Nov 25, 2018

The year 2018 is shaping up to be a year of stable economic growth, with the economy recovering from the effects of the previous year that slowed down economic growth, including prolonged drought and the protracted electioneering period. Kenya is one of the fastest growing economies in the Sub-Saharan Africa region, with GDP growth expected to average 5.5% in 2018, an increase from the 4.9% GDP growth recorded in 2017. By contrast, the International Monetary Fund (IMF) estimates the Sub Saharan African average economic growth to average 3.8% in 2018, from 3.1% in 2017.The table below highlights the GDP growth expectations from different bodies;

|

Kenya 2018 Annual GDP Growth Outlook |

|||||

|

No. |

Organization |

Q1'2018 |

Q2'2018 |

Q3'2018 |

Q4'2018 |

|

1 |

Central Bank of Kenya |

6.2% |

6.2% |

6.2% |

|

|

2 |

Kenya National Treasury |

5.8% |

5.8% |

5.8% |

|

|

3 |

Oxford Economics |

5.7% |

5.7% |

5.7% |

|

|

4 |

African Development Bank (AfDB) |

5.6% |

5.6% |

5.6% |

|

|

5 |

Stanbic Bank |

5.6% |

5.6% |

5.6% |

|

|

6 |

Citibank |

5.6% |

5.6% |

5.6% |

|

|

7 |

International Monetary Fund (IMF) |

5.5% |

5.5% |

5.5% |

|

|

8 |

World Bank |

5.5% |

5.5% |

5.5% |

5.7% |

|

9 |

Fitch Ratings |

5.5% |

5.5% |

5.5% |

|

|

10 |

Barclays Africa Group Limited |

5.5% |

5.5% |

5.5% |

|

|

11 |

Cytonn Investments Management Plc |

5.4% |

5.5% |

5.5% |

|

|

12 |

Focus Economics |

5.3% |

5.3% |

5.3% |

|

|

13 |

BMI Research |

5.3% |

5.2% |

5.2% |

|

|

14 |

The Institute of Chartered Accountants in England and Wales |

|

5.6% |

5.6% |

|

|

15 |

Standard Chartered |

4.6% |

4.6% |

4.6% |

|

|

|

Average |

5.5% |

5.5% |

5.5% |

5.7% |

In this weekly focus, we seek to review the performance of economic environment in Kenya, the fiscal and monetary policies in place, as well as other factors affecting the country’s economic growth and our view on the way forward. As such, we shall discuss the following items:

- Analysis of the economy, where we shall examine the Gross Domestic Product (GDP) growth for the first half of the year, in comparison with last year’s economic performance,

- A review of the fiscal and monetary policies in place, and how they have contributed to economic growth during the review period. Here, we shall look at factors such as interest rates, public debt, private sector credit growth and the recent tax reforms,

- Other factors affecting the economic environment, including socio-political issues, ease of doing business, security and investor sentiment, and,

- Our view and way forward.

Section I: Economic Overview

The country's Gross Domestic Product (GDP), adjusted for inflation, has been on the rise in 2018 having expanded by 5.7% in Q1’2018 and 6.3% in Q2’2018, higher than the 4.8% and 4.7% growth in similar periods the previous year, respectively. The improved growth has been against a backdrop of a stable macroeconomic environment, driven by:

A recovery in agriculture, which saw the sector record a growth of 5.2% and 5.6% in Q1’2018 and Q2’2018, respectively, due to improved weather conditions. In terms of sectoral contribution, agriculture remains the highest contributor coming in at 25.5% and 23.2% in Q1’2018 and Q2’2018, respectively,Improved business and consumer confidence, evidenced by the Stanbic Bank’s Monthly Purchasing Managers Index (PMI), which has averaged 54.5 in the 10-months to October 2018, a rise from 46.4, recorded in a similar period in 2017. Key to note, a PMI reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. The improvement in the business environment has also been facilitated by the improved ease of doing business, which saw Kenya’s rank improved by 19 positions to #61 from #80 as per the World Bank Doing Business Report 2019 as highlighted in our Analysis of Kenya’s Doing Business Environment. This was mainly driven by improvements in protection of minority investors, getting credit and resolving insolvency, and,Increased output in the real estate, manufacturing, and wholesale & retail trade sectors, which grew by 6.6%, 3.1% and 7.7%, respectively, and favorable weather conditions that positively affected output from agricultural and hydroelectricity activities.

