The Role of Special Purpose Vehicles (SPVs) in Finance and Investments in Kenya, and Cytonn Weekly #04/2025

By Research Team, Jan 26, 2025

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 136.7%, higher than the overall subscription rate of 78.6%, recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 16.8 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 419.8%, significantly higher than the undersubscription rate of 84.6%, recorded the previous week. The subscription rates for the 182-day decreased to 38.2% from the 54.5% recorded the previous week, while the subscription rates for the 364-day papers increased to 122.0% from the 100.3% recorded the previous week. The government accepted a total of Kshs 32.8 bn worth of bids out of Kshs 32.8 bn bids received, translating to an acceptance rate of 100.0%. The yields on the government papers were on a downward trajectory, with the yields on the364-day, 182-day and 91-day papers decreasing by 1.0 bps, 0.2 bps and 4.0 bps respectively to 11.29%, 10.03% and 9.53% from the 11.31%, 10.03% and 9.56% recorded the previous week;

In the primary bond market, the government is looking to raise Kshs 70.0 bn through the reopened two infrastructure bonds; IFB1/2022/14 and IFB1/2023/17 with a tenor to maturity of 11.8 years and 15.1 years respectively. The bonds will be offered at fixed coupon rates of 13.9% and 14.4% respectively. The period of sale opened on Thursday, 23rd January 2025, and will close on 12th February 2025. Our bidding range for the reopened bonds are 12.85%-13.55% and 12.95%-13.65% for the IFB1/2022/14 and IFB1/2023/17 respectively;

During the week, the global ratings agency, Moody’s announced its revision of Kenya’s credit outlook to positive from negative, while maintaining the credit rating at Caa1, on the back of a likelihood of an ease in liquidity risks and improved debt affordability;

We are projecting the y/y inflation rate for January 2025 to increase to within the range of 3.1% - 3.4% mainly on the back of: a rise in fuel prices in January and the decrease in the Central Bank Rate (CBR) by 75.0 bps to 11.25% from 12.00%.

In the primary bond market, the government is looking to raise Kshs 70.0 bn through the reopened two infrastructure bonds; IFB1/2022/14 and IFB1/2023/17 with a tenor to maturity of 11.8 years and 15.1 years respectively. The bonds will be offered at fixed coupon rates of 13.9% and 14.4% respectively. The period of sale opened on Thursday, 23rd January 2025, and will close on 12th February 2025. Our bidding range for the reopened bonds are 12.85%-13.55% and 12.95%-13.65% for the IFB1/2022/14 and IFB1/2023/17 respectively;

During the week, the global ratings agency, Moody’s announced its revision of Kenya’s credit outlook to positive from negative, while maintaining the credit rating at Caa1, on the back of a likelihood of an ease in liquidity risks and improved debt affordability;

We are projecting the y/y inflation rate for January 2025 to increase to within the range of 3.1% - 3.4% mainly on the back of: a rise in fuel prices in January and the decrease in the Central Bank Rate (CBR) by 75.0 bps to 11.25% from 12.00%.

Equities

During the week, the equities market was on an upward trajectory, with NSE 10 gaining the most by 3.0% while NSE 25, NSE 20 and NASI gained by 2.9%,1.8% and 1.3% respectively, taking the YTD performance to gains of 6.2%, 5.7%, 3.3% and 3.2% for NSE 20, NASI, NSE 10 and NSE 25, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as EABL, KCB and DTBK of 7.2%, 6.6%, and 5.3% respectively. The gains were however weighed down by losses recorded by large-cap stocks such as Bamburi, Stanbic and BAT of 3.5%, 1.6%, and 0.5% respectively;

Real Estate

During the week, Kenya Bureau of Statistics (KNBS) released 2023/24 Kenya Housing Survey Basic Report that provides a comprehensive analysis of the housing sector in Kenya. The survey aims to gather information and generate estimates for key housing indicators, and real estate indicators in the country. The report provides detailed insights into housing conditions, affordability, and tenure across the country. Conducted by KNBS in collaboration with government agencies, the survey aimed to inform evidence-based housing policies aligned with national and global development goals.

Also during the week, Kenya Bureau of Statistics (KNBS) released 2023/2024 Real Estate Survey Report which highlighted significant growth, regulatory challenges, and market dynamics. The market has grown by 33.7% from 2019 to 2023, driven by urbanization, infrastructure, and initiatives like the Affordable Housing Program. However, gaps in reliable housing data hinder effective decision-making. The report indicates that in 2023, about 34.4% of advertised office space remained unoccupied due to low demand.

During the week, Hass Consult, a Kenyan consulting and Real Estate development firm, released its Property Index Q4’2024 Report, focusing on the residential Real Estate sector's performance in the Nairobi Metropolitan Area (NMA).

Also during the week, Hass Consult released Land Price Index Q4’2024 Report which highlighted the performance of the Real Estate land sector in the Nairobi Metropolitan Area (NMA).

During the week, a private developer, GulfCap Real Estate broke ground on a Kshs 120.0 bn housing project in Kisumu marking a significant development in Kenya's real estate sector. Spanning 285 acres, the project aims to address the growing demand for housing in Kisumu, a city experiencing rapid urbanization and population growth. The initiative is expected to create thousands of jobs, both directly and indirectly, through construction activities and the establishment of supporting services. This employment boost is anticipated to stimulate the local economy and improve livelihoods in the region.

During the week, an investor, The View by the Park Limited, has proposed a Kshs 1.3 bn hotel development overlooking Nairobi National Park, aiming to capitalize on the park's unique proximity to the city center. The proposed hotel is expected to offer panoramic views of the park, providing guests with a distinctive experience of urban and natural landscapes. The hotel's location is advantageous, situated near key transport routes and close to Nairobi's central business district. This strategic positioning is anticipated to attract both international tourists and business travelers seeking convenient access to the city's amenities while enjoying the tranquility of the park's surroundings.

During the week, the Local Authorities Pensions Trust (Laptrust) revised its plans for the Ugatuzi Tower project in Nairobi, reducing the proposed 50-storey office building to 34 floors. This adjustment comes in response to a surplus of office space in the market and escalating construction costs. The revised project is estimated to cost approximately Kshs 3.1 bn. Originally, Laptrust intended to construct a 50-storey tower at an estimated cost of Sh5 billion. However, legal challenges from some of its members delayed the project's commencement, leading to the current revision. The proposed building will occupy 1.3 acres at the intersection of Argwings Kodhek and Chaka Road in the Hurlingham area. Laptrust plans to complete the project within 24 months after obtaining the necessary licenses and beginning construction.

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 17th January 2025. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 17th January 2025, representing a 45.0% loss from the Kshs 20.0 inception price;

Focus of the Week

A Special Purpose Vehicle (SPV), sometimes known as a Special Purpose Entity (SPE), is a legally separate and independent entity formed for a specific, defined purpose, typically to isolate financial risk. SPVs are widely utilized in securitization, project finance, structured finance, and asset-backed transactions. They are intended to be bankruptcy-resistant, meaning that their operations and liabilities are separate from the parent or sponsoring organization. SPVs can be established as either limited liability companies (LLCs) or limited partnerships, trust or even a subsidiary of the originator. Since they operate as independent entities, they remain off the sponsor’s or parent company’s balance sheet. We chose to focus on SPVs given their limited understanding in the local market, yet they are crucial to bringing much needed capital to fund businesses and projects;

Investment Updates:

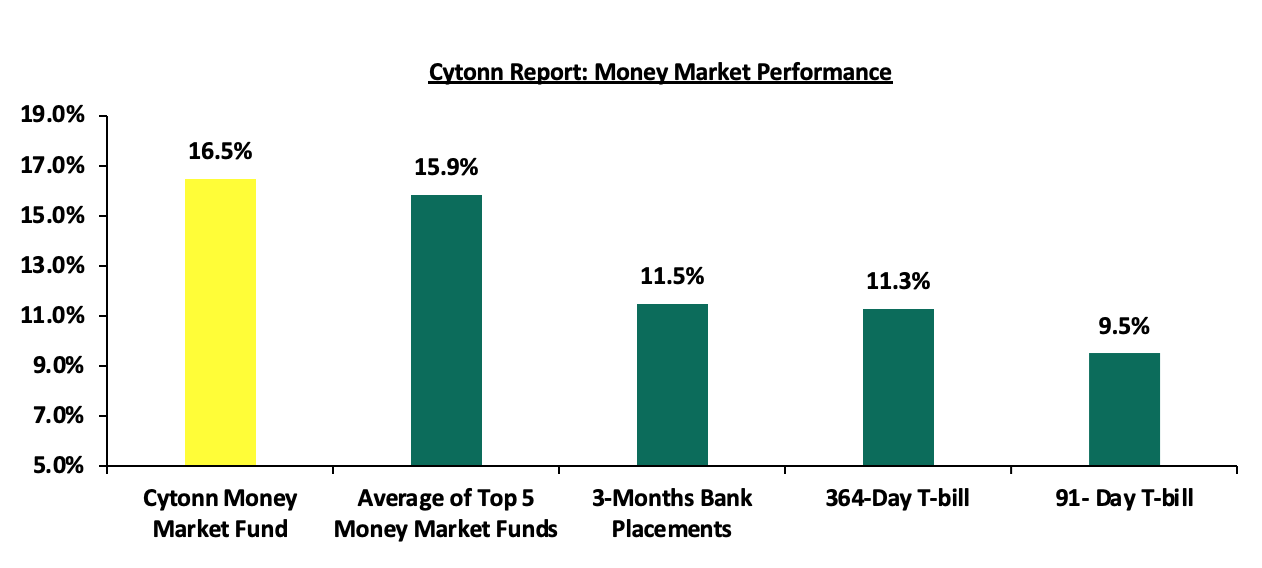

- Weekly Rates: Cytonn Money Market Fund closed the week at a yield of 16.5% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Tuesday, from 7:00pm to 8:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

