Cytonn 2024 Markets Outlook

By Cytonn Research, Jan 28, 2024

Executive Summary

Global Markets Outlook

According to the World Bank’s Global Economic Prospects 2024, global economic growth is expected to remain subdued for the third consecutive year, slowing down to 2.4%, from the estimated 2.6% growth rate in 2023. The expected economic slowdown is driven by the persistent high global inflation that has in turn necessitated tightening of monetary policies slowing down activity in most economies, subdued global trade and investment, restrictive credit conditions, and the pre-existing supply chain constraints worsened by geopolitical tensions as evidenced by the Russian-Ukraine conflict as well as the recent conflicts in the Middle East. The 2024 inflation rate is expected to ease to 3.7% in 2024 as compared to the 6.9% estimate in 2023, mainly attributable to declining commodity prices. However, despite the expected ease in inflation, global inflation will remain elevated driven by persistent supply chain constraints and currency depreciations. Moreover, the growth in the Emerging Market and Developing Economies (EMDEs) is expected to expand by 3.5% in 2024, 0.3% points increase from the estimated growth of 3.2% in 2023;

Sub-Saharan Africa Regional Market Outlook:

According to the World Bank’s Global Economic Prospects 2024, growth in the Sub-Saharan Africa region is expected to rebound to 3.8% in 2024, from the estimated growth rate of 2.9% recorded in 2023 mainly attributable to the easing inflationary policies, reduction in prices of key imports such as fertilizers, metal and fuel, improved fiscal support and the expected increase in domestic demand. However, the projections remain subject to key downward risks such as the monetary policy tightening across the region to address inflation which may lead to reduced economic activity in the region. Additionally, expected policy hikes in developed economies such as the US are to put pressure on the region’s investment landscape as a result of increased capital outflows to more attractive markets;

Kenya Macro Economic Outlook:

GDP Growth – Our outlook for 2024 is Neutral on GDP Growth. We are projecting the economy to register a growth within the range of 5.0%-5.4% in 2024 supported by continued recovery of business activity, expected rebound in the agricultural sector, and robust performance in the services sector driven by growth in information and technology as well as accommodation and food services as a result of increased tourism. The key downside to this growth shall be restrictive monetary policy stance, high risk of debt distress, elevated inflation, and local currency depreciation;

Inflation - Our outlook for 2024 is Neutral on Inflation. We expect the annual average inflation rate to fall back within the government’s target of 2.5%-7.5% coming in at an average of 6.9% as compared to 7.7% in 2023. We expect the decline in inflation to be driven by the rebound in the agricultural sector and the expected cooling in inflation, both globally and locally as the tightened monetary policy continues to take effect. However, we expect inflationary pressures to remain elevated due to high electricity prices, high fuel costs, and continued depreciation of the Kenyan shilling;

Currency - Our outlook for 2024 is Negative on Currency. We project the Kenya Shilling to trade within the range of between Kshs 183.2 and Kshs 189.6 based on the purchasing power parity (PPP) and interest rate parity (IRP) approach respectively, with a bias towards 16.4% depreciation against the USD in 2024. We expect the depreciation to be mainly driven by the persistent current account deficit with Kenya being a net importer, which will increase dollar demand in the market placing more strain on the local currency. Additionally, the increasing debt servicing costs continue to put pressure on forex reserves given the Eurobond coupons which are falling due ahead of the maturity of the 2014 issue in June 2024;

Interest Rates – Our outlook for 2024 is Neutral on Interest Rates. We expect the Central Bank to maintain its tight monetary policy stance in the short term with the intention of anchoring inflation and mitigating the depreciation of the Kenyan shilling. However, we expect the interest rate environment to stabilize in the medium term as the government meets the coupon payments and the eventual redemption of the 10-year Eurobond due in June 2024 with the support of concessional loans and commercial financing;

Government borrowing – Our outlook for 2024 is Negative on Government Borrowing. We expect the government to borrow aggressively from both the domestic and foreign markets as it plans to borrow Kshs 703.9 bn in the FY’2024/25 to plug in the fiscal deficit, which is projected to come in at Kshs 704.0 bn, equivalent to 3.9% of the GDP. Furthermore, the government expects to receive more concessional financing from the IMF and the World Bank, in addition to commercial loans from loans from commercial lenders such as the Trade & Development Bank (TDB) and the African Development Bank. On revenue collection, we expect continued improvement in 2024 due to the raft of measures taken by the Kenya Revenue Authority such as the implementation of the Finance Act 2023 which revised a number of taxes upwards and widened the tax base to include the informal sector and digital services. The regime has also taken measures to strengthen tax administration by leveraging technology to seal leakages, rolling out a Tax Invoice Management System (e-TIMS), and enhancing both the iTax platform and the Integrated Customs Management System (iCMS). However, the upward revision of taxes comes at a time when the business environment remains subdued which will weigh down on the projected revenue performance;

Investor Sentiment – Our outlook for 2024 is Neutral on Investor Sentiment. We expect the low investor sentiments witnessed in 2023 to persist through the short term of 2024, mainly due to elevated inflationary pressures driven by high electricity costs and high fuel costs, and continued depreciation of the Kenyan currency as a result of increased dollar demand from importers and high debt servicing. However, we expect investor sentiments to improve in the medium term as the country meets its coupon payments and the eventual maturity of the USD 2.0 bn Eurobond due in June 2024. Additionally, we expect the renewed focus on Public-private Partnerships (PPP) to finance commercially viable projects to spur growth in the private sector;

Security – Our outlook for 2024 is Positive on Security. We expect security to be maintained in 2024 with a stable political environment, following the peaceful dispute-resolution mechanisms adopted by the current regime and the opposition;

Fixed Income Outlook

We expect interest rates to remain elevated on the back of the government’s increased borrowing for upcoming external debt maturities, budgetary support, funding of infrastructure projects, and payment of domestic maturities which stand at Kshs 620.6 bn for the second half of the FY’2023/2024. Investors should be biased towards SHORT-TERM FIXED INCOME INSTRUMENTS to reduce duration risk resulting from the upwards trend of the current interest rates market;

Equities Outlook

We have a NEUTRAL outlook on the Kenyan Equities market in the short term but “BULLISH” in the medium to long term. We expect a slight improvement in the listed sector’s earnings growth in 2024, largely driven by the expected 5.0%-5.4% GDP growth and the improvement of the country’s business environment. The business environment showed signs of improvement in the last month of 2023, with the Purchasing Manager’s Index (PMI) coming in at 48.8, higher than the year’s average of 48.1. The dwindling currency and investor flight which has still persisted in the early weeks of the year may, however, inhibit the growth of the equities market in the short-term;

Real Estate Outlook:

Residential sector: Our outlook for the Nairobi Metropolitan Area (NMA) residential sector is NEUTRAL. The demand for housing is expected to persist in 2024, driven by positive population demographics. Increased efforts by the government to implement its affordable housing agenda are expected to spur further growth in the sector. Additionally, expansion and development of infrastructural projects is set to boost the sector, as well as efforts by the government to avail low-cost loans to Kenyans through Kenya Mortgage Refinance Company (KMRC), which are poised to enhance homeownership. Conversely, we expect the sector to be weighed down by the prevailing tough economic environment such as the weakening Shilling, high inflation, the low penetration of mortgages, as well as soaring cost of construction. For detached units, investment opportunity lies in areas such as Ngong, Syokimau, and Athi River, while for apartments, investment opportunity lies in Waiyaki Way, Athi River and Thindigua due to their remarkable returns driven by relatively high returns to investors;

Commercial Office Sector: Our overall outlook for the NMA commercial office sector is NEUTRAL. We expect a slight increase in performance by 0.2% points, attributable to the expected increase in the overall rental rates. We expect the improved performance to be supported by; i) increased entry of multinational companies into the country, ii) Kenya’s continued recognition as a regional business hub which continues to attract multinational companies expanding into the continent, iii) increasing number of start-ups, iv) gaining traction in co-working spaces, and, v) landlords growing preference for dollar-denominated rental prices, in efforts geared towards mitigating forex losses. However, we expect that an increased incoming supply compared to a similar period last year and the existing oversupply estimated at 5.8 mn SQFT in the Nairobi Metropolitan Area (NMA) will weigh down on the sector’s performance by stifling absorption rates. Investment opportunity lies in Westlands, Gigiri, and Parklands, which continue to record high returns at 8.5%, 8.2%, and, 8.0%, respectively, compared to the market average of 7.7%;

Retail Sector: We have a NEUTRAL outlook on the retail sector’s performance which is expected to be driven by the; i) continuous aggressive expansion by both local and foreign retailers taking up new and existing spaces, ii) progressive developments in public infrastructure of roads and railway projects boosting accessibility in new areas for investments, and, iii) positive demographics facilitating increasing demand. However, sub-optimal growth in the sector is expected to be facilitated by some negative factors such as; i) existing oversupply at approximately 3.0 mn SQFT in NMA and the rest of the Kenyan retail sector totalling approximately 1.7 mn SQFT, ii) growing adoption of e-commerce by most retailers which continues to undermine occupier demand, and, iii) limited access and expensive financing from financial institutions to cater for developments, expansion and improvement in operations towards advanced technological levels geared at enhancing their efficiency by both small and medium-sized enterprises. Investment opportunities lie in Westlands, Karen, and Kilimani with relatively higher returns of 9.9%, 10.2%, and 9.5% respectively, compared to the market average of 8.3%, attributed to the presence of high-quality retail spaces fetching high rents, coupled with the availability of quality infrastructure services;

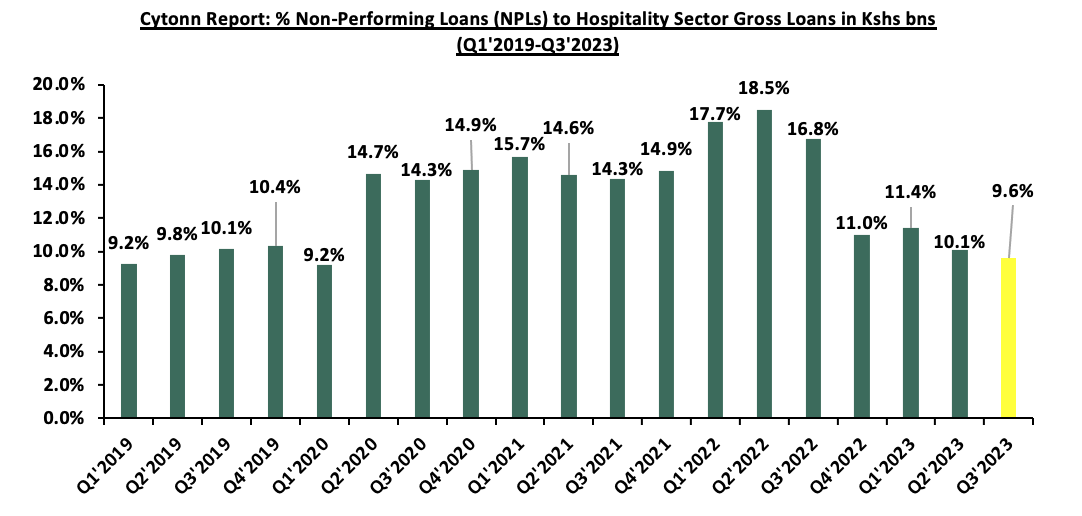

Hospitality Sector: We have a POSITIVE outlook for the sector as we expect the sector to continue registering improved performance moving forward in terms of overall hotels in operations, hotel bookings, and hotel occupancies. The direct flights from Dubai to Mombasa by FlyDubai will create a new and convenient travel option for international tourists, potentially boosting the number of arrivals in Mombasa. Notably, there has been a substantial 31.7% Year-on-Year (y/y) surge in international arrivals through Jomo Kenyatta International Airport (JKIA) and Moi International Airport (MIA) in Q3’2023, reaching 451,441, as reported in the Leading Economic Indicators (LEI) October 2023 report, compared to 342,904 recorded in Q3’2022. The ease of access is likely to attract tourists seeking the vibrant tourism offerings in Kenya. However, we anticipate factors such as; i) the release of cautionary statements by governments like China and Canada in December 2023, advising their citizens against traveling to Kenya due to worries about terrorism threats, elevated crime rates, frequent power outages, and unsafe transport systems, is anticipated to compound challenges in the sector, ii) the weakening of Kenyan shilling against the US dollar, raising the prices of crucial inputs hence escalating operational costs, iii) difficulty in accessing finance as lenders demand more collateral to cushion themselves owing to elevated credit risk, and, iv) projected decline in the volumes of mergers and acquisitions within the hospitality industry due to increased associated costs, attributable to the increase in capital gains tax in January 2023. Prime investment prospects lie in Westlands, Limuru Road, and Kilimani, where average rental yields stood at 10.2%, 8.2%, and 7.7%, respectively, surpassing the market average of 6.8% in 2023. This is due to their proximity to the CBD, the existence of top-tier serviced apartments commanding premium rates, convenient accessibility, and their closeness to international organizations, fostering a robust demand for serviced apartments in these areas;

Land Sector: We retain a POSITIVE outlook for the land sector in the NMA which has consistently demonstrated its resilience, affirming its position as a reliable investment opportunity. We expect that the sector's performance will be driven by several key factors including; i) increased demand for land for development supported by positive population demographics, ii) ongoing government initiatives to streamline land transactions leading to a more efficient and accessible market, iii) notable increase in the initiation and completion of affordable housing projects owing to both government and private sector involvement, iv) tax policies, and, v) rapid expansion of satellite towns, coupled with substantial infrastructural developments resulting in higher property prices. The investment opportunity lies in Juja, Utawala, and Rongai for unserviced land, which recorded annualized capital appreciations of 12.3%, 11.6%, and 9.8% respectively compared to a market average of 8.8%. For serviced schemes, Ruiru-Juja, and Ruai recorded the highest annualized capital appreciations of 6.8% and 6.0%, respectively against the serviced average of 5.9%;

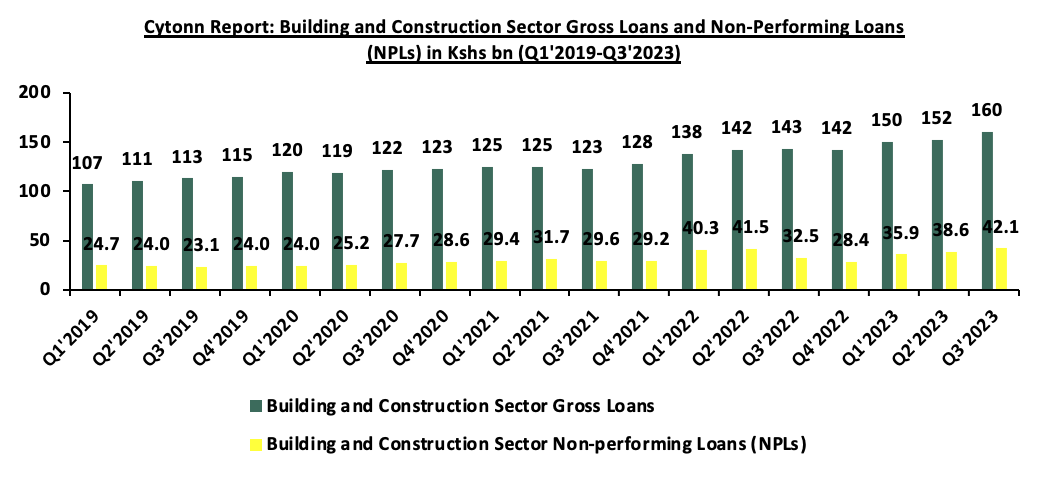

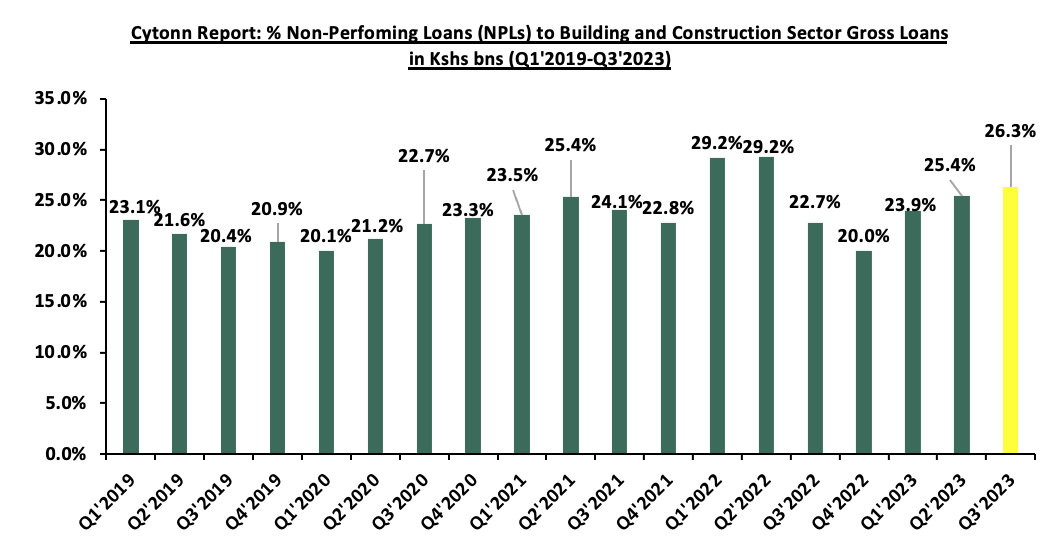

Infrastructure Sector: We have a NEUTRAL outlook for the sector as we expect to continue seeing the progress, execution, and completion of more infrastructural developments in 2024 mainly supported by the government's aggressiveness to; i) construct and rehabilitate roads, bridges, railways, airports, and affordable housing units, among others, ii) increase its diplomacy and partnerships in development among neighbouring nations, and, iii) step up on the competition for attracting regional and international investors against other countries in Eastern Africa like Tanzania through railway connections and ports infrastructure. According to the Draft 2024 Budget Policy Statement, the government's Infrastructure, Energy, and ICT allocation for the FY'2024/2025 is forecasted to be Kshs 505.7 bn, representing an 8.0% increase from Kshs 468.2 bn FY'2023/2024. This increase is attributed to an extensive array of strategic programs and interventions. However, recent budgetary cuts to the state department for housing, and a general reduction in the country’s development expenditure will potentially hinder optimal performance of the sector. According to the Supplementary Budget FY’2023/24, allocation to the State Department of Roads was reduced by 8.3% to Kshs 230.1 bn from Kshs 250.8 bn. This was attributed to the redirection of funds to other key sectors such as education, as well as to address mounting costs over debt repayment, on the back of increasing debt obligations exacerbated by the continued depreciation of the Kenyan Shilling. The above indicates a shift in the government’s spending priorities, signaling reduced road expenditure in the FY’2023/24. We anticipate that Kenya’s infrastructure sector will witness a slowdown in the number of initiated and completed road construction and maintenance projects going forward;

Industrial Sector: We have a POSITIVE outlook on the industrial sector’s performance. We expect to witness sustained growth in the sector as investors continue to respond to the growing demand for industrial space. Data centres, cold rooms, growth in e-commerce, and rising demand for fast-moving consumer goods will drive growth in the industrial sector. In 2024, we expect heightened development activities in the sector with projects such as the Africa Data Centres’ (ADC) new facility scheduled for completion in the first quarter of 2024. This facility is set to deliver an additional 15 MW of IT load, expanding ADC's current infrastructure and addressing the increasing demand for digital services in East Africa. Moving forward, we expect the Kenyan industrial sector will continue on an upward trajectory supported by; i) rising demand for e-commerce warehouses in the retail sector, ii) the rising demand for space to store goods meant for delivery to clients across the country, as more people shift towards home delivery as a convenient and efficient way to purchase goods, iii) government's accelerated focus on exporting agricultural and horticultural products to the international market, with an aim to improve the quantity, quality, efficiency, and reliability of Kenya-farmed produce thereby increasing the country’s competitiveness, iv) Kenya’s continued recognition as a regional hub hence attracting investments, and, v) continued improvement in infrastructure through projects such as the Standard Gauge Railway (SGR), the Eastern and Northern Bypasses connecting Jomo Kenyatta International Airport (JKIA) and other regions in the Nairobi Metropolitan Area, among other key infrastructural improvements which we expect will increase the output of Special Economic Zones (SEZs) and Inland Container Depots (ICDs);

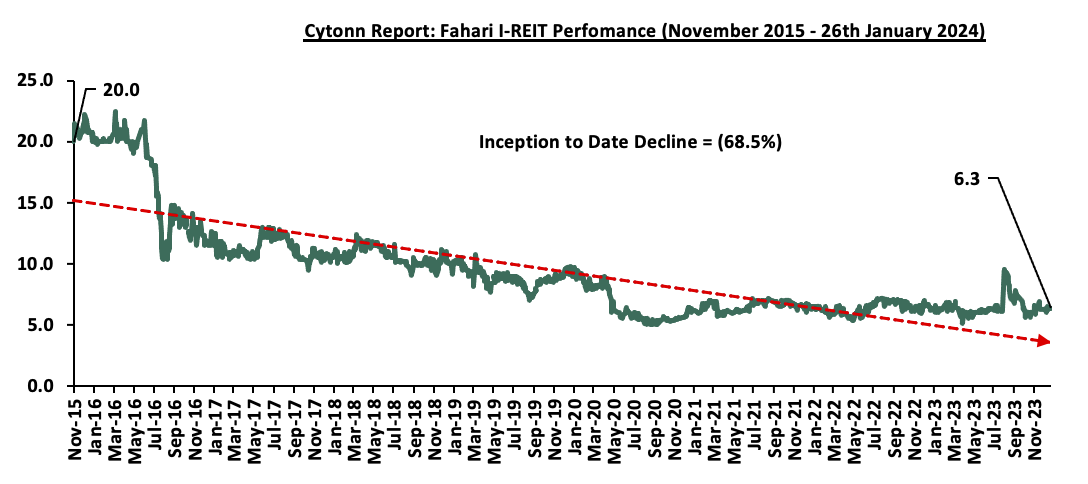

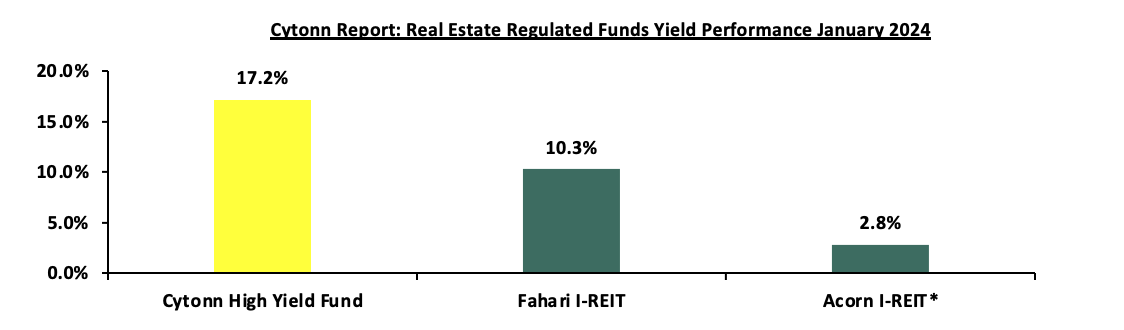

Listed Real Estate: We retain a NEUTRAL outlook for the Kenyan REIT sector, leaning towards the negative. Some of the factors expected will continue hindering the optimal performance of the sector market include; i) low investors’ appetite in trading and investing in the market, ii) lengthy registration, licensing, and approval process, iii) high minimum investment amounts Set at Kshs 5.0 mn, iv) insufficient Investment Knowledge and Awareness of the REITs market v) subdued performance in some Real Estate sectors with oversupply of spaces in Commercial Office Sector at 7.3 mn SQFT and Retail Sector at 3.0 mn SQFT in the NMA expected to affect performance of the instrument due to low rental yields, and, vi) high Minimum capital requirements for a Trustee of Kshs 100.0 mn. However, we expect initiatives including; i) the proposed establishment of the Kenya National REIT (KNR), ii) business operational restructuring strategies employed by key industry players such as Fahari I-REIT geared towards achieving business and financial optimization as well as sustainability, and iii) the launch of the Vuka Investment Platform towards the end of 2022 will assist neutralize and mitigate the above challenges, thereby contributing to the overall enhancement of the sector's performance in the Kenyan Real Estate capital markets.

Outlook Summary

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 15.72% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

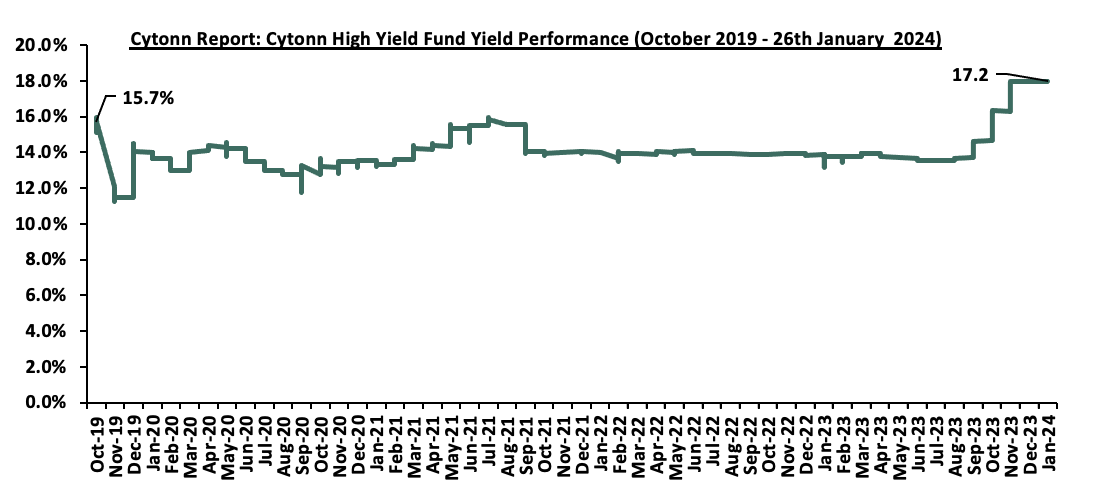

- Cytonn High Yield Fund closed the week at a yield of 17.95% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Monday, from 10:00 am to 12:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire, and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Global Economic Growth:

According to the World Bank’s Global Economic Prospects 2024, global economic growth is expected to remain subdued for the third consecutive year, slowing down to 2.4%, from the estimated 2.6% growth rate in 2023. The expected economic slowdown is driven by the persistent high global inflation that has in turn necessitated tightening of monetary policies slowing down activity in most economies, subdued global trade and investment, restrictive credit conditions, and the pre-existing supply chain constraints worsened by geopolitical tensions as evidenced by the Russian-Ukraine conflict as well as the recent conflicts in the Middle East. The 2024 inflation rate is expected to ease to 3.7% in 2024 as compared to the 6.9% estimate in 2023, mainly attributable to declining commodity prices. However, despite the expected ease in inflation, global inflation will remain elevated driven by persistent supply chain constraints and currency depreciations. Moreover, the growth in the Emerging Market and Developing Economies (EMDEs) is expected to expand by 3.5% in 2024, a 0.3% points increase from the estimated growth of 3.2% in 2023.

Growth in 2024 shall be shaped by the following four key themes:

- Tightened Monetary Policies

In line with inflation targeting strategies, we expect most of the Central banks to continue raising their interest rates as they monitor inflation levels given the persistent high fuel prices as well as food prices, especially in developing economies. Key to note, the past two years have seen one of the fastest monetary policy tightening initiatives in history. The tightening of monetary policy will be driven by the need to control the heightened inflation by reducing the money supply and easing the upward cost pressures. Additionally, the interest hikes will be adopted driven by the need to anchor local currencies from aggressive currency depreciations following increased benchmark rates in developed economies. Notably, most Central banks raised their benchmark interest rates in 2023 with the intention to anchor inflation, however, the tightened monetary policies led to reduced economic activity translating to a subdued global demand. while interest rate hikes are anticipated to continue at a more moderate pace, they are expected to exert a dampening effect on economic performance due to the resulting tighter financial conditions. This, in turn, will impede both production and consumer spending, ultimately contributing to a decline in global trade.

In their latest meeting, the USA Federal Reserve maintained the tightened monetary stance at 5.25%-5.50% in a bid to anchor the high inflation level having increased by 0.2% points to 3.4% in December 2023, from 3.1% recorded in November. However, the Fed noted that their efforts to anchor inflation through monetary policy tightening were still transmitting in the economy as inflation had eased by 3.1% points from the 6.5% inflation recorded in December 2022. Additionally, in their most recent sittings, China, England, Canada, and the Euro Area also kept their tightened monetary policy rates unchanged. As such, Central Banks, particularly in emerging markets, will have to perform difficult balancing acts in order to avoid stifling economic growth and post-pandemic recovery. In our view, we expect the coming rate hikes to be gradual as economies seek to adopt accommodative policies that we see inflation ease while avoiding stifling economic growth.

The table below highlights the policy stance adopted by the Central Banks of major economies

|

Cytonn Report: Monetary Policy Stance Adopted by Central Banks in Select Economies |

|||||

|

No |

Country |

Central Bank |

Previous Rate |

Current Rate |

Margin |

|

1 |

USA |

Federal Reserve |

5.00%-5.25% |

5.25%-5.5% |

Unchanged |

|

2 |

Australia |

Reserve Bank of Australia |

4.35% |

4.35% |

Unchanged |

|

3 |

Malaysia |

Bank Negara Malaysia |

3.00% |

3.00% |

Unchanged |

|

4 |

China |

Bank of China |

3.45% |

3.45% |

Unchanged |

|

5 |

England |

Bank of England |

5.25% |

5.25% |

Unchanged |

|

6 |

Canada |

Bank of Canada |

5.00% |

5.00% |

Unchanged |

|

7 |

Euro Area |

European Central Bank |

4.50% |

4.50% |

Unchanged |

- Easing Commodity Prices

In 2023, most of the commodity prices were on a downward trajectory and are projected to ease further in 2024. According to the World Bank’s report, the recent conflict in the Middle East has so far had only a muted impact on commodity prices as most of the prices weakened to varying degrees, however, remaining above pre-pandemic levels as shown in the table below:

|

Cytonn Report: Average Commodity Prices (USD) |

||||||

|

Commodity Index |

2022 |

2023 |

Average y/y change |

Jun-23 |

Dec-23 |

Half-year Change |

|

Fertilizers |

235.7 |

153.5 |

(34.9%) |

138.3 |

119.4 |

(13.7%) |

|

Energy Prices |

152.6 |

106.9 |

(29.9%) |

95.2 |

99.5 |

4.52% |

|

Non-energy commodities |

122.1 |

110.1 |

(9.8%) |

107.7 |

107.2 |

(0.4%) |

|

Metals & Minerals |

115.0 |

104.0 |

(9.6%) |

101.2 |

102.4 |

1.15% |

|

Agriculture |

119.3 |

110.7 |

(7.2%) |

109.1 |

108.9 |

(0.2%) |

|

Precious metals |

136.8 |

147.3 |

7.70% |

147.4 |

153.4 |

3.83% |

Oil prices have been under downward pressure declining by 29.9% in 2023, a reversal form the 60.0% increase which was recorded in 2022, amid weak global economic activity coupled with slowed global demand on the back of the easing supply chain constraints which had been worsened by the Russia-Ukraine conflict. Oil prices are expected to decline further in 2024 but remain above the pre-pandemic levels on the back of supply disruption concerns in the aftermath of the Middle East conflict, Slower-than-expected growth, and the extension and deepening of production cuts by OPEC+. Prices of metals and minerals also exhibited a decline of 9.6% in 2023 and are expected to decline by 5.0% in 2024 mainly on the back of a sharper slowdown in activity among advanced economies and China, which could further weaken metal demand in 2024, coupled with trade restrictions and other policy actions. Food prices, which is the biggest component of the agriculture World Bank Commodity index fell by 10.1% in 2023 and is expected to decline by 1.0% amid the ample supplies with prices of oils and meals, and grains having declined by 22.1% and 13.0% to USD 118.9 and USD 133.0, from USD 154.2 and USD 150.4 respectively, an indication of better agricultural productions globally. However, Key upside risks to food prices include increases in energy costs, adverse weather events, further trade restrictions, and geopolitical uncertainty, as this will further constrain the supply chain and hence exert pressure on prices.

- Global Trade

The World Bank projects the global trade growth to improve to 2.3% growth in 2024 from the 0.2% growth rate in 2023 on the back of projected growth in global output. Goods trade is expected to start expanding again, while the contribution of services to total trade growth is expected to decrease, aligning more closely with the trade composition patterns observed before the pandemic. However, growth in global trade remains subdued mainly due to the persistent supply chain constraints worsened by the Russian-Ukraine conflict, and the tight monetary policies adopted by economies especially developed economies leading to massive capital outflows from emerging and developing economies. Key to note, the ongoing geographical conflicts in the Middle East remain a key risk in 2024 and could potentially disrupt the recovering global supply chains hence slowing down global trade. Additionally, uncertainty unfolds as major global economies such as United States, United Kingdom, and Russia as well as other key Emerging Markets nations such as India, Taiwan, Mexico, and South Africa are expected to conduct their general elections in 2024 which can lead to great policy regime shifts and hence affecting global trade. In our view, global trade will remain subdued in the near term due to the elevated global inflationary pressures despite global inflation projection coming in at 3.7% in 2024, 3.2% points below the 6.9% recorded in 2023, inflationary pressures still remain significantly above the pre-pandemic (2015-2019) average of 2.3%.

- Public Debt

High debt levels especially in Emerging Markets and developing economies (EMDEs) are expected to persist in 2024 mainly on the back of widened current account deficits and surging debt service costs due to declining global trade and currency depreciation in most economies, coupled with tighter financial conditions undermining economic growth. According to the Global Debt Monitor by (IMF), the global public debt (public and non-financial private debt stocks) came in at 238.0% of the GDP, (USD 235.0 tn) in 2022, translating to 10.0% points decline from 247.0% of the GDP recorded in 2021. Similarly, public debt stock as a percentage of GDP declined by 3.6% points to 92.0% in 2022, from 96.0% recorded in 2021. However, given the perceived interest hikes in 2024, especially in developed economies such as the US that have strengthened the dollar, global public debt is expected to increase significantly due to the increase of debt servicing costs with a huge chunk of the external debt in most economies being dollar-denominated. In our view, global cooperation is needed to address debt sustainability concerns, particularly in regard to countries already at risk, given record-high debt levels and growing debt-servicing costs.

Below is a summary of the regional growth rates by country as per the World Bank:

|

|

Cytonn Report: World GDP Growth Rates |

||||||

|

Region |

2019 |

2020 |

2021 |

2022 |

2023e |

2024f |

|

|

1. |

India |

4.0% |

(6.6%) |

9.1% |

7.2% |

6.3% |

6.4% |

|

2. |

Kenya |

5.0% |

(0.3%) |

7.6% |

4.8% |

5.0% |

5.2% |

|

3. |

China |

6.0% |

2.2% |

8.4% |

3.0% |

5.2% |

4.5% |

|

4. |

Sub-Saharan Africa* |

2.5% |

(2.0%) |

4.4% |

3.7% |

2.9% |

3.8% |

|

5. |

Middle East, North Africa |

0.9% |

(3.6%) |

3.8% |

5.8% |

1.9% |

3.5% |

|

6. |

United States |

2.3% |

(2.8%) |

5.9% |

1.9% |

2.5% |

1.6% |

|

7. |

Brazil |

1.2% |

(3.3%) |

5.0% |

2.9% |

3.1% |

1.5% |

|

8. |

South Africa |

0.1% |

(6.3%) |

4.7% |

1.9% |

0.7% |

1.3% |

|

9. |

Japan |

(0.2%) |

(4.3%) |

2.6% |

1.0% |

1.8% |

0.9% |

|

10. |

Euro Area |

1.6% |

(6.1%) |

5.9% |

3.4% |

0.4% |

0.7% |

|

|

Global Growth Rate |

3.1% |

(3.2%) |

6.2% |

2.9% |

2.6% |

2.4% |

|

*Including South Africa |

|||||||

Global economic growth is forecasted to decline to 2.4% in 2024, from an estimate of 2.6% recorded in 2023 on the back of the persistent inflationary pressures, high global fuel and energy prices, continued geopolitical conflicts in Ukraine and the Middle East, and the sustained monetary policy tightening by most economies. Growth in China and USA is expected to slow down in 2024 to 4.5% and 1.6%, from 5.2% and 2.5% in 2023, respectively. The expected slowed growth in China is attributable to the Subdued investor sentiments which is expected to weigh on consumption as well as the persistent strains in the property sector due to the decline in property prices and sales in the country. Additionally, growth in Emerging Markets and Developing Economies (EMDEs) is projected to remain subdued at about 3.5% in 2024 and hence weigh down global growth on the back of the tighter financial conditions, heightened uncertainties brought by surging debt levels in the EMDEs, and the aggressive currency depreciation.

According to the World Bank’s Global Economic Prospects 2024, growth in the Sub-Saharan Africa region is expected to rebound to 3.8% in 2024, from the estimated growth rate of 2.9% recorded in 2023 mainly attributable to the easing inflationary policies, reduction in prices of key imports such as fertilizers, metal and fuel, improved fiscal support and the expected increase in domestic demand.

However, the projections remain subject to key downward risks such as:

- Monetary Policy tightening across the region to address inflation which may lead to reduced economic activity in the region. Additionally, expected policy hikes in developed economies such as the US are to put pressure on the region’s investment landscape as a result of increased capital outflows to more attractive markets,

- Persistent global inflationary pressures, which may lead to the deterioration of financial conditions in the region and high cost of living due to the high prices necessitating aggressive policy rate hikes in the region,

- The high debt levels in the region as borrowing persists in the region due to the ever-present fiscal deficits in the region. Additionally, the increased debt servicing costs due to the sustained currency depreciation of the local currencies against the Dollar are expected to put more pressure on the region’s growth as most of the region’s debt is dollar-denominated, and,

- Further rise in global or regional instability, such as the possible escalation of the conflict in the Middle East, which could drive up global energy and food prices which would in turn affect growth in the Sub-Saharan Africa region considering that most of the countries in the region are net importers.

In Nigeria, the region largest economy, growth is projected to accelerate 3.3% in 2024, from the estimated growth of 2.9% in 2023 attributable to the increase in oil production as witnessed in 2023 However, services growth weakened partly driven by a disruptive currency demonetization policy in the first quarter of 2023. Additionally, growth in South Africa is expected to increase slightly to 1.3% in 2024, from the estimated growth of 0.7% in 2023. The slowed growth in South Africa is attributable to the weaker demand in the context of weak job creation, high prices, and monetary policy tightening in the country, coupled with the persistent energy crisis with power outages hitting record highs in 2023, holding back manufacturing and mining production. Moreover, growth in the region is expected to be hampered by the high debt levels, stifled demand, persistent depreciation of local currencies as well as the increased cases of corruption in the region as indicated by the Corruption Perceptions Index. Growth in the Eastern African region is expected to remain subdued due to the witnessed political clashes in Ethiopia, South Sudan and the Democratic Republic of Congo, coupled with persistent unfavourable weather conditions which continue to stifle agricultural production.

The table below highlights the real GDP forecasts of select Sub - Saharan Africa countries;

|

Cytonn Report: Real GDP Forecasts of Select Sub - Saharan Africa countries |

||

|

Country |

2023e |

2024f |

|

Senegal |

4.1% |

8.8% |

|

Rwanda |

6.9% |

7.5% |

|

Ethiopia |

5.8% |

6.4% |

|

Uganda |

5.3% |

6.0% |

|

Tanzania |

5.1% |

5.5% |

|

Kenya |

5.0% |

5.2% |

|

Mauritius |

5.0% |

4.6% |

|

Nigeria |

2.9% |

3.3% |

|

Angola |

0.5% |

2.8% |

|

Ghana |

2.3% |

2.8% |

|

South Africa |

1.9% |

1.4% |

|

Average |

2.9% |

3.8% |

Note: e - estimate, f – forecast. Data Source: World Bank

- Economic Growth

According to the Kenya National Bureau of Statistics (KNBS) Q3’2023 Gross Domestic Product Report, the Kenyan economy recorded a 5.9% growth in Q3’2023, an improvement from the 4.7% expansion recorded in a similar period in 2022. The performance in Q3’2023 was mainly driven by the 6.7% growth in the agricultural sector due to favourable weather conditions, which led to a rebound in agricultural output. Consequently, the economy recorded an average growth of 5.5% in the first 3 quarters of 2023, a slight decline from the 5.6% average growth recorded in a similar period in 2022. The average GDP growth rate for 2023 is expected to be 5.2%, an improvement from the 4.8% expansion witnessed in 2022.

In 2024, we expect the economy to continue its recovery trajectory with the projected GDP growth to come in at a range of 5.0% - 5.4%.

The key factors that shall support growth include:

- Continued growth in Services and Agricultural sectors: The resurgence in the agricultural sector witnessed in 2023 is expected to continue into 2024 following continued support by the government through fertilizer and seed subsidy programs with the State Department for Crop Development getting the highest increase in budget allocation by 28.9% to Kshs 60.2 bn from Kshs 46.7 bn in the Supplementary Budget for the Fiscal Year 2023/24. The service sector is expected to register robust performance driven by growth in information and technology as internet connectivity increases, as well as accommodation and food services as a result of increased tourism,

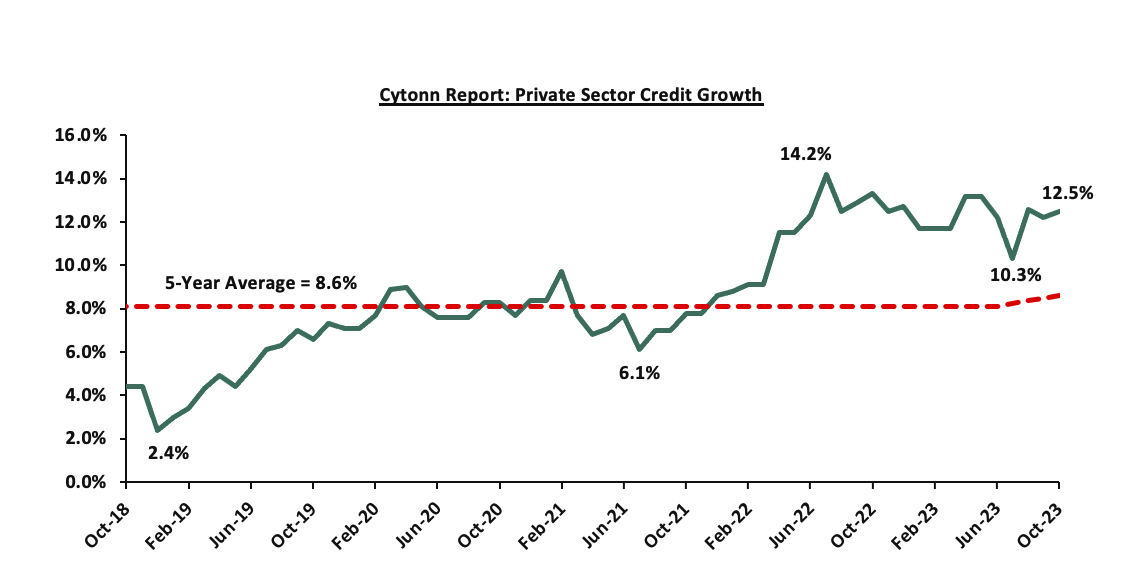

- Gradual Increase in Access to Credit: During the first 10 months of 2023, private sector credit growth rate averaged 12.1%, slightly higher than the 11.5% average growth rate recorded over the same period in 2022. The expansion of credit to the private sector is anticipated to sustain its momentum, driven by current policy initiatives such as the MSMEs Credit Guarantee Scheme and the ongoing economic revival. Additionally, we expect the renewed focus on Public-private Partnerships (PPP) to finance commercially viable projects to spur growth in the private sector. Furthermore, the Hustler Fund has continued to inject affordable credit to the private sector having disbursed Kshs 42.0 bn as of December 2023, and is expected to offer specific financial products starting January 2024. Despite the banking sector registering an increase in gross non-performing loans ratio to 13.1% in Q3’2023 from 12.2% in Q3’2022, the banks continued to advance credit to the private sector following the adoption of risk-based lending. The chart below shows 5-year private sector credit growth;

Source: CBK

However, key risks threaten economic growth including:

- High Risk of Debt Distress: According to International Monetary Fund and the World Bank, Kenya is currently at risk of high debt distress with the country’s debt to GDP ratio coming in at 72.6% as at Sep 2023, 20.1% points above the recommended IMF threshold of 50.0% for developing countries. Additionally, Kenya’s debt stood at Kshs 10.6 tn as of September 2023, 21.7% higher than the Kshs 8.7 tn debt recorded over a similar period in 2022. Consequently, the government will face significant pressure to service the existing debt with the debt service to revenue ratio standing at 55.0% as of December 2023, 25.0% points above the 30.0% threshold recommended by the IMF. Economic growth potential diminishes when debt levels are high because a significant part of the revenue is allocated towards servicing the existing debt, leaving less for developmental spending,

- Tightened Monetary Policy – In 2023, the Monetary Policy Committee (MPC) raised the Central Bank Rate (CBR) by 375.0 bps from 8.75% in January to 12.5% in December, in a bid to anchor the inflation rate within the CBK’s target range of 2.5%-7.5% from the 7.7% average registered in 2023 and also to support the Kenyan shilling which lost 26.8% of its value against the US Dollar in the year 2023. The high CBR is expected to stifle economic growth, and,

- Elevated Inflation –The country’s inflation rate averaged 7.7% in 2023 above the CBK’s target range of 2.5%-7.5%. Despite the overall headline inflation remaining within the CBK’s target range in the second half of 2023, the inflation rate is expected to remain in the upper bound of CBK’s target range in the short term and will weigh down on the business environment.

- Currency:

The Kenya Shilling depreciated by 26.8% against the US Dollar to close at Kshs 156.5 in 2023, compared to Kshs 123.4 at the end of 2022, adding to adding to the 9.0% depreciation recorded in 2022. The depreciation was partly driven by the aggressive hike in the US Federal interest rates by 100 bps in 2023 from a range of 4.25%-4.50% in December 2022 to a range of 5.25%-5.50% in July 2023. Going forward, we expect the shilling to trade against the US dollar within a range of Kshs 183.2 and Kshs 189.6 by the end of 2024, based on the purchasing power parity (PPP) and interest rate parity (IRP) approach respectively. The Kenyan shilling will be supported by:

- Improving diaspora remittances standing at a cumulative USD 4.2 bn for the year 2023, representing a 4.0% y/y increase from the total remittances of USD 4.0 bn recorded in 2022. Notably on a m/m basis, the remittance for the month of December 2023 increased by 5.0% to USD 372.6 mn, from USD 355.0 mn recorded in November 2023. In 2024, diaspora remittances are set to improve further, mainly driven by the recovery of the global economy, increasing Kenyan population in the diaspora, and advancing technology that has facilitated easier transfer of money,

- Expected dollar inflows from both commercial and concessional financing, boosting the country’s forex reserves. On 17th January 2024, The Executive Board of the International Monetary Fund (IMF) concluded the 2023 Article IV consultation with Kenya together with the sixth reviews allowing for the immediate disbursement of USD 624.5 mn (KES 100.4 bn) under the Extended Fund Facility (EFF) and the Extended Credit Facility (ECF) arrangements and USD 60.2 mn (KES 9.7 bn) under the Resilience Sustainability Facility (RSF). In the same week, Kenya secured a USD 210.0 mn loan from the Trade & Development Bank (TDB), with the National Treasury expecting more financing from the TDB, World Bank, and the African Development Bank,

- The high interest rates, with the Monetary Policy Committee increasing the CBR to 12.5% in its last sitting, signalling a tightening stance to support the shilling and tame inflation. According to the MPC, the increment was made to tame the local currency depreciation, which the Committee noted had a significant contribution to the country’s inflation, contributing 3.0% of the 6.8% inflation rate recorded in November 2023, as well as the high cost of debt service. Interest rates on government securities remain high which are attractive to foreign investors, especially the infrastructure bond which is also tax-free, and,

- The Government measures to stabilize the foreign exchange market which includes the Government-to-Government petroleum supply arrangement. According to the Draft 2024 Budget policy, this arrangement was mainly intended to address the US Dollar liquidity challenges and exchange rate volatility caused by the global US Dollar shortage and spot market reactions that were driving volatility and causing a false depreciation.

The Kenyan shilling will however face the following challenges:

- An ever-present current account deficit estimated at 3.5% of GDP in Q3’2023, an improvement from the 6.4% deficit recorded in a similar period in 2022. The persistent current account deficit reflects the country’s reliance on imports and with the high global commodity prices, it has resulted in increased demand for foreign currency which continues to put more strain on the local currency,

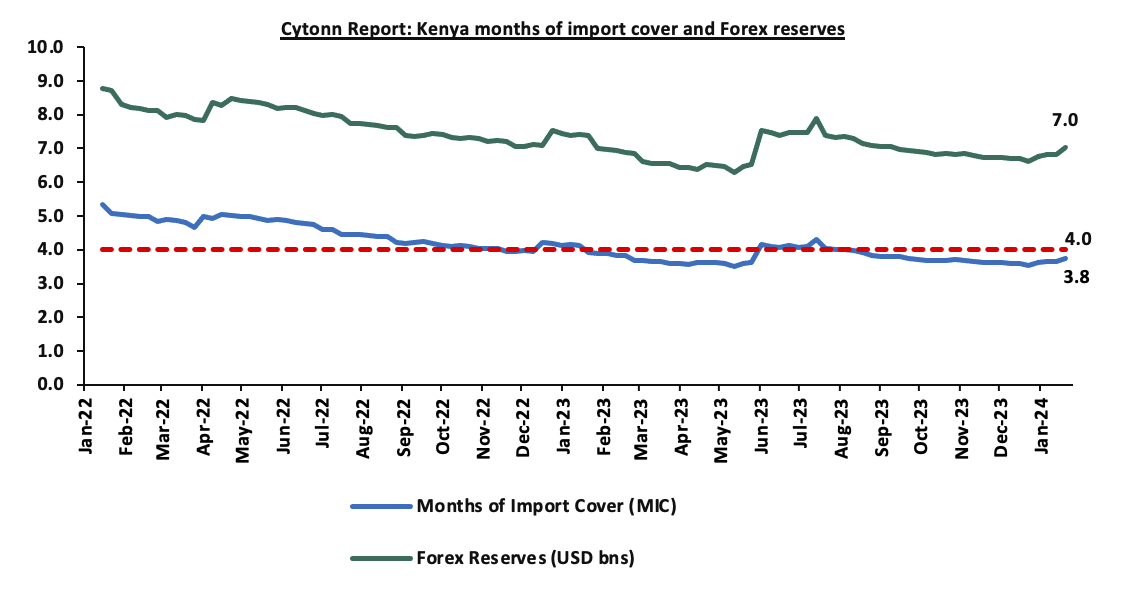

- Dwindling forex reserves, having declined by a significant 11.0% to USD 6.7 bn (equivalent to 3.6 months of import cover) in December 2023, from USD 7.5 bn (equivalent to 4.0 months of import cover) in a similar period in 2022. The drop is largely attributed to increased debt service obligations due to the continued depreciation of the Kenyan shilling. Notably, the country faces a USD 2.0 bn Eurobond maturity in June 2024, piling pressure on the country’s forex reserves,

- Elevated risk of increase in global crude oil prices as a result of supply chain constraints following the rising geopolitical tension in the Middle East. Consequently, the rise in global oil process is set to increase demand for the US Dollar by oil and energy importers, as well as manufacturers against a low supply of US Dollar currency, and,

- The increasing debt servicing costs which continue to put pressure on forex reserves given the Eurobond coupons which are falling due ahead of the maturity of the 2014 issue in June 2024. Notably, the debt service to revenue ratio stood at 55.0% as of December 2023, 25.0% points above the 30.0% threshold recommended by the IMF.

We expect the shilling to remain within a range of Kshs 183.2 and Kshs 189.6 against the USD by the end of 2024 based on the purchasing power parity (PPP) and interest rate parity (IRP) approach respectively, with a bias towards a 16.4% depreciation by the end of the year.

- Inflation:

In 2023, the average inflation rate in the country was 7.7%, a marginal increase from the average inflation rate of 7.6% witnessed in 2022. Key to note, the overall inflation eased to 7.3% in July 2023, falling within the Central Bank’s target range of 2.5% and 7.5% for the first time in 14 months, and remained within target range during the latter half of 2023. Despite the improvement recorded towards the end of 2023, we expect the inflation rate to remain elevated in the medium term given that the current tightening of the fiscal policy does not address the cost-driven inflation.

We expect inflation to average 6.9% in 2024, within the government target range of 2.5% - 7.5%. Key risks driving inflationary pressure are the high electricity prices, elevated fuel costs, and continued depreciation of the Kenyan shilling.

- Interest Rates:

The Central Bank is expected to continue with the restrictive monetary policy stance in the medium term with the intention of supporting the depreciating shilling and lowering the inflation rate. Given that the 12.5% Central Bank rate set in December 2023 is the highest since September 2012, we expect the CBK to maintain the interest rates in the short term as it monitors the performance of the local currency and the country’s inflation rate. However, we could see a downward revision of the CBR in the medium term if the performance of the Kenyan shilling stabilizes.

Despite the projected decline in borrowing by 20.6% to Kshs 703.9 bn in FY’2024/25 from Kshs 886.6 bn in FY’2023/24, Kenya still has an ever-present fiscal deficit, projected at 3.9% in FY’2024/25. As such, we expect the government to continue borrowing aggressively from both the domestic and foreign markets. The escalating debt service due to further borrowing will persistently burden the government, compelling it to borrow more to cover the maturing debts. Among these impending maturities is the 10-year USD 2.0 bn Eurobond due in June 2024. Consequently, the increased borrowing will continue to exert upward pressure on the yield curve in the short term as investors seek recompense for potential losses. However, the interest rate environment is expected to stabilize in the medium term as the government receives a boost from concessional loans from the IMF and the World Bank, improving the country’s credit outlook.

The table below summarizes the various macroeconomic factors and the possible impact on the business environment in 2024. With two indicators being negative, four being neutral and one being positive, the general outlook for the macroeconomic environment in 2024 is NEUTRAL.

|

Cytonn Report: Macro-Economic & Business Environment Outlook |

|||

|

Macro-Economic Indicators |

2024 Outlook |

Effect |

|

|

Government Borrowing |

|

Negative |

|

|

Exchange Rate |

|

Negative |

|

|

Interest Rates |

|

Neutral |

|

|

Inflation |

|

Neutral |

|

|

GDP |

|

Neutral

|

|

|

Investor Sentiment |

|

Neutral |

|

|

Security |

|

Positive |

|

The change from last year’s outlook is:

- Interest Rate to Neutral from Negative necessitated by the restrictive monetary policy which is expected to be maintained in the short term of 2024 to anchor the elevated inflation and stabilize the depreciating shilling. However, we expect the interest rate environment to stabilize in the medium term as the government meets the coupon payments and the eventual redemption of the 10-year Eurobond due in June 2024 with the support of concessional loans and commercial financing.

Out of the seven metrics that we track, four have a neutral outlook, two have a negative outlook and one has a positive outlook; from last year where three had a neutral outlook, three had a negative outlook and one had a positive outlook. Our general outlook for the macroeconomic environment remains NEUTRAL for 2024, unchanged from 2023.

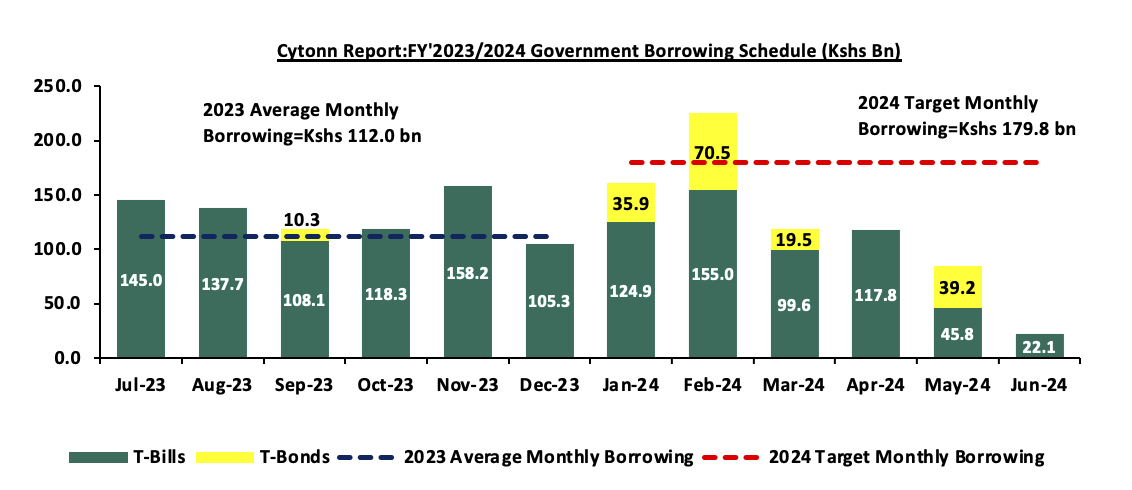

The government is currently 34.0% behind its prorated domestic borrowing target, having borrowed Kshs 181.2 bn domestically, against the pro-rated target of Kshs 274.5 bn, going by the government domestic borrowing target of Kshs 471.4 bn, mainly on the back of the high debt maturities. However, we expect the government to catch up with its prorated domestic borrowing target, especially with the new infrastructure bond issue targeting to raise Kshs 70.0 bn. In order to meet the domestic borrowing target, the government has to borrow an average of Kshs 179.8 bn on a monthly basis, in the 2nd half of the current fiscal year. We expect upward pressure on the interest rates as the government will need to borrow aggressively from the local market to plug in the deficit projected to end at 5.5% of GDP for the FY’2023/2024, given that the international capital markets remain challenging as investors continue demanding for high yields, coupled with the local currency depreciation that has increased debt servicing costs.

Below is a summary of treasury bills and bond maturities and the expected borrowings over the same period. The government will need to borrow Kshs 179.8 bn on average each month for the rest of the fiscal year to meet the domestic borrowing target of Kshs 471.4 bn for the FY’2023/2024, and cover T-bill and T-bond maturities, as illustrated in the graph below:

Fig: Schedule of Treasury bills and bonds maturities and the expected target borrowings in the 2023-2024 fiscal year to cater for the maturities and additional government borrowing.

Weekly Market Performance;

Money Markets, T-Bills Primary Auction:

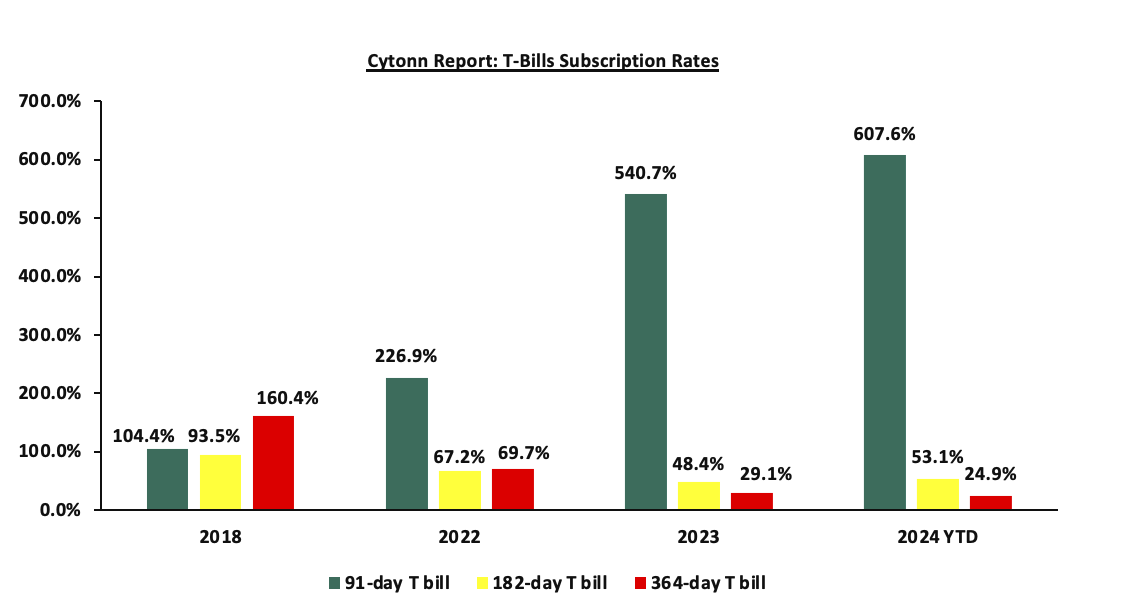

During the week, T-bills were oversubscribed for the fourth consecutive week, with the overall oversubscription rate coming in at 102.0%, albeit lower than the oversubscription rate of 147.0% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 16.6 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 414.0%, lower than the oversubscription rate of 639.0 % recorded the previous week. The subscription rate for the 182-day paper decreased to 52.4%, from 61.9% recorded the previous week, while the subscription rate for the 364-day paper decreased to 26.7%, from 35.3%, recorded the previous week. The government accepted a total of Kshs 21.9 bn worth of bids out of Kshs 24.5 bn of bids received, translating to an acceptance rate of 89.5%. The yields on the government papers continued to rise with the yields on the 364-day, 182-day and 91-day papers increasing by 3.1 bps, 7.5 bps and 5.6 bps to 16.5%, 16.4% and 16.3%, respectively. The chart below compares the overall average T-bill subscription rates obtained in 2018, 2022, 2023, and 2024 Year-to-date (YTD:

In the primary bond market, the government is seeking to raise additional Kshs 70.0 bn for infrastructure projects support in the FY’2023/24 by issuing the new 8.5-year bond IFB1/2024/8.5 with a tenor to maturity of 8.5 years. The bidding process opened on 24th January 2024 and will close on 14th February 2024, with the coupon rate to be determined by the market. The bond’s value date will be 19th February 2024, with a maturity date of 9th August 2032 and will be tax free as is the case for infrastructure bonds as provided for under the Income Tax Act. We anticipate the bond to be oversubscribed, given that it is tax free in nature, however, investors are expected to attach higher yields as they seek to cushion themselves against future losses on the back of the government’s debt sustainability concerns. Notably, the last infrastructure bond to be issued was the 7-year IFB1/2023/6.5 in October 2023 which sought to raise Kshs 50.0 bn. The bond registered an oversubscription rate of 177.8% at a yield of 17.9%. Based on trading of bonds of similar tenor and nature, we expect the IFB1/2024/8.5 to price at 21.5%-22.3%;

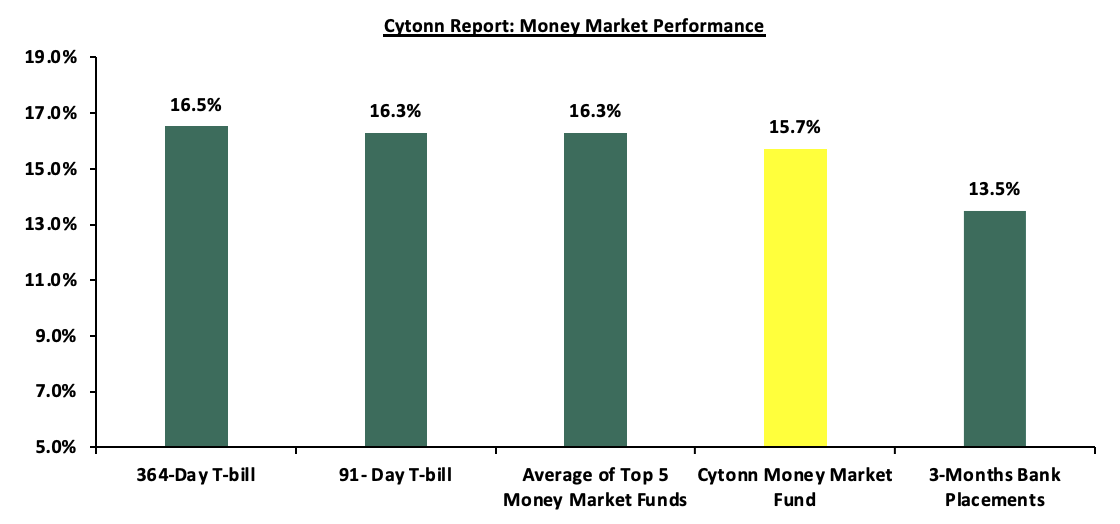

Money Market Performance:

In the money markets, 3-month bank placements ended the week at 13.5% (based on what we have been offered by various banks), and the yields on the 364-day and 91-day papers increased by 3.1 bps and 5.6 bps to 16.5% and 16.3%, respectively. The yields of the Cytonn Money Market Fund remained unchanged at 15.7% recorded the previous week, while the average yields on the Top 5 Money Market Funds increased by 4.2 bps to 16.3%, from 16.2% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 26th January 2024:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 26th January 2024 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Etica Money Market Fund |

17.2% |

|

2 |

Lofty-Corban Money Market Fund |

16.6% |

|

3 |

Nabo Africa Money Market Fund |

16.1% |

|

4 |

GenAfrica Money Market Fund |

15.8% |

|

5 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn App) |

15.7% |

|

6 |

Apollo Money Market Fund |

15.2% |

|

7 |

Madison Money Market Fund |

15.2% |

|

8 |

Kuza Money Market fund |

15.0% |

|

9 |

Enwealth Money Market Fund |

14.8% |

|

10 |

GenCap Hela Imara Money Market Fund |

14.7% |

|

11 |

Co-op Money Market Fund |

14.6% |

|

12 |

Sanlam Money Market Fund |

14.1% |

|

13 |

Jubilee Money Market Fund |

14.0% |

|

14 |

Absa Shilling Money Market Fund |

14.0% |

|

15 |

Mayfair Money Market Fund |

13.7% |

|

16 |

KCB Money Market Fund |

13.6% |

|

17 |

Old Mutual Money Market Fund |

13.1% |

|

18 |

Orient Kasha Money Market Fund |

12.9% |

|

19 |

Dry Associates Money Market Fund |

12.8% |

|

20 |

CIC Money Market Fund |

12.0% |

|

21 |

ICEA Lion Money Market Fund |

12.0% |

|

22 |

Mali Money Market Fund |

11.7% |

|

23 |

Equity Money Market Fund |

11.5% |

|

24 |

British-American Money Market Fund |

10.2% |

|

25 |

AA Kenya Shillings Fund |

7.1% |

Source: Business Daily

Liquidity:

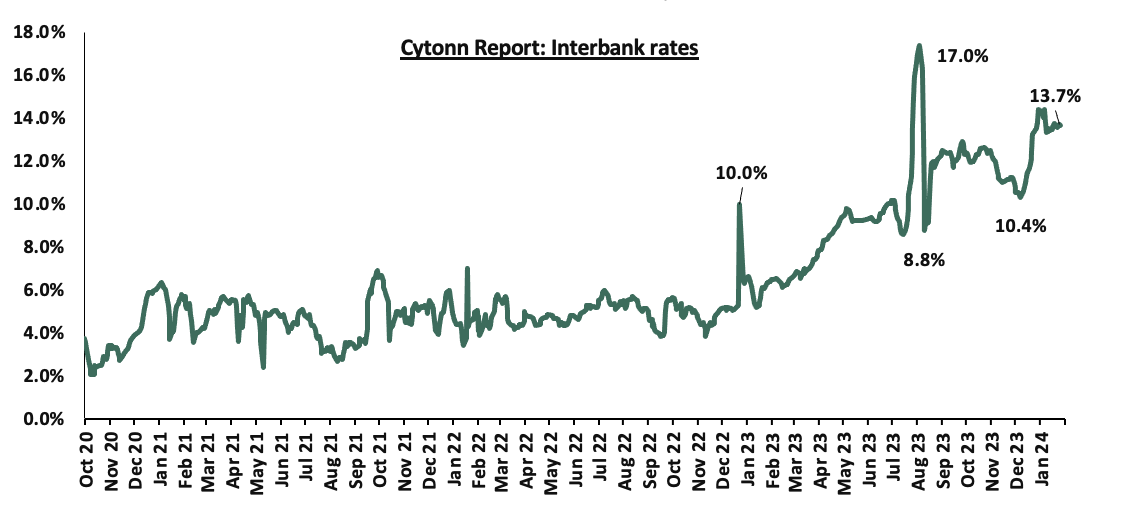

During the week, liquidity in the money markets marginally tightened for the second consecutive week, with the average interbank rate increasing by 2.3 bps, remaining relatively unchanged from 13.7% recorded the previous week, partly attributable to the tax remittances that offset government payments. The average interbank volumes traded decreased by 24.3% to Kshs 15.9 bn from Kshs 21.0 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Eurobonds recorded a mixed performance, with the yields on the 7-year Eurobond issued in 2019 increasing the most by 0.5% points, to 11.2% from 10.7% recorded the previous week, while the yields on the 10-year Eurobond issued in 2014 decreased by 0.5 bps, remaining relatively unchanged from 14.3% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 25th January 2024;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Tenor |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD) |

2.0 bn |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

|

Years to Maturity |

0.4 |

4.1 |

24.1 |

3.4 |

8.4 |

10.4 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

1-Jan-24 |

13.6% |

9.8% |

10.2% |

10.1% |

9.9% |

9.5% |

|

2-Jan-24 |

14.2% |

10.0% |

10.3% |

10.3% |

10.0% |

9.6% |

|

18-Jan-24 |

14.3% |

10.2% |

10.4% |

10.7% |

10.1% |

9.7% |

|

19-Jan-24 |

13.7% |

10.0% |

10.3% |

10.4% |

10.0% |

9.6% |

|

22-Jan-24 |

13.5% |

9.9% |

10.3% |

10.4% |

10.0% |

9.6% |

|

23-Jan-24 |

13.8% |

10.3% |

10.5% |

11.0% |

10.3% |

9.9% |

|

24-Jan-24 |

13.9% |

10.3% |

10.5% |

11.0% |

10.3% |

9.9% |

|

25-Jan-24 |

14.3% |

10.4% |

10.6% |

11.2% |

10.4% |

9.9% |

|

Weekly Change |

(0.0%) |

0.3% |

0.1% |

0.5% |

0.2% |

0.2% |

|

MTD Change |

0.8% |

0.6% |

0.4% |

1.1% |

0.5% |

0.4% |

|

YTD Change |

0.8% |

0.6% |

0.4% |

1.1% |

0.5% |

0.4% |

Source: Central Bank of Kenya (CBK) and National Treasury

To note, with the recent Eurobond issue by Ivory Coast, which raised a total of USD 2.6 bn, at an average coupon rate of 7.9%, we expect to see more sovereigns in the Sub-Saharan Africa (SSA) region tapping into the international capital markets in 2024. However, debt sustainability concerns continue to persist in the SSA region in 2024 amid a slow post-pandemic recovery, domestic currency depreciation and elevated inflationary pressures with many counties in Sub-Saharan Africa (SSA) being on the verge of debt distress, with Zambia, Ghana and Ethiopia having defaulted on their debts. According to IMF Economic Outlook-Sub-Saharan Africa, debt-to GDP ratio largely stabilized at 60.0% in the region, mainly on the back of increasing spending and reduced revenue collection during and after the COVID-19 pandemic. The table below shows the SSA countries that have issued Eurobonds and their respective risk of debt distress;

Sub-Saharan Africa (SSA) Eurobond Countries

|

Cytonn Report: Sub-Saharan Africa Eurobond Countries |

|||||

|

Country |

Debt to GDP Ratio (2022, IMF) |

Debt to GDP Ratio (2023, IMF Projected) |

Debt Service to Revenue Ratio |

Risk of overall debt distress ( Joint IMF & Word bank DSA) |

Current Situation |

|

Zambia |

98.5% |

98.3% |

61.0% |

In debt distress |

External Debt Restructuring Ongoing |

|

Ghana |

92.4% |

84.9% |

97.1% |

In debt distress |

External and domestic debt restructuring ongoing |

|

Angola |

66.7% |

84.9% |

19.5% |

High risk of debt distress |

No debt restructuring ongoing |

|

Senegal |

76.6% |

81.0% |

21.7% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

South Africa |

71.1% |

73.7% |

36.2% |

High risk of debt distress |

No debt restructuring ongoing |

|

Kenya |

66.7% |

70.1% |

55.0% |

High risk of debt distress |

No debt restructuring ongoing |

|

Namibia |

69.8% |

67.6% |

13.8% |

High risk of debt distress |

No debt restructuring ongoing |

|

Gabon |

57.7% |

64.9% |

48.9% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Rwanda |

61.1% |

63.3% |

30.1% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Seychelles |

61.5% |

60.8% |

- |

High risk of debt distress |

No debt restructuring ongoing |

|

Ivory Coast |

56.8% |

56.8% |

34.0% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Benin |

54.2% |

53.0% |

64.7% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Tanzania |

42.3% |

42.6% |

14.2% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Cameroon |

45.5% |

41.9% |

51.6% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Nigeria |

39.6% |

38.8% |

57.1% |

Moderate risk of debt distress |

Domestic Debt Restructuring |

|

Ethiopia |

46.4% |

37.9% |

16.8% |

In debt distress |

External Debt Restructuring Ongoing |

|

Average |

62.9% |

63.8% |

41.4% |

|

|

Sources: International Monetary Fund (IMF) 2023 economic outlook & Joint Debt Sustainability Analysis (DSA), World Bank

Key take-outs in the table include

- The average debt to GDP ratio for the above countries came in at 62.9% in 2023 and is projected to end 2023 at 63.8%, high above the recommended International Monetary Fund (IMF) threshold of 50.0% to developing economies,

- Three countries already defaulted on their debt: Ghana, Zambia and Ethiopia are already in debt distress, and have already initiated different forms of debt restructuring, especially at the G20,

- The average debt servicing consumes above 41.4% of the total revenue collected, translating to less allocation for development purposes, and,

- Although Kenya’s debt to GDP ratio is projected to increase to 70.1% in 2023 from 66.7% in 2022, the government’s debt appetite might push the ratio higher, having recorded a debt to GDP ratio of 70.2% as of June 2023, despite the current administration’s initiatives towards fiscal consolidation

Kenya Shilling:

During the week, the Kenya Shilling depreciated against the US Dollar by 0.2% to close at Kshs 160.6, from Kshs 160.3 recorded the previous week. On a year-to-date basis, the shilling has depreciated by 2.3% against the dollar, adding to the 26.8% depreciation recorded in 2023. We expect the shilling to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 3.5% of GDP in Q3’2023 from 6.4% recorded in a similar period in 2022,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.5% of Kenya’s external debt was US Dollar denominated as of September 2023, and,

- Dwindling forex reserves, currently at USD 7.0 mn (equivalent to 3.8 months of import cover), which is below the statutory requirement of maintaining at least 4.0 months of import cover.

The shilling is however expected to be supported by:

- Diaspora remittances standing at a cumulative USD 3,817.4 mn as of November 2023, 4.0% higher than the USD 3,670.6 mn recorded over the same period in 2022, which has continued to cushion the shilling against further depreciation. In the November 2023 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 57.2% in the period, and,

- The tourism inflow receipts which came in at USD 268.1 mn in 2022, a significant 82.9% increase from USD 146.5 mn inflow receipts recorded in 2021, and tourist arrivals improved by 34.1% in the 12 months to October 2023, compared to a similar period in 2022.

Key to note, Kenya’s forex reserves increased by 3.0% during the week to USD 7.0, from USD 6.8 bn recorded the previous week, equivalent to 3.8 months of import cover higher than 3.7 months of import cover recorded the previous week, and remained below the statutory requirement of maintaining at least 4.0 months of import cover. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights:

- Côte d’Ivoire Raises USD 2.6 Bn from New Eurobond Issues

During the week, Ivory Coast (Côte d’Ivoire) became the first Sub-Saharan Africa (SSA) country to tap into the international capital markets, issuing two bonds with respective maturities of 8.5 years and 12.5 years, maturing on 30th January 2033 and 30th January 2037 respectively. This was the first issue in the SSA region since 2022, when rising global interest rates and geopolitical tensions made foreign currency debt prohibitively expensive for most African borrowers. Notably, the sovereign raised a total of USD 2.6 bn from the two tranches, with the two issues recording an oversubscription of over USD 8.0 bn. The coupon rates for the 8.5-year (maturity 2033) and the 12.5-year (maturity 2037) were fixed at 7.625% and 8.250% respectively, with the coupons being payable semi-annually in arrears. Notably, both issues will be redeemed in two equal installments payable in January 2032 and January 2033 for the 8.5-year (2033 maturity), while the installments for the 12.5-year (2037 maturity) will be due in January 2036 and January 2037. Also, this was the first dollar-denominated issue by the sovereign in seven years, having most of its international debt in Euros. However, the country also executed a dollar-euro currency hedge operation, covering the entire issued amount, which will reduce the currency risk for the Ivory Coast, which operates within the West African Economic and Monetary Union (WAEMU) whose currency is pegged to the Euro.

Côte d'Ivoire’s finance ministry announced that the funds will be utilized to refinance the existing Eurobond issues, noting that the country has outstanding Eurobond issues maturing in 2024, 2025, 2028, 2030, 2031, and 2032. In addition to that, funds from the new issues will also be used to restructure and refinance the country’s international bank loans, which will in turn help the country lower its debt servicing costs and extend its debt maturity profile.

Notably, Côte d'Ivoire’s issuer ratings according to Moody’s, S&P Global, and Fitch stand at Ba3 (positive), BB- (stable), and BB- (stable) respectively, indicating that the country has the ability to meet its financial commitments despite substantial credit risk being present. Kenya’s issuer ratings according to Moody’s, S&P Global, and Fitch stand at B3 (negative), B+ (negative), and B (negative) respectively. In comparison, Kenya’s credit rating ranks six positions lower than that of Côte d'Ivoire, implying that the country is able to meet its financial commitments but there is a material risk of default due to deteriorating business and economic environment. Additionally, Kenya’s debt to GDP ratio stood at 70.1% in 2023, 13.3% points above that of Côte d’Ivoire indicating a higher debt burden for Kenya. As such, if Kenya was to issue a Eurobond, the state would need to propose a higher coupon rate to successfully issue a 10-year Eurobond. We estimate that this would be in the range of 10.5% and 12.5%, given that Kenya’s credit rating ranks six positions lower than that of Côte d'Ivoire, coupled with the higher debt to GDP ratio, which necessitates investors to attach higher risk to Kenya because of increased risk.

The Ivory Coast Eurobond issue 2024 is a significant milestone for the country and the continent, as it demonstrates the resilience and attractiveness of African debt markets amid global challenges. Additionally, it signals a shift by investors from the investment grade bonds offered by developed countries, to the emerging markets such as Africa, as investors expect the US Fed to cut its interest rates in 2024. However, it also poses some risks and challenges, such as the sustainability of the debt burden, the volatility of the exchange rates, and the uncertainty of the global economic outlook.

- January 2024 Inflation Projection

We are projecting the y/y inflation rate for January 2024 to come in at the range of 6.3%-6.6% mainly on the back of:

- Reduced Fuel Prices – Fuel prices reduced by 2.5%, 2.4% and 2.3% to retail at Kshs 196.5, Kshs 194.1, and Kshs 207.4 respectively, from Kshs 201.5, Kshs 199.1 and Kshs 212.4 per litre for Diesel, Kerosene and Petrol respectively, according to the latest EPRA report, following a decline in global fuel prices with landed costs registering an average 5.3% decline in December. The government also on September 2023 made efforts to stabilize fuel prices by extending the existing oil supply deal with the three Gulf-based companies namely; Emirates National Oil Corporation, Abu Dhabi National Oil Corporation, and Saudi Aramco until December 2024. The decrease in fuel prices will consequently aid in easing inflationary pressures as it provides a stabilizing effect on consumer purchasing power as well as business operational costs, and,

- Increasing of Central bank rate from 10.5% to 12.50% – In December, the Monetary Policy Committee (MPC) increased the CBR rate by 200 bps to 12.50% from 10.50%, mainly to tame the free fall of the shilling as well as contain the heightened inflation, which stood at 6.8% for the month of November, remaining with the upper bound of the CBK preferred range of 2.5%-7.5%. However, the effect of an increase in CBR rate might be muted given that the current inflation is cost-driven and not demand-driven,

Going forward, we expect inflationary pressures to ease in the short term while remaining in the CBK’s target range of 2.5% to 7.5% aided by easing in global commodity prices like fuel. Additionally, the increase in Central Bank Rate from 10.5% to 12.50% in the Month of December, is meant to continue reducing money supply, in turn easing inflation in the short to medium term. We also expect the measures taken by the government to subsidize major inputs of agricultural production such as fertilizers, coupled with the ongoing sufficient rainfall across the country, to support the easing of inflation in the long term as a result of decreased prices of farm produce.

- February MPC Meeting

The Monetary Policy Committee (MPC) is set to meet on Tuesday, 6th February 2024, to review the outcome of its previous policy decisions and recent economic developments, and to decide on the direction of the Central Bank Rate (CBR). We expect the MPC to maintain the Central Bank Rate (CBR) at 12.50% with their decision mainly being supported by;

- The ease in y/y inflation in December 2023 to 6.6%, from 6.8% recorded in November 2023 marking the sixth consecutive month that inflation has fallen within the CBK target range of 2.5%-7.5%. However, the risk lies on the back of elevated fuel prices despite a decrease in global prices mainly on the back of the depreciating Shilling. As such, we expect the MPC to maintain the CBR as the current monetary stance still transmits in the economy,

- The need to support the Shilling from further depreciation as other Central Banks maintain high rates, is expected to remain a key factor in maintaining the CBR rate elevated. The Kenya Shilling has been on a free fall, having depreciated by 4.9% since the last MPC meeting on 5th December 2023, to close at Kshs 160.8 on 26th January 2024. The depreciation of the shilling is mainly on the back of a high demand for foreign currency by importers, decline in foreign exchange reserves, which are currently below the statutory requirement, widening current account deficit and global markets uncertainty. As such, a decrease in the CBR rate would possibly weaken the Shilling further by reducing its demand, and,

- The need to support the economy by adopting an accommodative policy that will ease financing activities. The Purchasing Managers Index (PMI) has for the last four months remained below the 50.0 no change threshold, with the December 2023 PMI coming in at 48.8, an indication of deterioration in the business environment. An additional hike in the CBR rate might curtail economic growth given the current macroeconomic and business environment, which cannot accommodate further hikes

For a more detailed analysis, please see our February 2024 MPC note.

Rates in the Fixed Income market have been on an upward trend given the continued high demand for cash by the government and the occasional liquidity tightness in the money market. The government is 34.0% behind of its prorated net domestic borrowing target of Kshs 274.5 bn, having a net borrowing position of Kshs 181.2 bn out of the domestic net borrowing target of Kshs 471.4 bn for the FY’2023/2024. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to maintain the fiscal surplus through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

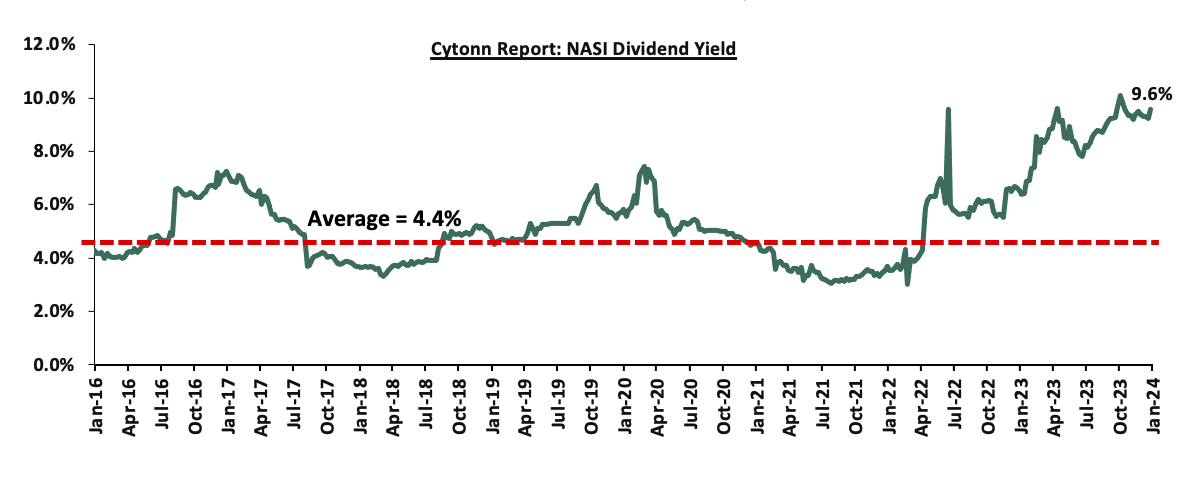

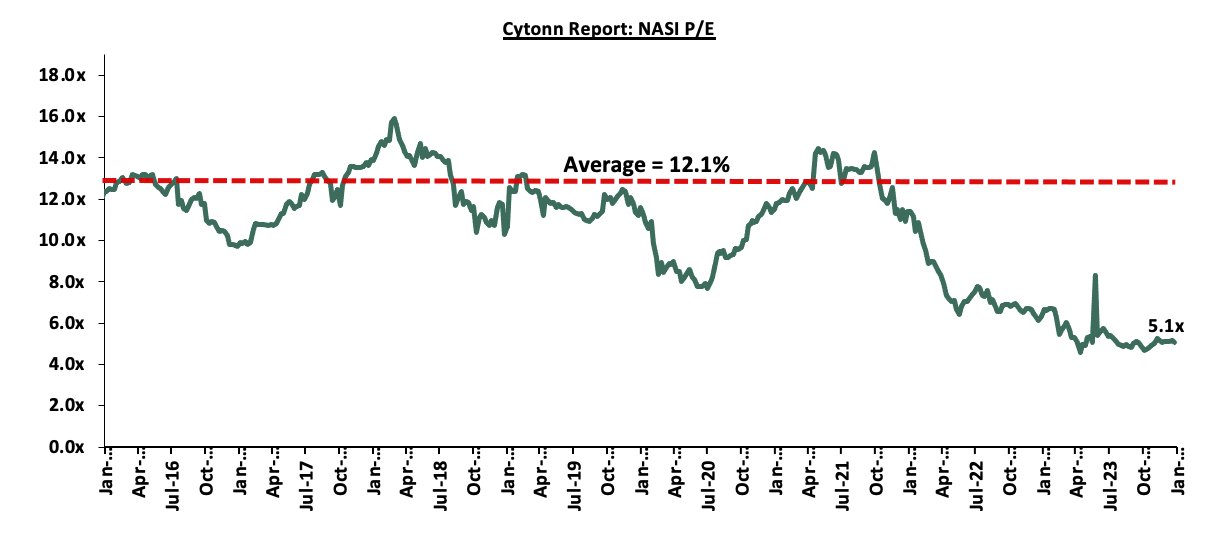

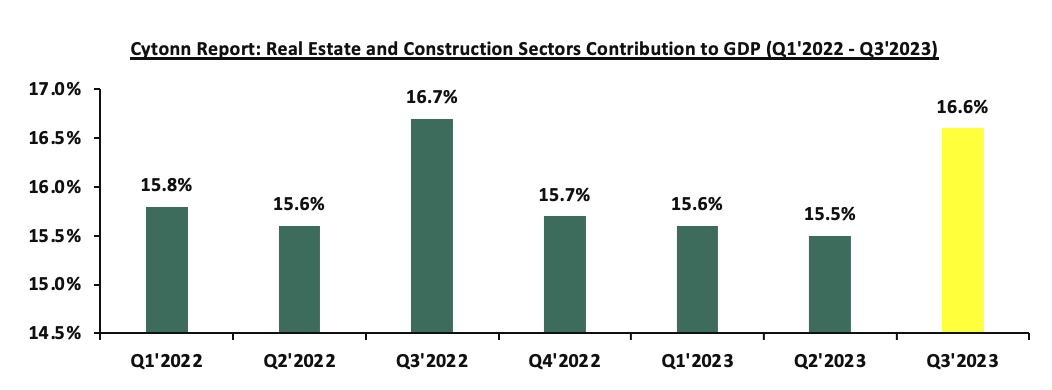

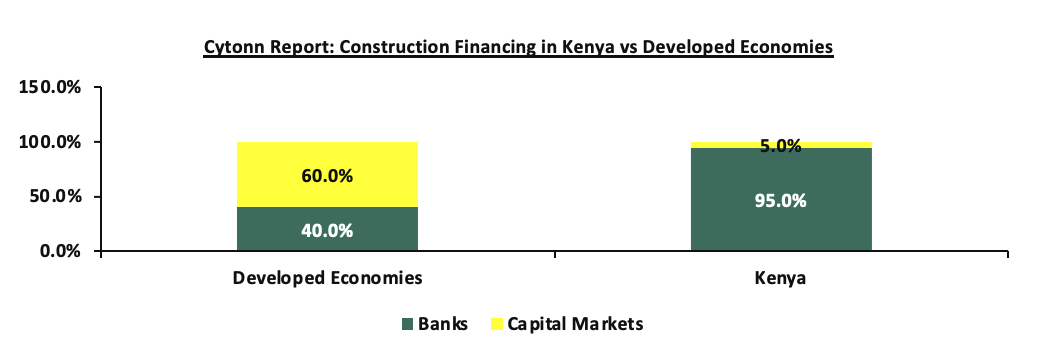

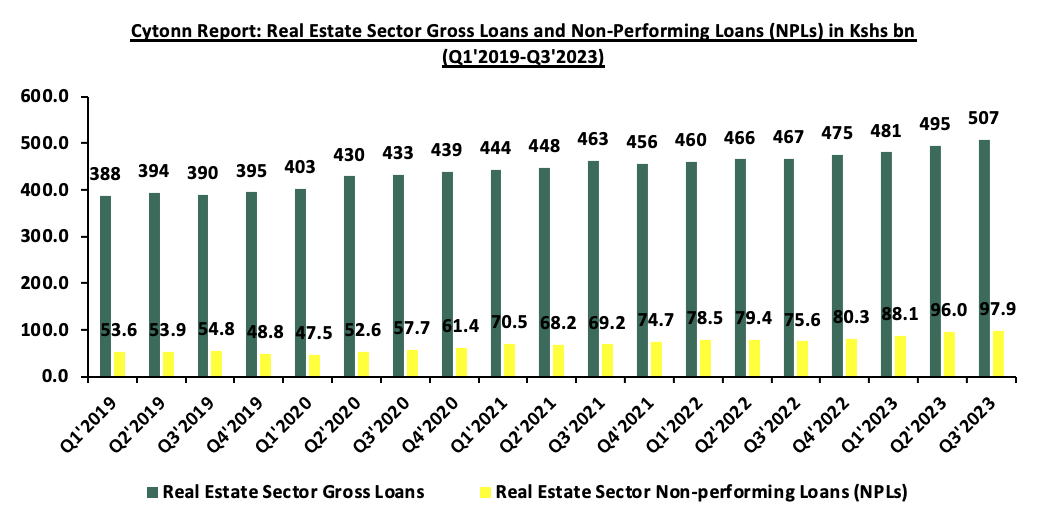

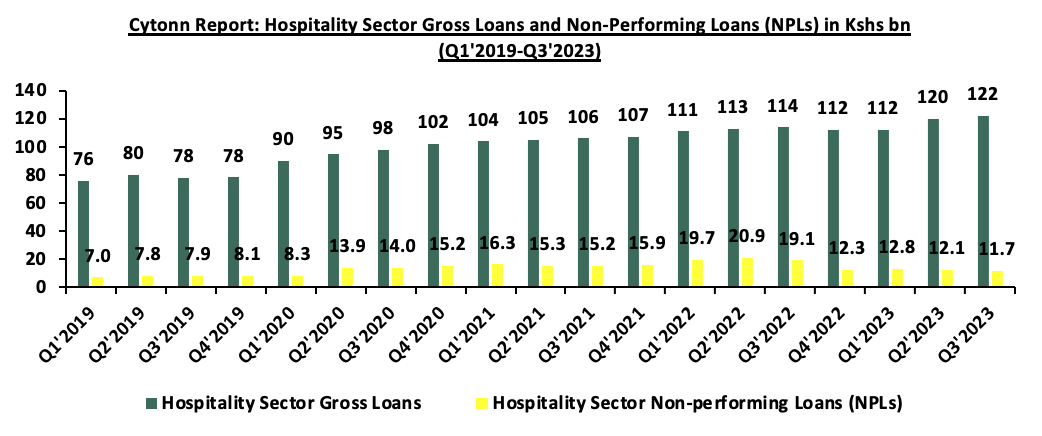

In 2023, the Kenyan equities market was on a downward trajectory, with NASI, NSE 20, and NSE 25 declining by 27.7%, 10.4%, and 24.2%, respectively. The equities market performance was driven by losses recorded by large-cap stocks such as KCB Group, Safaricom, EABL, Equity Group, Diamond Trust Bank Kenya, Absa Bank, and Co-operative Bank Kenya of 42.9%, 42.2%, 32.9%, 25.3%, 9.6%, 6.1%, and 5.8% respectively. The performance was, however, supported by gains by large-cap stocks such as Bamburi Cement, Standard Chartered Bank, and Stanbic Bank of 14.0%, 11.7%, and 6.6% respectively. The performance during the year was mainly attributable to increased sell offs by foreign investors as they exited the market, ending the year at a net selling position of USD 92.0 mn. Additionally, interest rate hikes in developed economies such as the United States caused dollar investments to be more appealing and thus lowering their appetite for risky investments in emerging markets such as Kenya.