Cytonn 2026 Markets Outlook

By research team, Jan 18, 2026

Executive Summary

Global Markets

According to the World Bank’s Global Economic Prospects Report, global economic growth is expected to remain subdued, slowing down to 2.6%, from the estimated 2.7% growth rate in 2025. The expected economic slowdown is driven by the weakening of trade growth driven by trade tensions and policy uncertainty from higher tariffs. Tariffs have significantly risen since January 2025 and are further expected to rise in 2026, which could further weaken exports and demand. The 2026 inflation rate is expected to ease to 2.6% as compared to the 3.2% estimate in 2025, mainly attributable to weaker labor markets, lower demand for tradable goods, and declining energy prices. However, despite the expected easing in inflation, global inflation remains at risk due to higher tariffs, which could increase the cost of imported goods and production inputs, and businesses are likely to pass these additional costs on to consumers, therefore fueling further inflationary pressures. Moreover, the growth in the Emerging Markets and Developing Economies (EMDEs) is expected to ease by 4.0% in 2026, 0.2% points decrease from the estimated growth of 4.2% in 2025;

Sub-Saharan Africa Regional Market

According to the World Bank’s Global Economic Prospects , growth in the Sub-Saharan Africa region is expected to rebound to 4.3% in 2026, from the estimated growth rate of 4.0% recorded in 2025 mainly attributable to the easing inflationary policies, ongoing reforms in some countries, improved fiscal support and domestic investment growth. However, the projections remain subject to key downward risks such as high debt levels in the region as borrowing persists due to the ever-present fiscal deficits in the region. Additionally, the increased debt servicing costs are expected to put more pressure on the region’s growth, despite most of the Sub-Saharan African currencies appreciating against the U.S. dollar since the United States’ announcement of tariffs;

Kenya Macro Economic

GDP Growth – Our outlook for 2026 is Positive on GDP Growth. We are projecting the economy to register a growth within the range of 5.2%-5.5% in 2026 supported by continued recovery of business activity, expected strong growth in the agricultural sector, and robust performance in the services sector driven by growth in information and technology as well as accommodation and food services as a result of increased tourism. The key downside to this growth shall be the persistent high debt burden, potential global economic headwinds, and domestic political uncertainties;

Inflation - Our outlook for 2026 is Neutral on Inflation. We expect the annual average inflation rate to remain within the government’s target of 2.5%-7.5% coming in at an average of 5.0% as compared to 4.1% in 2025. We expect the inflation rate to remain relatively stable in the short term, but face upward pressure in the medium to long term during 2026, driven by the lagged effects of monetary policy easing, high electricity and fuel prices and potential depreciation of the Kenyan Shilling;

Currency - Our outlook for 2026 is Neutral on Currency. We project the Kenya Shilling to trade against the US dollar within a range of Kshs 129.0 and Kshs 132.0 by the end of 2026, with a bias of 2.3% depreciation against the USD in 2026. We expect the shilling to remain largely stable, supported by record-high forex reserves of USD 12.5 billion (equivalent to 5.4 months of import cover, significantly above the policy target minimum of 4.0 months), effective CBK liquidity management through open market operations, improving diaspora remittances and enhanced export performance. The CBK's demonstrated ability to maintain exchange rate stability through strategic dollar purchases and liquidity management provides a strong foundation for currency stability in 2026;

Interest Rates Our outlook for 2026 is Positive on Interest Rates. We expect the Central Bank to maintain a balanced monetary policy stance in 2026, with potential for modest further easing in the first half of 2026 if inflation remains anchored and the shilling remains stable. Furthermore, we expect the yield curve to continue normalizing as the government adopts a more disciplined approach to domestic borrowing, increasingly rejecting highly-priced bids in Treasury bill and bond auctions, thereby forcing yields downward and reducing the government's domestic borrowing costs;

Government borrowing – Our outlook for 2026 is Negative on Government Borrowing. We expect the government to borrow aggressively from both the domestic and foreign markets to plug in the fiscal deficit, which is projected to come in at Kshs 923.2 bn, equivalent to 4.8% of the GDP. On revenue collection, we expect continued improvement in 2026 due to the raft of measures the administration has put in place to boost tax collection such implementation of the Finance Act 2025which is geared towards expanding the tax base and increasing revenues through sealing revenue leakages to meet the government’s budget for the fiscal year 2025/2026 of Kshs 4.2 tn, as well as reduce the budget deficit and borrowing;

Investor Sentiment – Our outlook for 2026 is Positive on Investor Sentiment. We expect positive investor sentiments to strengthen in 2026, driven by anchored inflation, improved currency stability, ongoing infrastructure developments, and the government's commitment to fiscal consolidation. The successful implementation of public-private partnerships and continued digital economy growth will bolster confidence. However, political developments, debt sustainability concerns, and global economic conditions remain a key risk to the investors’ confidence;

Security and political environment– Our outlook for 2026 is Negative on Security and Political Environment. We expect 2026 to be characterized by heightened political activity and tensions as the country enters the pre-election period ahead of the August 2027 general elections. Political positioning, coalition building, early campaign activities, and intensified competition among political actors are expected to create significant uncertainty and potential disruptions to the business environment;

Fixed Income

We expect interest rates to stabilize, particularly at the short end of the curve, as the yield curve continues to normalize, supported by easing inflationary pressures, improved liquidity conditions in the money markets, and the government’s rejection of highly priced bids. This is expected to enable cheaper borrowing for budgetary support, infrastructure financing, and the repayment of domestic maturities. We expect the yield curve to continue normalizing over the short to medium term as inflationary pressures moderate further and borrowing costs adjust downward. In this environment, investors should maintain a bias toward LONG-TERM FIXED INCOME INSTRUMENTS to lock in current relatively elevated interest rates.

Equities

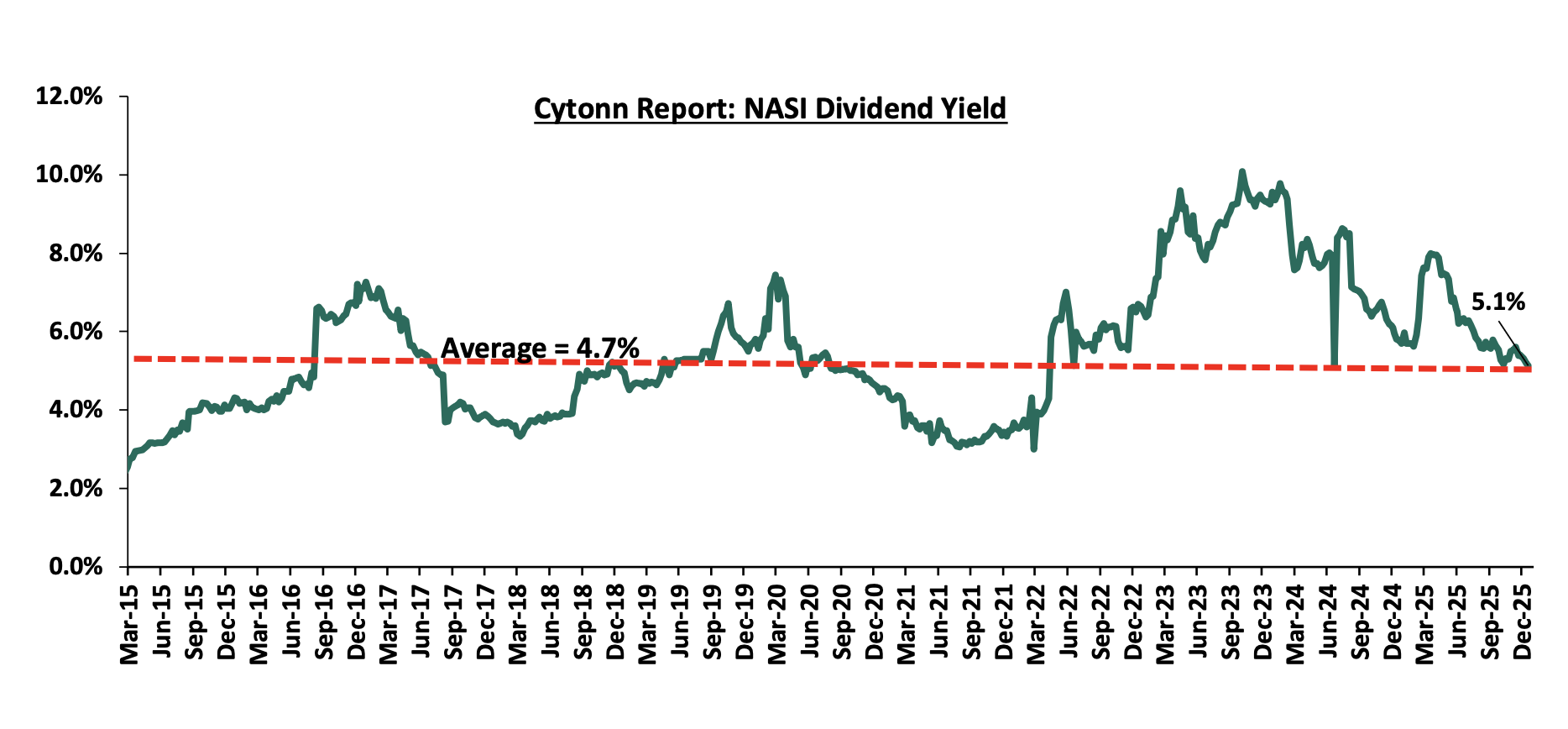

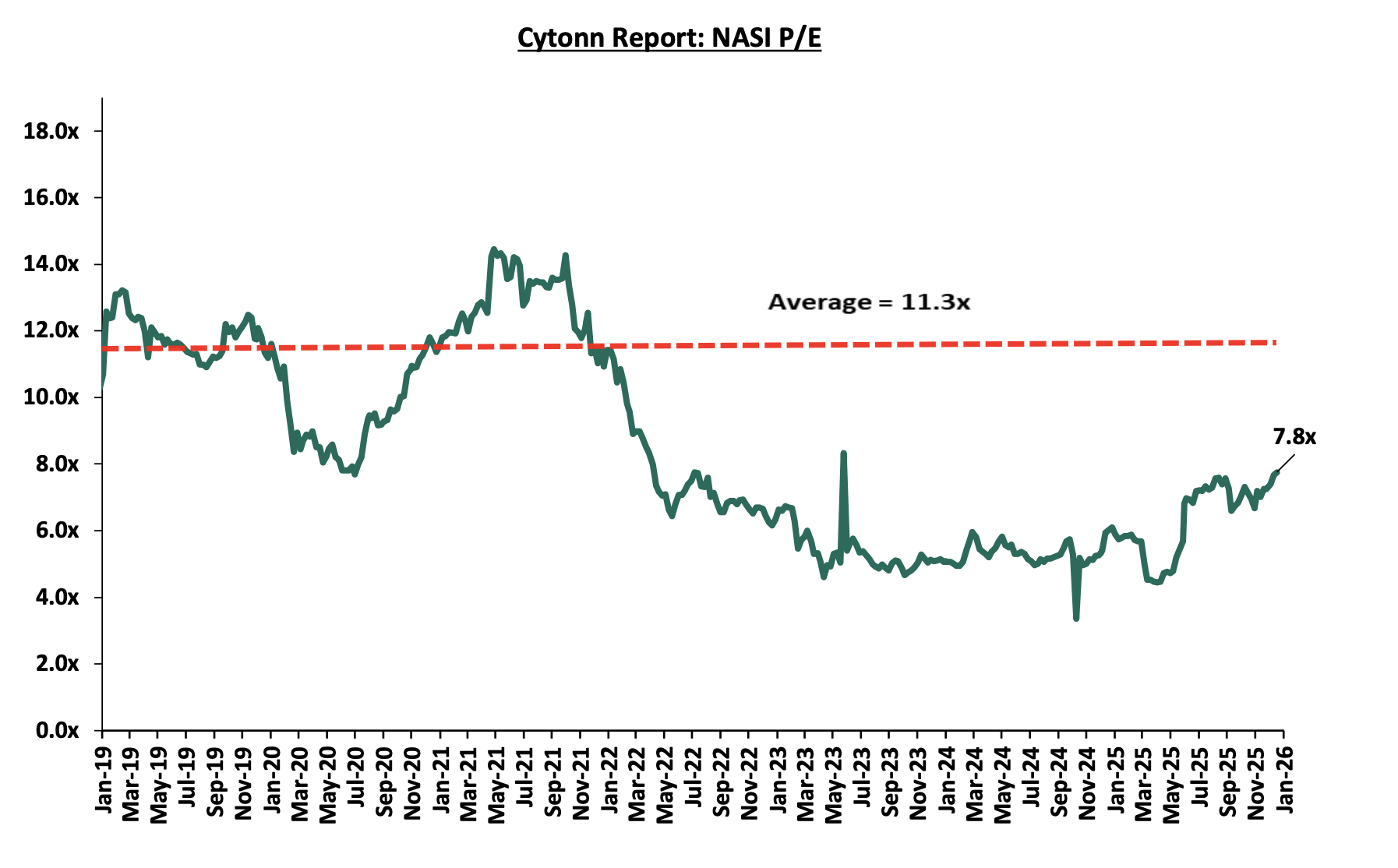

We have a BULLISH outlook on the Kenyan Equities market in the short term but “NEUTRAL” in the medium to long term. We expect a continued improvement in the listed sector’s earnings growth in 2026, largely driven by the expected 5.2%-5.5% GDP growth, decreased yields in the fixed income markets and the improvement of the country’s business environment. The business environment showed signs of improvement in the last quarter of 2025, with the Purchasing Manager’s Index (PMI) averaging at 53.7 in Q4’2025, higher than the year’s average of 51.0. Additionally, the Kenyan currency appreciated against the major select currencies, gaining 0.2% against the USD dollar in 2025 indicating a stability. Strong foreign investor inflows expected in the early weeks of the year may, further, support and accelerate the growth of the equities market in the short term

