Dec 16, 2018

Following the release of Q3’2018 results by Kenyan listed banks, the Cytonn Financial Services Research Team undertook an analysis on the Kenyan Banking Sector to point out any material changes from our H1’2018 Banking Report. In our Q3’2018 Banking Report, we analyze the results of the listed banks in order to determine which banks are the most attractive and stable for investment from a franchise value, and from a future growth opportunity (intrinsic value) perspective.

The report is themed “Deteriorating Asset Quality Dampens on Growth”, as we assess the key factors that influenced the improved performance of the banking sector during the period under review, factors that are dampening growth, and also areas that will be crucial for growth of banks going forward. As a result, we seek to answer the questions, (i) “what influenced the banking sector’s performance?”, and (ii) “what should be the focus areas for the banking sector going forward?” as the sector navigates the relatively tougher operating environment, albeit better compared to a similar period in the previous year. As such, we shall address the following:

- The Key Themes That Shaped the Banking Sector Performance in Q3’2018;

- Summary Performance of the Banking Sector in Q3’2018;

- Focus Areas of the Banking Sector Players Going Forward; and,

- Outcome of our Analysis.

Section I: The Key Themes That Shaped the Banking Sector Performance in Q3’2018:

Below, we highlight the key themes that shaped the banking sector in Q3’2018:

- Consolidation – The banking sector has continued to witness continued consolidation activity, as players in the sector are either acquired or merge together, forming relatively larger and possibly more stable entities, as discussed below:

- In August 2018, State Bank of Mauritius (SBM) Bank Kenya completed the acquisition of certain assets and liabilities of Chase Bank Limited, which was under receivership. Following the agreement between the Central Bank of Kenya (CBK), Kenya Deposit Insurance Corporation (KDIC), and SBM Bank Kenya, 75.0% of the value of all moratorium deposits at Chase Bank will be transferred to SBM Bank Kenya. The remaining 25.0% will remain with Chase Bank. This is a major milestone as this is the first successful instance, in the history of Kenya, of a bank being successfully brought out of receivership. Chase Bank was put under receivership in 2016, with customer deposits in excess of Kshs 100.0 bn. The acquisition saw SBM, which initially had 20 branches, take control of the 60 Chase Bank branches, of which they closed 20 branches, significantly increasing the bank’s foothold in the country to 60. SBM Bank has injected Kshs 2.6 bn in Chase Bank, and is planning to inject a further Kshs 6.0 bn to aid in the revival of the bank. In our view, the deal marks an important milestone in handling of banks under receivership, and consequently, with the acquisition taking place, it points to the continued attractiveness of the Kenyan banking sector, as banks both local and foreign drive their growth inorganically.

- On 11th December 2018, CBK announced the acceptance of a binding offer from KCB Group, for the acquisition of Imperial Bank Kenya Limited (Under Receivership). KCB Group offered its second bid to acquire a stake in Imperial Bank Limited (Under Receivership) (IBLR). IBLR was put under receivership in August 2015, with a loan book of Kshs 41.0 bn and deposits of Kshs 58.0 bn. KCB Group and Diamond Trust Bank (DTB) submitted offers in April, whose details were undisclosed, but were tasked with revising their offers, with DTB declining to participate further. Kenya Deposit Insurance Corporation (KDIC) highlighted that it had received the revised proposal from KCB Group. CBK and KDIC engaged KCB Group in discussions with the aim of maximizing the value for depositors. Consequently, KCB communicated to CBK and KDIC on 7th December, the modification of the terms of the Binding Offer with respect to the release of depositors’ funds and verification of loans. The Binding Offer accepted, includes granting access to 12.7% of eligible depositor balances remaining at IBLR within 14-days of the announcement made on 11th December 2018, subject to account and identity verifications. Combining this with earlier disbursements will result in a total recovery of approximately 35.0% percent of original eligible deposits held at the date of receivership. In addition, the Binding Offer outlines that KCB will complete the loan verification process by March 2019. The loan verification process is expected to result in further recoveries for eligible depositors of IBLR. CBK and KDIC assessed that KCB’s Binding Offer represented a viable proposal for the resolution of IBLR, for the benefit of depositors and the strengthening of the Kenyan financial sector. With the bank edging closer to be brought out of receivership, this would mark the second instance of a bank being brought out of receivership, after that of Chase Bank Limited. This would aid depositors of the bank gain access to their deposits locked in the bank since 2015. This in our view continues to instill confidence in the banking sector’s stability, as well as indicating the safeguarding of depositors’ interest by both the CBK and KDIC. We also note that the enforcement of strict regulations, operating procedures and corporate governance principles is key to avoid similar occurrences in the future.

