The Role of Kenya’s Capital Market on Economic Growth, & Cytonn Weekly #01/2021

By Research Team, Jan 10, 2021

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 65.7%, an increase from the 21.6% recorded the previous week. This can be mainly attributed to the concurrent primary bond issue where the government issued a 2-year bond, FXD1/2021/002, which recorded a higher overall subscription rate of 244.6%, coupled with the continued tightening of liquidity in the money markets, evidenced by 0.2% points increase in the average interbank rate to 6.2% from 6.0%, recorded last week. The Central Bank of Kenya had issued a 2-year bond, FXD1/2021/002, with a coupon of 9.5%. There was a slight improvement in the business conditions as the Stanbic’s Monthly Purchasing Managers’ Index (PMI) improved to 51.4 in December 2020, from the 51.3 recorded in November 2020;

Equities

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 1.4%, 1.5% and 0.8% respectively, taking their YTD performance to gains of 1.4%, 1.3% and 1.0%, for NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as BAT, Co-operative Bank, Bamburi and Diamond Trust Bank (DTB-K) of 8.4%, 4.0%, 3.6% and 3.3% respectively. The gains were however weighed down by losses recorded by other large-cap stocks such as NCBA Group, Standard Chartered Bank and ABSA Bank of 4.3%, 2.9% and 1.9%, respectively;

Real Estate

During the week, the National Treasury announced plans to draft a national property rating legislation to replace the outdated Valuation for Rating Act of 1956 and the Rating Act of 1963;

Focus of the Week

Business owners can fund their business through various means but they fall mainly into two main brackets i.e. equities or debt. There is occasional structuring that is done to get some in between the two forms of capital sources to enhance the attractiveness to potential investors. Globally, capital markets play a key role in ensuring that businesses get the requisite funding and that owners of Capital are well-protected and get the return that is required;

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.76%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.59% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We successfully handed over Phase 3 of the Alma project on the 22nd of December 2020. Please see attached photos of the happy homeowners;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- For Pension Scheme Trustees and members, we shall be having different industry player’s talk about matters affecting Pension Schemes and the pensions industry at large. Join us every Wednesday from 9:00 am to 11:00 am for in-depth discussions on matters pension;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

- For recent news about the company, see our news section here.

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 65.7%, an increase from the 21.6% recorded the previous week. This can be mainly attributed to the concurrent primary bond issue where the government issued a 2-year bond, FXD1/2021/002, which recorded a higher overall subscription rate of 244.6%, coupled with the continued tightening of liquidity in the money markets, evidenced by 0.2% points increase in the average interbank rate to 6.2%, from 6.0% recorded last week. The highest subscription rate was in the 364-day paper, which rose to 100.2%, from 39.5% recorded the previous week. On the other hand, the subscription for both the 182-day and 91-day papers rose to 50.0% and 18.7%, from 5.7% and 16.7% recorded the previous week, respectively. The yields on the 91-day and 182-day papers rose by 11.0 bps and 79.0 bps to 6.9% and 7.5% respectively, while the 364-day paper declined by 15.0 bps to 8.4%. The government continued to reject expensive bids with the acceptance rate declining to 87.8%, from 100.0% recorded the previous week, accepting bids worth Kshs 13.8 bn out of the Kshs 15.8 bn worth of bids received.

On the Primary bond market, there was a high demand for this month’s bond offer, with the overall subscription rate coming in at 244.6%, partly supported by investor preference of shorter-dated papers in this period of economic uncertainty. The Central Bank of Kenya issued a bond, FXD1/2021/002, with an effective tenor of 2 years and a coupon of 9.5%. The government received bids worth Kshs 61.1 bn, higher than the Kshs 25.0 bn offered and accepted only Kshs 55.9 bn, translating to an acceptance rate of 91.3%, with the weighted average rate of accepted bids coming in at 9.5%.

