Mar 17, 2019

In June 2018, we published a Research Note on Ruaka suburb, where Cytonn has two residential developments, The Alma and Taraji Heights. According to the June 2018 note, the area recorded average returns of 11.1% p.a, with the rental yield and capital appreciation coming in at 5.3% and 5.8%, respectively. This week, we look into why the area is still a great investment opportunity, by updating and analyzing our research data as at December 2018 that shows Ruaka’s residential market performance in terms of uptake, rental yield, capital appreciation and return to investors in the real estate sector. The performance in 2018 came in at 12.5% p.a, 1.4% points higher than 11.1% annual total returns in June the same year, mainly due to a 7.3% annual increase in property prices fueled by land price growth and the increased demand for housing in the area by the growing middle-class population.

In this week’s topical, we shall cover the following:

- Overview of Ruaka

- The Factors Driving the Growth in Ruaka

- Ruaka Residential Market Performance

- Ruaka Compared to Nairobi Metropolitan Area Residential Market

- Conclusion and Recommendation

- Overview of Ruaka

Ruaka is a suburb within Kiambu County, located approximately 10-km from Nairobi Central Business District (CBD) to the North West. The area is accessible via Limuru Road and the Northern Bypass. On completion, the proposed Western Bypass will also link Ruaka to the Nairobi - Nakuru Highway at Gitaru. Approximately 7-years ago, Ruaka was primarily an agricultural area, however, this has been phased out by the development of both residential and commercial properties.

- The Factors Driving Growth in Ruaka

Real estate in the area has grown over the years, driven by:

- Good Transport Network: The area is accessible through main roads such as Limuru Road and the Northern Bypass, which links it to Kiambu Road. The area will also be served by the proposed Western Bypass, which on completion will link Ruaka to the Nairobi-Nakuru Highway at Gitaru. These roads connect Ruaka to and from several neighboring areas such as Westlands, Kiambu Town, Runda, Limuru, and Waiyaki Way, thus making the area easily accessible;

- Presence of International Organizations: The presence of international organizations such as the United Nations (UN), United Nation Environmental Program (UNEP) in Gigiri, and International Organization for Migration (IOM) - Migration Health Assessment Centre, has attracted foreigners who not only boost the appeal of the town, but also create a market for residential and commercial real estate;

- Relaxation of Zoning Restrictions: Ruaka town has seen an increase in high density developments that have resulted in an increase in the value of real estate property. Land prices in Ruaka have grown at a 7- year CAGR of 12.2% from Kshs 40.0 mn per acre as at 2011 to Kshs 89.7 mn per acre as at 2018;

- Security: Improvement in security in the area, with county measures on security and a general increase in security personnel in the country;

- Hotels, Malls, and Recreational Facilities: Large commercial mixed-use developments such as Two Rivers, Riviera Mall and the Village Market surround Ruaka. This is in addition to hotels such as Tribe at the Village Market and Trademark Hotel along Limuru Road. The large retail and commercial footprint create an opportunity for employment, thus favoring property development to house this increase in personnel.

Despite the above factors, the main challenge facing the Ruaka market is slow infrastructural development in comparison to the rate of housing development in the area, leading to challenges such as frequent traffic snarl-ups within the town. There is, therefore, need for better planning and infrastructural development including road expansion and installation of a sewer system to accommodate the growing population.

- Ruaka Residential Market Performance

The relatively high rate of urbanization at 4.3%, compared to a global average of 2.0%, and the expansion of the middle-class in Kenya has led to increased demand for housing in satellite towns and areas within the Nairobi Metropolitan Area, such as Ruaka and Ruiru, leading to an increase in land and property prices in these areas. Land in Ruaka is currently priced at approximately Kshs 89.7 mn per acre, and this is relatively high compared to other satellite towns such as Ngong, Utawala, and Ruiru, whose prices per acre are Kshs 13.8 mn, Kshs 12.8 mn and Kshs 20.6 mn, respectively, according to Cytonn Research. In December 2018, we conducted research in order to update on the residential market performance in Ruaka, where we focused on the following;

- Unit Sizes of Apartments: This is to be used to establish what the market is offering and also determine the home buyers’ preferences for sizes of houses;

- Selling Prices of Apartments: This will give an overview of the average exit prices of apartments in the area;

- Rental Rates of Apartments: This informs on the average rental prices, and yields for investment analysis;

- Uptake: This gives an indication of the rate at which apartments have been bought hence indicating the attractiveness of residential property in the area.

