Sep 30, 2018

According to Kenya National Bureau of Statistics (KNBS), Kenya’s economy expanded by 6.3% in Q2’2018, higher than 4.7% in Q2’2017. This was due to (i) recovery of agricultural sector, which recorded a growth of 5.6% due to improved weather conditions, (ii) improved business and consumer confidence, and (iii) increased output in the real estate, manufacturing, and wholesale & retail trade sectors, which grew by 6.6%, 3.1% and 7.7% respectively. For a more comprehensive analysis see the Q2’2018 Quarterly GDP Review and Outlook note

During Q3’2018, we tracked Kenya’s GDP growth projections for FY’2018 released by 15 organizations, that comprised of research houses, global agencies, and government organizations. The average GDP growth, including our projection of 5.5% as at Q3’2018, came in at 5.5%, unchanged from average projections released in Q2’2018. The common view is that GDP growth will improve in 2018, from 4.9% in 2017, generally due to (i) recovery in the agriculture sector on the back of improved weather conditions, and (ii) improvement in the business environment following easing of political risk caused by the prolonged political impasse over the 2017 presidential elections.

|

Kenya 2018 Annual GDP Growth Outlook |

||||

|

No. |

Organization |

Q1'2018 |

Q2'2018 |

Q3’2018 |

|

1. |

Central Bank of Kenya |

6.2% |

6.2% |

6.2% |

|

2. |

Kenya National Treasury |

5.8% |

5.8% |

6.0% |

|

3. |

Oxford Economics |

5.7% |

5.7% |

5.7% |

|

4. |

African Development Bank (AfDB) |

5.6% |

5.6% |

5.6% |

|

5. |

Stanbic Bank |

5.6% |

5.6% |

5.6% |

|

6. |

Citibank |

5.6% |

5.6% |

5.6% |

|

7. |

International Monetary Fund (IMF) |

5.5% |

5.5% |

5.5% |

|

8. |

World Bank |

5.5% |

5.5% |

5.5% |

|

9. |

Fitch Ratings |

5.5% |

5.5% |

5.5% |

|

10. |

Barclays Africa Group Limited |

5.5% |

5.5% |

5.5% |

|

11. |

Cytonn Investments Management Plc |

5.4% |

5.5% |

5.5% |

|

12. |

Focus Economics |

5.3% |

5.3% |

5.3% |

|

13. |

BMI Research |

5.3% |

5.2% |

5.2% |

|

14. |

The Institute of Chartered Accountants in England and Wales |

5.6% |

5.6% |

5.6% |

|

15. |

Standard Chartered |

4.6% |

4.6% |

4.6% |

|

Average |

5.5% |

5.5% |

5.5% |

|

The Kenya Shilling:

The Kenya Shilling gained marginally against the US Dollar by 0.1% in Q3’2018 to close at Kshs 101.0 from Kshs 101.1 at the end of Q2’2018. This week, the Kenya Shilling depreciated by 0.2% against the dollar to close at Kshs 101.0 from Kshs 100.8 the previous week. In our view, the shilling should remain relatively stable to the dollar in the short term, supported by:

- The narrowing of the current account deficit to 5.8% in the 12-months to June 2018, from 6.3% in March 2018, attributed to improved agriculture exports, and lower capital goods imports following the completion of Phase I of the Standard Gauge Railway (SGR) project,

- Stronger inflows from principal exports, which include coffee, tea, and horticulture, which increased by 1.7% during the month of July to Kshs 24.7 bn from Kshs 24.3 bn in June, with the exports from horticulture improving by 9.1%,

- Improving diaspora remittances, which increased by 71.9% y/y to USD 266.2 mn in June 2018 from USD 154.9 mn in June 2017 and by 4.9% m/m, from USD 253.7 mn in May 2018, with the largest contributor being North America at USD 130.1 mn attributed to; (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient, and