Real Estate

Residential sector: Our outlook for the residential sector in 2026 is NEUTRAL, reflecting a balance between supply and demand dynamics. On the supply side, ongoing and pipeline developments in 2026 are expected to be driven by the government’s continued rollout of the Affordable Housing Programme, targeting the delivery of 200,000 housing units annually, alongside sustained private sector participation to help bridge the housing deficit and continued infrastructure development across key urban and peri-urban areas. On the demand side, the outlook for 2026 is neutral, as high taxes, elevated construction costs and cautious lending standards are expected to constrain buyers’ purchasing power and limit uptake, even as inflation and the Central Bank Rate have eased modestly and the ongoing urbanisation. In terms of investment opportunities, detached units remain attractive in Kitengela, Ngong, and South B & C, while apartments continue to offer relatively higher returns in Kahawa West, Westlands, and Dagoretti, supported by resilient rental demand and favourable occupancy levels;

Commercial Office Sector: Our overall outlook for the Nairobi Metropolitan Area commercial office sector is POSITIVE. We expect the sector to remain stable with a slight improvement by 0.2% in rental yields recorded in FY’2026, attributable to an expected increase in overall rental rates by 0.5% in FY’2026. The improved performance may be supported by; i) the increasing presence of multinational companies in Kenya is likely to drive up occupancy levels, ii) co-working spaces are gaining in popularity in the region iii) the gradual return to “working from office” after the Covid-19 pandemic, iv) more start-ups are expected to drive demand for commercial spaces, and v) a considerable uptake of prevailing commercial office spaces. However, the sector continues to face challenges due to a significant oversupply of office space, currently standing at 5.7 mn SQFT as at FY’2025. Despite these challenges, investment opportunity lies in areas such as Westlands, Gigiri, and Kilimani, which offer rental yields of 9.3%, 8.5% and 8.2%, compared to the market average of 7.8%;

Retail Sector: We maintain a NEUTRAL outlook on the retail sector’s performance for 2026, influenced by several factors; i) continued expansion by local and international retailers, driven by evolving consumer preferences and market trends, ii) infrastructure improvements, including ongoing road and railway projects, are set to increase accessibility to key retail zones, unlocking further investment opportunities, and iii) favorable demographic trends, such as a growing urban population, will sustain demand for retail goods and services. However, growth could face challenges from: i) oversupply issues, with around 3.6 mn SQFT of retail space available in Nairobi and an additional 1.9 mn SQFT countrywide, leading to low occupancy rates and rental yields, ii) e-commerce adoption, increasingly shifting retail demand online, pushing brick-and-mortar outlets to adapt, and iii) limited financing options for retail developments, along with high costs, are likely to hinder investment, especially for small and medium-sized enterprises (SMEs) that need to adopt technology to stay competitive;

Hospitality Sector: We maintain a POSITIVE outlook for the hospitality sector, supported by several key drivers: i) aggressive marketing campaigns promoting Kenya’s tourism, expected to boost tourist arrivals and improve occupancy rates at hospitality venues, ii) continued international recognition of Kenya’s tourism industry, enhancing its status as a leading tourist destination and drawing more global visitors, iii) strategic partnerships within the tourism sector, fostering innovation and collaboration to capitalize on new opportunities, iv) events and initiatives aimed at increasing tourism activity and improving guest experiences. However, while the sector demonstrated resilience in its overall performance in 2025, the outlook remains cautiously optimistic due to i) Kenya continues to face significant competition from neighboring markets, such as Rwanda, which employs aggressive promotional strategies, alongside Zanzibar, Tanzania, and South Africa, these regions actively position themselves as attractive alternatives, challenging Kenya's market share in the region, ii) difficulty in accessing finance as lenders demand more collateral to cushion themselves owing to elevated credit risk, and iii) occasional release of cautionary statements by governments like Australia to their citizens advising them against travelling to Kenya due to threats like terrorism and elevated crime rates;

Land Sector: We maintain a POSITIVE outlook for the land sector in the Nairobi Metropolitan Area (NMA), We expect the performance to be further boosted by factors driving demand for development land such as; i) Increased infrastructure developments which has improved and opened up areas for investment, ii) Roll out of numerous affordable housing projects by both the public and private sectors, iii) Affordability of land in the satellite towns, iv) Limited supply of land especially in urban areas which has contributed to exorbitant prices, and, v) Positive demographics driving demand for land upwards, facilitated by high population growth and urbanization rates of 2.0% p.a and 3.7% p.a, respectively against the global averages 1.0% p.a and 1.7% p.a, respectively;

Infrastructure Sector: We maintain a POSITIVE outlook in the infrastructural sector. We anticipate the government will continue with its aggressive efforts to; i) construct and rehabilitate roads, bridges, railways, airports, and affordable housing units, among others, ii) increase its diplomacy and partnerships in development among neighbouring nations, and, iii) step up on the competition for attracting regional and international investors against other countries in Eastern Africa like Tanzania through railway connections and ports infrastructure. However, the sector may face challenges such as fiscal constraints, execution delays, land disputes, cost overruns, and climate risks. Although the government acknowledges the importance of Public-Private Partnerships (PPPs) in tackling financing challenges, we believe that prioritizing PPPs is fundamental in addressing funding shortfalls. By leveraging the resources and expertise of the private sector, PPPs can support sustainable infrastructure development and stimulate economic growth;

Industrial Sector: We maintain a NEUTRAL outlook on the industrial sector’s performance. We expect slight growth in the sector as investors continue to respond to the growing demand for industrial spaces both in Nairobi and around the country. Data centres, cold rooms, growth in e-commerce, and rising demand for fast-moving consumer goods will continue to foster growth in the industrial sector. In 2026, we expect a slight increase in development activities in the industrial sector through government support in line with its Bottom Up Economic Transformation Agenda (BETA) which aims to tap into the manufacturing sector to create wealth, employment and reduce poverty levels among Kenyan citizens. However, optimal performance in this sector may be weighed down by factors like high development costs for industrial facilities, low technological adoption and inadequate infrastructure to support operation of these facilities. Going forward, we expect the sector to continue on an upward trajectory driven by: i) the rising demand for data centers in the country, ii) an increasing demand for cold rooms, especially in the Nairobi Metropolitan Area, iii) demand for quality warehouses due to the growing e-commerce business in the country, iv) support from the government, as evidenced by the establishment of Special Economic Zones (SEZ) and Export Processing Zones (EPZ), v) increased development activities by industry players such as ALP Africa Logistics & Devki steel mills, vi) Kenya’s continued recognition as a regional hub, hence attracting international investors, and, vii) efforts by the government to support agricultural and horticultural products in the international market Viii) continued improvement in infrastructure through projects such as the Standard Gauge Railway (SGR), the Eastern and Northern Bypasses connecting Jomo Kenyatta International Airport (JKIA) and other regions in the Nairobi Metropolitan Area, among other key infrastructural improvements which we expect will increase the output of Special Economic Zones and Inland Container Depots (ICDs);

Real Estate Investment Trusts : We maintain NEUTRAL outlook for the REITs sector and we expect Kenya’s Real Estate sector to remain on a growth trend, supported by: i) demand for housing sustained by positive demographics, such as urbanization and population growth rates of 3.7% p.a and 2.0% p.a, respectively, against the global average of 1.7% p.a and 1.0% p.a, respectively, as at 2024, ii) activities by the government under the Affordable Housing Program (AHP) iii) heightened activities by private players in the residential sector. However, challenges such as rising construction costs, strain on infrastructure development (including drainage systems), high capital requirements for REITs, and existing oversupply in select Real Estate sectors will continue to hinder the sector’s optimal performance by limiting developments and investments;

Investment Updates:

- Weekly Rates: Cytonn Money Market Fund closed the week at a yield of 11.6% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Tuesday, from 7:00 pm to 8:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

- Global Economic Growth:

According to the World Bank’s Global Economic Prospects Report, global economic growth is expected to remain subdued, slowing down to 2.6%, from the estimated 2.7% growth rate in 2025. The expected economic slowdown is driven by the weakening of trade growth driven by trade tensions and policy uncertainty from higher tariffs. Tariffs have significantly risen since January 2025 and are further expected to rise in 2026, which could further weaken exports and demand. The 2026 inflation rate is expected to ease to 2.6% as compared to the 3.2% estimate in 2025, mainly attributable to weaker labor markets, lower demand for tradable goods, and declining energy prices However, despite the expected easing in inflation, global inflation remains at risk due to higher tariffs, which could increase the cost of imported goods and production inputs, and businesses are likely to pass these additional costs on to consumers, therefore fueling further inflationary pressures. Moreover, the growth in the Emerging Markets and Developing Economies (EMDEs) is expected to ease by 4.0% in 2026, 0.2% points decrease from the estimated growth of 4.2% in 2025;

Growth in 2026 shall be shaped by the following four key themes:

- Global Trade

The World Bank projects the global trade growth to slow down to 2.2% in 2026 from the 3.4% growth rate in 2025 as the effects of higher tariffs are fully realized over the course of the year. In March 2025, the U.S. implemented country‑ and sector‑specific tariffs, which led major economies such as Canada, China, and the European Union to respond with retaliatory measures. This triggered a global rise in tariffs and heightened uncertainty around trade policies. The full impact of these higher tariffs will emerge gradually, since they initially excluded goods already in transit to the United States. Additionally, the tariff levels introduced in late 2025 are expected to remain in place throughout the year. However, nations with more diversified export markets are projected to see relatively stronger trade growth. In our view, global trade growth will remain constrained in the near term as the temporary boost from stockpiling and front‑loading fades, while the full impact of higher tariffs and weaker demand in major economies increasingly weighs on global goods and services trade.

- Easing Inflation and Monetary Policies

Inflation is expected to ease in 2026 to 2.6% from the estimated 3.2% in 2025, with global inflation moving closer to the targets set by central banks in most economies. In line with inflation-targeting strategies, central banks are expected to continue easing monetary policies in 2026, reducing interest rates to stimulate economic activity as inflationary pressures subside. Since 2024, major central banks in advanced economies have cut their policy rates, moving their policy stance towards neutral. Notably, as of December 2025, advanced economies, including the Euro Area, the UK, and the US cumulatively cut their rates by 1.0%, 1.0%, and 0.75%, respectively, compared to the same period in 2024. The change in global monetary conditions is easing the pressure on emerging market economies, with their currencies strengthening against the US dollar and financial conditions improving. This will help reduce imported inflation pressures, allowing these countries to pursue more easily their own disinflation path.

In their latest meeting on 10th December 2025, the USA Federal Reserve cut their policy rates by 25.0 bps to a range of 3.50%-3.75% from a range of 3.75%-4.00%, marking the third consecutive cut. The Fed’s decision to lower rates was driven by the need to support stable economic activity amid modest wage pressures, rising costs, and growing financial strains on households, while anticipating tariff‑related cost increases in 2026. As of December 2025, the y/y inflation rate stood at 2.7%, unchanged from November 2025. The Fed noted that inflation remains somewhat elevated above the target of 2.0%, and stable economic activity. Additionally, in their most recent sittings, other major economies such as the UK also cut their monetary policy rates by 0.25 bps to 3.75% from 4.00%. On the other hand, in their most recent sittings, Canada, China, Malaysia, Australia and the Euro Area also kept their monetary policy rates unchanged. While lowering rates could stimulate domestic growth and ease financial conditions, they must balance this with the risk of inflationary pressures, currency devaluation, and capital outflows. In our view, upcoming rate cuts are expected to be measured and cautious, given that policy rates have already been declining since 2024. Central banks are therefore likely to ease gradually to support economic activity while avoiding a resurgence of inflationary pressures.

