The IMF Precautionary Credit Facility 2018, & Cytonn Weekly #35/2018

By Cytonn Research Team, Sep 16, 2018

Executive Summary

Fixed Income

T-bills were oversubscribed during the week, with the overall subscription rate coming in at 181.1%, up from 148.7% recorded the previous week. Yield on the 91-day paper remained unchanged at 7.6%, while the yields on the 182-day and 364-day papers declined by 0.1% points to 8.8% and 9.7%, from 8.9% and 9.8% recorded the previous week, respectively. During the week, the Kenyan President received the Finance Bill 2018 from the Speaker of the National Assembly. He however did not assent to the Bill and instead, referred it back to the National Assembly for reconsideration due to the reservations he had, mainly on the postponement of VAT on fuel by another 2-years to September 2020 as voted by the National Assembly. He has further proposed the VAT to be imposed on fuel to be cut by 50.0% to 8.0% from the initial 16.0%, as well as other expenditure cuts and austerity measures across all arms of the government;

Equities

During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 declining by 3.4%, 3.4% and 3.0%, respectively, taking their YTD performance to declines of 7.6%, 19.4% and 8.2%, respectively. For the last twelve months (LTM), NASI, NSE 20 and NSE 25 have declined by 3.9%, 21.5% and 5.8%, respectively. Five banks have been fined by the Central Bank of Kenya for allegedly aiding and abetting the transfer of graft proceeds from the National Youth Service;

Private Equity

The education sector in Kenya continues to attract private equity investment, driven by the demand for quality and affordable education from the private sector. During the week, Fanisi Capital agreed to invest Kshs 400.0 mn in Kitengela International School (KISC) with an initial injection of Kshs 205.0 mn for an undisclosed stake. The school has an ambitious strategy to triple the number of students, which currently stands at 1,000 in its four institutions, and to open two more schools over the next five years;

Real Estate

During the week, Qatar Airways announced plans to venture into its second destination in Kenya, after Nairobi, with the launch of direct flights from Doha, Qatar, to Mombasa. The airline will fly four times a week to and from Doha and Mombasa, highlighting the recovery of the tourism industry at the Coast region. Elsewhere, a consortium of Kenyan and Dubai firms announced plans to put up a Mixed-Use-Development (MUD) in Juja, as international investors continue investing in the local real estate market;

Focus of the Week

Treasury announced that it would not renew the precautionary credit facility with the IMF, despite having requested an extension of the same in March 2018. The Treasury argued that the country had kept macroeconomic fundamentals stable, occasioned by the low inflation levels and stable shilling. The Executive Board of the IMF was set to make a decision on Friday 14th September, on whether or not to grant Kenya access to a precautionary credit facility of USD 989.8 mn (Kshs 99.0 bn), having extended a similar facility amounting to USD 985.9 mn (Kshs 99.0 bn) in March 2016. Previously, we had highlighted the IMF’s various forms of lending and the reasons why Kenya needs the IMF standby facility, while in this focus we shall highlight on the likely economic implications now that the Government chose not to renew the IMF’s precautionary credit facility.

- On Friday, we officially opened the Central Rift Office. The office is located on Westside Mall in Nakuru on the 3rd Read the Press Release here

- Shiv Arora, Head - Private Equity Real Estate was on Citizen T.V to discuss the state of the economy amid piling debt in the country. Watch Shiv here

- Shiv Arora, Head - Private Equity Real Estate was on Citizen T.V to discuss the rejection of the Finance Bill 2018. Watch Shiv here

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. The Wealth Management Training is run by the Cytonn Foundation under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- We continue to beef up the team with ongoing hires for IT Network Engineer and Unit Managers - Mt. Kenya Region. Visit the Careers section on our website to apply

- Cytonn Real Estate is looking for a 0.75-acre land parcel for a joint venture in any of the following areas, Lavington, Loresho (near Loresho Shopping Centre and its environs), Spring Valley Shopping Centre and its environs, Redhill Road (should be between Limuru Road Junction and Westlands Link Road), Lower Kabete Road (between Ngecha Road Junction and UON Campus), and Karen. The parcel should be in a good location with frontage to a tarmac road. For more information or leads, email us at rdo@cytonn.com

T-Bills & T-Bonds Primary Auction:

T-bills were oversubscribed during the week, with the overall subscription rate coming in at 181.1%, up from 148.7% recorded the previous week. Yield on the 91-day T-Bill remained unchanged at 7.6%, while the yields on the 182-day and 364-day papers declined by 0.1% points to 8.8% and 9.7%, from 8.9% and 9.8% recorded the previous week, respectively. The acceptance rate for T-bills declined to 59.8%, from 76.7% recorded the previous week, with the government accepting a total of Kshs 26.0 bn of the Kshs 43.5 bn worth of bids received. The subscription rate for the 91-day and 182-day papers improved to 182.9% and 170.9% from 64.0% and 126.2%, recorded the week, respectively, while the subscription on the 364-day paper declined to 181.1%, from 205.1% the previous week.

For the month of September, the Kenyan Government has re-opened 2 bonds, FXD 1/2018/10 and FXD 2/2018/20, with 10-years and 19.9-years to maturity, and coupon rates of 12.7% and 13.2%, respectively. The government will be seeking to raise Kshs 40.0 bn for budgetary support. We expect the 20-year tenor bond to have a lackluster performance compared to the 10-year bond due to the relatively flat yield curve on the long-end, making it relatively unattractive to hold longer-term bonds considering the current uncertainties in the interest rate environment, with the 20-year bond having had a performance rate of 34.7% on its initial auction in July compared to the 74.6% subscription rate for the 10-year bond in August. These Treasury bonds are currently trading at yields of 12.5% and 12.8% in the secondary market, respectively. As such we see the average yield of the bonds coming in between 12.5% and 12.7% for the FXD 1/2018/10 and between 12.8% and 13.1% for the FXD 2/2018/20.

Liquidity:

The average interbank rate declined to 4.2%, from 5.5% the previous week, while the average volumes traded in the interbank market increased by 40.4% to Kshs 18.4 bn, from Kshs 13.1 bn the previous week with the increased activity being partly attributed to the mobilization of funds for PAYE remittances. The decline in the average interbank rate points to improved liquidity, which the Central Bank of Kenya attributed to large banks trading at lower interest rates.

Kenya Eurobonds:

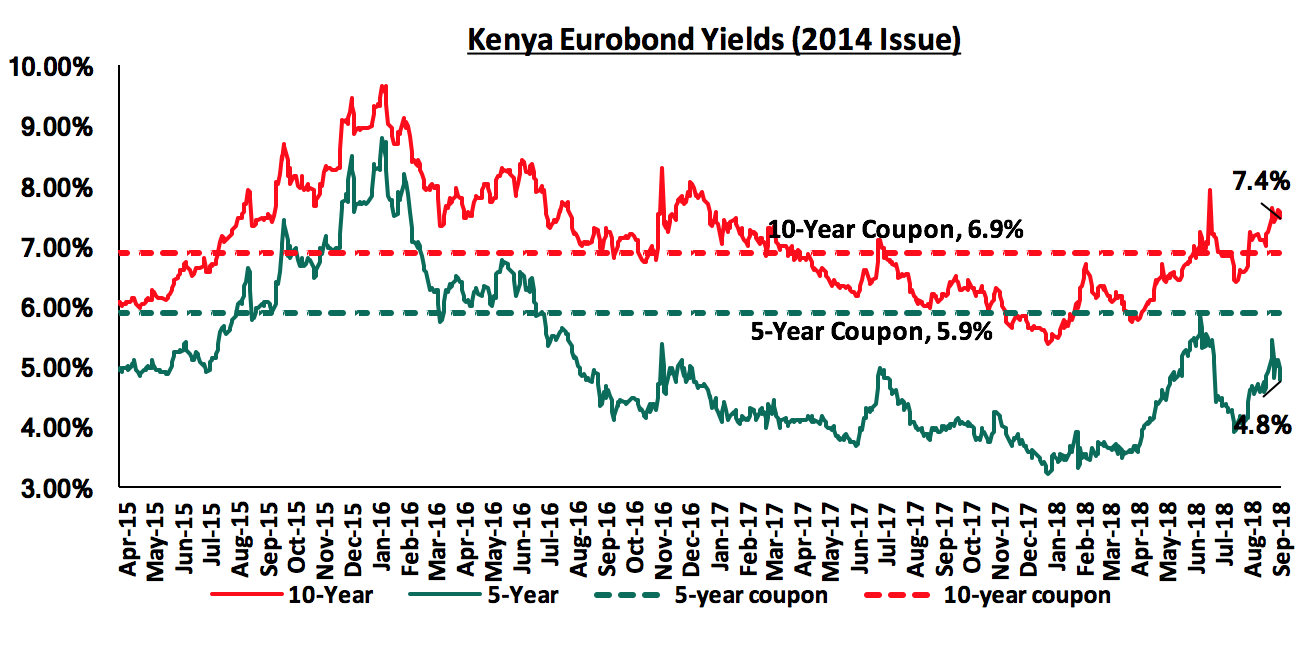

According to Bloomberg, the yield on the 10-Year and 5-year Eurobonds issued in 2014 remained unchanged at 7.4% and 4.8%, from the previous week. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 4.0% points and 2.2% points for the 5-year and 10-year Eurobonds, respectively, an indication of the relatively stable macroeconomic conditions in the country. Key to note is that these bonds have 0.8-years and 5.8-years to maturity for the 5-year and 10-year, respectively.

