Cytonn Annual Markets Review - 2018

By Cytonn Research Team, Jan 6, 2019

Executive Summary

Global Markets Review

Global economic growth is expected to come in at 3.7% in 2018 as per data from the International Monetary Fund (IMF), similar to the 3.7% recorded in 2017, as growth in the US was countered by the negative effects of the trade conflicts between the US, China and Eurozone, as well as a weaker expected growth for some key emerging markets such as China and Brazil. Central Banks’ Policy stance in advanced economies adjusted towards economic tightening, with the US Federal Reserve raising the Federal Funds Rate four times in 2018, while the European Central Bank indicating a cease to the monthly bond purchases in December 2018, an end to the 3-year stimulus program;

Sub-Saharan Africa Region Review

Sub-Saharan Africa economic growth remained relatively strong in 2018 with preliminary data indicating that the region recorded a 2.7% GDP growth in 2018, better than the 2.3% recorded in 2017. Regional currencies depreciated in 2018 underpinned by capital outflows from emerging markets to advanced markets, following a tightening of monetary policy in the United States as well as the strengthening dollar, coupled with events in the global markets, which included the trade war between China and the USA;

Kenya Macro Economic Review

The Kenyan economy expanded by an average of 6.0% for the first three quarters of 2018 compared to an average of 4.7% in a similar period in 2017 driven by (i) recovery of agricultural sector, which recorded a growth of 5.3% due to improved weather conditions, (ii) improved business and consumer confidence, and (iii) increased output in the real estate, manufacturing and wholesale & retail trade sectors;

Fixed Income

During the year, yields on the 91-day, 182-day and 364-day T-bills declined by 80 bps, 160 bps and 120 bps to close at 7.3%, 9.0% and 10.0% in 2018 from 8.1%, 10.6% and 11.2% at the end of 2017, respectively. This is attributed to the low lending rates that have seen banks shy away from lending to the private sector and instead turn to the less risky government securities hence reducing the competition for government securities, coupled with the Central Bank of Kenya’s efforts to keep the rates low by rejecting expensive bids. The average subscription rates came in at 123.2% for T-Bills, and 75.8% for primary T-bond auctions. The yield curve experienced downward pressure during the year as the Kenyan Government contained rates by rejecting expensive bids in the auction market;

Equities

During the year, the market was on a downward trend, with NASI, NSE 25 and NSE 20 declining by 18.0%, 17.1% and 23.7%, respectively, as a result of declines in most large cap stocks. Listed banks recorded a 16.2% increase in their core earnings per share in Q3’2018 compared to a decline of 9.3% in Q3’2017. The growth in earnings can be attributable to improved operating efficiencies in the wake of the interest rate cap, with banks streamlining operations through digitization strategies. In 2018, 8 companies issued profit warnings as compared to last year’s 6, while 2 companies, namely Deacons and ARM Cement, were suspended from trading at the Nairobi Securities Exchange;

Private Equity

During the year, private equity activity was high as evidenced by increased deal activity by local and global investors including Kuramo Capital, AfricInvest, and Goldman Sachs, among others. In Financial Services sector, Kuramo Capital acquired a 90.9% stake in GenAfrica. In the Hospitality sector, Emerging Capital Partners (ECP) acquired a majority stake in Artcaffé Group. In the Fintech sector, Jumo, a mobile financial services platform, raised Kshs 6.6 bn. In the Education sector Makini School Limited was acquired for Kshs 1.5 bn, while in Real Estate Vantage Capital acquired an undisclosed stake in the Rosslyn Riviera Shopping Mall for Kshs 800.0 mn;

Real Estate

During the year, the real estate sector recorded continued investment across all themes driven by (i) the political stability following the conclusion of the electioneering period in Q4’2017 (ii) the continued positioning of Nairobi as a regional hub, leading to increased entry of multinationals thus creating demand for residential units, retail centres, commercial offices and hotels, (iii) the kicking off of the affordable housing initiative as part of the Kenyan Government’s Big 4 Agenda, which has gained momentum with the outlining of plans to launch projects, and (iv) the improving macroeconomic environment, with the country’s GDP growing by 6.0% in Q3’2018, higher than the 4.7% recorded in Q3’2017.

- Cytonn Asset Managers Limited (CAML), the regulated affiliate of Cytonn Investments, has been registered and authorized by the Retirement Benefits Authority (RBA) to manage retirement benefit scheme funds. This comes a few months after the Capital Markets Authority (CMA) licensed CAML in March 2018. Read the full press statement here You can also read the media story here

- Faith Maina, Investments Analyst, was on KTN to discuss the events that shaped 2018 as well as what Cytonn has to offer going to 2019. Watch Faith here

- The Ridge, a comprehensive lifestyle development at Ridgeways in Nairobi County, by Cytonn Real Estate, offers a live work play environment. To view show house images click here. The site is open to clients all week long.

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. The Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects;

- We continue to beef up the team with ongoing hires for Financial and Real Estate Advisors for our offices in Nairobi, Nakuru, Kisumu, and Nyeri. Visit the Careers Section on our website to apply;

- Cytonn Centre for Affordable Housing (CCFAH) is looking for a 2-acre land parcel for a joint venture in; Kiambu County (Ruiru, Kikuyu, and Lower Kabete), Nairobi County and its environs.

The parcel should be; (i) fronting a main road, or not more than 800 metres from the main road, and (ii) priced at Kshs 20mn per acre or below. For more information or leads email us at affordablehousing@cytonn.com

The year 2018 was characterized by a flat global growth as the growth in the US was weighed down by the negative effects of the trade conflicts between the US, China and Eurozone, as well as a weaker outlook for some key emerging markets such as China and Brazil, arising from country-specific factors such as (i) country-wide industrial action in Brazil, (ii) political uncertainty in Britain due to the Brexit vote, and (iii) country-wide protests in France, tighter financial conditions, and geopolitical tensions. According to IMF, global GDP growth in 2018 is expected to come in at 3.7%, similar to the growth registered in 2017, and higher than the 5-year average of 3.5%. The IMF downgraded their expectations for global growth this year from 3.9% in June 2018 to 3.7% in October 2018, citing that the trade tensions between the U.S. and trading partners have started to hit economic activity worldwide.

In terms of trade, the World Trade Organization (WTO) downgraded their outlook for world trade growth in 2018 to 3.9% from their 4.4% expectation in April 2018, citing a rise in trade tariffs targeting a variety of exports from large economies, mainly the US, China and the Eurozone. The uncertainty generated by the continuous trade conflicts has had the impact of reducing international trade. Monetary policy tightening in developed economies has also contributed to volatility in exchange rates, especially in emerging markets, thereby further negatively affecting international trade.

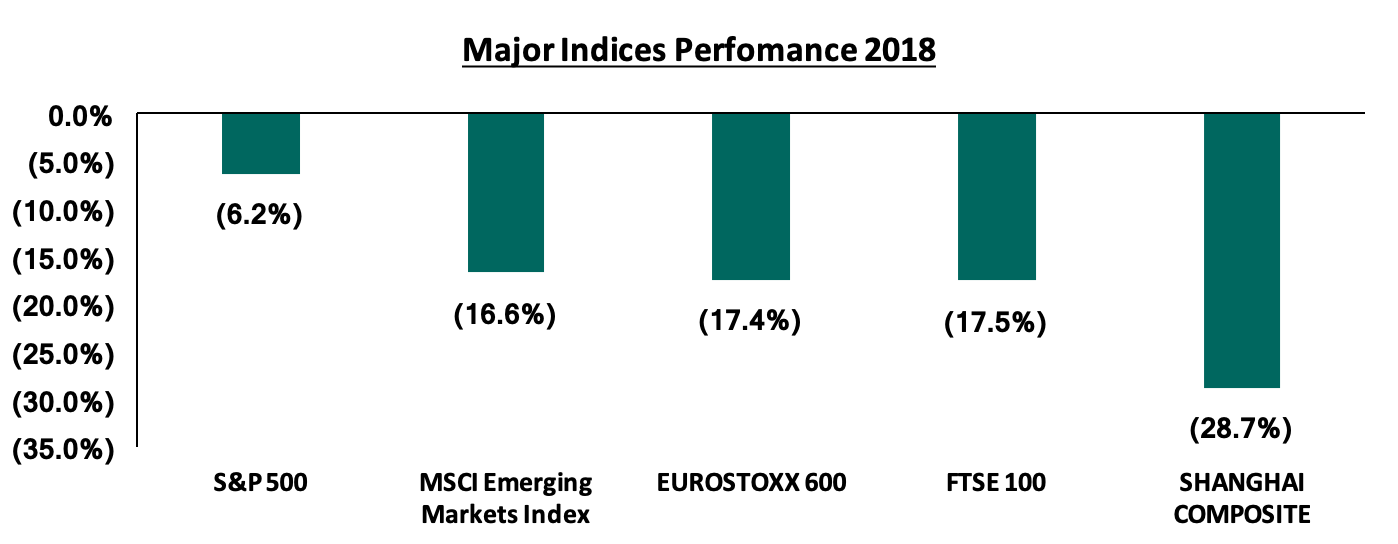

Global equity markets registered declines during the year, as shown in the chart below, as gains made during the first 9-months of the year were wiped-out by large declines in the fourth quarter of the year. The poor performance in the last quarter of the year was due to a slowdown in global economic growth prospects, following a persistence in trade conflict among major economies, increased geopolitical tensions and declining commodity prices, which dampened investor sentiment leading to sustained price declines.

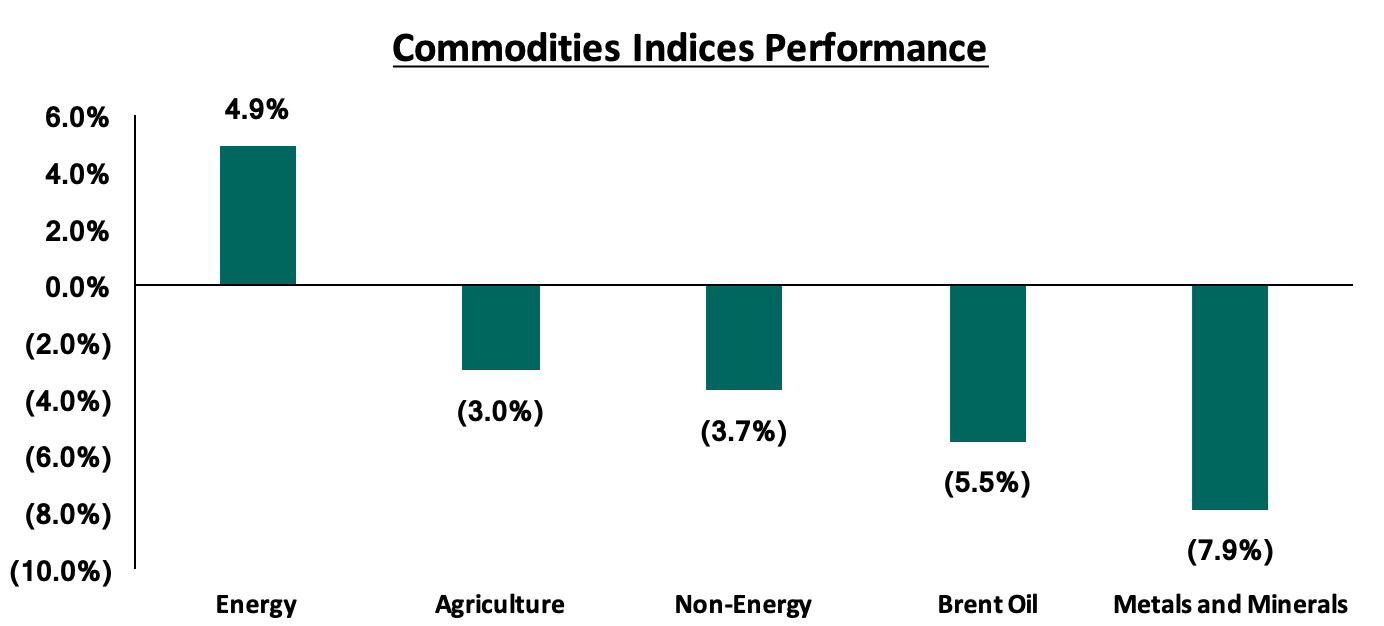

Global commodities registered declines in 2018, with agriculture, non-energy commodities, Brent oil and metals & minerals registering declines of 3.0%, 3.7%, 5.5%, and 7.9%, respectively, while energy gained by 4.9%, according to the World Bank Commodity Prices Index. The rise in energy prices was driven by gains in natural gas prices in US, Japan and Europe that rose 49.9%, 34.8%, and 15.8%, respectively, coupled with the 1.8% rise in crude oil prices. Below is a chart highlighting the performance of select commodity indices:

United States

The US economy continued to register strong growth with the growth for Q3’2018 coming in at 3.5%, slower than the 4.2% recorded in Q2’2018, but faster than the 2.8% recorded in Q3’2017. The growth has largely been attributed to the Trump administration’s USD 1.5 tn tax cut package, which has boosted consumer spending, and consequently supported business investment, as shown by the increased overall inventory accumulation. The labor market has remained strong, with Non-Farm Payroll (NFP) increasing by 155,000 in November 2018, and at an average monthly increase of 192,000 during the year. This has seen the unemployment rate remain at a 49-year low of 3.7%. Wage growth has also remained strong, coming in at a 0.9% q/q increase, and a 3.1% y/y increase, the highest since June 2009.

