May 17, 2020

In our Q1’2020 Kenya Macroeconomic review, we analyzed the 7 macroeconomic indicators namely; Government Borrowing, Exchange Rate, Inflation, Interest rate, GDP, Security, and Investor Sentiment that we expected to influence Kenya’s economic growth. Based on these indicators, we switched our 2020 outlook to negative from positive with the decision mainly driven by the expected effects of the Coronavirus on the economy. On the interest rates, we gave a negative outlook since we anticipated upward pressure to emanate from the increased government borrowing. As the business environment becomes more challenging, we expect a dip in tax revenues amidst the Government being in dire need of funding to offer the requisite financial stimulus to the economy. The currency outlook was negative due to continued pressure on the shilling from the unfavorable balance of payments position, as we expected forex inflows to be impacted by the negative global economic outlook and the disruption of global supply chains. In this note, we shall be focusing in detail the factors that are expected to drive the performance of the Kenya shilling and the interest rates and thereafter give our outlook for 2020 based on these factors. We shall cover the following:

- Historical Performance of the Kenyan Shilling,

- Evolution of the Interest Rate Environment,

- Factors Expected to Drive Currency Performance,

- Underlying Factors Expected to Drive The Interest Rate Environment, and,

- Conclusion and Our View Going Forward

Section I: Historical Performance of the Kenyan Shilling

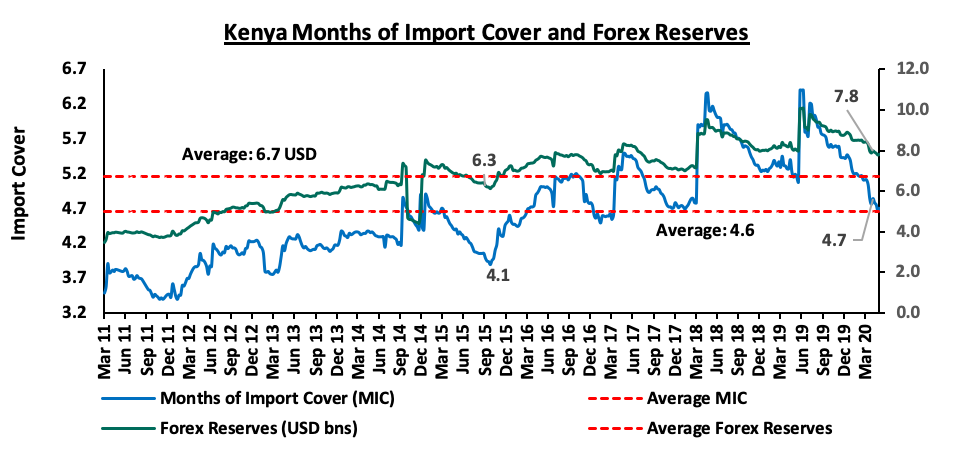

Over the past 5 years, the Kenya Shilling has been relatively stable against the US Dollar, as the Central bank has continuously maintained high forex reserves at above the statutory target of 4.0-months import cover, having averaged USD 6.7 bn equivalent to 4.6 months average import cover. The chart below shows the trend of the evolution of the forex reserves:

The healthy forex reserves have been supported by:

- Strong diaspora remittances, which have grown by a 9-year CAGR of 13.8% to USD 228.8 mn in March 2020 from USD 71.6 mn recorded in March 2011,

- The narrowing of the current account due to the increased value of the country’s principal exports with a key focus on the value of tea exports which have grown by a 9-year CAGR of 4.8% to an estimate of Kshs 11.0 bn in February 2020 from Kshs 7.2 bn recorded in February 2011, and,

- Recovery of the tourism sector.

