Apr 5, 2020

During Q1’2020, we tracked Kenya 2020 GDP growth projections released by 11 organizations, that comprised of research houses, global agencies, and government organizations. At the beginning of the quarter the average growth rate was projected to be 6.0% but due to the novel Coronavirus pandemic, economic growth is expected to decline due to reduced demand by Kenya’s main trading partners and disruptions of supply chains and domestic production. Based on the impact on other economies, Cytonn Investments, have also reduced Kenya’s forecasted GDP growth. Based on the impact on other economies, we believe that Coronavirus may have a 10.0% to 25.0% impact on GDP growth for the year 2020. The 10.0% impact is an optimistic case in the event the outbreak is contained, and a 25.0% impact in the event it is not contained. As such, the Coronavirus could reduce Kenya’s GDP growth to 4.3% for the year 2020 depending on the severity of the outbreak and economic implications for Kenya. The Central Bank of Kenya also reduced the 2020 forecasted economic growth rate from a baseline estimate of 6.4% to 3.4%. The table below shows GDP projections from 11 firms with the consensus GDP growth as per the 11 firms below expected to come in at 5.2%.

However, we expect this growth rate to be revised downwards as global research houses downgrade their GDP growth estimates for 2020 once they factor in the economic impact of Coronavirus.

|

Kenya 2020 Annual GDP Growth Outlook |

|||

|

No. |

Organization |

Q1’2020* |

Q1’2020** |

|

1. |

Citigroup Global Markets |

6.2% |

6.2% |

|

2. |

International Monetary Fund |

6.0% |

6.0% |

|

3. |

African Development Bank |

6.0% |

6.0% |

|

4. |

World Bank |

6.0% |

6.0% |

|

5. |

National Treasury |

6.0% |

6.0% |

|

6. |

African Development Bank (AfDB) |

6.0% |

6.0% |

|

7. |

Capital Economics |

5.9% |

5.9% |

|

8. |

United Nations Conference on Trade and Development (UNCTAD) |

5.5% |

5.5% |

|

9. |

Cytonn Investments Management PLC** |

5.7% |

4.3% |

|

10. |

Central Bank of Kenya** |

6.2% |

3.4% |

|

11. |

McKinsey & Company *** |

5.2% |

1.9% |

|

|

Average |

5.9% |

5.2% |

|

*As at the beginning of the year **Revised GDP Growth **Revised GDP Growth |

|||

Inflation:

The average inflation rate rose to 6.1% in Q1’2020 as compared to 4.4% in a similar period in 2019. During the month of March, the Kenya National Bureau of Statistics (KNBS), revised the commodity basket and included several items such as mobile phone airtime, pay-tv, and garbage collection while dropping several archaic items such as radio and video cassettes. The revision was in a bid to reflect the true cost of living due to increased urbanization and the expanding middle-class population. The revision brings the number of items included in the commodity basket to 330, from 234 items previously, while data collection zones have increased from the previous 25 to 50. The KNBS also adjusted the weighting assigned to items in the commodity basket such as the Food and Non-Alcoholic Beverages, Alcoholic Beverages, Tobacco and Narcotics, and Transport Indices, which previously had a weighting of 36.0%, 2.1%, and 8.7%, respectively, to 32.9%, 3.3%, and 9.7%, respectively.

Inflation for the month of March came in at 6.1% with the m/m inflation increased marginally by 0.2%. The increase in the month-on-month inflation in March was mainly due to:

- A 0.6% increase in the food and non-alcoholic beverage index, driven by increases in prices of some food items such as Mangoes, Irish Potatoes, onions and cooking oils which increased by 5.4%, 2.3%, 2.1%, and 0.8%, respectively.

- A 0.1% decrease in transport cost driven by a 1.3% decline in pump prices for petrol, and

- A marginal decline (0.02%) in Housing, Water, Electricity, Gas and Other Fuels Index stimulated by a 2.2% decrease in prices of cooking fuels which offset the 0.9% increase in house rent.

|

Major Inflation Changes – March 2020 |

|||

|

Broad Commodity Group |

Price change m/m (March-20/Feb-20) |

Price change y/y (March-20/March-19) |

Reason |

|

Food & Non-Alcoholic Beverages |

0.6% |

11.9% |

The m/m decline was due to an increase in prices of some foodstuffs for instance Mangoes, Irish Potatoes, onions and cooking oils |

|

Transport Cost |

(0.1%) |

5.5% |

The m/m decline was mainly on account of a decrease in pump prices of petrol |

|

Housing, Water, Electricity, Gas and other Fuels |

(0.02%) |

4.5% |

The m/m marginal decline was as a result of a decrease in prices of cooking fuels which offset the increase in house rent |

|

Overall Inflation |

0.2% |

6.1% |

The m/m increase was due to a 0.6% increase in the food index which has a revised CPI weight of 32.9% |