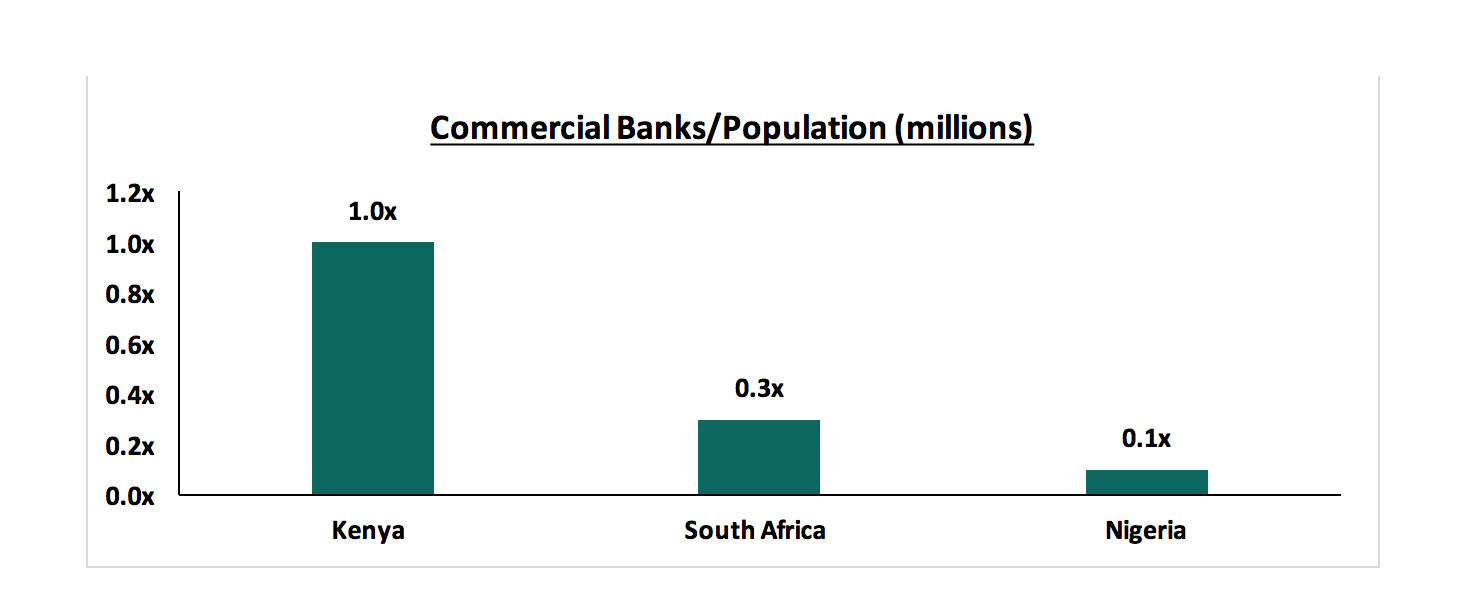

- Commercial Bank of Africa (CBA) and NIC Group issued a joint statement on a possible merger, subject to approval from the relevant regulatory bodies such as Capital Markets Authority (CMA) and the CBK, and other stakeholders. CBA is a Tier I Bank with total assets of Kshs 242.6 bn and deposits of Kshs 191.3 bn, and NIC Group is a Tier II bank with total assets of Kshs 201.8 bn and deposits of Kshs 145.0 bn. As analyzed in our Nairobi Metropolitan Area Serviced Apartments Report - 2018, & Cytonn Weekly #47/2018, a merger of the two banks will result in the second largest commercial bank in Kenya by customer deposits, with a market share of 10.9%, after KCB Group, which controls 14.7%. The potential merger will likely enhance the growth of the new entity in various aspects of banking and wealth management by consolidating CBA’s strength in retail banking given that it has approximately 21.5 mn accounts, and NIC’s corporate banking expertise, with the banking having approximately 116,000 accounts. Furthermore, if CBA is merged into NIC, the new entity will have access to capital from the capital markets. This, in our view, will create a financial entity that combines CBA’s high Non-Funded Income (NFI) generation and NIC’s interest income generation. With a larger balance sheet and high liquidity, the entity will be better positioned to take advantage of the numerous growth opportunities such as undertaking large transactions, and possibly undertaking other acquisitions. Consolidation activity in the banking sector has been gathering pace, with one deal having taken place during the year, and two more in the pipeline. We continue to expect more consolidation in the banking sector, as the relatively weaker banks that probably do not serve a niche become acquired by the larger counterparts who have expertise in deposit gathering, or serve a niche in the market. Consolidation will also likely happen, as entities form strategic partnerships, as they navigate the relatively tougher operating environment that is exacerbated by the stiff competition among the various players in the banking sector. Kenya remains overbanked when compared to other countries as shown in the chart below, and needs to have fewer but strong players, to ensure the sector’s overall stability in the long run.

A summary of the deals that have happened for the last 5 years is summarized in the table below:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs bns) |

