Aug 25, 2024

Following the release of the H1’2024 results by all four authorized Real Estate Investment Trusts (REITs) in Kenya, the Cytonn Real Estate Research Team undertook an analysis of the financial performance of the REITs and identified the key factors that shaped the performance of the sector. For the earnings notes of the various REITs, click the links below:

- ILAM Fahari I-REIT H1’2024 Earnings Note

- LapTrust Imara I-REIT H1’2024 Earnings Note

- Acorn I-REIT and D-REIT H1’2024 Earnings Note

The in the report we will assess the financial performance of the current REITs in the market during H1’2024 in terms of operational metrics, profitability metrics, leverage ratios, liquidity ratios, and valuation metrics. In addition, we highlight the outlook regarding our expectations for the REITs sector going forward. This we will cover as follows;

- Overview of the REITs Sector in Kenya,

- Themes that shaped the Real Estate Sector in H1’2024,

- Summary Performance of the REITS in H1’2024, and,

- Conclusion and Outlook for the REITs sector.

Section I: Overview of the REITs Sector in Kenya

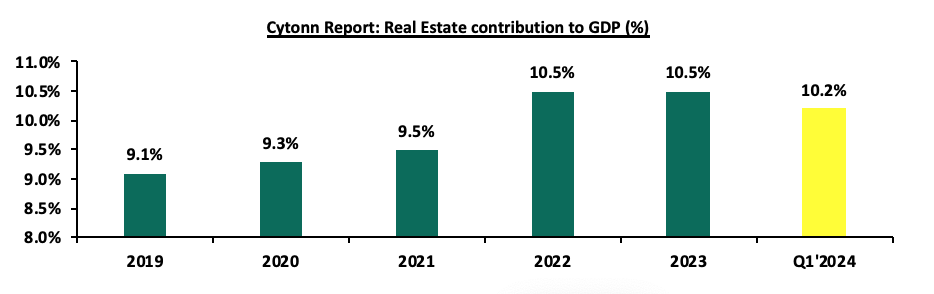

In H1’2024, Kenya’s Real Estate sector recorded notable growth in terms of activity compared to a similar period in 2023, attributable to continued investments flowing into the sector. Kenya's Real Estate sector continues to play a vital role in the nation's GDP, growing at a Compound Annual Growth Rate (CAGR) of 5.5% over the past five years. In Q1’2024, the sector expanded by 6.6 %, reaching Kshs 329.2 bn, up from Kshs 306.9 bn in the same period of 2023. This growth underscores the sector's increasing significance, with its contribution to the national GDP rising to 10.2% in Q1’2024 from 10.1% in the same period in 2023.

Several factors have driven this growth, including: i) the Kenyan government is actively working to increase affordable housing availability, ii) infrastructure development continues to support real estate growth by opening new areas for investment, iii) the Kenya Mortgage Refinance Company (KMRC) is making home loans more accessible, iv) the retail sector is expanding, driven by both local and international retailers Kenya's status as a regional business hub is boosting demand for commercial and residential real estate, v) high urbanization and population growth rates are sustaining housing demand vi) investor confidence in the hospitality sector is growing, with a positive outlook for hotel development, and, vii) the alternatives market, particularly in specialized real estate, is showing potential for growth in 2024.

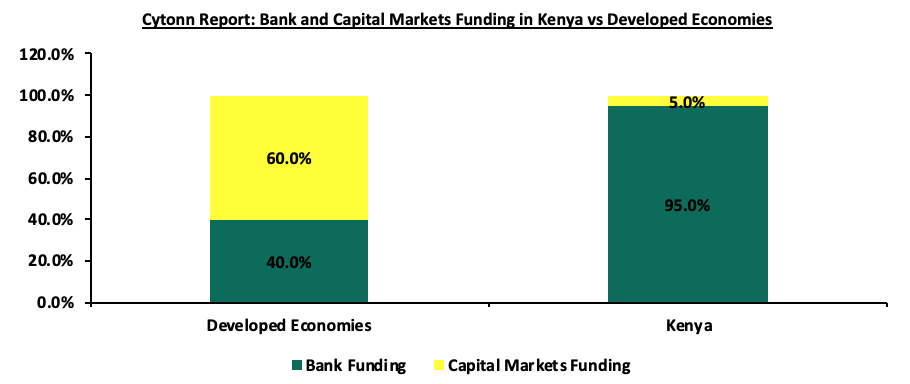

Despite the aforementioned cushioning factors, several challenges hinder the optimal performance of the Real Estate sector. These challenges include Construction costs increased by 17.6% in H1’2024, primarily due to higher prices for key materials, which could hinder sector development. Oversupply of physical space exists in various sectors, leading to prolonged vacancy rates. The REITs market in Kenya faces challenges like large capital requirements, prolonged approval processes, and limited investor knowledge. Rising interest rates have made borrowing more expensive, reducing demand for mortgages and developer financing. Lenders are tightening their requirements, leading to constrained financing for developers and an increase in Non-Performing Loans (NPLs). Underdeveloped capital markets limit funding for real estate projects, with banks providing nearly 95.0% of funding for developers in Kenya. To address the funding gap, players in the Real Estate sector have increasingly turned to alternative financing methods like Real Estate Investment Trusts (REITs). In 2013, the Capital Markets Authority (CMA) introduced a detailed framework and regulations for REITs, enabling developers to secure capital through this investment avenue.

