Review of the Affordable Housing Bill 2023, & Cytonn Weekly #03/2024

By Research, Jan 21, 2024

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed for the third consecutive week, with the overall oversubscription rate coming in at 147.0%, down from the oversubscription rate of 241.5% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 25.6 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 639.0%, significantly lower than the oversubscription rate of 1114.4% recorded the previous week. The subscription rate for the 182-day paper decreased to 61.9%, from 101.0% recorded the previous week, while the subscription rate for the 364-day paper increased to 35.3%, from 32.9%, recorded the previous week. The government accepted a total of Kshs 34.1 bn worth of bids out of Kshs 35.3 bn of bids received, translating to an acceptance rate of 96.8%. The yields on the government papers continued to rise, with the yields on the 364-day, 182-day, and 91-day papers increasing by 10.0 bps, 11.3 bps, and 8.9 bps to 16.5%, 16.3%, and 16.2%, respectively;

In the primary bond market, the Central Bank of Kenya released the auction results for the tap sale of the newly issued bond FXD1/2024/003 with a tenor to maturity of 3.0 years and the re-opened bond FXD1/2023/005 with a 4.5-year tenor to maturity. The tap sale was undersubscribed with the overall subscription rate coming in at 79.1%, receiving bids worth Kshs 11.9 bn against the offered Kshs 15.0 bn. The government accepted bids worth Kshs 11.8 bn, translating to an acceptance rate of 99.1%. The weighted average yield of accepted bids came in at 18.4% and 18.8% for the FXD1/2024/003 and FXD1/2023/005, respectively. The coupon rates for the FXD1/2024/003 and FXD1/2023/005 were set at 18.4% and 16.8%, respectively. With the Inflation rate at 6.6% as of December 2023, the real return of the bonds is 11.8% and 12.2% for the FXD1/2024/003 and FXD1/2023/005, respectively;

During the week, The Executive Board of the International Monetary Fund (IMF) concluded the 2023 Article IV consultation with Kenya together with the sixth reviews and augmentations of access of USD 941.2 mn (Kshs 151.3 bn) under the Extended Fund Facility (EFF) and the Extended Credit Facility (ECF) arrangements, and the first review under the 20-month Resilience and Sustainability Facility (RSF) arrangement, approved in July 2023. The Board’s decision allows for the immediate disbursement of USD 624.5 mn (Kshs 100.4 bn) under the EFF/ECF arrangements - which includes an augmentation of access of USD 310.6 mn (Kshs 50.0 bn) - and brings total disbursements under the EFF/ECF arrangements to USD 2.7 bn (Kshs 431.1 bn);

Also during the week, the National Treasury gazetted the revenue and net expenditures for the sixth month of FY’2023/2024, ending 29th December 2023 highlighting that total revenue collected as at the end of December 2023 amounted to Kshs 1,092.1 bn, equivalent to 42.4% of the revised estimates of Kshs 2,576.8 bn for FY’2023/2024 and is 84.8% of the prorated estimates of Kshs 1,288.4 bn;

Equities

During the week, the equities market was on an upward trajectory, with NASI gaining the most by 0.6%, while NSE 20, NSE 25, and NSE 10 gained by 0.2%, 0.5%, and 0.4% respectively; taking the YTD performance to gains of 1.5%, 0.5%, 1.8% and 1.7% for NASI, NSE 20, NSE 25 and NSE 10, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Bamburi, Equity Group, and Standard Chartered Bank of 6.0%, 2.0%, and 1.9% respectively. The gains were, however, weighed down by losses recorded by large-cap stocks such as EABL, Stanbic, and KCB of 1.7%, 1.6%, and 1.4% respectively;

Real Estate

During the week, the Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) November 2023 Report which highlighted that the value of building plans approved in the Nairobi Metropolitan Area increased y/y by 29.4% to Kshs 173.5 bn as at November 2023, from Kshs 134.1 bn recorded during a similar period last year;

In the residential sector, President Ruto laid the foundation stone for the Emgwen Affordable Housing Project in Chesumei Sub-County, Nandi County. The project will comprise 220 units incorporating studio, one, two, and three-bedroom typologies, a well-designed landscape, adequate parking, an underground tank, and adequate pavement for pedestrian use;

In the regulated Real Estate Funds sector, under the Real Estate Investment Trusts (REITs) segment, Fahari I-REIT closed the week trading at an average price of Kshs 6.4 per share in the Nairobi Securities Exchange representing a 0.3% gain from Kshs 6.3 recorded the previous week;

On the Unquoted Securities Platform, as at 19th January 2023, Acorn D-REIT and I-REIT closed the week trading at Kshs 24.4 and Kshs 21.7 per unit, a 22.0% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. In addition, Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 18.0%, remaining relatively unchanged from the previous week;

Focus of the Week

Over the years the Kenyan government has put its best foot forward towards delivering affordable housing to its citizens. The Affordable Housing Bill 2023 represents a strategic attempt by the government to develop a pool of resources geared towards the provision of affordable housing. This bill was first tabled in Parliament on 7th December, 2023 by the National Assembly Majority Leader Kimani Ichung’wa, to cure for the issues raised by the High Court. The fundamental concept of the bill is the contentious housing levy; first introduced in the Finance Bill 2023 under Section 84. In November 2023, the High Court rendered it a blow, terming it as unconstitutional, primarily for its opaqueness and discriminatory nature. In a race against time, the government, through the Majority Leader has sought to regularize the levy through the Affordable Housing Bill 2023. Therefore, in our topical this week, we will review the Affordable Housing Bill 2023;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 15.72% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 17.95% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Monday, from 10:00 am to 12:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

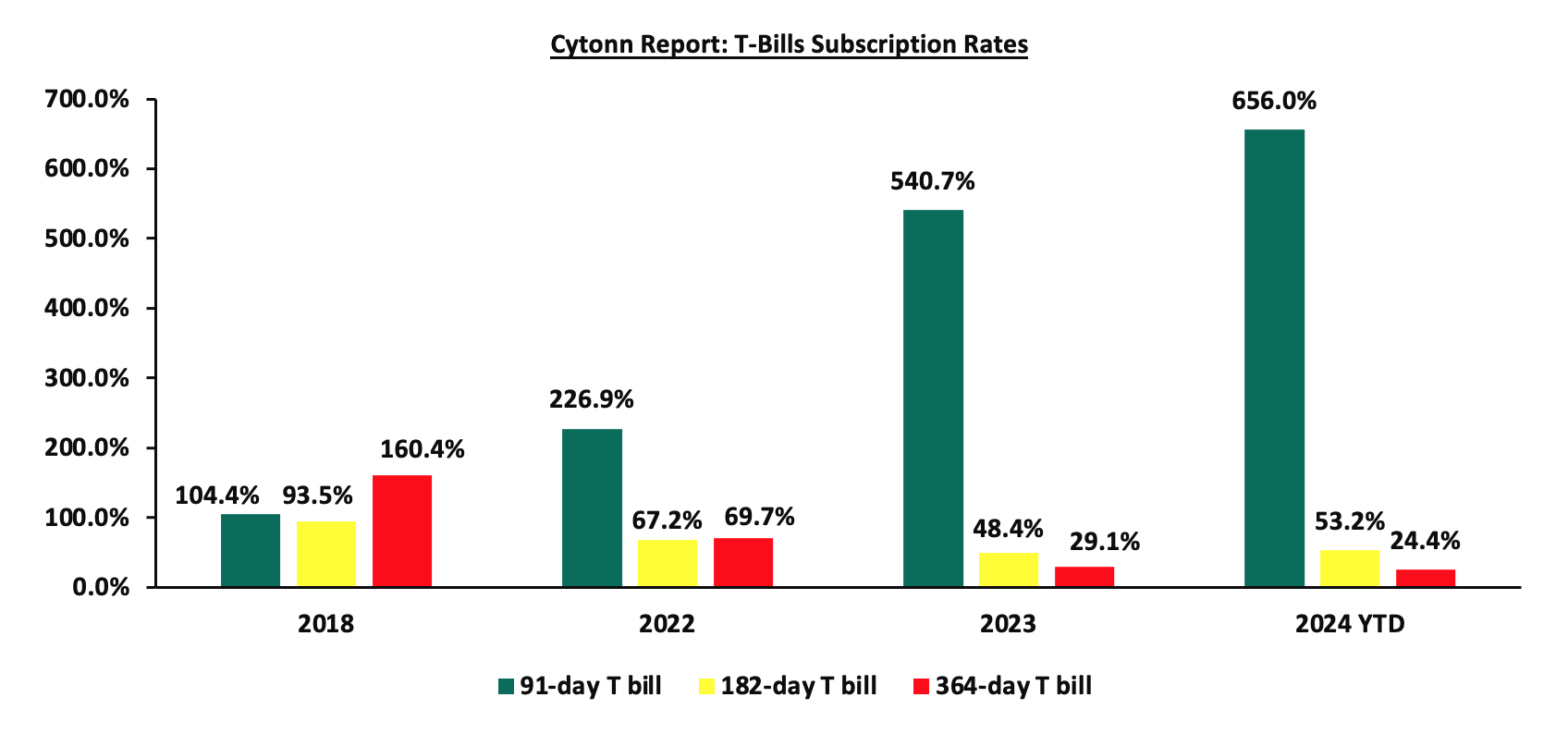

During the week, T-bills were oversubscribed for the third consecutive week, with the overall oversubscription rate coming in at 147.0%, down from the oversubscription rate of 241.5% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 25.6 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 639.0%, significantly lower than the oversubscription rate of 1114.4% recorded the previous week. The subscription rate for the 182-day paper decreased to 61.9%, from 101.0% recorded the previous week, while the subscription rate for the 364-day paper increased to 35.3%, from 32.9%, recorded the previous week. The government accepted a total of Kshs 34.1 bn worth of bids out of Kshs 35.3 bn of bids received, translating to an acceptance rate of 96.8%. The yields on the government papers continued to rise, with the yields on the 364-day, 182-day, and 91-day papers increasing by 10.0 bps, 11.3 bps, and 8.9 bps to 16.5%, 16.3%, and 16.2%, respectively. The chart below compares the overall average T-bill subscription rates obtained in 2018, 2022, 2023, and 2024 Year-to-date (YTD:

In the primary bond market, the Central Bank of Kenya released the auction results for the tap sale of the newly issued bond FXD1/2024/003 with a tenor to maturity of 3.0 years and the re-opened bond FXD1/2023/005 with a 4.5-year tenor to maturity. The tap sale was undersubscribed with the overall subscription rate coming in at 79.1%, receiving bids worth Kshs 11.9 bn against the offered Kshs 15.0 bn. The government accepted bids worth Kshs 11.8 bn, translating to an acceptance rate of 99.1%. The weighted average yield of accepted bids came in at 18.4% and 18.8% for the FXD1/2024/003 and FXD1/2023/005, respectively. The coupon rates for the FXD1/2024/003 and FXD1/2023/005 were set at 18.4% and 16.8%, respectively. With the Inflation rate at 6.6% as of December 2023, the real return of the bonds is 11.8% and 12.2% for the FXD1/2024/003 and FXD1/2023/005, respectively.

Money Market Performance:

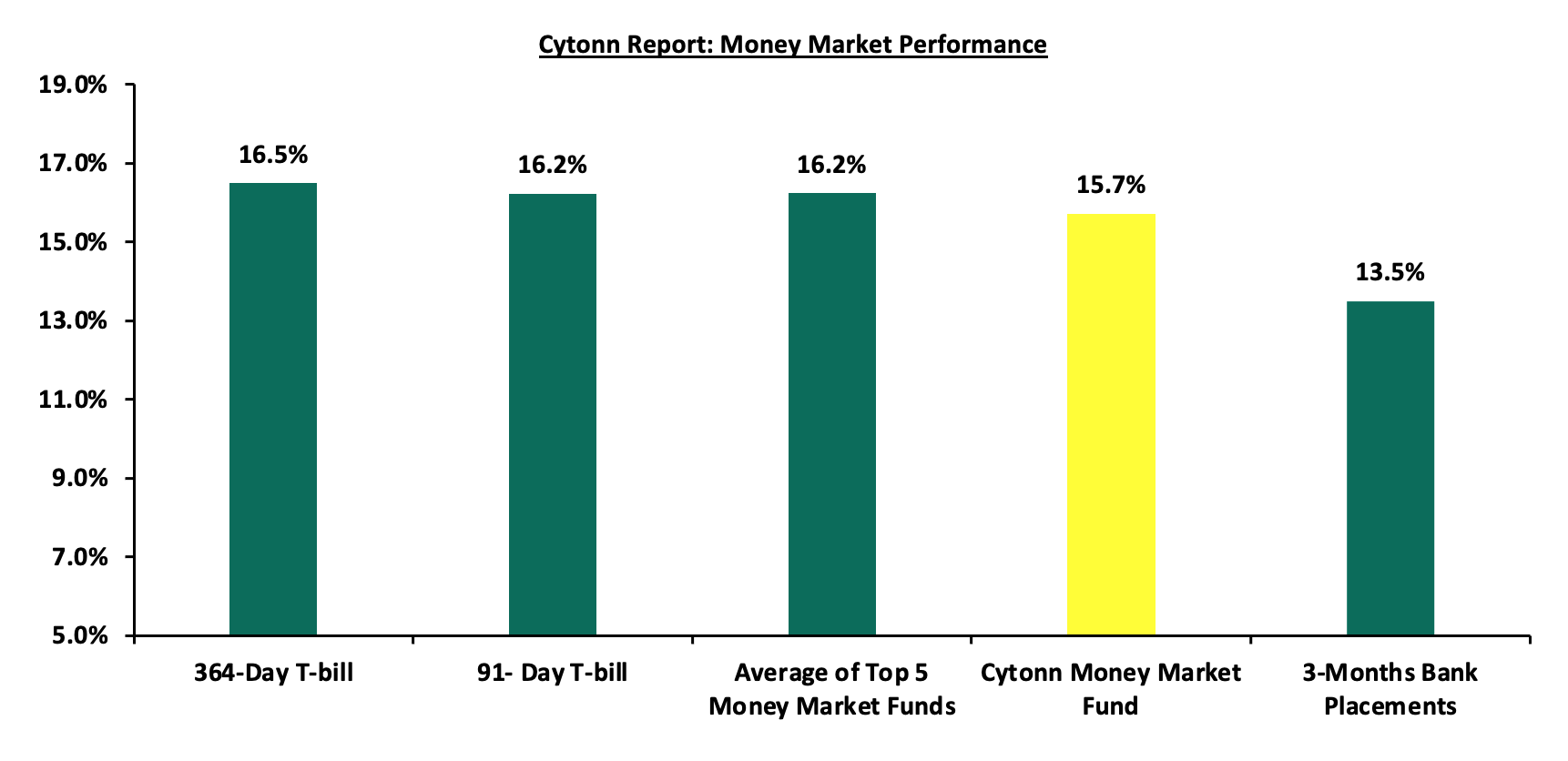

In the money markets, 3-month bank placements ended the week at 13.5% (based on what we have been offered by various banks), and the yields on the 364-day paper increased by 10.0 bps to 16.5% and 91-day T-bill yield increased by 8.9 bps to 16.2%. The yields of the Cytonn Money Market Fund increased by 22.0 bps to 15.7% from 15.5% recorded the previous week, and the average yields on the Top 5 Money Market Funds increased by 15.6 bps to 16.2%, from 16.1% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 19th January 2024:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 19th January 2024 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Etica Money Market Fund |