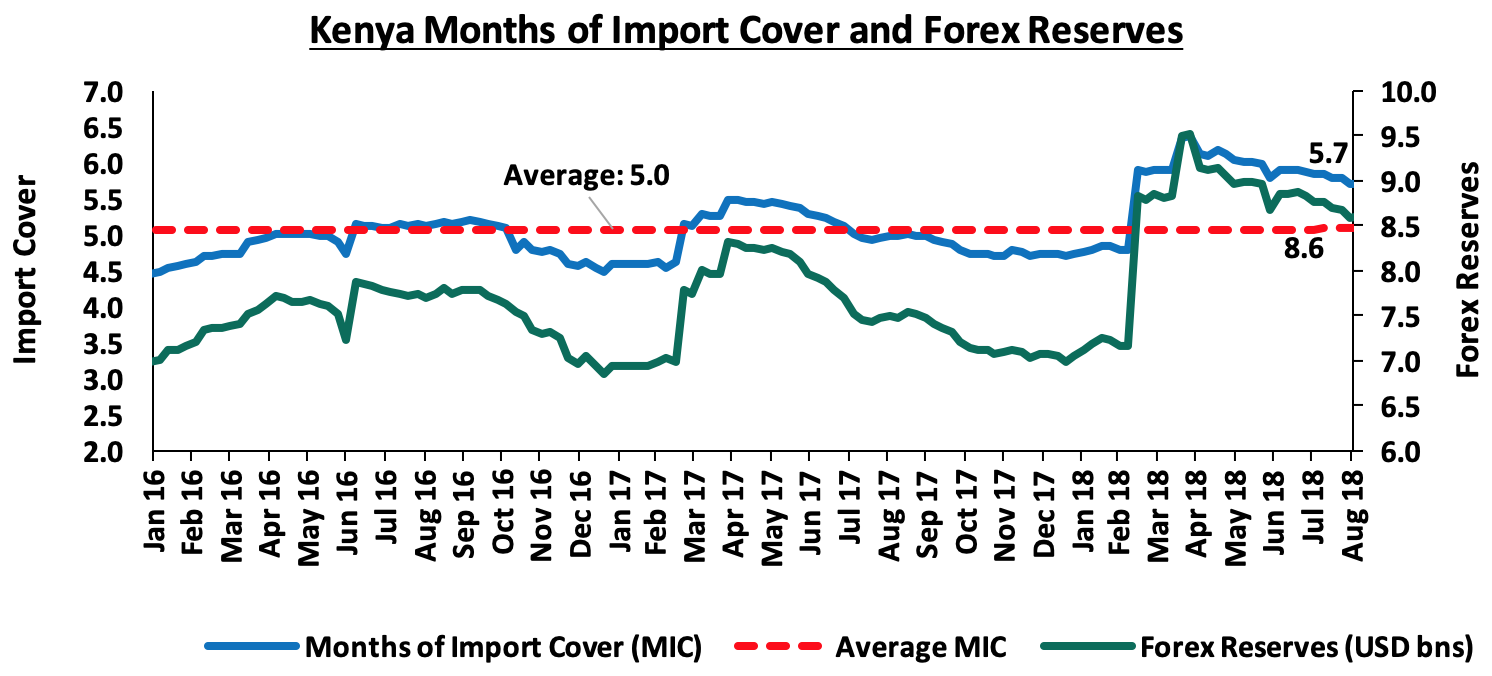

- High forex reserves, currently at USD 8.5 bn, equivalent to 5.6 months of import cover, compared to one-year average of 5.4 months.