Analysis by sector showed that there was accelerated growth in the manufacturing sector, though the major concern was on its declining sectoral contribution to GDP, recording a 9.6% contribution in both quarters from 9.9% in Q2’2017. This is despite the Kenyan Government singling it out as one of the key pillars to drive the economy in the Big 4 Agenda. The sector’s contribution is still way below the government’s target of increasing it to 15.0% of GDP by 2022, which is expected to increase manufacturing sector jobs by more than 800,000 per annum over the next four years.

Section II: Review of the Fiscal and Monetary Policy

In this section, we examine the monetary and fiscal policies put in place by the Central Bank as well as the Treasury, and how they affected macroeconomic fundamentals in the country.

- Fiscal Policy

Kenya’s fiscal policy has been expansionary over the years as the country’s economic growth is mainly reliant on government spending, which has seen the expenditure side exceeding the revenue collections, leading to the budget deficits, which have been plugged in by borrowing. In the FY’2018/2019 budget, the government was keen on fiscal consolidation as a key agenda in order to narrow the fiscal deficit to 5.7% of GDP, from the 6.8% recorded in FY’2017/2018, which was below the 7.2% target; and in effect stabilize the Debt-to-GDP ratio (currently at 52.2%) to below 50.0%. The government aimed to implement this through revenue enhancement measures in the form of introduction of new tax policies that included:

- The introduction of 8.0% VAT on petroleum products, which was lowered from the planned 16.0%, as from September 2018,

- The Housing Development Fund Levy that requires workers in formal employment to submit 0.5% of their gross salary towards a National Fund for Affordable Housing, with employers required to match employee’s contribution,

- Increase in excise tax on mobile money transactions to 12.0% from 10.0%,

- Increase in excise duty for cars above 2,500cc to 30.0% from 20.0%, and,

- Capital gains tax of 5.0% on property transfers by insurance firms.

The Government also aimed at strengthening expenditure control and improving the efficiency of public spending through public financial management reforms and various austerity measures. This was in a bid to free fiscal space for priority social and economic projects, such as the affordable housing and universal healthcare initiatives.

According to the Q1’2018/2019 budget outturn numbers, the government managed to meet 83.5% of its revenue target, with the main issue having been the delay of implementation of the new tax measures. The expenditure side however, continued to grow faster, recording a 9.8% growth, compared to the 5.9% growth in revenue collection, but lower than the targeted Kshs 502.9 bn, with the government spending Kshs 452.5 bn, which was 90.0% of its budget. The faster growth in expenditure compared to the revenues led to widening of the fiscal deficit to Kshs 82.9 bn, or 0.8% of GDP in Q1’2018/2019, from Kshs 65.1 bn, translating to 0.7% of GDP in Q1’2017/2018. This, in effect, has led to increased total government borrowing, both foreign and domestic to plug in the deficit, with domestic borrowing having increased by 40.7% to Kshs 69.2 bn from Kshs 49.2 bn in Q1’2017/2018, while foreign borrowing has increased by 124.0% to Kshs 16.8 bn, from Kshs 7.5 bn in Q1’2017/2018.

According to the Treasury, the gross public debt as at 30th September 2018 was Kshs 5.0 tn as compared to Kshs 4.5 tn as of 30th September 2017, with external debt comprising 52.0% (Kshs 2.6 tn) and domestic debt taking up 48.0% of the total debt (Kshs 2.4 tn) by end September 2018. Of the external debt obligations, 30.6% is owed to bilateral institutions; 35.4% to multilateral institutions, and 33.3% and 0.7% of debt owed to commercial banks and suppliers’ credit, respectively. The Debt-to-GDP ratio as at FY’2017/2018 increased to 52.2%, from 47.9% in FY’2016/2017, attributed to external loan disbursements and the uptake of domestic debt during the period. This led to the International Monetary Fund (IMF) raising the risk of Kenya’s debt distress from low to moderate in October 2018. We maintain our view that, in order to reduce our debt levels in line with the IMF sustainable levels, the government should consider achieving:

- Enhanced tax revenue collection growth by increasing the tax base as well as introducing Value Added Tax (VAT) on fuel products,

- Involve private sector in development through Public-Private Partnerships (PPP’s), and,

- Reduce recurrent expenditure and improve on development budget absorption rates.

