May 14, 2023

According to the World Bank, Kenya's urbanization rate stood at an average of 3.7% as of 2021, higher than the global average of 1.6%. Similarly, the annual population growth rate averaged 1.9% as of 2021, which is also higher than the global average of 0.9%. As a result, the demand for housing in Kenya is very high, far exceeding the available supply, with Centre for Affordable Housing Finance Africa (CAHF) estimating that there is an 80.0% annual housing deficit in Kenya. This is evidenced by the fact that only 50,000 new houses are delivered annually in the country, whereas the demand is estimated to be at about 250,000 units per year. This leaves a shortfall of about 200,000 houses per year, which is a significant gap to fill. As such, the government has since initiated various programs, policies and strategies to ensure provision of adequate housing for all citizens. Some of the housing initiatives include the following:

- Kenya Slum Upgrading Programme (KENSUP), aimed at improving the living conditions of residents in informal settlements in Kenya. This is done through construction of low cost houses, installation of social and physical infrastructure, introducing income generation activities, facilitating security of tenants, environment and solid waste management through community and resource mobilization,

- Affordable Housing Programme (AHP), which was envisioned in the Big Four Agenda, a government initiative aimed at accelerating the country's economic development. The AHP is designed to address the housing deficit in Kenya, by mobilizing both public and private resources to construct affordable housing units. The AHP aims to achieve this goal through several strategies, including;

- Incentives to Developers: These include; i) availing land to county governments for construction of affordable housing units, ii) exemption from Value Added Tax (VAT) on importation and local purchase of goods for construction of houses under the affordable housing programme, iii) low corporate tax rate of 15.0% for developers of over 100 units, iv) exemption from 4.0% (urban areas) and 2.0% (rural areas) stamp duty for first time buyers of houses under the affordable housing progamme, and, vi) tax relief of 15.0% of savings to drive contributions towards home ownership. These are expected to accelerate the state’s agenda of providing affordable housing to Kenyans,

- The Kenya Mortgage Refinancing Company (KMRC): which was established in 2018 and began lending in 2020 with the aim of providing long-term financing to primary mortgage lenders such as banks, microfinance institutions, and SACCOs at low and fixed interest rates. The KMRC seeks to increase access to affordable housing finance by providing lenders with the liquidity they need to offer affordable mortgages to Kenyans. In 2022, KMRC refinanced 1,948 mortgage loans valued at Kshs 6.8 bn, representing a 278.0% increase from 574 home loans valued at Kshs 1.3 bn disbursed in 2021, and,

- The National Housing Development Fund (NHDF): which was first established in 2018 through the Finance Act, and managed by the National Housing Corporation (NHC), with an objective of raising funds from various sources in an initiative aimed at providing affordable housing to Kenyans. The fund would de-risk private developers by guaranteeing offtake for units, enable buyer uptake by providing affordable finance solutions, and allow mortgage and cash buyers to save towards the purchase of affordable homes through the Home Ownership Savings Plan (HOSP).

In May 2023, the Cabinet Secretary for the National Treasury submitted the Finance Bill 2023 to the National Assembly for discussion and consideration for enactment into the Finance Act 2023. The Finance Bill has various proposals, one of them being an introduction of a 3.0% levy on the employee’s gross monthly income, with a matching contribution from the employer that will be remitted to the National Housing Development Fund (NHDF). First established in 2018 through the Finance Act, the Housing Fund is managed by the National Housing Corporation (NHC), with the main objective being to raise funds from various sources aimed at providing affordable housing to Kenyans. The proposed amendment on the housing levy has created a lot of debates with the public, stakeholders and policy makers raising concerns about the impact of the housing fund levy on the taxpayers and the overall implementation of the Affordable Housing Programme (AHP). As such, we saw if fit to cover a topical the National Housing Development Fund (NHDF) to shed light on the current state of the housing sector in Kenya as well as discuss the operationalization of the Housing Fund and the impacts of the proposed levy. We shall also make a comparison with similar initiatives in other countries and give our recommendations towards achieving a sustainable Housing Fund in Kenya. We shall undertake this by looking into the following;

- Overview of the housing sector in Kenya,

- National Housing Development Fund (NHDF),

- Case Study and Recommendations, and,

- Conclusion.

Section One: Overview of the housing sector in Kenya

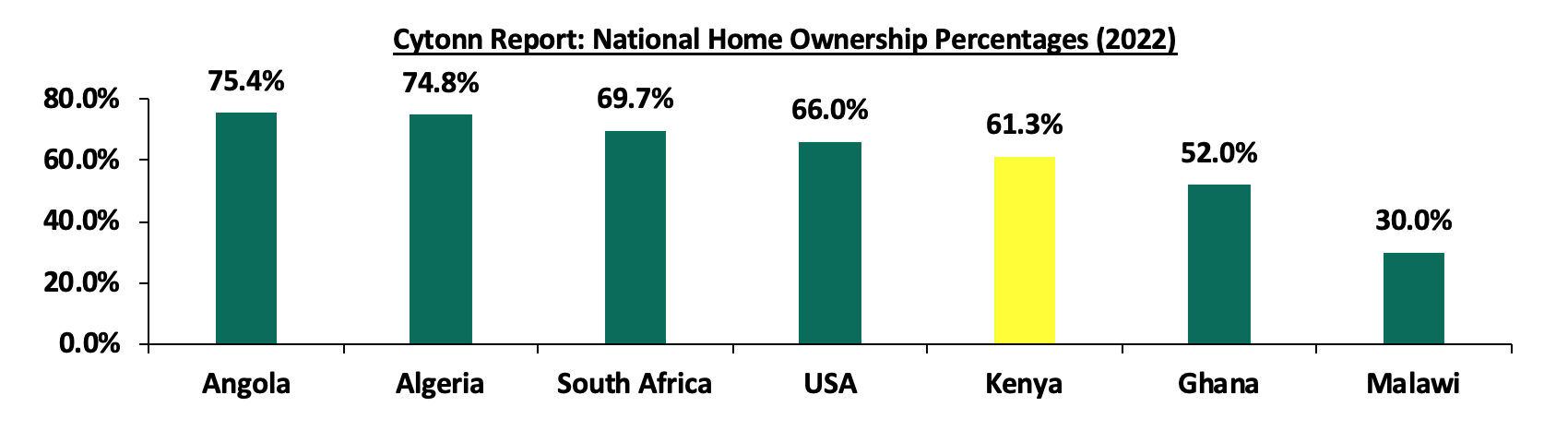

According to the Kenya National Bureau of Statistics (KNBS), the Real Estate sector contributed 10.1% to the country's GDP in FY'2022, with a growth rate of 4.5%. The demand for housing in Kenya is high, mainly attributable to positive demographics in the country as well as increased infrastructural developments which have opened up new areas for investment. Consequently, Kenya faces a significant housing deficit of about 2.0 mn units according to the National Housing Corporation (NHC). The Centre for Affordable Housing Finance in Africa (CAHF) reports that 61.3% of Kenyans own homes, compared to other African countries like Angola and Algeria with 75.4% and 74.8% national home ownership rates respectively. The graph below shows the national home ownership percentages for different countries compared to Kenya;

