Analysis of new CMA guidelines to Collective Investments Schemes, & Cytonn Weekly #41/2020

By Research Team, Oct 11, 2020

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed, with the subscription rate coming in at 110.0%, up from 64.9% the previous week. The oversubscription is partly attributable to the favorable liquidity in the money markets as evidenced by the average interbank rate declining to 2.1% from 3.3% recorded the previous week. The highest subscription rate was in the 91-day paper, which came in at 186.5%, up from 154.7% recorded the previous week. The subscription for the 182-day paper fell to 39.3% from 40.6% in the previous week. The subscription for the 365-day paper rose to 150.1% from 53.34% recorded the previous week. During week Stanbic Bank released the Monthly Purchasing Managers’ Index (PMI) for September 2020, which came in at 56.3, up from the 53.0 seen in August 2020. The posting was up to its highest since April 2018, pointing towards strong improvement in the Kenyan private sector;

Equities

During the week, the equities market was on a downward trajectory, with NASI, NSE 25 and NSE 20 all recording losses of 0.1%, 0.5% and 0.8%, respectively, taking their YTD performance to losses of 15.8%, 21.3%, and 30.8%, for NASI, NSE 25 and NSE 20, respectively. The performance was mainly driven by losses recorded by large-cap stocks such as ABSA, BAT and Equity Group, which declined by 4.1%, 3.0% and 2.9%, respectively. During the week, ABSA disclosed that it would be offering unsecured loans to Micro, Small and Medium Enterprises (MSMEs) in a bid to support businesses recover from the effects emanating from the COVID-19 pandemic;

Real Estate

During the week, Big Square, a fast-food retail chain, opened its second branch outside Nairobi, in Eldoret, at Rupa’s Mall. The government of the United States of America, through the United States Agency for International Development (USAID), announced plans to inject approximately Kshs 750.0 mn into Kenya’s tourism sector in support of the tourism recovery efforts. Nairobi Metropolitan Services (NMS), announced that it is set to implement the new property valuation system that will determine the land rates within Nairobi County based on the market conditions, market value and rates. Acorn holdings, a real estate developer, announced the launch of an investor roadshow for its Acorn Students Accommodation (ASA), Real Estate Investment Trust (REIT), as it seeks to establish a D-Reit and an I-Reit with an expected Internal Rate of Return of 18.0%;

Focus of the Week

The Capital Markets Authority (CMA) recently published guidelines to Collective Investments Schemes on the valuation, performance measurement and reporting by Fund Managers. The guidelines are aimed at ensuring standardization of the sector as well as consistency across various market players in the sector for the ease of comparison. These new guidelines though a commendable move by the CMA, present various shortcomings and as such, we found it necessary to demystify the guidelines and give our view on what they mean to the fund managers and the CIS industry in general;

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.9%. To invest or withdraw, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.5% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- For Pension Scheme Trustees and members, we shall be having different industry players talk about matters affecting Pension Schemes and the pensions industry at large. Join us every Wednesday from 9:00 am to 11:00 am for in-depth discussions on matters pension;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills were oversubscribed, with the subscription rate coming in at 110.0%, up from 64.9% the previous week. The oversubscription is partly attributable to the favorable liquidity in the money markets as evidenced by the decline in the average interbank rate to 2.1% from 3.3%, recorded the previous week. The highest subscription rate was in the 91-day paper, which came in at 186.5%, up from 154.7% recorded the previous week. The subscription for the 182-day paper fell to 39.3% from 40.6% in the previous week, while that of the 365-day paper rose to 150.1% from 53.3% recorded the previous week. The yields on the 91-day, 182-day and 364-day papers rose marginally by 0.1% points, respectively, to 6.5%, 6.9% and 7.8%, from the 6.4%, 6.8% and 7.7% recorded the previous week. The acceptance rate increased to 93.9%, from 68.7% recorded the previous week, with the government accepting bids worth Kshs 24.8 bn out of the Kshs 26.4 bn worth of bids received.

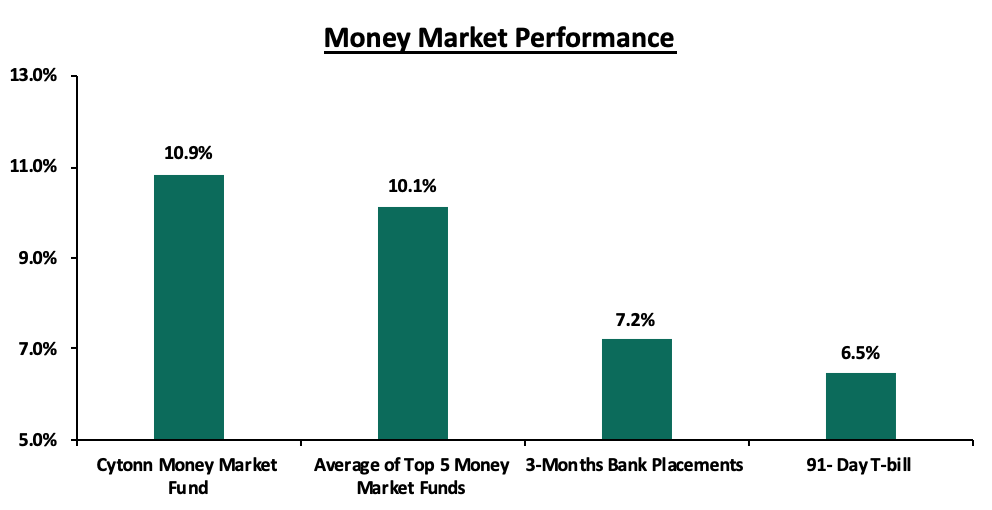

In the money markets, 3-month bank placements ended the week at 7.2% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased marginally to 6.5%, from 6.4% recorded the previous week. The average yield of the Top 5 Money Market Funds remained unchanged at 10.1%. The yield on the Cytonn Money Market increased by 0.3% points to close at 10.9%, from the 10.6% recorded the previous week.