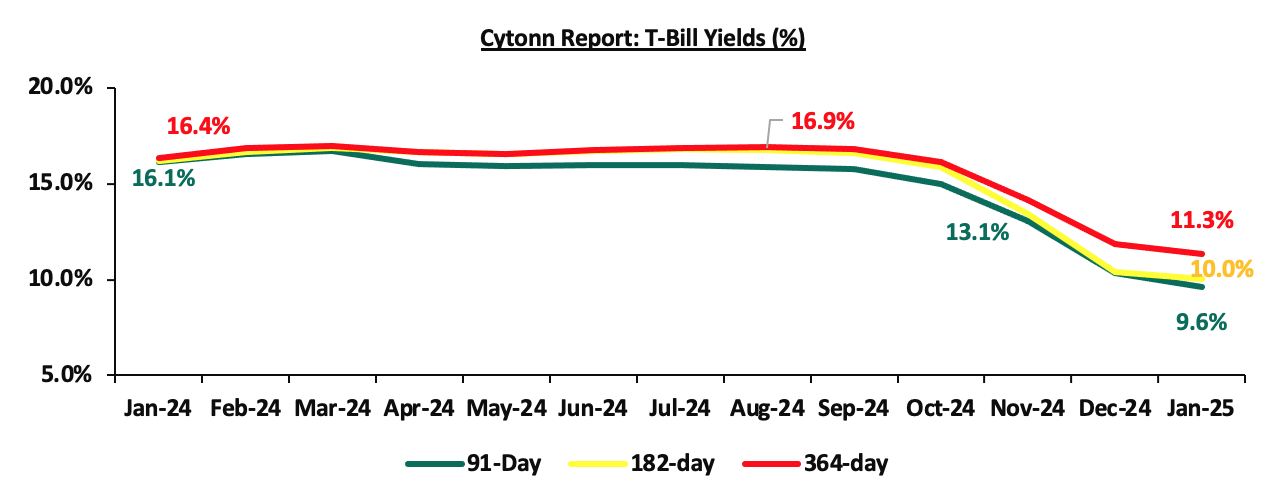

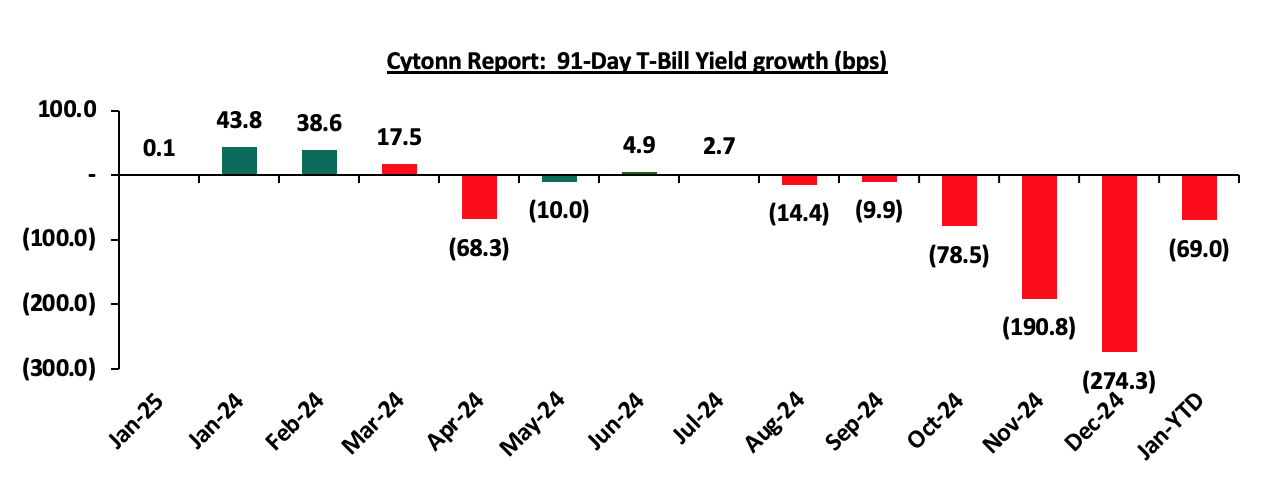

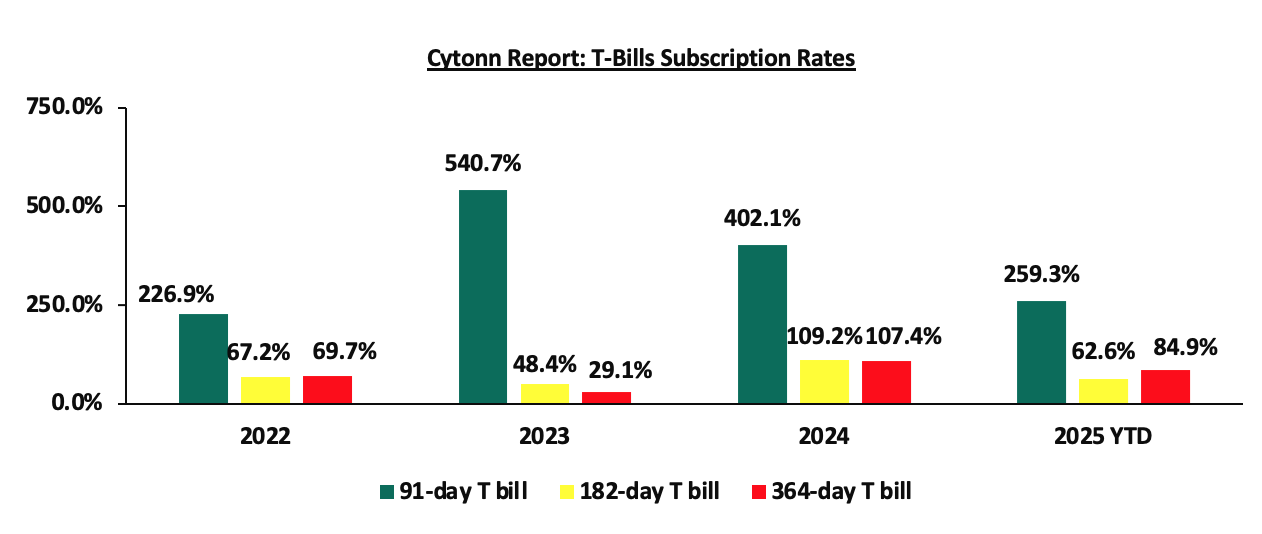

During the week, T-bills were oversubscribed, with the overall oversubscription rate coming in at 136.7%, higher than the overall undersubscription rate of 78.6%, recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 16.8 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 419.8% significantly higher than the undersubscription rate of 84.6%, recorded the previous week. The subscription rates for the 182-day decreased to 38.2% from the 54.5% recorded the previous week, while the subscription rates for the 364-day papers increased to 122.0% from the 100.3% recorded the previous week. The government accepted a total of Kshs 32.8 bn worth of bids out of Kshs 32.8 bn bids received, translating to an acceptance rate of 100.0%. The yields on the government papers were on a downward trajectory, with the yields on the 364-day, 182-day and 91-day papers decreasing by 1.0 bps, 0.2 bps and 4.0 bps respectively to 11.29%, 10.03% and 9.53% from the 11.31%, 10.03% and 9.56% recorded the previous week.

The charts below show the performance of the 91-day, 182-day and 364-day papers from January 2024 to January 2025:

The chart below shows the yield growth for the 91-day T-bills:

The chart below compares the overall average T-bill subscription rates obtained in 2022,2023, 2024 and 2025 Year-to-date (YTD):

In the primary bond market, the government is looking to raise Kshs 70.0 bn through the reopened two infrastructure bonds; IFB1/2022/14 and IFB1/2023/17 with a tenor to maturity of 11.8 years and 15.1 years respectively. The bonds will be offered at fixed coupon rates of 13.9% and 14.4% respectively. The period of sale opened on Thursday, 23rd January 2025, and will close on 12th February 2025. Our bidding range for the reopened bonds are 12.85%-13.55% and 12.95%-13.65% for the IFB1/2022/14 and IFB1/2023/17 respectively.

Money Market Performance:

In the money markets, 3-month bank placements ended the week at 11.5% (based on what we have been offered by various banks), and yields on the government papers were on a downward trajectory, with the yields on the 364-day and 91-day papers decreasing by 1.0 bps and 4.0 bps respectively to 11.29% and 9.53% respectively, from the 11.30% and 9.56% respectively recorded the previous week. The yield on the Cytonn Money Market Fund decreased by 6.0 bps to close the week at 16.5%, from the 16.6% recorded the previous week, while the average yields on the Top 5 Money Market Funds decreased by 20.0 bps to close the week at 15.9% from the 16.1% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 24th January 2025:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 24th January 2025 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn app) |

16.5% |

|

2 |

Gulfcap Money Market Fund |

16.3% |

|

3 |

Lofty-Corban Money Market Fund |

15.7% |

|

4 |

Ndovu Money Market Fund |

15.5% |

|

5 |

Kuza Money Market fund |

15.3% |

|

6 |

Etica Money Market Fund |

15.3% |

|

7 |

Mali Money Market Fund |

15.2% |

|

8 |

Dry Associates Money Market Fund |

13.7% |

|

9 |

Orient Kasha Money Market Fund |

13.6% |

|

10 |

Sanlam Money Market Fund |

13.5% |

|

11 |

Jubilee Money Market Fund |

13.2% |

|

12 |

GenAfrica Money Market Fund |

13.1% |

|

13 |

Genghis Money Market Fund |

13.0% |

|

14 |

British-American Money Market Fund |

13.0% |

|

15 |

Madison Money Market Fund |

12.8% |

|

16 |

Faulu Money Market Fund |

12.8% |

|

17 |

CIC Money Market Fund |

12.6% |

|

18 |

Co-op Money Market Fund |

12.6% |

|

19 |

ICEA Lion Money Market Fund |

12.4% |

|

20 |

Old Mutual Money Market Fund |

12.2% |

|

21 |

Absa Shilling Money Market Fund |

12.1% |

|

22 |

Enwealth Money Market Fund |

12.0% |

|

23 |

Nabo Africa Money Market Fund |

11.9% |

|

24 |

KCB Money Market Fund |

11.9% |

|

25 |

Ziidi Money Market Fund |

11.7% |

|

26 |

Apollo Money Market Fund |

11.5% |

|

27 |

AA Kenya Shillings Fund |

11.2% |

|

28 |

Arvocap Money Market Fund |

10.8% |

|

29 |

Mayfair Money Market Fund |

10.3% |

|

30 |

Stanbic Money Market Fund |

10.0% |

|

31 |

Equity Money Market Fund |

6.9% |

Source: Business Daily

Liquidity:

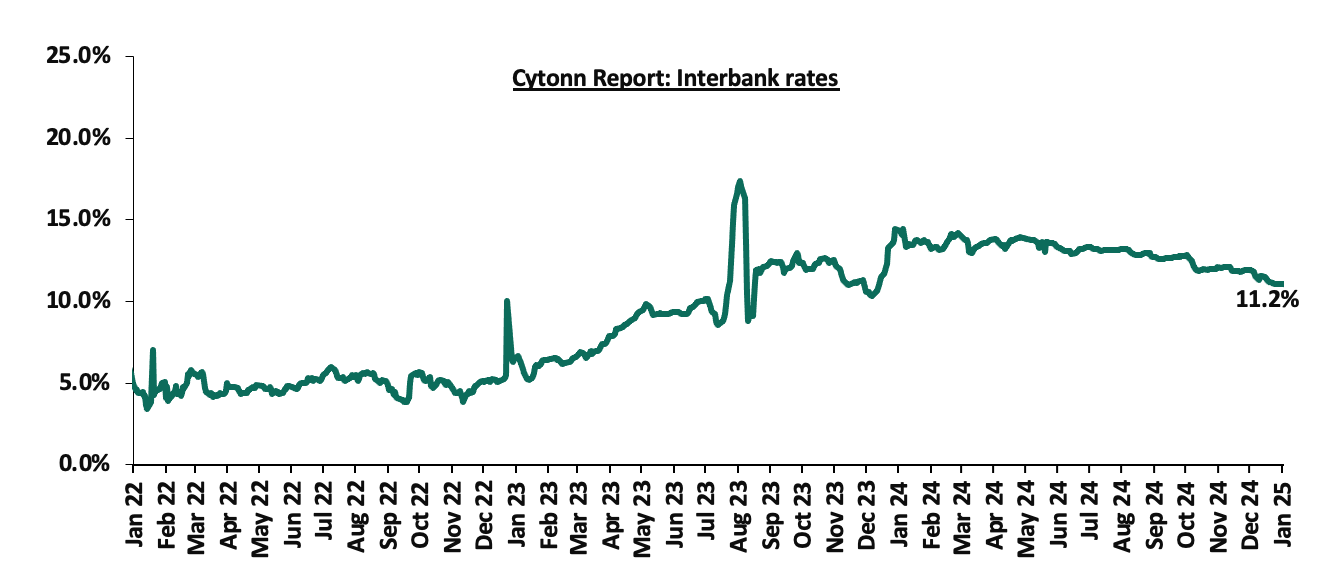

During the week, liquidity in the money markets marginally eased, with the average interbank rate decreasing by 0.5 bps, to remain relatively unchanged from the 11.3% recorded the previous week, partly attributable to tax remittances that were offset by government payments. The average interbank volumes traded decreased by 22.7% to Kshs 23.1 bn from Kshs 29.9 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

Kenya Eurobonds:

During the week, the yields on Kenya’s Eurobonds were on an upward trajectory, with the yield on the 10-year Eurobond issued in 2018 increasing the most by 20.2 bps to 9.0% from 8.8% recorded the previous week. The table below shows the summary performance of the Kenyan Eurobonds as of 23rd January 2025;

|

Cytonn Report: Kenya Eurobonds Performance |

|||||||||

|

|

2018 |

2019 |

2021 |

2024 |

|||||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

|||

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

|||

|

Years to Maturity |

3.1 |

23.1 |

2.3 |

7.3 |

9.4 |

6.1 |

|||

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

|||

|

02-Jan-25 |

9.1% |

10.3% |

8.5% |

10.1% |

10.1% |

10.1% |

|||

|

16-Jan-25 |

8.8% |

10.1% |

8.2% |

9.8% |

9.8% |

9.8% |

|||

|

17-Jan-25 |

8.8% |

10.1% |

8.3% |

9.8% |

9.9% |

9.8% |

|||

|

20-Jan-25 |

8.8% |

10.1% |

8.3% |

9.8% |

9.9% |

9.8% |

|||

|

21-Jan-25 |

8.7% |

10.1% |

8.2% |

9.7% |

9.8% |

9.7% |

|||

|

22-Jan-25 |

8.9% |

10.1% |

8.3% |

9.8% |

9.9% |

9.9% |

|||

|

23-Jan-25 |

9.0% |

10.2% |

8.3% |

10.0% |

10.0% |

10.0% |

|||

|

Weekly Change |

0.2% |

0.1% |

0.1% |

0.2% |

0.2% |

0.2% |

|||

|

MTD Change |

(0.1%) |

(0.0%) |

(0.1%) |

(0.1%) |

(0.1%) |

(0.1%) |

|||

|

YTD Change |

(0.1%) |

(0.0%) |

(0.1%) |

(0.1%) |

(0.1%) |

(0.1%) |

|||

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling appreciated against the US Dollar by 23.7 bps, to close the week at Kshs 129.3, from 129.6 recorded the previous week. On a year-to-date basis, the shilling has appreciated by 3.4 bps against the dollar, a contrast to the 17.4% appreciation recorded in 2024.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,945.0 mn in 2024, 18.0% higher than the USD 4,190.0 mn recorded in 2023. The United States remained the largest source of remittances to Kenya accounting for 51.0% in the period, and,

- The tourism inflow receipts which came in at USD 352.5 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 14.9% in the 12 months to October 2024, compared to a similar period in 2023.