Source: Centre for Affordable Housing Africa, US Census Bureau

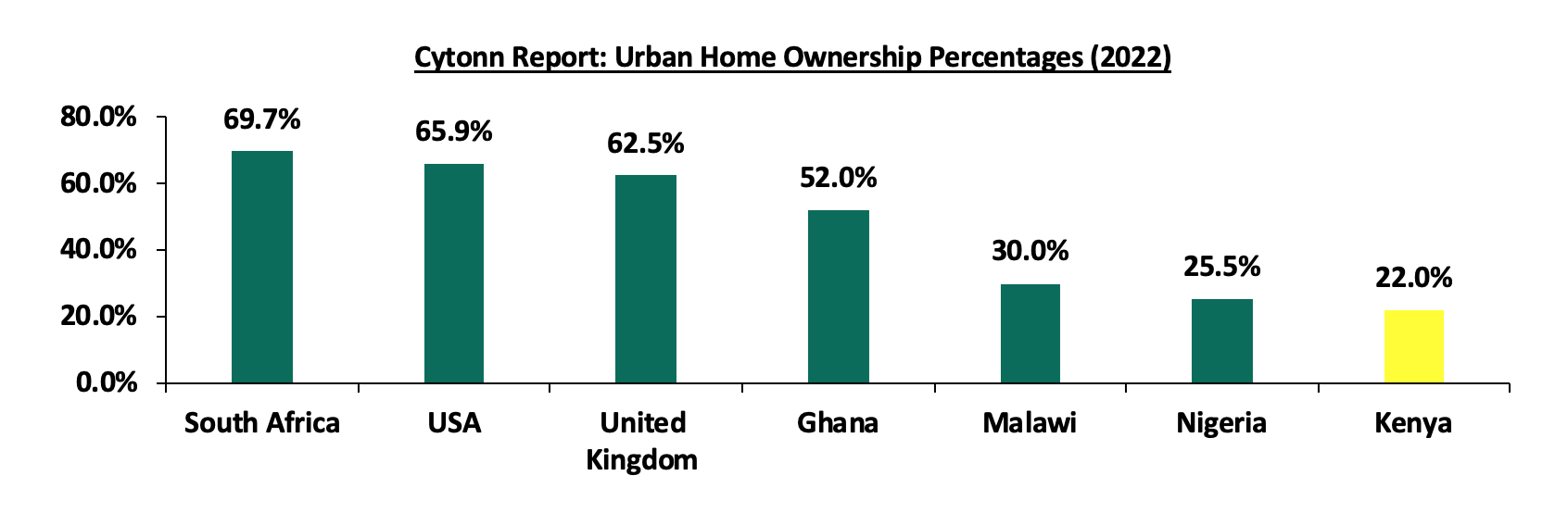

On the other hand, the rate of home-ownership in urban areas in Kenya is significantly low, standing at only 22.0%. This is in contrast to other countries such as South Africa and Ghana, where the home-ownership rates in urban areas are much higher at 69.7% and 52.0%, respectively. The graph below shows the urban home-ownership rate in Kenya compared to select countries as at 2022;

Source: Centre for Affordable Housing Africa, US Census Bureau, UK Office for National Statistics

In response to this, the Affordable Housing Programme (AHP) was launched by the government in December 2017, as part of the ‘Big Four Agenda’, one of which is to address the housing deficit by delivering 500,000 low-cost housing units. The table below shows affordable housing projects by the government in the pipeline;

|

Cytonn Report: Notable Ongoing Affordable Housing Projects by the Government |

||||

|

Name |

Developer |

Location |

Launch Date |

Number of Units |

|

Ziwani Starehe Affordable Housing Project |

National Government and GulfCap Africa Limited |

Ziwani |

March 2023 |

6,704 |

|

Pangani Affordable Housing Program |

National Government and Tecnofin Kenya Limited |

Pangani |

June 2020 |

1,562 |

|

River Estate Affordable Housing Program |

National Government and Erdemann Property Limited |

Ngara |

March 2019 |

2,720 |

|

Park Road Affordable Housing Program |

National Housing Corporation |

Ngara |

February 2019 |

1,370 |

|

Mukuru Affordable Housing Program |

National Housing Corporation |

Mukuru kwa Njenga, Enterprise Road |

December 2021 |

15,000 |

|

Mavoko Affordable Housing Project |

National Government and Epco Builders |

Syokimau, Machakos County |

December 2022 |

5,360 |

|

NHC Stoni Athi View (Economy Block-Rental) |

National Housing Corporation |

Athi River, Machakos County |

December 2021 |

50 |

|

NHC Stoni Athi View |

National Housing Corporation |

Athi River, Machakos County |

December 2021 |

120 |

|

Mariguini Informal Settlement |

National Government |

Starehe, Nairobi County |

March 2021 |

2,600 |

|

Kibera Soweto East Zone B |

National Government |

Kibera, Nairobi County |

October 2022 |

3,000 |

|

Starehe Affordable Housing Project |

National Government and Tecnofin Kenya Limited |

Starehe, Nairobi County |

March 2023 |

3,000 |

|

Shauri Moyo A Affordable Housing Units |

National Government and Epco Builders |

Shauri Moyo, Nairobi County |

February 2020 |

2,731 |

|

Clay City Project |

Housing Finance Development and Investment and Clay Works Limited |

Kasarani, Thika Road |

October 2018 |

1,800 |

|

Bachelors Jevanjee Estate |

County Government of Nairobi and Jabavu Village |

Ngara |

February 2020 |

720 |

|

Kings Boma Estate |

National Government and Kings Developers Limited |

Ruiru, Kiambu County |

January 2020 |

1,050 |

|

Total |

|

|

|

47,787 |

Source: Boma Yangu

In addition, there also exist several projects initiated by private developers to fast-track the delivery of housing projects through the AHP, through Public-Private Partnerships (PPPs) among other incentives with the government. Below is a table showing affordable housing projects by the private sector in the pipeline;