Liquidity:

The money markets liquidity improved during the week, with the average interbank rate decreasing to 2.4%, from 3.5% recorded the previous week, mainly supported by government payments. The average interbank volumes declined by 22.0% to Kshs 8.0 bn, from Kshs 10.2 bn recorded the previous week. According to the Central Bank of Kenya, commercial banks’ excess reserves came in at Kshs 14.8 bn in relation to the 4.25% Cash Reserve Ratio.

Kenya Eurobonds:

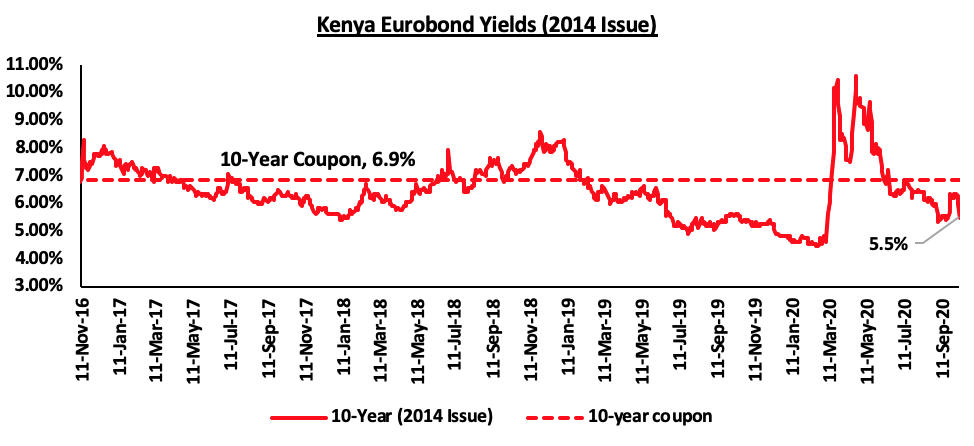

The yields on all Eurobonds decreased during the week, pointing to improved investor sentiment and the perception of reduced risk by foreign investors on the country’s outlook. During the week, according to Reuters, the yield on the 10-year Eurobond issued in June 2014 declined by 0.9% points to 5.5%, from 6.4% recorded the previous week.

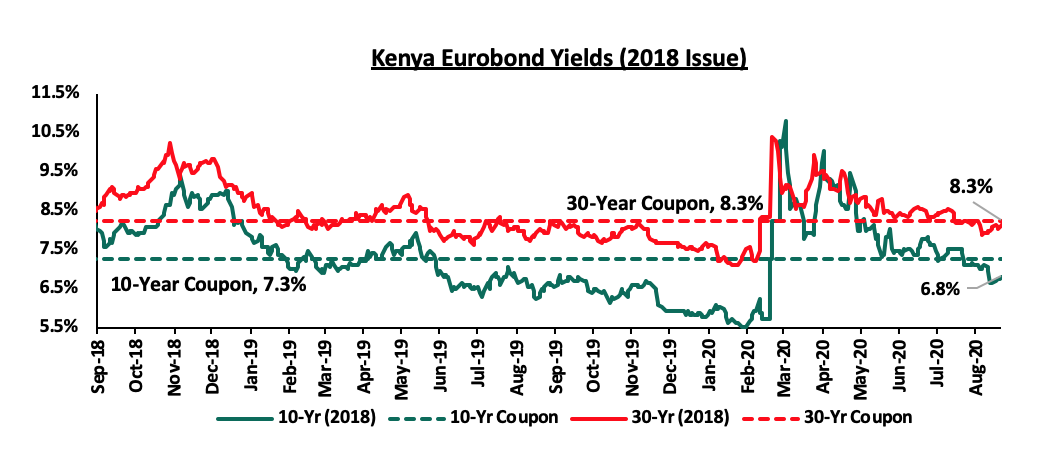

During the week, the yields on the 10-year and 30-year Eurobonds both declined by 0.6% points and 0.4% points, respectively, to close at 6.8% and 8.3%, respectively, from the 7.4% and 8.7% recorded the previous week.

During the week, the yields on the 7-year and 12-year Eurobonds both declined by 1.0% and 0.7%, respectively to close at 6.4% and 7.4%, from the 7.4% and 8.1% recorded the previous week.

Kenya Shilling:

During the week, the Kenyan shilling remained unchanged against the US dollar, to close at Kshs 108.5, similar to what was recorded the previous week. On an YTD basis, the shilling has depreciated by 7.1% against the dollar, in comparison to the 0.5% appreciation in 2019.

In the short term, the shilling is expected to be supported by:

- The high levels of forex reserves, currently at USD 8.5 mn (equivalent to 5.1-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover;

- Relatively strong Diaspora remittances that increased by 27.9% to USD 274.1 million in August compared to USD 214.3 million in August 2019, despite being 1.0% lower than the USD 277.0 million in July 2020, leading to the narrowing of the country’s current account deficit to 4.7% of GDP in the 12 months to August 2020, similar to the level in July.

Weekly Highlight

During week Stanbic Bank released the Monthly Purchasing Managers’ Index (PMI) for September 2020, which came in at 56.3, up from the 53.0 seen in August 2020. Notably, a reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. The posting was its highest since April 2018, pointing towards strong improvement in the Kenyan private sector. This comes as the government relaxed corona virus disease restrictions during the third quarter of the year. Firms saw expanded demand as foreign and domestic clients returned to the market. Output levels expanded at a sharp pace and sales grew strongest since January 2016. Consequently, the rising demand increased work backlogs, creating opportunities to hire new workers. This counteracted job cuts at other firms, amid efforts to reduce expenses. As such, employment was broadly level during the month, following a six-month run of declines. Input inflation cost softened but remained solid overall due to increased fuel and commodity prices. Despite the strong upturn and plans to raise investment into new markets, the general sentiment on the 12-month outlook is weak with few expecting continued expansion.

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the Central Bank as they reject expensive bids. The government is 51.3% ahead of its prorated borrowing target of Kshs 130.9 bn having borrowed Kshs 198.0 bn. In our view, the government will not be able to meet their revenue collection targets of Kshs 1.9 tn for FY’2020/2021 because of the current subdued economic performance in the country brought about by the spread of COVID-19, and therefore leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term to medium-term fixed income securities to reduce duration risk.

Market Performance

During the week, the equities market was on a downward trajectory, with NASI, NSE 25 and NSE 20 all recording losses of 0.1%, 0.5% and 0.8%, respectively, taking their YTD performance to losses of 15.8%, 21.3%, and 30.8%, for NASI, NSE 25 and NSE 20, respectively. The performance was mainly driven by losses recorded by large-cap stocks such as ABSA, BAT and Equity Group, which declined by 4.1%, 3.0% and 2.9%, respectively.

Equities turnover declined by 22.6% during the week to USD 10.9 mn, from USD 14.0 mn recorded the previous week, taking the YTD turnover to USD 1.2 bn. Foreign investors remained net sellers during the week, with a net selling position of USD 2.0 mn, from a net selling position of USD 2.8 mn recorded the previous week, taking the YTD net selling position to USD 259.2 mn.

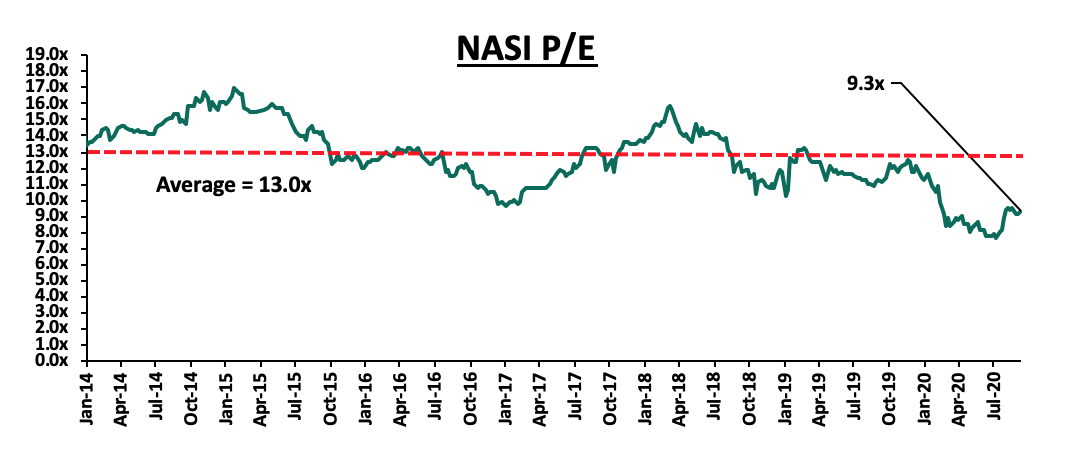

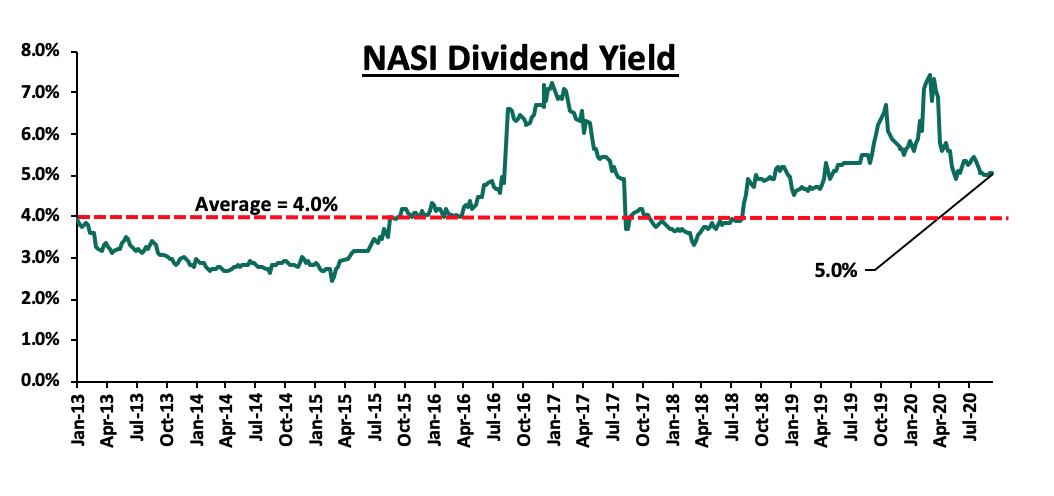

The market is currently trading at a price to earnings ratio (P/E) of 9.3x, 28.5% below the 11-year historical average of 13.0x. The average dividend yield is currently at 5.0%, unchanged from the previous week and 1.0% points above the historical average of 4.0%.

With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 9.3x is 20.6% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, ABSA disclosed that it would be offering unsecured loans to Micro, Small and Medium Enterprises (MSMEs) in a bid to support businesses recover from the effects emanating from the COVID-19 pandemic. The bank, through the recently launched ‘ABSA One Account’ will offer unsecured loans of up-to Kshs 10.0 mn to businesses and a maximum of Kshs 5.0 mn to individuals. This efforts by ABSA mirror the partnership seen earlier last week between Equity Group and Proparco, a French Development Finance Institution, whereby Equity disclosed that it would be issuing USD 100.0 mn (Kshs 108.5 bn) loans to support MSMEs affected by the pandemic in Kenya. The tough operating environment brought about by the pandemic has increased cash constraints by businesses and households with most businesses struggling to keep afloat due to the subdued revenues. The move by the two lenders to support the struggling private sector during this subdued operating environment is commendable. The Central Bank has been keen to cushion the economy from the pandemic through efforts such as reducing the Cash Reserve Ratio (CRR) to 4.25% from 5.25% in a bid to improve liquidity in the money market. However, despite these efforts, private sector growth has remained muted as banks shy away from lending due to the elevated credit risk. As such, we look forward to see whether these efforts by ABSA and Equity will be transmitted to the intended parties given that despite the CBK’s efforts, private sector credit growth has remained muted. Additionally, we believe that the banking sectors asset quality still remains a concern as most businesses continue to struggle to meet their loan repayment requirements further elevating credit risks.

Universe of Coverage:

|

Company |

Price at 02/10/2020 |

Price at 09/10/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank*** |

61.3 |

63.8 |

4.1% |

(41.5%) |

109.0 |

119.4 |

4.2% |

91.5% |

0.3x |

Buy |

|

Kenya Reinsurance |

2.4 |

2.4 |

(1.7%) |

(22.1%) |

3.0 |

4.0 |

4.7% |

74.2% |

0.2x |

Buy |

|

Sanlam |

12.5 |

12.0 |

(4.0%) |

(30.2%) |

17.2 |

18.4 |

0.0% |

53.3% |

1.2x |

Buy |

|

I&M Holdings*** |

43.6 |

43.6 |

0.1% |

(19.3%) |

54.0 |

57.8 |

5.8% |

38.4% |

0.7x |

Buy |

|

NCBA*** |

22.7 |

22.6 |

(0.2%) |

(38.7%) |

36.9 |

30.7 |

1.1% |

36.9% |

0.6x |

Buy |

|

Liberty Holdings |

7.6 |

7.3 |

(3.9%) |

(29.3%) |

10.4 |

9.8 |

0.0% |

33.9% |

0.6x |

Buy |

|

Equity Group*** |

36.0 |

34.9 |

(2.9%) |

(34.8%) |

53.5 |

44.5 |

5.7% |

33.2% |

0.9x |

Buy |

|

Co-op Bank*** |

11.7 |

11.5 |

(1.7%) |

(29.7%) |

16.4 |

14.2 |

8.7% |

32.2% |

0.8x |

Buy |

|

KCB Group*** |

38.5 |

38.1 |

(1.0%) |

(29.4%) |

54.0 |

46.4 |

9.2% |

31.0% |

0.8x |

Buy |

|

Standard Chartered*** |

161.0 |

161.5 |

0.3% |

(20.2%) |

202.5 |

197.2 |

7.7% |

29.8% |

1.2x |

Buy |

|

ABSA Bank*** |

9.8 |

9.4 |

(4.1%) |

(29.6%) |

13.4 |

10.8 |

11.7% |

26.6% |

1.2x |

Buy |

|

Jubilee Holdings |

291.8 |

270.0 |

(7.5%) |

(23.1%) |

351.0 |

313.8 |

3.3% |

19.5% |

0.5x |

Accumulate |

|

Britam |

7.4 |

7.8 |

4.6% |

(13.8%) |

9.0 |

8.6 |

3.2% |

14.0% |

0.8x |

Accumulate |

|

Stanbic Holdings |

80.0 |

83.8 |

4.7% |

(23.3%) |

109.3 |

84.9 |

8.4% |

9.8% |

0.6x |

Hold |

|

HF Group |

4.0 |

4.0 |

0.3% |

(38.1%) |

6.5 |

4.1 |

0.0% |

2.5% |

0.2x |

Lighten |

|

CIC Group |

2.2 |

2.4 |

9.1% |

(10.8%) |

2.7 |

2.1 |

0.0% |

(12.1%) |

0.7x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are banks in which Cytonn and/ or its affiliates are invested in |

||||||||||

We are “Neutral” on equities for investors because, despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim.

- Retail Sector

Big Square, a fast-food retail chain, opened its second branch outside Nairobi, in Eldoret at Rupa’s Mall, bringing the total number of stores operated by the retail chain to 12. Big Square has a total of 10 stores operating in Nairobi, and one in Mombasa. The move is part of the retailer’s strategy to increase its footprint country wide. Eldoret has remained an attractive investment area for retailers supported by; i) positive demographics with Eldoret having a population of 475,715 an increase by 64.4%, from 289,340 in 2009, ii) a growing middle class, iii) improving infrastructure, and, iv) availability of retail space with Uasin Gishu, where Eldoret is the main town, having a total retail supply of 0.9 mn SQFT as per Cytonn’s Kenya Retail Real Estate Sector Report 2019.

In terms of retail sector performance, Eldoret recorded an average rental yield of 7.9%, 0.9% higher than the market average of key towns in Kenya at 7.0%, as shown in the table below;

All Values in Kshs unless stated otherwise

|

Summary of 2019 Retail Performance in Key Urban Cities in Kenya |

|||

|

Region |

Rent 2019 |

Occupancy Rate 2019 |

Rental Yield 2019 |

|

Mt. Kenya |

129.8 |

80.0% |

8.6% |

|

Nairobi |

168.6 |

75.1% |

8.0% |

|

Eldoret |

131.0 |

82.3% |

7.9% |

|

Mombasa |

122.8 |

73.3% |

7.3% |

|

Kisumu |

96.9 |

75.8% |

5.6% |

|

Nakuru |

59.2 |

77.5% |

4.5% |

|

Average |

118.0 |

77.3% |

7.0% |

Source: Cytonn Research

We expect the continued expansion of both local retailers and international retailers such as Big Square, Carrefour and Naivas to cushion the performance of the Kenyan retail sector by taking up space left behind by struggling retailers such as Tuskys. The expansion will be supported; by i) improving infrastructure, ii) positive demographics with Kenya’s current urbanization and population growth rates at 4.0% and 2.2% against a global average of 1.9% and 1.1%, respectively, according to the World Bank, iii) changing tastes and preferences of consumers, and, iv) shifting consumer trends which have fuelled the entry of international retailers thus increasing demand for formal retail space. In spite of this, key factors likely to negatively impact the performance of the sector include; i) shifting focus to e-commerce thus affecting demand for physical retail spaces, ii) exit by some local and international retailers due to decline in revenues amid tough economic times, and, iii) the existing oversupply of approximately 2.8 SQFT of space as at 2019.

- Hospitality

During the week, the government of the United States of America, through the United States Agency for International Development (USAID), announced plans to inject approximately Kshs 750.0 mn into Kenya’s tourism sector in support of the tourism recovery efforts. The funds which will be disseminated in a three-year local works programme, will be used to support the local communities in the Mara Landscape, Northern, and Coastal areas of Kenya as they recover from loss of tourism and livelihoods as a result of the COVID-19 pandemic. The three year local works programme is also aimed at engaging Kenyan leaders and community members to design solutions that will attract and increase private sector investments and to economically empower the local communities, as well as, enhancing the capacity of community conservancies. The hospitality sector has been the hardest hit by the COVID-19 pandemic mainly because of its reliance on tourism and conferences. This is evident by the closure of most hospitality facilities, particularly major hotels after the onset of the COVID-19 pandemic. The sector has however witnessed steady recovery after lifting of the ban on travel to and from the country thus opening up to key tourism markets such as UK and USA. We expect the financial support through USAID will boost the recovery of the hospitality sector by easing the financial distress faced by local communities relying on the existence of tourism activities as a means of livelihood. This will also complement other government strategies such as the Ministry of Tourism Post-Corona recovery funds aimed at offering financial aid to hotel and other establishments in the hospitality industry through the Tourism Finance Corporation (TFC), repackaging of the tourism sector products to appeal to domestic tourists, and relaxation of travel advisories aiming at increasing the number of international tourist arrivals into the country, all aimed at supporting the recovery of the sector.

- Land

During the week, the Nairobi Metropolitan Services (NMS), announced that it is set to unveil the new property valuation system that will determine the land rates in Nairobi County based on the market conditions, market value and rates. The new Geographical Information Systems (GIS)-based mass valuation, will be rolled out in the 2020/2021 financial year at a cost of Kshs 160.0 mn as indicated in the Nairobi County Annual Development Plan. The new system is expected to increase the number of properties in the supplementary valuations by approximately 5,000 from 156,000 as at 2019. City hall has been relying on the 1980 valuation roll whose update has been long overdue. The new property valuation system is aimed at enabling the county to; (i) increase the number of parcels of land captured in the valuation roll by including parcels of land that may have been erroneously left out through the previously used manual method, (ii) reset land rates within the county based on market values, and (iii) easily track parcels of land whose land rates have not been paid thus easier debt collection. The expected increased efficiency in the collection of land rates through the help of the GIS system, will result in increased revenues to the county government which has previously reported losses of approximately Kshs 188.0 bn every financial year from uncollected land rates, according to the Commission on Revenue Allocation.

In our view, if successfully implemented, the new GIS based mass valuation system will; i) facilitate easier planning for development within the city, with land details being availed through the system, thus other institutions such as the Ministry of Transport, Infrastructure Housing, Urban Development and Public Works can use the information for planning, ii) streamline the revenue collection of land rates in Nairobi County as it will be easier to identify unpaid land rates through the system, and iii) promote equitable land rates valuation within Nairobi by mapping out land within the same area through the system. We expect the improved revenue collection to increase the county government’s financial capability to undertake infrastructural projects within the city such as improvement of roads, expansion of sewer and drainage systems thus improving property value, ease of access into areas for development thus boosting the real estate sector.

- Listed Real Estate

Acorn holdings, a real estate developer, announced the launch of an investor roadshow for its Acorn Students Accommodation (ASA) REIT with the aim of establishing a D-Reit and an I-Reit in the next 3 years with an expected Internal Rate of Return of 18.0%. The fund size for the two REITS is estimated at Kshs 4.0 bn for the D-Reit and Kshs 4.1 bn for the I-Reit in the initial fundraising. In their campaign, Acorn is seeking for investors to invest a total of 24.0% equity on the development of student accommodation D-Reit, and up to 67.0% in the I-Reit. So far the firm has secured Kshs 1.0 bn equity investment from one of its anchor investor, InfraCo, a private infrastructure development group. The development real estate investment trust (D-Reit) is expected to finance the student hostels whereas the Investment real estate investment trust (I-Reit) will be used to acquire property for rental income. Acorn has been exploring various financing options having issued a green bond in 2019 worth Kshs 5.0 bn. The green bond, which was cross-listed in Nairobi and London stock markets registered 85.0% subscription, raising Kshs 4.3 bn compared to the target of Kshs 5.0 bn as of October 2019.

The move be Acorn to issue a REIT indicates that developers continue to explore available structured financing options in the capital markets. Currently, there is heavy reliance on bank funding as opposed to funding from the capital markets, with 95.0% of business funding in Kenya being sourced from the banking industry and only 5.0% from the latter. Some of the key emerging structured financing options in real estate include; (i) real estate structured notes which may include project notes, real estate-backed medium term notes and other high yield loan notes, and, (ii) Real Estate Investment Trusts (REITS). In spite of this, the REIT market in Kenya has remained undeveloped with the Fusion Capital D-Reit, which was launched in 2016, having failed due to low subscription rates while the Cytonn D-REIT has faced delays in approvals by the Capital Markets Authority due to the limited number of approved trustees in the market. The poor performance of the D-REITs is attributed to the high minimum investment amounts set at Kshs 5.0 mn, high minimum capital requirement for a trustee at Kshs 100.0 mn, and, lengthy approval process. On the other hand, the only listed I-REIT, Fahari I-REIT is trading at a price of Kshs 5.4 as of 9th October 2020, a 73.0% drop from its issuance price of Kshs 20.0 in November 2015, and the poor performance is mainly attributed to potential investors’ lack of knowledge about the products, high fees for the REIT structure and low quality of assets in the REIT. Other challenges facing the REIT market include; lack of institutional development capacity as most of the real estate that is currently under development is not institutional-grade and thus does not have the capacity to take up specialized funding, and the sluggish growth in select sectors within the real estate market.

In our view, the move by Acorn to conduct an investors’ roadshow prior to launching the REITs is a noble way of mitigating against the current challenges facing the REITs market, through promoting the products’ awareness and enhancing investor confidence, and thus increasing the chances of the products’ success through anticipated uptake. In addition, the products are set to be focused on the student accommodation sector, which has continued to offer relatively high yields to investors at approximately 7.4% compared to other real estate sectors like the residential and Mixed-use developments which have an average rental yield of 5.0% and 7.3%, respectively as per the Cytonn Student Housing Market Kenya Research.

The real estate sector is expected to record activities supported by; i) expansion of local retailers, ii) channeling of funds to support the recovery of the hospitality sector, iii) the expected improvement in infrastructure within Nairobi County on account of increased revenue collection through land rates collection, and, iv) the exploring of alternative financing for real estate projects by developers.

The Capital Markets Authority (CMA) recently published guidelines to Collective Investments Schemes, (CIS), on the valuation, performance measurement and reporting by Fund Managers, highlighting that the guidelines would ensure the standardization of the sector as well as ensure the consistency of the information presented across the sector. The guidelines are a commendable move by the CMA as they will ensure the alignment of the market players and ease comparability across various players. However, they present various shortcomings such as: can the regulator determine the asset allocation for managers? And, do these guidelines override the fund managers trust deed? With this in mind, we found it necessary to demystify these guidelines and give our view on what they mean to fund managers and the CIS industry in general. In this week’s topical, we shall delve into the guidelines with a focus on the below;

- Governance of CIS and where the guidelines fit in,

- CMA Guidelines to CIS on the valuation, performance and reporting by Fund Managers,

- Impact and Emerging Issues in the sector,

- Recommendations on the improvement of the Capital Markets, and,

- Conclusion and our view going forward,

Section I: Governance of CIS and where the guidelines fit in

Collective Investment Schemes (CIS) are pools of funds that are managed on behalf of investors by fund managers. The amounts invested in the CIS are pooled and utilized by fund managers to buy stocks, bonds or other securities that are in accordance with the funds’ objective, with the aim of generating returns for their investors. In Kenya, Collective Investments Schemes are governed by the Capital Markets Authority (CMA) and are regulated under the Capital Markets Collective Investments Schemes Regulations, 2001. The governance structure of CIS’ is such that there are checks and balances to ensure investors’ capital and returns are protected. According to the regulations, to ensure the proper running of a CIS, it should have a Fund Manager, a Trustee; as well as a Custodian. The Fund Manager administers, manages and ensures that the funds from their investors are invested in accordance with the fund investment objective. A custodian is a company, usually a bank, approved by the Authority to hold in safe custody the funds/ assets of a collective investment scheme. Trustees on the other hand, ensure that the investors’ interests are protected at all times.

According to the CMA, these guidelines will be read together with the Collective Investments Schemes Regulations, 2001 and as such, we believe that these guidelines will provide a comprehensive guidance to fund managers on the effective management of investors’ funds.

Section II: CMA Guidelines to CIS on the Valuation, Performance and Reporting by Fund Managers

The guidelines, which will be effective 1st January 2021, are meant to encourage international best practice in the capital markets through standardization, thereby enhancing the comparability and consistency of the information presented across the sector. The same policies will indicate how performance is calculated, measured and presented, aside from identifying the methodology to be used for valuing each asset type. The guidelines touch on the operation of CIS, performance reporting, advertisement guidelines and returns calculation for the CIS among others.

- CIS Operations

Fund Managers are required to establish comprehensive and documented investments policy procedures that will govern the valuation of assets held in the CIS. The policy procedure which will be used to value each type of asset, should be consistent across all the funds managed by the Fund Manager. In the establishment of various funds, fund managers shall be guided by the following criteria:

- Money Market Funds – The fund shall invest only in interest bearing assets such as Fixed Deposits, Government Securities, Credit Rated Private Commercial Papers / Approved Public Commercial Papers, etc. with a maximum weighted average tenor of 13 months,

- Equity Fund - The fund shall invest a minimum of 60.0% of the Assets under Management (AUM) in the equities market. Funds not invested in the equities market shall be invested in cash and cash equivalents,

- Balanced Fund - The fund shall maintain a maximum exposure of 60.0% of the AUM in the investments done in the Money Market, Fixed Income and Equities asset classes. Additionally, the maximum exposure in any other asset class shall comply with the limits provided under Regulation 78 of the Capital Markets Regulations, 2001,

- Fixed Income Fund - The fund shall invest a minimum of 60.0% of the AUM in fixed income securities, and,

- Special Funds – The funds shall invest based on the Fund Managers’ investments strategy.

Key to note, the investments limits provided in Part VII / Regulation 78 of the CIS Regulations, 2001, specifically are not fund specific, however they limit the maximum investments exposure as below;

- Securities listed on a securities exchange in Kenya – 80.0%,

- Securities issued by the Government of Kenya – 80.0%,

- Other Collective Investments Schemes – 25.0%,

- Immovable Property – 25.0%,

- Any other security not listed on a securities exchange in Kenya – 25.0%, and,

- Off-shore Investments – 10.0%.

Consequently, the recently released guidelines have to be read together with the existing Regulation 78 and also likely inconsistent with fund specific constitutive documents, and may lead to confusion with regard to investment limits given there are now 3 different places to look.

- CIS Performance Reporting, Calculation and Valuation

Fund Managers shall be required to prepare and submit their performance reports to CMA quarterly and the report shall be submitted within 21 days after the end of each quarter. Additionally, the report shall be made available to the fund managers existing and prospective clients. When determining the total AUM, the fund manager will consider the aggregate fair value of the assets and ensure that the assets have not been double counted. According to the guidelines, should a fund manager choose to benchmark the fund’s returns, the report shall be inclusive of the description of the benchmark for instance its name and features. Additionally, the benchmark used shall be of the same type of return, same currency as the fund and the same period for which the returns have been reported. To put it to perspective, for instance, if the fund manager is reporting the performance of the Equity Fund portfolio, the benchmark used may either be the NASI, NSE 20 or NSE 25. In this case, given that Equity Funds primarily invests in the Equities Market, the benchmark used cannot be in the Fixed Income market such as the short term government papers given the variance in the returns and the investments made.

The fund manager’s portfolios will be valued daily and in accordance with the definition of fair value under International Financial Reporting Standards (IFRS 13). IFRS 13 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). In terms of the funds returns, the returns will be calculated using the time weighted rate of return method.

Current Provision: The CIS regulations, 2001, provide that the Net Asset Value (NAV) of the fund shall be calculated by the fund manager at the end of each business day and that the formula to be adopted during the determination of the NAV will be dividing the value of the assets of the fund less its liabilities (including such provisions and allowances for contingencies as the fund manager may think appropriate) by the number of shares issued and fully paid. The regulations also provide that the fund manager’s trust deed shall also include the specific method used for the calculations of the value of the unit trust.

- Advertisement

When publishing the returns of the fund in any advertisement platform, fund managers will be required to include at a minimum, the Net Asset Value of the fund, the yield in terms of Year to Date (YTD), Month to date (MTD) as well as Quarter to Date (QTD). Net Asset Value refers to the net value of an asset minus the value of the liabilities. Additionally, for all publications, the fund manager shall present the total returns according to at least one, three and five year annualized returns through the most recent period.

- Disclosure

The guidelines stipulate that the fund manager will be required to list all the funds offered inclusive of the summary of the description of the funds in its website or any other platform that is easily accessible to the funds current and future investors.

Section III: Impact and Emerging Issues in the sector

These new guidelines raise substantive issues with the law and present various shortcomings as set out below:

- Do these guidelines override the fund managers' trust deed? – The Guidance by the Authority state that Money Market Funds invests only in interest earning assets that have a maximum weighted average tenor of 13 months. The Guidelines however do not address the options available to such schemes given this change impacts the investment strategy of the fund, which is a fundamental attribute of the fund. We note that typically, regulators across the world usually guide Fund Managers on the next steps including a change of name, transition timelines, amendment of the scheme documents as per the CIS Regulations or an option for investors to exit or transition; in this case, the new guidelines leave it vague as to what happens next,

- The guidelines have not dealt with the issue as to what happens with existing investment contracts that run for longer periods of time. Thomas Hobbes once noted that ‘before the law, there is no transgression of the law’. This common law principle is interpreted to mean that, the law in most circumstances cannot be applied retrospectively. A newly passed law cannot invalidate a practice that was considered legal prior to its enactment. A law by its nature seeks to provide clarity and not confusion. The provision by the Authority of a transition period and guidance on funds that may not have achieved the criteria set by the commencement date because of investments made prior to the publication of the Guidelines would have been in order. In deed laws in general, have a Savings and Transition Clause to deal with matters in the interim, and,

- Regulation 17 (1) Requires Investments according to “provisions of the incorporation documents, the information memorandum, the rules of the collection investment scheme…” It is not clear what happens where the incorporation documents required by Regulation 17 (1) are inconsistent with the Guidelines.

On the upside, these guidelines;

- Will enhance the accountability and transparency in the reporting of the performance of Collective Investments Schemes,

- Will boost investor confidence,

- Given the standardization in the reporting of the funds returns, investors will be able to easily compare between the various funds and make an informed decision regarding their investments,

- Risk supervision by the authority will also be made easier given that the guidelines promote transparency in the Capital Markets, and,

- The Guidelines have given Specialized Funds the flexibility to “invest based on the Fund Managers’ investments strategy”, which will allow for innovative structures.

However despite the potential upsides;

- The guidelines provide the fund managers with a short notice to align their portfolios given that they will be effective 1st January 2021. This short notice will see fund managers incur losses in their portfolio given the increased trading activities in the current volatile market. For instance, a fund manager whose Balanced Fund portfolio has equity stocks above the 60.0% maximum exposure and decides to sell 5,000 KCB shares which had been purchased on 2nd January 2020 at Kshs 54.3, will incur losses of Kshs 16.3 per share should the manager sell the shares today at Kshs 38.0,

- The guidelines stipulate that Money Market Funds should only invest in interest bearing assets with a maximum weighted average tenor of 13 months. We believe that capping the maximum weighted average tenor to 13 months will see MMFs invest in assets that offer relatively lower returns such as the 364-day paper, which is currently trading at 7.8%. This effectively locks out potential Money Market Investors who wish to pursue yield generation. Consequently, the returns offered by Money Market Funds will have marginal differences with the bank deposit rates and therefore lose their competitive edge in the market. Over the years, Money Market Funds have gained popularity among Kenyans given the high rate of returns they offer, which has continuously outperformed the bank deposit rates. In Q1’2020, Money Market Funds had an industrial average of 8.7%, 1.7% points above the 7.0% Central Bank deposit rate. In our view, the Authority should have provided for two categories of Money Market Funds (1) Short term money market fund - hold high quality short term money market instruments that are highly liquid; and (2) Standard money market fund – hold quality money market instruments that are highly liquid but have a longer portfolio maturity than a short term money market fund. This would then address the various investment objectives of different investors and is in line with other jurisdictions such as Australia that have adopted the same,

- It is not clear how the compliant and non-compliant fund managers will be distinguished by the public. We believe the Regulator’s intention is to ensure investors invest in funds that adhere to their various investment strategies so the naming of the funds can be used as a tool by investors to identify funds they would like to invest in. As such, we believe that there is need for capacity building around the global standards such as the Global Investments Performance Standards.

Section IV: Recommendations on the Improvement of the Capital Markets

In light of the above shortcomings, we recommend the following;

- Provision of clarity on what happens with existing investment contracts that run for longer periods of time. It is not clear whether these guidelines will affect the existing investments contacts that have a tenor above the recommended 13 months or whether they will only affect new investments contracts done on 1st January 2021 going forward. We believe that the application of these new guidelines to past circumstances that were previously legal would have a negative effect to previous contracts, and as such the guidelines should only affect contracts made after 1st January 2021. In any event, CMA needs to come out clearly and state what happens to existing contracts,

- Allow for different forms of money market funds. Additionally, to ensure investors continue to earn above average returns, the authority should consider allowing Fund Managers offer a Standard and a Short Term Money Market Fund which can cater to investors pursuing both liquidity, capital preservation and high returns,

- Improve the disclosures for unit trust investors by requiring the fund managers to publish reports that indicate specifically where the funds have been invested. Q3’2020 saw investors in Amana Capital, whose funds had been frozen for the past 2 years, receive a 59.0% impairment on their investments following the losses incurred from investing in the Nakumatt commercial paper. Section 3.2 of the guidelines only require the fund manager to report performance-related information on the general areas of investment for the fund and as such, investors will not be able to specifically identify where their funds are invested. This is a big shortcoming of the Guidelines,

- Allow for sector funds: The current capital markets regulations require that funds must diversify. Consequently, one has to seek special dispensation in form sector funds such as a financial services funds, a technology fund or a real estate UTF fund. Regulations allowing unit holders to invest in sector funds would expand the scope of unit holders interested in investing, and,

- Reduce the minimum investments to reasonable amounts: Sector funds, in addition to cumbersome incorporate as mentioned above, have high minimums of Kshs 1,000,000, which is way above the median wage of Kshs 50,000. Having sector funds minimum that is 20 times the national income seems unreasonably high.

Conclusion

The robust governance structure put in place by the authority, inclusive of these guidelines, will ensure that Kenya’s Capital Market more so the Collective Investments schemes are managed well and in a legal and regulatory framework thereby ensuring investor protection and a financially stable system. Additionally, the standardization in the CIS will make it easier for investors to evaluate the performance the funds and compare between the different fund managers. However, we believe that CMA needs to offer clarity to the fund managers on what happens to existing contracts that run for a long period than the recommended tenor. Given that the guidelines take effect on 1st January 2021, we believe that this clarity will go a long way in ensuring a stable financial market without destabilizing the returns offered by the funds more so Money Market Funds. The Collective Investments Schemes Regulations, 2001 indicates that provisions done in the Trust deed relating to unit trusts should be consistent with any provision in the regulations as well as in the Capital Markets Act. Therefore, given that the new guidelines should be read together with the Collective Investments Schemes Regulations, 2001, we believe that fund managers will need to align their trust deeds and other incorporation documents with these new guidelines, but keeping in mind that some changes in the trust deeds may require approval of unit holders.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.