The Progress of Affordable Housing in Kenya, & Cytonn Weekly #36/2023

By Cytonn Research, Sep 10, 2023

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed for the first time in three weeks, with the overall subscription rate coming in at 161.8%, compared to the 96.6% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 34.8 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 870.8%, higher than the subscription rate of 539.8% recorded the previous week. The subscription rate for the 364-day and 182-day papers increased to 27.8% and 12.3%, respectively, from 6.2% and 9.6% recorded the previous week. The government accepted a total of Kshs 38.77 bn worth of bids out of Kshs 38.83 bn of bids received, translating to an acceptance rate of 99.8%. The yields on the government papers continued to rise, with the yields on the 364-day, 182-day, and 91-day papers increasing by 109.5 bps, 43.0 bps, and 24.9 bps to 14.9%, 14.4%, and 14.2%, respectively;

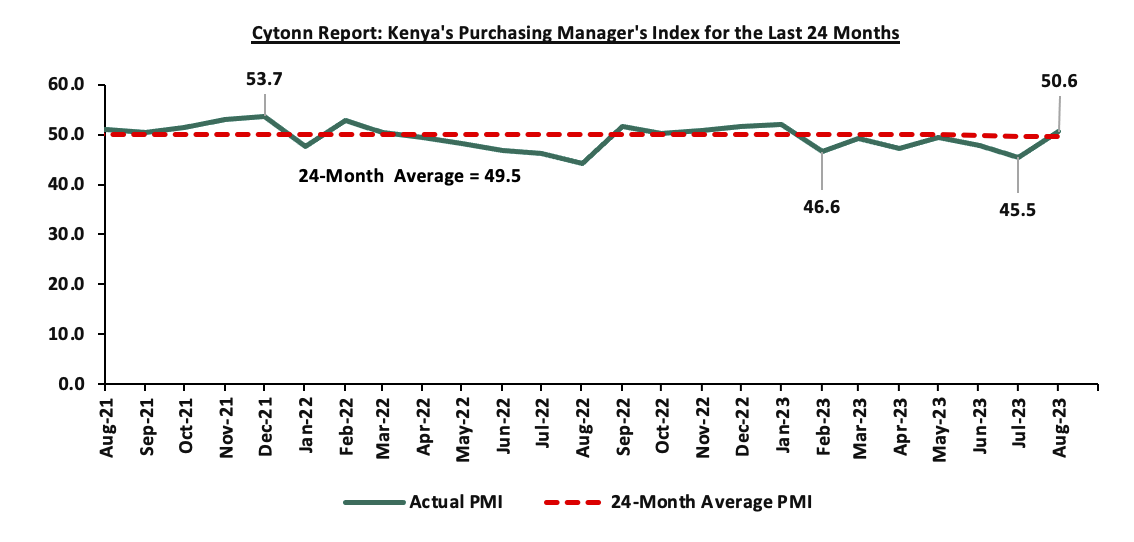

During the week, Stanbic Bank released its monthly Purchasing Manager’s Index (PMI), highlighting that the index for the month of August 2023 came in at 50.6, up from 45.5 in July 2023, signalling an expansion in business conditions for the first time since January. The expansion was attributable to the greater political stability, improved food supply and increased marketing of products which led to the increase in new orders and higher purchasing activity especially in the services and manufacturing sectors;

Equities

During the week, the equities market recorded mixed performance, with NASI and NSE 20 gaining by 0.6% and 0.2% respectively, while NSE 25 and NSE 10 declined by 0.5% and 1.3% respectively, taking the YTD performance to losses of 22.5%, 8.0%, and 18.8% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by gains recorded by large-cap stocks such as Bamburi, Safaricom and Standard Chartered of 5.7%, 2.6% and 1.6% respectively. The gains were however weighed down by losses recorded by stocks such as EABL, Equity Group and KCB Group of 3.5%, 3.3% and 0.4% respectively;

During the week, Nairobi Securities Exchange (NSE) announced that it had launched two new market indices, NSE 10 share index (N20) and the NSE Bond Index (NSE-BI) to track the performance of equities market and bond market respectively;

Additionally, Safaricom announced that it had secured a Kshs 15.0 bn deal, with a consortium of four Kenya banks consisting of ABSA Bank, Stanbic Bank, Standard Chartered Bank and KCB Bank, that is scalable to Kshs 20.0 bn by accordion. The multi-billion Sustainability Linked Loan (SLL) facility is expected to support Safaricom Environmental, Social, Governance agenda. The facility is the largest ESG-linked loan facility ever undertaken in East Africa and the first of its kind for Safaricom;

Real Estate

During the week, Absa Bank Kenya announced a strategic partnership with Unity Homes, a leading property developer of residential communities in Kenya, which will allow potential home buyers to access affordable mortgage loans backed by the Kenya Mortgage Refinancing Company to purchase homes at Unity One. Additionally, the International Finance Corporation (IFC) disclosed details of a Kshs 2.9 bn (USD 20.0 mn) proposed loan to Centum Real Estate Limited (CRE), a wholly owned subsidiary of Centum Investment Company Plc;

In the infrastructure sector, CPF Financial Services, a leading provider of innovative financial services in Kenya and Africa Finance Corporation (AFC) signed a memorandum of understanding to jointly collaborate on infrastructure investments within the country;

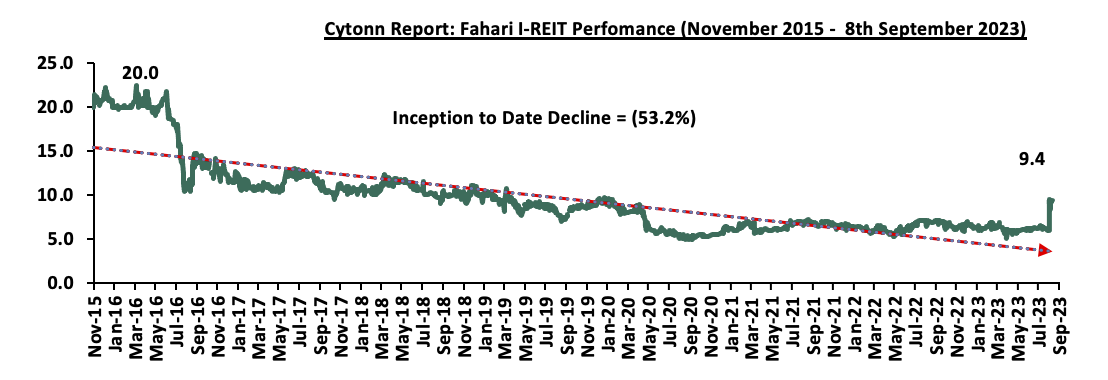

In regulated Real Estate Funds, under the Real Estate Investment Trusts (REITs) segment, ICEA Lion Asset Management (ILAM) published the Conversion Offering Memorandum to provide information to ILAM Fahari Income REIT (IFIR) unitholders regarding; i) Proposed redemption of up to 36,585,134 units from non-professional investors who hold units worth Kshs 5.0 mn and below, at a redemption offer price of Kshs 11.0 per unit, ii) proposed conversion of the I-REIT from an unrestricted I-REIT, into a restricted I-REIT after successful redemption of units from non-professional Investors, and, iii) proposed delisting of the I-REIT from the Unrestricted Main Investment Market Segment (UMIMS) of the Nairobi Securities Exchange (NSE) and subsequent quoting of ILAM Fahari I-REIT Units on the Unquoted Securities Platform (USP).

On the Nairobi Securities Exchange, Fahari I-REIT closed the week trading at an average price of Kshs 9.4 per share representing a 4.0% gain from the Kshs 9.0 recorded the previous week. On the Unquoted Securities Platform as at 08 September 2023, Acorn D-REIT and I-REIT closed the week trading at Kshs 25.3 and Kshs 21.7 per unit, a 26.6% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. In addition, Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 13.8%, a 0.1% points increase from 13.7% recorded the previous week;

Focus of the Week

The Affordable Housing Programme (AHP) was launched in 2017, as one of the key pillars of the ‘Big Four Agenda’. The initiative targeted to deliver 500,000 affordable homes for Kenyans across all 47 counties by 2022, in five years. However, the target was far from achieved by the end of the 5-year tenure, with an estimated 13,529 units only being delivered with minimal delivery in the social housing category, amounting to less than 3.0% of the intended target. In 2022, President William Ruto, upon assuming office upheld the initiative, integrating it as one of six foundational pillars of his government’s agenda, with a goal to achieve an annual delivery of 200,000 housing units, hence one million units in 5 years. This week, we seek to review the progress of the initiative;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 13.44% p.a To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 13.78% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday, from 9:00 am to 11:00 am. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

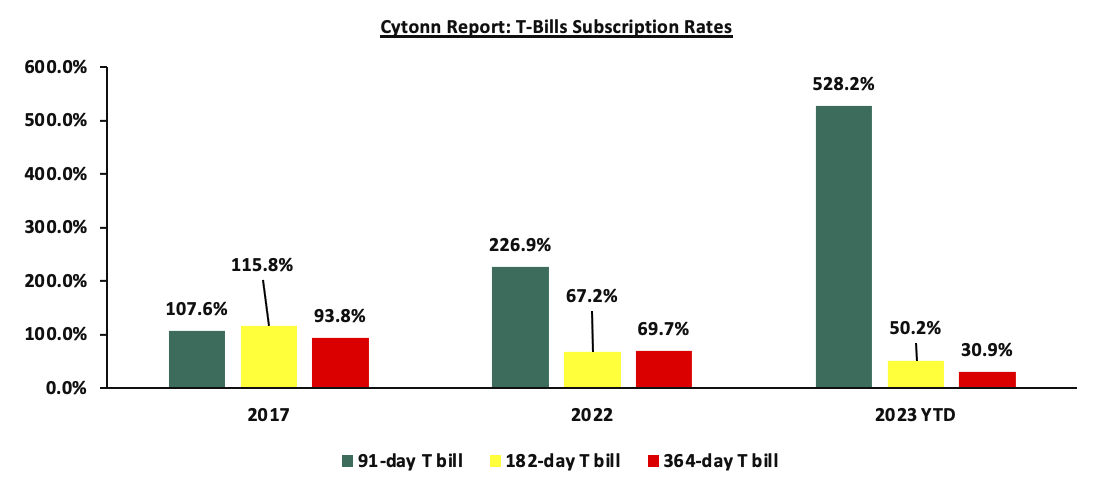

During the week, T-bills were oversubscribed for the first time in three weeks, with the overall subscription rate coming in at 161.8%, compared to the 96.6% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 34.8 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 870.8%, higher than the subscription rate of 539.8% recorded the previous week. The subscription rate for the 364-day and 182-day papers increased to 27.8% and 12.3%, respectively, from 6.2% and 9.6% recorded the previous week. The government accepted a total of Kshs 38.77 bn worth of bids out of Kshs 38.83 bn of bids received, translating to an acceptance rate of 99.8%. The yields on the government papers continued to rise, with the yields on the 364-day, 182-day, and 91-day papers increasing by 109.5 bps, 43.0 bps, and 24.9 bps to 14.9%, 14.4%, and 14.2%, respectively.