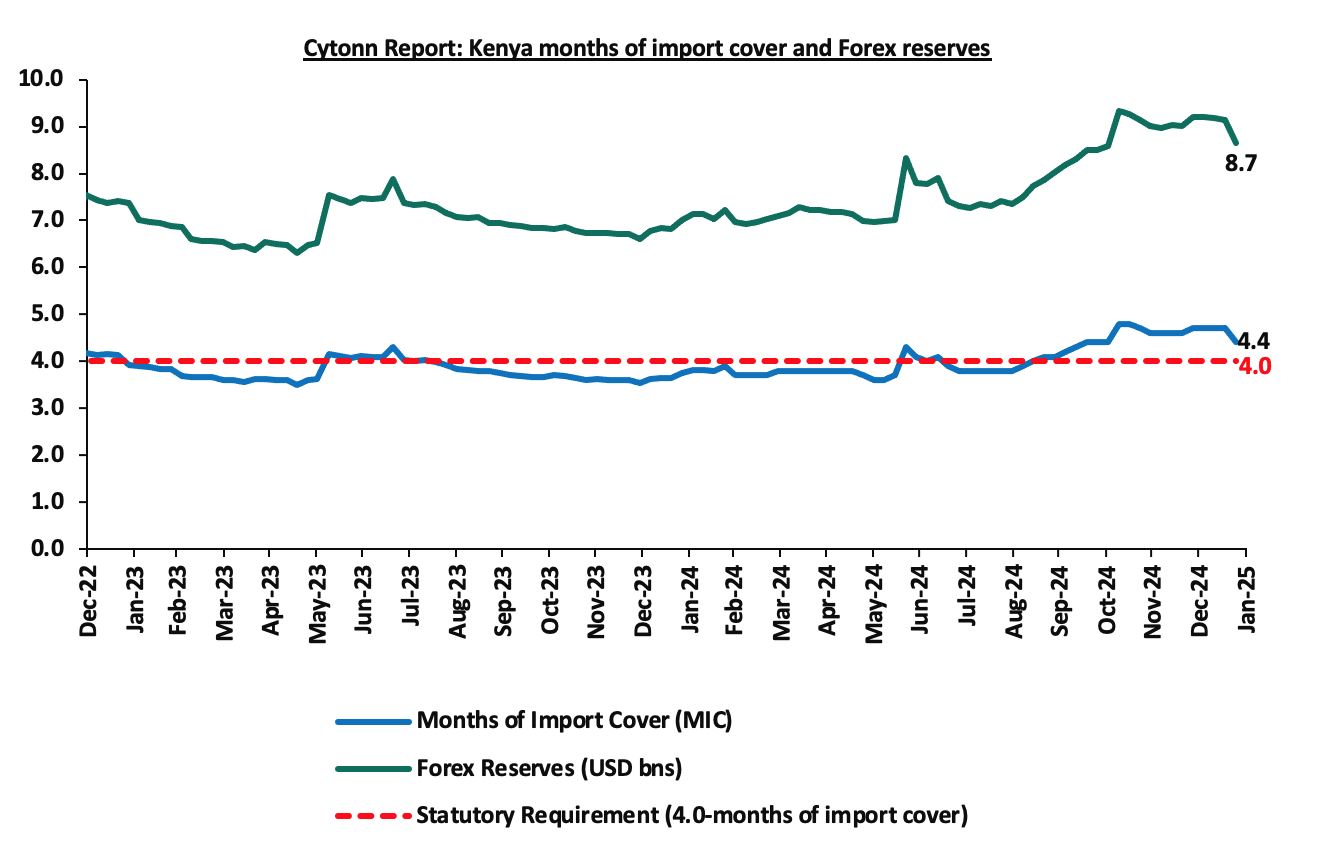

- Improved forex reserves currently at USD 8.7 bn (equivalent to 4.4-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover but below the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2025 as a result of:

- An ever-present current account deficit which came at 4.0% of GDP in Q3’2024 which remained relatively unchanged from Q3’2023 and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.2% of Kenya’s external debt is US Dollar-denominated as of June 2024.

Key to note, Kenya’s forex reserves decreased by 5.4% during the week, to USD 8.7 bn, from the USD 9.1 bn recorded in the previous week, equivalent to 4.4 months of import cover and above the statutory requirement of maintaining at least 4.0-months of import cover. During the week the months of import cover decreased by 6.4% to 4.4 months from 4.7 months recorded the previous week. The recent decrease in forex reserves is primarily attributed to increased demand of foreign exchange in the week which marginally outpaced inflows from remittances and the tea sector.

The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights

- Moody’s Revises Kenya’s Credit Negative Outlook to Positive and Affirms Caa1 Rating

On January 24th 2025, the global ratings agency, Moody’s announced its revision of Kenya’s credit outlook to positive from negative, while maintaining the credit rating at Caa1, on the back of a likelihood of an ease in liquidity risks and improved debt affordability. The improved debt affordability is largely attributable to the reduction in domestic borrowing costs, evidenced by the sharp decline of yields for short-dated papers. Given the low inflation rates in the country, the stability of the exchange rate, and the ease in the monetary policy stance, domestic borrowing costs are expected to continue decreasing over the short-medium term.

Inflation remained within the CBK’s preferred target range of 2.5%-7.5% throughout 2024, with the average inflation rate for 2024 coming in at 4.5%. As of December 2024, inflation came in at 3.0%, a slight increase by 0.2% points from the 2.8% recorded in November 2024, nearing the lower end of the target range. The low inflation coupled with a stable exchange rate has led to an expansionary monetary stance by the Central Bank of Kenya, improving domestic liquidity and reduced short-term interest rates. Since July 2024, the government’s domestic borrowing costs have significantly decreased with the average yields on the 91-day treasury bill decreasing by 6.4% points to 9.6% by January 2025 from 16.0% in July 2024. While yields on longer-term Treasury bonds have also declined, the drop has been more gradual. Bonds with maturities exceeding five years saw yields decrease from 16.5% six months ago to between 14.0% and 15.0% in recent auctions.

The affirmed Caa1 credit rating shows that the high credit risks remain due to the high debt-service to revenue ratios, which stood at 56.3% as of December 2024, 26.3% points above the IMF threshold of 30.0%. Additionally, the lower borrowing costs could feed into a more positive debt trajectory for the government. In addition, Kenya's local currency (LC) ceiling remains at B1, maintaining a three-notch gap with the sovereign rating. The foreign currency (FC) ceiling was also remains at B2, one notch below the LC ceiling, reflecting Kenya's relatively low external debt and moderately open capital account, which, while not completely eliminating, do reduce the need for transfer and convertibility restrictions during periods of financial stress.

This moves positions Kenya alongside emerging economies like Nigeria and Egypt. The revision comes after the rating agencies downgraded Kenya’s credit rating in late 2024, after the withdrawal of Finance Bill 2024. Notably, S&P Global Ratings announced its revision of Kenya’s long-term sovereign credit rating, downgrading it to B-, and a stable outlook from a credit rating of B and a negative outlook, on 23rd August 2024. Additionally, the global ratings agency, Fitch Ratings announced its revision of Kenya’s credit score, downgrading it to B- from a credit rating of B while also revising the outlook to stable, from a negative outlook on 2nd August 2024. Below is a summary of the credit rating on Kenya by various rating agencies;

|

Cytonn Report: Kenya’s Credit Ratings |

||||||

|

Rating Agency |

Previous Rating |

Previous Outlook |

Current Rating |

Current Outlook |

Meaning |

Date Released |

|

Moody's Rating |

Caa1 |

Negative |

Caa1 |

Positive |

Substantial credit risks |

24th January, 2025 |

|

Fitch Ratings |

B |

Negative |

B- |

Stable |

Highly Speculative |

2nd August 2024 |

|

S&P Global |

B |

Negative |

B- |

Stable |

Extremely high risk, very vulnerable to default |

23rd August 2024 |

Source: Fitch Ratings, S&P Global, Moody’s

Going forward, Kenya's government faces the challenge of managing a fiscal strategy that relies on revenue-driven expenditure through a broadened tax base. The agency noted that Kenya’s rating could be upgraded if domestic financing conditions improved, fiscal reforms succeed in lowering liquidity risks, and the debt burden starts to decline sustainably. Strong external reserves and reliable access to affordable external funding would also support an upgrade. However, if financing conditions worsen or fail to improve, leading to higher liquidity risks and poor debt affordability, the outlook would shift to stable. A downgrade is unlikely in the near term but could occur if rising liquidity risks limit funding access and weaken fiscal and debt metrics.

- January Inflation projection

We are projecting the y/y inflation rate for January 2025 to increase to within the range of 3.1% - 3.4% mainly on the back of:

- A Rise in Fuel Prices in January– In their last fuel prices release, EPRA announced that the maximum allowed price for Super Petrol, Diesel and Kerosene increased by Kshs 0.3, Kshs 2.0 and Kshs 3.0 respectively. Consequently, Super Petrol, Diesel and Kerosene is now retailing at Kshs 176.6, Kshs 167.1 and Kshs 151.4 per litre respectively, from Kshs 176.3, Kshs. 165.1 and Kshs 148.4 per litre respectively, representing increases of 0.2%, 1.2% and 2.0% for Super Petrol, Diesel and Kerosene respectively. This rise in fuel prices is likely to increase pressure on consumers’ purchasing power as well as business operational costs, since fuel is a major input cost for businesses, and,

- The decrease in the Central Bank Rate (CBR) by 75.0 bps to 11.25% from 12.00% – In 2024, the CBK Monetary Policy Committee began reducing the Central Bank Rate (CBR) with a 25.0 bps cut in August, lowering it to 12.75%. In their final meeting on 5th December 2024, they implemented a more significant reduction, cutting the CBR by 75.0 bps to 11.00%. This reduction in the CBR is likely to increase the money supply through lower borrowing costs, which may cause a slight rise in inflation rates as the effects of the CBR gradually take hold in the broader economy.

We, however, expect that inflation rate will, be supported by:

- Stability of the Kenya Shilling against the US Dollar – The Kenya Shilling has recorded a slight 3.4 appreciation as of 24th January 2025 to remain relatively unchanged at Kshs 129.3 recorded at the beginning of the month. and,

- Reduced electricity prices – In January 2025, electricity prices decreased marginally on the back of a drop in fuel cost charges and forex adjustment charges. EPRA set the fuel cost charge at Kshs 3.55, down from Kshs 3.57 in December 2024, while the forex adjustment was lowered to Kshs 0.83 from Kshs 1.1 in December 2024. With electricity being one the major inputs of inflation, this decrease is expected to reduce production costs for businesses as well as decrease electricity costs for households and thus easing inflation.

Going forward, we expect inflationary pressures to remain anchored in the short term, remaining within the CBK’s target range of 2.5%-7.5% aided by the stable fuel prices, decreasing energy costs and stability in the exchange rate. However, risks remain, particularly from the potential for increased demand-driven inflation due to an accommodative monetary policy. The CBK’s ability to balance growth and inflation through close monitoring of both inflation and exchange rate stability will be key to maintaining inflation within the target range.

Rates in the Fixed Income market have been on a downward trend due to high liquidity in the money market which allowed the government to front load most of its borrowing. The government is 137.3% ahead of its prorated net domestic borrowing target of Kshs 235.6 bn, and 36.9% ahead of the total FY’2024/25 net domestic borrowing target of Kshs 408.4 bn, having a net borrowing position of Kshs 559.1 bn. However, we expect a continued downward readjustment of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to normalize in the short to medium-term and hence investors are expected to shift towards the long-term papers to lock in the high returns.

Market Performance

During the week, the equities market was on an upward trajectory, with NSE 10 gaining the most by 3.0% while NSE 25, NSE 20 and NASI gained by 2.9%,1.8% and 1.3% respectively, taking the YTD performance to gains of 6.2%, 5.7%, 3.3% and 3.2% for NSE 20, NASI, NSE 10 and NSE 25, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as EABL, KCB and DTBK of 7.2%, 6.6%, and 5.3% respectively. The gains were however weighed down by losses recorded by large-cap stocks such as Bamburi, Stanbic and BAT of 3.5%, 1.6%, and 0.5% respectively;

During the week, equities turnover increased by 31.3% to USD 18.6 mn, from USD 14.2 mn recorded the previous week, taking the YTD total turnover to USD 56.7 mn. Foreign investors became net sellers for the first time in two weeks, with a net selling position of USD 1.0 mn, from a net buying position of USD 0.7 mn recorded the previous week, taking the YTD foreign net selling position to USD 5.8 mn.

