Cytonn Annual Markets Review - 2025

By Cytonn Research, Jan 4, 2026

Executive Summary

Global Markets Review

According to the World Bank's June 2025 Global Economic Prospects report, the global economy is projected to grow at 2.3% in 2025, lower than the 2.8% growth recorded in 2024. This forecast marks a significant downward revision from earlier projection in January of 2.7%, reflecting anticipated economic downturn, particularly due to rising international trade disputes and policy uncertainties. The World Bank’s growth projection of 2.3% is 0.9% points lower than the IMF’s October 2025 World Economic Outlook forecast of 3.2%, which was also revised from the July 2025 projection of 3.0%. In their last Global Economic Prospects Report in June 2025, the World Bank revised their global growth forecasts downward due to weakening global trade, largely driven by rising U.S. tariffs and the resulting trade tensions, which disrupted global supply chains and slowed cross-border economic activity. Notably, advanced economies are expected to record a 1.2% growth in 2025, down from the 1.7% expansion recorded in 2024. Additionally, emerging markets and developing economies are projected to expand by 3.8% in 2025, down from the 4.2% expansion recorded in 2024. On the other hand, the IMF revised their projection upwards to 3.2% from the July 2025 projection of 3.0% due to private sector agility, new trade deals, and restraint from most countries in keeping markets open. However, with U.S. tariffs still high and trade tensions unresolved, the longer‑term impact may intensify as costs shift to consumers and efficiency declines;

Sub-Saharan Africa Regional Review

According to the World Bank, the Sub-Saharan economy is projected to grow at a moderate rate of 3.7% in 2025, which is 0.2% points higher than the 3.5% growth recorded in 2024, but a downward revision from the January 2025 projection of 4.1%. The downward revision is mainly due to the rising trade barriers coupled with the weakened global investor confidence. The expected recovery from 2024 is primarily driven by global economic stability, and easing of monetary policy rates in the region, which is expected to boost private consumption and investment. However, most countries face the risk of increased inflation due to increased food prices resulting from drought, prompting them to increase or hold off on further easing of the rates. Nevertheless, the risk of debt distress remains high with the region’s public debt to GDP ratio expected to remain high at 58.0% in 2025, with more than half of countries facing unsustainable debt burdens. Public debt is expected to remain high due to increased debt servicing costs as a result of high interest rates in developed economies and a reduction in donor support;

In 2025, most of the select Sub-Saharan currencies appreciated against the US Dollar, primarily due to the respective central bank efforts, increased foreign currency inflows and debt-restructuring and policy reforms which have improved forex reserves. Foreign currency inflows supported currency appreciation by boosting foreign exchange reserves, increasing dollar supply, and strengthening market confidence in the domestic currency’s stability. The Ghanaian Cedi appreciated the most by 25.7% in 2025 to close at GHS 10.9 against the US Dollar, compared to GHS 14.7 recorded in 2024 while the Tanzanian shilling was the worst performer during the year, depreciating by 2.2% against the dollar to close the year at TSh 2,447.5 from TSh 2,394.8 in 2024;

Kenya Macro Economic Review

According to the Kenya National Bureau of Statistics (KNBS) Q2’2025 Quarterly Gross Domestic Product Report, the Kenyan economy recorded a 5.0% growth in Q2’2025, 0.4% points higher from the 4.6% growth rate recorded in Q2’2024. The main contributor to Kenyan GDP remains the Agriculture, Fishing and Forestry sector which grew by 4.4% in Q2’2025, albeit lower than the 4.5% expansion recorded in Q2’2024. All sectors in Q2’2025 recorded positive growths, with varying magnitudes across activities. Most sectors recorded contraction in growth rates compared to Q2’2024 with Accommodation & Food Services, Financial Services Indirectly Measured and Other services recording growth rate declines of 27.2%, 8.9% and 3.4% points to 7.8%, 1.4% and 1.4% from 35.0%, 10.3% and 4.8% respectively. Other sectors recorded an expansion in growth rates, from what was recorded in Q2’2024, with Mining and Quarrying, Construction and Electricity and Water Supply recording the highest growths in rates of 20.8%, 9.4% and 4.5% points, to 15.3%, 5.7% and 5.7% from (5.5%), (3.7%) and 1.2% respectively. Notably, the overall economic performance highlighted modest growth despite a slowdown in several key sectors, reflecting the mixed performance across industries amid a challenging operating environment;

For FY’2025, the Kenyan economy is projected to grow at an average of 5.0%, up from 4.7% in FY’2024. The faster growth is supported by easing monetary policy, accommodative financial conditions, and a rebound in key sectors, particularly agriculture which has benefited from favorable weather conditions after previous droughts. The economic environment has been bolstered by several positive macroeconomic indicators, including inflation within the Central Bank's target range, a stable exchange rate, and foreign exchange reserves at record highs. The services sector, including tourism and financial services, is also expected to contribute positively to growth. Additionally, improved business sentiment and gradually recovering consumer demand are supporting economic expansion. However, growth remains constrained by fiscal consolidation efforts as the government works to address budget deficits and manage elevated public debt levels, alongside higher taxation measures that have weighed on disposable incomes, private consumption, and overall business activity;