The Federal Reserve has continued implementing its tighter monetary policy, having started on a tightening cycle in December 2016. In 2018, the Fed implemented four hikes, of 25 bps each, in March, June, October and December, with the Federal Funds rate ending the year at a band of 2.25% - 2.50%, from a range of 1.25% - 1.5% at the beginning of the year. The rate hikes were driven by:

- A strong labor market, with an average of 192,000 new jobs added every month during the year and the unemployment rate at lows of 3.7% in December, compared to 5.0% unemployment rate that is considered full employment in the US economy,

- A relatively strong annual economic growth, which is projected to come in at 2.9% in 2018, higher than 2.3% recorded in 2017, driven by increased consumer spending, and,

- A desired rate of inflation in the economy. On a 12-month basis, both overall inflation and inflation for items other than food and energy have remained near the government’s preferred level of 2.0%, coming in at 2.2% in November 2018,

The stock market registered declines, with the S&P 500 declining by 6.2%, as 9.0% YTD gains to September 2018 were eroded during the fourth quarter of the year. The gains in the first 9 months of the year were supported by strong growth in corporate earnings, and expected implementation of pro-growth policies under the administration of President Trump, including tax reforms that have resulted in corporate tax rates falling to 21.0% from 35.0%, with the administration indicating the possibility of further tax declines. However, for the fourth quarter of the year, stock markets posted declines as increased concerns of a slower global economic growth, tighter monetary conditions, increased trade and geopolitical tensions, and the possibility of an economic recession in the US in 2019 dampened investor sentiment. In terms of valuations, the Cyclically Adjusted Price/Earnings (CAPE) ratio is currently at 29.0x, 72.6% above the historical average of 16.8x, indicating the market albeit on a declining trend, remains overvalued relative to historical levels.

Eurozone

Economic growth in the Eurozone slumped to a four year low in Q3’2018, as GDP expanded by 0.2%, slower than the 0.4% recorded in Q1’2018 and Q2’2018, and 0.7% in Q3’2017.The slowdown is due to:

- Reduced exports from the region, which contracted by 0.1% q/q from the 2.0% growth recorded in Q2’2018, owing to the cooling global trade,

- An increase in geopolitical tensions, which weighed on investment in the quarter, as fixed investment growth came in at 0.2%, significantly lower than the 1.5% recorded in Q2’2018, and,

- A slowdown in business activity, with the Eurozone’s Purchasing Managers Index (PMI) falling to a 49-month low of 51.3 in December 2018, from 60.6 in December 2017, indicating that growth of business activity in the euro area slowed to the weakest for over four years in December.

The region is expected to grow by 2.0% in 2018, compared to a 2.4% growth experienced in 2017, and a downward revision from the 2.2% expected growth rate as at June 2018 on slower expected growths in major economies such as Germany and France, of 1.9% and 1.6%, compared to earlier projections of 2.2% and 1.8%, respectively. The labor market recovery continued, with the unemployment rate dropping to 8.1% in October 2018, from 8.6% in December 2017. This, however, is still below the desired level of 5.0%

The European Central Bank (ECB) announced that it would stop its asset-bond buying program in December 2018. This is after the bank had accumulated EUR 2.6 tn in assets over nearly four-years, in a bid to stimulate the Eurozone’s economic recovery. The ECB reiterated that it would continue to reinvest the principal payments from maturing securities for an undefined extended period time, which should keep conditions accommodative. Throughout the year, the ECB left the refinancing rate at 0.0%, the marginal lending rate at 0.25% and deposit facility rate at -0.4%. Inflation remained stable during the year at 1.9% as at November 2018, within the target of 2.0%.

Eurozone stock markets were on a declining trend with The EuroStoxx 600 index declining by 17.4% during the year, driven by dampened investor sentiment owing to reduced global economic growth, and heightened geopolitical tensions, following civil unrest in France and increased uncertainty on Britain’s withdrawal from the EU (“Brexit”). In terms of valuations, the EuroStoxx 600 Index is currently trading at a P/E of 14.8x, 27.1% below its historical average of 20.3x, indicating markets are undervalued and are trading at cheap valuations relative to historical levels.

China

The World Bank expects China’s 2018 growth to come in at 6.6%, slightly lower than the 6.7% recorded in 2017. The economy recorded a 6.5% growth in Q3’2018, the lowest growth since Q1’2009, largely weighed down by reduced global trade owing to heightened geopolitical tensions and trade tensions. China and the US have been caught up in a trade war, with the US imposing a 10.0% tariff on goods worth USD 200.0 bn, and China imposing a further retaliatory 10.0% tariff on goods worth USD 60.0 bn, bringing the value of goods under imposed/proposed tariffs by China to USD 110.0 bn.

The government has adopted a more accommodative monetary policy as they reduced their pace in the campaign to reduce the government debt, amid concerns about the slowdown in investment, and negative impact of the trade war with the US. The central government is focusing on encouraging local governments to speed up spending of unused revenues and banks to ensure adequate financing for local government projects. The Chinese Government announced CNY 1.2 tn (USD 180.0 bn) in business tax cuts in addition to policies aimed at boosting infrastructure expenditure.

The stock market recorded a negative return during the year, with the Shanghai Composite declining by 28.7% in 2018, weighed down by the dampened investor sentiment owing to the prolonged trade tensions with the US, heightened geopolitical tensions, and an overall slower economic growth. In terms of valuations, the Shanghai Composite index is currently trading at a P/E of 11.6x, 24.7% lower than the historical average P/E of 15.4x, indicating the market is currently undervalued, and is currently trading at cheap valuations relative to historical levels.

According to the World Bank, Sub-Saharan Africa economic growth remained relatively strong in 2018 with preliminary data indicating that the region recorded a 2.7% GDP growth in 2018, a rise from 2.3% recorded in 2017. In East Africa, a rebound in growth was recorded in Rwanda, Uganda and Kenya, which grew by 7.7%, 6.8% and 6.0%, respectively, as at Q3’2018 driven by improved agricultural performance attributed to improved weather conditions. A slowdown was however recorded in Tanzania mainly underpinned by an unfavorable investment climate following President John Magufuli’s stringent policy changes. In Western Africa, several countries recorded growths of 6.0% and above which include Benin, Burkina Faso, Cote d’Ivoire, and Senegal. There was however subdued growth in other countries in the region such as Nigeria which recorded a growth of 1.5% in Q2’2018 compared to the economic growth rebound of 1.95% and 2.1% recorded in Q1’2018 and Q4’2017, respectively with the subdued growth being attributed to a decline in oil production, which was due to pipeline closures during the period. In the Southern Africa region, growth was subdued in South Africa and Angola, which are the two major economies in the region. Growth in Angola, the region’s second largest oil exporter was dampened by reduced oil output following the maturity of key oil fields. Subdued growth in South Africa was mainly driven by weakness in agriculture, mining, and construction which dragged the economy into a technical recession due to negative growth recorded in two subsequent quarters in Q1’2018 and Q2’2018 at -2.6% and -0.4%, respectively.

Currency Performance

Regional currencies registered a depreciating trend in 2018 with the major decliner being the Zambian Kwacha, which registered a 19.0% depreciation, attributed to negative investor sentiments on the country’s debt sustainability, following the country’s ballooning debt levels, projected to have hit 69.0% of GDP as at the end of 2018. The underperformances of the region’s currencies was also underpinned by:

- Capital outflows from emerging markets to advanced markets following tightening of monetary policy, which saw the Federal Reserve raise the benchmark interest rate 4 times during the year to close the year at a range of 2.25% - 2.5% in its final meeting in December, and,

- The strengthening dollar, coupled with events in the global markets, which included the trade war between China and the USA that put pressure on emerging market currencies.

Below is a table showing the performance of select African currencies, ranked by 2018 y/y change.

|

Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Dec-16 |

Dec-17 |

Dec-18 |

2017 y/y change (%) |

2018 y/y change (%) |

|

Kenyan Shilling |

102.5 |

103.2 |

101.8 |

(0.7%) |

1.4% |

|

Nigerian Naira |

315.3 |

360.0 |

362.6 |

(14.2%) |

(0.7%) |

|

Malawian Kwacha |

727.5 |

725.5 |

736.8 |

0.3% |

(1.6%) |

|

Ugandan Shilling |

3596.5 |

3643.3 |

3708.5 |

(1.3%) |

(1.8%) |

|

Mauritius Rupee |

36.0 |

33.6 |

34.3 |

6.7% |

(2.2%) |

|

Tanzanian Shilling |

2181.0 |

2234.6 |

2298.7 |

(2.5%) |

(2.9%) |

|

Ghanaian Cedi |

4.2 |

4.5 |

4.9 |

(6.8%) |

(8.6%) |

|

Botswana Pula |

10.7 |

9.8 |

10.7 |

8.1% |

(9.0%) |

|

South African Rand |

13.7 |

12.4 |

14.3 |

9.9% |

(15.9%) |

|

Zambian Kwacha |

9.9 |

10.0 |

11.9 |

(0.4%) |

(19.0%) |

Of the currencies covered, the Kenya Shilling was the only currency which appreciated against the dollar in 2018.

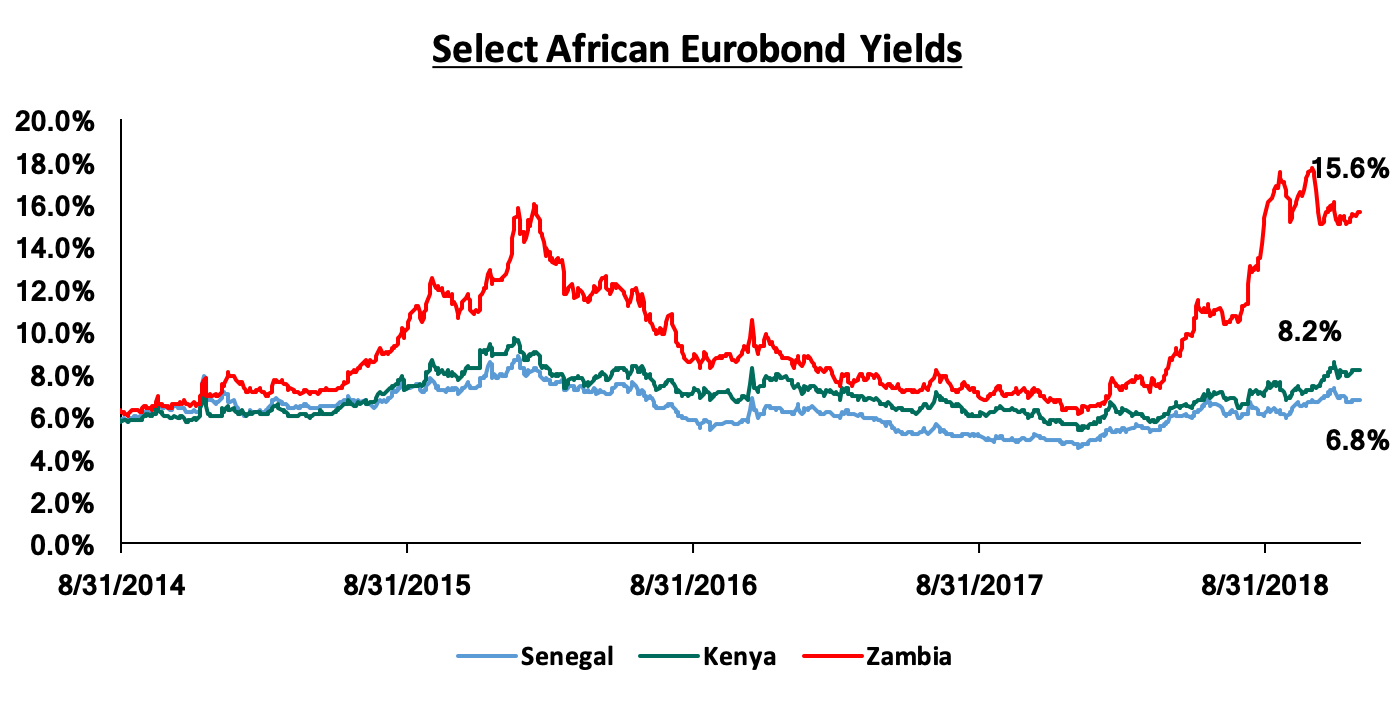

African Eurobonds:

Yields on African Eurobonds rose in 2018 partly attributed to the aggressive tightening monetary policy regime adopted by the U.S Federal reserve, coupled with the China-U.S trade tensions, which dampened investor sentiment in emerging markets. Domestic country risks also exacerbated the rise in yields. As a result, most foreign investors began pulling out their capital in the wake of rising US treasury yields and a strong dollar, thereby increasing the risk profile of most emerging market economies.

Appetite for government securities in Sub Saharan Africa remained strong in 2018, as risk-adjusted returns remained higher compared to those in developed economies. Eurobonds issued during the year included:

- Ghana, which issued a dual-tranche Eurobond in May 2018, raising a total of USD 2.0 bn in 10-year and 30-year instruments of USD 1.0 bn each. The issue, which was to raise funds for budgetary purposes and liability management, was 4.0x oversubscribed with USD 8.0 bn in bids received,

- Nigeria, which issued a triple-tranche debt note of USD 1.2 bn with a 7-year tenor, USD 1.0 bn with a 12-year tenor and USD 0.8 bn with a 30-year tenor in November 2018, with total bids received amounting to USD 9.5 bn translating to a 3.3x oversubscription.