2. Monetary Policy

On the monetary policy front, the direction this year has been expansionary, with the Monetary Policy Committee having lowered the Central Bank Rate (CBR) twice, in the 5 meetings held so far in order to support economic activity, citing that economic output was below its potential level, and there was room for further accommodative monetary policy. During their meeting in March 2018, the MPC lowered the CBR to 9.5% from the earlier 10.0% that had been set in September 2016. The MPC later lowered the CBR by another 50 bps during their July 2018 meeting to 9.0%, from the 9.5% set in March 2018. The decision by the MPC to lower the CBR this year has mainly been guided by:

- Inflation: Inflationary pressure has been relatively muted in 2018, with y/y inflation having averaged 4.5% in the 10-months to October, down from 8.7% recorded in a similar period in 2017, and well within the 2.5% - 7.5% government set target. The decline has mainly driven by a decline in the food prices on the back of improved food production due to improved weather conditions, which has mitigated the rise in fuel prices and other Consumer Price Index (CPI) components. Inflation in the remaining part of the year is expected to experience upward pressure due to the various tax amendments as per the Finance Bill 2018, but at a lower rate than earlier anticipated. This is due to the reduction of the VAT charge on fuel to 8.0% from 16.0% effective 21st September 2018, affirming our expectations of a 7.0% inflation rate for the year from 8.0% last year, averaging within the government’s set target of 2.5% - 7.5%.

- Exchange Rates and Forex Reserves: The Kenya Shilling remained relatively stable during the year, which saw the IMF reclassifying Kenya from a floating arrangement to stabilized arrangement, in their Annual Report on Exchange Arrangements and Exchange Restrictions released on 30th April 2018. The classification of the arrangement is primarily based on the degree to which the exchange rate is determined by the market rather than by official action. For a country to be classified as a stabilized arrangement, the market exchange rate should remain within a margin of 2.0% for 6-months or more with respect to a single currency or a basket of currencies, thus showing the stability of the Kenyan Shilling. Against the US Dollar, the exchange rate has remained relatively stable, exchanging at Kshs 103.2 in November 2018 from Kshs 103.7 in November 2017. The stability is on the backdrop of strong inflows from coffee and horticultural exports, resilient diaspora remittances as well as improved receipts from services such as tourism. The volatility of the Kenyan Shilling has also been cushioned by Central Bank’s efforts to pump dollars into the market, which has seen the forex reserves decline by 4.4% to USD 8.1 bn, from USD 8.4 bn since the last MPC meeting in September 2018. Despite the decline, forex reserves remain high with an average of 5.1 months of import cover, well above the optimal level of reserves for Kenya as per the IMF, set at 3.5-months of import cover. The ongoing prospects of the Treasury issuing another Eurobond could also eliminate the need for tightening the monetary policy, as it will enhance the forex reserves, thus cushioning the shilling.