Transaction Stake |

Transaction Value (Kshs bns) |

P/Bv Multiple |

Date |

|

SBM Bank Kenya |

Chase Bank ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Limited Kenya |

2.38 |

100.0% |

1.82 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.75 |

100.0% |

2.75 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.80 |

51.0% |

1.30 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

2.95 |

100.0% |

5.00 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.15 |

75.0% |

2.60 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.08 |

66.0% |

2.50 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.86 |

70.0% |

8.60 |

3.2x |

Nov-13 |

|

Average |

|

|

80.3% |

|

1.8x |

|

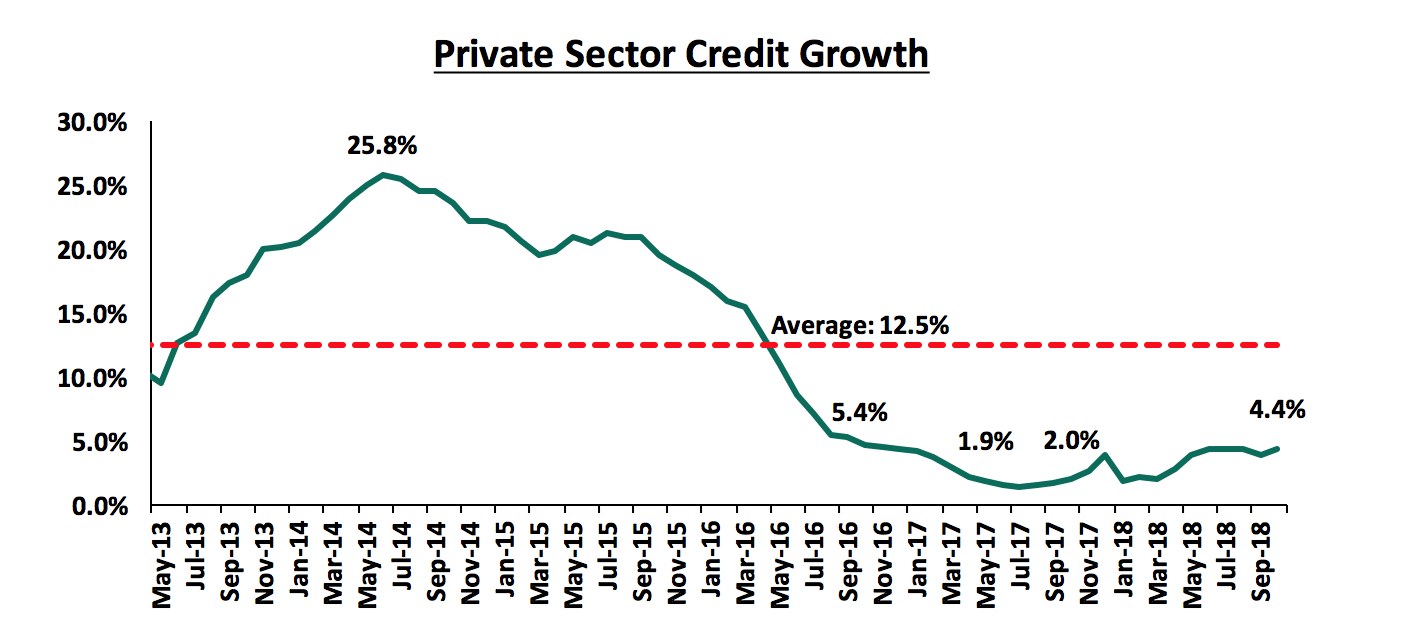

- Asset Quality – The banking sector continued to witness a deterioration in its asset quality over the quarter, with the Gross Non-Performing Loans (NPLs) ratio rising to a weighted average of 9.9%, from 7.8% in Q3’2017, much higher than the 5-year average of 8.4%, owing to the challenging operating environment witnessed in 2017. The effects of the harsh operating environment spilled over to 2018, with the economic recovery from the previous year being slower than anticipated in sectors such as trade and real estate, which resulted in an increase in the number of bad loans. The major sectors touted as leading in asset quality deterioration include tourism, manufacturing, retail, agriculture and real estate, all of which were affected by the tough operating environment experienced last year that was occasioned by a volatile political environment due to the prolonged electioneering period, and a severe prolonged drought that affected the agriculture sector, which remains the largest GDP contributor. Another major reason touted is that of delayed payments by the government, affecting various sectors, with small to mid-sized entities affected the most. Owing to the deteriorating asset quality, banks have adopted stringent lending policies in a bid to curb the relatively high number of NPLs. The stringent lending policies have further contributed to the tightening of credit standards in the economy, with the listed banking sector’s net loan growth coming in at 3.8%, slower than the 6.1% growth experienced in Q3’2017. With reduced deposit intermediation and consequently credit extension largely to the Micro Small and Medium Enterprises (MSME), as shown in the graph below, who make up approximately 80.0% of the private sector, the country’s economic growth will likely be affected in the long run.

- Revenue Diversification – Non-Funded Income’s contribution to banks’ total operating income has continued to rise, as this portion of income contributed 34.5% of total operating income in Q3’2018, as compared to 34.0% in Q3’2017. With compressed margins on interest income due to the Banking (Amendment) Act 2015, the effects of the regulation have been mitigated by ventures into new segments to support and improve the bottom line. Main forays have been made largely into bancassurance and brokerage. Examples of ventures undertaken in 2018 include I&M Holdings completing a full buyout of Youjays Insurance Brokers for an undisclosed amount on 5th April 2018, and KCB Group partnering with Liberty Holdings for the education savings plan dubbed Elimisha in June 5th 2018.