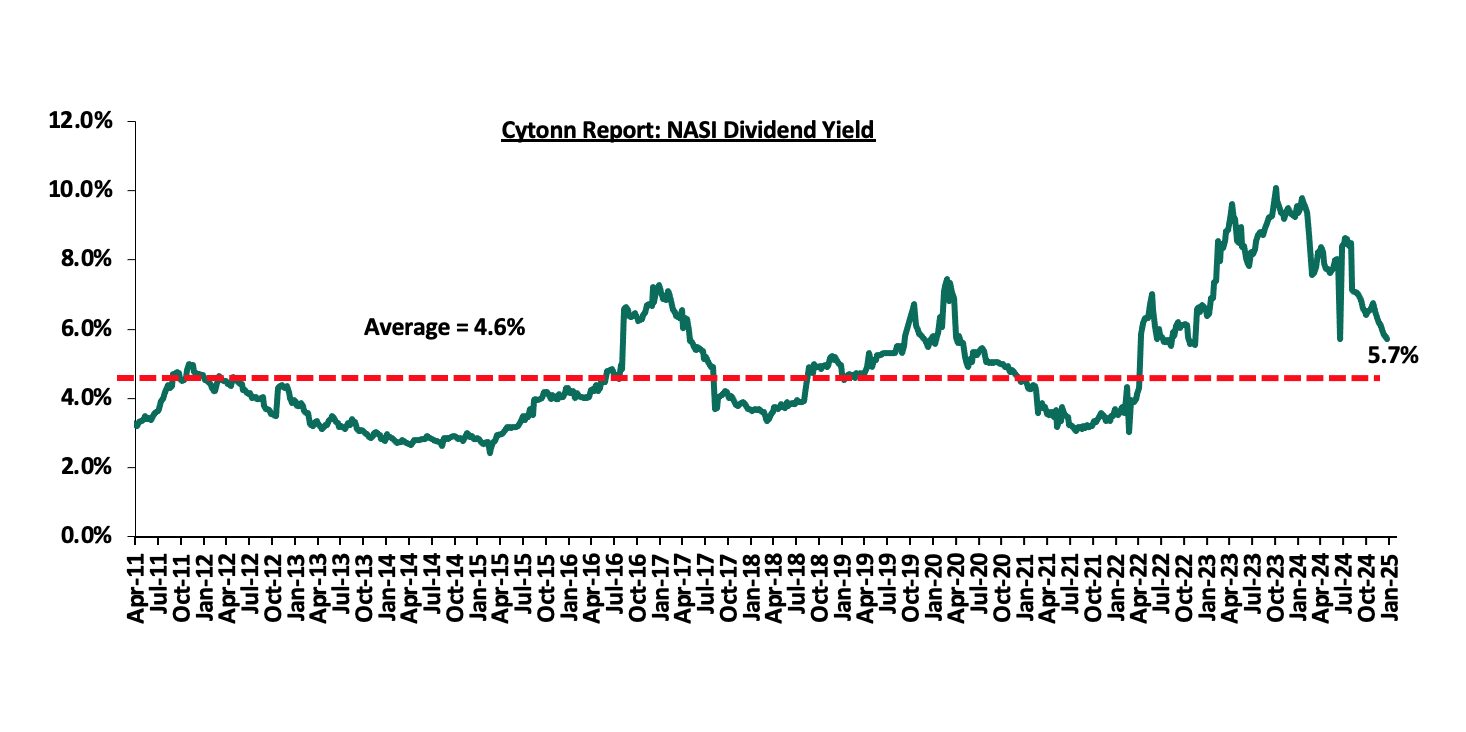

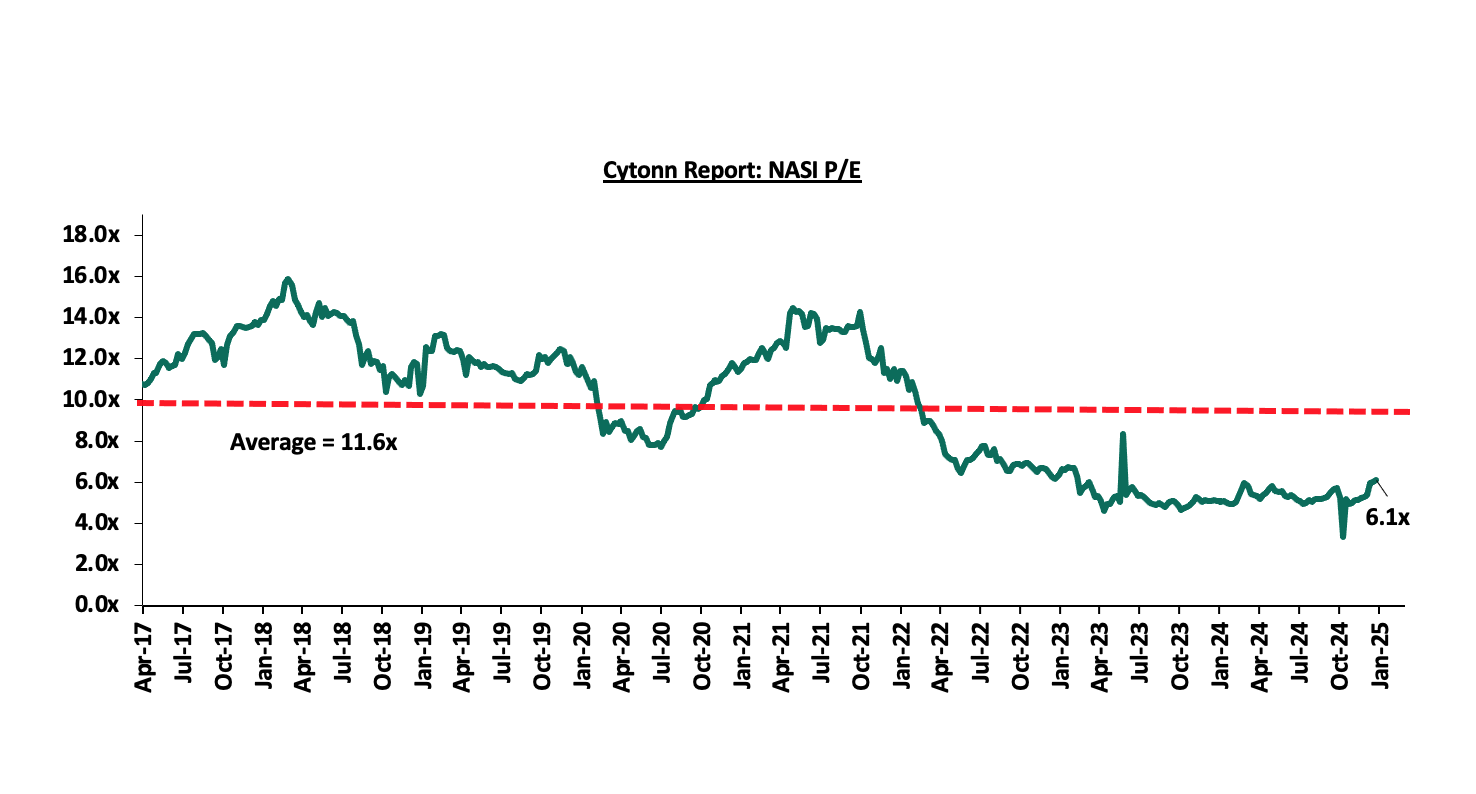

The market is currently trading at a price-to-earnings ratio (P/E) of 6.1x, 47.7% below the historical average of 11.6x. The dividend yield stands at 5.7%, 1.1% points above the historical average of 4.6%. Key to note, NASI’s PEG ratio currently stands at 0.8x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

||||||||||

|

Company |

Price as at 17/01/2025 |

Price as at 24/01/2025 |

w/w change |

YTD Change |

Year Open 2025 |

Target Price* |

Dividend Yield*** |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Jubilee Holdings |

194.3 |

203.3 |

4.6% |

16.3% |

174.8 |

260.7 |

7.0% |

35.3% |

0.3x |

Buy |

|

Equity Group |

48.5 |

48.7 |

0.4% |

1.5% |

48.0 |

60.2 |

8.2% |

31.8% |

1.0x |

Buy |

|

Co-op Bank |

16.2 |

16.2 |

0.0% |

(7.2%) |

17.5 |

18.8 |

9.3% |

25.3% |

0.7x |

Buy |

|

NCBA |

47.7 |

49.1 |

2.9% |

(3.8%) |

51.0 |

53.2 |

9.7% |

18.1% |

0.9x |

Accumulate |

|

Stanbic Holdings |

140.3 |

138.0 |

(1.6%) |

(1.3%) |

139.8 |

145.3 |

11.1% |

16.4% |

0.9x |

Accumulate |

|

ABSA Bank |

17.2 |

17.9 |

4.4% |

(5.0%) |

18.9 |

19.1 |

8.7% |

15.4% |

1.4x |

Accumulate |

|

CIC Group |

2.5 |

2.6 |

2.8% |

21.5% |

2.1 |

2.8 |

5.0% |

12.7% |

0.8x |

Accumulate |

|

Standard Chartered Bank |

280.3 |

286.5 |

2.2% |

0.4% |

285.3 |

291.2 |

10.1% |

11.8% |

1.9x |

Accumulate |

|

KCB Group |

43.0 |

45.8 |

6.6% |

8.0% |

42.4 |

50.3 |

0.0% |

9.8% |

0.7x |

Hold |

|

Diamond Trust Bank |

66.3 |

69.8 |

5.3% |

4.5% |

66.8 |

71.1 |

7.2% |

9.1% |

0.3x |

Hold |

|

I&M Group |

33.2 |

34.9 |

5.1% |

(3.1%) |

36.0 |

32.3 |

7.3% |

(0.1%) |

0.7x |

Sell |

|

Britam |

7.5 |

8.4 |

13.1% |

45.0% |

5.8 |

7.5 |

0.0% |

(11.1%) |

1.0x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Dividend Yield is calculated using FY’2023 Dividends |

||||||||||

We are “Bullish” on the Equities markets in the short term due to current cheap valuations, lower yields on short-term government papers and expected global and local economic recovery, and, “Neutral” in the long term due to the adverse operating environment and huge foreign investor outflows.

With the market currently trading at a discount to its future growth (PEG Ratio at 0.8x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the economic outlook in the short term.

- Industry Report

- Kenya housing survey basic report 2023/2024

During the week, Kenya Bureau of Statistics (KNBS) released 2023/24 Kenya Housing Survey Basic Report that provides a comprehensive analysis of the housing sector in Kenya. The survey aims to gather information and generate estimates for key housing indicators, and real estate indicators in the country. The report provides detailed insights into housing conditions, affordability, and tenure across the country. Conducted by KNBS in collaboration with government agencies, the survey aimed to inform evidence-based housing policies aligned with national and global development goals. In a nutshell the report found that 85.5% of rural households own homes, while urban homeownership stands at 22.8%. Renting rates in the urban areas were recorded at 72.3%, 63.4% points higher than rural areas which recorded 8.9% renting rate. Nationally, 58.9% of dwellings use durable construction materials, and 73.5% of households access improved drinking water. Additionally, 53.5% of the population is aware of the Affordable Housing Program, but only 7.7% are aware of stamp duty exemptions for first-time buyers. Technological adoption in housing processes is growing, with 20.5% of counties digitizing building plan applications and 23.3% georeferencing land records. The report underscores the importance of sustainable planning and enhanced access to housing utilities. The survey established the below key finding:

- Household Demographic and Economic Characteristics: The report surveyed on the demographic characteristics of households to provide a background for determining the socio-economic status of household members and to provide the information necessary for development planning and resource allocations. The report found out that the total dependency ratio stood at 65.5%, with a child dependency ratio of 59.0% and an old-age dependency ratio of 6.5%. Kiambu, Kajiado, and Nakuru had higher proportions of households in urban areas, with 73.8%, 66.0%, and 54.9% respectively, compared to rural areas, while Nairobi and Mombasa were entirely urban. The most common household sizes were 1-2 persons (34.1%) and 3-4 persons (33.5%), with the 1-2-person household size more prevalent in urban areas (43.7%) than in rural areas (28.0%). Among homeowners, 41.9% had a primary level education, and 20.5% had no education. Out of the sampled households, owned homes represented a 61.3% while 34.4% were either rented or leased. The national employment-to-population ratio was 61.6%, with men at 68.1% and women at 55.1%. About 33.1% of households with individuals who have mobility challenges reported safe housing units, though few had special aids like grab bars (2.8%) or smoke alarms (0.0%). Low income was cited as the primary reason for housing inadequacy by 77.9% of households. Nationally, 53.7% of the population owned a mobile phone, and 64.9% used one. About 36.3% of households had internet access, and 8.8% owned computers.