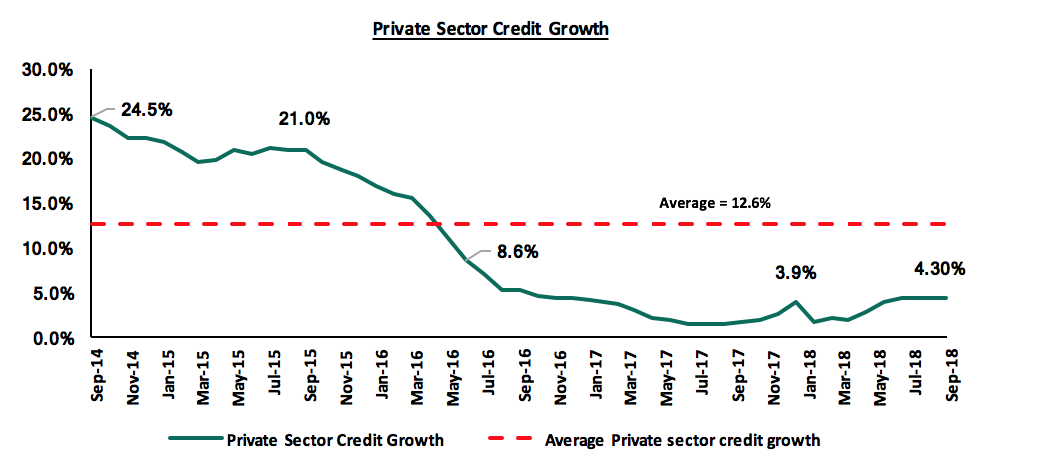

- Private Sector Credit Growth: Private sector credit growth has started picking up, albeit slowly, attributed to constrained access to credit since the implementation of the interest rate caps. Despite the recommendations by the IMF, as well as lobbying by the National Treasury for the repeal of the interest rate cap law, the National Assembly voted to retain the cap on borrowings at 4.0% above the Central Bank Rate (CBR) and only scrapped off the minimum rate on deposits. The legislators cited that that there was no justification for the repeal the interest rate cap, as there was no effort by banks to address the issue of high credit risk pricing. Despite this, private sector credit growth has remained unchanged at 4.3% since July to September 2018. This has been the highest growth rate since December 2016. Sectoral credit growth analysis, according to the Treasury, indicates that lending to manufacturing sector grew by 12.1%, while credit growth to the building and construction sector was 11.3%. Credit expansion to the consumer durables and financial/insurance sectors was at 7.9% and 6.6%, respectively. We expect private sector credit to pick up gradually as the economy continues to recover, despite the retention of the interest rate caps in the recently passed Finance Bill 2018.

The key concern however remains the effectiveness of monetary policy with the interest rate cap still in place.

Section III: Other Factors That Affect Economic Growth

- Socio-Political Environment - The year 2017 was characterized by, among other factors, a protracted electioneering period that negatively affected economic growth due to the political unrest that ensued. Real GDP expanded by 4.9%, compared to 5.9% for FY’2016. The economy has since been on a recovery trajectory, with real GDP expanding by 6.3% in Q2’2018, compared to 4.7% in Q2’2017. With the next elections slated for 2022, we expect the economy to continue its recovery due to political stability evidenced by the handshake between the President and the opposition leader, thereby improving confidence in the government’s agenda of implementing economic reforms.

- Ease of Doing Business - The World Bank Group released the Doing Business 2019 Report, noting that Kenya’s ranking improved by 19 positions to #61 from #80 in the 2018 Report, out of 190 countries ranked. In addition, Kenya maintained its 4thposition in Africa from last year’s report after Mauritius, Rwanda and Morocco, and the score improved by 5.1 points to 70.3, from 65.2 in the previous report. The main drivers for improvement included protection of minority investors, access to credit, and insolvency resolution. For more information, see our weekly focus on Analysis of Kenya’s Doing Business Environment.

- Investor Sentiment - Yields on the Kenyan Eurobonds have been on the rise during the year. The yield on the 2014 issues rose by 190 bps and 230 bps for the 5-year and 10-year Eurobonds issued in 2014, respectively; while the yields on the 10-year and 30-year Eurobonds issued in 2018 have risen by 140 bps and 130 bps, respectively, since the issue date. The rising yield on all the Eurobonds signals higher country risk perception and declined investor sentiments by investors, partly attributed to International Monetary Fund (IMF) raising the risk of Kenya’s debt distress from low to moderate on October, resulting in investors demanding a higher return for the risk. The increased yields have also been attributed to the monetary stance adopted by the Federal Reserve, having hiked the Federal Rate twice this year, currently at 2.0% - 2.25%. This has led to market correction in Eurobond yields in the emerging markets. More recently, global investors have been shunning risky assets in broader emerging markets, prompting net sell-offs as foreign investors exited the local markets. This has been due to fears of a global economic slowdown and an aggressive monetary stance adopted by the Federal Reserve Bank of the US.

- Security - The political climate in the country has eased, with security maintained and business picking up. The handshake between the Kenyan President and the opposition leader served to calm any political tension. Kenya recently commenced direct flights to and from the USA, which is a sign of improving security in the country. We expect security to be maintained in 2018, especially given that there is relative calm as the two principals, alongside other legislators across the political divide, work together towards combating corruption and promoting economic transformation agenda.

Section IV: Conclusion

The table below shows the macro-economic indicators that we track, indicating our expectations for each variable

|

Macro-Economic & Business Environment Outlook |

||||||

|

Macro-Economic Indicators |

2018 Expectations at Beginning of Year |

YTD 2018 Experience |

Going Forward |

Outlook - Beginning of Year |

Current Position |

|

|

Government Borrowing |

Government to come under pressure to borrow as it is well behind both domestic and foreign borrowing targets for FY 2017/18, and KRA is unlikely to meet its collection target due to expected suppressed corporate earnings in 2017 |

i. The government surpassed its domestic borrowing target for the 2017/18 fiscal year, having borrowed Kshs 390.2 bn against a target of 297.6 bn |

With the interest rate cap still in place, we do not expect upward pressure on interest rates. However, with National Assembly against a complete repeal and The Draft Financial Markets Conduct Bill, 2018 having not addressed the issue of the interest rate cap, we are positive on government borrowing. |