Banks have also been promoting the usage of alternative channels of transactions such as mobile banking, internet banking, and agency banking as they seek to grow their NFI. Notable moves towards the alternative channels segment in 2018 include:

- Housing Finance launching their own mobile banking app dubbed HF Whizz. The app aims to change the way consumers open and access their bank accounts. Users of the app will be able to open an account, access loans, and deposit and transfer cash via their mobile phones,

- Barclays Bank launched its own digital platform, dubbed Timiza, which allows customers to send money to their respective accounts, pay for utilities such as water and electricity, procure micro insurance, and pay for online taxi hailing services. In addition to this, the app grants customers with the access to micro loans of between Kshs 100 and Kshs 150,000 from the platform at interest rates of 1.2% monthly, and a one-off facilitation fee of 5.0%, with the loan repayable after 30-days,

- Equity Group launched its FinTech subsidiary, Finserve, a technological service company, tasked to drive disruptive technology innovation in the financial services segment. Finserve will operate as an autonomous commercial enterprise, delivering technological solutions not just for Equity Group, but also to the entire economy. Finserve houses products like Equitel, Equity Eazzy app, EazzyBiz and EazzyNet. Through Finserve, Equity Group aims to provide an edge in terms of integration with all major global card associations including American Express, Mastercard, Visa, JCB, Dinners, and Union Pay, becoming the single largest aggregator of card payments in the region, in its quest to grow the payment services segment, and the alternative channels in its various regional subsidiaries.

We believe that revenue expansion by product diversification and cost containment is one of the core opportunities for the banking sector, in the quest to achieve sustainable growth in the long run.

- Regulation - Regulation remains a key aspect affecting the banking sector, with the regulatory environment evolving and becoming increasingly tighter. In September 2018, The National Assembly voted to retain the cap on loans in the Finance Act 2018, effectively retaining the 4.0% cap above the Central Bank Rate (CBR) on interest chargeable on loans. However, the 70.0% of the CBR floor on interest payable on deposits was removed, effectively enabling banks to pay lower interest on their deposits. With the removal of the same, banks have adjusted accordingly, with various players indicating a lowering of their interest expense requirements, and a possible improvement in the Net Interest Margin, whose benefits will be fully realized in 2019. Regulation in the sector has increasingly been centered on consumer protection, and promoting prudence in the financial services sector.

Section II: Summary Performance of the Banking Sector in Q3’2018:

The table below highlights the performance of the banking sector, showing the performance using several metrics, and they the key take-outs of the performance.

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income (NFI) Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth In Govt Securities |