The table below highlights the policy stance adopted by the Central Banks of major economies

|

Cytonn Report: Monetary Policy Stance Adopted by Central Banks in Select Economies |

|||||||

|

No |

Country |

Central Bank |

Last meeting date |

Previous Rate |

Current Rate |

Margin |

|

|

1 |

Canada |

Bank of Canada |

10-Dec-25 |

2.25% |

2.25% |

Unchanged |

|

|

2 |

USA |

Federal Reserve |

10-Dec-25 |

3.75%-4.00% |

3.50%-3.75% |

(0.25%) |

|

|

3 |

Euro Area |

European Central Bank |

18-Dec-25 |

2.15% |

2.15% |

Unchanged |

|

|

4 |

China |

Bank of China |

22-Dec-25 |

3.00% |

3.00% |

Unchanged |

|

|

5 |

England |

Bank of England |

17-Dec-25 |

4.00% |

3.75% |

(0.25%) |

|

|

6 |

Malaysia |

Bank Negara Malaysia |

06-Nov-25 |

2.75% |

2.75% |

Unchanged |

|

|

7 |

Australia |

Reserve Bank of Australia |

09-Dec-25 |

3.60% |

3.60% |

Unchanged |

|

Data Source: Cytonn Research

- Easing Commodity Prices

In 2025, most of the commodity prices were on an upward trajectory. However, the energy prices pulled down the aggregate index. The commodity prices are projected to ease in 2026. According to the World Bank’s Commodity Markets Outlookreport, commodity prices are expected to decrease by 7.0% percent in 2026, after softening 6.5% in 2025. This would lead aggregate commodity prices to their lowest levels since 2020. The projected declines are led by an oversupply in the global oil market, a subdued economic growth and a stable outlook for agricultural and metal commodities. The table below shows select commodity price indices:

|

Cytonn Report: Average Commodity Prices (USD) |

||||||

|

Commodity Index |

2024 |

2025 |

Average y/y change |

Jun-25 |

Dec-25 |

Half-year Change |

|

Precious metals |

180.2 |

258.6 |

43.5% |

243.0 |

317.9 |

30.8% |

|

Agriculture |

115.0 |

115.4 |

0.3% |

116.6 |

111.4 |

(4.5%) |

|

Metals & Minerals |

106.7 |

112.2 |

5.2% |

106.5 |

121.8 |

14.4% |

|

Non-energy commodities |

112.5 |

115.2 |

2.4% |

114.0 |

115.6 |

1.4% |

|

Energy prices |

101.5 |

90.0 |

(11.3%) |

88.0 |

83.7 |

(4.9%) |

|

Fertilizers |

117.6 |

138.7 |

17.9% |

135.1 |

137.6 |

1.9% |

|

Aggregate index |

105.1 |

98.3 |

(6.5%) |

96.6 |

94.3 |

(2.4%) |

Data Source: World Bank

Oil prices have been under downward pressure declining by 11.3% in 2025, higher than the 5.1% decrease which was recorded in 2024, due to weak demand growth in China, the continued rapid adoption of electric and hybrid vehicles, and a further increase in global oil supply. As a result, excess supply in the global oil market expanded significantly in 2025. Oil prices are expected to decline further in 2026 but remain above the pre-pandemic levels as rising non-OPEC+ production, particularly from U.S. shale, alongside the potential for higher-than-expected OPEC+ output, is likely to result in a significantly oversupplied global oil market. In 2026, fertilizer prices are projected to decline by 2.7%, from the 17.9% increase recorded in 2025. This decline is attributed to elevated input costs, ongoing export restrictions, and sanctions, including China’s limits on nitrogen and phosphate fertilizer exports and continued EU sanctions and tariffs affecting major suppliers such as Belarus and Russia. Similarly, food prices, which represent the largest component of the World Bank Agriculture Commodity Index, are expected to fall by 2.3% in 2026. This decline is driven by improved supply conditions for key crops, including expanded soybean acreage in Brazil and better coffee and cocoa production, while U.S. soybean exports are redirected at lower costs. These trends are likely to reduce agricultural input costs, easing inflationary pressures in food-dependent economies. However, risks such as unpredictable weather patterns or trade restrictions could still impact price stability and agricultural output.

- Public Debt

High debt levels especially in Emerging Markets and developing economies (EMDEs) are expected to persist in 2026 mainly on the back of declining aid from advanced economies, limited progress on debt restructuring and surging debt service costs due to declining global trade and currency depreciation in most economies, coupled with tighter financial conditions undermining economic growth. According to the Global Debt Monitor by (IMF), the global debt (public and non-financial private debt stocks) came in at 235.5% of the GDP, (USD 251.0 tn) in 2024, translating to 0.1% points decline from 235.6% of the GDP (USD 250.0 tn) recorded in 2023. Conversely, public debt stock as a percentage of GDP increased by 1.0% points to 92.8% in 2024 from 91.8% in 2023. However, given the perceived interest cuts in 2025, especially in developed economies such as the US, global debt levels may experience mixed impacts. While reduced borrowing costs could ease the debt servicing burden for some nations, the elevated refinancing costs for long-term debt and the persistent structural challenges, including fiscal deficits and weak revenue collection, are likely to counteract these benefits. Additionally, geopolitical risks and inflationary pressures, although moderating, remain key concerns that could strain fiscal positions, particularly in EMDEs. In our view, global debt is projected to remain elevated, with governments and corporations facing continued pressure to manage their liabilities amidst a challenging economic and financial landscape.

Below is a summary of the regional growth rates by country as per the World Bank:

</thead.

|

Cytonn Report: World GDP Growth Rates |

||||||

|

Region |

2022 |

2023 |

2024 |

2025e |

2026f |

|

|

1. |

India |

7.6% |

9.2% |

6.5% |

7.2% |

6.5% |

|

2. |

Kenya |

4.9% |

5.7% |

4.7% |

4.9% |

4.9% |

|

3. |

China |

3.1% |

5.4% |

5.0% |

4.9% |

4.4% |

|

4. |

Sub-Saharan Africa |

3.9% |

3.0% |

3.7% |

4.0% |

4.3% |

|

5. |

Middle-East, North Africa |

5.4% |

2.1% |

2.6% |

3.1% |

3.6% |

|

6. |

United States |

2.5% |

2.9% |

2.8% |

2.1% |

2.2% |

|

7. |

Brazil |

3.0% |

3.2% |

3.4% |

2.3% |

2.0% |

|

8. |

South Africa |

2.1% |

0.7% |

0.6% |

1.3% |

1.4% |

|

9. |

Euro Area |

3.5% |

0.5% |

0.9% |

1.4% |

0.9% |

|

10. |

Japan |

0.9% |

0.7% |

(0.2%) |

1.3% |

0.8% |

|

|

Global Growth Rate |

3.3% |

2.8% |

2.8% |

2.7% |

2.6% |

Data Source: World Bank

According to the World Bank’s Global Economic Prospects , growth in the Sub-Saharan Africa region is expected to rebound to 4.3% in 2026, from the estimated growth rate of 4.0% recorded in 2025 mainly attributable to the easing inflationary policies, ongoing reforms in some countries, improved fiscal support and domestic investment growth.

However, the projections remain subject to key downward risks such as:

- If trade barriers and related uncertainty increase further, adverse shifts in trade policy may slow global growth, reduce demand for commodities like minerals and metals, and particularly affect countries heavily reliant on exports to the U.S., such as Côte d’Ivoire, Kenya, Lesotho, Madagascar, Mauritius, and South Africa

- Persistent global inflationary pressures, which may lead to the deterioration of financial conditions in the region and high cost of living due to the high prices necessitating aggressive policy rate hikes in the region,

- The high debt levels in the region as borrowing persists in the region due to the ever-present fiscal deficits and high debt-servicing costs in the region, especially due to reduced donor support, high long-term interest rates and limited fiscal headroom, and,

- Further rise in global or regional instability, such as the possible escalation of the conflict in Sudan and DRC, which could heighten humanitarian emergencies and growing food insecurity, potentially affecting other nations.

In Nigeria, the region's largest economy, growth is projected to accelerate to 4.4% in 2026 from an estimated 4.2% in 2025. This improvement is attributed to increased non-oil sector activity, particularly in agriculture and services, supported by reforms to address structural economic challenges. Additionally, growth in South Africa is expected to increase slightly to 1.4% in 2026, from the estimated growth of 1.3% in 2025. The growth in South Africa is attributable to growth in private consumption and investment driven by ongoing reforms in the business environment and the public sector. However, growth in the region is expected to be hampered by the high debt levels, rising trade barriers and uncertainty, slow reform implementation, persistent or worsening conflicts, intensified weather shocks, declining development assistance, weaker global growth, falling commodity prices, as well as the increased cases of corruption in the region as indicated by the Corruption Perceptions Index. Growth in the Eastern African region is expected to remain subdued due to the witnessed political clashes in Sudan, South Sudan and the Democratic Republic of Congo, coupled with persistent unfavourable weather conditions which continue to stifle agricultural production.

The table below highlights the real GDP forecasts of select Sub - Saharan Africa countries;

|

Cytonn Report: Real GDP Forecasts of Select Sub-Saharan Africa countries |

||

|

Country |

2025e |

2026f |

|

Rwanda |

7.0% |

7.2% |

|

Ethiopia |

7.2% |

7.1% |

|

Uganda |

6.3% |

6.4% |

|

Tanzania |

6.0% |

6.2% |

|

Kenya |

4.9% |

4.9% |

|

Ghana |

4.3% |

4.6% |

|

Nigeria |

4.2% |

4.4% |

|

Senegal |

6.4% |

4.1% |

|

Mauritius |

3.0% |

3.4% |

|

Angola |

2.3% |

2.6% |

|

South Africa |

1.3% |

1.4% |

|

Sub-Saharan Africa Growth Rate |

4.0% |

4.3% |

Data Source: World Bank

- Economic Growth:

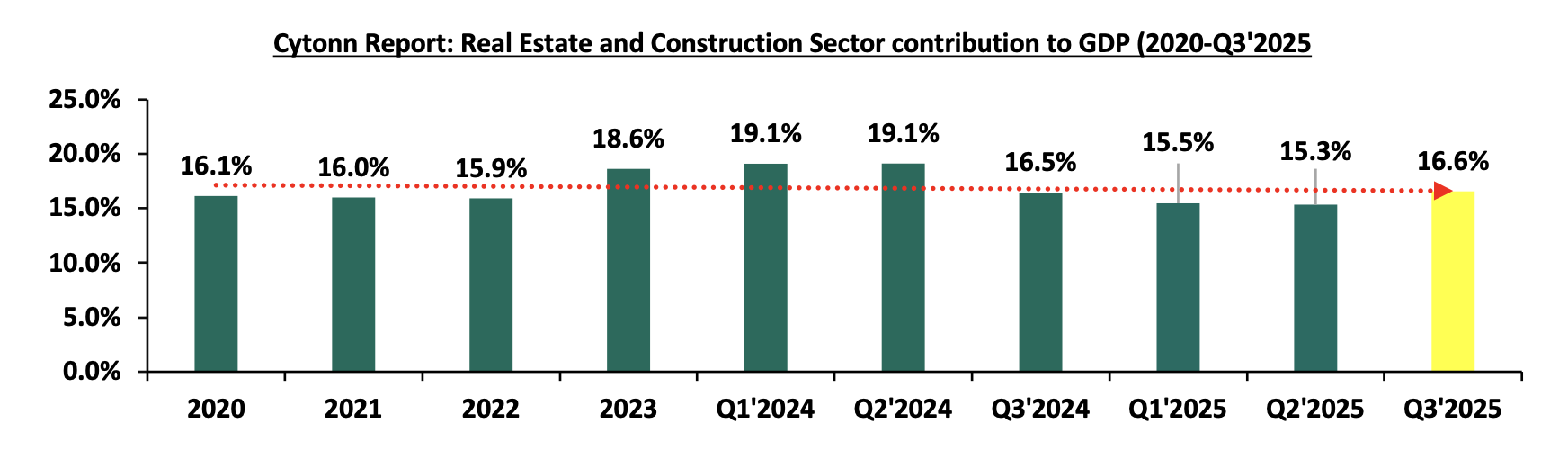

According to the Kenya National Bureau of Statistics (KNBS) Q3’2025 Gross Domestic Product Report, the Kenyan economy recorded a 4.9% growth in Q3’2025, higher than the 4.2% growth recorded in Q3’2024. The improved performance was largely driven by accelerated growth in key sectors, with Mining and Quarrying rebounding to 16.6% in Q3’2025 from a 12.2% contraction in Q3’2024, Construction expanding by 6.7% in Q3’2025 from a 2.6% contraction in Q3’2024, and Electricity and Water Supply growing by 3.6% in Q3’2025 from 0.9% in Q3’2024. Consequently, the economy recorded an average growth of 4.9% in the first three quarters of 2025, an improvement from the 4.5% average growth recorded in a similar period in 2024. The average GDP growth rate for 2024 is expected to come in at an average of 5.0%, an improvement from the 4.7% expansion witnessed in 2024.

In 2026, we expect the economy to continue its recovery trajectory with the projected GDP growth to come in at a range of 5.2% - 5.5%.

The key factors that shall support growth include:

- Continued growth in Services and Agricultural sectors: The steady performance in the agricultural sector witnessed in 2025 is expected to continue into 2026 following continued support by the government through fertilizer subsidy program. In the FY’2025/2026 budget, the government allocated Kshs 8.0 bn for the fertilizer subsidy program aimed at lowering the cost of farm inputs and enhancing food supply in the country, despite a reduction from Kshs 10.0 bn in FY’2024/2025. Additionally, the favorable weather conditions and sufficient rainfall experienced in the country is set to continue supporting the sector. The service sector is expected to register robust performance driven by growth in information and technology as internet connectivity increases, as well as accommodation and food services as a result of increased tourism,

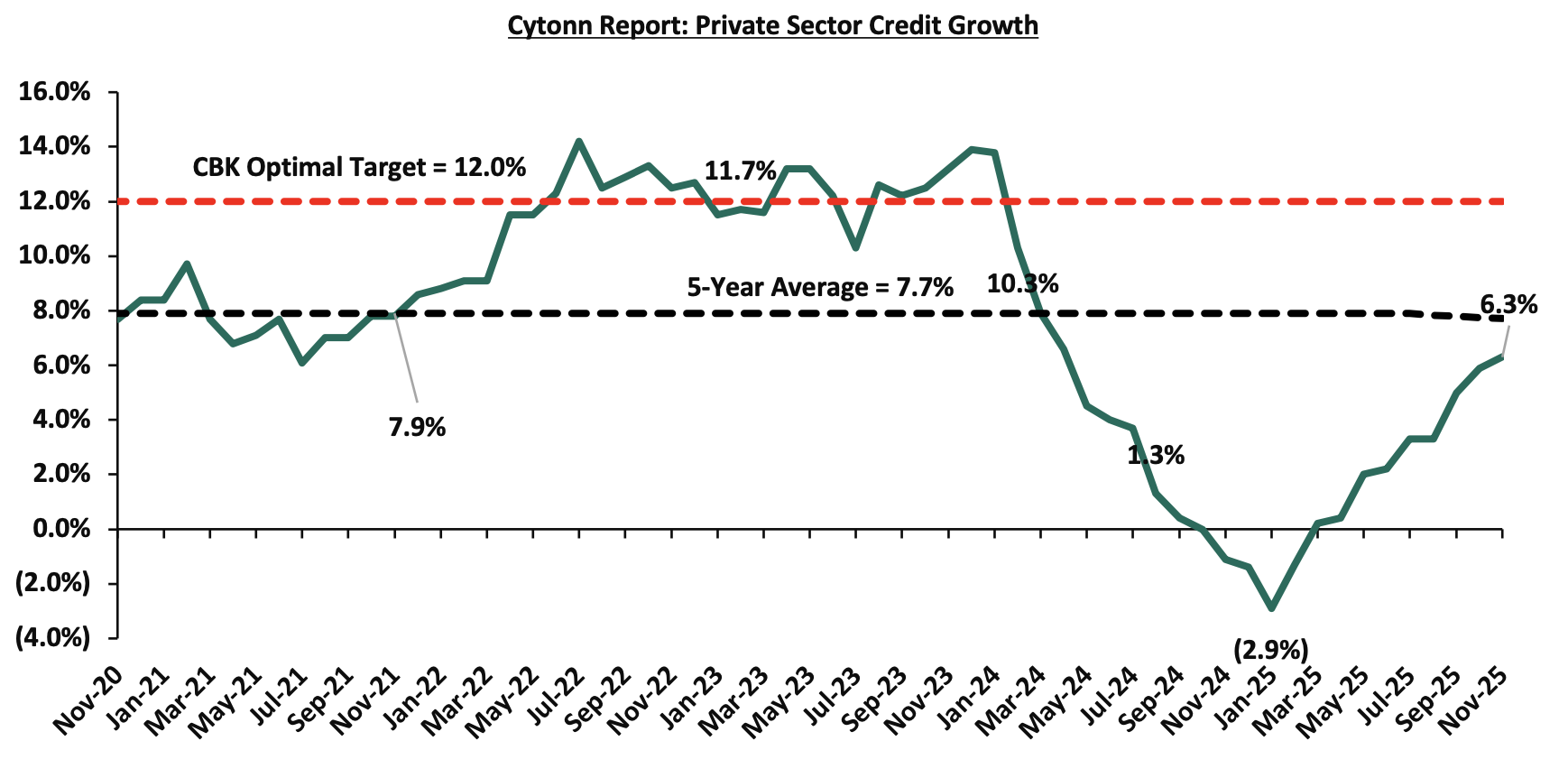

- Eased monetary policy – In 2025, the Monetary Policy Committee (MPC) lowered the Central Bank Rate (CBR) by a total of 175.0 bps from 10.75% in February to 9.00% in December in a bid to support the economy, noting that its previous measures had successfully reduced overall inflation to below the mid-point of the target range of 2.5% - 7.5%, stabilized the exchange rate, and anchored inflationary pressures. We expect the MPC to continue lowering the rates gradually in the short to medium term therefore lowering borrowing costs, leading to increased spending and an uptick in the business environment. Further, this is expected to support private sector credit growth, which, despite recent improvements, has remained in single digits, at 6.3% in November 2025, after recording negative growth rates from November 2024 to February 2025. The low CBR is also expected to support overall economic growth, and,

- Gradual increase in access to credit: During the first 11 months of 2025, private sector credit growth rate averaged 2.2%, significantly lower than the 4.7% average growth rate recorded over the same period in 2024. This decline occurred despite the CBK's aggressive monetary easing, with the CBR cut to 9.0% from 13.0% through nine consecutive reductions since August 2024. The weak credit growth reflects the lagged transmission of monetary policy to actual lending rates, with commercial banks slow to reduce their lending rates in line with CBR cuts, as well as lingering caution from the higher interest rate environment that prevailed through much of 2024. Despite this decline, we anticipate an expansion of credit to the private sector driven by, the expansionary monetary policy stance by the Central Bank of Kenya, policy initiatives such as the MSMEs Credit Guarantee Scheme and the ongoing economic revival. Additionally, we expect the renewed focus on Public-private Partnerships (PPP) to finance commercially viable projects to spur growth in the private sector. Furthermore, with the expected reduction in credit risk and a decline in yields in the short-term government papers, we expect the banking sector to increase its lending to the private sector in search of better yields following the adoption of risk-based lending. The chart below shows 5-year private sector credit growth:

Source: CBK

However, key risks threaten economic growth including:

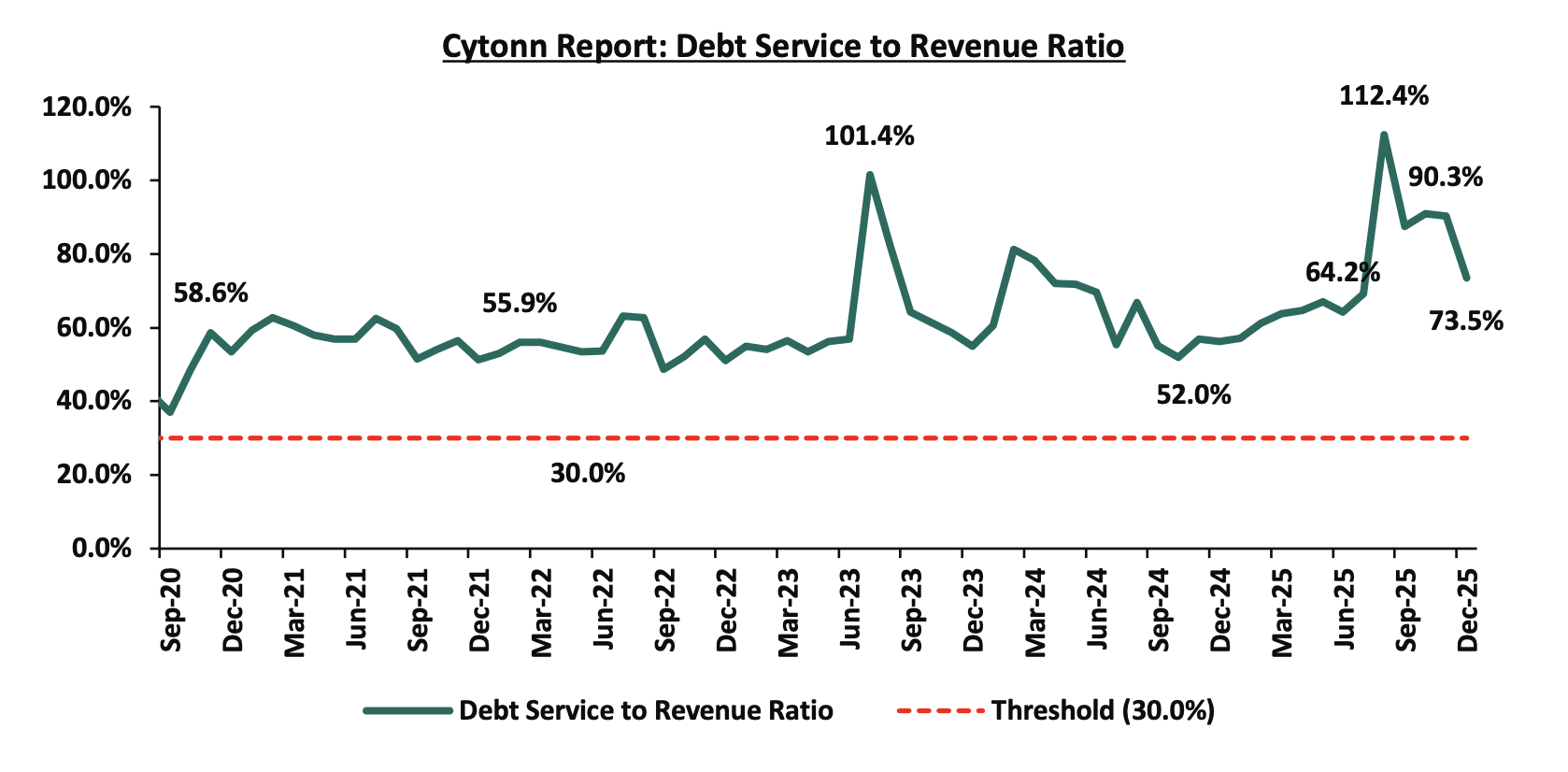

- High Risk of Debt Distress: According to International Monetary Fund and the World Bank, Kenya is currently at risk of high debt distress with the country’s debt to GDP ratio coming in at 67.7% as at June 2025, 17.7% points above the recommended IMF threshold of 50.0% for developing countries. Additionally, Kenya’s debt stood at Kshs 12.3 tn as of November 2025, 12.8% higher than the Kshs 10.9 tn debt recorded over a similar period in 2024. Consequently, the government will face significant pressure to service the existing debt with the debt service to revenue ratio standing at 75.3% as of December 2025, 45.3% points above the 30.0% threshold recommended by the IMF. Economic growth potential diminishes when debt levels are high because a significant part of the revenue is allocated towards servicing the existing debt, leaving less for developmental spending, and,

- Rising Inflationary Pressures – The country’s inflation rate averaged 4.1% in 2025, remaining within and falling below the mid-point of the CBK’s target range of 2.5%-7.5%. Despite the improvement recorded in 2025, we expect the inflation rate to remain relatively stable in the short term, but face upward pressure in the medium to long term during 2026, weighing down the business environment.

- Currency:

The Kenya Shilling appreciated by 0.2% against the US Dollar to close at Kshs 129.0 in 2025, compared to Kshs 129.3 at the end of 2024 a significant moderation from the 17.4% appreciation recorded in 2024. This stability has been achieved despite significant global shocks including US trade tariffs and Middle East conflicts, underscoring the strength of Kenya's foreign exchange management framework.

Going forward, we expect the shilling to trade against the US dollar within a range of Kshs 129.0 and Kshs 132.0 by the end of 2026.

The Kenyan shilling will be supported by:

- Improving diaspora remittances standing at a cumulative USD 5,036.7 mn in the 12 months to December 2025, 1.9% higher than the USD 4,945.2 mn recorded over the same period in 2024. In the December 2025 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 53.3% in the period. In 2026, diaspora remittances are set to improve further, mainly driven by the recovery of the global economy, increasing Kenyan population in the diaspora, and advancing technology that has facilitated easier transfer of money,

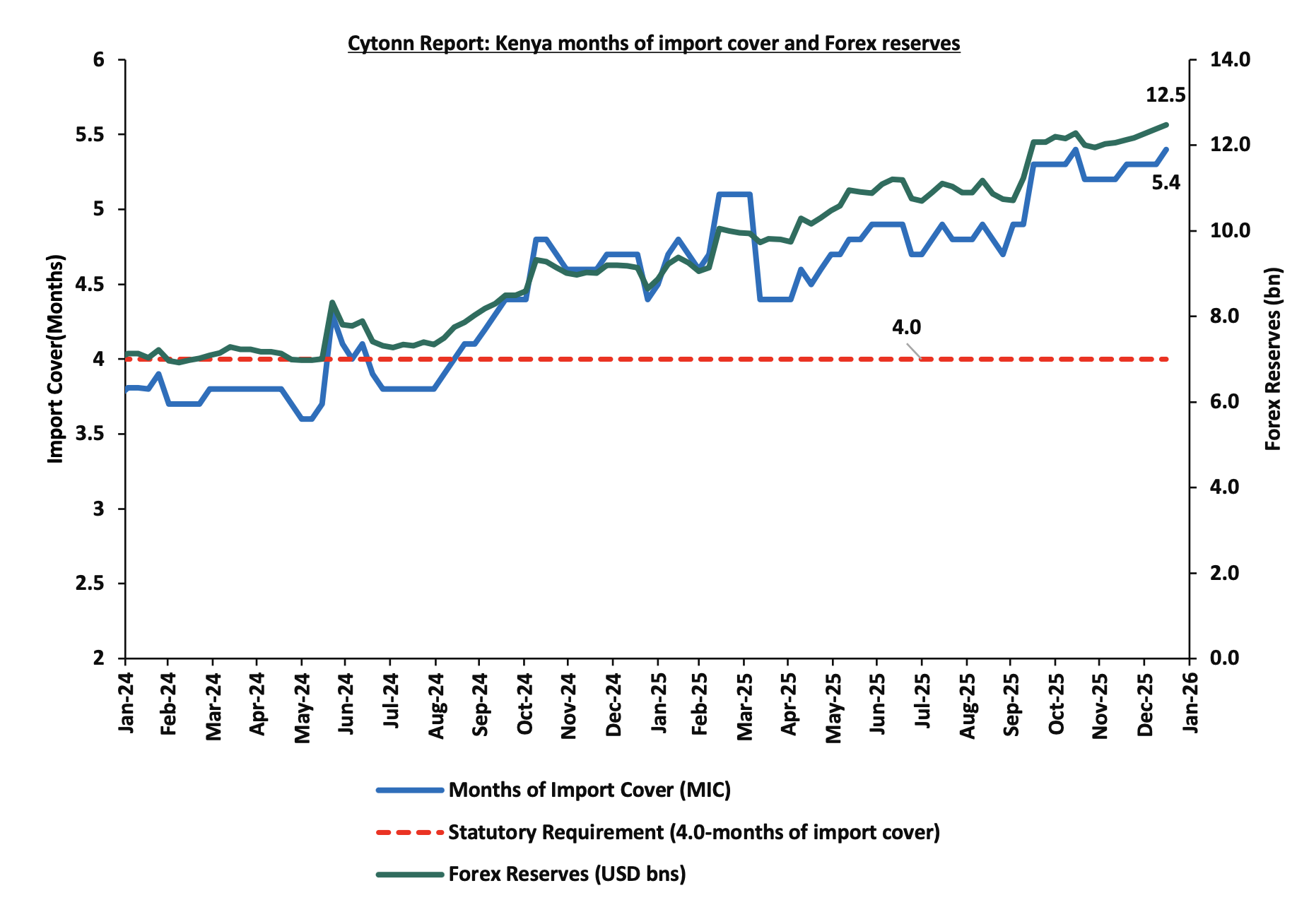

- Improving forex reserves currently at USD 12.5 bn (equivalent to 5.4-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and the EAC region’s convergence criteria of 4.5-months of import cover. Forex reserves improved by a significant 32.3% to USD 12.5 bn (equivalent to 5.4 months of import cover) in January 2026, from USD 9.2 bn (equivalent to 4.0 months of import cover) in a similar period in 2024. The rise is largely attributed to the Eurobond buyback program of the USD 900.0 mn tranche maturing in 2027 in February 2025, which alleviated the country’s credit risk and increased dollar supply in the market. This was further supported by reduced debt service obligations, aided by the stability of the Kenyan shilling, and,

- The Central Bank has demonstrated exceptional capability in managing liquidity conditions to support exchange rate stability. In 2025, the CBK mopped up a cumulative Kshs 9.2 tn in liquidity from the banking sector through repurchase agreements (repos) and term auction deposits (TADs). This strategic liquidity management came at a time when the CBK was actively purchasing dollars from the market to build reserves, with the liquidity mop-up preventing excess shilling supply that could have weakened the currency. The CBK's sophisticated use of open market operations, including repos, reverse repos, and TADs, demonstrates its ability to maintain optimal liquidity conditions that support currency stability.

The Kenyan shilling will however face the following challenges:

- An ever-present current account deficit which came in at 2.2% of GDP in the twelve months to October 2025, a deterioration from the 1.5% deficit recorded in a similar period in 2024. The persistent current account deficit reflects the country’s reliance on imports which has resulted in increased demand for foreign currency which continues to put more strain on the local currency,

- The low interest rates, with the Monetary Policy Committee reducing the CBR to 9.00% in its last sitting, extending its expansionary monetary policy stance, noting that its previous measures had successfully reduced overall inflation to below the mid-point of the target range of 2.5% - 7.5% and stabilized the exchange rate. The lower rates pose a challenge to the Kenyan Shilling, increasing pressure on the currency’s stability due to reduced attractiveness for foreign investors, especially in the face of sustained external borrowing needs and global market fluctuations,

- Elevated risk of increase in global crude oil prices as a result of supply chain constraints following the rising geopolitical tension in South America. Consequently, the possible rise in global oil prices is set to increase demand for the US Dollar by oil and energy importers, as well as manufacturers against a low supply of US Dollar currency, and,

- The high debt servicing costs which continue to put pressure on forex reserves. Notably, the debt service to revenue ratio stood at 75.3% as of December 2025, 60.3% points above the 30.0% threshold recommended by the IMF, and 59.7% of Kenya’s external debt is US Dollar-denominated as of June 2025.

- Ever since the Covid-19 pandemic, Kenya had benefited from near-continuous financing from the IMF and World Bank, supporting fiscal stability and reforms. However, in 2025, both lenders froze funding, USD 750.0 mn in World Bank DPO financing was suspended, and the IMF terminated its multi-year programme, due to Kenya’s failure to meet key prior actions, including amendments to the Competition Act, Treasury Single Account, e-procurement, and other policy reforms. Despite this, the outlook for 2026 is more positive, as Kenya is actively engaging with both institutions to unlock funding, progress has been made on reforms, and record-high forex reserves of USD 12.5 bn provide a strong buffer against liquidity pressures, improving the likelihood of IMF and World Bank support compared to 2025.

We expect the shilling to remain within a range of Kshs 129.0 and Kshs 132.0 against the USD by the end of 2026 with a bias towards a 2.3% depreciation by the end of the year.

- Inflation:

In 2025, the average inflation rate in the country was 4.1%, marking 0.4% points decrease from the average inflation rate of 4.5% witnessed in 2024. Notably, the y/y inflation rate remained unchanged in December 2025 at the 4.5% recorded in November 2025. Key to note, the overall inflation rates throughout 2025, remained within the Central Bank’s target range of 2.5% and 7.5%, hitting its lowest in January 2025 at 3.3%. Despite the improvement recorded in 2025, we expect the inflation rate to remain relatively stable in the short term, but face upward pressure in the medium to long term during 2026, given that the current fiscal measures do not address the cost-driven inflation, in addition to a ripple effect of the current expansionary monetary stance.

We expect inflation to average 5.0% in 2026, within the government target range of 2.5% - 7.5%. Key risks driving inflationary pressure are the high electricity prices, fuel costs, and exchange rate fluctuations on the Kenyan shilling.

- Interest Rates:

The Central Bank of Kenya (CBK) is expected to continue with the expansionary monetary policy stance in the short-to-medium term attributable to a stronger and stable currency and the eased inflation currently below the mid-point of the CBK’s preferred target of a range of 2.5% - 7.5%. The 9.00% Central Bank Rate (CBR) set in December 2025 marks the lowest level since January 2023. In the short term, we anticipate the Central Bank of Kenya (CBK) will adopt a more cautious approach to rate adjustments as it evaluates the performance of the local currency and inflation trends. However, in the medium term, there is potential for further reductions in the CBR to stimulate private sector credit growth, which, despite recent improvements, has remained in single digits, at 6.3% in November 2025, after recording negative growth rates from November 2024 to February 2025.

Despite the projected marginal increase in borrowing by 1.6% to Kshs 901.0 bn in FY’2025/2026 from Kshs 887.2 bn in FY’2024/25, Kenya still has an ever-present fiscal deficit, projected at 4.8% of GDP in FY’2025/26. As such, we expect the government to continue borrowing aggressively from both the domestic and foreign markets, given that the government is already ahead of its total net domestic borrowing target of Kshs 634.8 bn in FY’2025/26. The escalating debt service due to further borrowing will persistently burden the government, compelling it to borrow more to cover the maturing debts. However, the interest rate environment is expected to stabilize in the medium term as the government receives a boost from concessional loans from the IMF and the World Bank, improving the country’s credit outlook.

The table below summarizes the various macroeconomic factors and their possible impact on the business environment in 2026. With two indicators assessed as negative, two as neutral, and three as positive, the general outlook for the macroeconomic environment in 2026 is NEUTRAL.

|

|

Cytonn Report: Macro-Economic & Business Environment Outlook |

|

|

|

Macro-Economic Indicators |

2026 Outlook |

2026 Outlook |

Previous Outlook (2025)

|

|

Government Borrowing |

· On the domestic front, we expect the government to borrow aggressively from the domestic market as it aims to plug in the fiscal deficit, which is projected to come in at Kshs 923.3 bn in the FY’2025/26 budget, 4.8% of the GDP. The government intends to plug this fiscal deficit through Kshs 287.7 bn in external financing and Kshs 635.5 bn in domestic borrowing. Borrowing domestically is less costly for the government than acquiring debt denominated in foreign currencies, which not only carry higher interest rates but also come with the added risk of currency fluctuations. · In our view, the level of foreign borrowing is likely to remain elevated in 2026 due to several key factors: (i) the continued need to service and refinance external obligations, including upcoming maturities such as the USD 1.0 bn Eurobond due in February 2028, even after partial buybacks of 2027 and 2028 bonds in 2025 that helped ease near‑term refinancing pressures and extend maturities; (ii) ongoing negotiations and prospects for additional financing from the International Monetary Fund (IMF), as Kenya has requested a new IMF support programme following the expiration of its previous ECF/EFF arrangements, which could provide much‑needed concessional funds to support macroeconomic stability and external obligations; and (iii) planned disbursements and new commitments from multilateral lenders, including the World Bank Development Policy Operations and commercial financing arrangements, as well as innovative instruments such as sustainability‑linked bonds and debt‑for‑food‑security swaps that are expected to be executed by early 2026 to diversify external funding sources and support development priorities. · On revenue collection, we expect continued improvement in 2026 due to the raft of measures the new administration has put in place to boost tax collection such implementation of the Finance Act 2025 which is geared towards expanding the tax base and increasing revenues through sealing revenue leakages to meet the government’s budget for the fiscal year 2025/2026 of Kshs 4.2 tn, as well as reduce the budget deficit and borrowing. · In 2026, the government’s revenue outlook is expected to remain constrained, reflecting limited scope for further tax hikes amid political pressures ahead of the August 2027 General Election and the lingering impact of youth-led protests. The National Treasury has revised down its tax revenue target, acknowledging subdued tax performance driven by compliance gaps, administrative challenges, and revenue-reducing measures under the Finance Act, 2025. Consequently, revenue mobilisation efforts are likely to lean more heavily on non-tax measures, enhanced tax administration, and asset disposals, even as easing the tax burden to placate the electorate risks widening the fiscal deficit and weighing on overall revenue growth. |

Negative |

Negative |

|

Exchange Rate |

• We expect the Kenyan shilling to trade within a range of KSh 129.0 to KSh 132.0 against the USD by the end of 2026, reflecting a moderate depreciation bias amid ongoing external and domestic pressures. The currency is likely to remain under pressure due to several factors. (i), a persistent current account deficit continues to generate strong demand for foreign currency, placing sustained strain on the shilling. (ii) external debt obligations, including upcoming Eurobond maturities in 2027 and 2028, even after the partial buybacks conducted in 2025, continue to weigh on foreign exchange reserves, requiring careful management of inflows and outflows. (iii) Kenya remains vulnerable to global commodity price shocks, particularly crude oil, as geopolitical tensions in key oil-producing regions could lead to sudden price spikes that increase import costs and strain reserves. (iv) while U.S. interest rates are easing, the dollar’s continued strength against emerging market currencies has sustained pressure on the shilling • On the positive side, strong diaspora remittances remain a key stabilizing factor, providing a steady source of foreign currency inflows that support domestic liquidity. These inflows are likely to moderate depreciation pressures and help maintain relative stability in the currency. While short-term volatility may persist due to external shocks and market sentiment, the overall outlook for the shilling in 2026 remains cautiously stable, reflecting a balance between persistent external pressures and supportive inflows from remittances and external financing. |

Neutral |

Neutral |

|

Interest Rates |

• Given the expansionary monetary policy stance maintained in 2025, we expect the Monetary Policy Committee (MPC) to continue accommodative measures in 2026, aimed at supporting economic growth and stimulating private sector activity while carefully monitoring inflation and the shilling’s performance. The yield curve is expected to remain relatively stable, as lower policy rates reduce short-term borrowing costs, encouraging investment and consumption without triggering excessive inflationary pressures • On the macroeconomic front, expansionary monetary policy is likely to bolster domestic demand, particularly in the manufacturing and services sectors, while providing liquidity to credit-constrained businesses. However, external vulnerabilities, including currency pressures from persistent current account deficits and potential commodity price shocks (notably crude oil), may continue to pose risks to inflation and reserves. The combination of accommodative monetary policy, prudent debt management, and supportive external financing is therefore expected to maintain a balanced environment, encouraging growth and investment while containing external and inflationary pressures. Overall, the outlook suggests a predictable interest rate environment, improved credit conditions, and continued resilience in Kenya’s macroeconomic framework throughout 2026. |

Positive |

Positive |

|

Inflation |

• We expect inflation to average 5.0% in 2026, remaining comfortably within the government’s target range of 2.5%–7.5%. The primary drivers of inflation are high electricity tariffs and elevated fuel costs, which increase production and transport expenses across the economy. In addition, the Central Bank of Kenya’s (CBK) accommodative monetary policy stance is contributing to inflationary pressures by sustaining domestic demand and increasing liquidity in the financial system. Overall, the combination of persistent cost-push factors and a demand-supportive monetary environment is expected to keep inflation moderately elevated, though still within the target range, allowing policymakers to balance growth objectives with price stability throughout 2026. |

Neutral |

Neutral |

|

GDP |

• We anticipate the economic growth to continue on its recovery trajectory in 2026, with the GDP growth rate ranging between 5.2% - 5.5%. We expect the GDP growth to be supported by the continued recovery of the agricultural sector and a robust performance in the services sector driven by growth in information and technology as well as accommodation and food services as a result of increased tourism. However, there are several risks could potentially hinder this growth such as the high risk of debt distress, elevated inflationary pressures and currency depreciation. |

Positive |

Neutral |

|

Investor Sentiment |

• We expect the high positive investor sentiments witnessed in 2025 to persist through the short to medium term of 2026, mainly due to; i) Anchored inflationary pressures driven by reduced fuel costs, ii) Stability of the Kenyan currency as a result of decreased dollar demand from importers, especially for oil and energy sectors, and iii) Recovery of the private sector as the low interest rate environment reduces borrowing costs leading to an uptick in the business environment. |

Positive |

Positive |

|

Security |

• We expect 2026 to be characterized by heightened political activity and tensions as the country enters the pre-election period ahead of the August 2027 general elections. Political positioning, coalition building, early campaign activities, and intensified competition among political actors are expected to create significant uncertainty and potential disruptions to the business environment |

Negative |

Negative |

The change from last year’s outlook is:

- GDP outlook revised to Positive from Neutral, supported by stronger-than-expected economic performance in 2025, easing monetary conditions following cumulative policy rate cuts, and improving macroeconomic stability marked by anchored inflation and a stable Kenyan shilling. These factors are expected to enhance private sector credit uptake and sustain the recovery momentum into 2026.

Out of the seven metrics that we track, two have a neutral outlook, two have a negative outlook, and three have a positive outlook, compared with last year when three were neutral, two were negative, and two were positive. While the number of positive metrics has increased, our general outlook for the macroeconomic environment remains NEUTRAL for 2026, unchanged from 2025. The composition of the outlook remains balanced, with improvements in currency stability and interest rate normalization being offset by persistent challenges, including elevated debt levels, constrained multilateral financing, and heightened political uncertainty as the country enters the pre-election period ahead of the August 2027 general elections

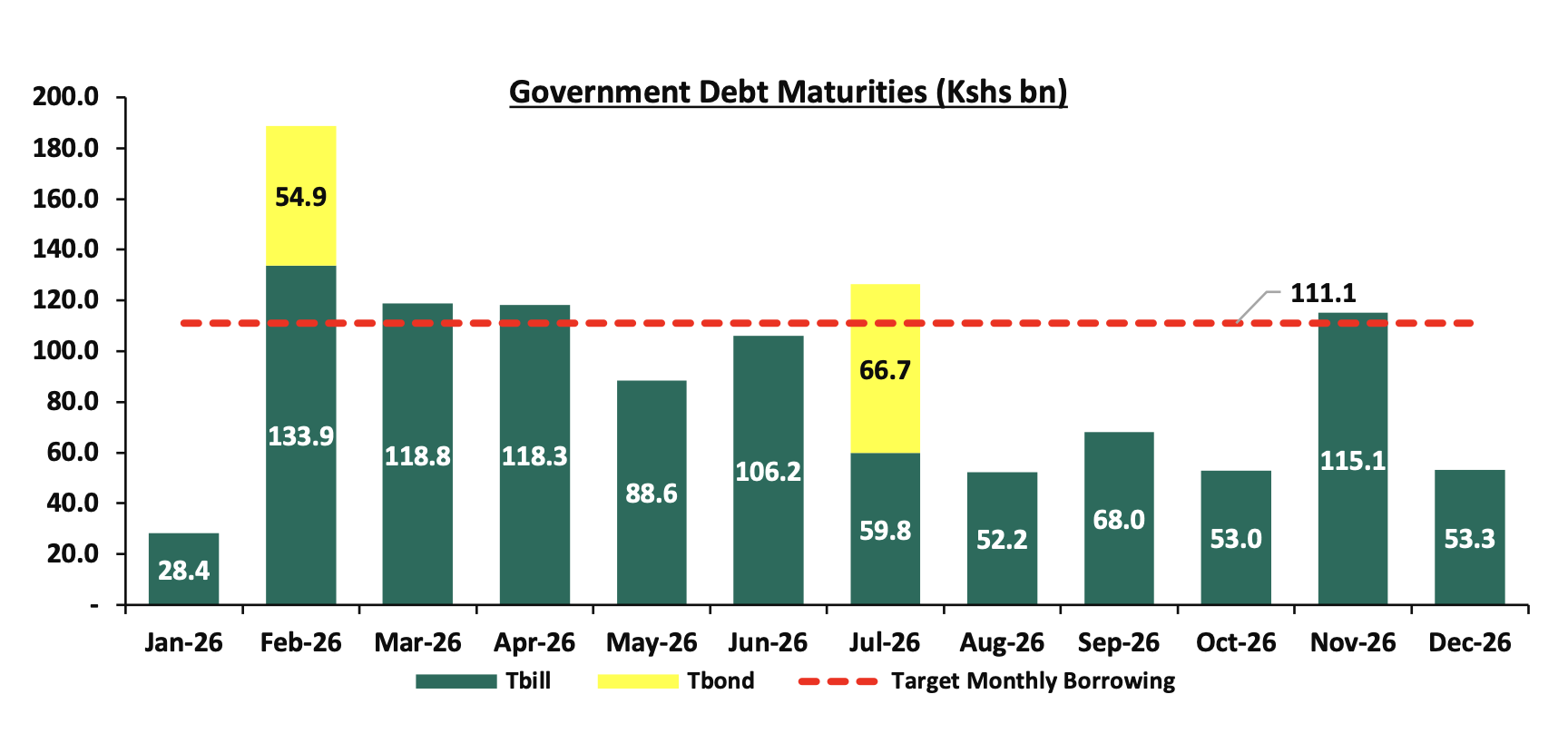

The government is currently 112.9% ahead its prorated domestic borrowing target, having a net borrowing of Kshs 750.1 bn domestically, against the pro-rated target of Kshs 352.3 bn, and 18.2% ahead of the total net domestic borrowing target of Kshs 634.8 bn for FY’2025/26, suggesting aggressive borrowing from the local market mainly on the back of the high debt maturities. We expect a moderate downward pressure on the interest rates, supported by the Central Bank of Kenya’s accommodative monetary policy stance and general economic improvement. While the international capital markets remain challenging, the reduced inflationary environment, easing global interest rates is expected to alleviate investor demands for high yields, though elevated debt servicing costs could still weigh on fiscal sustainability.

Below is a summary of treasury bills and bond maturities and the expected borrowings over the same period. The government will need to borrow Kshs 111.1 bn on average each month for the rest of the fiscal year to meet the domestic borrowing target of Kshs 634.8 bn for the FY’2025/2026, and cover T-bill and T-bond maturities, as illustrated in the graph below:

Fig: Schedule of Treasury bills and bonds maturities and the expected target borrowings in the 2025-2026 fiscal year to cater for the maturities and additional government borrowing.

Weekly Market Performance:

Money Markets, T-Bills Primary Auction:

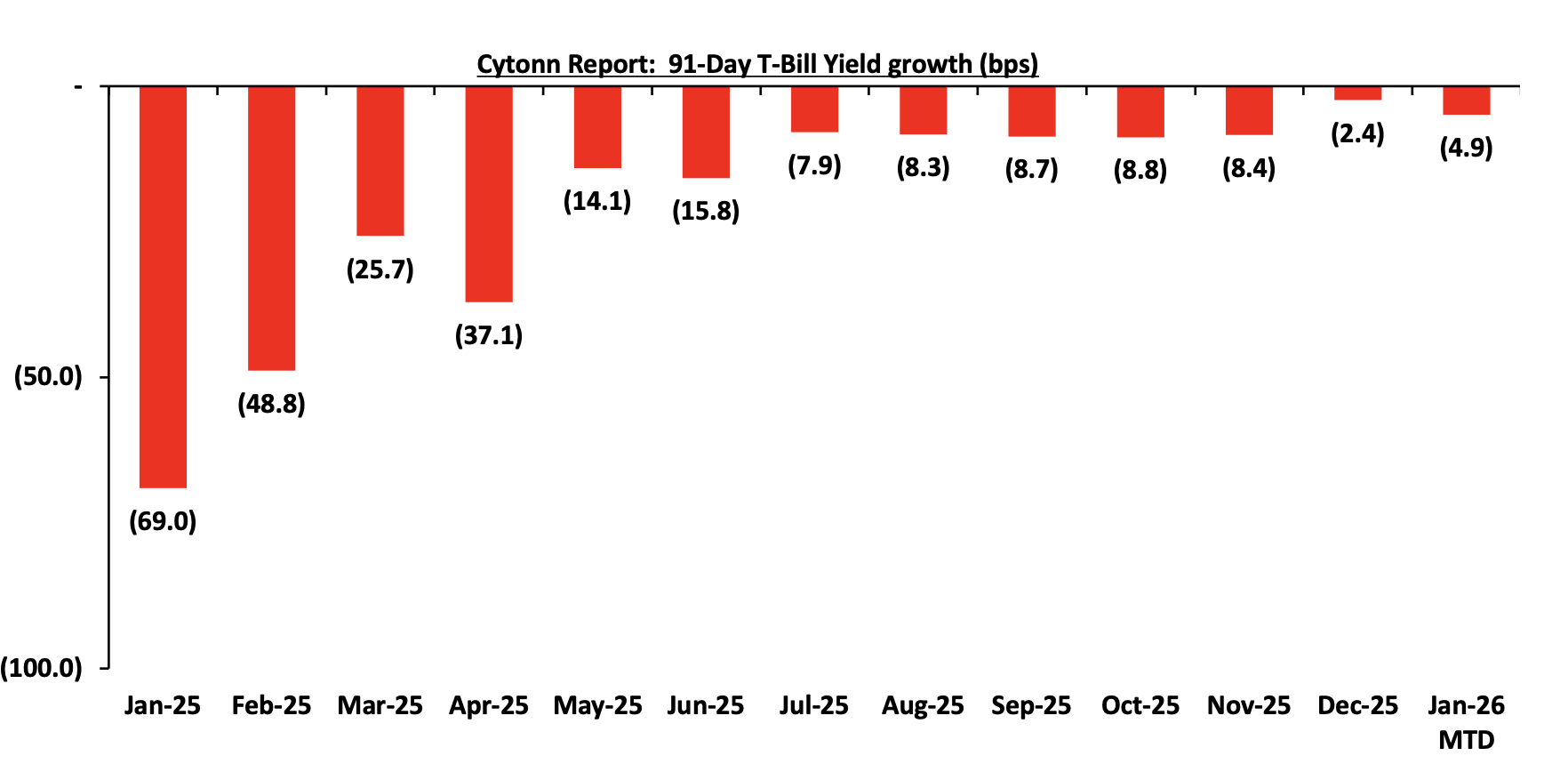

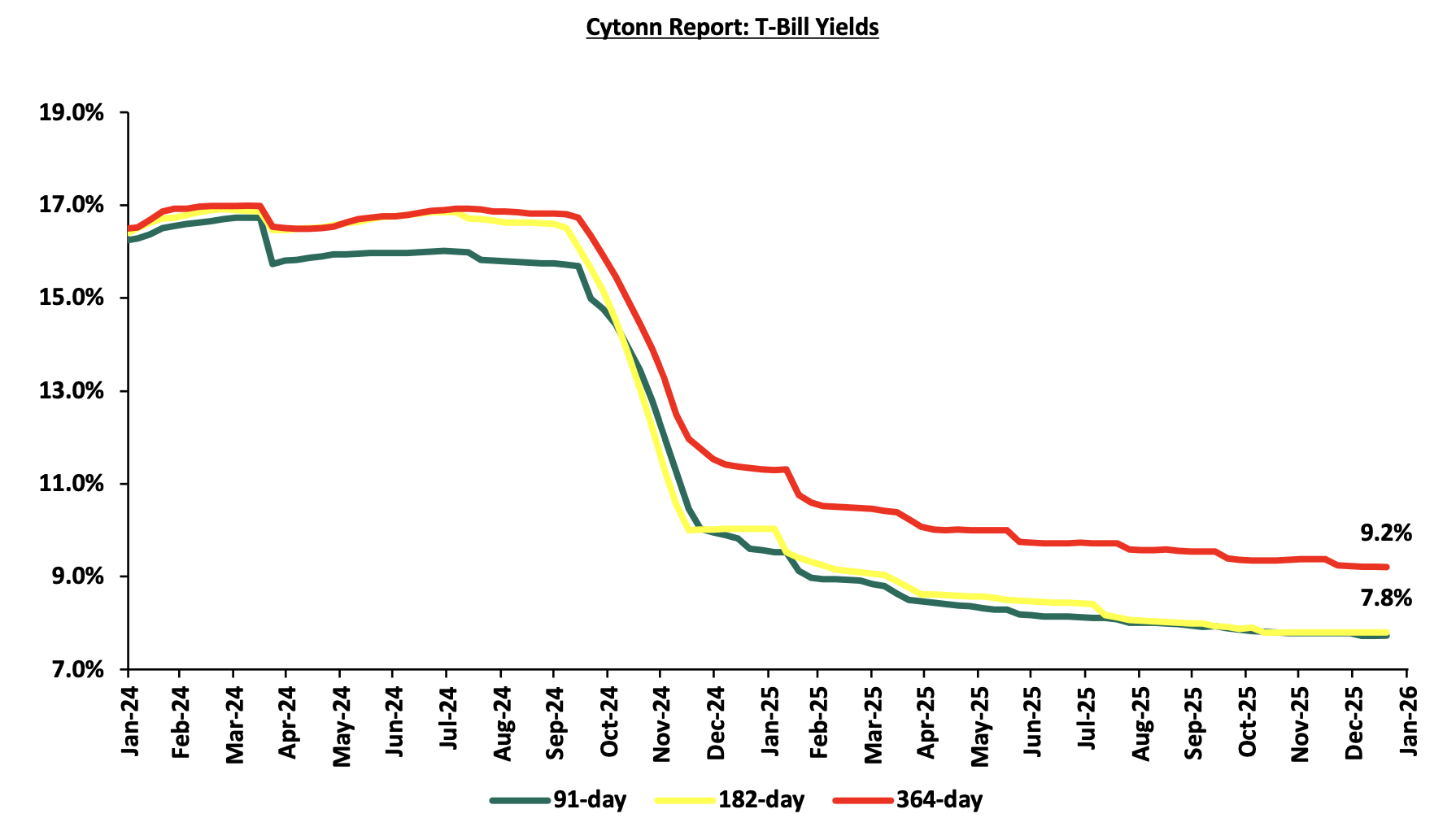

This week, T-bills were oversubscribed for the third consecutive week, with the overall subscription rate coming in at 128.4%, albeit lower than the subscription rate of 130.3% recorded the previous week. Investors’ preference for the shorter 91-day paper waned, with the paper receiving bids worth Kshs 1.0 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 24.0%, significantly lower than the subscription rate of 108.5%, recorded the previous week. The subscription rate for the 182-day paper decreased to 5.8% from the 96.1% recorded the previous week, while that of the 364-day papers increased to 292.8% from 173.2% recorded the previous week. The government accepted a total of Kshs 28.5 bn worth of bids out of Kshs 30.8 bn bids received, translating to an acceptance rate of 92.5%. The yields on the government papers showed mixed performance with the yield on the 182-day paper remaining unchanged at 7.8% compared to the previous week, while the yields on the 91-day and 364-day paper decreased by 2.7 bps and 0.1 bps to remain relatively unchanged at 9.2% and 7.7% respectively compared to last week. The chart below shows the yield growth rate for the 91-day paper over the period:

The chart below shows the performance of the 91-day, 182-day and 364-day papers from January 2024 to January 2026;

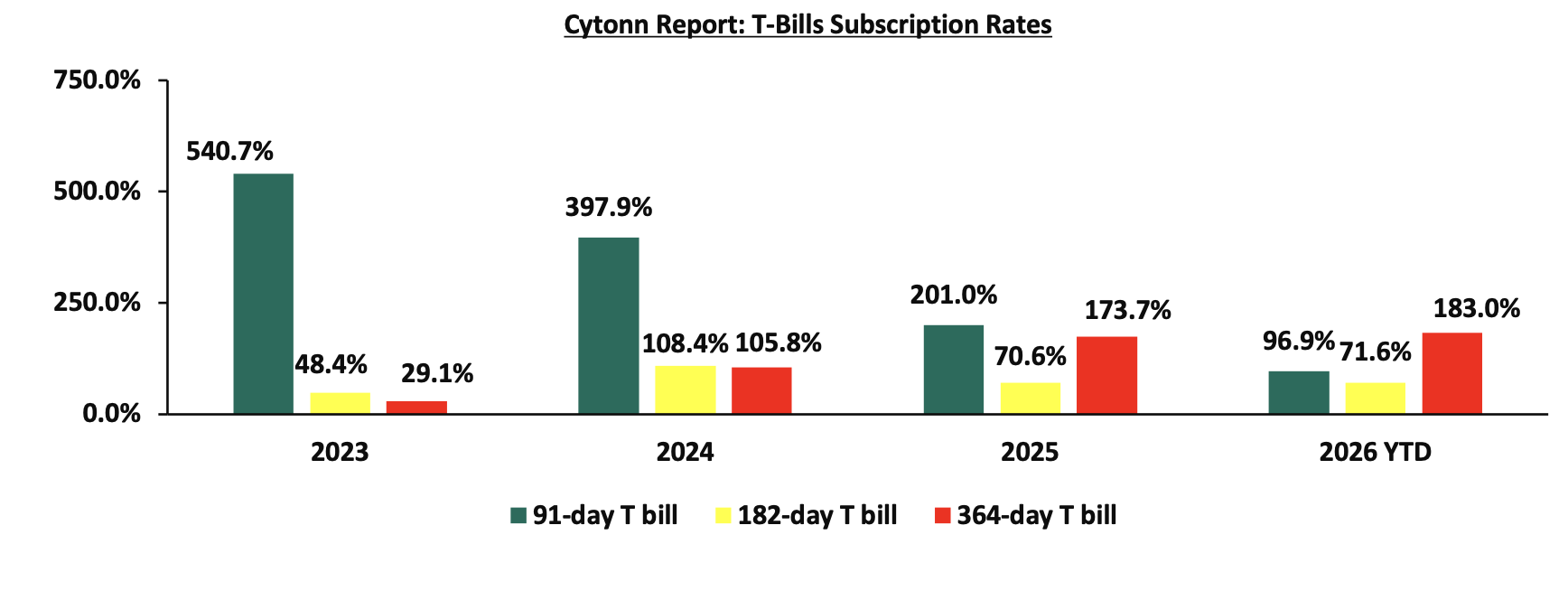

The chart below compares the overall average T-bill subscription rates obtained in 2023, 2024, 2025 and 2026 Year-to-date (YTD);

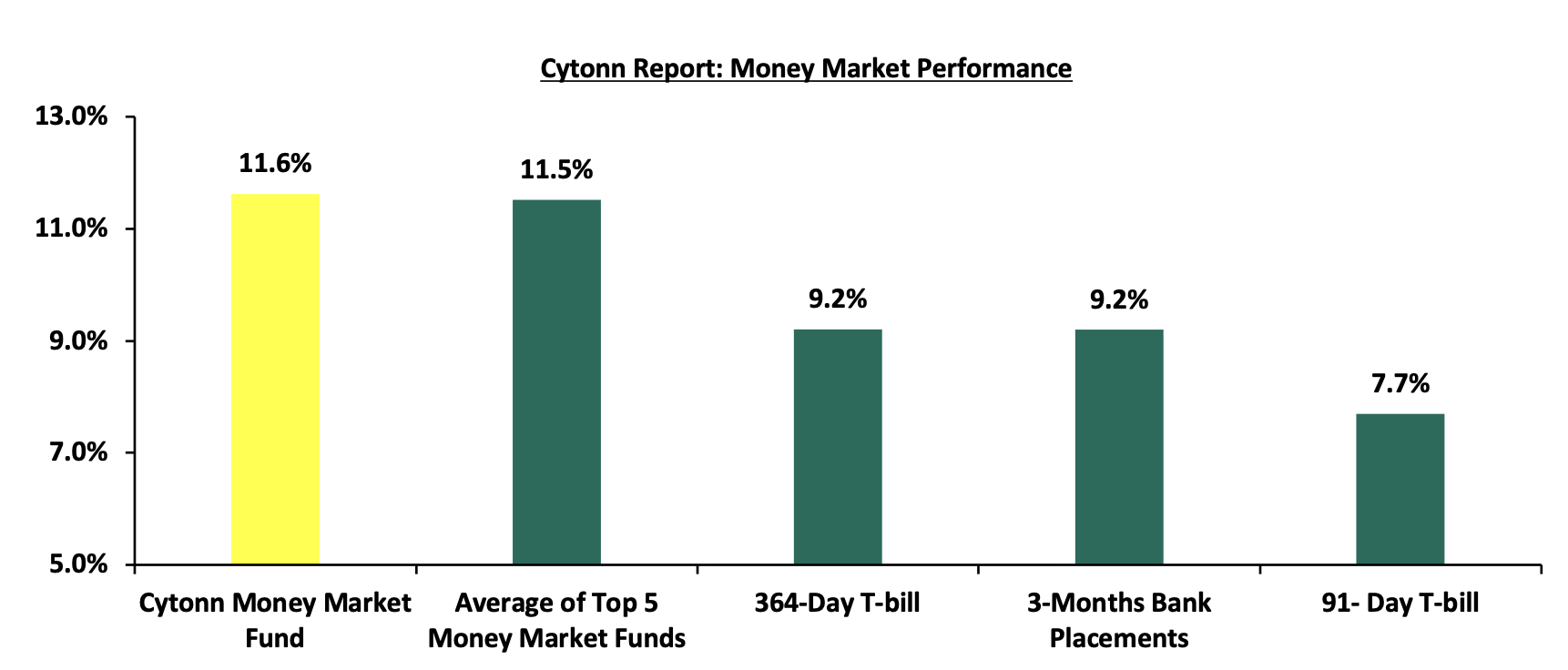

Money Market Performance:

In the money markets, 3-month bank placements ended the week at 9.2% (based on what we have been offered by various banks), and yields on the government papers decreased, with the yields on the 91-day and 364-day paper decreased by 2.7 bps and 0.1 bps to remain relatively unchanged at 9.2% and 7.7% respectively compared to the previous week. The yield on the Cytonn Money Market Fund declined by 6.0 bps to 11.6% from the 11.7% recorded the previous week, while the average yields on the Top 5 Money Market Funds increased marginally by 2.4 bps to remain relatively unchanged at 11.5% in comparison to the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 16th January 2026:

|

Money Market Fund Yield for Fund Managers as published on 16th January 2026 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Arvocap Money Market Fund |

12.2% |

|

2 |

Cytonn Money Market Fund (Dial *809# or download Cytonn App) |

11.6% |

|

3 |

Nabo Africa Money Market Fund |

11.6% |

|

4 |

Etica Money Market Fund |

11.1% |

|

5 |

Enwealth Money Market Fund |

11.1% |

|

6 |

Ndovu Money Market Fund |

11.1% |

|

7 |

Lofty-Corban Money Market Fund |

11.0% |

|

8 |

Gulfcap Money Market Fund |

10.8% |

|

9 |

Kuza Money Market fund |

10.4% |

|

10 |

Jubilee Money Market Fund |

10.4% |

|

11 |

Old Mutual Money Market Fund |

10.3% |

|

12 |

British-American Money Market Fund |

10.1% |

|

13 |

Orient Kasha Money Market Fund |

10.0% |

|

14 |

Madison Money Market Fund |

9.7% |

|

15 |

Dry Associates Money Market Fund |

9.6% |

|

16 |

SanlamAllianz Money Market Fund |

9.5% |

|

17 |

Apollo Money Market Fund |

9.5% |

|

18 |

KCB Money Market Fund |

9.5% |

|

19 |

GenAfrica Money Market Fund |

9.3% |

|

20 |

Faulu Money Market Fund |

9.1% |

|

21 |

Genghis Money Market Fund |

8.6% |

|

22 |

CIC Money Market Fund |

8.5% |

|

23 |

Mali Money Market Fund |

8.3% |

|

24 |

ICEA Lion Money Market Fund |

8.3% |

|

25 |

CPF Money Market Fund |

8.3% |

|

26 |

Co-op Money Market Fund |

8.2% |

|

27 |

Absa Shilling Money Market Fund |

7.5% |

|

28 |

Mayfair Money Market Fund |

7.0% |

|

29 |

AA Kenya Shillings Fund |

6.1% |

|

30 |

Ziidi Money Market Fund |

6.1% |

|

31 |

Stanbic Money Market Fund |

5.8% |

|

32 |

Equity Money Market Fund |

4.9% |

Source: Business Daily

Liquidity:

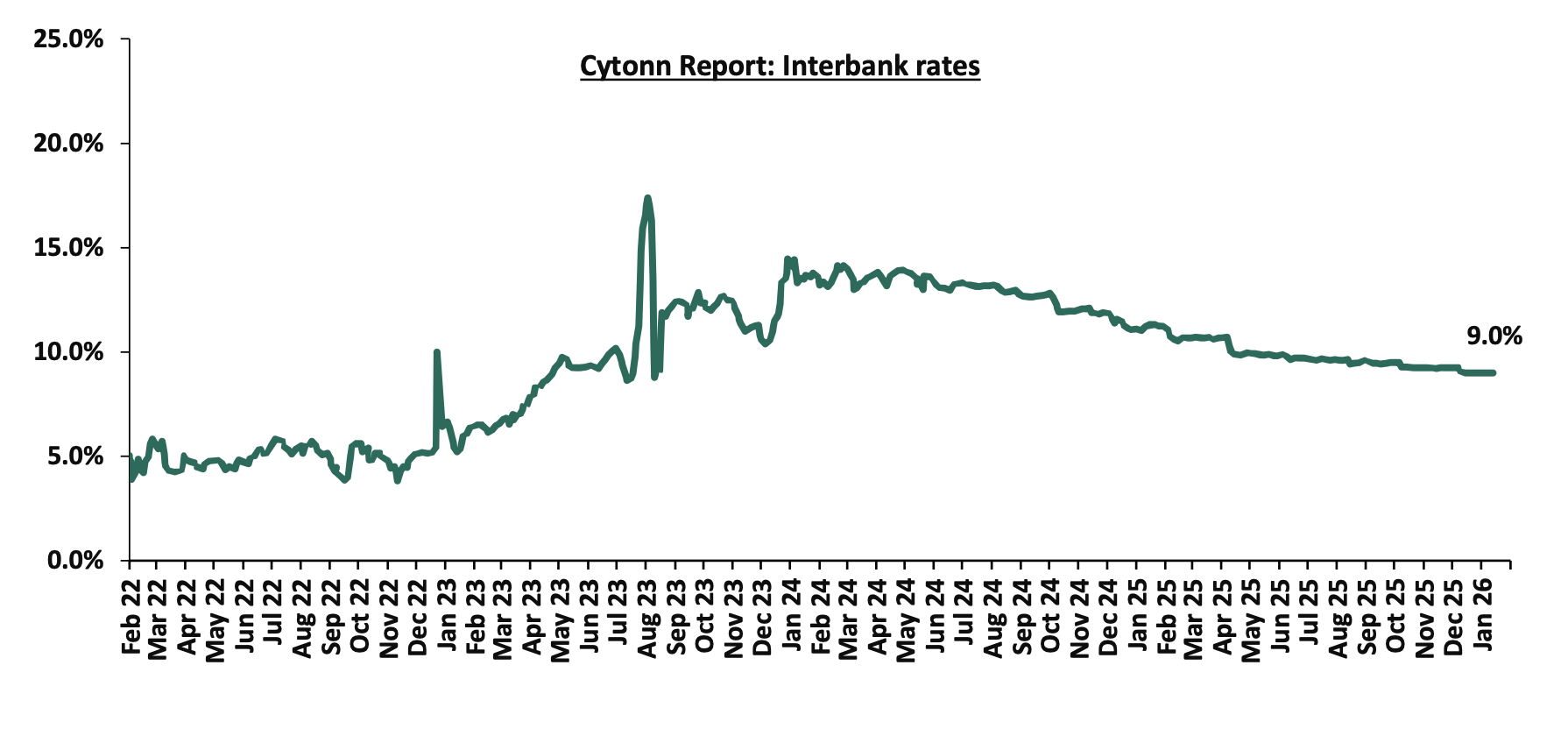

During the week, liquidity in the money markets marginally tightened, with the average interbank rate increasing by 0.7 bps remaining relatively unchanged at 9.0% compared to the previous week, partly attributable to the tax remittances that offset government payments. The average interbank volumes traded increased by 103.4% to Kshs 15.2 bn from Kshs 7.5 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Eurobonds were on a downward trajectory, with the yields on the 7-year Eurobond issued in 2024 decreasing the most by 31.9 bps to 7.0% from 7.3% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 15th January 2026:

|

Cytonn Report: Kenya Eurobond Performance |

|||||||

|

|

2018 |

2019 |

2021 |

2024 |

2025 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

11-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

1.5 bn |

|

Years to Maturity |

2.5 |

22.5 |

1.7 |

6.7 |

8.8 |

.5.5 |

10.5 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

9.9% |

|

2-Jan-26 |

6.1% |

8.8% |

0.0% |

7.2% |

7.8% |

7.1% |

|

|

8-Jan-26 |

6.2% |

9.1% |

0.0% |

7.4% |

8.1% |

7.3% |

|

|

9-Jan-26 |

6.2% |

9.0% |

0.0% |

7.4% |

8.1% |

7.2% |

|

|

12-Jan-26 |

6.2% |

9.0% |

0.0% |

7.4% |

8.1% |

7.3% |

|

|

13-Jan-26 |

6.2% |

9.0% |

0.0% |

7.4% |

8.1% |

7.2% |

|

|

14-Jan-26 |

6.2% |

9.0% |

0.0% |

7.4% |

8.0% |

7.2% |

10.0% |

|

15-Jan-26 |

6.2% |

8.9% |

0.0% |

7.2% |

7.9% |

7.0% |

|

|

Weekly Change |

(0.1%) |

(0.2%) |

- |

(0.2%) |

(0.2%) |

(0.3%) |

0.0% |

|

MTD Change |

0.1% |

0.1% |

- |

0.1% |

0.1% |

(0.1%) |

0.0% |

|

YTD Change |

0.1% |

0.1% |

- |

0.1% |

0.1% |

(0.1%) |

0.0% |

Source: Central Bank of Kenya (CBK)

Africa’s return to the Eurobond market in 2025 has been marked by strong investor appetite and improving sentiment. Ivory Coast, Benin, Kenya, Senegal, and Cameroon collectively raised over USD 6.3 bn, with all issuances oversubscribed, driven by yield-seeking investors and positive regional recovery prospects. Notable deals included Ivory Coast’s USD 2.6 bn dual-tranche bond and Kenya’s USD 1.5 billion Eurobond used for a 2027 buy-back. Cameroon’s USD 550.0 mn issuance in July 2024 became the most expensive in recent years, with a 10.8% yield. By June 2025, bond yields declined across most issuers, including Kenya, Benin and Ivory Coast reflecting easing inflation, currency stability, and stronger investor confidence. This trend highlights improved market access for African sovereigns, though borrowing costs remain high for fiscally risky nations like Nigeria, where the yield edged up slightly to 9.1%. The table below shows the SSA countries that have issued Eurobonds and their respective risk of debt distress:

|

Cytonn Report: Sub-Saharan Africa Eurobond Countries |

|||||

|

COUNTRY |

Debt to GDP (IMF 2025) |

Debt to GDP (IMF Forecasted) |

Debt Service to Revenue Ratio |

Risk of Overall debt distress (Joint IMF and World Bank DSA |

Current Situation |

|

Senegal |

122.9% |

124.3% |

30.5% |

In debt distress |

No debt restructuring ongoing |

|

Zambia |

114.9% |

114.9% |

14.0% |

In debt distress |

External debt restructuring ongoing |

|

Gabon |

76.2% |

82.0% |

48.9% |

High risk of debt distress |

No debt restructuring ongoing |

|

South Africa |

77.3% |

79.5% |

21.3% |

High risk of debt distress |

No debt restructuring ongoing |

|

Rwanda |

73.2% |

74.8% |

15.9% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Kenya |

68.0% |

70.1% |

62.6% |

High risk of debt distress |

No debt restructuring ongoing |

|

Namibia |

63.6% |

63.3% |

13.8% |

High risk of debt distress |

No debt restructuring ongoing |

|

Angola |

62.4% |

63.2% |

19.5% |

High risk of debt distress |

No debt restructuring ongoing |

|

Seychelles |

56.7% |

58.4% |

- |

High risk of debt distress |

No debt restructuring ongoing |

|

Ghana |

59.1% |

56.1% |

43.5% |

High risk of debt distress |

External and domestic debt restructuring ongoing |

|

Côte d'Ivoire |

55.6% |

54.1% |

34.0% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Benin |

50.7% |

49.6% |

64.7% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Tanzania |

49.6% |

48.3% |

44.6% |

Moderate risk of debt distress |

No debt restructuring ongoing |

|

Ethiopia |

46.7% |

41.1% |

31.0% |

In debt distress |

External debt restructuring ongoing |

|

Cameroon |

37.9% |

36.3% |

51.6% |

High risk of debt distress |

No debt restructuring ongoing |

|

Nigeria |

36.4% |

35.0% |

66.9% |

Moderate risk of debt distress |

Domestic debt restructuring |

|

Average |

65.7% |

65.7% |

35.2% |

||

Sources: International Monetary Fund (IMF) 2025 economic outlook & Joint Debt Sustainability Analysis (DSA), World Bank

Key take-outs in the table include

- Three countries already defaulted on their debt: Senegal, Zambia and Ethiopia are already in debt distress, and have already initiated different forms of debt restructuring, especially at the G20,

- The average debt servicing consumes above 35.2% of the total revenue collected, translating to less allocation for development purposes, and,

- Although Kenya’s debt to GDP ratio is projected to increase to 70.1% in 2026 from 68.0% in 2025, the government’s reduced debt appetite might push the ratio lower, having recorded a debt to GDP ratio of 68.3% as of June 2025, due to the current administration’s initiatives towards fiscal consolidation

Kenya Shilling:

During the week, the Kenya Shilling depreciated marginally against the US Dollar by 1.6 bps, to remain unchanged from Kshs 129.0 recorded the previous week. On a year-to-date basis, the shilling has appreciated marginally by 1.5 bps against the dollar, compared to the 22.9 bps appreciation recorded in 2025.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 5,036.7 mn in the 12 months to December 2025, 1.9% higher than the USD 4,945.2 mn recorded over the same period in 2024. In the December 2025 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 53.3% in the period, and,

- Tourism inflows, which strengthened significantly. Tourism receipts reached Kshs 560.0 billion in 2025, up from Kshs 452.2 billion in 2024, representing a 23.9% increase, supported by improved international arrivals through the country’s major airports, and,

- Improved forex reserves currently at USD 12.5 bn (equivalent to 5.4-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2026 as a result of:

- An ever-present current account deficit which came at 2.2% of GDP in the twelve months to October 2025, and,

- Elevated government debt servicing obligations, which continue to exert pressure on foreign exchange reserves, given that 59.7% of Kenya’s external debt is US Dollar-denominated as of June 2025, sustaining demand for hard currency in 2026.

Kenya’s forex reserves increased by 0.8% during the week to 12.5 bn from the USD 12.4 bn recorded the previous week, equivalent to 5.4 months of import cover, and above the statutory requirement of maintaining at least 4.0-months of import cover.

The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights:

- Fuel Prices effective 15th January – 14th February 2026

During the week, The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective from 15th January 2026 to 14th February 2026. Notably, the maximum allowed prices for Super Petrol, Diesel and Kerosene decreased by Kshs 2.0, Kshs 1.0 and Kshs 1.0 per litre to Kshs 182.5, Kshs 170.5 and Kshs 153.8 per litre from Kshs 184.5, Kshs 171.5 and Kshs 171.5 per litre respectively in December 2025, the first decrease in 4 months, with the last being on September 2025.

Other key take-outs from the performance include,

- The average landing cost per cubic metre of Kerosene, Diesel and Super Petrol decreased by 8.9%, 4.2% and 0.1% to USD 607.6, USD 626.8 and USD 592.2 in December 2025 from USD 667.1, USD 654.2 and USD 592.8 recorded in November 2025.

- The Kenyan Shilling appreciated against the US Dollar by 0.4 bps to Kshs 129.3 in December 2025 from the Kshs 129.8 recorded in November 2025.

We note that fuel prices in the country have stabilized in recent months largely due to the government's efforts to stabilize pump prices through the petroleum pump price stabilization mechanism which expended Kshs 13.7 bn in the FY’2024/25 to cushion the increases applied to the petroleum pump prices, coupled with the stabilization of the Kenyan Shilling against the dollar and other major currencies. Additionally, the government increased spending through the price stabilization mechanism, subsidizing Kshs 1.6 per litre for Petrol, compared to Kshs 5.7 and Kshs 9.1 deficits for Diesel and Kerosene in December saw a reduction in fuel prices for the period under review.

Going forward, we expect that fuel prices will stabilize in the coming months as a result of the government's efforts to mitigate the cost of petroleum through the pump price stabilization mechanism and a stable exchange rate. As such, we expect the business environment in the country to improve as fuel is a major input cost, as well as continued stability in inflationary pressures, with the inflation rate expected to remain within the CBK’s preferred target range of 2.5%-7.5% in the short to medium term.

- Exchequer Highlight December 2025

The National Treasury gazetted the revenue and net expenditures for the sixth month of FY’2025/2026, ending 31stDecember 2025. Below is a summary of the performance:

|

Item |

12-months Original Estimates |

Actual Receipts/Release |

Percentage Achieved |

Prorated |

% achieved of the Prorated |

|

Opening Balance |

|

6.4 |

|

|

|

|

Tax Revenue |

2,627.1 |

1,161.3 |

44.2% |

1,313.5 |

88.4% |

|

Non-Tax Revenue |

127.6 |

82.1 |

64.3% |

63.8 |

128.7% |

|

Total Revenue |

2,754.7 |

1,249.8 |

45.4% |

1,377.4 |

90.7% |

|

External Loans & Grants |

569.8 |

227.0 |

39.8% |

284.9 |

79.7% |

|

Domestic Borrowings |

1,098.3 |

670.4 |

61.0% |

549.1 |

122.1% |

|

Other Domestic Financing |

10.8 |

21.6 |

199.8% |

5.4 |

399.7% |

|

Total Financing |

1,678.9 |

919.0 |

54.7% |

839.4 |

109.5% |

|

Recurrent Exchequer issues |

1,470.4 |

809.2 |

55.0% |

735.2 |

110.1% |

|

CFS Exchequer Issues |

2,141.0 |

1,017.2 |

47.5% |

1,070.5 |

95.0% |

|

Development Expenditure & Net Lending |

407.1 |

145.0 |

35.6% |

203.5 |

71.3% |

|

County Governments + Contingencies |

415.0 |

172.2 |

41.5% |

207.5 |

83.0% |

|

Total Expenditure |

4,433.6 |

2,143.7 |

48.4% |

2,216.8 |

96.7% |

|

Fiscal Deficit excluding Grants |

1,678.9 |

893.8 |

53.2% |

839.4 |

106.5% |

|

Total Borrowing |

1,668.1 |

897.4 |

53.8% |

834.0 |

107.6% |

|

Public Debt |

1,901.4 |

941.6 |

49.5% |

950.7 |

99.0% |

The key take-outs from the release include;

- Total revenue collected as at the end of December 2025 amounted to Kshs 1,249.8 bn, equivalent to 45.4% of the original estimates of Kshs 2,754.7 bn for FY’2025/2026 and is 90.7% of the prorated estimates of Kshs 1,377.4 bn. Cumulatively, tax revenues amounted to Kshs 1,161.3 bn, equivalent to 44.2% of the original estimates of Kshs 2,627.1 bn and 88.4% of the prorated estimates of Kshs 1,313.5 bn,

- Total financing amounted to Kshs 919.0 bn, equivalent to 54.7% of the original estimates of Kshs 1,678.9 bn and is equivalent to 109.5% of the prorated estimates of Kshs 839.4 bn. Additionally, domestic borrowing amounted to Kshs 670.4 bn, equivalent to 61.0% of the original estimates of Kshs 1,098.3 bn and is 122.1% of the prorated estimates of Kshs 549.1 bn,