Oct 20, 2019

This week, we revisit the interest rate cap topic following the recommendation by President Uhuru Kenyatta to repeal the Interest Rate Cap, in a memorandum to Parliament in which he declined to assent the Finance Bill, 2019 into law. This is the strongest directive thus far by the government on the repeal of the interest rate cap and could mark the abolishment of the current regulated loan-pricing framework.

We, therefore, revisit the issue of the interest rate cap, focusing on:

- Background of the Interest Rate Cap Legislation - What Led to Its Enactment?

- A Recap on Our Analysis on the Subject

- A Review of the Effects It Has Had So Far in Kenya

- Recent Developments

- Next Steps, Options for the Legislature on the Finance Bill, 2019, and

- Our Views, Expectations, and Conclusion

Section I: Introduction

- Background of the Interest Rate Cap Legislation - What Led to Its Enactment?

The enactment of the Banking (Amendment) Act 2015 in September 2016, that capped lending rates at 4.0% above the Central Bank Rate (CBR), and deposit rates at 70.0% of the CBR, came against a backdrop of low trust in the Kenyan banking sector due to various reasons:

- The total cost of credit was high at approximately 21.0% per annum, yet on the other hand, the interest earned on deposits placed in banks was low, at approximately 5.0% per annum,

- Calls for capping interest rates were based on the high profitability in the banking sector because of high spreads between lending rates and deposits rates, which in 2016 was at a high of 9.5%. As a result, in 2016, the Return on Equity of Kenyan banks stood at 24.5% above the 5-year SSA average of 15.4%. The Return on Assets, on the other hand, stood at 3.1% above the 5-year SSA average of 1.5%, and,

- The period was marred with several failures of banks such as Chase Bank Limited, Imperial Bank Limited and Dubai Bank, due to failures in corporate governance. The failure of these banks rendered depositors helpless and unable to access their deposits in these banks, leading to public sentiment that something had to be done to the banking sector.

Section II. A Recap on Our Analysis on the Subject

Our view has always been that the interest rate cap regime would have an adverse effect on the economy and by extension to Kenyans, and as popular as they are, they needed to be repealed. We have previously written about this in eight focus notes, namely:

- Interest Rate Cap is Kenya's Brexit- Popular But Unwise, dated 21st August 2016, highlighted our view that the interest rate cap would have a clear negative impact on the economy. We noted that free markets tend to be strongly correlated with stronger economic growth, emphasized by the lack of compelling evidence of an economy where interest rate capping was successful, as evidenced by the World Bank report on the capping of interest rates in 76 countries around the world. In Zambia, for example, interest rate caps were introduced in December 2012 and repealed 3-years later, in November 2015, after the impact was found to be detrimental to the economy. We called for the implementation of a strong consumer protection agency and framework, coupled with the promotion of initiatives for competing for alternative products and channels. Below is a schedule of examples in Africa and what became of the rate caps:

|

Status of Interest Rate Caps in Sub Saharan Africa |

||

|

Country |

Year Implemented |

Status |

|

1. West Africa Economic & Monetary Union (WEAMU) |

1997 |

Still in effect with maximum interest rates chargeable by banks & MFIs |

|

2. Ethiopia |

1998 |

Still in effect for minimum deposit rates |

|

3. South Africa |

2007 |

Still in effect for different loan sub-categories with their own interest rates |

|

4. Zambia |

2012 |

Abolished capping in 2015 |

|

5. Monetary Community of Central Africa (CEMAC) |

2012 |

Still in effect with maximum interest rates chargeable by MFIs |

|

6. Kenya |

2016 |

Still in effect with maximum interest rates chargeable by banks |

|

7. Nigeria |

2017 |

Maximum cap on bank mortgages removed in September 2019 |

- Our second topical, Impact of the Interest Rate Cap, dated 28th August 2016, four days after the interest rate cap bill was signed into law, highlighted the immediate effects of the interest rate cap, as banking stocks lost 15.6% in 2-days. Here, we re-iterated our stance on the negative effects of the interest rate cap, while identifying the winners and losers of the Banking (Amendment) Act, 2015. Indeed, we had predicted wrongly, that the President would never sign the rate cap Act into law, we were surprised that he did and we are glad that he is now reversing it.