CIR |

Loan Growth |

LDR |

Return on Average Equity |

|

NBK |

303.2% |

(10.5%) |

(11.5%) |

(10.0%) |

6.6% |

(16.3%) |

26.8% |

(18.7%) |

(4.7%) |

3.2% |

91.8% |

(17.1%) |

51.7% |

3.2% |

|

Stanbic Bank |

46.7% |

13.3% |

19.7% |

9.7% |

4.9% |

19.6% |

47.0% |

9.3% |

20.3% |

16.7% |

57.9% |

16.3% |

77.8% |

14.3% |

|

SCBK |

33.9% |

4.8% |

2.1% |

5.9% |

8.5% |

9.7% |

32.6% |

31.2% |

(8.0%) |

(6.1%) |

57.2% |

(2.8%) |

50.6% |

18.6% |

|

KCB Group |

19.7% |

5.1% |

16.0% |

1.8% |

8.5% |

2.6% |

33.1% |

(7.9%) |

6.2% |

15.3% |

52.8% |

3.8% |

82.6% |

21.7% |

|

I&M Holdings |

18.3% |

3.3% |

16.8% |

(4.9%) |

6.7% |

38.4% |

35.1% |

30.1% |

27.6% |

8.0% |

51.7% |

8.6% |

78.1% |

17.2% |

|

DTBK |

10.0% |

3.0% |

3.0% |

2.9% |

6.1% |

6.3% |

21.7% |

7.4% |

6.5% |

17.7% |

56.9% |

0.7% |

70.0% |

13.3% |

|

Co-op Bank |

8.2% |

3.5% |

0.7% |

4.7% |

8.3% |

4.3% |

32.7% |

(29.7%) |

2.5% |

16.9% |

55.1% |

(2.0%) |

85.9% |

17.6% |

|

Equity Group |

8.1% |

8.6% |

13.5% |

7.2% |

8.5% |

(6.7%) |

40.0% |

(1.7%) |

9.1% |

24.1% |

54.6% |

8.6% |

71.7% |

22.2% |

|

Barclays Bank |

2.0% |

7.7% |

30.1% |

2.1% |

9.1% |

14.0% |

30.8% |

5.5% |

9.9% |

29.5% |

65.9% |

6.7% |

81.0% |

16.5% |

|

NIC Group |

(3.3%) |

5.5% |

22.2% |

(5.9%) |

5.8% |

7.2% |

30.9% |

5.7% |

10.3% |

16.2% |

60.6% |

(3.1%) |

79.3% |

12.1% |

|

HF Group |

N/A |

(14.1%) |

(11.7%) |

(17.8%) |

4.6% |

(7.2%) |

25.0% |

(30.9%) |

3.1% |

429.5% |

113.5% |

(11.3%) |

90.7% |

(3.3%) |

|

Weighted Average Q3'2018* |

16.2% |

6.1% |

12.5% |

3.8% |

8.0% |

5.9% |

34.5% |

0.6% |

7.4% |

17.8% |

56.3% |

4.2% |

75.3% |

18.8% |

|

Weighted Average Q3'2017* |

(9.3%) |

(5.8%) |

(0.5%) |

(7.3%) |

8.5% |

10.9% |

33.3% |

10.5% |

13.8% |

10.3% |

59.4% |

6.1% |

77.7% |

17.5% |

|

*Market cap weighted as at 30th November 2018/2017 respectively |

||||||||||||||

Key takeaways from the table above include:

Key take-outs from the table above include:

- Listed banks have recorded a 16.2% average increase in core Earnings per Share (EPS), compared to a decline of 9.3% in Q3’2017. NIC Group and HF Group were the only banks that recorded declines in core EPS, with NIC recording a decline of 3.3%, and HF recording a decline to a loss per share of Kshs 0.9 from a core earnings per share of Kshs 0.5 in Q3’2017. National Bank recorded the highest growth of 303.2% y/y, that was realized after adding back the exceptional items expense of Kshs 0.5 bn incurred in Q3’2018,