|

Cytonn Report: Notable Ongoing Affordable Housing Projects by the Private Sector |

||||

|

Name |

Developer |

Location |

Launch Date |

Number of Units |

|

Great Wall Gardens Phase 5 |

Erdemann Limited |

Mavoko, Machakos County |

December 2022 |

1,128 |

|

Samara Estate |

Skymore Pine Limited |

Ruiru |

July 2020 |

1,824 |

|

Moke Gardens |

Moke Gardens Real Estate |

Athi River |

October 2021 |

30,000 |

|

Habitat Heights |

Afra Holding Limited |

Mavoko |

December 2019 |

8,888 |

|

Tsavo Apartments Projects |

Tsavo Real Estate |

Embakasi, Riruta, Thindigua, Roysambu, and, Rongai |

October 2020 |

3,200 |

|

Unity West |

Unity Homes |

Tatu City |

November 2021 |

3,000 |

|

RiverView |

Karibu Homes |

Athi River |

October 2020 |

561 |

|

Kings Serenity |

Kings Developers Limited |

Ongata Rongai, Kajiado County |

October 2022 |

734 |

|

Joinven Estate |

Joinven Investments Limited |

Syokimau, Machakos County |

December 2022 |

440 |

|

Stima Heights |

Stima SACCO |

Ngara West, Nairobi County |

March 2023 |

450 |

|

Total |

|

|

|

50,225 |

Source: Boma Yangu

Despite the progress made by the Affordable Housing Programme (AHP) with several project in the pipeline, the objectives of the AHP have not been fully met with approximately 2.8% of the housing units delivered as of 2022. This has been primarily on the back of various limitations such as;

- High cost of construction: Construction costs have remained high averaging at Kshs 5,210 per SQFT in 2022, a 5.0% increase from Kshs 4,960 per SQFT recorded in 2021, attributable to price increase of key construction materials such as cement, steel, paint, aluminium and PVC. The continued rise in prices of the materials is mainly attributable to increased demand coupled with limited supply consequently making construction more expensive. This has made it difficult to construct affordable housing units in order to deliver to the market,

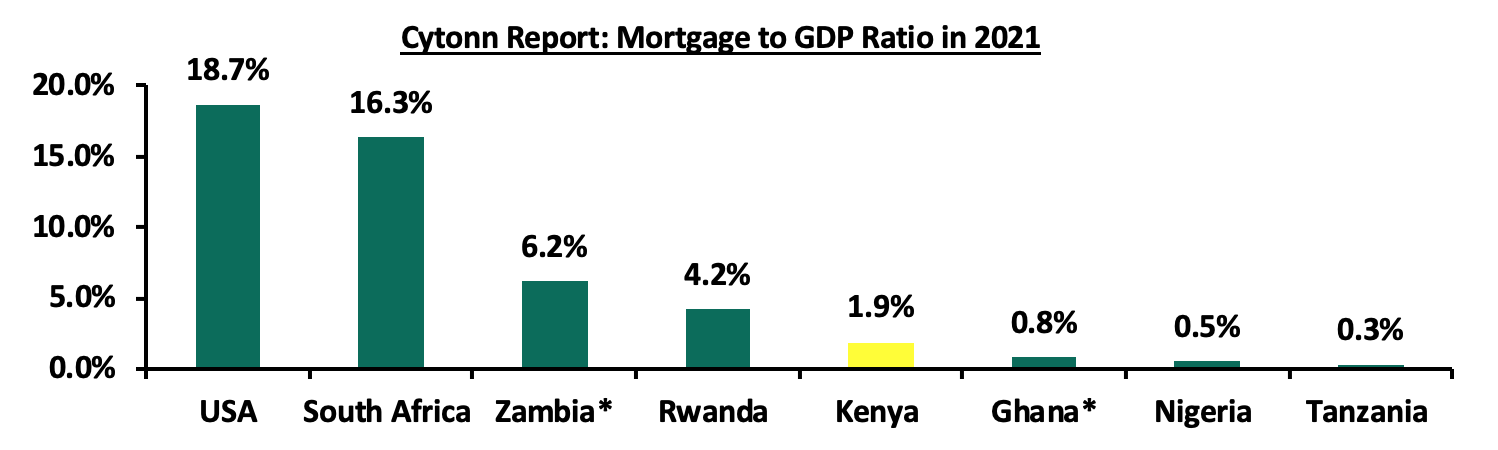

- Lack of access to affordable mortgages: Access to affordable financing is a significant challenge for many Kenyans, particularly those looking to purchase homes. The high cost of mortgage financing makes it difficult for many Kenyans to afford to purchase homes, which reduces the uptake of affordable housing units. As a result, Kenya’s mortgage to GDP continues to underperform at 1.9% to GDP in comparison to other African countries such as South Africa and Rwanda at approximately 16.3% and 4.2% respectively. The graph below shows the mortgage to GDP ratio in Kenya in comparison to other countries;

*(2020)