- Senegal, which issued two bonds of USD 1.0 bn each, which were 8.0x oversubscribed with USD 9.3 bn in bids received. The stated plan was for new infrastructure development as well as refinancing some USD 150.0 mn of foreign debt, due in 2021, and,

- Kenya, which issued a USD 1.0 bn, 10-year tenor bond and another 30-year tenor bond of a similar amount; earmarked for infrastructural development and active debt management. The issue raised USD 14.0 bn from investors, thus an oversubscription by 7.0x.

Equities Market Performance

Most of the Sub-Saharan African (SSA) stock markets recorded negative returns in 2018, erasing the gains made in Q1’2018. The region experienced capital outflows as profit-taking investors exited the markets to realize the gains made in various sectors as at Q1’2018, such as oil and gas that had been boosted by a global rally in crude oil prices, and the financial services sector. The price correction due to the capital outflows coupled with the depreciating currencies resulted in most exchanges registering a decline in performance. Below is a summary of the performance of key exchanges:

|

Equities Market Performance (Dollarized*) & Price to Earnings (P/E) |

||||||

|

Country |

Current Price to Earnings (P/E) |

Dec-16 |

Dec-17 |

Dec-18 |

2017 y/y change (%) |

2018 y/y change (%) |

|

Malawi |

- |

18.3 |

29.8 |

39.8 |

62.5% |

33.6% |

|

Rwanda |

- |

0.2 |

0.2 |

0.1 |

1.0% |

(5.5%) |

|

Ghana |

- |

395.6 |

569.7 |

510.8 |

44.0% |

(10.3%) |

|

Kenya |

10.8x |

1.3 |

1.7 |

1.4 |

27.5% |

(16.9%) |

|

Zambia |

12.1x |

421.7 |

532.1 |

441.1 |

26.2% |

(17.1%) |

|

Tanzania |

11.8x |

1.0 |

1.1 |

0.9 |

6.6% |

(17.1%) |

|

Nigeria |

7.9x |

85.3 |

106.2 |

86.5 |

24.5% |

(18.6%) |

|

Uganda |

- |

0.4 |

0.6 |

0.4 |

35.0% |

(20.9%) |

|

South Africa |

14.5x |

3688.1 |

4802.6 |

3667.1 |

30.2% |

(23.6%) |

|

BRVM |

8.0x |

0.5 |

0.4 |

0.3 |

(4.2%) |

(32.5%) |

|

*The index values are dollarized for ease of comparison |

||||||

The Sub-Saharan Africa region is expected to perform well supported by increased public spending on infrastructural development owing to the high demand for basic needs. Key risks remain difficult business conditions and poor infrastructure, reliance on commodity exports, political tension in some countries and debt sustainability due to high levels of public debt in most economies in the region. Stock markets valuations remain attractive for long-term investors. The improved regional economic growth prospects remain key towards enhancing investor sentiment and attracting investment inflows into the region.

Economic Growth:

The country's Gross Domestic Product (GDP), adjusted for inflation, increased in 2018 having expanded by 5.7% in Q1’2018, 6.3% in Q2’2018 and 6.0% in Q3’2018 to record an average growth of 6.0% for the 3 quarters compared to an average growth of 4.7% over the same period in 2017. The improved growth has been against a backdrop of a stable macroeconomic environment, driven by:

- A recovery in agriculture, which saw the sector record an average growth of 5.3% for the first 3 quarters of 2018, due to improved weather conditions. In terms of sectoral contribution, agriculture remained the highest contributor averaging 22.4% over the same period,

- Improved business and consumer confidence, evidenced by the Stanbic Bank’s Monthly Purchasing Managers Index (PMI), which averaged 54.3 in the 11-months to November 2018, a rise from 46.0, recorded in a similar period in 2017. Key to note, a PMI reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. The improvement in the business environment has also been facilitated by the improved ease of doing business, which saw Kenya’s rank improve by 19 positions to #61 from #80 as per the World Bank Doing Business Report 2019 as highlighted in our Analysis of Kenya’s Doing Business Environment. This was mainly driven by improvements in protection of minority investors, access to credit, improved property registration and insolvency resolution, and,

- Increased output in the real estate, manufacturing, and wholesale & retail trade sectors, which grew by 5.8%, 3.2% and 6.8%, respectively, and favorable weather conditions that positively affected output from agricultural and hydroelectricity activities.

Analysis by sector showed that there was accelerated growth in the manufacturing sector, though its contribution to GDP recorded an average of 10.0% in the first 3 quarters of 2018. This is despite the Kenyan Government singling it out as one of the key pillars to drive the economy in the Big 4 Agenda. The sector’s contribution is still way below the government’s target of increasing it to 15.0% of GDP by 2022, which is expected to increase manufacturing sector jobs by more than 800,000 per annum over the next four years.

Kenya Shilling:

The Kenya Shilling gained 1.4% against the US Dollar to close at 101.8 in 2018 compared to 103.2 at the end of 2017; the Kenya Shilling was the only major African currency, which appreciated against the dollar. In our view, the shilling should remain relatively stable to the dollar in the short term, supported by:

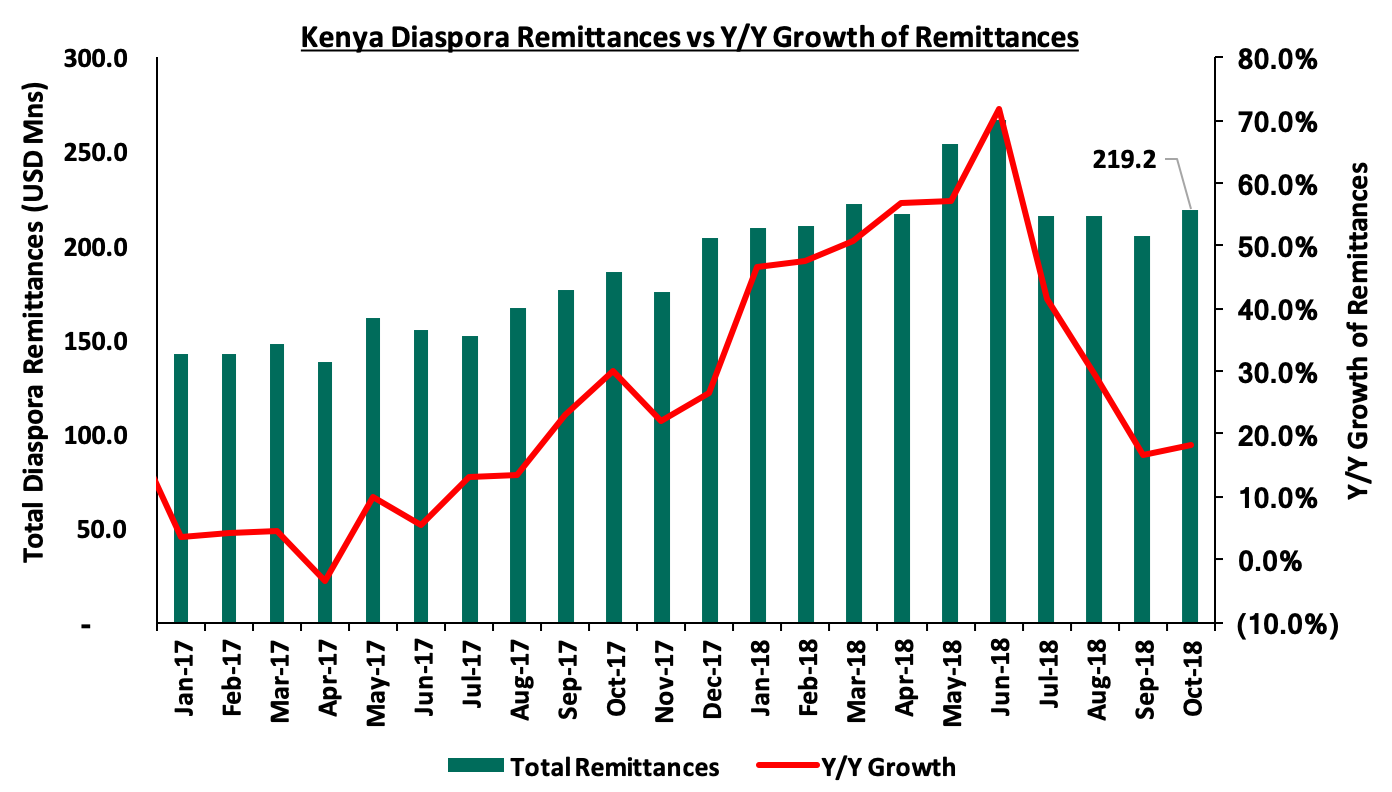

- The narrowing in the current account deficit to 5.3% in the 12 months to September 2018, compared to 6.5% in September 2017. The narrowing of the current account deficit is largely due to increased exports of tea and horticulture, increased diaspora remittances, strong receipts from tourism, and lower imports of food and SGR-related equipment relative to 2017.

- Inflows from principal exports, which include coffee, tea, and horticulture, which increased by 5.2% for the first 9 months of 2018 to Kshs. 209.0 bn from Kshs. 199.0 bn over the same period in 2017,

- Improving diaspora remittances, which increased by 42.5% to USD 2.2 bn during the first 10 months of 2018 from USD 1.6 bn during the same period in 2017, with the largest contributor being North America at USD 1.2 bn attributed to; (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient, and,

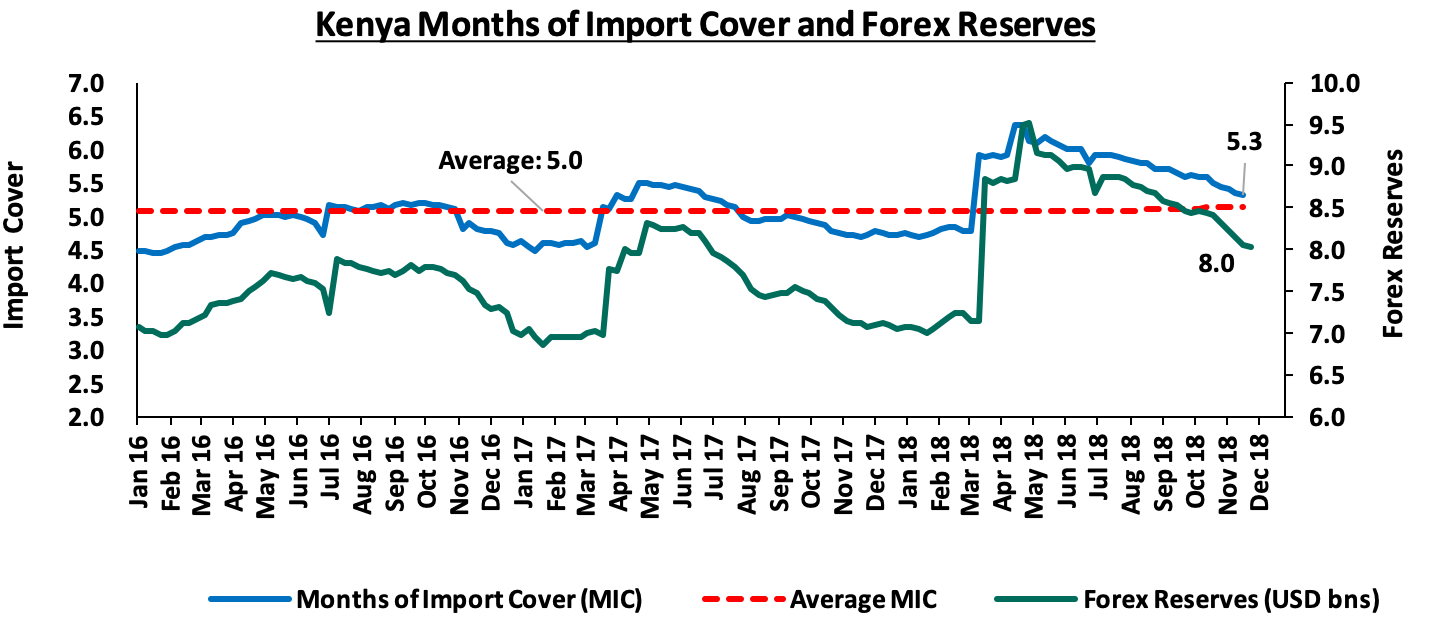

- High forex reserves, which currently stand at USD 8.0 bn (5.3 months of import cover) continue to provide adequate cover, and a buffer against short-term shocks in the foreign exchange market.

Inflation:

The inflation rate for the month of December 2018 rose to 5.7% from 5.6% recorded in November bringing the 2018 average to 4.7% compared to the 2017 average of 8.0%. Going forward, overall inflation is expected to remain within the target range (of 2.5%- 7.5%) in the near term, mainly due to expected lower food prices as a result of favorable weather conditions, the decline in international oil prices, and the recent downward revision in electricity tariffs. The recent excise tax adjustment on voice calls and internet services is expected to have a marginal impact on inflation.

Monetary Policy:

The Monetary Policy Committee lowered the Central Bank Rate (CBR) twice, in the 6 meetings held in 2018 in order to support economic activity, citing that economic output was below its potential level, and there was room for further accommodative monetary policy. During their meeting in March 2018, the MPC lowered the CBR to 9.5% from the earlier 10.0% that had been set in September 2016. The MPC later lowered the CBR by another 50 bps during their July 2018 meeting to 9.0%, from the 9.5% set in March 2018.