So far in the current FY’2023/24, government securities totalling Kshs 385.0 bn have been advertised. The government has accepted bids worth Kshs 426.1 bn, of which 301.5 bn and 124.6 bn were treasury bills and bonds, respectively. Total redemptions so far in FY’2023/24 equal to Kshs 361.3 bn, with treasury bills accounting for all redemptions. As a result, the government has a domestic net borrowing surplus of Kshs 64.9 billion in FY’2023/24

The chart below compares the overall average T- bills subscription rates obtained in 2017, 2022 and 2023 Year to Date (YTD):

Money Market Performance:

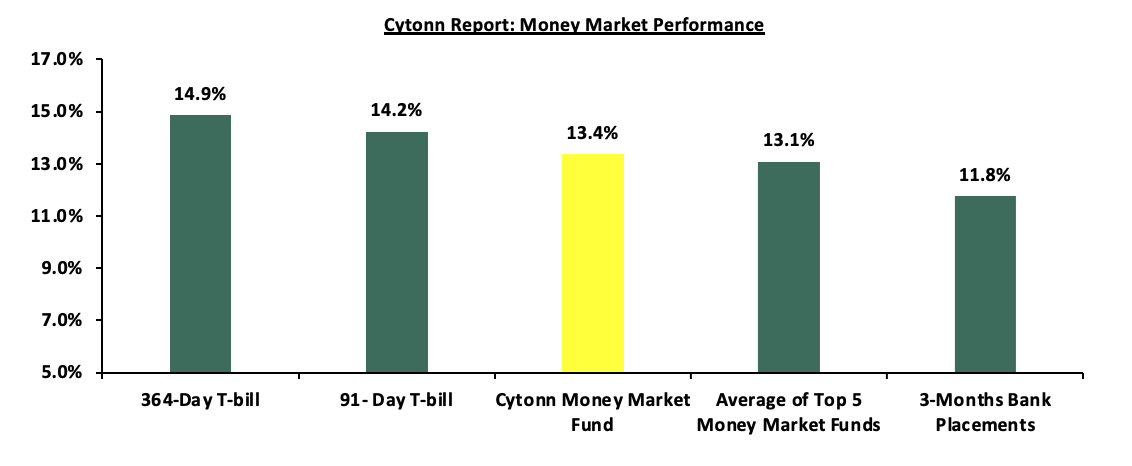

In the money markets, 3-month bank placements ended the week at 11.8% (based on what we have been offered by various banks), The yield on the 364-day paper increased by 109.5 bps to 14.9%, while that of 91-day paper increased by 24.9 bps to 14.2%. The yield of Cytonn Money Market Fund increased by 27.0 bps to 13.4% from 13.2% recorded the previous week and the average yields on the Top 5 Money Market Funds increased by 6.6 bps to 13.1% from 13.0% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 8th Sep 2023:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 8th September 2023 |

||

|

Rank |

Fund Manager |

Effective Annual |

|

1 |

Cytonn Money Market Fund |

13.4% |

|

2 |

GenAfrica Money Market Fund |

13.4% |

|

3 |

Etica Money Market Fund |

13.0% |

|

4 |

Enwealth Money Market Fund |

12.9% |

|

5 |

Apollo Money Market Fund |

12.6% |

|

6 |

Lofty-Corban Money Market Fund |

12.6% |

|

7 |

Madison Money Market Fund |

12.5% |

|

8 |

Co-op Money Market Fund |

12.5% |

|

9 |

Jubilee Money Market Fund |

12.4% |

|

10 |

Kuza Money Market fund |

12.1% |

|

11 |

Nabo Africa Money Market Fund |

12.0% |

|

12 |

GenCap Hela Imara Money Market Fund |

11.7% |

|

13 |

ICEA Lion Money Market Fund |

11.6% |

|

14 |

KCB Money Market Fund |

11.5% |

|

15 |

Sanlam Money Market Fund |

11.5% |

|

16 |

Old Mutual Money Market Fund |

11.5% |

|

17 |

Absa Shilling Money Market Fund |

11.3% |

|

18 |

Dry Associates Money Market Fund |

10.8% |

|

19 |

Orient Kasha Money Market Fund |

10.6% |

|

20 |

CIC Money Market Fund |

10.5% |

|

21 |

AA Kenya Shillings Fund |

10.2% |

|

22 |

Mali Money Market Fund |

10.1% |

|

23 |

British-American Money Market Fund |

9.5% |

|

24 |

Equity Money Market Fund |

9.0% |

Source: Business Daily

Liquidity:

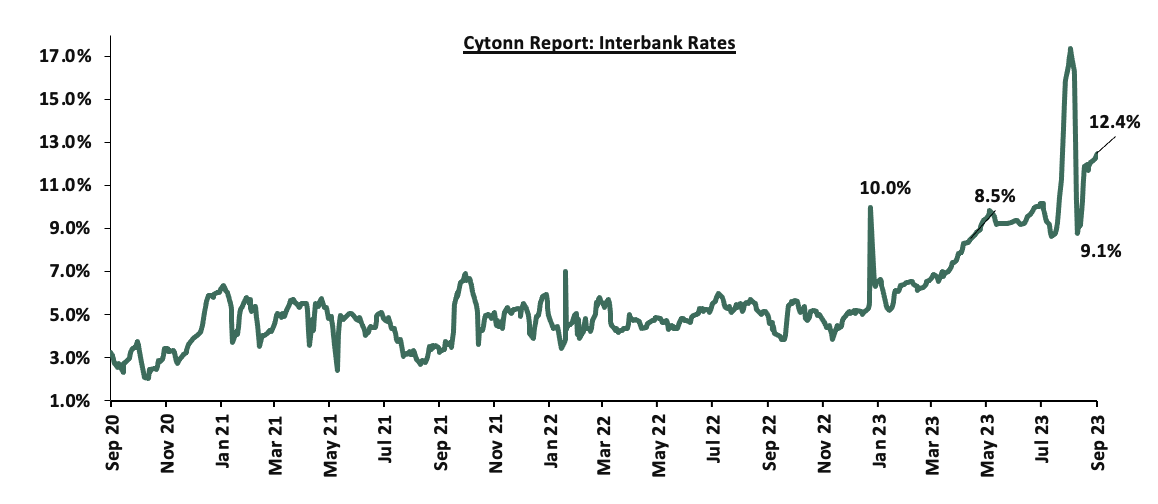

During the week, liquidity in the money markets tightened marginally, with the average interbank rate increasing to 12.4%, from 12.3% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded increased by 25.4% to Kshs 35.5 bn, from Kshs 28.3 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Eurobonds recorded mixed performance with the yield on the 10-year Eurobond issued in 2014 increasing the most by 0.7% points to 14.7%, from 14.0%, recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 7th Sep 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Tenor |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD) |

2.0 bn |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

|

Years to Maturity |

0.8 |

4.5 |

24.5 |

3.7 |

8.7 |

10.8 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

02-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

31-Jul-23 |

12.3% |

10.7% |

10.8% |

11.2% |

10.7% |

10.3% |

|

31-Aug-23 |

14.0% |

11.8% |

11.4% |

12.1% |

11.5% |

11.0% |

|

01-Sep-23 |

13.8% |

11.7% |

11.4% |

12.0% |

11.5% |

11.0% |

|

04-Sep-23 |

13.8% |

11.7% |

11.4% |

12.0% |

11.5% |

11.0% |

|

05-Sep-23 |

14.0% |

11.8% |

11.4% |

12.1% |

11.5% |

11.0% |

|

06-Sep-23 |

14.4% |

11.9% |

11.5% |

12.2% |

11.6% |

11.1% |

|

07-Sep-23 |

14.7% |

11.9% |

11.5% |

12.3% |

11.5% |

11.1% |

|

Weekly Change |

0.7% |

0.1% |

0.1% |

0.2% |

0.0% |

0.1% |

|

MTD Change |

0.9% |

0.2% |

0.1% |

0.3% |

0.0% |

0.1% |

|

YTD Change |

1.8% |

1.4% |

0.6% |

1.4% |

0.7% |

1.2% |

Source: Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling depreciated by 0.4% against the US dollar to close the week at Kshs 146.1, from Kshs 145.5 recorded the previous week. On a year to date basis, the shilling has depreciated by 18.4% against the dollar, adding to the 9.0% depreciation recorded in 2022. We expect the shilling to remain under pressure in 2023 as a result of:

- An ever-present current account deficit, which came at 2.3% of GDP in Q1’2023 from 4.2% recorded in a similar period last year, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 66.8% of Kenya’s external debt is US Dollar denominated as of April 2023, and,

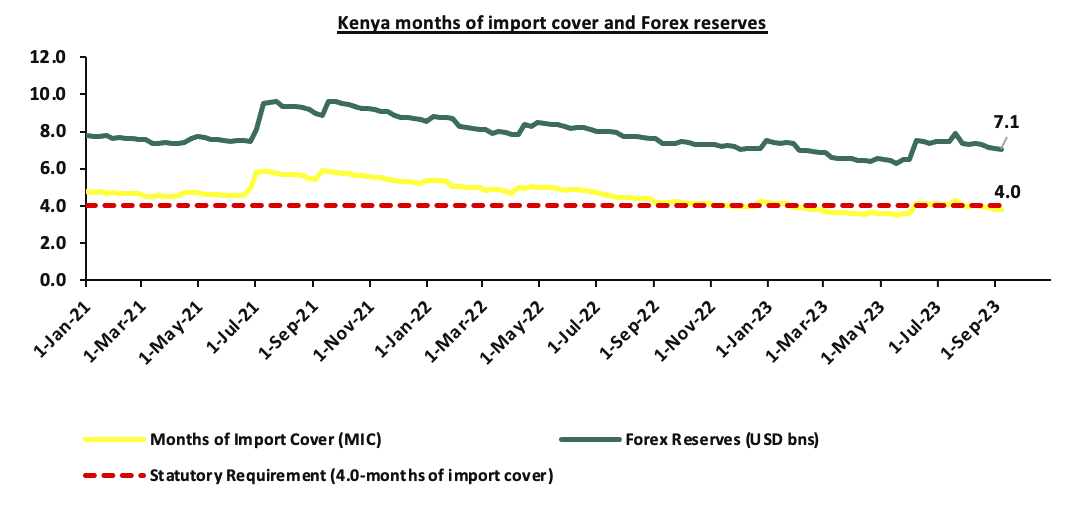

- Dwindling forex reserves currently at USD 7.1 bn (equivalent to 3.8-months of import cover), which is below the statutory requirement of maintaining at least 4.0-months of import cover.