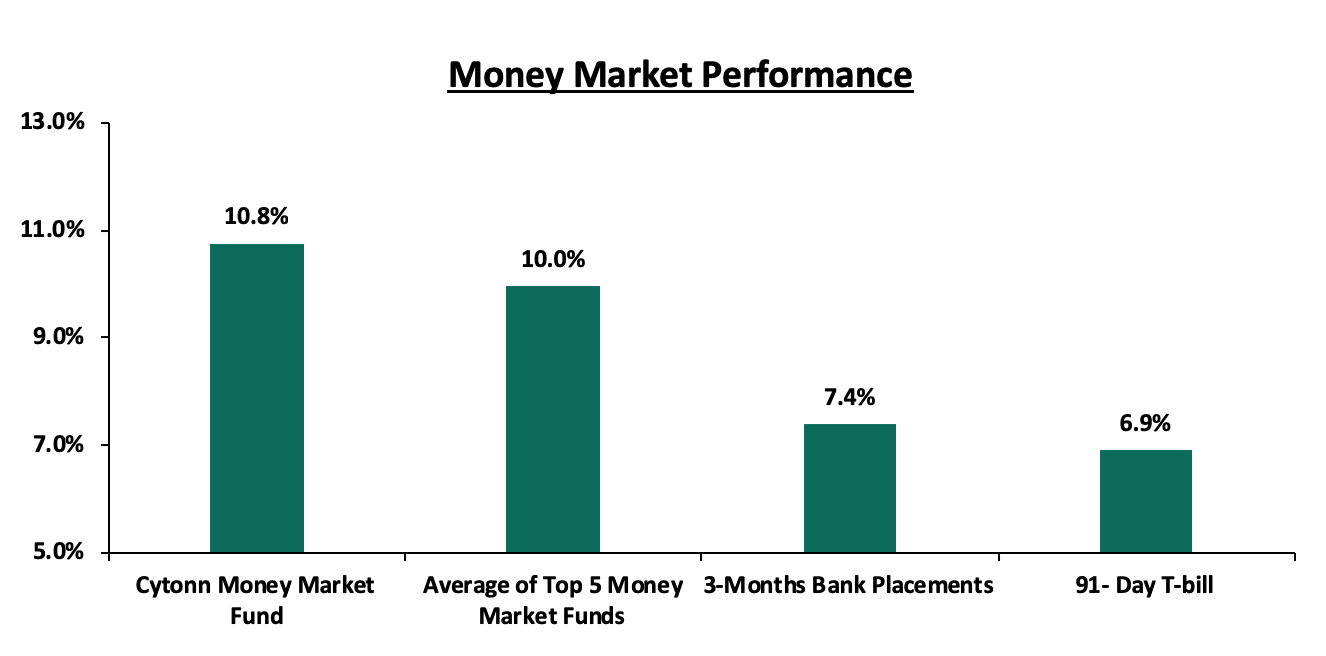

In the money markets, 3-month bank placements ended the week at 7.4% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased by 11.0 bps to 6.9%. The average yield of Top 5 Money Market Funds remained unchanged at 10.0%, as recorded the previous week. The yield on the Cytonn Money Market increased marginally to 10.8%, from the 10.7% recorded the previous week.

Liquidity:

During the week, liquidity in the market continued to tighten with the average interbank rate increasing to 6.2% from 6.0% recorded the previous week, attributable to government payments. The average interbank volumes declined by 57.7% to Kshs 6.6 bn, from Kshs 15.5 bn recorded the previous week. According to the Central Bank of Kenya’s weekly bulletin, released on 8th January, 2021, commercial banks’ excess reserves came in at Kshs 15.7 bn in relation to the 4.25% Cash Reserve Ratio.

Kenya Eurobonds:

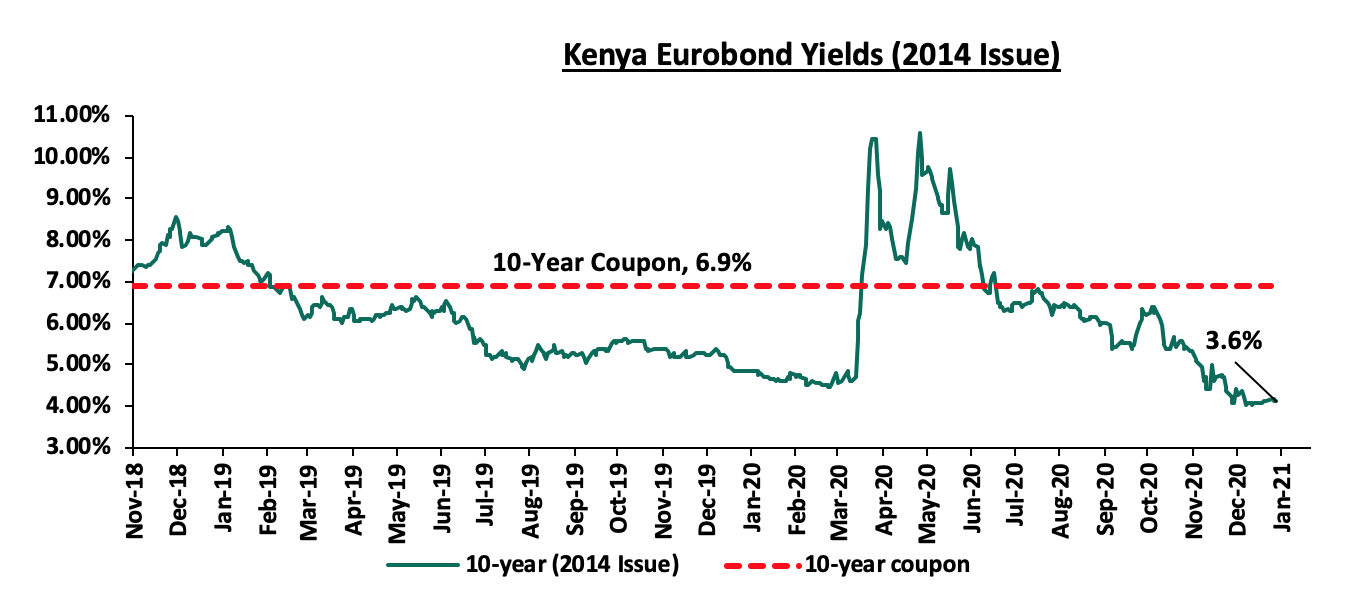

During the week, the yields on all Eurobonds recorded declines, pointing to an improved foreign investor confidence. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 declined marginally by 0.3% points to 3.6% from 3.9%, as was recorded the previous week.

