Update on Kenya Mortgage Refinance Company (KMRC) & Cytonn Weekly #06/2023

By Cytonn Research, Feb 12, 2023

Executive Summary

Fixed Income

During the week, T-bills remained oversubscribed, albeit at a lower rate, with the overall subscription rate coming in at 187.1%, down from 208.9%, recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 31.2 bn against the offered Kshs 4.0 bn, translating to a significant subscription rate of 780.0%, up from 718.6% recorded the previous week. The subscription rates for the 364-day and 182-day papers however declined to 43.8% and 93.3% from 105.3% and 108.5%, respectively, recorded the previous week. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day and 91-day papers increasing by 5.3 bps, 4.5 bps and 2.0 bps to 10.6%, 10.0% and 9.6%;

In the Primary Bond Market, the Central Bank of Kenya released the auction results for the recently re-opened bond; FXD1/2017/010 and the newly issued bond; FXD1/2023/010, with effective tenors to maturity of 4.5 years and 10.0 years for FXD1/2017/010 and FXD1/2023/010, respectively. Notably, the bonds recorded an undersubscription of 39.1%, in line with our expectations, partly attributable to the investor’s preference for the shorter dated papers as they sought to avoid duration risk, as well the tightened liquidity in the money markets, with the average interbank rate coming in at 6.2% during the period of the sale;

Additionally, the National Treasury presented the Supplementary Budget for FY’2022/23 to the National Assembly highlighting that the National Treasury is seeking to slightly increase the gross total budget by 0.4% to Kshs 3,373.3 bn from the previous estimates of Kshs 3,358.6 bn driven by an increase in the recurrent expenditure by 6.6% to Kshs 1,496.9 bn in the Supplementary estimates from Kshs 1,403.9 bn in the Original estimates. On the other hand, Development expenditure is set to reduce by 14.9% to Kshs 609.1 bn in the supplementary estimates from Kshs 715.4 bn in the original estimates;

Equities

During the week, the equities market recorded mixed performance, with NASI declining by 0.8%, while NSE 20 and NSE 25 gained by 0.5% and 0.1%, respectively, taking the YTD performance to gains of 0.7% and 1.4% for NASI and NSE 25, respectively, and a decline of 0.2% for NSE 20. The equities market performance was mainly driven by losses recorded by large cap stocks such as Bamburi and Safaricom of 2.9% and 2.4%, respectively. The losses were however mitigated by gains recorded by banking stocks such as NCBA Group and KCB Group of 5.8% and 1.4% respectively, while ABSA Bank and Co-operative Bank gained by 1.2% each;

Additionally during the week, the Central Bank of Kenya (CBK), released the Commercial Banks’ Credit Survey Report for the quarter ended December 2022, highlighting that the banking sector’s loan book recorded a 15.6% y/y growth, with gross loans increasing to Kshs 3.7 tn in Q4’2022, from Kshs 3.2 tn in Q4’2021. On a q/q basis, gross loans increased by 2.8% to Kshs 3.7 tn in Q4’2022, from Kshs 3.6 tn in Q3’2022;

Real Estate

During the week, Absa Bank Kenya PLC announced that it had availed funding worth Kshs 6.7 bn to property developer Acorn Holdings Limited (AHL), for the construction of 10 Purpose-Built Student Accommodation (PBSA) projects worth Kshs 11.0 bn. In the retail sector, international fast-food chain ChicKing, in partnership with M/s Crispy Limited, a local franchise, opened a restaurant outlet located in Mombasa along Nyerere Avenue, the first outlet in Kenya and the East African market. In the Infrastructure sector, the Kenya National Highways Authority (KeNHA) announced plans to begin rehabilitation and improvement of sections of Mombasa road which were damaged during the construction of the Nairobi Expressway, within the next 2 months. In addition, two major roads; Murang’a-Kangema and Murang’a-Kiriaini-Othaya located in Murang’a County were upgraded to national status for the purpose of rehabilitation and other maintenance works. In the Real Estate Investment Trusts (REITs) segment, the Capital Markets Authority (CMA) in collaboration with the Sanduku Investment Initiative, the Association of Pension Trustees and Administrators of Kenya (APTAK) and the Nairobi Securities Exchange (NSE) announced ongoing plans to create a Kenya National REIT (KNR) as an accreditation body for REITs and their stakeholders within the Kenyan REITs market. Additionally, in the NSE, Fahari I-REIT closed the week trading at an average price of Kshs 6.2 per share, a 0.7% gain from Kshs 6.1 per share recorded the previous week. In the Unquoted Securities Platform, Acorn D-REIT and I-REIT closed the week ending 3rd February 2023 trading at Kshs 23.9 and Kshs 20.9 per unit, respectively, a 19.4% and 4.4% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price;

Focus of the Week

The Real Estate sector in Kenya is characterized by a constantly growing demand for housing, but a low percentage of Kenyans are able to own homes due to the high costs. The government launched the Affordable Housing Programme (AHP) with the goal of delivering 200,000 affordable housing units annually, in order to curb the ever growing annual housing deficit. In April 2018, the Kenya Mortgage Refinance Company (KMRC) was established as a public-private partnership (PPP) firm to increase access to affordable mortgage financing in the country by providing long-term funds to Primary Mortgage Lenders (PMLs) at low and fixed interest rates. After commencing lending operations with funds worth Kshs 1.3 bn disbursed in 2021, KMRC has achieved several key milestones, but still faces several challenges which if addressed would be a step forward towards achieving the goal of a sustainable housing finance sector in the country. With the recent changes in lending thresholds from Kshs. 4 mn to 8 mn, we revisit our coverage of KMRC;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.75%. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 13.69% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert are welcome to consider one of the five projects currently available for assignment, click here for the latest term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns; See further details here: Summary of Investment-ready Projects;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

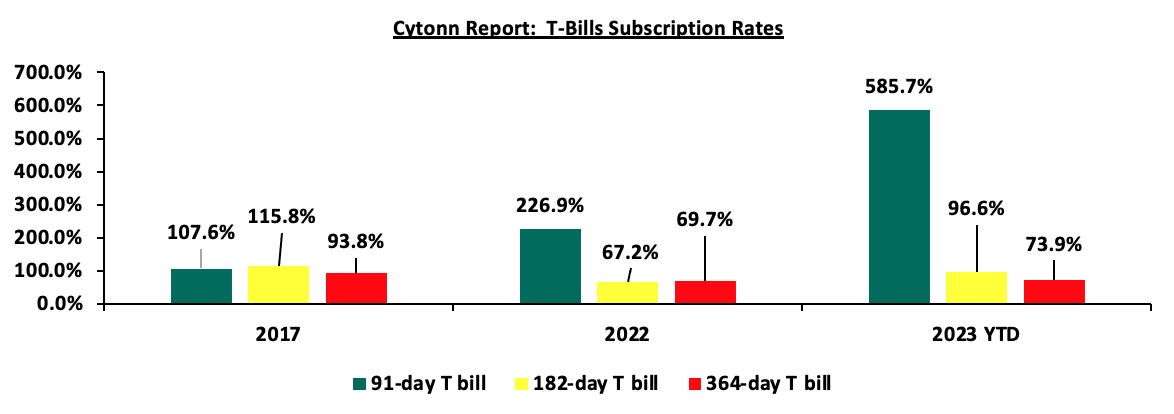

During the week, T-bills remained oversubscribed, albeit at a lower rate, with the overall subscription rate coming in at 187.1%, down from 208.9%, recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 31.2 bn against the offered Kshs 4.0 bn, translating to a significant subscription rate of 780.0%, up from 718.6% recorded the previous week. The subscription rates for the 364-day and 182-day papers however declined to 43.8% and 93.3% from 105.3% and 108.5%, respectively, recorded the previous week. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day and 91-day papers increasing by 5.3 bps, 4.5 bps and 2.0 bps to 10.6%, 10.0% and 9.6%, respectively. The Government rejected expensive bids, accepting Kshs 40.6 bn worth of bids out of the Kshs 44.9 bn worth of bids received, translating to an acceptance rate of 90.5%. The graph below compares the overall T- bills subscription rates obtained in 2017, 2022 and 2023 Year to Date (YTD):

In the Primary Bond Market, the Central Bank of Kenya released the auction results for the recent re-opened bond; FXD1/2017/010 and the newly issued bond; FXD1/2023/010, with effective tenors to maturity of 4.5 years and 10.0 years for FXD1/2017/010 and FXD1/2023/010, respectively. Notably, the bonds recorded an undersubscription of 39.1%, in line with our expectations, partly attributable to the investor’s preference for the shorter dated papers as they sought to avoid duration risk, as well the tightened liquidity in the money markets, with the average interbank rate coming in at 6.2% during the period of sale. The government issued the bonds seeking to raise Kshs 50.0 bn for budgetary support, received bids worth Kshs 19.5 bn and rejected expensive bids, accepting bids worth Kshs 16.7 bn, translating to an 85.7% acceptance rate. The weighted average yields for the bonds came in at 13.9% and 14.2% for FXD1/2017/010 and FXD1/2023/10, respectively, while the coupon rates came in 13.0% and 14.2% for FXD1/2017/010 and FXD1/2023/010, respectively.

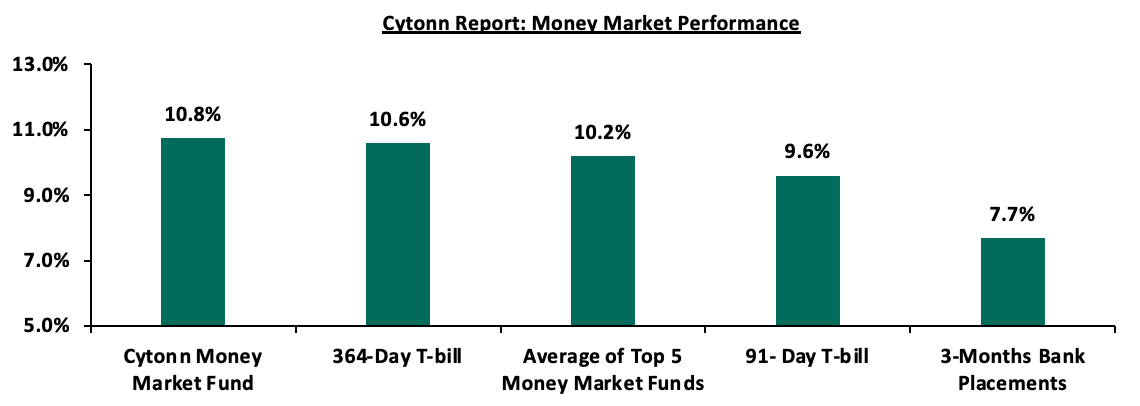

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 364-day T-bill and 91-day T-bill increased by 5.3 bps and 2.0 bps to 10.6% and 9.6%, respectively. The average yields on the Top 5 Money Market Funds and the Cytonn Money Market Fund remained relatively unchanged at 10.2% and 10.8%, respectively.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 10th February 2023:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 10th February 2023 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (dial *809# or download Cytonn App) |