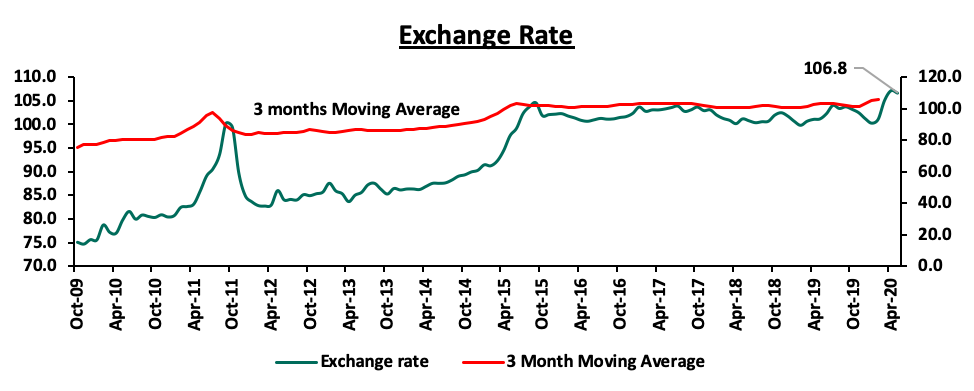

We have seen the shilling depreciate significantly since the onset COVID-19 pandemic. The shilling recorded an all-time low of Kshs 107.3 against the dollar on April 30th 2020. This was mostly attributable to the high dollar demand from foreigners exiting the market as they directed their funds to safer havens as well as merchandise, and energy sector importers beefing up their hard currency positions amid a slowdown in foreign dollar currency inflows.

The chart below is the Kshs Vs the USD over the last 10 years:

Source: Central Bank of Kenya

The Kenyan shilling has been on a depreciation streak having lost 5.4%, year to date, ending the week at Kshs 106.8. The recent depreciation has raised concerns, with the International Monetary Fund (IMF) indicating that Kenya’s debt structure increases the currency’s vulnerability to external shocks. In the past 5 months, forex reserves have declined by 3.4% to USD 8.5 bn (5.1-months import cover) from USD 8.8 bn (5.4-months imports cover) in January 2020. The depreciation has mainly been attributed to:

- A 6.3% reduction in diaspora remittances to USD 228.8 mn in March 2020 from USD 244.8 mn recorded in December 2019 attributable to Coronavirus pandemic,

- A decline in demand for Kenya’s exports due to lockdowns in major markets,

- Flight to safety by foreign investors invested in the Kenyan market,

- Increased demand from importers as they stock up dollars, and,

- The dwindling forex reserves have also exerted pressure on the shilling causing a depreciation of the currency. However, we note that the Kshs 78.7 bn disbursement from the IMF will assist in cushioning the shilling from external volatility.

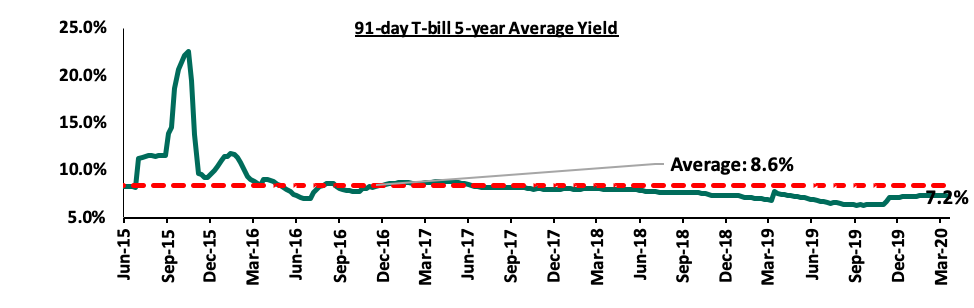

Section II: Evolution of the Interest Rate environment in Kenya

The Interest rates in Kenya have witnessed high volatility in 2011 and 2015 as seen by the significant increase in yields in the government papers. The yield on government papers largely follow what is happening in the economy and in times of expected high borrowing, lending rates tend to shoot up as was seen in September 2015 where, the yields on the 91-day papers increased to 18.6%, a 4-year high from the last recorded high yields of 20.9% recorded in 2011. The high borrowing target in the high cost of credit environment saw the government offer attractive rates on its papers.

Over the last 5 years, the rates on government papers have remained relatively stable despite the continuous high budget deficit. The capping of the interest rate through the Banking Amendment Bill (2016) saw banks not keen to lending to the private sector as the regulation limited their credit pricing, and so most of the cash was channeled towards government debt, which offered better returns on a risk adjusted return basis.

Source: Central Bank of Kenya

With the expected economic slowdown we expect to see more borrowing locally as the governments seeks to plunge in the budget deficit brought about by the slow-down in revenue collections. It shall also be difficult and expensive to raise funds from the international markets.

To address the Coronavirus pandemic that has dampened economic activities leading to significant revenue underperformance, The National Assembly on 22nd April approved the supplementary budget for the fiscal year 2019/20, paving the way to a Kshs 9.7 bn decline in the gross total supplementary budget. Despite the Kshs 9.7 bn reduction, the overall fiscal deficit has increased to an estimate of 7.8% of GDP from the earlier estimated deficit of 6.3% of GDP for FY 2019/20. The table below illustrates the allocation of the Supplementary Budget 2019/20, showing how much has been collected:

|

Item |

FY'2019/2020 Approved Estimates (Kshs bn) |

Collected Amount March 2020 (Kshs bn) |

% Met |

|

Total Revenue |

1,893.9 |

1,332.2 |

70.3% |

|

Grants |

44.6 |

13.6 |

30.5% |

|

Total Revenue & Grants |

1,938.5 |

1,345.8 |

69.4% |

|

Recurrent Expenditure |

1,248.6 |

1,154.4 |

92.5% |

|

Development Expenditure |

367.5 |

471.9 |

128.4% |

|

County Government |

316.5 |

214.8 |

67.9% |

|

Total Budget (Inclusive of CFS) |

2,803.1 |

1,841.1 |

65.7% |

|

Fiscal Deficit (Inclusive of Grants) |

(864.6) |

(495.3) |

- |

|

Deficit (Inclusive of grants) as a % of GDP |

7.8% |

- |

- |

|

Net Foreign Borrowing |

455.0 |

98.4 |

21.6% |

|

Net Domestic Borrowing |

404.4 |

290.9 |

65.0% |

|

Total Borrowing |

859.4 |

385.7 |

45.3% |

As seen above, the government has been able to raise 65.7% (Kshs 1,841.1 bn) of it’s total budget (Kshs 2,803.1 bn). With less than two months to the end of the fiscal year, the government will be under pressure to borrow domestically. We believe that in order for the government to ease pressure on the interest rate, they should;

- Consider seeking for debt restructuring to reduce the debt serving cost. In 2019, the debt to service ratio stood at 45.2% above the 30.0% recommended threshold, and

- Relook at the budget and consider shelving some of the projects that are not very urgent. Despite the Kshs 9.7 bn decline in the gross total supplementary budget for 2019/2020, the fiscal deficit remains high at an estimate of 7.8% of GDP, and,

- As highlighted in our Debt Relief Amidst the COVID-19 pandemic topical, the government should consider negotiating for a temporary debt stand still as well as look for concessional loans that will provide additional liquidity and serve as a bridge special purpose vehicle for commercial debt servicing

Section III: Factors expected to drive currency performance

In this section, we will analyze the key factors expected to drive the performance of the Kenyan Shilling:

- Balance of payments

According to the Economic Survey 2020 released by the Kenya National Bureau of Statistics, the current account deficit grew by 10.9% to a deficit of Kshs 567.0 bn in 2019 from a deficit of Kshs 511.3 bn recorded in 2018, attributed to a 2.9% decline in the value of exports despite 2.3% increase in the value of imports. Currently, the export sector has continued to suffer significant losses (it is estimated that the floriculture sector will lose Kshs 60.0 bn by the end of 2020) due to reduced demand for Kenyan exports and the decline of global commodity prices. Despite the easing of the lockdown measures in Kenya’s trading partners, we expect the business environment to have a sluggish growth towards the end of 2020. The tourism sector, one of the key foreign exchange earners, has suffered significant losses due to the ban on international travel. In March 2020, Kenya Airways announced a Kshs 8.0 mn revenue loss following the travel restrictions. On the plus side, however, Kenya could be facing a lower import bill on account of the reduced oil prices as well as the reduction in the imports of goods and services as many firms have scaled down their operations in light of the Coronavirus. The low import bill will however not be able to offset the current account deficit thereby and as such, we expect continued pressure on the shilling due to the high dollar demand.

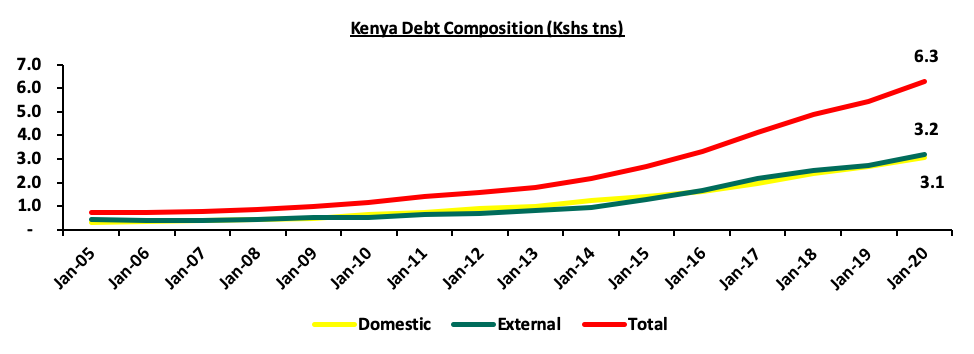

- Government debt

Currently, Kenya’s debt stands at Kshs 6.3 tn comprising of Kshs 3.2 tn in external debt and Kshs 3.1 tn in domestic debt as highlighted in the chart below:

In the recently approved Supplementary Budget II Estimates for the fiscal year 2019/20, Kenya is scheduled to pay a total of Kshs 253.4 bn comprising of Kshs 121.5 bn in external debt redemptions and Kshs 131.9 bn in external debt interest payments. In the 2018/19 fiscal year, the debt service to export earnings ratio came in at 30.2%, an increase from the 20.0% recorded the previous fiscal year, an indicator of increased pressure on the foreign exchange receipts that are being redirected to service debt. Given the poor performance in the export sector, we expect the debt service to export earnings ratio to continue rising this year due to the underperformance on the denominator side, which will in the essence put more pressure on the forex reserves as the country meets external debt obligations.

- Forex Reserves

Kenya’s Forex Reserves have been declining in 2020 so far they have witnessed a 3.4% decline to USD 8.5 bn (5.1-months import cover) in May 2020, from USD 8.8 bn (5.4-months imports cover in January 2020. The decline is due to low inflows amidst increased dollar demand. There shall be continued pressure on the reserves due to low exports of goods and lower diaspora remittances amidst increases in demand for dollars to service Kenya debt and as foreign investors flee to safer havens.

On the positive side, the IMF recently disbursed Kshs 78.7 bn (USD 739.0 mn) to help the country address the impact of Coronavirus pandemic. These funds will be used to provide budget-financing needs and allow the government to maintain an adequate level of foreign reserves to support the economy as well as cover the balance of payment gaps. Despite this, we still expect forex reserves to continue declining with our sentiments being on the back of (i) reduced diaspora remittances, (ii) continued investor capital outflows in the money market, and (iii) increased foreign debt repayments.

- Monetary Policy

Central Banks play an instrumental role in determining price stability and economic growth of a country. Depending on the economic cycle, Central Banks can either adopt an accommodative or a tight monetary policy. Given the current economic environment that has greatly been affected by the Coronavirus pandemic, the MPC implemented an accommodative policy by lowering the CBR by 25 bps to 7.00% from 7.25%. As a result, domestic investment activities will decline as Kenya’s financial and capital assets become less appealing to investors on account of their lower real rate of return. Consequently, the shilling will continue to depreciate as the demand for the dollar increases. We do not expect the CBK to increase the rates as the Central Bank is mainly focused on reviving the economy. Given that the Inflation rates have remained within the government’s target of 2.5% - 7.5% supported by the lower fuel prices and favorable weather conditions, the Central Bank will not be under pressure to increase the rates on this front, and as such, the shilling will continue to weaken.

Outlook:

|

Driver |

Outlook |

Effect on the currency |

|

Balance of Payments |

|

Negative |

|

Government Debt |

|

Negative |

|

Forex Reserves |

|

Negative |

|

Monetary Policy |

|

Neutral |

From the above currency drivers, 3 are negative (forex reserves, balance of payment, and government debt) while is neutral (Monetary Policy) indicating a negative outlook for the currency.

Section IV: Underlying factors expected to drive the Interest Rate environment

- Fiscal Policies

In the recently approved Tax Amendment Bill 2020, the government reduced its expenditure by Kshs 9.7 bn and forfeited an estimated Kshs 122.0 bn of the earlier expected revenue, due to the current constrained economic conditions, and as such increasing the fiscal deficit to an estimate of 7.8% of GDP from the earlier estimated deficit of 6.3% of GDP for FY 2019/20. This saw the domestic borrowing target adjusted upwards to Kshs 404.4 bn from the earlier approved Kshs 300.3 bn to plug in the fiscal deficit. The government is currently 28.1% behind its domestic borrowing target of Kshs 404.4 bn having borrowed Kshs 290.9 bn against a prorated target of Kshs 357.7 bn. With less than 2 months remaining to the end of the FY’2019/20, we do not believe the government will be able to meet this target as it is also burdened by high levels of debt maturities currently standing at Kshs 148.9 bn (Kshs 117.9 bn in T-Bill maturities and Kshs 31.0 bn in T-bond maturities) and as such, the government may resort to accepting expensive bids and destabilize the interest rates in the process. To relieve the burden of debt maturities, the Government is seeking to restructure the maturities of the Treasury Bills by switching T-bill investors to the June Infrastructure bond. Given that the 364-day T-bill will be maturing on June 1st 2020, investors have the option of rolling over their maturities or investing their proceeds to the June Infrastructure Bond. Due to the revenue side constraints given the current reduced economic activity as evidenced by the declining PMI to 34.8 from the 37.5 seen in March 2020, we foresee the government increasing its borrowing activities in the local market with a bias towards an upward adjustment of the yields to incentivize investors thus putting pressure on interest rates.

- Liquidity

In the March 2020 sitting, the MPC lowered the Cash Reserve to Ratio (CRR) to 4.25% from 5.25% and increased the maximum tenor of Repurchase Agreements (Repos) to days from 28 days enabling banks to access long-term liquidity secured in their holdings in government papers. The CBK also availed Kshs 35.2 bn to commercial banks, which would be used to support borrowers affected by the Coronavirus pandemic. Consequently, this move has led to ample liquidity in the money market as evidenced by the low interbank rates of 4.1% recorded during the week. In an ideal situation, the ample liquidity in the money market, the lowering of commercial banks’ lending, and deposit rates would lead to increased money supply in the economy and an increase in consumers’ purchasing power.

The lowering of the CRR will contribute towards increasing liquidity in the short term. According to the Central Bank of Kenya, the reduction of the CRR in March 2020 had by the end of April 2020 freed Kshs 17.6 bn, which was granted to 11 commercial banks and 1 microfinance bank to be used for onward lending to distressed borrowers.

As the effects of the Coronavirus continue to be felt in the economy, we believe banks will find it difficult to lend to businesses and individuals as the risk levels have increased as such a large proportion of these funds may be channeled to government securities offering some reprieve on the Government yields due to reduced credit competition from the private sector.

- Monetary Policy

In the April 2020 sitting, the MPC cut the CBR rate by 25 bps to 7.00% from 7.25% in order to support economic growth, stabilize the financial markets and mitigate the economic and financial disruptions brought about by the virus. Of the Kshs 32.5 bn availed by the CBK to the Commercial Banks in March 2020, 43.5% of the funds were utilized with the Tourism, Real Estate, and Agricultural sector being the major beneficiaries. As a result of the adoption of the accommodative policy in 2020, commercial banks’ lending rates declined to 12.2% in February 2020 from 12.3% seen in December 2019. In our view, should the MPC continue to pursue an accommodative monetary policy in this tough operating environment, lending rates may remain constant on account of the bank’s credit pricing models, therefore, locking out borrowers from accessing credit.

Due to the low credit risk associated with Government securities, the value of their stream of future cash payments is simply a function of the investors required return based on the inflation expectations as inflation erodes the purchasing power of a bond's future cash flows. Put simply, the higher the current rate of inflation and the higher the (expected) future rates of inflation, the higher the yields will rise across the yield curve, as investors will demand this higher yield to compensate for inflation risk. Inflation in the country is expected to remain stable and within the government target of 2.5%-7.5% and as such this might aid in mitigating the upwards readjustment of Government securities as investors will not be attaching a higher premium to meet their required real rate of return.

Outlook:

|

Driver |

Outlook |

Effect on Interest Rates |

|

Fiscal Policies |

|

Negative |

|

Monetary Policy |

|

Neutral |

|

Liquidity |

|

Negative |

From the above basis, 2 of the drivers are negative (fiscal policies and liquidity) while 1 is neutral (monetary policy). We, therefore, expect upward pressure on rates in the coming months.

Section V: Conclusion and our view going forward

Based on the factors discussed above and factoring the adverse effects the ongoing Coronavirus pandemic on the Kenyan economy,

- We expect the Kenyan shilling to depreciate by 5.5% by the end of 2020 on a YTD basis on account of:

- Reduced exports earning due to the lockdown measures put in place by Kenya’s trade partners in the wake of the Coronavirus pandemic. The trade disruptions will see the cost of imports rise thereby widening the current account deficit,

- Declining diaspora remittances that have been brought about by reduced economic activity, the decline in disposable income, and the increasing cost of goods will see the forex decline. In turn, the shilling will be exposed to foreign exchange shocks due to lowered forex exchange reserves, and,

- High levels of government debt that has widened Kenya’s fiscal deficit, thus making it hard for the government to access foreign debt as investors attach a high-risk premium on the country.

- We expect a slight upward readjustment on the yield curve with our sentiments being on the back of:

- Increased pressure on the government to plunge in the budget deficit by meeting its increased domestic borrowing. There is a probability that the government will accept expensive bids and in turn destabilize the interest rate environment,

- Investors will demand higher yields to compensate for inflation and as such, as investors will attach a high-risk premium to meet their required real rate of return, and,

- Despite the increased liquidity in the country, banks will not be willing to lend to the private sector, and as such, the excess liquidity will be channeled back to government securities.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.