Cytonn 2021 Markets Outlook

By Cytonn Research, Jan 17, 2021

Executive Summary

Global Markets Outlook

The year 2020 was a turbulent year for markets worldwide, due to the effects of the COVID-19 pandemic which impacted global trade and disposable incomes as unemployment rates increased. The global economy, therefore, plunged into a recession contracting by 4.3% according to the World Bank. Governments played a key part in containing the economic fallout caused by the pandemic by adopting accommodative monetary policy stance, such as lowering interest rates and providing the much-needed stimulus packages, effectively supporting liquidity in markets. According to the World Bank’s Global Economic Prospects 2021, the global economy is projected to recover in 2021 to a growth rate of 4.0%;

Sub Saharan Africa Regional Market Outlook

According to the World Bank in their Global Economic Prospects: January 2021, Sub Saharan Africa (SSA) is expected to register economic growth of 2.9% in 2021, higher than the 3.7% contraction in 2020. This is on the assumption that (i) the rollout of COVID-19 vaccines will not lag far much behind that of major economies and many other Emerging Markets and Developed Economies (EMDEs) and (ii) that demand for oil and industrial commodities will pick up. The forecast is higher than the initial 2.1% projection, mainly reflecting the expected growth when the pandemic subsides, on the back of policy reforms that have been fostered and accelerated in several countries to propel growth;

Kenya Macro Economic Outlook

GDP Growth – Following a projected growth of 1.0% in 2020, we are projecting the economy to register a growth of within the range of 3.9% - 4.1% in 2021 supported by improved business sentiment following the easing of restrictions meant to curb the spread of COVID-19. The key downside to this growth shall be any delays in the procurement, distribution and administration of the vaccine.

Inflation - We expect muted inflationary pressures and the inflation rate to remain within the government’s target of 2.5-7.5% and come in at 5.2% as there will be not much demand push inflation,

Currency - We project the Kenya Shilling to trade within the of between Kshs 107.0 and Kshs 110.0 against the USD in 2021, supported by the improving current account position which narrowed to 4.9% of GDP in the 12 months to October 2020 compared to 5.3% of GDP during a similar period in 2019,

Interest Rates - The Monetary Policy Committee is projected to maintain the accommodative policy stance taken in 2020 to support the economy from the adverse effects of the pandemic. However, we project some upward pressure on interest rates due to increased pressure by the government to meet possible increased borrowing target to plug in the fiscal deficit due to the decline in tax collection during the pandemic;

Fixed Income Outlook

We anticipate upward pressure on interest rates as the government seeks to borrow more to fund infrastructural projects, pay domestic maturities which stand at Kshs 531.6 bn for H1’2021 and bridge the fiscal deficit that has averaged 7.7% of GDP since 2012 and is now projected to increase fur to the Tax collections shortfall. Investors should be biased towards SHORT-TERM FIXED INCOME INSTRUMENTS to reduce duration risk.

Equities Outlook

We have a NEUTRAL outlook on the Kenyan Equities market in the short term but “BULLISH” in the medium to long term. We expect a gradual upward recovery in earnings growth in 2021, supported by a relatively stable business operating environment, coupled with the improving investor sentiment to support the performance in the equities market in 2021;

Real Estate Outlook

Residential sector: Our outlook for the residential sector is NEUTRAL. We expect the tough economic environment to continue affecting transaction volumes. For detached units, investment opportunity lies in areas such as Rosslyn, Ridgeways and Ruiru while for apartments, the investment opportunity lies in satellite towns such as Thindigua and Syokimau, as well as the upper mid-end segment in areas such as Kilimani;

Commercial Office Sector: Our outlook for the commercial sector is NEGATIVE as the sector’s performance continues to be constrained by the oversupply of 6.3 mn SQFT of space as at 2020. The sector is also facing reduced demand as some firms downsize due to financial constraints while others embrace the working from home strategy amid the Covid-19 pandemic. The asking prices and rents are also expected to decline as landlords continue giving discounts and concessions to attract and retain clients;

Retail Sector: We have a NEUTRAL outlook for the sector with performance being constrained by; (i) the existing oversupply of space estimated at 2.0 mn SQFT, ii) dwindling demand for physical space due to shifting focus to e-commerce, iii) reduced purchasing power among consumers amid a tough economic environment, and iii) reduced rental rates. However, we remain optimistic that the sector’s performance will be cushioned by the continued expansion of local and international retail chains;

Hospitality Sector: Our outlook for the hospitality sector is NEUTRAL. Despite the sector being the hardest hit by the COVID-19 pandemic, it has begun to gradually recover supported by financial aid from the government through the Post Corona Hospitality Sector Recovery Stimulus by the Ministry of Tourism through the Tourism Finance Corporation (TFC) and other international agencies, repackaging of the tourism sector to appeal to domestic tourists and relaxation of travel advisories. We expect this to fuel resumption of activities and resultant improved performance in the medium term;

Land Sector: We have a POSITIVE outlook for the land sector. We expect an annual capital appreciation of 1.7% in 2021, with the performance being cushioned by; (i) the growing demand for development land especially in the satellite towns as developers strive to drive the government’s Big Four government agenda on the provision of affordable housing, (ii) improving infrastructure, and (iii) demand for development land by the growing middle-income population;

Infrastructure Sector: We have a NEUTRAL outlook for the infrastructure sector, despite the reduced budget allocation for the infrastructure sector with funds being redirected to dealing with the COVID-19 pandemic, the government continues to implement select projects and we expect this to open up areas for developments upon their completion thus boosting the real estate sector;

Listed Real Estate: Our outlook for the REIT market is NEGATIVE due to the continued poor performance of the REIT market. However, we are of the view that for the REIT market to pick, a supportive framework needs to be put in place to increase investor appetite in the instrument.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.68%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.54% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We successfully handed over Phase 3 of the Alma project on the 22nd of December 2020. Please see attached photos of the happy homeowners;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

- For recent news about the company, see our news section here.

The year 2020 was a turbulent year for markets worldwide, due to the effects of the COVID-19 pandemic on global trade and disposable incomes as unemployment rates increased globally. According to the World Bank, the global economy is estimated to have contracted by 4.3% in 2020, compared to the 2.3% growth, recorded in 2019. Governments played a key part in containing the economic fallout caused by the pandemic by adopting an accommodative monetary policy stance, such as lowering interest rates and providing much-needed stimulus packages, effectively supporting liquidity in markets. According to the World Bank’s Global Economic Prospects 2021, the global economy is projected to recover in 2021 to a growth rate of 4.0%.

Growth in 2021 shall be supported by the following three key themes:

- Pick Up in Global Trade

According to the World Bank, global trade contracted by 13.4% in 2020, a larger contraction than the 9.9% contraction recorded during the 2008/2009 financial crisis. Global trade is however expected to recover faster than during the financial crisis. By November 2020, six months from the peak of the pandemic, global trade was at 99.5% the April levels, compared to an 83.5% recovery in global trade as at May 2009, a similar 6-month period following the financial crisis. Overall, in 2021 global trade is projected to grow at 5.1%.

- Accommodative Monetary Policies

Most Central’s Banks came up with accommodative policies to help inject liquidity in the money markets which would lead to increased cash for onward lending to individuals and companies leading to economic growth. We expect most of this to remain in place into 2021 to support growth. The table below shows how Central Banks of major global economies that have moved to maintain their interest rates so far:

|

No. |

Country |

Central Bank |

Rate in Dec 2019 |

Current Rate |

Reduction Margin |

|

1 |

USA |

Federal Reserve |

1.50%-1.75% |

0.00%-0.25% |

1.50% points |

|

2 |

Australia |

Reserve Bank of Australia |

0.75% |

0.10% |

0.65% points |

|

3 |

Malaysia |

Central Bank of Malaysia |

3.00% |

1.75% |

1.25% points |

|

4 |

China |

People’s Bank of China |

4.15% |

3.85% |

0.30% points |

|

5 |

England |

Bank of England |

0.75% |

0.10% |

0.65% points |

- Recovering Commodity Prices

Commodity prices declined in H1’2020 due to subdued demand before recovering in H2’2020 as markets gradually opened and demand increased. According to the World Bank Commodities Markets Outlook, agriculture and non-energy commodities gained by 2.8% and 1.1% respectively in 2020, with agriculture forecasted to gain further by 2.8% and non-energy commodities forecasted to gain by 1.1% in 2021. Metals and minerals recorded a 1.1% decline while crude oil declined 33.2% in 2020, with the World Bank forecasting a 2.7% growth for metals and minerals and a 7.3% growth for crude oil in 2021. The performance of oil, metals and minerals was driven down by a decline in demand as a result of significant reduction in travel coupled with decline in manufacturing as plants slowed down operations. As travel restrictions are expected to decrease in 2021, crude oil is expected to rebound due to the subsequent increased demand. With the resumption of travel, trade and manufacturing activities we expect that commodity prices will increase based on demand increases.

Below is a summary of the regional growth rates by country as per the World Bank:

|

World GDP Growth Rates |

||||||

|

Region |

2017 |

2018 |

2019 |

2020e |

2021f |

|

|

1. |

China |

6.8% |

6.6% |

6.1% |

2.0% |

7.9% |

|

2. |

India |

7.2% |

6.1% |

4.2% |

(9.6%) |

5.4% |

|

3. |

Kenya |

4.9% |

6.3% |

5.4% |

1.0% |

4.7% |

|

4. |

Sub-Saharan Africa* |

2.7% |

2.6% |

2.4% |

(3.7%) |

2.7% |

|

5. |

Middle East, North Africa |

1.1% |

0.5% |

0.1% |

(5.0%) |

2.1% |

|

6. |

Brazil |

1.3% |

1.8% |

1.4% |

(4.5%) |

3.0% |

|

7. |

United States |

2.4% |

3.0% |

2.2% |

(3.6%) |

3.5% |

|

8. |

Euro Area |

2.5% |

1.9% |

1.3% |

(7.4%) |

3.6% |

|

9. |

South Africa (SA) |

1.4% |

0.8% |

0.2% |

(7.8%) |

3.3% |

|

10. |

Japan |

1.9% |

0.6% |

0.3% |

(5.3%) |

2.5% |

|

|

Global Growth Rate |

3.1% |

3.0% |

2.3% |

(4.3%) |

4.0% |

|

|

*Including South Africa |

|||||

Source: World Bank

It is key to note that growth will largely be supported by the recovery in Developed and Emerging Markets but the African markets and other frontier markets shall lag the recovery.

According to the World Bank, in their Global Economic Prospects: January 2021, the Sub Saharan Africa region is expected to register economic growth of 2.9% in 2021, higher than the estimated 3.7% contraction in 2020. This is on the back of export growth which is expected to accelerate gradually, in line with the rebound in activity among major trading partners despite the expected slow recovery in private consumption and investment. The resumption in activity in the key trading partners of the region such as Europe, China and the US is chiefly underpinned by positive news on vaccine development and rollout as well as new rounds of fiscal stimulus. However, COVID-19 is likely to weigh on the growth for an extended period, as the rollout of vaccines in the region is expected to lag that of major economies and many other EMDEs. The forecast is higher than the initial 2.1% projected, mainly reflecting the expected growth when the pandemic subsides, on the back of policy reforms that have been fostered and accelerated in several countries to propel growth.

Despite the expected growth, risks to the regional outlook abound and they include:

- Weaker-than-expected recoveries in key trading partners, like the United States, European Union, and China who account for almost 50.0% of all exports from sub-Saharan Africa,

- Slow distribution of the Corona Virus Vaccines,

- Scarring Logistical hurdles more especially infrastructure and storage facilities that further impede vaccine distribution,

- The High Debt levels in some countries amounting to 70% of GDP as of 2020,

- Lower productivity due to the changes in the working patterns,

- Impacts of declined demand and consequently the price of commodities in the region, and,

- Limited fiscal space on the back of declined government revenue.

- Economic Growth

The Kenyan economy contracted by an average of 0.4% in H1’2020 and is projected to contract by an average of 1.0% in the whole of 2020 according to the World Bank. The performance was driven by declines in most sectors with accommodation and food being worst hit declining by 83.3% as the travel ban affected them significantly. The lockdown restrictions imposed on the onset of the pandemic led to subdued business performance through the year. This downturn was however mitigated by resilient growth in the agricultural sector which recorded a growth of 6.4% during the same period.

In 2021, we project the economy to recover and the projected GDP growth to come in at a range of 3.9% - 4.1%.

The key factors that shall support growth include:

- Improved Business Recovery: A recovery in the business environment has been recorded as evidenced by PMI index numbers in the second half of the year, which averaged 54.2, higher than the H1’2020 average of 42.4, where a reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. With the vaccines now being ready for distribution, we expect that the gradual lifting of movement restrictions will reduce the supply chain disruptions experienced globally and also help improve consumer demand,

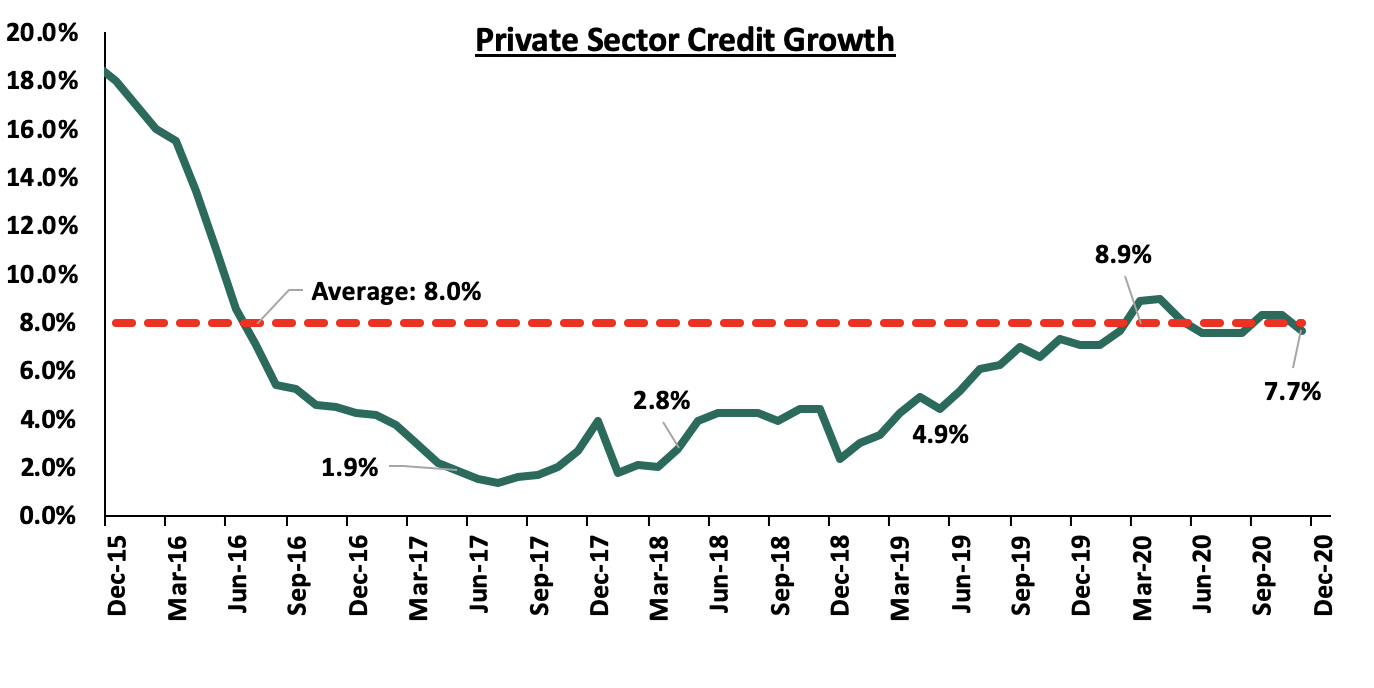

- Access to affordable Credit: Private Sector Credit growth, has remained relatively stable even during the pandemic averaging about 7.7%. According to data from the latest Monetary policy committee, strong growth was observed in the manufacturing, trade, transport & communication and real estate sectors where credit grew by 22.7%, 18.7%, 14.5% and 12.8%, respectively. Given that the main concern is the loan quality, with the expected recovery of the business environment, we might see a gradual improvement in credit growth in the private sector.

- Stable growth of the agricultural sector, following the favorable weather experienced in Q4’2020, and the re-opening of the economies of some of Kenya’s major trading partners. The sector is expected to support growth despite the expectations of a mild locust invasion where there have been reports of immature locust swarms located in the semi-arid areas of the country,

Risks abound to economic growth however include:

- The speed at which the Vaccines shall reach the country and how fast they shall be distributed shall determine how fast the economy can get back to normalcy. A resurgence of the Corona Virus cases could lead to further measures not supportive of growth,

- Ongoing concerns on the sustainability of the country’s debt levels. It is expected that the government will have a shortfall in terms of revenue collection in 2021 due to the depressed business environment. With the country’s debt to GDP ratio currently at 69.6%, 15.6% above the recommended IMF threshold for developing countries, it is expected that the government will have significant pressure considering the limited fiscal space.

- The Country’s early politicking on issues such as the coming general election in 2022 and the BBI initiative, which gets people away from focusing on the economy.

- Currency:

The Kenyan Shilling depreciated by 7.7% against the USD during the year to close at Kshs 109.2, mainly due to increased dollar demand as people prefer holding onto hard currency during such times and also a decline in dollar inflows from both exports of goods and services like tourism.

Going forward we expect the shilling to remain range-bound this year supported by:

- High Diaspora inflows which rose by 10.7% to a record high of USD 3,094 mn for 2020, compared to the USD 2,796.6 mn recorded in 2019. In December 2020 it rose to USD 299.0 mn, a 19.5% improvement from the USD 250.3 mn in December 2019. This has been possible through financial innovations that have provided Kenyans in the diaspora more convenient channels to transact,

- CBK’s supportive activities through open market operations, such as sale and repurchase agreements,

- Improving Current account position which narrowed to 4.7% of GDP in the 12 months to November 2020 compared to 5.4% of GDP during a similar period in 2019. This will be mainly driven by increased exports of tea and horticulture,

- Increased flows into the capital markets as there are expectations of improved investor sentiment,

- The expectation of stable fuel prices in the global markets attributable to the continued global recovery, coupled with increased production in the US which should counterbalance the supply cuts by the OPEC hence making the amounts spent on Oil predictable,

The Kenyan shilling will however face the following challenges:

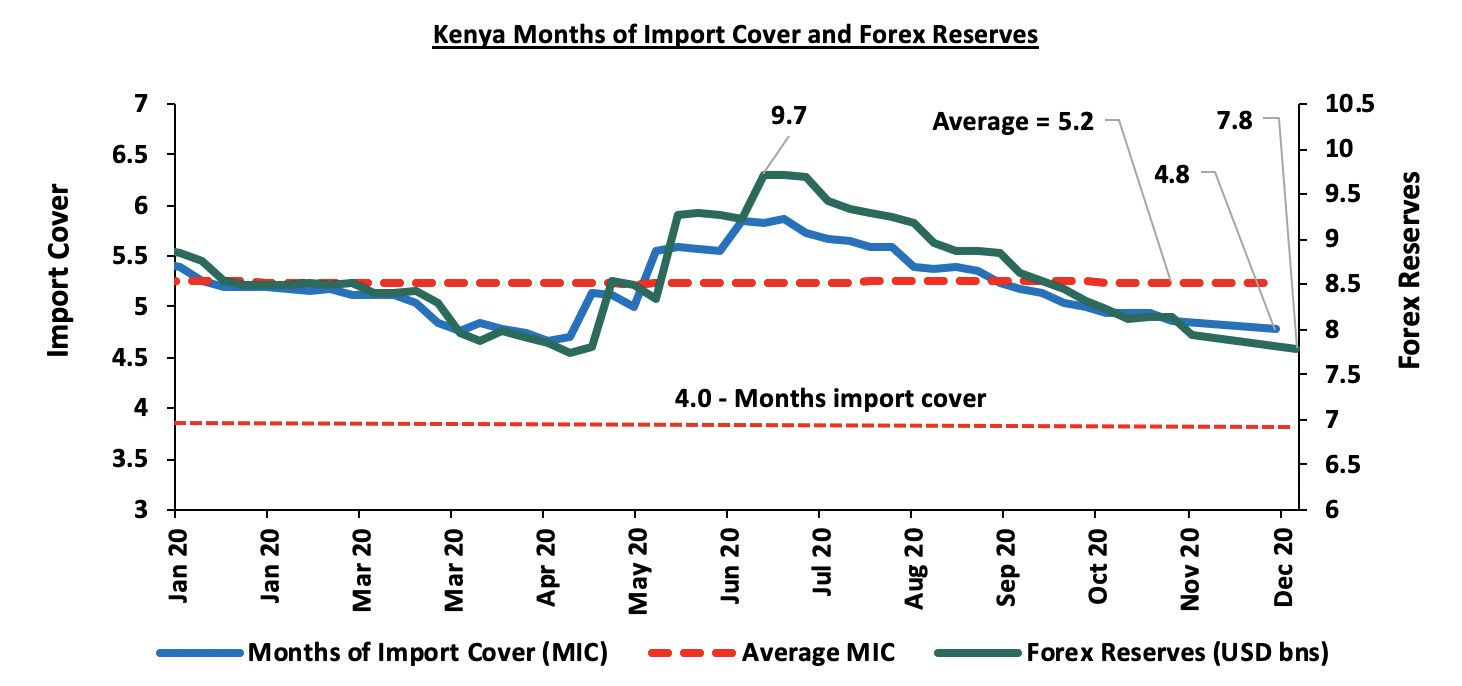

- Dwindling forex reserves which have been on a downward trend since June 2020 where we had USD 9.7 bn, compared to the close of 2020 where we had USD 7.8 bn. Notably, we are still well above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- Lower exports especially horticultural products due to lower demand as the countries that they are exported to are affected by the lockdown restrictions and also as the individuals have lesser income to spend, support forex inflow through remittances inflows, and export earnings which have been on the rise in the tail end of 2020.

We expect the shilling to remain within a range of Kshs 107.0 and Kshs 110.0 against the USD in 2020 with a bias to a 0.4% appreciation by the end of 2021.

- Inflation:

In 2020, inflation averaged 5.2%, slightly lower than the 5.1% recorded in 2019. Inflation was varied through the year but closed at an eight-month high of 5.6% in December, due to an increase in the food and non-alcoholic beverages index which was up 2.5%. The year’s performance can be attributed to the low fuel prices experienced during the first half of the year, coupled with the favorable weather conditions experienced at the tail end of the year which has ensured that food commodity prices remained low through most of the year.

We expect inflation to average 5.2% in 2021, within the government target range of 2.5% - 7.5% with inflationary pressure gradually easing off, due to improved agricultural production. According to the UN, there is a risk that a few locust swarms could breach the central region through the bulk should be constrained to the semi-arid regions.

- Interest Rates:

The Central Bank Rate is expected to remain stable as the governments seeks to continue supporting the economy from the adverse effects of the pandemic. This is in-line with the policy stance in other developed economies such as the United States and various counties in the Eurozone

Despite the government being 11.1% ahead of its domestic borrowing target at the end of 2020, it is expected that there will be a need for more borrowing as the Kenya Revenue Authority lags behind revenue collections. According to the Treasury, tax cuts introduced in April 2020 to cushion businesses and households from the pandemic had resulted to persistent revenue shortfalls where collections for the five months through November 2020 declined by Kshs 100.7 bn, compared to a similar period in 2019. The risk on interest rates stems from the rising debt levels and expected domestic maturities amounting to Kshs 531.6 bn, coupled with the limited fiscal space which might result in a slight upward pressure on the yield curve due to the pressure on the government to meet its domestic borrowing target to plug in the fiscal deficit, considering the decline in tax collection during the pandemic.

The table below summarizes the various macro-economic factors and the possible impact on the business environment in 2021. With two indicators being positive, one at negative and four neutral, the general outlook for the macroeconomic environment in 2021 is NEUTRAL.

|

Macro-Economic & Business Environment Outlook |

||

|

Macro-Economic Indicators |

2021 Outlook |

Effect |

|

Government Borrowing |

|

Negative |

|

Exchange Rate |

|

Neutral |

|

Interest Rates |

|

Neutral |

|

Inflation |

|

Positive |

|

GDP |

|

Neutral |

|

Investor Sentiment |

|

Positive |

|

Security |

|

Neutral |

The change from last year’s outlook is:

- Security to neutral from positive in 2020, necessitated by the increased activity on the political front where politicians are getting ready for the next general elections and discussions around the BBI initiative,

Out of the seven metrics that we track, two have a positive outlook while four have a neutral outlook and one with a negative outlook, from last year where three had a positive outlook, three had a neutral outlook and one had a negative outlook. Our general outlook for the macroeconomic environment will remain NEUTRAL for 2021, unchanged from 2020.

The government is currently 5.0% ahead of its prorated domestic borrowing target, having borrowed Kshs 274.9 bn domestically, against the pro-rated target of Kshs 261.8 bn, going by the government domestic borrowing target of Kshs 486.2 bn as per the Budget Review and Outlook Paper (BROP) 2020. Given the high financing needs to support government initiatives, we foresee a likely upward revision of the domestic borrowing target before the end of the current fiscal year.

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the Central Bank as they reject expensive bids. Due to the current subdued economic performance brought about by the effects of the COVID-19 pandemic, the government will record a shortfall in revenue collection with the target having been set at Kshs 1.9 tn for FY’2020/2021 thus leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug the deficit.

OUR VIEW IS THAT INVESTORS SHOULD BE BIASED TOWARDS SHORT-TERM FIXED-INCOME SECURITIES TO REDUCE DURATION RISK.

In 2020, the Kenyan equities market was on a downward trajectory, with NASI, NSE 25 and NSE 20 declining by 8.6%, 16.7% and 29.6%, respectively. Large-cap decliners in 2020 included Bamburi, Equity Group, Diamond Trust Bank, KCB Group and Standard Chartered which declined by 52.7%, 31.7%, 31.2%, 29.4%, and 28.8%, respectively. Key to note, Safaricom recorded gains of 8.7% YTD, attributable to the continued demand from investors as the firm is expected to see a faster recovery in the post-COVID environment. Additionally, the directive by the Central Bank of Kenya on the reinstatement of the fees on mobile transfers saw the stock price rally in the last week of December 2020. Notably, Safaricom continues to benefit from working from home environment and increased digitization trends.

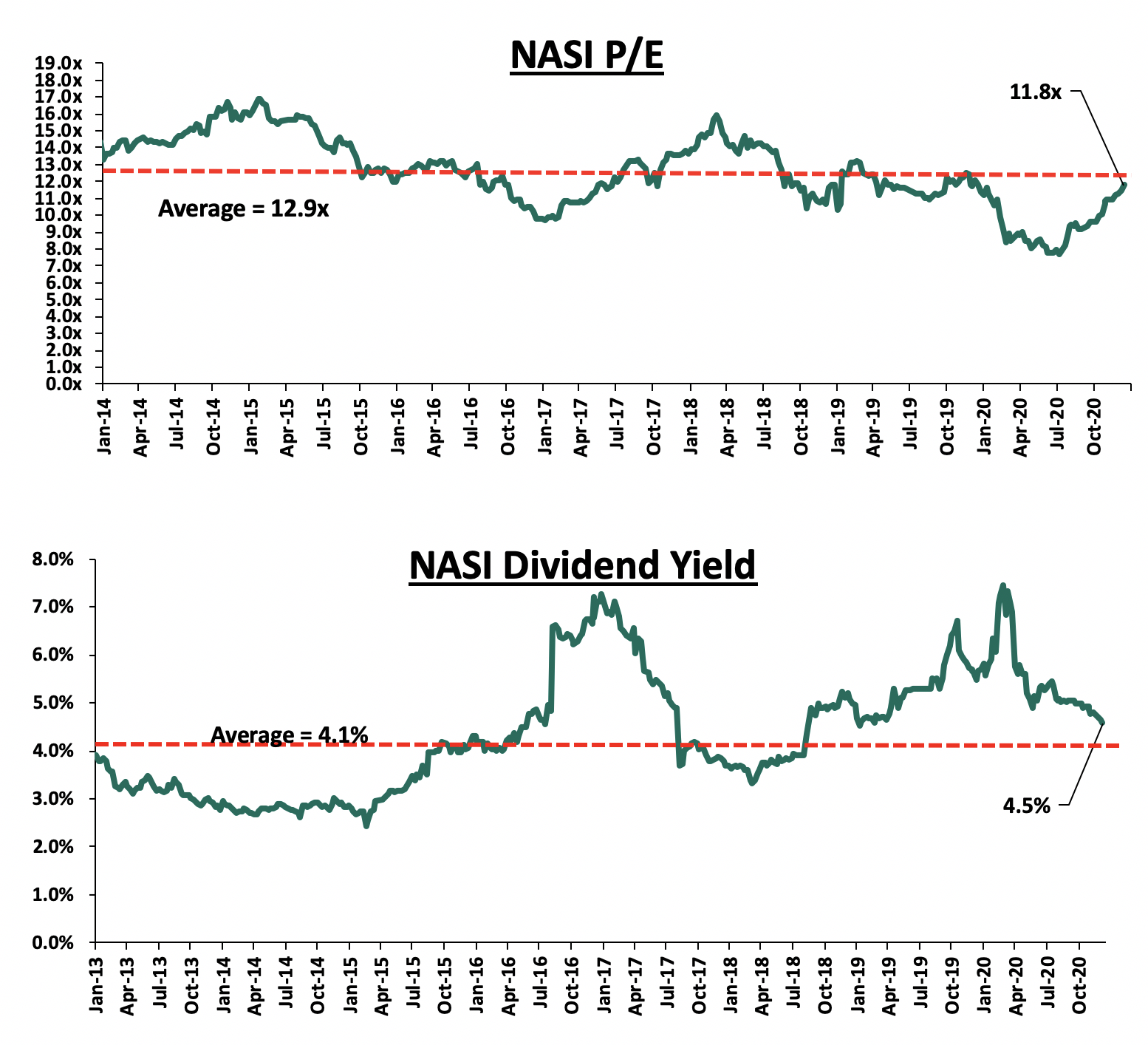

Following the poor performance in the equities market in 2020, the market valuation declined below the historical average with NASI closing the year at a price to earnings ratio (P/E) of 11.3x, 12.9% below the 11-year historical average of 12.9x, and a dividend yield of 4.6%, 0.5% points above the historical average of 4.1%. Equity turnover on the other hand declined by 5.9% to USD 1.4 bn, from USD 1.5 bn in FY’2019. Foreign investors turned net sellers, with a net outflow of USD 280.9 mn, compared to net inflows of USD 10.7 mn recorded in FY’2019. The year also saw 15 companies issuing profit warnings, a rise from 10 companies in 2019, attributable to the tough macro-economic environment amid the COVID-19 pandemic. Key to note, Companies are required to issue profit warnings if they project a more than 25.0% decline in profits year-on-year. For more information, see our Cytonn Annual Markets Review - 2020.

Kenyan 2021 Equities Outlook

In 2021, we project the following positive factors to affect the direction of the Kenyan equities market:

- Gradual recovery in Corporate Earnings: We expect a gradual upward recovery in earnings growth in 2021, supported by a relatively stable business-operating environment, coupled with the low base coming from 2020. However, despite this, we expect Safaricom and the banking stocks, which currently comprise above 60.0% of the Nairobi All Share Index (NASI), to register modest growth in their earnings in 2021 due to; (i) expected lower provisioning by banks, (ii) Increased lending as the economy rebounds, (iii) growth in Safaricom earnings from the M-PESA revenue line following the expiry of the waiver on M-PESA transaction fees, and (iv) increased use of digital platforms by banks;

- Attractive valuations: Following the poor performance in the equities market in 2020, the market valuations declined to below historical average with NASI closing the year at a price to earnings ratio (P/E) of 11.3x, 12.9% below the 11-year historical average of 12.9x, and a dividend yield of 4.6%, 0.5% points above the historical average of 4.1%. Given these low valuations, we expect investors to take advantage of this and buy into the market;

- Capital Markets Investor Sentiment: We expect the equities market to register increased foreign inflows in 2021, mainly supported by the fact that Kenya and specifically, Safaricom, has an increased weighting in the MSCI Emerging Markets Index, as capital flows go back to Emerging and Frontier markets. Kenya is projected to be one of the key beneficiaries as the economy recovers and as the ease of doing business remains attractive. Key to note, Kenya ranked position 56 globally and 4th in Sub-Saharan Africa in the 2020 Ease of Doing Business report;

- Diversification of Capital Markets and New Listings: We expect several activities to be undertaken by NSE in 2021 including; increasing the number of Single Stock Futures traded on the derivatives market. Currently, the bourse offers 6 Single Stock Futures namely Safaricom Plc, Kenya Commercial Bank Group Plc, Equity Group Holdings Plc, East African Breweries Ltd, ABSA Bank Kenya and British American Tobacco Plc. In 2020, the Derivatives Market recorded an 83.6% growth in turnover to Kshs 38.0 mn, from Kshs 20.7 mn recorded in 2019 while the trading volume increased by 118.0% to 1,247, from the 572 recorded in 2019.It is our view that these initiatives would result in; (i) increased liquidity in the market by increasing the volume of securities available for trading, and (ii) improved depth in the capital market by increasing product offerings at the exchange, consequently attracting investors;

- Monetary Policy Direction: We expect monetary policy to remain stable in 2021 as the Central Bank continues to support the economy amid the COVID-19 pandemic. As such, we expect the accommodative monetary policy stance to lead to increased capital inflows into the Equities markets as investors take on additional risks in search of higher returns as the bond yields fall, and as such, bolster the equities markets in the medium term. Further, we expect low rates to lead to increased economic activities and higher earnings for firms.

Below, we summarize the metrics used in coming up with our 2021 Equities Outlook;

|

Equities Market Indicators |

Outlook for 2021 |

Current View |

|

Macro-Economic Environment |

|

Neutral |

|

Corporate Earnings Growth |

|

Neutral |

|

Valuations |

|

Positive |

|

Investor Sentiment and Security |

|

Neutral |

Out of the four metrics that we track, three have a “neutral” outlook while one has a “positive” outlook. Compared to 2020, we have maintained our positive outlook on the valuations of the market. As such in consideration of the above, we have a ‘’NEUTRAL” outlook on the Kenyan Equities market in the short term. However, we maintain our bias towards a “BULLISH” equities markets in the medium to long term, with the expectations of a gradual recovery in corporate earnings, the cheaper valuations currently in the market, and the improving investor sentiment.

Weekly Market Performance

During the week, the equities market was on an upward trajectory with NASI, NSE 25 and NSE 20 recording gains of 2.6%, 1.3% and 1.2%, respectively, taking their YTD performance to gains of 4.0%, 2.5% and 2.3% for the NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Bamburi, Safaricom and Equity Group of 15.1%, 4.4%, and 2.5%, respectively. The gains were however weighted down by losses recorded by other large-cap stocks such as KCB, EABL and Co-operative Bank of 3.7%, 2.4% and 0.8%, respectively.

Equities turnover increased by 30.4% during the week to USD 19.0 mn, from USD 14.6 mn the previous week, taking the YTD turnover to USD 33.6 mn. Foreign investors turned net buyers during the week, with a net buying position of USD 6.6 mn, from a net selling position of USD 1.9 mn recorded the previous week, taking the YTD net buying position to USD 4.7 mn.

The market is currently trading at a price to earnings ratio (P/E) of 11.8x, 8.7% below the 11-year historical average of 12.9x. The average dividend yield is currently at 4.5%, 0.1% points below what was recorded the previous week and 0.4% points above the historical average of 4.1%.

With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 11.8x is 53.2% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the market’s historical P/E and dividend yield.

Universe of Coverage

|

Banks |

Price at 08/01/2020 |

Price at 15/01/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank*** |

77.5 |

77.0 |

(0.6%) |

0.3% |

76.8 |

105.1 |

3.5% |

40.0% |

0.3x |

Buy |

|

I&M Holdings*** |

46.0 |

45.9 |

(0.3%) |

2.2% |

44.9 |

60.1 |

5.6% |

36.6% |

0.7x |

Buy |

|

KCB Group*** |

38.3 |

36.9 |

(3.7%) |

(3.9%) |

38.4 |

46.0 |

9.5% |

34.1% |

1.0x |

Buy |

|

Kenya Reinsurance |

2.5 |

2.6 |

6.5% |

14.3% |

2.3 |

3.3 |

4.2% |

29.2% |

0.3x |

Buy |

|

Sanlam |

12.0 |

13.2 |

10.0% |

1.5% |

13.0 |

16.4 |

0.0% |

24.2% |

1.1x |

Buy |

|

Liberty Holdings |

7.9 |

8.0 |

1.3% |

3.9% |

7.7 |

9.8 |

0.0% |

22.5% |

0.6x |

Buy |

|

ABSA Bank*** |

9.5 |

9.5 |

0.2% |

(0.2%) |

9.5 |

10.5 |

11.6% |

22.1% |

1.2x |

Buy |

|

Equity Group*** |

36.0 |

36.9 |

2.5% |

1.8% |

36.3 |

43.0 |

5.4% |

22.0% |

1.1x |

Buy |

|

Co-op Bank*** |

13.0 |

12.9 |

(0.8%) |

2.8% |

12.6 |

14.5 |

7.8% |

20.2% |

1.0x |

Buy |

|

Britam |

7.4 |

7.5 |

0.5% |

6.6% |

7.0 |

8.6 |

3.4% |

18.6% |

0.8x |

Accumulate |

|

Standard Chartered*** |

140.0 |

139.8 |

(0.2%) |

(3.3%) |

144.5 |

153.2 |

8.9% |

18.6% |

1.1x |

Accumulate |

|

Stanbic Holdings |

80.3 |

80.5 |

0.3% |

(5.3%) |

85.0 |

84.9 |

8.8% |

14.2% |

0.8x |

Accumulate |

|

Jubilee Holdings |

291.5 |

290.0 |

(0.5%) |

5.2% |

275.8 |

313.8 |

3.1% |

11.3% |

0.7x |

Accumulate |

|

NCBA*** |

25.6 |

25.5 |

(0.4%) |

(4.1%) |

26.6 |

25.4 |

1.0% |

0.6% |

0.7x |

Lighten |

|

CIC Group |

2.1 |

2.2 |

2.4% |

1.9% |

2.1 |

2.1 |

0.0% |

(2.3%) |

0.8x |

Sell |

|

HF Group |

3.4 |

3.6 |

7.7% |

15.9% |

3.1 |

3.0 |

0.0% |

(17.6%) |

0.1x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/ or its affiliates are invested in |

||||||||||

We are “Neutral” on the Equities markets in the short term. We expect the recent discovery of a new strain of COVID-19 coupled with the introduction of strict lockdown measures in major economies to continue dampening the economic outlook. However, we maintain our bias towards a “Bullish” equities markets in the medium to long term. We believe there exist pockets of value in the market, with a bias on financial services stocks given the resilience exhibited in the sector. The sector is currently trading at historically cheaper valuations and as such, presents attractive opportunities for investors.

In 2020, the real estate sector recorded moderate activities with a general decline in transactions attributed to the tough economic environment in the wake of the Covid-19 pandemic that had adverse effects on the sector. The effects of the pandemic were mainly felt in the sector from Q2’2020 with the real estate and construction recording a growth of 6.1% down from 13.2% growth recorded in Q2’2019.

The main factors that constrained performance of the real estate sector included;

- Constrained financing to developers due to the increased perceived risk levels,

- Business restructuring with some firms downsizing hence reducing occupancies and overall rental yields, and,

- Travel restrictions, attributed to the COVID-19 pandemic that led to a near cessation of international flights in a bid to minimize the spread of the virus which mainly affected the performance of the hospitality sector.

Despite the sluggish growth, performance of the real estate sector was cushioned by;

- Good demand given the positive demographics with Kenya’s high urbanization and population growth rates currently standing at 4.0% and 2.2%, compared to the global averages of 1.9% and 1.1%, respectively,

- Continued launch of affordable housing projects,

- Improved access to mortgage loans especially through the Kenya Mortgage Refinancing Company (KMRC),

- Improved infrastructure opening up areas for investment, and,

- Towards the end of the year, easing of travel restrictions as well the government’s post-COVID stimulus packages boosting the hospitality sector.

In 2020, the real estate sector recorded moderate activities with a general decline in concluded transactions. There was a decline in the performance of all the sectors, resulting to an average rental yield for the real estate market of 6.1%, 0.9% points lower compared to 7.0% recorded in 2019.

The table below is a summary of thematic performance of average rental yields in 2020 compared to 2019;

|

Real Estate Thematic Performance- Average Rental Yields |

|||

|

Theme |

Rental Yield FY’2020 |

Rental Yield FY’2019 |

Y/Y Change (% Points) |

|

Residential |

4.7% |

5.0% |

(0.3%) |

|

Commercial Office |

7.0% |

7.5% |

(0.5%) |

|

Retail |

7.5% |

7.8% |

(0.3%) |

|

Mixed Use Developments (MUDs) |

7.1% |

7.3% |

(0.2%) |

|

Serviced Apartments |

4.0% |

7.6% |

(3.6%) |

|

Grand Average |

6.1% |

7.0% |

(0.9%) |

The decline is attributed to subdued performance across all sectors due to reduced sale and rental rates in a bid to attract and retain tenants amid a tough economic environment, as well as oversupply of approximately 6.3 mn SQFT of office space and 3.1 msn SQFT of retail space in the wake of reduced demand for physical space in the two sectors. For a detailed review of 2020 performance, see our Real Estate Annual Markets Review 2020 Note.

In 2021, we expect the key drivers of real estate to be:

- The Affordable Housing Initiative: Increased activities are expected on the affordable housing front despite the reduced budget allocation in the FY’2020/21 National Budget, with an allocation of Kshs 6.9 bn, 34.3% lower than the Kshs 10.5 bn allocated in 2019/2020. The Kenyan Government through the Nairobi Metropolitan Service has so far launched phase two of the affordable housing programme in ten city estates under the Nairobi Urban regeneration project while other affordable housing projects such as Shauri Moyo, Makongeni and Starehe houses are underway,

- Infrastructural development: The government continues to implement select projects such as the Nairobi Express way, Nairobi-Western Bypass, Lamu Port and Lamu-Southern Sudan-Ethiopia Transport Corridor Project (LAPSSET), and, Mombasa Port Development Project and we expect these to open up areas for developments upon their completion thus boosting the real estate sector,

- Attractive Demographic Profile: Kenya has a relatively high population and urbanization growth rate of 4.0% and 2.2% against a global average of 1.9% and 1.1% according to the World Bank, and this is expected to continue to support demand in the real estate sector,

- Attractiveness of Kenya as a regional hub due to ease of doing business in Kenya: Kenya has been ranked position #56 by World Bank in the ease of doing business index. This is likely to boost investor confidence in Kenya thus driving foreign direct investment which is likely to boost the performance of the real estate especially on the infrastructure, commercial and retail sectors,

- Gradual Recovery of the Tourism Industry: The gradual recovery of the tourism industry is expected to boost the hospitality sector supported by financial aid from government through the Post-Corona Hospitality Sector Recovery Stimulus package offered by the Ministry of Tourism through the Tourism Finance Corporation (TFC), repackaging of the tourism sector to appeal to domestic tourists and relaxation of travel advisories, and,

- Provision of Affordable Mortgage Loans by Kenya Mortgage Refinance Corporation (KMRC): The establishment of the KMRC is expected to boost the mortgage market in Kenya through lending at relatively low interest rates of 5.0% to Primary Mortgage Lenders (PML’s) enabling them to write off loans at an interest rate of 7.0% which is lower than the current average interest rate of 12.0%.

- E-commerce: As a result of the government’s guidelines on social distancing due to the coronavirus pandemic retailers embraced online shopping evident by 8.6% growth in internet subscription rates according to Economic Survey 2020.This has further been enabled by mobile wallets gaining popularity, hence making online shopping more convenient. E-commerce is also supported by most businesses scaling down on physical retail space to reduce expenses amid tough economic times.

Despite the above drivers, the sector is expected to be constrained by the following factors in 2021:

- Oversupply in Select Sectors: The real estate sector has witnessed increased space supply over the last 5-years and this is likely to affect the demand of some of these sectors. Some of the affected sectors include;

- The commercial office sector which has an oversupply of 6.3m SQFT, and,

- The retail sector, which has an existing oversupply of 3.1 mn SQFT within Nairobi and 2.0 in the Kenya Retail market,

- Constrained Financing for Developers: Constrained financing to developers is a factor that is expected to negatively impact the performance of the real estate sector as financiers such as banks aim to limit exposure amidst increasing loan deferrals and defaults in the wake of the pandemic,

- Reduced Disposable Income: Reduced disposable income as a result of the tough economic times brought about by the COVID-19 pandemic is expected to affect uptake of property thus impacting on the performance of the real estate market,

- Kenya Mortgage and Refinance Company facing a challenge in limitation of housing options: Given the relatively low loan size of Kshs 4.0 for property within the Nairobi Metropolitan Area, potential homeowners will have few or no options of housing units within the NMA due to the relatively high property prices and low supply of affordable housing units thus forcing them to focus on housing units within satellite towns which are relatively affordable,

- Ineffectiveness of Public-Private Partnerships (PPPs) for Housing Development: This will continue to cause delays in delivery of affordable housing projects due factors such as to regulatory hindrances such as lack of a mechanism to transfer public land to a Special Purpose Vehicle (SPV) to facilitate access to private capital through the use of the land as security, lack of clarity on returns and revenue-sharing, bureaucracy and slow approval processes.

The table below summarizes our outlook on the various real estate themes and the possible impact on the business environment in 2021;

Thematic Performance Review and Outlook

|

Thematic Performance Review and Outlook |

|||

|

Theme |

2020 Performance |

2021 Outlook |

Effect |

|

Residential Sector |

|

|

Neutral |

|

Commercial Office Sector |

|

|

Negative |

|

Retail Sector |

|

|

Neutral |

|

Hospitality Sector |

|

|

Neutral |

|

Land Sector |

|

|

Positive |

|

Infrastructure Sector |

|

|

Neutral |

|

Listed Real Estate |

|

|

Negative |

Out of the seven sectors, the outlook is positive for one sector-land; neutral for four sectors-residential, retail, hospitality and infrastructure; and, negative for two sectors-commercial offices and listed real estate. Therefore, the overall outlook for the real estate sector is NEUTRAL, supported by; continued focus on the affordable housing initiative, the operationalization of KMRC, expansion of local and international retailers, the government’s post- COVID stimulus package set to boost performance of the hospitality sector, and, improvement of infrastructure opening up areas for investment. The sector will however continue to experience constraints such as oversupply of 6.3mn SQFT of office space 3.1mn SQFT within the NMA of retail space and sluggish performance of the REIT market.

For the detailed real estate market outlook report, see our Real Estate Sector 2021 Market Outlook Note.

Outlook Summary

Our outlook for Fixed Income is “neutral”, and our view is investors should be bias towards short-term fixed income securities, in a bid to reduce duration risk. Our outlook for equities is “neutral”, while our outlook for real estate is “neutral”. In summary, our Outlook for 2021 Asset Classes is Neutral.

Key: Green – POSITIVE, Grey – NEUTRAL, Red – NEGATIVE

|

|

Fixed Income & Equities Outlook for 2021 |

|

Fixed Income |

Our view is that investors should be biased towards SHORT-TERM FIXED INCOME INSTRUMENTS to reduce duration risk. The political climate is expected to heat up earlier with the investors expected to retrieve to “Safer” asset classes – Fixed income securities, in the H2’2021 as they closely monitor the political situation. We anticipate upward pressure on interest rates as the government seeks to borrow more to fund infrastructural projects |

|

Equities |

We have a NEUTRAL outlook on the Kenyan Equities market in the short term but “POSITIVE” in the medium to long term. We expect an upward recover in earnings growth in 2021, supported by a relatively stable business operating environment, coupled with the improved investor sentiment to support positive performance in the equities market in 2021 |

|

Real Estate Outlook Summary |

|

|

Real Estate Sector |

The overall outlook for the real estate sector is NEUTRAL, supported by; continued focus on the affordable housing initiative, the operationalization of KMRC, expansion of local and international retailers, the government’s post- COVID stimulus package set to boost performance of the hospitality sector, and, improvement of infrastructure opening up areas for investment |