2018 Highlights:

- The Kenyan National Treasury released the fiscal year 2018/19 national budget in June 2018. Below were some of the key highlights

Amounts in Kshs trillions unless stated otherwise

|

Comparison of 2017/18 and 2018/19 Fiscal Year Budgets |

|||||

|

|

2018/19 |

% change 2017/18 to 2018/19 |

2017/18 |

% change 2016/17 to 2017/18 |

2016/17 |

|

Revenue |

1.9 |

14.5% |

1.7 |

9.6% |

1.5 |

|

Recurrent expenditure |

1.5 |

7.7% |

1.4 |

13.3% |

1.2 |

|

Development expenditure |

0.6 |

7.8% |

0.6 |

(27.3%) |

0.8 |

|

County governments |

0.4 |

7.3% |

0.4 |

16.4% |

0.3 |

|

Total expenditure |

2.5 |

7.7% |

2.3 |

(0.2%) |

2.3 |

|

Deficit as % of GDP |

(5.7%) |

1.5% |

(7.2%) |

1.9% |

(9.1%) |

|

Net foreign borrowing |

0.3 |

(11.2%) |

0.3 |

(30.3%) |

0.5 |

|

Net domestic borrowing |

0.3 |

(8.6%) |

0.3 |

(14.7%) |

0.3 |

|

Total borrowing |

0.6 |

10.0% |

0.6 |

(23.6%) |

0.8 |

Key take-outs from the table:

- Total expenditure in the fiscal year 2018/2019 was set to increase by 7.7%, to Kshs 2.5 tn from Kshs 2.3 tn in the fiscal year 2017/18,

- Development expenditure was set to increase at a slightly faster rate than recurrent expenditure; with the latter increasing by 7.8% to Kshs 1.5 tn from Kshs 1.4 tn, while development expenditure increased by 7.8% to Kshs 625.0 bn from Kshs 579.6 bn in FY 2017/18,

- The budget deficit was projected to decline to 5.7% of GDP from an estimated 7.2% of GDP in the FY 2017/18; this in line with the International Monetary Fund’s (IMF’s) recommendation, in a bid to reduce Kenya’s public debt requirements,

- The total borrowing requirement to plug in the deficit declined to Kshs 558.9 bn from Kshs 620.8 bn, in a bid to reduce Kenya’s public debt burden which was estimated at 55.6% of GDP as at 2017 by the IMF, 5.6% above the East African Community (EAC) Monetary Union Protocol, the World Bank Country Policy and Institutional Assessment Index, and the IMF threshold of 50.0%, but well below the 74.0% mark considered a signal for debt unsustainability, and,

- Debt financing of the 2018/19 budget was split 51:49 between foreign and domestic borrowing, with the foreign and domestic debt being estimated at Kshs 287.0 billion (equivalent to 3.0% of GDP) and Kshs 271.9 billion (equivalent to 2.8% of GDP), respectively.

- The National Assembly convened for special parliamentary sittings held on 18th September and 20th September to discuss the President’s reservations against the Finance Bill through his memorandum. All the proposals as per the President’s memorandum were tabled in parliament and passed despite a chaotic sitting, after which the president assented to the Finance Bill 2018 on 21st September 2018. We covered a detailed analysis of this in our Cytonn Weekly #36/2018,

- The International Monetary Fund (IMF) paid a visit to Kenya where discussions were held with the Kenyan Government on the second review under a precautionary Stand-By Arrangement (SBA), which was extended to Kenya on 14th March 2016. For more information, see our Cytonn Weekly #30/2018. The second review however was not completed, leading to the expiry of the precautionary stand-by facility granted to Kenya on 14th September 2018,

- According to the Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI), the business environment in the country slowed to a year low in November 2018. The seasonally adjusted PMI dropped to 53.1 in November from 54.0 in October. The index score has however improved generally during the year to average at 54.3 in the 11-months to November 2018, a rise from 46.0, recorded in a similar period in 2017. A PMI reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. Firms reported growth in value of outputs due to the continued rise in new orders, which rose for the 9th consecutive month. This was despite high input costs attributed to raw material shortages. In response to increased output requirements, firms also raised their staffing levels during the month though at a modest rate. The private sector has remained resilient as the PMI is still above 50.

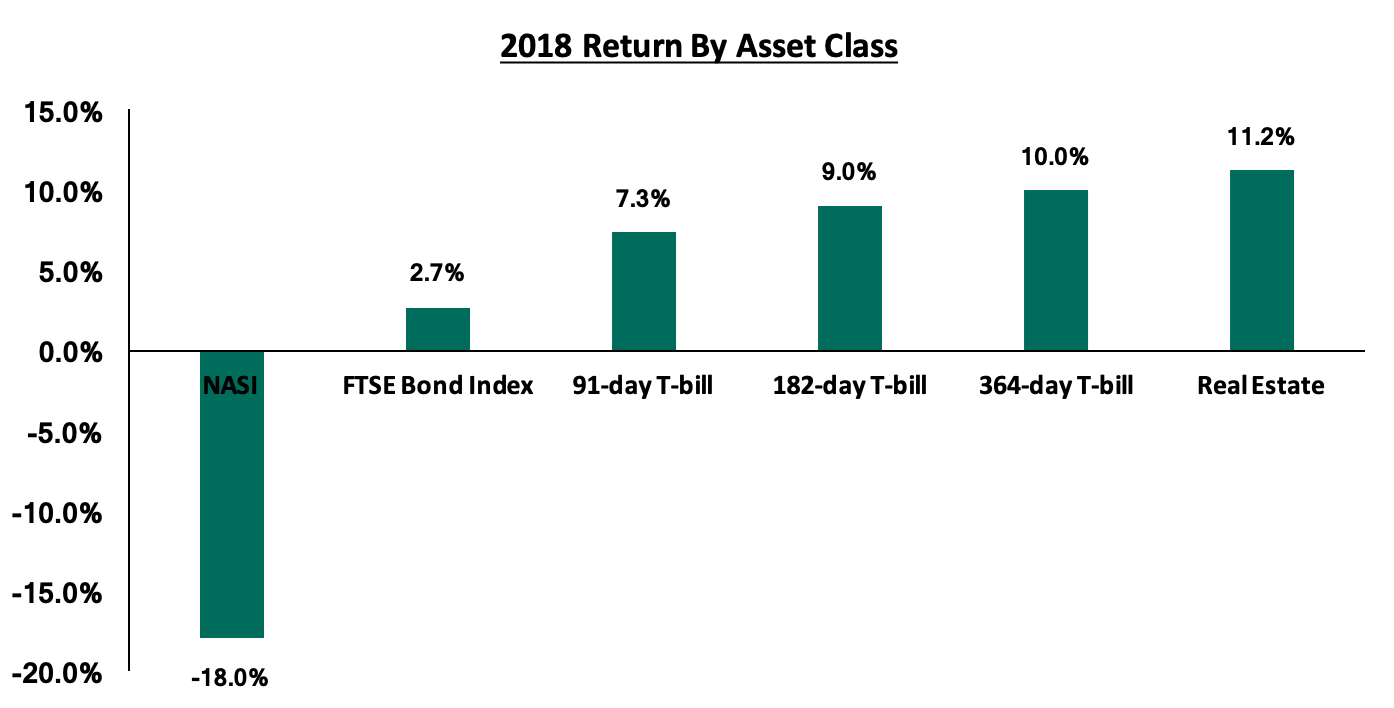

The graph below shows the summary of returns by asset class in 2018 (T- Bonds, T-Bills and Equities). The best performing asset in 2018 was Real Estate with returns of 11.2% followed by government bills with the 364-day, 182-day, and 91-day T-bills recording yields of 10.0%, 9.0% and 7.0% respectively. Investors continue to diversify their portfolio following the poor performance in the equities market as evidenced by the decline in NASI of 18%;

The table below shows the macro-economic indicators that we track, indicating our expectations for each variable at the beginning of 2018 versus the actual experience

|

Macro-Economic Indicators |

2018 Expectations at Beginning of Year |

Outlook - Beginning of Year |

2018 Experience |

Effect |

|

Government Borrowing |

We expected the government to come under pressure to borrow as it was well behind both domestic and foreign borrowing targets for FY 2017/18, and KRA was unlikely to meet its collection target due to expected suppressed corporate earnings in 2017 |

Negative |

i. The government surpassed its domestic borrowing target for the 2017/18 fiscal year, having borrowed Kshs 390.2 bn against a target of 297.6 bn |

Positive |

|

Exchange Rate |

Currency was projected to range between Kshs 102.0 and Kshs 107.0 against the USD in 2018. With the possible widening of the current account deficit being a possible point of concern, we expected the CBK to continue to support the Shilling in the short term through its sufficient reserves of USD 8.1 bn (equivalent to 5.3-months of import cover) |

Neutral |

The Kenya Shilling gained 1.4% against the US Dollar to close at 101.8 in 2018 compared to 103.2 at the end of 2017, and ranging between 100.0 and 103.4. |

Positive |

|

Interest Rates |

We expected upward pressure on interest rates, especially in the first half of the year, as the government fell behind its borrowing targets for the fiscal year. However, with the Banking (Amendment) Act, 2015, we did not expect much action by MPC with the CBR which had remained at 10.0% throughout 2017 |

Neutral |

The Monetary Policy Committee lowered the Central Bank Rate (CBR) twice, in the 6 meetings held in order to support economic activity; During their meeting in March 2018, the MPC lowered the CBR to 9.5% from the earlier 10.0% that had been set in September 2016. The MPC later lowered the CBR by another 50 bps during their July 2018 meeting to 9.0%, from the 9.5% set in March 2018 In their last meeting on 27th November 2018 they retained the CBR at 9.0 citing that inflation expectations remained well anchored within the target range, and that the economy was operating close to its potential |

Neutral |

|

Inflation |

Inflation was expected to average 7.5% compared to 8.0% last year |

Positive |

The inflation rate for the month of December 2018 rose to 5.7% from 5.6% recorded in November bringing the 2018 average to 4.7% (in line with the government’s target of 2.5% to 7.5%) compared to the 2017 average of 8.0%. |

Positive |

|

GDP |

GDP growth was projected to come in at between 5.4% - 5.6% |

Positive |

Kenya’s economy expanded in 2018 by 5.7% in Q1’2018, 6.3% in Q2’2018 and 6.0% in Q3’2018 to record an average growth of 6.0% for the 3 quarters compared to an average growth of 4.7% over the same period in 2017 |

Positive |

|

Investor Sentiment |

Investor sentiment expected to improve in 2018 given the now settling operating environment after conclusion of the 2017 elections |