- The sector recorded weaker deposit growth, which came in at 7.4%, slower than the 13.8% growth recorded in Q3’2017. Despite the slower deposit growth, interest expenses increased by 12.5%, indicating banks have been mobilizing expensive deposits, as well as taking up borrowed funds from international financial institutions, thereby driving up the interest expense, ,

- Average loan growth was anemic coming in at 4.2%, which was lower than 6.1% recorded in Q3’2017, indicating that there was an even slower credit extension in the economy, due to sustained effects of the interest rate cap. Government securities on the other hand recorded a growth of 17.8% y/y, which was faster compared to the loans, and faster than 10.3% recorded in Q3’2017. This indicates that banks’ continued preference towards investing in government securities, which offer better risk-adjusted returns. Interest income increased by 6.1%, compared to a decline of 5.8% recorded in Q3’2017, as banks adapted to the interest rate cap regime, with increased allocations in government securities. The Net Interest Income (NII) thus grew by 3.8% compared to a decline of 7.3% in Q3’2017,

- The average Net Interest Margin in the banking sector currently stands at 8.0%, down from the 8.5% recorded in Q3’2017, despite the Net Interest Income increasing by 3.8% y/y. The decline was mainly due to the faster 17.8% increase in allocation to relatively lower yielding government securities,

- Non-funded Income grew by 5.9% y/y, slower than 10.9% recorded in Q3’2017. The growth in NFI was weighed down as total fee and commission growth was flat, growing by 0.6%, slower than the 10.5% growth recorded in Q3’2017. The growth in fee and commission income continued to be subdued by the slow loan growth, and,

- The sector continued to improve on its operational efficiency, with the Cost to Income Ratio (CIR) improving to an average of 56.3% from 59.4% in Q3’2017, buoyed by an improvement in operating income, which outpaced the operational expenses increments. Cost containment was also aided by reduced cost of risk demands, owing to lower provisioning levels. It is worth noting that some banks reduced their specific provisioning levels, even after experiencing a deterioration in asset quality. This is largely due to the fact that the first year of implementation of IFRS 9, banks are allowed to pass the effect of asset quality through the balance sheet, hence reducing the specific provisioning demands for the period, even after the implementation of IFRS 9.