Kenya's Real Estate sector has been expanding due to ongoing construction activities driven by strong demand for real estate developments. The residential market is significantly under-supplied, with an 80.0% housing deficit; only 50,000 units are delivered annually against an estimated need for 200,000 units per year. Additionally, the formal retail market in Kenya is still in its nascent stages, with a penetration rate of approximately 30.0%, as reported by the Nielsen Report 2018. Despite the high demand, developers in Kenya encounter limited financing options, with local banks providing nearly 95.0% of construction financing, in stark contrast to the 40.0% typically seen in developed countries. The graph below illustrates the comparison of construction financing in Kenya versus developed economies;

Source: World Bank, Capital Markets Authority (CMA)

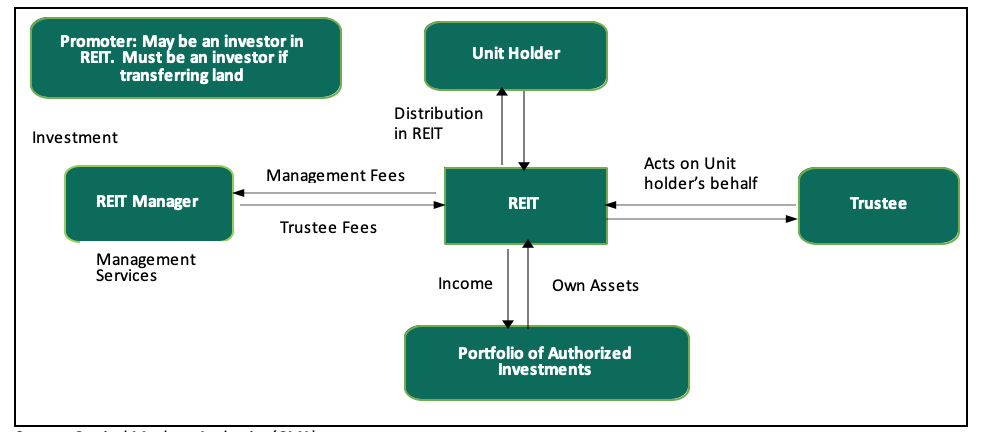

To bridge the funding gap, developers are increasingly turning to alternative financing methods. In 2013, the Capital Markets Authority (CMA) introduced a regulatory framework for Real Estate Investment Trusts (REITs) in Kenya. REITs are collective investment vehicles that pool funds from investors, who then acquire rights or interests in a trust divided into units. Investors benefit from profits or income generated by the real estate assets held within the trust. To ensure transparency, accountability, and the protection of investors' interests, four essential entities play key roles in the REIT structure in Kenya:

- The Promoter: This entity is responsible for establishing the REIT scheme. The promoter acts as the initial issuer of REIT securities and handles submissions to regulatory authorities for approvals of trust deeds, prospectuses, or offering memorandums. Examples of REIT promoters in Kenya include Acorn Holdings Limited and LAP Trust.

- The REIT Manager: This is a licensed company in Kenya that provides real estate and fund management services for a REIT scheme on behalf of investors. There are currently 10 REIT Managers in Kenya, including Cytonn Asset Managers Limited, Acorn Investment Management, and Stanlib Kenya Limited.

- The Trustee: A corporation or company appointed under a trust deed and licensed by the CMA to hold real estate assets on behalf of investors. The trustee's primary role is to act in the best interests of investors by evaluating investment proposals from the REIT Manager and ensuring compliance with the Trust Deed. REIT trustees in Kenya include Kenya Commercial Bank (KCB) and Co-operative Bank.

- Project/Property Manager: The project manager oversees the planning and execution of construction projects within the REITs. Meanwhile, the property manager handles the management of completed real estate developments acquired by a REIT, with a focus on generating profit.

The relationship between key parties in a typical REIT structure is depicted in the figure below;

Source: Capital Markets Authority (CMA)

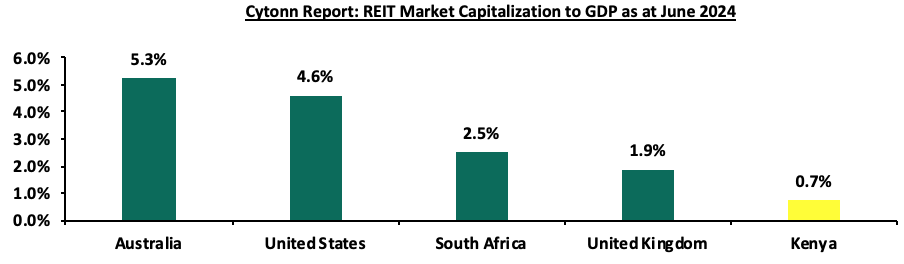

Since its introduction in 2013, the REIT market in Kenya has faced several hurdles that have hindered its growth. Key challenges include the hefty capital requirement of Kshs 100.0 mn for trustees, limiting this role largely to banks, and a protracted approval process for setting up REITs. Additionally, the high minimum investment threshold of Kshs 5.0 mn discourages potential investors, while a lack of sufficient investor education and awareness further impedes market expansion. As a result, the REIT market capitalization in Kenya remains significantly lower compared to other regions

Source: European Public Real Estate Association (EPRA), World Bank

Kenya's REIT market faces additional challenges due to its relatively underdeveloped capital markets, especially when compared to countries like South Africa. Currently, there is only one listed REIT in Kenya, which is not actively trading. This reflects a sector that has largely remained stagnant since the introduction of REIT regulations in 2013. Consequently, most property developers in Kenya continue to rely on traditional funding sources, such as banks, unlike in more developed markets. Since the establishment of REIT regulations, four REITs have been approved in Kenya, all structured as closed-ended funds with a fixed number of shares. However, none of these REITs are actively trading on the Main Investment Market Segment of the Nairobi Securities Exchange (NSE). Following the recent delisting of ILAM Fahari I-REIT, LAPTrust Imara I-REIT is the only listed REIT in the country, quoted on the restricted market sub-segment of the NSE's Main Investment Market. It is important to note that Imara did not raise funds upon listing. The ILAM Fahari I-REIT, Acorn I-REIT and D-REIT are not listed but trade on the Unquoted Securities Platform (USP), an over-the-counter market segment of the NSE. The table below outlines all REITs authorized by the Capital Markets Authority (CMA) in Kenya

|

Cytonn Report: Authorized REITs in Kenya |

||||||

|

# |

Issuer |

Name |

Type of REIT |

Listing Date |

Market Segment |

Status |

|

1 |

ICEA Lion Asset Management (ILAM) |

Fahari |

I-REIT |

July 2024 |

Unquoted Securities Platform (USP) |

Trading |

|

2 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

I-REIT |

February 2021 |

Unquoted Securities Platform (USP) |

Trading |

|

3 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

D-REIT |

February 2021 |

Unquoted Securities Platform (USP) |

Trading |

|

4 |

Local Authorities Pension Trust (LAPTrust) |

Imara |

I-REIT |

March 2023 |

Restricted Market Sub-Segment of the Main Invesment Market |

Restricted |

Source: Nairobi Securities Exchange, CMA

Section II: Themes that Shaped the REIT Sector in H1’2024

In this section, we examine the key themes that have significantly shaped the REIT sector up to H1 2024. We explore how evolving regulations, strategic acquisitions, and capital-raising initiatives have influenced the REIT industry's trajectory. Additionally, we provide insights into the broader factors that have impacted the sector's performance and overall direction during this period.