17.3% |

|

2 |

Lofty-Corban Money Market Fund |

16.4% |

|

3 |

Nabo Africa Money Market Fund |

16.2% |

|

4 |

Cytonn Money Market Fund (Dial *809# of download the Cytonn app) |

15.7% |

|

5 |

GenAfrica Money Market Fund |

15.7% |

|

6 |

Apollo Money Market Fund |

15.2% |

|

7 |

Kuza Money Market fund |

14.8% |

|

8 |

Enwealth Money Market Fund |

14.8% |

|

9 |

Madison Money Market Fund |

14.5% |

|

10 |

GenCap Hela Imara Money Market Fund |

14.5% |

|

11 |

Co-op Money Market Fund |

14.4% |

|

12 |

Sanlam Money Market Fund |

14.0% |

|

13 |

Absa Shilling Money Market Fund |

13.7% |

|

14 |

Mayfair Money Market Fund |

13.6% |

|

15 |

AA Kenya Shillings Fund |

13.1% |

|

16 |

Orient Kasha Money Market Fund |

12.8% |

|

17 |

Old Mutual Money Market Fund |

12.8% |

|

18 |

Dry Associates Money Market Fund |

12.7% |

|

19 |

Jubilee Money Market Fund |

12.7% |

|

20 |

KCB Money Market Fund |

12.5% |

|

21 |

CIC Money Market Fund |

12.0% |

|

22 |

ICEA Lion Money Market Fund |

11.7% |

|

23 |

Mali Money Market Fund |

11.6% |

|

24 |

Equity Money Market Fund |

11.5% |

|

25 |

British-American Money Market Fund |

10.3% |

Source: Business Daily

Money Market Performance (USD):

The yields of the Cytonn Money Market Fund (USD) closed the week with a yield of 6.3%, remaining unchanged from the previous week. The table Below shows the Money Market Funds (USD) performance:

|

USD Money Market Fund Yield for Fund Managers as published on 19th January 2024 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund USD |

6.31% |

|

2 |

Lofty-Corban Money Market Fund USD |

6.29% |

|

3 |

Old Mutual Dollar Money Market Fund |

6.19% |

|

4 |

Absa Money Market Fund USD |

5.91% |

|

5 |

Dry Associates Money Market Fund USD |

5.77% |

|

6 |

Sanlam Dollar Fund |

5.68% |

|

7 |

Kuza Money Market Fund USD |

5.48% |

|

8 |

CIC Dollar Fund |

5.43% |

|

9 |

KCB Money Market Fund USD |

5.08% |

|

10 |

Nabo Africa Money Market Fund USD |

4.72% |

Liquidity:

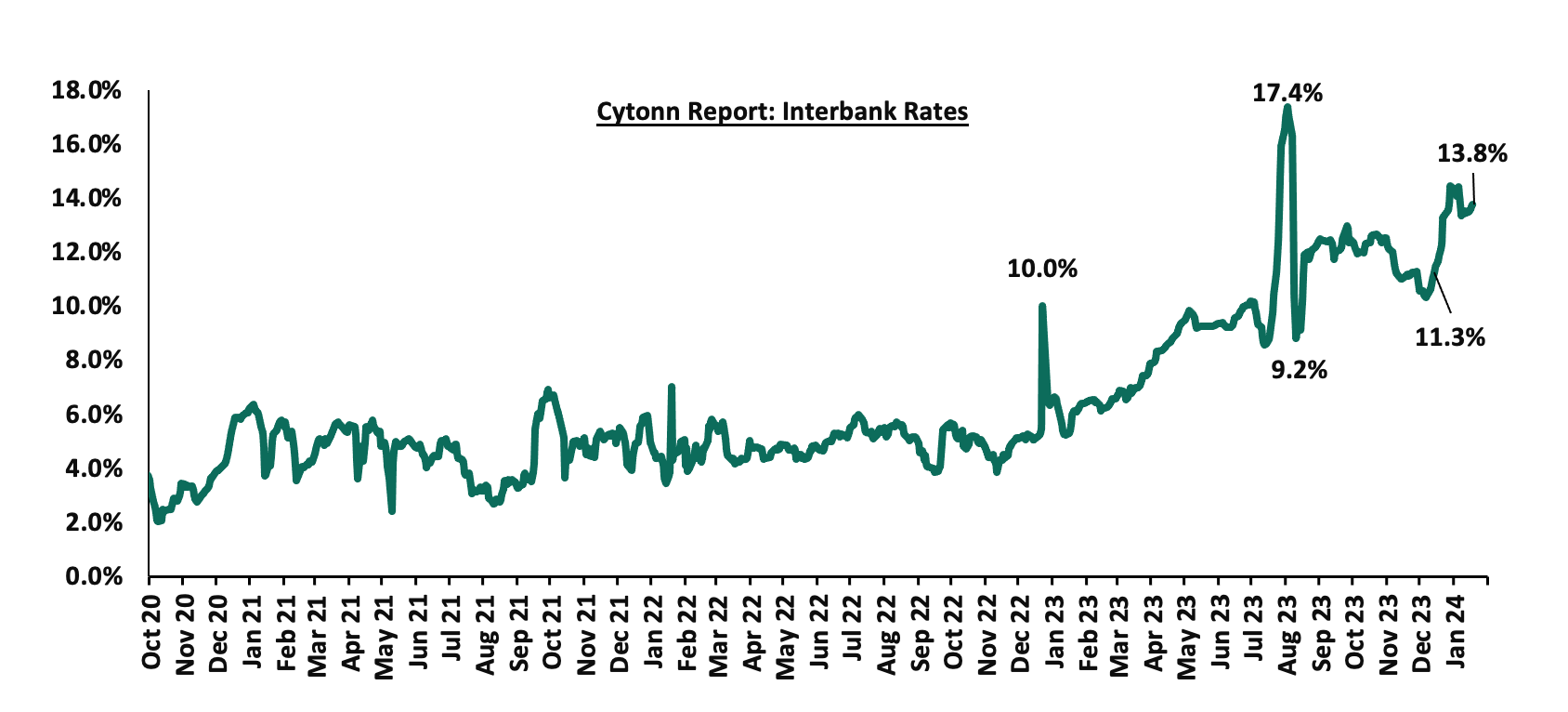

During the week, liquidity in the money markets tightened, a reversal from the previous week, with the average interbank rate increasing to 13.7% from 13.4 recorded the previous week, partly attributable to the tax remittances that offset government payments. The average interbank volumes traded decreased by 3.4% to Kshs 21.0 bn from Kshs 21.7 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Eurobonds recorded a mixed performance, with the yields on the 10-year Eurobond issued in 2014 decreasing the most by 0.4% points, to 14.3% from 14.7% recorded the previous week. On the other hand, the yields on the 30-year Eurobond issued in 2018, the 7-year and 12-year Eurobonds issued in 2019, and the 12-year Eurobond issued in 2021 remained relatively unchanged from the yields recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 19th January 2024;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Tenor |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD) |

2.0 bn |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

|

Years to Maturity |

0.4 |

4.1 |

24.1 |

3.4 |

8.4 |

10.4 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

1-Jan-24 |

13.6% |

9.8% |

10.2% |

10.1% |

9.9% |

9.5% |

|

2-Jan-24 |

14.2% |

10.0% |

10.3% |

10.3% |

10.0% |

9.6% |

|

11-Jan-24 |

14.7% |

10.2% |

10.4% |

10.7% |

10.1% |

9.8% |

|

12-Jan-24 |

14.1% |

10.0% |

10.3% |

10.5% |

10.0% |

9.6% |

|

15-Jan-24 |

14.2% |

10.2% |

10.4% |

10.7% |

10.1% |

9.7% |

|

16-Jan-24 |

14.2% |

10.2% |

10.4% |

10.7% |

10.1% |

9.7% |

|

17-Jan-24 |

14.8% |

10.4% |

10.5% |

10.9% |

10.2% |

9.9% |

|

18-Jan-24 |

14.3% |

10.2% |

10.4% |

10.7% |

10.1% |

9.7% |

|

Weekly Change |

(0.4%) |

(0.1%) |

0.0% |

0.0% |

0.0% |

0.0% |

|

MTD Change |

0.8% |

0.4% |

0.2% |

0.6% |

0.2% |

0.2% |

|

YTD Change |

0.8% |

0.4% |

0.2% |

0.6% |

0.2% |

0.2% |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling depreciated against the US Dollar by 0.3% to close at Kshs 160.3, from Kshs 159.9 recorded the previous week. On a year-to-date basis, the shilling has depreciated by 2.1% against the dollar, adding to the 26.8% depreciation recorded in 2023. We expect the shilling to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 3.5% of GDP in Q3’2023 from 6.4% recorded in a similar period in 2022,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.1% of Kenya’s external debt was US Dollar denominated as of June 2023, and,

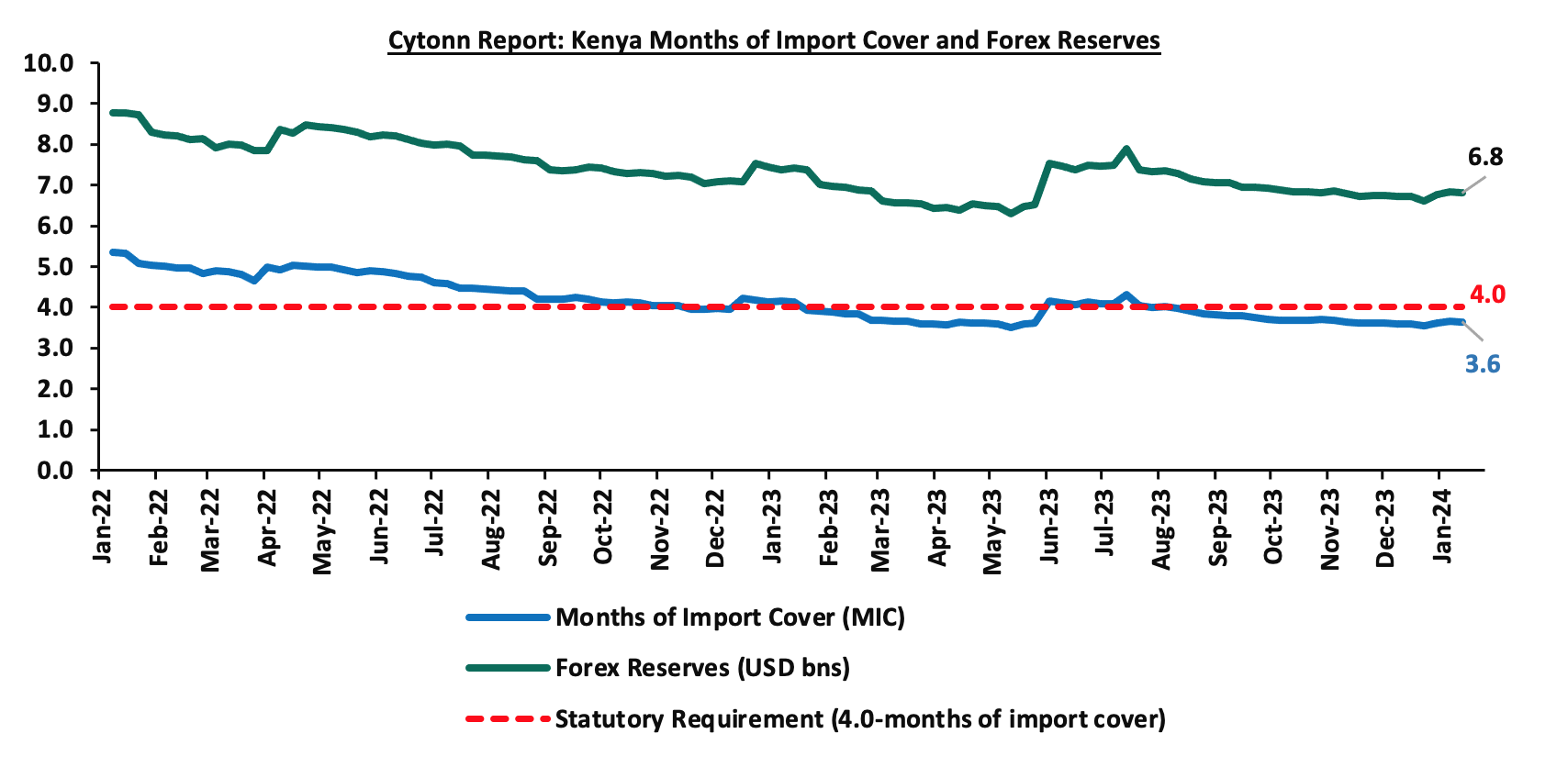

- Dwindling forex reserves, currently at USD 6.8 mn (equivalent to 3.6 months of import cover), which is below the statutory requirement of maintaining at least 4.0 months of import cover.

The shilling is however expected to be supported by:

- Diaspora remittances standing at a cumulative USD 3,817.4 mn as of November 2023, 4.0% higher than the USD 3,670.6 mn recorded over the same period in 2022, which has continued to cushion the shilling against further depreciation. In the November 2023 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 57.2% in the period, and,

- The tourism inflow receipts which came in at USD 333.9 mn in 2023, a 24.6% increase from USD 268.1 mn inflow receipts recorded in 2022, and tourist arrivals improved by 34.1% in the 12 months to October 2023, compared to a similar period in 2022.

Key to note, Kenya’s forex reserves decreased marginally by 0.2% during the week to USD 6.81, from USD 6.83 bn recorded the previous week, equivalent to 3.6 months of import cover lower than 3.7 months of import cover recorded the previous week, and remained below the statutory requirement of maintaining at least 4.0 months of import cover. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights:

- International Monetary Fund (IMF) Loan facility

During the week, The Executive Board of the International Monetary Fund (IMF) concluded the 2023 Article IV consultation with Kenya together with the sixth reviews and augmentations of access of USD 941.2 mn (Kshs 151.3 bn) under the Extended Fund Facility (EFF) and the Extended Credit Facility (ECF) arrangements, and the first review under the 20-month Resilience and Sustainability Facility (RSF) arrangement, approved in July 2023.

