Sep 23, 2018

Following the release of the H1’2018 results by Kenyan listed banks, the Cytonn Financial Services Research Team undertook an analysis on the Kenyan Banking Sector to point out any material changes from our FY’2017 Banking Report. In our H1’2018 Banking Report, we analyze the results of the listed banks in order to determine which banks are the most attractive and stable for investment from a franchise value and from a future growth opportunity perspective.

The report is themed “Growth and Efficiency aided by Technology, amid deteriorating Asset Quality”as we assess the key factors that influenced the improved performance of the banking sector during the period under review, and also areas that will be crucial for growth of banks going forward. As a result, we seek to answer the questions, (i) “what influenced the banking sector’s performance?”, and (ii) “what should be the focus areas for the banking sector going forward?”, as we look forward to a relatively better operating environment for the banking sector compared to a similar period the previous. As such, we shall address the following:

- The key themes that shaped the banking sector performance in H1’2018;

- Summary of the performance of the banking sector in H1’2018;

- The focus areas of the banking sector players going forward; and,

- Brief summary of the outcome of our analysis.

Section I: The key themes that shaped the banking sector in H1’2018

Below, we highlight the key themes that shaped the banking sector in H1’2018:

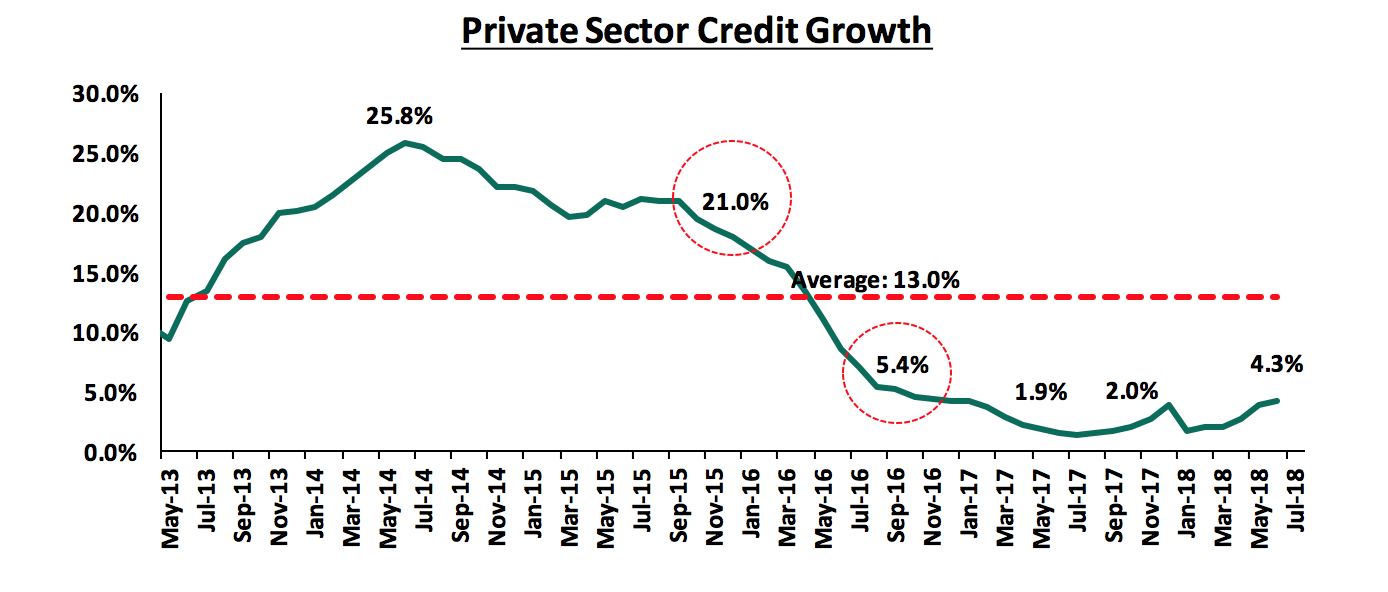

- Regulation– The effects of the Banking (Amendment) Act 2015 have continued to be felt in the sector, with banks recording a slow 2.4% growth in loans and advances to Kshs 1.94 tn in H1’2018 from Kshs 1.90 tn in H1’2017. This is in stark contrast to the 7.2% growth y/y to Kshs 1.8 tn in H1’2016 from Kshs 1.6 tn in H1’2015, before the law was enacted. Reduced loan growth could be attributed to banks’ tightening their credit standards owing to the Banking (Amendment) Act 2015, coupled with industry wide deteriorating asset qualities. The amendment stipulated a deposit and loan-pricing framework, with (i) a cap on lending rates at 4.0% above the Central Bank Rate (CBR), and (ii) a floor on the deposit rates at 70.0% of the CBR. The capping of interest rates constrained banks from lending to SMEs and the private sector, and as a result, they preferred to invest in risk-free government securities, unable to price risky borrowers within the set margins. The law, which was originally set up to address the high cost of borrowing and improve credit access to mainly the Micro, Small and Medium Enterprises (MSMEs), has failed to achieve any of the initial objectives, since (i) credit access to the MSMEs has not improved, with private sector credit growth remaining below 5.0% since the enactment of the law, compared to a 5-year average of 13.0%, as banks were unable to price risk within the set margins. Thus, with banks unwilling to lend to MSMEs at the rated prescribed with Banking (Amendment) Act, there were increased allocations to government securities, (ii) in addition to constraints in credit access, the law has inhibited the central bank in its monetary policy function, as any monetary policy decision it makes, have the converse of the desired impact. Thus, when the central bank adopts expansionary policy by lowering the policy rate, this has the opposite effect of reducing credit access due to the lower rate. Plans to repeal the Banking (Amendment) Act 2015 were dealt a blow, with a majority of the members of The National Assembly voting to retain the law, whose repeal proposition was included in the Finance Bill. The proposition to remove the floor of 70.0% of the CBR on deposits was included in the Finance Bill, in a move that is set to see banks reduce interest payable on deposit, given that the bill has been passed, thereby possibly alleviating the reduced Net Interest Margins (NIMs) that came with the law.

To mitigate the reduced lending, the National Treasury formulated the draft Financial Markets Conduct Bill, which was drafted to assess the whole credit management in the economy. The bill seeks to:

- Ensure better conduct by banks and other lenders in terms of extending credit to retail financial customers. By categorically not defining lenders as banks, this, in our view, might be the introduction of licensing for credit companies that are not banks,

- Provide consumer protection, mainly for retail customers by ensuring their credit contracts are clear and well understood in terms of interest, fees, charges and costs on credit facilities, thereby removing the opacity that has been existent in loan pricing.

However, as noted in our focus note The Draft Financial Markets Conduct Bill, 2018, the bill only addresses consumer protection and fails to address the problem of access to credit by the private sector. We are of the view that a lot more still needs to be done to address the issue of credit access as banks will still prefer to lend to the risk free government as opposed to lending to a riskier retail private sector at the current 13.0%, (4.0% points above the current CBR of 9.0%) as dictated by the Banking (Amendment) Act 2015.

To further add more regulatory requirements, The Central Bank of Kenya proposed to introduce a Banking Sector Charter that will guide service provision in the sector. The Charter aims to instill discipline in the banking sector in order to make it responsive to the needs of the banked population. It is expected to facilitate a market-driven transformation of the Kenyan banking sector, thereby considerably improving the quality of service provided, and increasing access to affordable financial services for the unbanked and under-served population. In achieving its objective, the Banking Sector Charter will be guided by the following objectives:

- To enhance the quality of financial services to the banked population that is negatively affected by the lack of credit access,

- To create a roadmap that will guide in the development of a more resilient, competitive and dynamic financial system based on the four central pillars of the banking sector’s vision,

- To ensure that institutions proactively engage their customers in financial literacy and consumer education drives, to enhance customers’ financial knowledge and skills for them to make informed financial decisions,

- To provide the basis for the sector’s engagement with other stakeholders,

- To establish targets and quantified responsibilities with respect to each objective and outline processes for implementing the Charter as well as mechanisms to monitor and report on progress towards given goals which are aligned with Kenya Vision 2030,

- To ensure institutions develop and submit a time bound plan approved by the Board in compliance with the Charter for CBK’s monitoring purposes, and,

- To ensure institutions submit quarterly reports to CBK on the progress of their implementation of the Charter by timelines determined by the CBK.

The achievement of the above objectives will be hinged on transformation of financial institutions around key areas such as; fairness, transparency, financial inclusion and access to financial services. We are of the view that, if adopted, the Banking Sector Charter will go a long way towards removing the existing opacity in loan prices, and promote the adoption of the risk-based loan-pricing framework. However, we are of the stronger view, that the best way to bring discipline in the banking sector is to reduce banking sector dominance by promoting alternative financial products. In a developed economy, bank-funding makes about only 40% of business funding, while in Kenya, it makes up 95% of business funding, thus meaning businesses and individuals alike are over reliant on bank funding. Thus, a free market that promotes competing sources of financing will trigger its own price regulation, thereby benefiting the credit consumers in the process.

- Revenue Diversification – With banks registering declining interest income and by extension compressed net interest income following the capping of interest rates, banks shifted their business models with increased focus on diversifying income sources, mainly through non-funded income. Non-funded income (NFI) grew by 6.9% in H1’2018, higher than 5.1% growth witnessed in H1’2017 taking its contribution to total income to 34.3%, compared to 34.0% in H1’2017. We expect this to continue going forward, as banks seek alternative sources of income to boost profitability under the interest rate cap regime. Banks have been venturing into various NFI growth initiatives such bancassurance. Notable forays into the bancassurance segment include:

- I&M Holdings having completed a full buyout of Youjays Insurance Brokers for an undisclosed amount on 5th April 2018,

- Standard Chartered partnered with Sanlam in October 2017, to offer general insurance products via its bancassurance division,

- KCB partnering with Liberty Holdings for the education savings plan dubbed Elimisha in June 5th 2018,

- Barclays acquired First Assurance in 2015 for Kshs 2.2 bn,

- Equity Group Holdings setting up an insurance arm (Equity Insurance Agency) in December 2006 that offers both life and non-life insurance products,

- NIC Group setting up an insurance agency (NIC insurance agency) in 2008, which provides general insurance products,

- Co-operative Bank’s bancassurance arm that provides Medical insurance, Motor cover, agricultural insurance and life insurance, and

- National Bank of Kenya setting up NBK insurance Agency insurance which provides property insurance, education policies, medical insurance, annuities and agricultural insurance.

Banks have also been seeking to grow the NFI by promoting the usage of alternative channels of transactions such as mobile banking, internet banking, and agency banking. Notable moves towards the alternative channels segment include:

- Housing Finance launching their own mobile banking app dubbed HF Whizz. The app aims to change the way consumers open and access their bank accounts. The application promises to set itself apart from by prioritizing on customer experience, with frequent software upgrades suited to the lifestyle of the customer, key integrations to be able to have the social experience whilst ensuring seamless transactions. Users of the app will be able to open an account, access loans, and deposit and transfer cash via their mobile phones,

- Barclays bank launched its own digital platform, dubbed Timiza, which allows customers to send money to their respective accounts, pay for utilities such as water and electricity, procure micro insurance, and pay for online taxi hailing services. In addition to this, the app grants customers with the access to micro loans of between Kshs 100 and Kshs 150,000 from the platform at interest rates of 1.2% monthly, and one-off facilitation fee of 5.0%, repayable after 30 days,

- Equity Group launched its fintech subsidiary, Finserve, a technological service company, tasked to drive disruptive technology innovation in the financial services segment. Finserve will operate as an autonomous commercial enterprise, delivering technological solutions not just for Equity Group, but also to the entire economy. Finserve houses products like Equitel, Equity Eazzy app, EazzyBiz and EazzyNet. Through Finserve, Equity group aims to provide an edge in terms of integration with all major global card associations including American Express, Mastercard, Visa, JCB, Dinners, and Union Pay, becoming the single largest aggregator of card payments in the region, in its quest to grow the payment services segment, and the alternative channels in its various regional subsidiaries.

We believe that revenue expansion by product diversification is one of the core opportunities for the banking sector, in the quest to achieve sustainable growth in the long run.

- Asset Quality – The banking sector continued to witness a deterioration in its asset quality over quarter, with the gross non-performing loans ratio rising to a weighted average of 10.0% from 7.7% in H1’2017, much higher than the 5-year average of 8.4%, owing to the challenging operating environment witnessed in 2017. The effects of the harsh operating environment spilled over to the first half of 2018, and resulted in an increase in the number of bad loans. The major sectors touted as leading in asset quality deterioration include tourism, manufacturing, retail, agriculture and real estate, all of which were affected by the tough operating environment experienced last year that was occasioned by a volatile political environment due to the prolonged electioneering period, and a severe prolonged drought that affected the agriculture which remains the largest GDP contributor. Owing to the deteriorating asset quality, banks have adopted stringent lending policies in a bid to curb the relatively high number of Non-Performing Loans (NPLs). The stringent lending policies have further contributed to the tightening of the credit standards in the economy. To mitigate this deterioration, banks have adopted a raft of measures to try to improve their asset qualities. Main strategies include (i) remediation of collapsed businesses and thereby enabling them to service their obligations to the bank, and (ii) Collateralization of bad debt to third parties. A relatively new strategy banks have also been using is the adoption of sophisticated credit pre-scoring models through the use of new technologies such as artificial intelligence, to pre-identify any delinquencies before they happen. This relatively new method is likely to contribute to the transition to a risk-based credit-pricing model, in line with the Central Bank of Kenya’s recommendation.

- Efficiency – With the inception of the Banking (Amendment) Act 2015 in 2016, Banks sought to mitigate the reduced interest income via various cost rationalization measures. This saw banks align their employee head count to their operational needs as several banks laid of staff in voluntary retirement programs. Furthermore, a number of banks also closed branches. Thus, operational efficiency has improved as shown by the Cost to Income Ratio (CIR), which improved to 55.7% in H1’2018 from 59.2% in H1’2017. Another key avenue that banks have been using to improve their efficiency, is the product development centered on leveraging on alternative distribution channels. The use of alternative channels has gained prominence among bank customers due to the convenience it provides. Thus, increased use of alternative channels has also contributed to increased non-funded income in the form of transactional income due to the high number of transactions via these channels, thereby also contributing in the improvement in the cost to income ratio. Cost reduction has to be accompanied by revenue expansion for banks to achieve sustainable growth. The table below highlights the various staff layoffs and branch closures:

|

Kenya Banking Sector Restructuring |

|||

|

No. |

Bank |

Staff Lay-off |

Branches Closed |

|

1 |

Bank of Africa |

0 |

12 |

|

2 |

Barclays Bank |

301 |

7 |

|

3 |

Ecobank |

0 |

9 |

|

4 |

Equity Group |

400 |

7 |

|

5 |

Family Bank |

Unspecified |

0 |

|

6 |

First Community Bank |

106 |

0 |

|

7 |

KCB Group |

223 |

Unspecified |

|

8 |

National Bank |

150 |

4 |

|

9 |

NIC Group |

32 |

Unspecified |

|

10 |

Sidian Bank |

108 |

0 |

|

11 |

I&M Holdings |

0 |

Unspecified |

|

12 |

Standard Chartered |

300 |

4 |

|

13 |

HF Group |

112 |

0 |

|

Total |

1,732 |

42 |

|

- Prudence – With the implementation of IFRS 9 from January of 2018, departing from the previous IAS 39, banks are required to provide for both the non-performing loans and performing loans. This then points to increased provisioning levels by banks. IFRS 9 takes on a forward-looking credit assessment approach. Credit losses under IFRS 9 have to be computed under the Expected Credit Loss (ECL) model, as opposed to the Incurred Credit Loss (ICL) model, that was used under IAS 39 framework. The implementation of IFRS 9 saw the total capital position of banks relative to the risky assets decline by an average of 0.4% after adjusting for IFRS 9, on account of increasing provisions. To operate under this new standard, banks have adopted stringent lending policies, with some banks adopting advanced credit pre-scoring methods. The implementation of IFRS 9 was done ensure financial institutions had adequate provisions to cover for credit losses as and when they occur.

- Consolidation– In 2018, only one acquisition has been completed. SBM Bank Kenya Ltd completed the acquisition of certain assets and liabilities of Chase Bank Limited, which was under receivership. Following the agreement between the Central Bank of Kenya (CBK), Kenya Deposit Insurance Corporation (KDIC) and SBM Bank Kenya, 75% of the value of all moratorium deposits at Chase Bank will be transferred to SBM Bank Kenya. The remaining 25% will remain with Chase bank Limited. This is a major milestone as this is the first successful instance, in the history of Kenya, of a bank being successfully brought out of receivership. Chase Bank was put under receivership in 2016, with customer deposits in excess of Kshs 100.0 bn. The acquisition will see SBM take control of the 62 Chase Bank branches, significantly increasing the bank’s foothold in the country to 60 branches after closing 20 braches initially with Chase Bank. SBM Bank has injected Kshs 2.6 bn in Chase Bank, and is planning to inject a further Kshs 6.0 bn to aid in the revival Chase bank. In addition to this, the bank is expected to absorb a significant number of the 1,300 former employees of Chase Bank Limited.

KCB Group offered its second bid to acquire a stake in Imperial Bank Limited (IBL), which is under receivership. IBL was put under receivership in August 2015, with a loan book of Kshs 41.0 bn and deposits of Kshs 58.0 bn. KCB Group and Diamond Trust Bank (DTB) submitted offers in April, whose details were undisclosed, but were tasked with revising their offers, with DTB declining to participate further. Kenya Deposit Insurance Corporation (KDIC) highlighted that it had received the revised proposal from KCB Group, while the other bidder had withdrawn from the process. The Central Bank of Kenya (CBK) and KDIC will engage KCB Group in discussions with the aim of maximizing the value for depositors. The bidders were tasked to disclose the oversight frameworks they planned to implement, the type of transaction they intended to proceed with, and the financial resources that could be deployed to compete the transaction. The impending resolution of the matter, which could possibly result in the bank coming out of receivership, will be a boost to customers, whose deposits have been locked in the bank since August 2015. We note that The process needs to be expedited as the transaction falls way behind the expected timelines shared by the CBK, who, in September 2017, had scheduled to have a winning bidder by February 2018. If successful, this would mark the second instance a bank is successfully brought out of receivership.

We are of the view that the industry needs more consolidation, as smaller banks with depleted capital positions need to be acquired as their performance deteriorates due to the sustained effects of the Banking (Amendment) Act 2015. We note that the industry needs fewer but stronger players to ensure the sector remains stable.

Below is a summary of the completed deals in the last 5 years:

|

Summary of Acquisition Transactions |

||||||

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs bns) |

Transaction Stake |

Transaction Value (Kshs bns) |

P/Bv Multiple |

Date |

|

SBM bank Kenya |

Chase Bank ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

Diamond Trust Bank Kenya |

Habib Bank Limited Kenya |

2.38 |

100.0% |

1.82 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.75 |

100.0% |

2.75 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.80 |

51.0% |

1.30 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

2.95 |

100.0% |

5.00 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.15 |

75.0% |

2.60 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.08 |

66.0% |

2.50 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.86 |

70.0% |

8.60 |

3.2x |

Nov-13 |

|

Average |

80.3% |

1.8x |

||||

Section II: Summary of the performance of the Banking Sector in H1’2018

The table below, highlights the performance of the banking sector, showing the performance using several metrics, and they the key take outs of the performance.

|

Listed Banking Sector Operating Metrics |

|||||||||||||||

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Cost to Income Ratio |

Non-Funded Income (NFI) Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth In Govt Securities |

Loan Growth |

LDR |

Cost of Funds |

Return on Average Equity |

|

CFC Stanbic |

104.5% |

15.4% |

21.7% |

11.9% |

4.9% |

50.1% |

34.0% |

50.0% |

(4.2%) |

21.3% |

26.9% |

15.4% |

71.4% |

3.1% |

14.8% |

|

National Bank |

39.3% |

(9.6%) |

(10.1%) |

(8.9%) |

6.9% |

95.6% |

(13.1%) |

28.8% |

(15.7%) |

(2.8%) |

9.8% |

(16.1%) |

49.8% |

3.0% |

(0.6%) |

|

Standard Chartered |

30.3% |

7.9% |

8.8% |

7.5% |

8.0% |

61.0% |

12.2% |

32.9% |

36.2% |

2.8% |

3.5% |

(1.1%) |

48.4% |

3.6% |

18.0% |

|

KCB Group |

18.0% |

6.1% |

11.9% |

4.3% |

8.6% |

52.0% |

(0.1%) |

32.2% |

(6.0%) |

8.7% |

8.7% |

3.6% |

80.3% |

3.0% |

21.9% |

|

Equity Group |

17.6% |

10.2% |

14.0% |

9.1% |

8.8% |

52.8% |

1.5% |

40.2% |

(1.0%) |

8.5% |

18.7% |

3.8% |

69.9% |

2.7% |

23.9% |

|

I&M holdings |

11.7% |

5.1% |

13.2% |

0.1% |

7.1% |

53.7% |

34.4% |

35.1% |

39.5% |

30.6% |

(8.0%) |

12.6% |

77.2% |

4.6% |

17.2% |

|

Co-op Bank |

7.6% |

7.9% |

2.2% |

10.4% |

8.6% |

54.9% |

(1.6%) |

32.1% |

(2.6%) |

3.9% |

12.0% |

(0.6%) |

84.6% |

3.9% |

18.0% |

|

Barclays Bank |

6.2% |

7.6% |

22.4% |

4.0% |

9.0% |

66.3% |

6.9% |

30.0% |

1.9% |

14.9% |

33.6% |

7.5% |

81.2% |

2.60% |

17.5% |

|

DTB |

2.5% |

3.9% |

3.0% |

4.6% |

6.5% |

57.4% |

8.0% |

21.6% |

7.2% |

9.9% |

22.5% |

3.5% |

70.4% |

5.0% |

15.5% |

|

NIC Group |

(2.1%) |

8.6% |

30.0% |

(4.9%) |

6.0% |

60.9% |

7.0% |

29.5% |

(3.0%) |

10.5% |

25.7% |

(1.5%) |

78.2% |

5.4% |

12.8% |

|

Housing Finance |

(95.7%) |

(13.2%) |

(12.7%) |

(13.9%) |

4.9% |

99.3% |

38.2% |

30.4% |

7.2% |

(3.1%) |

17.3% |

(9.8%) |

131.4% |

7.0% |

(0.2%) |

|

Weighted Average H1'2018* |

19.0% |

7.9% |

12.0% |

6.4% |

8.1% |

55.7% |

6.9% |

34.3% |

4.6% |

10.0% |

14.9% |

3.8% |

73.8% |

3.4% |

19.5% |

|

Weighted Average H1'2017** |

(14.4%) |

(7.2%) |

(6.0%) |

(6.9%) |

8.0% |

59.2% |

5.1% |

34.0% |

12.5% |

9.4% |

21.5% |

7.3% |

77.9% |

3.4% |

17.9% |

|

*Market cap weighted as at 31/08/2018 |

|||||||||||||||

|

**Market cap weighted as at 31/08/2017 |

|||||||||||||||

Key takeaways from the table above include:

- The listed banks recorded a 19.0% average increase in core Earnings Per Share (EPS), compared to a decline of 14.4% in H1’2017. Only NIC Group and Housing Finance Group recorded declines in core EPS, registering declines of 2.1% and 95.7%, respectively. CFC Stanbic recorded the highest growth at 104.5% y/y, aided by 21.9% increase in total operating income, coupled with a 14.0% decrease in total operating expenses. HF Group recorded the biggest decline at 95.7%, on the back of a 13.9% decline in Net Interest Income (NII), and a high cost to income ratio of 99.3% ;

- The sector recorded a relatively strong deposit growth, which came in at 10.0%. The strong deposit growth led to a 12.0% growth in the interest expenses. However, the cost of funds remained flat at 3.4%, an indication that the greater proportion of deposit accounts were non-interest bearing;

- Average loan growth was anemic coming in at 3.8%, which was lower than 7.3% recorded in H1’2017, indicating that there was an even slower credit extension in the economy, due to sustained effects of the interest rate cap. Government securities on the other hand recorded a growth of 14.9% y/y, which was faster compared to the loans, albeit slower than 21.5% recorded in H1’2017. This indicates that banks’ continued preference towards investing in government securities, which offer better risk-adjusted returns. Interest income increased by 7.2%, as banks adapted to the interest rate cap regime, with increased allocations in government securities. This, however, should be a point of concern as it points to a reduction in the banking sector’s primary function of intermediation between depositors and credit consumers, with the loan to deposit ratio declining to 73.8% from 77.9% in H1’2017. Reduced credit extension especially to the private sector comprised mainly of the MSMEs, curtails both the short and long-run economic growth;

- The average Net Interest Margin in the banking sector currently stands at 8.1%, a slight improvement from the 8.0% recorded in H1’2017. The improvement was mainly due to the increase in Net Interest Income by 6.4% y/y, aided by the 7.9% improvement in the interest income y/y, and,

- Non-funded Income grew by 6.9% y/y, faster than 5.1% recorded in H1’2017. The growth included a total fee and commissions growth of 4.6% although it was slower than 12.5% recorded in H1’2017. The growth in fee and commission income was however subdued by the slow loan growth, thus impacting the fee and commission income from loans. Banks have however been focusing on expanding the other fee and commission income, with increased focus on transactional income from alternative transaction channels. Banks have been shifting focus to this revenue space, by offering holistic banking services such as advisory. With increased focus on other NFI sources such as transaction income from mobile and online channels, bancassurance, money remittance, and payment services etc., banks will likely see expansion in NFI going forward as net interest income remains somewhat subdued under the current interest rate cap regime.

Section III: The focus areas of the Banking Sector Players going forward

In summary, the banking sector had an improvement in performance, largely aided by the improving economic conditions and a more conducive operating environment compared to a similar period last year, which was marred by election jitters. However, the banking sector has been fraught by two main challenges (i) the deteriorating asset quality brought about by a spilled over effects of challenging operating environment experienced in 2017, and (ii) the capping of interest rates, which has led to subdued growth in the credit extended to the private sector. We however noted that the sector in general has adapted to operating in the tough environment, posting a 19.0% increase in core EPS. We believe the key factors banks need to consider going forward are asset quality management, continued revenue diversification, efficiency, and downside regulatory compliance risks amid tighter regulatory requirements. To grow profitability amidst the tighter regulated environment, banks will:

- Continue diversifying their income sources by growing their fee-income businesses, bancassurance, asset management and advisory services,

- Be more prudent in loan disbursement, as well as enhancing their risk assessment framework to improve asset quality, so as to tame any rising financial impairments arising from implementation of IFRS 9, and,

- Improve efficiency by leveraging on mobile and internet banking, for cost reduction especially on staff numbers and revenue expansion from transaction income, with all these strategies aimed at improving their profitability margins.

We believe the banking sector is well poised to grow in future and continue to outperform other sectors, but there is still a need to address the subdued growth in credit, which has remained below 5.0%, below the 5-year average of 13.0% as seen below.

Section IV: Brief Summary of the outcome of our analysis

As per our analysis on the banking sector, from a franchise value and from a future growth opportunity perspective, we carried out a comprehensive ranking of the listed banks. For the franchise value ranking, we included the earnings and growth metrics in the table above as well as the operating metrics in the table below in order to carry out a comprehensive review of the banks.

|

Bank |

LDR |

CIR |

ROACE |

Deposit/Branch |

Gross NPL Ratio |

NPL Coverage |

Tangible Common Ratio |

|

Coop Bank |

84.6% |

54.9% |

18.0% |

1.9 |

10.9% |

31.0% |

16.8% |

|

KCB Group |

80.3% |

52.0% |

21.9% |

2.0 |

8.4% |

63.6% |

14.4% |

|

DTBK |

70.4% |

57.4% |

15.5% |

2.0 |

7.1% |

70.7% |

13.0% |

|

Equity Bank |

69.9% |

52.8% |

23.9% |

1.4 |

8.5% |

51.8% |

14.7% |

|

I&M Holdings |

77.2% |

53.7% |

17.2% |

5.0 |

13.0% |

43.4% |

14.7% |

|

NIC Bank |

78.2% |

60.9% |

12.8% |

3.0 |

13.1% |

52.2% |

13.6% |

|

Barclays Bank |

81.2% |

66.3% |

17.5% |

2.4 |

7.7% |

68.2% |

12.6% |

|

SCBK |

48.4% |

55.2% |

18.0% |

6.6 |

14.8% |

75.0% |

14.5% |

|

CFC Stanbic |

71.4% |

54.0% |

14.8% |

8.3 |

6.6% |

51.5% |

11.8% |

|

HF Group* |

91.1% |

99.3% |

(0.2%) |

1.5 |

17.4% |

39.0% |

15.7% |

|

NBK |

49.8% |

95.6% |

(0.6%) |

1.4 |

46.5% |

56.5% |

4.1% |

|

Weighted Average H1'2018 |

73.8% |

55.6% |

19.5% |

2.9 |

10.0% |

55.9% |

14.4% |

|

*Used Loans to loanable funds due to nature of the business |

|||||||

The overall ranking was based on a weighted average ranking of Franchise value (accounting for 40%) and Intrinsic value (accounting for 60%). The Intrinsic Valuation is computed through a combination of valuation techniques, with a weighting of 75.0% on Discounted Cash-flow Methods and 25.0% on Relative Valuation, while the Franchise ranking is based on banks operating metrics, meant to assess the efficiency, asset quality, diversification, corporate governance and profitability, among other metrics. The overall H1’2018 ranking is as shown in the table below:

|

Bank |

Franchise Value Total Score |

Intrinsic Value Score |

Weighted Score |

H1'2018 Rank |

Q1'2018 Rank |

|

KCB Group |

47 |

3 |

20.6 |

1 |

1 |

|

Equity Bank |

61 |

5 |

27.4 |

2 |

2 |

|

I&M Holdings |

73 |

4 |

31.6 |

3 |

3 |

|

Coop Bank |

71 |

6 |

32.0 |

4 |

6 |

|

DTBK |

80 |

2 |

33.2 |

5 |

4 |

|

Barclays Bank |

76 |

7 |

34.6 |

6 |

5 |

|

SCBK |

75 |

8 |

34.8 |

7 |

8 |

|

NIC Bank |

87 |

1 |

35.4 |

8 |

8 |

|

CFC Stanbic |

76 |

9 |

35.8 |

9 |

7 |

|

NBK |

103 |

11 |

47.8 |

10 |

11 |

|

HF Group |

105 |

10 |

48.0 |

11 |

10 |

Major changes include:

- Co-operative bank climbed 2 spots to Position 4 from Position 6 in our Q1’2018 Banking Sector Report, owing to its net interest margin, with the bank having the third best NIM at 8.6%, higher than industry average of 8.1%, the best loan deposit ratio at 84.6%, above the industry average of 73.8%, and,

- Stanbic Holdings dropped 2 spots to Position 9 from Position 7 in our Q1’2018 Banking Sector Report, due to a low franchise value score caused by low Net Interest Margin at 4.9%, against the industry average 8.1%, a low corporate governance score ranking 10th in the Cytonn Corporate Governance Index, and a high Price to earnings Growth ratio of 0.9x, ranking 9th overall.

For a comprehensive analysis on the ranking and methodology behind it, see our Cytonn H1’2018 Banking Sector Report

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.