Section III: Focus Areas of the Banking Sector Players Going Forward:

In summary, the banking sector had an improvement in performance, largely aided by the improving economic conditions and a more conducive operating environment compared to a similar period last year, which was marred by election jitters. However, the banking sector has been fraught by two main challenges: (i) the deteriorating asset quality brought about by the spillover effects of the challenging operating environment experienced in 2017 and the delayed payments by the Government, and (ii) the capping of interest rates, which has continued to subdue credit extension to the private sector. Instead, banks have been allocating even more of the deposits into government securities, as shown by the strong 17.8%y/y growth in government securities allocation. The increased allocation to relatively lower yielding assets has consequently reduced the Net Interest Margin (NIM) Private sector credit growth has remained subdued, coming in at 4.4% in October 2018, below the 5-year average of 12.4%, further indicating reduced intermediation, which has largely affected the MSMEs who comprise a majority of the private sector. We however note that the sector in general has adapted to operating in the tough environment, posting a 16.2% increase in core EPS. We believe the key factors banks need to consider going forward are asset quality management, continued revenue diversification, efficiency, and downside regulatory compliance risk management, amid tighter regulatory requirements by the CBK. To grow profitability amidst the tighter regulated environment, banks will:

- Continue diversifying their income sources by growing their fee-income businesses, bancassurance, asset management and advisory services,

- Be more prudent in loan disbursement, as well as enhancing their risk assessment framework to improve asset quality, so as to tame any rising financial impairments arising from implementation of IFRS 9, and,

- Improve efficiency by leveraging on mobile and internet banking, for cost reduction especially on staff numbers and revenue expansion from transaction income, with all these strategies aimed at improving their profitability margins.

Section IV: Outcome of our Analysis:

As per our analysis on the banking sector, from a franchise value and from a future growth opportunity perspective, we carried out a comprehensive ranking of the listed banks. For the franchise value ranking, we included the earnings and growth metrics as well as the operating metrics in the table below in order to carry out a comprehensive review of the banks.