Inflation:

The inflation rate declined significantly to an average of 4.4% YTD as compared to 9.0% in a similar period in 2017. However, inflation has been on an upward trend in Q3’2018 increasing to 5.7% in September from 4.0% in August 2018, which was in line with our expectations, with the m/m inflation increasing by 1.0% which was on account of; (i) a 0.4% increase in the Food and Non-Alcoholic Drinks Index driven by an increase in prices of some food basket items such as potatoes, sugar and cabbages outweighing decreases in others, (ii) an 8.0% increase in the Transport Index driven by a rise in the pump prices of petrol and diesel which triggered increase in prices of other transport components, and (iii) a 0.5% increase in the Housing, Water, Electricity, Gas and Other Fuels’ Index on account of the review of tariff structure for electricity.

|

Major Inflation Changes in the Month of September 2018 |

|||

|

Broad Commodity Group |

Price change m/m (Sep-18/Aug-18) |

Price change y/y (Sep-18/Sep-17) |

Reason |

|

Food & Non-Alcoholic Beverages |

0.4% |

0.5% |

This was due to increase |

|

Transport Cost |

8.0% |

17.3% |

This was on account of increase in the pump prices of petrol and diesel which triggered increase in prices of other transport components |

|

Housing, Water, Electricity, Gas and other Fuels |

0.5% |

17.4% |

This was on account of a review of the electricity tariff structure |

|

Overall Inflation |

1.0% |

5.7% |

The m/m increase was due to an 8.0% increase in the Transport Index and a 0.5% increase in the Housing, Water, Electricity, Gas and Other Fuels’ Index which have a CPI weight of 8.7 and 18.3 respectively |

Monetary Policy:

The Monetary Policy Committee (MPC) met twice in Q3’2018. In the July 30th meeting, the committee decided to lower the Central Bank Rate (CBR) to 9.0% from 9.5%, noting that inflation expectations were well anchored within the target range of 2.5% - 7.5%, and that economic growth prospects were improving. This was evidenced by; (i) a stable foreign exchange market, with the current account deficit narrowing to 5.8% in the 12 months to June 2018 from 6.3% in March, and (ii) a stable and resilient banking sector, with average liquidity and capital adequacy ratios at 48.0% and 18.0% respectively in June 2018. The committee also noted that economic output was below its potential level, and there was room for further accommodative monetary policy. In the September 25th meeting, the MPC retained the CBR at 9.0%, citing that inflation expectations remained well anchored within the target range largely due to lower food prices and that there was sustained optimism for stronger economic growth in 2018 as per the private sector market perception survey. This was mainly attributed to a rebound in agriculture, pick up in private sector economic activity, renewed business confidence due to the ongoing war against corruption and a stable macroeconomic environment. The MPC noted that there was, however, need to monitor the second-round inflationary effects arising from the VAT on petroleum products, and any perverse response to its previous decisions.

Q3’2018 Highlights:

- The National Assembly convened for special parliamentary sittings held on 18th September and 20th September to discuss the President’s reservations against the Finance Bill through his memorandum. The President rejected the Finance Bill 2018 received from the Speaker of the National Assembly, which had amendments as voted by the National Assembly such as (i) postponing the imposition of VAT on fuel by another 2-years to September 2020, citing that its implementation would lead to a rise in inflation, and (ii) retaining of the interest rate cap citing that there was no justification for the repeal. All the proposals as per the President’s memorandum tabled in parliament were passed despite a chaotic sitting, after which the president assented to the Finance Bill 2018 on 21st September 2018. The proposals included (i) deletion of the clause which sought to postpone the imposition of VAT on fuel by another 2 years to commence in September 2020 (ii) an increase on the excise duty charged on excisable value on telephone and internet data service to 15.0% from the earlier 10.0%, and (iii) a reduction in the taxation on winnings under the betting, lotteries and gaming Act to 15.0% from the earlier proposed 20.0%. Due to assent of the Finance Bill 2018, we are of the view that imposition of some of the tax measures as introduced in the Finance Bill raise concerns in the country’s economic growth, especially on corporate earnings this year with the main focus being on the Telecommunication and Financial services industry due to the increased excise tax on both money transfers and internet charges which could slow down consumption of these services. For more information, see our Cytonn Weekly #36/2018,