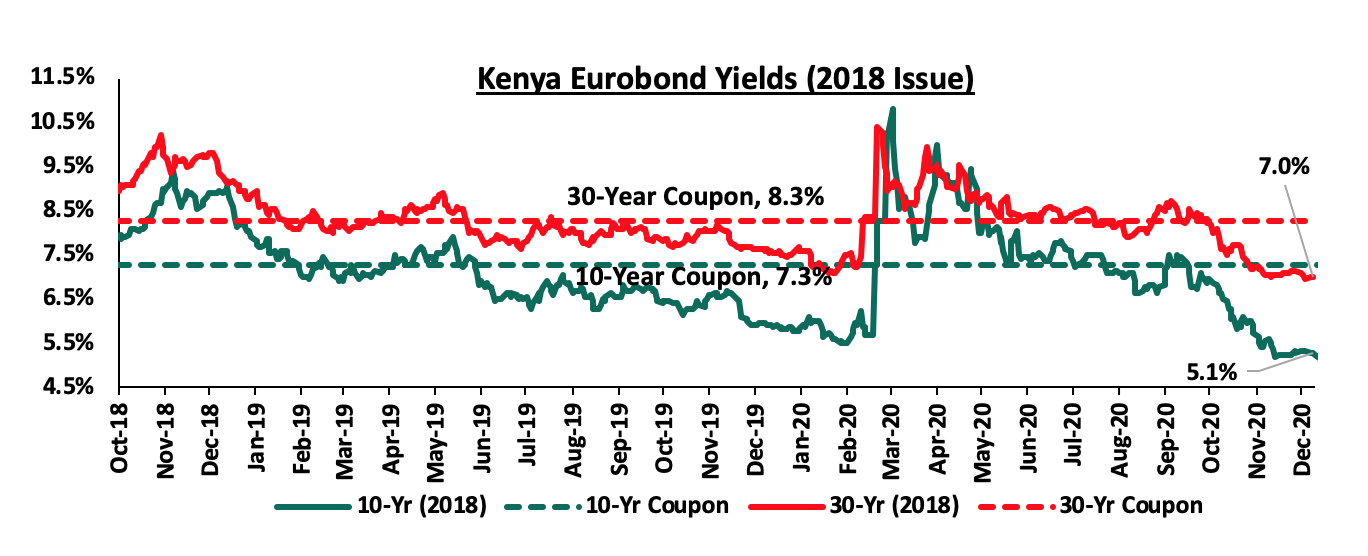

During the week, the yields on the 10-year and 30-year Eurobonds issued in 2018 declined with the 10-year issue declining by 0.2% points to 5.1%, from 5.3% recorded last week. The 30-year issue declined marginally by 0.1% points to 7.0%, from 7.1% recorded last week.

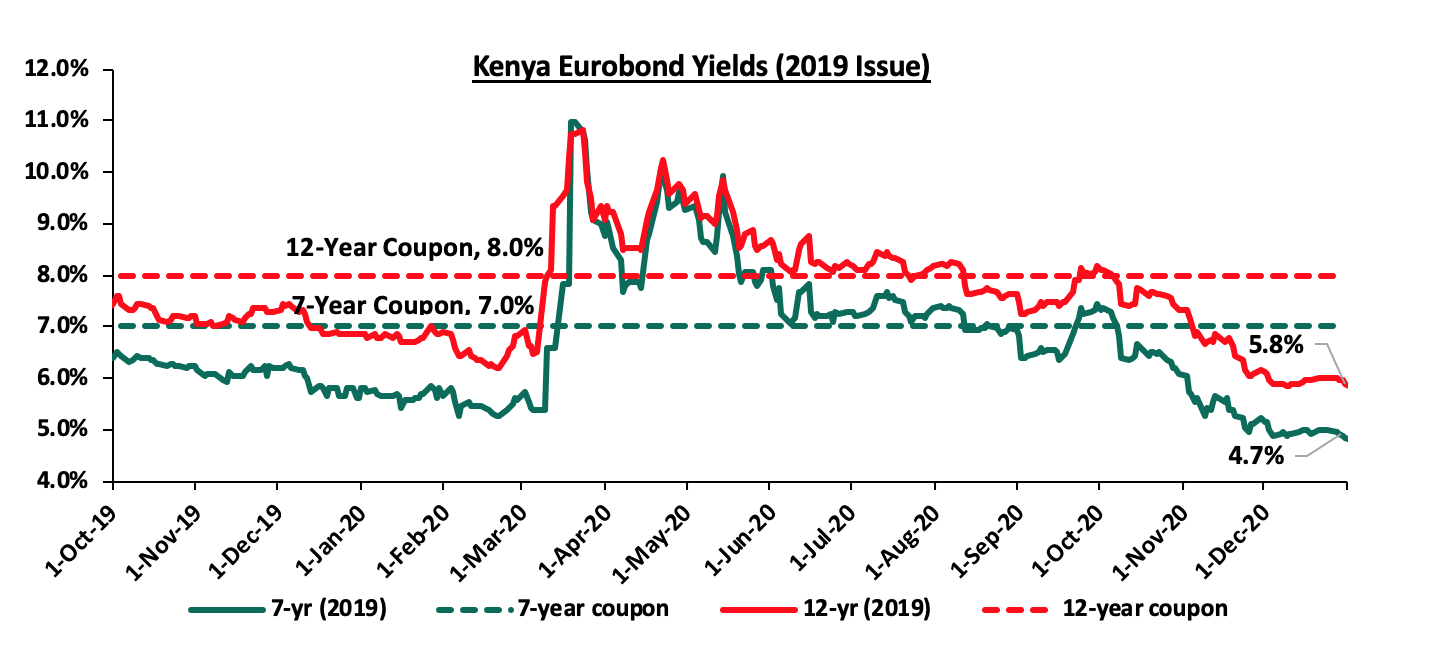

During the week, the yields on both the 2019 dual-tranche Eurobonds declined by 0.2% points with the 7-year Eurobond declining to 4.7%, from 4.9% recorded last week. While, the 12-year Eurobond declined to 5.8%, from the 6.0% recorded last week.