|

Listed Banks Operating Metrics |

|||||||||||

|

Bank |

LDR |

CIR |

ROACE |

Deposit/Branch |

Gross NPL Ratio |

NPL Coverage |

Tangible Common Ratio |

Non-Interest Income/Revenue |

|||

|

Equity Group |

71.7% |

54.6% |

22.3% |

1.4 |

8.9% |

38.9% |

15.0% |

40.2% |

|||

|

KCB Group |

82.6% |

52.8% |

21.7% |

2.0 |

7.6% |

60.4% |

15.0% |

33.1% |

|||

|

SCBK |

50.6% |

57.2% |

18.6% |

6.3 |

15.6% |

74.2% |

15.6% |

32.6% |

|||

|

Stanbic Bank |

77.8% |

57.9% |

18.0% |

7.0 |

7.2% |

60.6% |

11.3% |

46.5% |

|||

|

Coop Bank |

85.9% |

55.1% |

17.6% |

1.9 |

11.2% |

36.8% |

17.3% |

32.7% |

|||

|

I&M Holdings |

78.1% |

51.7% |

17.2% |

5.1 |

12.7% |

49.2% |

14.9% |

35.1% |

|||

|

Barclays Bank |

81.0% |

67.6% |

16.5% |

2.5 |

7.7% |

70.5% |

13.0% |

30.8% |

|||

|

DTBK |

70.0% |

56.9% |

13.3% |

2.0 |

7.7% |

72.5% |

13.2% |

21.7% |

|||

|

NIC Group |

79.3% |

60.6% |

12.1% |

3.0 |

13.0% |

51.4% |

15.9% |

30.9% |

|||

|

HF Group |

90.7%* |

113.5% |

10.2% |

1.6 |

18.2% |

42.4% |

15.7% |

25.0% |

|||

|

NBK |

51.7% |

87.5% |

(3.3%) |

1.3 |

47.1% |

57.1% |

5.1% |

26.8% |

|||

|

Weighted Average Q3'2018** |

75.3% |

56.5% |

18.8% |

2.9 |

9.9% |

54.2% |

14.8% |

34.5% |

|||

|

*Loans to Loanable Funds Used, owing to Nature of the business ** Market Capitalization weighted as at 30th November 2018 |

|||||||||||

The overall ranking was based on a weighted average ranking of franchise value (accounting for 40%) and intrinsic value (accounting for 60%). The intrinsic valuation is computed through a combination of valuation techniques, with a weighting of 75.0% on Discounted Cash-flow Methods and 25.0% on Relative Valuation, while the franchise ranking is based on banks’ operating metrics, meant to assess the efficiency, asset quality, diversification, corporate governance and profitability, among other metrics. The overall Q3’2018 ranking is as shown in the table below:

|

Listed Banking Sector Composite Ranking |

|||||

|

Bank |

Franchise Value Total Score |

Intrinsic Value Score |

Weighted Score |

Q3'2018 Rank |

H1'2018 Rank |

|

KCB Group |

43 |

2 |

18.4 |

1 |

1 |

|

Equity Group |

69 |

1 |

28.2 |

2 |

2 |

|

I&M Holdings |

70 |

3 |

29.8 |

3 |

3 |

|

Coop Bank |

69 |

6 |

31.2 |

4 |

4 |

|

DTBK |

79 |

4 |

34.0 |

5 |

5 |

|

Stanbic Holdings |

71 |

10 |

34.4 |

6 |

9 |

|

NIC Group |

80 |

5 |

35.0 |

7 |

8 |

|

SCBK |

74 |

9 |

35.0 |

7 |

7 |

|

Barclays Bank |

81 |

7 |

36.6 |

9 |

6 |

|

HF Group |

102 |

8 |

45.6 |

10 |

11 |

|

NBK |

114 |

11 |

52.2 |

11 |

10 |

Major changes include:

- Stanbic Holdings rose 3 positions to position 6 from position 9 due to an improved franchise value score, with the bank having the lowest NPL ratio of 7.2%, lower than the industry average of 9.9%, the highest deposits per branch of Kshs 7.0 bn of above the industry average of Kshs 2.9 bn, and the highest NFI to total operating income ratio of 46.5%, above the 34.5% industry average,

- NIC Group climbed 1 spot to Position 7 from Position 8 in our H1’2018 Banking Sector Report, owing to improvement in capitalization, with the bank having the second best tangible common ratio at 15.9%, higher than industry average of 14.8%, the third best Price to Tangible Book (P/TBv) of 0.6x, and the third best Corporate Governance score, and,

- Barclays Bank dropped 3 spots to Position 9 from Position 6 in our H1’2018 Banking Sector Report, due to a low franchise value score caused by a high Price-Earnings Growth (PEG) Ratio at 1.4x, a low efficiency due to the high Cost to Income ratio (CIR) of 67.6%, above the 56.3% industry average, ranking 9th, a high P/TBv at 1.4x, and low capitalization with a tangible common ratio of 13.0%, below the 14.8% industry average.

For a comprehensive analysis on the ranking and methodology behind it, see our Cytonn Q3’2018 Banking Sector Report

Disclaimer: The Cytonn Weekly is a market commentary published by Cytonn Asset Managers Limited, “CAML”, CAML is regulated by the Capital Markets Authority. However, the views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.