- The State of Interest Rate Cap, dated 14th May 2017, 9-months after the interest rate cap was signed into law. We assessed the interest rate cap and its effects on private sector credit growth, the banking sector, and the economy in general, following concerns raised by the IMF. We noted that the law had the effect of (i) inhibiting access to credit by SMEs and other “small borrowers” whom banks cited as being “risky”, and were unable to be fitted within the 4.0% margin imposed by the Law, and (ii) contributed to subduing of private sector credit growth, which was recorded at 4.0% in March 2017. We suggested that policymakers review the legislation, highlighting that there existed, and continues to exist, opportunities for structured financial products and private equity players to come in and provide capital for SMEs and other businesses to grow, and consequently improve private sector credit growth.

- In the Update of Effect on Interest Rate Caps on Credit Growth and Cost of Credit, dated 23rd July 2017, approximately 1-year after the Banking (Amendment) Act 2015 was signed into law, we analyzed, on the back of the rate cap, the decline in private sector credit growth and lending by commercial banks, coupled with the elevated total cost of credit, which was higher than the legislated 14.0%, as banks loaded excessive additional charges, while noting that the large banks, which control a substantial amount of the banking sector loan portfolio, were the most expensive. We suggested (i) a repeal or modification of the interest rate cap, (ii) increased transparency on credit pricing, (iii) improved and more accommodating regulation, (iv) consumer education, (v) diversification of funding sources into alternatives, and (vi) enhanced consumer protection agencies. More still needs to be done in terms of addressing consumer protection and diversifying sources of funding.

- In our note titled The Total Cost of Credit Post Rate Cap, dated 14th January 2018, we analyzed the true cost of credit, the initiatives put in place to make credit cheaper and more accessible, the impact of the interest rate cap on private sector credit growth, and we gave our view on what more can be done to remedy the effects of the interest rate cap, which included to implement strong consumer protection agencies and frameworks, and to diversify funding sources to include alternative products and channels.

- In Rate Cap Review Should Focus More on Stimulating Capital Markets, dated 13th May 2018, we revisited the interest rate cap following an announcement by the Treasury that they were in the process of completing a draft proposal that will address credit management in the economy, where we gave our views on how promoting competing sources of financing would lead to a self-pricing regulatory structure, which would effectively reduce credit prices, as opposed to relying on bank funding.

- In our note on the Status of the Rate Cap Review in Finance Bill 2018, 26th August 2018, we revisited the interest rate cap topic following the proposed amendments to the Finance Bill, 2018, tabled by the Parliamentary Committee on Finance and Planning in the National Assembly during its second reading. In this focus, we highlighted that legislation and policies to promote competing sources of financing should be the centerpiece of the repeal legislation.

In our focus note Review of the Interest Rate Cap, dated 23rd June 2019, we revisited the interest rate cap topic following the proposal by the National Treasury Cabinet Secretary, Mr. Henry Rotich, in the Budget reading for the 2019/20 fiscal year, to repeal Section 33B of the Banking Act, which was included in the Finance Bill, 2019. In this focus, we discussed policy measures that can protect borrowers from excessive interest rates, including consumer education and protection measures, as well as promoting capital markets infrastructure to spur competition in the credit market through non-bank funding.

Section III: A Review of the Effects It Has Had So Far in Kenya

The interest rate cap has had the following five key effects to Kenya’s Economy since its enactment, most of them clearly negative, save for spurring alternative financial services channels, which we believe will have long-term positive effects:

- Private Sector Credit Crunch

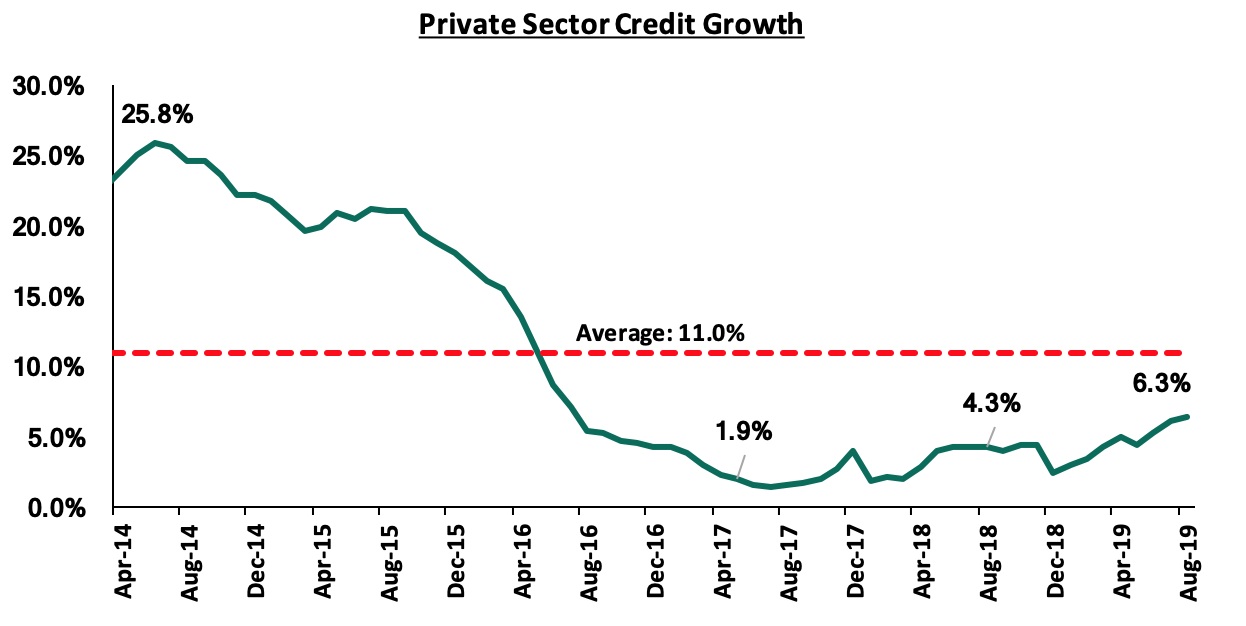

Private sector credit growth in Kenya has been declining, and the enactment of the Banking (Amendment) Act 2015, had the adverse effect of further subduing credit growth. In the first year following the introduction of the interest rate capping, the stock of credit to MSMEs declined sharply by 10% y/y on account of difficulty for banks to price the SMEs within the set margins, as they were perceived “risky borrowers”. Banks thus invested in asset classes with higher returns on a risk-adjusted basis, such as government securities. Lending to the public sector increased sharply with a growth of over 25% y/y over the same period. Private sector credit growth touched a high of 25.8% in June 2014, and averaged 11.0% over the last five-years, but dropped to below 5.0% after the implementation of interest rates controls, rising slightly to 6.3% in August 2019. The chart below highlights the trend in private sector credit growth.

- Loan Accessibility Reduced

Following the enactment of the Banking (Amendment) Act, 2015, banks recorded a rise in demand for loans, as did the number of loan applications, which increased by 20.0% in Q4’2016, according to the CBK Credit Officer Survey of October-December 2016. This was on account of borrowers attempting to access cheaper credit. However, the supply of loans by banks did not meet this rise in demand as evidenced by:

- Reduced Loan Growth: According to the Bank Supervision Annual Report 2017, the Net Loan growth declined since the implementation of the interest rate cap law, having come from a growth of 11.2% in 2015 to a decline of 7.7% as at December 2017.

- The Decline in the Number of Loan Accounts: The number of loan accounts in large banks (Tier I) declined by 27.8%, the largest among the three tiers, followed by Tier II banks with a decline of 11.1% between October 2016 and June 2017,

- Increase in Average Loan Size: Despite a 26.1% decline in the industry’s number of loan accounts between October 2016 and June 2017, the average loan size increased by 36.0% to Kshs 548,000, from Kshs 402,000 between October 2016 and June 2017. This points to lower credit access by smaller borrowers, while also demonstrating that credit was extended to larger and more “secure” borrowers, and,

- Decrease in Average Loan Tenures: The average loan tenure declined by 50.0% to 18-24 months compared to 36-48 months prior to the introduction of the interest rate cap. This is due to bank’s increasing their sensitivity to risk, thereby opting to extend only short-term and secured lending facilities to borrowers, rather than longer-term loans to be used for investments, according to the latest survey by the Kenya Bankers Association (KBA) on the effects of the Banking (Amendment) Act, 2015.

