Feb 27, 2022

In 2020, we released a topical named ‘Student Housing Market in Kenya’ where we explained the concept of student housing, surveyed the market and gave recommendations on investment opportunity in the asset class. Student housing or purpose-built student accommodation (PBSA), refers to housing that has been designed specifically to meet the demands and requirements of the modern-day student. Most student housing facilities range from studios to flats with a cluster of up to eight rooms sharing living quarters. It also comprises of shared social spaces which provide amenities such as cable TV, laundry facilities and even organized social events, with others also offering gym facilities. Most of these facilities and amenities are positioned in central locations and with all-inclusive rents hence making PBSA popular to students. The concept has continued to gain traction globally, and in Kenya, its niche in the market is evidenced by the high investor appetite which has supported launch of numerous student housing developments, especially in areas surrounding institutions of higher learning.

This week we updated our research on the student housing market in the Nairobi Metropolitan Area with the aim of evaluating the market performance and offering recommendation on investment opportunity by covering;

- Global Overview of Student Housing,

- Student Housing in Kenya,

- Nairobi Metropolitan Area (NMA) Student Housing Market Performance,

- Recommendation, and,

- Conclusion

Section I: Global Overview of Student Housing

The growth of student housing has generally been driven by the increasing number of student enrollment against the backdrop of limited supply. The development of the sector has been in line with the globalization of higher education, supported by migration and international student numbers increasing in key developed countries such as the United Kingdom (UK) and the United States of America (USA). With this, other markets have recognized the importance of student housing in bridging the demand-supply gap while fueling domestic economic growth through returns. Most universities have initiated national internationalization programs and improved the marketing of their universities to attract and cater for international students who are the best potential clients for PBSA.

The United States of America (USA), for example, has a capacity of approximately 2.8 mn beds in private purpose-built student housing units against a university enrollment of approximately 20.0 mn students with a demand of 8.5 mn beds from students who prefer to live off-campus. Additionally, according to Savills, a global Real Estate services provider, the US is the largest inbound market for international students at about 1.0 mn which further necessitates the need for investment in student housing. This continues to drive the need to invest in student housing facilities to accommodate the growing number of international students.

In the United Kingdom (UK), more than 728,000 students applied to start a full-time undergraduate course at UK universities for the 2020/21 academic year. However, the approximate bed capacity stood at approximately 600,000 beds according to Knight Frank. Further, the UK is the world’s second most popular destination for international students, who are much more likely to live in PBSA than domestic students. As for the Australian student housing market which is placed third in terms of hosting international students, student bed capacity stood at 109,000 against a university enrollment of approximately 1.6 mn students as at 2020.