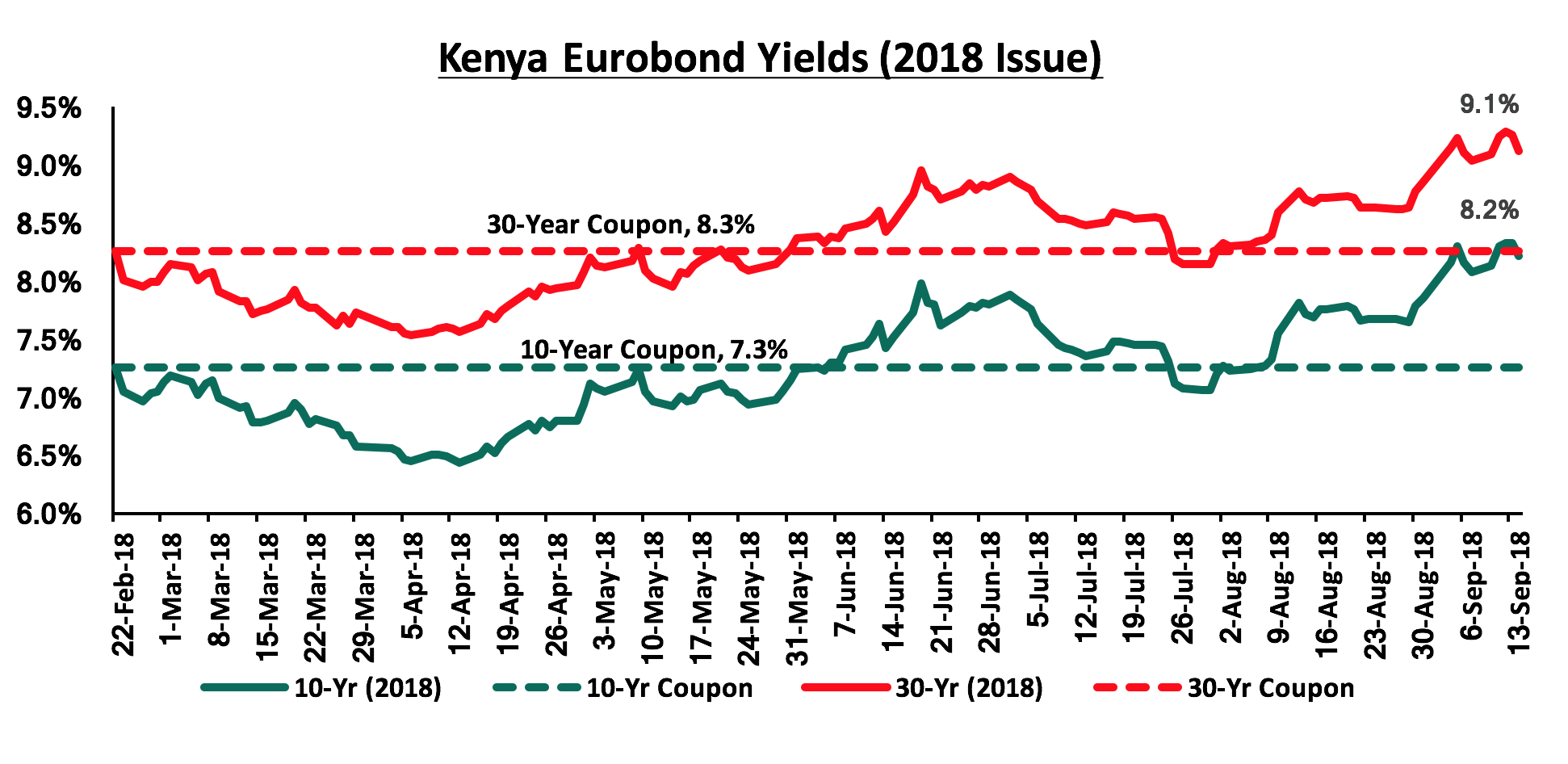

For the February 2018 Eurobond issue, during the week, the yields on both the 10-year and 30-year Eurobonds increased by 0.1% points to 8.2% and 9.1% from 8.1% and 9.0% the previous week, respectively. Since the issue date, the yields on the 10-year and 30-year Eurobonds have increased by 0.9% points and 0.8% points, respectively.

The Kenya Shilling:

During the week, the Kenya Shilling depreciated by 0.5% against the US Dollar to close at Kshs 101.2, from Kshs 100.7 the previous week, mainly driven by increased dollar demand from banks and importers over uncertainty regarding an IMF stand-by arrangement. The Kenya Shilling has appreciated by 1.9% year to date and in our view the shilling should remain relatively stable against the dollar in the short term despite the expiry of the IMF standby precautionary facility, supported by:

- The narrowing of the current account deficit to 5.8% in the 12-months to June 2018, from 6.3% in March 2018, attributed to improved agriculture exports, and lower capital goods imports following the completion of Phase I of the Standard Gauge Railway (SGR) project,

- Stronger inflows from principal exports, which include coffee, tea, and horticulture, which increased by 10.8% during the month of May to Kshs 24.3 bn from Kshs 21.9 bn in April, with the exports from coffee, tea and horticulture improving by 11.0%, 19.1% and 2.0% m/m, respectively,

- Improving diaspora remittances, which increased by 71.9% y/y to USD 266.2 mn in June 2018 from USD 154.9 mn in June 2017 and by 4.9% m/m, from USD 253.7 mn in May 2018, with the largest contributor being North America at USD 130.1 mn attributed to; (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient, and,

- High forex reserves, currently at USD 8.5 bn, equivalent to 5.7 months of import cover.

Highlights of the Week:

During the week, the President received the Finance Bill 2018 from the Speaker of the National Assembly, which had amendments as voted by the National Assembly such as;

- Postponing the imposition of VAT on fuel by another 2-years to September 2020, citing that its implementation would lead to a rise in inflation,

- Retaining of the interest rate cap citing that there was no justification for the repeal, as there were no concerted efforts by banks to address the issue of high credit risk pricing,

- Removal of the 70.0% minimum limit on deposits, pegged on the Central Bank Rate (CBR) instead, leaving the decision of the interest rate to be given on deposits at the discretion of the banks and customers

- Scrapping off the Robin Hood Tax, citing that it was punitive and the Kshs 500,000 set threshold was too low, and,

- Scrapping off the 2.0% points tax increment on mobile transfers from 10.0% to 12.0%.

The President however did not assent to the Bill referring it back to the National Assembly for reconsideration due to the reservations he had concerning it he had, mainly on the postponement of VAT on fuel by another 2-years to September 2020 as voted by the National Assembly. A gazette notice dated 13th September stated that special parliamentary sittings shall be held on 18th September and 20th September to discuss budget supplementary estimates and the President’s reservations against the Finance Bill. The President has proposed the VAT to be imposed on fuel to be cut by 50.0% to 8.0% from the initial 16.0% as well as other expenditure cuts and austerity measures across all arms of the government targeting the less essential spending such as expenditure on hospitality, travel, seminars and training. The ball is now on the National Assembly’s court and according to the constitution, the legislators may accommodate the President’s concerns following which the Bill would be resubmitted to the President for assent. However, Parliament may pass the Bill a second time without amendments by a vote supported by two thirds of the members of the National Assembly. If passed, the Speaker of the National Assembly would submit the Bill within 7-days to the President and the President would have 7-days to assent the Bill. If the President does not assent to the Bill after the 7-day expiry period, the Bill shall be taken to have been assented to on expiry. The proposal to reduce the VAT is a well-informed move as it would scale back the effects on the cost of living. We are however of the view that revenue generation ought to go hand in hand with management of government expenditure. Despite revenue generation improving over the years, there has been concerns over expenditure management as it does not reflect prudence and accountability. The continued rise in government expenditure with the target for FY’18/2019 increasing by 11.7% to Kshs 2.5 tn from Kshs 2.3 tn in the FY’17/2018 budget with the bulk of it being on recurrent expenditure, has continued to mount pressure on the Kenya Revenue Authority (KRA) due to the tax collection targets set to finance the budget. Going forward, it is essential for government institutions tasked with providing financial oversight to minimize poor management of public resources as well as ensure accountability to avoid fiscal leakages through corruption. With regards to this, the president has also proposed increased funding to bodies tasked with accountability of public funds e.g. the Judiciary and the Office of the Directorate of Criminal Investigations.