- During the special parliamentary sittings, the National Assembly also discussed the supplementary estimates for FY’2018/2019 presented by the Budget and Appropriations Committee, which proposed a reduction in the total budget estimate by Kshs 55.1 bn due to the expected shortfall in revenue arising from the amendments made in the Finance Bill 2018. The National Assembly however passed an expenditure reduction of Kshs 37.6 bn, which is to be achieved through a reduction in recurrent expenditure and capital expenditure for FY’2018/2019 by Kshs 9.1 bn and Kshs 28.5 bn, respectively coupled with a reinstatement of Kshs 1.5 bn to the judiciary,

- The International Monetary Fund (IMF) paid a visit to Kenya where discussions were held with the Kenyan Government on the second review under a precautionary Stand-By Arrangement (SBA), which was extended to Kenya on 14th March 2016. For more information, see our Cytonn Weekly #30/2018. The second review however was not completed, leading to the expiry of the precautionary stand-by facility granted to Kenya on 14th September 2018 as the National Treasury was not keen on seeking to renew the facility noting that the macro-economic fundamentals of the country have continued to stabilize despite the country not drawing on the facility. We believe that access to the facility would have been useful in cushioning the Kenyan Shilling from exogenous shocks as well as maintaining the country’s fiscal discipline due to the pre-set conditions that come attached to the facility, which effectively reduces the risk perception of countries while improving investor sentiments. However, the country faces no immediate adverse risks as the country’s external position is still strong, a view which the IMF has also affirmed through their local representative, as we have adequate forex reserves currently at USD 8.5 bn, equivalent to 5.6 months of import cover, compared to a one-year average of 5.4 months, and

- According to the Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI), the business environment in the country expanded at a marked pace in August 2018. The seasonally adjusted PMI recovered to 54.6 in August from a 6-month low of 53.6 in July. A PMI reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. Firms reported growth in value of outputs due to the continued rise in new orders, which rose for the 9thconsecutive month. This was despite high input costs attributed to raw material shortages. In response to increased output requirements, firms also raised their staffing levels during the month though at a modest rate. The private sector has remained resilient as the PMI is still above 50; we however expect the private sector to experience increased input costs going forward should the 16.0% VAT on petroleum products be maintained.

Kenya’s current account deficit improved during Q2’2018, coming in at Kshs 85.8 bn from Kshs 130.4 bn in Q2’2017, a decline of 34.2%, equivalent to 7.1% of GDP from 11.4% recorded in Q2’2017. This was mainly due to the 57.1% increase in the Secondary Income (Transfers) Balance, largely attributed to 56.9% increase in the diaspora inflows to Kshs 74.7 bn from Kshs 47.6 bn in Q2’2017. For a more comprehensive analysis see the Q2’2018 Quarterly Balance of Payments Note

Macroeconomic Indicators Table:

The table below summarizes the various macroeconomic indicators, the expectation at the beginning of 2018, the actual Q3’2018 experience, the impact of the same, and our expectations going forward:

|

Key Macro-Economic Indicators – Kenya |

||||||

|

Indicators |

Expectations at start of 2018/2019 Fiscal Year |

YTD 2018 Experience |

Going forward |

Outlook at the Beginning of the Year |

Current Outlook |

|

|

|

GDP growth projected to come in at between 5.4% - 5.6% |

Kenya’s economy expanded by 6.3% in Q2’2018, higher than 4.7% in Q2’2017. This was due to; i. recovery in agriculture, which recorded a growth of 5.6% due to improved weather conditions, ii. improved business and consumer confidence, increased output in the manufacturing and electricity & water supply sectors which grew by 3.1% and 8.6% respectively |

GDP growth is projected to come in between 5.4% - 5.6% in 2018 driven by recovery of growth in the agriculture sector, continued growth in the tourism, real estate and construction sectors, and growth in the manufacturing sector |

Positive |

Positive |

|

|

Interest Rates |

A stable outlook on interest rates in 2018 with the CBR maintained at 9.5% |

The Monetary Policy Committee (MPC) met on September 25th and maintained the Central Bank Rate (CBR) at 9.0% citing that there was need to monitor the second-round inflationary effects arising from the VAT on petroleum products, and any perverse response to its previous decisions. |

The interest rate environment is expected to remain relatively stable, with the CBK not accepting high yields on treasury securities with the CBR rate having been lowered twice and with the interest rate cap still in place |

Neutral |

Neutral |

|

|

Inflation |

To average within the government annual target of between 2.5% - 7.5% in 2017 |

Inflation has averaged 4.4% in the first 9 months of 2018. The year on year inflation rate for the month of September increased to 5.7% from 4.0% in August and the m/m inflation rose by 1.0% due to increases in housing, water, electricity ,gas and other fuels index, coupled with an increase in the transport index. |

Inflation in H2’2018 is expected to experience upward pressure due to the various tax amendments as per the Finance Bill 2018, but at a lower rate than earlier anticipated following the reduction of the VAT charge on fuel to 8.0% from 16.0% effective 21st September 2018, affirming our expectations on inflation for the year averaging within the government’s set target of 2.5%-7.5% |

Positive |

Positive |

|

|

Exchange rate |

To remain stable supported by dollar reserves |

The Shilling has appreciated by 2.2% against the USD YTD to 101.0. The current account deficit narrowed to 5.3% of GDP in the 12 months to July 2018 from 5.6% in June 2018. It is expected to narrow further to 5.4% of GDP in 2018, with strong growth of agricultural exports particularly tea and horticulture, resilient diaspora remittances, and improved tourism receipts. IMF Standby Credit Facility expired in September 2018 |

Kenya’s forex reserves currently stand at USD 8.5 bn (equivalent to 5.6 months of import cover), sufficient to cushion the economy from unforeseen short-term shocks. Kenya’s current account deficit has also improved to 5.8% of GDP in Q1’2018, from 11.3% recorded in Q1’2017. Despite the expiry of the IMF standby credit facility, we expect the currency to remain relatively stable against the dollar, supported by, (i) stronger horticulture export inflows driven by increasing production and improving global prices, (ii) improving diaspora remittances, and (iii) the ample forex reserves |

Neutral |

Neutral |

|

|

Corporate Earnings |

Corporate earnings growth of 8.0% in 2017 due to lower earnings for commercial banks attributed to the cap on interest rates |

Listed Banks have recorded a weighted average increase in core EPS of 19.0% in H1’2018 |

We expect corporate earnings to improve in 2018, |

Positive |

Positive |

|

|

Investor Sentiment |

Investor sentiment was expected to improve in 2018 given the now settling operating environment after conclusion of the 2017 elections |

The Kenya Eurobond was 7.0x oversubscribed partly showing the appetite for Kenyan securities by the foreign community, and investor confidence in Kenya’s stable and relatively diversified economy |

We still expect investor sentiment to improve in 2018 given; (i) the now settled operating environment after the conclusion of the long electioneering period in 2017, (ii) the expectation that long term investors will continue entering the market seeking to take advantage of the valuations which are still historically low, and (iii) expectations of a relatively stable shilling |

Positive |

Positive |

|

|

Security |

Security expected to be maintained in 2018, especially given the elections were concluded and the USA lifted its travel warning for Kenya, placing it in the 2nd highest tier of its new 4-level advisory program, indicating positive sentiments on security from the international community |

The political climate in the country has eased, with security maintained and business picking up. The hand shake between the president and the opposition leader served to calm any political tension. Kenya now has direct flights to and from the USA, a possible sign of improving security in the country |

We expect security to be maintained in 2018, especially given that there is relative calm, as the two principals work together towards combating corruption and promoting economic transformation agenda |

Positive |

Positive |

|

Of the 7 indicators we track, 5 are positive and 2 are neutral. The outlook of the 7 indicators has remained unchanged from H1’2018. From this, we maintain our positive outlook on the 2018 macroeconomic environment.