Kenya Shilling:

During the week, the Kenyan shilling depreciated against the US dollar by 0.3% to Kshs 109.5, from Kshs 109.2 recorded the previous week. This is partly attributable to dollar demand from traders as they resume business after the festive season. On an YTD basis, the shilling has depreciated by 0.3% against the dollar, in comparison to the 7.7% depreciation in 2020 and the 0.5% appreciation in 2019. We expect continued pressure on the Kenyan shilling due to:

- Demand from merchandise traders as they beef up their hard currency positions as businesses reopen following the festive season, amid a slowdown in foreign dollar currency inflows, and,

- Continued uncertainty globally making people prefer holding dollars and other hard currencies.

However, in the short term, the shilling is expected to be supported by:

- The Forex reserves which are currently at USD 7.7 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- The improving current account position which narrowed to 4.7% of GDP in the 12 months to November 2020 compared to 5.4% of GDP during a similar period in 2019,

- Improving diaspora remittances evidenced by a 17.3% y/y increase to USD 263.1 mn in October 2020, from USD 224.3 mn recorded over the same period in 2019, has cushioned the shilling against further depreciation, and,

- The continued reopening of the global economy as the COVID-19 vaccine becomes more accessible.

Weekly Highlight:

Stanbic December PMI

During the week, Stanbic Bank released the Monthly Purchasing Managers’ Index (PMI) for December 2020, which came in at 51.4, a marginal increase from the 51.3 recorded in November 2020. Output rose at the slowest rate in six months, although new order growth quickened slightly, expansion was softer than those seen from July to October as the economy recovered from the COVID-19-led downturn. Key to the expansion is the reported improvement in cash flow, looser restrictions and higher customer orders. The month recorded stronger sales leading to a renewed increase in backlogs of work at the end of the year, which supported a third successive monthly rise in employment. The issues with global supply chains as a result of COVID-19 and input shortages led to the stock levels increasing at the slowest rate for six months although the purchasing activity rose further in December, while lead times improved at the weakest rate in seven months. These supply-side issues also led to an accelerated pace of cost inflation, as purchase prices rose at the quickest rate since March, with the uptick slightly easing by a further decline in staff costs. Despite some firms passing higher costs on to customers, average prices charged fell for the second month running in December, as some firms gave discount offerings to attract new clients. Business confidence slipped below November's previous record low at the end of the year as continued worries were surrounding the impact of the COVID-19 pandemic on future activity. We have a cautious outlook in the short term owing to the increase in COVID-19 infections, despite the discovery of vaccines coupled with the recent improvement in some of the leading economic indicators.

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the Central Bank as they reject expensive bids. The government is 0.9% ahead of its prorated borrowing target of Kshs 252.5 bn having borrowed Kshs 254.7 bn. In our view, due to the current subdued economic performance brought about by the effects of the COVID-19 pandemic, the government will record a shortfall in revenue collection with the target having been set at Kshs 1.9 tn for FY’2020/2021 thus leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term to medium-term fixed income securities to reduce duration risk.

Market Performance

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 1.4%, 1.5% and 0.8% respectively, taking their YTD performance to gains of 1.4%, 1.3% and 1.0%, for NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as BAT, Co-operative Bank, Bamburi and Diamond Trust Bank (DTB-K) of 8.4%, 4.0%, 3.6% and 3.3% respectively. The gains were however weighed down by losses recorded by other large-cap stocks such as NCBA Group, Standard Chartered Bank and ABSA Bank of 4.3%, 2.9% and 1.9%, respectively.

Equities turnover increased by 239.7% during the week to USD 14.6 mn, from USD 4.3 mn recorded the previous week, taking the YTD turnover to USD 14.6 mn. Foreign investors turned net sellers during the week, with a net selling position of USD 1.9 mn, from a net buying position of USD 0.5 mn recorded the previous week, taking the YTD net selling position to USD 1.9 mn.