The International Monetary Fund’s (IMF) precautionary stand-by facility granted to Kenya expired on 14th September 2018. The National Treasury was not keen on seeking to renew the facility noting that the macro-economic fundamentals of the country have continued to stabilize despite the country not drawing on the facility. This is as evidenced by inflation, which has remained within the government’s set target of 2.5% - 7.5% target averaging 4.2% in the 8 months to August 2018, the stable Kenyan Shilling, which has gained by 1.9% year to date and the country’s GPD having grown by 5.7% in Q1’2018, up from 4.8% in Q1’2017. The Cabinet Secretary for Treasury further noted that Kenya should reduce its reliance on the facility as stand by facilities are meant to be short term with a maximum of 2-years after which the country should ideally graduate and get out of the program. The Treasury however insisted that the country can still engage and get access to the facilities in the future. Key to note, the country had not managed to meet the conditions set by the IMF for the renewal of the facility, which included:

- Removal, or significant modification, of the interest rate controls by Parliament of which the National Assembly voted for the retaining of the interest rate cap with the only modification being the removal of the floor on deposit pegged at 70.0% of the Central Bank Rate (CBR), and,

- Fiscal consolidation in order to minimize the budget deficit and reduce public debt through rationalization of expenditure, supported by widening of the tax base by reducing exemptions in the VAT and income tax, as well as on-going improvements in revenue administration.

We believe that access to the facility would have been useful in cushioning the Kenyan Shilling from exogenous shocks as well as maintaining the country’s fiscal discipline due to the preset conditions that come attached to it, which effectively reduces the risk perception of countries while improving investor sentiments. However, the country faces no immediate adverse risks as the country’s external position is still strong, a view which the IMF has also affirmed through their local representative, as we have adequate forex reserves currently at USD 8.5 bn (equivalent to 5.7 months of import cover). There has however been misplaced fears on the state of the Eurobond issues in 2018 due to the clause under events of default on the prospectus dated 26th February 2018, which provided holders of at least 25.0% notes in aggregate principal amount of the relevant notes then outstanding maturing in 2028 and 2048 a leeway to declare such notes to be immediately due and payable at their principal amount together with accrued interest if the country ceases to be a member of the IMF or ceases to be able to use the general resources of the IMF. The country however does not face that risk as it is still a member of the IMF and is still eligible to use the general resources of the IMF thus lack of access to the standby facility does not constitute a default event.

According to the Energy Regulatory Commission (ERC), petrol prices have declined by 1.7% to Kshs 113.7 from Kshs 112.2 per litre previously, while diesel and kerosene prices have both increased by 0.3% to Kshs 115.5 and Kshs 97.7 per litre, respectively, effective 15th September – 14th October 2018. Key to note, the prices have changed from the recently revised prices as per the addendum released by the ERC that took effect from 1st September - 14th September 2018, taking into account the 16.0% VAT charge on fuel. The changes in prices have been attributed to the decline in average landing costs of imported super petrol by 2.3% to USD 743.9 per ton in August from USD 761.6 in July and Kerosene by 0.6% to USD 717.3 in August from USD 721.6 in July. Landing costs for diesel however increased by 0.4% to USD 686.0 in August from USD 683.3 in July. The means monthly USD to Kenyan Shilling exchange rate depreciated by 0.1% to Kshs 100.7 in August from Kshs 100.6 in July. Inflation for the month of September is expected to rise driven by the transport index and the housing, water, electricity, gas and other fuels due to the imposition of the 16.0 VAT charge on fuel as from 1st September 2018. We will release our inflation projection for the month of September 2018 in next week’s report.

Rates in the fixed income market have been on a declining trend, as the government continues to reject expensive bids as it is currently 37.3% ahead of its pro-rated borrowing target for the current financial year, having borrowed Kshs 86.2 bn against a pro-rated target of Kshs 62.7 bn. The 2018/19 budget had given a domestic borrowing target of Kshs 271.9 bn, 8.6% lower than the 2017/2018 fiscal year’s target of Kshs 297.6 bn, which may result in reduced pressure on domestic borrowing. With the rate cap still in place, and the National Assembly having voted to retain it in the finance bill despite the president referring it back to the National Assembly, we maintain our expectation of stability in the interest rate environment. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium-term fixed-income instruments.

Market Performance:

During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 declining by 3.4%, 3.4% and 3.0%, respectively, taking their YTD performance to declines of 7.6%, 19.4% and 8.2%, respectively. This week’s performance was driven by declines in large cap stocks such as Bamburi Cement, Barclays Bank of Kenya, Diamond Trust Bank and Safaricom that declined by 9.4%, 7.7%, 3.7% and 3.6%, respectively. For the last twelve months (LTM), NASI, NSE 20 and NSE 25 have declined by 3.9%, 21.5% and 5.8%, respectively.

Equities turnover increased by 6.4% to USD 26.0 mn from USD 24.5 mn the previous week. During the week, foreign investors remained net sellers, with net sales of USD 4.1 mn. We expect the market to remain supported by positive investor sentiment this year, as investors take advantage of the current attractive stock valuations in select counters.

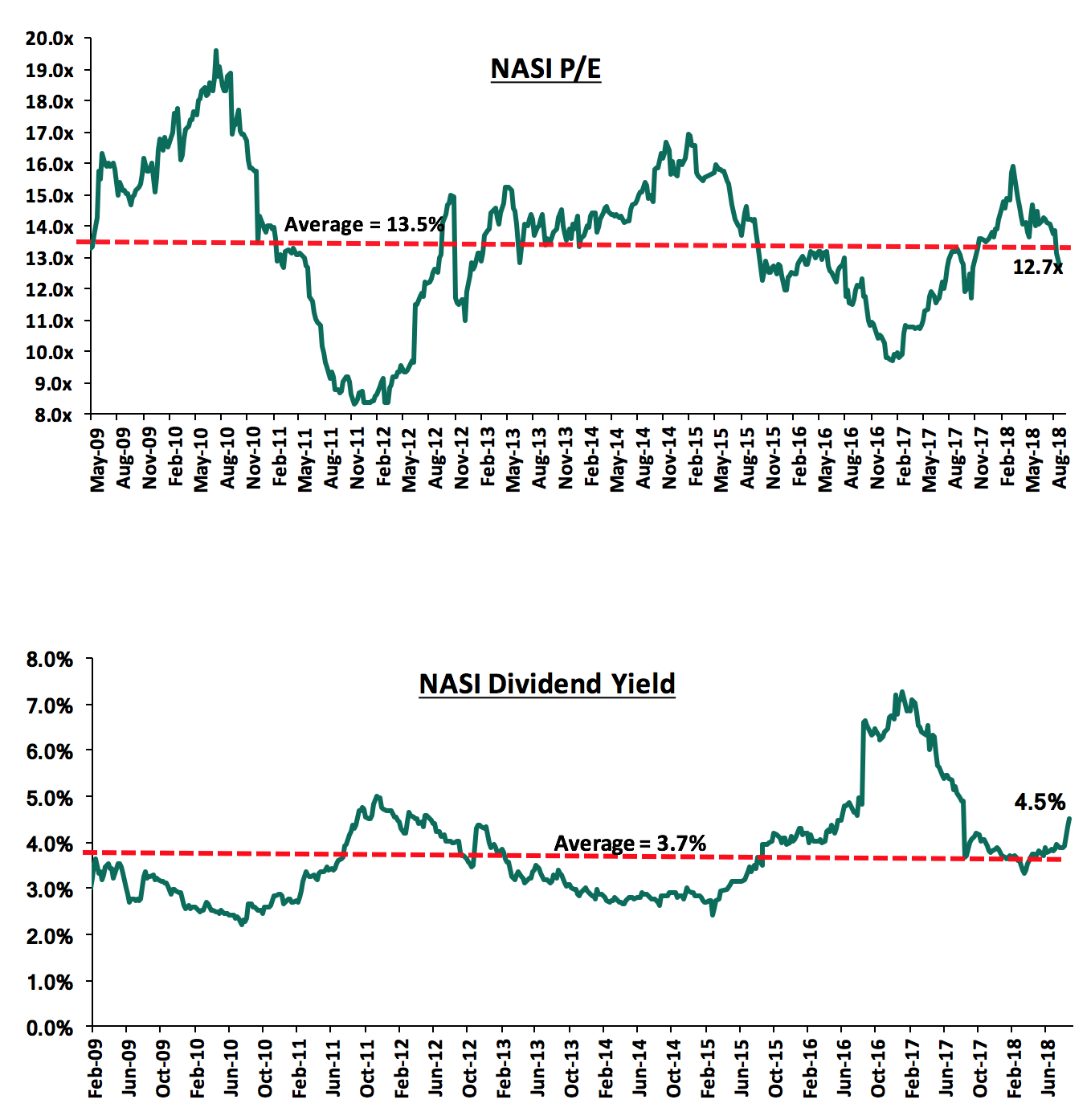

The market is currently trading at a price to earnings ratio (P/E) of 12.7x, which is 5.9% below the historical average of 13.5x, and a dividend yield of 4.5%, higher than the historical average of 3.7%. The current P/E valuation of 12.7x is 29.6% above the most recent trough valuation of 9.8x experienced in the first week of February 2017, and 53.0% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market:

Weekly highlights:

Five banks implicated in the National Youth Service (NYS) Scandal, where Kshs 9.0 bn was lost in a graft scandal that saw several companies receive payments for goods not delivered, have been fined a collective Kshs 392.5 mn. The banks, which include KCB Group, Equity Group Holdings, Standard Chartered Bank of Kenya (SCBK), Co-operative Bank and Diamond Trust Bank (DTB), have been granted a period of two-weeks to seal the loopholes that aided the occurrence of the fraud without notice to the relevant authorities. The Central Bank of Kenya ordered the banks to submit an action plan aimed at thwarting such lapses within the two-weeks. KCB Group has been levied with the highest penalty for allegedly channeling money stolen from the Government through the NYS scam. The bank will be required to pay Kshs 149.5 mn for processing amounts of up to Kshs 639.0 mn. This is despite the bank processing lower amounts than its peers. Standard Chartered Bank processed Kshs 1.6 bn, but was fined Kshs 77.5 mn, while Equity Bank processed Kshs 886.0 mn, and was fined Kshs 89.5 mn. Co-operative Bank was found culpable for helping divert Kshs 263.0 mn and will have to pay a fine of Kshs 20.0 mn. Diamond Trust Bank will pay Kshs 56.0 mn for transferring Kshs 162.5 mn to NYS suspects’ accounts. The banks seemed to have done little to no due diligence on the customers they handed cash to and sometimes handed over large sums of money without appropriate documentation. This comes after it was revealed that some of the companies under investigation opened accounts a few hours before the NYS money was credited. Banks, which are required to report large transactions, contravened their mandate by not reporting transactions that exceeded Kshs 1.0 mn to the Financial Reporting Centre. The CBK Governor indicated that the investigation would now be handed to the Directorate of Criminal Investigations and the Office of the Director of Public Prosecutions to pursue criminal culpability where, if an individual is found guilty of contravening the Crime and Anti-Money Laundering Act, they face an imprisonment term not exceeding 14-years or may be fined Kshs 5.0 mn. This comes after the Kenya Bankers Association (KBA) introduced stringent rules where bank customers planning to withdraw or deposit Kshs 10 mn and above in cash will now be required to give a three-days’ notice and get clearance from branch managers. The KBA, in a circular, directed bank managers to ensure customers also provide supporting evidence for their source of cash when depositing and its use while withdrawing. These rules are aimed at combatting any money laundering and financial crimes that have become increasingly prevalent. We are of the view that increased emphasis on due diligence on customers conducting bank transfers of significant amounts, supported with appropriate documentation, will aid in combating the vice that has bedeviled the country.

Equities Universe of Coverage:

Below is our Equities Universe of Coverage:

|

Banks |

Price as at 7/09/2018 |

Price as at 14/09/2018 |

w/w change |

YTD Change |

LTM Change |

Target Price* |

Dividend Yield |

Upside/Downside** |

P/TBv Multiple |

|

Zenith Bank*** |

20.9 |

20.1 |

(4.1%) |

(21.8%) |

(9.7%) |

33.3 |

13.5% |

79.7% |

0.9x |

|

NIC Bank*** |

29.5 |

28.5 |

(3.4%) |

(15.6%) |

(21.6%) |

48.8 |

3.5% |

74.7% |

0.8x |

|

Union Bank Plc |

5.3 |

5.0 |

(5.7%) |

(35.9%) |

(16.7%) |

8.2 |

0.0% |

63.0% |

0.6x |

|

Diamond Trust Bank*** |

188.0 |

181.0 |

(3.7%) |

(5.7%) |

(0.5%) |

283.7 |

1.4% |

58.2% |

1.1x |

|

UBA Bank |

7.9 |

7.4 |

(6.3%) |

(28.2%) |

(16.9%) |

10.7 |

11.5% |

56.1% |

0.5x |

|

KCB Group*** |

42.8 |

41.3 |

(3.5%) |

(3.5%) |

(1.8%) |

61.3 |

7.3% |

55.9% |

1.4x |

|

Ghana Commercial Bank*** |

5.4 |

5.3 |

(0.2%) |

5.7% |

20.3% |

7.7 |

7.1% |

51.7% |

1.3x |

|

I&M Holdings*** |

102.0 |

101.0 |

(1.0%) |

1.0% |

(19.8%) |

138.6 |

3.5% |

40.7% |

1.0x |

|

Equity Group |

44.3 |

43.5 |

(1.7%) |

9.4% |

11.5% |

56.2 |

4.6% |

33.8% |

2.1x |

|

Barclays |

11.0 |

10.2 |

(7.7%) |

5.7% |

(1.9%) |

12.5 |

9.9% |

33.0% |

1.5x |

|

Ecobank |

9.0 |

8.1 |

(9.9%) |

6.6% |

27.3% |

10.7 |

0.0% |

32.5% |

2.0x |

|

CRDB |

160.0 |

160.0 |

0.0% |

0.0% |

(8.6%) |

207.7 |

0.0% |

29.8% |

0.5x |

|

Co-operative Bank |

16.7 |

16.1 |

(3.3%) |

0.6% |

(3.3%) |

19.9 |

5.0% |

28.6% |

1.5x |

|

Access Bank |

9.1 |

7.8 |

(13.8%) |

(25.4%) |

(19.6%) |

9.5 |

5.1% |

26.9% |

0.6x |

|

CAL Bank |

1.3 |

1.2 |

(9.2%) |

9.3% |

34.9% |

1.4 |

0.0% |

18.6% |

1.1x |

|

Guaranty Trust Bank |

35.0 |

34.8 |

(0.7%) |

(14.7%) |

(8.1%) |

37.1 |

6.9% |

13.7% |

2.2x |

|

Stanbic Bank Uganda |

33.0 |

33.0 |

0.0% |

21.1% |

21.1% |

36.3 |

3.5% |

13.5% |

2.3x |

|

Bank of Kigali |

290.0 |

290.0 |

0.0% |

(3.3%) |

3.6% |

299.9 |

4.8% |

8.2% |

1.6x |

|

HF Group*** |

6.5 |

6.5 |

0.0% |

(37.5%) |

(35.9%) |

6.6 |

4.9% |

6.5% |

0.2x |

|

Standard Chartered |

203.0 |

199.0 |

(2.0%) |

(4.3%) |

(16.7%) |

196.3 |

6.3% |

4.9% |

1.6x |

|

SBM Holdings |

6.6 |

6.6 |

0.0% |

(12.0%) |

(14.9%) |

6.6 |

4.5% |

3.9% |

0.9x |

|

Stanbic Holdings |

96.0 |

95.5 |

(0.5%) |

17.9% |

18.6% |

92.6 |

2.4% |

(0.7%) |

0.9x |

|

National Bank |

5.5 |

5.2 |

(5.5%) |

(44.4%) |

(52.7%) |

4.9 |

0.0% |

(5.8%) |

0.4x |

|

Bank of Baroda |

144.0 |

144.0 |

0.0% |

27.4% |

30.9% |

130.6 |

1.7% |

(7.6%) |

1.3x |

|

Stanbic IBTC Holdings |

45.0 |

42.3 |

(6.1%) |

1.8% |

5.6% |

37.0 |

1.4% |

(11.0%) |

2.3x |

|

FBN Holdings |

9.0 |

9.0 |

0.0% |

2.3% |

56.3% |

6.6 |

2.8% |

(23.6%) |

0.5x |

|

Standard Chartered |

26.0 |

26.0 |

0.0% |

3.1% |

51.8% |

19.5 |

0.0% |

(25.2%) |

3.3x |

|

Ecobank Transnational |

19.5 |

18.0 |

(7.7%) |

5.9% |

0.0% |

9.3 |

0.0% |

(48.4%) |

0.7x |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 5th largest shareholder **** Stock prices are in respective country currency |

|||||||||

We are “NEUTRAL” on equities for investors with a short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for long-term investors, and with expectations of higher corporate earnings this year, we are “POSITIVE” for investors with a long-term investment horizon.

In the education sector, Fanisi Capital, a private equity and venture capital firm that focuses on healthcare, education, consumer goods, and agriculture, agreed to invest Kshs 400.0 mn in Kitengela International School (KISC), with an initial injection of Kshs 205.0 mn for an undisclosed stake. KISC opened its doors in January 2009, with an 8-4-4 curriculum, having both a mixed day and boarding primary school, and a girls’ high school. The mixed day and boarding primary school, and the girls’ boarding high school are located five kilometers from Kitengela town off Namanga road. It has since expanded to four schools, one offering a British curriculum located off Namanga road five kilometers from Kitengela town, and the other the 8-4-4 curriculum for primary school, which is located in Mlolongo, off Mombasa Road.