During the week, KNBS released the y/y inflation for December 2025 highlighting that inflation remained unchanged from the 4.5% recorded in November 2025. This was in line with our projection, where our projection was mainly driven by the appreciation of the Kenya Shilling against the USD coupled with the stability of fuel prices. The headline inflation in December 2025 was majorly driven by a rise in prices of items in the Food and Non-Alcoholic Beverages at 7.8 %, Transport at 5.2 %, and Housing, Water, Electricity, Gas and other fuels at 1.6%;

Fixed Income

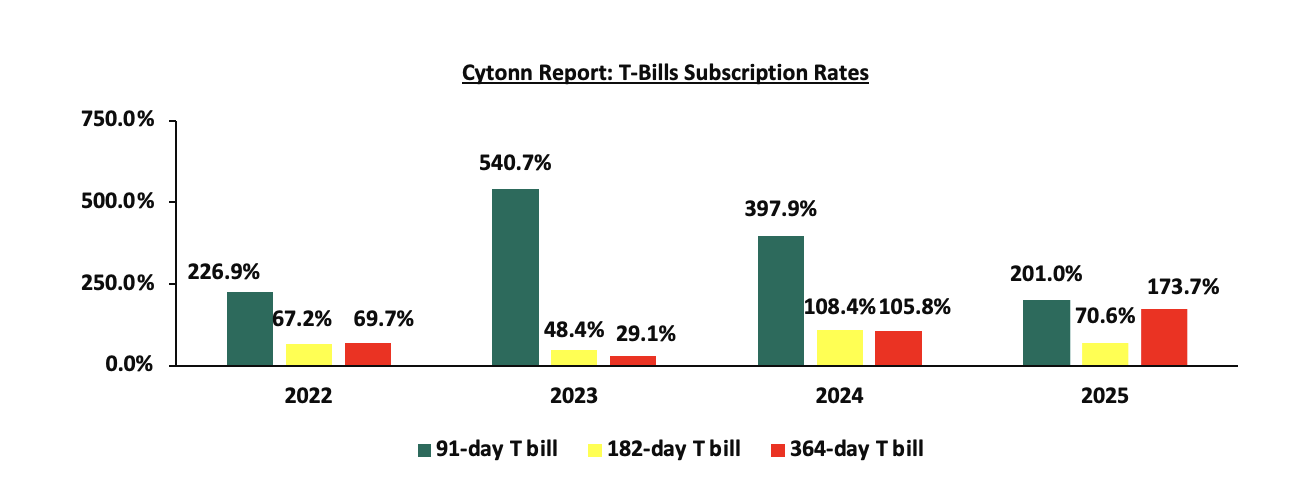

During the year, T-bills were oversubscribed, with the overall subscription rate coming in at 135.6%, down from 153.3% in FY’2024. Investors’ preference for the 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 423.5 bn against the offered Kshs 208.0 bn, translating to an oversubscription rate of 203.6%, albeit lower than the oversubscription rate of 399.7% recorded in FY’2024. Overall subscription rates for the 364-day paper came in at 175.0% higher than the 103.0% recorded in FY’2024 while that of the 182-day papers came in 69.1%, lower than the 104.9%, recorded in FY’2024. The average yields on the 364-day, 182-day, and 91-day papers were on a downward trajectory with the 182-day yields decreasing the most by 7.2% points to 8.6%, from 15.7% in 2024, while the 91-day and 364-day decreased by 6.9% points and 6.1% points bps to 8.3% and 10.0% in 2025, from 15.2% and 16.0% in 2024, respectively. Additionally, on y/y basis, the yields on the government papers registered significant decline in 2024 with the 182-day paper decreasing the most by 222.2 bps to close the year at 7.8% from the 10.0% recorded at the close of FY’2024, while the yields on the 364-day and 91-day decreased by 219.9 bps and 216.7 bps to close the year at 9.2% and 7.7%, from the 11.4% and 9.9%, respectively, recorded at the end of FY’2024. The year-on-year decline in yields is primarily driven by investors perceiving lower risks due to eased inflation, currency appreciation, and improved liquidity positions. As a result, there is less demand for higher returns to compensate for potential losses. The average acceptance rate during the period came in at 88.7%, higher than the 77.3% recorded in FY’2024, with the government accepting a total of Kshs 1,501.8 bn out of the Kshs 1,692.7 bn worth of bids received. Notably, the decline in the government papers yields continued in December 2025, with the yields on the 91-day paper decreasing by 2.4 bps, compared to 8.4 bps decline that was recorded in November 2025, as the government manages the borrowing costs amid budgetary pressures;

Primary T-bond auctions in 2025 were generally oversubscribed, with bonds receiving bids worth Kshs 1,691.7 bn against the offered Kshs 755.0 bn, translating to an oversubscription rate of 224.1%, higher than the oversubscription rate of 171.1% recorded in 2024. The government accepted Kshs 1,109.3 bn of the Kshs 1,691.7 bn worth of bids received, translating to an acceptance rate of 65.6%;