This follows discussions held in November 2023 where the IMF Executive Board reached staff-level agreements with the Kenyan authorities for the sixth reviews of Kenya’s economic program supported by the IMF’s Extended Fund Facility (EFF) and Extended Credit Facility (ECF), and the first Review under the Resilience Sustainability Facility (RSF). Notably, the discussions considered Kenya’s request for an augmentation under the EFF/ECF arrangement and the RSF, leading to a potential total commitment of more than USD 4.4 bn (Kshs. 707.1 bn) over the program's duration.

The Board’s decision allows for the immediate disbursement of USD 624.5 mn (Kshs 100.4 bn) under the EFF/ECF arrangements - which includes an augmentation of access of USD 310.6 mn (Kshs 50.0 bn) - and brings total disbursements under the EFF/ECF arrangements to USD 2.7 bn (Kshs 431.1 bn). The approval also allows for an immediate disbursement of USD 60.2 mn (Kshs 9.7 bn) under the RSF arrangement, taking the total disbursement under this program to USD 60.2 mn (Kshs 9.7 bn).

In conducting reviews, the Executive Board approved changes to program conditions. The Board granted waivers to the country for not meeting the continuous performance criterion on avoiding new external arrears by End-June 2023 and End-December 2023 tax revenue targets. These waivers were given based on corrective actions taken by the authorities. Additionally, a waiver of applicability was approved for all other End-December 2023 performance criteria.

While concluding the review, the IMF commended Kenya’s Monetary Policy stating that it has demonstrated its ability to react to inflation shocks and anchor expectations. The IMF added that the strengthening of the monetary policy framework would support price stability and external sustainability and that the exchange rate should be allowed to respond flexibly to market conditions. However, the IMF noted that emerging vulnerabilities in the banking system need close monitoring.

|

Cytonn Report: International Monetary Fund (IMF) EFF and ECF Financing Programme |

||

|

Date |

Amount Received (USD mn) |

Amount Received (Kshs bn, 1 USD = Kshs 160.8) |

|

Apr-21 |

307.5 |

49.4 |

|

Jun-21 |

407.0 |

65.4 |

|

Dec-21 |

258.1 |

41.5 |

|

Jul-22 |

235.6 |

37.9 |

|

Nov-22 |

433.0 |

69.6 |

|

Jul-23 |

415.4 |

66.8 |

|

Jan-24 |

624.5 |

100.4 |

|

Total Amount Received |

2,681.1 |

431.1 |

|

Amount Pending |

1,198.9 |

192.8 |

|

*Expected funds upon IMF management and executive board disbursement |

||

The disbursements will come as a reprieve as Kenya is grappling with acute liquidity challenges amid uncertainty over its ability to access funding from financial markets before a USD 2.0 bn (Kshs 321.4 bn) Eurobond matures in June. The government has stated that the funds expected from the World Bank and regional banks like the African Export-Import Bank and Trade & Development Bank, coupled with the IMF funds will help Kenya to pay the looming foreign debt maturity without running down its hard currency reserves. Kenya's balance of payments and financial positions have also been strained by the legacy of the COVID-19 pandemic and frequent climate change-induced droughts, according to the IMF, while its shilling currency has weakened. Additionally, the loan disbursement will support the country’s Medium Term Debt Strategy, which aims to optimize the use of concessional loans and reduce the use of the costly commercial loans, and the new administration’s plans to cut public expenditure to reduce the budget deficit.

- Revenue and Net Expenditures for FY’2023/2024

The National Treasury gazetted the revenue and net expenditures for the sixth month of FY’2023/2024, ending 29th December 2023. Below is a summary of the performance:

|

Cytonn Report: FY'2023/2024 Budget Outturn - As at 29th December 2023 |

||||||

|

Amounts in Kshs bns unless stated otherwise |

||||||

|

Item |

12-months Original Estimates |

Revised Estimates |

Actual Receipts/Release |

Percentage Achieved of the Revised Estimates |

Prorated |

% achieved of the Prorated |

|

Opening Balance |

2.6 |

|||||

|

Tax Revenue |

2,495.8 |

2,495.8 |

1,050.8 |

42.1% |

1,247.9 |

84.2% |

|

Non-Tax Revenue |

75.3 |

80.9 |

38.7 |

47.8% |

40.5 |

95.6% |

|

Total Revenue |

2,571.2 |

2,576.8 |

1,092.1 |

42.4% |

1,288.4 |

84.8% |

|

External Loans & Grants |

870.2 |

849.8 |

78.5 |

9.2% |

424.9 |

18.5% |

|

Domestic Borrowings |

688.2 |

851.9 |

269.7 |

31.7% |

425.9 |

63.3% |

|

Other Domestic Financing |

3.2 |

3.2 |

3.5 |

111.1% |

1.6 |

222.2% |

|

Total Financing |

1,561.6 |

1,704.9 |

351.8 |

20.6% |

852.4 |

41.3% |

|

Recurrent Exchequer issues |

1,302.8 |

1,360.1 |

561.0 |

41.2% |

680.1 |

82.5% |

|

CFS Exchequer Issues |

1,963.7 |

2,078.8 |

667.9 |

32.1% |

1,039.4 |

64.3% |

|

Development Expenditure & Net Lending |

480.8 |

457.2 |

70.4 |

15.4% |

228.6 |

30.8% |

|

County Governments + Contingencies |

385.4 |

385.4 |

142.5 |

37.0% |

192.7 |

73.9% |

|

Total Expenditure |

4,132.7 |

4,281.6 |

1,441.8 |

33.7% |

2,140.8 |

67.3% |

|

Fiscal Deficit excluding Grants |

1,561.6 |

1,704.9 |

349.7 |

20.5% |

852.4 |

41.0% |

|

Total Borrowing |

1,558.4 |

1,701.7 |

348.2 |

20.5% |

850.8 |

40.9% |

Amounts in Kshs bns unless stated otherwiseThe Key take-outs from the release include;

- Total revenue collected as at the end of December 2023 amounted to Kshs 1,092.1 bn, equivalent to 42.4% of the revised estimates of Kshs 2,576.8 bn for FY’2023/2024 and is 84.8% of the prorated estimates of Kshs 1,288.4 bn. Cumulatively, tax revenues amounted to Kshs 1,050.8 bn, equivalent to 42.1% of the revised estimates of Kshs 2,495.8 bn and 84.2% of the prorated estimates of Kshs 1,247.9 bn,

- Total financing amounted to Kshs 351.8 bn, equivalent to 20.6% of the revised estimates of Kshs 1,704.9 bn and is equivalent to 41.3% of the prorated estimates of Kshs 852.4 bn. Additionally, domestic borrowing amounted to Kshs 269.7 bn, equivalent to 31.7% of the revised estimates of Kshs 851.9 bn and is 63.3% of the prorated estimates of Kshs 425.9 bn,

- The total expenditure amounted to Kshs 1,441.8 bn, equivalent to 33.7% of the revised estimates of Kshs 4,281.6 bn, and is 67.3% of the prorated target expenditure estimates of Kshs 2,140.8 bn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 561.0 bn, equivalent to 41.2% of the revised estimates of Kshs 1,360.1 and 82.5% of the prorated estimates of Kshs 680.1 bn,

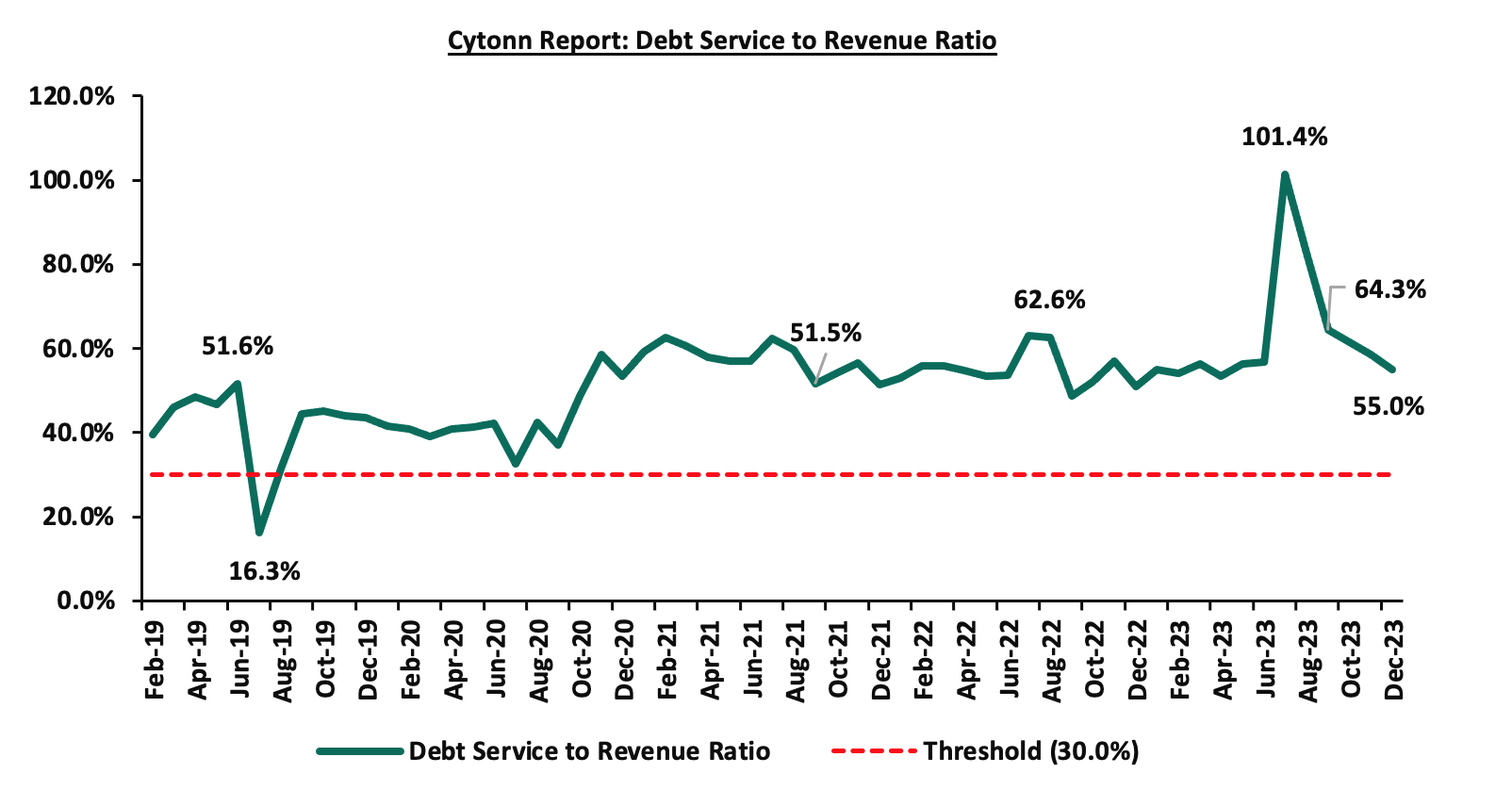

- Consolidated Fund Services (CFS) Exchequer issues came in at Kshs 667.9 bn, equivalent to 32.1% of the revised estimates of Kshs 2,078.8 bn, and are 64.3% of the prorated amount of Kshs 1.039.4 bn. The cumulative public debt servicing cost amounted to Kshs 600.7 bn which is 32.2% of the revised estimates of Kshs 1,866.0 bn, and is 64.4% of the prorated estimates of Kshs 933.0 bn. Additionally, the Kshs 600.7 bn debt servicing cost is equivalent to 55.0% of the actual revenues collected as at the end of December 2023. The chart below shows the debt serving to revenue ratio;

- Total Borrowings as at the end of December 2023 amounted to Kshs 348.2 bn, equivalent to 20.5% of the revised estimates of Kshs 1,701.7 bn for FY’2023/2024 and are 40.9% of the prorated estimates of Kshs 850.8 bn. The cumulative domestic borrowing of Kshs 851.9 bn comprises of Net Domestic Borrowing Kshs 471.4 bn and Internal Debt Redemptions (Rollovers) Kshs 380.5 bn.

December’s 84.8% attainment of the revenue target is a 2.6%-points improvement from the performance in November where the government achieved 82.2% of the revenue targets. This improvement can be attributed to the improved business environment evidenced by the increase in the Purchasing Manager’s Index which came in at 48.8, up from 45.8 in November 2023. However, the government's continued failure to achieve its prorated revenue targets for the sixth consecutive month in FY’2023/2024 reflects the challenges posed by the tough economic situation. The revenue collection continues to be impeded by the sustained depreciation of the Kenya shilling as well as the business environment which remains difficult despite showing signs of improvement. We believe that the performance of revenue collection in the coming months will be largely determined by how soon the country’s business environment stabilizes. Notably, the government continues to implement strategies to enhance revenue collection, such as expanding the revenue base and addressing tax leakages, as well as suspending tax relief payments.

Rates in the Fixed Income market have been on an upward trend given the continued high demand for cash by the government and the occasional liquidity tightness in the money market. The government is 34.1% behind of its prorated net domestic borrowing target of Kshs 265.5 bn, having a net borrowing position of Kshs 175.1 bn out of the domestic net borrowing target of Kshs 471.4 bn for the FY’2023/2024. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to maintain the fiscal surplus through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the week, the equities market was on an upward trajectory, with NASI gaining the most by 0.6%, while NSE 20, NSE 25, and NSE 10 gained by 0.2%, 0.5%, and 0.4% respectively; taking the YTD performance to gains of 1.5%, 0.5%, 1.8% and 1.7% for NASI, NSE 20, NSE 25 and NSE 10, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Bamburi, Equity Group, and Standard Chartered Bank of 6.0%, 2.0%, and 1.9% respectively. The gains were, however, weighed down by losses recorded by large-cap stocks such as EABL, Stanbic, and KCB of 1.7%, 1.6%, and 1.4% respectively.

During the week, equities turnover decreased by 10.2% to USD 3.8 mn from USD 4.3 mn recorded the previous week, taking the YTD total turnover to USD 9.7 mn. Foreign investors became net sellers for the second consecutive week, with a net selling position of USD 0.04 mn, from a net selling position of USD 0.6 mn recorded the previous week, taking the YTD foreign net selling position to USD 0.5 mn.