Source: Centre for Affordable Housing Africa

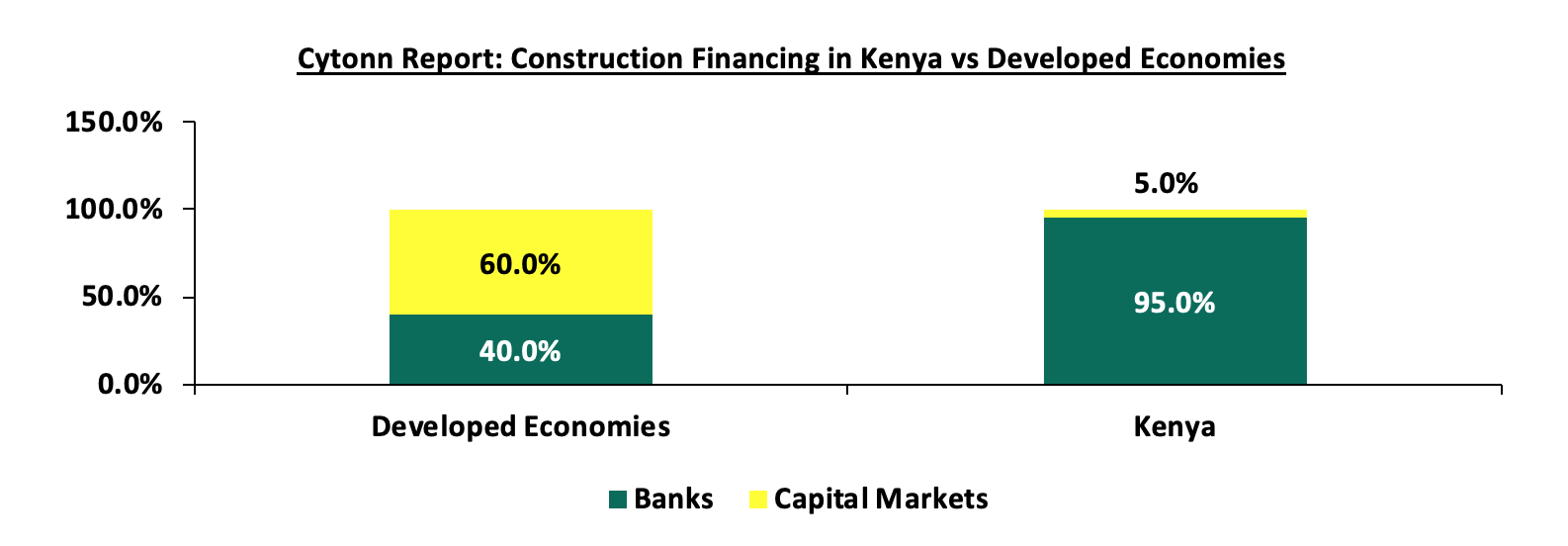

- Inadequate development financing: Lenders continue to tighten their lending requirements and demand more collateral from developers as a result of elevated credit risk in the Real Estate sector. This is evidenced by the 7.5% increase in gross Non-Performing Loans (NPLs) to Kshs 80.3 bn in Q4’2022, from Kshs 74.7 bn recorded during Q4’2021. In addition, there is an overreliance on banks for the expensive funding by private developers hence making it difficult to raise funds for affordable housing projects, unlike developed countries where capital markets account for majority of funding. The graph below shows the comparison of construction financing in Kenya against developed economies;

Source: World Bank, Capital Markets Authority

- Extended transaction timelines: The transaction timelines for property registration in Kenya are longer compared to other African countries, taking 44 days and costing 5.9% of the property price on average. That is relatively higher than countries like Rwanda, which takes 7 days and costs 0.1%. This illustrates the generally slow processes in Kenya, and,

- Inadequate supply of serviced land: There is scarcity of affordable land serviced with support infrastructure such as water, sewerage and electricity necessary for development of affordable units. This is due to rising land prices in urban areas with the average land prices in the NMA coming in at Kshs 130.4 mn per acre in Q1’2023, a 5.7% increase from Kshs 129.6 mn per acre realized in Q1’2022.

Section Two: National Housing Development Fund (NHDF)

Having discuss the status of the Kenya’s housing sector, in this section we look at the formation and operationalization of NHDF, its management and financial structures as well as key developments surrounding the Fund. We shall also highlight the key benefits the Fund offers to its members and the economy in the long-terms as well as the challenges facing the fund in regards to execution of its mandate.

- Formation and Operationalization of NHDF

The Housing Act Cap 117 1967 stipulates that a Housing Fund is a public funding platform for affordable housing. The National Housing Corporation is responsible for overseeing and managing the fund, where it consolidates contributions from formal and informal employees in both the public and private sectors, as well as from local authorities, companies and societies. The amount of contributions to the fund is determined by the Parliament and may be changed periodically and be either rendered voluntary or mandatory. Introduced in 2018 under Section 6 (1) of the Housing Act since enactment of the Housing Fund section in 1967, the main objective of the NHDF is to provide affordable finance solutions for homeowners for purchase of affordable homes through; i) the Tenant Purchase Scheme (TPS) which is currently under review with proposals made by President William Ruto as discussed in Cytonn Weekly #40/2022, ii) creation of a housing portal that will integrate all services regarding supply, demand and accessibility of the affordable housing, update on the progress of AHP and availability to financial resources by registered members such as mortgage and, iii) implementation of an affordable Home Ownership Saving Plan (HOSP) that facilitate tax-advantage contributions from employees, employers, and self-employed individuals as discussed in our topicals Cytonn Home Ownership Savings Plan and Home Ownership Savings Plan Update. Additionally, the Housing Fund will bridge demand for affordable housing accessibility by low and middle-income earners and increase supply of affordable housing units by private developers under a special agreement known as the Offtake Agreement.

- Management and Financial Structure

The management of the NHDF was handed to NHC under the Housing Act 2018. The Corporation is mandated to draw down framework for the operations of the fund, how the consolidated funds will be managed and come up with alternative measures in ensuring efficiency and sustainability of delivering the goal of the fund in enabling the success of the AHP. Some of the responsibilities by NHC in regards to the Fund include;

- Establishment and maintenance of individual Housing Fund account known as Housing Fund Credit where contributions for every member registered in the Housing Fund are credited,

- Specify a specific mode of payment for members of the fund when making their contributions,

- Approve transaction for refund of amounts paid by a member of the Housing fund erroneously. The approval will be done under the consent of the victim but the refund will not accrue interest,

- Determination of annual return on contributions by individuals who shall access the funds for purposes of security for mortgage, offsetting housing loans, or housing development after five years of uninterrupted contribution,

- Set out the rate of return on investment for the contribution made by the employer and employee which will be reviewed from time to time,

- Evaluate and grant loans to members registered under the Housing Fund for purposes of security for mortgage, offsetting housing loans, or housing development, and,

- Approve budget for Housing Fund.

- Financial Structure

The NHDF was established with a self-sufficient and cost-effective financial structure aimed at addressing the demand for affordable housing in Kenya. Key to note is that since its inception, no upgrades have been made to the financial structure, and there have been limited opportunities for investors to contribute funds to support its operations, which is against the goals of the Big Four Agenda for the Housing Fund. This is largely due to lack of significant progress made by the NHDF since its establishment. With the current proposal, the fund will generate funding from the following sources;

- Statutory and voluntary contributions: the fund will accumulate funds from contributions made by self-employed, employees and employers to the National Housing Development Fund as stipulated in the current Finance Act Section 31. However, the required amount deducted from the income of such individuals has faced major legal hurdles especially from workers and Employers lobby groups with the labor courts suspending the statutory contributions regulation. The latest statutory provision is contained in the Finance Bill 2023 which suggests a mandatory 3.0% deduction of gross income per month of employees in both the public and private sectors with employers matching the amount to a maximum of Kshs 5,000 per month. Through the National Housing Corporation, every contributor is allocated a Housing Fund account where all the monthly contributions will be accumulated in the account over the period of contribution. However, any member is allowed to increase their contributions to the account voluntarily which shall reflect in their account.