- Housing accessibility, affordability and perception: The survey highlights a growing housing deficit, especially in urban centers like Nairobi, where demand surpasses supply. More than 60.0% of urban households are renting, with many exceeding the 30.0% affordability threshold recommended by the United Nations. The report also notes disparities in housing affordability between income groups, with high-end developments benefiting wealthier individuals while the low and middle-income groups struggle to find affordable options. Proposed solutions include subsidized housing programs, expanded mortgage availability, and tax incentives for affordable housing developers. The survey highlights critical insights into housing, safety, and policy awareness. A significant 87.6% of respondents reported being comfortable in their current residences, though only 60.5% felt secure in their neighbourhoods at night. Safety remains a concern, with 15.4% having been victims of crime. Public knowledge of housing regulations is alarmingly low, with 75.9% unaware of building sector rules and 83.0% uninformed about minimum housing standards. Affordability is a pressing issue, as 45.2% believe government agencies should regulate housing loan and mortgage interest rates. While 53.5% of respondents were aware of the affordable housing program, awareness of associated incentives remains limited. Only 7.7% knew of the stamp duty exemption for first-time buyers, and 11.3% were aware of affordable housing tax relief, of whom 16.2% reported benefiting. These findings underscore the need for stronger public awareness, improved safety measures, and more effective outreach for housing initiatives.

- Housing Quality and Amenities: The report emphasizes that a significant percentage of urban households, particularly in informal settlements, lack basic amenities such as clean water, adequate sanitation, and waste disposal. It reveals that around 40.0% of households in informal areas rely on shared sanitation facilities, contributing to health hazards. The findings call for infrastructure upgrades, including water supply systems and improved waste management, to enhance the quality of housing and living conditions. The survey highlights that 78.8% of dwelling units in Kenya were classified as being of inadequate quality. The Crowding Index showed that 68.1% of dwelling units were fit for habitation based on the number of persons per room, with an average of two persons per room, pointing to overcrowding issues. The Structure Fitness Index found that only 44.1% of dwellings used durable materials for roofs, walls, and floors, making them fit for habitation. Meanwhile, the Water and Sanitation Fitness Index revealed that 59.7% of dwellings had access to adequate facilities for drinking water and human waste disposal. The Energy Use Fitness Index indicated that 70.1% of households relied on unclean sources of energy for cooking and lighting, underscoring significant deficiencies in essential services and living conditions across the country.

- Homeownership and Renting: The report records a stark imbalance, with only about 20.0-25.0% of urban dwellers owning homes. The primary challenges cited are high property prices, limited mortgage access, and lengthy loan approval processes. Mortgages account for less than 5.0% of housing finance, emphasizing the need for innovative financing solutions. The Affordable Housing Program, despite its goals, has faced challenges such as land acquisition issues and delays in project execution. The survey reveals that bungalows are the most common type of dwelling in Kenya at 51.8%. Urban renters allocate 38.0% of their expenditure to rent, with 76.5% paying rent directly to landlords. However, 71.8% of tenants lack formal rental agreements. Notably, 87.4% of tenants have not experienced rent increases in the last five years, while 76.9% are unwilling to purchase their current dwellings. About 55.5% prefer to build their homes, with 63.1% favoring bungalows for ownership. Nairobi is the top choice for 17.1% of tenants seeking homeownership, while 52.2% cite distance from work as a primary reason for renting. Rent disputes affect 8.2% of tenants, with the highest cases reported in Nandi County (17.9%). According to the report, 84.0% of urban tenants face eviction threats and 52.5% of houses were constructed through one-off methods. Additionally, 85.5% of homes were built in under a year, with architects involved in 19.4% of housing acquisitions

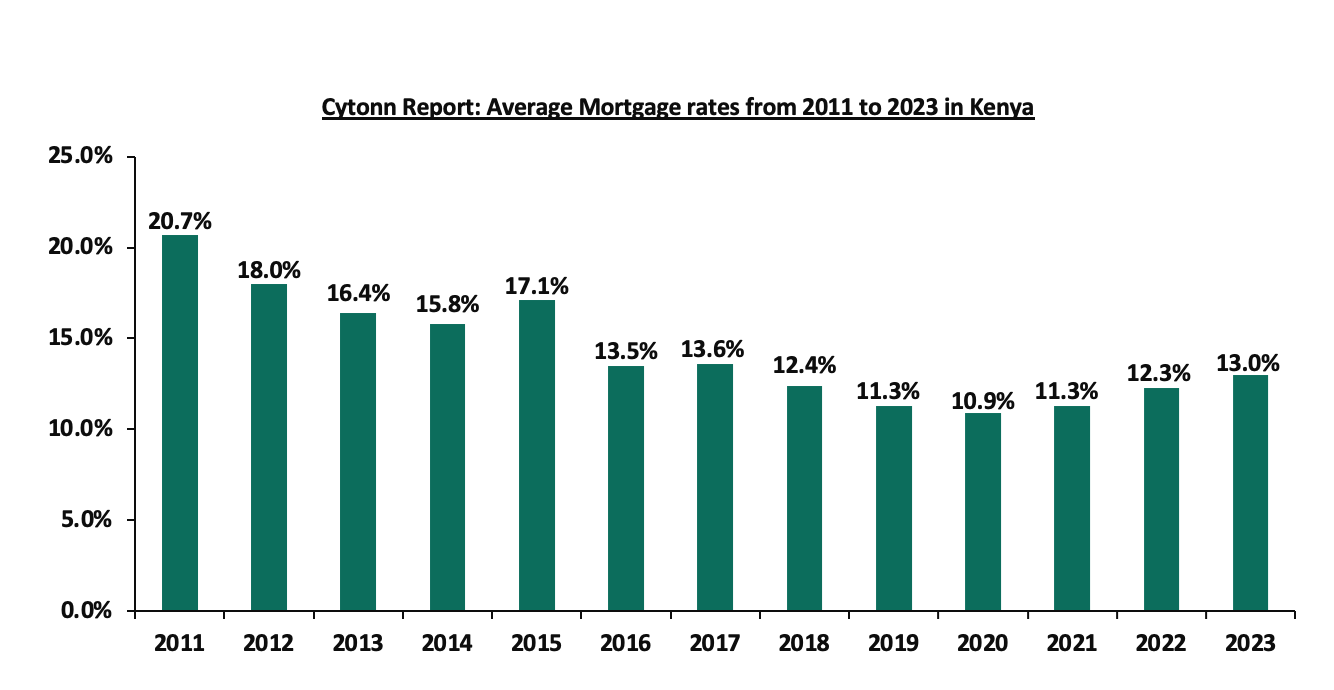

- Housing finance: The report aimed at finding the access to finance since it is a limiting factor to housing developments. Key trends undermining housing development with respect to access to finance include; about 33.4% of financiers offer savings products for land purchases, 20.9% for incremental building, and only 10% for mortgages. Among commercial banks, 38.9% have savings products tailored for mortgages, while 34.2% of SACCOs focus on savings for land purchases. Mortgage finance dominates housing finance products for commercial banks at 86.1%, while microfinance banks (MFBs) primarily offer construction finance for rental units at 53.8%, and SACCOs focus on land acquisition at 60.8%. As of December 2023, housing non-performing loans (NPLs) accounted for 12.7% of total housing loans, with MFBs recording the highest rate at 24.0%, commercial banks at 15.3%, and SACCOs at 3.9%. Mortgage interest rates averaged 13.0%, with commercial banks reporting 14.0% and SACCOs 12.0%. A lack of long-term capital remains the primary barrier to lending, hindering financiers’ ability to expand their housing finance portfolios. The chart below shows the mortgage rates across the years from 2011 to 2023;

Source: KMRC and KNBS

- Housing Developments and property prices: The rapid population growth and urbanization in Kenya have significantly increased the demand for urban housing. Private sector players dominate housing supply, utilizing diverse development and financing models such as site and service schemes, incremental construction, tenant purchase arrangements, self-financing, joint ventures, public-private partnerships, and off-plan projects. Housing developers, whether companies or individuals, play a crucial role in shaping urban communities by designing, building, and selling residential properties. They provide a wide range of housing solutions, from single-family homes to large-scale apartment complexes, helping to meet the diverse needs of the urban population. The survey reveals critical insights into housing development processes, costs, and preferences in Kenya which include;

- Delays in approvals by county governments (66.0%) and NEMA (35.9%) are a major challenge, with 56.6% of developers citing high county approval fees. However, most developers (67.9% for NEMA and 66.0% for NCA) find their processes reasonably efficient, and over 60% consider their fees reasonable,

- Awareness of alternative building technologies is high, indicating potential adoption,

- Key factors influencing site selection include land availability (94.1%), expected returns (88.2%), access to materials (82.4%), and infrastructure (64.7%),

- While 69.1% of developers know about VAT exemptions on construction inputs, only 10.5% benefit from the incentive.

- Average property prices in 2023 were high, with bungalows costing Kshs 19.3–49.9 mn and maisonettes, apartments, and townhouses ranging from Kshs 19.4–23.3 mn, and,

- Prices were highest in Nairobi Upper, Kilifi, and Mombasa, with stand-alone properties being more expensive than apartments.

- Institutional and Regulatory Framework: The report noted that counties achieved a housing building plan approval rate of 99.6% in 2023, a significant increase from 81.2% in 2022. Applications for changing land use from residential to other purposes rose by 13%, reaching 2,300. The country has 392 slums, with 38.1% of counties reporting slums within their jurisdictions. The primary county intervention for improving informal settlements is the regularization of tenure, with 90.9% of counties indicating this measure. NEMA received 6,994 housing construction license applications, approving 5,472, a 78.2% approval rate. This was an improvement from 2022 when NEMA received 7,186 applications, approving 5,472, or 74.3%. Additionally, 142,290 land transfer applications were received nationwide, with 120,370 successfully processed, reflecting an overall processing rate of 84.6%. Samburu, Laikipia, and Trans Nzoia processed all their land transfer applications in 2023.

- Land use, tenure, consumption rate and green spaces: According the report’s findings, the most prevalent form of land ownership documentation in Kenya is the title deed, held by 66.0% of landowners, while 15.9% of parcels lack formal documentation. Land acquisition is primarily through inheritance (53.5%), followed by purchase (31.0%) and family allocation (8.6%). Land use is predominantly for agriculture (47.2%) and residential purposes (47.1%), with a small portion (3.4%) reserved for future development. These trends highlight the importance of inheritance as a primary method of land acquisition and the dual focus on agricultural and residential land use in the country. From 2016 to 2023, the four counties experienced an average increase of 34.45% in built-up areas. Nakuru County saw the highest growth at 47.1%, followed by Kisumu at 46.5%, Mombasa at 29.9%, and Nairobi City at 14.3%. In contrast, green space areas declined by an average of 21.7% across the counties. Nairobi City led this reduction with a 42.2% decrease, followed by Nakuru at 26.3%, and Kisumu at 14.6%. This shift highlights significant urban expansion, especially in Nakuru and Kisumu, coupled with a concerning loss of green spaces, particularly in Nairobi.

The real estate sector has experienced notable growth, with a 33.7% increase in sector output from 2019 to 2023. This growth is underpinned by urbanization, infrastructure development, and government initiatives such as the Affordable Housing Program, which seeks to build 200,000 housing units annually. However, the lack of consistent and comprehensive data, oversupply in the high-end market and slow uptake in affordable housing persist remains major challenges. To address this, the 2023/2024 survey was conducted to collect current market data on residential and commercial property prices, trends in housing typologies, and housing finance arrangements.

Going forward we expect significant opportunities for growth in the housing sector, driven by government initiatives, technological advancements, and private sector involvement. Areas earmarked for infrastructure projects, such as roads and commuter rail lines, are expected to see a surge in real estate developments. The report highlights the potential for green and sustainable housing developments, which can reduce costs and align with global climate goals. This can be achieved through the key recommendations from the report to address the above noted key issues. These recommendations include

- Policy interventions: The report advocates for the implementation of policies aimed at increasing the supply of affordable housing. This includes incentivizing private sector participation, streamlining regulatory frameworks, and enhancing public-private partnerships.

- Financial accessibility: Improving access to affordable mortgage financing is crucial. The report suggests revisiting lending policies, offering subsidies, and developing financial products tailored to low and middle-income earners.

- Infrastructure development: Investing in essential infrastructure such as roads, sanitation, and water supply is imperative to improve living conditions, particularly in informal settlements.

The report provides critical insights into the current state of housing in Kenya. It underscores the pressing need for multifaceted approaches to tackle housing challenges, emphasizing that adequate housing is not only a fundamental human right but also a cornerstone for social and economic development. While the 2023/24 Kenya Housing Survey Basic Report provides a strong foundation for understanding the country's housing landscape, a concerted effort to implement innovative, sustainable, and inclusive strategies is critical for addressing Kenya’s housing challenges effectively. The housing sector has the potential to be a transformative driver of Kenya’s socio-economic growth, but only with comprehensive action from all stakeholders.

