Nov 24, 2019

In 2018, we published the Nairobi Metropolitan Area Serviced Apartments Report, 2018, which highlighted that serviced apartments within the Nairobi Metropolitan Area(NMA) recorded average rental yield and occupancy rates of 7.4% and 79.9%, respectively, supported by an improved political environment following the conclusion of the prolonged elections which spilled over from 2017 to early 2018, and increased marketing efforts of Kenya as a travel destination by the Kenyan Government. This year, we update our report findings on serviced apartments in NMA by focusing on:

- Overview of the Kenyan Hospitality Sector,

- Introduction to Serviced Apartments,

- Supply and Distribution of Serviced Apartments In the Nairobi Metropolitan Area,

- Performance of Serviced Apartments in the Nairobi Metropolitan Area,

- Serviced Apartments Performance by Node

- Comparative Analysis- 2018/2019 Market Performance

- Performance per Typology

- Recommendation and Outlook.

Section I: Overview of the Kenyan Hospitality Sector

The hospitality sector has continued being a key driver of the Kenyan economy evidenced by the continued contribution to GDP by accommodation and food services, whose growth expanded to 16.6% in 2018, compared to 14.4% in 2017, according to the KNBS Economic Survey 2019. The sector has continued to record entry and expansion of international players such as Radisson Hotel Group, driven by strong demand for hospitality services and facilities. According to the KNBS, the total number of visitors arriving through Jomo Kenyatta (JKIA) and Moi International Airports (MIA) increased by 5.4% to 1.2 mn between January and September 2019, from 1.1 mn persons during the same period in 2018.

Factors that have continued to drive the hospitality sector include:

- Improved Security - Kenya’s security has continued to improve evidenced mainly by the reduced terrorist attacks. This has boosted tourists’ confidence in the country, making it a preferred travel destination for both business and holiday travelers,

- Growth of Meetings, Incentives, Conferences and Exhibitions (MICE) Tourism - According to KNBS Economic Survey 2019, local conferences grew by 7.9% in 2018 to 4,147, from 3,844 in 2017, while international conferences grew by 6.8% to 204, from 191 in 2017, signaling a growth in the MICE tourism sector, which has continued to drive the hospitality sector. The growth in the sector has been largely enabled by the presence of conferencing facilities such as the Kenyatta International Convention Centre (KICC), which was crowned as the leading meetings and conference center in Africa at the World Travel Awards 2019. Notable conferences in 2019 included the International Conference on Population and Development (ICDP) Nairobi Summit that saw more than 6,000 world leaders converge in Nairobi. International conferences of such stature solidify the confidence of the international community to find Kenya as a preferred destination for business tourism,

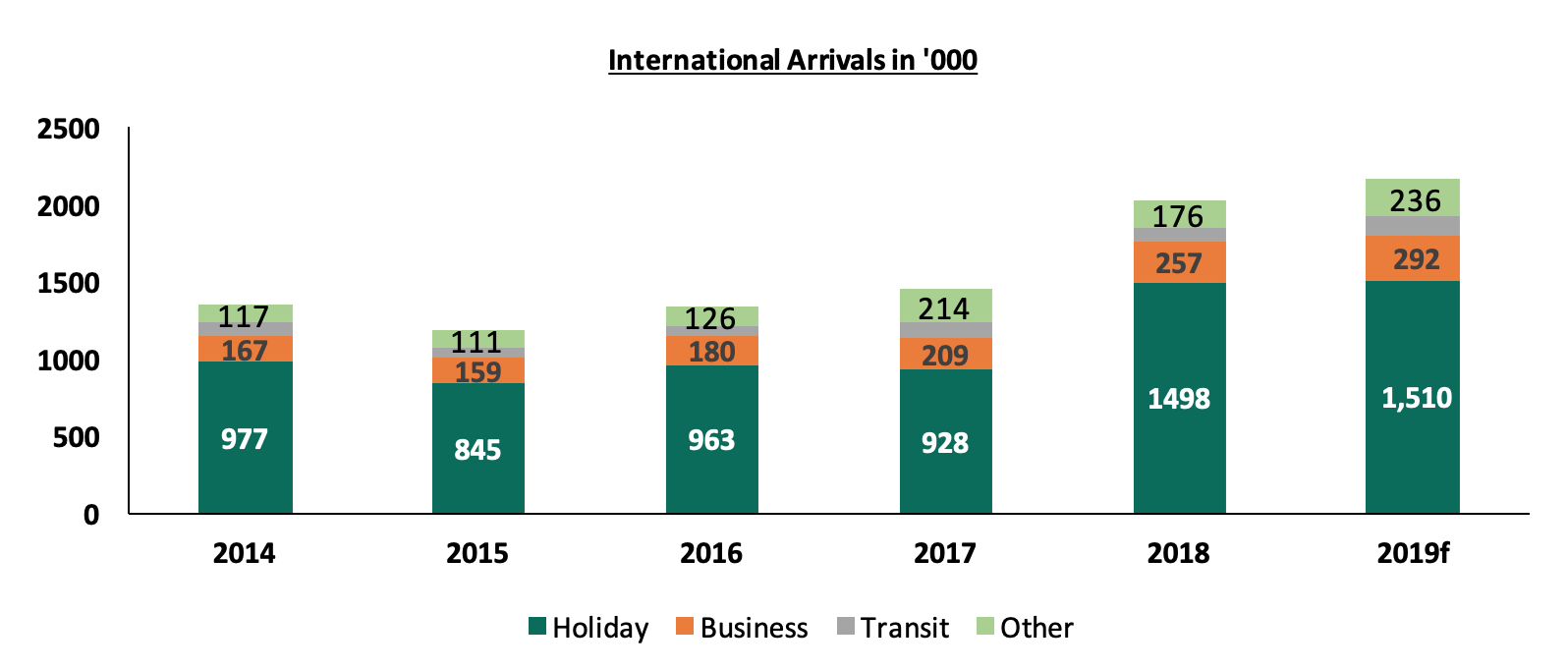

- Travel Tourism - Holiday travelers are the main drivers of Kenya’s hospitality sector, accounting for approximately 71.2% of international arrivals over the last 5-years. In 2018, the number of holiday travelers came in at 1.5 mn, 61.5% higher than the 0.9 mn recorded in 2017 and we expect this to grow further in 2019, enhancing the continued demand for food and accommodation services, thus boosting the hospitality sector. The graph below shows the growth of tourist arrivals by purpose over the years:

Source: Kenya National Bureau of Statistics

- Recognition of Nairobi as a Regional Hub - The strategic geo-positioning of Nairobi, in addition to the improving infrastructure, sets it up as a preferable regional hub for the East Africa Community, and this has thus continued to enhance the growth of business travelers into the region, and,

- Positive Accolades - Kenya’s hospitality facilities continue to receive global recognition, boosting the country’s status as a preferred travel destination globally while promoting it as an attractive investment opportunity for international players. Case in point, (i) Nairobi edged out notable cities like Johannesburg, and Kigali to be crowned as Africa’s leading business travel destination while Nairobi’s own KICC was awarded as the leading meetings and conference destination during the 2019 World Travel Awards, (ii) JKIA received the ‘Highly Acclaimed’, African Airport of the Year Award during the 4th edition of ACA 2019 Conference held in Johannesburg, South Africa, and (iii) seven Kenyan hotels received various awards at the World Luxury Hotel Awards 2019 in Finland, see the list on Cytonn Weekly#43/2019

Nevertheless, the sector continues to face challenges, mainly;

- Travel Advisories - Despite an elongated prevalence of peace in the country, Kenya still suffers from risk-prone travel advisories. With the United States of America travel advisory highlighting some areas in Kenya such as Kilifi, Lamu, Kibera, Eastleigh, and the Somali border as high-risk crime and terrorism prone areas, and,

- Delayed Infrastructural Projects - This continues to cripple access to areas, for example with the dragging expansion of Malindi Airport, which continues to result in a reduced number of tourist arrivals at the East African coast due to lack of direct flights to the airport.

Section II: Introduction to Serviced Apartments

To reiterate our 2018 Topical, a serviced apartment is a fully furnished apartment, available for both short-term and long-term stays, providing amenities for daily use, housekeeping and a range of other services, all included within the rental price. The concept has gained popularity in recent years also outside the business travel space, as more leisure travelers are finding that serviced apartments are easily available and offer a credible and cost-effective alternative. They are especially economical for longer stays and for group and family travel. According to the KNBS statistics, the average length of stay of guests improved slightly by 0.1% points to 13.1% in 2018, from 13.0% in 2017, and these long term stays have continued to drive the demand for serviced apartments in Kenya with an occupancy rate of up to 88.0% in some submarkets.

The advantages of a serviced apartment include;

- They offer more space than a traditional hotel room, with the former having units of up to 140 SQM, while a standard hotel room size ranges between 30- 50 SQM, within the Nairobi market,

- Substantially cheaper than a hotel room when staying for a longer period of time. For example, a standard 3-star hotel in Nairobi charges on average Kshs 10,700 per night for a suite, while a studio serviced apartments charges on average Kshs 8,000 per night within the same location,

- Compared to hotels, a serviced apartment is more of a home, with utilities that enable more freedom and comfort,

- Offers the ease of integration, as the concept offers guests a chance to integrate with the larger community as they are located within or in close proximity to other residential developments,

- It resembles the culture of the specific area. This gives insight into what a real local apartment would look like, giving a more comprehensive immersion of the culture and values compared to hotel rooms, which usually all look alike, and

- The easy conversion, as serviced apartments can easily be converted into furnished or normal apartments in the case where the former is not performing well.

However, as the concept continues to gain traction, competition on local players continues to heighten with renowned international brands such as Radisson Hotel Group and Mövenpick Hotels & Resorts joining the market.

Section III: Supply and Distribution of Serviced Apartments in the Nairobi Metropolitan Area

Serviced apartments in the Nairobi Metropolitan Area (NMA) increased by a 5-Year CAGR of 10.4% to 5,593 in 2019, from 3,414 in 2015. Some of the developments introduced in the market during the year include 122-room Radisson Hotel and Residency by Radisson Hotel Group in Kilimani, which opened in October, and CySuites by Cytonn Investments, a 40-unit development in Church Road, Westlands, set to begin operations in November 2019.

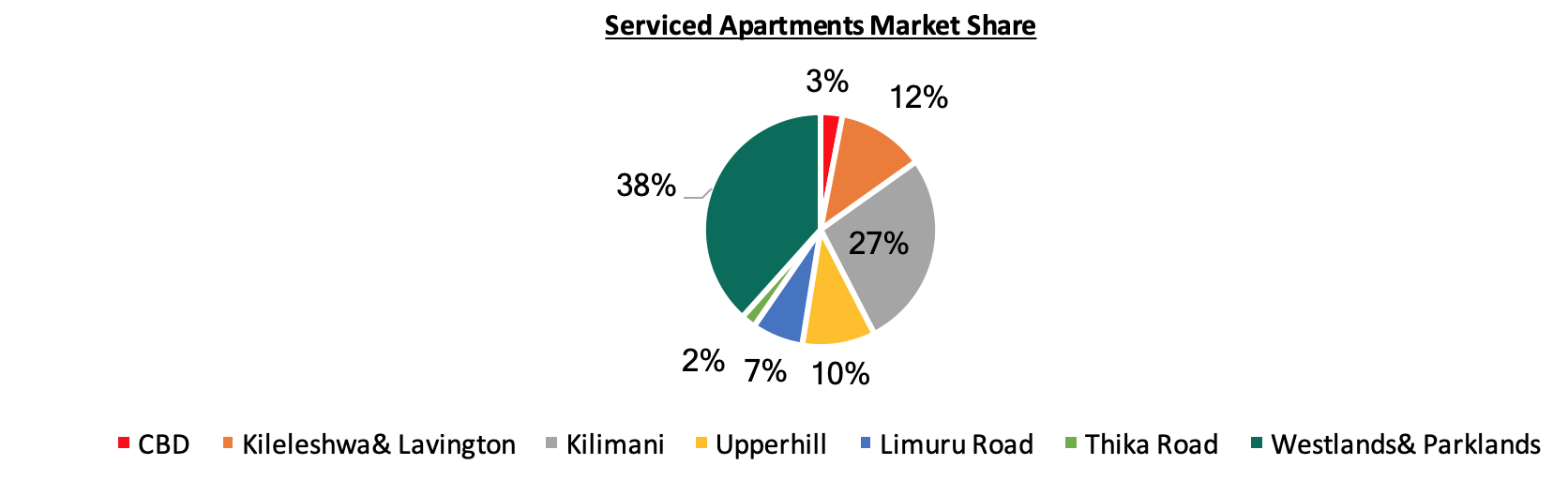

In terms of distribution, Westlands and Kilimani recorded the largest market share of serviced apartments within the Nairobi Metropolitan Area, recording market shares of 37.6% and 26.7%, respectively, of the total developments. This is attributed to the attractiveness of the areas due to; (i) proximity to the Nairobi CBD and other major business nodes such as Upperhill and Westlands, (ii) good security as the nodes serve as United Nations (UN) Blue Zone areas offering a conducive and favorable environment for expatriates to reside, and (iii) high presence of international organizations such as International Committee of the Red Cross (ICRC), Oxfam and Save the Children International.

Source: Cytonn Research 2019

Currently, there are at least 824 apartments in the development pipeline set for completion by 2020. Some of the developments in the pipeline include:

|

Serviced Apartments Developments in the Pipeline |

||||

|

Name |

Developer |

Location |

Number of Units |

Completion |

|

Skynest |

Elegant Properties |

Westlands |

250 |

2020 |

|

Britam |

Britam |

Kilimani |

163 |

2020 |

|

Sun Africa Luxury Apartments |

Sun Africa Hotels Group |

Kilimani |

20 |

2020 |

|

9 Oak |

Mifta Holdings |

Kilimani |

120 |

2020 |

|

Avic |

Avic |

Westlands |

51 |

2020 |

|

Ole Sereni |

Ole sereni |

Mombasa Road |

20 |

2020 |

|

Elsie Ridge |

Intime Group |

Spring Valley |

40 |

2020 |

|

Habitat |

Ekco Investments |

Kilimani |

160 |

2020 |

|

Total |

824 |

|||

Source: Cytonn Research 2019

Section IV: Performance of Serviced Apartments in the Nairobi Metropolitan Area

For the purpose of this report, we tracked the performance of serviced apartments in 7 nodes in the Nairobi Metropolitan Area and compared this to the performance to 2018. The key metrics we looked at include:

- Charged Rates: This is the amount guests pay for an apartment in a specific market, on a daily basis, weekly and/or monthly. It informs potential investors on the rental income they are likely to gain from investing in serviced apartments,

- Occupancy Rates: This measures the number of apartments that are let out of the total available, in order to inform on the expected rental yield of the developments, and,

- Rental Yields: This refers to the measure of return on the real estate investment, from the rental income collected annually. The rental yield informs potential investors on the return they are likely to get from a property and hence the time it will take an investor to recoup the money invested. To calculate this, we have estimated annual income from monthly revenues having deducted operational costs assumed to be at 40.0% of revenues. To estimate the investment value, we have calculated development cost per SQM by factoring in land costs based on the location, construction costs, equipping costs, professional fees and other development-related costs. The formula to calculate rental yield is as follows;

Rental Yield= Monthly Rent per SQM x Occupancy Rate x (1-40.0% operational cost) x 12 months

Development Cost per SQM

*Important to note, however, is that depending on the actual incurred land cost, plot ratios, the level of finishing and equipping, investors will generally incur varying costs.

On performance, we will start by covering the performance by the node during the year, compare this with 2018 performance, then cover the performance by typology.

- Serviced Apartments Performance by Node

From our analysis, serviced apartments within the NMA recorded an average rental yield of 7.6% in 2019, 0.2% points higher than the 7.4% recorded in 2018, and this we attribute to a 2.3% increase in monthly charges per SQM, from Kshs 2,742 in 2018 to Kshs 2,806 in 2019, fueled by the continued demand for serviced apartments by both guests on business and leisure travels. The improved performance has on overall been supported by the stable political environment and improved security, thus making Nairobi an ideal destination for both business and holiday travelers.

The table below shows a summary of the performance of the various nodes within NMA:

(All values in Kshs unless stated otherwise)

|

|

2019 Summary of Performance per Node |

|||||||||||

|

|

Unit Sizes (SQM) |

Monthly Charges per Unit (Kshs) |

|

|

|

|

||||||

|

Node |

Studio |

1 bed |

2 bed |

3 bed |

Studio |

1 Bed |

2 Bed |

3 Bed |

Occupancy 2019 |

Monthly Charge per SQM 2019 |

Devt Cost per SQM(Kshs) |

Rental Yield 2019 |

|

Westlands& Parklands |

33 |

85 |

115 |

177 |

249,700 |

279,018 |

319,529 |

337,408 |

80.8% |

3,884 |

209,902 |

10.8% |

|

Kilimani |

39 |

69 |

110 |

149 |

160,000 |

221,167 |

362,813 |

418,000 |

80.0% |

3,353 |

202,662 |

9.5% |

| Limuru Road/ Gigiri |

|

51 |

137 |

187,400 |

197,184 |

260,500 |

300,000 |

88.2% |

3,430 |

231,715 |

9.4% |

|

|

Kileleshwa & Lavington |

38 |

70 |

134 |

140,000 |

193,333 |

268,990 |

474,000 |

82.4% |

2,845 |

206,132 |

8.2% |

|

|

Upperhill |

75 |

110 |

156 |

195,000 |

304,600 |

368,333 |

67.8% |

2,577 |

209,902 |

6.0% |

||

|

Nairobi CBD |

51 |

90 |

115 |

137 |

130,250 |

170,500 |

241,786 |

331,250 |

72.0% |

2,230 |

224,571 |

5.1% |

| Thika Road |

|

70 |

100 |

144 |

110,000 |

131,667 |

155,000 |

84.4% |

1,321 |

200,757 |

4.0% |

|

|

Average |

40 |

73 |

117 |

153 |

173,470 |

195,172 |

269,983 |

340,570 |

79.4% |

2,806 |

212,234 |

7.6% |

|

High |

51 |

90 |

137 |

177 |

249,700 |

279,018 |

362,813 |

474,000 |

88.2% |

3,884 |

231,715 |

10.8% |

|

Low |

33 |

51.11 |

100 |

137 |

130,250 |

110,000 |

131,667 |

155,000 |

67.8% |

1,321 |

200,757 |

4.0% |

|

||||||||||||

Source: Cytonn Research 2019

- Comparative Analysis- 2018/2019 Market Performance

Overall, serviced apartments’ performance slightly improved in 2019, evidenced by an increase in rental yields to 7.6% from 7.4%, supported by the growing number of tourist arrivals, despite the tough economic environment.

The table below shows the comparative analysis:

(All values in Kshs unless stated otherwise)

|

Comparative Analysis- 2018/2019 Market Performance |

|||||||||

|

Node |

Monthly Charge per SM 2019 |

Monthly Charge per SM 2018 |

Monthly charge per SQM % ∆ |

Occupancy 2019 |

Occupancy 2018 |

Occupancy Rates ∆ %points |

Rental Yield 2019 |

Rental Yield 2018 |

% Rental Yield ∆ |

|

Westlands& Parklands |

3,884 |

4,044 |

(4.0%) |

80.8% |

76.4% |

4.4% |

10.8% |

10.6% |

0.2% |

|

Kilimani |

3,353 |

3,567 |

(6.0%) |

80.0% |

86.0% |

(6.0%) |

9.5% |

10.9% |

(1.4%) |

|

Limuru Road/ Gigiri |

3,430 |

3,685 |

(6.9%) |

88.2% |

84.4% |

3.8% |

9.4% |

9.7% |

(0.3%) |

|

Kileleshwa& Lavington |

2,869 |

2,686 |

5.9% |

82.4% |

82.9% |

(0.4%) |

8.2% |

7.8% |

0.4% |

|

Upperhill |

2,577 |

2,580 |

(0.1%) |

67.8% |

60.0% |

7.8% |

6.0% |

5.3% |

0.7% |

|

Nairobi CBD |

2,230 |

2,374 |

(6.1%) |

72.0% |

74.4% |

(2.4%) |

5.1% |

5.7% |

(0.5%) |

|

Thika Road |

1,321 |

1,361 |

(2.9%) |

84.4% |

90.0% |

(5.6%) |

4.0% |

4.4% |

(0.4%) |

|

Msa Road |

1,642 |

85.0% |

5.0% |

||||||

|

Average |

2,806 |

2,742 |

2.3% |

79.4% |

79.9% |

(0.5%) |

7.6% |

7.4% |

0.2% |

|

|||||||||

Source: Cytonn Research 2019

- Upperhill recorded the highest increased in average rental yield to 6.0% from 5.3% recorded in 2018, and this we attribute to a 7.8% increase in occupancy rates attributed to a growing preference of the area given its the proximity to business nodes such as Kilimani, Westlands and the Nairobi CBD, ease of accessibility, proximity to the main airports that is Jomo Kenyatta International Airport (JKIA) and the Wilson Airport, in addition to the low supply of serviced apartments. However, the performance of the node remains relatively low compared to the market as the area is more of a commercial node thus has low preference for residence,

- Kilimani ranked second in performance with average rental yields of 9.5%. However, this was a 1.4% points decline from 10.9% recorded in 2018, which we attribute to the 6.0% points decline in occupancy rates and 6.0% correction in monthly charges per SQM, attributed to the growing competition from neighboring nodes such as Westlands, in addition to the growing supply.

- Performance per Typology

In terms of performance per typology, studio units recorded the highest average rental yield at 13.7%, mainly attributed to the relatively high occupancy rates at 83.9%, compared to 1, 2 and 3 bedroom units at 83.8%, 76.4% and 75.5%, respectively, supported by the relatively low supply of the typology in the market.

The table below shows the summary of performance per typology:

(All values in Kshs unless stated otherwise)

|

2019 Performance per Typology |

||||

|

Typology |

Average Size (SQM) |

Monthly Charges per SQM (Kshs) |

Occupancy |

Rental Yield 2019 |

|

Studio |

39 |

4,821 |

83.9% |

13.7% |

|

1 bedroom |

75 |

2,739 |

83.8% |

7.8% |

|

2 bedroom |

116 |

2,311 |

76.4% |

6.0% |

|

3 bedroom |

152 |

2,172 |

75.5% |

5.6% |

|

3,011 |

79.9% |

8.3% |

||

|

||||

Source: Cytonn Research 2019

Section V: Recommendations and Outlook

Having looked at the factors driving the hospitality industry, and specifically the serviced apartments sector, challenges and the current performance, we now conclude with a recommendation of the investment opportunity and outlook.

|

Serviced Apartments Sector Outlook |

||

|

Measure |

Sentiment |

Outlook |

|

Serviced Apartments Performance |

In 2019, serviced apartments recorded relatively high rental yield at 7.6%, 0.2% points higher than 7.4% recorded in 2018, and 2.7% points higher than 4.9% for the residential sector (apartments) according to Cytonn Research. Given the growing popularity of the concept, improved security and political stability, we expect the theme to continue recording improved performance going forward. |

Positive |

|

International Tourism |

The total number of international visitors arriving through JKIA and MIA increased by 5.4% to 1.2 mn for the period between January and September 2019 from 1.1 mn persons during the same period in 2018. We expect the numbers to continue going up supported by; political stability, positive accolades, in addition to the ongoing marketing efforts by the government and the industry players. |

Positive |

|

MICE Tourism |

MICE tourism has continued to grow evidenced by the 6.8% and 7.9% increase in international and local conferences, respectively, with 204 conferences in 2018, from 191 recorded in 2017, while the local conferences grew to 4,147 in 2018 from 3,844 in 2017. We expect this to increase in 2020 and onwards, supported by the calm political environment, aggressive marketing by the Kenyan government and the improving infrastructure. |

Positive |

|

Supply |

There were approximately 5,505 serviced apartment units in Nairobi as at 2019 with an additional 1,377 apartments set for completion by 2021. We therefore expect increased competition especially in areas such as Westlands and Kilimani which have the majority of the units in operation and also in the development pipeline. |

Neutral |

Based on the above metrics, we had 3 positive factors and only 1 neutral factor, thus our overall outlook for the serviced apartments theme is POSITIVE. The investment opportunity lies in Westlands and Parklands, and Kilimani, which have continued to be best performing nodes with average rental yields of 10.8% and 9.5%, respectively.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.