- Banks’ Changed their Operating Models to Mitigate the Effects of the Rate Cap Legislation

The enactment of the Banking (Amendment) Act, 2015, saw banks changing their business and operating models to compensate for reduced interest income (their major source of income) as a result of the capped interest rates. Thus, banks adapted to this tough operating environment by adopting new operating models through:

- Increased Focus on Non-Funded Income (NFI): This is evidenced by the fact that the proportion of non-interest income to total income stood at 28.4% in September 2016, and has risen to the current average of 37.2%, for listed commercial banks in H1’2019,

- Increased Lending to the Government Rather than Individuals and the Private Sector: This is evidenced by the growth in allocations to government securities by 15.1% in the year after implementing the interest rate cap, compared to the 7.7% decline in loans, as government securities rose to 24.9% of total banking sector assets in FY’2017, from 23.4% prior to the caps. This trend has persisted, with allocation to government securities rising by 12.1% as at H1’2019, faster than the 9.8% growth in loan allocations, given the higher risk-adjusted returns offered by government debt.

- Cost Rationalization: Banks also stepped up their cost rationalization efforts by increasing the use of alternative channels by mainly leveraging on technology such as mobile money and digital banking to improve efficiency and consequently reduce costs associated with the traditional brick and mortar approach. This led to the closure of branches and staff layoffs in a bid to retain the profit margins in the tough operating environment, due to depressed interest income, and,

- Focus on Niche Segments: The implementation of the law saw the larger banks venture into the small banks’ niche markets such as Small and Medium Enterprises (SMEs) banking, and consequently, most of the Tier II and Tier III banks have struggled to operate. The smaller banks have witnessed declining top-line revenue, leading to increased operational inefficiency, and operating losses; this has led to depleted capital, spurring an increase in the consolidation activity in the banking sector, which has seen smaller banks struggling to operate being acquired, merging or forming strategic relationships with larger banks in order to leverage on the synergies created.

- The Proliferation of Alternative Credit Markets

As a result of the private sector credit crunch, there was a rapid rise in the alternative credit markets as evidenced by the Mobile Financial Services (MFS) rising to become the preferred method to access financial services in 2019, with 79.4% of the adult population using the channels, up from 71.4% in 2016. According to Global Digital, in 2018 there were about 6.1 mn digital borrowers in the country coupled with 28.3 mn unique mobile users. Players in this segment charge exorbitant interest rates, e.g. M-Shwari charges a facilitation fee of 7.5% on amounts borrowed, and an interest rate of 90% when annualized, while Tala and Branch offer varying rates depending on the repayment period with a month’s loans offered at a rate of 15.0%, and the annualized rates vary between 132% and 152%. While the immediate effects of these alternative channels have been predatory, we believe that the investments and progress made in developing the alternative channels will have positive long-term impact as an alternative financial services channel once the sector becomes regulated.

- Reduced Effectiveness of the Monetary Policy

The introduction of interest rate controls has made it difficult for the CBK to adjust the monetary policy rates in response to economic developments. Before the interest rates were capped, the CBK was able to adjust the Central Bank Rate (CBR) in relation to changes in inflation and growth. This is mainly because any alteration to the CBR would directly affect credit conditions. Expansionary monetary policy is difficult to implement since lowering the CBR has the effect of lowering the lending rates and as a consequence, banks find it even more difficult to price for risk at the lower interest rates, leading to pricing out of even more risky borrowers, and hence further reducing access to credit. On the other hand, if the CBK was to employ a contractionary monetary policy, so as to reduce inflation and credit growth for example, then raising the CBR would have the reverse effect of increasing the supply of credit in the economy since banks would be able to admit riskier borrowers.

Section IV: Recent Developments

- President declines to assent to the Finance Bill, 2019

The Finance Bill, 2019 was passed by the National Assembly on 26th September 2019, retaining the interest rate caps, and was presented to the President for assent, upon which it was to become law. The President has however declined to assent the Bill into Law, and instead sent the Bill back to Parliament with a recommendation to repeal the interest rate cap, citing the following reasons:

- Reduction of Credit to the Private Sector, Particularly the Micro, Small and Medium Enterprises (MSMEs). In the first year following the introduction of the interest rate cap, the stock of credit to MSMEs declined sharply by 10% y/y on account of difficulty for banks to price the SMEs within the set margins, as they were perceived “risky borrowers”. Most commercial banks adjusted their lending towards large corporates and the public sector.