The Kenya Shilling:

The Kenya Shilling depreciated against the US Dollar by 3.3% in Q1’2020, to close at Kshs 104.7, from Kshs 101.3 at the end of Q4’2019 attributable to the persistent worries about the impact of the Coronavirus outbreak on export earnings, prompting CBK to sell dollars to limit the losses. During the week, the Kenya Shilling depreciated against the US Dollar by 0.5% to close at 105.7 from 105.1, the previous week. We expect depreciation of the shilling in 2020 as a result of:

- Rising uncertainties in the global market due to the Coronavirus outbreak, which has seen the disruption of global supply chains. The shortage of imports from China for instance, which accounts for an estimated 21.0% of the country’s imports, is likely to cause local importers to look for alternative import markets, which may be more expensive and as such higher demand for the dollar from merchandise importers, and,

- Subdued diaspora remittances growth following the close of the 10.0% tax amnesty window in July 2019. We also foresee reduced diaspora remittances, owing to the decline in economic activities globally hence a reduction in disposable incomes. This coupled with increased prices of household items abroad might see a reduction in money expatriated into the country.

The shilling is however expected to be supported by:

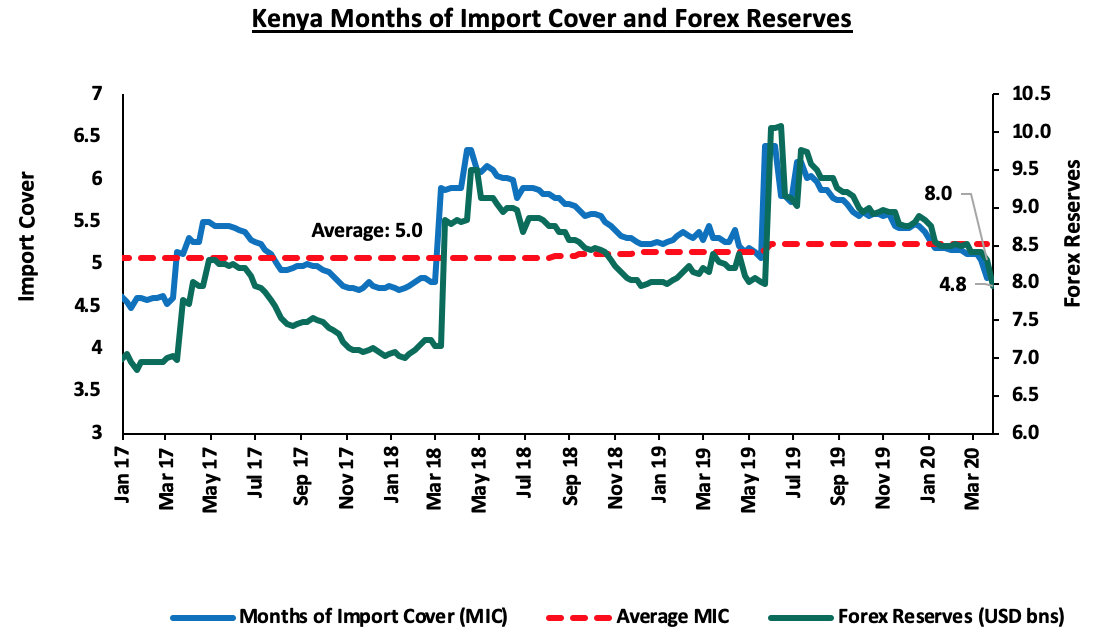

- High levels of forex reserves, currently at USD 7.9 bn (equivalent to 4.8-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover, and,

- CBK’s supportive activities in the money markets, with the Central Bank of Kenya (CBK) having already indicated that it’s looking to purchase USD 400.0 mn from banks for four months beginning from March to bolster the forex reserves.

Monetary Policy:

The Monetary Policy Committee (MPC) met twice in Q1’2020, cutting the Central Bank Rate (CBR) by 125 bps cumulatively to 7.25%. In the January 27th meeting, the committee cut the CBR by 25 bps noting that inflation expectations were well anchored within the target range of 2.5% - 7.5% and that the economy was operating below its potential level, not in line with our expectations where we had expected the MPC to maintain the CBR at 8.5%. This was evidenced by;

- Improving private sector credit growth, despite being below historical averages, coming in at 7.1% in the 12-months to December. Strong growth in credit to the private sector was being observed in the consumer durables (26.0%), manufacturing (9.2%) and trade (8.9%), and,

- Stability in the foreign exchange market supported by the narrowing of the current account deficit to 4.6% of GDP in 2019, from 5.0% in 2018, driven by strong receipts from transport and tourism services, resilient diaspora remittances and lower imports of food and SGR related equipment. The foreign exchange market has also been supported by adequate forex reserves currently at USD 8.5 bn (equivalent to 5.2-months of import cover), that continue to provide adequate cover and a buffer against short-term shocks in the foreign exchange market.

For more information, see our note on Monetary Policy Committee Meeting for January 2020.

In the March 23rd meeting, the committee cut the CBR by 100 bps, a move to help mitigate the economic and financial impact of the COVID-19 health crisis, in line with our expectations. The MPC noted that the effects of the virus are already being felt in the economy as evidenced by:

- Volatility in the foreign exchange market driven by uncertainties concerning the impact of COVID-19 as evidenced by the recent downward trend of the shilling,

- Economic growth, which is expected to decline from a baseline estimate of 6.4% to 3.4% as per the Central Bank of Kenya, attributable to reduced demand by Kenya’s main trading partners, disruptions of supply chains and domestic production caused by COVID-19 pandemic.

For more information see our note on Monetary Policy Committee Meeting for March 2020. As such, the MPC concluded that due to the adverse economic outlook attributable to the COVID-19 health crisis, it will ensure that the interbank market and liquidity management across the sector continue to function smoothly. The committee also pointed out that it will closely monitor the impact of this change and therefore, reconvene after a month for an early assessment of the COVID-19 pandemic.

Q1’2020 Highlights:

- The Treasury released the Draft 2020 Budget Policy Statement, which highlights the current performance of the country’s economy and gives a medium-term outlook, in preparation for the FY2020/21 Budget for comments from the general public. The Budget Policy Statement (BPS) is a government policy document that sets out the strategic priorities, policy targets as well as a summary of the government’s spending plans in preparation for the FY 2020/21 Budget. For more information, see our Cytonn Weekly #04/2020,

- Moody’s Credit Agency released an update highlighting Kenya’s international creditworthiness. Kenya’s rating by the agency was maintained at B2 with a stable outlook, on the back of relative diversification of the economy and moderate economic strength. The agency, however, warned that Kenya’s debt burden coupled with poor revenue collection may negatively affect the country’s credit rating. For more information, see our Cytonn Weekly #08/2020,

- The Central Bank of Kenya (CBK), under Sections 9 and 51 of the CBK Act and following approval by the CBK Board, announced that it has transferred Kshs 7.4 bn from its General Reserve Fund to the Government Consolidated Fund in support of the fight against Coronavirus. For more information, see our Cytonn Weekly #12/2020,

- According to Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI), released earlier during the week, the economy suffered another difficult month with a sharp decline in business activities leading to a steep fall in total sales. The seasonally adjusted PMI came in at 37.5 in March, a 29- month low and a sharp decline from 49.0 in February 2020. A PMI reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. The downturn in business was widely due to the outbreak of coronavirus in the country. The sharper decline in new business saw export demand drop due to low demand by foreign clients with many customers cancelling their orders due to the uncertainty surrounding the coronavirus. The decline in business caused a decline in employment with demand for inputs falling rapidly as well. Most businesses also highlighted that raw materials were in short supply during the month mainly attributable to the lockdown in China where most businesses source their inputs from. The report, however, noted that the overall level of sentiment in the Kenyan private sector remained strong, despite the impact of the pandemic.

Macroeconomic Indicators Table:

|

Macro-Economic & Business Environment Outlook |

|||

|

Macro-Economic Indicators |

YTD 2020 Experience and Outlook Going Forward |

Outlook at the Beginning of the Year |

Current outlook |

|

Government Borrowing |

|

Negative |

Negative |

|

Exchange Rate |

|

Neutral |

Negative |

|

Interest Rates |

|

Neutral |

Negative |

|

Inflation |

|

Positive |

Neutral |

|

GDP |

|

Neutral |

Negative |

|

|||

|

Investor Sentiment |

|

Positive |

Neutral |

|

Security |

|

Positive |

Positive |

Of the 7 indicators we track, 1 is positive, 2 are neutral and 4 are negative with changes in GDP, interest rates, and currency which were neutral at the beginning of the year and now negative and inflation and investor sentiment which were positive and now neutral. We have switched our outlook on 2020 macroeconomic environment from positive to negative depending on how fast the Coronavirus is contained. Based on the impact on other economies, we believe that Coronavirus may have a 10.0% to 25.0% impact on GDP growth for the year.