The school has an ambitious strategy to triple the number of students, which is currently 1,000 in its four institutions, and to open two more schools over the next five-years. The school has enough land on it premises to allow for expansion of the girls’ high school, primary school, and the international school. The school will use the proceeds to expand their reach and capacity without affecting the quality of education offered. The school was founded and is currently managed by Paul Mwangangi.

In 2011, Fanisi Capital acquired a 55% stake in Hillcrest International School after settling the Kshs 620 mn debt the school owed to Barclays Bank of Kenya with a consortium of investors, making KISC their second investment in the education sector.

The investment is evidence of increasing investor interest in Kenya’s education sector. Other investors who have invested in the education sector include;

- Advtech Group, a private education provider, listed in the Johannesburg stock exchange, which opened a school under its Crawford Schools brand in Tatu City on 4th September 2018, offering pre-primary education focusing on the THRASS (Teaching, Handwriting, Reading and Spelling Skills) curriculum.

- Nova Pioneer, a South African educator, has set up a primary school and a high school in Tatu city offering the 8-4-4 curriculum.

- Centum Limited, an investment firm, in partnership with Sabis Education Network, has set up the Sabis International School in Runda.

- Cytonn Investments, through its education affiliate Cytonn Education Services, will provide education at all levels. From Early Childhood Development Education (ECDE) to tertiary education, beginning with a technical college-branded Cytonn College of Innovation and Entrepreneurship.

- Advtech Group, Schole (Mauritius) Limited, a London based education provider, and Caerus Capital, a leading international education consultancy group jointly acquired Makini Schools at an estimated value of ZAR 184.2 mn (Kshs 1.7 bn).

The investments are an indication of investors’ interest in the education sector in Sub-Saharan Africa which is motivated by;

- Increasing demand for quality and affordable education, according to The Business of Education in Africa report by Caerus Capital, the Gross Enrollment Ratio (GER) has doubled over the last ten years, from 4.5% in 2006 to 8.5% in 2016.

- Support, such as ease of approvals, offered to investors in the education sector by governments looking to meet Sustainable Development Goals (SDGs) targets of universal access to education.

Private equity investments in Africa remains robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and a stable macroeconomic environment will continue to boost deal flow into African markets.

Hospitality

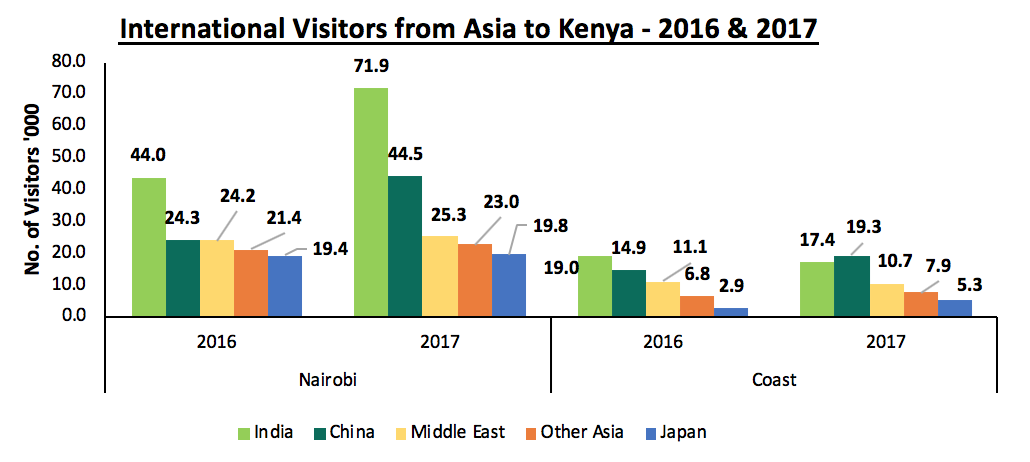

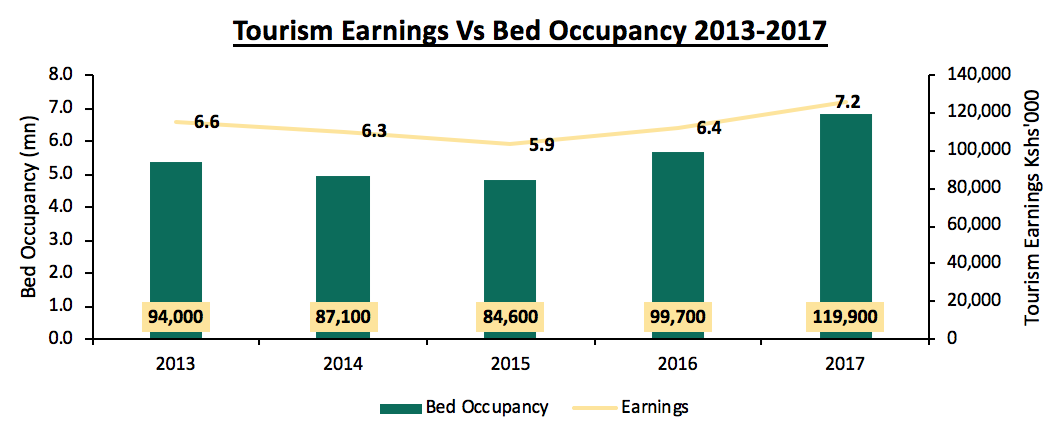

During the week, Qatar Airways announced plans to launch direct flights to Mombasa starting December 2018, a move that will see four flights between Doha, Qatar, and Mombasa, Kenya, per week. This will be Qatar Airways’ second Kenyan destination, after Nairobi. In our view, the move will aid further in the recovery of tourism at the Kenyan Coast, where according to the Kenya National Bureau of Standards (KNBS), hotel occupancy in the region registered a growth of 19.2% in 2017 to 2.9 mn, from 2.5 mn in 2016, in comparison to Nairobi’s increment of 10.0% to 1.7 mn from 1.5 mn in the same period. Currently, countries like India, China, and the Middle East region, which consists of countries like Qatar, United Arab Emirates, Egypt, Yemen, and Saudi Arabia, among others, are the leading sources of Asian visitors to Kenya. In 2017, the number of visitors from Asia to the Kenyan Coast saw an increase of 10.8% to 60,600 in 2017 from 54,700 in 2016, in comparison to a 38.4% increase in Nairobi to 184,500 in 2017, from 133,300 in 2016, as shown below:

Source: KNBS

Source: KNBS

Other international airlines that operate flights to Mombasa include Ethiopian Airlines, Turkish Airlines, and RwandAir; while local jet airlines include Fly Sax, Fly540, and Fast Jet. Thus, this new addition underlines the return of consumer confidence from a place of security concerns following the incidences of insecurity in between 2012 and 2015, which saw several countries, including the USA and France, impose travel advisories on the Kenyan Coast. The recovery has been as a result of the government’s aggressive marketing of Kenya’s tourism industry in international markets, enhanced security, infrastructural improvements in the Coastal Region such as the construction of the Standard Gauge Railway, the Port Reitz Road, Moi International Airport Access Road, and the Dongo Kundu Bypass, among others. We expect the increase in local and international flights, to boost the local tourism industry in general especially following recovery of the economy from the effects of the double election in 2017, with the Tourism Board projecting a 16.0% growth in international arrivals in 2018, which in our view will be made possible by the open-air policy, and the on-arrival visa policy for African visitors.

Also during the week, the owners of Sentrim Hotels and Lodges, the hotel chain that owns the Sentrim Hotels brand, put up the business for sale, consisting of a portfolio of eight hotels located in prime hospitality nodes across Kenya, at a price of Kshs 5.2 bn.

The Sentrim portfolio is as shown below:

|

Sentrim Hotels & Lodges Portfolio |

|||

|

Name of Development |

Acreage |

Location |

Keys |

|

680 Hotel |

0.7 |

Nairobi CBD |

240 |

|

Hotel Boulevard |

4.2 |

Nairobi CBD |

72 |

|

Royal Castle Hotel |

|

Mombasa |

68 |

|

Sentrim Elementaita |

|

Nakuru |

84 keys; 58 cottages |

|

Sentrim Amboseli |

58 |

Amboseli Park |

60 |

|

Sentrim Mara |

91.3 |

Maasai Mara |

31 |

|

Sentrim Samburu |

15 |

Samburu National Reserve |

21 |

|

Sentrim Tsavo |

21.3 |

Tsavo East National Park |

21 |

Source: Knight Frank, Online Sources

In our view, the move to sell the establishments is bound to benefit the purchasers in that, the business is relatively established in Kenya with over four decades of operations, thus, a solid customer base and goodwill, in addition to the land, which is over 190-acres. Moreover, the Kenyan hospitality industry has been on a recovery path, recording a 20.3% increase in earnings in 2017 to Kshs 119.9 bn from Kshs 99.7 bn in 2016, as per KNBS Economic Survey, 2018 whereas, hotel bed-nights occupancy increased by 11.3% to 7.2 mn in 2017 from 6.4 mn in 2016, thus, sustaining demand for hotel beds.