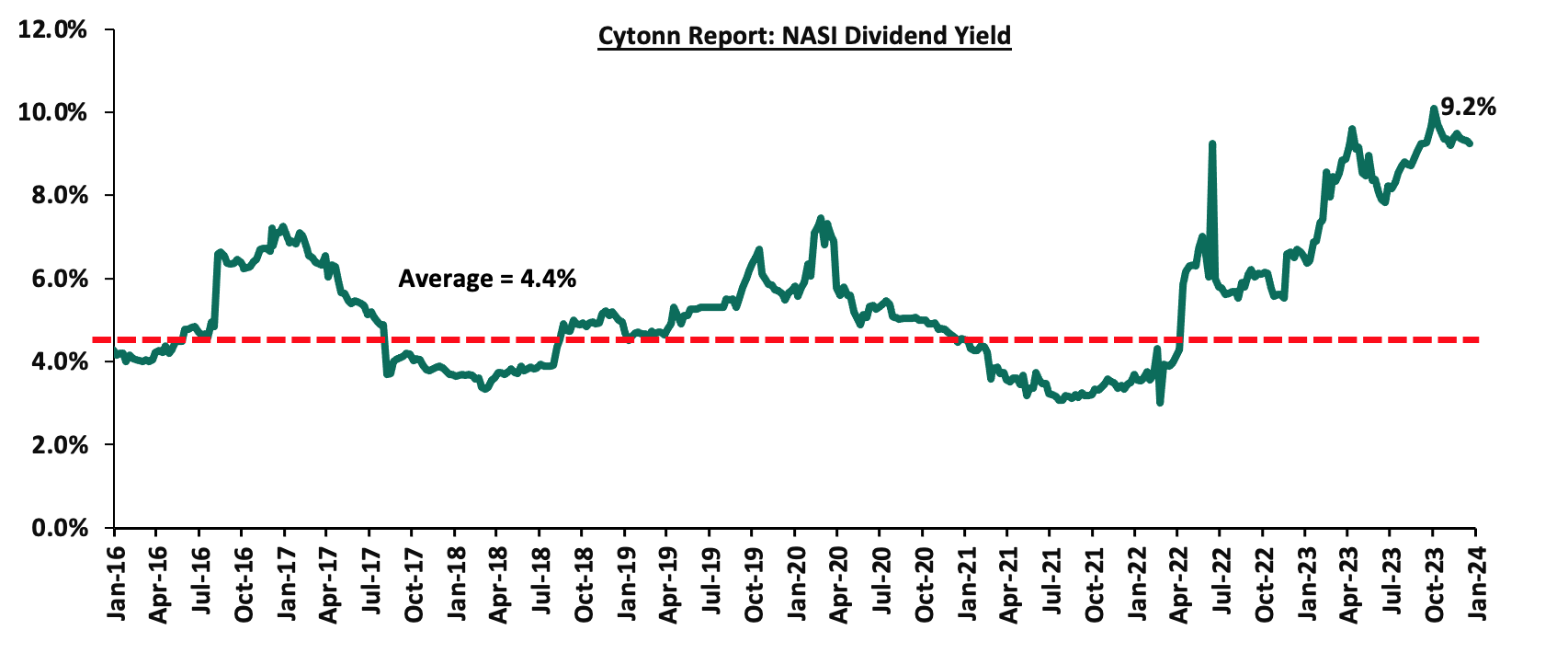

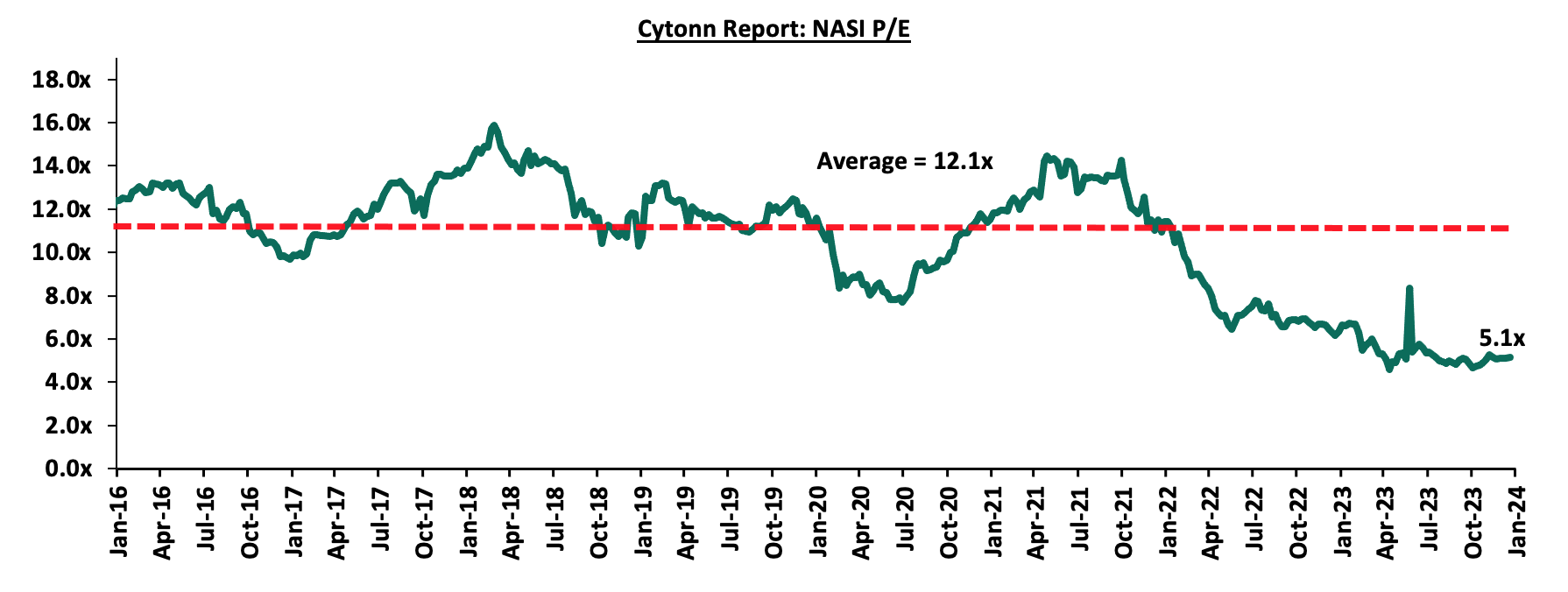

The market is currently trading at a price-to-earnings ratio (P/E) of 5.1x, 57.5% below the historical average of 12.1x. The dividend yield stands at 9.2%, 4.8% points above the historical average of 4.4%. Key to note, NASI’s PEG ratio currently stands at 0.7x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Universe of Coverage |

|||||||||

|

Company |

Price as at 12/01/2024 |

Price as at 19/01/2024 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

KCB Group*** |

22.0 |

21.7 |

(1.4%) |

(1.1%) |

31.2 |

9.2% |

53.0% |

0.4x |

Buy |

|

Kenya Reinsurance |

2.0 |

1.9 |

(4.6%) |

0.5% |

2.5 |

10.8% |

45.7% |

0.1x |

Buy |

|

Jubilee Holdings |

180.0 |

190.0 |

5.6% |

2.7% |

260.7 |

6.3% |

43.5% |

0.3x |

Buy |

|

Diamond Trust Bank*** |

44.8 |

44.8 |

0.0% |

0.0% |

58.5 |

11.2% |

41.9% |

0.2x |

Buy |

|

I&M Group*** |

17.5 |

17.5 |

0.0% |

0.3% |

22.1 |

12.9% |

39.1% |

0.4x |

Buy |

|

ABSA Bank*** |

11.3 |

11.5 |

1.8% |

(0.4%) |

14.6 |

11.7% |

38.7% |

0.9x |

Buy |

|

NCBA*** |

37.8 |

38.0 |

0.5% |

(2.2%) |

48.3 |

11.2% |

38.3% |

0.8x |

Buy |

|

Sanlam |

6.0 |

7.6 |

26.7% |

26.7% |

10.3 |

0.0% |

35.4% |

2.1x |

Buy |

|

Co-op Bank*** |

11.3 |

11.4 |

0.9% |

0.0% |

13.8 |

13.2% |

34.8% |

0.5x |

Buy |

|

Stanbic Holdings |

111.8 |

110.0 |

(1.6%) |

3.8% |

132.8 |

11.5% |

32.2% |

0.8x |

Buy |

|

Equity Group*** |

35.8 |

36.5 |

2.0% |

6.7% |

42.8 |

11.0% |

28.2% |

0.8x |

Buy |

|

Standard Chartered*** |

161.0 |

164.0 |

1.9% |

2.3% |

185.5 |

13.4% |

26.5% |

1.1x |

Buy |

|

CIC Group |

2.3 |

2.1 |

(6.2%) |

(7.4%) |

2.5 |

6.1% |

24.1% |

0.7x |

Buy |

|

Liberty Holdings |

5.0 |

5.2 |

3.6% |

34.2% |

5.9 |

0.0% |

14.3% |

0.4x |

Accumulate |

|

Britam |

5.1 |

5.5 |

7.4% |

7.0% |

6.0 |

0.0% |

8.5% |

0.8x |

Hold |

|

HF Group |

3.4 |

3.7 |

8.2% |

7.0% |

3.9 |

0.0% |

5.7% |

0.2x |

Hold |

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently being undervalued to its future growth (PEG Ratio at 0.7x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors' sell-offs to continue weighing down the equities outlook in the short term.

- Industry Report

During the week, the Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) November 2023 Report which highlighted the performance of major economic indicators. Key highlights related to the Real Estate sector include;

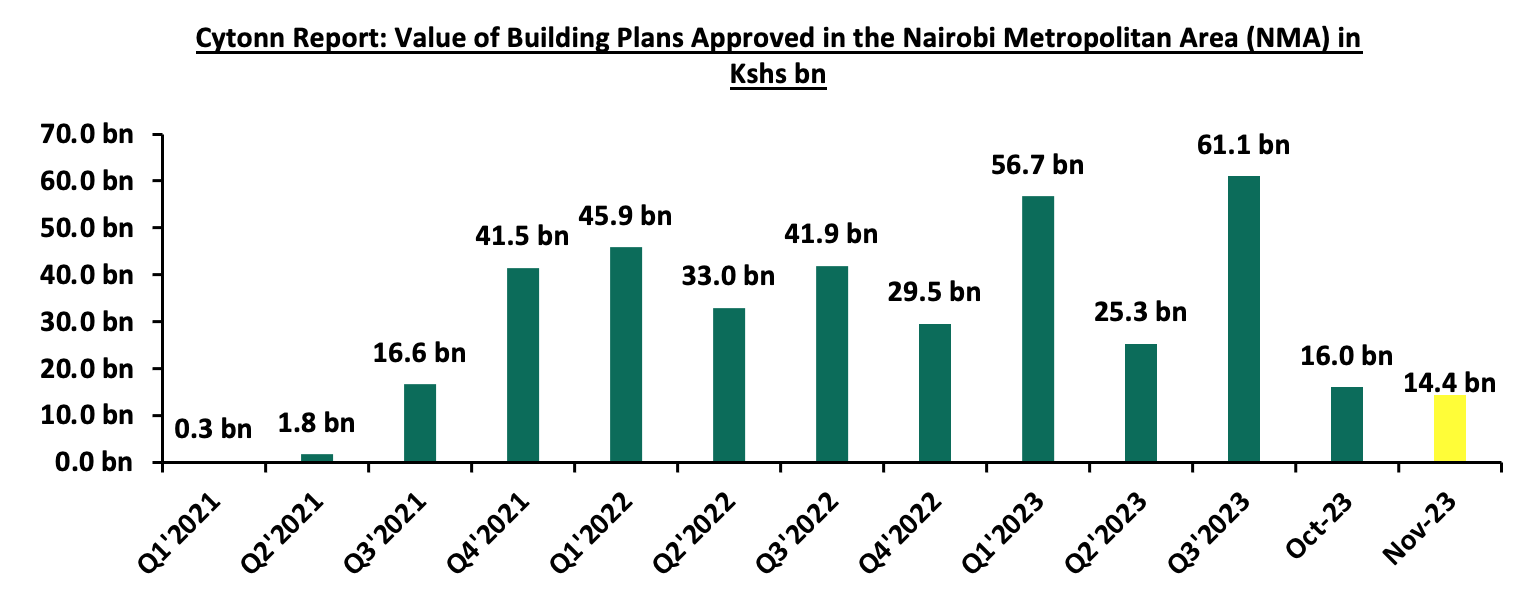

- In the month of November, the value of building plans approved in the Nairobi Metropolitan Area decreased by 10.4% to Kshs 14.4 bn from Kshs 16.1 bn in October 2023. On a y/y basis, the value of approved building plans in the NMA increased by 29.4% to Kshs 173.5 bn as at November, from Kshs 134.1 bn recorded during a similar period last year. This was attributable to the clearing of a large number of pending approvals by the Nairobi County Government, and sustained demand for Real Estate development facilitated by positive demographics which are above global averages. The chart below shows the trend in the value of approved building plans in Kenya between Q1’2021 and November 2023;

Source: Kenya National Bureau of Statistics (KNBS)

Moving forward, we anticipate the Real Estate sector in Kenya will observe positive growth and enhanced performance primarily due to; i) a surge in visitor arrivals following the government's initiative for visa-free entry, expected to boost the hospitality industry by increasing room and bed occupancies, ii) improved access to financing, indicated by a 6.2% year-on-year rise in gross loans extended to the Real Estate sector, reaching Kshs 495.0 bn in Q2’2023, up from Kshs 466.0 bn in Q2’2022, and, iii) sustained demand for Real Estate development, driven by favorable population demographics exceeding global averages. Nevertheless, challenges are expected, including; i) heightened construction costs amid rising inflation, ii) oversupply concerns in specific Real Estate segments, and, iii) increased credit risk due to a 20.9% surge in gross Non-Performing Loans (NPLs) in the Real Estate sector, reaching Kshs 96.0 bn in Q2’2023, up from Kshs 79.4 bn in Q2’2022, potentially impeding the sector's optimal performance.