The shilling is however expected to be supported by:

- Diaspora remittances standing at a cumulative USD 2,411.9 mn in 2023 as of July 2023, 20.26% higher than the USD 2,364.0 mn recorded over the same period in 2022, and,

The chart below summarizes the evolution of Kenya months of import cover over the years:

Weekly Highlights:

- August 2023 Purchasing Managers Index (PMI)

During the week, Stanbic Bank released its monthly Purchasing Manager’s Index (PMI), highlighting that the index for the month of August 2023 came in at 50.6, up from 45.5 in July 2023, signalling an expansion in business conditions for the first time since January. The expansion was attributable to the greater political stability, improved food supply and increased marketing of products which led to the increase in new orders and higher purchasing activity especially in the services and manufacturing sectors. Output levels recovered slightly in August as new orders increased which saw firms grow more confident about their output prospects leading to an accelerated job creation.

However, the improvement was weighed down by elevated input prices which rose at an historically strong pace, leading to the fastest increase in prices of goods and services since June 2022. The rise in input prices was mainly driven by high input costs due to the sustained currency depreciation, increased fuel prices as well as the introduced higher taxes of major inputs which made production expensive making businesses to transfer the burden to their customers in order to maintain their profit margins. Key to note, a PMI reading of above 50.0 indicates an improvement in the business conditions, while readings below 50.0 indicate a deterioration. The chart below summarizes the evolution of PMI over the last 24 months.

Going forward, we project the business environment in Kenya will improve in the short term, primarily due to the eased political environment as well as increased food supply which saw the August inflation ease to 6.7%, from 7.3% recorded in the month of July. As a result, the volume of new businesses is expected to rise as purchasing activity continues to improve. However, the continued currency depreciation as well as the recently enacted tax measures in the Finance Act is expected to slow down the growth in the private sector owing to the elevated cost of doing business which has led to the increase in prices of basic goods and services.

Rates in the Fixed Income market have been on an upward trend given the continued high demand for cash by the government and the occasional liquidity tightness in the money market. The government is 44.1% behind its prorated net domestic borrowing target of Kshs 116.0 bn, having a net borrowing position of Kshs 64.9 bn of the domestic net borrowing target of Kshs 586.5 bn for the FY’2023/2024. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to bridge the fiscal deficit through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk

Market Performance:

During the week, the equities market recorded mixed performance, with NASI and NSE 20 gaining by 0.6% and 0.2% respectively, while NSE 25 and NSE 10 declined by 0.5% and 1.3% respectively, taking the YTD performance to losses of 22.5%, 8.0%, and 18.8% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by gains recorded by large-cap stocks such as Bamburi, Safaricom and Standard Chartered of 5.7%, 2.6% and 1.6% respectively. The gains were however weighed down by losses recorded by stocks such as EABL, Equity Group and KCB Group of 3.5%, 3.3% and 0.4% respectively;

During the week, equities turnover decreased by 32.9% to USD 7.9 mn from USD 11.7 mn recorded the previous week, taking the YTD total turnover to USD 552.7 mn. Foreign investors remained net sellers for the second consecutive week with a net selling position of USD 2.8 mn, from a net selling position of USD 2.4 mn recorded the previous week, taking the YTD foreign net selling position to USD 276.8 mn.

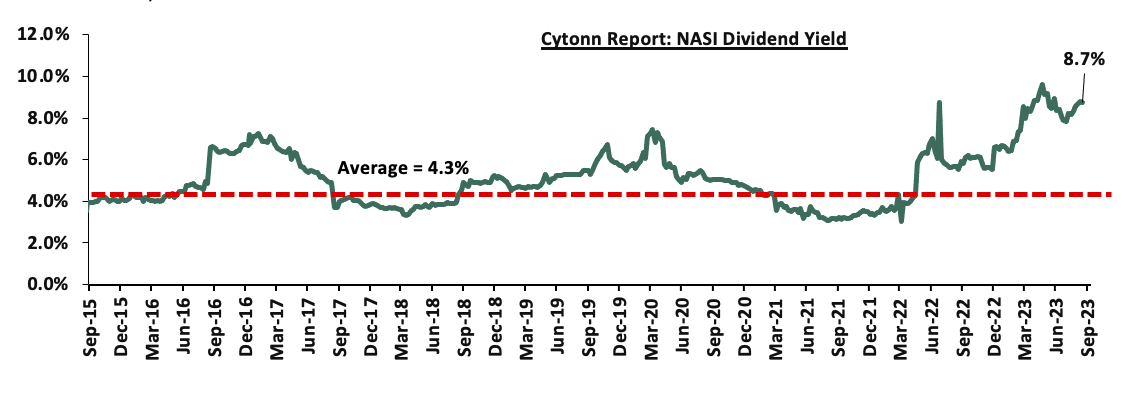

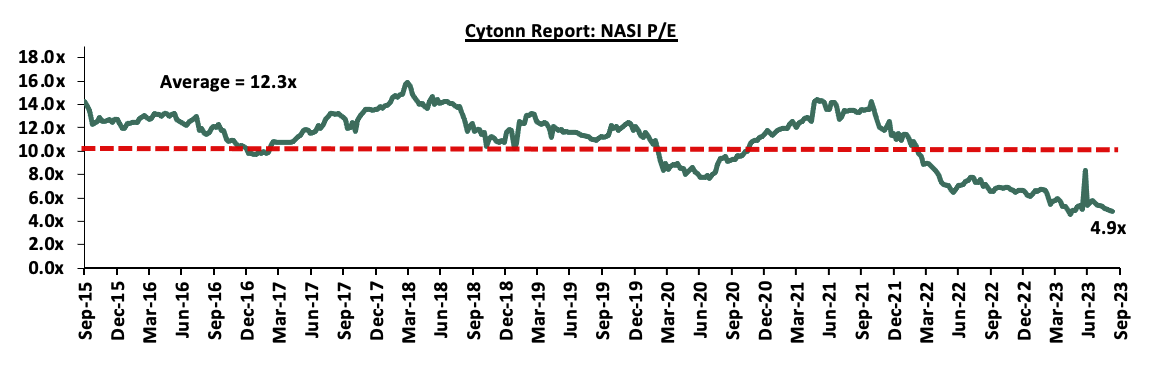

The market is currently trading at a price to earnings ratio (P/E) of 4.9x, 60.3% below the historical average of 12.3x. The dividend yield stands at 8.7%, 4.4% points above the historical average of 4.3%. Key to note, NASI’s PEG ratio currently stands at 0.6x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of coverage:

|

Company |

Price as at 01/09/2023 |

Price as at 08/09/2023 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

KCB Group*** |

23.5 |

23.4 |

(0.4%) |

(39.1%) |

41.3 |

8.6% |

85.3% |

0.4x |

Buy |

|

Jubilee Holdings |

176.0 |

175.8 |

(0.1%) |

(11.6%) |

260.7 |

6.8% |

55.1% |

0.3x |

Buy |

|

Kenya Reinsurance |

1.8 |

1.8 |

0.0% |

(3.7%) |

2.5 |

11.1% |

50.6% |

0.1x |

Buy |

|

Equity Group*** |

38.5 |

37.2 |

(3.3%) |

(17.4%) |

51.2 |

10.8% |

48.3% |

0.8x |

Buy |

|

Liberty Holdings |

3.7 |

4.0 |

9.6% |

(20.6%) |

5.9 |

0.0% |

48.0% |

0.3x |

Buy |

|

Co-op Bank*** |

11.9 |

11.8 |

(0.4%) |

(2.5%) |

15.0 |

12.7% |

39.4% |

0.6x |

Buy |

|

ABSA Bank*** |

11.8 |

11.8 |

0.0% |

(3.7%) |

14.7 |

11.5% |

36.3% |

0.9x |

Buy |

|

Sanlam |

8.0 |

7.6 |

(5.0%) |

(20.7%) |

10.3 |

0.0% |

35.4% |

2.1x |

Buy |

|

NCBA*** |

40.0 |

40.0 |

0.0% |

2.7% |

48.9 |

10.6% |

32.8% |

0.8x |

Buy |

|

HF Group |

4.5 |

4.5 |

0.0% |

42.9% |

5.8 |

0.0% |

29.1% |

0.2x |

Buy |

|

Stanbic Holdings |

111.0 |

110.0 |

(0.9%) |

7.8% |

127.9 |

11.5% |

27.7% |

0.8x |

Buy |

|

Standard Chartered*** |

160.0 |

162.5 |

1.6% |

12.1% |

183.9 |

13.5% |

26.7% |

1.1x |

Buy |

|

Diamond Trust Bank*** |

48.5 |

49.0 |

1.1% |

(1.7%) |

54.6 |

10.2% |

21.6% |

0.2x |

Buy |

|

I&M Group*** |

18.1 |

17.9 |

(0.8%) |

5.0% |

19.5 |

12.6% |

21.3% |

0.4x |

Buy |

|

CIC Group |

2.1 |

2.2 |

5.3% |

13.6% |

2.5 |

6.0% |

21.2% |

0.7x |

Buy |

|

Britam |

5.3 |

5.3 |

(0.4%) |

1.9% |

6.0 |

0.0% |

12.6% |

0.7x |

Accumulate |

Weekly Highlights:

- NSE launches new market indices (NSE 10 and NSE-BI)

During the week, Nairobi Securities Exchange (NSE) announced that it had launched two new market indices, NSE 10 share index (N20) and the NSE Bond Index (NSE-BI) to track the performance of equities market and bond market respectively.

The N10 index shall be based on a set of 10 companies which will be reviewed semi-annually, namely, Safaricom, Equity Group Holdings, KCB Group, The Co-operative Bank, ABSA Bank, East Africa Breweries Plc, Kengen Plc, NCBA Group Plc, Kenya Re Insurance Cooperation and Centum Investments Co Plc. The index is based on a market capitalization float adjusted methodology

On the other hand, the NSE-BI will be a weekly index and will be based on benchmark government bonds listed on the NSE and is expected that the index will form part of a fixed rate future contracts that will be issued on the NSE derivatives market.