Source: KNBS

Source: KNBS

Also during the week, STR Global released hotels performance across African Cities for H1’2018. As per the report, Nairobi’s bed-occupancy rates fell by 0.6% points to 49.3% in H1’2018, from 49.9% as Q4’2017, while Average Daily Rates (ADR) declined by 6.5%. The decline in performance, in our view, is attributable to the continued increased supply of hotel rooms and serviced apartments, especially with the continued entry of international hoteliers such as Marriott International, Movenpick, Carlson Rezidor, and Hilton, among others with a pipeline of 4,675 hotel rooms and 1,260 serviced apartments, per our Cytonn Hospitality Report 2017, hence a decline in occupancy rates. In addition, the protracted electioneering period saw various western countries such as the United States issue temporary travel alerts, thus, affecting visitors’ confidence. As per the STR Data, the best hotel market in Africa is Marrakech, Morocco, which posted a 40.7% increase in ADR to USD 195, from USD 115.8 as Q4’ 2017, and a 12.3% points increase in occupancy rates.

Residential

During the week, Capitaland East Africa, an East Africa based commercial and residential real estate, investment and project management syndication company, announced plans to set up a Mixed-Use Development (MUD) in Mang’u, Juja. The project, named Artstone Valley, will be on 25-acres of land, off the Nairobi-Thika Highway, and will comprise of a residential component consisting of 960 3-bedroom units, 480 2-bedroom units, and 60 1-bedroom apartment units; and social facilities including a hospital, primary and nursery schools, as well as a mall.

The project, which is set to be completed within the next 40-months, is a joint venture between Capitaland, UAE-based real estate firms Abu Dhabi Investment and Housing and Emirate Homes Group; and investment firm, Royal Investment Group. These firms join the list of multinationals investing in the Kenyan real estate sector, with others include UK-based Kiloran-All Design consortium, who plan to develop The Beacon Mall in Nairobi; Aviation Industry Corporation of China (AVIC), which has invested in projects such as Two Rivers Mall; Taaleri, a Finnish Fund invested in Cytonn Investments and Fusion Capital; and Tata Group from India planning to venture into the local residential market, among others. The multinationals are attracted to Kenya, and the real estate sector in particular, by;

- Ongoing infrastructural developments such as the Standard Gauge Railway, construction of roads such as Eastern, Southern and Northern Bypasses, among others,

- High demand as a result of a demographic dividend that has continued to grow by 2.6% per annum, and a growing middle class,

- Attractive returns in the real estate sector, which has recorded returns of on average 24.3% p.a. over the last 5 years, compared to traditional asset classes’ 5-year returns, which have averaged at 13.2% per annum,

- Favorable legal and operating environment, such as the scrapping of land title search fees, NCA & NEMA levies, 15.0% corporate tax for developers of a 100 low cost units p.a., and digitization of the lands ministry, all of which saw Kenya’s rank in Ease of doing Business improve to 80 in 2017, from 92 in 2016, and,

- Nairobi’s status as a leading regional hub that have seen multinational firms continue to set up regional headquarters, thus sustaining demand for upper mid-end and high-end dwellings with a live-work-play concept.

Juja’s investment opportunity is enhanced by (i) good location along a major highway, that is, the Thika Superhighway, (ii) relatively affordable land prices, with an average price per acre of Kshs 9.6 mn, 111.5% lower than the average of Kshs 20.3 mn per acre for satellite towns in Nairobi, and (iii) the prevalent young population, especially from institutions such as Jomo Kenyatta International University, as well as the young working class from key business nodes such as the CBD, Thika Road, Ruiru, and Thika. As at H1’ 2018, average total returns in Juja increased by 0.5% points to 6.1%, from 5.6% in 2017, with average annual uptake rates increasing by 8.4% points to 23.7%, from 15.3% as at September 2017. Despite the increase in returns in 2018, key to note is that among the 11 Satellite Towns in our universe of coverage, Juja has the lowest returns, with price appreciation and total returns of 0.0% and 6.1%, respectively, in comparison to the satellite market averages of 2.7%, and 8.6%, respectively. This is as the area’s population structure, which mostly constitutes of the young population are mainly renters, thus, constraining investor returns.

(All Prices in ‘Kshs’ Unless Stated Otherwise)

|

Satellite Towns Residential Performance 2017/ 2018 - Apartments |

||||||||

|

Location |

Average of Price Per SQM |

Average of Rent per SQM |

Average of Annual Sales (%) |

Average of Rental Yield |

Average of Price Appreciation |

Average of Total Return 2018 |

Average Total Returns 2017 |

Change in Total Returns (Points) |

|

Thindigua |

92,603 |

454 |

28.2% |

5.9% |

5.3% |

11.2% |

19.3% |

(8.1%) |

|

Ruaka |

101,163 |

440 |

25.6% |

5.3% |

5.8% |

11.1% |

11.8% |

(0.7%) |

|

Ruiru |

89,918 |

469 |

20.6% |

6.3% |

3.7% |

9.9% |

8.4% |

1.5% |

|

Athi River |

63,395 |

351 |

25.4% |

6.3% |

2.4% |

8.7% |

7.4% |

1.3% |

|

Rongai |

70,983 |

338 |

23.7% |

5.9% |

2.8% |

8.7% |

5.4% |

3.3% |

|

Lower Kabete |

86,026 |

415 |

24.3% |

5.8% |

2.6% |

8.4% |

7.8% |

0.6% |

|

Kitengela |

67,018 |

327 |

19.4% |

6.4% |

1.8% |

8.2% |

11.8% |

(3.6%) |

|

Kikuyu |

76,046 |

336 |

22.3% |

5.3% |

2.7% |

8.1% |

10.7% |

(2.6%) |

|

Syokimau/Mlolongo |

75,313 |

299 |

22.0% |

5.0% |

1.8% |

6.8% |

- |

|

|

Thika |

49,155 |

284 |

25.0% |

6.1% |

0.3% |

6.4% |

9.1% |

(2.7%) |

|

Juja |

50,728 |

259 |

23.7% |

6.1% |

0.0% |

6.1% |

5.6% |

0.5% |

|

Average |

74,759 |

361 |

23.7% |

5.9% |

2.7% |

8.6% |

9.5% |

|

Source: Cytonn Research

Infrastructure

Residents of Kitengela are set to construct their own sewer line, that will service over 100-homes and approximately 20,000 persons. The 45-Km sewer line, will be funded by residents who are expected to raise a total of Kshs 39.0 mn towards the project. However, in our view the project will need other investors to actualize, as based on previous government projects, the average construction cost per Km for a sewerage project is Kshs 31.8 mn, including the construction of sewerage plants and other contingencies. With our estimates, the Kitengela sewer line should have a total cost of approximately Kshs 1.4 bn. Previously, the government has partnered with such institutions as African Development Bank (AfDB) and World Bank, for local sewerage projects, with the estimated costs of some of the projects as shown below:

(All Prices in ‘Kshs’ Unless Stated Otherwise)

|

Government of Kenya Sewerage Improvement Projects |

||||

|

Sewerage Project |

Length (Km) |

Project Funding |

Project Cost |

Cost per Km |

|

Kiambu Sewerage project |

30.3 |

GoK, AfDB |

995,750,000 |

32,863,036 |

|

Kikuyu Sewerage Project |

25.0 |

GoK, AfDB |

537,000,000 |

21,480,000 |

|

Ol Kalou Project |

14.3 |

GoK, AfDB |

416,157,240 |

29,101,905 |

|

Ruiru Sewerage Project |

57 |

GoK, World Bank |

2,400,000,000 |

42,105,263 |

|

Average |

31,387,551 |

|||

Source: NEMA, Athi Water Services Board

The Kitengela sewer line will adjoin the Exports Processing Zone’s (EPZ) Athi River Sewerage system in the neighboring Machakos County. Currently, Kitengela has a population of approximately 71,426 persons. The town has been one of the notable real estate investment nodes in Kajiado County, and the Nairobi Metropolitan Area in general, mainly on account of availability of affordable land for development with an average price per acre Kshs 11.3 mn, compared to the Nairobi Metropolitan average of Kshs 140.9 mn. In the residential sector, as at H1’2018, Kitengela had average total returns of 9.6%, as per the Cytonn Nairobi Metropolitan Residential Report 2018. However, this was a 3.3% points decline from the 12.9% recorded in H1’ 2017, whereas annual uptake declined by 3.5% y/y points to an average of 21.0% from 24.5% in 2017. The connection to the main sewer line, as well as other infrastructural developments aimed at decongesting the town, such as the Kshs 100.0 mn upgrading of the Athi River-Namanga Highway, and other Kitengela slip roads by the Kenya National Highways Authority (KeNHA), which commenced in 2017, are likely to lead to an increase in real estate development activities, uptake and real estate performance in the town. This is as infrastructural services lead to better quality of life in towns, thus boosting demand for real estate in the towns. For instance, in 2017, following the announcement that Ruiru would be connected to the sewer, the town recorded a relatively high capital appreciation in Nairobi Metropolitan Area of 3.7%, 1.0% points higher than the market average of 2.7%, and 1.8% points higher than 1.9% recorded in 2016. Also, since 2012, with the completion of the Northern Bypass, Ruaka has recorded an increase in development activity, with developments such as The Alma, and Taraji by Cytonn Investments, and others such as Glenwood Apartments, coming up. As of 2016, the town recorded attractive returns with average rental yields of 5.1%, price appreciation of 16.1%, resulting in total returns of 21.2%; while in 2018, the town recorded the highest capital appreciation in the satellites market, with an average of 5.8% p.a., 3.1% higher than the market average of 2.7% (as seen in the table above).

Listed Real Estate

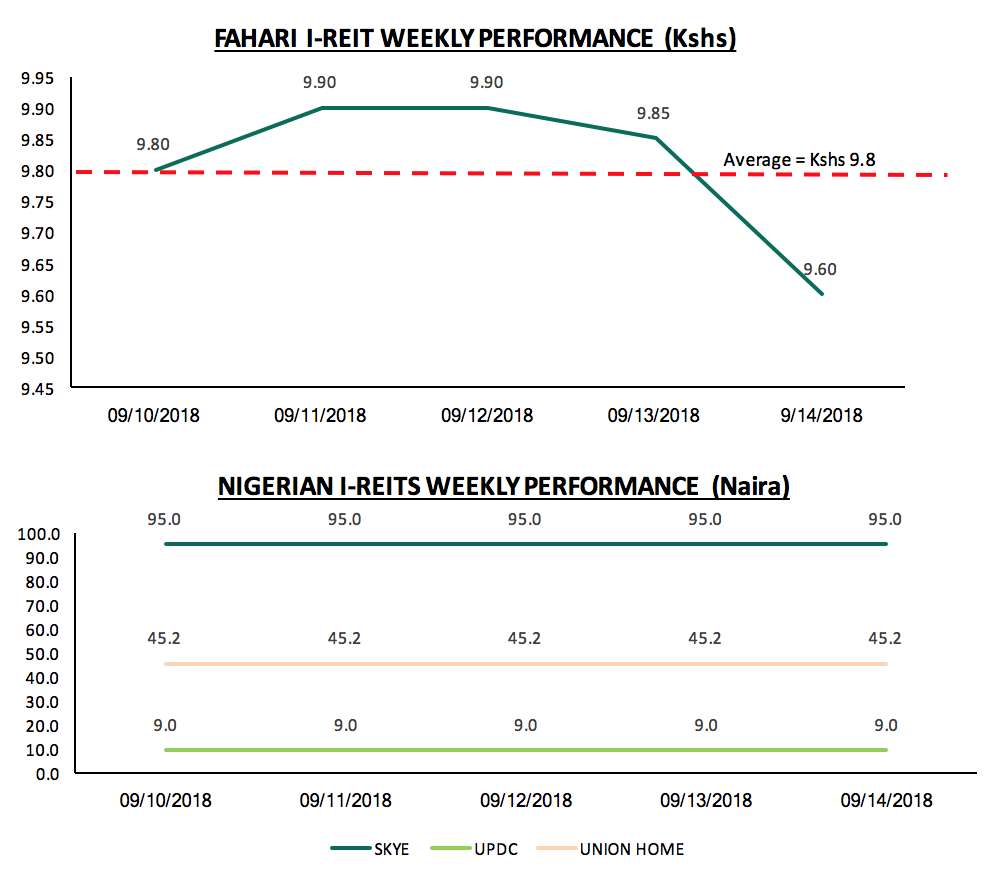

The Fahari I-REIT closed the week at Kshs 9.6, 2.0% lower than the week’s opening price of Kshs 9.8. During the week, it recorded an average price of Kshs 9.8, which is a decline of 15.5% from the average trading price same time last year, of Kshs 11.6. The continued poor performance is attributed to a temporary increase in vacancies, coupled with some tenants bargaining for reduced rentals upon the renewal of leases, leading to a reduction in rental income, noted during the release of the H1’2018 results, thus resulting to low trade volumes, an indication of low investor appetite.

The Nigerian I-REIT market remained unchanged, with Union Homes, Skye Shelter, and UPDC, retaining a price per share of N45.2, N95, and N9, respectively, throughout the week. We attribute to the inadequate investor knowledge about the market hence low investor interest in the instrument, and poor valuation of the market, which leads to lower levels of demand by potential investors.

We expect the real estate sector to continue on an upward performance trajectory boosted by: (i) increased local and international investor interest, (ii) continued investment in infrastructure, (iii) an expanding middle class, (iv)the huge housing deficit of 2.0 mn units, which is growing by 200,000 houses p.a, and (v) relatively high real estate returns which have averaged at 24.3% p.a. over the last 5 years.

Recently, the International Monetary Fund (IMF) concluded their review under a precautionary Stand-By Arrangement (SBA), which was extended to Kenya on 14th March 2016. The SBA is a lending arrangement extended by the IMF to member countries in emerging markets in need of financial assistance in case of occurrence of exogenous shocks such as drought, increase in global oil prices or changes in international financial markets. Previously, we had highlighted the IMF’s various forms of lending and the reasons why Kenya may benefit from the IMF standby facility (for more information, see our focus on Kenya’s IMF Standby Facility), while in this focus we shall highlight on the possible economic implications of missing out on the IMF’s precautionary credit facility. In a press statement after the visit, the IMF stated that their mission to assess the Kenyan economy achieved significant progress, but remained uncertain whether Kenya’s access to the standby facility would be extended. The Executive Board of the IMF was set to make a decision on Friday 14th September, on whether or not to grant Kenya access to a precautionary credit facility of USD 989.8 mn (Kshs 99.0 bn), having extended a similar facility amounting to USD 985.9 mn (Kshs 99.0 bn) in March 2016. The program expired on September 14th 2018 after being extended from 14th March 2018, and the Treasury announced that it would not renew the precautionary credit facility with the IMF despite having requested an extension of the same in March 2018, arguing that the country had kept macroeconomic fundamentals stable, occasioned by the low inflation levels and stable shilling. This week, we highlight on the current economic environment, the government’s efforts to comply with the conditions for the IMF to extend the facility, and give a view going forward on the economic implications after the precautionary credit facility expired. As such, we shall address the following items:

- IMF Visit to Kenya 2018 and Key Take Outs from the IMF Review;

- Commitments laid out by the government in order to qualify for the IMF precautionary credit facility, and the efforts made by the government to address economic challenges relating to these commitments;

- Possible economic implications should the Government not take advantage of the IMF’s precautionary credit facility; and,

- Our View and Way Forward.

Section I: IMF Visit to Kenya 2018 and Key Take Outs from the IMF Review

A team from the International Monetary Fund (IMF) visited Kenya from July 23rd to August 2nd, 2018, to hold discussions on the second review under a precautionary Stand-By Arrangement (SBA). From the discussions with the Kenyan authorities, it was noted that:

- Kenya’s economy had continued to perform well with the GDP having expanded by 5.7% in Q1’2018, up from 4.9% growth experienced in Q1’2017, with the growth being driven by improved investor confidence following the conclusion of the prolonged electioneering period, improved weather conditions in 2018 and a recovery in tourism sector, which can be evidenced by an increase in the total number of visitors arriving through Jomo Kenyatta International Airport (JKIA) and Moi International Airports, that increased by 2.1% to 76,608 in June 2018 from 75,028 in May 2018, despite a 4.4% decline y/y from 80,121 in June 2017, as per data from Kenya National Bureau of statistics (KNBS),

- Inflation has remained within the government’s set target of 2.5% - 7.5% target, averaging 4.2% in the 8 months to August 2018, compared to 9.5% in a similar period in 2017. We expect inflation to remain within target in 2018 despite the expectations of upward pressure in H2’2018, partly due to the base effect, and other tax reforms proposed under the Finance Bill 2018,

- Kenya had managed to meet the IMF’s program fiscal target for the FY2017/2018, with the budget deficit for the 2017/2018 fiscal year coming in at Kshs 614.6 bn (equivalent to 7.0% of GDP), significantly narrowing from 9.0% of GDP previously,

- The current account deficit has started to improve in 2018, after widening to 6.7% of GDP in 2017 from 5.2% in 2016, which was mainly driven by higher food imports and weaker agricultural exports as a result of the drought experienced during the year, coupled with higher fuel imports owing to rising global oil prices. The lower current account deficit so far in 2018, which narrowed to 5.8% in the 12-months to June 2018 from 6.3% in March 2018, has been attributed to improved agriculture exports, and lower capital goods imports following the completion of Phase I of the SGR project, and,

- The Kenyan Shilling has remained resilient against major currencies, while foreign exchange reserves have been relatively high currently standing at about USD 8.5 bn, equivalent to 5.7-months of imports cover.