During the week, T-bills were oversubscribed for the first time in three weeks, with the overall subscription rate coming in at 108.0%, higher than the subscription rate of 22.5% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 6.3 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 158.2%, significantly higher than the subscription rate of 60.4%, recorded the previous week. The subscription rate for the 182-day paper increased to 112.9% from the 7.1% recorded the previous week, while that of the 364-day papers increased to 83.0% from 22.8% recorded the previous week. The government accepted a total of Kshs 25.91 bn worth of bids out of Kshs 25.92 bn bids received, translating to an acceptance rate of 99.97%. The yields on the government papers showed mixed performance with the yield on the 182-day paper remaining unchanged at the 7.8% recorded the previous week, while the yield on the 91-day paper increased by 0.1 bps to remain relatively unchanged at the 7.7% recorded the previous week. The yield on the 364-day paper decreased by 0.1 bps to remain relatively unchanged at the 9.2% recorded the previous week;

Equities

During the year, the Kenyan equities market was on an upward trajectory, with NSE 20 gaining the most by 52.5%, while NASI, NSE 10 and NSE 25 gained by 48.9%, 48.0% and 47.4% respectively. The equities market performance was driven by gains recorded by large-cap stocks such as DTBK, Safaricom, NCBA, KCB, EABL, Stanbic, Equity, Co-operative, ABSA, BAT and SCBK of 71.5%, 64.8%, 64.7%, 55.1%, 49.9%, 41.5%, 39.1%, 37.2% 31.0%, 22.0% and 4.2% respectively. The performance was, however, marginally weighed down by losses by large-cap stocks such Bamburi of 1.8%;