- Residential Sector

During the week, President Ruto laid the foundation stone for the Emgwen Affordable Housing Project in Chesumei Sub-County, Nandi County. The project will comprise 220 units incorporating studio, one, two, and three-bedroom typologies, a well-designed landscape, adequate parking, an underground tank and pavement for pedestrian use. There will also be solar lighting in the common areas, adequate rainwater harvesting resources, the use of greywater harvesting, adequate green spaces, and trees in the social areas within the development. Development of the project shall be in compliance with Edge Certification and will be on a 6.4-acre piece of land. The tables below give a summary of the unit types, sizes, and prices for the project;

|

Cytonn Report: Emgwen Affordable Housing Project-Affordable Housing |

||||

|

Typology |

Size (SQM) |

Price (Kshs in mns) |

Price per SQM |

Monthly Payment |

|

Studio |

20 |

0.9 |

46,000 |

5,200 |

|

1-bedroom |

30 |

1.0 |

33,333 |

5,200 |

|

2-bedroom |

40 |

1.9 |

48,000 |

10,400 |

|

3-bedroom |

60 |

2.9 |

48,000 |

15,600 |

|

Average |

38 |

1.7 |

43,833 |

9,100 |

Source: Boma Yangu

Upon implementation, the project will create approximately 3,500 jobs, both direct and indirect. The project will also assist in stimulating economic activities in the surrounding area as Jua Kali artisans will be engaged to produce 1,200 doors valued at Kshs 26.0 mn. Other affordable housing projects launched recently include the Kapsuswa and Pioneer affordable housing projects in Uasin Gishu County and Nanyuki Affordable housing project in Laikipia County.

We expect the project will; i) improve the living standards of the residents through the provision of decent, quality housing, ii) boost housing supply in Nandi County, iii) help curb land fragmentation in the county, iv) contribute towards the bridging of the existing housing deficit in the country which stands at 2.0 mn units, and, v) boost homeownership rates in the country which have remained significantly low at 21.3% in urban areas as at 2023, compared to other African countries like South Africa and Ghana with 53.0% and 54.0% urban home ownership rates respectively.

- Regulated Real Estate Funds

- Real Estate Investments Trusts (REITs)

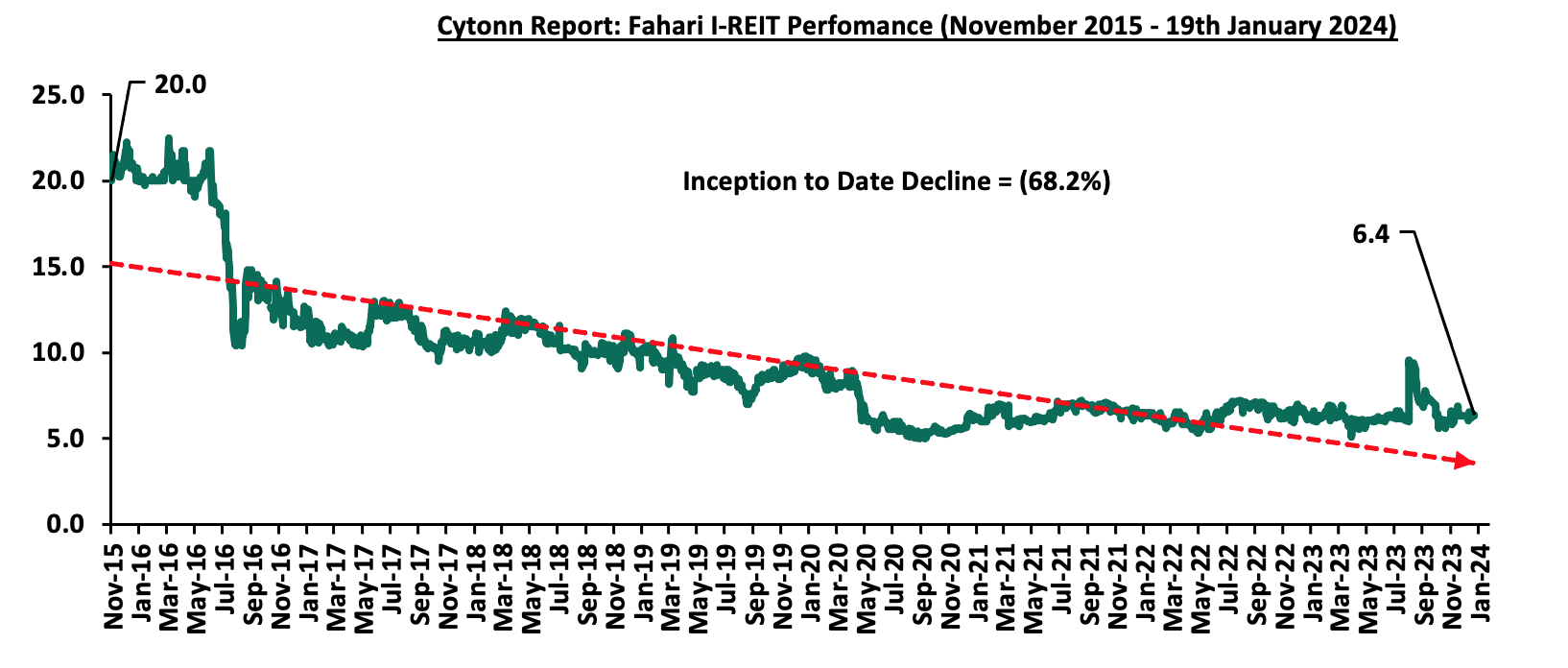

In the Nairobi Securities Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.4 per share. The performance represents a 0.3% gain from Kshs 6.3 per share recorded last week, taking it to a 1.0% Year-to-Date (YTD) gain from Kshs 6.3 per share recorded on 2nd January 2023. Additionally, the performance represents a 68.2% Inception-to-Date (ITD) loss from the Kshs 20.0 price. The dividend yield currently stands at 10.2%. The graph below shows Fahari I-REIT’s performance from November 2015 to 19th January 2024;

In the Unquoted Securities Platform Acorn D-REIT and I-REIT traded at Kshs 24.4 and Kshs 21.7 per unit, respectively, as of 19th January 2024. The performance represented a 22.0% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 30.7 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 633.8 mn, respectively, since inception in February 2021.

REITs provide various benefits like tax exemptions, diversified portfolios, and stable long-term profits. However, the continuous deterioration in performance of the Kenyan REITs and restructuring of their business portfolio is hampering major investments that had previously been made. The other general challenges include; i) inadequate comprehension of the investment instrument among investors, ii) prolonged approval processes for REITs creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and, iv) minimum investment amounts set at Kshs 5.0 mn, continue to limit the performance of the Kenyan REITs market.

- Cytonn High Yield Fund (CHYF)

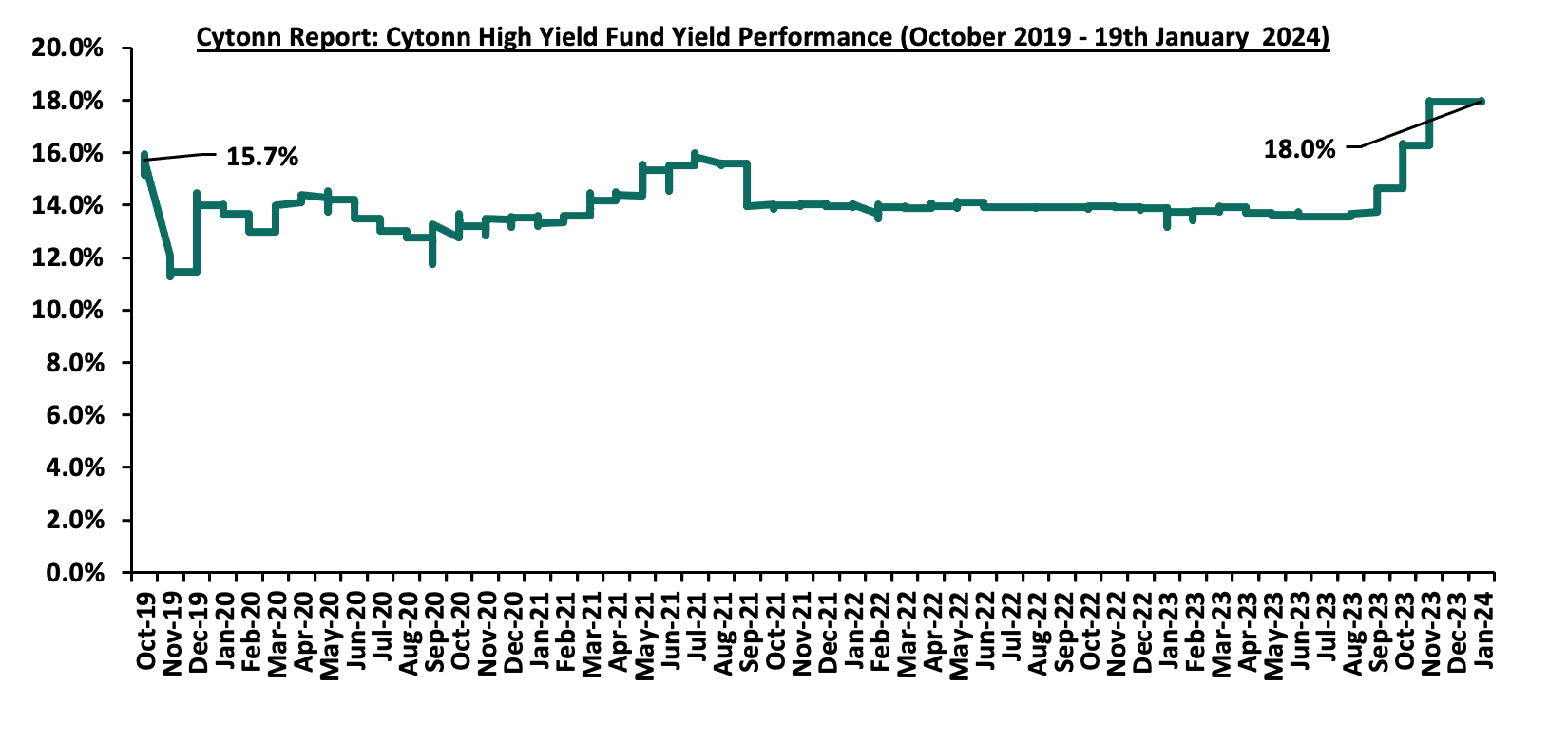

Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 18.0%, remaining relatively unchanged from the previous week and yield recorded on 1st January 2024, and represented a 2.3% points Inception-to-Date (ITD) increase from the 15.7% yield. The graph below shows Cytonn High Yield Fund’s performance from November 2019 to 19th January 2024;

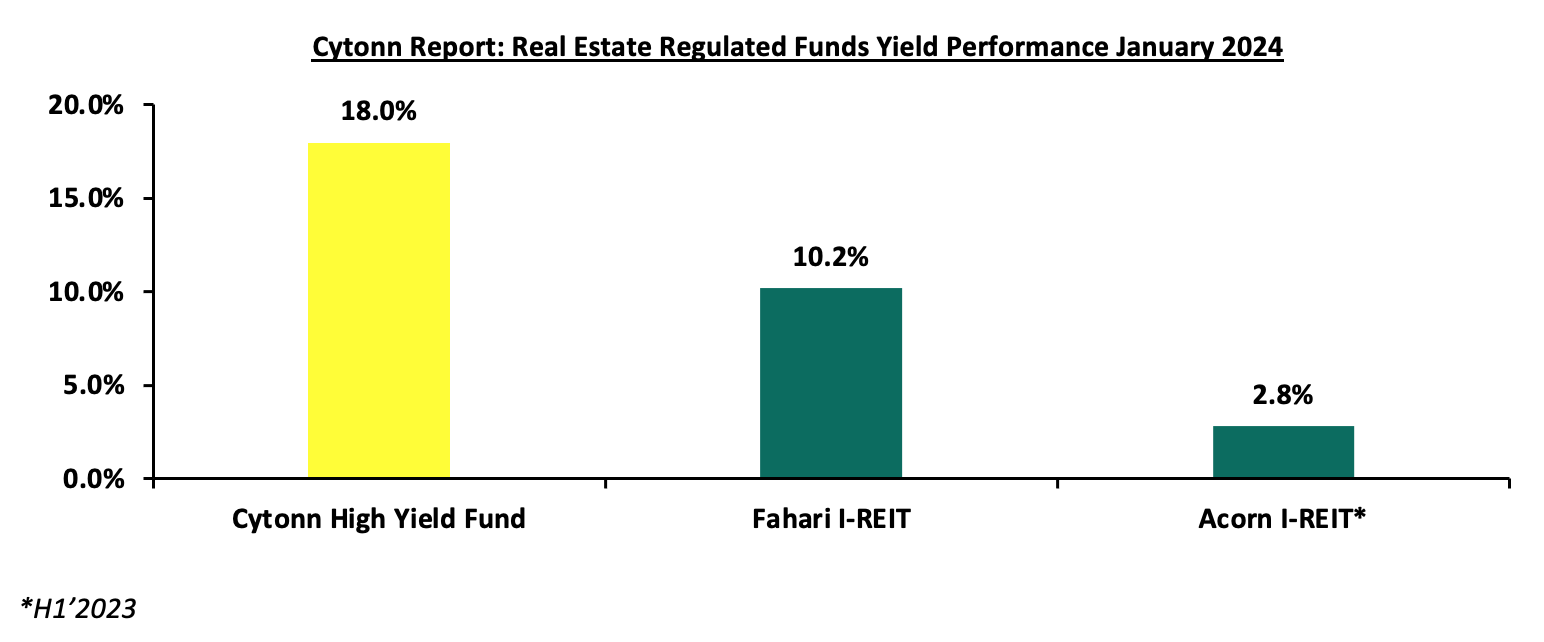

Notably, the CHYF has outperformed other regulated Real Estate funds with an annualized yield of 18.0%, as compared to Fahari I-REIT and Acorn I-REIT with yields of 10.2%, and 2.8% respectively. As such, the higher yields offered by CHYF makes the fund one of the best alternative investment resource in the Real Estate sector. The graph below shows the yield performance of the Regulated Real Estate Funds;

Source: Cytonn Research

We expect the performance of Kenya’s Real Estate sector to be driven by; i) sustained demand for Real Estate development, facilitated by positive demographics above global averages, ii) increased initiations of affordable housing projects across the country, iii) increased visitor arrivals into the country poised to boost the hospitality sector, and, iv) improved access to affordable financing. However, factors such as rising costs of construction, limited investor knowledge in REITs, and, existing oversupply in select Real Estate sectors will continue to hinder optimal performance of the sector by limiting developments and investments.

Over the years the Kenyan government has put its best foot forward towards delivering affordable housing to its citizens. The current regime, since assuming office, has shown consistent commitment to addressing the existing housing deficit in the country, integrating housing and settlement as one of the five pillars of its Bottom Up Economic Transformation Agenda(BETA). The plan envisages delivering 250,000 new homes annually and growing the number of mortgages from 30,000 to 1,000,000, thereby increasing the percentage of affordable housing supply from 2.0% to 50.0% by 2027.