Positive |

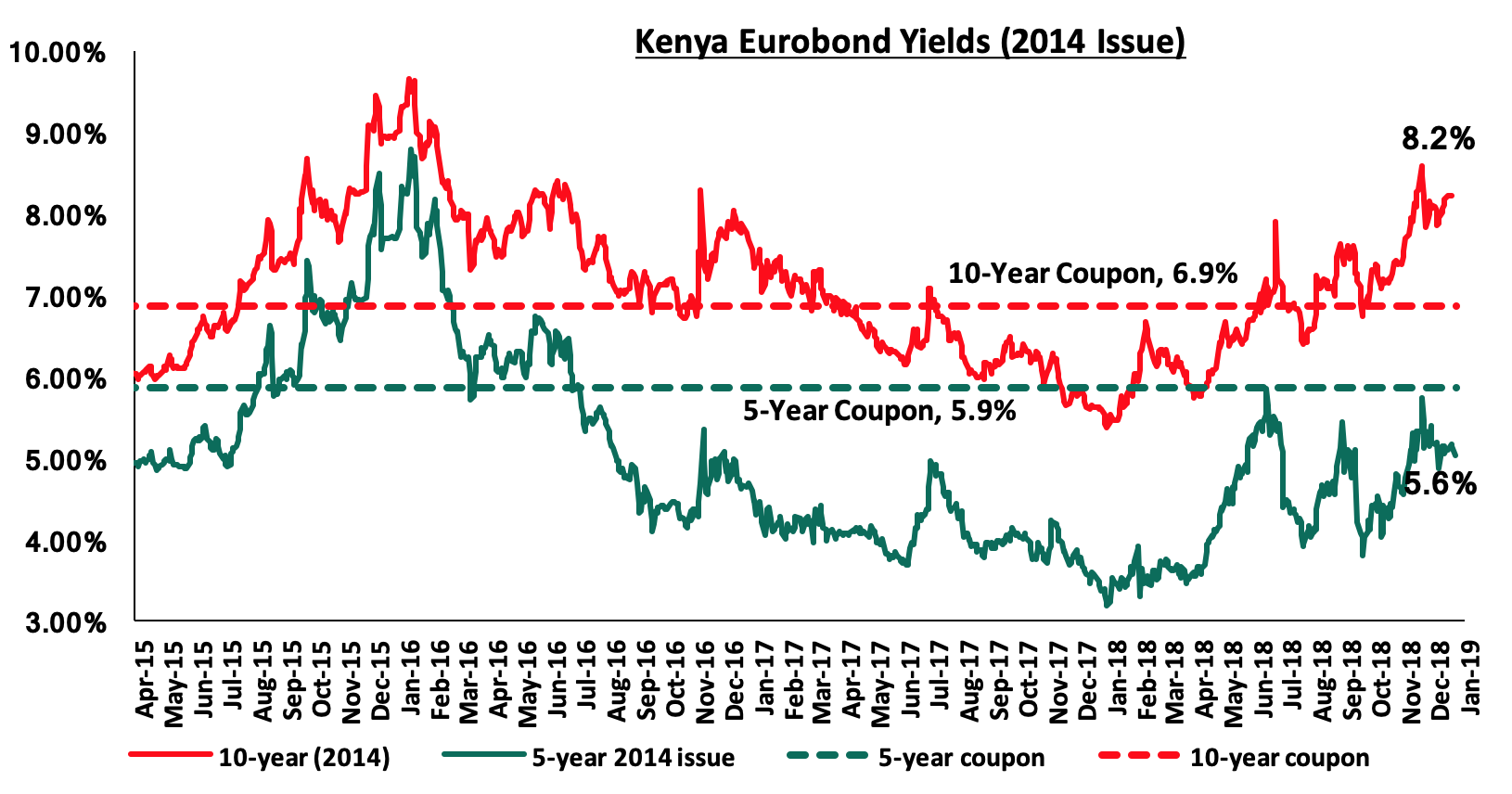

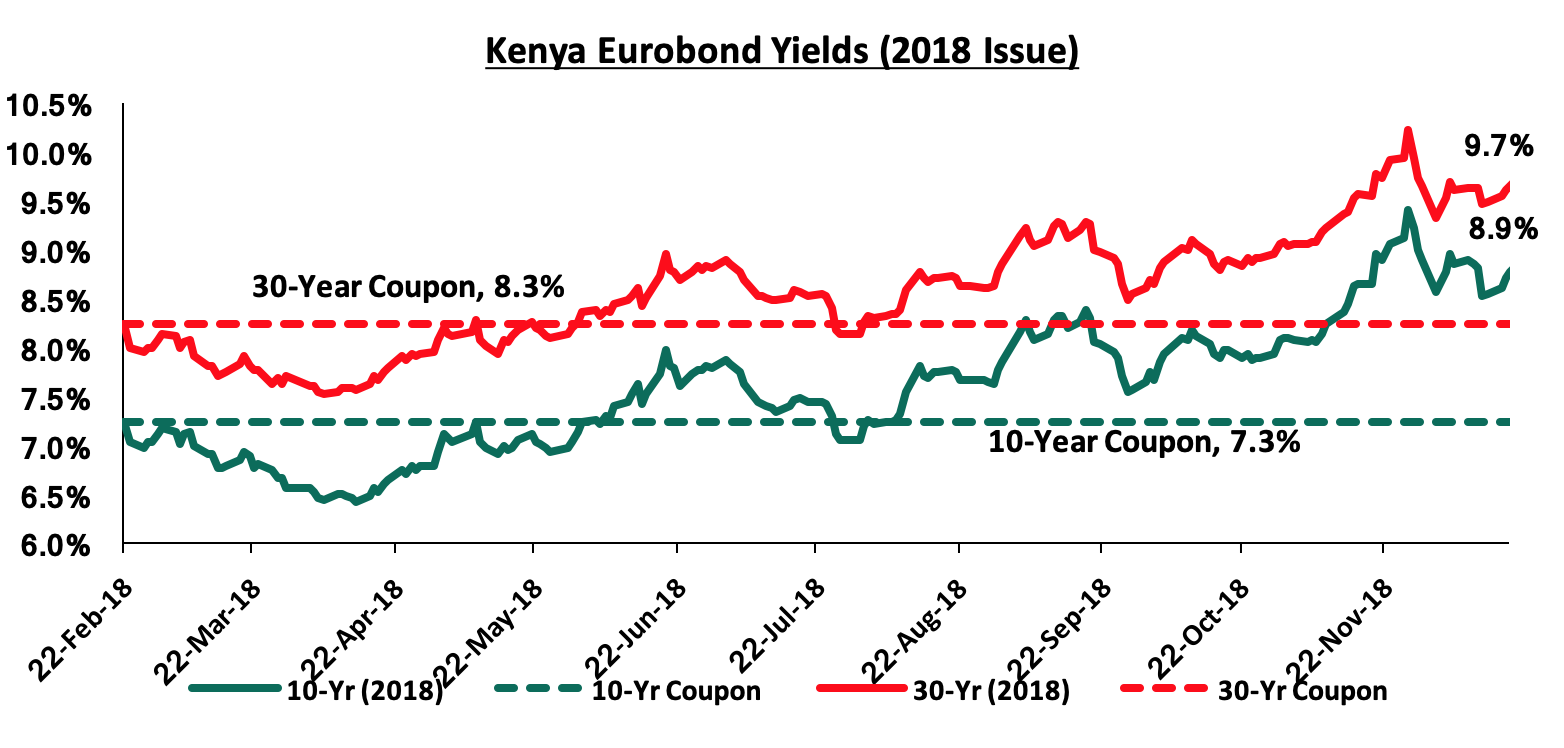

The Kenya Eurobond yields have been increasing, with the yields on the 2014 Eurobond issue rising by 220 bps and 230 bps YTD for the 5-year and 10-year Eurobonds, while the yields on the 10-year and 30-year Eurobonds issued in 2018 have risen by 170 bps and 150 bps, respectively, since the issue date. There has also been increased sell-offs by foreign equity investors amid fears of global economic slowdown, coupled with rising US Treasury yields. |

Neutral |

|

Security |

Security was expected to be maintained in 2018, especially given that the elections were concluded and the USA lifted its travel warning for Kenya, placing it in the 2nd highest tier of its new 4-level advisory program, indicating positive sentiments on security from the international community |

Positive |

The political climate in the country has eased, compared to 2017 with security maintained and business picking up. Kenya now has direct flights to and from the USA, a signal of improving security in the country |

Positive |

Out of the seven metrics that we track, five had a positive effect while two had a neutral effect, compared to the beginning of the year where four had a positive outlook, two had a neutral outlook and one factor had a negative outlook. In conclusion, macroeconomic fundamentals remained positive during the year because of an improved business environment created through political goodwill and improved security in the country.

T-Bills & T-Bonds Primary Auction:

During the year 2018, T-bills auction recorded an oversubscription with the average subscription rate coming in at 123.2% compared to an average of 110.5% in 2017. The yield on the 91-day, 182-day and 364-day T-bills declined by 80 bps, 160 bps and 120 bps to close at 7.3%, 9.0% and 10.0% in 2018 from 8.1%, 10.6% and 11.2% at the end of 2017, respectively. This is mainly attributed to the Central Bank of Kenya’s (CBK’s) efforts to keep rates low by rejecting expensive bids. Following the enactment of the Banking (Amendment) Act, 2015, banks have preferred to lend to the less risky government as opposed to the riskier private sector.

Primary T-bond auctions in 2018 were undersubscribed with the subscription rate averaging 75.8% lower than the average subscription rate for 2017, which came in at 100.2%. This was mainly attributed to efforts by the government to raise its debt maturity profile to reduce the potential rollover risks in the medium term, by issuing longer-dated papers, which recorded lackluster performance due to uncertainties in the interest rates environment with the proposal of repealing the interest rate cap having been tabled in parliament through the Finance Bill 2018. The continued issuing of longer-term papers also led to saturation of long-end offers, leading to a relatively flat yield curve on the long-end. The average acceptance rate for 2018 came in at 73.0%, as the market adjusted to the efforts of the CBK to maintain the rates at low levels, with tap sales being a common method used by the CBK throughout the year to tame expensive bids and keep interest rates at low levels.

Secondary Bond Market Activity:

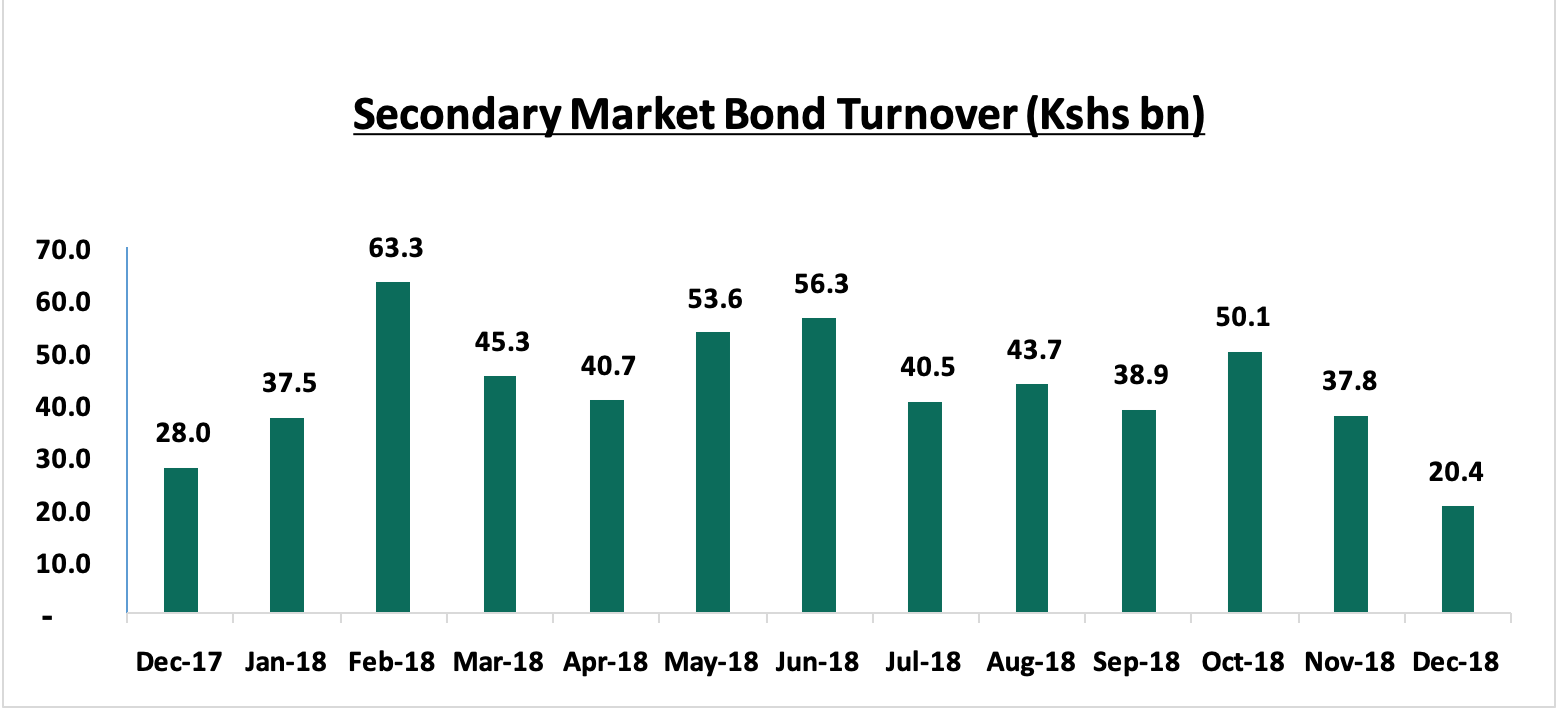

The NSE FTSE bond index recorded a 2.7% gain in 2018 with the secondary bond market recording increased activity with the turnover having increased by 26.1% to Kshs 528.2 bn from Kshs 419.0 bn in 2017, as the local institutional investors increased their allocation to treasury bonds as a result of poor performance of the equities market, which declined by 18.0%.

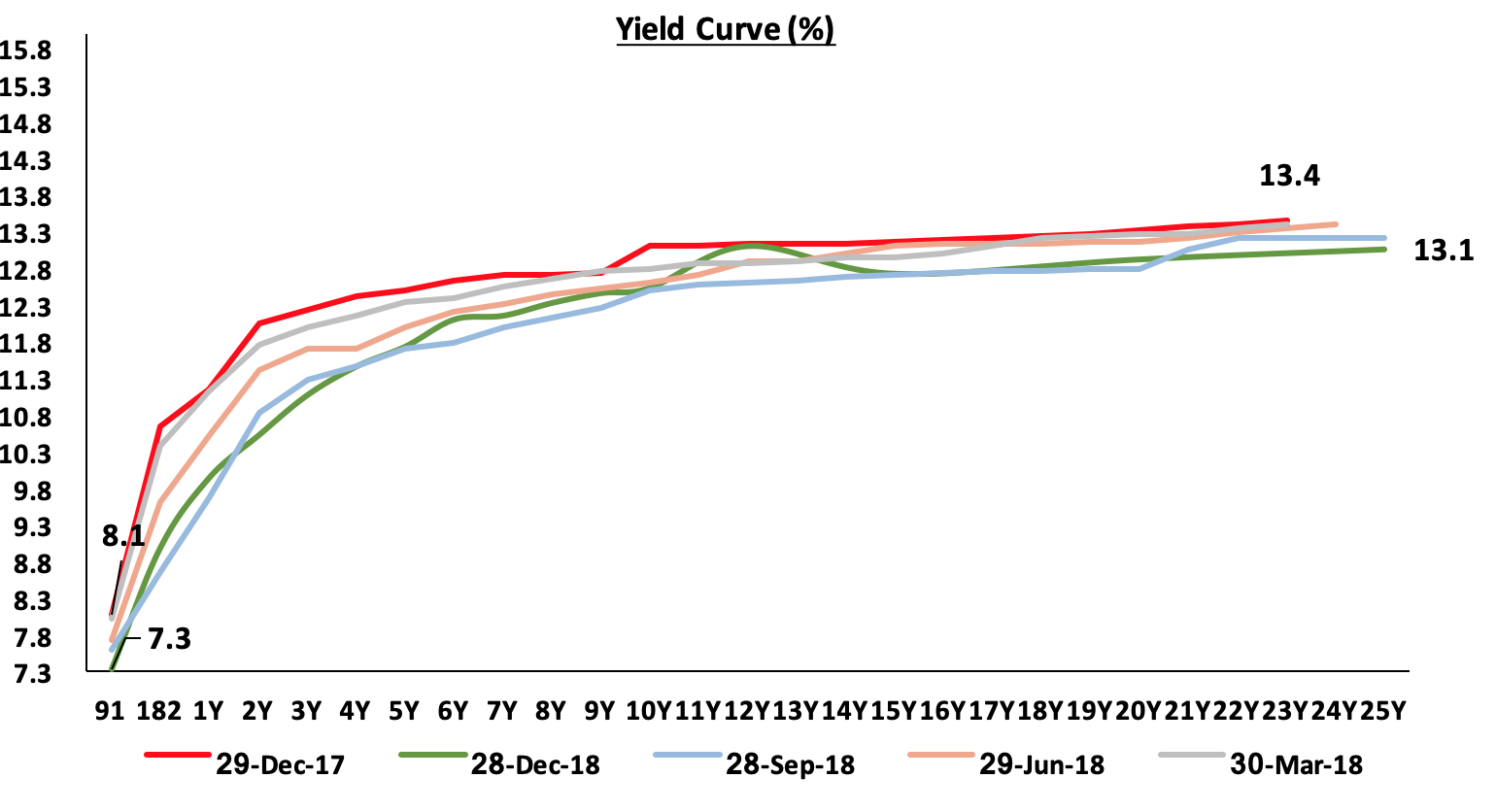

The graph below shows the evolution of the yield curve during the year, with yields declining, given that the government was only accepting reasonable bids in the auction market resulting into a downward pressure on yields in the secondary market.