10.8% |

|

2 |

GenCap Hela Imara Money Market Fund |

10.3% |

|

3 |

Apollo Money Market Fund |

10.2% |

|

4 |

Zimele Money Market Fund |

9.9% |

|

5 |

NCBA Money Market Fund |

9.9% |

|

6 |

Nabo Africa Money Market Fund |

9.9% |

|

7 |

Old Mutual Money Market Fund |

9.8% |

|

8 |

Sanlam Money Market Fund |

9.8% |

|

9 |

Kuza Money Market fund |

9.8% |

|

10 |

Madison Money Market Fund |

9.7% |

|

11 |

Dry Associates Money Market Fund |

9.7% |

|

12 |

AA Kenya Shillings Fund |

9.5% |

|

13 |

Co-op Money Market Fund |

9.3% |

|

14 |

CIC Money Market Fund |

9.2% |

|

15 |

ICEA Lion Money Market Fund |

8.7% |

|

16 |

British-American Money Market Fund |

8.6% |

|

17 |

Orient Kasha Money Market Fund |

8.6% |

|

18 |

Absa Shilling Money Market Fund |

7.9% |

|

19 |

Equity Money Market Fund |

7.6% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets remained tight, with the average interbank rate slightly increasing to 6.50% from 6.46% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded declined by 7.7% to Kshs 25.1 bn from Kshs 27.2 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds were on an upward trajectory, partly attributable to increased perceived risks in the economy amid the country’s dwindling forex reserves that raise concerns on the country’s ability to service its public debt obligations. The yield on the 10-year Eurobond issued in 2018 recorded the largest gain having gained by 1.0% points to 10.9% from 9.9%, recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 9th February 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD bn) |

2.0 |

1.0 |

1.0 |

2.1* |

1.0 |

|

|

Years to Maturity |

1.3 |

5.0 |

25.0 |

4.2 |

9.2 |

11.3 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

02-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

01-Feb-23 |

11.2% |

10.2% |

10.6% |

10.5% |

10.3% |

9.8% |

|

02-Feb-23 |

10.6% |

9.9% |

10.4% |

10.1% |

10.0% |

9.5% |

|

03-Feb-23 |

10.9% |

10.8% |

10.5% |

10.3% |

10.3% |

9.8% |

|

06-Feb-23 |

11.2% |

10.8% |

10.6% |

10.6% |

10.5% |

9.9% |

|

07-Feb-23 |

11.2% |

11.2% |

10.6% |

10.6% |

10.5% |

9.9% |

|

08-Feb-23 |

10.8% |

11.2% |

10.5% |

10.3% |

10.3% |

9.8% |

|

09-Feb-23 |

10.8% |

10.9% |

10.5% |

10.2% |

10.2% |

9.8% |

|

Weekly Change |

0.2% |

1.0% |

0.1% |

0.1% |

0.2% |

0.3% |

|

MTD Change |

(0.4%) |

0.7% |

(0.1%) |

(0.3%) |

(0.1%) |

- |

|

YTD Change |

(2.1%) |

0.4% |

(0.4%) |

(0.7%) |

(0.6%) |

(0.1%) |

*2019 aggregate amount issued for the two issues was USD 2.1 bn

Source: Central Bank of Kenya (CBK)

Kenya Shilling:

During the week, the Kenyan shilling depreciated by 0.4% against the US dollar to close the week at Kshs 125.1, from Kshs 124.6 recorded the previous week, partly attributable to increased dollar demand from importers, especially oil and energy sectors against a slower supply of hard currency. On a year to date basis, the shilling has depreciated by 1.3% against the dollar, adding to the 9.0% depreciation recorded in 2022. We expect the shilling to remain under pressure in 2023 as a result of:

- High global crude oil prices on the back of persistent supply chain bottlenecks coupled with high demand,

- An ever-present current account deficit estimated at 4.9% of GDP in 2022, despite improving by 0.3% points from 5.2% recorded in 2021, and,

- The need for Government debt servicing which continues to put pressure on forex reserves given that 69.3% of Kenya’s External debt was US Dollar denominated as of October 2022.

The shilling is however expected to be supported by:

- Improving diaspora remittances standing at USD 349.4 mn as at January 2023, representing a 3.2% y/y increase from USD 338.7 mn recorded in a similar period in 2022

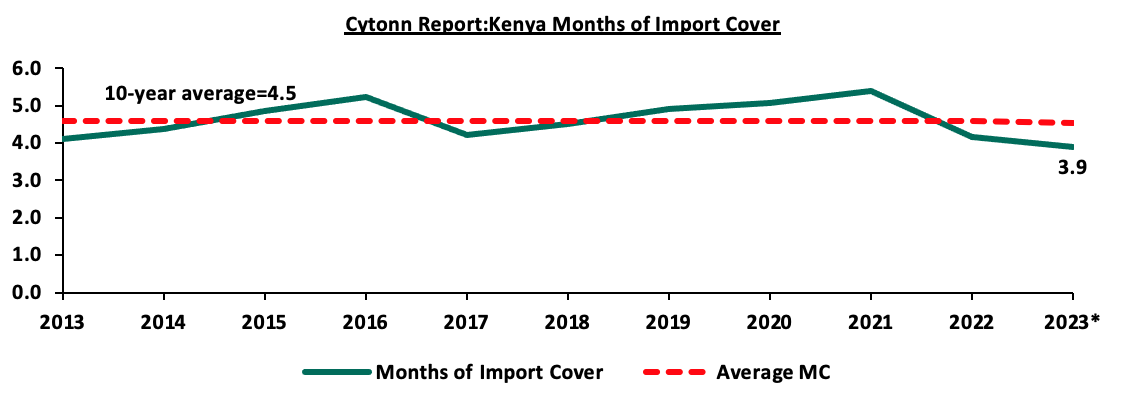

Key to note, Kenya’s forex reserves declined by 0.4% to USD 6.9 bn as at 9th February 2023 from USD 7.0 bn recorded the previous week. As such, the country’s months of import cover remained relatively unchanged at 3.9 months, and are marginally below the statutory requirement of maintaining at least 4.0-months of import. The chart below summarizes the evolution of Kenya months of import cover over the last 10 years;

*Figure as of 9th February 2023

Weekly Highlight: Supplementary Budget for the FY’2022/23

During the week, the National Treasury presented the Supplementary Budget for the Fiscal Year 2022/23 to the National Assembly. Notably, this will be the first supplementary budget under the new administration, and the Treasury is seeking to increase slightly the gross total budget by 0.4% to Kshs 3,373.3 bn from the previous estimates of Kshs 3,358.6 bn. The table below summarizes the overall change in the FY’2022/23 budget estimates;

|

Cytonn Report: FY’2022/23 Supplementary Budget Estimates (Kshs bn) |

|||

|

Item |

Original Approved Estimates FY’2022/23 |

Supplementary Estimates FY’2022/23 |

% Change |

|

Recurrent Expenditure |

1,403.9 |

1,496.9 |

6.6% |

|

Development Expenditure |

715.4 |

609.1 |

(14.9%) |

|

Ministerial National Government Expenditure |

2,119.3 |

2,105.9 |

(0.6%) |

|

Consolidated Fund Services |

869.3 |

867.8 |

(0.2%) |

|

County Equitable Allocation |

370.0 |

399.6 |

8.0% |

|

Total Expenditure |

3,358.6 |

3,373.3 |

0.4% |

Source: The National Treasury

Key take outs from the table include;

- The recurrent expenditure (Costs incurred to cover regular government expenses such as salaries, operational costs and maintenance costs) increased by 6.6% to Kshs 1,496.9 bn in the Supplementary estimates from Kshs 1,403.9 bn in the original estimates, against the current administration’s commitment to cut on recurrent spending,

- Development expenditure (Costs incurred in order to create assets that will provide long term public infrastructure such as roads, hospitals, and schools) declined by 14.9% to Kshs 609.1 bn in the supplementary estimates from Kshs 715.4 bn in the original estimates, a detriment to the sectors such as infrastructure, energy, water and health that require heavy development financing,

- As such, the Ministerial National Government expenditure estimates for the FY’2022/23 Supplementary budget is set to slightly decline by 0.6% to Kshs 2,105.9 bn from Kshs 2,119.3 bn in the original estimates, saving the government only Kshs 13.3 bn, against a projected cut of Kshs 300.0 bn attributable to austerity measures such as cutting spending on foreign travel, training, purchases of furniture and motor vehicles as well as other non-essential spending under all Ministries, Departments and Agencies (MDAs) by the government to contain expenditures to remain within sustainable fiscal path signalling future fiscal consolidation,

- Consolidated Fund Services (CFS) (refers to the Consolidated Fund established in the Kenya’s constitution into which development partners deposit funds before disbursing to the Exchequer accounts for projects such as servicing of public debt, and subscription to International Organizations) has seen a slight decline of 0.2% to Kshs 867.8 bn from Kshs 869.3 bn in the original estimates. This is attributable to a 7.2% decline in external debt redemptions to Kshs 223.8 bn from Kshs 241.0 bn in the previously approved estimates with notable decline in the external debt redemptions owed to Italy by 54.5% to Kshs 9.1 bn from Kshs 14.0 bn, and Exim Bank of China by 10.2% to Kshs 72.5 bn from Kshs 80.7 bn. However, allocation for guaranteed debt servicing was revised up by a significant 548.1% to Kshs 14.7 bn from Kshs 2.2 bn in the original estimates, as expected, due to the elevated levels of public debt, which came in at Kshs 9,146.0 bn as at December 2022. This is also in line with the increased foreign financing, which was revised up to 2.7% of GDP from the original estimates of 2.0% of GDP for the FY’2022/23, and,

- The County Equitable Share (allocation on national government revenue to county governments) increased by 8.0% to Kshs 399.6 bn from the original estimates of Kshs 370.0 bn, representing 11.8% of the total supplementary budget allocation to counties, amid calls from the county governments to increase allocation to Kshs 425.0 bn or at least 15.0% of the total revenue collected by the national government.