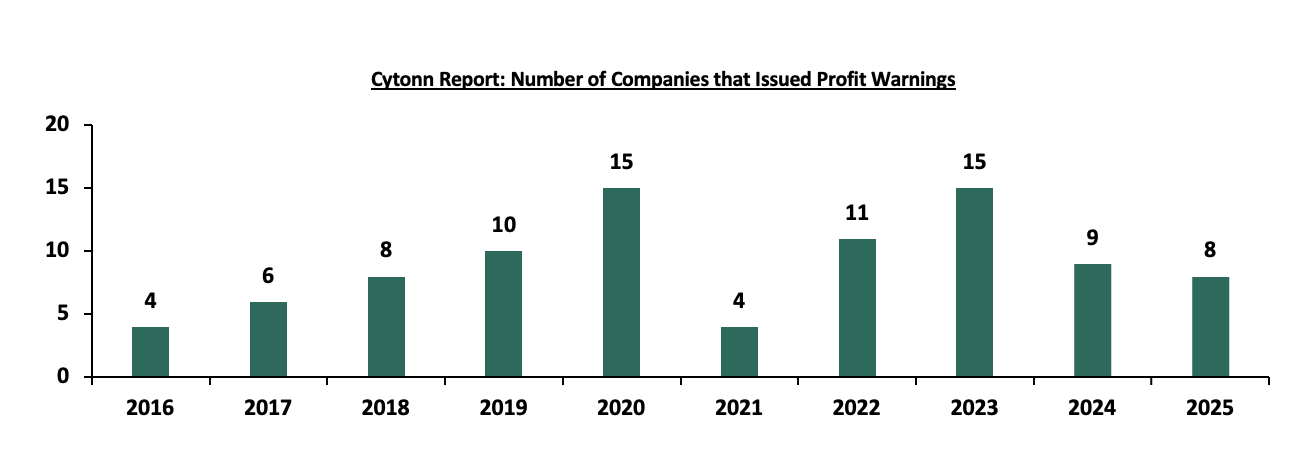

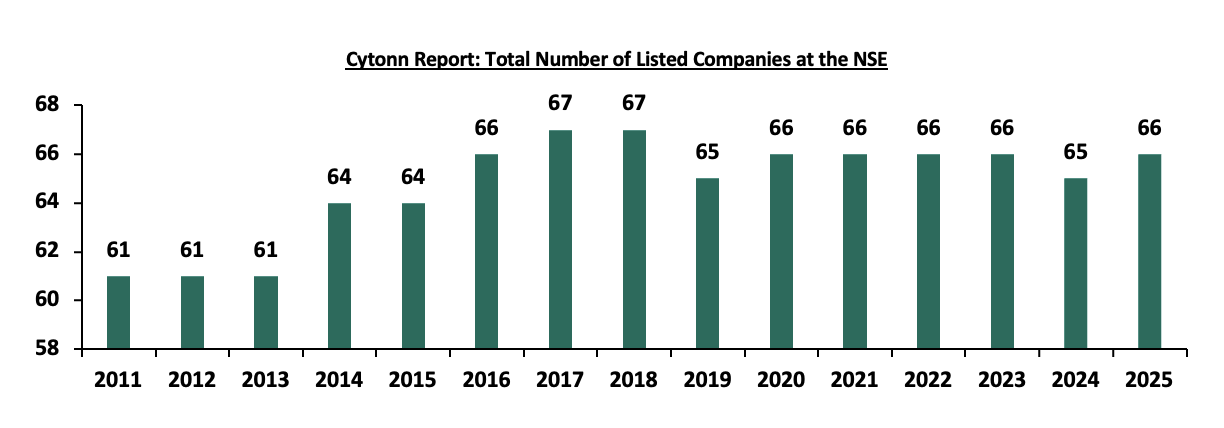

In the banking sector, the Kenya listed banks recorded a weighted growth in the core Earnings Per Share of 7.6% in Q3’2025, compared to a weighted growth of 24.6% recorded in Q3’2024, while in the Insurance sector, the listed insurers recorded a weighted decline in core earnings per share of 6.6% in H1’2025, compared to the weighted growth of 39.6%, in H1’2024. During the year, the Nairobi Securities Exchange (NSE) welcomed two notable new listings that broadened investment options and deepened market participation, Shri Krishana Overseas Ltd (SKL) was listed on 24th July 2025 on the NSE’s Small and Medium Enterprises segment, marking the first new equity listing in five years and offering 50.5 mn shares by introduction to public investors and the Satrix MSCI World Feeder ETF was listed on 16th July 2025, becoming Kenya’s first equity based exchange traded fund on the NSE and providing local investors with accessible exposure to over 1,300 global large and mid cap companies in developed markets. The NSE also suspended Bamburi Cement, East African Cables and Trans- Century bringing the total suspended companies in the NSE to 6 including are Mumias Sugar Company, ARM Cement, and Deacons East Africa bringing the total companies trading in the NSE to 66 in 2025During the year, 8 companies issued profit warnings, as compared to 9 companies in 2024, and 15 companies in 2023 an indication that the operating environment became slightly better in 2025 compared to the previous years. Some of the companies that issued profit warnings include Centum Plc, Standard Chartered, Kenya Airways and Williamson Tea Kenya;

During the year, the Nairobi Securities Exchange (NSE) launched the NSE Banking Sector Share Index (NSE BSI) on 1st October 2025 to track the performance of all listed commercial banks in Kenya. This index provides investors with a transparent benchmark to measure the performance of banking stocks and serves as a basis for structured products and investment strategies;

During the year, Sanlam Kenya Plc executed a rights issue, raising additional capital to strengthen its balance sheet and support growth initiatives, while the East Africa Equity (EAE) 20 Share Index was launched, providing a regional benchmark that tracks 20 leading companies by liquidity and free-float, enhancing market transparency and offering investors a robust tool for portfolio management;

During the year, major consolidation and strategic divestments continued to shape the market, highlighted by Diageo Plc agreeing to sell its 65.0% stake in East African Breweries Ltd (EABL) to Japan’s Asahi Group Holdings for about USD 2.3 bn, marking one of the largest deals involving a Kenyan-listed company and aligning with Diageo’s strategy to reduce non-core assets while securing long-term brand licensing arrangements. Vodafone Kenya also announced plans to acquire an additional 15.0% stake in Safaricom Plc from the Government of Kenya for USD 1.6 bn, which would increase Vodafone’s total holding to 55.0%, with the government retaining 20.0% and the public 25.0%. This move reflects ongoing foreign investment and ownership restructuring in key Kenyan blue-chips;

Additionally, during the year, Kalahari Cement Ltd announced plans to acquire a 29.2% stake in East African Portland Cement Plc (EAPC) for Kshs 27.30 per share, positioning the deal as a strategic, long-term investment to support EAPC’s recovery, pending regulatory approvals;

Real Estate

In 2025, the general Real Estate sector continued to witness considerable growth in activity in terms of property transactions and development activities. Consequently, the sector’s activity contribution to Gross Domestic Product (GDP) grew by 5.5% to Kshs 364.6 bn in Q2’2025, from Kshs 339.2 bn recorded during the same period in 2024. In addition, the sector contributed 8.1% to the country’s GDP, to remain relatively unchanged from the 8.1% recorded in Q1’2025. Cumulatively, the Real Estate and Construction sectors contributed 15.3% to GDP, 3.8% points decrease from 19.1% in Q2’2024, attributable to decline in construction contribution to GDP by 3.7% points, to 5.0% in Q2’2025, from 8.7% recorded in Q2’2024;

The NMA residential sector recorded a marginal increase in performance, with the average total returns to investors coming in at 6.6%, a 0.8%-point increase from 5.8% recorded in FY’2024. The performance was attributed to an increase in the residential average y/y price appreciation which came in at 0.8% in FY’2025, 0.4%-points higher than the 0.4% appreciation recorded in FY’2024, driven by increased property transactions during the year. On the other hand, the average rental yield came in at 5.9% in FY’2025, recording a 0.5%-points increase from the 5.4% rental yield recorded in FY’2024. This was driven by an increase in the average rent per SQM by 9.7% to Kshs 622, from Kshs 567 recorded in FY’2024;