- Real Estate survey report 2023/2024

During the week, Kenya Bureau of Statistics (KNBS) released 2023/2024 Real Estate Survey Report which

highlighted significant growth, regulatory challenges, and market dynamics. The market has grown by 33.7% from 2019 to 2023, driven by urbanization, infrastructure, and initiatives like the Affordable Housing Program. However, gaps in reliable housing data hinder effective decision-making. The report indicates that in 2023, about 34.4% of advertised office space remained unoccupied due to low demand.

The residential market is diverse, with three-bedroom flats being the most common. Nairobi City dominates, accounting for 66.7% of available properties. Demand is strong, with 76.2% of properties sold in 2023, but price variations are notable across regions. The rental market is competitive, with flats and apartments making up the majority, and townhouses commanding the highest rental rates. Rental yields vary by property type, with two-bedroom townhouses offering the highest returns. On the commercial side, office buildings dominate, particularly in Nairobi, Kiambu, Mombasa, and Machakos. Despite high demand for office space, hotel properties experience slower sales.

Rental prices for commercial properties vary, with industrial spaces attracting the lowest rates. The survey reveals that the majority of real estate firms in Kenya (95.1%) are privately owned, with a small proportion being cooperatives (3.4%) and parastatals (1.5%). Approximately 40.7% of firms are registered with the Valuers Registration Board (VRB), while 33.9% are affiliated with the Kenya Valuers and Estate Agents. About 10.0% of these firms offer housing finance options to buyers or renters, with 31.8% partnering with cooperatives or SACCOs, 22.7% with housing finance institutions, and 13.6% with microfinance institutions. Additionally, 63.4% of firms own the properties they manage, while 36.7% do not.

They key finding of the report are as follows

- Sector growth: The real estate sector experienced a 33.7% increase in output from 2019 to 2023, growing from Kshs 946.7 bn to Kshs 1.3 tn. This growth is attributed to infrastructural developments, rapid urbanization, and government initiatives like the Affordable Housing Program, which aims to construct 200,000 housing units annually.

- Regulatory compliance: The survey reveals that 47.1% of real estate firms operate without registration from professional or regulatory bodies. Reasons for non-registration include a perceived lack of necessity and the cumbersome nature of the registration process. This lack of oversight raises concerns about consumer protection and industry professionalism.

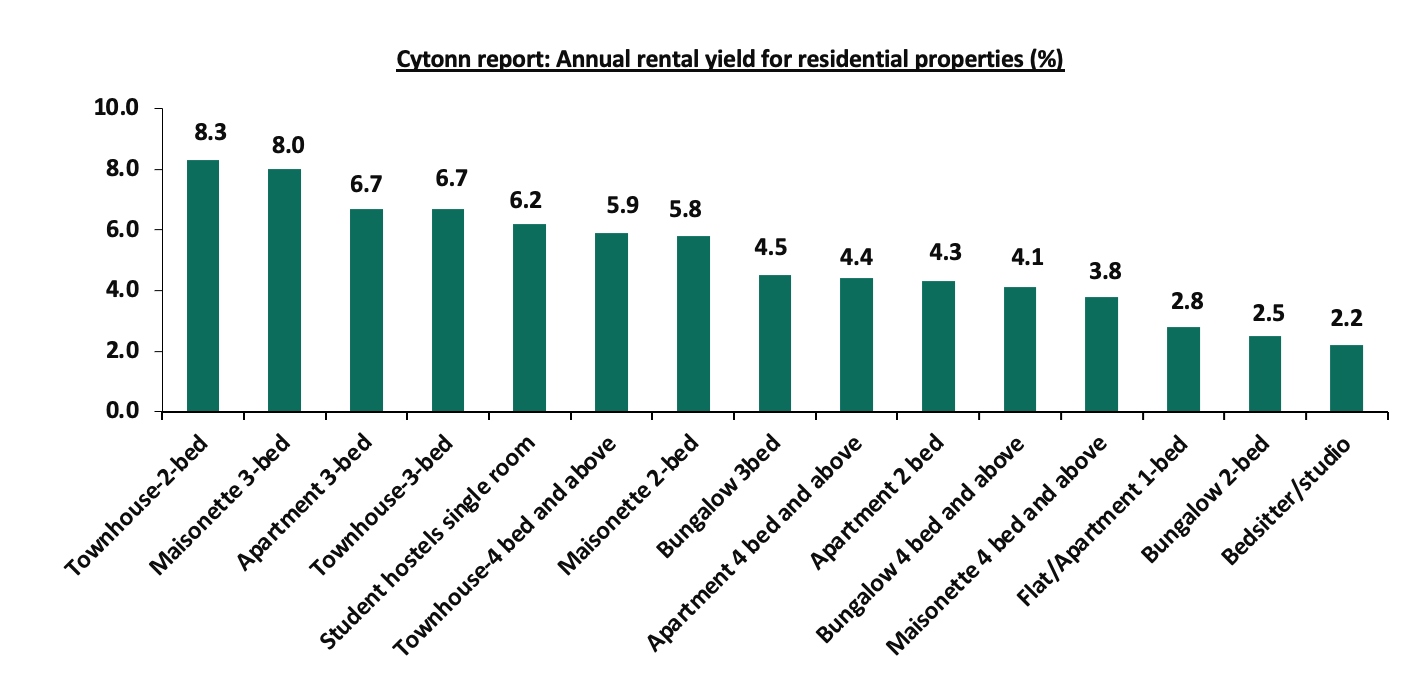

- Residential property prices: Data indicates significant variations in residential property prices across different regions and property types. Urban centers, particularly Nairobi, have higher property values compared to rural areas. The report emphasizes the need for comprehensive data collection to monitor these trends effectively. On properties rental yield, bedsitters and studio apartments recorded the lowest rental yield of 2.2% while two-bedroom town houses had the highest rental yield of 8.3% followed by three-bedroom maisonette at 8.0%. The below chart shows the residential properties yields for the different typologies as per the KNBS survey report:

Source: KNBS

- Commercial property market:

- The commercial property sector shows a diverse range of rental rates, with special-purpose properties and suites/condominiums attracting the highest rents at Kshs 150.0 and Kshs 140.0 per square foot, respectively. Industrial and warehousing properties have the lowest rental rates, at Kshs 40.0 per square foot. Service charges also vary, with industrial properties incurring higher costs due to maintenance. The office buildings have the biggest proportion of 61.6% followed by Industrial/warehouse by 22.1%. The graph below shows the various types of commercial properties and their distribution.

Source: KNBS

The report gave key recommendations to ensure the Real Estate sector continues to grow. These recommendations include:

- Enhance regulatory framework: To address the high percentage of unregistered firms, the report suggests streamlining the registration process and increasing awareness about the benefits of professional accreditation. Strengthening regulatory oversight is crucial for consumer protection and maintaining industry standards.

- Data-driven policy making: The report underscores the importance of consistent and comprehensive data collection to inform policy decisions. Establishing a centralized real estate data system would aid in monitoring market trends and addressing issues like housing affordability.

- Promote affordable housing: Given the significant growth in the sector, there's a need to focus on affordable housing solutions to cater to the low and middle-income populations. Encouraging private sector participation through incentives and public-private partnerships can help achieve this goal.

The Report provides valuable insights into Kenya's real estate sector, highlighting areas of growth and challenges. Implementing the recommendations can foster a more regulated, transparent, and inclusive real estate market, contributing to the country's socio-economic development.

We expect the Kenyan Real Estate sector market performance will be supported by; i) increased and consistently growing demand for Real Estate developments facilitated by the country’s positive demographic profile, ii) government’s continued focus on provision of affordable housing, iii) initiation and implementation of various infrastructural improvements opening up new areas for investment and boosting property prices, iv) renewed investor confidence in the hospitality sector as a result of continuous recovery, as evidenced by increased international arrivals, v) efforts by the government through the Kenya Mortgage Refinance Company (KMRC) to provide affordable home loans to buyers, vi) initiation and implementation of infrastructure projects, vi) aggressive expansion efforts by both local and international retailers, and, vii) continued recognition of Kenya as a regional business hub, attracting foreign investments. However, rising construction costs, existing oversupply of physical space in the commercial office and retail sectors, slow delivery of affordable housing projects, recently issued travel advisories by multiple governments, impacting tourism, the deteriorating business environment and, low investor appetite for REITs is expected to hinder the optimum performance of the sector.

- Hass Consult Land and property price index

During the week, Hass Consult, a Kenyan consulting and Real Estate development firm, released its Property Index Q4’2024 Report, focusing on the residential Real Estate sector's performance in the Nairobi Metropolitan Area (NMA). The following are the key take outs from the report;

The average selling prices for all properties posted a 0.8% increase on a quarter-on-quarter (q/q) basis in Q4’2024, an improvement from 0.7 % increase in Q3’2024. The performance can be linked to 1.5% increase in detached house prices. However, apartment units’ prices registered a q/q decline in performance of 0.6% in Q4’2024. Similarly, semi-detached units registered a 0.8% decline in selling prices, undermining the overall performance. On a year-on-year (y/y) basis, property prices showed a 5.2% increase, contrasting from a 2.5% increase witnessed in Q4’2023. This significant hike further elevated the cost of financing house purchases, making it more expensive for buyers. Additionally, protests that affected the country during the year in June and July saw cautious pricing in a period of uncertainty, dampening the market that was coming off a period of strong price growth in the last quarter of 2023 and first half of 2024. Furthermore, developers are facing rising construction costs, which they are forced to pass on to homebuyers, further driving up property prices.

- The average asking rents of housing units in the NMA during period under review increased slightly by 0.2% on q/q basis, higher compared to a 0.6% decrease recorded in Q3’2024. On a y/y basis, the average asking rent decreased slightly by 0.02% compared to the 2.5% increase recorded in Q4’2023. The decrease in performance was attributable to decreased rents in semidetached houses, registering q/q decline of 1.4% in Q4’2024, as landlords tried to hedge against a tough operating environment during the period,

- Apartments registered the highest y/y increase in asking rents of 2.5% in Q4’2024, a decrease from 10.2% increase in Q4’2023. In addition, detached units witnessed 0.6% increase in asking rents a decrease from 2.4% increase recorded in Q4’2024 and semi-detached units witnessed 4.8% decrease in asking rents, a further decrease from 1.4% decline recorded in Q4’2023. The rise in rental rates can be attributed to the growth of the middle class, with more people joining this income bracket and thereby increasing demand for apartments. At the same time, as some individuals transition from the middle class to higher income levels, demand for detached units has also increased, driving up prices in this segment of the market.

- In the Nairobi Suburbs apartments, Parklands was the best-performing region recording a y/y capital appreciation of 5.3%, due to i) Its close proximity to key commercial, social, and recreational facilities such as Sarit center and Westgate malls, among other retail outlets, ii) its accessibility to the Central Business District, supported by good road such as Limuru road and Waiyaki Way networks that reduce commute times, and iii) many developers in Parklands have embraced modern architectural designs, offering high-quality apartments with contemporary finishes and amenities, such as gyms, swimming pools, and security systems. On the other hand, Muthangari saw the highest year-on-year price correction of 8.7%, driven by reduced demand as residents favored nearby areas like Kilimani, Kileleshwa and parklands.

- In the satellite towns, properties in Juja posted the highest year-on-year price appreciation, coming at 12.9%. This surge can be linked to several factors: i) Excellent connectivity via the Thika Super Highway, ii) an increasing preference among the middle class to settle and raise families in this area, iii) proximity to major retail centers like Unicity Mall and Juja City Mall, and iv) access to essential amenities, including educational institutions such as Jomo Kenyatta University of Agriculture and Technology (JKUAT) and hospitals. On the other hand, Athi River recorded the lowest year-on-year price growth at 3.0%, mainly due to strong competition from similar proximity areas like Kitengela and Rongai, which are becoming increasingly favored by residents seeking a superior residential environment.

- In satellite towns’ apartments, Ongata Rongai recorded the highest y/y price appreciation of 9.9% which was supported by good connectivity through infrastructure such as the Lang’ata road, Southern bypass and Ngong’ road , With rising property prices in Nairobi itself, Rongai has become an ideal alternative, offering spacious apartments and gated communities that cater to middle-income earners, and the area has seen an increase in the development of social amenities, including shopping centers, schools, and healthcare facilities, making it convenient for residents. Proximity to retail centers like Galleria Mall and nearby medical facilities enhance Rongai’s attractiveness for families and working professionals alike. Conversely, Ruaka registered the lowest y/y price depreciation of 1.7% attributed to stiff competition faced from neighbourhoods such as Kiambu and Gigiri which have more access to international activities and better road networks

The findings of the report are in line with our Cytonn Annual Markets Review – 2024, highlighting that selling prices of residential properties in the Nairobi Metropolitan Area (NMA) recorded a 0.7% appreciation in FY’2024. The performance was supported by 0.4% price appreciation realized by both apartments, detached and semi-detached units the period under review.