Additionally, the table below shows the allocation of the supplementary budget to key state departments and ministries;

|

Cytonn Report: Supplementary Gross Budget FY’2022/23 (Kshs bn) |

||||

|

|

Approved Original Estimates (Kshs bn) |

Supplementary Budget Estimates (Kshs bn) |

Change (Kshs bn) |

% Change |

|

Ministry of Energy |

95.7 |

54.0 |

(41.7) |

(43.6%) |

|

State Department for Housing and Urban Development |

20.4 |

12.4 |

(7.9) |

(39.0%) |

|

Ministry of Water & Sanitation and Irrigation |

83.9 |

59.7 |

(24.2) |

(28.9%) |

|

State Department for Infrastructure |

221.3 |

174.0 |

(47.3) |

(21.4%) |

|

Ministry of Health |

122.5 |

113.5 |

(9.0) |

(7.4%) |

|

Other Ministries and State Departments |

1,509.3 |

1,559.4 |

50.1 |

3.3% |

|

State Department for Crop Development &Agricultural Research |

41.5 |

66.6 |

25.1 |

60.5% |

|

Ministry of Petroleum and Mining |

24.7 |

66.4 |

41.7 |

169.3% |

|

State Department for Cooperatives |

2.3 |

22.0 |

19.7 |

871.3% |

|

Total |

2,119.3 |

2,105.9 |

(13.3) |

(0.6%) |

Source: The National Treasury

Key take outs from the table include:

- The Ministry of Energy suffered the highest notable decline of allocation of 43.6%, to Kshs 54.0 bn from Kshs 95.7 bn in the approved original estimates. This is attributable to a 45.2% reduction in the allocation to power transmission and distribution to Kshs 39.6 bn from Kshs 72.2 bn in the approved original estimates, due to reduction on account of budget rationalization, amid proposed reforms to increase tariffs on electricity,

- The State Department for Cooperatives had the highest budget allocation increase by 871.3% to Kshs 22.0 bn from Kshs 2.3 bn in the original estimates, with an additional allocation to Kshs 12.2 bn for the provision of the Financial Inclusion Fund (The Hustler’s Fund) in order to increase credit access to Kenyans,

- The State Department for Housing and Urban Development has seen its budget brought down by 39.0% to Kshs 12.4 bn from the original approved estimates of Kshs 20.4 bn, attributable to a 41.3% reduction to the allocation to the programme of Housing Development and Human Settlement to Kshs 8.4 bn from Kshs 14.4 bn due to budget rationalization. We expect this to undermine the ongoing efforts to facilitate the development of decent, safe and affordable housing under the Affordable Housing Programme,

- The State Department for Crop Development & Agricultural Research has seen its budget increased by 60.5% to Kshs 66.5 bn from Kshs 41.5 bn due to increase in allocation for crop development and management by 88.3% to Kshs 46.6 bn from Kshs 24.7 bn to cater for the ongoing fertilizer subsidy programme for the short and long rains. Additionally, the allocation for agricultural research and development was increased by 53.8% to Kshs 9.7 bn from Kshs 6.3 bn in the original estimates, to cater for provision of funding to settle the already terminated maize flour subsidy initiated by the previous administration, and,

- The Ministry of Petroleum and Mining had its budget increased by 169.3% to Kshs 66.4 bn from Kshs 24.7 bn, due to the increase in the allocation for the programme of General Administration Planning & Support Services by 203.7% to Kshs 63.6 bn from Kshs 20.9 bn in the approved original estimates, in order to cater for the provision for fuel subsidy, despite the calls to the Administration completely do away with the programme since it has been a burden to the country’s expenditure.

The approval of the FY’2022/23 Supplementary Budget projects to the overall fiscal deficit level including grants to 5.7% of GDP from the original projections of 6.2% of GDP, as well as reflect more austerity measures by the current administration to contain fiscal spending. Key to note, reducing the fiscal deficit as a percentage of GDP needs the government to meet the revenue collection targets as well as ensuring expenditure falls within the projected range. However, the government was not able to meet the revenue collection for the first half of FY’2022/23, with the period between July 2022 and December 2022, collecting Kshs 1,106.4 bn against a target of Kshs 1,158.2 bn, translating to a shortfall of Kshs 51.8 bn. As such, we expect the government to ramp up its revenue collection initiatives in the remaining 6 months for the current fiscal year to meet its original estimates target of Kshs 2.1 tn. Moreover, the budget allocation in the Supplementary Budget is aimed at addressing emerging priorities and emergencies such as the persistent drought that has necessitated relief food as well and fertilizer subsidies in a bid to reduce the cost of agricultural production. As such, we expect the proposed marginal budget cuts to only moderately support the government’s plan to ease the elevated debt levels. However, the continuation of consumption subsidies such as for fuel calls into question the earlier announced efforts by the Administration to do away with subsidies and ease pressure on the country’s expenditure.

Rates in the Fixed Income market have remained relatively stable due to the relatively ample liquidity in the money market. The government is 5.1% behind its prorated borrowing target of Kshs 362.8 bn having borrowed Kshs 344.3 bn of the Kshs 581.7 bn borrowing target for the FY’2022/2023. We expect sustained gradual economic recovery as evidenced by the revenue collections of Kshs 987.9 bn in the FY’2022/2023 as at the end of December, equivalent to a 46.1% of its target of Kshs 2.1 tn. Despite the performance, we believe that the projected budget deficit of 5.7% is relatively ambitious given the downside risks and deteriorating business environment occasioned by high inflationary pressures. We however expect the support from the IMF and World Bank to ease the need for elevated borrowing and thus help maintain a stable interest rate environment since the government is not desperate for cash. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the week, the equities market recorded mixed performance, with NASI declining by 0.8%, while NSE 20 and NSE 25 gained by 0.5% and 0.1%, respectively, taking the YTD performance to gains of 0.7% and 1.4% for NASI and NSE 25, respectively, and a decline of 0.2% for NSE 20. The equities market performance was mainly driven by losses recorded by large cap stocks such as Bamburi and Safaricom of 2.9% and 2.4%, respectively. The losses were however mitigated by gains recorded by banking stocks such as NCBA Group and KCB Group of 5.8% and 1.4% respectively, while ABSA Bank and Co-operative Bank gained by 1.2% each.

During the week, equities turnover increased by 61.4% to USD 11.1 mn from USD 6.9 mn recorded the previous week, taking the YTD turnover to USD 78.9 mn. Additionally, foreign investors turned net buyers, with a net buying position of USD 2.4 mn, from a net selling position of USD 0.2 mn recorded the previous week, taking the YTD net selling position to USD 21.0 mn.

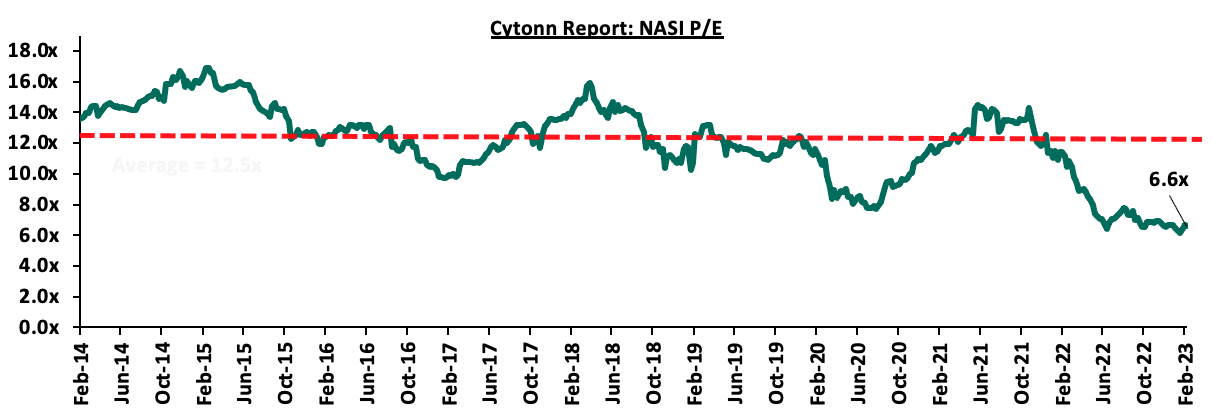

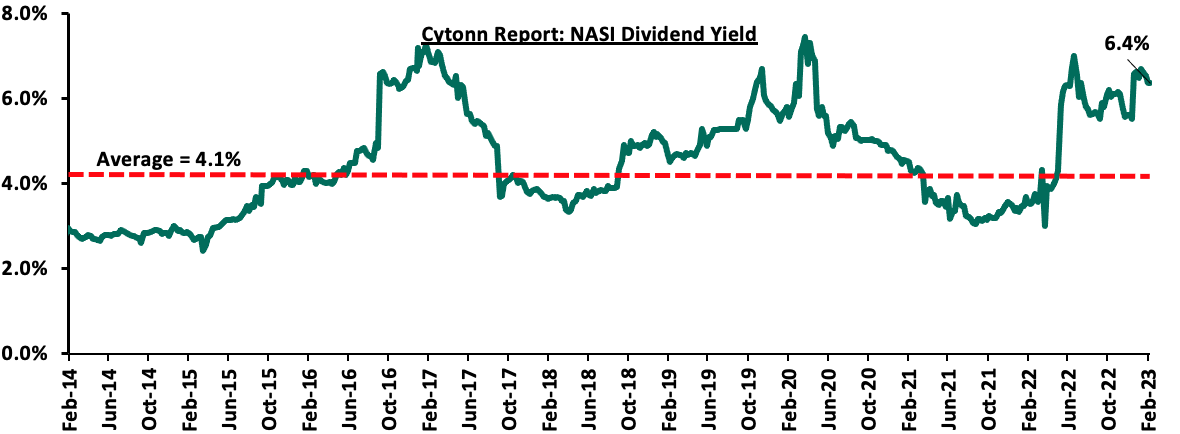

The market is currently trading at a price to earnings ratio (P/E) of 6.6x, 47.3% below the historical average of 12.5x, and a dividend yield of 6.4%, 2.3% points above the historical average of 4.1%. Key to note, NASI’s PEG ratio currently stands at 0.8x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Weekly Highlight: Central Bank of Kenya Credit Survey Report Q4’2022

The Central Bank of Kenya (CBK), recently released the Commercial Banks’ Credit Survey Report for the quarter ended December 2022. The CBK undertakes the quarterly credit survey to identify potential drivers of risk particularly in the banking sector. For the quarter ended 31 December 2022, 38 operating commercial banks and 1 mortgage finance company participated in the Commercial Banks Credit Officer Survey. The report highlighted that the banking sector’s loan book recorded a 15.6% y/y growth, with gross loans increasing to Kshs 3.7 tn in Q4’2022, from Kshs 3.2 tn in Q4’2021. On a q/q basis, gross loans increased by 2.8% to Kshs 3.7 tn in Q4’2022, from Kshs 3.6 tn in Q3’2022. The increase in gross loans was largely witnessed in the manufacturing, personal and household and real estate sectors.

Other key take-outs from the report include:

- Profit before Tax (PBT) recorded a y/y increase of 16.0% to Kshs 57.2 bn in Q4’2022 from Kshs 49.3 bn in Q4’2021. However, on a q/q basis, PBT declined by Kshs 14.9% to Kshs 57.2 bn from Kshs 67.2 bn in Q3’2022, attributable to a higher increase in quarterly expenses by Kshs 19.4 bn as compared to Kshs 9.3 bn increase in quarterly income.

- The aggregate balance sheet recorded a y/y increase of 9.8% to Kshs 6.6 tn in Q4’2022 from Kshs 6.0 tn in Q4’2021. The expansion in the balance sheet is attributable to a 6.5% increase in deposits to Kshs 4.7 tn in Q4’2022 from Kshs 4.4 tn in Q4’2021. On a q/q basis, the aggregate balance sheet recorded a 2.8% increase to Kshs 6.6 tn in Q4’2022, from Kshs 6.4 tn in Q3’2022,

- The asset quality deteriorated, with Gross Non-Performing Loans (NPLs) ratio increasing 0.2% points to 13.3% in Q4’2022 from 13.1% in Q4’2021. However, on a q/q basis, the asset quality improved to 13.3% in Q4’2022, from 13.7% recorded in Q3’2022, attributable to 0.8% decline in gross NPLs coupled with a 2.3% increase in gross loans. The decline in gross NPLs is attributable to continued recovery in most sectors of the economy as well as sustained improvement in business environment evidenced by an average Purchasing Manger’s Index (PMI) of 50.9 in Q4’2022, compared to 47.4 in Q3’2022,

- The Capital adequacy remained sufficient at 19.0%, 4.5% points above the minimum statutory of 14.5%. However, it was a decline from 19.6% recorded in Q4’2021. On a q/q basis, it remained unchanged from Q3’2022,

- The Return on Equity (ROE) increased to 25.6% in Q4’2022 from 21.6% in Q4’2021. However, on a q/q basis, ROE decreased by 1.6% points to 25.6% in Q4’2022, from 27.2% recorded in Q3’2022, attributable to the decrease in profits, and,

- Liquidity in the banking sector remained well above the minimum statutory of 20.0% despite declining to 50.8% in Q4’2022 from 56.2% in Q4’2021. Also on a q/q basis it marginally declined by 0.7% points to 50.8%, from 51.5% recorded in Q3’2022.

We expect to see increased lending by the banking sector mainly as a result of the ongoing economic recovery in most sectors. Additionally, with sufficient liquidity, we expect credit extension to private sector to increase as banks looks to deploy the additional liquidity. Private sector credit growth increased by 3.9% points to 12.5% in December 2022, from 8.6% in December 2021 attributable to sustained improvement in business environment, evidenced by an average Purchasing Manger’s Index (PMI) of 50.9 in Q4’2022, compared to 47.4 in Q3’2022. However, we expect credit uptake to be weighed down by high cost of borrowing as a result of high lending rates occasioned by the tightened monetary policy stance. Additionally, most sectors in the economy are likely to suffer from subdued consumer demand due to high commodity prices on the back of the high inflation at 9.0% in January 2023, which are likely to lower their earnings and thus elevating the risk of defaulting on loans. However, the banking sector remains well positioned, as the high lending rates are expected to increase their earnings.

Universe of coverage:

|

Company |

Price as at 03/02/2023 |

Price as at 10/02/2023 |

w/w change |

YTD Change |

Year Open 2023 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Jubilee Holdings |

185.8 |

182.0 |

(2.0%) |

(8.4%) |

198.8 |

305.9 |

0.5% |

68.6% |

0.3x |

Buy |

|

Kenya Reinsurance |

1.8 |

1.8 |

(0.6%) |

(5.9%) |

1.9 |

2.5 |

5.7% |

48.3% |

0.1x |

Buy |

|

Liberty Holdings |

4.6 |

5.0 |

8.5% |

(1.0%) |

5.0 |

6.8 |

0.0% |

35.3% |

0.4x |

Buy |

|

KCB Group*** |

38.2 |

38.8 |

1.4% |

1.0% |

38.4 |

52.5 |

7.7% |

43.2% |

0.6x |

Buy |

|

Sanlam |

8.3 |

8.3 |

(0.2%) |

(13.2%) |

9.6 |

11.9 |

0.0% |

43.1% |

0.9x |

Buy |

|

Britam |

5.1 |

5.3 |

4.7% |

2.7% |

5.2 |

7.1 |

0.0% |

33.3% |

0.9x |

Buy |

|

ABSA Bank*** |

12.4 |

12.6 |

1.2% |

2.9% |

12.2 |

15.5 |

12.0% |

35.1% |

1.1x |

Buy |

|

NCBA*** |

35.5 |

37.6 |

5.8% |

(3.6%) |

39.0 |

43.4 |

11.3% |

26.9% |

0.8x |

Buy |

|

Equity Group*** |

45.8 |

45.7 |

(0.3%) |

1.3% |

45.1 |

58.4 |

6.6% |

34.4% |

1.1x |

Buy |

|

Co-op Bank*** |

12.5 |

12.6 |

1.2% |

4.1% |

12.1 |

15.5 |

7.9% |

30.7% |

0.7x |

Buy |

|

I&M Group*** |

17.2 |

17.3 |

0.6% |

1.2% |

17.1 |

20.8 |

8.7% |

29.4% |

0.4x |

Buy |

|

Diamond Trust Bank*** |

49.9 |

50.0 |

0.2% |

0.3% |

49.9 |

57.1 |

6.0% |

20.3% |

0.2x |

Buy |

|

CIC Group |

2.0 |

2.0 |

1.0% |

5.8% |

1.9 |

2.3 |

0.0% |

14.9% |

0.7x |

Accumulate |

|

Stanbic Holdings |

110.8 |

111.8 |

0.9% |

9.6% |

102.0 |

112.0 |

8.1% |

8.3% |

1.0x |

Hold |

|

Standard Chartered*** |

158.0 |

158.0 |

0.0% |

9.0% |

145.0 |

166.3 |

3.8% |

9.0% |

1.1x |

Hold |

|

HF Group |

3.2 |

3.6 |

9.6% |

12.7% |

3.2 |

3.4 |

0.0% |

(3.4%) |

0.2x |

Sell |

|

Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Neutral” on the Equities markets in the short term due to the current adverse operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently trading at a discount to its future growth (PEG Ratio at 0.8x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the economic outlook in the short term.

- Residential Sector

During the week, Absa Bank Kenya PLC announced that it had availed funding worth Kshs 6.7 bn to property developer Acorn Holdings Limited (AHL), for the construction of 10 Purpose-Built Student Accommodation (PBSA) projects worth Kshs 11.0 bn. The balance in funding will be provided by Kshs 4.3 bn equity raised by investors in the Acorn Student Accommodation Development REIT (ASA D-REIT) for construction of the projects over a period of 3 years. These will consist of 12,000 bed-capacity hostels, targeting students within the University of Nairobi (UoN), Kenyatta University (KU), Jomo Kenyatta University of Agriculture and Technology (JKUAT), and other private universities, bringing AHL’s investment in student accommodation to an average capacity of 21,000 beds from its current 11,013 bed-capacity either under development or operational. The projects will be run by ASA D-REIT, Qwetu, which is the premium offering, and, Qejani for the mass market, and will be sold to the Acorn Student Accommodation Income REIT (ASA I-REIT) when completed.

The developer, AHL, has continued to focus on PBSA investment owing to its positive track record in the sector with attractive returns offered to investors in its previously issued corporate and green bonds to fund its previous projects. This has contributed to financial institutions such as Absa Bank Kenya PLC gaining confidence in providing additional debt financing to supplement equity from its REIT investors for further development of PBSA projects. In addition to Qwetu and Qejani, AHL plans to launch Palma, a purpose-built accommodation investment project catered to young professionals and the middle working class. The Palma project is currently in its conceptualization and ideation phase. This stage includes project set up, data collection and review, target customer segment insights, concept benchmarks, market size estimation, and feasibility study of the project. Upon launch, it is expected that Palma will complement AHL’s current portfolio by tapping into the housing demand of the young working class demographic, with Qwetu and Qejani catering for student accommodation.

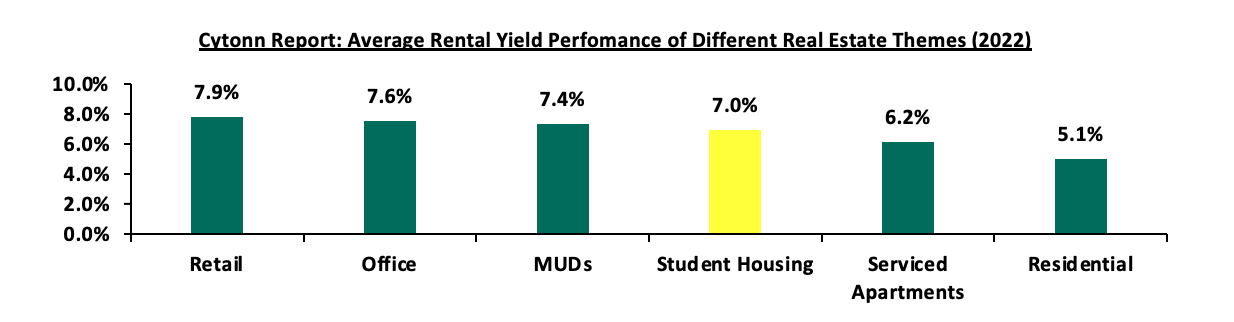

In terms of performance, PBSA investments continue to provide relatively higher rental yields compared to other asset classes, such as the serviced and residential apartments in 2022 as highlighted below;

Source: Cytonn Research

We expect the appetite for investment in PBSA development in the Real Estate sector to continue growing supported by factors such as; i) rapidly increasing student population in higher learning institutions in the country, ii) proven resilience by student housing against economic headwinds, iii) increase in tertiary institutions of learning, iv) public policies boosting enrolment of international students to local institutions, and, v) attractive returns offered by PBSA owing to the high occupancy rates achieved in hostels. Consequently, the demand for student housing will continue on an upward trend thereby contributing to the growth of Kenya’s Real Estate sector. On the other hand, setbacks such as increasing costs of construction on the back of elevated inflationary pressures from both local and global economic shocks is expected to subdue optimum investment efforts. This will translate to developers asking for higher rents and prices which will in turn limit optimum occupancy rates in certain regions of the country. Nevertheless, the concentration of developers such as AHL group in targeting international students and young professionals will continue holding up occupancy levels within the current and upcoming PBSA developments thereby underpinning higher rental yields to investors.

- Retail Sector

During the week, international fast-food chain ChicKing, in partnership with M/s Crispy Limited, a local franchise, opened a restaurant outlet located in Mombasa along Nyerere Avenue, the first outlet in Kenya and the East African market. The Dubai-based Halal restaurant chain that specializes in fried chicken, burgers and French fries, announced plans to also open a new outlet in Nairobi as part of its expansion plans to have a total of 30 new outlets in Kenya, within a five-year time-frame, according to our Cytonn weekly #19/2022. The move by the international chain to open stores in the country is driven by;

- Presence of young population in Kenya who prefer to eat fast-food products,

- Increasing Muslim population given Kenya’s relatively attractive demographic profile which creates a high demand for Halal-prepared foods,

- Need to expand against the competition from other international fast food chains in Kenya such as Subway, Kentucky Fried Chicken (KFC), Burger King, and Eat’N’Go, among others,

- Continued growth of the global fast-food restaurant segment, currently valued at an estimated total market cap of USD 442.7 bn (Kshs 55.4 tn), which boosts investor appetite, and,

- Kenya’s recognition as a regional and global investment hub by multinational franchises.

We expect the expansion efforts with the growth of the fast-food segment to support the performance of the retail sector. In addition, the sector is expected to continue witnessing growth in terms of activities, facilitated by factors such as; i) aggressive expansion by local and international retailers such as Naivas, Carrefour, and QuickMart, among others, in a bid to achieve market dominance, ii) infrastructural developments leading to opening up of areas for economic activities, and, iii) increasing demand for retail products, due to Kenya’s relatively high urbanization and population growth rates of 3.7% p.a and 1.9% p.a, respectively, against the global average of 1.6% p.a and 0.9% p.a, respectively as of 2021. However, the existing oversupply of physical space at approximately 3.0 mn SQFT in the Nairobi Metropolitan Area (NMA) retail market and 1.7 mn SQFT in the overall Kenyan retail market, increased adoption of e-commerce strategy in retail market, and reduced purchasing power amid the prevailing inflationary pressure are expected to continue hindering the performance of the sector.

- Infrastructure

During the week, the Kenya National Highways Authority (KeNHA) announced plans to begin rehabilitation and improvement of sections of Mombasa road which were damaged during the construction of the Nairobi Expressway, within the next 2 months. The rehabilitation will cost Kshs 9.0 bn and will be undertaken by the operator of the Nairobi Expressway, Moja Expressway Company Ltd, through their engineering company, Procure and Construct (EPC) Contractor CALE Infrastructure Construction Limited. The scope of works on the road will include; i) re-carpeting the existing tarmac, ii) fixing the drainage system, iii) establishing infrastructure for a Bus Rapid Transit (BRT) system, iv) fixing damaged pedestrian walk-ways, v) setting up additional street lighting, and, vi) construction of additional pedestrian footbridges. This is after construction of the Nairobi Expressway chipped away some lanes of Mombasa road, leaving it narrower and increasing traffic congestion in the lower deck. The construction further limited pedestrian access due to motorists often using the walk-ways during rush hours. The rehabilitation efforts are expected to improve the condition of the old Mombasa road up to standards of the Nairobi Expressway thereby reducing the traffic gridlock and ensuring efficient transport along the road.

Additionally, during the week, two major roads; Murang’a-Kangema and Murang’a-Kiriaini-Othaya located in Murang’a County were upgraded to national status for the purpose of rehabilitation and other maintenance works. Previously, the roads were under the Kenya Rural Roads Authority (KeRRA), a State corporation mandated with development and maintenance of the rural road network in the country, to which Kshs 21.8 bn is allocated in FY’2022/2023, with plans to disburse Kshs 62.0 mn in every Constituency. The two roads will now be administered by the Kenya National Highways Authority (KeNHA), and will be rehabilitated using part of the Kshs 295.4 bn projected exchequer budgetary allocation. The rehabilitation of the aforementioned projects commenced in 2019, but had stalled owing to inadequate financing. Once the projects are complete, they are expected to spur Murang’a County’s Real Estate sector performance through; i) higher returns from capital appreciation with increased property transactions owing to boosted economic activities, ii) lower costs to developers during transport of construction materials due to less trip times, and, iii) increased construction activity with the areas having better access to amenities.

We expect the continued improvement of infrastructure through the rehabilitation and improvement of the aforementioned roads to steadily boost the performance of the Real Estate industry through increased sector activity. However, the 2023 Draft Budget Policy Statement indicated that the government's allocation for Infrastructure, Energy, and Information and Technology (ICT) for the fiscal year 2023/2024 is expected to be Kshs 398.2 bn, a 4.4% decline from the previous fiscal year's allocation of Kshs 416.4 bn. In addition, the FY'2022/2023 Supplementary Budget to the State Department of Infrastructure was slashed by Kshs 47.3 bn, representing a 21.4% reduction in expected spending to Kshs 174.0 bn, from the previous Kshs 221.3 bn allocated towards infrastructure projects for the year ended June 2023. This comes as the government is prioritizing the completion of previously stalled projects and avoiding initiation of new expensive projects amid the current regime’s promised spending cuts. Consequently, we expect the sourcing of funding for infrastructure projects in the country to further shift to alternative financing strategies such as; Public-Private Partnerships (PPPs), issuing of infrastructure bonds, joint ventures, and, grants and concessional loans from more foreign organizations, in order for the government to fast-track the infrastructural development that is critical in growing the Kenyan economy.

- Real Estate Investment Trusts (REITs)

During the week, the Capital Markets Authority (CMA) in collaboration with the Sanduku Investment Initiative, the Association of Pension Trustees and Administrators of Kenya (APTAK) and the Nairobi Securities Exchange (NSE) announced ongoing plans to create a Kenya National REIT (KNR) as an accreditation body for REITs and their stakeholders within the Kenyan REITs market. REITs that will be registered under KNR will be structured for immediate investor uptake in the capital markets as scalable asset classes with the potential to contribute to national economic growth. The Retirements Benefits Authority (RBA) and the APTAK will also work with Trustees to review the REIT investment mandates, thereby allowing participation of pension funds in the KNR REITs as an alternative asset class. The objectives of KNR model include;

- registering REITS for the development of affordable housing and infrastructure through Special Purpose Vehicles (SPVs),

- streamlining the incorporation process for REITs,

- increasing the investment appetite for REITs, and,

- acting as the focal point for the engagement of REIT stakeholders with policy makers.

The Sanduku Investment Initiative is a Public-Private Partnership (PPP) financing model launched by President Ruto to bring together the participation of financial sector players such as; pension funds, insurance companies, SACCOs, Islamic finance institutions, and global investors. The objective of the model is to raise Kshs 1.0 tn over the next five years, as part of Kenya’s Economic Transformation Agenda. Sanduku aims to financially support the government’s priority projects such as; the Railway City Development, Nairobi International Financial Centre, Kenani Leather Park, and Makongeni Modern Suburb, among others, in line with the government’s plan for significant infrastructure initiatives and the Affordable Housing Programme (AHP). After the REITs market and industry stakeholders validate the proposed KNR model, additional engagements will be conducted to ensure there is investment appetite and support. This will be followed by structuring and launching a pilot REIT under KNR.

Going forward, we expect the envisioned KNR model to spur the Kenyan REITs market by reducing some of the existing obstacles in the sector by increasing investment from financial players such as pension funds. This will further complement the ongoing AHP by both the government and the private sector through fund raising from the capital markets. However, we note that much is yet to be done in terms of streamlining the Kenyan REITs regime that is marred by various challenges such as; i) inadequate investor knowledge of the investment vehicle, ii) lengthy approval process for REITs, iii) high minimum capital requirements for a Trustee at Kshs 100.0 mn, iv) only few entities capable of incorporating REITs, and, v) high minimum investment amounts set at Kshs 5.0 mn, which continue to hinder investors’ appetite in REITs as a viable asset class in the country ever since formulation in 2013.

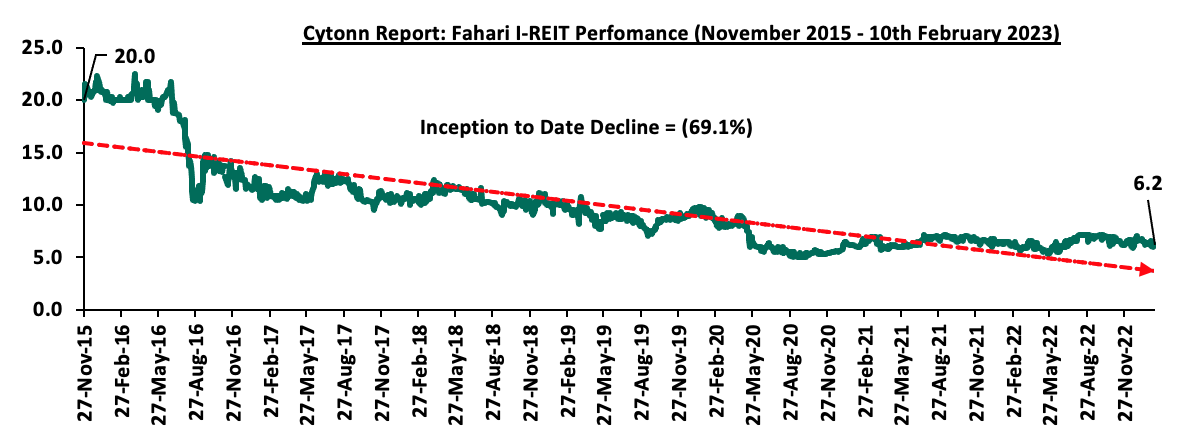

In the Nairobi Securities Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.2 per share. The performance represented a 0.7% gain from Kshs 6.1 per share recorded the previous week, taking it to an 8.8% Year-to-Date (YTD) decline from Kshs 6.8 per share recorded on 3rd January 2023. In addition, the performance represented a 69.1% Inception-to-Date (ITD) loss from the Kshs 20.0 price. The dividend yield currently stands at 8.1%. The graph below shows Fahari I-REIT’s performance from November 2015 to 10th February 2023;

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 23.9 and Kshs 20.9 per unit, respectively, as at 3rd February 2023. The performance represented a 19.4% and 4.4% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 29.0 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 598.9 mn, respectively, since inception in February 2021.

We expect the performance of the Real Estate sector to continue on an upward trend, supported by factors such as; i) increased PBSA construction activities in the residential sector, and, ii) expansionary efforts by multinational franchises in the retail sector, and, iii) ongoing rehabilitation efforts in the infrastructure sector. However, the presence of financial constraints amid the prevailing tough economic environment, the existing oversupply of physical space in selected sectors, and low investor appetite for REITs are expected to continue subduing the optimal performance of the sector.

The Kenya Mortgage Refinance Company (KMRC) is as a non-deposit taking, public-private partnership (PPP) firm formed by the Government of Kenya and regulated by the Central Bank of Kenya (CBK). The primary mandate of KMRC is to ensure sustainable home financing in the country, by providing long-term funds to primary mortgage lenders (PMLs) such as; banks, microfinance institutions, and SACCOs at low and fixed interest rates. KMRC was incorporated in April 2018 under the Companies Act 2015, and authorized by the CBK to begin lending operations in September 2020. During 2021, the company received 12 applications and disbursed funds worth Kshs 1.3 bn to 7 PMLs. KMRC currently has 23 shareholders which include; the Kenyan government through the National Treasury (25.3%), 8 commercial banks and one microfinance bank (44.3%), 11 SACCOs (7.5%), with the remainder, 22.9%, being owned by 2 development finance institutions; Shelter Afrique and the International Finance Corporation.

As a wholesale financial institution, KMRC does not take deposits nor lend directly to individuals. This enables KMRC to focus on increasing liquidity to PMLs and developing standardized lending practices through working with the government and other stakeholders. This is geared to enable the mortgage lending institutions to continue lending to home buyers without worrying about a lack of long-term funding, by gaining ability to cover any unexpected short-term deposit outflows. In addition to providing long-term funding, KMRC also plays a key role in promoting the development of the economy in Kenya by expanding the capital markets through the issuance of corporate bonds for long-term financing. The Capital Markets Authority of Kenya (CMA) supervises KMRC's bond issuance activities. We have previously covered five topicals on KMRC namely;

- Kenya Mortgage Refinance Company (KMRC) Progress, in May 2022 where we analyzed the performance of KMRC since the company commenced its lending operations,

- Kenya Mortgage Refinance Company Update in August 2021, where we benchmarked with the Jordan Mortgage Refinance Company,

- Kenya Mortgage Refinance Company Recap in November 2020, where we drew lessons from Saudi Real Estate Refinance Company,

- Kenya Mortgage Refinance Company Update in April 2019, where we reintroduced what mortgage refinance companies are, why they are needed, how they operate, what benefits they give, and,

- Kenya Mortgage Refinance Company in April 2018, where we introduced KMRC as a mortgage liquidity facility and demystified the conditions necessary for the KMRC to thrive.

This week, we update on the progress of KMRC by highlighting the key developments, challenges and milestones the company has achieved towards the goal of sustainable home financing in the country. In addition, we shall provide our expectations for KMRC and give recommendations regarding how to boost mortgage financing in Kenya by looking towards similar companies in other countries. This we shall cover through the following;

- Overview of the Housing Sector in Kenya,

- Home Financing in Kenya,

- Kenya Mortgage Refinance Company (KMRC) Update,

- Case Studies and Lessons Learnt, and,

- Conclusion.

Section I: Overview of the Housing Sector in Kenya

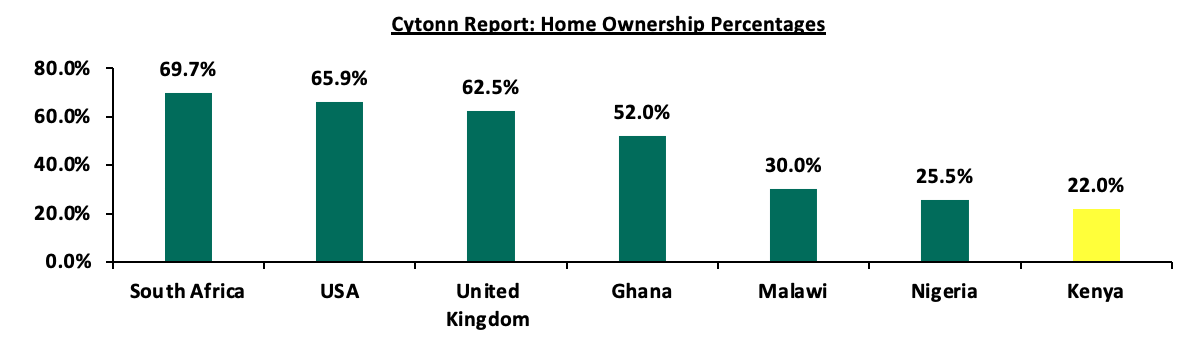

The housing situation in Kenya is characterized by a high demand for dwellings, driven by the relatively high urbanization and population growth rates averaging 3.7% and 1.9%, compared to the global averages of 1.6% and 0.9%, respectively, according to the World Bank as of 2021. The Centre for Affordable Housing Finance Africa (CAHF) estimates that Kenya has an 80.0% annual housing deficit, as only about 50,000 new houses are delivered each year against a demand for 250,000 units per year hence the demand outstripping supply at an average of 200,000 houses every year. The prevailing tough economic environment in the country has continually led to gradual increase in the costs of construction and building materials such as cement and steel on the back of elevated inflation, which in turn necessitates higher financing costs for developers, that they pass on to the market. This has led to a high cost of housing, with many people being unable to afford to buy or rent homes in the country. As a consequence, the percentage of Kenyans who own homes is relatively low, coming in at 22.0% in urban areas, with the majority of the population, 78.0%, being property renters. This is in contrast to other Sub-Saharan African countries such as South Africa and Ghana with home-ownership rates of 69.7% and 52.0%, respectively, as shown below;

Source: Centre for Affordable Housing Africa, US Census Bureau, UK Office for National Statistics

In response to this challenge, the Government of Kenya launched the Affordable Housing Programme (AHP), with two key components of delivery housing units, the supply side, and enabling purchasing of housing units, the demand side.

On the supply side, the government has set a goal of delivering 200,000 affordable housing units on an annual basis. To supply the required units, the government has been on a robust drive to launch affordable housing projects, with the AHP pipeline currently boasting about 30 projects being undertaken by both the government and private developers. This is through various incentives such as; i) exemption of VAT on importation and local purchase of goods for the construction of houses under the AHP, ii) lower corporate tax rate at 15.0% for AHP developers of over 100 units, iii) exemption from 4.0% (urban areas) and 2.0% (rural areas) stamp duty for first time buyers of houses under the AHP, iv) tax relief of 15.0% of savings to drive contributions towards home ownership, v) exemption from restrictions in interest expense deduction for foreign controlled companies undertaking AHP projects, and, vi) availing State land to County governments for the construction of affordable housing units.

On the supply side of the AHP is to increase access to mortgage financing for low and middle-income households in Kenya. To achieve this, the government aims to restructure the housing finance scheme in the country, by instituting a National Housing Fund and Cooperative Social Housing Scheme, which will guarantee uptake of houses that are developed under the AHP. This is envisioned to increase the number of mortgage accounts from the current 26,723 to a target of 1,000,000 by enabling affordable mortgages at monthly repayments of Kshs 10,000 and below. This is from the current average repayment amounts of Kshs 96,847 per month, given an average mortgage size of Kshs 9.2 mn repaid at an annual interest rate of 11.3% over 20 years. As such, the KMRC plays a vital role in supporting the ongoing AHP, through its objectives which include;

- Providing sustainable, long-term funding at attractive rates to participating financing institutions which will enable them to scale up their mortgage lending operations,

- Boosting the growth of the capital markets in the country through the issuance of corporate bonds as a source of sustainable long-term funding,

- Standardization of mortgage practices in Kenya which is geared to enable efficiency of lending processes by working together with the government and stakeholders,

- Facilitating the entry of new mortgage lenders in the market in a bid to increase competition among PMLs in order to lead to a wider range of high-quality mortgage products,

- Ensuring lower overall transaction costs to PMLs through pooling issuance, as compared to accessing the markets individually, that will in turn enable them to offer lower rates to homebuyers, and,

- Facilitating participating institutions to extend the mortgage maturity durations in line with the goal of achieving long-term housing finance.

Section II: Home Financing in Kenya

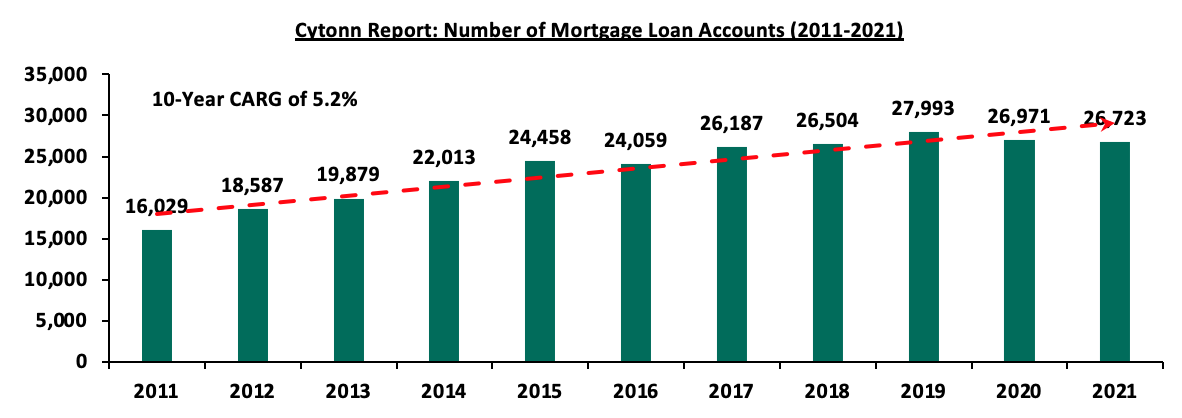

The housing finance industry plays a crucial role in Kenya's Real Estate sector. Despite its potential for growth, the mortgage sector, in particular, has not fully developed, as evidenced by recent declines in the number of mortgage accounts. In 2021, the number of mortgage accounts declined by 0.9% to 26,723 from 26,971 in 2020 which also represented a 3.7% decline from 27,993 accounts in 2019. The few number of mortgage accounts, even with the entrance of KMRC in the sector in 2021, still represents a relatively smaller portion of the overall financial landscape, contributing only 1.9% to the country's GDP as at 2021.

However, the average number of loan accounts has recorded a 10-year Compounded Annual Growth Rate (CARG) of 5.2%, showcased by a growing demand for homeownership among Kenyans, driven by steady economic growth and a subsequent increase in disposable income to invest in property especially during the pre-COVID-19 period. The recent decline in the number of mortgage accounts suggests that there are still challenges to overcome to sustain this growth in the future. Despite these challenges, there is significant room for growth in the Kenyan housing finance industry, as more Kenyans look for ways to invest in the real estate sector such as personal savings, sale of other assets, SACCO loans, inheritance/gift, investment groups, and a blend of several financing. The graph below shows the average mortgage loan accounts from 2011 to 2021;

Source: Central Bank of Kenya

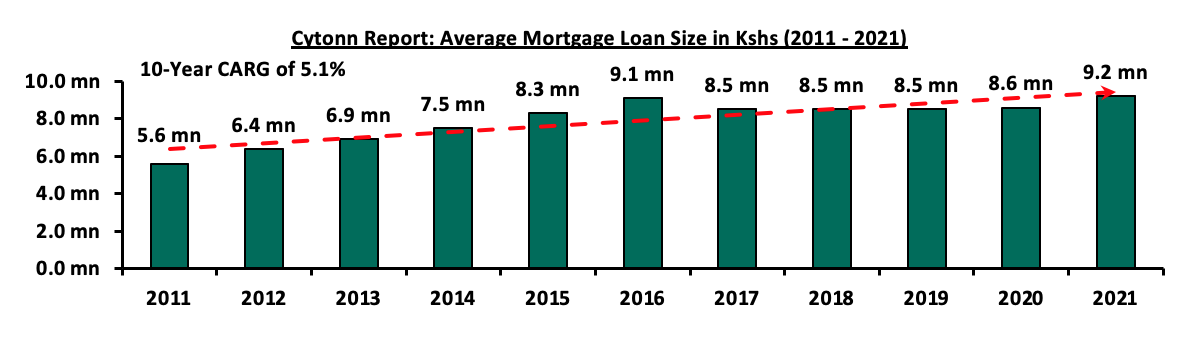

In line with the growth of mortgage loan accounts, the trend of average mortgage loan size has also been upward in the recent past, realizing a 10-year CAGR of 5.1% to Kshs 9.2 mn from Kshs 5.6 mn as shown in the graph below;

Source: Central Bank of Kenya

This growth can be attributed to the joint efforts of the government and private financial institutions in enhancing financial accessibility and providing more reasonable and flexible mortgage options which accommodate the general public.

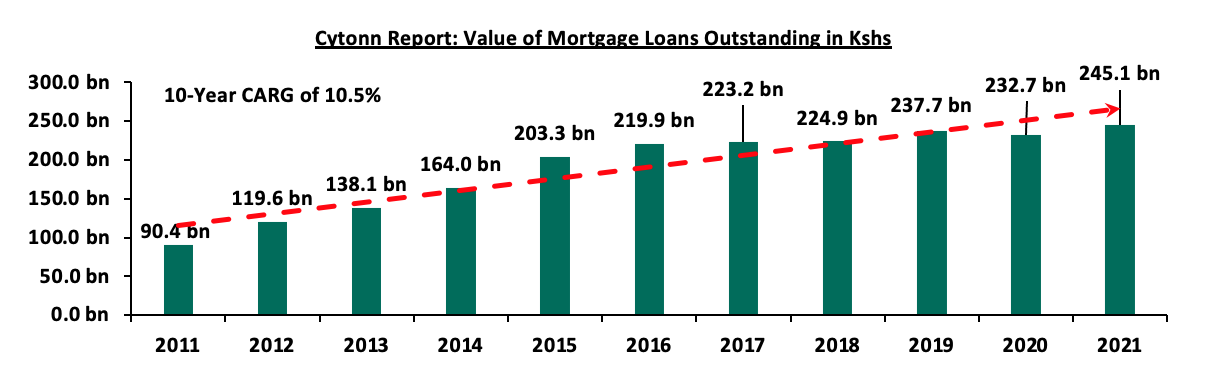

According to Bank Supervision Annual Report 2021, the value of mortgage loans outstanding increased by Kshs 12.4 bn, representing 5.3% increase to Kshs 245.1 bn in 2021 from Kshs 232.7 bn in 2020. The upward trajectory of the loans which also represented a positive 10-year CARG of 10.5% was attributed to increase in the value of mortgages granted by banks, with the average loan size significantly adjusted to Kshs 9.2 mn from Kshs 8.6 mn in 2020 and Kshs 8.5 mn in 2019. This was at the back of recovery of the economy from a depressed 2020, where the mortgage sector was negatively affected by the COVID-19 pandemic. The graph below illustrates the trend of value of mortgage loans outstanding from 2011 to 2021;

Source: Central Bank of Kenya (CBK)

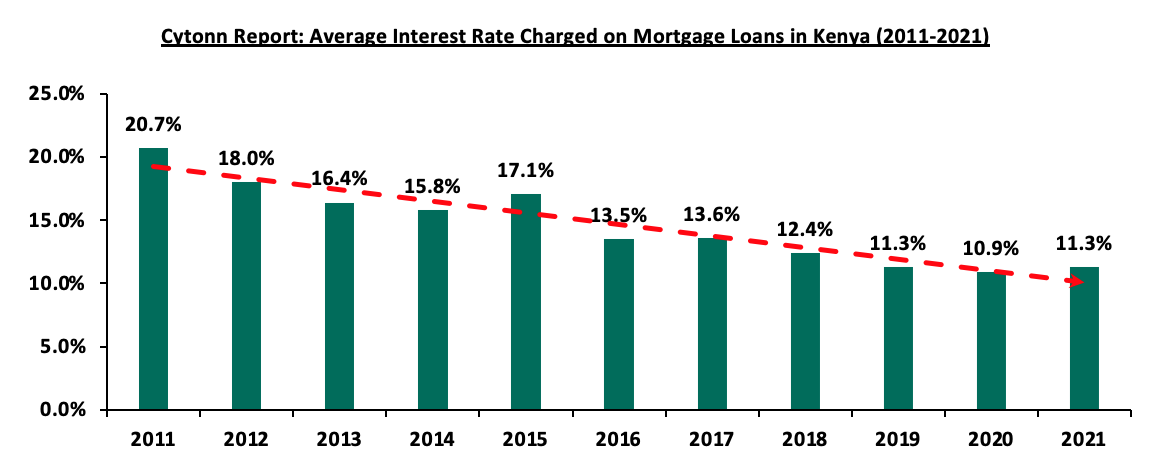

Additionally, the industry recorded an average interest rate charged on mortgages of 11.3% which was 0.4% points increase from 10.9% recorded in 2020. The interest rates majorly ranged from 7.1% to 15.0% in 2021 compared to a range from 7.0% to 15.0% charged in 2020. The increase in the interest rates was attributed to the consistency of increasing interest rates in the economy during 2021. However, for the past decade, the interest rate charged on mortgage loans has been on a downward trajectory mainly attributed by the introduction of the interest rate cap imposed by the Central Bank of Kenya (CBK) in September 2016 and later removed in November 2019. This resulted to significant drop in interest rates offered by banks during the period as shown in the graph below;

Source: Central Bank of Kenya (CBK)

Nevertheless, this rate is still considered unaffordable for most low-income and low-middle income earners. Assuming a low-middle income earner applies for a mortgage size of Kshs 9.2 mn, at an interest rate of 11.3%, and a maximum repayment term of 20 years, the client would need to pay approximately Kshs 96,847 per month, given that the average median household income in Kenya is Kshs 50,000 per month. Additionally, we expect that the continued adoption of risk based pricing models by commercial banks will drive interest rates further upwards, given that banks will be able to adequately price their risks.

The maximum loan that an average median household income of Kshs. 50,000 can afford, assuming 30% of the income, Kshs. 15,000, goes into mortgage payment is 2.5 mn (assuming interest rate of 11.3%, 20 years payment, and 15,000 per month payment.)

On the other hand, the maximum loan as a percentage of property value, also known as Loan to Value Ratio stabilized at 90.0% since 2014, whereas the average maturity of the loans was 12 years. Loan maturity ranged from 5 years as the minimum and 25 years as the maximum number of years. This was a one-year increase of 11 years recorded in 2020 ranging from a minimum of 4 years to a maximum of 20 years.

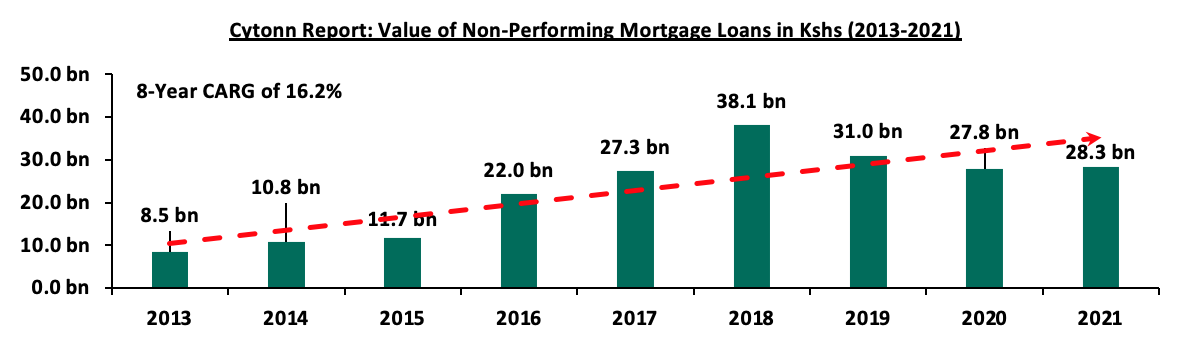

The outstanding value of Non-Performing Mortgage Loans increased by 1.8% to Kshs 28.3 bn in 2021 from Kshs 27.8 bn in 2020. This was attributed to ripple effect of COVID-19 pandemic which caused widespread economic disruption in 2020, leading to widespread job loss and reduction in income for many individuals. As a result, a significant number of housing investors found it difficult to service their mortgage loans. The pandemic also disrupted housing market activity, leading to a slowdown in Real Estate sales and making it more difficult for investors to sell their homes and refinance their mortgages during the period. However, the Non-Performing Mortgage Loans to Gross Mortgage Loans ratio was at 11.6%, 2.5% points lower compared to industry gross non-performing loans to gross loans ratio of 14.1%. The graph below shows the performance of non-performing mortgage loans from 2013 to 2021;

Source: Central Bank of Kenya (CBK)

On the other hand, the value of Non-Performing Mortgage Loans recorded an 8-year CARG of 16.2% between 2013 and 2021, which was majorly attributed by a significant increase of 88.0% in the value of Non-Performing Mortgage Loans to Kshs 22.0 bn in 2016 from Kshs 11.7 bn in 2015. Additionally, the political instability caused by the August 2017 general elections and the repeat elections in October 2017 likely had a negative impact on the housing market in Kenya, contributing to the 39.7% increase in the value Non-Performing Mortgage Loans between 2017 and 2018. This instability majorly caused a slowdown in Real Estate sales and made it more difficult for individuals finance their mortgages, leading to an increase in non-performing loans.

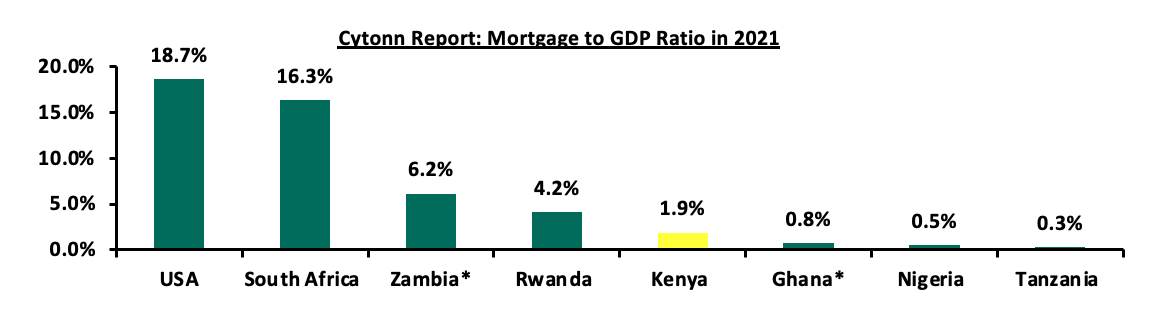

Subsequently, Kenya’s mortgage to GDP continues to underperform at approximately 1.9%, compared to countries such as South Africa and Rwanda which are at approximately 16.3% and 4.2% as at 2021, respectively, as shown below;

*(2020)

Source: Centre for Affordable Housing Africa

Currently, Kenya has 26,723 mortgage loan accounts with an average size of Kshs 9.2 mn bringing the total value of mortgages to Kshs 245.1 bn, which translates to a 1.9% mortgage-to-GDP ratio. To match South Africa's 16.3% mortgage to GDP ratio, the Kenyan mortgage market needs a Kshs 2,121.9 bn expansion. This means we require an additional 230,646 mortgages given the same average mortgage size to achieve that target.

However, several challenges have contributed to the underperformance of the Kenyan mortgage market such as;

- Ripple negative impact of COVID-19 in 2021 which continued to cause economic downturns and uncertainty regarding investing in Real Estate hence most borrowers struggled to repay the loans or take more mortgages,

- Low level of income among most consumers which reduces their ability to qualify for and make mortgage repayments, increasing the risk of default, and consequently putting pressure on banks to manage their risks and comply with the sustained new financial regulations,

- High cost of property purchase making it difficult for the consumers to afford high monthly repayments hence slowing down the mortgage process. On the other hand, the value of collateral used to secure the mortgage loans has also been on the rise, making it more difficult for banks to recover their losses in an event of default,

- Limited access to affordable long-term finance as most consumers struggle to access credit from banks and financial institutions due to strict lending criteria imposed especially during the COVID-19 period,

- Weak property rights regarding disputes over the ownership of a property undermine most consumers to secure mortgages and making it difficult for a bank to recover its funds in case of defaults,

- KMRC, which officially began its lending in 2021, is yet to stamp its dominance in the market and increase its attractiveness to more stakeholders in the sector, and

- Political and economic instabilities such as general elections and elevated inflationary pressures has made banks become more cautious about granting mortgages, as they are concerned about the risk of default and the potential loss of their funds, hence discouraging investments and limiting the growth of the mortgage market.

Section IV: Kenya Mortgage Refinance Company (KMRC) Progress Update

- Overview of the Kenya Mortgage Refinance Company

The Kenya Mortgage Refinance Company (KMRC) is a treasury backed non-deposit taking financial institution established in 2018 under the Companies Act 2015, and was licensed by the Central Bank of Kenya (CBK) to commence core business operations in September 2020. KMRC is the sole institution licensed to carry out Mortgage Liquidity Facility (MLF) activities in Kenya, which include provision of long-term funds to Primary Mortgage Lenders (PMLs) such as banks, microfinance institutions and SACCOS for purposes of increasing availability of affordable home loans to Kenyans. Typical of all MLFs, the KMRC acts as an intermediary between PMLs and the capital markets through issuance of bonds subject to regulation and supervision of the CBK and Capital Markets Authority (CMA), with the objective of providing long term funds at better rates. As such, KMRC does not lend directly to individual borrowers. The issuer was established as a crucial component in the implementation of the Affordable Housing Plan aimed at increasing the low rates of home ownership, particularly in urban areas coming in at 22.0%, resulting from limited and inaccessible housing financing as well as high housing costs. In support of this, KMRC was purposely established through a public private partnership arrangement between the Government of Kenya, and World Bank with majority ownership being by the private sector at 75.0%. Currently, KMRC has 23 shareholders which include;

|

Cytonn Report: KMRC Shareholders |

|||

|

# |

Umbrella Body |

Individual Shareholders |

Estimated Stake (%) |

|

1 |

The Government of Kenya |

The National Treasury and Economic Planning |

25.3% |

|

2 |

Development Finance Institutions |

International Finance Corporation (IFC), Shelter Afrique |

22.9% |

|

3 |

Commercial Banks |

KCB Bank, Co-operative Bank, Stanbic Bank, NCBA, Credit Bank, DTB, Absa Bank Kenya, HFC Limited |

44.3% |

|

4 |

Microfinance Bank |

Kenya Women Microfinance Bank (KWFT) |

|

|

5 |

Savings and Credit Cooperatives (SACCOs) |

Stima, Imarisha, Ukulima, Tower, Mwalimu, Unaitas, Harambee, Bingwa, Kenya Police, Safaricom & Imarika SACCOs |

7.5% |

Source: Kenya Mortgage Refinance Company (KMRC)

KMRC, through the provision of low-interest, fixed, long-term financing to participating primary lenders at 5.0% with a repayment period of up to 25 years, has boosted the funds available for subsequent lending to borrowers at single-digit rates. Correspondingly, KMRC has increased the supply of housing finance in Kenya’s housing market by refinancing mortgage loans of its member PMLs. To this end, KMRC has been fundamental in the push to increase homeownership in Kenya. In terms of products, KMRC’s offers two key refinance loan products categorized as either:

- Affordable Housing Loans: These are loans extended to Primary Mortgage Lenders to refinance mortgage portfolios defined as “Affordable” by the Government capped at Kshs 8.0 mn in Nairobi Metropolitan Area (Nairobi, Kiambu, Machakos & Kajiado) and Kshs 6.0 mn in other parts of the country to individual borrowers whose monthly household income is not more than Kshs 150,000. These mortgages are predominantly refinanced through the concessional funding provided by the World Bank (up to 80.0% of portfolios presented to KMRC by PMLs) and AfDB funding (up to 40.0% of portfolios presented to KMRC by PMLs), and,

- Market-Rate Housing Loan: These are PML loans for mortgages with a value of more than Kshs 8.0 mn. These mortgages are partially refinanced through the concessional funding provided by the World Bank (up to 20.0% of the portfolio presented to KMRC by PMLs), the AfDB financing (up to 60.0% of the portfolio presented to KMRC by PMLs) and future bond issuances.

- KMRC Progress and Key Milestones Achieved

KMRC was incorporated in April 2018 in accordance with the requirements of the Companies Act 2015. In 2019, KMRC completed a successful capital mobilization drive resulting in the Government of Kenya, eight commercial banks, one microfinance bank and eleven SACCOs becoming shareholders of the Company. In June 2020, KMRC held its first Annual General Meeting and was later issued with its license in September 2020. Following its licensing by the CBK to begin core business operations, KMRC in December 2020 approved loans for disbursement of cumulative value Kshs 2.8 bn to participating PMLs. They included; KCB Bank Kenya Limited, Housing Finance Company Limited, Stima Sacco Society Limited, and Tower Sacco Society Limited. These approvals for disbursement were to be funded from the World Bank line of credit. It is worth noting however, that despite most of KMRC’s business operations beginning in 2020, actual lending operations to PML began in 2021. In 2021, KMRC disbursed Kshs 1.3 bn to seven PMLs out of the twelve received applications closing the year on a high note, and reported a Profit After Tax (PAT) of Ksh 0.2 bn for the year, a 154.6% increase from Kshs 0.1 bn in 2020. This improvement in performance was attributed to growth in investment income and disbursements to the primary mortgage lenders. The table below shows a summary of KMRC’s income statement for FY’2020 and FY’2021;

|

Cytonn Report: Summary of KMRC Statement of Comprehensive Income |

|||

|

|

FY’2020 |

FY’2021 |

y/y Change |

|

Interest Income: |

|

|

|

|

Interest on Loans and Advances |

- |

24,419,799 |

100.0% |

|

Other Interest Income |

221,094,696 |

686,526,589 |

210.5% |

|

Total Interest Income |

221,094,696 |

710,946,388 |

221.6% |

|

Interest Expenses |

(25,389,655) |

(246,873,372) |

872.3% |

|

Net Interest Income |

195,705,041 |

464,073,016 |

137.1% |

|

Impairment Provision |

- |

(440,814) |

100.0% |

|

Other expenses |

(78,474,909) |

(178,353,474) |

127.3% |

|

Total expenses |

(78,474,909) |

(178,794,288) |

127.8% |

|

Profit Before Tax (PBT) |

101,615,001 |

285,278,728 |

180.7% |

|

Income Tax Expense |

(24,397,662) |

(88,667,655) |

263.4% |

|

Profit After Tax (PAT) |

77,217,339 |

196,611,073 |

154.6% |

Source: Kenya Mortgage Refinance Company (KMRC)

The table below shows a summary of KMRC’s balance sheet for FY’2020 and FY’2021;

|

Cytonn Report: Summary of KMRC Statement of Financial Position |

|||

|

|

FY’2020 |

FY’2021 |

y/y Change |

|

Assets |

|||

|

Loans and Advances |

- |

1,286,717,998 |

0.0% |

|

Cash and Cash equivalents |

6,062,907,771 |

6,684,792,247 |

10.3% |

|

Total Assets |

6,309,802,091 |

9,823,579,908 |

55.7% |

|

Liabilities |

|||

|

Borrowings |

3,725,173,478 |

6,771,588,698 |

81.8% |

|

Total Liabilities |

3,793,113,568 |

7,456,134,267 |

96.6% |

|

Equity |

|||

|

Share Capital |

1,291,000,100 |

1,808,375,125 |

40.1% |

|

Total Equity |

2,516,688,523 |

2,367,445,641 |

(5.9%) |

Source: Kenya Mortgage Refinance Company (KMRC)

Other key milestones achieved by KMRC during 2021 and 2022 include;

- Blue Company Certification – KMRC become a certified blue company, an initiative that is geared towards helping to create a corruption-free business environment in East Africa,

- Standardization of mortgage origination practices – KMRC successfully managed to standardize mortgage origination practices for participating SACCOs. This was in turn expected to revolutionize mortgage lending to SACCOs and increase loan processing efficiency, and,

- Convened the first Affordable Housing Conference – In December 2021, KMRC convened its first Affordable Housing Conference geared towards enhancing demand and supply sides linkages, and discussing issues affecting the delivery of affordable housing and how to resolve them.

In January 2022, KMRC received approval from the CMA to issue a Medium-Term Note (MTN) under its inaugural bond program. The table below shows the particulars of the MTN;

|

Cytonn Report: Summary of KMRC Medium-Term Note |

|

|

Issuer |

Kenya Mortgage Refinance Company (KMRC) |

|

Trustee |

Ropat Trust Company Ltd |

|

Aggregate Nominal Amount |

Kshs 10.5 bn |

|

Issue Date |

4th March 2022 |

|

Listing Date |

14th March 2022 |

|

Nairobi Securities Exchange (NSE) Market Segment |

Fixed Income Securities Market Segment (FISMS) |

|

Tranche 1 |

Kshs 1.4 bn |

|

Oversubscription Rate |

478.6% |

|

Expected Date Tranche 2 |

June 2023 |

|

Interest Rates |

12.5% p.a., payable semi-annually in arrears |

|

Placing Agent |

NCBA Investment Bank Ltd. |

|

Receiving Bank |

KCB Bank Kenya Ltd. |

|

Specified Denomination |

Kshs 100,000 with integral multiples of Kshs 100,000 thereof |

|

Tenor |

7 years amortizing, with a Weighted Average Life of 4.5 years |

|

Interest on Late Payments |

Initial Interest Rate plus a margin of 2.0% p.a. to trade creditors |

|

Credit Rating |

GCR-AA+AA- (Highest certainty of timely payment of obligations) |

|

Default |