The Affordable Housing Bill 2023 represents a strategic attempt by the government to develop a pool of resources geared towards the provision of affordable housing. The bill was first tabled in Parliament on 7th December, 2023 by the National Assembly Majority Leader Kimani Ichung’wa, to cure for the issues raised by the High Court. The fundamental concept of the bill is the contentious housing levy; first introduced in the Finance Bill 2023 under Section 84. In November 2023, the High Court rendered it a blow, terming it as unconstitutional, primarily for its opaqueness and discriminatory nature. The court’s decision was anchored on the grounds that the levy lacked a comprehensive legal framework, in violation of articles 10 and 201 of the Kenyan Constitution regarding principles of public finance. In addition, the Court noted that the levy was discriminatory in nature, since it would only be subjected to Kenyans in the formal sectors hence leaving out those in the informal sector.

In a race against time, the government, through the Majority Leader has sought to regularize the levy through the Affordable Housing Bill 2023. Simultaneously, the bill also seeks to iron out the fiscal grey areas that were pointed out by the court. Having already gone through the first reading, the bill is currently in the public participation stage. It seeks to mandatorily deduct 1.5% of an employee’s gross monthly salary and have a matching 1.5% contribution remitted by employers on behalf of each employee from their payroll on a monthly basis.

The bill has outlined its fundamental objectives as; i) to give the right to accessible and adequate housing, ii) to impose a levy to finance the provision of affordable housing and associated infrastructure, and, iii) provide a legal framework for the implementation of the affordable housing levy, programs and projects. Putting the above-mentioned into consideration, the government continues to demonstrate efforts in addressing the critical housing issue in the country. However, the bill comes against the backdrop of the High Court ruling and remains contentious especially because of the legality issues surrounding it. The anticipation of interesting developments implies potential legal complexities and uncertainties in the near future, with regard to the implementation and subsequent success of the levy in bridging the country’s housing gap. In our topical this week, we review the Affordable Housing Bill 2023 by covering the following;

- Overview of the Kenya’s Real Estate Sector,

- Current State of Housing in Kenya,

- Analysis of Affordable Housing Bill 2023, and,

- Conclusion and Recommendations.

Section I: Overview of Kenya’s Real Estate Sector

The Real Estate sector in Kenya has grown over the years to become one of the largest contributors to the country’s Gross Domestic Product (GDP), supported by factors such as; i) positive demographics including higher urbanization and population growth rates of 3.7% and 1.9% respectively, against global averages of 1.5% and 0.8%, ii) government’s sustained efforts to promote infrastructural development, opening up new areas for investments, iii) emphasis to provide affordable housing by the government through programs such as the Affordable Housing Program (AHP), iv) increased investment by both local and foreign investors, and, v) increased accessibility to low-interest loans provided by entities such as Kenya Mortgage Refinance Company (KMRC) among others.

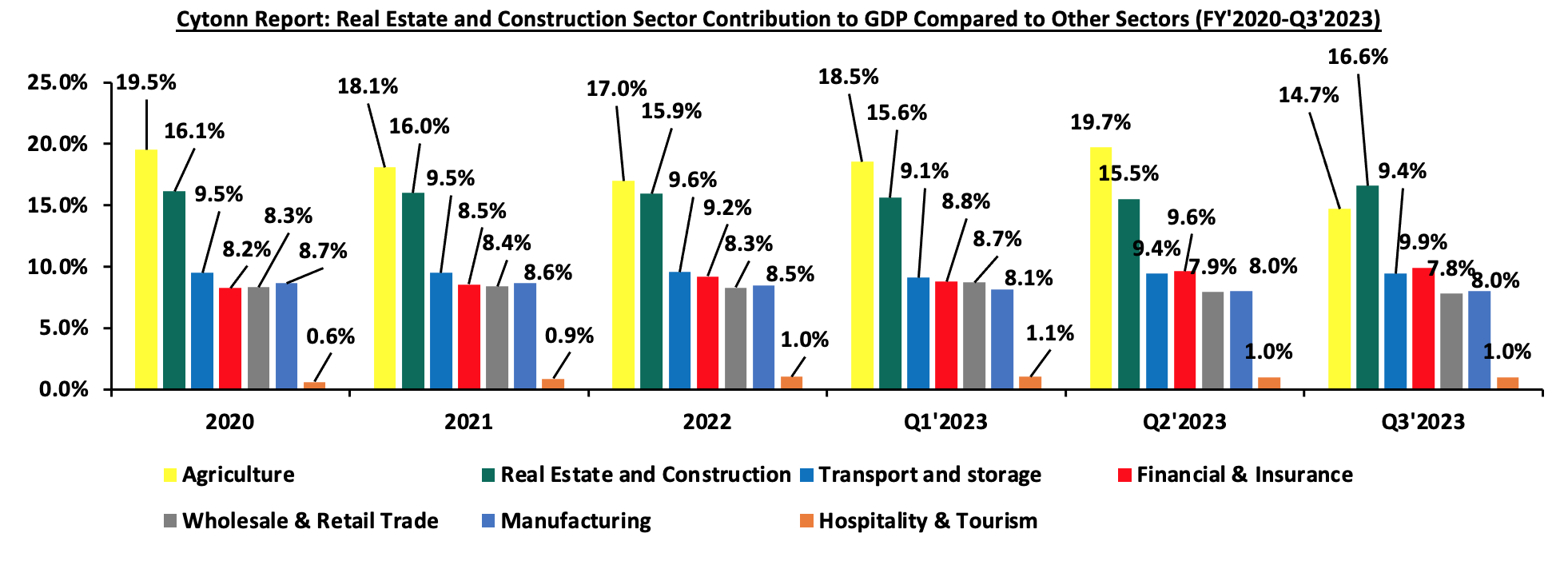

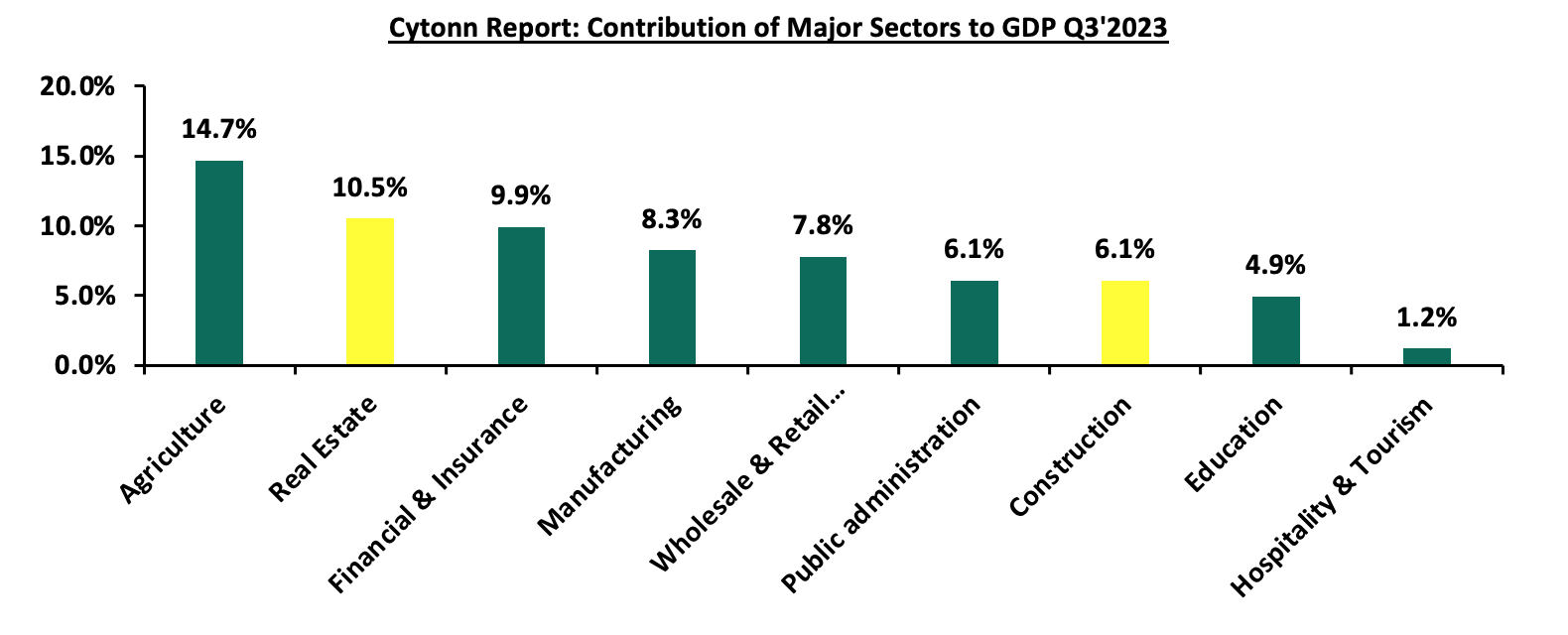

As we assess the growth in the Kenyan property market, it is imperative to recognize the growth achieved by the Real Estate sector, collaboratively with the construction sector, given their interdependence and inherent correlation. Construction and Real Estate sectors jointly contributed to 16.6% to the country’s GDP in Q3’2023, subsequently being the largest contributors. The performance surpassed major and perennial sector contributors including agriculture at 14.7%, transport at 9.4%, financial services and insurance at 9.9%, and

manufacturing which contributed 8.0%. The performance of the two sectors confirms their importance to the Kenyan economy, and additionally draws a positive outlook. The graph below shows the trend of the Real Estate and Construction sectors contribution to GDP between FY’2020 and Q3’2023;

Source: Kenya National Bureau of Statistics (KNBS)

Below is a graph highlighting the top sectoral contributors to GDP in Q3’2023;

Source: Kenya National Bureau of Statistics (KNBS)

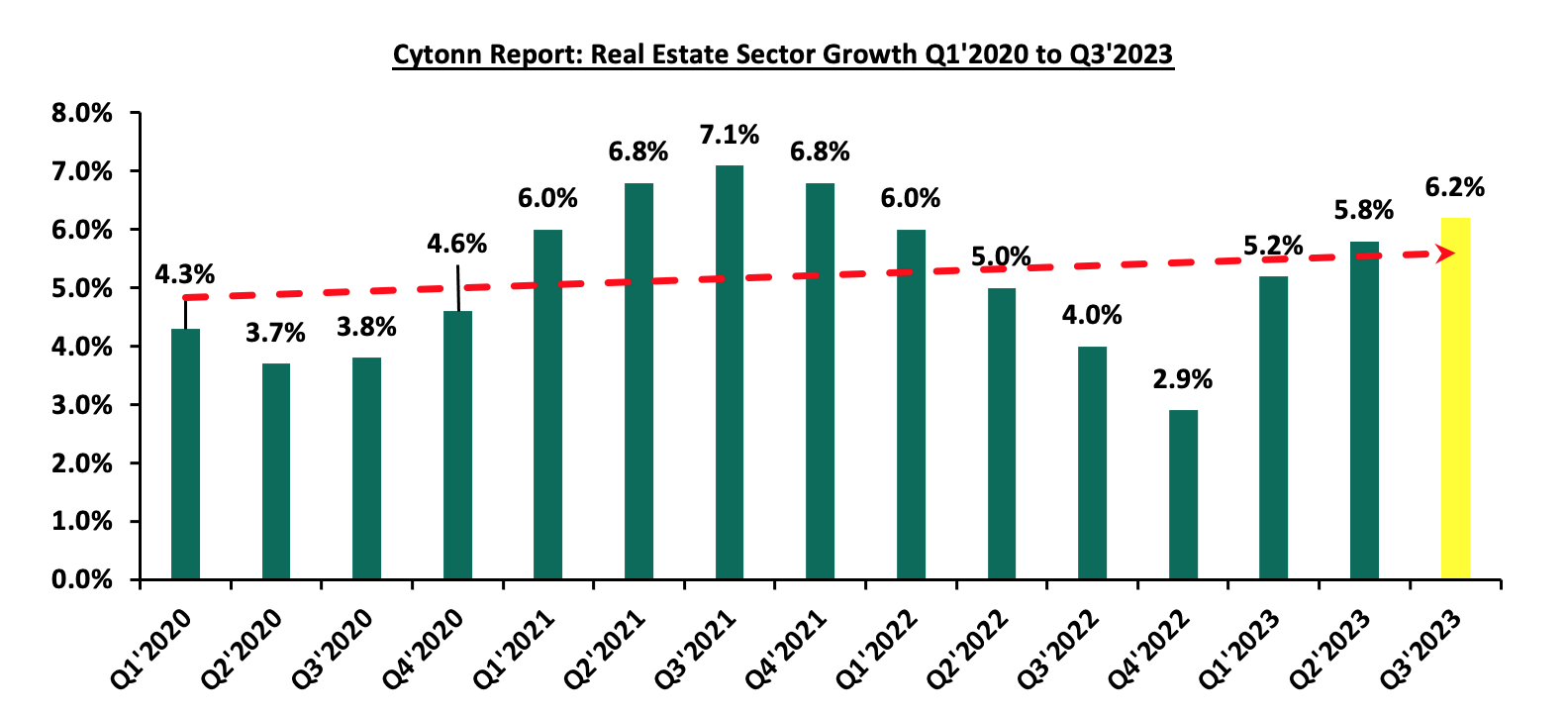

Despite the growth in the sector, the sector has also experienced some setbacks ranging from macro-economic factors to sector specific factors over the years. In FY’2020, the sector experienced the hardest shock from the unprecedented COVID-19 pandemic. However, the sector has since made a turnaround in FY’2021 as the business world embarked on reopening driven by mass administration of COVID-19 vaccine and ease of travel restrictions and lockdowns.

In 2022, however, the sector’s witnessed a turnaround in performance, reverting to a downward trajectory. Notably, the sector’s growth declined to 2.9% in Q4’2022 from 6.0% in Q4’2021, attributable to the August general elections. In the period leading to the elections, investors faced uncertainty as they assessed the country’s political environment. However, the electioneering period concluded peacefully which boosted investors’ confidence, and paved way for the resumption of business activities in 2023 as evidenced by the 5.2% growth rate recorded in Q1’2023.