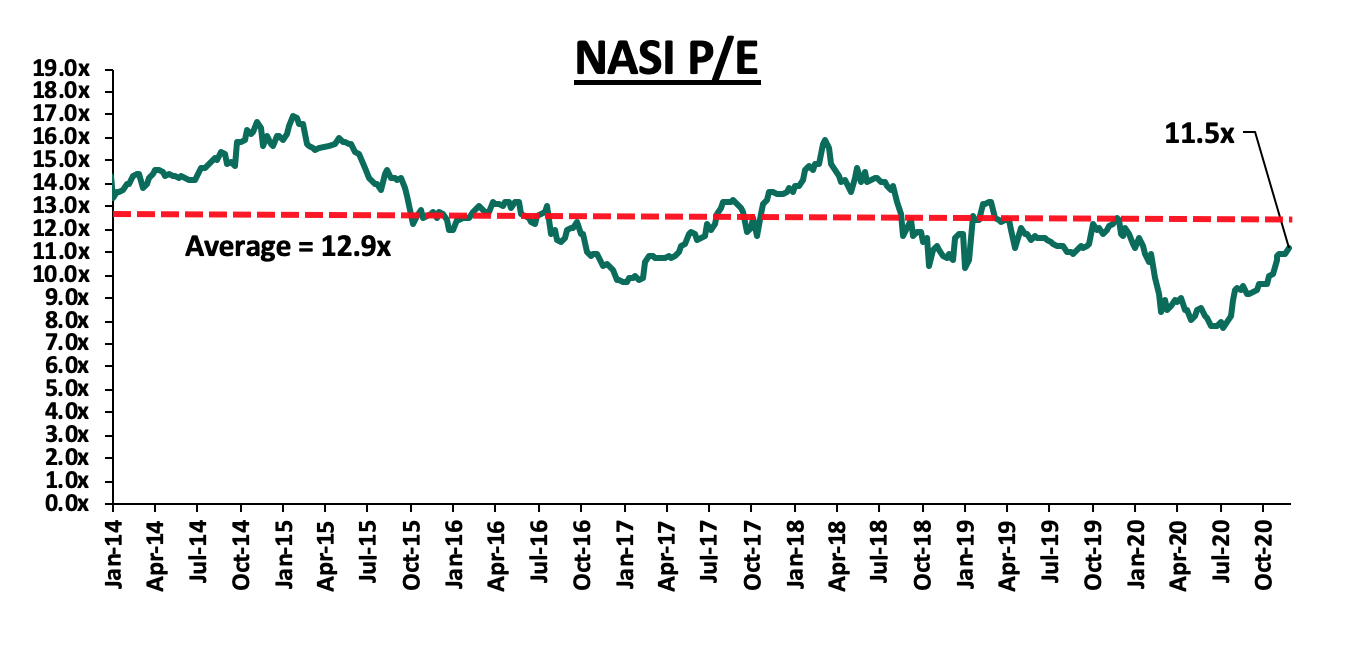

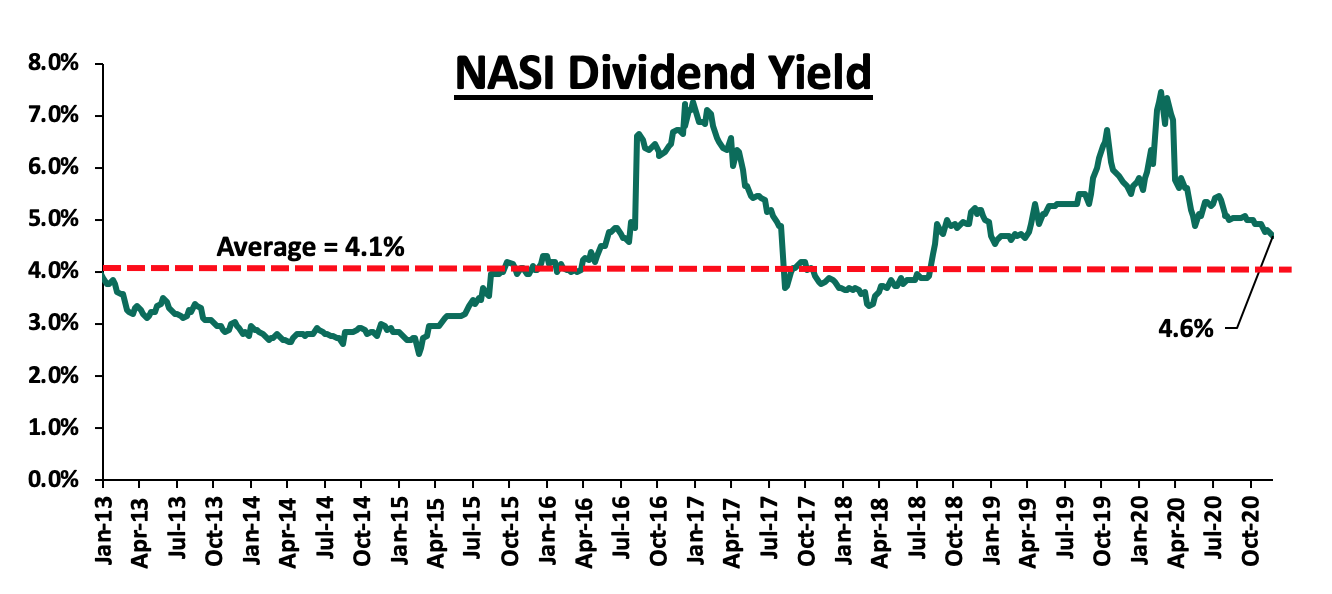

The market is currently trading at a price to earnings ratio (P/E) of 11.5x, 11.2% below the 11-year historical average of 12.9x. The average dividend yield is currently at 4.6%, unchanged from what was recorded the previous week and 0.5% points above the historical average of 4.1%.

With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 11.5x is 49.1% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the market’s historical P/E and dividend yield.

|

Company |

Price at 31/12/2020 |

Price at 8/1/2021 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank*** |

75.0 |

77.5 |

3.3% |

1.0% |

76.8 |

105.1 |

3.5% |

39.1% |

0.3x |

Buy |

|

Kenya Reinsurance |

2.3 |

2.5 |

6.9% |

7.4% |

2.3 |

3.3 |

4.4% |

37.5% |

0.3x |

Buy |

|

Sanlam |

13.0 |

12.0 |

(7.3%) |

(7.7%) |

13.0 |

16.4 |

0.0% |

36.7% |

1.1x |

Buy |

|

I&M Holdings*** |

45.0 |

46.0 |

2.2% |

2.6% |

44.9 |

60.1 |

5.5% |

36.2% |

0.7x |

Buy |

|

KCB Group*** |

38.1 |

38.3 |

0.5% |

(0.3%) |

38.4 |

46.0 |

9.1% |

29.2% |

1.0x |

Buy |

|

Equity Group*** |

36.6 |

36.0 |

(1.5%) |

(0.7%) |

36.3 |

43.0 |

5.6% |

25.0% |

1.1x |

Buy |

|

Liberty Holdings |

7.7 |

7.9 |

2.6% |

2.6% |

7.7 |

9.8 |

0.0% |

24.1% |

0.6x |

Buy |

|

ABSA Bank*** |

9.7 |

9.5 |

(1.9%) |

(0.4%) |

9.5 |

10.5 |

11.6% |

22.4% |

1.2x |

Buy |

|

Britam |

7.3 |

7.4 |

2.2% |

6.0% |

7.0 |

8.6 |

3.4% |

19.3% |

0.8x |

Accumulate |

|

Co-op Bank*** |

12.5 |

13.0 |

4.0% |

3.6% |

12.6 |

14.5 |

7.7% |

19.2% |

1.0x |

Accumulate |

|

Standard Chartered*** |

144.3 |

140.0 |

(2.9%) |

(3.1%) |

144.5 |

153.2 |

8.9% |

18.4% |

1.1x |

Accumulate |

|

Stanbic Holdings |

85.0 |

80.3 |

(5.6%) |

(5.6%) |

85.0 |

84.9 |

8.8% |

14.6% |

0.8x |

Accumulate |

|

Jubilee Holdings |

284.0 |

291.5 |

2.6% |

5.7% |

275.8 |

313.8 |

3.1% |

10.7% |

0.7x |

Accumulate |

|

NCBA*** |

26.8 |

25.6 |

(4.3%) |

(3.8%) |

26.6 |

25.4 |

1.0% |

0.2% |

0.7x |

Lighten |

|

CIC Group |

2.1 |

2.1 |

(1.4%) |

(0.5%) |

2.1 |

2.1 |

0.0% |

0.0% |

0.8x |

Sell |

|

HF Group |

3.3 |

3.4 |

1.8% |

7.6% |

3.1 |

3.0 |

0.0% |

(11.2%) |

0.1x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are banks in which Cytonn and/ or its affiliates are invested in |

||||||||||

We are “Neutral” on the Equities markets in the short term but “Bullish” in the medium to long term. We expect the recent discovery of a new strain of COVID-19 coupled with the introduction of strict lockdown measures in major economies to continue dampening the economic outlook. However, we believe there exist pockets of value in the market, with a bias on financial services stocks given the resilience exhibited in the sector. The sector is currently trading at historically cheaper valuations and as such, presents attractive opportunities for investors.

- Statutory Reviews

During the week, the Kenya’s National Treasury announced plans to draft a national property rating legislation to replace the outdated Valuation for Rating Act of 1956 and the Rating Act of 1963. The agency seeks to overhaul the 1956 property valuation laws in a bid to determine new land rates and ensure inclusion of more property owners into the tax bracket.

The outdated property legislations have been undermining the valuation rolls and tax base of properties that are rateable. As per the current legislation, the land rates are based on the 1980 valuation, and the old valuation roll has never been updated since 1956 even though best practice requires the valuation roll to be updated every ten years. In addition, there is no uniform method for valuers to determine the value of land, and, there is no provision for challenging wrong valuation rolls. These have resulted in relatively low property rates thus hindering the government from realizing revenues accruing from accumulated property values over the years. The new legislation is expected to ensure that all properties are captured within the valuation roll, land rates are based on improved property values and will also provide a legal framework in the event that the valuations are legally challenged hence the need to correct the anomalies in the current legislation.

In our view, the effort by the government in streamlining land and property transactions will; (i) enable increased revenue collection by county governments by exposing the rise in property values, (ii) enhance effective enforcement of payment of rates, and, (iii) improve land information records through the updated valuation as per current property prices. Other plans that the government through the Ministry of lands has been working on to improve transactions and enhance transparency include; i) digitization of land records and processes to enhance security of land records, improve accessibility and cut down cost of land transactions, ii) rolling out a titling programme that targets to resolve long-standing land ownership disputes and uncertainties that have locked out land-owners and businesses from accessing credit facilities from financial institutions, iii) working on a new Land Valuation Index to guide land valuations for investment and other purposes across the country, and, iv) decentralization of the services by the Ministry of Land by construction of new Land Registries in Kitui, Mbeere, Bomet and Ol Kalou. We expect the supportive framework that the government plans to put in place will enhance the ease of land transactions, and enhance revenue collection at county level thus availing funds for infrastructural projects, thus boosting the real estate sector.

We expect positive reforms within the Ministry of Lands to boost activities within the land sector thus supporting the real estate sector in general.

Business owners can fund their business through various means but they fall mainly into two main brackets i.e. equities or debt. There is occasional structuring that is done to get some in between the two forms of capital sources to enhance the attractiveness to potential investors. Globally, capital markets play a key role in ensuring that businesses get the requisite funding and that owners of Capital are well protected and get the return that is required. Most of the investments in the Capital Markets are long term in nature and it is therefore important that all the players actually understand the products that are offered in the markets before either issuing them to raise funds and also before buying into them. For instance, with the pandemic, there was a lot of volatility in most markets with the Kenyan equities market for example declining by 8.6% last year.

Despite the volatility, it is important to note that capital markets continue to play a key role in economic development more so as a source of funding for businesses and individuals and as such, we saw the need to revisit the topic, focusing on Kenya’s Capital Markets. Below are the previously done topics where we covered;

- The role of Capital Markets in economic development – In March 24, 2019, we wrote about the role of the capital markets in economic development and concluded that a well –developed capital markets creates a sustainable low-cost distribution mechanism for multiple financial products and services across the country, and,

- Capital Markets as a catalyst for economic growth – In September 18, 2019 we wrote about Capital Markets being a catalyst for economic growth and saw that a well-established capital market enables the business community to raise long term capital funds that are used to purchase capital goods, thereby propelling their growth and supporting the country’s economic growth,

Given the significant role that the capital markets play, we shall then focus on Kenya’s Capital Markets and the impact they have made on the economy. As such, we shall cover:

- The role of capital markets in an economy,

- Developments in the Kenyan capital markets,

- The challenges facing the Kenyan capital market,

- Recommendations for the Kenyan capital markets, and,

- Conclusion.

Section I: The Role of Capital Markets in an economy

Capital markets main role is to link suppliers of capital for example pension schemes or SACCOs with users of the capital i.e. people who are mainly in the production of goods and services across sectors. The capital markets therefore play a vital role in economic development as they promote growth in the real economy by enabling access to long-term financing for producers of goods and services, and entities tasked with infrastructure development like the government.

To be able to efficiently do this, the capital market players should ensure that:

- They are promoting a Saving and Investments Culture: Given that Capital market offers a variety of financial instruments, it is important that the products offered are attractively priced and easily understood across the board. Additionally, to promote the savings and investments culture in the economy, capital markets need to ensure that the products offered meet the risk-return threshold and that the units are affordable to the larger public,

- Linking Suppliers and Users of Capital: Though the link between agents with a monetary deficit and the ones with monetary surplus can take place directly through direct financing, it can as well take place through the financial intermediaries in form of indirect financing. This is a situation whereby operators facilitate the contact between the real economy and the financial market enabling optimum use of assets and resources in monetary form which promote economic growth, and,

- Facilitate Efficient and Effective Allocation of Resources: By offering a wide range of financial instruments with different risk profiles and returns, the capital markets support efficient allocation of deficient financial resources in the financial market. The competitive pricing of securities and a large variety of financial instruments with different risk and return features allow investors to juggle around their risk profiles and return appetite.

Section II: Key developments in the Kenyan capital markets

Over time, the Kenyan capital markets has evolved achieving a number of milestones over the years and in effect catalysing economic growth. Some of the most recent developments include:

- The Authority holds a Capital Markets Industry Webinar to engage stakeholders in the Industry. Some of the key bottlenecks has been lack of knowledge on how the capital markets operate and the lack of a feedback mechanism on the products already issued in the market. However, we have seen a lot of effort by the Regulator, professional association and individual firms coming forth with both training and stakeholder webinars to continue giving information and also answer questions regarding the capital markets products,

- Increased product offering in the market such as;

- Approval of the issuance of Kenya’s first unlisted green bond in 2019 which were received with huge appetite by both foreign and local investors and consequently led to a first time listing of the Kenyan shilling bond in the United Kingdom. The bond structured as a restricted public offer for sophisticated investors sought to raise Kshs 5.0 bn to fund sustainable and climate-resilient student accommodation. This posed to be a critical step in advancing the development of an effective ecosystem to support the establishment of green capital markets in Kenya, now that the necessary legal instruments are in place to facilitate such issuances,

- Approval of the issuance of Real Estate Investment Trusts: Following the issuance of the Fahari I-REIT in 2015, Acorn also got the approval to issue a REIT to finance their student housing in 2020. We expect more and more people to follow the same route. For more information on the same, see our Cytonn Weekly #50/2020, and,

- Continued approval of the Corporate Bonds: In 2020, we saw Centum get approval to issue a corporate bond that shall be used to invest in the real estate projects.

- Developments led by the Nairobi securities exchange: As a Self-Regulatory Organisation (SRO), the Nairobi securities exchange has come up with great initiatives to help companies that want to list in the securities exchange. Some of them include:

- Establishment of the Growth Enterprise Market Segment (GEMS) that was set up in 2013 with the intention of enabling venture companies without a profit history as well as small and medium sized firms to list. So far, the segment has four listed companies and still attracts more, as recently, Homeboyz Entertainment was listed by way of introduction on the GEMS, and,

- The Nairobi Securities Exchange (NSE) launched Kenya’s first formal Over-the-Counter (OTC) market platform, the Unquoted Securities Platform, to facilitate the trading, clearing and settlement of securities of unquoted companies. The OTC will enable unlisted commercial banks, cooperative societies and private companies access the benefits of an efficient OTC market anchored on leading technology capabilities and resources. For more information on the same, see our Cytonn Weekly #51/2020.

- The Setting up of the National Credit Guarantee Fund in 2017 meant to provide support to potential NSE Growth Enterprise Market Segment (GEMS) entities and FinTech start-ups thus reducing market concentration risk. The fund has helped enterprises hedge against credit risk and thus made GEMS more attractive to companies,

- Gazettement and Implementation of the Capital Markets (Commodities markets) regulations 2020 and Capital Markets (Coffee Exchange) Regulations on April 2020, which will play a vital role in promoting food security and nutrition as defined in the big four agenda outline. The authority is still engaging with stakeholders to ensure a positive transition,

- Increased innovation by creating a regulatory Sandbox that allows people to test their products and technology before rolling them out, and,

- Launch of the NSE digital application in 2020, which is a major milestone in the Kenyan capital markets as it will increase participation of both local and foreign investors in the market. Investors as well as other players such as the brokers and investment banks, will be able to monitor their portfolios and market trends from the comfort of their homes.

Section III: Challenges facing the Kenyan Capital Markets and the effects on the economy:

Economic growth in any economy relies on an efficient and viable financial sector that is responsible for mobilizing private capital to finance domestic development. Despite the developments in the Kenyan capital markets, there are still factors that hindered significant growth of the markets. Below are some of the challenges that Kenya faces in developing its capital markets:

- Overreliance on bank funding: According to the World Bank, banks in Kenya provide 99.0% of funding, with other alternative sources such as the capital markets providing a combined less than 1.0%. This is comparison to developed markets, where banks provide only 40.0% of the capital in the economy while other sources provide 60.0%. Kenya’s over-reliance in bank funding can be attributed to the lack of knowledge by both suppliers and users of capital on how best to structure and ensure there are products that meet their aspiration. The large amount of capital in the domestic market is still partially affiliated to banks,

- Deepening of the capital markets: Capital market’s depth can be measured by how easy it is to get in and out of the market and this can be a product of the different types of products on offer and the volumes. Capital market deepening is guided by the below four thematic areas namely; i) Robust policy and regulatory framework for the capital markets, ii) Diversification of capital markets products and services, iii) Efficient capital markets infrastructure and institutional arrangements, and, iv) Investor education and public awareness. Kenyan capital markets have continued to make strides in introducing new products such as the New Gold Exchange Traded Funds (NSE: GLD) and NEXT derivatives which allow one to trade in equity index futures and single stock futures. This was mainly done to broaden and deepen capital markets in Kenya. Despite this, we still have some work to do in order to be at par with other markets like the South African markets, which for example, has diversified the products they offer by venturing into the Real Estate Investment Trusts (REIT). The Market Cap to GDP for Kenya is currently 0.06% of GDP in Kenya compared to 6.9% in South Africa, shows significant opportunity for REITs. Lack of diversity in product has forced investors to rely on banks for short to medium terms loans as they have to contend with a thin capital basket,

- Facilitative regulatory framework and supervision: To reliably extract the benefits of well-functioning markets, adequate regulation of users of funds, investors, and intermediaries in addition to robust supervisory arrangements to protect investors, promote deep and liquid markets, and manage systemic risk are critical. A lot of legislative action has been focused on banks, yet we still need legislation for other competitive products which will enable investors tap into alternative avenues that are more flexible and pocket friendly, and,

- Limited supply of issuers: Investors play a catalytic role in market development and adding liquidity to the capital markets. However, such an investor base remains limited in Kenya as the number of issuers willing and capable of accessing markets is limited considering the cost and complexity of issuing securities restraining interest. Potential issuers tend to shy away from capital markets evidenced by the fact that only 65 companies have been listed in the NSE since its official declaration. This still points to the complexities of getting into the market which results to extremely low liquidity from insufficient supply and demand. As a result, this tends to lead to extremely high volatility in the country,

- Past corporate Failures: Some investors have lost money in the capital markets and this has led to some bad taste in their mouth making it difficult for them to participate in new offerings if they are to come to market, and,

- Inadequate Knowledge that acts as a barrier: The capital markets experiences less participation owing to the inadequate knowledge among some investors and the general public which would have helped to build their confidence and promote active participation in the market and consequently disseminate growth of the market

Section IV: Recommendations on enhancing the Development of Local Capital Markets to Leverage Economic Growth

In line with the challenges mentioned above, there is still much to be done with regards to deepening the Kenyan capital markets. Below are some of the steps that Kenya should take to ensure that capital markets play their role in the economy:

- Innovative Financial Products and Services: In order to deepen the capital markets and provide alternative platforms for investors, it is imperative that more sophisticated products and value adding services are created. This should be in line with technology advancements, investor education and accompanied by the necessary regulatory policies and supervisory frameworks to support their growth. In addition, the capital markets should introduce more technological innovations to make it more efficient. This can be borrowed from other developed capital markets like South African Reserve Bank that has set up an electronic trading platform for primary dealers in an effort to improve liquidity and transparency in the government bond market,

- Embracing Structured Products in the Kenyan Market: The investing public should spend time and understand the structured products and participate in those that they can tolerate the risk and they understand the returns. Products which respond to falling or rising markets in periods of high or low volatility will be available as structured products are flexible and can be tailored to meet individual investment needs,

- Tax Amendments and favourable regulations: To provide an incentive to issuers so that they invest in capital markets, structured Products and non-bank funding need to be given favourable tax treatment and favourable issuing securities,

- Amendments in the regulatory frameworks: The capital markets should adopt regulations that allow market players to craft their products within the general principles, balance the cost and profit margins as well as diversify risks. In return, this will lead to innovations resulting to deepened and developed capital markets. The authority should also develop policies which will require listed firms to disclose corporate news and price sensitive information to the bourse before going to the media. This will improve market access and efficiency seeing that in order to achieve efficiency, high quality and timely information is required. This is derived from better disclosures by listed companies.

Section V: Conclusion

In conclusion, Capital markets influences economic growth by providing the capital that is required for investment in the real economy. It is also important that the issuers together with the Regulatory bodies ensures that proper products are put out in the market to ensure that all issued products get back to the investors what was truly promised. The Investing public should spend more time understanding the capital markets and how they operate and only invest where they fully understand. The government should continue putting in place regulations that support capital markets and should encourage more players in the field. Capital markets can create greater financial inclusion by introducing alternative products and services meant to suit investors’ preference for risk and return.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.