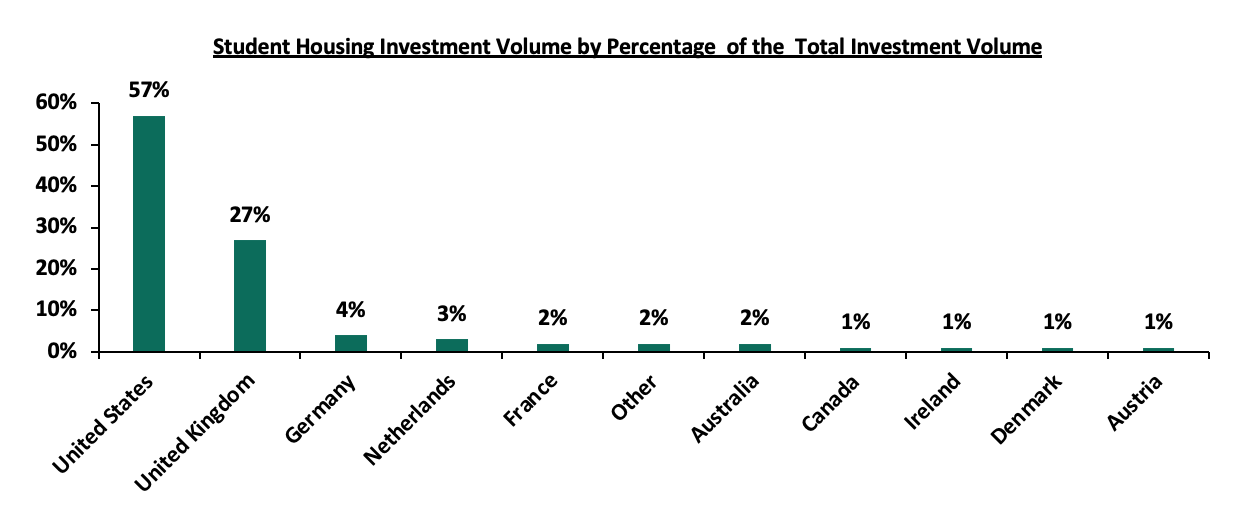

With demand outweighing supply, investment in student housing has taken shape with the global student housing investment volume totalling USD 18.0 bn (Kshs 2.0 tn) as at 2019 and the breakdown is as shown in the graph below;

Source: Knight Frank; Online Sources

Major institutional investors in the student housing market include sovereign wealth funds (SWF), pension funds, insurance funds, as well as large-scale Real Estate developers. The most common methods of investing include buying properties to earn rental income whereas others invest in Real Estate Investment Trusts (REITs) that own student accommodation.

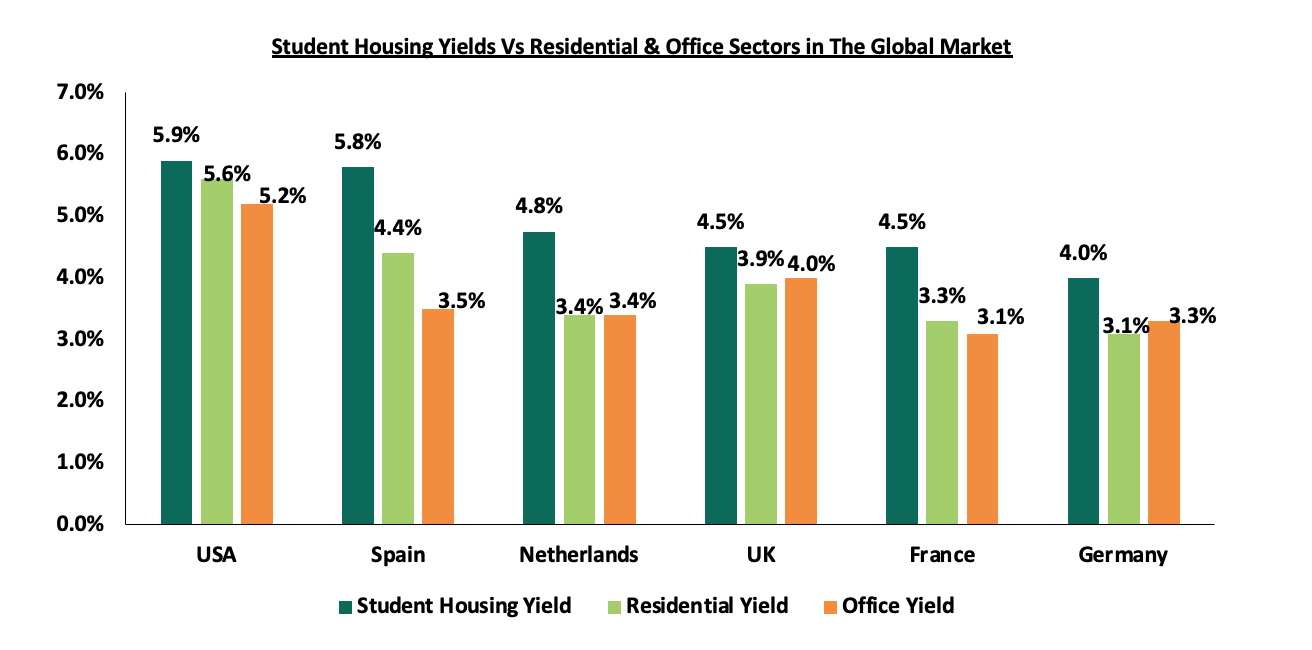

In terms of returns, according to Savills, the sub-sector registered relatively high returns surpassing other Real Estate classes such as conventional residential and commercial sectors.