Based on the above, we are of the view that Kenya is on the right trajectory towards improving the macroeconomic conditions in the country. From the FY’2018/2019 budget, the government is set to focus on a fiscal consolidation plan aimed at narrowing the fiscal deficit to 5.7% of GDP from 7.2% of GDP in the FY’2017/18 and further to around 3.0% of GDP by FY’2021/22. The government plans to achieve this through measures aimed at improving revenue collection by the Kenya Revenue Authority, which is projected to grow by 17.5% to Kshs 1.9 tn (equivalent to 20.0% of GDP) in the FY’2018/19 from the estimated Kshs 1.7 tn collected in the FY’2017/18, and a reduction in Government expenditure, which will in turn lead to reduced dependency on debt with the total borrowing requirement to plug in the deficit expected to decline to Kshs 558.9 bn from Kshs 620.8 bn, in a bid to reduce Kenya’s public debt burden.

Section II: Commitments laid out by the government in order to qualify for the IMF precautionary credit facility, and the efforts made by the government to address economic challenges relating to these commitments

The Executive Board of the IMF had approved the Government’s request for a 6-month extension of the Stand-By Arrangement (SBA) on 12th March, 2018, to allow more time for the completion of the two outstanding reviews. In a letter of intent dated 6th March 2018, the government stated that the extension was needed, giving reason that the second and third reviews had not been completed as the performance criteria on the primary balance (the difference between government revenues and its non-interest expenditures) for December 2016 and June 2017 were missed, due to revenue shortfalls and spending pressures partly on account of the drought, therefore no common ground could be reached on corrective policies to address the fiscal slippages resulting from the extended election period. The IMF agreed to extend the tenor of precautionary credit facility by 6 months on condition that certain requirements were to be met to necessitate eligibility for the insurance loan. Among the requirements included:

- Fiscal consolidation in order to reduce the budget deficit and public debt through rationalization of expenditure: The IMF had raised concerns that the public debt would reach nearly 60.0% of GDP this year. The government promised strong action to put the deficit and debt firmly on a downward path and reduce financing risks associated with the high debt levels. This would be done through corrective measures including steps to rationalize expenditure in the near-term and measures to increase revenues over the medium-term. Specifically, the government had committed to a reduction in the fiscal deficit to 7.2% of GDP by the end of the last fiscal year (June 2018), to be achieved by postponement of lower-priority capital projects. In addition, the government committed to a further 1.5% of GDP adjustment in 2018/19 to reach a deficit of 5.7% of GDP, to be supported by widening of the tax base by reducing exemptions in the VAT and income tax, as well as on-going improvements in revenue administration. By comparison, the FY’2017/2018 fiscal deficit decreased to 6.2% of GDP from 9.1% in FY’2016/2017, on the back of improved revenue collection by the government as businesses recovered from the effects of drought and the prolonged electioneering period. This was better than the 7.2% deficit that the IMF had expected by the end of the fiscal year 2017/2018. However, increased debt appetite by the government has pushed the debt burden to 55.6% of GDP from 48.9% in June 2016, with concerns that it may reach 60.0% by June 2019 if left unchecked. High recurrent expenditure by the government may increase the government’s financing needs, thereby increasing the public debt.

- Removal, or significant modification of the interest rate controls by Parliament: The IMF was of the strong view that interest rate controls, which were adopted in 2016, have contributed to a collapse in bank lending to the private sector and lower tax revenues from the banking sector, and have also reduced the effectiveness of the monetary policy framework. To minimize the adverse effect of the rate cap, the IMF required government to eliminate or significantly modify interest rate controls such that they would no longer hinder lending and access to finance, or hinder the conduct of monetary policy. However, legislators rejected the repeal of the rate-cap law among other tax reforms proposed in the Finance Bill 2018, arguing that most banks are still profitable despite the reduced lending margins. Legislators voted to keep the rate cap in place while removing the floor on pricing of deposits, which was set at 70.0% of the CBR.

- Monetary policy framework modernization: This was to follow the removal or modification of interest rate caps, whereby the government would be required to introduce an interest rate corridor around the Central Bank’s policy rate. This would help to strengthen the monetary policy transmission channel and allow the Central Bank of Kenya to move toward a full inflation-targeting regime. However, the Treasury’s efforts to convince legislators to repeal the Banking (Amendment) Act, 2016, did not bear fruit as MPs declined to repeal the interest rate cap legislation.

- Other reforms: The authorities had indicated keenness in pursuit of efforts to deepen financial sector reforms, improve the transparency and efficiency of public spending, and strengthen the quality of macroeconomic statistics. To address this, the Treasury proposed a number of taxes in its Budget statement for the 2018/2019 fiscal year to try and reduce the widening budget deficit, including:

- The ‘Robin Hood’ tax on bank transfers, which required banks to remit 0.05% tax on transfers above Kshs 500,000;

- The Housing Development Fund Levy that required workers in formal employment to submit 0.5% of their gross salary towards a National Fund for Affordable Housing, with employers required to match employee’s contribution;

- Excise tax on mobile money transactions were increased to 12.0% from 10.0%;

- Increase in excise duty for cars above 2,500cc to 30.0% from 20.0%; and,

- Capital gains tax of 5.0% on property transfers by insurance firms.

The Robin Hood tax was suspended by the High Court on grounds that due process was not followed in engaging stakeholders through public participation. In addition, the tax would stifle the flow of funds and curb investments, thereby compromising efforts to consolidate regional leadership as a financial hub, according to the Kenya Bankers’ Association (KBA). The housing levy fund, meant to finance the construction of 500,000 affordable housing units in five-years, was also rejected by MPs on grounds that it would be costly to companies while putting Kenyans at a disadvantage due to double taxation. The legal obstacles facing implementation of the additional taxes will likely serve to widen the budget deficit and cripple additional revenues that would go into servicing the huge debt stockpile, which is currently at 55.6% of Kenya’s GDP. The government may have to fill in the revenue gaps using more debt, which, in our view, will result into deteriorating debt levels.

Section III: Possible economic implications should the Government not take advantage of the IMF’s precautionary credit facility

This section will examine the implications to the economy should the Government fail to take advantage of the precautionary facility offered by the IMF.

- Depreciation of the Kenya Shilling: The announcement by the Treasury on Thursday 13th September that the government will not be seeking the extension of the tenor for the IMF’s facility triggered weakening of the shilling by 0.2% against the dollar to cross 101.22 units to the dollar. However, with the intervention of the CBK by pumping dollars into the market, the shilling regained marginally to close at 100.85 units to the dollar. So far, the shilling has been held steady during the year as a result of increased inflows from export earnings, diaspora remittances and foreign direct investments (FDIs). The Central Bank of Kenya (CBK) forex reserves currently stands at USD 8.5 bn (Kshs 850.0 bn), which the CBK believes will cushion the local currency against depreciation, now that Kenya chose not to renew the precautionary credit facility. However, should the local currency weaken, the country’s stock of dollar-denominated debt will rise sharply making it even more expensive for the country to service its debt obligations.

- Adverse Movements in Balance of Payments Position: These may arise from the vulnerabilities to exogenous shocks such as increase in global oil prices, drought or adverse changes in the international financial markets. Kenya has become more integrated into the global financial system over the years, hence it is exposed to such possible occurrences in the future which could negatively affect the current account deficit due to increased outflows of foreign capital.

- Reduced Investor Confidence: The above implications would mean a reduction of investor confidence in the country as international investors may view Kenya as a high-risk investment destination. This would slow down economic growth, stifle access to capital and raise fears of an economic meltdown.

Section IV: Our View and Way Forward

The announcement by the Treasury not to renew the USD 989.8 mn (Kshs 99.0 bn) precautionary credit facility with the IMF caused some uncertainty around the future of the economy, with the current facility having ended on Friday 14th September 2018. As a result, there are concerns that the shilling may depreciate and investor confidence in the country may wane, hence reducing foreign investment and stunting economic growth.

In our view, however, while the facility is a nice to have, there is no immediate threat to the economy as a result of the failure to renew the IMF facility, due to

- Sufficient forex reserves of USD 8.5 bn, equivalent to 5.7 months of import cover,

- The stability of the shilling, having appreciated 1.9% year-to-date despite the government having not drawn down on the IMF facility, and,

- The expected narrowing of the current account deficit to 5.4% of GDP by the end of the year, from 5.8% in June 2018, according to the CBK.

In addition, according to IMF representative Jan Mikkelsen, Kenya’s external position remains strong and foreign exchange reserves are at a comfortable level. The government should continue with its efforts to work on a fiscal consolidation plan aimed at narrowing the fiscal deficit to 5.7% of GDP from 7.2% of GDP in the FY 2017/18 and further to around 3.0% of GDP by FY 2021/22. This can be achieved through revenue enhancement measures, which will in turn lead to reduced dependency on debt in a bid to reduce Kenya’s public debt burden. Therefore, despite the possible implications of failure by the government to renew the precautionary credit facility, we perceive no immediate adverse effects on the economy. However, the government needs to work on the conditions set by the IMF since the improvement in these areas stand to benefit the economy with or without the IMF precautionary credit facility.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.