Hass Consult also released Land Price Index Q4’2024 Report which highlighted the performance of the Real Estate land sector in the Nairobi Metropolitan Area (NMA). The following were the key take outs from the report;

- The average q/q selling prices for land in the Nairobi suburbs grew by 1.7%, compared to a 3.3% increase recorded in Q3’2023. On a y/y basis, the performance represented 2.5 % points increase to 6.5% from the 4.0% increase recorded in Q3’2023. Consequently, q/q and y/y land prices in satellite towns of Nairobi increased by 1.9% and 10.6% respectively, compared to the 3.7% and 9.3% growth respectively recorded in Q3’2023. The tough economic conditions and increased interest rates impacted the ability of developers to finance land purchases however, the ongoing market recovery underscores the sector's resilience, with demand steadily increasing due to emerging opportunities in retail, manufacturing, and logistics, which are crucial for supporting the rapid urbanization of towns and the Nairobi CBD. This growth is further fuelled by the strategic expansion of infrastructure and businesses looking to capitalize on the expanding urban population and improving economic conditions. The convergence of these factors positions the sector for sustained growth as it adapts to the evolving needs of a dynamic urban environment.

- Spring Valley was the best-performing node in the Nairobi suburbs with a y/y price appreciation of 15.0%. This was attributed to; i) Its close proximity to key commercial, social, educational, and recreational facilities, including malls like West Gate, Village Market, Two Rivers mall and other retail centers ii) improved accessibility thanks to well-developed road networks such as Redhill link road, and iii) growing preference among land buyers compared to neighboring areas like Kitisuru. In contrast, Kitisuru experienced the lowest year-on-year land price depreciation at 2.0%. This can be attributed to land buyers increasingly favoring nearby areas such as Spring Valley, Loresho and Nyali, which offer a wider range of amenities, superior infrastructure, closer proximity to retail hubs, and a more established residential environment.

- For satellite towns, Kiserian was the best-performing node with a y/y capital appreciation of 18.1%, followed by Limuru which recorded a y/y capital appreciation of 17.2%. The improvement in performance in Kiserian was driven by; i) enhanced access provided by Ngong’ road, southern bypass, and Lang’ata road, which has made the area more accessible for both residential and commercial developments ii) there has been a surge in demand for both residential and commercial land, driven by its strategic location near Nairobi. This demand has been further boosted by infrastructure developments and the area's growing attractiveness to investors seeking high returns on their property investments. On the other hand, land prices in Limuru were bolstered by its its proximity to Nairobi and excellent connectivity via Nakuru-Nairobi highway, making it a prime location for residential and industrial developments. Conversely, Ngong’ was the least performing node with a y/y price depreciation of 2.6%, attributable to increased competition from the neighboring areas which are closer in proximity to the CBD and other urban areas such as Rongai, Kiserian and Kitengela

The findings of the report are also in line with our Cytonn Annual Markets Review – 2024 which highlighted that the overall average selling prices for land in the NMA recorded a price appreciation of 2.7% to Kshs 130.9 mn from 128.9 mn. This performance was bolstered by; i) growing demand for housing which is driven by positive demographics such as high population and urbanization, which currently stands at 1.9% and 3.8%, which is relatively higher than the global averages of 0.9% and 1.6% respectively, ii) the fixed supply of land has intensified demand, particularly for residential and commercial purposes, leading to an increase in land prices, iii) there is an expanding middle class in the NMA with disposable income, willing to invest in land as a savings and investment option,iv) the government's ongoing infrastructural development projects, such as roads, sewers, railways, and water connections, are opening up more satellite towns, subsequently driving land prices upward, v) the widely held belief among the middle class that land represents a secure form of wealth has prompted many families to save specifically for land acquisition, and, vi) the government’s Affordable Housing Program, under the Bottom-Up Economic Transformation Agenda (BETA), has initiated construction projects across various parts of Nairobi and the country, further increasing land values due to heightened construction activity.

- Residential sector

During the week, a private developer, GulfCap Real Estate broke ground for a Kshs 120.0 bn housing project in Kisumu marking a significant development in Kenya's real estate sector. Spanning 285 acres, the project aims to address the growing demand for housing in Kisumu, a city experiencing rapid urbanization and population growth. The initiative is expected to create thousands of jobs, both directly and indirectly, through construction activities and the establishment of supporting services. This employment boost is anticipated to stimulate the local economy and improve livelihoods in the region. The project is also poised to enhance infrastructure in Kisumu, including roads, water supply, and sewage systems. Such improvements are essential for accommodating the new housing developments and ensuring a high quality of life for residents.

By focusing on affordable housing, the developer aims to make homeownership accessible to a broader segment of the population. This approach aligns with national objectives to reduce the housing deficit and promote inclusive growth. The project is expected to attract significant investment, both domestic and international, into Kisumu's real estate market. This influx of capital can lead to further development opportunities and economic diversification in the region. This housing project in Kisumu represents a substantial contribution to addressing housing shortages, stimulating economic growth, and improving infrastructure in the region. Its successful implementation could serve as a model for similar initiatives across Kenya.

We expect the residential sector to continue being supported by both private and government initiatives such as the Affordable Housing Programme throughout the year in an effort to boost home ownership in Kenya. We also expect the sector to be supported by the completion and expansion of various infrastructural projects which will lead to opening up of satellite areas, which were previously inaccessible consequently leading to increased property prices and values. Furthermore, infrastructural development and increased connectivity of key utilities such as water and electricity in these areas will likely boost property prices upwards. On the other hand, we expect the sector will be mainly weighed down by high cost of financing which may affect uptake and occupancy in several nodes, ultimately affecting rental yields and property prices.

- Hospitality Sector

During the week, an investor, The View by the Park Limited, has proposed a Kshs 1.3 bn hotel development overlooking Nairobi National Park, aiming to capitalize on the park's unique proximity to the city center. The proposed hotel is expected to offer panoramic views of the park, providing guests with a distinctive experience of urban and natural landscapes. The hotel's location is advantageous, situated near key transport routes and close to Nairobi's central business district. This strategic positioning is anticipated to attract both international tourists and business travelers seeking convenient access to the city's amenities while enjoying the tranquility of the park's surroundings.

The development is projected to create numerous employment opportunities during both the construction and operational phases. This includes jobs in construction, hospitality services, and related sectors, contributing to the local economy and providing livelihoods for residents. By offering a unique lodging experience with views of Nairobi National Park, the hotel aims to enhance the city's tourism appeal. It is expected to attract visitors interested in eco-tourism and those seeking accommodations that blend urban amenities with natural beauty.

The development plans to incorporate sustainable building practices, including energy-efficient designs and waste management systems. These measures aim to minimize the environmental footprint of the hotel and align with global standards for eco-friendly construction. The proposed Kshs 1.3 bn hotel overlooking Nairobi National Park represents a significant investment in the city's hospitality sector. By leveraging its unique location, the development seeks to boost tourism, create employment, and contribute to the economic growth of Nairobi. If realized, it could set a precedent for future developments that harmonize urban growth with environmental conservation.

We expect the hospitality industry to continue growing owing to several key drivers: i) aggressive marketing campaigns promoting Kenya’s tourism, expected to boost tourist arrivals and improve occupancy rates at hospitality venues, ii) continued international recognition of Kenya’s tourism industry, enhancing its status as a leading tourist destination and drawing more global visitors, iii) strategic partnerships within the tourism sector, fostering innovation and collaboration to capitalize on new opportunities, iv) events and initiatives aimed at increasing tourism activity and improving guest experiences. However, while the sector demonstrated resilience in its overall performance in 2024, the outlook remains cautiously optimistic due to i) Kenya continues to face significant competition from neighboring markets, such as Rwanda, which employs aggressive promotional strategies, alongside Zanzibar, Tanzania, and South Africa, these regions actively position themselves as attractive alternatives, challenging Kenya's market share in the region, ii) difficulty in accessing finance as lenders demand more collateral to cushion themselves owing to elevated credit risk, and iii) occasional release of cautionary statements by governments like China and United States to their citizens advising them against travelling to Kenya due to threats like terrorism and elevated crime rates.

- Commercial office sector

During the week, the Local Authorities Pensions Trust (Laptrust) revised its plans for the Ugatuzi Tower project in Nairobi, reducing the proposed 50-storey office building to 34 floors. This adjustment comes in response to a surplus of office space in the market and escalating construction costs. The revised project is estimated to cost approximately Kshs 3.1 bn. Originally, Laptrust intended to construct a 50-storey tower at an estimated cost of Sh5 billion. However, legal challenges from some of its members delayed the project's commencement, leading to the current revision. The proposed building will occupy 1.3 acres at the intersection of Argwings Kodhek and Chaka Road in the Hurlingham area. Laptrust plans to complete the project within 24 months after obtaining the necessary licenses and beginning construction.

The decision to reduce the building's height aligns with data from the Kenya National Bureau of Statistics, which indicates that in 2023, about 34.4% of advertised office space remained unoccupied due to low demand. Laser Property Services, the development manager for the project, noted that the change was also informed by the need to deliver a "positive market return acceptable" to the pension scheme. The building is planned to be certified green in line with International Finance Corporation (IFC) Edge green building standards, aiming to use at least 20% less energy or water than conventionally built buildings.

Since the project's inception, various economic factors, including the COVID-19 pandemic, have influenced office space demand. The pandemic reinforced the culture of working from home and co-sharing office spaces, leading to a gradual increase in demand, though not yet returning to pre-pandemic levels. In 2021, the Kenya County Government Workers Union challenged Laptrust's plan in court, citing high costs and the inclusion of certain workers. However, they lost the case, allowing the project to proceed. The Ugatuzi Tower project is expected to contribute significantly to Nairobi's skyline and the local economy, providing modern office space in a prime location.

Despite oversupply challenges and developers revising their building plans, We expect the sector to remain stable with a slight improvement attributable to i) the increasing presence of multinational companies in Kenya is likely to drive up occupancy levels, ii) co-working spaces are gaining in popularity in the region iii) the gradual return to “working from office” after the Covid-19 pandemic, iv) more start-ups are expected to drive demand for commercial spaces, and v) a considerable take-up of prevailing commercial office spaces after developers adopted a 'wait-and-see' approach to avoid vacancies in newly built spaces, However, the sector continues to face challenges due to a significant oversupply of office space, currently standing at 5.8 mn SQFT.

- Real Estate Investments Trusts (REITs)

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 17th January 2025. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at Kshs 12.8 mn and Kshs 34.8 mn shares, respectively, with a turnover of Kshs 323.5 mn and Kshs 722.8 mn, respectively, since inception in February 2021. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 17th January 2025, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 138,600 shares for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015.

REITs offer various benefits, such as tax exemptions, diversified portfolios, and stable long-term profits. However, the ongoing decline in the performance of Kenyan REITs and the restructuring of their business portfolios are hindering significant previous investments. Additional general challenges include:

- Insufficient understanding of the investment instrument among investors leading to a slower uptake of REIT products,

- Lengthy approval processes for REIT creation,

- High minimum capital requirements of Kshs 100.0 mn for REIT trustees compared to Kshs 10.0 mn for pension funds Trustees, essentially limiting the licensed REIT Trustee to banks only

- The rigidity of choice between either a D-REIT or and I-REIT forces managers to form two REITs, rather than having one Hybrid REIT that can allocate between development and income earning properties

- Limiting the type of legal entity that can form a REIT to only a trust company, as opposed to allowing other entities such as partnerships, and companies,

- We need to give time before REITS are required to list – they would be allowed to stay private for a few years before the requirement to list given that not all companies maybe comfortable with listing on day one, and,

- Minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs. The significant capital requirements still make REITs relatively inaccessible to smaller retail investors compared to other investment vehicles like unit trusts or government bonds, all of which continue to limit the performance of Kenyan REITs.

We expect Kenya’s Real Estate sector to remain on a growth trend, supported by: i) demand for housing sustained by positive demographics, such as urbanization and population growth rates of 3.8% p.a and 2.0% p.a, respectively, against the global average of 1.7% p.a and 0.9% p.a, respectively, as at 2023,, ii) activities by the government under the Affordable Housing Program (AHP) iii) heightened activities by private players in the residential sector iv) increased investment by local and international investors in the retail sector. However, challenges such as rising construction costs, strain on infrastructure development (including drainage systems), high capital requirements for REITs, and existing oversupply in select Real Estate sectors will continue to hinder the sector’s optimal performance by limiting developments and investments.