Below is the summarized performance:

- Annual Uptake: Ruaka recorded a relatively higher average annual uptake of 24.0% in 2018, compared to the residential market average of 22.8%. This means that developers in the market are able to recoup their investments within a short period of time, through the sale of units,

- Occupancy: In terms of occupancy, Ruaka market recorded an average rate of 97.1%, compared to the residential market average of 81.0%, indicating higher demand for housing units in Ruaka market,

- Rental Yield: Ruaka market’s rental yield came in at 5.2%, 0.5% points higher than the residential market’s average of 4.7%. This thus means that investors in the Ruaka market are able to fetch higher than market average rents and occupancy rates,

- Price Appreciation: Ruaka market recorded a 7.3% y/y price appreciation, compared to the residential market average of 4.2% y/y, indicating higher growth of the demand for property in Ruaka,

- Total Returns: On average, the total returns for Ruaka came in at 12.5% in 2018, 3.6% points higher than the 8.9% recorded by the residential market on overall, indicating that investors in Ruaka are able to achieve significantly higher returns.

|

Residential Market Performance Summary |

|||

|

Metric |

Residential Market Average |

Ruaka Market Average |

% Points Difference |

|

Annual Uptake |

22.8% |

24.0% |

1.2% |

|

Occupancy |

81.0% |

97.1% |

16.1% |

|

Rental Yield |

4.7% |

5.2% |

0.5% |

|

Price Appreciation |

4.2% |

7.3% |

3.1% |

|

Total Returns |

8.9% |

12.5% |

3.6% |

|

· The total returns for Ruaka came in at 12.5% in 2018, 3.6% points higher than the 8.9% recorded by the residential market on overall, indicating that investors in Ruaka are able to achieve significantly higher returns |

|||

Source: Cytonn Research

The table below shows the summarized performance for each unit typology;

|

(All values in Kshs unless stated otherwise) |

||||||||||||

|

Summary of the Ruaka Residential Market Performance |

||||||||||||

|

Typology |

Unit Plinth Area (SQM) |

Price 2016 |

Price 2017 |

Price Dec 2018 |

Rent Dec 2018 |

Price per SQM’18 |

Rent per SQM ‘18 |

Annual Uptake |

Occupancy ‘18 |

Rental Yield’18 |

y/y price appreciation |

Total Returns Dec 18 |

|

1-bed |

55 |

5.2m |

5.8m |

6.2m |

30,000 |

113,077 |

505 |

25.0% |

100.0% |

4.5% |

10.7% |

15.2% |

|

2-bed |

87 |

8.4m |

8.7m |

8.9m |

39,429 |

99,531 |

438 |

22.7% |

95.8% |

5.3% |

6.7% |

12.0% |

|

3-bed |

122 |

10.6m |

11.2m |

11.5m |

50,200 |

88,832 |

431 |

23.7% |

95.5% |

5.7% |

4.5% |

10.2% |

|

Average |

100,480 |

458 |

24.0% |

97.1% |

5.2% |

7.3% |

12.5% |

|||||

|

· Ruaka Residential market recorded average total returns of 12.5% in 2018 |

||||||||||||

Source: Cytonn Research 2018

- 3-bedroom units recorded the highest average rental yield of 5.7%, while 1 and 2-bedroom units recorded rental yields of 4.5% and 5.3%, respectively;

- On price appreciation, 1-bedroom units recorded the highest at 10.7%, compared to 2 and 3-bedroom units at 6.7% and 4.5%, respectively;

- The 1-bedroom units had the highest price per square metre at Kshs 113,077, compared to 2 and 3-bedroom prices per sqm at Kshs 99,531 and Kshs 88,832, respectively;

- Overall, 1 and 2-bedroom apartments have the highest total returns at 15.2% and 12.0%, respectively, and we attribute this to higher demand for the 1 and 2-bedroom units boosted by the increased preference of units by single adults and young couples thus the high demand for the same. 3-bedroom units also tend to perform well in gated communities and high-density developments as they attract family units.

- Ruaka Compared to Nairobi Metropolitan Area Residential Market

Ruaka market recorded improved performance in December 2018 compared to June 2018, with average total returns coming in at 12.5% in December 2018, 1.4% points higher than 11.1% in June the same year. We attribute this to the increased demand for housing in the area mainly by the growing middle-class population. In addition, Ruaka was ranked as one of best low mid-end satellite towns to invest in, according to our Cytonn 2018 Market Review Report, among areas such as Donholm and Thindigua, which were ranked top with 14.4% and 13.8% total returns, respectively.

Below is a summary of the performance of the low mid- end areas:

|

(All Values in Kshs Unless Stated Otherwise) |

|||||||

|

Top 5: Lower Mid-End Areas |

|||||||

|

Location |

Average Price per SQM |

Average Rent per SQM |

Average Annual Uptake |

Average Occupancy |

Average Rental Yield |

Average Price Appreciation |

Average Total Returns |

|

Donholm & Komarock |

81,015.5 |

402.1 |

25.0% |

100.0% |

6.0% |

8.4% |

14.4% |

|

Thindigua |

97,510.2 |

502.5 |

24.6% |

81.9% |

4.1% |

9.6% |

13.8% |

|

Ruaka |

100,480.1 |

458.0 |

23.8% |

97.1% |

5.2% |

7.3% |

12.5% |

|

Athi River |

68,490.1 |

359.3 |

23.6% |

73.1% |

4.4% |

6.2% |

10.6% |

|

Rongai |

59,695.5 |

345.2 |

20.3% |

83.30% |

5.5% |

3.6% |

9.1% |

|

Average |

81,438 |

413 |

23.5% |

87.1% |

5.0% |

7.0% |

12.0% |

|

· Donholm-Komarock posted the highest total returns owing to a relatively high rate of price appreciation driven by high demand from investors. The area offers relatively affordable rental rates while being in close proximity to the CBD and other nodes such as Mombasa Road and Thika Road, thus high occupancy rates |

|||||||

Source: Cytonn Research

The lower mid-end segment registered higher average total returns of 12.0% in comparison to the upper mid-end segment with 10.9%. This is as the areas are preferable to majority of Nairobi’s population consisting of young families and the working-class due to their affordability and infrastructural improvements that have rendered them increasingly convenient, hence the growing uptake. Donholm and Ruaka had the highest occupancy rates at 100.0% and 97.0%, respectively, indicating high levels of demand.

In addition, Ruaka market also recorded higher returns than the top areas in the upper mid- end market such as Riverside, Kilimani, and Westlands, which recorded returns of 11.6%, 11.5%, and 10.3%, respectively.

Below is the summary of the upper mid- end market performance:

|

(All Values in Kshs Unless Stated Otherwise) |

|||||||

|

Top 5: Upper Mid-End Areas |

|||||||

|

Row Labels |

Average Price per SQM |

Average Rent per SQM |

Average of Annual Uptake |

Average Occupancy |

Average Rental Yield |

Average Price Appreciation |

Average Total Returns |

|

Riverside |

175,085.2 |

763.8 |

24.7% |

88.9% |

4.4% |

7.1% |

11.6% |

|

Kilimani |

127,423.8 |

721.8 |

29.7% |

90.3% |

5.7% |

5.7% |

11.5% |

|

Westlands |

135,041.3 |

757.5 |

27.9% |

87.5% |

5.7% |

4.7% |

10.3% |

|

Loresho |

115,289.5 |

573.5 |

24.0% |

90.4% |

5.4% |

4.8% |

10.3% |

|

Spring Valley |

147,453.1 |

552.9 |

22.5% |

63.6% |

3.4% |

6.5% |

9.9% |

|

Average |

138,209.9 |

704.2 |

26.6% |

89.3% |

5.3% |

5.6% |

10.9% |

|

Ruaka Market |

100,480.1 |

458.0 |

23.8% |

97.1% |

5.2% |

7.3% |

12.5% |

|

· Riverside registered the highest price appreciation with 7.1% in comparison to the market average of 5.6%, while Westlands and Kilimani registered the highest average rental yields as they attract premium rents while offering relatively affordable prices |

|||||||

Source: Cytonn Research

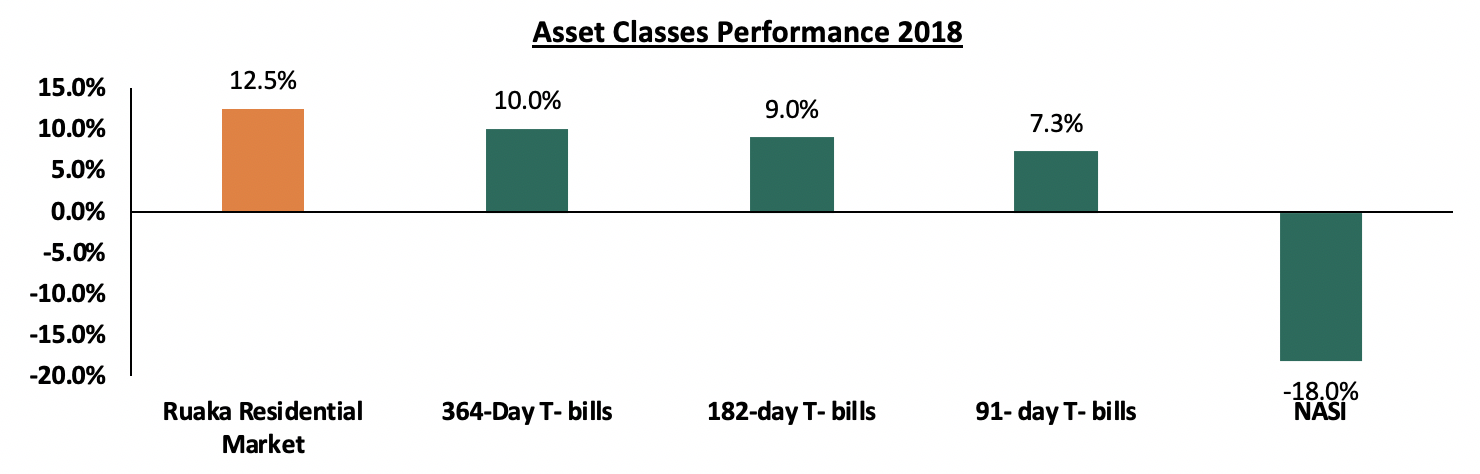

Key to note, Ruaka market returns also outperformed other asset classes such as government bills with the 364-day, 182-day, and 91-day T-bills recording yields of 10.0%, 9.0%, and 7.3% respectively, while in the equities market, NASI recorded a 18.0% decline in 2018.

Source: Cytonn Research 2018

- Conclusion & Recommendation

Ruaka remains an attractive investment area, evidenced by the residential apartments’ total returns of on average 12.5%, compared to the average residential market returns of 8.9%. Some of the drivers of real estate in this area include; i) the growing demand for land and housing in satellite towns, ii) the construction of the Western Bypass, which will enhance access in the area, and iii) the availability of social amenities and the growing state of investment grade developments in Ruaka. Therefore, we expect continued increase in property prices in the area, and this should accelerate with the upcoming Western Bypass, thus the market still presents a good investment opportunity. For details on our projects at Ruaka, see the links for Taraji Heights and The Alma.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.