Liquidity:

During the year, liquidity levels remained stable and well distributed in the market as indicated by the decline in the average interbank rate to 5.2% in 2018 from 6.4% in 2017, coupled with the 5.5% decline in the average volumes traded in the interbank market to Kshs 16.1 bn in 2018 from Kshs 17.0 bn recorded in 2017.

Kenya Eurobonds:

According to Bloomberg, yields on the 5-year and the 10-year Eurobond issued in 2014 increased by 2.2% points and 3.2% points to close at 5.6% and 8.2% at the end of 2018, from 3.4% and 5.0% at the end of 2017, respectively; the significant increase in yields during the year was due to;

- A higher country risk perception by investors, partly attributed to the International Monetary Fund (IMF) raising the risk of Kenya’s debt distress from low to moderate on October, resulting in investors demanding a higher return for the risk, and,

- The aggressive tightening monetary policy regime adopted by the U.S Federal reserve, that saw the Federal reserve raise the benchmark interest rate 4 times during the year, exacerbated the rise in yields as most foreign investors began pulling out their capital in the wake of rising US treasury yields and a strong dollar.

Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 3.8% points and 1.4% points for the 5-year and 10-year Eurobonds, respectively, due to the relatively stable macroeconomic conditions in the country. Key to note is that these bonds have 6-months and 5.5-years to maturity for the 5-year and 10-year, respectively.

For the February 2018 Eurobond issue, the yields on the 10-year Eurobond and the 30-year Eurobond have increased by 1.7% points and 1.5% points to close the year at 8.9% and 9.7% from a yield of 7.3% and 8.3% when they were issued in February 2018, respectively.

Rates in the fixed income market have remained relatively stable despite the government being 30.3% behind its pro-rated domestic borrowing target for the current financial year, having borrowed Kshs 91.1 bn against a pro-rated target of Kshs 130.7 bn. The 2018/19 budget had given a domestic borrowing target of Kshs 271.9 bn, 8.6% lower than the 2017/2018 fiscal year’s target of Kshs 297.6 bn, which may result in reduced pressure on domestic borrowing. With the rate cap still in place, we maintain our expectation of stability in the interest rate environment. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium-term fixed-income instruments

Market Performance

During the year, the Kenyan equities market was on a downward trend, with NASI, NSE 25 and NSE 20 declining by 18.0%, 17.1% and 23.7%, respectively. Since the peak in February 2015, NASI and NSE 20 are down 20.9% and 48.4%, respectively. The only large cap gainer during the year was Barclays Bank, which gained 14.1%, while the largest losers were East Africa Breweries (EABL), Bamburi Cement, Diamond Trust Bank (DTB), NIC Group and Safaricom, which lost 26.6%, 26.4%, 18.5%, 17.6% and 17.0% during the year, respectively. Key to note is that Safaricom continues to be a key part of Kenyan equities portfolios, accounting for 42.4% of Nairobi Stock Exchange (NSE’s) market capitalization, and has dominated on both the market turnover and in determining the direction of the market given its weight and liquidity in the Nairobi Securities Exchange.

Equity turnover during the year rose by 2.3% to USD 1,723.8 mn from USD 1,684.4 mn in FY’2017. Foreign investors turned net sellers with a net outflow of USD 425.6 mn compared to net outflows of USD 113.7 mn recorded in FY’2017. The foreign investor outflows during the year can be attributed to negative investor sentiment, as international investors exited the broader emerging markets due to the expectation of rising US interest rates, coupled with the strengthening US Dollar.

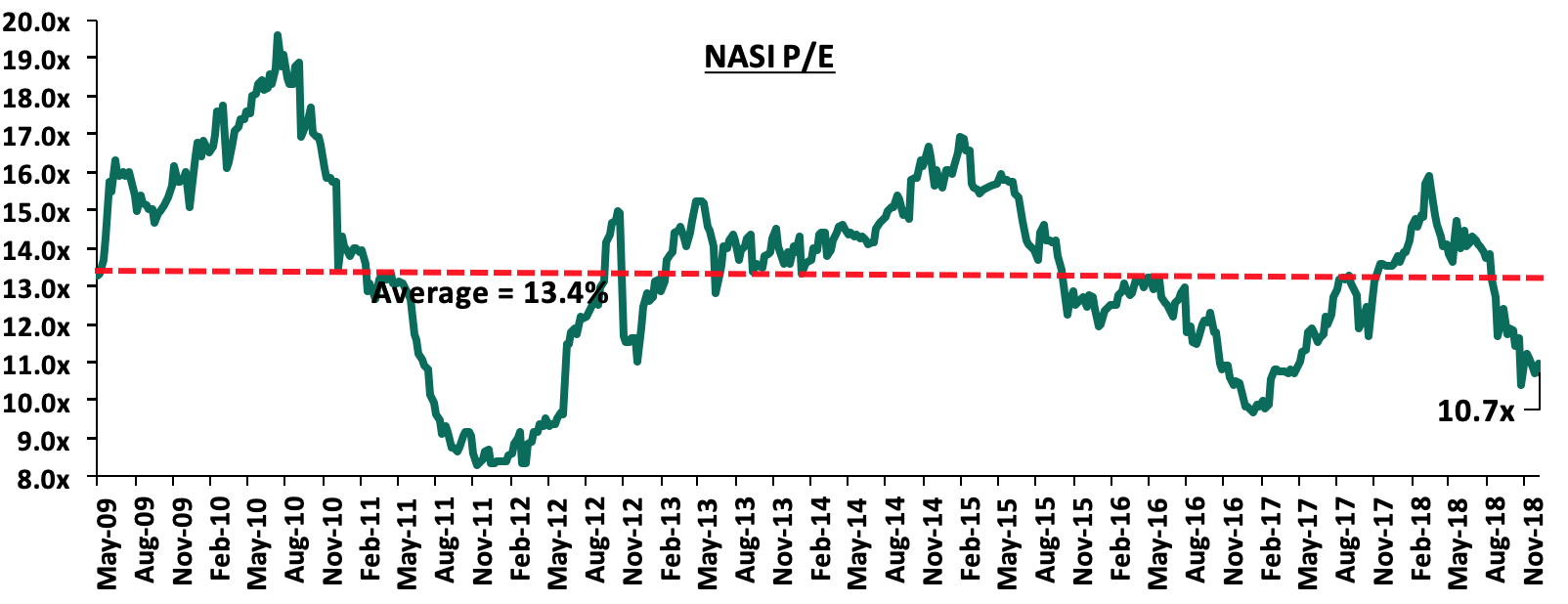

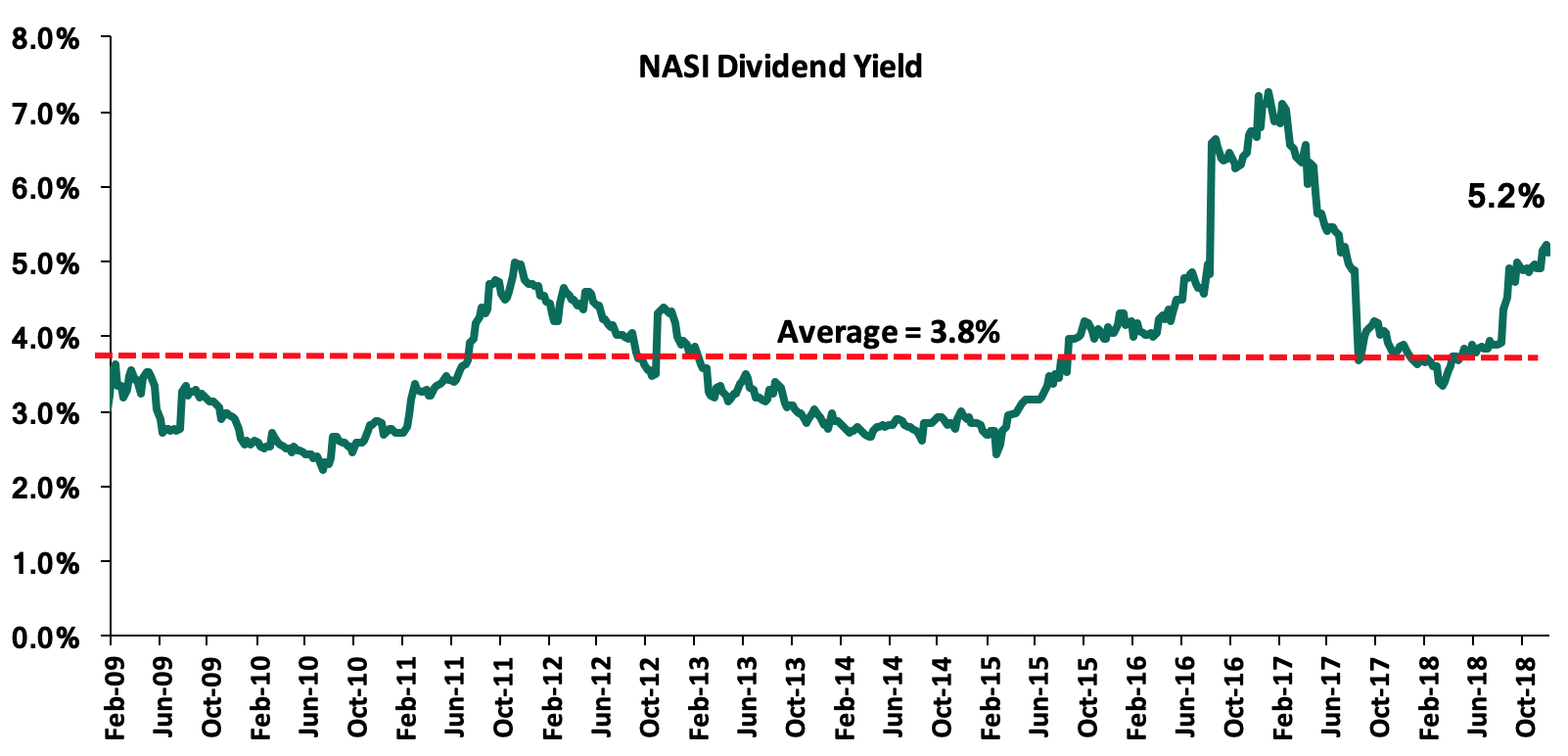

The market is currently trading at a price to earnings ratio (P/E) of 10.7x, 19.9% below the historical average of 13.4x, and a dividend yield of 5.2%, above the historical average of 3.8%. The current P/E valuation of 11.0x is 9.6% above the most recent trough valuation of 9.8x experienced in the first week of February 2017, and 29.2% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Banking Sector Earnings

During the year, Kenyan listed banks released their Q3’2018 results recording an average increase in core earnings per share of 16.2%, compared to an average decline of 9.3% in Q3’2017, owing to the improved efficiency because of digitization strategies employed by banks in streamlining operations. Only NIC Group and HF Group recorded a decline in core earnings per share, with NIC reporting a 3.3% decline while HF Group recorded a loss per share of Kshs 0.9 from a core EPS of 0.5 in Q3’2017. The table below highlights the performance of the banking sector using several metrics, and the key take-outs of the performance. The table below highlights the performance of the banking sector, showing the performance using several metrics, and they the key take-outs of the performance.

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income (NFI) Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth In Govt Securities |

CIR |

Loan Growth |

LDR |

Return on Average Equity |

|

NBK |

303.2% |

(10.5%) |

(11.5%) |

(10.0%) |

6.6% |

(16.3%) |

26.8% |

(18.7%) |

(4.7%) |

3.2% |

91.8% |

(17.1%) |

51.7% |

3.2% |

|

Stanbic Bank |

46.7% |

13.3% |

19.7% |

9.7% |

4.9% |

19.6% |

47.0% |

9.3% |

20.3% |

16.7% |

57.9% |

16.3% |

77.8% |

14.3% |

|

SCBK |

33.9% |

4.8% |

2.1% |

5.9% |

8.5% |

9.7% |

32.6% |

31.2% |

(8.0%) |

(6.1%) |

57.2% |

(2.8%) |

50.6% |

18.6% |

|

KCB Group |

19.7% |

5.1% |

16.0% |

1.8% |

8.5% |

2.6% |

33.1% |

(7.9%) |

6.2% |

15.3% |

52.8% |

3.8% |

82.6% |

21.7% |

|

I&M Holdings |

18.3% |

3.3% |

16.8% |

(4.9%) |

6.7% |

38.4% |

35.1% |

30.1% |

27.6% |

8.0% |

51.7% |

8.6% |

78.1% |

17.2% |

|

DTBK |

10.0% |

3.0% |

3.0% |

2.9% |

6.1% |

6.3% |

21.7% |

7.4% |

6.5% |

17.7% |

56.9% |

0.7% |

70.0% |

13.3% |

|

Co-op Bank |

8.2% |

3.5% |

0.7% |

4.7% |

8.3% |

4.3% |

32.7% |

(29.7%) |

2.5% |

16.9% |

55.1% |

(2.0%) |

85.9% |

17.6% |

|

Equity Group |

8.1% |

8.6% |

13.5% |

7.2% |

8.5% |

(6.7%) |

40.0% |

(1.7%) |

9.1% |

24.1% |

54.6% |

8.6% |

71.7% |

22.2% |

|

Barclays Bank |

2.0% |

7.7% |

30.1% |

2.1% |

9.1% |

14.0% |

30.8% |

5.5% |

9.9% |

29.5% |

65.9% |

6.7% |

81.0% |

16.5% |

|

NIC Group |

(3.3%) |

5.5% |

22.2% |

(5.9%) |

5.8% |

7.2% |

30.9% |

5.7% |

10.3% |

16.2% |

60.6% |

(3.1%) |

79.3% |

12.1% |

|

HF Group |

N/A |

(14.1%) |

(11.7%) |

(17.8%) |

4.6% |

(7.2%) |

25.0% |

(30.9%) |

3.1% |

429.5% |

113.5% |

(11.3%) |

90.7% |

(3.3%) |

|

Weighted Average Q3'2018* |

16.2% |

6.1% |

12.5% |

3.8% |

8.0% |

5.9% |

34.5% |

0.6% |

7.4% |

17.8% |

56.3% |

4.2% |

75.3% |

18.8% |

|

Weighted Average Q3'2017* |

(9.3%) |

(5.8%) |

(0.5%) |

(7.3%) |

8.5% |

10.9% |

33.3% |

10.5% |

13.8% |

10.3% |

59.4% |

6.1% |

77.7% |

17.5% |

*Market cap weighted as at 30th November 2018/2017 respectively

Key highlights from the table above include:

- Average deposit growth came in at 7.4%, weaker than the 13.8% growth recorded in Q3’2017. Despite the slower deposit growth, interest expenses increased by 12.5%, indicating banks have been mobilizing expensive deposits, as well as taking up borrowed funds from international financial institutions, thereby driving up the interest expense,

- Average loan growth was anemic at 4.2%, lower than 6.1% recorded in Q3’2017, indicating slower credit extension in the economy, due to sustained effects of the interest rate cap,

- Investment in government securities recorded a growth of 17.8% y/y, which was faster compared to the loan growth at 4.2%, and faster than 10.3% increase recorded in Q3’2017. This indicates that banks’ continued preference towards government securities, which offer better risk-adjusted returns,

- Non-funded Income grew by 5.9% y/y, slower than 10.9% recorded in Q3’2017. The growth in NFI was weighed down as total fee and commission growth was flat, growing by 0.6%, slower than the 10.5% growth recorded in Q3’2017. The growth in fee and commission income continued to be subdued by the slow loan growth, and,

- The average Net Interest Margin in the banking sector currently stands at 8.0%, down from the 8.5% recorded in Q3’2017, despite the Net Interest Income increasing by 3.8% y/y. The decline was mainly due to the faster 17.8% increase in allocation to relatively lower yielding government securities,

For a comprehensive analysis on the Kenya Listed Banks performance, see our Cytonn Q3’2018 Banking Sector Report

Other Key Results

Safaricom Limited released H1’2019 results, recording core earnings per share growth of 20.2% to Kshs 0.8 from Kshs 0.6 in H1’2018. The earnings growth was supported by a 7.7% growth in service revenue (M-PESA, messaging, mobile data and fixed service) to Kshs 118.2 bn from Kshs 109.7 bn in H1’2018 due to increased usage of non-voice services, particularly M-PESA services, coupled with a 3.5% decline in direct costs to Kshs 4.3 bn from Kshs 4.5 bn in H1’2018.

This year, 8 companies issued profit warnings to investors compared to 6 companies in 2017, despite the improving macro-economic environment in 2018. Companies are required to issue profit warnings if they project a more than 25% decline in profits year-on-year. They are namely Deacons, UAP Holdings, Bamburi, Sameer Africa, HF Group, Britam Holdings, KPLC and Sanlam:

- Bamburi attributed the shortfall in profits to difficult market conditions and escalating energy prices in Kenya and Uganda, as well as increasing costs of power in the country,

- UAP Holdings attributed the drop to dwindling investment income due to the poor performance of the equities market in H2’2018, coupled with low rental yields and occupancy rates on property in Kenya and South Sudan, leading to adverse valuations on property. The drop was also on the back of one-off redundancy costs associated with staff re-organisation efforts,

- Sameer Africa was affected by severe stock shortages due to production bottlenecks experienced by some its major offshore trading partners,

- In HF Group’s case, downward revisions of the Central Bank Rate (CBR) affected interest income, while a tough operating environment in 2017 occasioned a deterioration in asset quality, hence affecting business performance. The Group also undertook a redundancy exercise in tandem with implementation of its Digital Strategy, in which it incurred a one-off redundancy cost,

- Deacons, a fashion retailer, attributes its expected loss to reduced traffic to malls where 98% of its stores, due to non-performance of major anchor tenants such as Nakumatt, coupled with the loss of revenue arising from discontinued operations and diminished operating margins which have contributed to cash flow constraints,

- Britam’s expected decline is attributable to the downward equity markets trend that reduced returns from equity investments, and a challenging operating environment,

- KPLC attributed the expected decline in profits to a challenging economic environment, poor hydrological conditions and the protracted electioneering period in 2017,

- Sanlam attributes the expected decline in profits to the 100% impairment of Kshs 1.1 bn corporate bonds placed in currently distressed local enterprises as well as effects of the interest rate capping such as restricted access to bank credit

Listings, De-listings and Suspensions

On November 30, 2018, Rwandese firm BK Group Plc (Bank of Kigali) cross-listed its shares on the Nairobi Securities Exchange (NSE), becoming the first Rwandese company to tap into the Kenyan capital market. Established in 1966, BK Group is Rwanda’s largest lender in assets with operations across banking, insurance and investments. BK Group raised Kshs 7.0 bn from the exercise, which was to be used to capitalize subsidiaries in the bank’s expansion drive.

During the year, the Nairobi Securities Exchange (NSE) suspended the following companies from trading on the bourse:

- Deacons (East Africa), with the suspension period to last 40 days from November 19th 2018, following the invocation of the Insolvency Act as the company ran into financial distress, and,

- ARM Cement, effective August 30, 2018, following its placement under administration after it became insolvent and was unable to meet its obligations to creditors.

Legislations and other Developments

The year 2018 saw enactment of a number of legislations and other developments that affected the equities market and investor sentiment, namely:

- The National Assembly voted to retain the cap on loans in the Finance Act 2018, effectively retaining the 4.0% cap above the Central Bank Rate (CBR) on interest chargeable on loans. However, the 70.0% of the CBR floor on interest payable on deposits was scrapped, effectively enabling banks to reduce interest payable on customer deposits. With the removal of the same, banks have adjusted accordingly, with various players indicating a lowering of their interest expense requirements, and a possible improvement in the Net Interest Margin, whose benefits will be fully realized in 2019. Regulation in the sector centered on consumer protection and promoting prudence in the financial services sector,

- Draft Financial Markets Conduct Bill 2018: The National Treasury completed the Draft Financial Markets Conduct Bill that sought to create effective financial consumer protection, make credit more accessible and consequently support financial innovation and competition. The Bill’s main objectives thus are (i) to ensure better conduct by banks and other lenders in terms of extending credit to retail financial customers, and (ii) to provide consumer protection, mainly for retail customers by ensuring their credit contracts are clear and well understood in terms of interest, fees, charges and costs on credit facilities, thereby removing the opacity that has been existent in loan pricing. For more information, see our Draft Financial Markets Conduct Bill, 2018 Note ,

- Banking Sector Charter: The Central Bank of Kenya proposed to introduce a Banking Sector Charter that will guide service provision in the sector. The Charter aims to instill discipline in the banking sector in order to make it responsive to the needs of the banked population. It is expected to facilitate a market-driven transformation of the Kenyan banking sector, thereby considerably improving the quality of service provided, and increasing access to affordable financial services for the unbanked and under-served population,

- IFRS 9 Implementation: With the implementation of IFRS 9, which took effect from 1st January 2018, banks total capital position relative to their risk-weighted assets declined by an average of 0.4%. The implementation of IFRS 9 forced banks to review their business models, strategic objectives and credit policies. Thus, banks adopted stringent lending policies, and consequently skewed lending towards collateral based lending as opposed to unsecured lending. To avoid the high provisioning levels that would be required, banks unwillingness to lend to the private sector and more specifically to SMEs is likely to persist, and

- Large Cash Transactions Restrictions by Kenya Bankers Association: The KBA, in a circular, directed bank managers to ensure customers also provide supporting evidence for their source of cash when depositing and its use while withdrawing. Bank customers planning to withdraw or deposit Kshs 10.0 mn and above in cash will now be required to give a three-day notice and get clearance from their respective branch managers.

- The Nairobi Securities Exchange (NSE) launched Ibuka, an incubation and acceleration program aimed at addressing the recent lack of listings at the NSE. The program has attracted Expression of Interest from 13 companies including Tuskys Supermarket, while 10 other companies have shown a keen interest in participating. The program, in our view, is a great initiative that will go a long way in increasing the number of listings in the NSE as it will sensitize companies on the importance of listing and prepare them for the process.

- Kenya Commercial Bank (KCB) will acquire some prime Imperial Bank branches following a takeover of the collapsed lender’s loan book. Imperial Bank had 27 branches when it went into receivership. Financial details of the takeover are however yet to be made public. Depositors now have access to approximately 12.7% of deposit balances through KCB’s deposit recovery process, assisted by the Kenya Deposit Insurance Corporation (KDIC). Imperial Bank went in to receivership on October 13th, 2015, with Kshs 58.0 bn in customer deposits and 52,398 deposit accounts, and operations in Kenya and Uganda. We expect consolidation in the sector, as smaller banks with depleted capital positions and not serving a particular niche are acquired as their performance deteriorates due to the sustained effects of the Banking (Amendment) Act 2015.

In 2018, Kenya’s operating environment was characterized by improving macro-economic conditions owing to a recovery in agriculture due to improved rainfall as well as low inflation and improved investor confidence. However, despite the economic recovery in 2018, the market has slumped and brought the market P/E below its’ historical average of 13.4x to 10.7x, below the most recent peak of 15.9x in April, showing that pockets of value still exist. We remain neutral on equities for investors with short-term investment horizon, but are positive for investors with a long-term investment horizon.

During the year, private equity activity was high as evidenced by increased deal activity by local and global investors including Kuramo Capital, AfricInvest, and Goldman Sachs, among others. We highlight major Private Equity deals, Mergers and Acquisition, Quoted Private Equity and Fundraising deals under the Financial Services, Hospitality, Financial Technology (FinTech), Education, and Real Estate Sectors in 2018. We also highlight fundraising activities by Private Equity firms and key Private Equity reports in the year;

Financial Services Sector

Entry:

- Kuramo Capital, a New York based investment management firm focused on alternative investments in frontier and emerging markets acquired a stake of 90.9% in GenAfrica Asset Managers Ltd from the management and staff of GenAfrica Asset Managers and Centum Investments who held 17.5% and 73.4%, respectively. Kuramo earlier in the year also completed a transaction to acquire a minority stake in Kenyan investment bank, Sterling Capital, for an undisclosed amount. For more information, see our Cytonn Weekly #32/2018,

- Mauritius based SBM Holdings, a banking institution with headquarters in Port Louis, Mauritius, through its subsidiary SBM Kenya Limited, acquired certain assets and liabilities of Chase Bank. SBM Kenya, assumed 75% of the value of the deposits and took control of 62 branches and employees. SBM has injected Kshs 2.6 bn in Chase Bank and is planning to inject a further Kshs 6.0 bn to revive the bank. For more information, see our Cytonn Weekly #30/2018,

- AfricInvest, a private equity and venture capital firm based in Tunisia with a focus on agribusiness, financial services, healthcare, education and commercial sectors, completed a transaction to buy a 14.3% stake in Britam, a diversified financial services group that is listed on the Nairobi Securities Exchange, for Kshs 5.7 bn. For more information, see our Cytonn Weekly #21/2018. Following the transaction, Swiss Re, a reinsurance company based in Zurich, Switzerland, also acquired a 13.8% stake in Britam for Kshs 4.8 bn. For more information, see our Cytonn Weekly #24/2018,

- Old Mutual, a UK based international financial services group providing investment and savings, insurance, asset management and retirement solutions, increased its stake in UAP - Old Mutual Holdings from 60.7% to 66.7%, in a deal to purchase a 6.0% stake in UAP-Old Mutual for GBP 24.0 mn (Kshs 3.1 bn) from Chairman Joe Wanjui and Director James Muguiyi. For more information, see our Cytonn Weekly #32/2018,

- Badoer Investments Limited, a Dubai-based investment firm, bought a 15.6% stake in Sumac Microfinance Bank for Kshs 100.0 mn (USD 1.0 mn). For more information, see our Cytonn Weekly #29/2018,