- Regulations

REITs are formally established in accordance with regulations set forth for Real Estate Investment Trusts (REITs) and granted approval by the Capital Markets Authority (CMA) under the Capital Markets Real Estate Investment Trusts Collective Investment Schemes Regulations of 2013. Instead of taking the form of conventional companies, they are structured as trusts. The management of investment properties falls under the purview of a corporate REIT manager, licensed by the CMA. Units of listed REITs are traded on the Nairobi Securities Exchange (NSE), akin to shares of any other company listed on both the Main Market Segment and the Unquoted Security Platform (USP), providing investors with a liquid stake in Real Estate. Both individual and corporate investors have the opportunity to partake in a public offering on the NSE, as outlined in the Regulations of 2013.

Furthermore, the regulations stipulate that Kenyan REITs are mandated to distribute a minimum of 80.0% of distributable earnings to their unitholders. REITs automatically qualify for several tax exemptions such as the Income Tax Act (ITA), Value Added Tax (VAT), and Capital Gains Tax (CGT) under the authorization of the Kenya Revenue Authority (KRA). Some of the recent regulatory transformations in the REITs industry include;

- Exemption from Income Tax Act

Section 20 (1) (c) and (d) of the Income Tax Act (ITA) mandates that, upon registration with the Commissioner of the Kenya Revenue Authority (KRA), both REITs and the companies they invest in are exempt from the standard 30.0% Income Tax Rate (ITR). Furthermore, income distributed by REITs to their investors (unitholders) is not taxed. However, this exemption does not apply to the withholding tax on interest income and dividends received by non-exempt unitholders, as outlined in the first schedule of the ITA. The applicable withholding tax rates can be found in paragraph 5 of the third schedule of the Income Tax Act.

- Capital Gains Tax (CGT) exemptions

A capital gain arises when the value of a unit upon transfer exceeds its adjusted cost. The disparity between these values is liable to a tax rate of 15.0%. Consequently, any profits made by a promoter or investors of a REIT from transferring property into the REIT are now subject to Capital Gains Tax (CGT) at the revised rate of 15.0%, supplanting the previous rate of 5.0% effective from 1 January 2023. Additionally, individuals holding units in a REIT who opt to sell their ownership stake are also required to remit CGT. This stipulation emerged following an amendment to Section 34 (1) (j) of the Income Tax Act through the Finance Act 2022.

However, within the REIT industry, there are certain scenarios that qualify for exemptions from CGT:

- Transfers of property from life insurance companies to a REIT are exempt from CGT, as outlined in Section 19 (6B) of the Income Tax Act (ITA),

- Indirect transfer of property into a REIT when the promoter first transfers properties to a Special Purpose Vehicle (SPV). Subsequently, the shares of the investee company held by the SPV are transferred to the REIT. This is considered a restructuring, as the property transfer does not involve a third party. This exemption is based on Paragraph 13 of the Eighth Schedule to the ITA. However, CGT is applicable on gains made during the transfer of shares from the investee company to the REIT Trustee,

- Payments received by unit holders or shareholders in a REIT for unit redemption or share sale are exempt from CGT in accordance with section 20 (2) of the ITA, and,

- Gains realized by the REIT from the sale of properties, whether directly or through an SPV, are also exempt from CGT.

- Exemption from Value Added Tax (VAT)

The Finance Act 2021 reinstated a significant alteration concerning the exemption from Value Added Tax (VAT) for transactions involving the transfer of assets to REITs and asset-backed securities. This exemption had previously been rescinded by the Tax Laws Amendment Act No. 2 of 2020. In line with Paragraph 33 of Part II of the First Schedule to the VAT Act 2021, a direct transfer of property from the REIT promoter or investors is not subject to VAT. However, if the transfer of assets to the REIT occurs indirectly, through the initial transfer of assets to the investee company, VAT will apply. It is noteworthy that the transfer of shares from a REITs SPV to the REIT trustee will be exempt from VAT, regardless of whether the initial asset transfer involved VAT.

- Reintroduction of Stamp Duty from January 2023

In accordance with the Stamp Duty Act's Section 96A, transfers of stabilized properties from Development REITs (D-REITs) to Income REITs (I-REITs) were previously exempt from stamp duty. However, this exemption expired on December 31, 2022. Effective January 1, 2023, such transfers are now subject to stamp duty as per Section 96A subsection 4.

The intricate nature of REIT regulations, combined with the complexity of the REIT structure, can make it challenging for individuals to understand the tax implications of their investments. This lack of clarity can deter potential investors, fostering skepticism about the fairness and reliability of the REIT market.

Moreover, the limited public information available on REIT regulations exacerbates this issue. Investors who are unaware of the tax consequences of their decisions may avoid investing altogether or make uninformed choices, potentially impacting their financial returns.

To address these concerns, it is crucial for both the government and REIT stakeholders to prioritize the following: i) Enhanced Transparency: Increase public access to clear and concise information about REIT regulations and tax implications, ii) educational Initiatives: Launch educational campaigns and provide resources to inform investors about REITs and their associated tax considerations, iii) collaboration: Foster collaboration between regulatory authorities and industry stakeholders to raise awareness about the benefits and drawbacks of REIT investments, iv) Clear Documentation: Provide easily understandable documentation outlining the tax implications of various investment scenarios, and, v) Consultation Services: Establish accessible consultation services to allow investors to seek expert advice on tax-related aspects of REIT investments.

