Special Interest Group Funds in Kenya, & Cytonn Weekly #28/2024

By Research Team, Jul 14, 2024

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed for the second consecutive week, with the overall oversubscription rate coming in at 137.3%, higher than the oversubscription rate of 124.4% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 14.6 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 364.7%, albeit lower than the oversubscription rate of 370.1% recorded the previous week. The subscription rates for the 182-day and 364-day papers increased to 100.6% and 83.0% respectively from the 94.2% and 56.3% respectively recorded the previous week. The government accepted a total of Kshs 30.2 bn worth of bids out of Kshs 32.9 bn bids received, translating to an acceptance rate of 91.8%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day, and 91-day papers increasing by 5.0 bps, 2.7 bps, and 0.9 bps to 16.88%, 16.82%, and 16.00% respectively from 16.83%, 16.80% and 15.99% respectively recorded the previous week;

During the week, the global ratings agency, Moody’s announced its revision of Kenya’s credit score, downgrading it by one scale to Caa1 from a credit rating of B3 while maintaining a negative outlook, on the back of the government's decision to forgo proposed tax increases through the Finance Bill 2024 and rely on expenditure cuts, significantly impacting Kenya's fiscal trajectory and financing needs;

During the week, the Kenya Revenue Authority (KRA) released the annual revenue performance for FY’2023/24, highlighting that revenue mobilization for the period grew by a notable 11.1% up from 6.4 % growth in the previous financial year, after KRA collected Kshs 2.4 tn compared to Kshs 2.2 tn in the previous financial year. This translates to a performance rate of 95.5%;

Equities

During the week, the equities market was on an upward trajectory, with NSE 20 gaining the most by 2.2% while NSE 10, NSE 25, and NASI gained by 1.9%, 1.9%, and 0.9% respectively, taking the YTD performance to gains of 24.6%, 21.9%, 19.6% and 12.4% for NSE 10, NSE 25, NASI and NSE 20 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Bamburi, KCB Group, and EABL of 37.9%, 6.7%, and 4.7% respectively. The performance was, however, weighed down by losses recorded by large-cap stocks such as Safaricom and ABSA bank of 1.4%, and 1.1% respectively;

Also, during the week, Amsons Industries (K) Limited of Tanzania announced its intention to acquire 100% of the ordinary shares of Bamburi Cement Plc with a par value of Kshs 5.0 each for a cash consideration. The offer value of Kshs 23.6 bn translates to a purchase price of Kshs 65.0 per share, which is 42.4% above the price of 45.7 as at one month ago. This offer has been made in accordance to the Capital Markets (Take-overs & Mergers) Regulations, 2002. This acquisition, if successful, will make Amsons Industries (K) Limited the sole owner of Bamburi Cement Plc;

Real Estate

During the week, Finsco Africa, a Real Estate firm, announced that it recently secured a Kshs 5.0 bn deal with Atlanta-based Go Greenwood Bank LLC for onward long-term funding with a key focus on affordable housing targeting the lower and upper middle class.

During the week, TPS Eastern Africa, the owner of Serena hospitality brand, announced its plan to build a multi-purpose conference facility next to its Nairobi Serena Hotel. The facility, estimated to cost up to USD 30.0 mn (Kshs 3.9 bn), targets the meetings, conferences, and exhibitions market.

In the Regulated Real Estate Funds sector, under the Real Estate Investment Trusts (REITs) segment, ICEA Lion Asset Managers (ILAM) Fahari I-REIT was admitted to the Unquoted Securities Platform (USP) of the Nairobi Securities Exchange (NSE), following their delisting from the main investment market in February 2024. ILAM Fahari joined Acorn I-REIT, Acorn D-REIT, and the Linzi Sukuk in the USP, marking the first trading day in the segment;

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 24.5 and Kshs 22.0 per unit, respectively, as per the last updated data on 12th July, 2024. The performance represented a 22.5% and 10.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 12th July, 2024, representing a 45.0% loss from the Kshs 20.0 inception price;

Focus of the Week

Special interest group funds in Kenya, such as the Financial Inclusion Fund (Hustler Fund) and the Youth Enterprise Development Fund (YEDF), aim to promote financial inclusivity and support economic growth by providing accessible credit to marginalized communities. However, recent audits reveal significant issues with these funds, casting doubts on their transparency, accountability, and overall effectiveness. The Hustler Fund, for instance, faced scrutiny for its management and loan recovery processes, with inconsistencies in financial statements and systemic deficiencies in its loan management system. Similarly, the Youth Enterprise Fund has struggled with high default rates, unserviced loans, and questionable financial transactions, leading to concerns over its sustainability and operational integrity. These challenges highlight the critical need for robust oversight and improved governance to ensure these funds fulfill their intended purpose of empowering underserved populations and fostering economic development. This topical will delve into the various special funds examining the structures, operational sustainability, performance and offering insights into potential reforms for more effective management of special interest group funds in Kenya;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 18.33% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Mondays and Thursdays, from 7:00 pm to 8:30 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

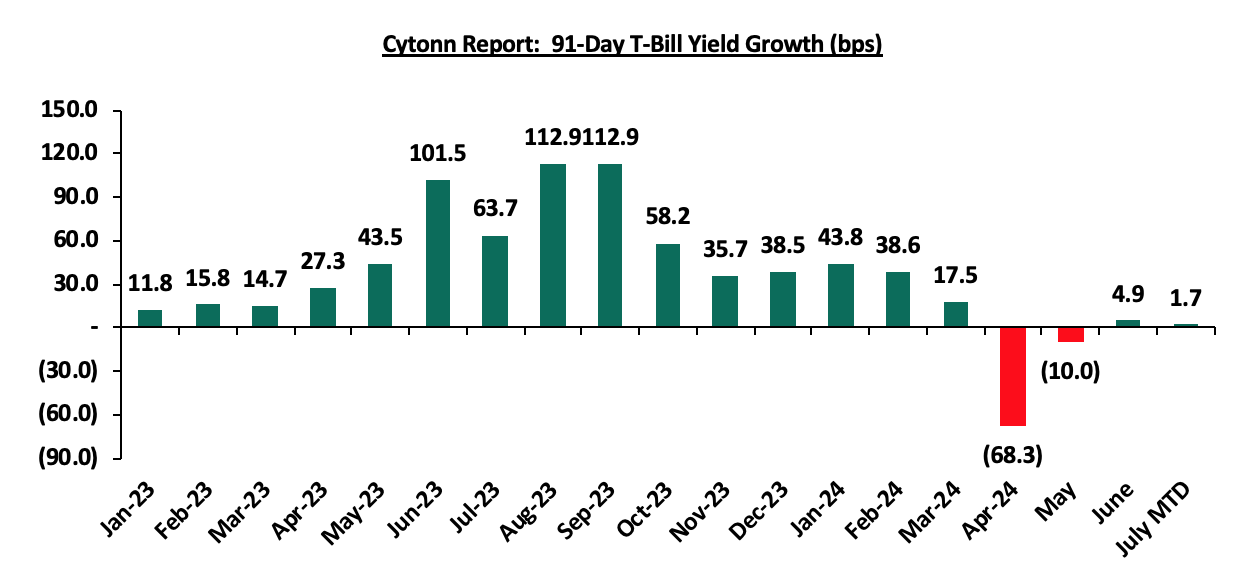

During the week, T-bills were oversubscribed for the second consecutive week, with the overall oversubscription rate coming in at 137.3%, higher than the oversubscription rate of 124.4% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 14.6 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 364.7%, albeit lower than the oversubscription rate of 370.1% recorded the previous week. The subscription rates for the 182-day and 364-day papers increased to 100.6% and 83.0% respectively from the 94.2% and 56.3% respectively, recorded the previous week. The government accepted a total of Kshs 30.2 bn worth of bids out of Kshs 32.9 bn bids received, translating to an acceptance rate of 91.8%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day, and 91-day papers increasing by 5.0 bps, 2.7 bps, and 0.9 bps to 16.88%, 16.82%, and 16.00% respectively from 16.83%, 16.80% and 15.99% respectively recorded the previous week. The chart below shows the yield growth rate for the 91-day paper over the period:

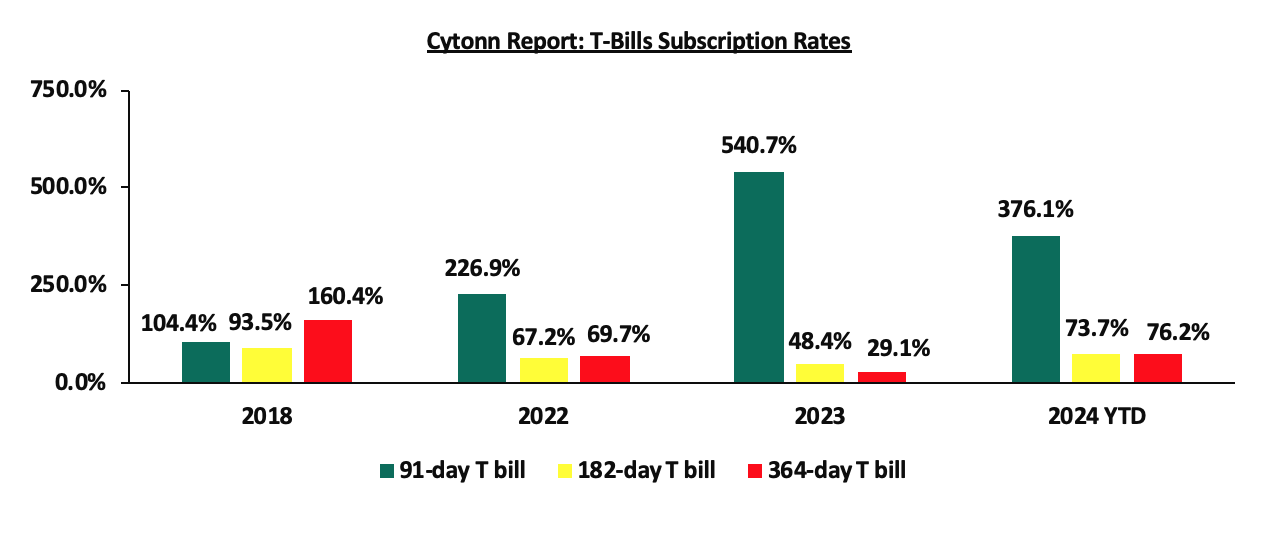

The chart below compares the overall average T-bill subscription rates obtained in 2018, 2022, 2023, and 2024 Year-to-date (YTD):

Money Market Performance:

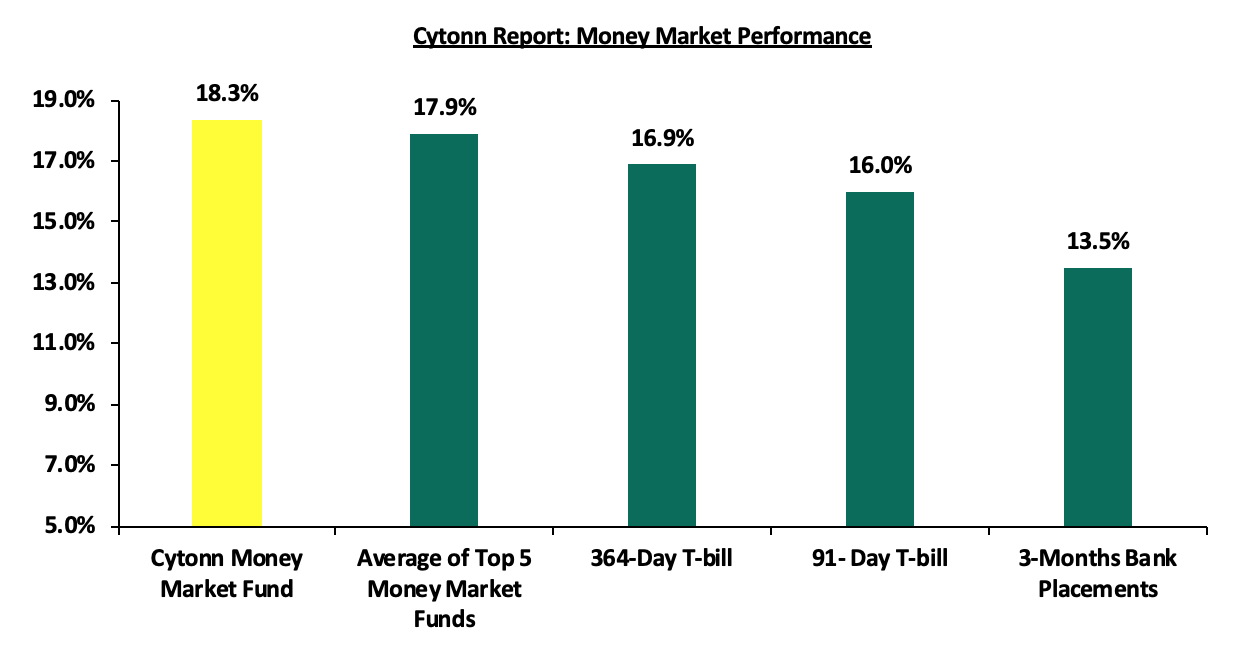

In the money markets, 3-month bank placements ended the week at 13.5% (based on what we have been offered by various banks), and the yields on the government papers were on an upward trajectory, with the yields on the 364-day and 91-day papers increasing by 5.0 bps and 0.9 bps to 16.88% and 16.00% respectively from 16.83% and 15.99% respectively recorded the previous week. The yields on the Cytonn Money Market Fund decreased marginally by 1.0 bps to close the week at 18.3% remaining relatively unchanged from last week, while the average yields on the Top 5 Money Market Funds increased by 2.8 bps to remain relatively unchanged at 17.9% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 12th July 2024:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 12th July 2024 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Etica Money Market Fund |

18.5% |

|

2 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn App) |

18.3% |

|

3 |

Lofty-Corban Money Market Fund |

18.3% |

|

4 |

Kuza Money Market fund |

17.2% |

|

5 |

Arvocap Money Market Fund |

17.1% |

|

6 |

GenAfrica Money Market Fund |

16.6% |

|

7 |

Nabo Africa Money Market Fund |

16.5% |

|

8 |

GenCap Hela Imara Money Market Fund |

16.0% |

|

9 |

Enwealth Money Market Fund |

15.9% |

|

10 |

KCB Money Market Fund |

15.7% |

|

11 |

Apollo Money Market Fund |

15.6% |

|

12 |

Jubilee Money Market Fund |

15.6% |

|

13 |

Mayfair Money Market Fund |

15.4% |

|

14 |

Co-op Money Market Fund |

15.4% |

|

15 |

Madison Money Market Fund |

15.2% |

|

16 |

Mali Money Market Fund |

15.2% |

|

17 |

Sanlam Money Market Fund |

15.1% |

|

18 |

Absa Shilling Money Market Fund |

14.9% |

|

19 |

Orient Kasha Money Market Fund |

14.8% |

|

20 |

Dry Associates Money Market Fund |

14.0% |

|

21 |

Equity Money Market Fund |

14.0% |

|

22 |

AA Kenya Shillings Fund |

13.8% |

|

23 |

Old Mutual Money Market Fund |

13.6% |

|

24 |

CIC Money Market Fund |

13.5% |

|

25 |

British-American Money Market Fund |

13.5% |

|

26 |

ICEA Lion Money Market Fund |

12.4% |

Source: Business Daily

Liquidity:

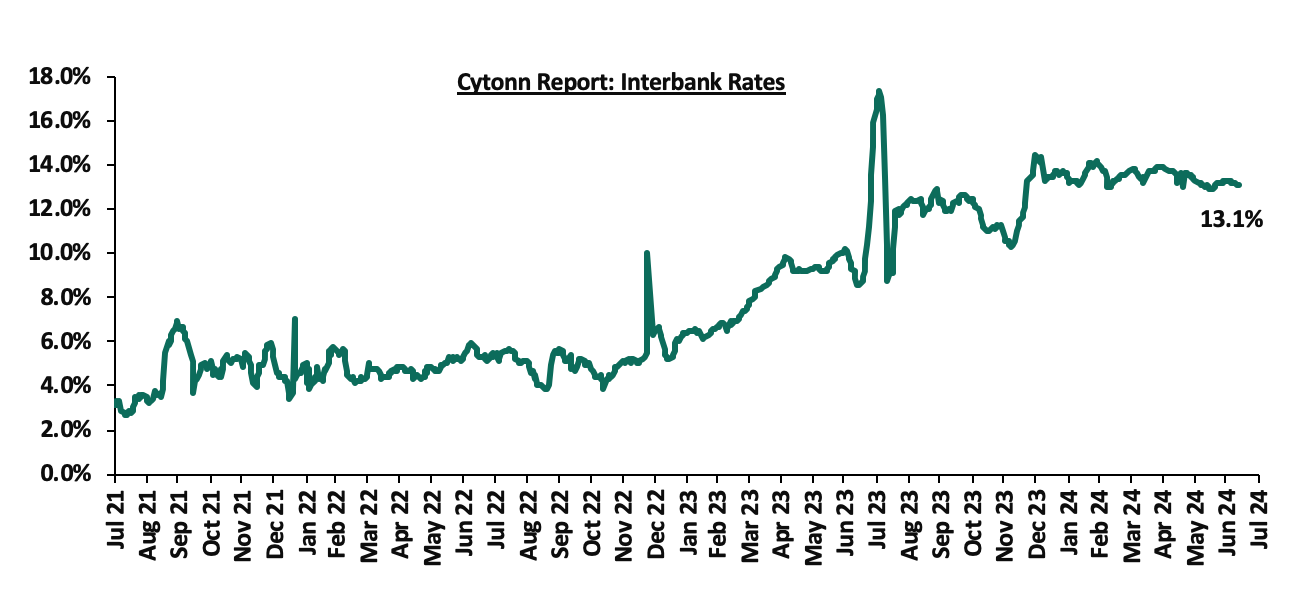

During the week, liquidity in the money markets marginally eased, with the average interbank rate decreasing by 13.2 bps, to 13.2% from 13.3% recorded the previous week, partly attributable to government payments that offset tax remittances. The average interbank volumes traded increased significantly by 92.5% to Kshs 38.4 bn from Kshs 20.0 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Eurobonds were on a downward trajectory, with the yields on the 7-year Eurobond issued in 2024 decreasing the most by 43.3 bps to 10.5% from 10.9% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 11th July 2024;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2018 |

2019 |

2021 |

2024 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

|

Years to Maturity |

3.7 |

23.7 |

2.9 |

7.9 |

10.0 |

6.7 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

|

1-Jan-24 |

9.8% |

10.2% |

10.1% |

9.9% |

9.5% |

|

|

1-Jul-24 |

10.6% |

11.1% |

10.3% |

11.0% |

11.0% |

11.1% |

|

04-Jul-24 |

10.4% |

10.9% |

10.0% |

10.9% |

10.9% |

10.9% |

|

05-Jul-24 |

10.1% |

10.8% |

10.0% |

10.7% |

10.7% |

10.7% |

|

08-Jul-24 |

9.9% |

10.7% |

9.6% |

10.5% |

10.5% |

10.5% |

|

09-Jul-24 |

10.1% |

10.8% |

10.0% |

10.7% |

10.6% |

10.7% |

|

10-Jul-24 |

10.0% |

10.7% |

9.8% |

10.6% |

10.6% |

10.6% |

|

11-Jul-24 |

9.9% |

10.7% |

9.7% |

10.5% |

10.5% |

10.5% |

|

Weekly Change |

(0.4%) |

(0.2%) |

(0.4%) |

(0.4%) |

(0.4%) |

(0.4%) |

|

MTD Change |

(0.6%) |

(0.4%) |

(0.7%) |

(0.5%) |

(0.5%) |

(0.6%) |

|

YTD Change |

0.1% |

0.5% |

(0.4%) |

0.6% |

1.0% |

- |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling depreciated against the US Dollar by 0.6%, to close at Kshs 129.3, from Kshs 128.5 recorded the previous week. On a year-to-date basis, the shilling has appreciated by 17.7% against the dollar, a contrast to the 26.8% depreciation recorded in 2023.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,509.8 mn in the 12 months to May 2024, 12.8% higher than the USD 3,997.3 mn recorded over the same period in 2023, which has continued to cushion the shilling against further depreciation. In the May 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 56.0% in the period,

- The tourism inflow receipts which came in at USD 352.5 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 27.2% to 2.1 mn in the 12 months to March 2024, from 1.6 mn recorded during a similar period in 2023, and,

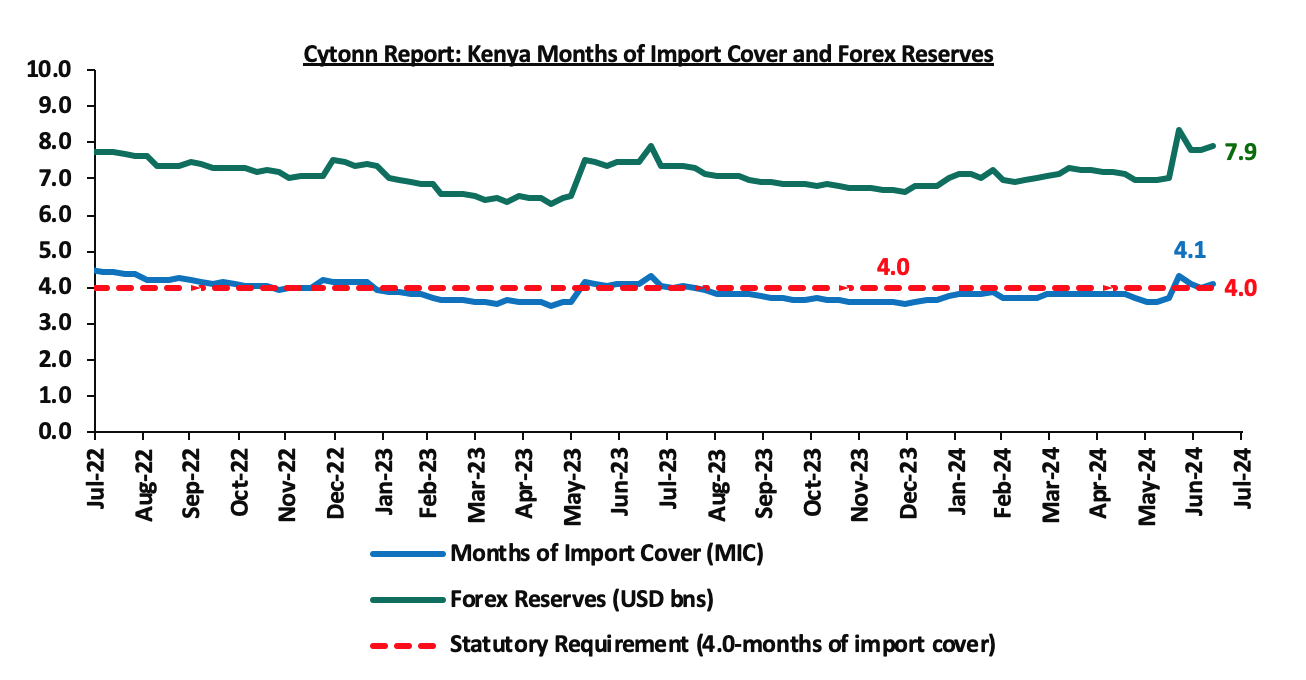

- High Forex reserves currently at USD 7.9 bn (equivalent to 4.1-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, albeit lower than EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 3.2% of GDP in Q1’2024 from 3.0% recorded in Q1’2023, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.3% of Kenya’s external debt is US Dollar-denominated as of December 2023.

Key to note, Kenya’s forex reserves increased by 1.6% during the week to USD 7.9 bn, from the USD 7.8 bn recorded the previous week, equivalent to 4.1 months of import cover, an increase from the 4.0 months recorded the previous week, and above the statutory requirement of maintaining at least 4.0-months of import cover. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights

- Moody’s Downgrades Kenya’s Credit Rating and Maintains Negative Outlook

On July 8th 2024, the global rating agency, Moody’s announced its revision of Kenya’s credit rating, downgrading it to Caa1 from a credit rating of B3 while maintaining a negative outlook, on the back of the government's decision to forgo proposed tax increases through the Finance Bill 2024 and rely on expenditure cuts, significantly impacting Kenya's fiscal trajectory and financing needs. The downgrade of Kenya's rating indicates a greatly reduced ability to implement fiscal consolidation measures focused on revenue, which are necessary to improve debt affordability and reduce overall debt.

In response to recent protests, the government withdrew the planned tax increases that were part of the 2024 Finance Bill. These tax measures were originally expected to generate Kshs 346.0 bn, or 1.9% of GDP. Given the current social climate, it is now unlikely that the government can implement these revenue-raising measures. Consequently, the government intends to cut spending by Kshs 177.0 bn, while increasing borrowing and expanding the fiscal deficit to 4.6% of GDP, which is 1.3% points higher than the initially projected 3.3% for fiscal 2025.

The negative outlook highlights potential risks to government liquidity. The revised forecasts still anticipate a reduction in the fiscal deficit through spending cuts, though at a slower pace than previously expected. Increased financing needs or higher borrowing costs could exacerbate liquidity risks. Specifically, slower fiscal consolidation might further limit external funding options, including reduced support from multilateral creditors, who have been the main source of external financing since 2020. Additionally, greater financing needs could decrease domestic interest in government securities, complicating the government's ability to service domestic debt.

In addition, Kenya's local currency (LC) ceiling was downgraded from Ba3 to B1, maintaining a three-notch gap with the sovereign rating. This change reflects the country's relatively weak institutions, unpredictable policies, and moderate political risks, counterbalanced by the government's small economic footprint and limited external imbalances. The foreign currency (FC) ceiling was also lowered, from B1 to B2, one notch below the LC ceiling. This adjustment takes into account Kenya's relatively low external debt and moderately open capital account, which, while not completely eliminating, do reduce the need for transfer and convertibility restrictions during periods of financial stress.

This move positions Kenya alongside emerging economies like Nigeria and Egypt. The downgrade comes after Fitch affirmed the Sovereign’s Long-Term Issuer Default Rating (IDR) to B with a negative outlook on 16th February 2024. Additionally, the downgrade follows the S&P Global affirming Kenya’s IDR at B with a negative outlook on 7th February 2024 following the partial buyback of its USD 2.0 bn Eurobond that matured in June 2024.

To note, Kenya tapped into the international capital markets, having successfully issued a USD 1.5 bn Eurobond with a tenor of 6 years at a coupon rate of 9.75%. This followed Ivory Coast, which successfully issued two bonds with respective maturities of 8.5 years and 12.5 years and coupon rates of 7.65% and 8.25% respectively, maturing on 30th January 2033 and 30th January 2037 respectively, and Benin issuing their debut dollar bond with a tenor of 14 years at a coupon rate of 8.375% on February 6th 2024.

Below is a table comparing Kenya, Ivory Coast, and Benin’s Moody’s credit rating and a summary of the Eurobond issues:

|

Cytonn Report: Moody’s Rating's Long-Term Foreign-Currency Issuer Default Rating (IDR) |

||||||

|

Moody’s Rating's Long-Term Foreign-Currency Issuer Default Rating (IDR) |

2024 Eurobond Issues |

|||||

|

Country |

IDR Credit Rating |

IDR Credit Outlook |

Date |

Value (USD mn) |

Tenor (Years) |

Coupon Rate |

|

Ivory Coast |

Ba2 |

Stable |

Mar- 2024 |

1,100.0 |

8.5 |

7.650% |

|

1,500.0 |

12.5 |

8.250% |

||||

|

Benin |

B1 |

Stable |

Sep-2023 |

750.0 |

14.0 |

8.375% |

|

Kenya |

Caa1 |

Negative |

July- 2024 |

1,500.0 |

6.0 |

9.750% |

Going forward, Kenya's government faces the challenge of managing a fiscal strategy that relies on expenditure cuts rather than revenue-driven through the planned tax increases. This approach, coupled with ongoing social tensions, is likely to prolong fiscal deficits, weaken debt affordability, and increase liquidity risks. Limited external financing options further complicate the government's ability to meet substantial borrowing needs. Clear fiscal management and policy coherence will be crucial to maintaining investor confidence and achieving sustainable economic growth.

- Kenya Revenue Authority (KRA) FY’2023/24 Revenue Performance

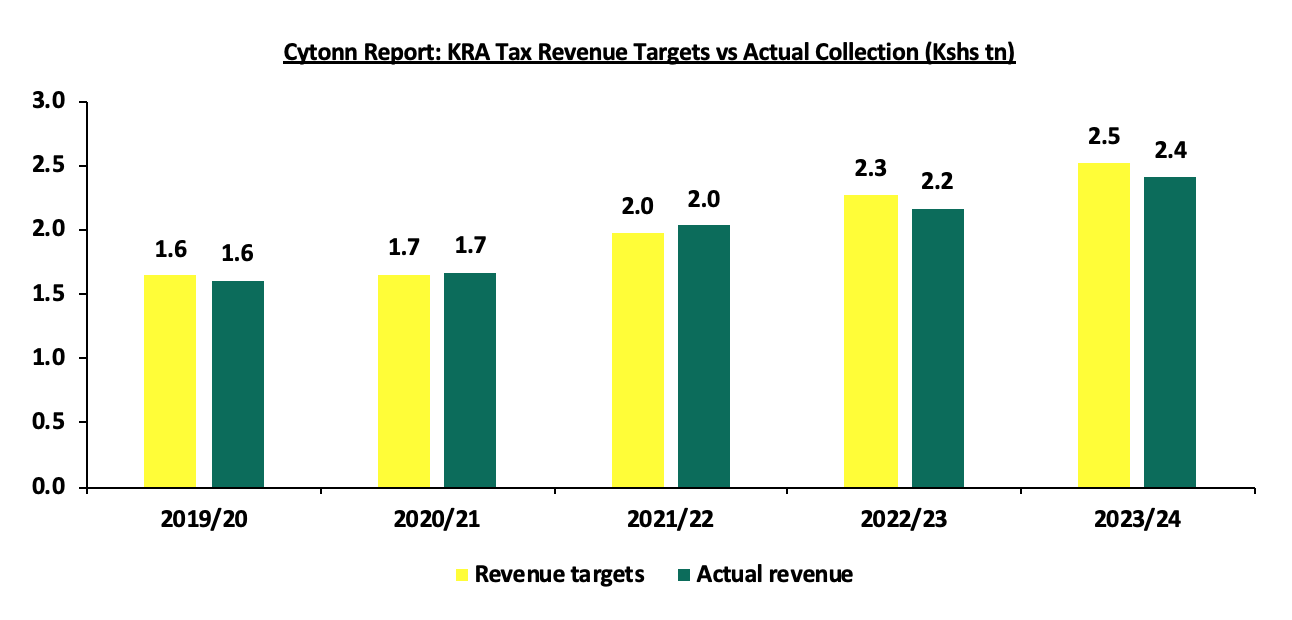

During the week, the Kenya Revenue Authority (KRA) released the annual performance for FY’2023/24, highlighting that revenue mobilization for the period grew by a notable 11.1% up from 6.4 % growth in the previous financial year, after KRA collected Kshs 2.4 tn compared to Kshs 2.2 tn in the previous financial year. This translates to a performance rate of 95.5% against the target. The chart below shows the revenue collected against the targets in the last five years

Some of the key take-outs from the release include;

- The Exchequer revenue (revenue collected for the National Treasury) grew by 9.5% after KRA collected Kshs 2.2 tn compared to Kshs 2.0 tn collected in the previous financial year,

- Agency revenue (collected for government agencies) recorded a 34.9% growth with a collection of Kshs 184.0 bn compared to 136.4 bn collected in FY’2022/23,

- Customs Revenue recorded growth of 4.9% with a collection of Kshs 791.3 bn compared to the 754.1 bn collected in FY’2022/23, and,

- Domestic Taxes registered a revenue growth of 14.4% after collecting Kshs 1.6 tn, from the Kshs 1.4 tn collected in the previous financial year.

The table below summarizes the performance of some of the key tax heads;

|

Cytonn Report: Performance of Key Tax Heads (Kshs Bn) |

|||

|

Tax head |

Collection FY'2022/2023 |

Collection FY'2023/24 |

y/y growth |

|

Excise on betting |

19.2 |

24.3 |

26.2% |

|

Domestic VAT |

272.5 |

314.2 |

15.3% |

|

Corporation tax |

263.8 |

278.2 |

5.4% |

|

PAYE |

495.0 |

543.2 |

9.7% |

|

Domestic excise |

68.1 |

73.6 |

8.1% |

The improved tax revenue collections were mainly attributable to the following key revenue drivers;

- Tax Amnesty: Through the tax amnesty programme, KRA collected Kshs 43.9 bn. This is after over 2.6 mn taxpayers were granted amnesty during the period,

- Tax Base Expansion (TBE): The program enabled KRA to collect Kshs 24.6 bn in revenue. Some initiatives under the TBE include recruitment of landlords under Monthly Rental Income (MRI) obligation and Block Management System (BMS) to map out potential taxpayers. Through the period, KRA recruited over 1.2 mn additional active taxpayers for the period under review,

- Debt Collection Initiatives: KRA enhanced collection from debt programmes on non-compliant taxpayers, collecting a total of Kshs 103.4 bn during the period. This performance is attributable to follow-ups on demand notices and the debt installment plans agreed upon with taxpayers,

- Betting and Gaming Tax: The integration of betting and gaming companies into the tax system has given KRA real-time access to companies in the sector. During the period under review, KRA collected Kshs 24.3 bn in excise duty and withholding tax from 111 onboarded companies, and,

- Anti-Corruption Measures: The public and staff reported 883 cases involving tax malpractices. This was done through the iWhistle system and led to the recovery of Kshs 4.2 bn.

We note that the government has been missing its revenue targets despite increased taxes due to a small tax base, widespread tax evasion, ineffective revenue collection strategies, economic challenges, and administrative inefficiencies within the KRA. Going forward, we expect the Kenya Revenue Authority (KRA) to significantly enhance its revenue mobilization and operational efficiency through the implementation of the 9th Corporate Plan, spanning five years instead of the previous three-year cycles. This plan will focus on simplifying tax and Customs compliance processes, expanding the tax base, scaling up infrastructure to meet growing business demands, and optimizing human resource capacity and capability. Additionally, KRA will implement the National Tax Policy and the Medium-Term Revenue Strategy (MTRS) for FY 2024/25 - 2026/27, aiming to boost tax compliance and streamline revenue collection. Despite the current challenging economic environment, the resilience shown by taxpayers is encouraging, with a notable increase in tax returns filed. However, we expect the withdrawal of the Finance Bill 2024, following nationwide protests to create a revenue shortfall from the FY’2024/25 target of Kshs 2.95 tn.

Rates in the Fixed Income market have been on an upward trend given the continued high demand for cash by the government and the occasional liquidity tightness in the money market. The government is 47.2% ahead of its prorated net domestic borrowing target of Kshs 10.1 bn, having a net borrowing position of Kshs 14.9 bn. However, we expect a downward readjustment of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to normalize in the medium to long-term and hence investors are expected to shift towards the long-term papers to lock in the high returns.

Market Performance:

During the week, the equities market was on an upward trajectory, with NSE 20 gaining the most by 2.2% while NSE 10, NSE 25, and NASI gained by 1.9%, 1.9%, and 0.9% respectively, taking the YTD performance to gains of 24.6%, 21.9%, 19.6% and 12.4% for NSE 10, NSE 25, NASI and NSE 20 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Bamburi, KCB Group, and EABL of 37.9%, 6.7%, and 4.7% respectively. The performance was, however, weighed down by losses recorded by large-cap stocks such as Safaricom and ABSA bank of 1.4%, and 1.1% respectively;

During the week, equities turnover increased by 15.4% to USD 8.7 mn from USD 7.6 mn recorded the previous week, taking the YTD total turnover to USD 364.6 mn. Foreign investors became net sellers with a net selling position of USD 0.2 mn, from a net buying position of USD 0.6 mn recorded the previous week, taking the YTD foreign net buying position to USD 7.0 mn.

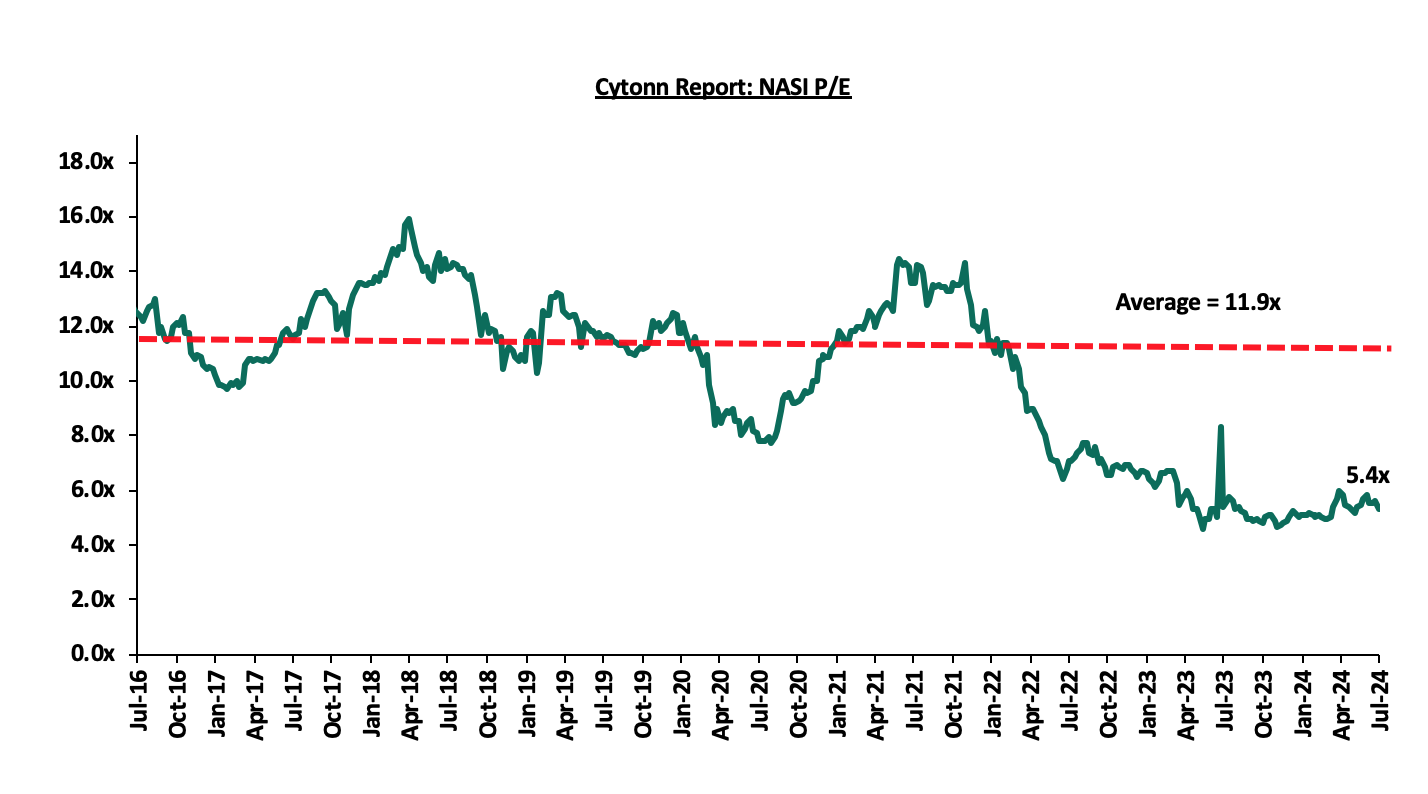

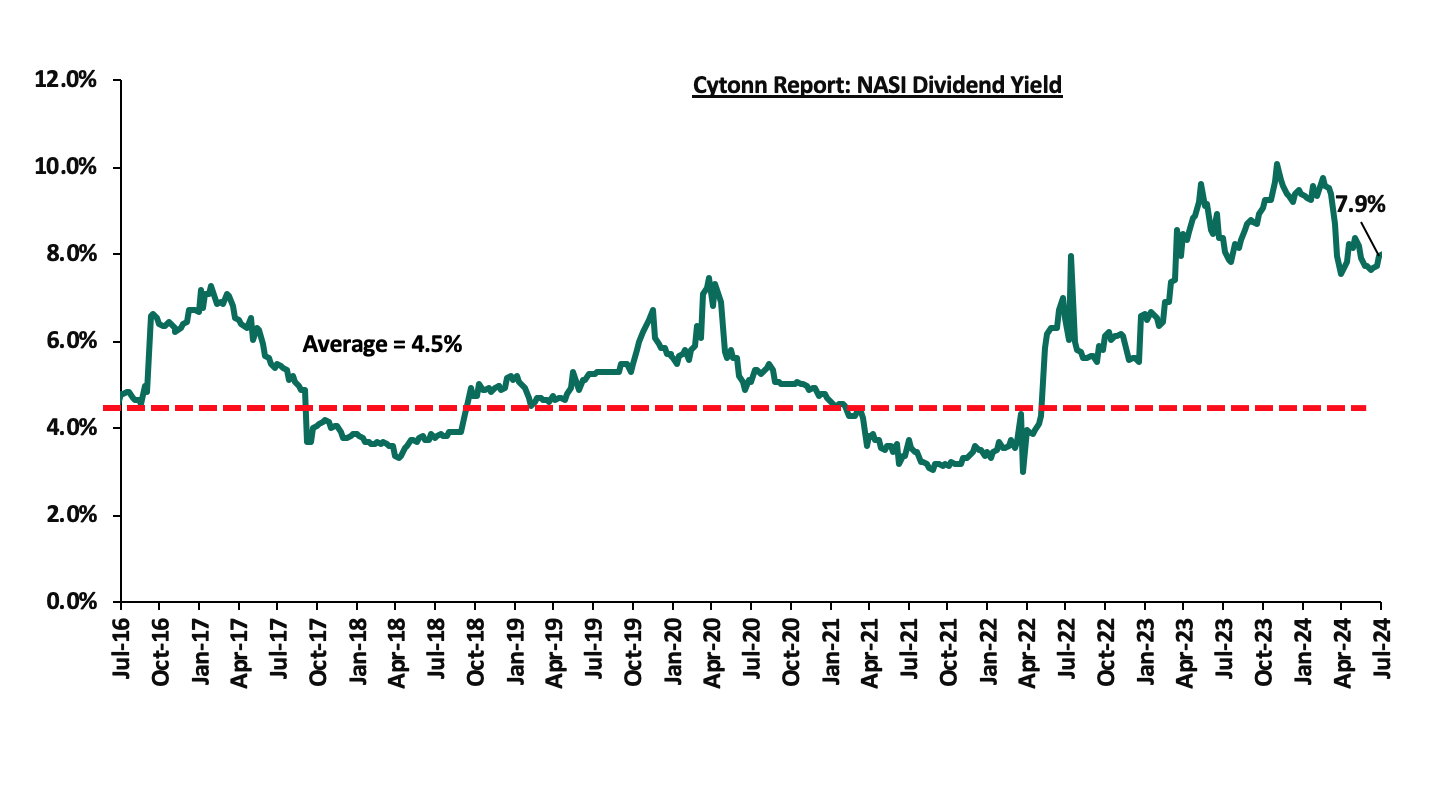

The market is currently trading at a price-to-earnings ratio (P/E) of 5.4x, 54.8% below the historical average of 11.9x. The dividend yield stands at 7.9%, 3.4% points above the historical average of 4.5%. Key to note, NASI’s PEG ratio currently stands at 0.7x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

||||||||||

|

Company |

Price as at 05/07/2024 |

Price as at 12/07/2024 |

w/w change |

YTD Change |

Year Open 2024 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Jubilee Holdings |

168.0 |

176.3 |

4.9% |

(4.7%) |

185.0 |

260.7 |

8.1% |

56.0% |

0.3x |

Buy |

|

Diamond Trust Bank*** |

46.4 |

46.5 |

0.2% |

3.8% |

44.8 |

65.2 |

10.8% |

51.1% |

0.2x |

Buy |

|

Equity Group*** |

42.0 |

43.3 |

3.1% |

26.6% |

34.2 |

60.2 |

9.2% |

48.3% |

0.9x |

Buy |

|

NCBA*** |

41.1 |

41.2 |

0.2% |

6.0% |

38.9 |

55.2 |

11.5% |

45.5% |

0.8x |

Buy |

|

Co-op Bank*** |

12.7 |

13.0 |

2.4% |

14.1% |

11.4 |

17.2 |

11.6% |

44.4% |

0.6x |

Buy |

|

Stanbic Holdings |

113.0 |

115.0 |

1.8% |

8.5% |

106.0 |

145.3 |

13.3% |

39.7% |

0.8x |

Buy |

|

KCB Group*** |

32.0 |

34.2 |

6.7% |

55.6% |

22.0 |

46.7 |

0.0% |

36.6% |

0.5x |

Buy |

|

ABSA Bank*** |

14.1 |

13.9 |

(1.1%) |

20.3% |

11.6 |

17.3 |

11.2% |

35.6% |

1.1x |

Buy |

|

Standard Chartered*** |

193.8 |

194.5 |

0.4% |

21.4% |

160.3 |

233.1 |

14.9% |

34.8% |

1.3x |

Buy |

|

Britam |

6.0 |

5.7 |

(5.0%) |

10.5% |

5.1 |

7.5 |

0.0% |

32.0% |

0.8x |

Buy |

|

CIC Group |

2.2 |

2.2 |

3.7% |

(2.6%) |

2.3 |

2.8 |

5.8% |

31.4% |

0.7x |

Buy |

|

I&M Group*** |

21.7 |

21.7 |

0.2% |

24.4% |

17.5 |

25.5 |

11.8% |

29.3% |

0.4x |

Buy |

|

Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

||||||||||

Weekly Highlights

- Amsons Industries (K) Intent to Acquire 100% shareholding of Bamburi Cement Plc

During the week, Amsons Industries (K) Limited of Tanzania announced its intention to acquire 100.0% of the ordinary shares of Bamburi Cement Plc with a par value of Kshs 5.0 each for a cash consideration. The offer value of Kshs 23.6 bn translates to a purchase price of Kshs 65.0 per share, which is 42.4% above the price of 45.7 as at one month ago. This offer has been made in accordance to the Capital Markets (Take-overs & Mergers) Regulations, 2002. This acquisition, if successful, will make Amsons Industries (K) Limited the sole owner of Bamburi Cement Plc.

The Tanzania-based company is a direct investment company, that has ventured into energy, construction, food, and agri-industry, with operations in Zambia, Malawi, Mozambique, Democratic Republic of Congo, and Burundi. As it stands, Amsons Industries does not own any shares, directly or indirectly in Bamburi.

With the Kshs 23.6 bn, this deal will represent a 42.4% premium on the closing price of Bamburi cement shares of Kshs 45.7 recorded on 9th July 2024, a day before the announcement was made. It shall also be a gain of 52.9% of the Kshs 42.5 weighted average share price of Bamburi cement for the past 30 days leading to the announcement of the deal. The deal’s Price to Earning before interest, tax, depreciation and amortization (P/EBITDA) stands at 6.0x.

Additionally, the notice indicated that Bamburi Cement directors may declare a special dividend for its shareholders in relation to the proceeds received from the completed divestment of Bamburi shareholding in Hima Cement Limited. Earlier this year, Bamburi Cement Plc announced the successful completion of the sale of 1.3 mn ordinary shares in Hima Cement Limited, representing 70.0% of the total shares owned by Bamburi Cement Plc through its parent company Himcem Holdings Limited, to Sarrai Group Limited and Rwimi Holdings Limited. This deal injected an estimated Kshs 12.0 bn in the company’s books.

The notice indicated that Amsons Limited already got an undertaking from two existing shareholders of Bamburi as part of the offer; Fincem Holding Limited and Kencem Holding Limited. In the agreement, should this offer achieve acceptance of 75% or more of the ordinary shares, Amsons Limited will evaluate the continued listing of the cement company, and shall apply for delisting from the market. If delisted, this will amplify the challenges that the stock market has been facing with subdued listing, reducing the number of listings from the current 66 to 65.

Given the 42.4% premium on the last recorded share price and an additional dividend payment which will drive up capital gains for the shareholders, we anticipate and project that the deal will achieve an acceptance rate above 75.0%.

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery. With the market currently being undervalued for its future growth (PEG Ratio at 0.7x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors’ sell-offs to continue weighing down the equities outlook in the short term.

- Residential Sector

During the week, Finsco Africa, a Real Estate firm, announced that it recently secured a Kshs 5.0 bn deal with Atlanta-based Go Greenwood Bank LLC for onward long-term funding with a key focus on affordable housing targeting the lower and upper middle class. The two firms signed a Memorandum of Understanding (MoU) the Kenya National Chamber of Commerce and Investment offices where Greenwood Bank LCC committed to providing the funds in tranches to support Finsco Africa’s affordable residential projects in Nairobi, Kiambu, Murang’a, Machakos, Kisumu, Eldoret, and Nakuru where the developer’s projects are domiciled. By making homeownership more accessible for Kenyans and Africans at large, this collaboration will drive sustainable development in the region, addressing the high demand for affordable and quality housing.

We expect this partnership to pave the way for similar investments, further stimulating the affordable housing sector and improving living standards for many Kenyans. This development signals a positive trajectory for Finsco Africa and the broader real estate sector, promising robust growth and sustainable economic development in the region.

The Affordable Housing Program (AHP) in Kenya is a key component of the government's Big Four Agenda, targeting the construction of 250,000 affordable homes annually. Despite these ambitious targets, the current housing supply falls significantly short, with only about 50,000 units being delivered annually against a demand of 250,000 units. This deficit underscores the critical need for initiatives like the Finsco-Greenwood partnership to boost affordable housing supply.

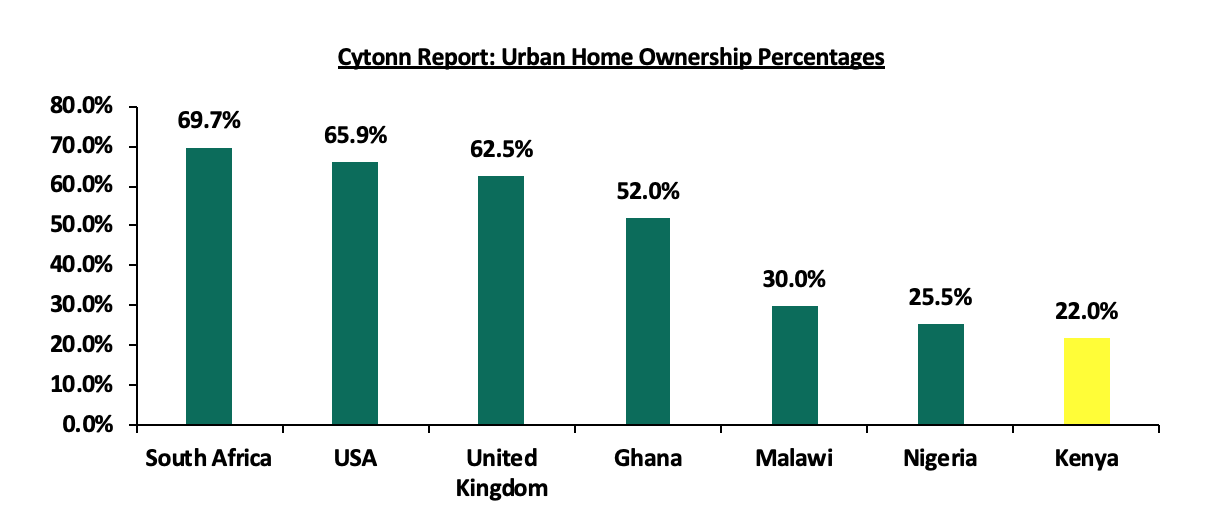

Homeownership in Kenya remains a challenge, with the majority of the population unable to afford homes due to high property prices and limited access to financing. The national homeownership rate stands at approximately 21.3% in urban areas sprawling the national average of 61.3% while 78.7% of urban dwellers rent. The government's push for affordable housing aims to improve this rate by making homes more accessible to lower and middle-income earners. The graph below highlights home ownership rates in different African countries;

Source: Centre for Affordable Housing Finance Africa (CAHF), US Census Bureau, UK Office for National Statistics

- Hospitality Sector

During the week, TPS Eastern Africa, the owner of Serena hospitality brand, announced its plan to build a multi-purpose conference facility next to its Nairobi Serena Hotel. The facility, estimated to cost up to USD 30.0 mn (Kshs 3.9 bn), targets the meetings, conferences, and exhibitions (MICE) market. The project is expected to commence early next year and will take 2 years to complete following the conclusion of feasibility studies in December 2024. According to the project team, the facility will sit on a 1.12-acre piece of land that is directly opposite the hotel’s main entrance, and which is currently being used as the hotel’s main car parking area. The planned conference room is expected to accommodate between 500 to 1000 people in a single sitting. The building is also expected to have banqueting space, meeting rooms, and an underground car park. It will also offer an opportunity to firms to lease space and operate their businesses.

This development marks a significant expansion for the Nairobi Securities Exchange-listed firm, which currently generates most of its revenue from hotels and lodges in Kenya, Uganda, and Tanzania. The renewed investment appetite comes as the company has recovered from the slump brought on by the COVID-19 pandemic in early 2020. We expect this investment to not only enhance the Nairobi Serena Hotel’s offerings but also to significantly contribute to the growth and diversification of TPS Eastern Africa’s revenue streams in the coming years.

Upon completion, we expect the new facility to enhance the hospitality sector by increasing capacity to host large-scale events, attracting both local and international conferences. The MICE sector is vital for Kenya’s tourism, significantly contributing to the industry's overall performance. The Tourism Sector Performance Report 2023 indicates that Kenya hosted 25,703 international delegates in 2023, up from 18,658 delegates, marking a 37.8% growth and reflecting the sector's recovery. In 2023, MICE and Business Tourism made up 24.0% of total tourist arrivals, although this was a 3.2% decrease from the previous year. Despite this, the sector shows significant growth compared to the pre-COVID period when it accounted for 13.5% of total arrivals. The new conference facility will strengthen Nairobi's position as a premier destination for MICE tourism in East Africa, attracting more business travelers and boosting hotel occupancy rates.

- Real Estate Investments Trusts (REITs)

- ILAM Fahari I-REIT Debuts on the NSE’s Unquoted Securities Platform

During the week, ICEA Lion Asset Managers (ILAM) Fahari I-REIT was admitted to the Unquoted Securities Platform (USP) of the Nairobi Securities Exchange (NSE), following their delisting from the main investment market in February 2024. ILAM Fahari joined Acorn I-REIT, Acorn D-REIT and the Linzi Sukuk in the USP, marking the first trading day in the segment. The delisting from the Main Investment Market Segment (MIMS) of the NSE will provide greater flexibility in managing the REIT's portfolio without affecting the unitholders’ ability to trade their units. The REIT’s shares (units) were available for trading on the platform at a fixed price of Kshs 11.0, representing the price at which a section of minority investors was bought out last year by ILAM, which is also the manager of the REIT. Investors seeking to buy into the REIT are required to acquire a minimum of 454,545 units worth Kshs 5.0 mn in the fund, based on the offering's restricted status dominated by high-net-worth or professional traders. The REIT manager expects the price per unit to grow based on the revaluation of the property fund, addressing some challenges that led to the fund's removal from the NSE’s main market segment. The REIT's price is expected to be determined by three valuation methods: the income approach, the market approach, and the asset approach. Non-Professional investors, whose unit value is less than Kshs 5.0 mn, are bundled into a Nominee Account.

ILAM will seek high-quality assets in prime locations with strong tenants and aims to double its portfolio value from Kshs 3.5 bn to Kshs 7.0 bn within the next three years. The restructuring is expected to create several benefits for unitholders, including increased flexibility to pursue a broader range of investment opportunities, such as direct real estate acquisitions and developments, improved alignment of the REIT's investment strategy with the long-term needs of its unitholders, and reduced costs and administrative burdens associated with being a listed REIT.

The increase in ILAM Fahari I-REIT's share price from Kshs 5.7 on February 9, 2024, to Kshs 11.0 is due to several strategic actions and market perceptions. The comprehensive restructuring involved converting the REIT from an unrestricted to a restricted I-REIT, delisting from the Main Investment Market Segment (MIMS), and transitioning to the Unquoted Securities Platform (USP). This restructuring included a buyout of minority investors at a premium price, reflecting a more accurate valuation of the REIT. Improved market perception, strategic repositioning, and future growth potential, including plans to double the portfolio value, have boosted investor confidence. Additionally, the price discovery process on the USP, dictated by valuation methods such as the income, market, and asset approaches, have revealed a higher intrinsic value for the REIT, resulting in the share price increase.

This restructuring is a result of ILAM Fahari I-REIT’s comprehensive strategic review in 2021, which sought to address the challenges the I-REIT faced and develop strategies to improve returns and market performance. The long-term plan aims to elevate returns and market performance through asset optimization and the growth of Assets Under Management (AUM). Upon successful implementation of the strategy, the REIT will consider relisting on the NSE after three years. Under this new segment, ILAM Fahari I-REIT will remain regulated by the Capital Markets Authority.

We expect this restructuring to enhance the ILAM Fahari I-REIT's operational flexibility and growth potential, providing unitholders with improved returns and diversified investment opportunities. This development is a positive signal for the real estate sector, highlighting the potential for innovative financial instruments to unlock value and drive growth in Kenya's market.

- I-REIT Weekly Performance

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 24.5 and Kshs 22.0 per unit, respectively, as per the last updated data on 12th July, 2024. The performance represented a 22.5% and 10.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 30.7 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 633.8 mn, respectively, since inception in February 2021. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 12th July, 2024, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 138,600 for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015.

REITs offer various benefits, such as tax exemptions, diversified portfolios, and stable long-term profits. However, the ongoing decline in the performance of Kenyan REITs and the restructuring of their business portfolios are hindering significant previous investments. Additional general challenges include: i) insufficient understanding of the investment instrument among investors, ii) lengthy approval processes for REIT creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and iv) minimum investment amounts set at Kshs 5.0 mn for the Investment REITs, all of which continue to limit the performance of the Kenyan REITs market.

We expect performance of Kenya’s real estate sector to be sustained by: i) increased investment from local and international investors, particularly in the commercial and residential sectors ii) Nairobi’s status as a recognized regional hub, which will sustain growth in the commercial office sector iii) Favorable demographics in the country, leading to higher demand for housing and real estate, and iv) ongoing residential developments under the Affordable Housing Agenda, aiming to reduce the housing deficit in the country. However, challenges such as rising construction costs, an oversupply in office spaces, strain on infrastructure development, and high capital demands in REITs sector will continue to impede the sector’s optimal performance by restricting developments and investments.

Special interest group funds in Kenya, such as the Financial Inclusion Fund (Hustler Fund) and the Youth Enterprise Fund (YEF), aim to promote financial inclusivity and support economic growth by providing accessible credit to marginalized communities. However, recent audits reveal significant issues with these funds, casting doubts on their transparency, accountability, and overall effectiveness. The Hustler Fund, for instance, faced scrutiny for its management and loan recovery processes, with inconsistencies in financial statements and systemic deficiencies in its loan management system. Similarly, the Youth Enterprise Fund has struggled with high default rates, unserviced loans, and questionable financial transactions, leading to concerns over its sustainability and operational integrity. These challenges highlight the critical need for robust oversight and improved governance to ensure these funds fulfill their intended purpose of empowering underserved populations and fostering economic development.

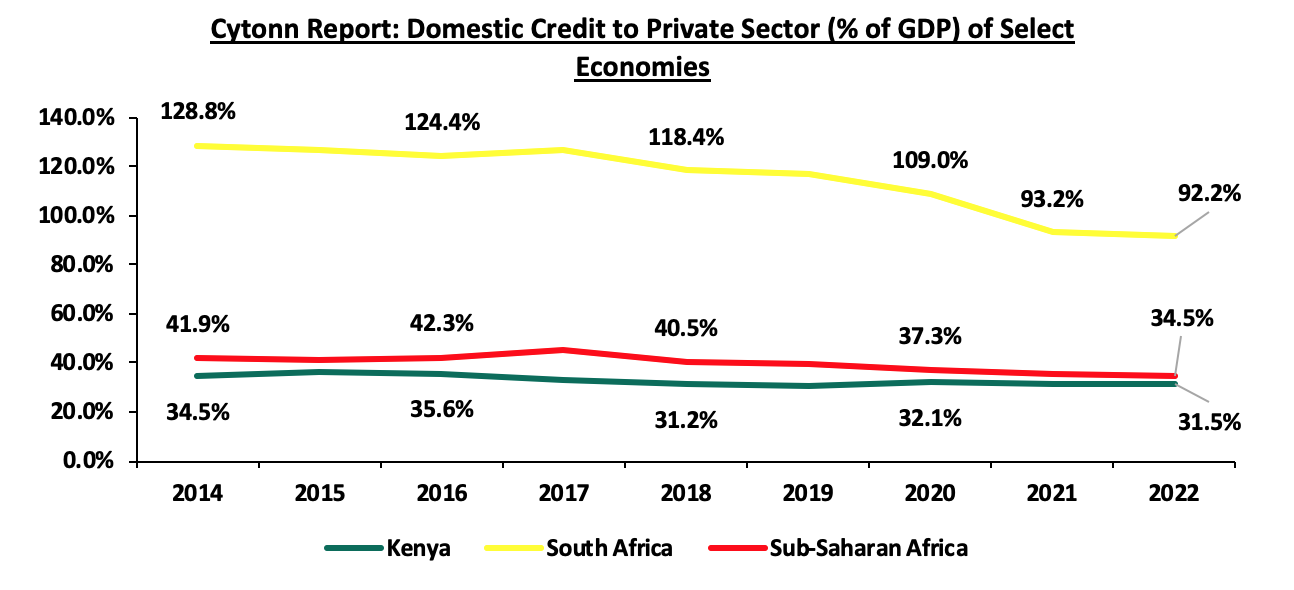

Kenya’s domestic credit extended to the private sector as a percentage of GDP was at 31.5% in 2022, compared to the 34.5% average for the Sub-Saharan African region and notably, 92.2% for South Africa, highlighting the gap in credit availability for businesses. This gap in credit availability underscores the importance of special interest group funds like the Hustler Fund and YEF. However, despite their potential, these funds only partially address the problem. If we take South Africa as an example, then we need to reach at least 90.0% credit to GDP to start to resolve the credit problem. That means an additional Kshs 6.1 tn in credit is needed. The graph below shows domestic credit extended to the private sector for select economies over the years

Source: World Bank

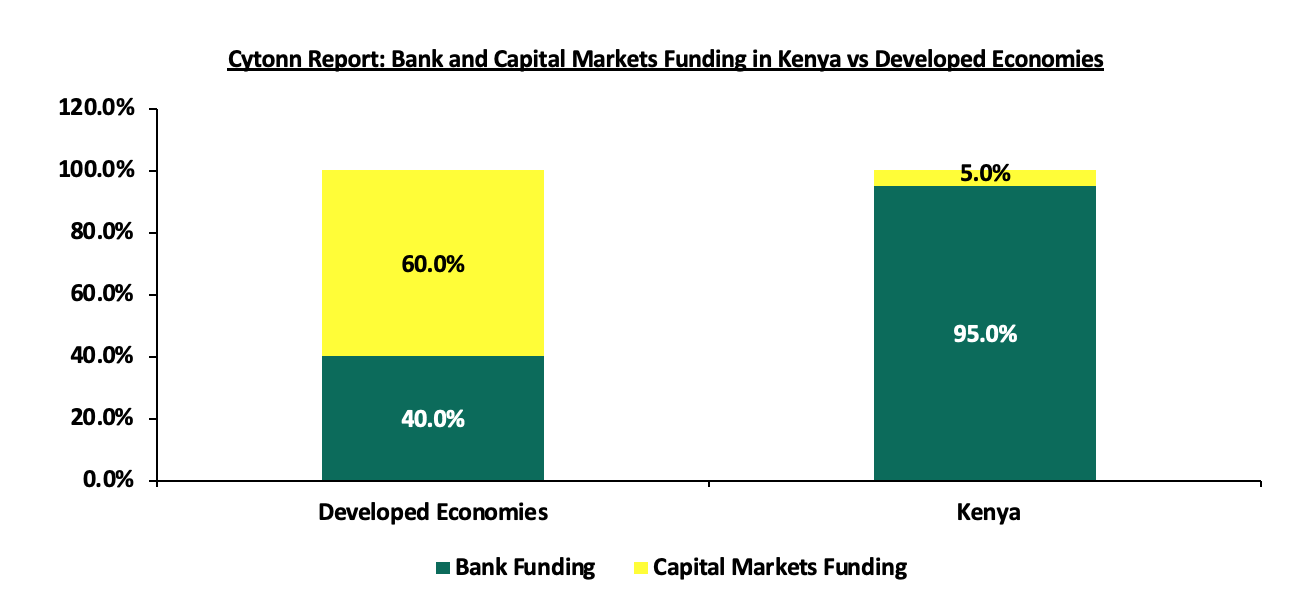

One of the key inhibitors to credit growth has been the fact that in Kenya, banks provide 95.0% of credit, as compared to other developed economies at 40.0%. Key to note, individuals at the bottom of economic pyramid have suffered more in terms of access to credit mainly because of bureaucratic measures in borrowing from banks coupled with the high interest rates charged. When credit has been advanced by digital credit providers, it has been equally as expensive, with often punitive terms. The chart below shows the comparison of development funding in Kenya against developed economies;

Source: World Bank, Capital Markets Authority (CMA)

In a bid to bridge the credit gap and in line with pre-election promises, the Kenya Kwanza Administration launched the Financial Inclusion Fund (Hustler Fund) on 30th November 2022, with the fund’s main objective being to improve the credit access to citizens at the bottom of the pyramid who have often struggled to obtain affordable credit. Key to note, the previous governments had introduced various special funds such as Uwezo Fund, Women Enterprise Fund, and Youth Enterprise Development Fund in a bid to increase credit access to various target groups. This topical will delve into the various special funds, with a focus on the Hustler Fund and the Youth Enterprise Development Fund, to have a deeper understanding of the funds by looking at the progress they have made, potential impact, and their sustainability. We shall undertake this by looking into the following;

- Introduction,

- Performance of Government Special Funds,

- Review of Fund Structure and Features,

- Review of Fund Operational Sustainability, and,

- Conclusion and Recommendations

Section 1: Introduction

In Kenya, Special Interest Groups Funds refer to fund allocation initiatives by the Government of Kenya aimed at improving economic equality and financial inclusion targeting the youth, women, and people with disabilities (PWDs).

The Financial Inclusion Fund, commonly known as the Hustler Fund, is one of several special interest group funds in Kenya designed to enhance financial inclusivity by providing accessible credit to marginalized communities. Launched on November 30, 2022, with a start-up capital of Kshs 50.0 bn, the Hustler Fund aims to offer affordable loans to individuals who have been excluded from the formal credit system for an extended period. The fund provides loans at an annual interest rate of 8.0%, which is the lowest in the country, and promotes a savings culture by allocating 5.0% of the borrowed amount to a savings account. The fund includes four products: Personal Finance, Micro Loan, SME Loan, and Start-Up Loan, with the Personal Finance component offering amounts between Kshs 500 and Kshs 50,000.

In addition to the Hustler Fund, the Kenyan government operates three other similar funds: The Youth Enterprise Development Fund (YEDF), the Women Enterprise Fund (WEF), and the Uwezo Fund. These funds target youth, women, and people with disabilities, providing affordable loans and grants to support their economic activities. Despite their noble objectives, recent audits and reviews have highlighted significant management issues within these funds, raising concerns about their transparency, accountability, and overall effectiveness.

Key to note, the main objectives of the funds are:

- Promote Financial Inclusion - The funds aim to expand access to credit by individuals, MSMEs, SACCOs, and start-ups to foster economic growth and job creation,

- Ensure Responsible Lending Culture - Addressing the qualitative dimension of financial inclusion by ensuring responsible lending and borrowing, ethical practices, offering financial literacy, and promoting consumer rights,

- Promote Affordable Credit - Implementing market interventions to enhance the supply of affordable credit to MSMEs, including creditworthiness-based lending, risk pricing, business and financial management skills, and reducing the cost of doing business, and,

- Enhance Health Coverage and Social Security - Improving participation in health insurance and retirement benefit schemes to ensure universal health coverage and social security.

Section 2: Performance of Government Special Funds

Previous regimes have rolled out three main avenues targeting SIGs which include; Uwezo Fund, Women Enterprise Fund, and Youth Enterprise Development Funds. Below is a summary of the performance of the existing special funds;

- Uwezo Fund - Founded on Legal Notice No. 21 under the Public Finance Management Regulations in September 2013 to enable women, youth, and persons with disabilities (PWDs) to access finance and promote enterprises at the constituency level. Since inception, the fund has disbursed a total of Kshs 7.5 bn to 79,274 groups, resulting in an average loan size of Kshs 91,207. As of June 2023, the fund’s cumulative repayment in the period under review stood at Kshs 2.9 bn, equivalent to a 38.3% repayment rate against a corresponding default rate of 61.7%,

- Women Enterprise Fund – Established under the Legal Notice No. 147 of 2007, the fund has disbursed a cumulative loan amounting to Kshs 26.4 bn to 136,721 self-help groups and 2,063,147 individuals since inception, resulting in an average loan size of Kshs 12,805.8. Key to note in the FY’2022/2023, the fund disbursed Kshs 1.8 bn to more than 60,000 individuals. Notably, in the period under review, the fund disbursed loans worth Kshs 1.7 bn under the Constituency Women Enterprise Scheme (CWES), and recovered Kshs 1.7 bn translating to a repayment rate of 97.0%. However, lending was stopped in the second half of the year as the fund was expected to transition to offer loans through the Financial Inclusion Fund platform. Furthermore, the fund has cumulatively trained 1,773,355 women on entrepreneurship and supported 50,153 women by providing market access and linkages, and,

- Youth Enterprise Development Fund (YEDF) – The YEDF was founded in May 2007 by the Legal Notice No. 63, under the Ministry of ICT, Innovation, and Youth Affairs. Since inception to June 2022, the fund had advanced loans amounting to 14.2 bn to 2.0 mn youth with the average loan size coming in at Kshs 7,100. For FY’2021/2022, the fund disbursed Kshs 370.1 mn and recovered Kshs 276.8 mn, translating to a repayment rate of 74.8% and a corresponding default rate of 25.2%. Additionally, the fund has facilitated and trained 97,880 youth on entrepreneurial skills, and supported 3,490 youth to market their products in trade fairs.

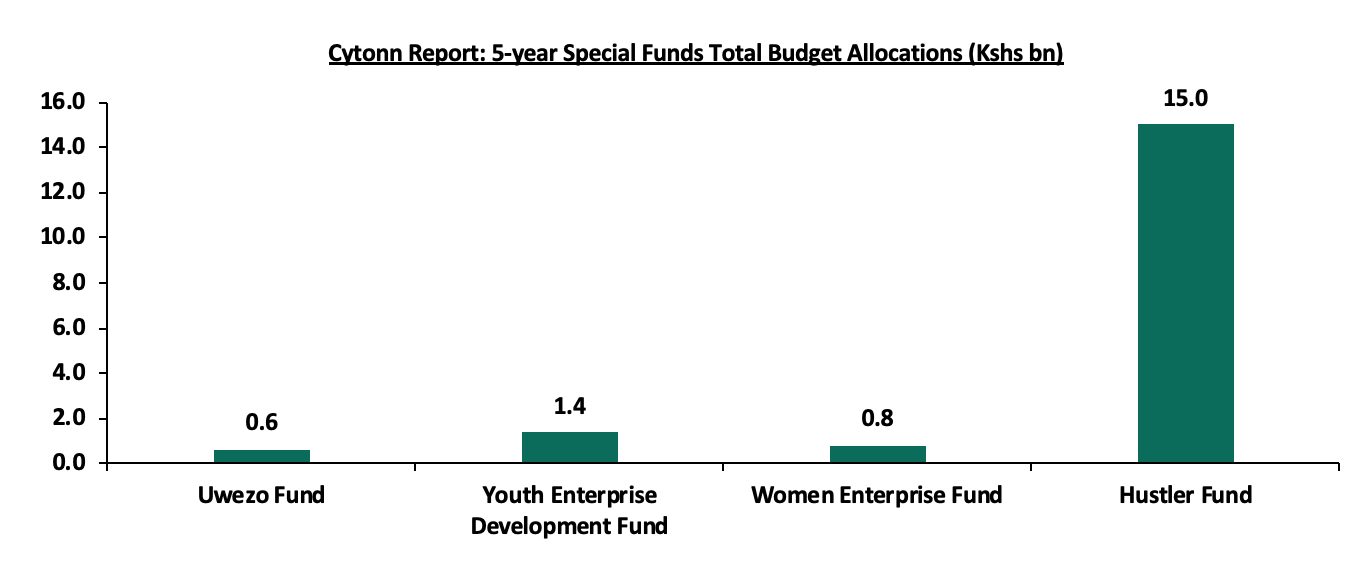

For the FY’2024/2025, the government has allocated Kshs 5.0 bn for the Hustler Fund, Kshs 200.0 mn for the Youth Enterprise Development Fund, Kshs 200.0 mn for the Uwezo Fund and Kshs 182.8 mn for the Women Enterprise Fund. Below is a table showing the funds’ budget allocations in the last five financial years;

|

Cytonn Report: Special Interest Group Funds Budgetary Allocations (Ksh mn) |

|||||

|

Special Group Fund |

Years |

||||

|

2020/21 |

2021/22 |

2022/23 |

2023/24 |

2024/25 |

|

|

Uwezo Fund |

82.0 |

62.0 |

92.0 |

192.0 |

200.0 |

|

Youth Enterprise Development Fund |

359.0 |

454.0 |

175.0 |

175.0 |

200.0 |

|

Women Enterprise Fund |

150.0 |

120.0 |

170.0 |

182.8 |

182.8 |

|

Hustler Fund |

- |

- |

- |

10,000.0 |

5,000.0 |

|

Total |

591.0 |

636.0 |

437.0 |

10,549.8 |

5,582.8 |

Source: Mwananchi Budget Guides, Budget Statements

The chart below shows the total budget allocations for the four special interest group funds in the last five years;

Source: Mwananchi Budget Guides, Budget Statements

However, success of these funds have been crippled by low recovery rates on advanced amounts. Only the Hustler Fund has recorded a relatively high recovery rate, at 79.4%. The table below shows the performance of the various funds;

|

Cytonn Report: Special Interest Group Funds’ Performance |

||||

|

Fund |

Amount disbursed (Kshs bn) |

Amount recovered (Kshs bn) |

Amount pending recovery (Kshs bn) |

Recovery Rate |

|

Uwezo Fund |

7.5 |

2.9 |

4.6 |

38.3% |

|

Women Enterprise Fund |

2.9 |

0.9 |

2.0 |

31.9% |

|

Youth Enterprise Fund |

2.7 |

0.1 |

2.6 |

3.8% |

|

Hustler Fund* |

52.9 |

42.0 |

10.9 |

79.4% |

*The performance of the Hustler Fund has been taken cumulatively since their inception to 12th July 2024, while the performance of the other Funds has been taken cumulatively since their inception to the period ending June 2023

Source: Cytonn Research

The funds have experienced significant financial challenges over the years, primarily due to high operating expenses and provisions for bad loans. These issues have led to substantial annual losses, which are further compounded by the outstanding loans. The Uwezo Fund, for example, has notable operating costs but lacks provisions for bad loans, while the Youth Fund shows a considerable provision for bad loans, contributing to its overall financial loss. Similarly, the Hustler Fund and the Women Enterprise Fund exhibit significant annual losses driven by their respective operational costs. The table below shows the estimated amount lost by the Special Funds per year;

|

Cytonn Report: Estimated Amount Lost per year (Kshs mn) |

||||

|

|

Hustler Fund |

Youth Fund |

Uwezo Fund |

Women Enterprise Fund |

|

Operating Expenses* |

232.8 |

387.6 |

169.9 |

534.5 |

|

Provision for bad loans* |

- |

395.5 |

- |

25.9 |

|

Total cost and provisions |

232.8 |

783.0 |

169.9 |

560.4 |

|

Doubtful loan balances** |

8,219.1 |

2,644.0 |

4,826.6 |

1,982.6 |

|

Years since inception |

2 |

10 |

16 |

16 |

|

Doubtful loans/year |

4,109.5 |

264.4 |

301.7 |

123.9 |

|

Estimated amount lost per year |

5,707.8 |

1,047.4 |

471.5 |

560.6 |

|

Total net assets |

13,966.7 |

3,238.6 |

7,135.1 |

4,251.3 |

|

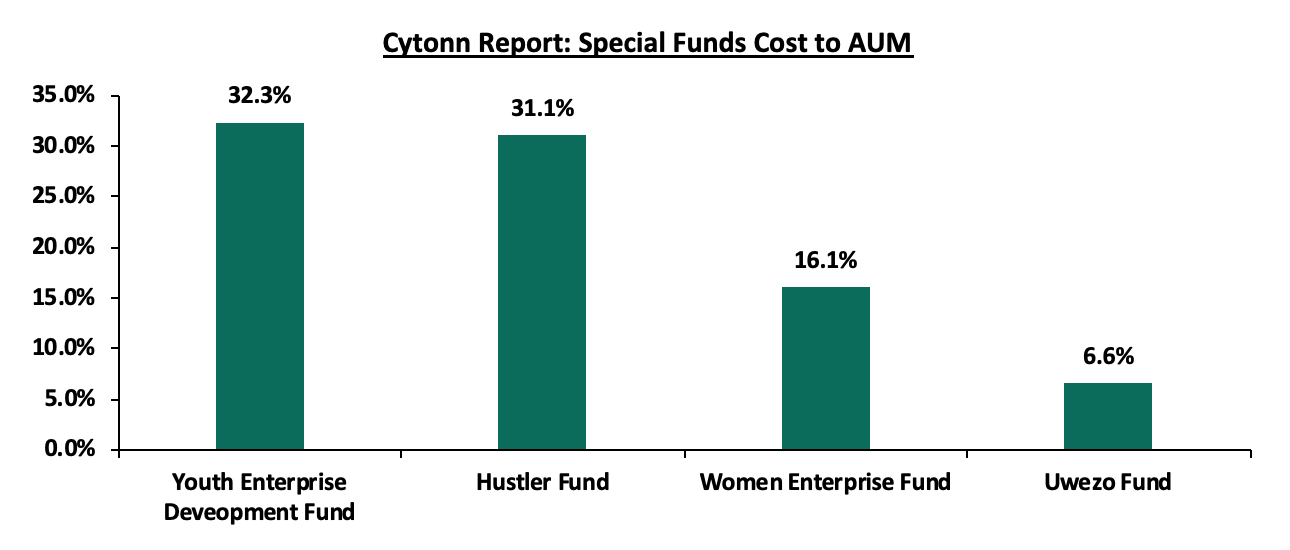

Cost to assets |

31.1% |

32.3% |

6.6% |

16.1% |

*Figures for Hustler fund, Uwezo fund and Women enterprise fund as of June 2023 while for Youth Fund as of June 2022

**Cumulative figures since inception to June 2023

The chart below shows the special funds’ estimated cost to Assets Under Management (AUM);

Section 3: Review of Fund Structures and Features

- Hustler fund

As aforementioned, the Hustler Fund was established to realize the economic model of the new regime by offering a credit line to individuals at the bottom of the economic pyramid. Key to note, the government, through the Cabinet Secretary for the National Treasury and Economic Planning tabled the PFM-Financial Inclusion Fund Regulation, 2022 as a guideline towards the operations of the Hustler Fund. The draft regulation provides information on the eligibility to qualify for the fund, the management structure and features of the fund as discussed below;

- Eligibility Criteria

The government removed many of the administrative bottlenecks when applying for the fund by soliciting already established platforms by liaising with telecoms such as Safaricom, Airtel, and Telkom in addition to banking institutions such as KCB Bank and Family Bank. However, it is important to note that for one to borrow, he/she must meet the prerequisites as stipulated below;

- Natural Person – For a natural person, that is, an individual and not an entity, the applicant should be eighteen years of age and above and a holder of a Kenyan national identity card and satisfy any other requirements that may be deemed necessary by the Board, and,

- MSMEs, SACCO Societies, Chama, Group, table banking group or any relevant association – The applicant within these categories should have all members aged eighteen and above, be registered by the appropriate government institution, and comply with any set obligation as may be determined by the Board.

Additionally, an applicant must have a registered mobile number from a recognized mobile operator in Kenya and have a mobile money account such as M-Pesa, Airtel Money, or T-Kash. The SIM card to be used during the loan application must have been active for more than 90 days. Importantly, no collateral is required for the loan.

- Management of the Hustler Fund

The fund is managed by a board headed by a non-executive chairperson appointed by the President and should perform an oversight role and further help in formulation of new policies. The board consists of;

|

Cytonn Report: Hustler Fund Board Membership |

|

|

1 |

Chairperson (Non-Executive) |

|

2 |

Principal Secretary to the National Treasury or Representative |

|

3 |

The Principal Secretary of the State Department or his representative |

|

4 |

The Principal Secretary of the State Department for MSMEs or his representative |

|

5 |

The Attorney-General or his representative, |

|

6 |

Two non-public officers appointed by the Cabinet Secretary MSMEs |

|

7 |

Fund Administrator-Ex-officio member (Secretary to the board) |

Key to note, the chairperson and all members should serve for a term of three years and can be appointed for another one term depending on their performance. Additionally, the Fund has a Chief Executive Officer who is competitively appointed by Cabinet Secretary to MSMEs upon recommendations by the board and meeting the relevant requirements.

- Features of the Hustler Fund

The hustler fund principal loan structure for the Personal Finance product ranges between Kshs 500 - Kshs 50,000 and an individual will only be eligible upon meeting the conditions stated above. According to the Terms and Conditions of the Fund, the term of the loan should be 14 days with interest charged at annual rate of 8.0% which should be accrued daily until the full repayment of the loan amount and should be advanced through the relevant Mobile Money Wallets.

Upon approval of the loan requested by an individual, the loan product has a savings component as discussed below;

- Savings Deduction - The fund will deduct 5.0% of the loan advanced that goes towards savings,

- Short-Term Savings – Key to note, 30.0% of the 5.0% savings deduction is applied to a savings account which will be available to borrowers after 365 days from the disbursement date unless there is a default upon which the borrower can access the funds earlier,

- Pension Remittance – Notably, 70.0% of the 5.0% savings deduction is applied towards the customer pension that will be accessible to the borrower upon attainment of the prerequisite age, and,

- Government Contributions – Additionally, the Government of Kenya matches the pension remittance of a borrower who has not defaulted at a ratio of 2:1. Here, for every Kshs 2.0 saved, the government adds Kshs 1.0 to a maximum government contribution of Kshs 6,000.0 annually.

Notably, the Hustler Fund has come up with the following precautionary measures to minimize the default rate;

- If the customer fails to pay within 14 days from the date of disbursement, the loan will attract a higher interest of 9.5% annually with effect from the 15th If the customer further fails to repay by the 30th day from the disbursement date, the bank will review the customer’s credit rating thus affecting the assigned credit limit. Key to note, the interest rate applies daily from the date of loan disbursement for a year, or such earlier date when the repayment should have been completed,

- In case the customer fails to repay the loan by the 30th day from the date of disbursement, he/she will not be eligible to borrow until the repayment of all outstanding debt obligations,

- Further, the fund should retain 30.0% meant for short-term savings in a suspense account until full repayment of the loan to mitigate against the risk of total default by borrowers, and,

- Once the customer has settled the outstanding debt, he/she should have access to the amount in the suspended account and will be at liberty to withdraw or keep it in the savings account.

- Youth Enterprise Development Fund

The Youth Enterprise Development Fund (YEDF) was established to champion the creation of employment for youth through enterprise development. In 2007, the Fund was transformed into a State Corporation under the then Ministry of State for Youth Affairs. The Fund is currently domiciled at the State Department for Youth Affairs and the Creative Economy. The draft regulation provides information on the management structure and features of the fund as discussed below;

- Management of the Youth Enterprise Development Fund

The fund is managed by a board headed by a non-executive chairperson appointed by the President and should perform an oversight role and further help in formulation of new policies. The board consists of;

|

Cytonn Report: Youth Fund Board Membership |

|

|

1 |

Chairperson (Non-Executive) |

|

2 |

Secretary to the Board and Chief Executive Officer (CEO) |

|

3 |

The Permanent Secretary, State Department of Youth Affairs and Creative Economy |

|

4 |

The Inspector of State Corporations or his representative |

|

5 |

The Permanent Secretary, National Treasury and Economic Planning or his representative, |

Key to note, the Fund has a Chief Executive Officer who will be competitively appointed by Cabinet Secretary to MSMEs upon recommendations by the board and meeting the relevant requirements.

- Features of the Youth Enterprise Development Fund

The Fund provides diverse financial products tailored to empower Kenyan youth entrepreneurs. The Fund aims to address youth unemployment through its loan products, comprehensive business support, and financial assistance.

Loan Products:

The Fund offers a variety of loan products designed to support the financial needs of youth-owned enterprises in Kenya. The loan offerings are divided into two main categories: group loans and individual loans.

- Group Loans:

- Rausha: A startup loan offering Kshs 100,000 with a three-month grace period and twelve-monthly repayments,

- Inua: Expansion loans ranging from Kshs 200,000 to Kshs 1,000,000, with varying repayment periods of up to 36 months, and,

- Special: Targeted loans for agriculture, livestock, and other periodic income-generating projects, with amounts up to Kshs 500,000.

- Individual Loans:

- Vuka: Startup and expansion loans up to Kshs 5,000,000, secured by conventional means, and tailored to support diverse business needs,

- Trade Finance: Financing for youth awarded tenders under AGPO, with loans up to Kshs 5,000,000 secured by guarantees and conventional security, and,

- Agri-Bizz Loan: Support for agricultural ventures with loans up to Kshs 2,000,000, featuring no interest but a management fee, and secured based on the loan amount.

The Fund also provides comprehensive support services to enhance the success and sustainability of youth-owned enterprises in Kenya. These services include;

- Entrepreneurship Training: Comprehensive programs covering business development, mentorship, and coaching,

- Market Support: Facilitation in establishing linkages with larger enterprises to enhance market access, and,

- Infrastructure: Provision of trading premises and worksites to foster business growth and stability.

Section 4: Review of Fund Operational Sustainability

- Hustler Fund

Since its inception, Hustler Fund has disbursed more than Kshs 52.9 bn as at 12th July 2024, up by 6.6% from the Kshs 49.6 bn as reported by Cabinet Secretary to the Co-operatives and MSME Development Ministry; in March 2024. The table below details the data on the fund’s transactions:

|

Cytonn Report: Hustler Fund Transactions Data as of 12th July 2024 |

|

|

Amount Disbursed |

Kshs 52.9 bn |

|

Repayment Amount |

Kshs 42.0 bn |

|

Savings Amount |

Kshs 2.3 bn |

|

Opted in Customers |

23.3 mn |

Source: www.hustlerfund.go.ke

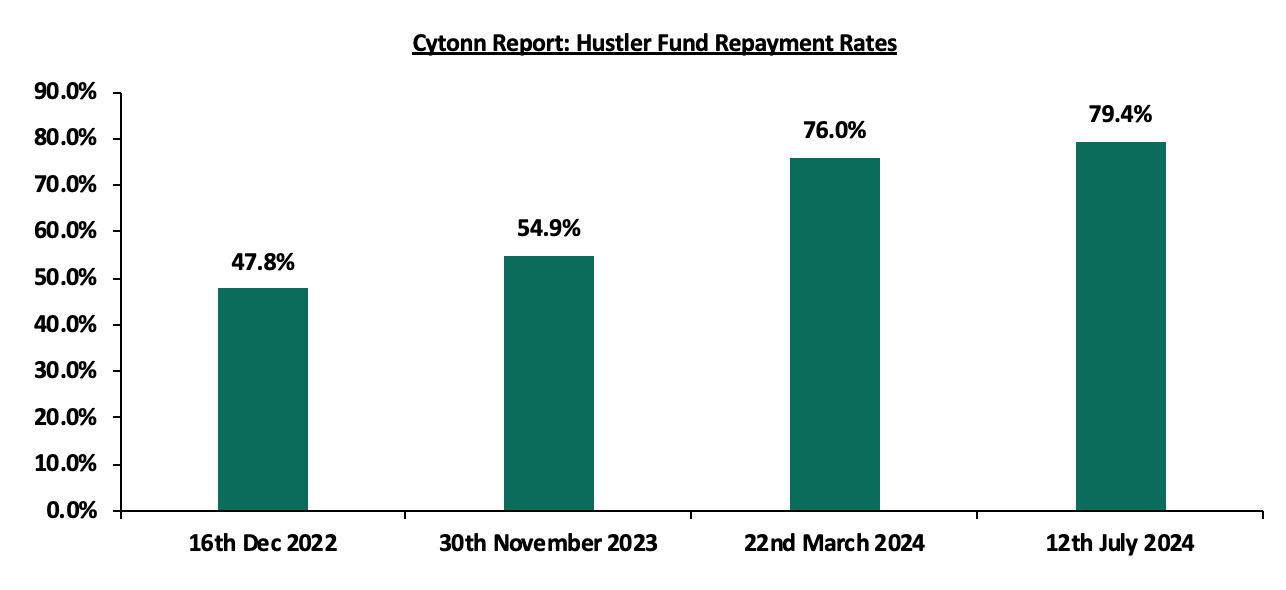

Further, the chart below shows the repayment rates as provided by the Co-operatives and MSME Development Ministry;

Source: Co-operatives and MSME Dev. Ministry

The Hustler Fund was established to offer holistic financial solutions targeting people at the bottom of the economic pyramid, emphasizing the importance of its long-term sustainability. As such, we shall analyze the fund’s operational sustainability based on the following metrics;

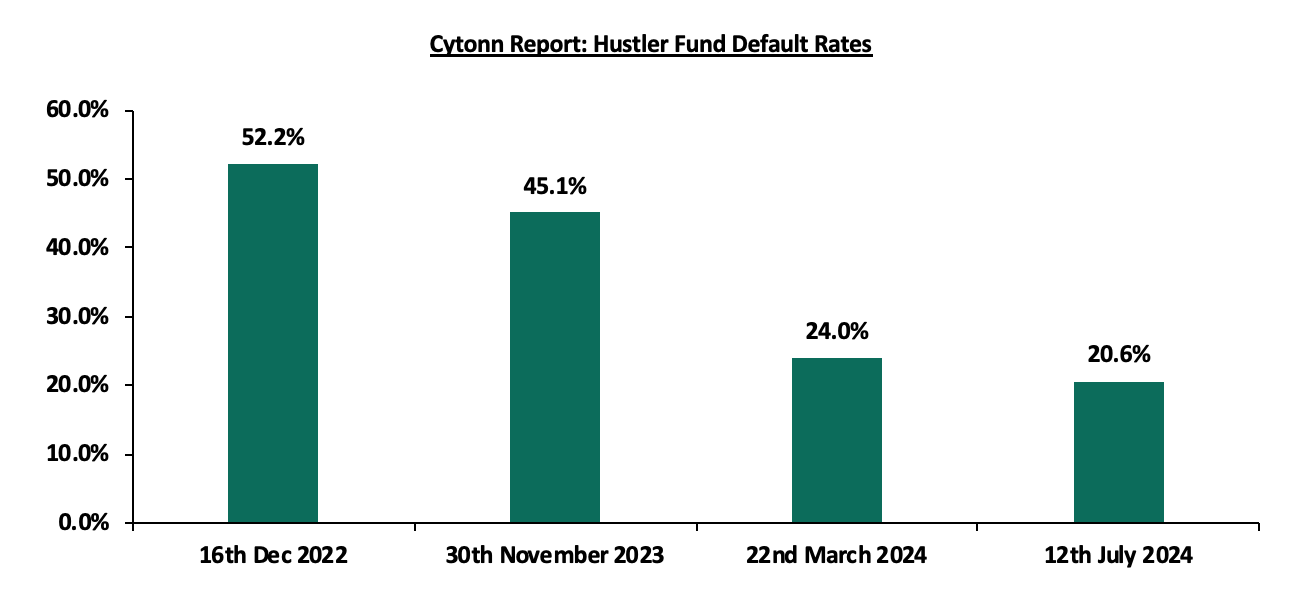

Cost of Bad Loans –The cost of bad loans significantly impacts the sustainability of the fund’s operation, resulting in reduced available capital for future lending and loss of expected interest income. Based on the provided data on the performance of the fund, the average default rate is currently at 20.6%. This indicates that averagely, for every Kshs 100 lent out, Kshs 20.6 is lost through bad loans. Although the default rates have been declining since December 2022, the fund has still not been able to achieve a 100.0% repayment rate on the amounts disbursed. The chart below shows the default rates as provided by the Co-operatives and MSME Development Ministry;

Sources: Co-operatives and MSME Dev. Ministry

- Cost of Operations – The fund has set the cost of operations at 3.0% of the approved budget for a financial year indicating that for every Kshs 100.0 lent out, Kshs 3.0 will be used to cover for administration cost and various operations, and,

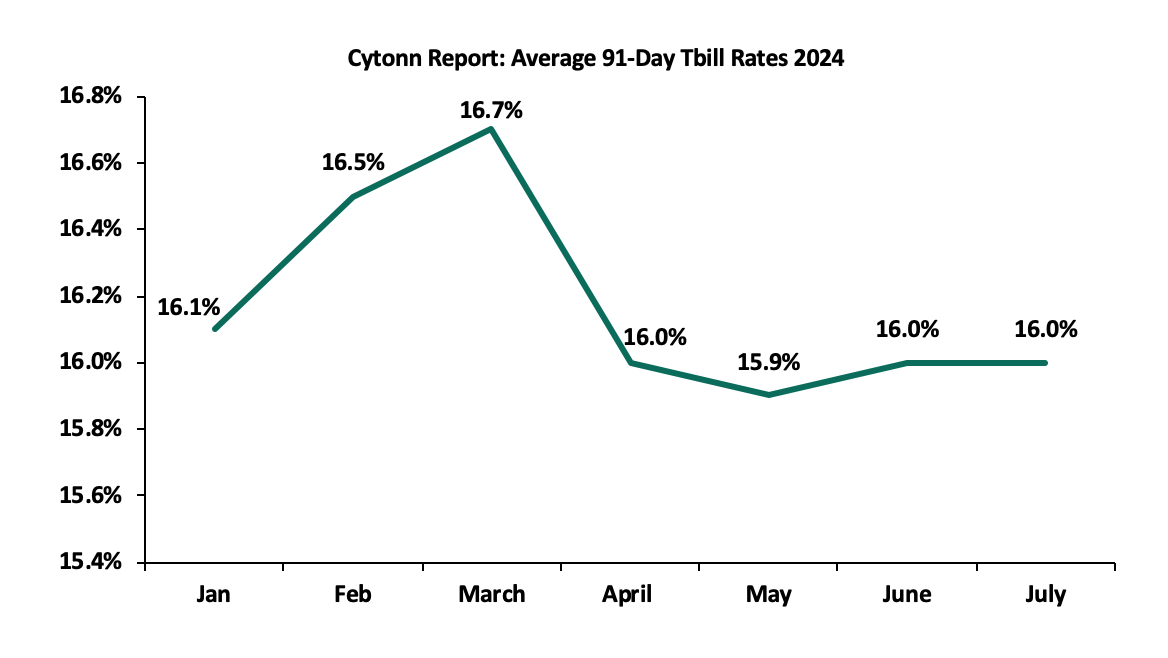

- Cost of Money – The cost of money refers to the expense that the government will incur when sourcing for funds. With Kenya already having a projected fiscal deficit of 5.7% of GDP in FY’2024/2025, it implies that financing the Hustler Fund is largely going to be financed through borrowing. Currently, the cost of short-term borrowing for the government, when using 91-day T-bill average is 16.2% for the year 2024. This indicates that for every Kshs 100.0 lent out, the government will use an estimated Kshs 16.2 to source for funds. The chart below shows the 91-day T-Bill rates for 2024;

Source: CBK

Key to note, summing up 20.6% for cost of bad loans, 3.0% for cost of operations, and 16.2% for cost of money brings the cost of fund to 49.8%. This indicates that the government is lending out money at a cost of 49.8% compared to the interest rate of 8.0% charged on the fund. The table below highlights the cost of funding for the fund;

|

Cytonn Report: Cost of Funds - Hustler Fund |

|

|

Cost of Bad loans |

20.6% |

|

Cost of Operations |

3.0% |

|

Cost of Money |

16.2% |

|

Cost of Funds |

49.8% |

|

Interest Rate |

8.0% |

|

Net Loss |

41.8% |

As such, the government will have a net loss of 41.8% meaning that out of the Kshs 50.0 bn lent out, the government’s cost of funds will stand at Kshs 24.9 bn. The analysis indicates that the Hustler Fund is unsustainable in its current state unless the government reduces the risk of bad loans caused by high default rates to ensure the fund's sustainability.

- Youth Enterprise Development Fund

According to the Report of the Auditor-General on Youth Enterprise Development Fund for the year ended 30th June 2022, the fund disbursed Kshs 370.0 mn across the country. Out of the total amount disbursed, Kshs 276.8 mn was recovered translating to a repayment rate of 74.8% and a corresponding default rate of 25.2%. Additionally, the fund attracts an interest rate of 6.0% and a one-off management fee of 1.0% netted off from the loans at disbursement. As a revolving fund designed to enhance economic opportunities and job creation for Kenyan youth through innovative, affordable financing, enterprise development, and strategic partnerships, it is crucial to emphasize the importance of its long-term sustainability. The table below highlights the cost of funding for the fund:

|

Cytonn Report: Cost of Funds – Youth Enterprise Development Fund |

|

|

Cost of Bad loans |

25.2% |

|

Cost of Operations |

1.0% |

|

Cost of Money (Average for the 91-day T-bill rates in 2024) |

16.2% |

|

Cost of Funds |

42.4% |

|

Interest Rate |

6.0% |

|

Net Loss |

36.4% |

The analysis above indicates that the Youth Enterprise Development Fund is unsustainable as it stands.

Furthermore, the Auditor-General's report for the year ending 30 June 2023 indicates that the fund has faced persistent financial difficulties, threatening its long-term viability. A major issue is the high cost associated with non-performing loans. The report reveals that a significant portion of the fund's receivables from exchange transactions, amounting to Kshs 2.5 bn, has not been serviced for over three years. This situation not only raises concerns about the accuracy and completeness of the fund's financial position but also signifies a substantial risk of bad debts. Additionally, the provision for bad and doubtful debts, set at Kshs 395.5 mn appears inadequate, further worsening the fund's financial instability.

The fund's poor financial performance over the past seven years has also eroded its capital base, impairing its ability to fulfill its mandate. Continuous losses and ineffective recovery mechanisms for outstanding loans cast doubt on the fund's ability to sustain its operations in the foreseeable future. To ensure the sustainability of the YEDF, it is crucial for the government to address these financial challenges. This includes improving loan recovery processes, increasing the provision for bad debts to accurately reflect the actual risk, and implementing stringent measures to minimize the occurrence of non-performing loans. Without these interventions, the fund's ability to support youth enterprises and contribute to job creation will remain compromised.

Section 6: Conclusion and Recommendations

As aforementioned, the funds experience particular challenges while trying to meet their objectives. As such, we have provided the following recommendations to mitigate such challenges and improve the quality of services offered by the funds;

- Stimulate Capital Markets to Contribute to Credit Markets – The capital market in Kenya is under-developed as it contributes about 5.0% of total funding to businesses while the banking sector is already maxed out contributing 95.0% of funding. As such, improving the capital markets framework will unlock a key financing avenue that businesses can tap into. It is, thus, prudent for the government, in conjunction, with the financial sector regulators to develop a sound legal framework to promote transparency of the corporate bond market bonds, as well as investor education on key legislations that apply to the specific bond market,

- Sustainability – The funds’ models are likely to fail because of the low interest rates, higher cost of bad loans, cost of operations and cost of money. To ensure long-term sustainability, the fund should develop partnerships and collaborations with other public sectors and NGOs and use their competency, financial capacity and established networks to meet the objectives of the fund at cost-effective rates,

- Governance Framework – The government should ensure that the funds are professionally managed and free from political interference to ensure transparency and avoid mismanagement of funds which has been witnessed in the past. Any person found guilty of misappropriation of funds should be charged and prosecuted as spelt out in the draft regulations. The government can also set up an independent oversight body to ensure accountability at any point in time and ensure that the operations cost is maintained at a minimum level, and,

- Establish a Legal Framework to Recover Loans – The funds currently have no legal framework to recover loans except for the option of using the defaulter’s savings. This is ineffective since it will not lead to sufficient recovery hence unsustainability. As such, the government needs to cushion itself against excessive default rate by setting up procedures to legally follow up on defaulters for the continuity of the funds.

The operational sustainability of both the Hustler Fund and the Youth Enterprise Development Fund is currently at risk due to high default rates, significant costs of operations, and the substantial cost of money. To ensure these funds can continue to fulfill their mandates, we firmly believe that the implementation of these recommendations will not only address the current challenges hindering the growth of the special funds, but also pave the way for a more vibrant and resilient financial ecosystem. These measures are crucial to reduce the financial burdens and enhance the long-term sustainability of these vital funds

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.