- European financial services company Allianz Group agreed to acquire 8.0% in African reinsurer Africa Re for EUR 69.0 mn (Kshs 8.14 bn), effectively valuing the firm at Kshs 101.8 bn (EUR 862.5 mn). For more information, see our Cytonn Weekly #23/2018, Sanlam Kenya, a financial services company, invested an additional Kshs 121.7 mn in equity in Sanlam General, formally Gateway Insurance. The investment, however, left their ownership unchanged at 67.6% as the minority shareholders also made an additional investment of Kshs 66.5 mn. For more information, see our Cytonn Weekly #19/2018, and,

- Fonds Européen de Financement Solidaire (Fefisol), a Luxembourg-based private equity (PE) firm, invested Kshs 100.0 mn in Kenya’s Musoni Microfinance Limited for an undisclosed stake. For more information, see our Cytonn Weekly #7/2018

See below the summary of acquisitions in the Financial Services sector;

|

No. |

Entity Acquired |

Acquirer |

Investment Type |

Investment Stake |

Investment Amount (Kshs bns) |

Date |

|

1. |

Sterling Capital |

Kuramo Capital |

Equity |

Undisclosed |

Undisclosed |

Jan-18 |

|

2. |

Musoni Microfinance LTD |

Fonds Européen de Financement Solidaire (Fefisol) |

Equity |

Undisclosed |

0.1 |

Feb-18 |

|

3. |

GenAfrica Asset Managers |

Kuramo Capital |

Equity |

90.8% |

Undisclosed |

Mar-18 |

|

4. |

Africa Re |

Allianz Group |

Equity |

8.0% |

8.1 |

May-18 |

|

5. |

Britam |

AfricInvest |

Equity |

14.3% |

5.7 |

May-18 |

|

6. |

UAP-Old Mutual Holdings |

Old Mutual |

Equity |

6.0% |

3.1 |

Jun-18 |

|

7. |

Britam |

Swiss Re |

Equity |

13.8% |

4.8 |

Jun-18 |

|

8. |

Sanlam General |

Sanlam Kenya |

Rights Issue |

N/A |

0.10% |

Jun-18 |

|

9. |

Sumac Microfinance Bank |

Badoer Investments Limited |

Equity |

15.6% |

0.1 |

Jul-18 |

|

10. |

Chase Bank |

SBM Kenya Limited |

Equity |

Undisclosed |

Undisclosed |

Jul-18 |

Exit:

- Filimbi Limited, an investment vehicle owned by Peter Munga and Jane Njuguna, sold 39.5 mn shares of Britam Holdings, a diversified financial services group with operations in Kenya, Tanzania, South Sudan, Uganda, Rwanda, Malawi and Mozambique. This reduced its stake in the investment company to 18.9 mn shares, worth Kshs 187.5 mn, at the current market price of Kshs 9.9 per share and representing 7.8% of shareholding, from 58.4 mn shares held previously. For more information, see our Cytonn Weekly #39/2018, and,

- Centum Investments exited its 33.0% stake in Platcorp Holdings Limited, the holding company of Platinum Credit, in two transactions. The first 8.0%, through a partial exit to an undisclosed investor for Kshs 432.0 mn, and the remaining 25.0% to Suzerain Investment Holdings Limited, for an undisclosed amount. The divestment from Platcorp is set to earn Centum about Kshs 1.3 bn, based on the stakes valuation in their 2017 annual report, 62.5% above their initial investment of Kshs 0.8 bn in December 2012. For more information, see our Cytonn Weekly #12/2018.

See below the summary of exits in the Financial Services sector;

|

No. |

Entity Exited |

Exiting Investor |

Investment Stake |

Exit Amount (Kshs bns) |

Date |

|

1. |

Platcorp Holdings Limited |

Centum Investments |

33.0% |

1.3 |

Mar-18 |

|

2. |

Britam |

Filimbi Limited |

1.6% |

0.4 |

Aug-18 |

Fundraising

- Sumac Microfinance Bank raised Kshs 534.9 mn in 2018 through debt comprising of Kshs 204.9 from US-based Social Investment Managers & Advisors, Kshs 153.0 mn from Mexican fund manager Triple Jump, Kshs 102.0 mn from the Regional MSME Investment Fund for Sub-Saharan Africa, Kshs 45.0 mn from the Development Bank of Kenya and Kshs 30.0 mn from the Micro Enterprise Support Programme Trust. For more information, see our Cytonn Weekly #29/2018,

- Musoni, a Kenyan microfinance institution, issued out Kshs 2.0 bn in debt notes with a tenor of 2-3-years and offering investors a chance to roll over funds instead of cashing in at maturity. The issue of the debt notes is to take place in four tranches of Kshs 500.0 mn each. For more information, see our Cytonn Weekly #26/2018, and,

- TransCentury, a Kenyan-based investment firm, with a focus in infrastructure, rolled over USD 3.5 mn (Kshs 360.2 mn) worth of short-term loans by 1-year. The loan was taken from Kuramo Capital, a New York-based investment management firm focused on alternative investments in frontier and emerging markets. For more information, see our Cytonn Weekly #44/2018.

See below the summary of fundraising in the Financial Services sector;

|

No. |

Funded Entity |

Investor |

Form of Funding |

Amount (Kshs bns) |

Date |

|

1. |

Musoni Microfinance Ltd |

Various Investors through debt notes |

Debt |

2.0 |

Feb-18 |

|

2. |

TransCentury |

Kuramo |

Debt Rollover |

0.3 |

Nov-18 |

|

3. |

Sumac Microfinance Bank |

Social Investment Managers & Advisors, Triple Jump, Regional MSME Investment Fund, Development Bank of Kenya and Micro Enterprise Support Programme Trust |

Debt |

0.5 |

Dec-18 |

Investors have continued to show interest in the financial services sector in 2018, motivated by attractive valuations, growth of financial inclusion and regulation that requires institutions to increase their capital requirements across the sector.

Hospitality Sector

Entry:

- South-African based private equity fund Uqalo invested Kshs 404.0 mn (USD 4.0 mn) to acquire an undisclosed stake in Kenyan fast food chain Big Square. For more information, see our Cytonn Weekly #10/2018, and,

- Emerging Capital Partners (ECP), a US based private equity firm has acquired a majority stake in Artcaffé Group, a Kenyan based hospitality chain. The stake acquired as well as the amount were undisclosed. For more information, see our Cytonn Weekly #49/2018.

See below the summary of acquisitions in the Hospitality sector:

|

No.. |

Entity Acquired |

Acquirer |

Investment Type |

Investment Stake |

Investment Amount (Kshs bns) |

Date |

|

1. |

Big Square |

Uqalo |

Equity |

Undisclosed |

0.4 |

Mar-18 |

|

2. |

Artcaffé Group |

Emerging Capital Partners (ECP) |

Equity |

Undisclosed |

Undisclosed |

Dec-18 |

The increased interest by investors in the hospitality sector in Kenya in 2018 was supported by (i) the growing middle class with increasing disposable income, and (ii) the continued growth of the sector in the country in the past years. The food and services sector produced a total of Kshs 16.2 bn in Gross Income in 2016, a 4.5% increase from Kshs 15.5 bn recorded in 2015.

Fintech Sector

Fundraising:

- Jumo, an emerging market technology start-up that offers credit to individuals, small businesses and banks through their mobile application, raised a total of USD 64.5 mn (Kshs 6.6 bn) in equity investments 2018. The investments was from various investors comprising of USD 12.5 mn (Kshs 1.3 bn) from London based Odey Asset Management and USD 52.0 mn from Goldman Sachs, Proparco (the private sector financing arm of the French Development Agency AFD), Finnfund, Vostok Emerging Finance, Gemcorp Capital and LeapFrog Investments. For more information, see our Cytonn Weekly #49/2018,

- BitPesa, a Kenyan digital currency exchange and payments company, secured USD 5.0 mn (Kshs 512.8 mn) in funding from Sompo Holdings, a Japanese insurance group for an undisclosed stake. For more information, see our Cytonn Monthly - November,

- PayPal Holdings Inc, a California-based technology company that offers digital and mobile payments solutions to customers worldwide, made a strategic investment in Tala, a California based financial technology start-up that lends to underserved consumers in emerging markets, for an undisclosed amount. Tala’s also raised Kshs 6.5 bn (USD 64.8 mn) in Series C financing, comprised of Kshs 5.0 bn (USD 49.9 mn) in equity funding and Kshs 1.5 bn (USD 15.0 mn) debt, led by Revolution Growth. For more information see our Cytonn Weekly #16/2018,

- German investment firm, GreenTec Capital Partners, invested an undisclosed amount for an undisclosed stake in Bismart Insurance, a Kenyan insurance aggregator start-up. Bismart also received seed capital of Kshs 1.0 mn (USD 10,000.0) from Standard Chartered’s Women in Tech Program. For more information, see our Cytonn Weekly #28/2018,

- Branch International, a mobile-based microfinance institution headquartered in California, with operations in Kenya, Tanzania and Nigeria, raised Kshs 350.0 mn (USD 3.5 mn) in capital investment based on its second issued commercial paper in the Kenyan market. Branch International also raised USD 70.0 mn (Kshs 7.2 bn) in Series B funding, which combined USD 50.0 mn (Kshs 5.1 bn) in debt and USD 20.0 mn (Kshs 2.0 bn) in equity. California-based Trinity Ventures led the funding round. Other investors include CreditEase Fintech Investment Fund, Victory Park, IFC, and Andreessen Horowitz. For more information, see our Cytonn Weekly #27/2018,

- Cellulant, a leading Pan-African digital payments service provider that prompts, collects, settles and reconciles payments in real time, raised Kshs 4.8 bn (USD 47.5 mn) in Series C funding from a consortium of investors led by: Texas Pacific Group (TPG) and Satya Capital, for an undisclosed stake. For more information, see our Cytonn Weekly #20/2018,

- Africa’s Talking, a Kenyan based mobile tech company that provides a platform for businesses and developers to integrate mobile communication and payment services to their applications raised a total of Kshs 860.0 mn (USD 8.6 mn). The investment was from Orange Digital Ventures along with Social Capital who invested a combined Kshs 260.0 mn (USD 2.6 mn) and the International Finance Corporation (IFC) who invested Kshs 600 mn (USD 6.0 mn) for an undisclosed stake. For more information, see our Cytonn Weekly #17/2018, and,

- Lendable, a FinTech platform based in Kenya and the US, secured a Kshs 45.3 mn (USD 0.45 mn) convertible grant from the Dutch Government’s Micro and Small Enterprise Fund (MASSIF), managed by FMO, the Dutch Development Bank. For more information, see our Cytonn Monthly – August 2018.

See below the summary of fundraising in the Fintech sector;

|

No. |

Funded Entity |

Investor |

Form of Funding |

Investment Amount (Kshs bns) |

Date |

|

1. |

Tala |

Revolution Growth |

Equity and Debt |

6.5 |

Apr-18 |

|

2. |

Branch International |

Trinity Ventures, CreditEase Fintech Investment Fund, Victory Park, IFC, and Andreessen Horowitz |

Equity and Debt |

7.2 |

Apr-18 |

|

3. |

Africa’s Talking |

Orange Digital Ventures ,Social Capital and International Finance Corporation (IFC) |

Equity |

0.9 |

Apr-18 |

|

4. |

Cellulant |

Texas Pacific Group (TPG) and Satya Capital |

Equity |

4.8 |

May-18 |

|

5. |

Bitpesa |

Sompo Holdings |

Equity |

0.5 |

Jun-18 |

|

6. |

Bismart Insurance |

GreenTec Capital Partners |

Equity |

Undisclosed |

Jul-18 |

|

7. |

Branch International |

Commercial Paper |

Debt |

0.4 |

Jul-18 |

|

8. |

Lendable |

Netherlands Development Finance Company |

Convertible Debt |

0.05 |

Aug-18 |

|

9. |

Jumo |

Odey Asset Management, Goldman Sachs, Proparco, Finnfund, Vostok Emerging Finance, Gemcorp Capital and LeapFrog Investments |

Equity |

6.6 |

Sep-18 |

|

10. |

Tala |

Paypal |

Equity |

Undisclosed |

Oct-18 |

Fintech lending and Microfinance institutions in general have been a major attraction for investors in Kenya and Sub-Saharan Africa. Lack of access to finance is a major issue for entrepreneurs and MSMEs across Africa. According to the IMF, there are 44.2 mn MSMEs in Sub-Saharan Africa with a potential demand for USD 404.0 bn in financing. The current volume of financing in Sub-Saharan Africa is estimated at USD 70.0 bn signifying a huge financing gap of USD 331.0 bn. Microfinance institutions and Fintech companies aim to bridge this gap by offering convenient access to credit.

Education Sector

Entry:

- Fanisi Capital, a private equity and venture capital firm that focuses on healthcare, education, consumer goods, and agriculture, agreed to invest Kshs 400.0 mn in Kitengela International School (KISC), with an initial injection of Kshs 205.0 mn for an undisclosed stake. For more information, see our Cytonn Weekly #35/2018, and,

- Kenya Based Makini School Limited was acquired through a Joint Venture between Schole (Mauritius) Limited, a subsidiary of Schole Limited, which is a London-based education provider, Caerus Capital, a leading international education consultancy group, and Advtech Group for ZAR 184.2 mn (Kshs 1.5 bn) for a 100% stake. For more information, see our Cytonn Weekly #34/2018.

See below the summary of acquisitions in the Education sector;

|

Acquirer |

Entity Acquired |

Investment Type |

Investment Stake |

Investment Amount (Kshs bns) |

Date |

|

Schole Limited, Caerus Capital, and Advtech Group |

Makini School Limited |

Equity |