By implementing these measures, we can help create a more informed and confident investment environment for REITs in Kenya.

- Portfolio Holdings & Acquisitions

Acquisitions play a pivotal role in the dynamic landscape of the Kenyan REITs industry. These strategic moves signify the industry's evolution, adaptability, sustainability, and growth potential. As of December 2023, the industry has witnessed noteworthy acquisitions that are reshaping the sector. These acquisitions hold a promising outlook for the industry, contributing to its progress and value proposition. They exemplify how REITs are actively enhancing their portfolios, expanding their market presence, and optimizing their performance. Some of the notable acquisitions as at H1’2024 include;

- LAPTrust Imara I-REIT possesses a diversified portfolio of properties which include; i) Pension Towers, Metro Park, and CPF House which are commercial office buildings located in Nairobi CBD, ii) Retail centre Freedom Heights mall located in Lang’ata, iii) Nova Pioneer which is a purpose-built educational facility located in Eldoret, iv) Freedoms Height residential apartments and serviced plot located in Lang’ata, and, v) Man apartments located in Kilimani,

- ILAM Fahari I-REIT manages and operates several properties under their portfolio which include: i) a mixed used development (MUD) Greenspan Mall located in Donholm, Nairobi, ii) 67 Gitanga Place which is a prime office property located in Lavington, and, iii) Bay Holdings and Highway House which are industrial properties located in Industrial Area and Mombasa Road area respectively,

- Acorn Student Accommodation (ASA) I-REIT has five completed student housing properties with 3,003 beds under their management serving up to 128 universities and colleges. These properties include; Qwetu Jogoo Road, Qwetu Ruaraka, Qwetu WilsonView in Lang’ata, Qwetu Parklands, and Qwetu Aberdare Heights I along Thika Road next to United States International University Africa (USIU-A). On the other hand, Acorn D-REIT boasts of four properties which are currently operational and six other properties under development bringing to a total of ten properties with 10,060 beds under its portfolio. Operational properties include; Qwetu Hurlingham, Qwetu Abedare Heights II, Qwetu Karen, Qejani Karen whereas properties under development include; Qwetu Chiromo, Qejani Chiromo, Qejani JKUAT next to Jomo Kenyatta University of Agriculture and Technology, Qejani Hurlingham, Qwetu KU, and Qejani KU next to Kenyatta University,

- During H1’2024, Acorn Student Accommodation Development REIT (ASA D-REIT) announced it had sold its stabilized asset, Qwetu Aberdare Heights II, to the Acorn Student Accommodation Income REIT (ASA I-REIT) in a Kshs 1.5 bn deal. The acquisition of the 630-bed capacity hostel located adjacent to Qwetu Aberdare Heights I and United States International University (USIU) brings the total number of assets acquired by the I-REIT to four over the last three years, after successful acquisitions of Qwetu Hurlingham in June 2023, Qwetu WilsonView in February 2021, and Qwetu Aberdare Heights I in October 2022. Through the sale, ASA D-REIT will repay Kshs 600.0 mn of the Acorn Green Bond, pushing the repayment of the Kshs 5.7 bn bond to Kshs 3.0 bn ahead of its maturity in November 2024. The bond which was first floated in 2019, was issued in partnership with Private Equity Fund Helios and had attracted an 85.0% subscription rate, raising Kshs 4.3 bn of the targeted amount of Kshs 5.0 bn. The bond was priced at a rate of 12.3%, and was intended to be used to finance sustainable and climate-resilient student accommodation with a combined capacity of 40,000 beds. and,

- During the year, the Capital Markets Authority (CMA) granted a license to Mi Vida Homes Limited to operate as a REIT Manager in efforts to strengthen and develop the country’s capital markets. This brings the total number of REIT managers in Kenya to 11. As a REIT Manager, the company will offer Real Estate and fund management services for Real Estate investment trusts (REITs) on behalf of investors within a REIT scheme. We expect this milestone will open exciting new opportunities for investors and further develop our country’s Real Estate market, as the country’s REIT market remains underdeveloped and relies primarily on conventional funding alternatives.

In the future, we expect REITs to maintain a strategic acquisition strategy. This will involve actively seeking opportunities to expand their portfolios, diversify their holdings, and respond to evolving market demands. Additionally, REITs are likely to prioritize environmental sustainability, as exemplified by Acorn Holding's issuance of green bonds. Such acquisitions can also stimulate innovation within the industry, encouraging the development of new ideas, designs, and services that cater to the needs of both investors and tenants.

- Capital Raising

Raising capital is essential in the REITs industry, fueling growth, development, and innovation. Securing funds from diverse sources, whether through debt or equity, enables REITs to expand their portfolios, improve existing properties, and explore new investment opportunities. This practice benefits the REITs and significantly shapes the Real Estate landscape, providing attractive investment options to stakeholders. Some of the notable capital infusion in the REITs industry as of H1’2024 include;

- Acorn Holdings, a student hostel developer in Nairobi announced a bid to raise Kshs 2.8 bn in new capital for its development and income Real Estate Investment Trusts (REITS) by February 2025 to fund the development and acquisition of new properties. The firm targets Kshs 1.9 bn for the Acorn student accommodation I-REIT and Kshs 810.0 mn for the D-REIT, which is set to be raised through a combination of a rights issue that closed on 31st July and open market offer which continues until February 2025. Acorn offered an open market price of Kshs 24.54 for the D-REIT and Kshs 22.03 for the I-REIT with existing unit holders enjoying a discount of 0.6% during the rights issue offer period which has since expired. The recent offer by Acorn Holdings forms the third supplemental cash call made by the firm since inception of the REITs, following similar issuances in 2022 and 2023 making this strategy the primary capital raising instrument for the company. As at the end of June 2024, the ASA D-REIT holds 11 properties under different development stages, with a total valuation of Kshs 10.9 bn. These properties include two hostels in Karen under the company’s Qwetu and Qejani brands, which the firm expects to offload to the I-Reit by the end of Q1’2025. Similarly, the ASA I-REIT holds a portfolio of 7 hostels with a combined valuation of Kshs 10.3 bn as at June 2024 with the most recent acquisitions being the Qwetu Hurlingham in September 2023 and Qwetu Aberdare Heights II in January 2024.