- A Decline in Economic Growth. The crowding out of the private sector, especially the MSMEs is estimated to have lowered Kenya’s economic growth by 0.4% points in 2017, and 0.2% points in 2018, as Kenya’s GDP growth came in at 4.9% and 6.3% in 2017 and 2018, respectively.

- Weakening Effectiveness of Monetary Policy Transmission. A recent analysis by the CBK on the impact of interest rate capping showed a slowdown in the monetary policy transmission to growth and inflation. Monetary policy transmission takes 3-12 months to impact growth and 12-20 months to affect inflation, which is 3-5 months longer compared to the period before the introduction of interest rate capping. In addition, the analysis showed evidence of perverse outcomes following a monetary policy action, particularly a reduction in loan advances by some banks after a lowering of the Central Bank Rate (CBR), which is contrary to the expected outcome of an increase in credit extension after the adoption of expansionary monetary policy.

- Reduction in Loan Accessibility. Loan accessibility reduced following the introduction of the interest rate cap. According to the CBK’s Annual Banking Sector Supervision Report for 2017, loans and advances stood at Kshs 2.0 tn in FY’2017, a 7.7% decline from the Kshs 2.2 tn in loans at end of 2016. In addition, banks moved to increase the average loan size and decrease the average loan tenure, thus further lowering credit access to small borrowers. Furthermore, banks decreased the diversity of their loan products and withdrew lending to specific segments of the market.

- The Emergence of Shylocks and Other Unregulated Lenders. There was a rapid rise in the alternative credit markets as evidenced by the Mobile Financial Services (MFS) rising to become the preferred method to access financial services in 2019, with 79.4% of the adult population using the channels up from 71.4% in 2016. These unregulated lenders have taken advantage of the situation under the capped interest rates to lend to borrowers at exorbitant interest rates e.g. M-Shwari charges a facilitation fee of 7.5%, while Tala and Branch offer varying rates depending on the repayment period with a month’s loans offered at a rate of 15.0%, which are very expensive when annualized.

The President noted that the capping of interest rates had not met its intended objective particularly in expanding credit access. In the memorandum to Parliament, the President also noted that the negative effects from the capping of interest rates had curtailed the government’s efforts at addressing the concerns of affordability and availability of credit from banks especially to the vulnerable sectors including MSMEs, Women and Youth. The specific measures that the government and commercial banks have initiated aimed at supporting greater access to credit at affordable terms by the vulnerable sectors include:

- Targeted programs to the vulnerable sectors in the economy, particularly the Women and Youth Funds. This is in collaboration with various development partners,

- A review of banks’ business models to become more customer-centric, adhering to the Banking Sector Charter issued by the CBK in February 2019, which is anchored on the pillars of customer-centricity, risk-based pricing, transparency and ethics, and,

- Introduction of new innovative products targeting MSMEs that leverage on innovative technology, e.g. the Stawi product by four commercial banks, namely NCBA Group, KCB Group, Diamond Trust Bank, and Co-operative Bank of Kenya.

- Calls by Various Organizations to Repeal the Interest Rate Cap Law

- IMF

The International Monetary Fund backed the National Treasury and CBK’s call for the repeal of the interest rates cap law. The IMF working paper, Do Interest Rate Controls Work? Evidence from Kenya, termed the interest rate controls Kenya introduced in September 2016 as the most drastic measures ever imposed. According to the paper, the reduction of the interest rate spreads, which initially was intended to increase access to bank credit and boost the return on savings, seems to have the opposite effect, evidenced by:

- A sharp decline in bank credit to SMEs, particularly in trade and agriculture,

- A disproportional hit on lending activity and the profitability of small banks, and,

- Reduced financial intermediation, with commercial bank credit shifting away from the private sector and towards the public sector.

The paper also points out the reduced signaling effect of the policy rate as an indicator of the monetary policy stance due to the increased divergence of interbank rates from policy rates following the implementation of the interest rates cap. The paper proposed that consideration should be given to using other policy instruments, instead of interest rate controls, to increase financial access and address equity concerns related to the high profits of the banking sector.

- Kenya National Chamber of Commerce and Industry

The Kenya National Chamber of Commerce and Industry (KNCCI) has backed the proposal to repeal the commercial lending rate caps law with the view that that the removal of the cap will provide an added incentive to banks to loosen risk considerations before extending credit to SMEs, thus improving credit access by small businesses.