- Debt and Borrowing: The Housing Fund will also obtain short-term capital from local banks and Development Finance Institutions (DFIs) through credit lines and warehouse funding. Additionally, the fund will issue mortgage-backed securities (MBS) in the local capital markets, just like the Kenya Mortgage Refinancing Company (KMRC), to lower funding costs for tenant purchase scheme home owners. The MBS will be issued in the following categories:

-

- 0 – 5 year Short-term/money market notes which will target money market funds and short-term investors and banks,

- 5 – 10 year Medium-term notes which will target banks, insurance companies and fund managers,

- 10 – 20 years’ Long-term notes which will target pension funds and life insurance funds, and

- 20 – 25 years Equity and Residual investments which will be retained by Housing Fund.

- Other sources of income include rental revenue from completed stock, grants, and returns from the fund's investments.

Additionally, the two main roles of NHDF in regards to the funds it sources are; i) financing the demand side by aggregating demand from potential home buyers to developers and investors, and, ii) financing the supply side by providing developers with offtake agreements which will enable the government to evaluate the standards for affordable houses by projects done by private developers and purchase qualifying affordable housing units as a de-risking measure. Eligible candidates for the NHDF will require a full housing portal profile administered by the NHC which is currently the Boma Yangu portal, regular contributions to the Housing Fund for at least 6-months, and accumulated at least 2.5% of the home value they intend to purchase. The funds accumulated by each individual is easily accessible at any moment for withdrawal and use in purchase for the affordable housing units.

- Developments Surrounding the Housing Development Fund in Kenya

Since its inception in 2018, the National Housing Development Fund (NHDF) has undergone several changes in response to other public and private housing funds as well as streamlining policies related to housing development. However, the concept of offering a platform for saving towards homeownership by the public was in existence even before the NHDF was conceptualized. Notably, there have been previous efforts to formulate and implement a national housing fund that would allow everyone to participate in the drive for affordable housing. Such developments include;

- Existence of the Civil Servants Housing Scheme Fund: Since 2004, the Government of Kenya has run the Civil Servants Housing Scheme Fund, which aims at (i) providing housing loan facilities to civil servants for the purposes of either purchasing or constructing residential houses, and (ii) developing housing units for sale and for rental by civil servants,

- Recommendations on the 2016 National Housing Policy's Sessional Paper No. 3: the sessional paper focused on creating a strong legal and administrative structure to support housing development. As part of this, the policy suggested establishing a National Social Housing Development Fund that would be regulated by the Public Finance Management Act, 2012. The fund would receive financing from budgetary allocations, as well as from development partners and other sources, to support rental social housing and related infrastructure, and other low-cost housing programs. The policy also aimed to create a framework that would allow the National Social Housing Development Fund to support research and slum upgrading,

- Finance Bill 2018: In June 2018, The National Treasury, through Former Finance Minister Henry Rotich, introduced the Finance bill 2018 in which the NHDF was established under the Housing Act and finalize on formation of regulations to operationalize the fund. The bill had proposed a mandatory 1.0% deduction from gross income of employees which was to be matched by the employers. In a move to spearhead the demand and supply sides of the AHP, the same bill was also used to introduce KMRC through the Central Bank of Kenya (CBK) Act. During the same month, the FY’2018/2019 budget was announced stating that the Housing levy was a mandatory deduction of 0.5%. Later on, the then minister for treasury admitted to the error on the percentage of deduction in the Finance bill 2018 which was at 1.0%. However, in August 2018, lawmakers rejected the policy citing over-burdening on income of Kenyans workers especially those at the low-income level. In September 2018, the then Former President Uhuru Kenyatta reinstated the levy from 0.5% to 1.5% of gross salaries of employees and the new regulation was to be scheduled to begin on January 2019. However, in December 2018, the Employment and Labour Relations Court suspended the regulation in favour of lobby groups such as the Central Organization of Trade Unions (COTU), Consumer Federation of Kenya (Cofek) and the Federation of Kenya Employers (FKE) citing improper consultation of the policy by the government. One year later in December 2019, the former president Uhuru Kenyatta ordered a revision of the Housing Fund regulations by the Ministry of Housing in conjunction with the Ministry of Treasury and other relevant government agencies to spearhead the operationalization of the fund and fast-track developments in the AHP,

- Enactment of the Finance Act 2019: The Finance Act 2019 provided exemption from income tax on the income of the NHDF and amounts withdrawn from the fund to purchase a house by a contributor who is a first-time home-owner. This was despite the proposal to levy a charge on employers and employees was the subject of a court case and was yet to come into force. Additionally, a section of the Income Tax Act was amended, to include Fund Managers or Investment Banks registered under the Capital Markets Act as approved institutions to hold deposits of a Home Ownership and Savings Plan (HOSP). This was in conjunction to the adoption of the Capital Markets Authority (CMA) investment guidelines to guide the investment of deposits held in a registered HOSP. For more information, see our Cytonn Home Ownership Savings Plan Update,

- Enactment of the Finance Act 2020: The Act repealed exemptions previously granted on incomes accruing to a registered Home Ownership Savings Plan (HOSP). Additionally, contributions by individuals to a HOSP did not qualify as an allowable deduction when determining the taxable income. Interest income earned on deposits in a HOSP was subjected to tax as opposed to previously where the initial Kshs 3.0 mn was tax exempted,

- Presentation of Notice on regulations for Housing Fund: In March 2020, the Ministry of Housing set up several regulations regarding the structure and operations of the NHDF and presented the notice to the National Assembly in May for discussions and approval. Key take out from the notice was a proposal to have; i) minimum monthly contribution of Kshs 200 to NHDF by all employees and employers who will be registered under the fund, where the Kshs 100 was directed to be part facilitating maintenance and operations of the fund and the rest of Kshs 100 was directed to member’s housing fund account, ii) make the deductions voluntary and not mandatory as stated in the Finance Bill 2018, and, iii) providing full authority to the NHC in disbursement of loans to local authorities, organisations, companies and individuals for purchase and construction of affordable units, at an interest rate that will be adjustable from time to time, and,

- Introduction of the Finance Bill 2023: Since the Ministry of Housing tabled the Housing Fund regulations in 2020, there have been no amendments made to the deduction rates on wages, until the current Finance Bill 2023. The bill is proposing an introduction of a new amendment in Section 31 of the Employment Act that recommends a 3.0% deduction on the basic salaries of both public and private sector employees who qualify for the low-cost housing scheme. This deduction will be matched with another 3.0% from their respective employers before the 9th of the following month after the deduction was made, and the total deduction will not exceed Kshs 5,000. The contribution will be directed to NHDF with the aim of financing the construction of 200,000 affordable houses annually across the country and also offer affordable financing solutions for employees who qualify for affordable housing to purchase housing units under the AHP.

In regards to those who will be eligible for the affordable housing scheme, the bill has proposed that the Cabinet Secretary for Housing and Finance will formulate new regulations for qualifications of eligible members in AHP. This will replace an existing regulation which states that each year, the state will then run a lottery system to allocate the houses available among the contributors paying for the houses. Additionally, this will allow for equal distribution and prevent the contributors with a stronger financial muscle from acquiring all the houses available and subsequently renting them out. Further, high-income earners who are ineligible for low-cost housing scheme will need to wait for seven years or until retirement to transfer the funds to a retirement benefits scheme or a pension scheme fund. Alternatively, they can opt to receiving their savings in cash as part of their income, which will be taxed at the prevailing rates. The contributions will also get a rate on return based on the returns made by the fund at the prevailing conditions of the economy.

Key to note is that, according to Economic Survey 2023 by Kenya National Bureau of Statistics (KNBS), there are approximately 3.0 mn wage employees in the formal public and private sector. Additionally, as the end of 2022, the average monthly gross income for Kenyan wage employees in the formal public and private sector came in at Kshs 72,130. Therefore, with the proposed 3.0% deduction from gross income, the government expects to collect Kshs 2,164 from each employee and the same amount from the employer every month. Therefore, the fund expects to collect up to Kshs 156.6 bn annually, which is set to increase onwards with regards to growth in the average monthly gross income and the wage employment annually.

- Benefits and Challenges facing the NHDF

NHDF provides several benefits for the government in bridging the supply and demand sides of the AHP and making the fund sustainable for the future. This will only happen with the required focus on regulatory restructuring, increasing funding from alternative sources, improving its management, and ensure implementation of the key guidelines to kick-start the operations in an efficient and effective way. Some of the benefits include:

- Mobilization of the public and private capital effectively: Being a large-scale entity, NHDF can efficiently collaborate with private sector entities, such as banks and the capital markets, to unlock local and international capital to aid in development or long-term financing for end users. This will further help the fund access affordable financing terms from the financial markets that are more favourable than those offered to smaller players. The favourable financing terms will be passed on to homeowners who will benefit from more affordable financing options,

- Advantage of economies of scale: The Housing Fund has a better ground on capitalizing the large size and scale of funding in its portfolio as compared to other platforms such as private banks and pension schemes. Therefore, this guarantees development of large-scale affordable housing projects that are more cost-effective to build and enabling developers and financiers to create bigger and more economical housing developments, allowing for more affordable housing units in the scheme,

- Consolidation of all relevant stakeholders: The Housing Fund serves as a platform for all stakeholders in the housing sector such as financiers, homeowners, investors, developers, regulators, and government bodies responsible for AHP. This allows for better engagement and coordination among these groups to achieve clear and consistent objectives,

- Liability capping: NHDF upon full actualization will ensure that the maximum amount of guarantees offered by the fund in any year is approved by the board, based on the Fund's financial ability and performance. This means that the management can only provide guarantees that have been ratified by the board. Additionally, the regulations governing the Housing Fund prevent it from having outstanding guarantees exceeding 150.0% of the Fund's Equity Capital at any given time. This mechanism helps to control risks and prevents the Fund from making commitments that it cannot meet,

- Incorporation of the private sector in the fund: NHDF combines the scale and stability of a public entity as it tries to tap in the agility, flexibility, and innovation of a private sector player has helped should the burden on the public sector. This allows for a more sustainable and effective approach to affordable housing development, and,

- Minimizing project risks and guaranteeing quality housing: Due to the Housing Fund's significant size and role as a housing off-taker, it establishes rigorous quality criteria on large-scale housing projects, avoiding compromises in the development of cost-effective housing through the Off-taker Agreement. Additionally, the off-taker agreement enables more private sector developers to participate in affordable housing projects as the Housing Fund is capable of absorbing market risk.

However, the NHDF has faced several challenges that has rendered it almost inefficient since its inception in 2018. One of the biggest hurdles has been numerous legal battles and opposition by the public and lobbies that govern and protect the interests of employees and employers with regards to the proposals made for implementation of the Housing Fund. Some of the issues raised by the public against implementation of the Fund’s regulations include;

- High unemployment and underemployment rates

The majority of the population in urban and rural towns are youths between the age of 15 years and 34 years who face high unemployment and underemployment rates. According to KNBS’s Q4’ 2022 Labour Force Report, the unemployment rate of the youth stood at 10.8% against an overall unemployment rate of 13.9% as of 2022. Consequently, the unemployment rate has increased by 0.6% points to 13.9% in 2022 from 13.3% in 2021, illustrating tougher economic environment for most businesses in the country. As a result, this hinders their capacity to purchase the decent, low-cost housing units and constrains the government's ambitious goal of increasing homeownership rates especially in the urban areas. Additionally, the high unemployment and underemployment rates lead to an increase in informal settlements and slums, which further exacerbates the housing crisis in Kenya,

- Potential for corruption

The public is apprehensive that the Housing Fund could be prone to corruption, given the prevalence of corruption cases in other public initiatives such as the National Youth Service (NYS) and the Kenya Medical Supply Authority (KEMSA), National Health Insurance Fund (NHIF), National Social Security Fund (NSSF) and many more. Such public initiatives have been rendered broke and inefficient to sustain most of their operations. If corruption were to occur, it could lead to mismanagement of funds, diversion of resources, and the allocation of housing units to individuals who are not eligible. Such actions would undermine the government's efforts to provide affordable housing to low and middle-income earners, and it could discourage contributors from participating in the scheme,

- Potential for losses

Government-sponsored funds have not been successful in the past. For instance, Uwezo Fund incurred losses of 64.2%, Youth Enterprise Fund incurred losses of 47.8%, and the losses of the Hustler Fund are yet to be revealed. If the Housing Fund were to experience similar losses, contributors could face up to 50.0% losses on their contributions. This could lead to a loss of trust in the government's ability to manage public funds, and consequently discouraging future contributions to the scheme,

- Dimmed clarity on the track record of Housing Projects done so far

The efficiency and expenditure of the government's ongoing housing projects compared to those of the private sector are uncertain. Moreover, there is no information available regarding the beneficiaries of the completed housing units, especially those that have been sold. This is despite the fact that the Kenyan government proposes to use the housing fund to finance affordable housing projects and allocate finances to the demand side for purchases of the housing units,

- Lack of proactive involvement of target groups and lobbies

The government has continuously been at the edge of not involving target and lobbies groups of workers and employers in the formulation of frameworks for housing fund. This has led to constant legal battles and opposition from the Kenyan public against the regulations it has been proposing over the years. The lack of involvement has also derailed the operations of the fund and hindered its ability to provide affordable housing to Kenyans since the inception of formation and operationalization of the fund. Additionally, the lack of involvement has led to reduced trust and confidence between the government and the public, which makes it difficult for NHDF to carry out its mandate effectively,

- Increased deductions on employees’ incomes

Kenyan employees face increased pressure on their incomes due high cost of living occasioned by the high inflation that has averaged 8.5% over the last one year, incomes have reduce by 3.0%, and recently National Social Security Fund (NSSF) deductions of 6.0% kicked in. As such, a further 3.0% housing levy proposal will see the employees in the formal sector overburdened given that their disposal incomes have already been reduced by a cumulative 17.5%. The reduced income among these employees has also pushed most Kenyan workers, especially in the urban areas, to informal settlements further catalysing the housing crisis in Kenya, and,

- Increased expenses for employers

Additionally, Kenyan employers in the private sector are hesitant in stretching their revenues further to facilitate homeownership goals of their employees due to the mandatory contributions they have to match with that of their employees towards NHDF. This is also along expectations of increasing salaries for the workers during the tough economic period. In the long run, this will compel most companies to cut down on manpower to reduce the cost of paying salaries and more deductions or outsource services from skilled workers outside the country to avoid the house levy deduction,

It is also worth noting that the introduction of the Housing Fund regulations in the Finance Bill 2023 has raised concerns from the public and lobby groups of workers and employers. These concerns include:

- The fate of families where all eligible members, such as the husband, wife, and elder children living under the same roof will still contribute to the fund for purchase of affordable housing units separately and how the NHDF will deal with such scenarios,

- There is no clear framework on how the NHC will guarantee transparency and accountability of the Housing Fund when there is a change of government after a general election. This lack of a framework may leave the fund vulnerable with a possibility that a new government might intentionally try to undermine the fund's objectives by introducing policies and regulations that will decrease spending on the program and hinder its technical and financial capacity to work effectively. Even worse, there is a risk that a new government could abolish the Housing Fund levy, which would be a major blow to those who would have made regular contributions towards the NHDF,

- The status of individuals who have registered and contributed to other private home saving schemes such as the Boma Yangu Home saving scheme, Tenant Purchase scheme under the social housing initiative, and schemes managed by banks and pension schemes, yet they will still be deducted funds for the NHDF platform,

- The fact that the fund will be managed by a government entity raises more fear for mismanagement of the consolidated funds and reduced trust by the public on the government running NHDF efficiently as evidenced in most government entities,

- There are no clear guidelines for those who will not be chosen as eligible participants in the affordable scheme by what the Cabinet Secretary for Housing will have decided with the mandate by the law. These individuals will have contributed to the fund with the expectation of being able to purchase housing units, but there are no provisions in place for them if they are not locked out. This creates uncertainty and potential unfairness in the allocation of the affordable housing units,

- The shift by some of the workers’ lobby organizations such as Central Organisation of Trade Unions (COTU), which had previously opposed the 1.5% deduction cut from employees, to now supporting a 3.0% deduction from incomes, which is a higher rate and a more significant burden on employees. This is especially concerning, given the high cost of living worsened factors such as the prevailing impact of the COVID-19 pandemic on the economy, depreciating Kenyan currency against other currencies, persistent drought affecting the agricultural sector and global elevated inflationary pressures, and,

- The fate of individuals who already own homes and are satisfied or have no spouse or heirs, benefit from the funds in future. Additionally, the concern that even after contributing the maximum amount of Kshs 5,000 per month for seven years, the total contribution will only be Kshs 420,000, which is not enough to purchase a house in the Boma Yangu portal, where the cheapest house is Kshs 1.5 mn for a 30.0 SQM house.

These concerns demonstrate the need for further clarification and revision of the Housing Fund regulations in the Finance Bill 2023 to ensure that they address the concerns of all stakeholders and provide affordable housing solutions for Kenyans.

Section Three: Case Studies and Recommendations

Housing Provident Funds are financial instruments based on mandatory contributions from employees and employers calculated as a proportion of the salary, and accumulated in workers’ individual accounts. HPFs have been created in several countries, and often vary in terms of structure and systems of operations. In our previous topical, National Housing Development Fund (NHDF), we provided a case study of the Nigeria National Housing Fund (NHF). In this topical, we look at the lessons and key takeout’s that we can derive from the aforementioned housing fund alongside China’s Housing Provident Fund (HPF), and proceed to give recommendations to improve the structure and operation of the Kenya National Housing Fund (NHDF).

For our study, we have decided to focus on China's HPF, as it has a comparable structure to Kenya's NHDF. In both cases, funds are raised through a housing levy, which involves monthly contributions from both employers and employees, with an objective to provide employees with savings aimed towards home ownership. The table below summarizes the key-take outs and features of the funds;

|

Cytonn Report: Summary of Housing Funds in Various Countries |

|

|

Institution |

Key-Takeouts/Features |

|

Nigeria National Housing Fund (NHF) |

|

|

China Housing Provident Fund (HPF) |

|

Source: Cytonn Research

In order to ensure the effectiveness of the Kenya’s NHDF, it is essential to address certain issues that can be identified by drawing from the structure and operations of the above-mentioned case studies. As such, we recommend taking the following actionable steps to ensure the success of the NHDF;

- Provide Tax Incentives to Encourage Participation: In order to encourage participation in the Fund, the NHDF should provide incentives such as tax breaks or matching contributions to encourage employers and employees to contribute to the Fund. In Nigeria, the National Housing Fund (NHF) exempts all fund contributions from payment of taxes. In Kenya, with the passing of the Finance Bill 2023, contributors of the Fund who will not be eligible for affordable housing will have their benefits taxed at prevailing rates upon withdrawal after seven years. In our view, tax exemptions of accrued benefits will not only encourage saving and participation by contributors, but will also assist encourage broad based public support for the initiative,

- Focus on Mobilizing Funds to Finance homebuyers and not for Construction: A more feasible strategy for NHDF would be to prioritize raising funds for financing homebuyers instead of using the available funds for constructing houses. China and Nigeria have implemented this model successfully, with the funds managed to sustain the mortgage financing industry in their countries. In our view, this approach is expected to also benefit the Kenya Mortgage Refinance Company (KMRC), which is currently the only mortgage financing entity serving a growing number of banks and Saccos seeking mortgage funds. Moreover, the government can obtain more funding for construction through alternative sources such as capital markets, Public-Private Partnerships (PPP), and loans and grants from multilateral institutions. Therefore, the approach will ensure that contributors to the Housing Fund can access affordable financing for purchasing their homes without risking losses through government-led construction projects,

- Introduce a Tiered System of Levy Deduction: China’s Housing Provident Fund (HPF) Provisions allow for cities to set varying contribution rates depending on their limits of urban areas. As such, major urban areas in China have higher set contribution rates compared the rest of the country. The NHDF should consider introducing a tiered system for the deduction levy. For instance, employees working in Nairobi, Mombasa, and other major urban towns can have a higher percentage of deduction, while those in smaller towns and rural areas can have a lower percentage. The variation in the deduction levy can be based on the cost of housing in each region, as well as the average income of employees in those regions. This will ensure that the deduction levy is affordable and equitable for all employees regardless of their location,

- Promote Equitable Contribution: The proposed Finance Bill 2023 suggests that both employers and employees will be required to make a mandatory contribution to the Housing Fund at a rate of 3.0% of the employee's monthly salary, with a maximum cap of Kshs 5,000. This means that high-income earners who receive Kshs 500,000 monthly will have Kshs 15,000 deducted from their gross income, and with an equal match from their employers, the total contribution will be Kshs 30,000. However, due to the maximum cap of Kshs 5,000, the high-income earners will only contribute Kshs 2,500, representing only 0.5% deduction, with the employer's similar match summing up to Kshs 5,000. Conversely, low-income earners who earn the current minimum wage of Kshs 15,000 will contribute Kshs 450, with an additional Kshs 450 from their employers, leading to an increased financial burden for low-income earners.

On the other hand, the high-income earners will have less money in their Housing Fund accounts relative to their gross incomes, which will not be sufficient to purchase a decent homes after contributing for very long time. The low-income earner will generate a significant amount of money in their fund account after a certain period of contribution for the purchase of affordable housing units. Therefore, to promote equality and fairness, NHDF should consider eliminating the Kshs 5,000 maximum cap should the bill pass into law to reduce the financial burden on low-income earners and enable high-income earners to generate more significant finances from the fund after a certain period of contribution for purchasing decent houses,

- Regular Revision of Contribution Rates: In China, Housing Committees set Housing Provident Fund (HPF) contribution ratios based on existing economic conditions, and conduct annual reviews to adjust contribution rates accordingly. The NHDF can adopt a similar approach to tailor contribution ratios to the country’s macro-economic environment to avoid overburdening contributors, and conduct regular reviews to ensure that the rates are equitable and affordable for all contributors,

- Optional contribution for existing home owners: If the Finance Bill 2023 will be enacted into the finance act, all income earners will be required to make monthly contributions to the Housing Fund irrespective of whether they already own homes or not. To ease the burden of mandatory contributions, NHDF should contemplate making the contributions voluntary for existing homeowners. This way, homeowners would be encouraged to save towards acquiring a second home without being compelled to do so. However, this raises concern as to which criteria the government will use to determine existing homeowners, particularly in rural areas where household data is almost non-existent compared to urban areas. As such, the government must formulate a framework that outlines the criteria for determining who qualifies for exemption to ensure equitable treatment of existing homeowners with regards to the mandatory contributions. Moreover, contributions to the Fund should be voluntary, granting all contributors autonomy to decide whether or not they wish to participate in the Fund,

- Creation of Awareness and Encourage Public Participation: The NHDF should prioritize educating the target contributors about the Fund to discourage resistance, low compliance, and eventually failure to raise the targeted funds. Public participation in all reform stages and activities should also be encouraged to incorporate contributor views and promote seamless Fund operationalization,

- Compliance: The government should implement policies to improve compliance and achieve the fund's objectives, particularly in the private sector where employers may avoid contributions. In the case of Nigeria, one of the main challenges facing the initial NHF was non-compliance by intended contributors (corporate and individual) and non-remittance of the deductions made by employers. However, a revised bill introduced penalties and suctions with the aim of driving compliance, and,

- Working on Enhancing Private Sector Funding to Supplement Government Funding: So far, capital formation efforts by the government have predominantly focused on public sector funding through taxation. The government should enhance policies that will catalyze private sector fund formation through Real Estate sector unit trust funds, development REITs such as the proposed Kenya National Reits (KNR) and Real Estate Asset Back Securities. Private capital markets have an important role to play, as such, we need to focus on how to bring on board private sector funds into the initiative.

Section Four: Conclusion

The reintroduction of the Housing Fund levy proposed by the Finance Bill 2023 has elicited mixed reactions, with stakeholders arguing the impact on employees will be severe especially at a time when many are grappling with the high cost of living, and are already burdened by multiple levies and taxes. The previous attempt to introduce the levy through the Finance Bill 2018 faced challenges and the Fund failed to take off due to opposition from various stakeholders, including trade unions, employers, and individual contributors. Some of the main concerns raised included the mandatory nature of the contributions, lack of transparency and accountability, and the possibility of misuse of funds. This prompted the previous administration to issue a directive to the National Treasury and State Department for Housing to go back to the drawing board and make revisions in respect to the Housing Fund Levy, in order to make the contributions voluntary so as to promote the implementation of the Fund, which had been lying dormant in the Housing Act since it was first established in 1967. In our view, it is unlikely that the revised bill will pass into law if it does not address the concerns of stakeholders, particularly those in the private sector who view the levy as an additional cost of doing business. Ultimately, the success of the reintroduction of the Housing Fund levy will depend on the government's ability to effectively engage with stakeholders, address concerns, and ensure compliance with the regulations. However, that remains to be seen.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.