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 27.4 and Kshs 23.2 per unit, respectively, as per the last updated data on 5th December 2025. The performance represented a 33.4% and 14.5% gain for the D-REIT and I-REIT, respectively, from the Kshs s 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 5th December 2025, representing a 45.0% loss from the Kshs 20.0 inception price;

Investment Updates:

-

Weekly Rates: Cytonn Money Market Fund closed the week at a yield of 12.0% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

-

We continue to offer Wealth Management Training every Tuesday, from 7:00 pm to 8:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

-

If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

-

Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

-

Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Hospitality Updates:

-

We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Global Economic Growth:

According to the World Bank's June 2025 Global Economic Prospects report, the global economy is projected to grow at 2.3% in 2025, lower than the 2.8% growth recorded in 2024. This forecast marks a significant downward revision from earlier projection in January of 2.7%, reflecting anticipated economic downturn, particularly due to rising international trade disputes and policy uncertainties. The World Bank’s growth projection of 2.3% is 0.9% points lower than the IMF’s October 2025 World Economic Outlook forecast of 3.2%, which was also revised from the July 2025 projection of 3.0%. In their last Global Economic Prospects Report in June 2025, the World Bank revised their global growth forecasts downward due to weakening global trade, largely driven by rising U.S. tariffs and the resulting trade tensions, which disrupted global supply chains and slowed cross-border economic activity. Notably, advanced economies are expected to record a 1.2% growth in 2025, down from the 1.7% expansion recorded in 2024. Additionally, emerging markets and developing economies are projected to expand by 3.8% in 2025, down from the 4.2% expansion recorded in 2024. On the other hand, the IMF revised their projection upwards to 3.2% from the July 2025 projection of 3.0% due to private sector agility, new trade deals, and restraint from most countries in keeping markets open. However, with U.S. tariffs still high and trade tensions unresolved, the longer‑term impact may intensify as costs shift to consumers and efficiency declines. The expected slowed down in global economic growth in 2025 as compared to 2024 is majorly attributable to;

-

Heightened trade tensions and rising U.S. tariffs - Escalating U.S. tariffs, particularly on imports from China and key trading partners have disrupted global supply chains and increased the cost of goods. This has led to the slowdown in international trade volumes and weakened export-driven growth in the emerging markets and developing economies. However, if the major economies settle their trade disputes, it could ease global economic pressures,

-

Trade policy uncertainty -The global economic landscape in 2025 is clouded by unpredictable trade policies, especially from major economies such as the United States, China and the European Union. Sudden tariff hikes, retaliatory measures and inconsistent enforcement have created a volatile environment for global trade. Developing countries, particularly those reliant on exports are facing reduced trading volumes and lower commodity prices, and,

-

Elevated Global Inflationary Pressures - Inflation remains above central bank targets and pre-pandemic averages, with some advanced economies even experiencing renewed price increases since late 2024. Disinflation over the past six months has largely reflected goods price stabilization, but services prices remain persistently high, keeping core inflation elevated. Trade restrictions have further fueled consumer inflation expectations, reinforcing upward price pressures. As a result, GDP-weighted global inflation is projected to average 2.9% in 2025, still above target levels, which dampens growth prospects.

The global economy is expected to remain subdued in 2025, mainly as a result of rising global trade tensions as well as volatile and unclear trade policies, which are expected to slow down economic growth.

Global Commodities Market Performance:

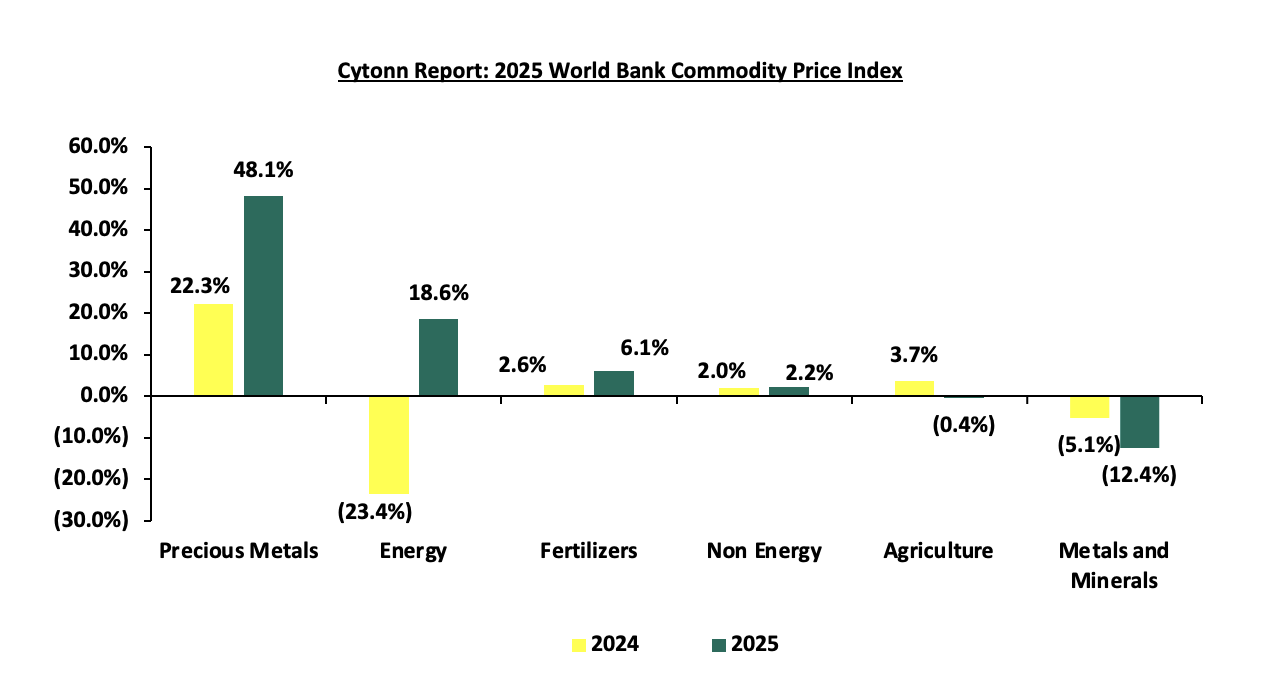

Global commodity prices registered mixed performance in 2025, with prices of precious metals increasing by 48.1%, compared to the 22.3% decrease recorded in 2024, mainly as a result of surging investment demand, fueled by geopolitical tensions, macroeconomic uncertainties, and heightened policy risks. This was reinforced by a weaker U.S. dollar, recent monetary policy easing in the U.S., and a sharp rise in global demand, up 13.0% in the first half of 2025, driven by a 117.0% surge in investment flows, particularly into gold-backed ETFs. Additionally, prices of energy increased by 18.6% compared to the 23.4% decline recorded in 2024 due to heightened trade policy uncertainty in April and were further driven up by geopolitical tensions following the June airstrikes on Iran’s nuclear facilities, which amplified concerns over supply disruptions. The prices of Fertilizers and Non-Energy increased by 6.1% and 2.2% from the 2.6% and 2.0% respectively recorded in 2024, due to increased demand, trade restrictions and production shortfalls. On the other hand, prices of metals and minerals decreased by 12.4% in 2025, compared to the 5.1% decline recorded in 2024, mainly due to strong global metal demand and increased investment in renewable energy and supporting infrastructure projects. Additionally, Agriculture prices declined by 0.4% compared to the 3.7% increase recorded in 2024, attributable to a decline in beverage and raw material prices. The chart below shows a summary of the performance of various commodities.

Source: World Bank

Global Equities Market Performance:

The global stock market was on an upward trajectory in 2025, with most indices in the developed countries recording gains during the period, largely attributable to increased investor sentiments as a result of continued economic recovery following strong corporate earnings, multiple Federal Reserve interest rate cuts, and the easing of severe trade tensions. Notably, GGSECI was the best performer during the period, recording a gain of 149.7% in 2025 largely driven rebounded investor confidence, supported by Ghana’s strengthening macroeconomic fundamentals, appreciation of the Cedi, and lower interest rates;

*The index values are dollarized for ease of comparison

According to the World Bank, the Sub-Saharan economy is projected to grow at a moderate rate of 3.7% in 2025, which is 0.2% points higher than the 3.5% growth recorded in 2024, but a downward revision from the January 2025 projection of 4.1%. The downward revision is mainly due to the rising trade barriers coupled with the weakened global investor confidence. The expected recovery from 2024 is primarily driven by global economic stability, and easing of monetary policy rates in the region, which is expected to boost private consumption and investment. However, most countries face the risk of increased inflation due to increased food prices resulting from drought, prompting them to increase or hold off on further easing of the rates. Additionally, due to their relatively low trade exposure to the United States, Sub-Saharan African countries are well-positioned to weather the impact of higher US tariffs. Nevertheless, the risk of debt distress remains high with the region’s public debt to GDP ratio expected to remain high at 58.0% in 2025, with more than half of countries facing unsustainable debt burdens. Public debt is expected to remain high due to increased debt servicing costs as a result of high interest rates in developed economies and a reduction in donor support. The growth in the region’s economic growth is attributable to;

-

Easing of Monetary Policy Rates - Most Sub-Saharan African countries including Kenya, South Africa and Ghana gradually eased the monetary policy interest rates supported by declining inflation across the region. The reduction in borrowing costs enhanced household purchasing power, while simultaneously stimulating private sector activity, driving business investment, and reinforcing overall economic momentum,

-

Declining Inflation - Consumer price inflation has steadily declined across much of Sub-Saharan Africa, with the number of countries achieving single-digit inflation rising from 27 in 2022 to 37 in 2025. Nearly 60.0% of the region experienced a slowdown in inflation in 2025 compared to the previous year, supported by favorable commodity prices and more stable exchange rates, which together have created a more predictable and growth-friendly macroeconomic environment and,