Negative |

Positive |

|

|

Exchange Rate |

Currency projected to range between Kshs 102.0 and Kshs 107.0 against the USD in 2018. With the possible widening of the current account deficit being a possible point of concern, we expect the CBK to continue to support the Shilling in the short term through its sufficient reserves of USD 8.1 bn (equivalent to 5.3-months of import cover) |

The Shilling has eroded all the YTD gains it had made against the US Dollar, exchanging at Kshs 103.2. |

The government projects the current account deficit to narrow to 5.4% of GDP in 2018 due to lower food and SGR imports. |

Neutral |

Neutral |

|

|

Interest Rates |

Upward pressure expected on interest rates, especially in the first half of the year, as the government falls behind its borrowing targets for the fiscal year. However, with the Banking (Amendment) Act, 2015, the MPC might be unable to do much with the CBR which has remained at 10.0% throughout 2017 |

The MPC met on 28th May 2018 and maintained the CBR at 9.5 citing that the impact of the 50 bps reduction in March had not yet been fully transmitted to the economy, despite there being room for monetary policy easing to further support economic activity |

The interest rate environment is expected to remain relatively stable with the CBK not accepting |

Neutral |

Neutral |

|

|

Inflation |

Inflation expected to average 7.5% compared to 8.0% last year |

Inflation has averaged 4.4% in the 9 months to September 2018, from 9.0% over a similar period in 2017. The year on year inflation rate for the month of September rose to 5.7% from 4.0% in August, driven by the introduction of the 8.0% VAT on petroleum products. |

Inflation in FY’2018 is expected to experience upward pressure, partly due to the base effect, and the rise in fuel and transport prices with the introduction of 8.0% VAT on petroleum products as from September 2018. |

Positive |

Positive |

|

|

GDP |

GDP growth projected to come in at between 5.3% - 5.5% |

Kenya’s economy grew by 6.3% in Q2’2018, compared to 4.7% in Q2’2017. The consensus GDP growth projection for Kenya in 2018 is at 5.5% (an average taken from 15 research firms, global agencies and government organizations projections), which is an improvement from the GDP growth experienced in 2017 |

GDP growth is projected to come in between 5.4% - 5.6% in 2018 driven by recovery of growth in the agriculture sector, continued growth in the tourism, real estate and construction sectors, and growth in the manufacturing sector |

Positive |

Positive |

|

|

Investor Sentiment |

Investor sentiment expected to improve in 2018 given the now settling operating environment after conclusion of the 2017 elections |

The Kenya Eurobond yields have been increasing, with the yields on the 2014 Eurobond issue rising by 190 bps and 230 bps YTD for the 5-year and 10-year Eurobonds, while the yields on the 10-year and 30-year Eurobonds issued in 2018 have risen by 140 bps and 130 bps, respectively, since the issue date. There has also been increased sell-offs by foreign equity investors amid fears of global economic slowdown, coupled with rising US Treasury yields. |

Given (i) the now settling operating environment following the elections in Q3’2017, (ii) the increased sell-offs by foreign investors in the equity markets due to rising bond yields in the US, and (iii) expectations of a relatively stable shilling, we still expect investor sentiment to improve in 2018 |

Positive |

Neutral |

|

|

Security |

Security expected to be maintained in 2018, especially given that the elections were concluded and the USA lifted its travel warning for Kenya, placing it in the 2nd highest tier of its new 4-level advisory program, indicating positive sentiments on security from the international community |

The political climate in the country has eased, compared to Q3’2017 with security maintained and business picking up. Kenya now has direct flights to and from the USA, a signal of improving security in the country |

We expect security to be maintained in 2018, especially given that the elections are now concluded, the government has settled into office, and the country's two principals are working together towards growing the economy |

Positive |

Positive |

|

Out of the seven areas that we track, four have a positive outlook while three factors have a neutral outlook, compared to the beginning of the year where four had a positive outlook, two had a neutral outlook and one factor had a negative outlook. Therefore, in conclusion, we expect macroeconomic fundamentals to remain positive because of an improved business environment created through political goodwill and improved security in the country.

Disclaimer: The Cytonn Weekly is a markets report published by Cytonn Asset Managers Limited, “CAML”, which is regulated by the Capital Markets Authority. CAML is also an affiliate of Cytonn Investments Management Plc. However, the views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.