- The Acorn D-REIT currently has an outstanding Kshs 1.86 bn green bond issued in October 2019, which financed eight hostel projects. The company had acquired Kshs 5.7 bn and has been making early repayments before the debt matures in November 2024. In February 2022, the D-REIT contracted a Kshs 6.7 bn loan from Absa Bank to fund 10 hostel projects, out of which Kshs 1.0 bn had been drawn down by June 2024 for ongoing projects at Juja, Kenyatta University and Hurlingham.

- The Linzi Sukuk bond was launched on July 31, 2024, marking Kenya's first Sharia-compliant bond aimed at funding affordable housing projects. President William Ruto announced that the KShs 3 bn (approximately Usd 20 mn) bond would finance the construction of 3,069 affordable housing units, significantly reducing the cost of home ownership for many Kenyans. The initiative allows potential homeowners to pay as little as KShs 7,000 per month over a 15-year period for homes valued at an average of KShs 1.4 mn. The Sukuk bond was structured to align with Islamic finance principles, which prohibit interest payments and instead provide investors with a share of profits from the underlying assets. The bond is expected to create thousands of jobs and stimulate economic growth by leveraging private funds for public housing. President Ruto emphasized the importance of using public land for these developments, arguing that it helps combat land speculation and ensures that housing benefits a broader segment of the population

- Delisting & Listing on the USP

ILAM Fahari I-REIT's delisting from the Main Investment Market Segment (MIMS) of the Nairobi Securities Exchange (NSE) was a strategic response to operational difficulties and the need for structural optimization. After receiving approval from the Capital Markets Authority (CMA), ILAM Fahari transitioned to a Restricted I-REIT, focusing on professional investors. This shift from the unrestricted segment to a restricted one highlights the REIT's challenges and its proactive restructuring approach. Operational issues prompted a reassessment, leading to resolutions at an Extraordinary General Meeting (EGM) in December 2023, where the decision to convert to a restricted REIT and delist received strong support from unitholders.

Implications of Delisting:

- Non-Professional Unitholders: Retail investors had to choose between accepting the redemption offer, which ended their unitholder status, or retaining units with post-conversion trading restrictions.

- Professional Unitholders: They remained largely unaffected, with the ability to trade units on the Unquoted Securities Platform (USP), though liquidity concerns persist.

- Tenants and Regulators: Minimal impact was observed, with the CMA continuing regulatory oversight as the REIT shifted to a Restricted I-REIT.

ILAM Fahari’s delisting and conversion were aligned with its goal to focus on professional investors, offering them specialized investment opportunities, enhancing flexibility, and unlocking growth potential. While this restructuring aids operational efficiency and capital raising, it limits retail investor participation, signaling a shift towards catering to high-net-worth individuals. Going forward, capital raising through equity, debt, and strategic partnerships, particularly in affordable housing and infrastructure, will be crucial in driving the expansion and sustainability of Kenya's REIT industry. Collaborative efforts, regulatory support, and investor education will be key to ensuring successful capital raising and a vibrant future for the sector.

During H1 2024, ICEA Lion Asset Managers (ILAM) Fahari I-REIT was admitted to the Unquoted Securities Platform (USP) of the Nairobi Securities Exchange (NSE), following their delisting from the main investment market in February 2024. ILAM Fahari joined Acorn I-REIT, Acorn D-REIT, and Linzi Sukuk in the USP, marking the first trading day in the segment. The delisting from the Main Investment Market Segment (MIMS) of the NSE will provide greater flexibility in managing the REIT's portfolio without affecting the unitholders’ ability to trade their units. The REIT’s shares (units) were available for trading on the platform at a fixed price of Kshs 11.0, representing the price at which a section of minority investors was bought out last year by ILAM, which is also the manager of the REIT.

Section III: Summary Performance of the REITs in H1’2024

The tables below highlight the performance of the Kenyan REITs sector, showing the performance using several National Association of Real Estate Investments Trusts (NAREIT) approved metrics, and the key take-outs;

|

Cytonn Report: Summary Performance Kenya REITs in H1’2024 |

|||||||||||||||

|

|

Laptrust Imara I-REIT |

ILAM Fahari I-REIT |

Acorn I-REIT |

Acorn D-REIT |

|

|

H1'2023 |

H1'2024 |

y/y change |

||||||

|

|

H1'2023 |

H1'2024 |

y/y Change |

H1'2023 |

H1'2024 |

y/y Change |

H1'2023 |

H1'2024 |

y/y Change |

H1'2023 |

H1'2024 |

y/y Change |

|||

|

Operating Metrics |

|||||||||||||||

|

Net Operating Income (NOI) |

99.6 |

162.4 |

63.0% |

86.0 |

53.8 |

59.8% |

128.0 |

309.9 |

142.1% |

334.2 |

260.2 |

(22.2%) |

647.9 |

786.3 |

21.4% |

|

Profitability Metrics |

|||||||||||||||

|

Funds from Operations |

99.6 |

162.4 |

63.0% |

86.0 |

53.8 |

59.8% |

149.8 |

359.0 |

139.6% |

334.2 |

260.2 |

(22.2%) |

669.7 |

835.3 |

24.7% |

|

Adjusted FFO |

99.6 |

162.4 |

63.0% |

84.4 |

55.1 |

53.2% |

149.8 |

359.0 |

139.6% |

334.2 |

260.2 |

(22.2%) |

668.1 |

836.6 |

25.2% |

|

Cash Available for Distribution (CAD) |

99.6 |

129.9 |

30.4% |

86.0 |

53.8 |

59.8% |

92.8 |

104.0 |

12.0% |

0.0 |

123.6 |

|

278.5 |

411.3 |

47.7% |

|

Cash Amounts Distributed (CAD) |

0.0 |

162.4 |

0.0% |

0.0 |

0.0 |

0.0% |

87.0 |

32.7 |

-62.4% |

0.0 |

181.4 |

|

87.0 |

376.5 |

332.8% |

|

Valuation Metrics |

|||||||||||||||

|

Net Asset Value (NAV) |

7,024.3 |

6,948.6 |

(1.1%) |

3,392.8 |

3,233.6 |

4.9% |

6,341.9 |

7,435.4 |

17.2% |

6,547.7 |

6749.5 |

3.1% |

23,306.6 |

24,367.1 |

4.5% |

Source: Cytonn Research

Key takeaways from the table include:

- The combined Net Operating Income (NOI) of Kenyan REITs saw a 21.4 % increase, reaching Kshs 786.3 mn in H1’2024, up from Kshs 647.9 mn in H1’2023. This growth was largely driven by a 142.1% rise in the net operating income of Acorn I-REIT, which increased to Kshs 309.9 mn from Kshs 128.0 mn in H1’2023. Additionally, Laptrust I-REIT reported a notable NOI growth of 63.0%, reaching to Kshs 162.4 mn from Kshs 99.6 in similar period in 2023, further contributing to the overall positive performance. Acorn D-REIT’s NOI saw the largest drop, falling by 22.2% to Kshs 250.2 mn from Kshs 334.2 mn in H1’2023

- Combined Funds from Operations (FFO) of Kenyan REITs increased by 24.7% in H1’2024, increasing to Kshs 835.3 mn from Kshs 669.7 mn in H1’2023. Similarly, Adjusted FFOs for Kenyan REITs increased by 25.2%, reaching Kshs 836.6 mn in H1’2024 from Kshs 668.1 mn in H1’2023. This increase was largely due to significant increases in NOIs except for Acorn D-REIT which recorded a decrease of 22.2% during the period,

- The REITs combined Cash amounts available for paying dividends to REIT investors which we measured using the Cash Available for Distribution (CAD) metric increased by 47.7% in H1’2024 to Kshs 411.3 mn from Kshs 278.5 mn in H1’2023. The performance was propelled by Laptrust Imara I-REIT’s distributable earnings which increased by 30.4% to come in at Kshs 129.9 mn from Kshs 99.6 mn during the same period last year. Additionally, Acorn D-REIT distributed earnings stood at 123.6 mn which was an improvement from the nil earnings recorded in H1’2023,

- Notably, the REIT managers of all four REITs recommended provisional dividends. For Laptrust Imara I-REIT, the REIT Manager suggested a first dividend distribution of Kshs 129.9 mn, amounting to Kshs 0.38 per unit, which was approved by the Trustee for the H1’2024, ILAM Fahari I-REIT’s manager proposed a first and final dividend of Kshs 0.3 per unit, making Kshs 53.83 mn available for distribution out of Kshs 181.0 mn. Acorn I-REIT increased its total distribution for the year to Kshs 104.0 mn, translating to Kshs 0.3 per unit, marking a 12.0 % rise from the Kshs 92.8 mn distributed in H1’2023. Acorn D-REIT recommended a distribution of Kshs 181.0 mn, equivalent to Kshs 0.7 per unit, which was an improvement from the nil distribution in H1’2023, and,

- The combined Net Asset Values (NAV) for Kenyan REITs increased by 4.5% to reach an all-time high of Kshs 24,367.1 mn in H1’2024, up from Kshs 23,306.6 mn in H1’2023. This growth was driven by a 17.2% increase in the NAV of Acorn I-REIT, reaching Kshs 7,435.4 mn from Kshs 6,341.9 mn in H1’2023, and a 3.1% rise in the NAV of Acorn D-REIT, which grew to Kshs 6,749.5 mn in H1’2024 from Kshs 6,547.7 mn in H1’2023, respectively.

The table below makes a comparison of the leverage and liquidity ratios of all four Kenyan REITs during H1’2024 and H1’2023;

|

Cytonn Report: Leverage & Liquidity Ratios of Kenyan REITs |

||||||||||||||||

|

|

Laptrust Imara I-REIT |

ILAM Fahari I-REIT |

Acorn I-REIT |

Acorn D-REIT |

H1’2023* |

H1’2024** |

y/y change |

|

||||||||

|

H1'2023 |

H1’2024 |

H1’2023 |

H1’2024 |

y/y Change |

H1’2023 |

H1’2024 |

y/y Change |

H1’2023 |

H1’2024 |

y/y Change |

|

|||||

|

Leverage Ratios |

||||||||||||||||

|

Debt to Equity Ratios |

0.0x |

0.0x |

0.0x |

0.0x |

0.0% |

0.0x |

0.0x |

0.0% |

0.6x |

0.3x |

(55.0%) |

0.2x |

0.1x |

(10.4%) |

|

|

|

Debt to Total Market Cap Ratio |

0.0% |

0.0x |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

64.0% |

28.0% |

(56.2%) |

29.7% |

8.1% |

(21.7%) |

|

|

|

Debt to Gross Book Value Ratio |

0.0% |

0.0x |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

35.1% |

14.6 % |

(58.4%) |

16.3% |

4.2% |

(12.1%) |

|

|

|

Debt to EBITDA Multiple |

0.0x |

0.0x |

0.0x |

0.0x |

0.0% |

0.0x |

0.0x |

0.0% |

11.8x |

7.0x |

(40.4%) |

5.5x |

2.0x |

(63.2%) |

|

|

|

Liquidity Ratios |

|

|||||||||||||||

|

Debt Service Coverage Ratio |

- |

|

- |

- |

- |

- |

- |

- |

8.1% |

14.2% |

6.1% |

2.5% |

4.1% |

1.6% |

|

|

|

Implied Capitalization Rate |

0.0% |

2.4% |

12.3% |

3.3% |

(72.8%) |

0.0% |

3.0% |

53.9% |

3.2% |

2.4% |

(26.5%) |

2.2% |

2.7% |

(0.4%) |

|

|

|

*Market cap weighted as at 30/06/2023 **Market cap weighted as at 30/06/2024 |

||||||||||||||||

Source: Cytonn Research

Key takeaways from the table include;

- Majority of the REITs remained ungeared during H1’2024, with their leverage ratios remaining at zero except Acorn D-REIT. Acorn D-REIT debt ratios decreased in H1’2024 on account of a 53.6% decline in its long-term borrowings to Kshs 1.8 bn from Kshs 3.9 bn in H1’2023,

- Notably, Acorn D-REIT’s Debt to EBITDA Multiple reduced by 40.4% to 7.0x in H1’2024, from 11.8x recorded in H1’2023. This was on the back of a faster decline in the REIT’s long-term borrowings which outpaced the EBITDA’s decline. Acorn D-REIT EBITDA in H1’2024 decreased by 22.2% to Kshs 260.1 mn from Kshs 334.2 mn in H1’2023, compared to a 53.6 % decrease in the REIT’s long-term debt, and,

- ILAM Fahari I-REIT traded at the highest implied capitalization rate of 3.3%, signifying a higher return on investment compared to other REITs. In contrast, Acorn D-REIT and Laptrust Imara I-REIT had the lowest implied capitalization rate of 2.4%. Despite this, we anticipate that Laptrust Imara I-REIT's performance will improve gradually, given that the REIT is still in its early years of operation.

The table below presents a summary of key valuation metrics of Kenyan REITs in H1’2024;

|

|

Cytonn Report: Valuation Metrics for Kenyan REITs |

|||||||||||||||

|

|

Laptrust Imara I-REIT |

|

ILAM Fahari I-REIT |

Acorn I-REIT |

Acorn D-REIT |

H1’2023 |

H1’2024 |

|

||||||||

|

|

H1'2023 |

H1’2024 |

y/y Change |

H1’2023 |

H1’2024 |

y/y Change |

H1’2023 |

H1’2024 |

y/y Change |

H1’2023 |

H1’2024 |

y/y Change |

y/y change |

|||

|

Price/ FFO per Share |

69.5x |

42.6x |

(38.6%) |

12.7x |

37.0x |

191.1% |

41.6x |

20.3x |

51.3% |

18.5x |

25.1x |

35.9% |

35.6X |

31.3X |

(12.2%) |

|

|

Dividend Yield

|

0.00% |

1.9% |

|

0.0% |

0.0% |

0.0% |

1.4% |

0.4% |

(0.9%) |

0.0% |

1.8% |

0.0% |

0.3% |

3.8% |

3.5% |

|

|

Dividend Coverage/ Payout Ratio |

100.0% |

80.0% |

(20%) |

0.0% |

0.0% |

0.0% |

93.7% |

10.6% |

(83.2%) |

0.0% |

69.7% |

0.0% |

48.4% |

40.1% |

(8.4%) |

|

|

Net Asset Value |

7,024.3 |

6,948.6 |

(1.1%) |

3,392.8 |

3233.6 |

(4.7%) |

6341.9 |

7,435.4 |

17.2% |

6,547.7 |

6,749.5 |

3.1% |

23,306.6 |

24,367.1 |

4.5% |

|

|

Net Asset Value per Share |

20.3 |

20.1 |

(1.1%) |

18.7 |

17.9 |

(4.7%) |

22.0 |

22.5 |

2.5% |

25.3 |

25.4 |

0.2% |

21.6 |

21.4 |

(0.6%) |

|

|

Annualized Dividend Yield |

0.0% |

3.8% |

0.0% |

0.0% |

0.0% |

0.0% |

2.7% |

0.9% |

(67.8%) |

0.0% |

3.6% |

0.0% |

0.7% |

2.1% |

1.4% |

|

Source: Cytonn Research

- Laptrust Imara I-REIT units are trading at a premium relative to its peers, with a Price to FFO per share multiple of Kshs 42.6, however this was a decrease of 38.6% from Kshs 69.5 price per FFO per share multiple,

- Laptrust Imara I-REIT’s and Acorn D-REIT boasted the highest annualized dividend yield in H1’2024 at 3.8% and 3.6% respectively, surpassing ILAM Fahari I-REIT 0.0% and Acorn I-REIT’s 0.9%. On the payout side, Imara’s dividend payout was 80.0%, adhering to Kenya's REIT regulations that mandate distributing at least 80.0% of net profits after tax as dividends. Conversely, Acorn I-REIT and D-REIT had lower payouts of 10.6% and 69.7%, respectively, falling short of the regulatory threshold, and,

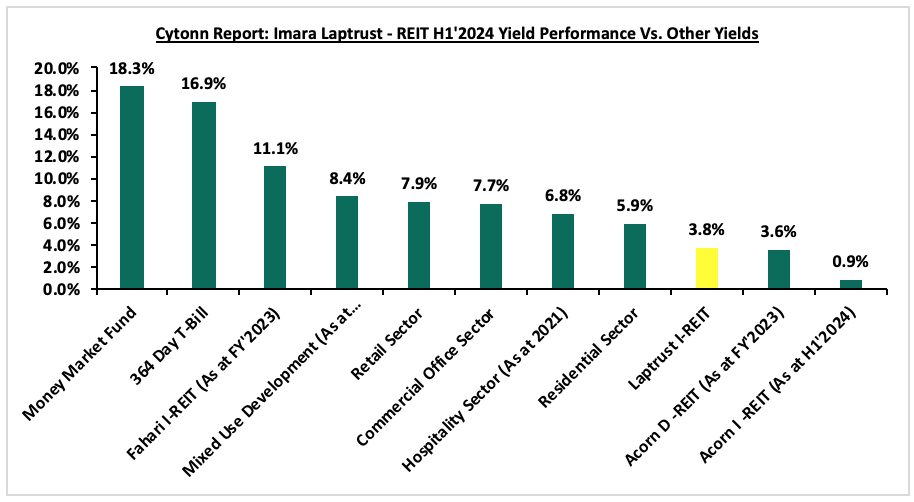

- Acorn D-REIT recorded the highest NAV per share at Kshs 25.4, a 0.2% increase from H1’2023’s NAV per share of Kshs 25.3. This is on the back of a faster growth in the number of shares, which increased by 2.9% to Kshs 266.2 mn from Kshs 258.7 mn in H1’2023; compared to a 6.6% growth in the Net Asset Value (NAV) to Kshs 6.6 bn from Kshs 6.2 mn. ILAM Fahari had the lowest NAV per share at Kshs 17.9, a 4.7% decline from 18.7 recorded in H1’2023. This is attributable to a 4.0% decrease in total assets to Kshs 3.4 bn from Kshs 3.5 bn in H1’2023.The chart below shows the comparison of REITS yield performance versus other assets.

Section IV: Conclusion, Recommendations, and Outlook for the REITs Sector

Kenya's REITs market has seen moderate performance, shaped by various factors. Despite challenges, there are encouraging trends, such as growth in net operating incomes, indicating improved financial performance. Additionally, leverage ratios for most REITs have remained low, with many REITs being ungeared and relying on short-term debt for their operations to avoid overexposure to rising interest rates. This trend is expected to continue as REITs seek to maintain financial sustainability, as evidenced by Acorn Holdings' issuance of a green bond. Moreover, the recent regulatory proposal by the Capital Markets Authority (CMA) to reduce the minimum investment amounts for professional investors to Kshs 10,000 is anticipated to increase interest in the sector and attract a broader investor base.

Recommendations to Enhance the REITs Sector:

- Stakeholder Education: There is a need to educate all key stakeholders on the REIT structure. Implementing investor education and awareness campaigns is essential to inform potential investors about the benefits and risks associated with REIT investments. By improving investor knowledge and understanding, it is likely that more individuals will be encouraged to participate in the REIT market, thereby contributing to its growth and development,

- Expanding Legal Entities: In South Africa, the REITs' legal and operational framework allows different legal entities to establish REITs, unlike Kenya, where this is limited to trusts. In both Belgium and the United States, REIT formation permits flexibility in the choice of legal entities, contributing to the diversity and dynamism of the REIT market. Belgium allows various legal structures, including public limited companies, limited liability companies, and cooperative companies, tailored to different investor preferences and business models. Similarly, in the US, REITs can be structured as corporations, trusts, or associations, providing versatility in organizational structures. To enhance the Kenyan REIT market, it is prudent to introduce similar flexibility. By expanding the range of permissible structures beyond traditional trust-based models to include corporations, partnerships, and limited liability companies, Kenya can better accommodate diverse investor needs and facilitate easier entry into the REIT market. This diversification would promote a more robust and dynamic REIT sector, catering to different organizational preferences,

- Streamlined Approval Process: To improve the efficiency of Real Estate Investment Trusts (REITs) approval, it is recommended to consolidate the approval structure into a single agency, instead of the current two (CMA and KRA). Merging the approval process under one agency would eliminate the need to navigate through two separate entities for REITs approval. This consolidation would streamline the process, enhancing efficiency, reducing costs, and improving transparency and accountability,

- Introduce Hybrid REIT Vehicles: Currently, investors have to subscribe to both of the separate REIT classes, forcing them to pay duplicate costs, due to the nature of exclusivity of the two. A hybrid REIT would provide investors integrated returns, by combining the higher return from development while reducing risk exposure through the relatively stable income component of the I-REIT. In addition, an IPO with such a hybrid REIT vehicle would eliminate the duplicated costs of running two separate REITs, thereby improving subscriptions by investors. Introducing a hybrid REIT within a unified structure would thus enable investors to capitalize on the strengths of both investment types, potentially leading to more balanced risk-reward profiles,

- Flexibility in Listing: Acknowledging the apprehensions of companies regarding an immediate shift to public listing, we propose a gradual, phased strategy. Providing REITs with an initial period of private operation before mandating public listing would facilitate a smoother transition and align with the comfort levels of corporate entities. Belgium's stipulation of ensuring 30.0% of shares held by the public strikes a balance between public ownership and flexibility for REIT promoters. Kenya could adopt a similar approach to encourage broader investor participation while ensuring sufficient liquidity in the market. Moreover, Kenya could follow the example of the United States by offering flexibility in listing options for REITs. Granting REITs the autonomy to choose between going public or remaining private offers increased flexibility to accommodate diverse investor preferences and business models. By accommodating both publicly listed and privately held REITs, Kenya can promote inclusivity in the market and cater to the needs of a wide range of investors, thereby bolstering the vibrancy and liquidity of the REIT market. This approach creates a favorable environment for REITs to thrive while addressing concerns related to the transition to public listing,

- Lower Capital Requirement for Trustees: We propose a reduction in the minimum capital requirement, presently set at Kshs 100.0 mn, as this financial threshold practically currently limits trusteeship options solely to banking institutions. Currently, four banks are registered as REIT Trustees, including Kenya Commercial Bank (KCB), Co-operative Bank (Coop), Housing Finance Bank, and NCBA Bank Kenya. We suggest lowering the minimum to Kshs 10.0 mn to align with the minimum required for a Pension Fund Trustee. This adjustment would expand the pool of potential Trustees available to REIT Managers,

- Introduce Tokenization of REITs: Introducing the concept of tokenization for REITs presents an innovative solution and has the potential to amplify market participation. This would facilitate the ownership of REIT units in smaller denominations, even as low as Kshs 100.0 and,

- Diminishing Entry Barriers: Reconsideration of the steep Kshs 5.0 mn minimum for D-REITs is vital to eliminate entry barriers that inadvertently limit individual market entry. A revised minimum could promote a more inclusive investment landscape.

The outlook for Kenya's REITs sector remains cautiously optimistic. While challenges such as high construction costs and market saturation in certain areas persist, the continued government support through infrastructure development and affordable housing initiatives provides a positive backdrop. Investors are expected to remain focused on income-generating REITs, particularly those tied to resilient sectors like retail and commercial properties. The sector's growth will likely hinge on increased investor awareness and the broadening of investment options within the REITs market.

To read the full Cytonn Kenya’s REITs H1’2024 Report, click here.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.