Section V: Next Steps, Options for the Legislature on the Finance Bill, 2019

President Uhuru Kenyatta declined to assent the Finance Bill, 2019 into Law, and recommended a repeal of Section 33 B, which pertains to the interest rate cap. Given that the President has referred the Finance Bill, 2019 back for reconsideration by Parliament, the next possible steps are referenced in Article 115 of the Constitution on Procedures for Enacting Legislation, Presidential Assent and Referral, as outlined below:

- Amend the Finance Bill, 2019 to Repeal Section 33 B.

If Parliament amends the Finance Bill, 2019 fully accommodating the President’s recommendation, Clause 45 of Section 33 B shall be repealed and deleted. This will do away with the interest rate capping, and the Speaker shall re-submit it to the President for assent.

- Pass the Bill a Second Time Without Amendment.

Parliament, after considering the President’s reservations, may pass the Finance Bill, 2019 a second time without amendments, or with amendments that do not fully incorporate the President’s changes. This has to be supported by two-thirds of members of the National Assembly, amounting to support from 233 Members of Parliament (MPs), out of the 349 MPs. As a result, if 233 MPs do not support the motion, the interest rate caps shall be repealed.

If Parliament passes the Finance Bill, 2019 without amendment, the Speaker shall within 7 days re-submit it to the President, who shall within 7 days assent to the Bill. In case of expiry of this period, the Bill shall be taken to have been assented.

Given the Finance Bill, 2019 is a critical legislation to be passed to ensure government revenues through the incorporation of additional tax measures, we do expect Parliament to move with haste to debate and vote on the recommendations.

Section VI: Our Views, Expectations, and Conclusion

The decision on whether to repeal the interest rate cap is now again in the hands of the lawmakers. Historically, the President’s reservations on Bills have been passed with minimal to no alteration. For instance, when the Finance Bill, 2018, was referred back to Parliament with the President recommending the introduction of a VAT charge on fuel, the general preference by MPs was to delay the tax to September 2020. MPs eventually passed the Bill with an amended lower rate of 8% as opposed to the intended 16%, and the Bill became law. However, given the high public interest around the interest rate capping and the vocal proponents supporting the interest rate cap, we expect heated discussions. MPs during the initial discussions and reading of the Finance Bill, 2019 expressed strong opinions towards why the cap should remain in place, among them being:

- Banks continue to record high profits, which is evidenced by the 9.0% increase in core earnings per share growth in H1’2019 for the listed banking sector, and,

- The high borrowing appetite by the government needs to reduce as it is crowding out funds to the private sector. In context, the government recently raised the debt ceiling to Kshs 9 tn, from a debt to GDP ratio target of 50.0%, indicating the growing appetite of the government for taking on additional debt. For more information on Kenya’s debt sustainability, please see our Debt Sustainability Note.

We do expect the executive to wield some political capital in order to convince MPs that repealing the interest rate cap is better overall for the economy. If the proposal to repeal the rate cap law is successful, we expect to see the following benefits accrue to the economy:

- Growth in Private Sector Credit: As of August 2019, the private sector credit growth rate stood at 6.3% according to the MPC market perception survey. With the repeal of the rate cap law, we expect that access to credit by Micro, Small and Medium Enterprises (MSMEs) will increase as banks will have sufficient margin to compensate for risks,

- Higher GDP Growth: Credit and economic growth are positively correlated and we expect that with increased access to credit by MSMEs, the economy is bound to expand as MSMEs make a significant contribution to the economy. According to data from the KNBS, Micro, Small and Medium Enterprises (MSMEs) 2016 survey, MSMEs account for approximately 28.4% of Kenya’s GDP, and,

- Increased Monetary Policy Effectiveness: With the repeal of the rate cap law, the Central Bank of Kenya will be free to adjust the monetary policy rate in response to economic developments such as inflation and growth.

In conclusion, the rate cap legislation should be repealed because a free market, where interest rates are set by the forces of demand and supply coupled with increased competition from non-bank financial institutions for funding, will see a competitive environment where the cost of credit reduces, as well as increase access to credit by borrowers that have been shunned under the current regulated loan-pricing framework.

However, after the repeal, we still recommend that we deal with two key outstanding issues of (i) Consumer Protection Against Abuse by Banks, and (ii) Promoting Competing Alternative Funding Channels.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.