Additionally, the NSE reviewed the NSE 20 share index, replacing WPP Scan Group Plc, Nairobi Securities Exchange Plc, and Diamond Trust Bank Kenya with CIC Insurance Group Plc, Bank of Kigali Group Plc and I&M Holdings Plc respectively.

As such, the new index development is expected to enhance investors ability to effectively monitor the performance of listed securities on the bourse.

- Safaricom Secures a multi-billion Sustainability Linked Loan (SLL) facility.

During the week, Safaricom announced that it had secured a Kshs 15.0 bn deal that is scalable to Kshs 20.0 bn by accordion. The multi-billion Sustainability Linked Loan (SLL) facility is expected to support Safaricom Environmental, Social, Governance agenda. The facility is the largest ESG-linked loan facility ever undertaken in East Africa and the first of its kind for Safaricom. Furthermore, it is the first Kenya Shilling-denominated SLL in the market. The facility will enable Safaricom to access funding based on the progressive achievement of milestones across key ESG areas.

The funding is arranged by a consortium of four banks: Standard Chartered Bank, which acted as a global coordinator, sustainable coordinator, and mandated lead arranger for the deal; KCB Bank, which also acted as mandated lead arranger; Stanbic Bank Kenya; and ABSA Bank Kenya.

The deal is aligned with Safaricom's sustainable business strategy as part of its ongoing transition to become a fully-fledged technology company by 2025. In particular, the facility is expected to aid Safaricom in achieving its Net Zero emission targets by tracking gender diversity and monitoring social equality impacts. Beyond Safaricom's individual journey, this agreement paves the way for more sustainability-focused financing endeavours in the region, reinforcing the region's commitment to a sustainable and diversified financial ecosystem as companies are increasingly committed to ESG reporting and financing.

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently being undervalued to its future growth (PEG Ratio at 0.6x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the equities outlook in the short term.

- Residential Sector

- Absa Bank Kenya Plc announces partnership with Unity Homes Kenya

During the week, Absa Bank Kenya announced a strategic partnership with Unity Homes, a leading property developer of residential communities in Kenya, which will allow potential home buyers to access affordable mortgage loans backed by the Kenya Mortgage Refinancing Company to purchase homes at Unity One. Unity One is an exclusive, contemporary gated community developed by Unity Homes and constitutes one-bedroom apartments sitting on 11.0 acres situated within Tatu City, Kiambu County. Through the collaboration, buyers will be required to pay a 10.0% deposit of the housing unit value and closing deal costs totaling to Kshs 1.2 mn, after which they will pay subsequent monthly repayments of Kshs 49,500 to purchase a one-bedroom house. The mortgages will have a repayment period of up to 25 years, and are open to both salaried and unemployed Kenyans at an annual interest rate of 9.5%. Unity One project is currently underway and the first phase of the project is scheduled for completion from January 2024. Other notable projects by Unity Homes include; i) Unity West, ii) Unity Gardens already completed and sold out, iii) Unity East, and iv) Silver Hill projects that are still ongoing. The table below highlights the particulars of the project;

|

Cytonn Report: Unity One Project |

|||

|

Typology |

Size (SQM) |

Price (Kshs in mn) |

Price per SQM |

|

1-bedroom |

45 |

5.9 |

131,111 |

Source: Unity Homes

We anticipate that the partnership will; i) play a pivotal role in promoting homeownership within the country by offering affordable home loans to Kenyan citizens, ii) empower Kenyans to acquire high-quality homes in a prime mixed-use development through a sustainable and affordable financial arrangement, and, iii) contribute to the government's affordable housing agenda by providing cost-effective home loans through the Kenya Mortgage Refinance Company (KMRC). Noteworthy, Absa Bank continues to set precedence for other commercial banks and financing partners to broaden their investment portfolios in the affordable housing sector, aligning with the government's increased emphasis on the Affordable Housing initiative. Going forward, we expect to see more financing partners diversifying and expanding their portfolios, particularly in the affordable housing segment.

- Centum Real Estate Limited to Receive Kshs 2.9 bn Housing Loan from International Finance Corporation (IFC)

During the week, the International Finance Corporation (IFC) disclosed details of a Kshs 2.9 bn (USD 20.0 mn) proposed loan to Centum Real Estate Limited (CRE), a wholly owned subsidiary of Centum Investment Company Plc. According to disclosures from the IFC, the loan will be used to partially finance Centum’s Mzizi Court project consisting of 1,940 affordable housing units located at Two Rivers. The total Mzizi Court project outlay is estimated to be Kshs 13.3 bn (USD 91.0 mn), of which IFC will be financing 21.8% of total project cost via the loan. The remaining balance of Kshs 10.4 bn (USD 71.0 mn) will be funded by CRE, using a mix of equity, pre-sales from buyer deposits or collections and reinvested profits from completed units. The funding comes just two months after the gazettement of the Two Rivers land as a private services-focused Special Economic Zone (SEZ). The SEZ spanning 64 acres grants businesses within the Two Rivers International Finance and Innovation Centre (TRIFIC) access to a wide array of incentives available under the Special Economic Zone regime, and positions Kenya as a hub for global investment and job creation by providing world-class infrastructure and amenities. Other projects covered by the SEZ include; i) Victoria Towers, and ii) Trific North, Grade A office developments covering approximately 150,000 SQFT collectively, iii) Holiday Inn Hotel, iv) Riverbank, v) Cascadia and vi) Loft residences.

Notably, the classification of Centum's Mzizi Court as affordable housing warrants careful examination. The table below contrasts the project to similar units under government’s Affordable Housing Program (AHP);

|

Cytonn Report: Comparison of Mzizi Court Project & Government’s AHP Units and Prices |

|||||||

|

Typology |

Size (SQM) |

Price (Kshs mn) |

Price per SQM (Kshs) |

Unit size of a similar apt under government’s AHP (SQM) |

Unit price of a similar apt under government’s AHP (Kshs mn) |

Price per SQM of a similar apt under government’s AHP (Kshs) |

Price per SQM Difference |

|

1 |

48 |

6.5 |

135,417 |

30 |

1.0 |

33,333 |

306.3% |

|

2 |

55 |

8.2 |

148,182 |

40 |

2.0 |

50,000 |

196.4% |

|

3 |

73 |

9.7 |

132,877 |

60 |

3.0 |

50,000 |

165.8% |

|

Average |

8.1 |

138,825 |

2.0 |

44,444 |

222.8% |

||

Source: Centum Real Estate

The average price per SQM for this development is Kshs 138,825, which starkly contrasts with the government's affordable housing benchmark of Kshs 44,444 per SQM. The juxtaposition reveals that the project is 222.8% more costly than what the government defines as affordable housing. In our recent topical tracking the progress of affordable housing within the Kenyan context, we define an affordable house as one that is valued at Kshs 1.9 mn for a single income household and Kshs 3.7 mn for a double income household. On the contrary, the pricing for Mzizi Court averages at Kshs 8.1 mn, far exceeding the range of what can be appropriately deemed as affordable housing in Kenya, and the government benchmark of Kshs 2.0 mn, thus remain far out of reach of most Kenyans. These significant disparities raise valid concerns about whether Mzizi Court can genuinely be considered as affordable housing in the context of established housing standards in Kenya.

Nevertheless, we expect the project will; i) increase access to high quality housing catering to the higher end segments of the market, ii) fuel increased demand for building materials, iii) assist in improving urban infrastructure such as roads, electricity, water and sanitation developed as a result of the project, and v) create direct and indirect jobs through the construction of the housing project.

- Infrastructure Sector

During the week, CPF Financial Services, a leading provider of innovative financial services in Kenya and Africa Finance Corporation (AFC) signed a memorandum of understanding to jointly collaborate on infrastructure investments within the country. The agreement will see CPF make an equity investment of an undisclosed value in AFC, a move aimed at diversifying its investments from traditional asset classes, and strengthening its infrastructure investments portfolio. Under the partnership, the two entities will collaborate in identifying, developing and co-financing infrastructure projects which are in line with Kenya’s development roadmap, leveraging their combined technical expertise and access to both global and domestic capital. AFC’s decision to partner with CPF Financial Services was informed by the potentially catalytic role of African investors in bridging infrastructural gap on the continent, as they constitute the single largest sources of investable capital in Africa. In support of this, African institutional investors such as pension funds, insurance companies and asset managers, hold approximately Kshs 145.9 tn (USD 1.0 tn) of Assets Under Management (AUM). This sum is not only equivalent to a third of the continent's collective Gross Domestic Product (GDP) but also surpasses the annual funding needs for infrastructure and climate initiatives in Africa by more than five times.

The AFC has been Kenya’s major development partner since 2017 with cumulative investments worth Kshs 58.4 bn (USD 400.0 mn), and a robust pipeline of infrastructure, industrial and trade finance projects valued at Kshs 109.4 bn (USD 750.0 mn). Some of the key investment areas of interest for the partners include; i) affordable housing, ii) Special Economic Zones (SEZs), iii) health infrastructure, and iv) geothermal energy. We expect the collaboration will; i) assist in advancing Kenya’s infrastructure agenda, ii) shield Kenya from the impacts of currency depreciation, which, in turn, escalate the cost of foreign loans by increasing debt servicing costs, and, iii) facilitate sustainable economic growth for Kenya and job creation. As such we anticipate to continue witnessing increased activities in the sector as major stakeholders within and beyond the infrastructure sector, including the local and national governments, continuously foster strategic partnerships geared at improving infrastructure in Kenya.

- Regulated Real Estate Funds

- Real Estate Investment Trusts (REITs)

During the week, ICEA Lion Asset Management (ILAM) published the Conversion Offering Memorandum to provide information to ILAM Fahari Income REIT (IFIR) unitholders regarding;

- Proposed redemption of up to 36,585,134 units from non-professional investors who hold units worth Kshs 5.0 mn and below, at a redemption offer price of Kshs 11.0 per unit,

- Proposed conversion of the I-REIT from an unrestricted I-REIT, into a restricted I-REIT after successful redemption of units from non-professional Investors, and,

- Proposed delisting of the I-REIT from the Unrestricted Main Investment Market Segment (UMIMS) of the Nairobi Securities Exchange (NSE) and subsequent quoting of ILAM Fahari I-REIT Units on the Unquoted Securities Platform (USP).

The strategic business review forms part of the ongoing operational restructuring put in place by the REIT manager ILAM, along with plans to divest non-core assets entailing the proposed sale of two properties valued at Kshs 200.4 mn. In our Cytonn Monthly – August 2023, we discussed key features and process of the conversion for unit holders, implications of subsequent delisting of the I-REIT, important timelines, and our expectations for the REIT going forward. Notably, non-professional investors who do not wish to convert their shares; i) will be accorded the option to top-up their investments to meet the professional investor threshold of Kshs 5.0 mn and above, and, ii) for unitholders those who also do not opt to increase their unit's value to Kshs 5.0 million and above, ILAM Fahari will consolidate their shares with those of other non-professional investors who also do not wish to participate in the conversion. These combined holdings will be placed in nominee accounts. Under the arrangement, the fund manager of the nominee account will act as a proxy to vote on behalf of the non-professional investors, ensuring that their interests are represented in the decision-making process.

This approach will allow the REIT to collectively manage their investments and streamline administrative procedures while avoiding complexities and additional costs, which would be incurred if separate units were to be issued in a new collective investment scheme. Importantly, unit holders will retain full ownership rights to their shares, including entitlements to dividends. They will also have the flexibility to sell their shares from the nominee account and exit from the I-REIT at their own convenience. In support of this, the offering memorandum stipulates an exit mechanism for non-professional investors through the amendment of the trust deed. According to the offering memorandum, the trust deed will be amended to provide a sunset period, ideally a three-year period from the closing date of the offer period, that is 6th October 2023, for the operation of the nominee account. The amendment will provide that, in the event a non-professional investor still holds units in the REIT at the end of the sunset period, these units will be automatically redeemed by ILAM Fahari I-REIT at the prevailing unit price through a redemption process or an alternative method that yields fair value for the investors and is in compliance with regulatory guidelines. With a clear exit mechanism and the capacity to represent non-professional investors’ interests in the REIT’s AGM, this nominee account approach will ensure that the interests of non-professional investors who are not able to exit during the transaction period, are protected and represented. It is also worth noting that the offer is only open to non-professional investors, hence professional investors cannot participate in the conversion process. Furthermore, the redemption offer is open only to investors who were part of the Register as of the Record Date 25th August 2023.

In the Nairobi Securities Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 9.4 per share. The performance represented a 4.0% increase from Kshs 9.0 per share recorded the previous week, taking it to a 38.1% Year-to-Date (YTD) growth from Kshs 6.8 per share recorded on 3 January 2023. However, the performance represented a 53.2% Inception-to-Date (ITD) decline from the Kshs 20.0 price. The dividend yield currently stands at 6.9%. The graph below shows Fahari I-REIT’s performance from November 2015 to 08 September 2023;

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.3 and Kshs 21.7 per unit, respectively, as at 01 September 2023. The performance represented a 26.6% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 30.4 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 627.6 mn, respectively, since inception in February 2021.

REITs provide various benefits like tax exemptions, diversified portfolios, and stable long-term profits. However the continuous deterioration in performance of the Kenyan REITs and restructuring of their business portfolio hampering major investment they had previously made are on top of other general challenges such as; i) inadequate comprehension of the investment instrument among investors, ii) prolonged approval processes for REITs creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and, iv) minimum investment amounts set at Kshs 5.0 mn, continue to limit the performance of the Kenyan REITs market.

- Cytonn High Yield Fund (CHYF)

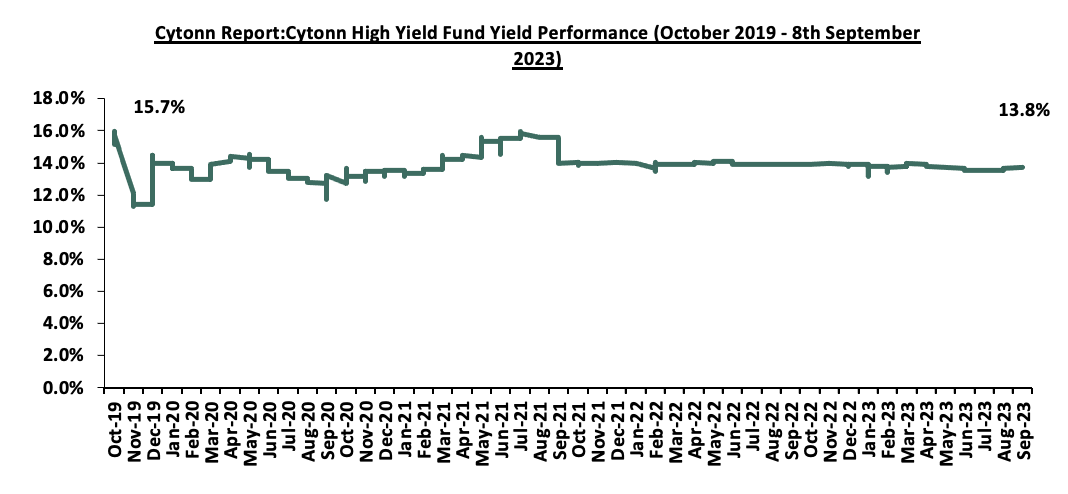

Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 13.8%, 0.1% points increase from 13.7% recorded the previous week. However, the performance represented 0.1% points Year-to-Date (YTD) decline from 13.9% yield recorded on 1 January 2023, and 1.9% points Inception-to-Date (ITD) decline from the 15.7% yield. The graph below shows Cytonn High Yield Fund’s performance from October 2019 to 08 September 2023;

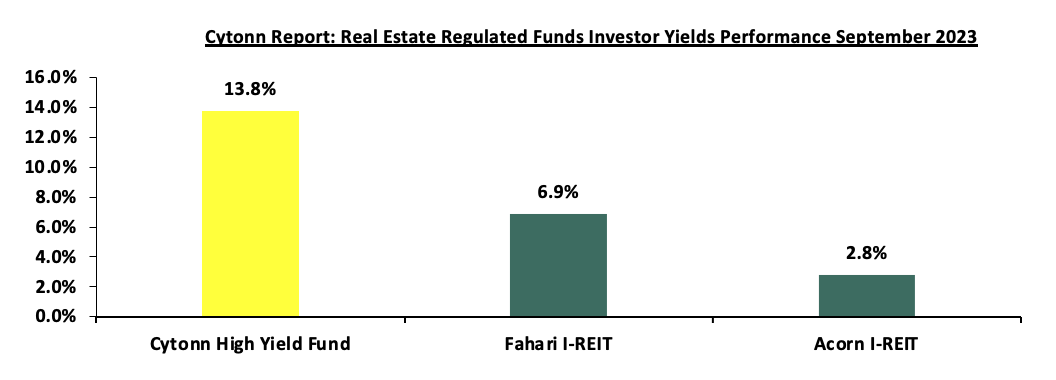

Notably, the CHYF has outperformed other regulated Real Estate funds with an annualized yield of 13.8%, as compared to Fahari I-REIT, and Acorn I-REIT with yields of 6.9% and 2.8% respectively. As such, the higher yields offered by CHYF makes the fund one of the best alternative investment options in the Real Estate sector. The graph below shows the yield performance of the Regulated Real Estate Funds:

Source: Cytonn Research

We anticipate that the Kenyan Real Estate sector will maintain its upward momentum in terms of performance supported by factors such as; i) continued investments in the Kenyan infrastructural sector opening up new areas for investments, ii) increased activities in the industrial sector fuelled by growing demand for high quality modern warehousing facilities and establishment of SEZs and industrial parks ii) positive demographic trends facilitating increased housing demand, iii) continued focus by the government and private sector to provide affordable housing, and, iv) strategic partnerships by the government and stakeholders in supporting housing and infrastructure developments. However, rising construction costs stemming from inflationary pressures, and limited investor knowledge and interest in the REITs industry, are expected to impede the general sector's optimal performance.

The Affordable Housing Programme (AHP) was launched in 2017, as one of the key pillars of the ‘Big Four Agenda’. The initiative targeted to deliver 500,000 affordable homes for Kenyans across all 47 counties by 2022, in five years. However, the target was far from achieved by the end of the 5-year tenure, with an estimated 13,529 units only being delivered with minimal delivery in the social housing category, amounting to less than 3.0% of the intended target. In 2022, President William Ruto, upon assuming office upheld the initiative, integrating it as one of six foundational pillars of his government’s agenda, with a goal to achieve an annual delivery of 200,000 housing units, hence one million houses in 5 years. Since his inauguration, the President has initiated several affordable housing projects, which include Shauri Moyo A, Kings Boma Estate, Gichugu, and most recently, the Bahati and Milimani affordable housing projects situated in Nairobi, Kiambu, Nakuru, and Kakamega counties respectively.

We have previously tackled four topicals related to affordable housing as follows;

- Affordable Housing in Kenya - In April 2018, we discussed whether the delivery of affordable housing can be a reality and concluded that the initial plan was very useful but some elements needed to be addressed to increase the likelihood of success,

- Accelerating Funding to Affordable Housing - In May 2020, we discussed ways of accelerating funding for affordable housing and concluded that there was need to mobilize alternative sources of funding, particularly the opening up of capital markets access to developers, to provide a low-cost capital raising mechanism,

- Affordable Housing in the Nairobi Metropolitan Area (NMA) – In January 2022, we focused on the status of affordable housing in the Nairobi Metropolitan Area (NMA) and benchmarked with more established case studies with the aim of giving recommendations on what can be done to achieve the initiative, and,

- The most recent topical being Affordable Housing in Kenya which was done in October 2022. Here we reviewed the initiative with a focus on the feasibility of the current government’s plan to deliver 200,000 housing units annually for the next five years, totaling to one million units.

This week, we seek to review the progress of the initiative by covering the following:

- Introduction to Affordable Housing,

- Current State of Housing in Kenya,

- Affordable Housing Initiative in Kenya,

- Lessons Kenya can learn from other countries, and,

- Recommendations and Conclusion.

Section One: Introduction to Affordable Housing

Affordable housing refers to housing units that are affordable by that section of society whose income is below the median household income. According to the United States Department of Housing and Urban Development (HUD) definition, a house is considered affordable if an individual or household allocates no more than 30.0% of their income towards housing, including mortgage payments and utilities. According to UN Habitat, affordable housing is such whose cost does not threaten or compromise the occupant’s enjoyment of other human rights and satisfaction of needs such as food, healthcare, education, and transport. While various organizations may hold varying perspectives on the concept of affordable housing, the general consensus is that it should cater to the requirements of households with low to lower-middle incomes. Globally, this standard is employed to assess the affordability of housing, however in Kenya, residents of urban areas spend up to 40.0% of their income exclusively for housing in rent expenses only.

According to statistics from the Kenya National Bureau of Statistics (KNBS) on income distribution, 42.2% of Kenyan employees in the formal sector earn a monthly median gross income of Kshs 50,000 and below, implying that a significant percentage of these individuals would benefit from the plan. Based on the above statistics, using a rule of thumb, that a maximum of 40.0% of their gross income is spent on housing cost, these are individuals who can afford to pay rent of Kshs 20,000 per month and below. For purposes of gauging the price of a house affordable by these income levels, we assumed a 25-year mortgage, at an average commercial mortgage interest rate of 12.3%, with a maximum of 40.0% of their income being used to pay monthly instalments, an affordable house in urban areas in Kenya is a house that is valued at Kshs 1.9 mn for a single income household and Kshs 3.7 mn for a double income household.

From our Cytonn H1’2023 Markets Review, the average price per SQM of an apartment in the Nairobi Metropolitan Area (NMA) residential market stood at Kshs 95,596. That would translate to a house price of Kshs 3.8 mn for the size of a 40.0-SQM 2 bedroom, which is almost two times the price of such a unit under the government’s affordable housing initiative. The table below gives a summary of what constitutes the average sizes and prices of affordable housing units in the Nairobi in the NMA;

|

Cytonn Report: Summary of Affordable Housing Units in the Nairobi Metropolitan Area |

|||

|

Typology |

Size (SQM) |

Unit Price (Kshs mn) |

Price per SQM (Kshs) |

|

1 |

30.0 |

1.0 |

33,333 |

|

2 |

40.0 |

2.0 |

50,000 |

|

3 |

60.0 |

3.0 |

50,000 |

|

Average |

44,444 |

||

Source: Boma Yangu

- Social Housing: This category is designated for individuals earning up to Kshs 14,999 monthly, accounting for 1.7% of the formal income earners as per the Kenya National Bureau of Statistics (KNBS),

- Low-Cost Housing: This category is designated for individuals earning between Kshs 15,000 and Kshs 49,999 monthly, accounting for 40.5% of the formal income earners, and,

- Mortgage-Gap Housing: This category is designated for individuals earning between Kshs 50,000 and Kshs 100,000 monthly, accounting for 57.8% of the formal income earners.

Section Two: Current State of Housing in Kenya

According to the Center for Affordable Housing Finance (CAHF), approximately 31.0% of Kenya’s total population currently reside in urban areas, while the majority still live in rural areas. Nevertheless, the curve is expected to shift, with an estimated 50.0% of the country’s population expected to live in urban areas by 2050. CAHF estimates Kenya’s housing demand at 250 000 houses annually, against a supply of only 50,000 new houses, which subsequently has led to an 80.0% housing deficit every year. The surging demand for housing is fueled by high urbanization and population growth rates of 3.7% and 1.9% which are above the global averages of 0.8% and 1.6% respectively. Significantly, the State Department of Housing and Urban Development in Kenya reports that 83.0% of the existing housing supply is targeted towards the high-income and upper-middle-income segments, leaving only 15.0% for the lower-middle-income group and a mere 2.0% for the low-income population. Evidently, despite 42.2% of Kenya's working population needing affordable housing, only 17.0% of the available housing supply is allocated to cater to this low to lower-middle income demographic, indicating a severe shortfall in the housing supply for the segments.

As per a report by the CAHF, a substantial 78.0% of urban households totaling 3.7 mn Kenyans rent their primary dwellings, in comparison to a mere 22.0% of owner-occupied households. According to the report, during the period from 2009 to 2019, Kenya’s urban rental sector experienced significant growth, witnessing an increase of 158,000 and 39,000 urban renter and urban owner-occupied households respectively. Notably, 89.0% of urban rental household are delivered almost entirely by the private sector. Remarkably, despite rental housing being a relatively critical form of tenure, particularly in urban areas, the affordable housing framework does not explicitly recognize the substantial contribution made by the rental market, and incorporate affordable renting into its policy.

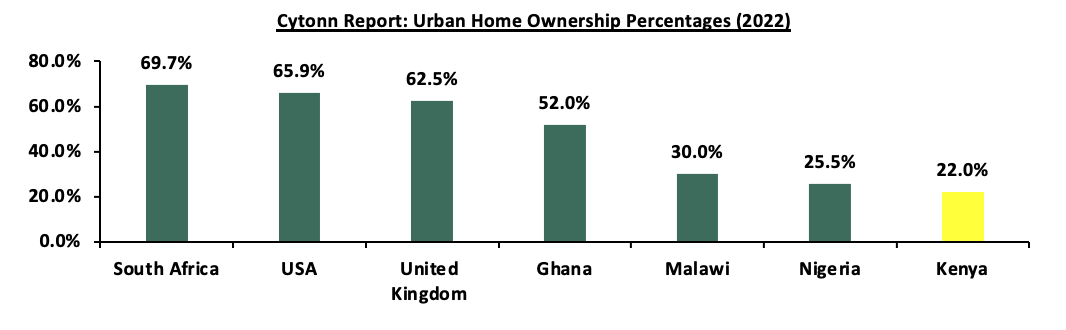

Additionally, home ownership in Kenya remains low compared to other African countries, at 22.0% in urban areas as at 2022, compared to other African countries such as South Africa and Ghana with 69.7% and 52.0% urban home ownership rates, respectively. This underscores the urgent need to prioritize investment in affordable housing, with the aim of addressing the housing deficit and promoting homeownership, particularly among low-income individuals in the country. The graph below shows home ownership percentages for different countries compared to Kenya;

Source: CAHF, United States Census Bureau, United Kingdom Office for National Statistics

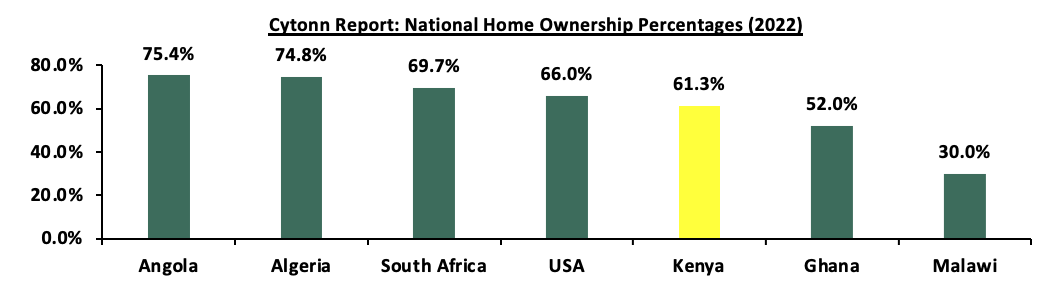

However, contrastingly, homeownership statistics at the national level highlight a nuanced divergence in the prevailing circumstances. National homeownership rates in Kenya are comparatively higher than urban homeownership rates. This raises concerns whether it is prudent for the government to continue focusing its delivery of housing units for homeownership in rural areas of Kenya, through the Affordable Housing Program Constituency Level Agenda. The graph below shows national homeownership percentages for different countries in comparison to Kenya;

Source: CAHF, United States Census Bureau, United Kingdom Office for National Statistics

Section Three: Affordable Housing Initiative in Kenya

To address the housing deficit in the country particularly for low-income earners, and the low level of urban home ownership, the government of Kenya has over the years put forward the initiative to ensure that low and middle-income households can access decent and affordable housing. This is through various national development plans as follows:

- The Kenya Vision 2030: In the first Medium Plan Term Plan (2008-2012) of the Vision 2023, the government targeted to construct 200,000 housing units every year by 2012, up from an estimated 35,000 only being supplied annually, given a demand of 150,000 housing units in urban areas per year. To achieve this, the private sector was to be encouraged with incentives to engage in housing construction, and individuals were to be supported through the creation of a secondary mortgage finance organization. Additionally, efforts were to be made to strengthen the capabilities of local authorities in offering developed land for the production of affordable housing, and motivating them to participate in constructing low-cost housing units through public-private partnership agreements. However, according to the World Bank’s Kenya Economic Update 2017, only 3,000 housing units were constructed by the government between 2009 and 2012.

- The Big Four Agenda: The Affordable Housing Programme (AHP) was an initiative by the government, as one of the pillars under the Big Four Agenda outlined in 2017, to ensure that low and middle-income households could access decent and affordable housing units. Under the initiative, the government also planned to; i) enhance affordability of homes by addressing the interest rate to be between 3.0%-7.0% and tenure of 25 years, ii) reduce cost of construction per SQM by 30.0%, iii) close the annual low-income housing gap by 60.0%, iv) create 350,000 jobs in the construction sector, and, v) construct 500,000 affordable housing units between 2017 and 2022. In 2022, the government further set a target to deliver 200,000 affordable housing units nationally per year under the programme, with a focus of 5,000 units per county. Additionally, in 2023, the government set forth to construct 200 units per constituency in the 2023/24 financial year beginning June 2023.

- Achievements of the Affordable Housing Initiative

The initiative by government to provide access to decent and affordable homes to citizens has over the years resulted in various achievements in the Kenyans housing market as follows;

- Launch of the Boma Yangu Platform

‘Boma Yangu’ is a platform that enables the allocation of affordable homes to Kenyans by; i) facilitating savings for home financing, ii) providing the target market with an inventory of the projects for purchase under the Affordable Housing Programme, iii) providing an inventory of the land bank availed by the government for the construction of housing units, among other benefits.

To be allocated a housing unit, Kenyan citizens create accounts on the online portal and get verified by providing their official details. Once registered, users then contribute any amount either through statutory or voluntary means for savings, which will go into the financing of an affordable home. Boma Yangu account holders can view all the available projects on the platform, wish list their preferred home and then select their desired unit of a certain typology and location. After they have saved a deposit at 10.0% of the home’s value, a purchase agreement through a mortgage or cash sale is initiated for the Boma Yangu account holder. Eventually, when government projects reach completion, housing units will be distributed to individuals registered under the Boma Yangu platform based on various eligibility criteria. These criteria for allocation will be determined by several factors, including the timing of reaching the required deposit amount, family status, social considerations, and the demand within different housing categories. For those Boma Yangu account holders who do not initially receive an allocation, they will be placed on a priority waiting list, ensuring their preference in subsequent allocations. This is meant to ensure that each Kenyan benefits only once by being allocated a single home under the platform. In the case of private sector projects, the allocation process will adhere to the terms and conditions specified in the sales agreements.

- Operationalization of the Kenya Mortgage Refinance Company (KMRC)

In order to bolster homeownership in the county, the Kenya Mortgage Refinance Company (KMRC) a non-deposit taking financial institution was incorporated in April 2018 under the Companies Act, 2015, and was authorized by the CBK to begin lending operations in September 2020. The government has been on track to operationalize the KMRC, allocating Kshs 5.0 bn to the institution during the 2023/2024 financial year, whose primary mandate is for the KMRC to ensure sustainable home financing in the country, by providing long-term funds to primary mortgage lenders (PMLs) such as; banks, microfinance institutions, and SACCOs at low and fixed interest rates. During 2022, the company refinanced 2,522 mortgages, translating to only 9.1% of the 27,786 total mortgage loan accounts in the country for the period. On the other hand, these KMRC mortgages were at a lower average interest rate of 9.5% with an average maturity tenor of 9.9 years, compared to the 12.3% average interest rate on mortgages by commercial banks with an average maturity tenor of 10.9 years. In H1’2023, the KMRC advanced Kshs 7.6 bn worth of loans to PMLs, a 13.2% increase from Kshs 6.8 bn recorded in FY’2022. The institution offers two categories of bulk loans to PMLs, including;

- Affordable Home Loans: These are of loan sizes up to Kshs 8.0 mn within the Nairobi Metropolitan Area (covering Nairobi, Kajiado, Machakos, and Kiambu Counties) and Kshs 6.0 mn for the rest of the country and limited to borrowers with a monthly income threshold of Kshs 150,000 and below, and,

- Market Home Loans: These are loans extended to PMLs to finance home loans above the affordable home loans threshold. Market home loans have no income limit.

As a wholesale financial institution, KMRC does not take deposits nor lend directly to individuals. This enables KMRC to focus on increasing liquidity to PMLs and developing standardized lending practices through working with the government and other stakeholders. This is geared to enable the mortgage lending institutions to continue lending to home buyers without worrying about a lack of long-term funding, by gaining ability to cover any unexpected short-term deposit outflows. In addition to providing long-term funding, KMRC also plays a key role in promoting the development of the economy in Kenya by expanding the capital markets through the issuance of corporate bonds for long-term financing. The Capital Markets Authority of Kenya (CMA) supervises KMRC's bond issuance activities. As such, the KMRC plays a vital role in supporting the ongoing AHP, through its objectives which include;

- Standardizing mortgage practices in Kenya that is geared to enable efficiency of lending processes by working together with the government and stakeholders,

- Facilitating the entry of new mortgage lenders in the market in a bid to increase competition among PMLs in order to lead to a wider range of high-quality mortgage products,

- Providing sustainable, long-term funding at attractive rates to participating financing institutions which will enable them to scale up their mortgage lending operations,

- Facilitating participating institutions to extend the mortgage maturity durations in line with the goal of achieving long-term housing finance,

- Ensuring lower overall transaction costs to PMLs through pooling issuance, as compared to accessing the markets individually, that will in turn enable them to offer lower rates to homebuyers, and,

- Boosting the growth of the capital markets in the country through the issuance of corporate bonds as a source of sustainable long-term funding.

- Construction of Affordable and Social Housing Projects

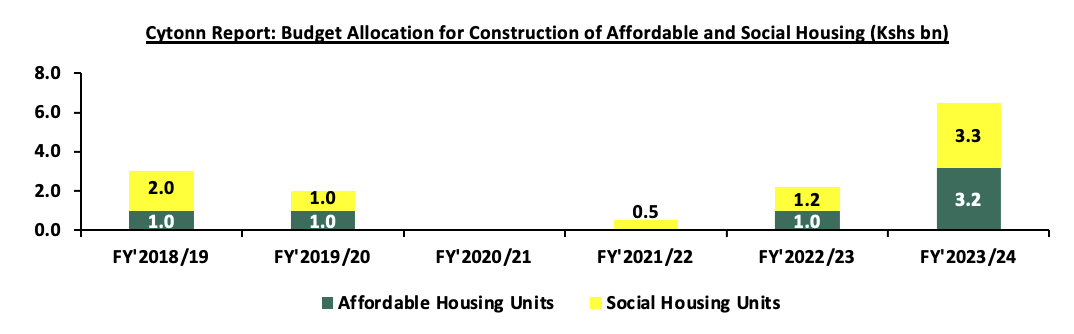

Since the Affordable Housing Programme (AHP) was introduced in 2017 under the Big Four Agenda, the government has continued to allocate funds for the initiative. The amounts have been facilitating the construction of new units, upgrading of existing units and has been offered to operationalize KMRC for the provision of affordable mortgages to Kenyans. The only exception was in FY’2020/2021 where budgetary allocation was reduced as funds were diverted to help the government in containing the spread of the COVID-19 pandemic. During FY’2023/2024, the government allocated a total of Kshs 35.3 bn to collectively fund the Affordable Housing Programme, with Kshs 3.2 bn and Kshs 3.3 bn focused on the construction of affordable and social housing units respectively. The graph below indicates the budgetary allocation towards the construction of housing units from FY’2018/19 to FY’2023/2024;

Source: National Treasury

Consequently, various housing projects have been initiated in various parts of the country over the years which include; Shauri Moyo A, Kings Boma Estate, Gichugu, and most recently, the Bahati and Milimani affordable housing projects situated in Nairobi, Kiambu, Nakuru, and Kakamega counties respectively. The table below shows some of the ongoing affordable housing projects by the government in the pipeline;

|

Cytonn Report: Notable Ongoing Affordable Housing Projects by the Government |

||||

|

Name |

Developer |

Location |

Launch Date |

Number of Units |

|

Ziwani Starehe Affordable Housing Project |

National Government and GulfCap Africa Limited |

Ziwani |

March 2023 |

6,704 |

|

Pangani Affordable Housing Program |

National Government and Tecnofin Kenya Limited |

Pangani |

June 2020 |

1,562 |

|

River Estate Affordable Housing Program |

National Government and Erdemann Property Limited |

Ngara |

March 2019 |

2,720 |

|

Park Road Affordable Housing Program |

National Housing Corporation |

Ngara |

February 2019 |

1,370 |

|

Mukuru Affordable Housing Program |

National Housing Corporation |

Mukuru kwa Njenga, Enterprise Road |

December 2021 |

15,000 |

|

Mavoko Affordable Housing Project |

National Government and Epco Builders |

Syokimau, Machakos County |

December 2022 |

5,360 |

|

NHC Stoni Athi View (Economy Block-Rental) |

National Housing Corporation |

Athi River, Machakos County |

December 2021 |

50 |

|

NHC Stoni Athi View |

National Housing Corporation |

Athi River, Machakos County |

December 2021 |

120 |

|

Mariguini Informal Settlement |

National Government |

Starehe, Nairobi County |

March 2021 |

2,600 |

|

Kibera Soweto East Zone B |

National Government |

Kibera, Nairobi County |

October 2022 |

3,000 |

|

Starehe Affordable Housing Project |

National Government and Tecnofin Kenya Limited |

Starehe, Nairobi County |

March 2023 |

3,000 |

|

Shauri Moyo A Affordable Housing Units |

National Government and Epco Builders |

Shauri Moyo, Nairobi County |

February 2020 |

2,731 |

|

Clay City Project |

Housing Finance Development and Investment and Clay Works |

Kasarani, Thika Road |

October 2018 |

1,800 |

|

Bachelors Jevanjee Estate |

County Government of Nairobi and Jabavu Village |

Ngara |

February 2020 |

720 |

|

Kings Boma Estate |

National Government and Kings Developers Limited |

Ruiru, Kiambu County |

January 2020 |

1,050 |

|

Gichugu Affordable Housing project |

Kirinyaga County Government and National Housing Corporation |

Gichugu, Kirinyaga County |

August 2023 |

110 |

|

Bahati Affordable Housing Project |

National Government |

Bahati, Nakuru County |

August 2023 |

220 |

|

Lurambi Affordable Housing Project |

National Government and Top Choice Surveillance Limited |

Lurambi, Kakamega County |

August 2023 |

220 |

|

Vihiga Affordable Housing Project |

National Government and Padaa Enterprise |

Vihiga County |

August 2023 |

220 |

|

Total |

48,557 |

|||

Source: Cytonn Research, Boma Yangu

In addition to the above government projects, there also exists projects initiated by private developers to fast-track the delivery of housing projects to Kenyans. These are undertaken through Public-Private Partnerships (PPPs) whereby the developer provides funding, with the land being availed by the government. The table below shows various ongoing affordable housing projects spearheaded by the private sector;

|

Cytonn Report: Notable Ongoing Affordable Housing Projects by the Private Sector |

||||

|

Name |

Developer |

Location |

Launch Date |

Number of Units |

|

Great Wall Gardens Phase 5 |

Erdemann Limited |

Mavoko, Machakos County |

December 2022 |

1,128 |

|

Samara Estate |

Skymore Pine Limited |

Ruiru |

July 2020 |

1,824 |

|

Moke Gardens |

Moke Gardens Real Estate |

Athi River |

October 2021 |

30,000 |

|

Habitat Heights |

Afra Holding Limited |

Mavoko |

December 2019 |

8,888 |

|

Tsavo Apartments Projects |

Tsavo Real Estate |

Embakasi, Riruta, Thindigua, Roysambu, and, Rongai |

October 2020 |

3,200 |

|

Unity West |

Unity Homes |

Tatu City |

November 2021 |

3,000 |

|

RiverView |

Karibu Homes |

Athi River |

October 2020 |

561 |

|

Kings Serenity |

Kings Developers Limited |

Ongata Rongai, Kajiado County |

October 2022 |

734 |

|

Joinven Estate |

Joinven Investments Limited |

Syokimau, Machakos County |

December 2022 |

440 |

|

Stima Heights |

Stima SACCO |

Ngara West, Nairobi County |

March 2023 |

450 |

|

Kings Orchid |

Kings Developers Limited |

Thika, Kiambu County |

August 2023 |

975 |

|

Total |

|

|

51,200 |

|

Source: Cytonn Research, Boma Yangu

- Legislation of the Affordable Housing Levy

The Finance Act 2023 introduced a sub-clause (31B) to the Employment Act, 2007, creating the Affordable Housing Levy. This levy requires a mandatory monthly deduction of 1.5% from the gross monthly salary of every formal employee in both the private and public sectors in Kenya. In addition, the levy mandates employers to match the employee's contribution with an equal amount, essentially doubling the funds allocated to affordable housing. The introduction of the Affordable Housing Levy represents a crucial step in funding and supporting affordable housing projects in the country in terms of;

- Utilization for Affordable Housing: The funds collected through the Affordable Housing Levy are designated for the development of affordable housing and the support of social and physical infrastructure. This allocation aligns with the primary goal of the Affordable Housing Initiative to increase the supply of affordable housing units in Kenya,

- Projectable Revenue: Given the large number of formal employees at approximately 3.0 mn Kenyans given the average gross income for Kenyan wage employees in the formal public and private sector at Kshs 72,130 as of 2022, the government anticipates significant revenue collection through this levy. This is expected to generate substantial funds, with estimates reaching up to Kshs 78.3 bn annually. The revenue is crucial for financing the construction of affordable housing units,

- Mandatory Deduction: The Affordable Housing Levy requires that both employees and employers contribute a specified percentage at 1.5% of the employee's gross monthly salary towards the Affordable Housing Fund. This mandatory deduction ensures a steady and substantial inflow of funds into the affordable housing initiative,

- Timely Remittance: Employers are mandated to deduct the required amount from their employees' gross monthly salaries and remit both the employee's and employer's contributions within nine days from the end of the month in which the payment is due. This ensures the efficient collection and allocation of funds for affordable housing development,

- Exclusivity of Use: Unlike the previous proposal, which allowed contributing members to access their funds after seven years, the change in terminology from a "fund" to a "levy" implies that the contributions are exclusively dedicated to affordable housing. This is meant to prevent contributors from accessing the funds for any other purpose, ensuring that the funds are utilized as intended,

- Penalties for Non-Compliance: To ensure compliance, the Act imposes a 2.0% penalty on employers who fail to remit the total deducted amounts from both employees and themselves. This penalty mechanism encourages employers to adhere to their obligations and contributes to the sustainability of the Affordable Housing Levy, and,

- Equality in Contributions: The Act does not specify any contribution limit based on individuals' income levels. This approach aims to promote equality by requiring the same percentage deduction from low-income, middle-income, and high-income earners. This ensures that everyone contributes proportionally to their earnings.

- Incentives to Developers

Within the framework of the affordable housing Initiative, the Kenyan government has provided support mechanisms aimed at bolstering the pivotal role played by Real Estate developers in addressing the nation's housing challenges. These incentives include;

- Corporate Tax Reduction: A pivotal measure introduced to incentivize developers in the Affordable Housing Initiative is a substantial reduction in corporate tax. Developers engaged in the construction of over 100 affordable housing units annually benefit from a 50.0% reduction in the corporate tax rate, which drops from 30.0% to 15.0%. This significant tax relief serves as a catalyst for large-scale affordable housing development, stimulating increased housing supply in Kenya,

- VAT Exemption: Developers are further incentivized through a Value Added Tax (VAT) exemption for supplies imported or purchased exclusively for use in constructing affordable housing units. This exemption applies to licensed Special Economic Zones (SEZs) that commit to developing a minimum of 5,000 units. Notably, this provision encourages the growth of such economic zones, with projects like Tatu City in Kiambu County serving as exemplary cases. The VAT exemption simplifies construction procurement and reduces overall project costs,

- Infrastructural Support: Developers may also benefit from government-provided infrastructure support, encompassing essential amenities such as road access, utilities, and other necessary infrastructure for affordable housing projects. This collaborative approach mitigates developers' infrastructure-related expenditures, ensuring a more efficient and cost-effective development process,

- Access to Land: To facilitate developers' involvement in affordable housing, the government actively engages in making suitable land available for such projects. This may involve the allocation of land to county governments for the construction of affordable housing units, thus ensuring a consistent supply of land resources for development purposes,

- Fast-Tracking of Approvals: Developers participating in affordable housing initiatives enjoy expedited and streamlined approval processes, a proactive step to reduce bureaucratic delays. These efficient approval mechanisms enable projects to commence and reach completion more swiftly, contributing to the timely delivery of affordable housing units, and,

- Public-Private Partnerships (PPPs): As part of its strategy to bolster the affordable housing sector, the government promotes the concept of Public-Private Partnerships (PPPs). These collaborative ventures offer developers access to additional resources, expertise, and support, fostering increased participation and investment in the affordable housing space.

Challenges Facing the Affordable Housing Initiative

The timely delivery of the Affordable Housing program has been impeded by several bottlenecks, with the government delivering an estimated 13,529 units only by 2022 with minimal delivery in the social housing category, amounting to less than 3.0% of the intended target of 500,000 within 5 years since 2017. Some of the bottlenecks that have been hampering the affordable housing initiative include;

- Rising costs of construction: Construction costs have remained high averaging at Kshs 5,210 per SQFT in 2022, a 5.0% increase from Kshs 4,960 per SQFT recorded in 2021, attributable to price increase of key construction materials such as cement, steel, paint, aluminium and PVC. The continued rise in prices of the materials is mainly attributable to inflationary pressures in the economy consequently making construction activities more expensive. This has made it difficult to construct affordable housing units in order to deliver to the market,

- Limited sustainable development financing: Lenders continue to tighten their lending requirements and demand more collateral from developers as a result of elevated credit risk in the Real Estate sector. This is evidenced by the 12.2% increase in gross Non-Performing Loans (NPLs) in the Real Estate sector to Kshs 88.1 bn in Q1’2023, from Kshs 78.5 bn in Q1’2022. In addition, on a q/q basis, the increase in NPLs represented a 9.7% increase from Kshs 80.3 bn realized in Q4’2022.

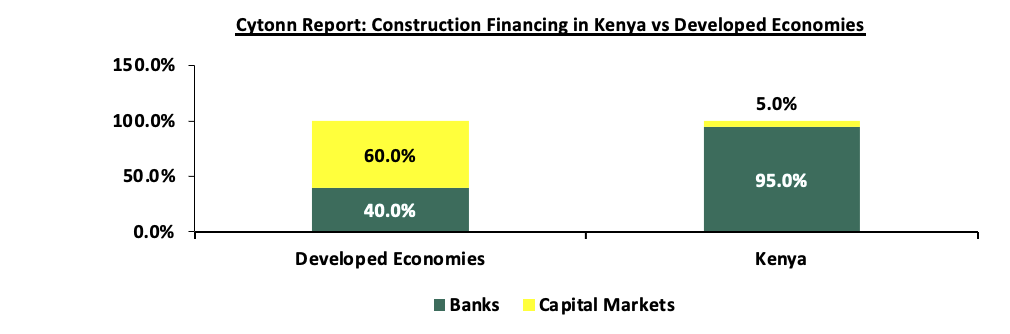

- Nonexistent Capital Markets Finance: Furthermore, there is an overreliance on banks for the expensive funding by private developers hence making it difficult to raise funds for affordable housing projects, unlike developed countries where capital markets account for majority of funding. The graph below shows the comparison of construction financing in Kenya against developed economies;

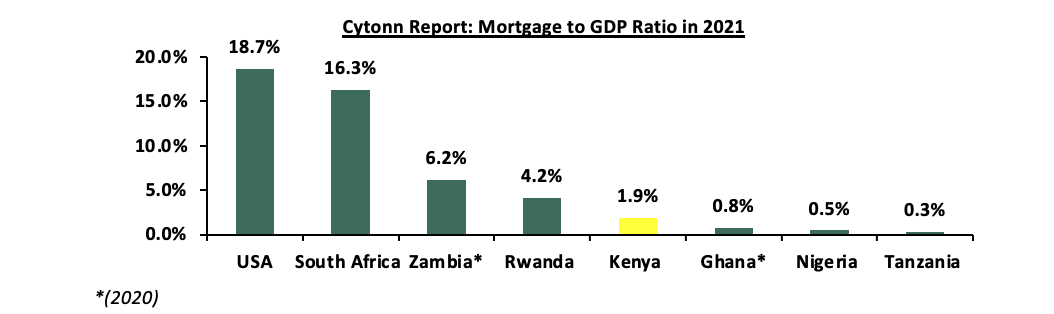

Source: World Bank, Capital Markets Authority - Inadequate access to affordable financing for homebuyers: Access to affordable financing is a significant challenge for many Kenyans, particularly those looking to purchase homes. The high cost of mortgage financing makes it difficult for many Kenyans to afford to purchase homes, which reduces the uptake of affordable housing units. As a result, Kenya’s mortgage to GDP continues to underperform at 1.9% to GDP in comparison to other African countries such as South Africa and Rwanda at approximately 16.3% and 4.2% respectively. The graph below shows the mortgage to GDP ratio in Kenya in comparison to other countries;

Source: Centre for Affordable Housing Africa - Prolonged bureaucratic transaction timelines: The transaction timelines for property registration in Kenya are longer compared to other African countries, taking 44 days and costing 5.9% of the property price on average. That is relatively higher than countries like Rwanda, which takes 7 days and costs 0.1%. This illustrates the generally slow processes in Kenya, and,

- Inadequate supply of development land: There is scarcity of affordable land serviced with support infrastructure such as water, sewerage and electricity necessary for development of affordable units. This is due to rising land prices in urban areas with the average land prices in the NMA coming in at Kshs 128.5 mn per acre in H1’2023, a 4.5% increase from Kshs 128.4 mn per acre realized in H1’2022.

Section Four: Lessons Kenya can Learn from Other Countries

In our previous topicals on the affordable housing initiative in Kenya, we highlighted Canada, Singapore, Japan and South Africa among the countries that have made strides in affordable housing. We now take a look at the lessons on initiatives that we can learn from Brazil, India and the United States of America.

|

Country |

Key Take-Outs |

|

Brazil |

|

|

India |

|

|

USA |

|

Source: Cytonn Research

Section Five: Recommendation and Conclusion

From the above lessons, the following can be implemented to accelerate the affordable housing initiative by the government and further solve the housing deficit in the country;

- Focus on Affordable Renting: It is imperative for the government to integrate rental housing into the affordable housing framework. This strategic move will help bridge the gap between housing demand and supply, rectifying the existing mismatch. By doing so, the government can take significant strides toward resolving the housing problem and reducing the housing deficit in the country. Incorporating rental housing into the affordable housing agenda will be a pivotal step in achieving the overarching goals of the affordable housing initiative.

- Removing Obstacles in the capital markets: The private sector’s participation in the development of affordable housing in Kenya has been crippled by the unavailability of financing for development activities. The government should therefore stimulate the capital markets and expand their investor base thus increasing the availability of capital for development projects, while reducing reliance on traditional financing channels such as bank loans. This can be achieved by; i) reducing the minimum investments in REITs, ii) allowing sector funds, iii) eliminating conflicts of interest in the governance of capital markets, and, iv) improving market transparency to provide investors with more information,

- Program monitoring and Evaluation Systems: Create a robust system for continuously monitoring and evaluating the impact of affordable housing initiatives. Regular assessments can identify areas for improvement, measure program effectiveness, and ensure that government efforts are yielding the desired results,