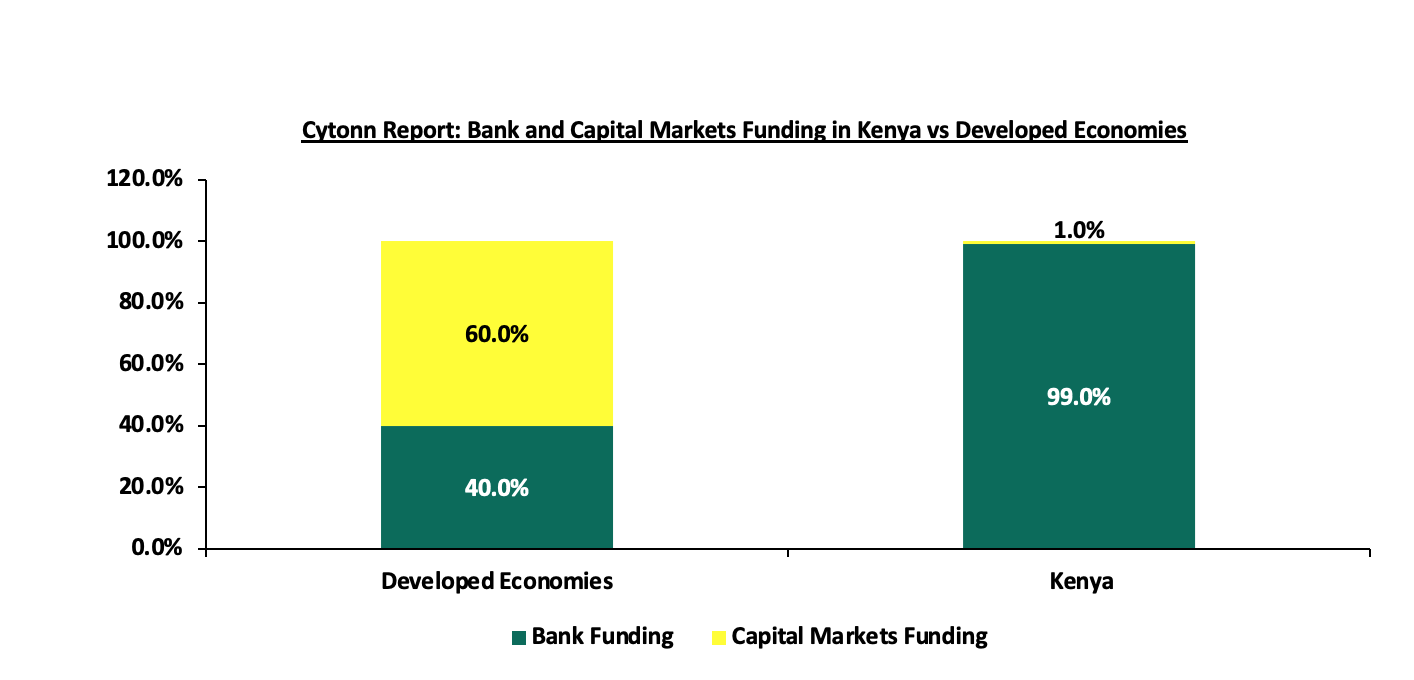

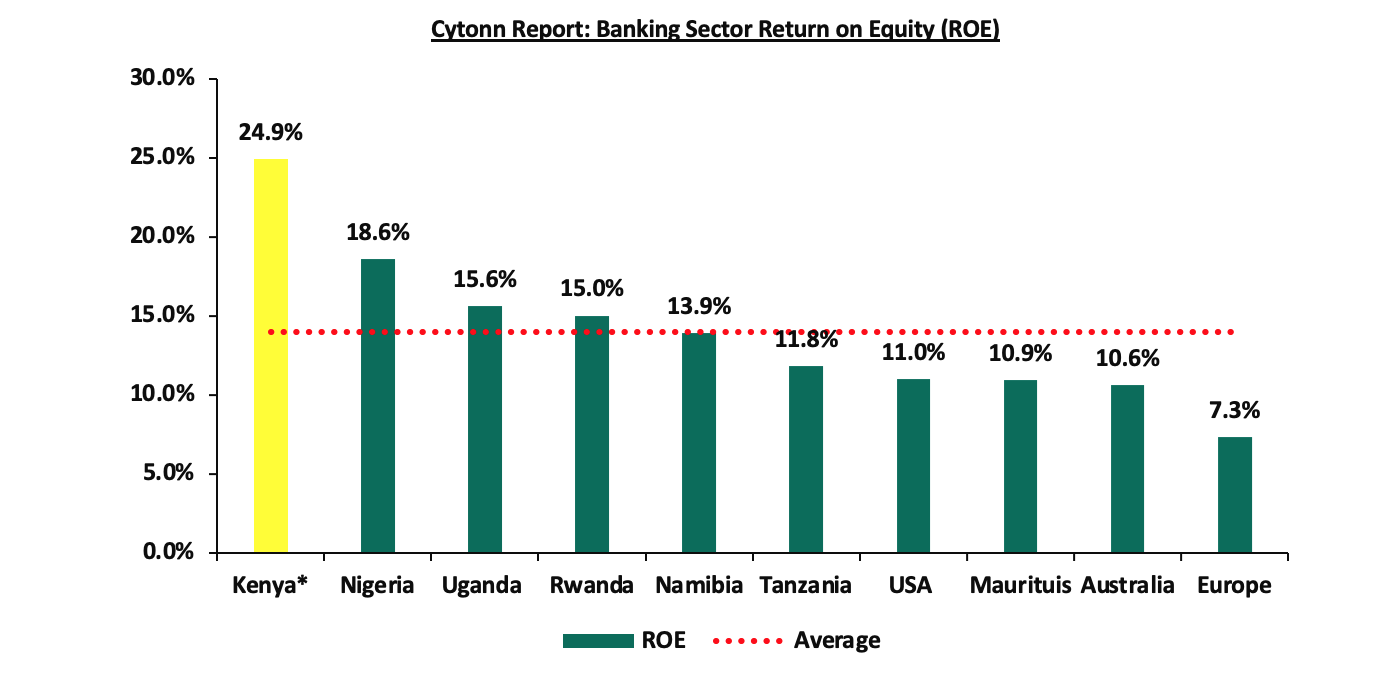

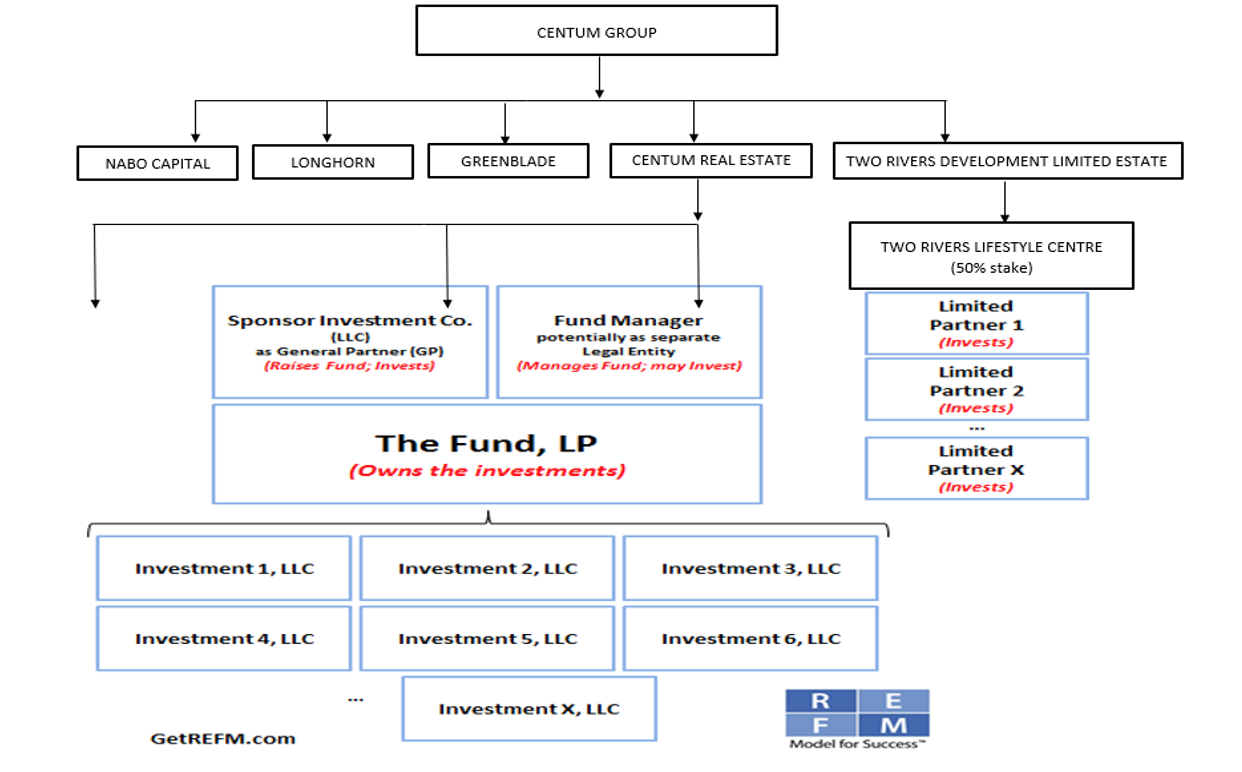

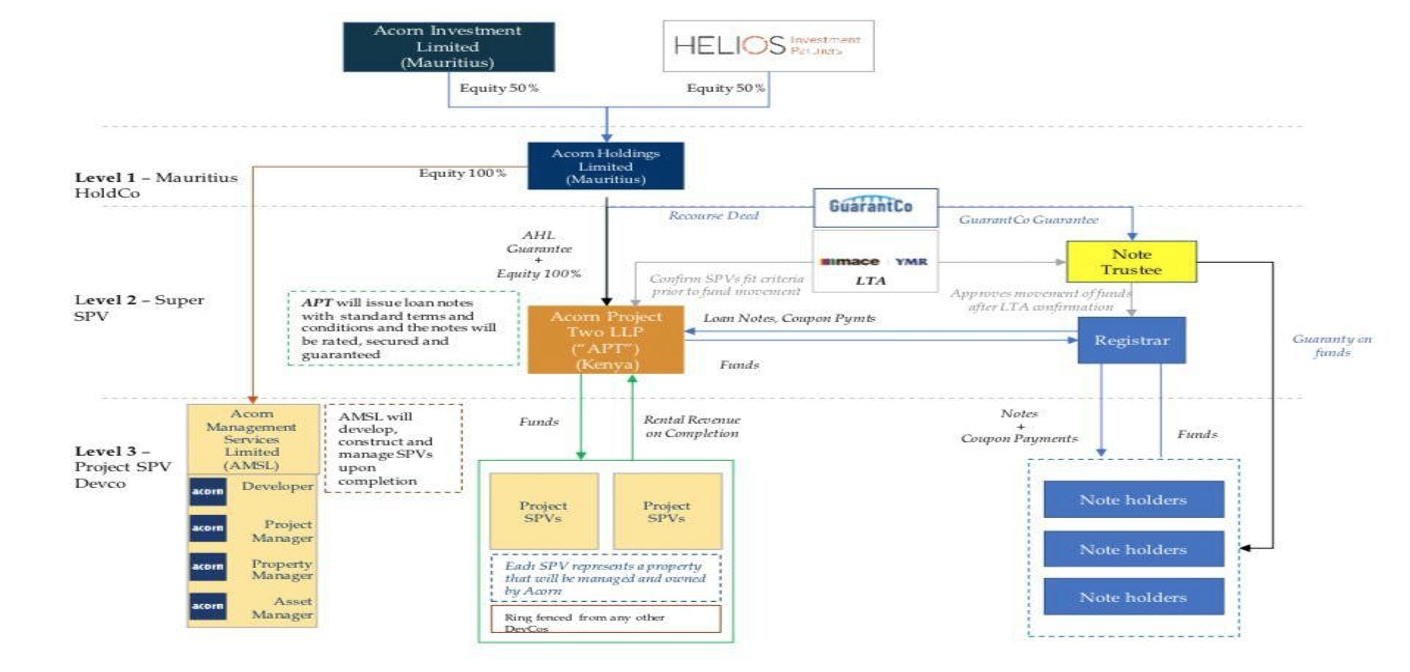

A Special Purpose Vehicle (SPV), sometimes known as a Special Purpose Entity (SPE), is a legally separate and independent entity formed for a specific, defined purpose, typically to isolate financial risk. SPVs are widely utilized in securitization, project finance, structured finance, and asset-backed transactions. They are intended to be bankruptcy-resistant, meaning that their operations and liabilities are separate from the parent or sponsoring organization.

We chose to focus on SPVs for two reasons: