Cytonn Annual Markets Review 2023

By Cytonn Research, Dec 31, 2023

Executive Summary

Global Markets Review

According to the October 2023 World Economic Outlook Report by the International Monetary Fund (IMF), the global economy is projected to grow at a rate of 3.0% in 2023, 0.5% points lower than the 3.5% growth recorded in 2022 and 0.9% points higher than the World Bank's earlier projection in June 2023. The expected slowdown in the Global economy’s growth is majorly attributable to the persistent inflationary pressures attributed to the high global fuel and energy prices experienced through most of the year. In line with this, most economies have continued to tighten their monetary policies in their efforts to fight inflation with the global headline inflation being expected to fall to 6.9% in 2023 from the 8.7% recorded in 2022. Notably, advanced economies continue to drive the decline in growth in 2023, with expected growth of 1.5% in 2023, a decline from the 2.6% growth in 2022. Moreover, the growth in the Emerging Markets and Developing Economies is expected to expand by 4.0% in 2023, 0.1%-points decline from the estimated growth of 4.1% in 2022;

Sub-Saharan Africa Region Review

According to the International Monetary Fund (IMF), the Sub-Saharan African economy is projected to grow at a rate of 3.3% in 2023, a 0.7% points decline from a growth of 4.0% recorded in 2022. Notably, the projection was revised downwards from the earlier forecast of 3.5% in July 2023 by the IMF. The downward revision of the regional growth by the IMF is mainly on the back of the continued depreciation of most currencies against the dollar, weak external demand, tight global financial conditions, and high inflationary pressures in most countries in the region. Additionally, public debt is expected to remain high due to increased debt-serving costs as a result of continued currency depreciation and increased interest rates in developed economies;

During the year, all select Sub-Saharan African currencies depreciated against the U.S Dollar, with the Nigerian Naira being the largest decliner in 2023, largely attributable to the adoption of a floating exchange rate regime in the country. Also, the region’s appetite for foreign-denominated Eurobonds remained muted, there being no issuer during the year. Additionally, Sub-Saharan Africa (SSA) stock markets recorded mixed performance in 2023, with the Zambia Stock Exchange (LASILZ) being the largest gainer with a 5.3% gain in 2023 due to gains in the financial as well as mining sectors of the economy;

Kenya Macro Economic Review

The Kenyan economy recorded an average growth of 5.5% in the period between January to September 2023, with Q3’2023 GDP coming in at 5.9%, adding to the 5.4% growth recorded in Q2’2023. The average GDP growth of 5.5% marked a slight decline from the 5.6% average growth recorded in a similar period in 2022. The performance in Q3’2023 was mainly driven by the 6.7% growth in the agricultural sector due to the favourable weather conditions, which led to more agricultural output as evidenced by the 28.0% increase in tea output to 138.8 thousand metric tonnes coupled with the 84.3% growth in fruit exports to 59.6 thousand metric tonnes in the quarter under review. All sectors in Q3’2023 recorded positive growths, with varying magnitudes across activities. Most sectors recorded improved growth compared to Q3’2022 with Accommodation and Food Services, Agriculture, Forestry and Fishing, and Mining and Quarrying Sectors recording the highest growth improvements of 9.1% points, 8.0% points, and 5.6% points, respectively. Other sectors that recorded expansion in growth rate, from what was recorded in Q3’2022 were Financial and Insurance Services, Information and Communication, and Real Estate sectors, of 5.1%, 2.7%, and 2.2% points respectively;

In 2023, the Kenyan economy is projected to grow at an average of 5.2%, higher than the 4.8% growth observed in 2022. The faster growth is mainly attributable to a rebound in the agricultural sector following the sufficient long rains that have been experienced in the country, coupled with recent fiscal policies such as subsidizing the costs of crucial farm inputs such as fertilizers that have enhanced agricultural output;

Fixed Income

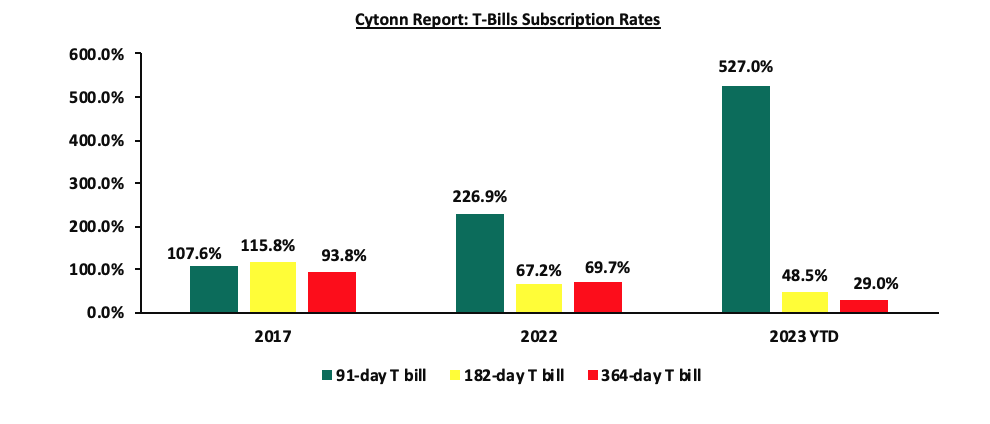

During the year, T-bills were oversubscribed, with the overall subscription rate coming in at 120.0%, up from 94.9% in FY’2022. Investors’ preference for the 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 1,100.5 bn against the offered Kshs 208.0 bn, translating to an oversubscription rate of 529.1%, higher than the oversubscription rate of 226.9% recorded in FY’2022. Overall subscription rates for the 364-day and 182-day papers came in at 29.0% and 48.5%, lower than the 69.7% and 67.2%, respectively, recorded in FY’2022. The average yields on the 364-day, 182-day, and 91-day papers were on an upward trajectory with the 91-day yields increasing the most by 409.2 bps to 12.3%, from 8.2% in 2022 while the 182-day and 364-day increased by 348.9 bps and 293.4 bps to 12.5% and 12.8% in 2023, from 9.0% and 9.9% in 2022, respectively. Likewise, on y/y basis, the yields on the government papers registered significant growth in 2023 with the 91-day paper increasing the most by 661.4 bps to close the year at 16.0% from the 9.4% recorded at the close of FY’2022. The yields on the 182-day and 364-day increased by 613.3 bps and 579.2 bps to close the year at 16.0% and 16.1%, from the 9.8% and 10.3%, respectively, recorded at the end of FY’2022. The upward trajectory in yields is mainly on the back of investors attaching higher risks amid high inflation, currency depreciation, and tight liquidity positions, hence the need for higher returns to cushion against the possible loss. The average acceptance rate during the period came in at 92.5%, albeit higher than the 89.3% recorded in FY’2022, with the government accepting a total of Kshs 1,385.9 bn out of the Kshs 1,497.7 bn worth of bids received;

Both the short term and long-term government papers were oversubscribed, with the average subscription rate for T-bills and T-bonds coming in at 120.0% and 117.8%, from the 94.9% and 98.8% subscription rates recorded in 2022, respectively. The oversubscription was partly attributable to the increased yields on the government papers during the year with all government papers registering an increase in their yields;

During the week, T-bills were undersubscribed, for the third consecutive week, with the overall subscription rate dropping significantly to 43.8%, down from the 86.8% recorded the previous week, partly attributable to the tightened liquidity in the money market with the average interbank rate increasing to 13.9% from 12.2% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 8.5 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 212.9%, albeit lower than the oversubscription rate of 415.9% recorded the previous week. The subscription rates for the 364-day and the 182-day papers also declined, with the 182-day paper decreasing the most to 3.2% from 22.9% and the 364-day paper decreasing to 16.6% from 19.2%, recorded the previous week. The government accepted a total of Kshs 9.0 bn worth of bids out of Kshs 10.5 bn of bids received, translating to an acceptance rate of 85.4%. The yields on the government papers recorded a mixed performance with the yields on the 364-day and 91-day papers increasing by 19.9 bps and 10.0 bps to 16.1% and 16.0% respectively, while the 182-day paper decreased by 0.5 bps to 16.0%;

During the week, the Kenya National Bureau of Statistics (KNBS) released the year-on-year inflation highlighting that the inflation in the month of December 2023 decreased by 0.2% points to 6.6%, from the 6.8% recorded in November 2023. This was well in line with our projections to within a range of 6.6% to 6.8%;

During the week, the Kenya National Bureau of Statistics (KNBS) released the Q3'2023 Quarterly Gross Domestic Product Report, highlighting that the Kenyan economy recorded a 5.9% growth in Q3’2023, faster than the 4.3% growth recorded in Q3’2022. The main contributor to Kenyan GDP remains to be the Agriculture, fishing and forestry sector which grew by 6.7% in Q3’2023 compared to a contraction of 1.3% in Q3’2022. All sectors in Q3’2023 recorded positive growths, with varying magnitudes across activities. Most sectors recorded improved growth compared to Q3’2022 with Accommodation and Food Services, Agriculture, Forestry and Fishing and Mining and Quarrying Sectors recording the highest growth improvements of 9.1% points, 8.0% points, and 5.6% points, respectively. Other sectors that recorded expansion in growth rate, from what was recorded in Q3’2022 were Financial and Insurance Services, Information and Communication and Real Estate sectors, of 5.1%, 2.7% and 2.2% points respectively;

During the week, the Kenya National Bureau of Statistics released the Quarterly Balance of Payment Report for Q3’2023 highlighting that Kenya’s balance of payments position deteriorated registering a deficit of Kshs 131.5 bn in Q3’2023, from a deficit of Kshs 112.7 bn recorded in Q3’2022, and a reversal from the Kshs 152.9 bn surplus recorded in Q2’2023;

During the month, Ethiopia became the third African country to default on its international government debt after the COVID-19 pandemic, joining Zambia and Ghana in the region, with the 14-day grace period for the USD 33.0 mn first repayment ending on December 25th;

