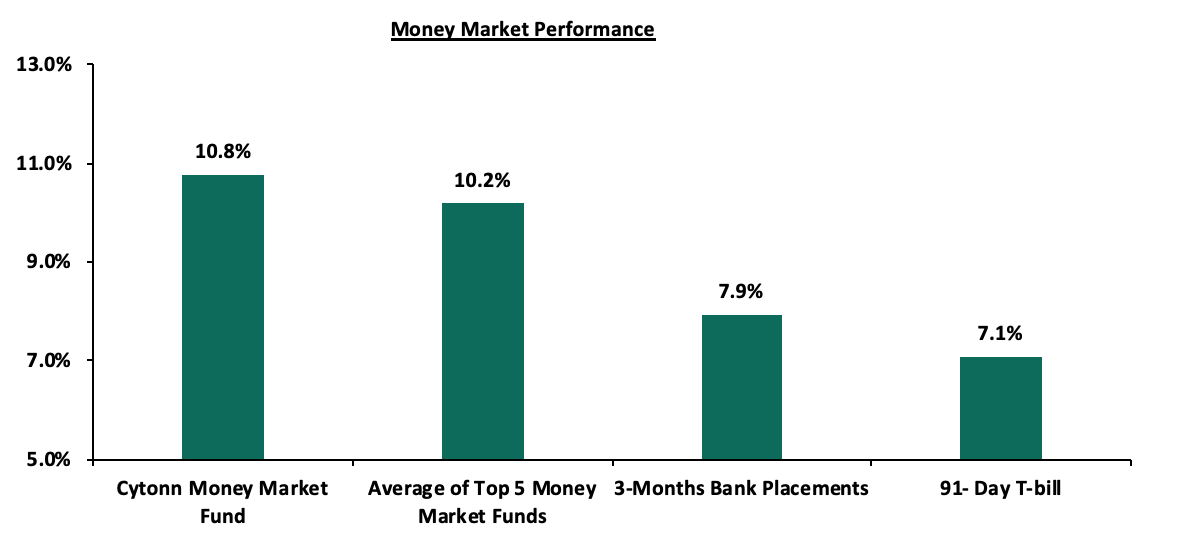

In the money markets, 3-month bank placements ended the week at 7.9% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased marginally to 7.1%, from 7.0% recorded last week. The average yield of the Top 5 Money Market Funds increased by 0.3% points to come in at 10.2%, from 9.9% recorded last week. The yield on the Cytonn Money Market increased marginally during the week by 0.3% points to come in at 10.8%, from 10.5% recorded the previous week.

Liquidity:

During the week, liquidity in the money market remained stable but the average interbank rate increased to 5.4%, from the 5.0% recorded the previous week, attributable to the payments made towards the settlements of the recently issued bonds coupled with tax receipts which were partly offset by government payments. The average interbank volumes decreased by 1.1% to Kshs 12.9 bn, from Kshs 13.0 bn recorded the previous week. According to the Central Bank of Kenya’s weekly bulletin released on 19th March 2021, commercial banks’ excess reserves came in at Kshs 21.6 bn in relation to the 4.25% Cash Reserve Ratio.

Eurobonds performance:

During the week, the yields on Eurobonds were on an upward trajectory. According to the Central Bank bulletin, the yields on the 10-year Eurobond issued in June 2014, and the 10-year and 30-year Eurobonds issued in 2018 all increased to 3.3%, 5.7% and 7.6%, respectively, from 3.3%, 5.6% and 7.5%. The yields on the 7-year and 12-year Eurobonds issued in 2019 both increased by 1.7 bps to 4.9% and 6.5%, respectively.

|

Kenya Eurobond Performance |

|||||

|

2014 |

2018 |

2019 |

|||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

|

31-Dec-2020 |

3.9% |

5.2% |

7.0% |

4.9% |

5.9% |

|

29-Jan-2021 |

3.6% |

5.3% |

7.2% |

4.8% |

6.1% |

|

26-Feb-2021 |

3.3% |

5.4% |

7.4% |

4.7% |

6.4% |

|

12-Mar-21 |

3.3% |

5.6% |

7.5% |

4.9% |

6.6% |

|

15-Mar-21 |

3.3% |

5.6% |

7.6% |

4.9% |

6.6% |

|

16-Mar-21 |

3.3% |

5.6% |

7.5% |

4.8% |

6.5% |

|

17-Mar-21 |

3.3% |

5.7% |

7.5% |

5.0% |

6.6% |

|

18-Mar-21 |

3.3% |

5.7% |

7.6% |

4.9% |

6.5% |

|

Weekly Change |

0.0% |

0.1% |

0.1% |

0.0% |

(0.1%) |

|

Monthly Change |

(0.3%) |

0.2% |

0.2% |

0.0% |

0.3% |

|

YTD Change |

(0.6%) |

0.4% |

0.5% |

0.0% |

0.6% |

Source: CBK Bulletin

Kenya Shilling:

During the week, the Kenyan shilling depreciated marginally by 0.2% against the US dollar to close at Kshs 109.9, from Kshs 109.6 recorded the previous week. This was mainly attributable to strong dollar demand from general merchandise manufacturers and energy importers, which outweighed dollar inflows from offshore investors and commodity exports. On a YTD basis, the shilling has depreciated by 0.6% against the dollar, in comparison to the 7.7% depreciation recorded in 2020. We expect continued pressure on the Kenyan shilling due to:

- A slowdown in foreign dollar currency inflows due to reduced dollar inflows from sectors such as tourism and horticulture, and,

- Continued uncertainty globally making people prefer holding dollars and other hard currencies.

However, in the short term, the shilling is expected to be supported by:

- The Forex reserves, currently at USD 7.4 bn (equivalent to 4.6-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- The improving current account position which narrowed to 4.8% of GDP in the 12 months to December 2020 compared to 5.8% of GDP during a similar period in 2019, and,

- Improving diaspora remittances evidenced by a 7.3% y/y increase to USD 278.3 mn in January 2021, from USD 259.4 mn recorded over the same period in 2020, has cushioned the shilling against further depreciation.

Weekly Highlights:

Maximum Wholesale and Retail Fuel Prices

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum wholesale and retail prices for fuel prices in Kenya effective 15th March 2021 to 14th April 2021. Below are the key take-outs from the statement:

- Petrol prices increased by 6.6% to Kshs 122.8 per litre, from Kshs 115.2 per litre previously, while diesel prices increased by 5.6% to Kshs 107.7 per litre, from Kshs 101.9 per litre. Kerosene prices also increased by 5.9% to Kshs 97.9 per litre, from Kshs 92.4 per litre.

- The changes in prices have been attributed to:

- An increase in the average landed cost of imported super petrol by 15.0% to USD 449.8 per cubic meter in February 2021, from USD 391.2 per cubic meter in January 2021,

- A 12.3% increase in average landed costs for diesel to USD 424.0 per cubic meter in February 2021, from USD 377.6 per cubic meter in January 2021,

- A 13.3% increase in landed costs for kerosene to USD 393.2 per cubic meter in February 2021, from USD 347.2 per cubic meter in January 2021,

- An 11.5% increase in Free on Board (FOB) price of Murban crude oil lifted in February 2021 to USD 61.6 per barrel, from USD 55.3 per barrel in January 2021, and,

- The Kenyan shilling appreciation of 0.2% against the dollar to close at Kshs 109.7 in February 2021, from Kshs 109.9 in January 2021.

We expect an increase in the transport and fuel index which carries a weighting of 8.7% in the total consumer price index (CPI) as a result of the increase in fuel prices. The increase will have a ripple effect on other components of the inflation index like food.

Additionally, we expect the fuel prices in Kenya to increase in the next months as the global fuel prices are expected to continue increasing, having increased by 32.9% to USD 66.8 per barrel this week, from USD 50.2 recorded in December 2020 (OPEC Basket Price). The increase in the global prices is attributable to the expected rebound in economic growth and the continued reduction of supply by Organization of the Petroleum Exporting Countries (OPEC).

Rates in the fixed income market have remained relatively stable but we have seen an upward trend in the short-term papers’ yields. The government is 9.6% behind its prorated borrowing target of Kshs 396.5 bn having borrowed Kshs 358.5 bn for the financial year 2021/2021. In our view, due to the current subdued economic performance brought about by the effects of the COVID-19 pandemic, the government will record a shortfall in revenue collection with the target having been set at Kshs 1.9 tn for FY’2020/2021, thus leading to a larger budget deficit than the projected 7.5% of GDP. The high deficit and the lower credit rating will mean that the government might be forced to borrow more from the domestic market which will ultimately create uncertainty in the interest rate environment. In our view investors should be biased towards short-term to medium-term fixed income securities to reduce duration risk.

Market Performance:

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 3.0%, 0.5% and 2.6%, respectively, taking their YTD performance to gains of 9.8%, 3.3% and 8.8% for NASI, NSE 20 and NSE 25 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Co-operative Bank, Equity Group, Safaricom and KCB Group, which gained by 7.3%, 4.1%, 4.0% and 3.5%, respectively. The gains were however weighed down by losses recorded by stocks such as EABL, Diamond Trust Bank (DTB-K) and Standard Chartered Bank, which declined by 3.0%, 2.0% and 1.1%, respectively.

Equities turnover declined by 47.8% during the week to USD 15.5 mn, from USD 29.6 mn recorded the previous week, taking the YTD turnover to USD 243.2 mn. Foreign investors turned net buyers, with a net buying position of USD 0.4 mn, from a net selling position of USD 2.9 mn recorded the previous week, taking the YTD net selling position to USD 5.0 mn.

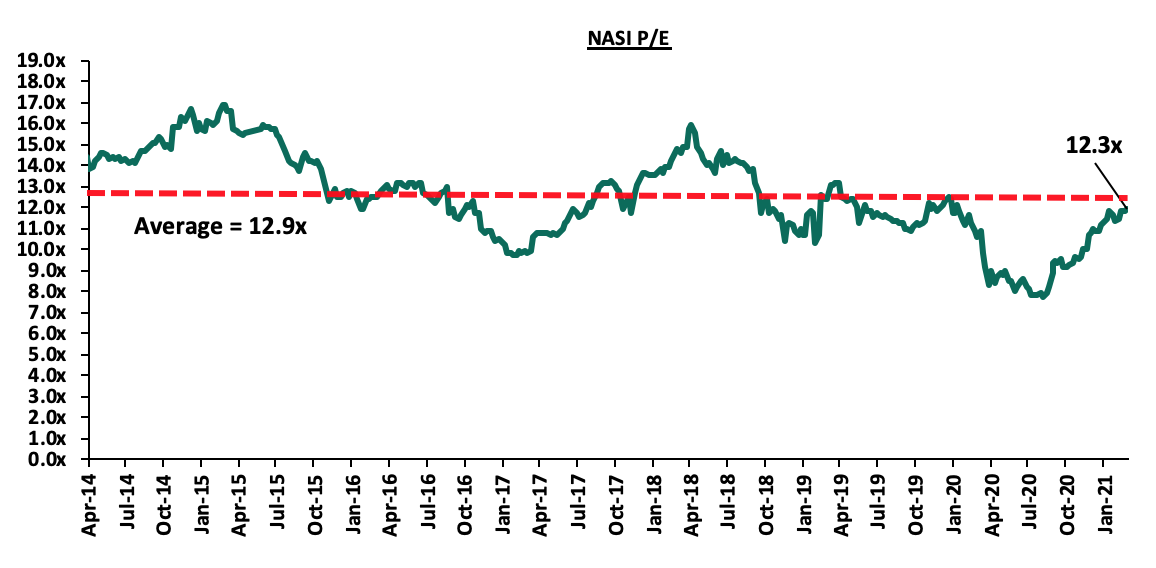

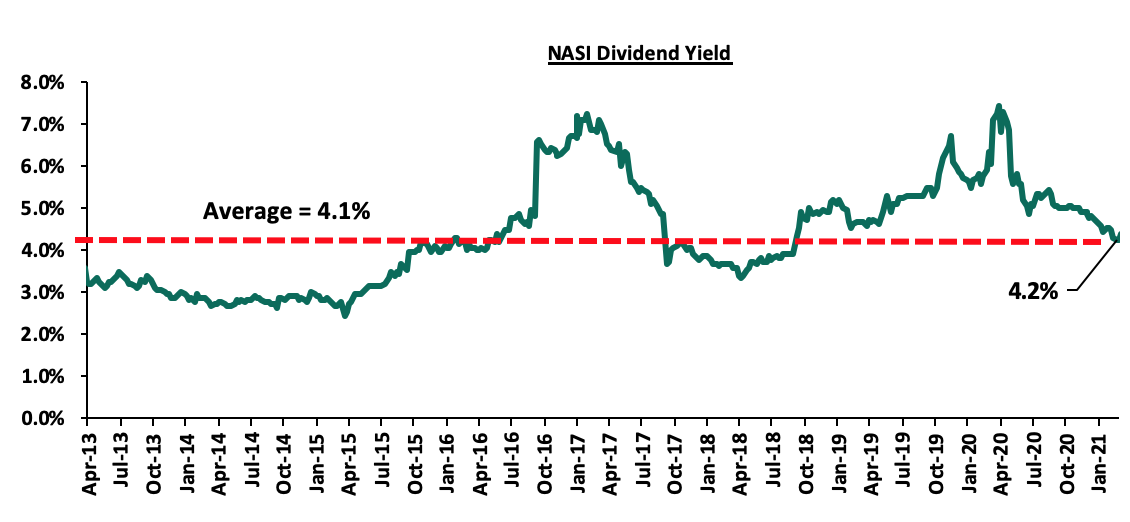

The market is currently trading at a price to earnings ratio (P/E) of 12.3x, 4.9% below the 11-year historical average of 12.9x. The average dividend yield is currently at 4.2%, 0.2% points below last week’s dividend yield which came in at 4.4%, and 0.1% points above the historical average of 4.1%.

With the market trading at valuations below the historical average, we believe that there are pockets of value in the market for investors with a higher risk tolerance. The current P/E valuation of 12.3x, is 59.5% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the market’s historical P/E and dividend yield.

Earnings Release:

During the week, KCB Group and Co-operative Bank released their FY’2020 financial results. Below is a summary of their performance;

- KCB Group

|

KCB Group FY’2020 Key Highlights |

|||

|

Balance Sheet |

|||

|

Balance Sheet Items |

FY’2019 (Kshs bn) |

FY’2020 (Kshs bn) |

y/y change |

|

Government Securities |

164.9 |

208.8 |

26.6% |

|

Net Loans and Advances |

539.7 |

595.3 |

10.3% |

|

Total Assets |

898.6 |

987.8 |

9.9% |

|

Customer Deposits |

686.6 |

767.2 |

11.7% |

|

Deposits per Branch |

2.0 |

2.1 |

6.5% |

|

Total Liabilities |

768.8 |

845.4 |

10.0% |

|

Shareholders’ Funds |

129.7 |

142.4 |

9.8% |

|

Income Statement |

|||

|

Income Statement Items |

FY’2019 (Kshs bn) |

FY’2020 (Kshs bn) |

y/y change |

|

Net Interest Income |

56.1 |

67.9 |

21.0% |

|

Net non-Interest Income |

28.2 |

28.5 |

1.0% |

|

Total Operating income |

84.3 |

96.4 |

14.3% |

|

Loan Loss provision |

(8.9) |

(27.5) |

209.5% |

|

Total Operating expenses |

(47.4) |

(70.7) |

49.1% |

|

Profit before tax |

36.9 |

25.7 |

(30.3%) |

|

Profit after tax |

25.2 |

19.6 |

(22.1%) |

|

Core EPS |

7.8 |

6.1 |

(22.1%) |

|

Key Ratios |

|||

|

Ratios |

FY’2019 |

FY’2020 |

% point change |

|

Yield on Interest Earning Assets |

10.9% |

11.1% |

0.2% |

|

Cost of Funding |

2.8% |

2.7% |

(0.1%) |

|

Net Interest Margin |

8.2% |

8.5% |

0.3% |

|

Non-Performing Loans (NPL) Ratio |

11.0% |

14.8% |

3.8% |

|

NPL Coverage |

59.5% |

59.8% |

0.3% |

|

Cost to Income with LLP |

56.2% |

73.3% |

17.1% |

|

Loan to Deposit Ratio |

78.6% |

77.6% |

(1.0%) |

|

Cost to Income Without LLP |

45.7% |

44.8% |

(0.9%) |

|

Return on Average Assets |

3.1% |

2.1% |

(1.0%) |

|

Return on Average Equity |

20.7% |

14.4% |

(6.3%) |

|

Equity to Assets Ratio |

15.1% |

14.4% |

(0.7%) |

|

Capital Adequacy Ratios |

|||

|

Ratios |

FY’2019 |

FY’2020 |

% point change |

|

Core Capital/Total Liabilities |

18.1% |

18.7% |

0.6% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess/Deficit |

10.1% |

10.7% |

0.6% |

|

Core Capital/Total Risk Weighted Assets |

17.2% |

18.2% |

1.0% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess/Deficit |

6.7% |

7.7% |

1.0% |

|

Total Capital/Total Risk Weighted Assets |

19.0% |

21.6% |

2.6% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess/Deficit |

4.5% |

7.1% |

2.6% |

Key take-outs from the earnings release include;

- The group’s core earnings per share declined by 22.1% to Kshs 6.1, from Kshs 7.8 in FY’2019. The performance is better than our projections of a 35.2% decline to Kshs 5.1. The variance was mainly attributable to the lender having a slower 49.1% growth in Total Operating expenses, compared to our projection of a 54.6% increase,

- Net Interest Income grew by 21.0% to Kshs 67.9 bn, from Kshs 56.1 bn in FY’2019, mainly driven by a 64.8% increase in interest income from government securities which increased to Kshs 23.2 bn, from Kshs 14.1 bn in FY’2019, coupled with a 9.8% increase in interest income from loans and advances, which increased to Kshs 64.8 bn from Kshs 59.0 bn in FY’2019. The increase was however weighed down by a 37.3% decline in income from deposits and placements with banking institutions to Kshs 0.8 bn, from Kshs 1.3 bn in FY’2019,

- The yield on interest-earning assets increased to 11.1% from 10.9% in FY’2019, attributable to the faster 19.4% growth in interest income, which outpaced the 16.9% growth in average interest earning assets,

- Interest expense increased by 14.2% to Kshs 20.8 bn, from Kshs 18.2 bn in FY’2019, following a 15.9% rise in Interest expense on customer deposits to Kshs 18.9 bn, from Kshs 16.3 bn in FY’2019. Interest expense on placements declined marginally by 0.1% to Kshs 1.954 bn from Kshs 1.953 bn in FY’2019. Cost of funds declined marginally by 0.1% points to 2.7% from 2.8% recorded in FY’2019, following a faster 22.3% increase in average interest bearing liabilities that outpaced the 14.2% increase in interest expense,

- Total operating expenses increased by 49.1% to Kshs 70.7 bn, from Kshs 47.4 bn in FY’2019, largely driven by a 209.5% increase in Loan Loss Provisions (LLP) to Kshs 27.5 bn, from Kshs 8.9 bn in FY’2019, on the back of the subdued operating environment seen during the year. Staff costs increased by 5.1% to Kshs 20.5 bn from Kshs 19.5 bn in FY’2019,

- The balance sheet recorded an expansion as total assets grew by 9.9% to Kshs 987.8 bn, from Kshs 898.6 bn in FY’2019. The growth was supported by a 26.6% increase in government securities to Kshs 208.8 bn, from Kshs 164.9 bn in FY’2019, coupled with a 10.3% loan book expansion to Kshs 595.3 bn, from Kshs 539.7 bn in FY’2019. The increased allocation in government securities was mainly on the back of the lender’s cautious lending amid the elevated credit risk. Notably, the lender disclosed that they restructured 19.6% of the total loan book amounting to Kshs 106.1 bn. Of the restructured loans, the Real Estate Sector accounted for the highest percentage of restructured loans at 27.6% (Kshs 27.6 bn),

- Total liabilities rose by 10.0% to Kshs 845.4 bn, from Kshs 768.8 bn in FY’2019, driven by an 11.7% rise in customer deposits to Kshs 767.2 bn, from Kshs 686.6 bn in FY’2019, with customer deposits from NBK amounting to Kshs 99.2 bn in FY’2020,

- Deposits per branch increased by 6.5% to Kshs 2.1 bn from Kshs 2.0 bn in FY’2019, with the number of branches increasing to 359 as at the end of 2020, from 342 in FY’2019,

- Gross non-performing loans increased by 52.4% to Kshs 96.6 bn in FY’2020, from Kshs 63.4 bn in FY’2019. Consequently, the NPL ratio deteriorated to 14.8% in FY’2020, from 11.0% in FY’2019, attributable to the faster 52.4% growth in Non-Performing Loans, which outpaced the 10.3% growth in loans. The rise in non-performing loans was mainly attributable to the poor performance from the Corporate segment, MSME segment, mortgage segment and Check-Off loans recording NPL ratios of 18.6%, 13.9%, 8.7% and 2.6%, respectively,

- Loan Loss Provisions (LLP) increased by 209.5% y/y to Kshs 27.5 bn in FY’2020, from Kshs 8.9 bn in FY’2019. The NPL coverage on the other hand improved marginally to 59.8% in FY’2020 from 59.5% in FY’2019, as general Loan Loss Provisions increased by 59.9% to Kshs 45.9 bn from Kshs 28.7 bn in FY’2019, attributable to the deterioration of the NPL ratio to 14.8% from 11.0% in FY’2019, and,

- KCB Group remains sufficiently capitalized with a core capital to risk-weighted assets ratio of 18.2%, 7.7% points above the statutory requirement. In addition, the total capital to risk-weighted assets ratio came in at 21.6%, exceeding the statutory requirement by 7.1% points. Adjusting for IFRS 9, the core capital to risk-weighted assets stood at 18.4%, while total capital to risk-weighted assets came in at 21.8%.

For a comprehensive analysis, please see our KCB Group FY’2020 Earnings .

- Co-operative Bank

|

Co-operative Bank FY’2020 Key Highlights |

|||

|

Balance Sheet |

|||

|

Balance Sheet Items |

FY’2019 (Kshs bn) |

FY’2020 (Kshs bn) |

y/y change |

|

Government Securities |

117.80 |

161.89 |

37.4% |

|

Net Loans and Advances |

266.7 |

286.6 |

7.5% |

|

Total Assets |

457.0 |

536.9 |

17.5% |

|

Customer Deposits |

332.8 |

378.6 |

13.8% |

|

Deposits per Branch |

2.1 |

2.4 |

13.8% |

|

Total Liabilities |

376.2 |

444.9 |

18.3% |

|

Shareholders’ Funds |

79.3 |

90.7 |

14.4% |

|

Income Statement |

|||

|

Income Statement Items |

FY’2019 (Kshs bn) |

FY’2020 (Kshs bn) |

y/y change |

|

Net Interest Income |

31.3 |

36.3 |

16.1% |

|

Net non-Interest Income |

17.2 |

17.5 |

1.9% |

|

Total Operating income |

48.5 |

53.8 |

11.1% |

|

Loan Loss provision |

(2.5) |

(8.1) |

219.5% |

|

Total Operating expenses |

(27.8) |

(39.4) |

41.7% |

|

Profit before tax |

20.7 |

14.3 |

(31.0%) |

|

Profit after tax |

14.3 |

10.8 |

(24.4%) |

|

Core EPS |

2.1 |

1.6 |

(24.4%) |

|

Key Ratios |

|||

|

Ratios |

FY’2019 |

FY’2020 |

% point change |

|

Yield on Interest Earning Assets |

11.8% |

11.4% |

(0.4%) |

|

Cost of Funding |

3.5% |

3.0% |

(0.5%) |

|

Net Interest Margin |

8.5% |

8.5% |

0.0% |

|

Non-Performing Loans (NPL) Ratio |

11.2% |

18.7% |

7.5% |

|

NPL Coverage |

51.8% |

50.3% |

(1.5%) |

|

Cost to Income with LLP |

57.4% |

73.2% |

15.8% |

|

Loan to Deposit Ratio |

80.1% |

75.7% |

(4.4%) |

|

Cost to Income Without LLP |

52.1% |

58.1% |

6.0% |

|

Return on Average Assets |

3.3% |

2.1% |

(1.2%) |

|

Return on Average Equity |

19.2% |

12.5% |

(6.7%) |

|

Equity to Assets Ratio |

17.1% |

17.1% |

0.0% |

|

Capital Adequacy Ratios |

|||

|

Ratios |

FY’2019 |

FY’2020 |

%point change |

|

Core Capital/Total Liabilities |

20.2% |

19.1% |

(1.1%) |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess/Deficit |

12.2% |

11.1% |

(1.1%) |

|

Core Capital/Total Risk Weighted Assets |

16.3% |

15.4% |

(0.9%) |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess/Deficit |

5.8% |

4.9% |

(0.9%) |

|

Total Capital/Total Risk Weighted Assets |

16.8% |

16.9% |

0.1% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess/Deficit |

2.3% |

2.4% |

0.1% |

Key take-outs from the earnings release include;

- The bank’s core earnings per share declined by 24.4% to Kshs 1.6 in FY’2020, from Kshs 2.1 in FY’2019, which was not in-line with our projections of Kshs 1.8, where the earnings for the period came in at Kshs 10.8 bn, slightly lower than our expectations of Kshs 12.4 bn. The variance can be attributed to our expectation of higher earnings of Kshs 13.2 bn, compared to the Kshs 10.8 bn recorded. The performance was driven by a 41.7% increase in total operating expenses to Kshs 39.4 bn in FY’2020, from Kshs 27.8 bn in FY’2019 but was mitigated by the 11.1% increase in total operating income,

- Net Interest Income rose by 16.1% to Kshs 36.3 bn in FY’2020, from Kshs 31.3 bn in FY’2019. The growth recorded was as a result of a 30.5% increase in interest income from government securities to Kshs 14.8 bn, from Kshs 11.4 bn in FY’2019, as well as a 5.4% rise in interest income from loans and advances to Kshs 33.5 bn, from Kshs 31.8 bn in FY’2019,

- The yield on interest-earning assets, however, declined to 11.4%, from 11.8% in FY’2019 due to the faster 18.1% growth in the average interest-earning assets that outpaced the 11.9% growth in interest income,

- Interest expense increased by 1.3% to Kshs 12.5 bn in FY’2020, from Kshs 12.3 bn in FY’2019, largely due to a 2.6% rise in interest expense from customer deposits to Kshs 10.9 bn, from Kshs 10.7 bn. This was however mitigated by a 13.2% decline in other interest expenses to Kshs 1.4 bn, from Kshs 1.6 bn in FY’2019. Consequently, the cost of funds declined to 3.0%, from 3.5% in FY’2019, owing to the faster 18.2% rise in the average interest-bearing liabilities, compared to the 1.3% decline in interest expense,

- Total operating expenses rose by 41.7% to Kshs 39.4 bn in FY’2020, from Kshs 27.8 bn in FY’2019, largely driven by the 219.5% rise in Loan Loss Provisions (LLP) to Kshs 8.1 bn, from Kshs 2.5 bn in FY’2019, coupled with a 38.7% rise in other operating expenses to Kshs 17.9 bn in FY’2020, from Kshs 12.9 bn in FY’2019. The increased provisioning levels by the lender is mainly as a result of the elevated levels of risk currently in the market. Staff costs also increased by 8.5% to Kshs 13.4 bn, from the Kshs 12.4 bn recorded in 2019,

- The balance sheet recorded an expansion as total assets grew by 17.5% to Kshs 537.0 bn in FY’2020 from Kshs 457.0 bn in FY’2019, mainly attributable to the 37.4% growth in government securities to Kshs 161.9 bn from Kshs 117.8 bn, coupled with a 7.5% growth in net loans and advances to Kshs 286.6 bn in FY’2020 from Kshs 266.7 bn in FY’2019. The increase in allocation to government securities shows the bank’s cautious lending strategy considering the elevated credit risk being experienced in the market. Additionally, the bank restructured Kshs 46.0 bn (14.9% of the bank’s loan book) and highlighted that 46.0% of their loan book consisted of personal consumer loans and that they had a total exposure of about 3.0% in the manufacturing, tourism, restaurant and hotel sectors combined, which are among the most affected sectors,

- Total liabilities grew by 18.3% to Kshs 444.9 bn, from Kshs 376.2 bn in FY’2019, which was largely attributable to a 74.2% rise in borrowings to Kshs 46.0 bn in FY’2020, from Kshs 26.4 bn in FY’2019, which is attributed to a Kshs 21.6 bn borrowing by Kingdom Bank to support its operations, coupled with the 13.8% rise in customer deposits to Kshs 378.6 bn, from Kshs 332.8 bn in FY’2019. Deposits per branch increased by 13.8% to Kshs 2.4 bn from Kshs 2.1 bn, as the number of branches remained unchanged at 159 branches,

- Gross Non-Performing Loans (NPLs) increased by 87.0% to Kshs 59.1 bn in FY’2020, from Kshs 31.6 bn in FY’2019. The NPL ratio deteriorated to 18.7% in FY’2020, from 11.2% in FY’2019 owing to slower growth in gross loans by 11.8% compared to the 87.0% growth in gross non-performing loans. It is important to note that the NPL Ratio is 11.0% higher than the 5-year average of 7.7%,

- The NPL coverage ratio deteriorated to 50.3% in FY’2020, from 51.8% in FY’2019, due to the faster 99.6% growth in General Loan Loss Provisions which was outpaced by the 87.0% growth in Gross Non-Performing Loans (NPLs). If the NPL Coverage remained at the 51.8% level recorded in FY’2019, we would have had an additional provisioning of Kshs 0.9 bn, which would have reduced the earnings per share from the reported Kshs 2.1 to Kshs 1.8, and,

- Co-operative Bank remains sufficiently capitalized with a core capital to risk-weighted assets ratio of 15.4%, 4.9% points above the statutory requirement of 10.5%. Also, the total capital to risk-weighted assets ratio came in at 16.9%, exceeding the statutory requirement of 14.5% by 2.4% points. Adjusting for IFRS 9, the core capital to risk-weighted assets stood at 13.9%, while total capital to risk-weighted assets came in at 15.4%,

For a comprehensive analysis, please see our Co-operative Bank FY’2020 Earnings Note .

Asset Quality

The table below is a summary of the asset quality for the companies that have released

|

Bank |

FY’2019 NPL Ratio |

FY’2020 NPL Ratio |

FY’2019 NPL Coverage |

FY’2020 NPL Coverage |

|

Co-operative Bank of Kenya |

11.2% |

18.7% |

51.8% |

50.3% |

|

Stanbic Bank |

9.6% |

11.8% |

57.1% |

60.6% |

|

KCB Group |

11.0% |

14.8% |

59.5% |

59.8% |

|

Mkt Weighted Average |

10.5%** |

15.7%* |

58.8%** |

56.8%* |

|

*Market cap weighted as at 19/03/2021 **Market cap weighted as at 09/04/2020 |

||||

Key take-outs from the table include;

- Asset quality for the 3 banks that have released their FY’2020 results deteriorated during the period of review, with the weighted average NPL ratio rising by 5.2% points to a market cap weighted average of 15.7% from 10.5% in FY’2019. The deterioration in asset quality was as a result of the coronavirus-induced downturn in the economy which led to an uptick in the non-performing loans,

- NPL Coverage for the 3 banks declined to a market cap weighted average of 56.8% in FY’2020 from 58.8% recorded in FY’2019, attributable to Co-operative bank’s comparatively low NPL coverage of 50.3% in FY’2020, a decline from an NPL coverage of 51.8% in FY’2019. We expect higher provisional requirements to subdue profitability during the year across the banking sector on account of the tough business environment, and,

- Co-operative Bank recorded a decline in their NPL Coverage despite their NPL ratio rising, which could suggest modest provisioning. Given the current economic environment and elevated risk of loans defaults, we expected higher provisioning for the bank. Key to note, If the NPL Coverage remained at the 51.8% level recorded in 2019, the bank would have had an additional provisioning of Kshs 0.9 bn, which would have reduced the earnings per share from the reported Kshs 2.1 to Kshs 1.8,

The table below highlights the performance of the banks that have released so far, showing the performance using several metrics, and the key take-outs of the performance;

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

COF*** |

YIEA*** |

|

Stanbic |

(18.6%) |

(3.4%) |

(1.6%) |

(4.1%) |

4.7% |

(8.7%) |

44.9% |

(18.7%) |

15.7% |

25.0% |

75.5% |

2.7% |

10.3% |

3.0% |

7.2% |

|

KCB |

(22.1%) |

19.4% |

14.2% |

21.0% |

8.5% |

1.0% |

29.5% |

(10.4%) |

11.7% |

26.6% |

77.6% |

10.3% |

14.4% |

2.7% |

10.5% |

|

Co-op |

(24.4%) |

11.9% |

1.3% |

16.1% |

8.5% |

1.9% |

32.5% |

0.7% |

13.8% |

37.4% |

75.7% |

7.5% |

12.5% |

3.0% |

11.4% |

|

FY'20 Mkt Weighted Average* |

(22.4%) |

13.8% |

7.8% |

16.0% |

8.0% |

0.0% |

32.6% |

(7.9%) |

12.9% |

29.9% |

76.7% |

8.3% |

13.2% |

2.8% |

10.3% |

|

FY'19Mkt Weighted Average** |

8.9% |

3.2% |

3.4% |

3.4% |

7.3% |

17.4% |

37.4% |

18.4% |

12.7% |

19.4% |

75.0% |

12.8% |

18.4% |

3.2% |

10.4% |

|

*Market cap weighted as at 19/03/2021 |

|||||||||||||||

|

**Market cap weighted as at 09/04/2020 *** COF means Cost of Funds; YIEA means Yield on Interest Earning Assets |

|||||||||||||||

Key takeaways from the table above include:

- For the three banks that have released, they have recorded a 22.4% weighted average decline in core Earnings Per Share (EPS), compared to a weighted average growth of 8.9% in FY’2019 for the entire listed banking sector,

- The Banks have recorded a weighted average deposit growth of 12.9%, slower than the 12.7% growth recorded in FY’2019,

- Interest expense grew at a faster pace, by 7.8%, compared to 3.4% in FY’2019. Cost of funds, however, declined, coming in at a weighted average of 2.8% in FY’2020, from 3.2% in FY’2019, owing to the faster growth in average interest-bearing liabilities, an indication that the listed banks were able to mobilize cheaper deposits,

- Average loan growth came in at 8.3%, lower than the 12.8% recorded in FY’2019. The loan growth was also slower than the 29.9% growth in government securities, an indication of the banks preference of investing in Government securities as opposed to lending due to the elevated credit risk occasioned by the pandemic,

- Interest income grew by 13.8%, compared to a growth of 3.2% recorded in FY’2019. Despite the growth in interest income, the Yield on Interest Earning Assets (YIEA) declined marginally to 10.3% from the 10.4% recorded in FY’2019, an indication of the increased allocation to lower-yielding government securities by the sector. The decline in the YIEA can also be attributed to the reduced lending rates for customers by the sector, in line with the Central Bank Rate cuts. Consequently, the Net Interest Margin (NIM) now stands at 8.0%, 0.7% points higher than the 7.3% recorded in FY’2019 for the whole listed banking sector, and,

- Non-Funded Income growth was flat compared to the 17.4% growth recorded in FY’2019. This can be attributable to i) a slower growth in the fees and commission which declined by 7.9% compared to a growth of 18.4% in FY’2019 and ii) the waiver on fees on mobile transactions below Kshs 1,000 coupled with the free bank-mobile money transfer.

Universe of Coverage:

|

Company |

Price at 12/3/2021 |

Price at 19/3/2021 |

w/w change |

YTD Change |

Year Open 2021 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

Recommendation |

|

Diamond Trust Bank*** |

75.3 |

73.8 |

(2.0%) |

(3.9%) |

76.8 |

105.1 |

3.5% |

46.0% |

Buy |

|

I&M Holdings*** |

43.0 |

43.2 |

0.5% |

(3.7%) |

44.9 |

60.1 |

6.3% |

45.4% |

Buy |

|

Kenya Reinsurance |

2.6 |

2.7 |

1.9% |

14.7% |

2.3 |

3.3 |

4.2% |

28.7% |

Buy |

|

Sanlam |

12.5 |

11.7 |

(6.4%) |

(10.4%) |

13.0 |

14.0 |

8.6% |

28.8% |

Buy |

|

Equity Group*** |

40.0 |

41.7 |

4.1% |

14.9% |

36.3 |

43.0 |

21.6% |

24.8% |

Buy |

|

Standard Chartered*** |

134.5 |

133.0 |

(1.1%) |

(8.0%) |

144.5 |

153.2 |

9.4% |

24.6% |

Buy |

|

Britam |

7.2 |

7.3 |

1.9% |

4.6% |

7.0 |

8.6 |

0.0% |

17.5% |

Accumulate |

|

NCBA*** |

24.9 |

25.0 |

0.4% |

(6.2%) |

26.6 |

25.4 |

15.2% |

17.0% |

Accumulate |

|

ABSA Bank*** |

9.4 |

9.4 |

0.2% |

(0.8%) |

9.5 |

10.5 |

2.6% |

13.9% |

Accumulate |

|

KCB Group*** |

40.0 |

41.4 |

3.5% |

7.7% |

38.4 |

46.0 |

2.4% |

13.7% |

Accumulate |

|

Co-op Bank*** |

13.0 |

13.9 |

7.3% |

10.8% |

12.6 |

14.5 |

7.2% |

11.5% |

Accumulate |

|

Liberty Holdings |

9.6 |

8.8 |

(8.9%) |

13.8% |

7.7 |

9.8 |

0.0% |

11.9% |

Accumulate |

|

Jubilee Holdings |

261.8 |

285.0 |

8.9% |

3.4% |

275.8 |

313.8 |

0.0% |

10.1% |

Accumulate |

|

Stanbic Holdings |

83.0 |

85.3 |

2.7% |

0.3% |

85.0 |

84.9 |

4.5% |

4.0% |

Lighten |

|

CIC Group |

2.3 |

2.3 |

0.0% |

8.5% |

2.1 |

2.1 |

10.9% |

2.6% |

Lighten |

|

HF Group |

3.4 |

3.4 |

0.3% |

8.9% |

3.1 |

3.0 |

0.0% |

(12.3%) |

Sell |

|

*Target Price as per Cytonn Analyst estimates as at Q3’2020. We are currently reviewing our target prices for the Banking Sector coverage **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are banks in which Cytonn and/ or its affiliates are invested in |

|||||||||

We are “Neutral” on the Equities markets in the short term. We expect the recent discovery of a new strain of COVID-19 coupled with the introduction of strict lockdown measures in major economies to continue dampening the economic outlook. However, we maintain our bias towards a “Bullish” equities markets in the medium to long term. We believe there exist pockets of value in the market, with a bias on financial services stocks given the resilience exhibited in the sector. The sector is currently trading at historically cheaper valuations and as such, presents attractive opportunities for investors.

- Residential Sector

During the week, the Kenya Mortgage and Refinance Company (KMRC), a treasury-backed lender, announced that it has so far advanced Kshs 2.8 bn in credit to mortgage lenders accounting for approximately 7.5% of the Kshs 37.2 bn they had planned to lend from September 2020. KMRC were to raise funds from 19 financial institutions for onward lending, out of which so far only 5 have participated with KCB bank accounting for the bulk of the lending at 2.1 bn, followed by Housing Finance(HF) at Kshs 515.0 mn, while others included Stima Sacco at Kshs 69.0 mn, Tower Sacco at Kshs 30.0 mn, and, Bingwa Sacco at Kshs 27.0 mn.

The move by KMRC has enabled them refinance a total of 1,427 mortgages with their aim of boosting the number of mortgage accounts to 60,000 in the next five years. Mortgage accounts growth is currently being constrained by; i) tough economic environment with potential home buyers suffering from job losses and salary cuts, ii) the relatively low loan size provided by KMRC capped at Kshs 4.0 mn for residents within the Nairobi Metropolitan Area (NMA) and Kshs 3.0 mn for all other areas outside the NMA, and, iii) risk of default discouraging lending.

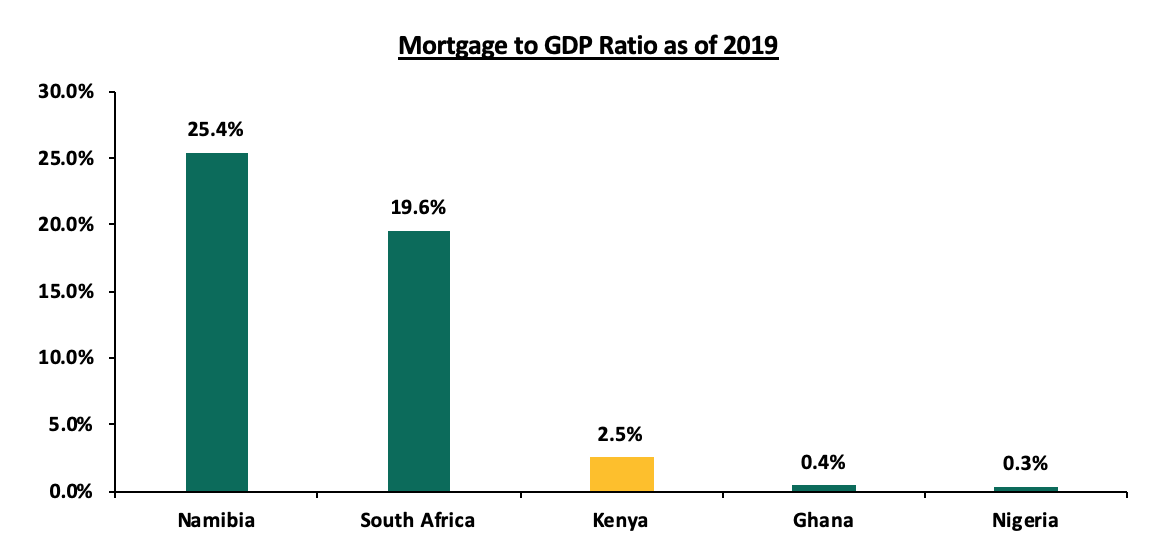

In terms of mortgage penetration, Kenya has continued to record a relatively low mortgage to GDP ratio which stands at 2.5% as at 2019, compared to other African countries such as Namibia at 25.4%. The low mortgage uptake has been low due to; i) the high interest rates and high deposit requirements, ii) soaring of property prices, iii) low-income levels making it hard to service loans, and, iv) lack of credit risk information for those in the informal sector leading to their exclusion.

The graph below shows mortgage to GDP ratios of different countries compared to Kenya as of 2019;

Source: Centre of Affordable Housing Africa

According to the Central Bank of Kenya, the number of mortgage accounts currently stands at 27,993 as of 2019, representing a 5.6% rise from 26,504 accounts recorded in 2018. With KMRC in place we expect that they shall continue providing secure, long-term funding to mortgage lenders thus increasing the availability and affordability of mortgage loans in Kenya which will boost the mortgage market and home ownership in Kenya. However, it is still not clear how KMRC will achieve their target lending rate of 7.0% given that even the government cost of borrowing for a 20-year period is currently at about 13.2% p.a.

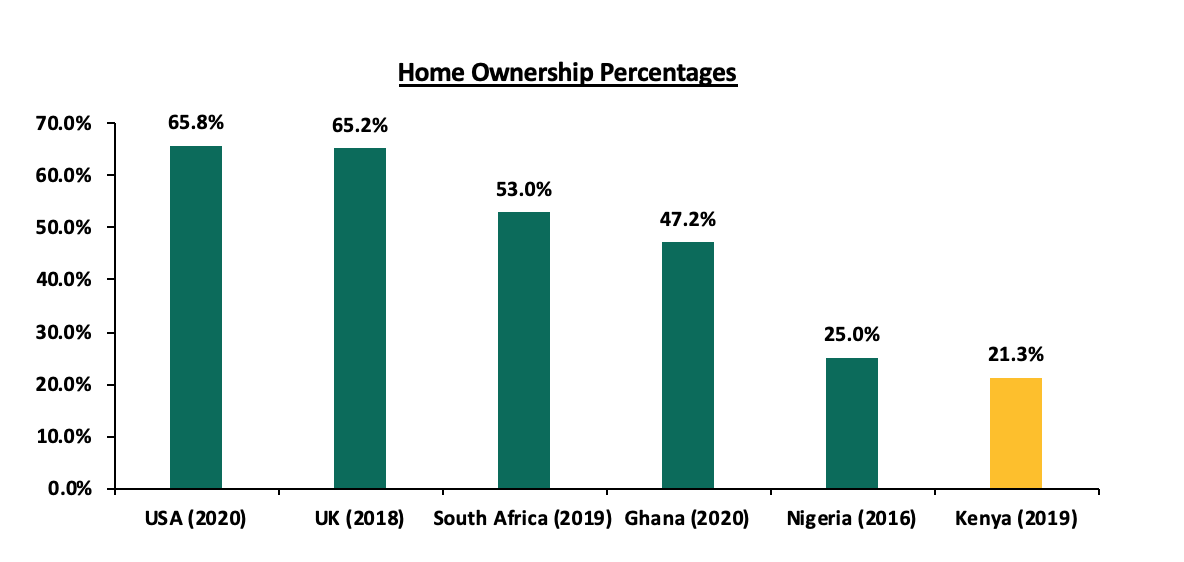

The graph below shows the home ownership percentages of different countries compared to Kenya as of 2019;

Source: Online Research

Student Factory Africa, a consortium of architects, partnered with Betonbouw B, a Dutch-based private equity firm to launch a 4,500-bed student accommodation hostel to be located next to Catholic University of Eastern Africa in Karen, at a cost of Kshs 5.0 bn. The development set to break ground in April will occupy more than 12 acres of land with the first phase anticipated to be completed in 12 months, with a third of the financing provided by Betonbouw B while the rest will come from debt as talks for financing with the International Finance Corporation(IFC) are ongoing. The hostels will be the second branded hostels after Acorn Group’s Qwetu and Qejani.

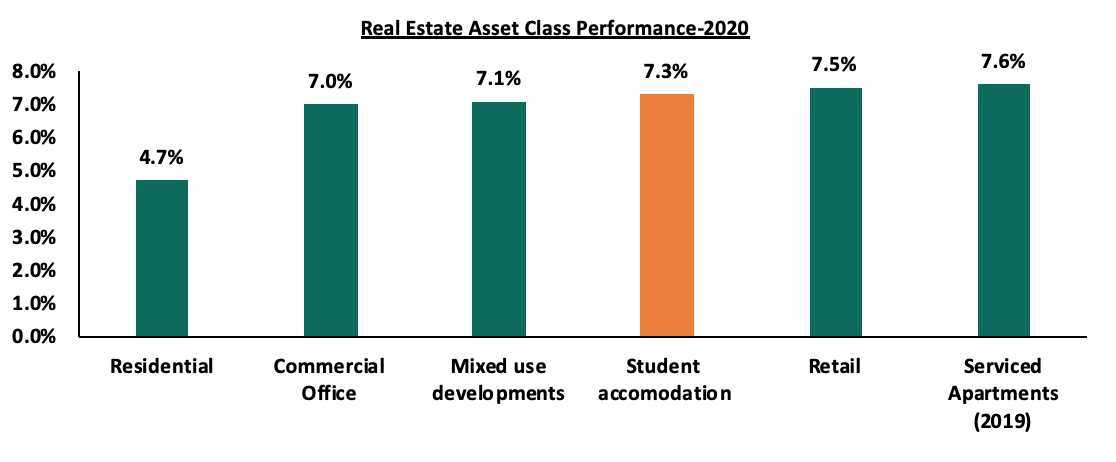

Modern student housing continues to gain traction with investors aiming to cash in on their high returns amidst the high demand for student accommodation as a result of the growing number of students. As of 2020, the number of available student housing stood at 300,000 against a university enrolment of 509,473 according to the Kenya National Bureau of Statistics data with the exclusion of technical colleges. This implies that there is a huge deficit of student accommodation which has been accelerated by i) high land rates, iii) insufficient access to funding, and, iii) and inadequate expertise to build and manage student housing. Student accommodation has relatively high yields of 7.4% as per the Cytonn Student Housing Market Kenya Research compared to other real estate sectors like the residential and Mixed-use developments which have an average rental yield of 4.7% and 7.1% respectively. In our view, the move by Student Factory Africa is a move in the right direction to gaining high returns while providing green-certified purpose-built student accommodation.

The graph below shows performance of different real estate classes in 2020;

Source: Cytonn Research

- Retail Sector

During the week Kentucky Fried Chicken (KFC), a US fast food chain, opened a new branch in Mombasa County, in an expansion drive that saw it take up approximately 2200 SQFT of space in Mombasa Trade Centre, marking its first outlet in the county and raising its national branch count to 24. KFC started operations in Kenya in 2011 has 35 outlets in East Africa with the other shops located in Uganda and Rwanda. KFC, which operates locally through franchisee Kuku Foods East Africa, has also been reaping benefits from deliveries and its expansion is being supported by rising disposable household incomes, fast economic growth and a young population with upgraded tastes and preferences. In our opinion, Mombasa presents a viable opportunity for the fast-food industry as it is a tourist destination. The continued expansion of KFC and other restaurants is expected to result in increased uptake of retail real estate developments thus improving the overall performance of the retail sector.

- Statutory Reviews

During the week, the Landlord and Tenant Bill of 2021 was tabled in Parliament with the aim of consolidating the laws relating to the renting of business and residential premises and regulating the relationship between the landlord and tenant in order to promote stability in the rental sector. The key take-outs from the Bill include;

- The jurisdiction of the tribunals moved from the ambit of the Minister or the Cabinet Secretary to the Chief Justice,

- Tribunals established under the Bill granted the power to enforce decrees, issue injunctive orders and execute orders in the same manner as the courts and punish for contempt in the same manner as any court of law,

- All disputes to be determined within three months to eliminate the huge backlogs currently being faced by the tribunals,

- Protection of tenants by requiring landlords to get orders from the tribunal before levying distress,

- Protection of landlords through reduction of notice period for terminating tenancy from 12 months to 60 days when the landlord requires the premises for personal use, right of a tenant to recover security deposit only after having restored the premises to the condition it was in at the time when the tenancy commenced, and the tenant having settled all utility bills, among others,

- Permits an inspector or other officer of a tribunal to institute criminal proceedings where offences under the Bill have been committed, and,

- Institution of increased penalties including; Failure to comply with lawful order of a tribunal has the fine increased to Kshs 100,000 and prison term to 12 months, or both, depriving tenant of service has the fine increased to Kshs 10,000 and prison term to six months or both, not keeping rent records has the fine increased to one month’s rent of the premises, and, subjecting tenant to annoyance has the fine increased to two months’ rent of the premises

We expect the above provision to help in resolving landlord- tenant disputes by protecting both parties as widening of the mandate of the tribunal aims to protect tenants from landlords but creates some return challenges for the landlords especially if the houses have loans that one is servicing.

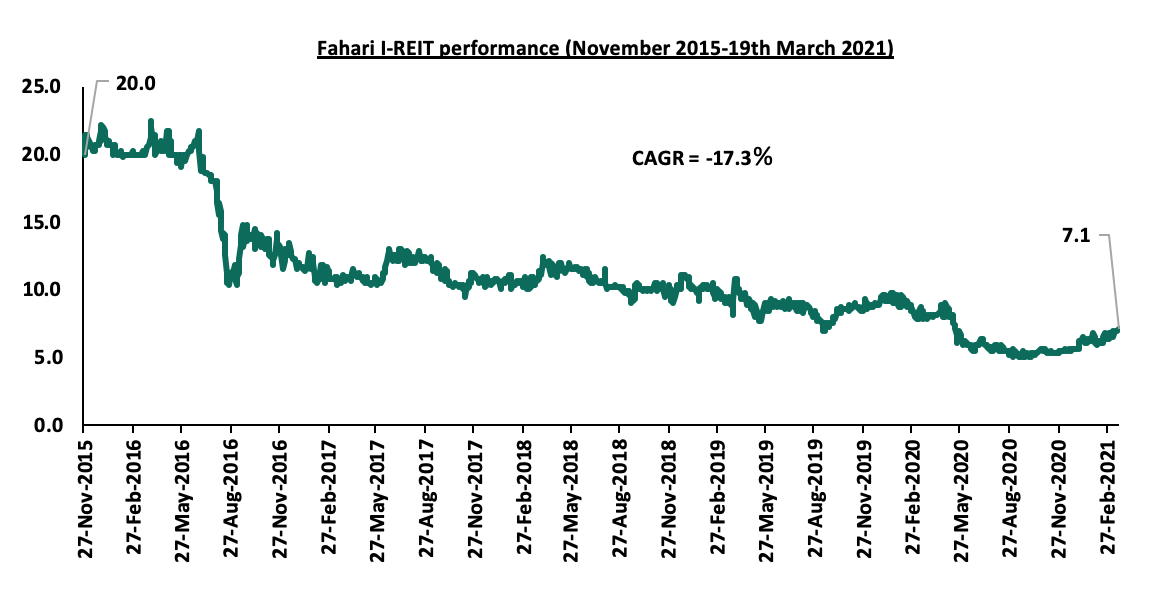

- Listed Real Estate

ILAM Fahari I-REIT released their FY’2020 earnings registering a 15.5% decline in earnings per unit to Kshs 0.82 in FY’2020 from Kshs 0.97 in FY’2019, driven by an 8.4% decline in total operating income to Kshs 347.5 mn, from Kshs 379.2 mn in FY’2019. Rental income declined by 0.9% to Kshs 341.2 mn, from Kshs 344.3 mn in FY’2019. Notably, the decline was mainly attributable to the COVID-19 impact on the retail and commercial office sectors which has led to rent rebates for struggling tenants thus, suppressing rental income growth. Distributable earnings declined by 6.7% to Kshs 134.4 mn, from Kshs 144.0 mn in FY’2019. The fund manager attributed the decline to the higher property expenses arising from a significant provision for bad debts as a result of non-performance of the anchor tenant at Greenspan Mall. This was partially offset by a reduction in fund operating expenses after the REIT Manager temporarily reduced their fees by 10.0% to cushion the investors during a particularly difficult year. The REIT recommended a Kshs 108.6 mn dividend distribution to its unitholders at Kshs 0.60 per unit. At the current price of Kshs 7.0, this translated to a dividend yield of 10.7%.

For a more comprehensive analysis, please see our ILAM Fahari I-REIT FY’2020 Earnings Note.

On the bourse, the Fahari I-REIT is currently trading at an average of Kshs 6.4 per share on a YTD basis, representing a 28.1% decrease compared to the same period under review in 2020 trading at an average Kshs 8.9. Since inception, the instrument has recorded a decline of 64.5% from Kshs 20.0 in November 2015 to Kshs 7.0 as at 19th March 2020

Our outlook for listed real estate is neutral with a bias to negative, attributed to continued lack of investor appetite in the instrument due to negative investor sentiments and negative performance of the office and retail sectors, coupled with low trading prices. However, we are of the view that some effort is being put by institutions such as Acorn to boost the REIT market having announced plans to launch a D-REIT and I-REIT in the next 3 years.

The real estate sector is expected to record improved performance supported by provision of relatively affordable mortgage facilities by KMRC with the aim of increasing home ownership and the expansion of international retail chains.

The Kenyan property market has witnessed significant growth over the past years, however in 2020, the real estate sector started on a rather high note but later the Covid-19 pandemic affected the performance real estate sector especially in terms of access to finance. Access to funds has been a key challenge for most real estate developers with most of them having relied on bank lending as a source of their funding. In order to bridge this gap, the real estate industry players have had to come up with various innovative products, e.g. joint venture models and structured products to raise capital. In helping bridge this gap and in a bid to further develop the Capital Markets, the Capital Markets Authority, CMA, in 2013 put in place REITs regulations that most developers can use to raise capital and we have seen some success stories already in the market. This regulatory framework has been in existence in Kenya for the past 8 years, and we have since done a topical on Real Estate Investment Trusts, REITs, as an Investment Alternative in 2019. This week, we update our topical by covering the following topics;

- Overview of REITs

- Types of REITs

- Benefits and risks associated with investing in REITs

- Challenges investors have encountered in investing in REITs

- REITs performance in Kenya

- Case study of Australia

- Lessons learnt from the case of Australia

- Conclusion

- Overview of REITs

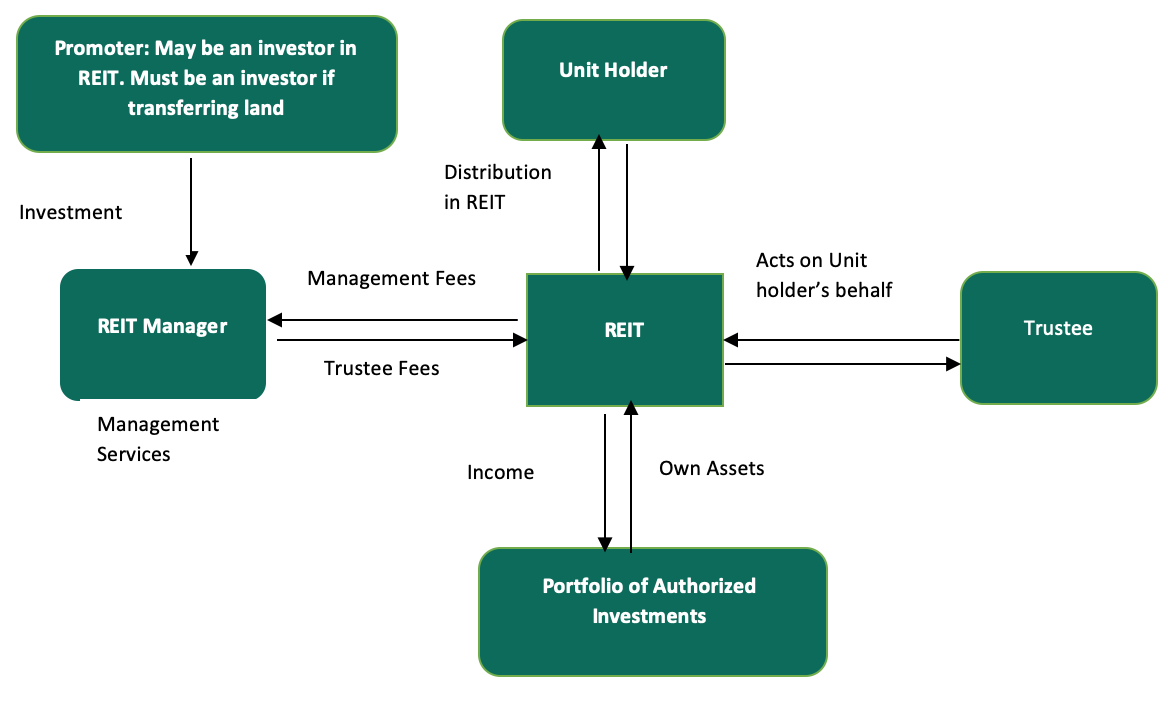

REITs are regulated collective investment vehicles which invests in real estate. REITs promoters source funds to build or acquire real estate assets, which they sell or rent to generate income. The income generated is then distributed to the investors as returns in investing in REITs. The property is held by a trustee on behalf of unit holders and professionally managed by a REIT manager. To help improve accountability and transparency within the REIT structure, there are four key parties who all work together to ensure that REITs interests are fully protected. These parties include:

- The Promoter: This is an individual or parties involved in setting up a real estate investment trust scheme. The promoter is regarded as the initial issuer of REIT securities and is involved in making a submission to the regulatory authorities to seek for approval of a draft trust deed, draft prospectus or an offering memorandum. For instance, in the existing Acorn D-REIT, Acorn Investment Management is the promoter. And for the attempted D-REITs, Fusion Investment Management Limited was the Promoter in the aborted Fusion D-REIT, and Cytonn Asset Managers Limited (CAML) was the Promoter in the aborted Cytonn D-REIT,

- The REIT Manager: This is a company that has been incorporated in Kenya and has been issued a license by the authority (CMA) to provide real estate management and fund management services for a REIT scheme on behalf of investors. There are currently 10 REIT Managers in Kenya, namely Cytonn Asset Managers Limited (CAML), Accorn Investment Management, Stanlib Kenya Limited Nabo Capital, ICEA Lion Asset Managers Limited, Fusion Investment Management Limited, H.F Development and Investment Limited, Sterling REIT Asset Management, Britam Asset Managers Limited, and CIC Asset Management Limited,

- The Trustee: This is a corporation or a company that has been appointed under a trust deed and is licensed by the regulatory authorities to hold the real estate assets on behalf of investors. The Trustee’s main role is to act on behalf of beneficiaries, usually the investors in the REIT, by assessing the feasibility of the investment proposal put forward by the REIT Manager and ensuring that the assets of the scheme are invested in accordance with the Trust Deed, and,

- Project/Property Manager: The role of the project manager is to oversee the planning and delivery of the construction projects in the REITs. The property manager on the other hand plays the role of managing the completed real estate development that has been acquired by the REIT.

The figure below shows the relationships between the key parties in a typical REITs structure;

Source: Capital Markets Authority

- Types of REITs

There are three main types of REITs and they include:

- Income Real Estate Investment Trusts (I-REITs): This is a real estate trust that primarily derives its revenues from rental properties. The investors gain through rental income and capital appreciation form the investments undertaken,

- Development Real Estate Investment Trust (D-REITs): This is a type of real estate trust where resources are pooled together for purposes of developing of real estate projects. Once a development has been completed, a D-REIT may be converted to an I-REIT and here the investors may choose to either re-invest their funds, sell, lease their shares or they can choose to sale the developments that have been undertaken, and,

- Islamic Real Estate Investment Trusts: This is a unique type of REITs which only undertakes Shari’ah compliant activities. A fund manager is required to do a compliance test before making an investment in this type of REIT to ensure it is Shari’ah compliant.

- Benefits of Investing in Real Estate Investment Trusts (REITs)

- Competitive Long-term returns: The performance of the REITs are derived from the real estate investments and we have seen that over time real estate have outperformed most other asset classes,

- Diversification: REITs, fixed income securities, and equities have different long-term investment characteristics creating diversification when combined within a single portfolio,

- Flexible Asset Class: REITs are regarded as a flexible payment option where investors are able to customize their REITs portfolio based on the fund characteristics, the various real estate sectors and geographic exposures,

- Liquidity: The REITs listed on securities exchange offer liquidity advantages for investors over the direct investments in real estate assets. The advantage of liquidity also extends to real estate developers as well since they may not need to completely sell their entire assets if they are seeking for some little liquidity,

- Stable and Consistent Income Stream: Investors especially those who take the I-REIT option have the advantage of getting rental income thus guaranteeing a stable and consistent income stream, I-REITs are required by the law to pay of at least 80.0% of their income to their unit holders in form of dividends,

- Taxation Benefits: REITs general have a number of tax benefits which include; i) REITs registered by the Commissioner of Income Tax are exempted from income tax except for the payment of withholding tax on interest income and dividends, ii) transfer of properties to a REIT also attracts a stamp duty exemption, as per Section 96A (1) (b) of the Stamp Duty Act, and, iii) REITs’ investee companies are exempted from income tax as stated in the Finance Bill 2019, section 20 of the Income Tax Act, and,

- Transparency: REITs provides operating transparency mainly because of how they are structured and operated. Additionally, the listed REITs are registered and regulated by the securities markets regulators adhering to high standards of corporate governance, financial reporting and information disclosure.

- Challenges facing the adaptation of REITs in Kenya & Suggested Solutions

- High Minimum Capital Requirements for a Trustee of Kshs 100.0 mn: This essentially limits the eligible trustees to only banks, efficiently eliminating corporate trustees and other fund managers. The Solution is to drop the minimum capital requirement to match what is required of a fund manager, to Kshs. 10.0 mn,

- Subdued Performance of the Real Estate Market: Some real estate sectors have experienced sluggish growth especially in 2020 attributed to the impact of the COVID-19 pandemic especially in the retail and commercial office sectors which are experiencing an oversupply of 3.1 mn SQFT and 6.3mn SQFT respectively and hence a resultant drop in the occupancy and rental returns,

- Lengthy Approval Process: The approval process can take time particularly to get the necessary documentations, and meet all the required regulatory requirements. This might discourage promoters from perusing their interests in focusing on REITs and look for other more efficient ways to raise capital. The Solution is to have a defined approval time within which an application must be processed and either approval or reasons for failure to approve clearly communicated to the applicant,

- Inadequate Investor Knowledge: REITs have been existence in the Kenyan market for the past 8 years, however, the popularity of the instrument has remained low mainly due to inadequate investor awareness or education of REITs hence low investment in the market. This is the main reason for low subscription rates and the consequent poor performance of the Ilam I-REIT and the failed issuance of the Fusion D-REIT in 2016 and 8 years since the establishment of the regulatory framework, there is not a single D-REIT in the market. The Solution is to have broader investor education on the benefits of REITs, but this will only make sense after several REITS have come to market, and,

- High Minimum Investment Amounts Set at Kshs 5.0 mn: Based on the current regulations, the minimum investment amounts for a D-REIT is 5.0 mn at 100X the medium income in Kenya, this is considered too high and might limit investors from preferring it as an investment option. The Solution is to bring down the minimum required investment amount for a REIT to Kshs. 100,000, which is the amount required by regulations for a private offer.

- REITs performance in Kenya

The regulatory framework, REITs was launched in Kenya in 2013, thus 8 years since inception in the Kenyan market. 8 years since the inception, the REITs market has remained underdeveloped with only one I-REIT, and no D-REIT with the Fusion Capital D-REIT, which was launched in 2016, having failed due to low subscription rates and the Cytonn D-REIT having failed due to conflicts of interest by the prospective bank Trustee. The current licensed REITs managers are 10 following the licensing of Acorn Investment Management by CMA in late 2020. Other examples of REIT managers in Kenya are; Cytonn Asset Managers Limited (CAML), Arcon Investment Management, Stanlib Kenya Limited Nabo Capital, ICEA Lion Asset Managers Limited, Fusion Investment Management Limited, H.F Development and Investment Limited, Sterling REIT Asset Management, Britam Asset Managers Limited, and CIC Asset Management Limited.

Acorn has made major strides with regards to investments in the REITs market and has since launched an investor road show for its Acorn Students Accommodation (ASA) REIT with the aim of establishing a D-REIT and an I-REIT in the next 2.5 years with an expected Internal Rate of Return of 18.0%. The development real estate investment trust (D-REIT) is expected to finance the student hostels whereas the Investment real estate investment trust (I-REIT) will be used to acquire property for rental income. The fund size for the two REITs is estimated at Kshs 4.0 bn for the D-REIT and Kshs 4.1 bn for the I-REIT in the initial fundraising. In their campaign, the organization plans to invest a total of 24.0% equity on the development of student accommodation D-REIT, and up to 67.0% in the I-REIT. In this regard, the firm announced that their anchor investor InfraCo, a private United Kingdom-funded injected Kshs 1.0 bn equity investment aimed at supporting their D-REIT and I-REIT.

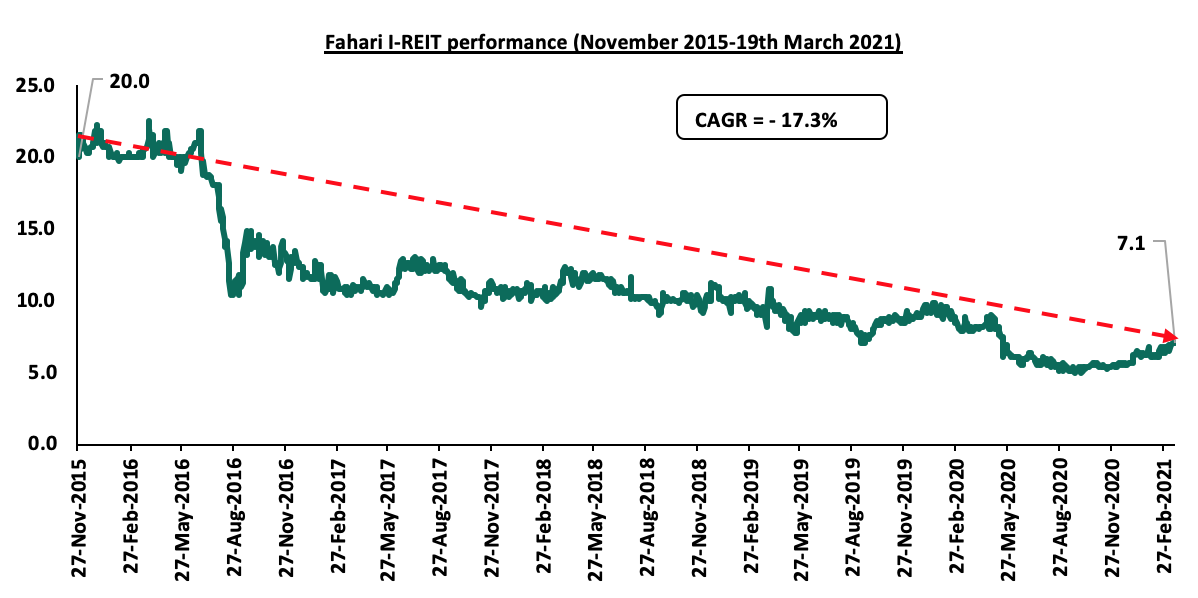

Kenya has only one listed REIT i.e. the Ilam Fahari i-REIT, listed on the Nairobi Securities Exchange (NSE) which started trading in November 2015. However, Ilam Fahari I-REIT’s performance, has been on a downturn since November 2015 when it was first listed, an indication of the dwindling interest for the instrument by investors. The Fahari I-REIT is currently trading at an average of Kshs 6.4 per share since the year started, representing a 28.1% decrease compared to the same period under review in 2020 trading at an average Kshs 8.9. Since inception, the instrument has recorded a decline of 64.5% from Kshs 20.0 in November 2015 to Kshs 7.1 as at 19th March 2020.

The graph below shows performance of the Fahari I-REIT since inception;

Based on the above, we believe that in order for REIT Market to improve and make it more attractive to local and foreign investors, the following supportive frameworks need to be put in place;

- Broaden the pool of trustees by reducing the minimum capital requirement which currently stands at Kshs 100.0 mn to avoid excluding corporate trustees; we have suggested Kshs 10.0 mn of capital,

- Reduce the minimum investments for real estate finance vehicles. The minimum of Kshs 5.0 mn per investor for the formation of a development REIT (D-REIT) is too high for a country where the median income is just Kshs 50,000, hence the minimum investment is 100 times higher than the median income, no wonder there is not a single Development REIT formed so far, making it hard to finance real estate initiatives such as the President’s housing agenda; we have suggested Kshs. 100,000 as the minimum, and,

- Develop institutional grade real estate assets which will lead to high returns.

- Case Study of Australia

The Australian REIT market was established in 1971 under the name Listed Property Trusts (LPTs) but was later renamed to Australian Real Estate Investment Trusts (A-REITs) after the Australian Stock Exchange Limited (ASX) decided to adopt the new naming convention in 2008. Australia is also receiving growing recognition as having the world's largest REITs market outside the United States with more than 12.0% of global listed property trusts listed in the ASX. The Australian REITs have grown to a market capitalization of $143.4 bn since its inception. There are currently 47 REITs listed on the Australian Securities Exchange (ASX). The ASX houses among the largest real estate groups in the world including the Goodman Group and the Scentre Group. The REIT market in Australia is highly corporatized given the large pools of pension fund cash due to compulsory saving in Australia. In Australia, listed REITs can be classified into a number of subsectors namely; i) Retail (45% of market capitalization of all REITs), ii) Office (12%), iii) Industrial (12%), iv) mixed use developments (27%), and v) Alternatives (4%). In the Australian market, there are two common REITS investment areas where people have focused on. These includes: i) the equity REITs which invests in and own properties and typically, income is generated through leasing out of properties and colleting rent, and, ii) mortgage REITs where investors are involved in the investment and ownership of property mortgages, these type of REITS loan money to the owners of real estate for mortgages and mortgage backed security and income is generated through the interests paid on the loan.

Some of the driving forces for the development of REITs in Australia Include:

- Diverse Property Offerings: The property sector in Australia is well diversified with large institutional developers in the real estate subsectors who have built a strong track record in real estate delivery, while at the same time giving attractive returns. This has had an effect on investors encouraging them to pull their investments in the real estate sector,

- Increased awareness: The Australian Stock Exchange (ASX) has made efforts to ensure that people are aware of the existence of REITs, as a result, more people have been able to invest in the instrument making it the second largest REITs market,

- Minimum Investment: In Australia, listed real estate have to be in compliance with the rules of the Australian Stock Exchange, the minimum amount of capital needed for one to invest in REITs is Kshs 50,000 ($500) for the equity REITS and mortgage REITS. In Kenya on the other hand the minimum capital outlay by an investor in a D-REIT is Kshs 5.0 mn. Taking the median income in Kenya of Kshs 50,000.0, the minimum for a REIT is 100 times their median income, and,

- Effective corporate Governance: Good regulation practices and corporate governance have acted as an incentive to both local and foreign investors, who have the assurance that their funds are being properly administrated and utilized.

- Lessons learnt from the case of Australia

The Kenyan REITs market has the potential to grow and this is possible if there is a supportive framework set up. Based on the case study of Australia, the following measures can be implemented to rejuvenate the REIT Market;

- Develop common workable standards that meet with international best practices especially in the areas of financial reporting, disclosure and corporate governance,

- Increased awareness of the existence of the REITs instruments to investors thus boosting their confidence,

- Kenya can initiate continuous improvement on the regulation and government support for REITs by providing regulations that assist in real estate uptake to help increase cash flows into the property market,

- Key industry players in the real estate market can work on developing institutional grade real estate assets. In this regard, development of institutional grade real estate assets would provide strong underlying assets for REITs, which can support the returns to investors,

- The Kenyan Industry players can seek ways to enhance confidence of investors in Kenyan REITs market through Providing minimum return guarantees for investors, and, promoting clearer and more transparent financial statements of real estate firms, listed properties and REITs in general, and,

- The REITs regulators in Kenya can work on reducing the minimum investments to a reasonable level in order to attract capital in the capital markets vehicles.

- Conclusion

Generally, REITs are a good investment option as they provide investors the opportunity to participate in real estate projects. For Kenya, REITs are still at the initial stages with only one being listed, the Fahari I-REIT. One of the main factors affecting the performance of the REITs market is minimal investor knowledge on the instrument. However, the REITs market in Kenya has a potential for growth with increased government support, and public sector sensitization of the REITs.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.