Source: Savills UK

In the Sub-Saharan Africa region, South Africa is a leader in the provision of higher education in Africa. Its universities are consistently ranked among the best in Africa. This recognition has resulted in strong demand from domestic, regional and international students. According to the International Finance Corporation, in 2020, the number of students enrolled at public and private universities in South Africa was estimated to be 1.2 mn students. However, as of 2020, there were approximately 223,000 purpose-built student beds available in South Africa for public universities and TVET college students. Given a bed-to-student provision ratio of 68.0%, there is an estimated supply-demand gap of approximately 600,000 beds. With enrollments set to grow to almost 1.6 million by 2025, this demand gap is set to grow to around 781,000 beds by 2025. These, coupled with population growth in the youth segment, government funding for post-school education, and household income growth have fueled demand for student housing in the county.

South Africa is considered to have the most mature PBSA market in Africa followed by Kenya and Nigeria. When compared to mature markets such as the United Kingdom, it is clear that African markets are lagging behind in terms of tertiary enrolment rates. However, even though these enrolment rates are lower compared to the United Kingdom, it is to be noted that the African markets have a comparatively larger student population, which in turn drives demand in the PBSA market. As African markets start to mature, it is reasonable to expect that the student population will continue to grow as more students are able to afford to enroll in institutions of higher learning, which will further drive the need for PBSA on the continent.

The table below shows comparison of key student housing markets in Africa compared to the UK;

|

Comparison of Student Housing Markets-2020 |

|||||

|

# |

Typology |

United Kingdom |

South Africa |

Kenya |

Nigeria |

|

Country Population |

66.3 mn |

58.6 mn |

52.6 mn |

201.0 mn |

|

|

Tertiary Enrolment Rates |

61.4% |

22.4% |

11.5% |

10.2% |

|

|

Student Population (2018) |

1,840,000 |

2,160,000 |

995,000 |

2,040,000 |

|

|

PBSA Stock (No. of Beds) |

651,000 |

223,110 |

41,400 |

- |

|

|

Average Rental Prices* (USD per bed per month) |

Studio/Single Room |

1,771 - 1,994 |

320 |

149 |

149 |

|

Bed in double room |

N/A |

286 |

76 – 142 |

67 |

|

|

Bed in 3+ room |

N/A |

199 |

60 – 128 |

42 |

|

|

Old University Stock |

639-879 |

- |

10-50 |

- |

|

|

Occupancy Rates |

98% |

95-100% |

98 - 99% |

98% |

|

|

Maturity of PBSA Markets |

Emerging |

Emerging |

Nascent but Emerging |

Nascent |

|

Source: JLL

Other factors driving growth of student housing include;

- Attractive Returns - According to Savills, a UK-based Real Estate services provider, student housing in the UK and the US delivered average rental yields of 4.5% and 5.9%, respectively, compared to the residential theme which delivered 3.9% and 5.6%, respectively, while the commercial office theme delivered 4.0% and 5.2% respectively. The trend of student housing delivering relatively high returns cuts across most countries and as such, the sector continues to attract high net-worth investors seeking strong returns on their investment,

- Hedge Against Economic Headwinds - Student housing has proven to be resilient especially during economic downturns such as the one caused by the COVID-19 pandemic, as well as the usual Real Estate cycles where yields may be affected by the economic environment. This is as student enrolment increases every year despite the prevailing economic climate, and even tends to spike during economic downturns as more people seek to diversify their skillsets,

- Expanding Middle Class – With the global rise of the middle class, the growth in disposable incomes has led to student mobility as more people seeking quality higher education can access it, hence creating a ready market for student housing, and,

- Need to Cater for International Students - The development of student housing has gone hand in hand with the globalization of higher education. As migration and international student numbers have become hot topics in the UK and US, other markets have recognized their importance as a tool to fuel domestic economic growth. They have initiated national internationalization programs and improved the marketing of their universities to attract international students and provide them with an exceptional student experience through modern Purpose Built Student Housing (PBSA).

Section II: Student Housing in Kenya

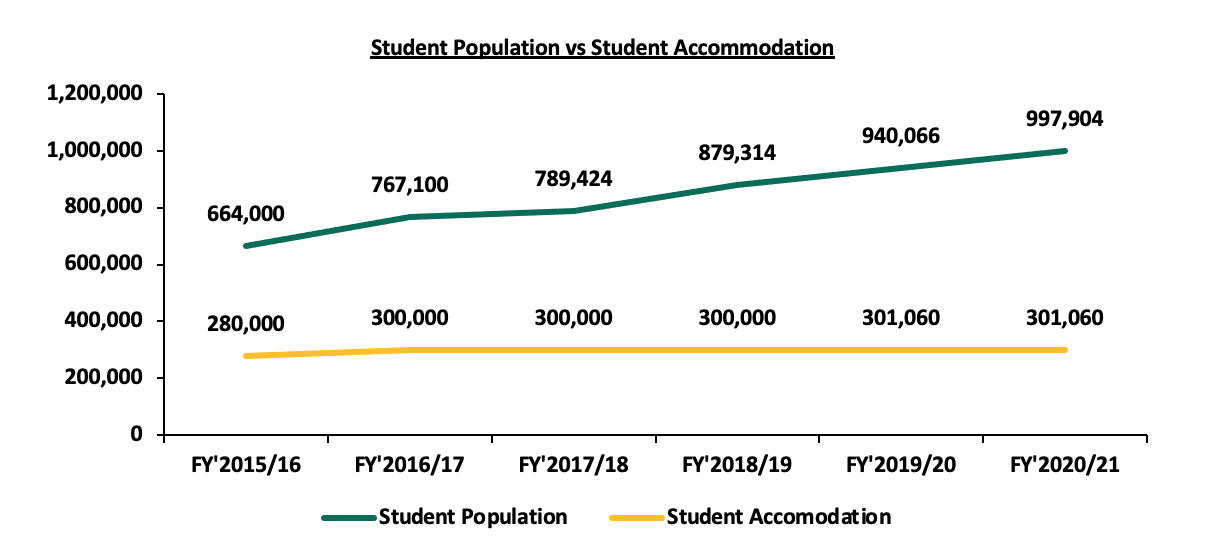

With Kenya being an emerging market for student housing, the concept has continued to gain traction by attracting private sector developers, investors, and operators. With the current available stock at 301,060, the student housing gap has attracted private sector participation to increase supply in order to cater to student preferences. Some of the factors that have driven demand for student housing in Kenya;

- Rapidly Growing Student Population: According to Kenya National Bureau of Statics (KNBS) 2021 Economic Survey, the student population in universities and vocational centres stood at 997,904 in FY’2020/21 from 664,000 in FY’2014/15. This represented a 5-yr CAGR of 8.5%, further expanding the student housing deficit by approximately 60,000 units. The numbers are set to increase as the university/college age demographic continues to grow. According to the 2019 population and housing census data, the number of individuals between 18-24 year who mostly represents university and vocational entry students was 6.4 mn, representing 13.4% of the total Kenyan population of 47.6 mn. The graph below shows the student population Vs the available student accommodation between 2015-2020;

Source: KNBS, Online Sources

- Increase in Tertiary Institutions: According to the KNBS, the overall number of Technical and Vocational Education and Training (TVET) institutions increased by 7.5% to 2,301 in 2020, from 2,140 in 2019. This increase especially in satellite branches is supported by government policy to increase the number of higher learning institutions to accommodate the growing student population that necessitates investment in student accommodation,

- Public Policy: Government measures such as scrapping visa requirements for other African countries is a boost for enrolment of international students to local institutions. In addition, the Kenya National Qualifications Authority has become more aggressive in fast-tracking recognition and equating of qualifications obtained from different countries, and the verification of certificates to ensure that they were genuine. To make Kenya more attractive, KNQA has planned to include upgrading accommodation facilities, setting out clearly defined academic calendars, and establishing international student directorates to assist learners. These will result in greater demand for quality student housing.

A few private sector players have taken interest in the concept of student housing, with institutional investors focusing their investment grade portfolio within Nairobi County. The key market players as shown below;

|

Purpose-Built Student Housing Investors in Kenya |

|||||

|

Key Players |

Type |

Brand |

Investment Areas |

Portfolio |

Expected Incoming Supply |

|

Acorn/Helios |

Joint Venture |

Qwetu/Qejani |

Ruaraka, Madaraka, Parklands, Jogoo Road, Thika Road, Hurlingham |

3,000 |

50,000 |

|

Century Developments Ltd/Kuramo |

Joint Venture |

- |

Nairobi County |

- |

10,000 |

|

Student Factory Africa/ Betonbouw B |

Joint Venture |

Student Village |

Karen |

- |

4500 |

|

Questworks |

Developer |

Parallelfour |

Madaraka |

<200 |

800 |

|

Defoca (Kenya Defense Forces Old Comrades Association) |

Owner |

Kafoca Studyville |

Madaraka |

500 |

- |

|

Total |

3,700 |

65,200 |

|||

Online Research

Incoming supply of student housing over the past 2 years has been limited by the COVID-19 pandemic which presumably slowed down the investment volumes and brought about the trend of online-learning which further limited demand for student accommodation. However, as vaccination programs accelerate to manage spread of the virus, the market has witnessed growing investor confidence and initiative in unlocking growth opportunities. One of the major trends that have been witnessed in the Kenyan market is Acorn Holding’s listing their development REIT (D-REIT) and income REIT (I-REIT) at the Nairobi Stock Exchange at a cost of Kshs 7.5 bn in February 2021. The REITs have been trading on the Unquoted Securities Platform (USP), which was launched in December 2020, with Acorn aiming to tap into Kenya’s capital market raise funds for growing its capacity in student hostels.

Despite the factors driving demand, supply of student housing continues to lag behind owing to the notion that provision of student accommodation is the role of the institutions of higher learning. The shortage of purpose-built student accommodation is further attributable to:

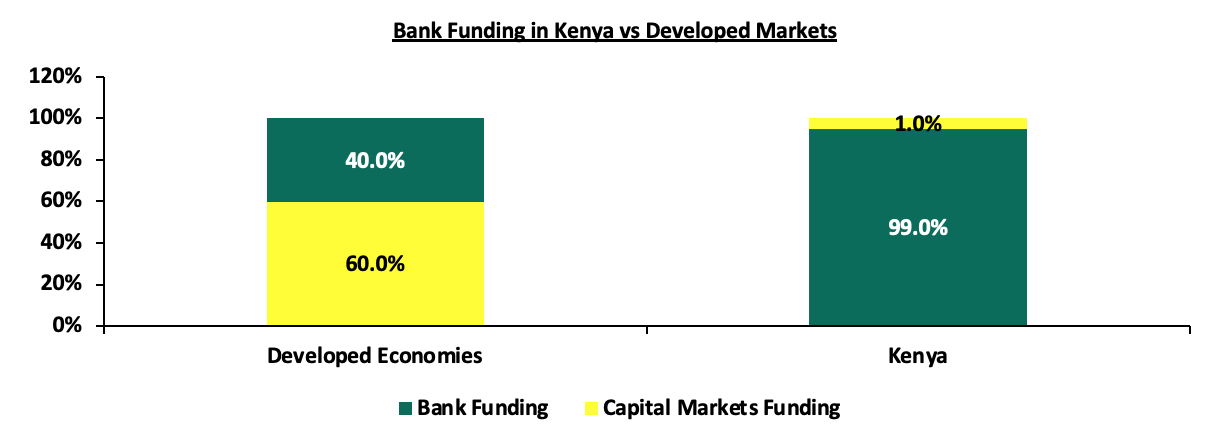

- Insufficient Access to Funding - Unlike in the developed markets where investors can easily secure debt and equity financing, obtaining financing for local developers has been difficult due to reluctance of lending institutions to finance such private developers and therefore apply strict underwriting standards. Additionally, the local capital markets, which can be a source of long-term funding remains relatively undeveloped. For instance, in Kenya, the capital markets contribute a mere 1.0% of Real Estate funding while banks contribute 99.0%, compared to 60.0% and 40.0% respectively in developed countries. The chart below compares bank funding in Kenya and capital markets,

Source: World Bank

- Ineffectiveness of Public-Private Partnerships (PPPs) - Public-private partnerships (PPPs) in Kenya face challenges such as; i) difficulties in managing the multi-stakeholder nature of most of the PPP projects, ii) lack of appropriate legal frameworks in Kenya to enable transfer of public land into special purpose vehicles to be able to attract private capital and bank debt, and, iii) the extended time-frame of PPPs while private developers prefer to exit projects within 3-5 years. The PPP hostel projects have a design, build, own, operate and transfer model, where the developers will recoup their return after an approximate 20-year period and this is unattractive to investors who prefer to exit early,

- High Land Costs - Land in urban areas in Kenya has continued to soar, driven by demand for development class land which has also led to its shortage, especially in Nairobi, where the price per acre averages Kshs 134.8 mn as at 2021, according to Cytonn Research, and,

- Inadequate Expertise - Purpose-built student housing accommodation requires high development and management expertise, which the majority of developers lack capacity for hence making them shy away from investment in the sector.

Section IV: Nairobi Metropolitan Area (NMA) Student Housing Market Performance

We conducted research and analysed data of 10 areas in the NMA namely; Parklands, Madaraka, Ruiru, Kahawa Sukari, Thome, Juja, Rongai, Athi River, Karen, and Thika. The student housing market in Kenya comprises of studio units and shared units of up to 8 beds with the most stock of shared spaces being that of 2 beds in a unit. These facilities have continued to offer amenities such as tuck shops, back-up generators, CCTV and 24/7 security teams, secure biometric access, common rooms with DSTV, gyms, and game rooms, laundry machines, separate study rooms, and some even offer shuttle services. The rents for PBSA range from Kshs 10,000 with the highest in the market currently being Kshs 34,000 per month.

In the overall performance, the student housing market recorded slight improvement in 2022, with the average rental yield coming in at 7.0%, a 0.1% marginal improvement from 6.9% recorded in 2020. The average rent per SQM increased by 18.3% to Kshs 505 in 2022, from Kshs 427 in 2020. However, the average occupancy rate registered at 1.7% points decline to 79.6% in 2022, from 81.4% in 2020. The table below gives a summary of the comparison in market performance between 2020 and 2022;

|

Comparison of Student Housing Performance in Nairobi Metropolitan Area (2020-2022) |

|||||||||

|

Number of Persons per Room |

Average Rent per SQM 2020 |

Average Rent per SQM 2022 |

∆ in % |

Average Occupancy 2020 |

Average Occupancy 2022 |

∆ in % Points |

Average Rental Yield 2020 |

Average Rental Yield 2022 |

∆ in % points |

|

1 |

637 |

690 |

8.4% |

76.8% |

80.4% |

3.6% |

11.7% |

11.3% |

(0.5%) |

|

2 |

457 |

526 |

15.1% |

81.2% |

81.6% |

0.4% |

8.9% |

8.7% |

(0.2%) |

|

4 |

345 |

445 |

29.0% |

81.0% |

77.9% |

(3.1%) |

6.7% |

7.1% |

0.3% |

|

6 |

270 |

357 |

32.5% |

86.5% |

78.7% |

(7.9%) |

5.6% |

5.7% |

0.1% |

|

Average |

427 |

505 |

18.1% |

81.4% |

79.6% |

(1.7%) |

*6.9% |

*7.0% |

0.1% |

|

|||||||||

The key take outs include;

- The relatively marginal improvement in 2022 was attributed to the COVID-19 pandemic that saw students shift to online learning hence reducing demand for student accommodation. However, as the economy reopened, landlords increased their rental rates in a bid to compensate for losses recorded in 2020 hence the relatively high rent per SQM at Kshs 505 in 2022. In comparison to other Real Estate themes, rent per SQM in student housing is in line with that of the residential sector which came in at Kshs 508 per SQM in 2021. However, it is relatively lower than that of the commercial office and retail sectors which came in at Kshs 93 per SQFT and Kshs 170 per SQFT, respectively in 2021,

- The rooms occupied by 1 person registered the highest rental yield at 11.3% in 2020. However, this represented 0.4% points decline from 11.7% recorded in 2020, and,

- 2-sharing rooms recorded the highest occupancy rate at 81.6% in 2022. On average, the private hostels charge Kshs 10,467 per month compared to university-let hostels, which charge a maximum of Kshs 3,000 per month.

We also analysed the data depending on the market segments, i.e upper mid-end markets, which tend to host private universities and the low mid-end and satellite towns which largely host mid-tier colleges and public universities. The upper mid-end segment remained the best performing as it generally attracts relatively higher rental rates that average at Kshs 622 per SQM in comparison to the low mid-end markets with Kshs 456 per SQM. In terms of rental yield, the upper mid end segment registered a 0.5% points increase in rental yield to 10.0% in 2022 from 9.5% in 2020. On the other hand, rental yield in the lower mid end segment remained unchanged at 7.5%, similar to 2020.

|

Nairobi Metropolitan Area Student Housing Summary 2022 |

|||||

|

Upper Mid-End Student Housing |

|||||

|

Area |

Average of Plinth Area |

Average of Rent 2022 |

Average of Rent per SQM 2022 |

Average Occupancy Rate 2022 |

Average Rental Yield |

|

Karen |

17 |

10,967 |

646 |

84.6% |

11.1% |

|

Thome |

25 |

16,278 |

657 |

78.9% |

10.5% |

|

Madaraka |

24 |

15,518 |

607 |

74.6% |

9.2% |

|

Parklands/Waiyaki Way |

21 |

12,038 |

577 |

78.2% |

9.2% |

|

Grand Total |

22 |

13,700 |

622 |

79.1% |

10.0% |

|

Lower Mid-End Student Housing |

|||||

|

Area |

Average of Plinth Area |

Average of Rent 2022 |

Average of Rent per SQM 2022 |

Average Occupancy Rate 2022 |

Average Rental Yield |

|

Rongai |

19 |

11,692 |

629 |

82.1% |

10.5% |

|

Kahawa Sukari/Wendani |

21 |

10,989 |

537 |

81.3% |

8.9% |

|

Ruiru |

19 |

9,471 |

517 |

78.6% |

8.3% |

|

Athi River |

25 |

8,458 |

388 |

86.8% |

6.9% |

|

Thika |

13 |

4,607 |

368 |

72.1% |

5.4% |

|

Juja |

14 |

4,133 |

297 |

87.9% |

5.3% |

|

Grand Total |

18 |

8,225 |

456 |

81.5% |

7.5% |

NB: The yields are calculated assuming an average development cost per SQM of Kshs 59,000 for purpose built student housing |

|||||

Source: Cytonn Research 2022

- Rental Rates – Thome and Karen Estates attracted the highest rent per SQM at Kshs 657 and Kshs 646, respectively. These areas host top tier private universities such as Catholic University of Eastern Africa and United States International University thus attracting students largely from the middle class and high-income families. Generally, the average monthly rental rates fluctuate based on location, the type of institutions targeted, which tend to warrant differences in terms of the quality of student housing and amenities expected by the students. Additionally, hostels within Nairobi County tend to charge higher than satellites owing to the relatively high land costs, which are passed onto the tenants,

- Amenities - Rental properties in the off-campus market offer a number of amenities, many of which are absent in on-campus housing. Three amenities that are available off-campus and almost non-existent on campus include; hot showers, wireless internet access and DSTV,

- Occupancy Rates – The low mid-end segment registered a higher average occupancy rate averaging 81.5% compared to upper mid-end areas with 79.1%. This is because the former tend to attract more student populations owing to their affordability with some opting to commute.

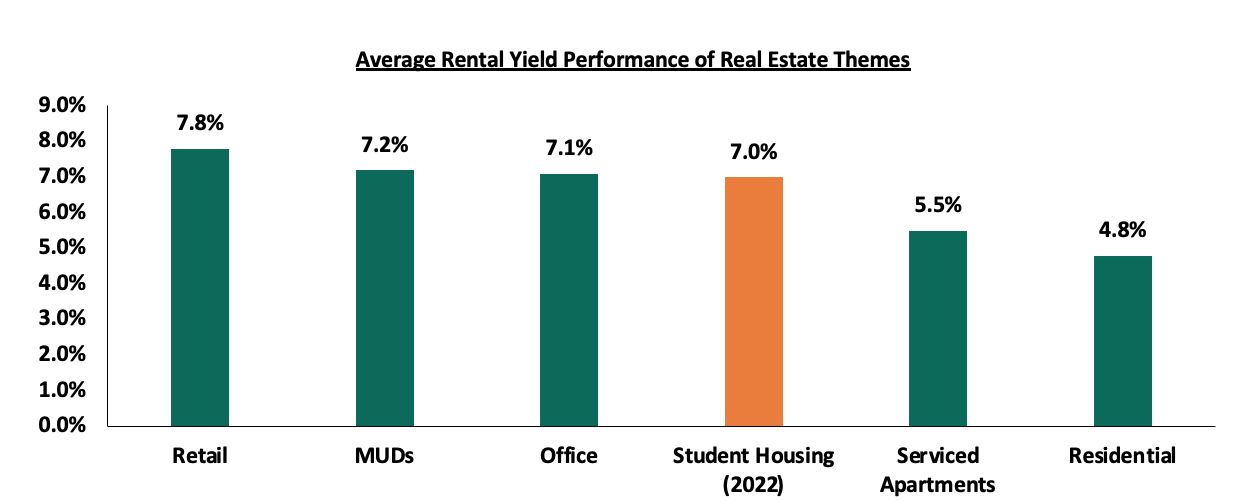

In comparison to other asset classes within the Real Estate sector, student housing posted a relatively high rental yield averaging 7.0% and surpassing serviced apartments and residential sectors which recorded 5.5% and 4.8% as at 2021, respectively, as shown below;

Source: Cytonn Research 2022

Section IV. Recommendation

For purpose-built student accommodation to be more attractive to students and enable investors benefit from high occupancy rates and consistent rental income, we recommend that investors should;

- Develop accommodation facilities that are in-line with international standards such as; i) high-quality finishes and amenities, ii) thoughtful and market-specific design, and iii) are located in close proximity to universities, ideally less than five minutes walking distance, and,

- Conduct thorough research to identify the niche markets.

Additionally, to support private sector participation in bridging the demand-supply gap in student housing, the government should;

- Remove Obstacles in the Capital Markets such as reducing minimum investments to reasonable amounts in order to access a wider pool of investors. Currently, the minimum investment for sector specific funds is Kshs 1.0 mn, while that for Development-Real Estate Investments Trusts (D-REIT) is currently at Kshs 5.0 mn hence crippling private sector’s participation in the development of student housing in Kenya, and,

- Reduce Bureaucracy and Regulatory Hindrances in the Working of PPPs by addressing such as, lack of a revenue sharing mechanism and lack of a mechanism to transfer public land to a Special Purpose Vehicle (SPV) to facilitate easier access to private sector funds through the use of the land as security.

Investment opportunities in Nairobi Metropolitan Area lies in markets such as Karen, Thome and Madaraka with relatively high rental yields of 11.1%, 10.5% and 9.2% attributed the areas hosting private universities in Kenya popular with international students, namely, United States International University (USIU) and Strathmore University, and as such, we expect that the region will continue to present a large gap for quality purpose-built accommodation.

Section V: Conclusion

With the continued development of PBSA and the increasing number of options available, coupled with amenities provided, students are increasingly choosing PBSA as their desired accommodation. PBSA is far better at catering to student’s needs which students are very much willing to pay for due to convenience and quality. It is clear that there is demand for student accommodation and PBSA is becoming more important and as such, we expect to witness more developments to cater for the rising number of student in institutions of higher learning. However, the trend towards online-learning due to the pandemic poses a challenge to the incoming supply of PBSA as this may reduce occupancy rates in the developments.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.