Equities

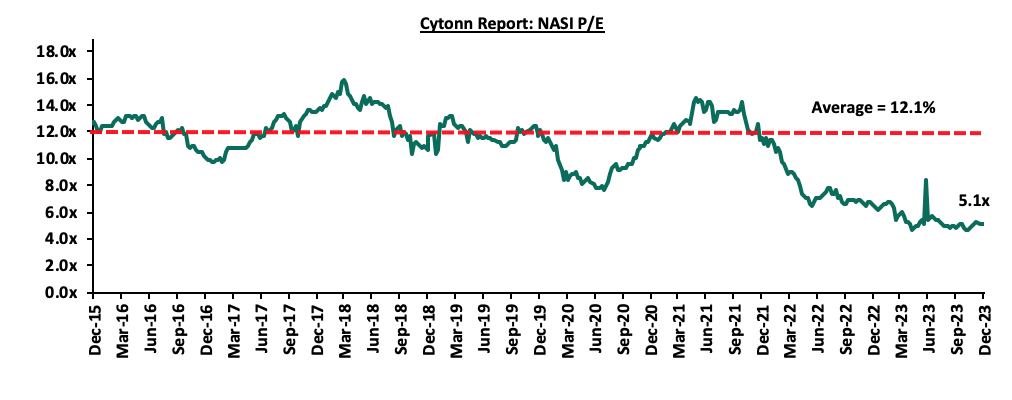

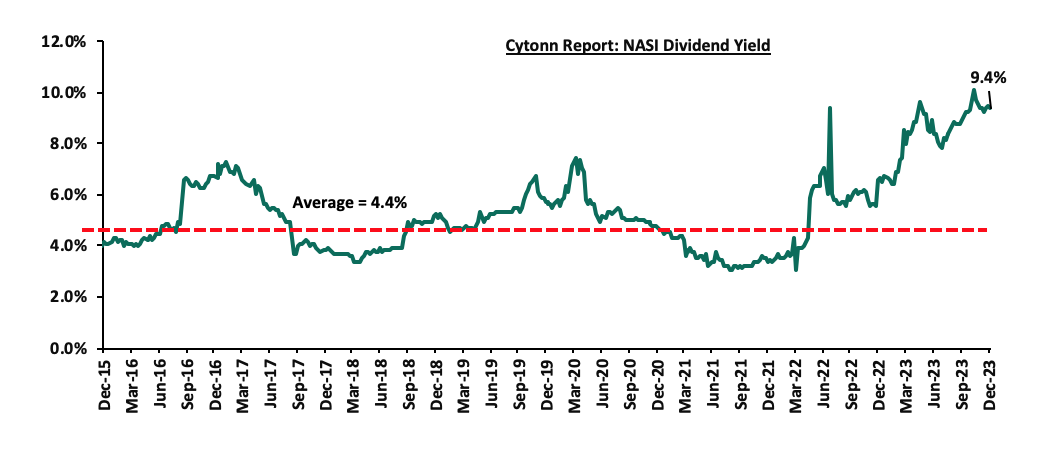

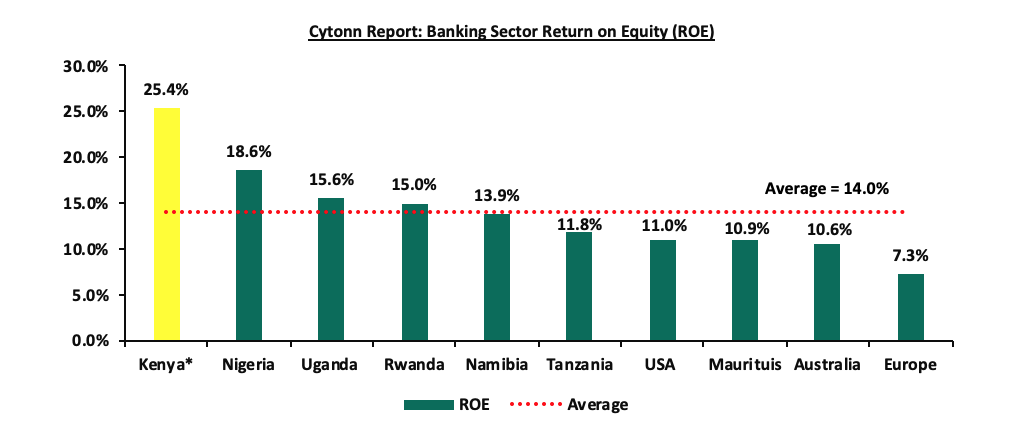

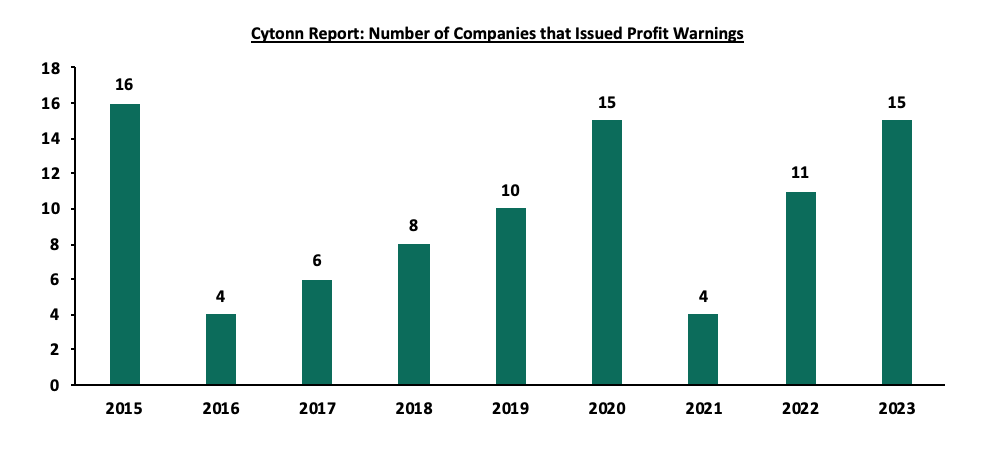

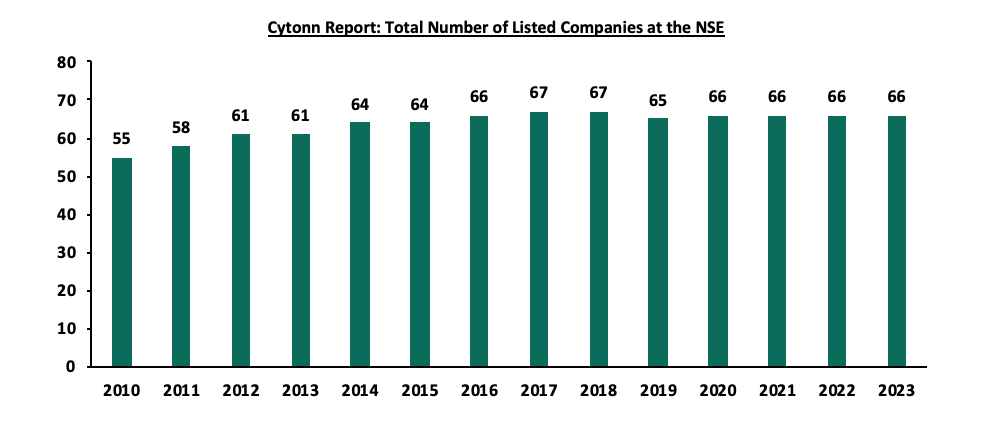

During the year, the Kenyan equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 27.7%, 10.4% and 24.2%, respectively. The equities market performance was driven by losses recorded by large-cap stocks such as KCB Group, Safaricom, EABL, Equity Group, Diamond Trust Bank Kenya, Absa Bank, and Co-operative Bank Kenya of 42.9%, 42.2%, 32.9%, 25.3%, 9.6%, 6.1%, and 5.8% respectively. The performance was, however, supported by gains by large-cap stocks such as Bamburi Cement, Standard Chartered Bank, and Stanbic Bank of 14.0%, 11.7%, and 6.6%. In the banking sector, the Kenya listed banks recorded a weighted average increase in the core earnings per share of 11.2% in Q3’2023, compared to a weighted average increase of 36.3% in Q3’2022, while in the Insurance sector, the listed insurers recorded a weighted average increase in core earnings per share of 19.8% in H1’2023, compared to a weighted average increase of 16.0% in H1’2022. During the year, 15 companies issued profit warnings, as compared to 11 companies in 2022, and 4 companies in 2021 an indication that the operating environment became increasingly difficult in 2023 compared to the previous years. Some of the companies in the financial services sector that issued profit warnings include Centum Group Plc and Sanlam Kenya Plc. Additionally, during the year, the Nairobi Securities Exchange officially listed the Local Authority Pension Trust (LAPTRUST) Imara Income Real Estate Investment Trust (I-REIT) on the Nairobi Securities Exchange (NSE) under the Restricted Sub-Segment after approval by the Capital Markets Authority last year. The NSE also launched two new indices, the NSE 10 share index and the NSE Bond Index. Four companies remained suspended at the Nairobi Securities Exchange, namely, Deacons (East Africa) PLC, ARM Cement PLC, Mumias Sugar Co. Ltd. and Kenya Airways;

Real Estate

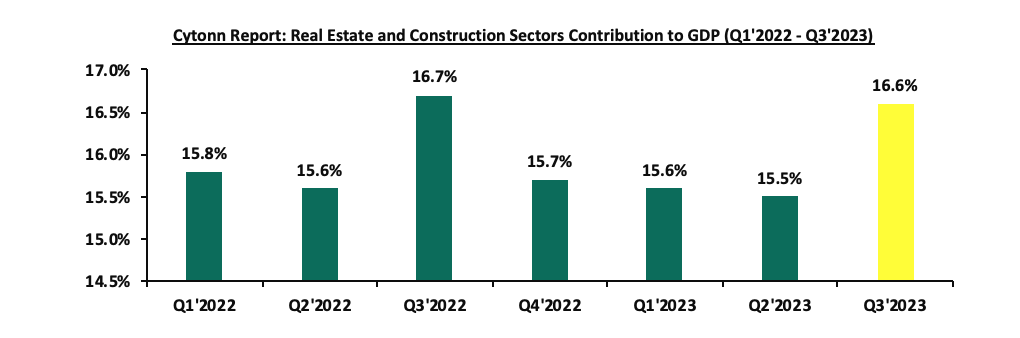

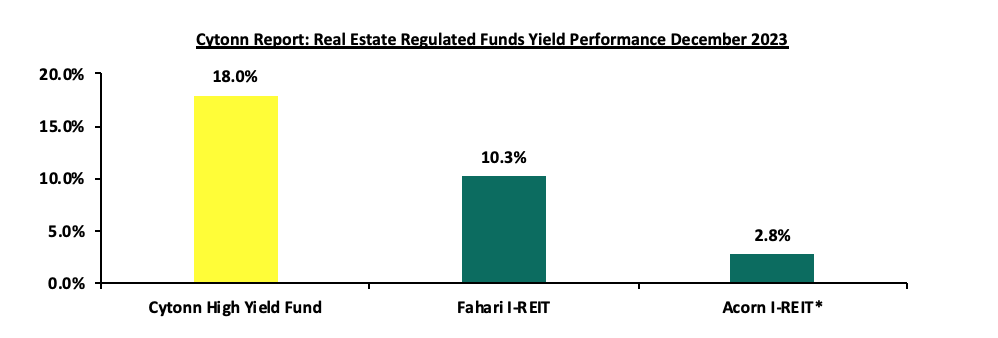

In 2023, the general Real Estate sector witnessed considerable growth in activity in terms of property transactions and development activities. Consequently, the sector’s activity contribution to GDP grew by 5.4% to Kshs 785.9 bn in Q3’2023, from Kshs 743.4 bn recorded during the same period in 2022. In addition, the sector contributed 10.5% to the country’s GDP, a 0.5% increase from 10.0% recorded in Q2’2023. Cumulatively, the Real Estate and construction sectors contributed 16.6% to GDP, a 1.1% improvement from 15.5% in Q2’2023, evidencing their growing contribution to Kenya's economy. Additionally, the escalation of selling and rental prices persisted, propelled by ongoing inflationary pressures and a depreciated shilling against the United States dollar, leading to an increase in the costs of construction materials. In terms of performance, the Nairobi Metropolitan Area (NMA) Residential, Commercial Office, Retail, Hospitality, and Mixed-Use Development sectors realized average rental yields of 6.1%, 7.7%, 8.3%, 6.8%, and 8.4%, respectively. This resulted to an average rental yield for the Real Estate market of 7.5%, 0.7% points higher than the 6.8% recorded in 2022;

In statutory reviews, Nairobi City County Government announced that the new valuation scheme for land rates payment within the county will come into effect in January 2024. This comes more than a year after the county issued a notice in November 2022, highlighting the increment of land rates to 0.115% of the current value of undeveloped land;

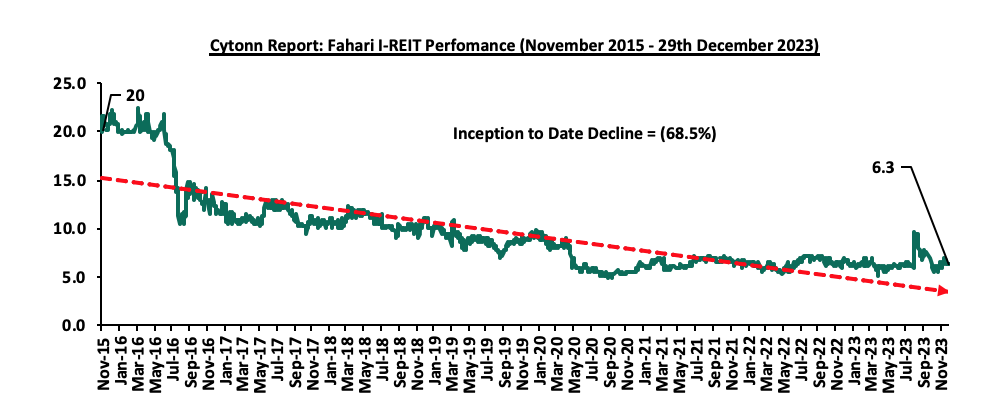

In the Regulated Real Estate Funds, under the Real Estate Investments Trusts (REITs) segment, Acorn Student Accommodation Development REIT (ASA D-REIT) announced it had sold its latest stabilized asset, Qwetu Aberdare Heights II, to the Acorn Student Accommodation Income REIT (ASA I-REIT) in a Kshs 1.5 bn deal. In the Nairobi Securities Exchange, Fahari I-REIT closed the week trading at an average price of Kshs 6.3 per share remaining relatively unchanged from the previous week;

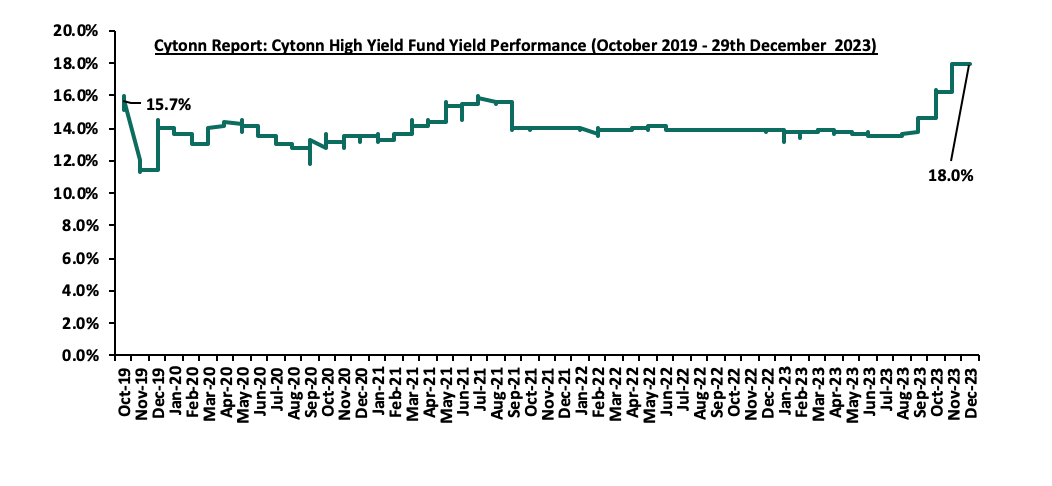

On the Unquoted Securities Platform, as at 1st December 2023, Acorn D-REIT and I-REIT closed the week trading at Kshs 25.3 and Kshs 21.7 per unit, a 26.6% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. In addition, Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 18.0%, remaining relatively unchanged from the previous week;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 15.45% p.a To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 17.95% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Monday, from 9:00 am to 11:00 am. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Global Economic Growth:

According to the October 2023 World Economic Outlook Report by the International Monetary Fund (IMF), the global economy is projected to grow at a rate of 3.0% in 2023, 0.5% points lower than the 3.5% growth recorded in 2022 and 0.9% points higher than the World Bank's earlier projection in June 2023. The expected slowdown in the Global economy’s growth is majorly attributable to the persistent inflationary pressures attributed to the high global fuel and energy prices experienced through most of the year. In line with this, most economies have continued to tighten their monetary policies in their efforts to fight inflation with the global headline inflation being expected to fall to 6.9% in 2023 from the 8.7% recorded in 2022. Notably, advanced economies continue to drive the decline in growth in 2023, with expected growth of 1.5% in 2023, a decline from the 2.6% growth in 2022. Moreover, the growth in the Emerging Markets and Developing Economies is expected to expand by 4.0% in 2023, a 0.1%-points decline from the estimated growth of 4.1% in 2022. The expected slowed down in global economic growth in 2023 as compared to 2022 is majorly attributable to;

- The elevated global inflationary pressures which have necessitated the hiking of interest rates by central banks around the world with the aim of anchoring inflation. As such, the global inflation is forecasted to ease slightly to 6.9% in 2023, from 8.7% in 2022,

- Tight global financial conditions occasioned by high cost of borrowing which have increased risks of debt distress in emerging economies as most advanced economies continue to tighten their monetary policies, and,

- Persistent supply chain constraints worsened by the ongoing Russia-Ukraine conflict which has impacted global fuel and food prices. Consequently, the high energy prices have increased inflationary pressures as well as contributed to currency depreciation as dollar demand increases especially in Emerging Markets and Developing Economies.

The global economy is expected to remain subdued in the short term mainly as a result of persistent inflationary pressures as well as tightening of monetary policies which are expected to weigh down on economic activity. Furthermore, the global economy’s future performance is majorly dependent on how soon the inflationary pressures will ease, which will see central banks ease their monetary policies hence boosting economic activity.

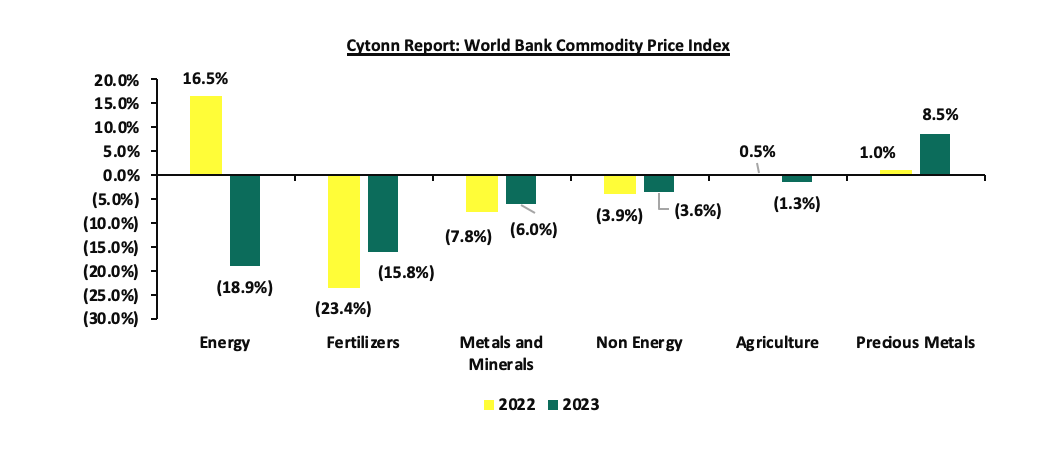

Global Commodities Market Performance:

Global commodity prices recorded mixed performance in 2023, with prices of energy decreasing the most by 18.9% compared to the 16.5% increase recorded in 2022, mainly as a result of slowed global demand on the back of the easing supply chain constraints which had been worsened by the Russia-Ukraine conflict. Similarly, prices of fertilizers decreased by 15.8% in 2023, compared to 23.4% in a similar period last year, while prices of metals and minerals, Non- energy and agriculture declined by 6.0%, 3.6%, and 1.3% respectively, on the back of reduced global demand coupled with easing supply chain constraints. The chart below shows a summary of the performance of various commodities.

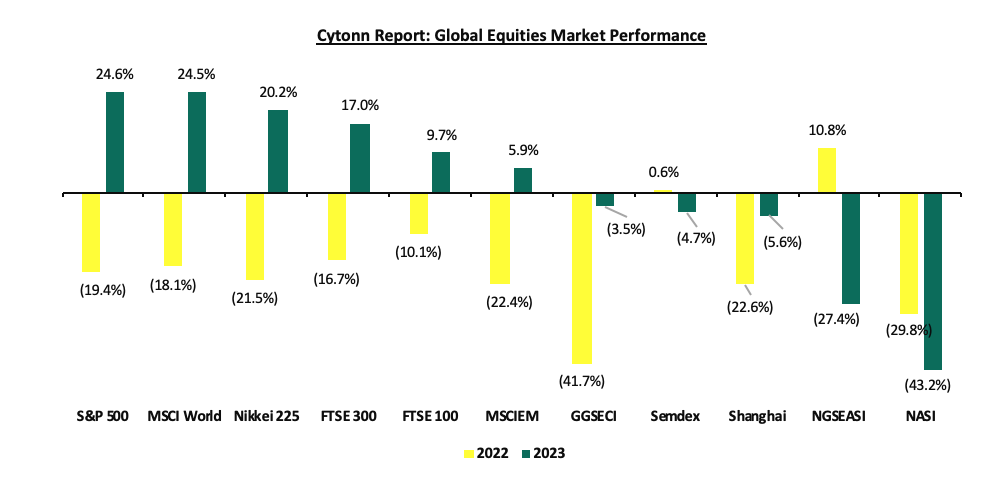

Global Equities Market Performance:

The global stock market recorded mixed performance in 2023, with most indices in the Sub-Saharan Africa declining attributable to capital outflows from equities market to the fixed income docket mainly on the back of elevated inflationary pressures which has led to increased interest rates. The S&P 500 was the largest gainer, recording a 24.6% gain, a reversal from the 19.4% decline in 2022, largely driven by increased investor sentiments following the relatively stable USA economy as well as the appreciation of the US dollar against other global currencies. Notably, stocks in the technology segment recorded significant gains mainly attributable to the well-established market dominance across the world with stocks such as Amazon, Microsoft and Apple gaining by 78.7%, 56.6% and 54.9% respectively on YTD basis. On the other hand, NASI was the largest decliner recording losses of 43.2%, mainly due to the increased capital flight as foreign investors withdrew from the Kenyan equities market on the back of deteriorated business environment. Additionally, investors have continued to attach higher risk premium to the country as a result of the inflationary pressures coupled with the sustained depreciation of the Kenyan shilling against the dollar so far having depreciated by 26.8% on year to date basis in 2023. Moreover, the tightening of the monetary policy in Kenya has seen interest rates rise thus attracting investors to the other alternatives such as government securities.

According to the International Monetary Fund (IMF), the Sub-Saharan African economy is projected to grow at a rate of 3.3% in 2023, a 0.7% points decline from a growth of 4.0% recorded in 2022. Notably, the projection was revised downwards from the earlier forecast of 3.5% in July 2023 by the IMF. The downward revision of the regional growth by the IMF is mainly on the back of the continued depreciation of most currencies against the dollar, weak external demand, tight global financial conditions and high inflationary pressures in most countries in the region. Additionally, public debt is expected to remain high due to increased debt serving costs as a result of continued currency depreciation and increased interest rates in developed economies. The decline in the region’s economic growth is attributable to;

- The heightened inflationary pressures following the Russia-Ukraine conflict which has prompted higher interest rates worldwide leading to slowing international demand, elevated spreads, and ongoing exchange rate pressures,

- Rising risk of debt distress in the region is expected to weigh down on the region’s growth due to increased debt-serving costs as a result of continued currency depreciation and increased interest rates in developed economies, and,

- High interest rates in developed economies such as the United States of America (USA) have led to a decline in foreign capital in the region further fuelling the economic decline in the SSA.

Currency Performance

In 2023, all select Sub-Saharan African currencies depreciated against the U.S Dollar, mainly on the back of the deteriorated business environment occasioned by the elevated inflationary pressures in the region, high debt servicing costs that continue to dwindle foreign exchange reserves, coupled with monetary policy tightening by advanced economies. The high interest rates in developed countries has led to massive capital outflows in SSA as investors seek to take advantage of the higher returns offered in developed economies. Further, the high cost of importation in the region continue to put pressure on the local currencies. The table below shows the performance of select African currencies against the USD;

|

Cytonn Report: Select Sub-Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Dec-21 |

Dec-22 |

Dec 23 |

2022 y/y change (%) |

2023 y/y change (%) |

|

Nigerian Naira |

413.0 |

447.1 |

896.6 |

(8.3%) |

(100.5%) |

|

Malawian kwacha |

816.4 |

1,026.4 |

1,689.7 |

(25.7%) |

(64.6%) |

|

Zambian Kwacha |

16.7 |

18.1 |

25.8 |

(8.4%) |

(42.4%) |

|

Ghanaian Cedi |

6.0 |

8.6 |

11.96 |

(43.3%) |

(39.1%) |

|

Kenyan Shilling |

113.1 |

123.4 |

156.5 |

(9.1%) |

(26.8%) |

|

South African Rand |

15.9 |

16.9 |

18.5 |

(6.3%) |

(9.5%) |

|

Tanzanian Shilling |

2,297.8 |

2,308.9 |

2,510.0 |

(0.5%) |

(8.7%) |

|

Botswana Pula |

11.7 |

12.8 |

13.4 |

(9.4%) |

(5.0%) |

|

Senegal CFA Franc |

577.0 |

615.0 |

592.1 |

(6.6%) |

(3.7%) |

|

Ugandan Shilling |

3,544.7 |

3,717.5 |

3,783.9 |

(4.9%) |

(1.8%) |

|

Mauritius Rupee |

43.5 |

43.9 |

44.0 |

(0.9%) |

(0.1%) |

Key take outs from the table include:

- The Nigerian Naira was the worst performer during the year, depreciating by 100.5% against the dollar, attributable to the deteriorated macroeconomic environment, evidenced by its elevated inflation, with November 2023 inflation rate coming in at a record of 28.2%, coupled with the tightened monetary policy as Nigeria’s interest rates were hiked to 18.8% in July 2023. Further, the recent decision by the Central Bank of Nigeria to adopt floating exchange rate regime, where the currency value of the Naira is allowed to vary according to the foreign exchange market hence making the overvalued naira to undergo a massive devaluation, broadly aligning the currency with its black-market rate,

- The Mauritius Rupee depreciated the least against the dollar, having depreciated by only 0.1% in 2023, mainly attributable to positive investor confidence following Mauritius’ improved macroeconomic performance following the expansion of the Mauritius economy by 6.0% as of Q2’2023, easing inflation rate with the November inflation coming in at 4.0% and the relatively stable foreign reserves in the country equivalent to over ten months of import cover, and,

- The Kenya Shilling depreciated by 26.8% in 2023 to close at Kshs 156.5 against the US Dollar, compared to Kshs 123.4 recorded at the beginning of the year, driven by increased dollar demand from importers, especially oil and energy sectors, the ever-present current account deficit and the need for government debt servicing which has continued to put pressure on the country’s forex reserves.

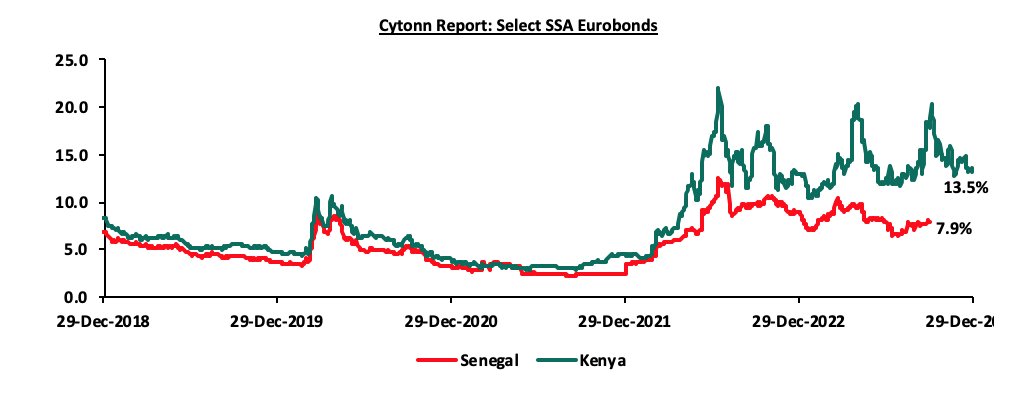

African Eurobonds:

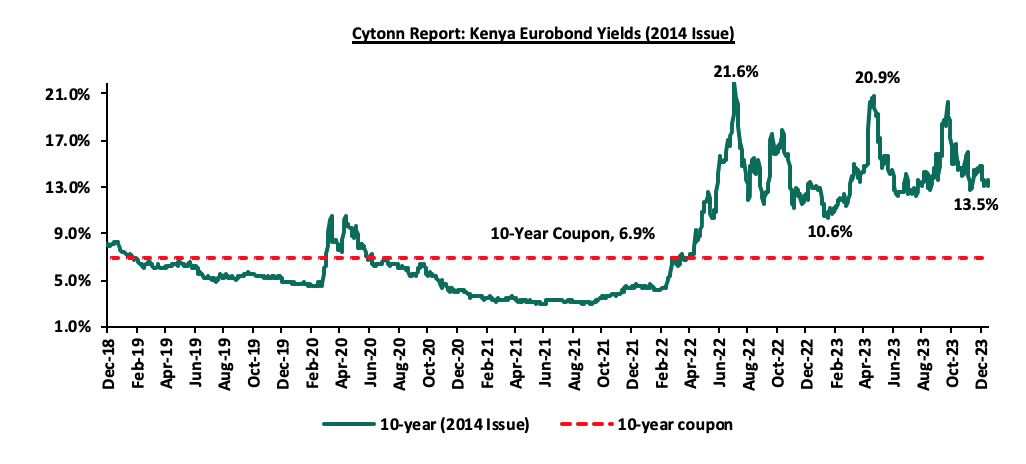

In 2023, most countries were not able to access the Eurobonds market because of the high and persistent interest rates and the difficult economic environment in the region. The main reason for the rise in interest rates was that investors attached high risk premium in the region following the elevated inflation, debt sustainability concerns, and weakening local currencies in the region. Yields on the Senegal Eurobond remained elevated despite recording marginal decline of 0.9% points as of the end Q3’2023 to 8.0% from 8.9% recorded at the end of 2022. On the other hand, the yield on Kenya’s Eurobond increased marginally by 0.6% points to 13.5% at the end of 2023, up from 12.9% recorded at the end of the previous year, on the back of debt sustainability concerns ahead of the 2024 bond maturity, coupled with the elevated credit risk as evidenced by the downgrade of Kenya’s long-term foreign currency and local-currency issuer ratings and senior unsecured debt ratings to B3 from B2 with a negative outlook by Moody’s Credit Rating Agency. Below is a 5-year graph showing the Eurobond secondary market performance of select 10-year Eurobonds issued by the respective countries.

Equities Market Performance:

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in 2023, with the Zambia Stock Exchange (LASILZ) being best performing market gaining by 5.3% largely driven by the gains in the financial as well as energy sectors coupled with increased copper exports to countries such as China, Switzerland and Singapore driving the country’s growth prospects. In addition, the improved macroeconomic environment supported by the IMF financial assistance has continued to accelerate investor confidence in the country. Notably, Nigeria all share index declined by 25.3% in 2023, a reversal from the 7.6% gain recorded in 2022 due to the aggressive depreciation of the Nigerian Naira against the dollar having depreciated by 100.5% in 2023 which has resulted to increased capital outflows in the country. Additionally, the reduction in oil production in Nigeria has led to the contraction of many key sectors of the economy considering that the country’s economy is highly dependent on crude oil exports. Below is a summary of the performance of the key SSA indices;

|

Cytonn Report: Equities Market Performance |

||||||

|

Country |

Index |

Dec-21 |

Dec-22 |

Dec-23 |

2022 y/y change (%) |

2023 y/y change (%) |

|

Zambia |

LASILZ |

364.7 |

406.9 |

428.7 |

11.6% |

5.3% |

|

Ghana |

GSECI |

465.6 |

271.5 |

262.2 |

(41.7%) |

(3.4%) |

|

South Africa |

JALSH |

4,618.3 |

4,292.8 |

4,038.5 |

(7.0%) |

(5.9%) |

|

Tanzania |

DARSDEI |

0.8 |

0.8 |

0.7 |

(1.9%) |

(13.2%) |

|

Rwanda |

RSEASI |

0.1 |

0.1 |

0.1 |

(4.6%) |

(17.2%) |

|

Uganda |

USEASI |

0.4 |

0.3 |

0.2 |

(25.0%) |

(23.1%) |

|

Nigeria |

NGEASI |

103.5 |

111.4 |

83.2 |

7.6% |

(25.3%) |

|

Kenya |

NASI |

1.5 |

1.0 |

0.6 |

(31.1%) |

(43.2%) |

|

*The index values are dollarized for ease of comparison |

||||||

The tough macroeconomic environment experienced in the region is expected to slow down economic growth. As such, subdued GDP growth rate in Sub-Saharan Africa is expected to continue in 2024, in line with the rest of the global economy. Elevated inflation rates, debt sustainability concerns, and supply chain constraints in the region are expected to persist in 2024, and this will continue to weigh down its economic growth. Additionally, the continued weakening of local currencies will even make debt servicing costlier, and this will lead to increased perceived risks in the region, resulting in reduced investor confidence in the region.

Economic Growth

The Kenyan economy recorded an average growth of 5.5% in the period between January to September 2023, with Q3’2023 GDP coming in at 5.9%, adding to the 5.4% growth recorded in Q2’2023. The average GDP growth of 5.5% marked a slight decline from the 5.6% average growth recorded in a similar period in 2022. The performance in Q3’2023 was mainly driven by the 6.7% growth in the agricultural sector due to the favourable weather conditions, which led to more agricultural output as evidenced by the 28.0% increase in tea output to 138.8 thousand metric tonnes coupled with the 84.3% growth in fruit exports to 59.6 thousand metric tonnes in the quarter under review. All sectors in Q3’2023 recorded positive growths, with varying magnitudes across activities. Most sectors recorded improved growth compared to Q3’2022 with Accommodation and Food Services, Agriculture, Forestry and Fishing, and Mining and Quarrying Sectors recording the highest growth improvements of 9.1% points, 8.0% points, and 5.6% points, respectively. Other sectors that recorded expansion in growth rate, from what was recorded in Q3’2022 were Financial and Insurance Services, Information and Communication, and Real Estate sectors, of 5.1%, 2.7%, and 2.2% points respectively.

In 2023, the Kenyan economy is projected to grow at an average of 5.3%, higher than the 4.8% growth observed in 2022. The faster growth is mainly attributable to a rebound in the agricultural sector following the sufficient long rains that have been experienced in the country, coupled with recent fiscal policies such as subsidizing the costs of crucial farm inputs such as fertilizers that have enhanced agricultural output. The table below shows the projections of Kenya’s 2023 GDP by various organizations:

|

Cytonn Report: Kenya 2023 growth Projections |

||

|

No. |

Organization |

2023 GDP Projections |

|

1 |

International Monetary Fund |

5.1% |

|

2 |

National Treasury |

6.1% |

|

3 |

World Bank |

5.0% |

|

4 |

Fitch Solutions |

5.1% |

|

5 |

Cytonn Investments Management PLC |

5.1% |

|

Average |

5.3% |

|

Source: Cytonn Research, 2023

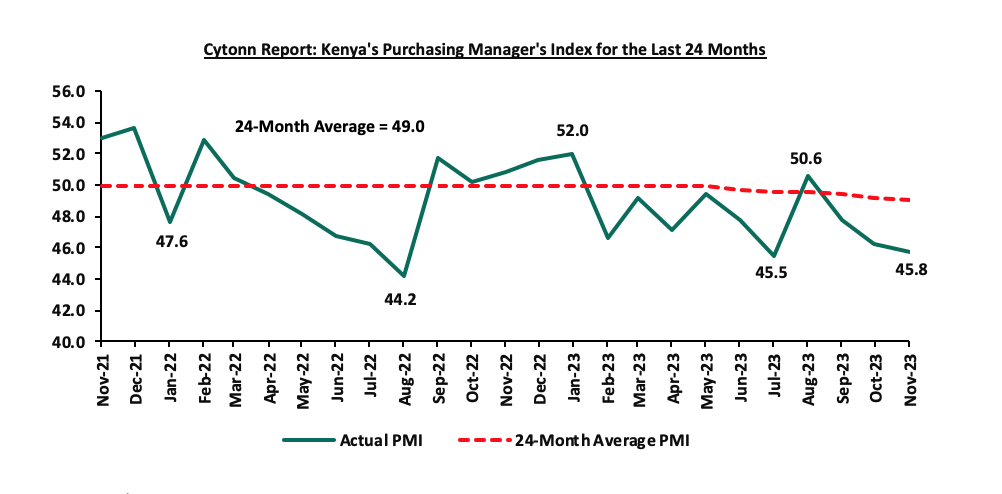

Business conditions in the Kenyan private sector remained subdued during the year, with the average Stanbic Bank Monthly Purchasing Managers’ Index (PMI) for the first eleven months averaging at 48.0, 1.0 points lower than the average of 49.0 recorded during a similar period in 2022 indicating a deterioration of the country’s business environment in 2023 compared to 2022. Similarly, PMI for the month of November 2023 came in at 45.8, down from 46.2 in October 2023 signalling a stronger downturn of the business environment for the third consecutive month. The agricultural sector, the manufacturing, wholesale, and retail sectors’ output, and new orders declined at a faster rate compared to October, as firms adjusted to reduced demand by cutting their workforce, resulting in the highest rate of workforce cut, with higher rates only registered during the first COVID-19 lockdown. The chart below shows the trend of Kenya’s Purchasing Managers index for the last 24 months;

Source: Stanbic PMI

Kenyan Shilling

The Kenya Shilling depreciated by 26.8% against the US Dollar to close at Kshs 156.5 in 2023, compared to Kshs 123.4 at the end of 2022, adding to adding to the 9.0% depreciation recorded in 2022. The chart below highlights the performance of the Kenyan Shilling against the US Dollar in 2023;

IMAGE 5 KSH VS USD

Source: Central Bank of Kenya

The depreciation of the Kenyan shilling in 2023 was driven by;

- Increased dollar demand by importers especially in the oil and energy sector, as well as manufacturers against a low supply of dollar currency leading to shortage of USD in the Kenyan market,

- An ever-present current account deficit which came at 3.5% of GDP in Q3’2023 from 6.4% recorded in a similar period last year. Key to note, the current account deficit narrowed by 42.1% to Kshs 122.5 bn in Q3’2023 from the Kshs 211.6 bn deficit recorded in Q3’2022. The performance was mainly driven by the contraction of the merchandise trade account deficit by 12.6% to Kshs 326.2 bn in Q3’2023, from Kshs 373.1 bn recorded in Q3’2022, coupled with a 35.2% improvement in the secondary income (transfer) balance to a to a surplus of Kshs 251.9 bn from a surplus of Kshs 186.3 bn in Q3’2022,

- The need for Government debt servicing which continues to put pressure on forex reserves given that 67.1% of Kenya’s external debt was US Dollar denominated as of June 2023,

- A continued hike in the USA Federal interest rates, with the Fed raising the rates by 100 bps in 2023 from a range of 4.25%-4.50% in December 2022 to a rage of 5.25%-5.50% in July 2023. The hike in rates meant to curb inflation in the US has strengthened the dollar against other currencies resulting in capital outflows from emerging and developing markets such as Kenya, and,

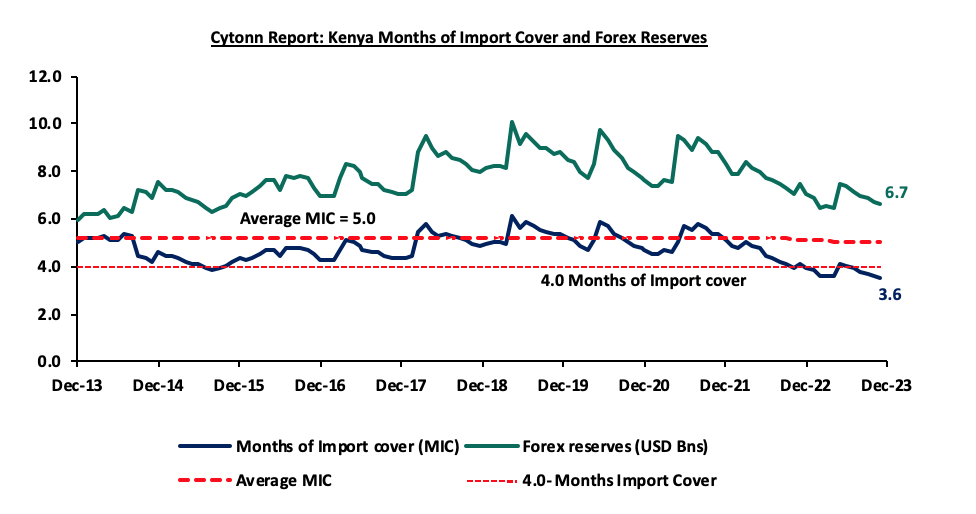

- Dwindling forex reserves closing the year at USD 6.7 bn (equivalent to 3.6 months of import cover), which is below the statutory requirement of maintaining at least 4.0-months of import cover. Notably, Kenya’s forex reserves have declined by 9.8% on a year-to-date basis from USD 7.4 bn recorded in January 2023 to USD 6.7 bn as of December 2023. The following is a graph showing Kenya months of import cover and forex reserves for the last 10 years;

Source: Central Bank of Kenya

The shilling received some support driven by:

- Improved diaspora remittances standing at a cumulative USD 3,817.4 mn as of November 2023, 4.0% higher than the USD 3,670.6 mn recorded over the same period in 2022, which has continued to cushion the shilling against further depreciation. In the November 2023 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 57.2% in the period,

- Foreign loan disbursements, with the government receiving USD 1.0 bn from the World Bank under the Development Policy Operation (DPO) facility in May 2023, as well as USD 415.0 mn from the International Monetary Fund (IMF) in July 2023 under the 38-month Extended Fund Facility (EFF) and Extended Credit Facility (ECF) following the completion of the fifth review and is expected to receive USD 682.3 mn upon completion of the sixth review, and,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars.

Beyond our expectations, the Kenyan shilling depreciated by 26.8% in 2023 to close the year at Kshs 156.5. We expected the Kenyan shilling to remain within a range of Kshs 130.2 and Kshs 134.4 against the USD in the medium term based on the Purchasing Power Parity (PPP) and Interest Rate Parity (IRP) approach respectively, with a bias of a 6.4% depreciation. The shilling’s depreciation against the USD dollar overshot our projection due to the aggressive hike in the US Federal interest rate as well as the adoption of a flexible mechanism by the CBK to allow the currency exchange rate reach an equilibrium hence hitting its true value. Read on our outlook on Performance of Kenya Currency.

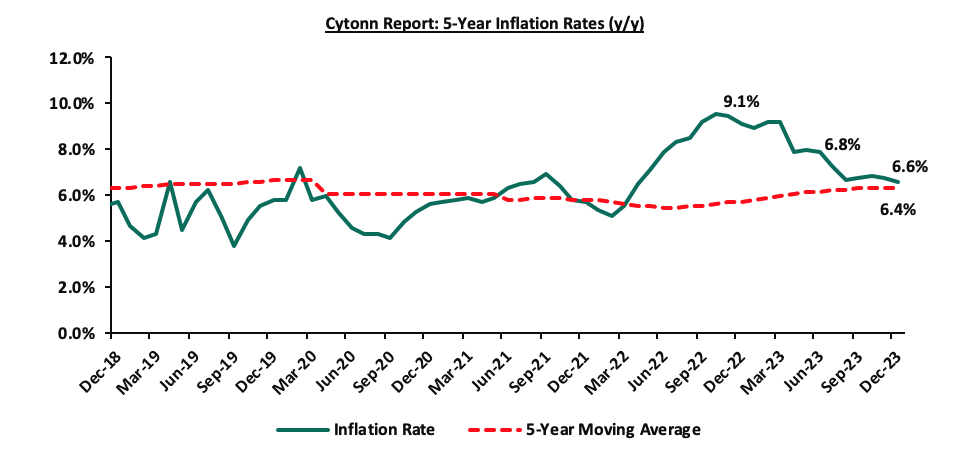

Inflation:

The inflation rate for the year 2023 averaged at 7.7%, 0.1% points higher than average inflation rate of 7.6% recorded over a similar period in 2022. Notably, the y/y inflation in December 2023 decreased by 0.2% points to 6.6%, from the 6.8% recorded in November 2023. This was in line with our projections to within a range of 6.6% to 6.8%. The headline inflation in December 2023 was majorly driven by increase in prices of commodities in the following categories, transport; housing, water, electricity, gas, and other fuels, and food and non-alcoholic beverages by 11.7%, 8.3%, and 7.7%, respectively. The overall headline inflation remained within the Central Bank of Kenya (CBK) target range of 2.5% to 7.5% for the sixth consecutive month.

Going forward, we expect inflationary pressures to ease in the short term, while remaining within the CBK’s target range of 2.5% to 7.5% aided by the easing in fuel prices and easing of domestic food prices on the account of improved supply attributed to the ongoing harvests and Government measures to zero-rate key food imports. Additionally, the upward revision of the CBR to 12.50% in the latest MPC meeting, from 10.50%, is meant to continue reducing money supply, in turn easing inflation in the short to medium term, though the impact of this might be muted given that the current inflation is cost driven and not demand driven as the money supply remain stable. We also expect the measures taken by the government to subsidize major inputs of agricultural production such as fertilizers to lower the cost of farm inputs and support the easing of inflation in the long term.

Monetary Policy:

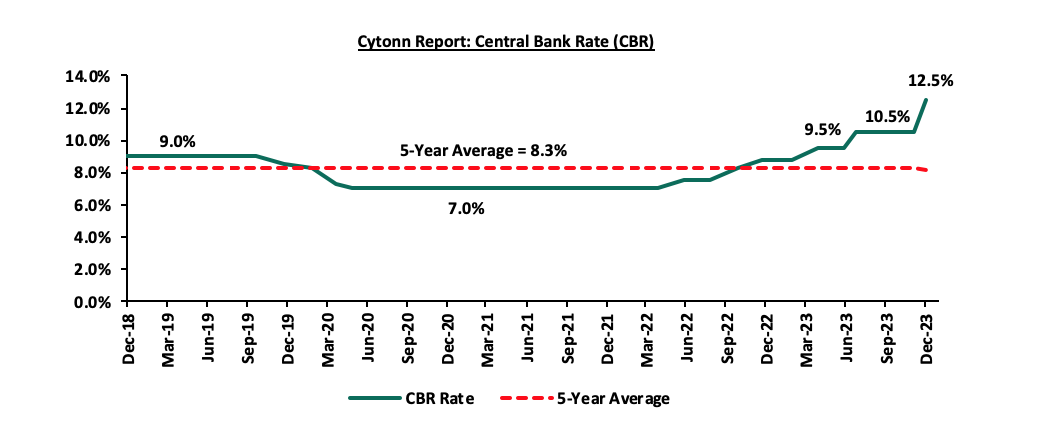

During the year the Monetary Policy Committee (MPC) met 7 times where it maintained the Central Bank Rate (CBR) at 8.75% and the Cash Reserve Ratio of 4.25% in the first meeting held in January. However, the MPC raised the CBR rate by 75.0 basis points (bps) to 9.50% March, and retained the rate in its May sitting, in a bid to anchor inflation which stood above the government’s target range of 2.5% - 7.5% in the first half of 2023. The MPC further hiked the CBR by an additional 100.0 bps to 10.50% in June and maintained the same rate in its August and October meetings and introduced a 250.0 bps interest rate corridor in the former. In its latest meeting held in December, the MPC raised the CBR rate by 200.0 bps to 12.5%, contrary to our expectation that the MPC would retain the CBR rate at 10.5% based on an eased inflation rate, coming in at 6.8% in November from 6.9% in October, remaining in the CBK preferred range of 2.5%-7.5% for the fifth consecutive month, as well as easing depreciation of the Shilling against the dollar, having depreciated by 1.7% in November compared to 1.9% in September. The increment was made to tame the local currency depreciation, which the Committee noted had a significant contribution to the country’s inflation, contributing 3.0% of the 6.8% inflation rate recorded in November, as well as the high cost of debt service. In total, MPC raised rates in 2023 by 3.75%, from 8.75% in January to 12.5% in December. We expect the MPC to continue raising the CBR rates in a bid to anchor the Kenyan shilling that has suffered a 26.8% depreciation against the US Dollar in the year 2023. The following is a graph highlighting the Central Bank Rate for the last 5 years;

Source: Central Bank of Kenya

2023 Key Highlights:

- FY’2023/2024 Budget Policy Statement

On 15th June 2023, the National Treasury presented Kenya’s FY’2023/24 National Budget to the National Assembly highlighting that the total budget estimate for the 2023/24 fiscal year increased by 8.7% to Kshs 3.7 tn from the Kshs 3.4 tn in FY’2022/23 budget. The government projects that total revenue will increase by 15.7% to Kshs 3.0 tn from the Kshs 2.6 tn in FY’2022/23, supported by a 17.3% increase in ordinary revenue to Kshs 2.6 tn for FY’2023/24, from the Kshs 2.2 tn in FY’2022/23. The FY’2023/24 budget focuses mainly on providing solutions to the heightened concerns on the high cost of living, the measures put in to accelerate economic recovery as well as undertaking a growth-friendly fiscal consolidation to preserve the country’s debt sustainability. Notably, the government projects to narrow the fiscal deficit to 4.4% of GDP in FY’2023/24, from the estimate of 5.8% of GDP in FY’2022/23. For more information, see our Kenya’s FY’2023/24 Budget Review.

- Credit Facilities extended to Kenya

-

- In 2022, Kenya received a total of USD 1 bn (Kshs 155.5 bn) under the Development Policy Operation (DPO) from the World Bank and a total of USD 415.0 mn (Kshs 64.5 bn) from the IMF under the Extended Credit Facility arrangement (EFF/ECF) for budgetary support by providing low-cost budget financing to support key policies and institutional reforms. Additionally, the funding from the World Bank would also boost Kenya’s post-COVID-19 recovery. Key to note, during the fifth review of the EFF/ECF program, the IMF approved USD 551.4 mn (Kshs. 85.7 bn) under the Resilience Sustainability Facility (RSF) programme to support Kenya’s ambitious efforts to build resilience to climate change. For more information, see our Cytonn Weekly #29/2023, and,

- On 15th November 2023, The International Monetary Fund (IMF) reached a staff-level agreement with the Kenyan authorities for the sixth reviews of Kenya’s economic program supported by the IMF’s Extended Fund Facility (EFF) and Extended Credit Facility (ECF), and the first Review under the Resilience Sustainability Facility (RSF). Notably, the discussions considered Kenya’s request for an augmentation under the EFF/ECF arrangement and the RSF, leading to a potential total commitment of approximately USD 4.4 bn (Kshs 670.1 bn) over the program's duration. Following the completion of the review by the IMF Executive Board, Kenya stands to gain immediate access to USD 682.3 mn (Kshs 103.9 bn), marking significant financial support toward the nation's economic programs. For more information, see our Cytonn Weekly #46/2023.

- FY’2022/2023 KRA Revenue Performance

On 14th July 2023, The Kenya Revenue Authority (KRA) released the annual revenue performance for the FY’2022/23, highlighting t that the total revenue collection amounted to Kshs 2.2 tn against the target of Kshs 2.3 tn, translating to a target achievement of 95.3%. The performance also marked the second consecutive year that the KRA has surpassed the Kshs 2.0 tn mark in revenue collection and a 6.6% growth in revenue from the 2.0 tn in FY’2021/22. The performance was mainly supported by an 8.5% growth in domestic tax revenue to Kshs 1.4 tn from Kshs 1.3 tn recorded in FY’2021/22, coupled with a 3.5% growth in customs tax revenue to Kshs 754.1 bn from Kshs 728.6 bn recorded in FY’2021/22. However, the performance of custom taxes was curtailed by an increase in exemptions and remissions, which grew by 39.7%, as a result of exemptions on imports of commodities such as rice, maize, sugar, and cooking oil. For more information, see our Cytonn Weekly #28/2023.

- Balance of Payments

The Kenya National Bureau of Statistics released the Q3’2023 Balance of Payments Report highlighting that Kenya’s balance of payments position (BoP) deteriorated during the quarter, registering a deficit of Kshs 131.5 bn in Q3’2023, from a deficit of Kshs 112.7 bn recorded in Q3’2022, and a reversal from the Kshs 152.9 bn surplus recorded in Q2’2023. The y/y performance in BoP was mainly driven by the reversal of the financial account balance to a deficit of Kshs 20.6 bn from a surplus of Kshs 175.1 bn in Q3’2022, which outweighed the 42.1% narrowing of the current account balance deficit to Kshs 122.5 bn in Q3’2023 from Kshs 211.6 bn in Q3’2022 and the 448.2% increase in the capital account balance to Kshs 3.4 bn from Kshs 0.6 bn recorded in a similar period in 2022.

- Credit Ratings

Kenya’s debt levels have been of concern in 2023, with global credit rating agencies such as Standard & Poor (S&P) Global, Fitch and Moody’s downgrading the country’s credit outlook from stable to negative. In February, S&P Global downgraded Kenya’s credit outlook from stable to negative based on weakening liquidity position brought about by limited access to the international market and undersubscription of domestic bond issuances limiting Kenya’s capacity to service its debt. In May, Moody’s downgraded Kenya’s senior unsecured debt rating as well as long-term foreign-currency and local-currency issuer ratings to B3 from B2 due to a decline in domestic financing leading to delays in funding. The agency also placed the country’s ratings on review, affirming the B3 rating in July and further downgrading the country’s credit outlook from stable to negative on the back of constrained refinancing options for the upcoming USD 2.0 bn Eurobond maturity due in June 2024. Similarly, Fitch Ratings adjusted the outlook on Kenya’s Long-Term Foreign-Currency Issuer Default Rating (IDR) from Stable to Negative, while confirming the IDR at B reflecting the growing constraints on external financing due to high funding needs, including the upcoming Eurobond maturity, declining international reserves, increasing financing costs, and uncertainty about the fiscal path. The downgrades of Kenya’s credit score have dimmed the country’s ability to access cheaper loans in the international financial markets, with the yields on the 10-year 2014 Eurobond Issue reaching a high of 20.3% on 3rd October 2023. For more information, see our media release, Cytonn Q3'2023 Markets Review. Below is a summary of the credit rating on Kenya by various rating agencies;

|

Cytonn Report: Kenya Credit Rating Agencies Ratings |

|||||

|

Rating Agency |

Previous Rating |

Previous Outlook |

Current Rating |

Current Outlook |

Date Released |

|

B3 |

Stable |

B3 |

Negative |

28 th July 2023 |

|

|

B |

Stable |

B |

Negative |

20 th July 2023 |

|

|

B2 |

Stable |

B3 |

Stable |

12 th May 2023 |

|

|

B |

Stable |

B |

Negative |

24 th February 2023 |

|

Source: Fitch Ratings, S&P Global, Moody’s

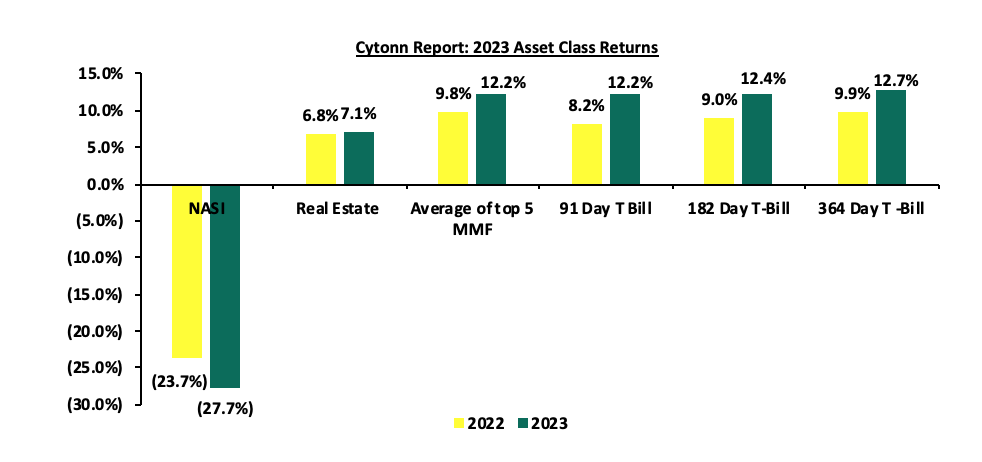

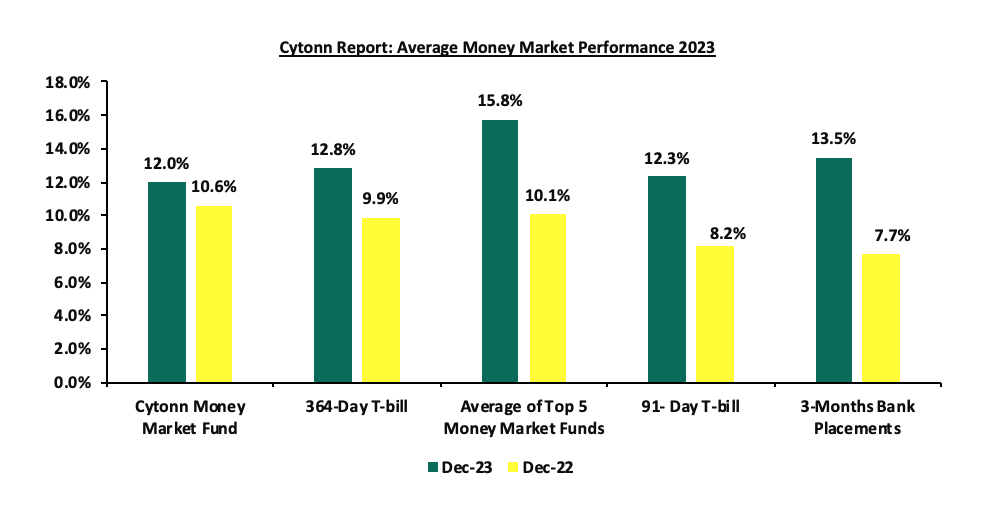

2023 returns by Various Asset Classes

The returns by the various asset classes improved in 2023, with the average of the top five money market funds (MMFs), Real Estate yield and government papers being on upward trajectories. The average of top 5 MMFs recorded a yield of 12.1%, 2.3% points higher than the 9.8% average recorded in 2022 as the average Real Estate yield also increased by 0.3% points to 7.1% in 2023, from 6.8% recorded in 2022. Similarly, the 364-day, 182-day and 91-day Government papers recorded average yields of 12.7%, 12.4% and 12.2%, respectively. However, for the equities class, NASI registered a 27.7% loss in 2023, a deterioration from the 23.7% loss recorded in 2022. The graph below shows the summary of returns by various asset classes (Average top 5 MMF, Fixed Income, Real Estate and Equities).

The table below shows the macro-economic indicators that we track, indicating our expectations for each variable at the beginning of 2023 versus the experience;

|

Cytonn Report: Macro-Economic & Business Environment Outlook |

||||

|

Macro-Economic Indicators |

2023 Outlook |

Effect |

2023 Experience |

Effect |

|

Government Borrowing |

|

Negative |

|

Negative |

|

Exchange Rate |

|

Negative |

|

Negative |

|

Interest Rates |

|

Negative |

|

Negative |

|

Inflation |

|

Neutral |

|

Neutral |

|

GDP |

|

Neutral |

|

Positive |

|

Investor Sentiment |

|

Neutral |

|

Negative |

|

Security |

|

Positive |

|

Neutral |

Since the beginning of the year, the notable changes we have seen out of the seven metrics that we track, fall under three metrics, namely; the GDP, investor sentiment, and Security. Key to note, economic growth improved from neutral to positive, while investor sentiments and security changed from neutral to negative and positive to neutral respectively. In conclusion, macroeconomic fundamentals showed mixed performance during the year with most metrics on downward trajectories. We expect a slight recovery in 2024 supported by the improving economic conditions in the country evidenced by momentum in GDP growth and declining inflation with the rate remaining within target range of 2.5% to 7.5% for the sixth consecutive month. However, improvement of the business conditions in the country depends on the decline in inflation rates and stabilization of the Kenyan currency.

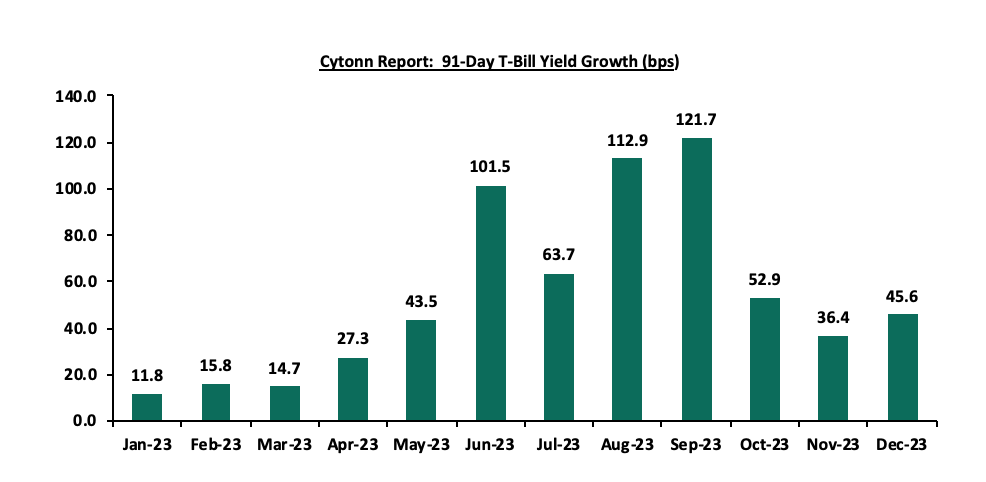

T-Bills & T-Bonds Primary Auction:

During the year, T-bills were oversubscribed, with the overall subscription rate coming in at 120.0%, up from 94.9% in FY’2022. Investors’ preference for the 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 1,100.5 bn against the offered Kshs 208.0 bn, translating to an oversubscription rate of 529.1%, higher than the oversubscription rate of 226.9% recorded in FY’2022. Overall subscription rates for the 364-day and 182-day papers came in at 29.0% and 48.5%, lower than the 69.7% and 67.2%, respectively, recorded in FY’2022. XX The average yields on the 364-day, 182-day, and 91-day papers were on an upward trajectory with the 91-day yields increasing the most by 409.2 bps to 12.3%, from 8.2% in 2022 while the 182-day and 364-day increased by 348.9 bps and 293.4 bps to 12.5% and 12.8% in 2023, from 9.0% and 9.9% in 2022, respectively. Likewise, on y/y basis, the yields on the government papers registered significant growth in 2023 with the 91-day paper increasing the most by 661.4 bps to close the year at 16.0% from the 9.4% recorded at the close of FY’2022. The yields on the 182-day and 364-day increased by 613.3 bps and 579.2 bps to close the year at 16.0% and 16.1%, from the 9.8% and 10.3%, respectively, recorded at the end of FY’2022. The upward trajectory in yields is mainly on the back of investors attaching higher risks amid high inflation, currency depreciation, and tight liquidity positions, hence the need for higher returns to cushion against the possible loss. The average acceptance rate during the period came in at 92.5%, albeit higher than the 89.3% recorded in FY’2022, with the government accepting a total of Kshs 1,385.9 bn out of the Kshs 1,497.7 bn worth of bids received. Notably, the growth in the government papers yields paced up in December compared to November, with the yields on the 91-day paper rising by 45.6 bps, compared to 36.4 bps growth that was recorded in November, as the government remains under pressure to keep borrowing for budgetary purposes. The chart below shows the yields growth rate for the 91-day paper during the year;

During the week, T-bills were undersubscribed, for the third consecutive week, with the overall subscription rate dropping significantly to 43.8%, down from the 86.8% recorded the previous week, partly attributable to the tightened liquidity in the money market with the average interbank rate increasing to 13.9% from 12.2% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 8.5 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 212.9%, albeit lower than the oversubscription rate of 415.9% recorded the previous week. The subscription rates for the 364-day and the 182-day papers also declined, with the 182-day paper decreasing the most to 3.2% from 22.9% and the 364-day paper decreasing to 16.6% from 19.2%, recorded the previous week. The government accepted a total of Kshs 9.0 bn worth of bids out of Kshs 10.5 bn of bids received, translating to an acceptance rate of 85.4%. The yields on the government papers recorded a mixed performance with the yields on the 364-day and 91-day papers increasing by 19.9 bps and 10.0 bps to 16.1% and 16.0% respectively, while the 182-day paper decreased by 0.5 bps to 16.0%. The chart below compares the overall average T- bills subscription rates obtained in 2017, 2022 and FY’2023;

Primary T-Bond Auctions in FY’2023

Primary T-bond auctions in 2023 were oversubscribed, with the subscription rate averaging 117.8%, an increase from the 98.8% average subscription rate recorded in 2022, mainly attributable to the rising yields on the government papers during the year. The average acceptance rate came in at 82.0% in 2023, 5.2% points lower than the 87.2% recorded in 2022 as the government sought to avoid expensive bids;

In the primary bond market, the government is seeking to raise additional Kshs 35.0 bn for budgetary support by issuing a new 3-year bond FXD1/2024/03 with a tenor of 3.0 years and reopening the 5-year bond FXDI/2023/05 with a tenor to maturity of 4.7 years. The coupon rate for the FXD1/2024/03 will be market-determined; however, that of FXD1/2023/05 is set at 16.8%. The bidding process opened on 14th December 2023 and will close on 14th January 2024, giving the bonds a value date of 15th January 2024. Any discount amounts and interest payments from the bonds will be subject to a withholding tax at a rate of 15.0%. We anticipate the bonds to be oversubscribed, given the short tenor to maturity of the FXD1/2024/03, with that investors attaching higher yields as they seek to cushion themselves against future losses on the back of the government’s debt sustainability concerns and the sustained inflationary pressures experienced in the country.

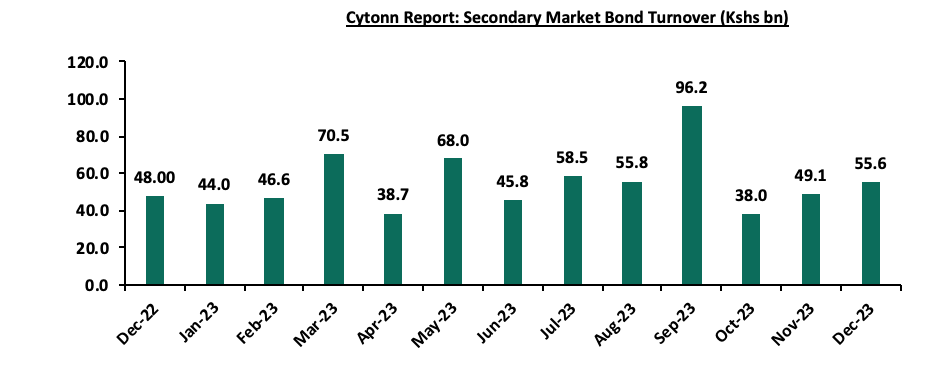

Secondary Bond Market Activity:

The secondary bond market recorded reduced activity during the year, with the turnover having declined by 9.5% to Kshs 666.9 bn, from Kshs 736.9 bn in 2022. The chart below shows the bond turnover over the past 12 months;

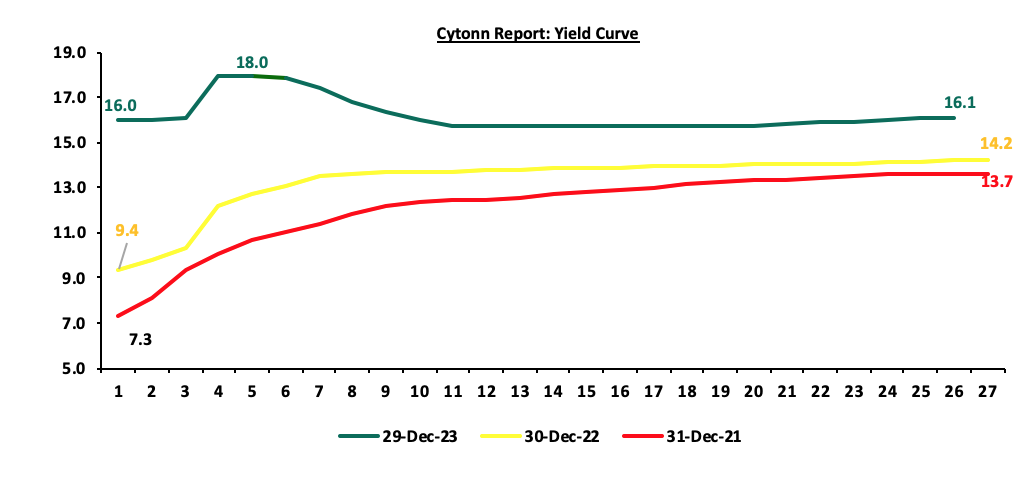

In 2023, the yield curve experienced an upward adjustment, mainly attributable to the increased government borrowing, local currency depreciation and the heighted credit risk with global credit rating agencies such as Fitch, Moody’s and S&P Global downgrading Kenya’s credit outlook from stable to negative amidst constrained liquidity ahead of the upcoming USD 2.0 bn Eurobond maturity due in 2024. As such, investors will continue to demand higher yields to compensate for inflation and currency depreciation risk leading to rise across the yield curve. The chart below is the yield curve movement during the period;

Money Market Performance:

During the week, 3-month bank placements ended the week at 13.5% (based on what we have been offered by various banks), while the yield on the 364-day T-bill and 91-day T-bill increased by 19.9 bps and 10.0 bps to 16.1% and 16.0%, respectively. Likewise, the average yield of the Top 5 Money Market Funds increased by 15.4 bps to 15.8% from15.6% recorded the previous week, while the yields of the Cytonn Money Market Fund remained relatively unchanged at 15.5% recorded the previous week. The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 29th December 2023:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 29th December 2023 |

||

|

Rank |

Fund Manager |

Effective Annual |

|

1 |

Etica Money Market Fund |

16.5% |

|

2 |

Nabo Africa Money Market Fund |

15.9% |

|

3 |

GenAfrica Money Market Fund |

15.8% |

|

4 |

Cytonn Money Market Fund (Dial *809# or download Cytonn App) |

15.5% |

|

5 |

Lofty-Corban Money Market Fund |

15.3% |

|

6 |

Enwealth Money Market Fund |

14.9% |

|

7 |

Sanlam Money Market Fund |

14.7% |

|

8 |

Apollo Money Market Fund |

14.4% |

|

9 |

Madison Money Market Fund |

14.3% |

|

10 |

Kuza Money Market fund |

14.1% |

|

11 |

AA Kenya Shillings Fund |

14.1% |

|

12 |

Co-op Money Market Fund |

13.9% |

|

13 |

Absa Shilling Money Market Fund |

13.8% |

|

14 |

GenCap Hela Imara Money Market Fund |

13.6% |

|

15 |

Jubilee Money Market Fund |

13.6% |

|

16 |

Old Mutual Money Market Fund |

13.4% |

|

17 |

Orient Kasha Money Market Fund |

13.0% |

|

18 |

Mayfair Money Market Fund |

12.7% |

|

19 |

Dry Associates Money Market Fund |

12.3% |

|

20 |

KCB Money Market Fund |

12.2% |

|

21 |

CIC Money Market Fund |

11.8% |

|

22 |

ICEA Lion Money Market Fund |

11.7% |

|

23 |

Equity Money Market Fund |

11.5% |

|

24 |

Mali Money Market Fund |

11.5% |

|

25 |

British-American Money Market Fund |

9.1% |

Source: Business Daily

Liquidity:

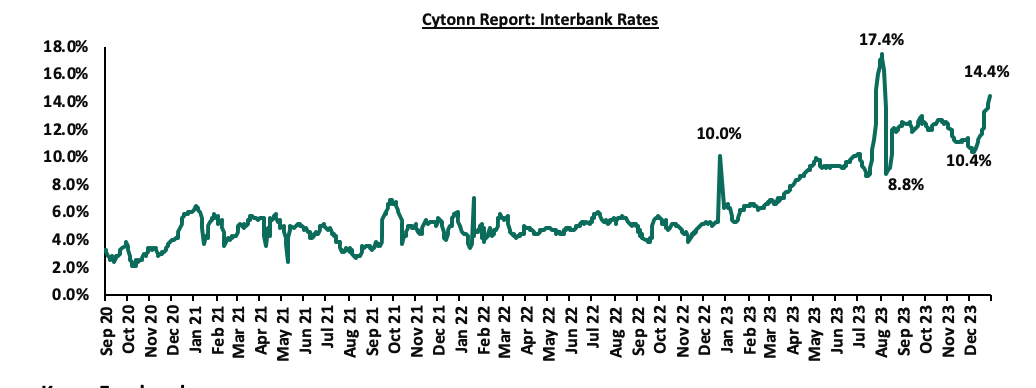

During the year, liquidity levels tightened as evidenced by the doubling in the average interbank rate to 9.8%, from 4.9% in 2022. The tightened liquidity is partly due to tax remittances which offset government payments. The average volumes traded in the interbank market increased by 16.1% to Kshs 21.6 bn in 2023 from Kshs 18.6 bn recorded in 2022.

During the week, liquidity in the money markets tightened, with the average interbank rate rising to 13.9% from 12.2% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded declined by 39.6% to Kshs 20.3 bn from Kshs 33.7 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

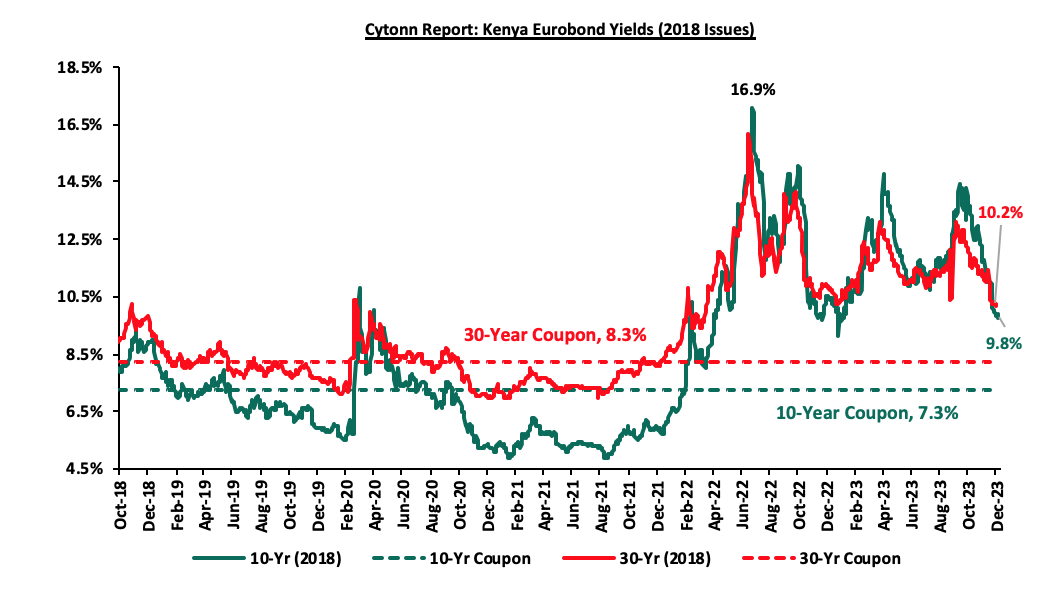

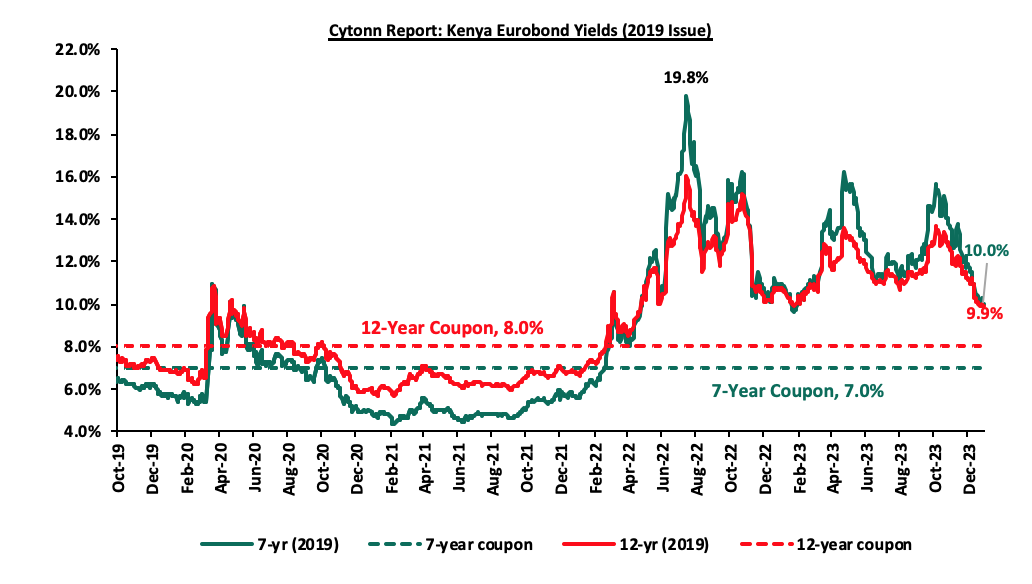

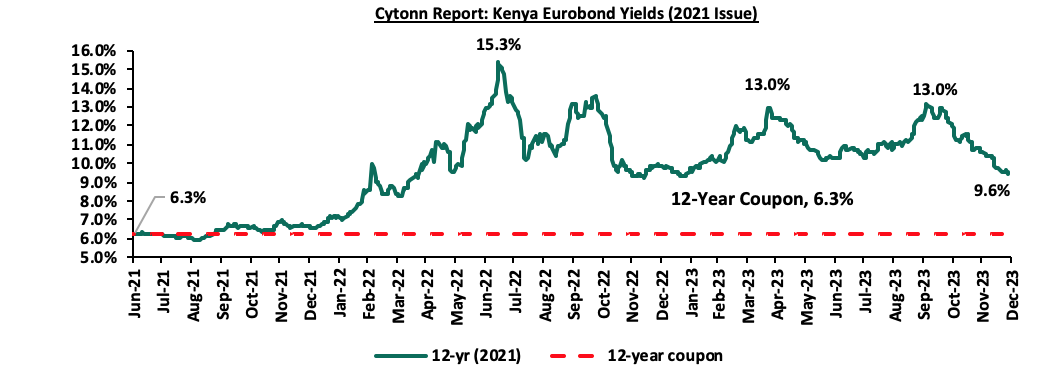

Kenya Eurobonds:

Yields on Kenya’s Eurobonds recorded mixed performance in 2023, with the yields on the 10-Year Eurobond issued in 2014, set to mature in 2024, increasing the most by 0.6% points to 13.5%, from 12.9% recorded at the end of 2022.

For the 2018 Eurobond issue, the yields on the 10-year Eurobond and the 30-year Eurobond both decreased by 0.7% points and 0.6% points to close the year at 9.8% and 10.2%, from 10.5% and 10.9% recorded at the end of 2022, respectively;

For the 2019 Dual-tranche Eurobond issue, the yields on the 7-year Eurobond and the 12-year Eurobond decreased by 0.9% points each, to close the year at 10.0% and 9.9%, from 10.9% and 10.8% at the close of 2022, respectively.

The yields on the 12-Year Eurobond issued in 2021, set to mature in 2033, decreased by 0.3% points to 9.6%, from 9.9% recorded at the end of 2022;

Likewise, during the week, the yields on Eurobonds recorded mixed performance with the 10-year Eurobond issued in 2014 increasing the most by 0.1% points, to 13.5% from 13.4% recorded the previous week, while the yields on the 7-year Eurobond issued in 2019 declined the most by 0.1% points to 10.0% from 10.1% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 29th December 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Tenor |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD) |

2.0 bn |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

|

Years to Maturity |

0.5 |

4.2 |

24.2 |

3.4 |

8.4 |

10.5 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

02-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

30-Nov-23 |

14.1% |

11.4% |

11.2% |

11.9% |

11.2% |

10.6% |

|

21-Dec-23 |

13.4% |

9.9% |

10.3% |

10.1% |

9.9% |

9.6% |

|

22-Dec-23 |

13.4% |

9.9% |

10.2% |

10.2% |

9.9% |

9.6% |

|

25-Dec-23 |

13.4% |

9.9% |

10.2% |

10.2% |

9.9% |

9.6% |

|

26-Dec-23 |

13.4% |

9.9% |

10.3% |

10.3% |

10.0% |

9.6% |

|

27-Dec-23 |

13.2% |

9.8% |

10.2% |

10.0% |

9.9% |

9.5% |

|

28-Dec-23 |

13.5% |

9.8% |

10.2% |

10.0% |

9.9% |

9.6% |

|

Weekly Change |

0.2% |

(0.0%) |

(0.0%) |

(0.1%) |

(0.0%) |

(0.0%) |

|

MTM Change |

(0.6%) |

(1.6%) |

(1.0%) |

(1.8%) |

(1.3%) |

(1.1%) |

|

YTD Change |

0.6% |

(0.7%) |

(0.6%) |

(0.9%) |

(0.9%) |

(0.3%) |

Source: Central Bank of Kenya (CBK)

Weekly Highlights:

- December 2023 Inflation

The y/y inflation in December 2023 decreased marginally by 0.2% points to 6.6%, from the 6.8% recorded in November 2023. This was well in line with our projections to within a range of 6.6% to 6.8%. The headline inflation in December 2023 was majorly driven by increase in prices of commodities in the following categories, transport; housing, water, electricity, gas and other fuels, and food and non-alcoholic beverages by 11.7%, 8.3% and 7.7%, respectively. The table below shows a summary of both the year on year and month on month commodity indices performance:

|

Cytonn Report: Major Inflation Changes – 2023 |

|||

|

Broad Commodity Group |

Price change m/m (December-2023/November-2023) |

Price change y/y (December-2022/December-2023) |

Reason |

|

Food and Non-Alcoholic Beverages |

0.3% |

7.7% |

The m/m increase was mainly driven by the increase in prices of commodities such as carrots, kale-sukumawiki and goat meat by 14.5%, 6.2%, and 5.1%, respectively. However, the increase was weighed down by decrease in prices of mangoes, potatoes (Irish) and maize flour- sifted by 5.7%, 4.9%, and 3.8%, respectively. |

|

Housing, Water, Electricity, Gas and Other Fuel |

0.4% |

8.3% |

The m/m performance was mainly driven by the increase in prices of Electricity of 50kWh and 200kWh by 1.2% and 1.0% respectively. However, there was a decrease in the price of a litre of kerosene by 2.0%. |

|

Transport cost |

0.5% |

11.7% |

The m/m increase in transport Index was mainly due to an increase in prices of country bus fares despite of the decline in the prices of a litre of petrol and diesel by 2.3% and 1.0%, respectively. |

|

Overall Inflation |

0.4% |

6.6% |

The m/m decrease was mainly supported by the slower 0.3% increase in food and non-alcoholic beverages. |

Notably, the overall headline inflation remained within the Central Bank of Kenya (CBK) target range of 2.5% to 7.5% for the sixth consecutive month. The decrease in headline inflation in December 2023 comes amid the recent decline in the Petrol, Diesel and Kerosene prices which decreased by 2.3%, 1.0% and 2.0% to Kshs 213.0, Kshs 202.2 and Kshs 199.8 per litre respectively, for the period between 15th December 2023 to 14th January 2024. The chart below shows the inflation rates for the past 5 years:

Going forward, we expect inflationary pressures to ease in the short term, while remaining within the CBK’s target range of 2.5% to 7.5% aided by the easing in fuel prices and easing of domestic food prices on the account of improved supply attributed to the ongoing harvests and Government measures to zero-rate key food imports. Additionally, the upward revision of the CBR to 12.50% in the latest MPC meeting, from 10.50%, is meant to continue reducing money supply, in turn easing inflation in the short to medium term, though the impact of this might be muted given that the current inflation is cost driven and not demand driven as the money supply remain stable. We also expect the measures taken by the government to subsidize major inputs of agricultural production such as fertilizers to lower the cost of farm inputs and support the easing of inflation in the long term.

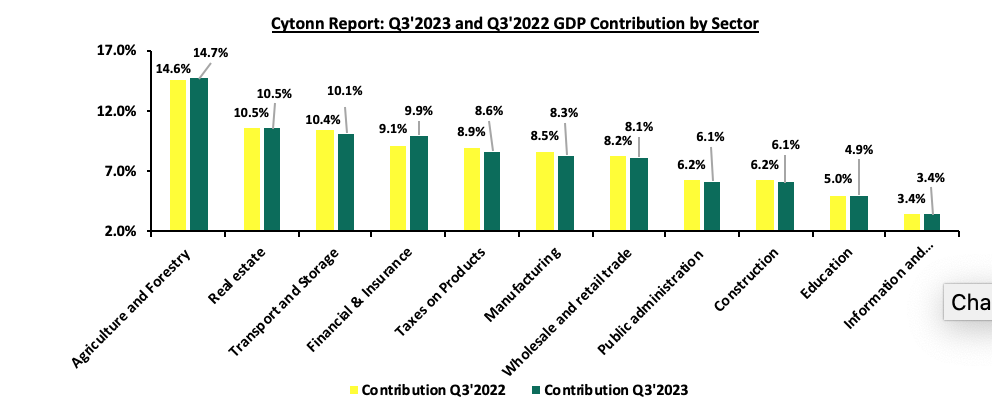

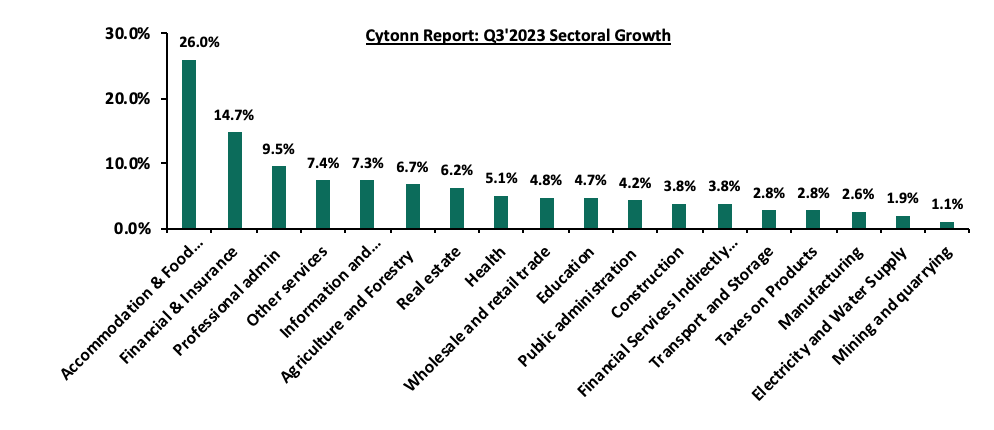

- Kenya Q3’2023 GDP Growth

During the week, the Kenya National Bureau of Statistics (KNBS) released the Q3'2023 Quarterly Gross Domestic Product Report, highlighting that the Kenyan economy recorded a 5.9% growth in Q3’2023, faster than the 4.3% growth recorded in Q3’2022. The main contributor to Kenyan GDP remains to be the Agriculture, fishing and forestry sector which grew by 6.7% in Q3’2023 compared to a contraction of 1.3% in Q3’2022. All sectors in Q3’2023 recorded positive growths, with varying magnitudes across activities. Most sectors recorded improved growth compared to Q3’2022 with Accommodation and Food Services, Agriculture, Forestry and Fishing and Mining and Quarrying Sectors recording the highest growth improvements of 9.1% points, 8.0% points, and 5.6% points, respectively. Other sectors that recorded expansion in growth rate, from what was recorded in Q3’2022 were Financial and Insurance Services, Information and Communication and Real Estate sectors, of 5.1%, 2.7% and 2.2% points respectively.

The key take-outs from the report include;

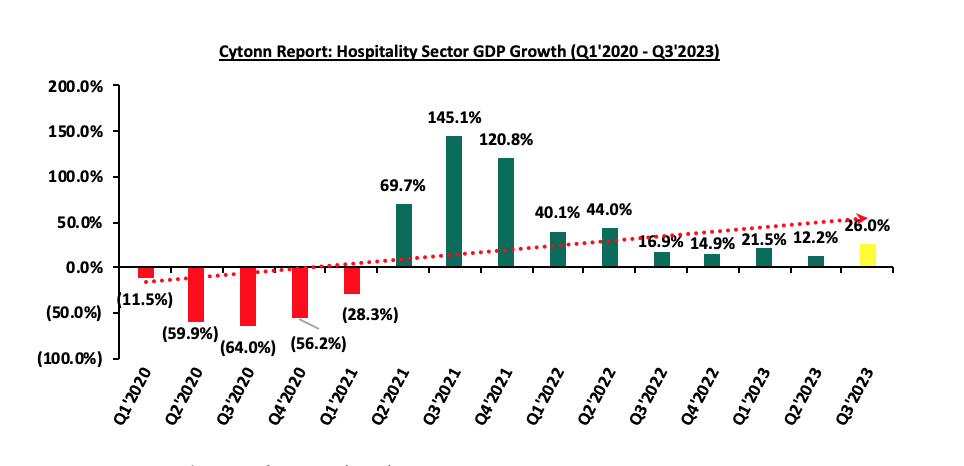

- Sectoral Contribution to Growth - The biggest gainer in terms of sectoral contribution to GDP was the Financial and Insurance sector, increasing by 0.8% points to 9.9% in Q3’2023 from 9.1% in Q3’2022, while the Transport and Storage sector was the biggest loser, declining by 0.3% points to 10.1% in Q3’2023, from 10.4% in Q3’2022. Real Estate was the second largest contributor to GDP at 10.5% in Q3’2023, remaining relatively unchanged from Q3’2022, indicating sustained growth. The Accommodation and Food Services sector recorded the highest growth rate in Q3’2023 growing by 26.0%, faster than the 16.9% growth recorded in Q3’2022.

The chart below shows the top contributors to GDP by sector in Q3’2023:

Source: KNBS Q3’2022 and Q3’2023 GDP Report

- Rebound in the Agricultural Sector– Agriculture and Forestry recorded a growth of 6.7% in Q3’2023. The performance was an increase of 8.0% points, from the contraction of 1.3% recorded in Q3’2022. The positive growth recorded during the quarter was mainly attributable to favorable weather conditions that characterized the first three quarters of 2023. Notably, during the quarter, production of key food crops and cash crops increased with a significant increase in the production of fruits, tea and vegetables during the quarter under review. However, the performance was weighed down by decline in the production of sugarcane.

- Increased growth in the Financial and Insurance Services Sector: The Financial and Insurance sector registered a significant growth of 14.7% in Q3’2023 compared to the 9.6% in Q3’2022. Additionally, the contribution to GDP increased to 9.9%, from 9.1% in Q3’2022. Some of the notable improvements include:

-

- Broad money supply (M3)-which is a collection of all the currency flowing in the economy, rose by 18.6% to Kshs 5.8 tn in Q3’2023 as compared to Kshs 4.9 tn recorded same period in 2022,

- Net foreign assets registered a remarkable growth of 142.1% to Kshs 708.0 bn in Q3’2023, from Kshs 292.5 bn in 2022, and,

- The Central Bank of Kenya (CBK) in efforts to curb the high inflation raised the Central Bank Rate (CBR) to 10.50% in Q3’2023, compared to 8.25% that was recorded same period in 2022, resulting to increased cost of credit by commercial banks, with interests on loans averaging 14.0% in Q3’2023 compared to the 12.4% recorded in Q3’2022.

- Decelerated growth in the electricity supply sector - The manufacturing sector recorded a decelerated growth of 1.9% in Q3’2023 compared to a 6.0% growth in a similar period of review in 2022.However, the sectoral contribution to GDP marginally decreasing to 2.6% in Q3’2023, from 2.7% recorded in Q3’2022.

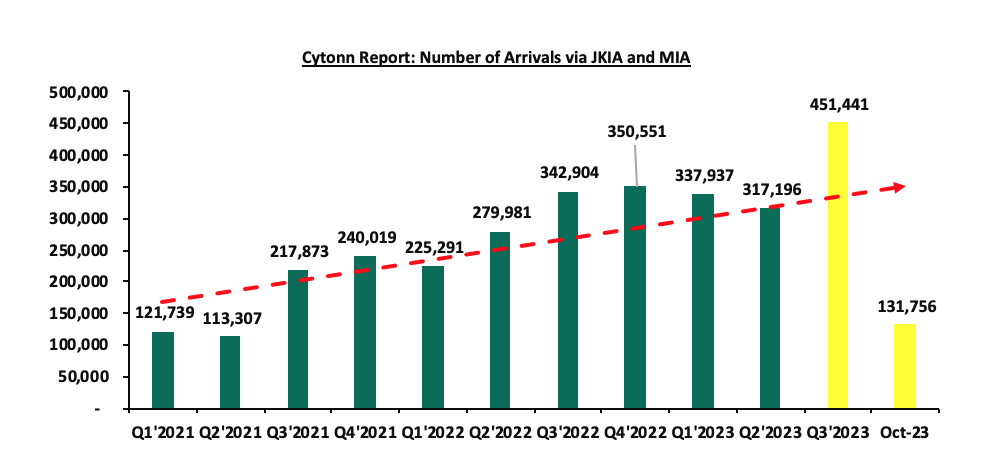

- Significant growth in the Accommodation and Food Service sector: Accommodation and Food Services sector recorded the highest growth rate among all the sectors in Q3’2023, having expanded by 26.0%, higher than the 16.9% recorded in Q3’2022. Additionally, the contribution to GDP increased by 0.2% points, to 1.2% in Q3’2023, compared to 1.0% recorded in Q3’2022.

The chart below shows the different sectoral GDP growth rates for Q3’2023:

Source: KNBS Q3’2023 GDP Report

In the near-term, we expect the economy to grow at a slower pace given the subdued general business environment in the country, mainly as a result of elevated inflationary pressures occasioned by high fuel and food prices. Additionally, the Central Bank of Kenya’s Monetary Policy Committee’s (MPC) decision on 5th December 2023 to increase the Central Bank Rate (CBR) to 12.5% from 10.5% in a bid to curb inflation and maintain price stability is expected to curtail economic growth. The higher CBR is set to maintain the cost of credit issued by lenders high, hence discouraging borrowing, which will in turn lead to reduced investment spending in the economy by both individuals and businesses. Additionally, the inflation in the country remains high, although within the Central Bank’s range, and risks going high in the short term with the persistent high fuel prices in the country, despite global fuel prices easing, mainly on the back of the depreciating shilling. Thus, the consumer purchasing power remains low, resulting in reduced demand for goods and services and consequentially slowed economic growth. However, we expect the agricultural sector to continue backing economic growth in the country, as the country continues to experience sufficient rain during the year. The sector remains Kenya’s largest contributor to GDP, as well as food prices being a major contributor to headline inflation.

- Kenya Q3’2023 BOP Growth

During the week, the Kenya National Bureau of Statistics released the Quarterly Balance of Payment Report for Q3’2023 report highlighting that Kenya’s balance of payments position deteriorated registering a deficit of Kshs 131.5 bn in Q3’2023, from a deficit of Kshs 112.7 bn recorded in Q3’2022, and a reversal from the Kshs 152.9 bn surplus recorded in Q2’2023. In this note, we provide a detailed analysis of the current account and the balance of payment before giving an outlook on both;

Balance of Payments

Kenya’s balance of payment (BoP) position deteriorated by 16.7% in Q3’2023, coming in at a deficit of Kshs 131.5 bn, from a deficit of Kshs 112.7 bn in Q3’2022, and a reversal from the Kshs 152.9 bn surplus recorded in Q2’2023. the reversal of the financial account balance to a deficit of Kshs 20.6 bn from a surplus of Kshs 175.1 bn in Q3’2022, which outweighed the 42.1% narrowing of the current account balance deficit to Kshs 122.5 bn in Q3’2023 from Kshs 211.6 bn in Q3’2022 and the 448.2% increase in capital account balance to Kshs 3.4 bn from Kshs 0.6 bn recorded in a similar period in 2022. The table below shows the breakdown of the various balance of payments components, comparing Q3’2023 and Q3’2022:

|

Cytonn Report: Current Account Balance |

||||

|

Item |

Q3'2022 |

Q2'2023 |

Q3'2023 |

Y/Y % Change |

|

Current Account Balance |

(211.6) |

(138.7) |

(122.5) |

(42.1%) |

|

Capital Account Balance |

0.6 |

4.9 |

3.4 |

448.2% |

|

Financial Account Balance |

175.1 |

321.5 |

(20.6) |

(111.8%) |

|

Net Errors and Omissions |

(76.9) |

(34.8) |

8.3 |

(110.7%) |

|

Balance of Payments |

(112.7) |

152.9 |

(131.5) |

16.7% |

All values in Kshs bns

Key take-outs from the table include;

- The current account deficit (value of goods and services imported exceeds the value of those exported) narrowed by a significant margin of 42.1% to Kshs 122.5 bn, from Kshs 211.6 bn in Q3’2022, mainly attributable to 12.6% improvement in the merchandise trade balance deficit to Kshs 326.2 bn, from Kshs 373.1 bn recorded in Q3’2022,

- The financial account balance deficit (the difference between the foreign assets purchased by domestic buyers and the domestic assets purchased by the foreign buyers) recorded a deficit of Kshs 20.6 bn in Q3’2023, a sharp decrease of 111.8% from the surplus of Kshs 175.1 bn recorded in Q3’2022. Notably, the stock of gross official reserves increased by 18.7% to Kshs 1,116.0 bn in Q3’2023 from Kshs 940.2 bn in Q3’2022, mainly attributed the increased disbursement of programme loans from the International Monetary Fund (IMF) and multilateral sources during the period of review,

- Consequently, the Balance of Payments (BoP) position deteriorated to a deficit of Kshs 131.5 bn in Q3’2023, from a deficit of Kshs 112.7 bn recorded in Q3’2022.

Current Account Balance

Kenya’s current account deficit narrowed by 42.1% to Kshs 122.5 bn in Q3’2023 from the Kshs 211.6 bn deficit recorded in Q3’2022. Similarly, the performance was an improvement from the previous quarter, with the Q3’2023 deficit narrowing by 11.7% from the deficit of Kshs 138.7 bn recorded in Q2’2023, driven by:

- The contraction of the merchandise trade (a scenario where imports are greater than exports of goods resulting to a negative net foreign investment) by 12.6% to Kshs 326.2 bn in Q3’2023, from Kshs 373.1 bn in Q3’2022,

- A 35.2% increase in the secondary income balance (the transactions recorded in the secondary income account pertain to those current transfers between residents and non-residents that directly affect the level of gross national disposable income and thus influence the economy’s ability to consume goods and services), a surplus of Kshs 251.9 bn from a surplus of Kshs 186.3 bn in Q3’2022.

The table below shows the breakdown of the various current account components, comparing Q3’2022 and Q3’2023:

|

Cytonn Report: Current Account Balance |

||||

|

Item |

Q3'2022 |

Q2'2023 |

Q3'2023 |

Y/Y % Change |

|

Merchandise Trade Balance |

(373.1) |

(343.2) |

(326.2) |

(12.6%) |

|

Services Trade Balance |

38.5 |

35.4 |

36.2 |

(5.8%) |

|

Primary Income Balance |

(63.3) |

(65.4) |

(84.5) |

33.5% |

|

Secondary Income (transfer) Balance |

186.3 |

234.5 |

251.9 |

35.2% |

|

Current Account Balance |

(211.6) |

(138.7) |

(122.5) |

(42.1%) |

All values in Kshs bns

The deterioration in the balance of payments performance is mainly due to the reversal of the financial account balance from a surplus to a deficit driven by debt servicing costs that have been on the rise given the continued depreciation of the Kenya shilling against the US dollar, given that 67.1% of Kenya's external debt as of June 2023 is denominated in USD. Consequently, the sustained depreciation of the shilling against hard currency continues to inflate the country's import bill, having depreciated by 26.8% against the USD since the year began. As such, we expect the high costs of imports, especially fuel imports, to continue weighing down on the current account's performance in the medium term. However, we expect that the current administration’s focus on fiscal consolidation will improve the balance of payments performance by minimizing the costs of servicing external debts and making adequate arrangements for the repayment of the 2014 Eurobond debt maturing in June 2024.

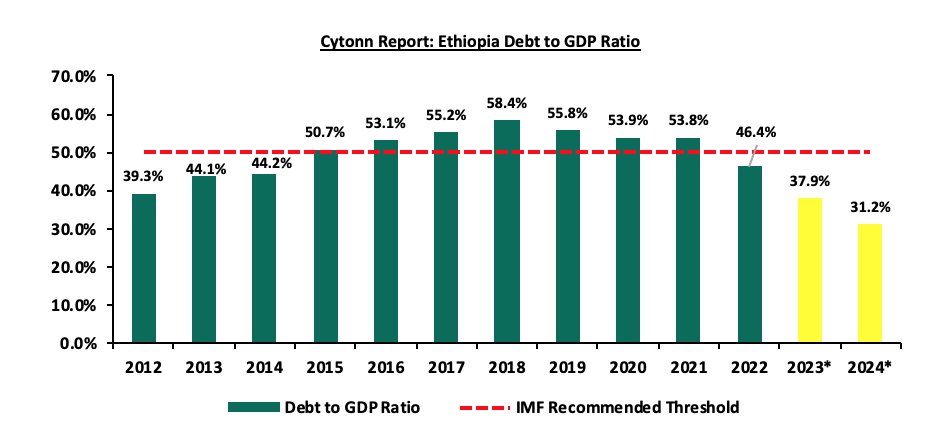

- Ethiopia Defaults on its First Installment of USD 1.0 bn Eurobond due in December 2023