We however note that the sector’s growth has been weighed down by other factors including an oversupply of 5.8 mn SQFT of commercial office space in the Nairobi Metropolitan Area (NMA), 3.3 mn SQFT in the NMA retail market, and 2.1 mn SQFT oversupply in the overall Kenyan retail market as at 2023, and harsh macro-economic environment. The graph below shows the Real Estate Sector Growth Rate between Q1’2020 and Q3’2023;

Source: Kenya National Bureau of Statistics (KNBS)

Section III: Current State of Housing in Kenya

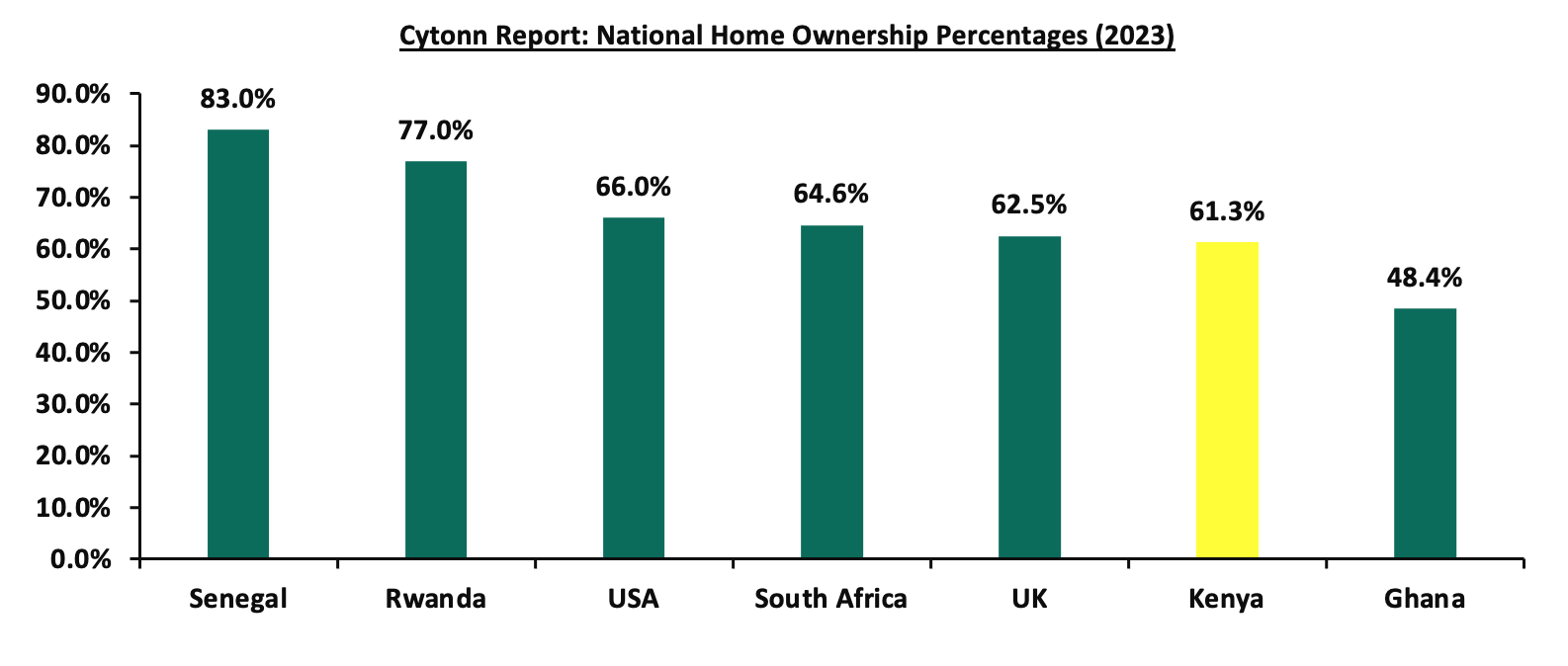

According to the Center for Affordable Housing Finance Africa (CAHF), the demand for buying property in Kenya is at 45.1%, compared to a 35.1% demand for renting, as of August 2023 indicating a strong inclination among Kenyans towards possessing their residences. Standalone properties and apartments exhibit higher preference, with their demand estimated at 27.6% and 26.7%, respectively. However, urban homeownership rates in Kenya have remained low at 21.3%. This translates to a renter population of 78.7%, out of which, 89.0% of the existing and incoming supply is estimated to be delivered entirely by the private sector.

On a national scale, Kenya’s home ownership rate stands at 61.3%, albeit significantly higher than urban homeownership rates. Nevertheless, it remains lower than other African countries such as Senegal, Rwanda and South Africa with 83.0%, 77.0% and 64.6% respectively. The graph below shows national home ownership percentages of other countries as compared to Kenya;

Source: Centre for Affordable Housing Africa, US Census Bureau, United Kingdom Office for National Statistics

Additionally, the Centre for Affordable Housing Africa reports that Kenya faces an annual housing deficit of 200,000 units, exacerbating the existing shortage estimated a 2.0 mn units. While the demand stands at 250,000 units, both private developers and government cumulatively supply merely 50,000 units annually, with the low-income group severely underserved, allocated only 2.0% of the constructed units. The Government of Kenya, in December 2017, launched the Affordable Housing Program (AHP), as part of the Big Four Agenda, aimed towards tackling the housing deficit issue. It planned to deliver 500,000 low-cost housing units in 5 years. Since then, the government has further initiated the 200 Units per Constituency Program in an effort to localize the Affordable Housing Program and stimulate local economic growth while contributing to the Bottom Up Economic Transformation Agenda (BETA). The initiative has resulted in the following achievements in the Kenyan housing market over the years as follows;

- Incentives to developers,

- Operationalization of the Kenya Mortgage Refinancing Company (KMRC) which aims to provide affordable mortgages,

- Launch of the Boma Yangu Platform where Kenyans can access the housing units,

- Legislation of the Affordable Housing Levy, and,

- Construction of Affordable and Social projects.

For more information on the above achievements, please see our topical on the Progress of Affordable Housing in Kenya 2023 Report. Despite the progress made by the Affordable Housing Program (AHP), the objectives have not been fully met as the project faces various limitations such as;

- High construction costs: In 2023, construction costs increased by 27.0% to an average of Kshs 71,200 per SQM from an average of Kshs 56,075 per SQM recorded in 2022, attributable to the price increase of key construction materials such as cement, steel, paint and aluminum. The increase in price is as a result of relatively high inflation which was at 6.6% in December 2023,

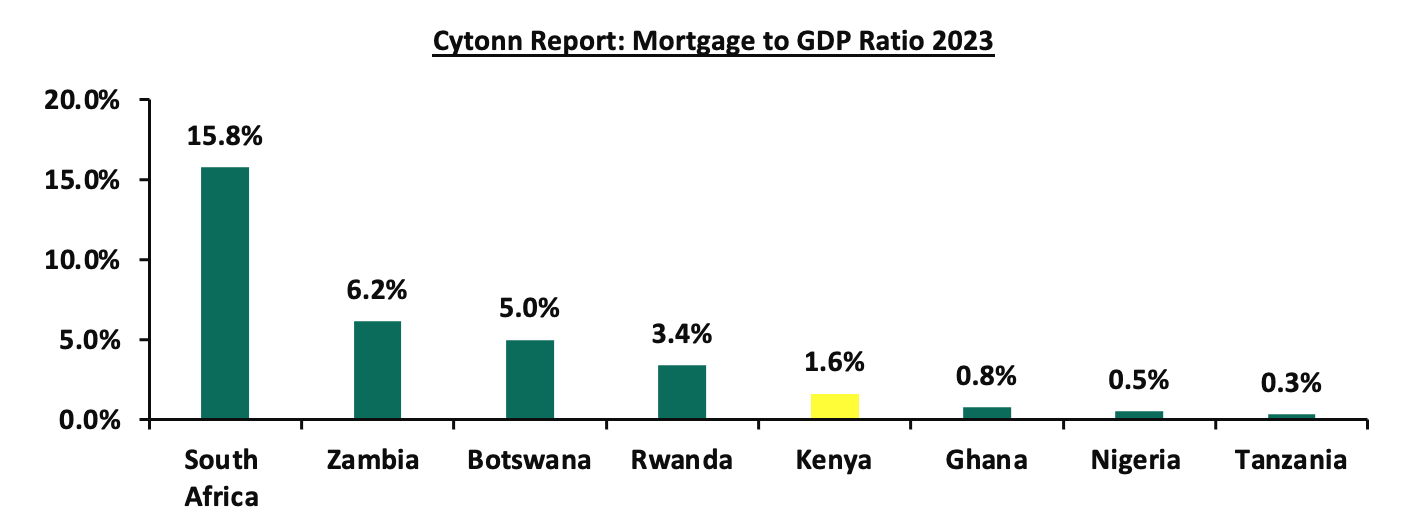

- Lack of access to affordable mortgages: Kenyans endure challenges while looking for financing to purchase homes due to high financing costs, which reduces the uptake of affordable homes and mortgages. As such, Kenya’s mortgage to GDP ratio continues to underperform at 1.6%, in comparison to other African countries such as South Africa, Zambia, Botswana and Rwanda at approximately 15.8%, 6.2%, 5.0%, and 3.4%. The graph below shows the mortgage to GDP ratio in Kenya in comparison with other African countries;

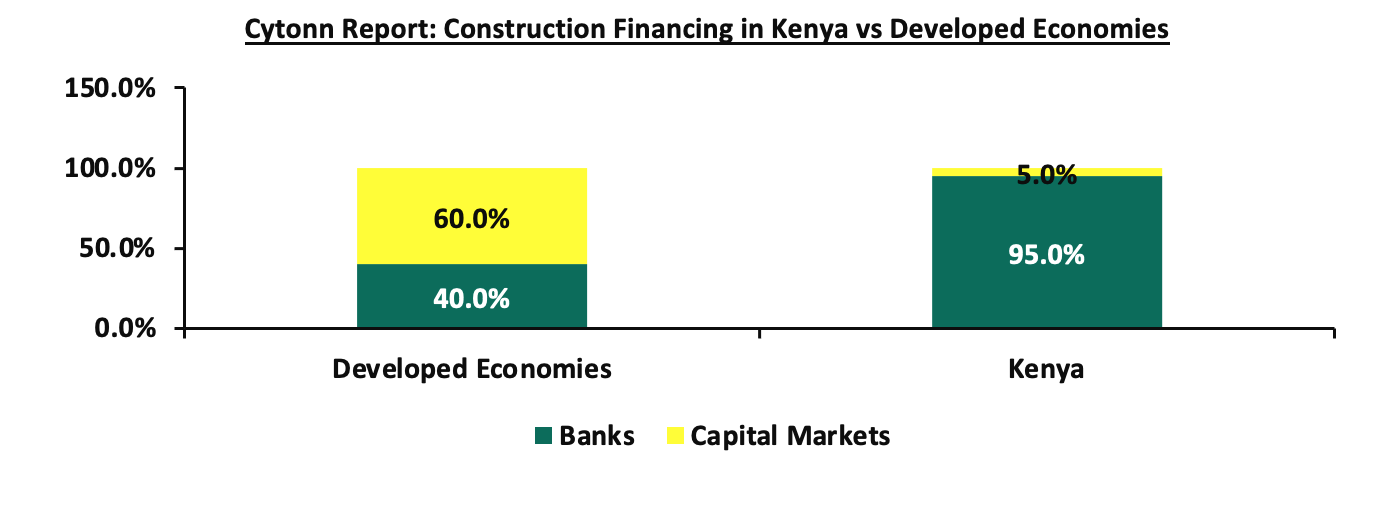

- Inadequate development financing: Lenders continue to tighten their lending requirements and demand more collateral from developers as a result of elevated credit risk in the Real Estate sector. This is evidenced by the 20.9% increase in gross Non-Performing Loans (NPLs) to Kshs 96.0 bn in H1’2023 from Kshs 79.4 bn recorded H1’2022. In addition, there is overreliance on banks for the expensive funding by private developers hence making it difficult to raise funds for affordable housing projects, unlike developed countries where capital markets account for majority of funding. The graph below shows the comparison of construction financing in Kenya against developed economies;

- Inadequate supply of serviced land: There is scarcity of affordable land serviced with support infrastructure such as water, sewerage and electricity necessary for development of affordable units. This is due to high land prices in urban areas with the average land prices in the NMA coming in at an average of Kshs 128.6 mn in FY’2023, and,

- Extended Timelines: Bureaucratic transaction timelines characterize property registration in Kenya, surpassing those of other African countries. The process takes an average of 159 days at an average cost of 2.8% of construction costs to obtain building permits. This is notably higher than countries such as Ghana, where the registration period is 10 days, ranging between a cost of 0.1% to 0.5%. These figures highlight the overall sluggish nature of processes in Kenya, indicating a need for improvement.

The Affordable Housing Levy

The Housing Levy was first introduced through the Finance Act of 2018, by way of amendments to the Employment Act, 2007. Under the levy, employers and employees were required to each make a contribution of 1.5% of the employee’s monthly basic salary to the Housing Fund, provided that the combined contribution did not exceed Kshs 5,000 per month. Persons who were not in formal employment or who were non-citizens were to contribute a minimum of Kshs 200 per month. The Fund was proposed to be under the control of the National Housing Corporation (NHC).

In September 2018, the Central Organization of Trade Unions (COTU) filed a suit, alongside lobby groups Consumer Federation of Kenya (Cofek) and the Federation of Kenya Employers (FKE) challenging the implementation of the housing levy which was set to take effect on 1st January 2019. COTU contested the implementation of the levy arguing it was unconstitutional and amounted to double taxation. The lobby groups also cited improper consultation of the policy by the government. This led to a court order suspending the implementation of the levy.

In March 2020, the Ministry of Housing set up several regulations regarding the structure and operations of the National Housing and Development Fund (NHDF) and presented the notice to the National Assembly in May for discussions and approval. Several key take outs from the notice were proposals to have; i) minimum monthly contribution of Kshs 200 to NHDF by all employees and employers who will be registered under the Fund, where the Kshs 100 was to be directed towards facilitating maintenance and operations of the Fund and the rest of Kshs 100 was to be directed to member’s housing fund accounts, ii) make the deductions voluntary and not mandatory as had previously been stated in the Finance Bill 2018, and, iii) providing full authority to the National Housing Corporation (NHC) in disbursement of loans to local authorities, organizations, companies and individuals for purchase and construction of affordable units, at an interest rate that will be adjustable from time to time. However, since the Ministry of Housing tabled the Housing Fund regulations in 2020, there were no amendments made to the deduction rates on wages until the Finance Act 2023.

In May 2023, under President Ruto’s government, the Cabinet Secretary for the National Treasury submitted the Finance Bill 2023 to the National Assembly for consideration for enactment into the Finance Act 2023. Among the various proposals in the bill was the re-introduction of the mandatory housing levy set at 3.0% of the employee’s gross monthly income, to be matched with the employer’s contribution that would be remitted to the National Housing Development Fund (NHDF). The deducted amount was required to be remitted to the collection agent by no later than the 9th day of the subsequent month following the deduction, and the cumulative deduction should not surpass Kshs 5,000. The main objective of the levy was to raise funds from various sources aimed at providing affordable housing to Kenyans. On 26th June 2023, the President assented the bill to the Finance Act 2023 which allowed the Treasury to begin collection of the levy.

It is essential to highlight that, prior to its enactment in June 2023, the finance bill precipitated the submission of constitutional petitions from various parties which challenged the constitutionality of the legislative process that resulted in the enactment of the Finance Act 2023.

In November 2023, a three-judge bench of the High Court ruled on the petitions, declaring the levy unconstitutional, on the basis that it was discriminatory in nature as it was to only be imposed on workers in the formal sector, disregarding those in the informal sector. The Court noted the policy was discriminatory, irrational, arbitrary and in violation of articles 27 and 201 (b) (i) of the constitution regarding principles of public finance. Additionally, the court ruled that the introduction of the Employment Act by section 84 of the Finance Act 2023 lacked a comprehensive legal framework in violation of articles 10, 201, 206 and 210 of the constitution respectively. Following the ruling, the High Court granted the government stay orders, allowing the National Treasury to continue with the collection of the levy for 45 days.

Subsequently, in December 2023, the Affordable Housing Bill was tabled in the National Assembly with the intention of addressing the issues raised by the High Court. The bill which was first tabled on 7th December 2023 is currently in the public participation stage. Alike previous legislations, it has not been without its challenges. Public participation was set to commence on 9th December 2023 to 28th December 2023 by the National Assembly through a published notice. In response to the short notice period, a Kisumu based lobby group moved to court under a certificate of urgency to halt the intended public participation on the Affordable Housing Bill 2023. On 20th December 2023, Kisumu High Court ordered the halting of the public participation on the bill pending the hearing of an inter-party application. However, despite the court order barring the exercise, the National Assembly has scheduled public forums and hearings across 19 counties commencing on 17th January 2024.

The Court of Appeal will on 26th January 2024 rule on the government’s application, seeking orders that suspend the High Court decision which declared the housing levy unconstitutional.

Section IV: Analysis of the Affordable Housing Bill 2023

- Imposition of Affordable Housing Levy

Section 4 of the bill mandates that both employed and non-employed individuals must remit the levy to designated collectors by the 9th of the subsequent month. Notably, the Kenya Revenue Authority (KRA) is earmarked as the primary collector. All funds collected, as stipulated by the Bill, are to be channeled into the Affordable Housing Fund, established to facilitate housing initiatives.

Employers bear the responsibility of deducting and remitting the levy from their employees' gross salaries, according to section 5 of the bill. Granting discretionary authority to the Cabinet Secretary for the National Treasury in consultation with the CS for Housing, the Bill allows for the exemption of specific income classes or groups from the levy. This provision aims to tailor the implementation to address potential disparities and challenges faced by particular segments of the population. We however note that a complete list of any income or class of income, persons or category of persons eligible for exemption is yet to be provided.

In the event of non-compliance by employers in remitting the levy, the bill prescribes a penalty of 3.0% of the total unpaid amount to be remitted to the Fund. However, concerns have been raised regarding the severity of this penalty, with suggestions for its reduction due to potential financial strain on businesses in the prevailing economic recession. The penalty's harshness could impose additional burdens on businesses already grappling with economic challenges. Advocates for a milder penalty argue that it would strike a balance between enforcing compliance and acknowledging the economic hardships faced by employers. This debate highlights the need for a nuanced approach to penalties, considering the broader economic context and the shared goal of fostering sustainable financial practices for both businesses and the Affordable Housing Fund.

- Establishment and Management of the Affordable Housing Fund

The legislative inception of the Affordable Housing Fund represents a strategic move aimed at financially supporting affordable housing initiatives in harmony with the goals set forth in the Affordable Housing Bill. This institutional framework stands as a pivotal stride towards realizing the broader objectives of the legislation. The Bill outlines diverse funding sources for the Fund, encompassing revenue from the affordable housing levy, income from investments, funds generated through statutory functions, and appropriations by the National Assembly.

The overarching mission of the Affordable Housing Fund is clarified, underscoring its role in funding affordable housing projects and the related social and physical infrastructure. The Fund is geared towards

- Facilitating the provision of funds for affordable housing and affordable housing schemes in the promotion of homeownership,

- Extending low-interest loans for the acquisition of affordable housing units within approved affordable housing schemes,

- Aiding scheme development in all counties,

- Developing long-term financial solutions for the development and off-take of affordable housing, Provide funds for the maintenance of any land or building, estate or interest therein for purposes of the Fund, and,

- Funding of any other activities’ incidental to the furtherance of objectives of the Fund.

Section 11 of the bill highlights the allocation plan, specifying designated percentages for various purposes to specified agencies, including; i) 30.0% to the National Housing Corporation, ii) 25.0% to slum upgrading, iii) 36.0% to institutional housing programs, iv) up to 2.0% to the levy collector, and, v) up to 2.0% to the Board for administrative tasks.

Crucial to effective governance, the Affordable Housing Bill establishes the Affordable Housing Board, tasked with overseeing Fund operations and ensuring resource allocation aligns with the Bill's objectives. The Board's composition includes;

- a non-executive chairperson appointed by the president,

- representatives from the National Treasury and State Department for Affordable Housing,

- appointees by the Cabinet Secretary,

- individuals with qualifications in the built environment, finance, or law appointed by the Cabinet Secretary, and,

- The Chief Executive Officer without voting rights.

The Board's duties involve i) coordinating optimal fund utilization for affordable housing programs, ii) ensuring efficiency and cost-effectiveness, iii) determining financial allocations based on a 5-year investment program, iv) managing and allocating funds per Section 11, v) ensuring annual allocations align with the approved work program, vi) limiting the use of funds for maintenance and rehabilitation to 5.0%, vii) monitoring and evaluating projects through audits, viii) complying with procurement regulations, ix) identifying potential revenue sources, x) approving fund accounts, xi) endorsing yearly budgets, and xii) performing other duties assigned by the Cabinet Secretary.

Qualifications for Board appointments emphasize expertise in housing and financial matters, with clearly defined tenures, vacancy filling procedures, and governance conduct regulations. Mandating transparency, the Bill requires Board members to disclose conflicts of interest, while addressing remuneration structures for Board members and the CEO to ensure equitable compensation.

Introducing the role of the Fund's administrator, responsible for day-to-day operations, fiscal safeguards are in place to prevent overdrawn scenarios, promoting financial prudence. The Bill addresses administrative costs, capped at 2.0% of the latest audited financial statement, empowering the administrator with access to pertinent information for effective decision-making. Administrative roles, including the Corporation Secretary, staff composition, and delegation of powers, are also outlined. The introduction of a common seal formalizes the authenticity of official documents and decisions, enhancing transparency and credibility. In summary, the section on the establishment and management of the affordable housing fund framework encapsulates a legislative framework crafted to oversee the affordable housing Fund and ensure responsible Fund utilization for the betterment of Kenya.

- Eligibility Criteria and Application Procedure for an Affordable Housing Unit

The eligibility criteria for affordable housing outlined in the bill require applicants to be Kenyan citizens, at least 18 years old, and possess a valid Kenyan ID. Applicants must submit formal applications to approved agencies. We however note that the list of specified agencies is yet to be provided thus creating uncertainty. The bill mandates agencies to prioritize marginalized individuals, vulnerable groups, youth, women, and persons with disabilities. The agency has the authority to off-take units under approved affordable housing schemes, subject to compliance with policy, statutory requirements, and additional criteria.

Beneficiaries seeking a change in allocated housing units must formally apply to the specific agency through which they made an application for a housing unit with, detailing the request for unit alteration and loan repayment transfer. The legislation introduces a loan application process for eligible beneficiaries, featuring interest rates based on a reducing balance. For social housing and affordable units, rates are at3.0% for both, and for affordable and market units 9.0%, respectively. The legislation categorizes affordable housing units into three distinct groups;

- Social Housing - Units intended for individuals earning less than Kshs 20,000 per month, with a plinth area of between 18-30 SQM,

- Affordable Housing - Units designed for those with monthly incomes ranging from Kshs 20,000 to Kshs 149,000, with a plinth area of 18-50 SQM and,

- Affordable Market Housing - Units aimed at individuals earning over Kshs 149,000 monthly, with a plinth area of 36-50 SQM.

Regarding voluntary savings, all the agencies must establish a dedicated bank account for participants, allowing withdrawals with a 90-day notice for a refund with accrued interest, if any.

- Financial and miscellaneous provisions of the Act including, penalties for offenders under the Act, repeal of Employment Act, 2007 among others

The bill requires the Fund's administrator to maintain accurate financial records, including income, expenditure, and assets, and submit the fund's accounts to the Auditor General within three months of each financial year's end.

Under the section, the Board is mandated to disseminate information about its activities through regular publications to keep the public informed. Violations of specified regulations may result in penalties upon conviction, with individuals facing fines of up to Kshs 10.0 mn or imprisonment for a period not exceeding 5 years.

Section 43 of the Affordable Housing Bill amends the Employment Act, 2007, by repealing sections 31B and 31C. The repeal implies that any payments made or actions taken under the repealed sections are considered to have been made or taken under the provisions of this Act. Furthermore, any commitments or obligations made by the national government regarding affordable housing, in accordance with the previous Act of Parliament, are now deemed to be commitments or obligations made under this Act.

In simpler terms, the changes in Section 43 mean that certain sections related to housing in the Employment Act, 2007, are removed and replaced by the Affordable Housing Bill. The repealed sections contained specific details about how employers should provide housing accommodation or additional sums for rent. The repeal means that the Affordable Housing Act, once enacted will now dictate the rules and regulations regarding employer responsibilities for affordable housing. Payments and actions taken under the old sections are still valid and considered under the new Act. Additionally, any commitments or obligations by the government for affordable housing, previously based on the Employment Act, are now considered commitments or obligations under the Affordable Housing Bill.

Section V: Recommendations and Conclusion

We recognize the efforts made by the bill to establish a legal structure for the affordable housing levy and address concerns raised by the High Court. Nevertheless, certain aspects of the bill necessitate additional consideration and resolution for enhanced practicality. In this regard, we present the following recommendations to the Kenyan government and all stakeholders involved in the implementation of the Housing Fund;

- Informal Sector Compliance: We note that the strategy for ensuring monthly deductions for the housing levy in the informal sector remains unclear. While it's straightforward to deduct from salaried Kenyans with pay slips, the same cannot be assumed for those without such documentation. It is therefore crucial for the government to provide a clear explanation of how it intends to ensure optimal compliance in the informal sector, as the current lack of articulation has resulted in speculation and uncertainty,

- Explicit Exemption Criteria: The bill needs to explicitly outline all circumstances warranting exemptions from mandatory contributions to the Levy. As it is, the bill does not expressly specify a list or provide clearly defined criteria for exemptions from the Levy, as is the case with other legislated Acts in the property sector. These include but are not limited to Stamp Duty and Capital Gains Tax Acts. The absence of a clearly defined list or criteria for Levy exemptions in the bill requires to be addressed in order to ensure transparency and promote public trust and compliance,

- Construction Approach and Risk Mitigation: The government should refrain from directly engaging in unit construction to mitigate potential citizen losses and avoid potential financial risks through government led projects, as well as to ensure timely project delivery,

- Alternative Development Approaches: Instead, the focus should be on emulating successful models employed in countries such as the United Kingdom and Zimbabwe, where the government promotes self-builds through providing serviced plots affixed with essential infrastructure either at a subsidized cost or free of charge to its citizens. It is worth noting that most governments are increasingly encouraging self-builds by offering citizens plots serviced with infrastructure (roads, footpaths, drainage) and utilities (water, electricity). Alternatively, the government ought to pursue more Public-Private Partnerships (PPPs) where under such arrangements, the government offers land and leaves construction and financing to developers. These approaches relieve the government of the responsibility of overseeing construction and subsequently the burden of funding developments,

- Optimized Fund Allocation: We propose the funds collected be used only towards the acquisition and provision of land, development of supporting infrastructure, strengthening the mortgage plan, and off-taking units from developers. This entails dividing the funds among three key areas: firstly, investing in the creation of essential infrastructure on land provided by the government; secondly, acquiring completed units from developers and thirdly, facilitating the provision of affordable home loans through the Tenant Purchase Scheme (TPS). In essence, the aim is to ensure a well-balanced distribution of resources to address infrastructure needs, expand housing finance availability, and make homeownership more accessible through affordable financing,

- Eligibility and Allocation Criteria: The bill provides that to qualify for affordable housing units, individuals must be Kenyan citizens aged 18 or above and possess an identity card. This implies that anyone able to meet deposit requirements, set as a percentage of the affordable housing unit's value (e.g., 10.0%), and having all necessary documentation, can apply for a unit, irrespective of whether or not they already have a house. However, there is a need for a more structured eligibility and allocation criteria prioritizing individuals with greater housing needs. This includes those currently without homes or living in informal settlements. This approach will foster and ensure a more equitable distribution of resources,

- Eliminate Ambiguity: The bill defines affordable housing as housing that is both adequate and costs no more than thirty percent of an individual's monthly income to rent or acquire. In principle, any residence, regardless of its cost, qualifies as affordable housing if the associated rent or mortgage payment constitutes less than 30.0% of a person's monthly income. This definition is therefore vague and needs refinement to eliminate any ambiguity as to what will constitute affordable housing under the legislation,

- Impose Milder Penalties: The proposed penalty in the Bill, set at 3.0% of the total unpaid amount to be remitted to the Fund, has sparked concerns over its severity. In the current harsh micro-economic environment, this harsh penalty could exacerbate the financial strain on businesses. As such, reducing it would strike a balance between enforcing compliance and recognizing the economic hardships faced by employers, thus fostering a more equitable approach in challenging times, and,

- Provide a Complete List of Agencies: While the bill establishes an eligibility criterion for affordable housing applicants, an ambiguity arises from the lack of specificity regarding the approved agencies to which formal applications must be submitted. This uncertainty could pose challenges for prospective applicants, as they may be unable to identify the specific entities responsible for processing their applications. Clarity on the list of specified agencies is crucial for ensuring a transparent and accessible application process, thereby promoting fairness and inclusivity in the distribution of affordable housing.

In conclusion, the recommendations outlined above are essential for refining and enhancing the effectiveness of the proposed affordable housing legislation. These refinements aim to create a robust framework that aligns with successful international models and optimizes the allocation of resources for a sustainable and equitable affordable housing solution in Kenya. In addition, the success of the Housing Fund levy in contributing to the Affordable Housing Program (AHP) will depend on the government's ability to effectively engage with stakeholders, address concerns raised, and ensure compliance with the set regulations.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor