The Draft Financial Markets Conduct Bill, 2018, & Cytonn Weekly #23/2018

By Cytonn Research Team, Jun 10, 2018

Executive Summary

Fixed Income

T-bills were oversubscribed during the week, with the subscription rate coming in at 210.5% up from 186.1%, the previous week. Yields on the 91- day paper remained unchanged at 7.9% while yields on the 182 and 364-day papers declined to 10.1% and 10.9% from 10.2% and 11.1%, the previous week, respectively. According to the Stanbic Bank Monthly Purchasing Manager’s Index (PMI), the business environment in the country continued to improve in May 2018, but at a slower pace compared to April, mainly driven by favorable economic conditions and continued strong demand from international markets;

Equities

During the week, the equities market was on an upward trend with NASI, NSE 20 and NSE 25 gaining 2.6%, 0.5% and 2.4%, respectively. For the last twelve months (LTM), NASI and NSE 25 have gained 18.6% and 16.5%, respectively, while NSE 20 has declined by 3.6%; The Central Bank of Kenya (CBK) has released data on national payment systems, which indicated that the value of transactions carried out through mobile platforms rose 6.9% to Kshs 961.0 bn in Q1’2018;

Private Equity

In the financial services sector, Germany-based insurance company Allianz Group shall acquire an 8.0% minority stake in Africa Re-insurance (Africa Re) for an agreed sum of Eur. 69.0 mn;

Real Estate

Knight Frank released their Hotel Report 2018, indicating that global and local hotel chains are gaining traction in Africa given the conducive environment and undersupply of international grade hotels, despite the expected increased demand for the same. A 5-storey building collapsed in Huruma, Nairobi, during the week, causing harm to 7 and casting a shadow of doubt on the implementation of approvals awarded before construction begun;

Focus of the Week

In our focus note on the interest rate cap review and how it should focus more on stimulating capital markets, we highlighted that the Treasury was completing a draft proposal that would seek to address credit management in the economy. This week we focus on The Draft Financial Markets Conduct Bill, 2018, which seeks to amend the Banking Act and the Consumer Protection Act, to promote a fair, non-discriminatory financial market. Our conclusion is that more still needs to be done by the key stakeholders to properly address the credit crunch and revive private sector credit growth in the economy as the Bill has only partly addressed its intended purpose i.e. consumer protection.

- On 8th June 2018, Cytonn Foundation, Cytonn Investment’s corporate social investment arm, held its quarterly media training session to educate members of the media on affordable housing in Kenya

- On 4th June 2018, Cytonn Education Services (CES), Cytonn Investment’s education services affiliate, held a media briefing on 6th Floor, Queensway House, Kaunda Street, Nairobi CBD, to introduce CES and Cytonn College of Innovation and Entrepreneurship (CCIE), ahead of the official opening of CCIE later this year. See Event Note

- Our Investment Analyst, Stephanie Onchwati, discussed the Kenya Shilling and market movements on the Nairobi Stock Exchange. Watch Stephanie on CNBC here

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the trainings for their teams. The Wealth Management Trainings are run by the Cytonn Foundation, under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- We continue to beef up the team with ongoing hires for: Quality Control and Assurance Manager & Associate, Sales & Marketing Manager, Procurement Manager, Head of Business Development- Cytonn Asset Managers Limited, Portfolio Manager and Investments Associate – Public Markets, among others. Visit the Careers section on our website to apply

T-Bills & T-Bonds Primary Auction:

T-bills were oversubscribed during the week, with the subscription rate coming in at 210.5% up from 186.1%, the previous week. The subscription rates for the 91, 182 and 364-day papers came in at 21.9%, 173.5%, and 322.9% compared to 230.0%, 117.1%, and 237.6%, respectively, the previous week. We note that the 364-day paper continued to receive the most interest from investors, having recorded the highest subscription rate of the 3 papers this week, at 322.9% from 237.6% the previous week, as investors seek to lengthen duration. Yields on the 91- day paper remained unchanged at 7.9% while yields on the 182 and 364-day papers declined to 10.1% and 10.9% from 10.2% and 11.1%, the previous week. The acceptance rate for T-bills declined to 40.5% from 47.7%, the previous week, with the government accepting a total of Kshs 20.5 bn of the Kshs 50.5 bn worth of bids received, against the Kshs 24.0 bn on offer. The acceptance rate continued to decline due to the government cutting down on local borrowing since it is currently 34.7% ahead of its pro-rated domestic borrowing target for the current fiscal year, having borrowed Kshs 377.6 bn, against a target of Kshs 280.4 bn (assuming a pro-rated borrowing target throughout the financial year of Kshs 297.6 bn).

For the month of June 2018, the Kenyan Government has issued a new 25-year Treasury bond (FXD 1/2018/25) with the coupon set at 13.4%, in a bid to raise Kshs 40.0 bn for budgetary support. The sale period ends on 19th June, and we shall give our view on a bidding range in next week’s report.

Liquidity:

The average interbank rate declined to 4.1% from 5.4%, the previous week, attributed to increased participation by large banks trading at lower rates, while the average volumes traded in the interbank market increased by 34.6% to Kshs 21.8 bn from Kshs 16.2 bn, the previous week. The decline in the average interbank rate also points to improved liquidity, which can be attributed to the government’s reduced borrowing appetite as evidenced by the 40.5% acceptance rate in the T-bill auction this week. The government’s reduced borrowing appetite has resulted in banks holding excess cash, which is likely to trickle down to the private sector.

Kenya Eurobonds:

According to Bloomberg, the yields on both the 5-year and 10-year Eurobonds issued in June 2014 rose by 20 bps each to 5.4% and 6.8% from 5.2% and 6.6%, the previous week. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 3.4% points and 2.9% points for the 5-year and 10-year Eurobonds, respectively, an indication of relatively stable macroeconomic conditions in the country.

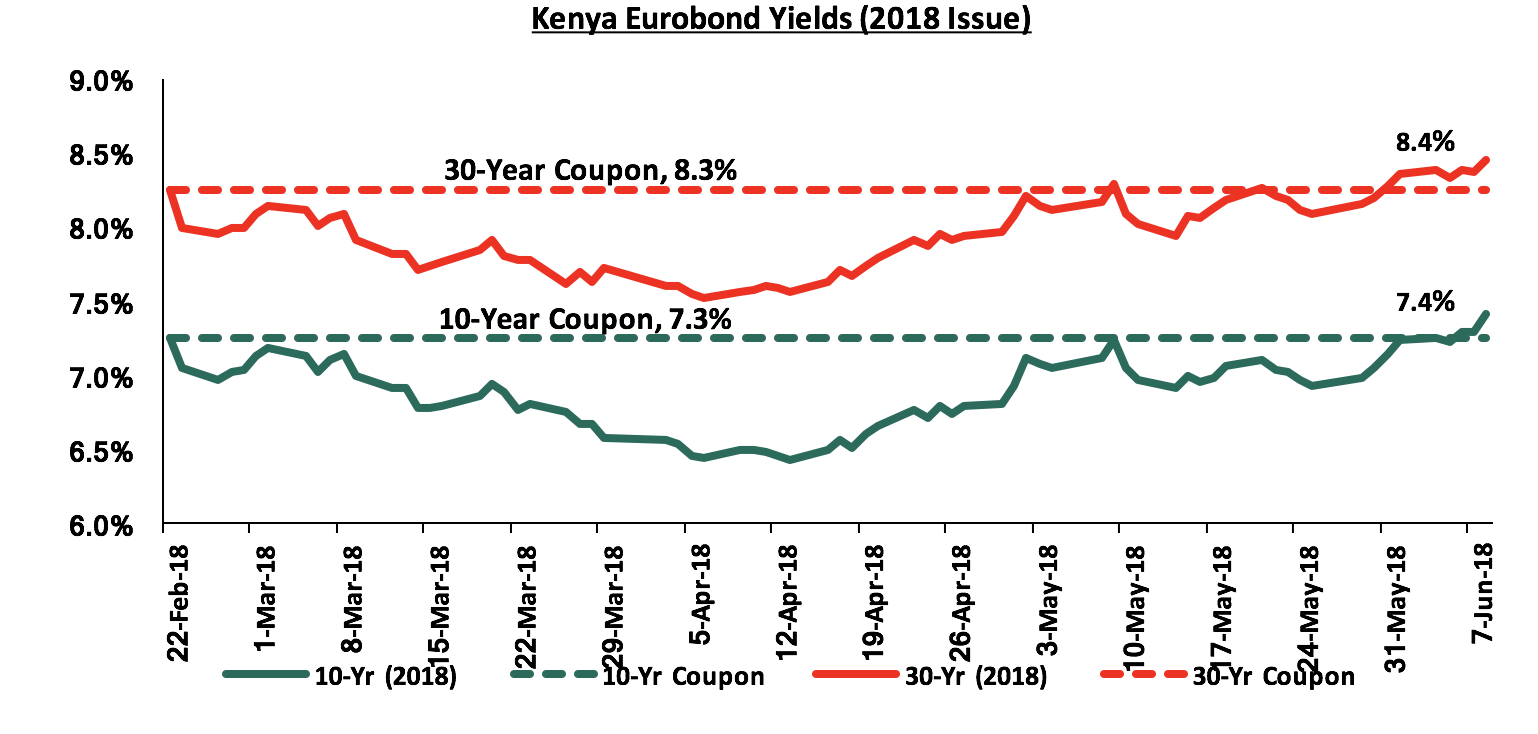

For the February 2018 Eurobond issue, during the week, the yields on the 10-year and 30-year Eurobonds increased by 30 bps and 10 bps to 7.4% and 8.4% from 7.1% and 8.3%, respectively, the previous week. Since the issue date, yields on the 10-year and 30-year Eurobonds have both increased by 0.1% points respectively.

We have noted the recent rise in Kenya Eurobond yields and this may be attributed to the current corruption scandals erupting in the country that seem to have led to varying sentiments across the market. Of interest is also the fact that bond yields have been on the rise globally attributed to:

- The end of the US Federal Reserve’s expansionary policy measures, which has seen a rise in the US Treasury yields against a backdrop of tighter monetary policy, rising interest rates, and inflation expected to rise in the coming months having edged up to 2.5% in April from 2.4% in March. This has resulted in corrections in global markets to the tune of US Treasury yields, as investors move to the relatively less risky USA securities, and,

- The current political crisis in Italy, which has had an effect on global bond yields. Italy is the third-largest economy in the Eurozone, and some investors have been exiting their positions in other markets to invest in the high Italian yields. The Italian bonds have been seen as an attractive investment as the country’s turmoil poses more of a political risk than economic. The economy is still growing above trend with GDP growth in 2017 coming in at 1.5%, a 7-year high and above a 5-year average of 0.04% coupled with low default rates thus providing a feasible investment opportunity.

The Kenya Shilling:

During the week, the Kenya Shilling appreciated by 0.7% against the US Dollar to close at Kshs 100.8 from Kshs 101.6, the previous week, due to increased diaspora remittances. On a YTD basis, the shilling has gained 2.3% against the USD. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- Stronger horticulture export inflows driven by increasing production,

- Improving diaspora remittances, which increased by 56.6% to USD 217.1 mn in April 2018 from USD 138.6 mn in March 2017, attributed to (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient, and,

- High forex reserves, currently at USD 9.0 bn (equivalent to 6.0 months of import cover) and the USD 1.5 bn stand-by credit and precautionary facility by the IMF, still available until September 2018.

Weekly Highlights:

According to the Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI), the business environment in the country continued to improve in May 2018, but at a slower pace compared to April, mainly driven by favorable economic conditions and continued strong demand from international markets. The PMI declined to 55.4 in May from 56.4 in April. A PMI reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. Firms reported growth in value of outputs midway through the second quarter, while new orders increased attributed to the continued rise in new export orders. This was despite high input costs due to a limited supply of resources experienced during the month as well as a modest rise in wages and staffing levels, leading to upward pressure on production costs, and consequently a rise in average selling prices for the sixth consecutive month. We expect output to continue rising, driven by a recovery in agricultural produce, mainly horticulture, as the Eurozone (Kenya’s main horticultural export destination) continues to recover and boost demand with the main focus currently being on the 2018/2019 budget and the outcome of the draft financial markets conduct bill, 2018 and its effects on the extension of credit to the private sector. We maintain our view that GDP is expected to grow at 5.4% in 2018 supported by growth in the manufacturing, agriculture, real estate, construction, and tourism sectors.

Kenya’s National Budget for the fiscal year 2018/19, projected at Kshs 2.5 tn, is set to be read on June 14th 2018. This will be a 9.1% increase from the current fiscal year’s budget of Kshs 2.3 tn. KRA is expected to raise Kshs 1.7 tn, a 9.1% rise from Kshs 1.3 tn previously, with the extra amount expected to be raised from recent initiatives by the Treasury such as the imposition of fuel VAT beginning September 2018, in line with the deal that Kenya made with the International Monetary fund (IMF) in March 2018. The fiscal deficit to GDP is expected to narrow to 6.0% from a projected 7.2% in the 2017/18 financial year, which is in line with the International Monetary Fund’s (IMF) recommendation in March as it pointed out that the initial targeted deficit of about 8.0-9.0% was not sustainable. The National treasury has budgeted a total of Kshs 97.7 bn, inclusive of Kshs 19.4 bn in interest payments, to finance the USD 750 mn, 5-year Eurobond issued in 2014 that is set to mature in the year ending June 2019. Including interest payments from the USD 2.0 bn 2018 issue, external debt financing in the 2018/19 fiscal year is estimated to increase by 51.9% to Kshs 364.7 bn from Kshs 240.1 bn in 2017/18, which will be 21.0% of budgeted revenues. Debt sustainability continues to be a key concern, with the public debt to GDP estimated to have hit 55.6% by the end of 2017, 5.6% above the East African Community (EAC) Monetary Union Protocol, the World Bank Country Policy and Institutional Assessment Index, and the IMF threshold of 50.0%. Following the recent recommendation by the CBK governor, that the country should shift its focus to other non-debt financing arrangements such as public private partnership to fund infrastructural projects, we expect increased measures to improve debt management going forward. We don’t expect the budget to significantly differ from the estimates provided in the 2018 BPS and shall provide a detailed breakdown in next week’s report, once the budget is officially released.

Rates in the fixed income market have remained stable as the government rejects expensive bids. The government is under no pressure to borrow for the remaining part of the current fiscal year as: (i) they are currently ahead of their domestic borrowing target by 34.7%, (ii) they have met 79.1% of their total foreign borrowing target and 83.9% of their pro-rated target for the current fiscal year, and (iii) the KRA is not significantly behind target in revenue collection. Come the next fiscal year, the government is likely to remain behind target for the better part of the first half as per historical data, but we do not expect this to result in a rise in interest rates with the interest rate cap still in place. Therefore, we expect interest rates to remain stable. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium to long-term fixed income instruments.

Market Performance:

During the week, the equities market was on an upward trend with NASI, NSE 20 and NSE 25 gaining 2.6%, 0.5% and 2.4%, respectively. This takes the YTD performance of the NASI, NSE 20 and NSE 25 to 3.4%, (9.8%) and 4.4%, respectively. This week’s performance was driven by gains in large cap stocks in the telecoms and banking sector, with Safaricom, Equity Group, KCB Group, Cooperative Bank and Diamond Trust Bank appreciating by 5.3%, 4.8%, 4.3%, 2.9% and 2.6%, respectively. For the last twelve months (LTM), NASI and NSE 25 have gained 18.6% and 16.5%, respectively, while NSE 20 has declined by 3.6%.

Equities turnover increased by 3.1% this week to USD 33.6 mn from USD 32.6 mn the previous week. We expect the market to remain resilient this year supported by positive investor sentiment, as investors take advantage of the attractive stock valuations in select counters.

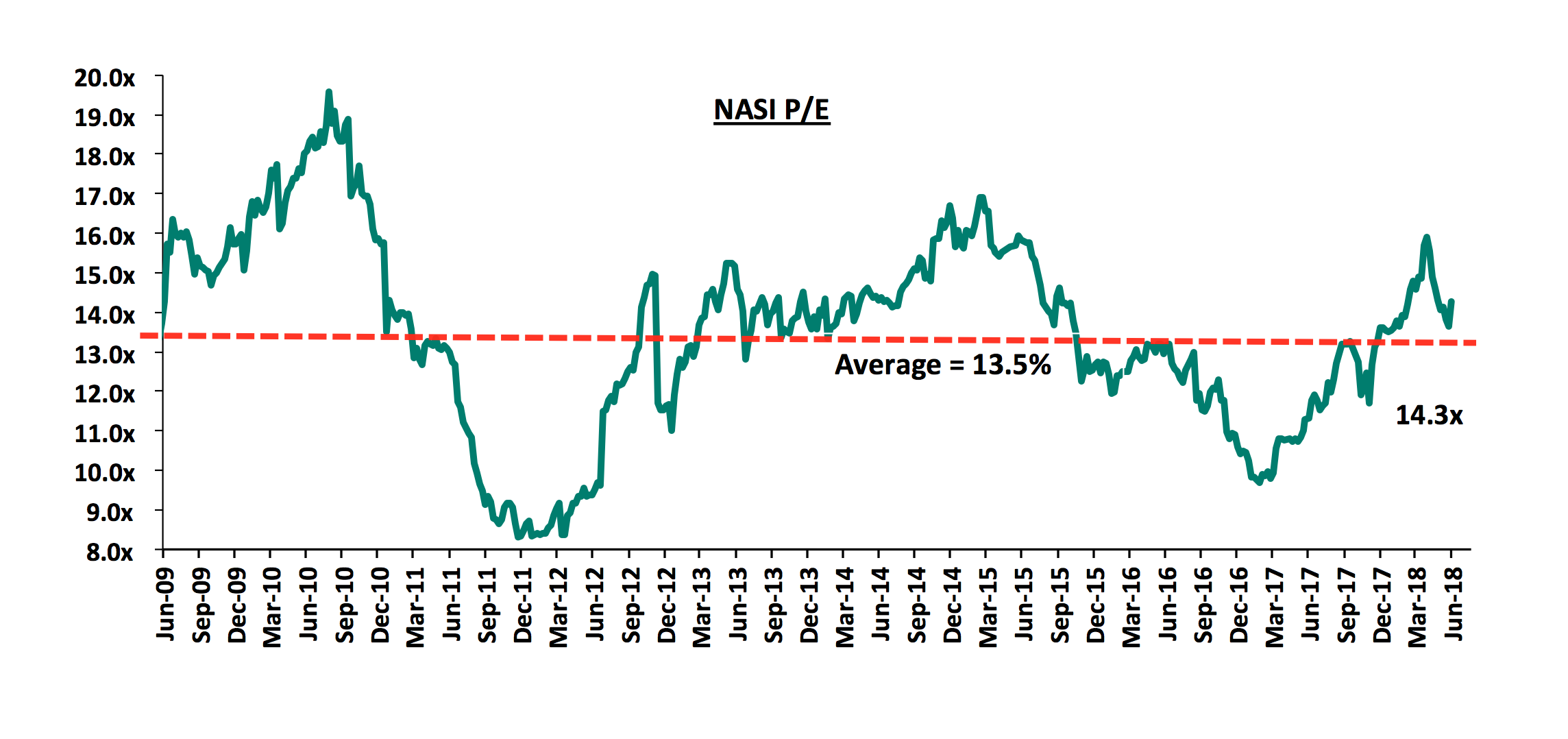

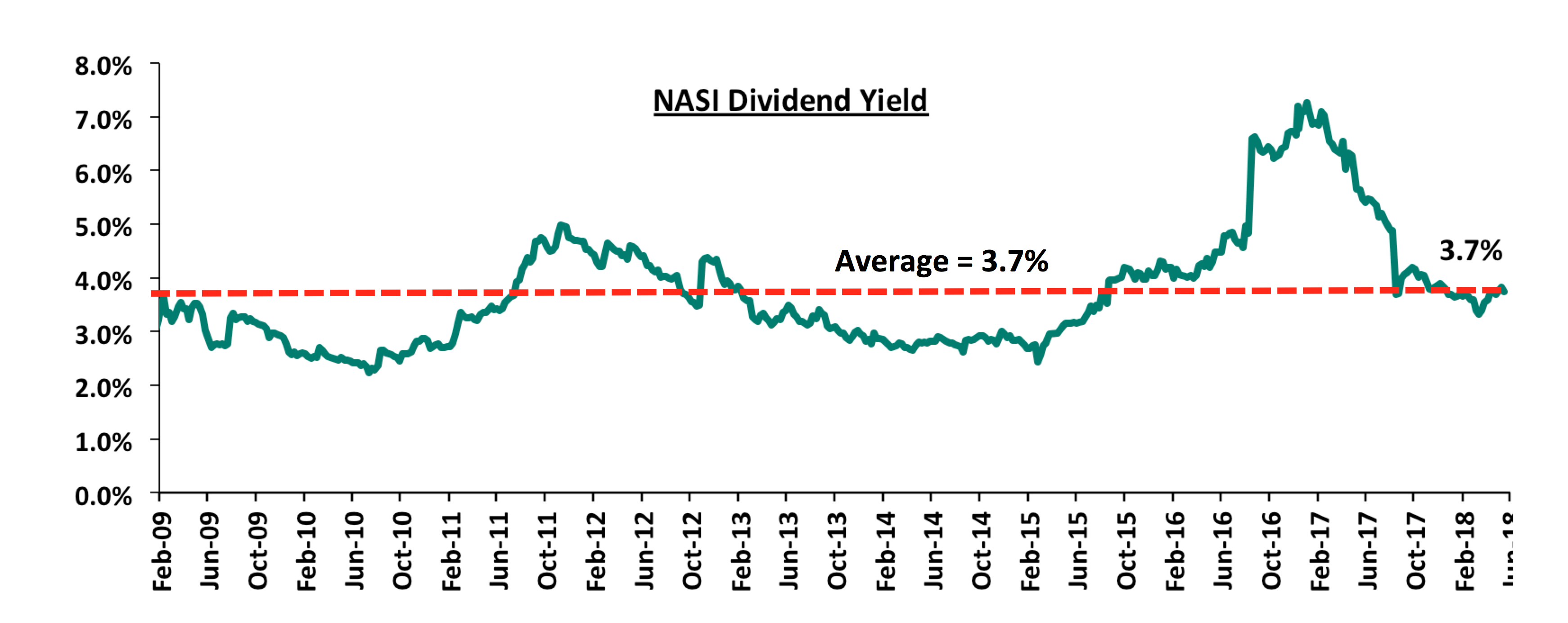

The market is currently trading at a price to earnings ratio (P/E) of 14.3x, which is above the historical average of 13.5x, and a dividend yield of 3.7%, consistent with the historical average of 3.7%. The current P/E valuation of 14.3x is 45.9% above the most recent trough valuation of 9.8x experienced in the first week of February 2017, and 72.3% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlights:

KCB Group and Liberty Life Assurance have collaborated to launch an insurance policy dubbed ‘KCB Elimisha’, through which customers can save for children’s education for a minimum premium of Kshs 500. The policy will be underwritten by KCB Insurance Agency, which is a non-banking subsidiary of KCB Group Plc. Policyholders will be paid benefits within five to twenty years, ranging from between Kshs 50,000 and Kshs 40.0 mn, with double the guaranteed pay out in case of accidental death. Through the partnership, KCB Group expects to grow its non-interest revenue, which declined marginally to Kshs 5.5 bn in Q1’2018 from Kshs 5.6 bn in Q1’2017. The bank’s Non-Funded Income (NFI) contribution to total income declined to 32.7% in Q1’2018 from 35.0% in Q1’2017, which is below the industry average of 33.6%; this is a very low number for such a strong brand that can be extended into lucrative fee income businesses such as investment advisory, investment banking, asset management and insurance. A number of banks have focussed on growing their NFI given the capping of interest rates that specifies a loan and deposit pricing framework, thus limiting growth in their net interest income. Hence, the partnership is set to boost KCB’s NFI generated from its bancassurance business line and improve the bank’s revenue diversification.

The Central Bank of Kenya (CBK) released data on national payment systems used by citizens. According to the CBK, the number of deals settled through card payments increased by 1.8% to 54.4 mn in Q1’2018 compared with 53.5 mn in Q1’2017, while the value of the payments increased by 2.0% to Kshs 350.6 bn in Q1’2018 from Kshs 343.6 bn in Q1’2017. Deals done via payment cards fell by 2.8% to 53.4 mn from 54.9 mn in Q1’2017, partly attributable to the shift to mobile transactions by retailers, as mobile transactions are deemed more secure compared to card payments. The number and value of mobile transactions continue to increase due to easier accessibility with the number of agents increasing by 24.2% to 196,002 in Q1’2018 from 157,855 in Q1’2017. The number of mobile transactions increased by 11.7% to 416.5 mn in Q1’2018 from 372.9 mn in Q1’2017, while the value of mobile payments rose by 6.9% to Kshs 961.0 bn from Kshs 899.1 bn in Q1’2017. Banks are increasingly pushing their customers to use alternative channels to perform transactions, in a bid to improve customer experience through easier accessibility of banking services, and increase their non-interest revenue in the wake of the interest rate cap.

Corporate Governance:

Bamburi Cement announced the resignation of two directors from its board; Jose Cantillana and Thibault Dornon, who was the alternate to Olivier Guitton. The company also gave notice of the appointment of Pierre Deleplanque to its board, effective 7th June 2018.

Following the changes:

- The board size has reduced to 9, an odd number, from 10 hence an improvement of the metric score to 1.0 from 0.5,

- Gender diversity has improved slightly to 33.3% from 30.0%, which changes its score to 1.0 from 0.5 as it is greater than 33.0%,

- Ethnic diversity improved marginally to 22.2% from 25.0%, hence the score remained the same at 1.0 since less than 30.0% are from one ethnicity,

- The proportion of non-executive members has declined slightly to 66.7% from 70.0% previously but the score remains unchanged at 1.0 as it is still greater than 50.0%;

Overall, the comprehensive score has therefore improved to 70.8% from 66.7% previously, and the rank improved to 21 from 22 in the 2017 CGI report.

Equities Universe of Coverage:

Below is our Equities Universe of Coverage:

|

Banks |

Price as at 31/05/2018 |

Price as at 8/06/2018 |

w/w change |

YTD Change |

LTM Change |

Price as at 8/06/2017 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

|

|

NIC Bank*** |

34.8 |

35.0 |

0.7% |

3.7% |

18.4% |

29.6 |

56.0 |

2.9% |

62.9% |

0.8x |

|

|

HF Group*** |

8.0 |

8.0 |

0.6% |

(23.1%) |

(14.2%) |

9.3 |

11.7 |

4.0% |

50.3% |

0.3x |

|

|

Union Bank Plc |

5.6 |

5.6 |

0.9% |

(28.2%) |

6.5% |

5.3 |

8.2 |

0.0% |

45.5% |

0.6x |

|

|

DTB |

190.0 |

195.0 |

2.6% |

1.6% |

38.3% |

141.0 |

272.9 |

1.3% |

41.3% |

1.0x |

|

|

I&M Holdings |

108.0 |

120.0 |

11.1% |

(5.5%) |

29.0% |

93.0 |

151.2 |

2.9% |

28.9% |

1.1x |

|

|

KCB Group |

46.0 |

48.0 |

4.3% |

12.3% |

20.0% |

40.0 |

63.7 |

4.2% |

36.8% |

1.5x |

|

|

CRDB |

160.0 |

160.0 |

0.0% |

0.0% |

(15.8%) |

190.0 |

207.7 |

0.0% |

29.8% |

0.5x |

|

|

Ghana Commercial Bank |

6.4 |

5.9 |

(6.9%) |

17.6% |

13.8% |

5.2 |

7.7 |

6.4% |

36.4% |

1.4x |

|

|

Co-operative Bank |

17.0 |

17.5 |

2.9% |

9.4% |

20.4% |

14.5 |

20.5 |

4.6% |

21.9% |

1.5x |

|

|

Barclays |

11.8 |

11.9 |

0.8% |

24.0% |

25.3% |

9.5 |

13.7 |

8.4% |

23.5% |

1.5x |

|

|

Equity Group |

47.3 |

49.5 |

4.8% |

24.5% |

26.1% |

39.3 |

54.3 |

4.0% |

13.8% |

2.5x |

|

|

Stanbic Bank Uganda |

31.5 |

32.0 |

1.6% |

17.4% |

23.1% |

26.0 |

36.3 |

3.7% |

17.0% |

2.0x |

|

|

UBA Bank |

10.8 |

11.0 |

1.4% |

6.3% |

23.9% |

8.8 |

10.7 |

13.7% |

11.4% |

0.7x |

|

|

Bank of Kigali |

289.0 |

289.0 |

0.0% |

(3.7%) |

18.0% |

245.0 |

299.9 |

4.8% |

8.6% |

1.6x |

|

|

Standard Chartered |

202.0 |

200.0 |

(1.0%) |

(3.8%) |

(1.5%) |

203.0 |

192.6 |

6.3% |

2.5% |

1.6x |

|

|

Guaranty Trust Bank |

40.5 |

41.2 |

1.6% |

1.0% |

22.7% |

33.6 |

37.2 |

5.8% |

(3.7%) |

2.3x |

|

|

Stanbic Holdings |

95.5 |

94.0 |

(1.6%) |

16.0% |

31.5% |

71.5 |

87.1 |

5.6% |

(1.7%) |

1.2x |

|

|

CAL Bank |

1.5 |

1.3 |

(13.1%) |

16.7% |

80.0% |

0.7 |

1.4 |

0.0% |

11.1% |

1.1x |

|

|

Access Bank |

10.4 |

10.7 |

2.9% |

2.4% |

4.2% |

10.3 |

9.5 |

3.7% |

(7.5%) |

0.7x |

|

|

Ecobank |

11.6 |

11.3 |

(2.8%) |

48.7% |

71.4% |

6.6 |

10.7 |

0.0% |

(5.0%) |

3.2x |

|

|

SBM Holdings |

7.7 |

7.5 |

(2.3%) |

(0.3%) |

0.0% |

7.5 |

6.6 |

4.0% |

(8.3%) |

1.1x |

|

|

Bank of Baroda |

160.0 |

160.0 |

0.0% |

41.6% |

45.5% |

110.0 |

130.6 |

1.6% |

(16.8%) |

1.4x |

|

|

Stanbic IBTC Holdings |

46.1 |

48.2 |

4.6% |

16.1% |

66.2% |

29.0 |

37.0 |

1.2% |

(22.0%) |

2.5x |

|

|

Standard Chartered |

26.0 |

27.0 |

3.9% |

7.0% |

67.6% |

16.1 |

19.5 |

0.0% |

(28.0%) |

3.4x |

|

|

FBN Holdings |

10.2 |

10.6 |

3.9% |

19.9% |

59.4% |

6.6 |

6.6 |

2.4% |

(34.8%) |

0.6x |

|

|

Ecobank Transnational |

19.5 |

20.0 |

2.6% |

17.6% |

59.5% |

12.5 |

9.3 |

0.0% |

(53.6%) |

0.7x |

|

|

*Target Price as per Cytonn Analyst estimates |

|||||||||||

|

**Upside / (Downside) is adjusted for Dividend Yield |

|||||||||||

|

***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 5th largest shareholder |

|||||||||||

We are “NEUTRAL” on equities for investors with a short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for long-term investors, and with expectations of higher corporate earnings this year, we are “POSITIVE” for investors with a long-term investment horizon.

European financial services company Allianz Group has agreed to acquire 8.0% in African reinsurer Africa Re. The total cash consideration payable at closing would amount to Eur. 69.0 mn. Headquartered in Munich, Germany, Allianz is the world's third-largest financial services company by revenue (Eur. 109.6 bn) as of year ended 2017. With Eur. 1,960.0 bn worth of assets under management, the group’s core businesses are insurance and asset management. African Reinsurance Corporation, commonly referred to as Africa Re, is a reinsurance company based in Lagos, Nigeria. Founded in 1976 by the member states of the African Union and African Development Bank (ADB), it has operations spanning more than 60 countries with physical presence in eight locations including Lagos (Nigeria), Casablanca (Morocco), Nairobi (Kenya), Abidjan (Ivory Coast), Johannesburg (South Africa), Ebene (Mauritius), Cairo (Egypt) and Addis Ababa (Ethiopia).

As of December 2016, Shareholding in Africa Re was as follows:

|

Shareholder |

Number of Shares |

In % |

|

41 Member States |

986,627 |

34.6 % |

|

Africa Development Bank |

240,000 |

8.42 % |

|

111 African Insurance Companies |

964,778 |

33.83 % |

|

3 Non-African Investors |

660,000 |

23.15 % |

The party selling its stake is yet to be disclosed. An 8.0 % stake will be equivalent to 228,112 shares. The purchase of 8.0% stake at Eur. 69.0 mn, implies a market valuation of Eur. 862.5 mn; based on their last published financial statements (December 2016), the book value was Eur. 774.8 mn, implying the transaction is valued at a P/B ratio of 1.2x. This investment is a significant milestone and in line with Allianz’s long-term growth strategy in Africa having identified it as one of the future growth markets. A similar deal in 2017 saw Allianz Group acquire 98.0% of Nigerian Insurer Ensure Insurance for Eur. 29.6 mn, a transaction valued at a P/B ratio of 1.5x. Allianz Group is also the sole insurance investor in BIMA, the digital micro-insurer that uses mobile technology to serve low-income customers in Africa, Asia and Latin America.

This is in line with recent deals in the insurance industry as shown in the table below:

|

Insurance Sector Transaction Multiples over the last Seven Years |

|||||||

|

No. |

Acquirer |

Insurance Acquired |

Book Value (bn Kshs) |

Transaction Stake |

Transaction Value (bn Kshs) |

P/B |

Date |

|

1 |

Africa Development |

Resolution |

N/A |

25.1% |

0.2 |

N/A |

Dec-10 |

|

2 |

Leapfrog |

Apollo |

0.3 |

26.9% |

1.1 |

15.6x |

Dec-11 |

|

3 |

Saham Finances |

Mercantile |

0.5 |

66.0% |

Undisclosed |

N/A |

Jan-13 |

|

4 |

Swedfund |

AAR |

0.4 |

20.0% |

0.4 |

5.4x |

May-13 |

|

5 |

BAAM |

Continental Re |

0.7 |

30.0% |

0.3 |

1.4x |

Apr-14 |

|

6 |

Union Insurance of |

Phoenix of East |

1.8 |

66.0% |

2 |

1.6x |

May-14 |

|

7 |

UK Prudential |

Shield |

0.1 |

100.0% |

1.5 |

10.2x |

Sep-14 |

|

8 |

Swiss Re |

Apollo |

0.6 |

26.9% |

Undisclosed |

N/A |

Oct-14 |

|

9 |

Britam |

Real Insurance |

0.7 |

99.0% |

1.4 |

2,1x |

Nov-14 |

|

10 |

Leap Frog |

Resolution |

0.2 |

61.2% |

1.6 |

11.7x |

Nov-14 |

|

11 |

Old Mutual Plc |

UAP Holdings |

9.6 |

60.7% |

11.1 |

1.9x* |

Jan-15 |

|

12 |

MMI Holdings |

Cannon |

1.7 |

75.0% |

2.4 |

1.9x |

Jan-15 |

|

13 |

Pan Africa |

Gateway |

1.0 |

51.0% |

0.6 |

1.1x |

Mar-15 |

|

14 |

Barclays Africa |

First Assurance |

2.0 |

63.3% |

2.9 |

2.2x |

Jun-15 |

|

15 |

IFC |

Britam |

22.5 |

10.4% |

3.6 |

1.5x |

Mar-17 |

|

16 |

Africinvest III |

Britam |

28.5 |

14.3% |

5.7 |

1.4x |

Sep-17 |

|

17 |

Allianz Group |

Africa Re |

91.9 |

8.0% |

8.2 |

1.2x |

Jun-18 |

|

|

Average |

|

10.2 |

47.3% |

2.9 |

1.65x |

|

*-Proforma Transaction Multiple

Private equity investments in Africa remains robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets

Weekly Highlights:

Knight Frank released its Hotels Report 2018 indicating that the global and local hotel chains target Africa as a growth region because of its undersupply of international grade hotels. The report highlighted international brands that have presence in Africa, hotel supply in Africa and the performance of the hospitality sector in the Sub Saharan Region and Africa in general. According to the report;

- The current hotel stock is heavily concentrated in a small number of markets along the coast line with North Africa, Southern Africa, East Africa, West Africa and Central Africa accounting for 38.0%, 30.0%, 21.0%, 9.0%, and 2.0% of branded hotels in Africa respectively, attributable to the reluctance of hotels to embrace international brands,

- Investors have shifted their focus to international chains supply in markets currently perceived as being undersupplied as reflected by the current projects in the pipeline. In the pipeline projects, West Africa account for the largest portion of projects under development at 35.0% followed by North Africa, East Africa, Southern Africa and lastly Central Africa at 29.0%, 27.0%, 5.0%, and 4.0%, respectively. This is mainly driven by the expectation of an increase in the demand for hospitality services, thus the multiple hotels under development in the region for international brands including Hilton, Sheraton and Marriott,

- The overall hotel room occupancy rate in Africa according to STR Global, was 58.0% in 2017 up from 54.9% in 2016 recording a 3.1%-point increase. The hotels also had an average ADR and REVPAR of USD 107 and USD 62 respectively, recording a 2.1% and 7.8% increase, compared to 2016 at USD 105 and USD 58, respectively. The improved performance can be attributed to the increase of occupancy rate for the North Africa region given the improved security in the region,

- The Sub Saharan Africa region recorded an average hotel occupancy of 60.0% in 2017, from 59.3% in 2016. Hotels in the region also recorded an average ADR of USD 121.4 in 2017 from USD 121.7 in 2016, thus a 0.3% drop, while the REVPAR increased by 7.8% to USD 73 in 2017. We attribute this overall improved performance to the stable demand for hospitality services in the region,

- Mauritius and Seychelles were ranked as 2017’s top-performing markets, in terms of both occupancy and room rates, this performance is attributed to the relative immunity to the security concerns that have influenced resort locations elsewhere in Africa, and increased investor interest in the markets.

Key highlights in the Kenyan market are;

- Kenya ranked as one of the hotel development hotspots in East Africa alongside Ethiopia and Tanzania, with the development activities being driven primarily by the expansion plans of the larger multinational hotel groups into the continent targeting increased international tourist arrivals at 8.1% increase in 2017 from 2016 according to KNBS Economic Survey 2018,

- Kenya ranked the fifth African country with the highest number of chain and branded hotels—excluding lodges, safari camps, chalets and cruise-hotels at 68 chain and branded hotels, while South Africa topped the list with 430, followed by Egypt at 300, Morocco at 153 and Tunisia at 103. This is attributable to Nairobi’s position as a major regional hub attracting business travelers, improved security and diversity in tourism activities.

This performance is in line with our report Cytonn Weekly #7/2018 , where we reported that internationally branded hotels have been on an expansion offensive in Nairobi with a total of 1,882 internationally branded hotel rooms expected to come to the market by the end of 2018, and a 4.0% increase in occupancy rates. We expect the trend to continue, driven by, (i) political calm, (ii) growth of MICE and domestic tourism, (iii) sustained international business and travel tourism and (iv) increased marketing by the Kenya Tourism Board (KTB).

The real estate sector continues to witness increase in collapse of the buildings, evidenced by the collapse of a 5-storey building in Huruma, Nairobi, during the week, causing harm to 7 and casting a shadow doubt on the implementation approvals awarded before the building started construction. The collapsed building was adjacent to Huruma Estate Primary School and was marked for demolition by the National Construction Authority (NCA). This is as a demolition exercise of unsafe buildings and structures by the National Building Inspectorate (NBI) commenced on 14th March 2018. An Audit recently conducted by the Inspectorate revealed that, half of the 2,260 buildings evaluated in selected estates in Nairobi had foundation defects. 13 buildings were earmarked for demolition at the beginning of this year of which 2 have been brought down. The remaining ones include; 2 in Zimmerman, 5 in Huruma, 1 in Mathare, 1 in Umoja and 1 in Kariobangi area. Other buildings that have collapsed in the capital Nairobi this year include a four-storey flat in Zimmerman and a seven-storey building in Kware Pipeline Estate. We attribute the increased number of similar tragedies to; (i) lack of adherence to set rules by property developers as they rush to meet the high demand for houses ii) poor workmanship (iii) poor regulation enforcement in the sector, and (iv) compromise on quality resulting in the use of sub- standard construction materials. To eliminate these tragedies, the National Construction Authority must thus put in place strict regulations such as frequent inspections, training of artisans, easing the building approval process by reducing costs and time and ensure they are adhered to, and demolish the substandard developments.

Other Weekly Highlights:

- The retail sector continues to record increased activities, with Java setting up plans to open two new branches in Nairobi and Mombasa. Java Group, recognized as the biggest restaurant chain in the East African region, currently has 64 branches in the East African Region. The retail sector has witnessed many retailers adopting the expansion strategy driven by increased demand driven by positive demographic trends such as, i) rapid urbanization that currently stands at 4.4% against a global average of 2.1%, (ii) rapid population growth rates of 2.6% against a global average of 1.2%, and iii) an expanding middle class with increased purchasing power due to higher disposable income, which increased to Kshs 6.6 tn in 2016 from Kshs 5.7 tn in 2015,

- Local airline carrier Silverstone Air Services is set commence flights between Nairobi and Mombasa, this July. The flight that targets tourists on the coastal circuits, is set to have a positive impact on the hospitality industry through increased inbound traffic,

- During the week, tenants of Jevanjee/Bachelors quarters in Ngara filed a complaint that they were not consulted in laying out the redevelopment plan of old housing estates by Nairobi Urban Housing Project. The tenants complained about the manner in which the redevelopment was being carried out without involving them. The projects affected are Old Ngara, Jevanjee Bachelors Accommodation that comprises of 114 and 80 housing units respectively. The issues risen revolve around the state not acquiring the Department of Public Works and necessary documentation lawfully.

Listed Real Estate:

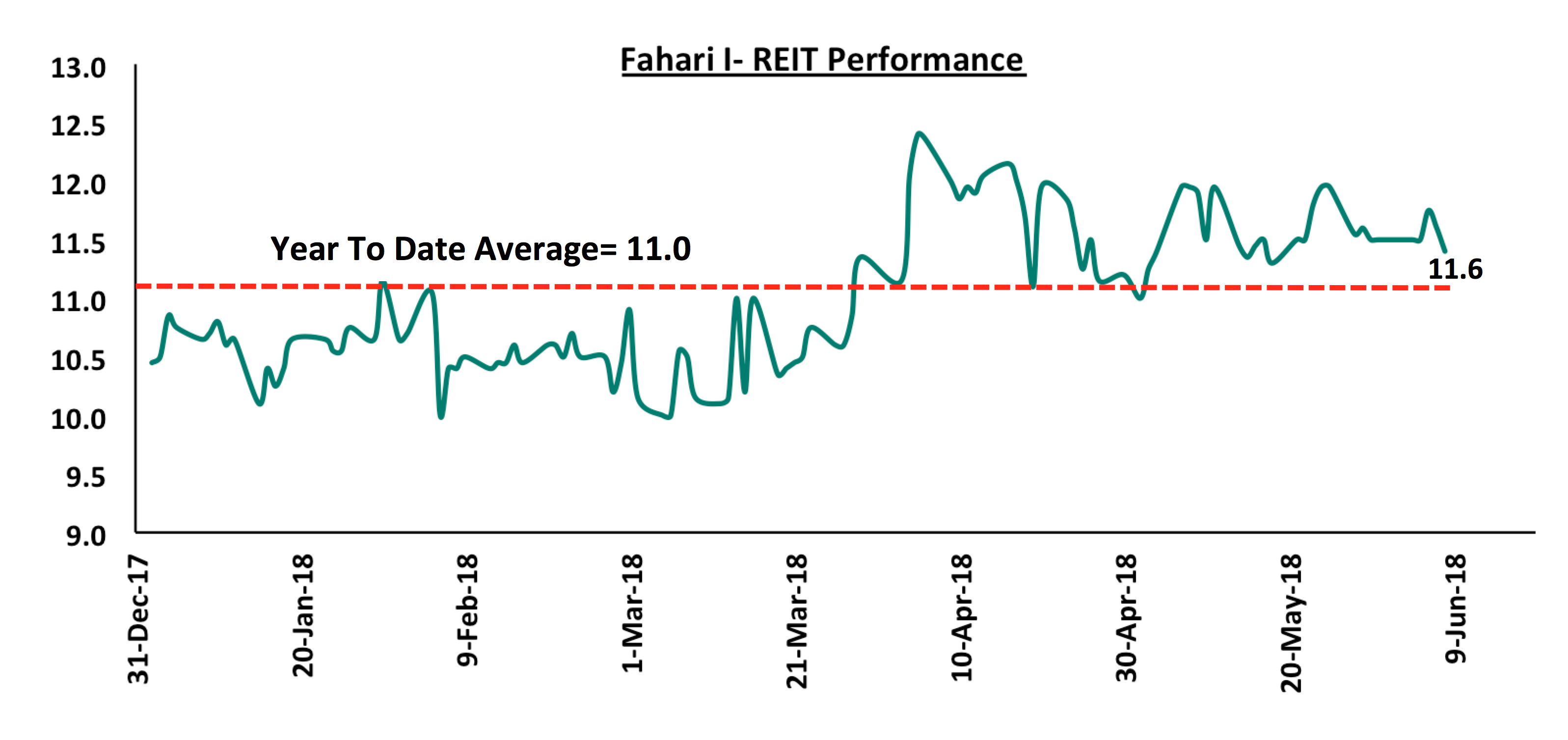

On the bourse, Stanlib’s Fahari I-REIT price rose by 0.1%, closing at Kshs 11.6 from Kshs 11.5 the previous week. The I -REIT continued to trade at 44.2% lower than its listing price of Kshs 20.8 in November 2015. In general, low performance of REITs is attributed to i) opacity of the exact returns from the underlying assets, ii) the negative sentiments currently engulfing the sector given the poor performance of Fahari I -REIT and Fusion D-REIT (FRED), iii) inadequate investor knowledge, and iv) lack of institutional support for REITs. We expect the REIT to continue trading at low prices and in low volumes.

Our outlook remains positive for the real estate sector given the increased traction of economic activities in the real estate sector, as depicted in the hospitality sector through increase in international investors. Other factors likely to result in this positive trend include; positive demographic trends such as i) rapid urbanization that currently stands at 4.4% against a global average of 2.1%, (ii) rapid population growth rates of 2.6% against a global average of 1.2%, (iii) sustained infrastructural development, and (iv) government initiatives to tackle the huge housing deficit of 2 mn units, growing by approximately 200,000 units per annum according to National Housing Corporation (NHC).

In our Focus Note on the interest rate cap review and how it should focus more on stimulating capital markets, published on 13th May, 2018, we highlighted that the Treasury was completing a draft proposal that would seek to address credit management in the economy. The National Treasury thus embarked on two recent possible solutions as follows:

- proposed a credit guarantee scheme for loans advanced to small and medium size enterprises (SMEs). The proposal is still at an early stage and the amounts and inception date are still not in place, as stakeholder consultations continue, and,

- developed a draft Financial Markets Conduct Bill, 2018 that will see the establishment of the Financial Markets Conduct Authority that will (a) regulate the cost of credit with the aim of protecting consumers, (b) promote a fair, non-discriminatory environment for credit access, and (c) ensure uniformity in standards and practices in the issue of financial products and services.

In light of these efforts, we look at the Financial Markets Conduct Bill, 2018, focusing on:

- a background of the Financial Markets Conduct Bill, 2018 – What led to its proposal?

- key highlights of the draft Bill,

- views on the Bill by key stakeholders, and,

- conclude by giving our views on the way forward.

Section I: Background of the Financial Markets Conduct Bill, 2018 – What led to its proposal?

Before the introduction of the interest rate cap that saw lending rates and deposit rates pegged to the Central Bank Rate (CBR), private sector credit growth had already begun declining from the 5-year high of 25.8% recorded in June 2014. From the chart below, we have identified two points of decline as follows:

- Period where banks begun to collapse: late 2015 saw the collapse of Imperial Bank, after which Chase Bank and Dubai Bank followed in early 2016, prompting concerns around the corporate governance and asset quality of banks. Private sector credit growth thereafter started on a steep decline, and,

- Period when the interest rate cap was introduced: September 2016 saw the passing into law of the Banking (Amendment) Act, 2016, which capped lending rates at 14.0%, 4.0% points above the prevailing CBR, 10.0% at the time. This marks the second noticeable node in the chart where private sector credit growth begun on a decline, though relatively more gradual.

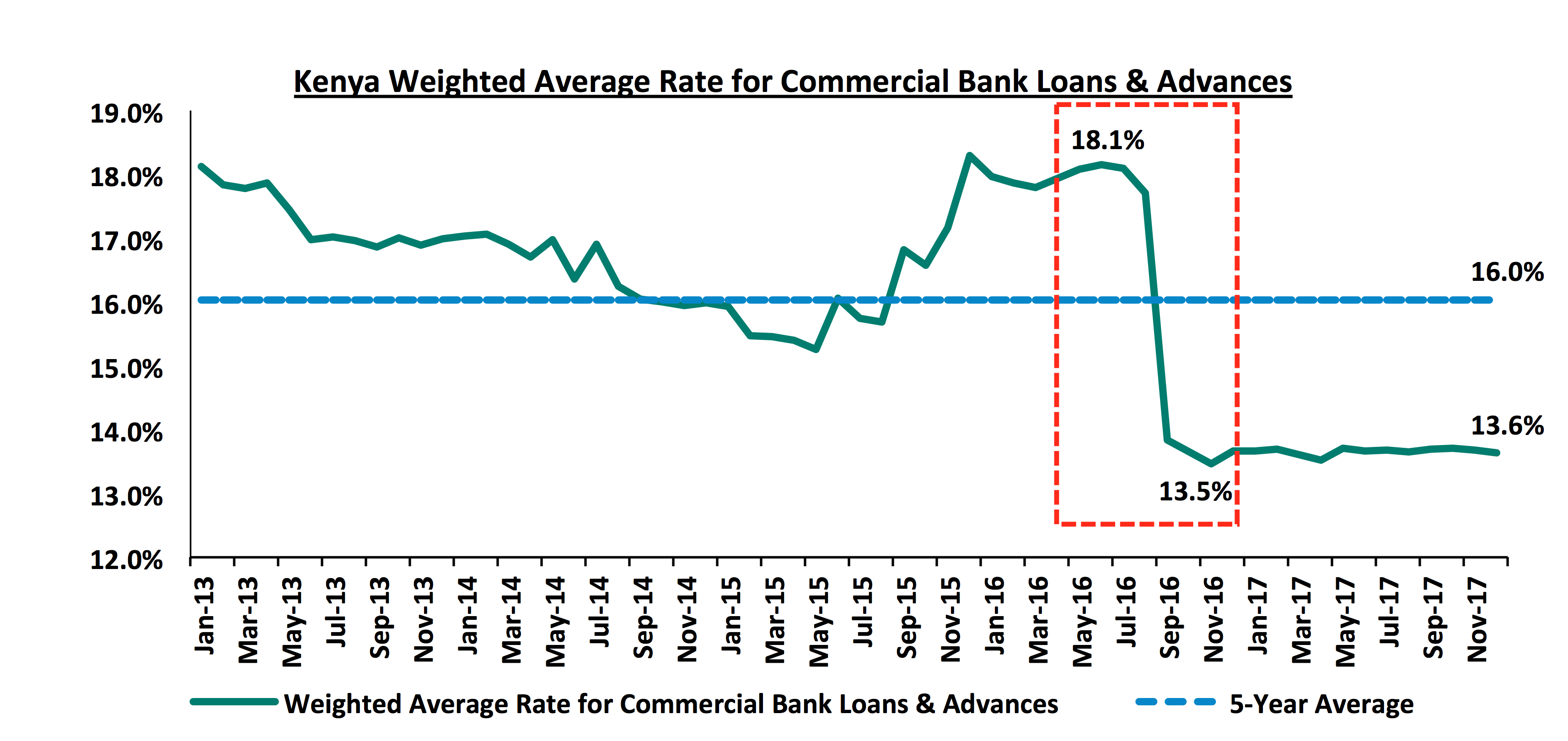

The further decline in private sector credit growth prompted calls from both the international and local communities to repeal or amend the interest rate cap, because the private sector had at their grasp seemingly cheaper loans rates (without additional fees and charges), but these loans were now not accessible; especially with banks adopting a more stringent credit risk assessment framework and preferring the less risky government securities as an alternative avenue to channel their funds. The chart below illustrates the drastic drop in loan rates by commercial banks following the introduction of the interest rate cap in September 2016:

The Government stood by its decision to cap interest rates, while the CBK in conjunction with the Kenya Bankers Association (KBA) set out to assess the effects of the cap on private sector lending and in turn, the economy. In March 2018, the International Monetary Fund (IMF) announced its decision to withdraw the USD 1.5 bn stand-by credit and precautionary facility to Kenya, citing failure to meet conditions previously agreed upon for the facility to be extended, key among these being lowering of the budget deficit to 3.7% of GDP by the fiscal year 2018/19 (projections as per the Draft 2018 BPS indicated a deficit of 6.0%). To have the facility extended, the National Treasury and the President endorsed the repeal of the cap, stating that it had contributed towards crowding out the private sector from accessing credit. The National Assembly, on the other hand, did not uphold the same view, stating that banks were colluding to frustrate the intended efforts of the cap, in order to have it repealed and in turn revert to their previously high margins. In light of this, the Treasury came up with the idea to draft a Bill that would address credit management in the economy. Treasury Cabinet Secretary, Mr. Henry Rotich, stated that the draft Bill would not only be centered on the cost of credit, but would also present some consumer protection policies. Now with the draft released, we look at its key highlights, and how effective it might be in achieving its intended purpose if passed.

Section II: Key highlights of the draft Bill

The Financial Markets Conduct Bill, 2018 seeks to amend the Banking Act and the Consumer Protection Act, and aims to promote a fair, non-discriminatory financial market, conducive for credit access by:

- Establishing practices and standards that cut across the board for providers of financial products and services,

- Regulating the cost of credit, and,

- Establishing the Financial Markets Conduct Authority, the Financial Sector Ombudsman and the Financial Sector Tribunal for effective supervision of providers’ dealing with retail customers.

The National Treasury accepted comments from institutions, organizations and individuals until 5th June, 2018, in order to ensure wide consultation and public participation before its review and finalization.

Here are eight key take-outs from the Bill:

- The Bill proposes the establishment of the Financial Markets Conduct Authority, an independent body whose key objectives are as follows:

- To protect retail financial customers from misleading conduct by financial product and service providers,

- To promote fair and sustainable access to financial products and services while ensuring information about these products and services are readily available to retail customers, to enable them make informed financial decisions and promote financial literacy,

- To ensure the accuracy, availability and protection of financial information through credit sharing mechanisms and public advertisements,

- To protect retail financial customers from inappropriate lending practices by regulating the cost of credit, and,

- The Authority shall cooperate and collaborate with the other financial services regulators when performing its functions for instance, the Bill provides that the Authority will collaborate when licensing and carrying out inspections & investigations, to minimize the duplication of effort and expense.

- The Bill introduces a Financial Conduct License that:

- Limits the provision of financial products and services to retail customers without the license,

- Curbs loan hawking by limiting persons who don’t hold the license from advertising for the provision of credit or the sale of or lease of property, where the advertisement suggests that the vendor will facilitate the provision of credit to a buyer or lessee of the property, and,

- Ensures licensed lenders advertisements are truthful and are not in any way misleading or deceptive even by omission.

Key to Note: Where an entity already holds a license under a sectoral law - such as the Capital Markets Act, the Banking Act or Microfinance Act - which covers the provision of financial products, that entity will be considered to have satisfied the requirements of the Bill. This is subject to a period of exemption of twenty-four months from when the Bill comes into force.

- Full disclosure: The Bill provides that a pre-contract statement and quotation be provided to a potential borrower and the guarantor before issuance of a loan. This ensures full disclosure from lenders for loans advanced including, the dates and number of instalments for the loans, the total amount to be paid in principal, interest, loan fees and charges at the end of the loan period.

- With regards to interest rates:

- The Bill limits lenders from charging or recovering from the borrower or guarantors interest exceeding the maximum rates as prescribed by the Authority from time to time,

- Lenders shall not have provisions in credit contracts that (a) allow for interest rates charged to vary during the term of the contract, unless by a fixed relationship to another reference rate as specified in the contract, that should be the same for all similar credit contracts by the same issuer, and (b) allow the lender to charge any interest, fee, charge or cost unless clearly stated in nature, amount and method of calculation in the pre-contract statement and quotation, and paid prior to disbursement of the loan,

- The lender is required to determine the likelihood that the borrower and the guarantor will be able to comply with the financial obligations under the contract without substantial hardship, and should the lender decline to lend, they will be under obligation to give a specific reason, and,

- The Bill has also specifically provided for early repayment, for which lenders had previously before charged a penalty.

- The draft Bill provides protection to guarantors, with a requirement that they are made aware of all the clauses in a loan contract before signing, and variation to guarantor terms after the agreement is signed is allowed.

- Safeguarding of financial customer information: lenders shall be restricted from providing credit reports that contain information about the customer, as well as recommendations about the credit worthiness of the customer, based on prohibited information.

- The Bill proposes the establishment of the Financial Sector Ombudsman, whose key objectives will be to resolve complaints by retail financial customers and providers of financial products and services in accordance with provisions of the Bill.

- The Bill proposes the establishment of the Financial Services Tribunal, which will also have the power to enforce terms of the credit contract, as well as to vary the terms of the contract on a case-by-case basis, apart from resolving disputes between financial customers and providers of financial products and services in accordance with provisions of the Bill.

Section III: Views on the Bill by key stakeholders

The Central Bank of Kenya (CBK) is of the view that the proposed bill is a deliberate attempt to strip it of its key mandate, and that it was not consulted by the National Treasury in the drafting of the Bill. In addition, the CBK noted that the proposed Bill does not address the capping of interests as had been anticipated.

We are sympathetic to the CBK sentiments that the proposed mandates of the Financial Markets Conduct (FCMA) Authority infringe on the mandate of the CBK in the following ways:

- Article 231(2) of the Constitution provides that the CBK is responsible for formulating monetary policy, promoting price stability and issuing currency. The FCMA’s mandate to prescribe interest rates charged by lenders takes away from the CBK, through the Monetary Policy Committee (MPC), the mandate to signal interest rates through the CBR, and,

- Article 231(3) of the Constitution further provides that the CBK shall not be under the direction or control of any person or authority in the exercise of its powers or in the performance of its functions. The FCMA introduces a parallel regulator from the CBK for commercial banks.

The Bill also subordinates the Banking Act by giving directives on the conduct of commercial banks. Furthermore, the proposed Bill seems to be re-introducing the concept of a common financial services authority but the progress on the Financial Services Authority Bill, 2016, which laid out the same has not been mentioned in the proposed Bill.

The Treasury has since defended the Bill, stating that before re-looking at the interest rate cap, the Treasury wanted to regulate lenders to ensure proper lending practices. This also seems to conflict with the CBK’s mandate.

Section IV: Our views on the way forward

If the Bill is adopted by Parliament and signed into law, it will:

- Ensure better conduct by banks and other lenders in terms of extending credit to retail financial customers. By categorically not defining lenders as banks, this, in our view, might be the introduction of licensing for credit companies that are not banks,

- Provide consumer protection, specifically for retail customers by ensuring their credit contracts are clear and well understood in terms of interest, fees, charges and costs on credit facilities,

- Add yet another level of consumer protection by providing legal avenues solely dedicated to resolving any complaints and disputes that may arise as a result of a breach of contract issued in accordance with provisions of the Bill, and,

- Improve on terms and conditions for credit access in the country, especially for retail customers.

However, while the Bill seeks to promote access to credit, protect consumers and regulate the cost of credit, we note that it does not point to a repeal or revision of the interest rate cap, as had earlier been anticipated. In our view, the Bill will achieve consumer protection but will fail to address the problem of access to credit. With the cap still in place and should the Bill be enacted, two boxes will be checked i.e. loans will appear cheaper though the true cost of credit still remains high given extra fees and charges by banks, and retail customers will be protected from exploitation by lenders. However, we are of the view that more still needs to be done to address the fact that banks will most likely still prefer to lend to the risk free government as opposed to lending to a riskier retail customer at the current 13.5% (4.0% points above the current CBR of 9.5%).

As concluded in our recent topical dubbed Rate Cap Should Focus More on Stimulating Capital Markets, we are still of the view that a repeal or review of the cap is necessary. We however remain concerned that a repeal would be more focused on banks, yet to manage bank dominance and funding reliance we have to focus on expanding capital markets as an alternative to banks. We laid out 7 measures as necessary accompaniments to the repeal. Below we look at the 7, highlighting what has been addressed by the Bill and what still needs to be addressed:

|

No. |

Measure |

Narrative |

Addressed? |

|

1. |

Legislation and policies to promote competing sources of financing should be the centerpiece of the repeal legislation |

Given that the Bill addresses “lenders” and not banks, it is an indication that it might be encompassing all lenders that are not banks |

Yes |

|

2. |

Consumer protection |

The Bill is centered on consumer protection, protecting the retail financial customer |

Yes |

|

3. |

Promote capital markets infrastructure |

The Bill could not have addressed this as it does not refer to the capital markets but is focused on lending. This one is for the Capital Markets Authority (CMA) to address by enhancing the capital markets’ depth and making it easier for new and structurally unique products to be introduced into the capital and financial markets |

No |

|

4. |

Addressing the tax advantages that banks enjoy |

The Bill does not address this. Making tax incentives that are available to banks also available to non-bank funding entities and capital markets products such as unit trust funds and private investment funds will be instrumental to leveling the capital playing field |

No |

|

5. |

Consumer education |

Borrowers need to be educated on the elements the Bill provides for their protection, as well as credit access, use of collateral, and the importance of a strong credit history. Educating those who will benefit from the Bill is essential to helping the consumer protection measures effective |

No |

|

6. |

The adoption of structured and centralized credit scoring and rating methodology |

The Bill does not address this. A centralized Credit Reference Bureau (CRB) would enhance risk pricing transparency and credit history information to lenders and borrowers, thus enabling banks to price customers appropriately and spur increased access to credit |

No |

|

7. |

Increased transparency |

The Bill addresses this by making it mandatory for lenders to fully disclose, in a simple and clear manner, the interest, charges and fees on credit facilities |

Yes |

Only 3 out of 7 of our suggested measures have been addressed by the Bill i.e. introduction of legislation & policies to promote competing sources of financing, consumer protection and increased transparency.

Conclusion:

In conclusion, more still needs to be done by the key stakeholders to properly address the credit crunch and revive private sector credit growth in the economy. The Bill has partly addressed its intended purpose i.e. consumer protection, but has not addressed the issue of the interest rate cap, and has clashed with the CBK’s constitutional mandate and provisions of the Banking Act. In our view, it would work better if the National Treasury were to have consultations with key stakeholders involved in credit access, to review the Bill and come up with a solution that addresses the remaining measures above, while avoiding conflicting and redundant provisions for already existing Authorities and Acts. It would be unwise to proceed with the Bill in its current form.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.