-

Narrowed Primary Deficits - Primary fiscal balances strengthened during the year due to ongoing consolidation measures, supporting greater stability in public finances despite existing interest rate obligations,

Currency Performance

In 2025, most of the select Sub-Saharan currencies appreciated against the US Dollar, mainly attributable to primarily due to the respective central bank efforts, increased foreign currency inflows and debt-restructuring and policy reforms which have improved forex reserves. Foreign currency inflows supported currency appreciation by boosting foreign exchange reserves, increasing dollar supply, and strengthening market confidence in the domestic currency’s stability. The table below shows the performance of select African currencies against the USD;

|

Cytonn Report: Select Sub-Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Dec-23 |

Dec-24 |

Dec-25 |

2024 y/y change (%) |

2025 y/y change (%) |

|

Ghanaian Cedi |

11.9 |

14.7 |

10.9 |

(23.7%) |

25.7% |

|

Zambian Kwacha |

25.7 |

27.8 |

22.2 |

(8.4%) |

20.1% |

|

South African Rand |

18.3 |

18.7 |

16.6 |

(2.3%) |

11.3% |

|

Botswana Pula |

13.4 |

13.9 |

13.0 |

(3.9%) |

6.4% |

|

Nigerian Naira |

899.4 |

1,535.3 |

1,456.9 |

(70.7%) |

5.1% |

|

Mauritius Rupee |

44.5 |

47.5 |

46.1 |

(6.7%) |

2.9% |

|

Ugandan Shilling |

3,815.0 |

3,670.3 |

3,619.7 |

3.8% |

1.4% |

|

Malawian kwacha |

1,683.4 |

1,734.0 |

1,716.0 |

(3.0%) |

1.0% |

|

Kenyan Shilling |

156.5 |

129.3 |

129.0 |

17.4% |

0.2% |

|

Tanzanian Shilling |

2,540.0 |

2,394.8 |

2,447.5 |

5.7% |

(2.2%) |

Key take outs from the table include:

-

The Ghanaian Cedi appreciated the most by 25.7% in 2025 to close at GHS 10.9 against the US Dollar, compared to GHS 14.7 recorded in 2024, driven rising global gold prices and the weakness of the U.S. dollar. The central bank’s increased bullion purchases, the establishment of GoldBod to formalize small-scale gold output, and stronger reserves boosted confidence in the currency, while fiscal discipline following debt restructuring reduced dollar demand,

-

The Tanzanian shilling was the worst performer during the year, depreciating by 2.2% against the dollar to close the year at TSh 2,447.5 from TSh 2,394.8 in 2024, attributable to the sustained import demand and foreign currency shortages which exerted downward pressure on its value, and,

-

Notably, the Kenyan Shilling appreciated by 0.2% against the dollar, closing the year at Kshs 129.0 compared from Kshs 129.3 in 2024, attributable to stronger forex inflows from diaspora remittances and tourism coupled with improved foreign reserves which amounted to USD 12.4 bn as of December 2025.

African Eurobonds:

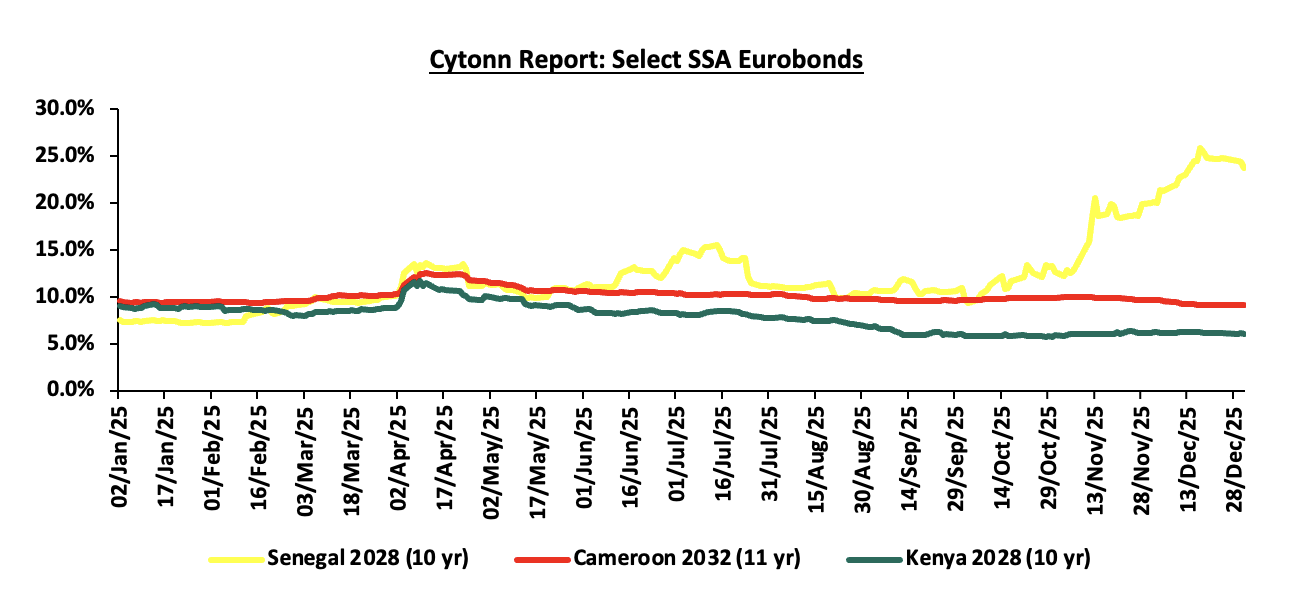

Africa’s appetite for foreign-denominated debt has increased in recent times with the issuers in 2025 being being Ivory Coast and Benin raising a total of USD 1.8 bn and USD 0.5 bn respectively in March 2025 and January 2025 respectively. In February 2025, Kenya issued a new USD 1.5 bn 11-year Eurobond with a coupon rate of 9.5% to facilitate the buyback of 7-year tenor USD 900.0 mn Eurobond notes issued in 2019, with that was set to mature in May 2027. Additionally, in October 2025, Kenya issued a USD 1.5 bn Eurobond in two parts, that is, a 7-year loan at an interest rate of 7.9% and a 12-year loan at 8.8%. The proceeds were used primarily to repurchase Kenya’s outstanding USD 1.0 bn 7.25% 2028 notes, with the remaining funds being allocated toward budgetary support and external debt refinancing. In October, Angola issued a dual-tranche Eurobond comprising a USD 1.0 billion 5‑year note with a 9.25% coupon and a USD 750 million 10‑year note carrying a 9.78% coupon. Notably, all the bonds were oversubscribed with the high support being driven by the yield hungry investors and also the outlook of positive recovery in the regional economies.

The Yields of the Kenya’s 10-year Eurobond maturing in 2028 decreased by 3.0% points to 6.0% as at the end of December 2025 from 9.1% in at the beginning of the year. Similarly, the yields for Cameroon’s 11-year maturing in 2032 decreased by 0.4% points to 9.2% from 9.6% recorded at the beginning of the year. On the other hand, the yields for Senegal’s 10-year Eurobond increased by 16.3% points to 23.8% from 7.5% recorded at the beginning of the year. Senegal’s Eurobond yields spiked in 2025 after an audit revealed USD 11.0 bn in hidden debt, significantly increasing the country’s debt-to-GDP ratio and heightening fears of default. The fiscal instability, revenue shortfalls, and subsequent sovereign credit rating downgrades by S&P and Moody’s to B- from B with a negative outlook led investors to demand higher yields to compensate for the elevated risk. Below is a graph showing the Eurobond secondary market performance of select Eurobonds issued by the respective countries.

Equities Market Performance:

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in 2025, with the Ghana Stock Exchange Composite Index (GGSECI) being best performing market gaining by 149.7% in 2025 largely driven by gains in the large-cap stocks in the banking and telecommunication sectors following improved earnings during the period, supported by appreciation of the Ghana Cedi and easing inflation. Notably, Rwanda All Share Index declined by 5.4% in 2025, due to the depreciation of the Rwandan Franc against the dollar having depreciated by 5.1% in 2025 which has resulted to reduced foreign exchange reserves which affected market stability coupled with the liquidity constraints in the market. Below is a summary of the performance of the key SSA indices:

|

Cytonn Report: Equities Market Performance |

||||||

|

Country |

Index |

Dec-23 |

Dec-24 |

Dec-25 |

2024 YTD change (%) |

2025 YTD change (%) |

|

Ghana |

GSECI |

254.5 |

330.7 |

804.6 |

26.9% |

149.7% |

|

Zambia |

LASILZ |

420.6 |

577.1 |

1,168.2 |

26.7% |

101.8% |

|

Nigeria |

NGEASI |

84.9 |

67.1 |

106.8 |

(20.9%) |

59.2% |

|

South Africa |

JALSH |

4137.9 |

4494.3 |

6,978.7 |

8.9% |

55.0% |

|

Kenya |

NASI |

0.6 |

1.0 |

1.4 |

61.8% |

49.2% |

|

Uganda |

USEASI |

0.2 |

0.3 |

0.5 |

42.2% |

42.3% |

|

Tanzania |

DARSDEI |

0.7 |

0.9 |

1.1 |

22.4% |

32.0% |

|

Rwanda |

RSEASI |

0.1 |

0.1 |

0.1 |

(6.3%) |

(5.4%) |

|

*The index values are dollarized for ease of comparison |

||||||

The tough macroeconomic environment experienced globally is expected to continue weighing down Sub-Saharan Africa’s growth prospects in 2025. As such, the region’s GDP growth rate, though projected at a moderate 3.7%, remains subdued relative to its potential, in line with the broader slowdown in the global economy. Elevated inflationary pressures, persistent debt sustainability concerns, and fiscal vulnerabilities are expected to remain key challenges, further compounded by volatile commodity prices and heightened trade policy uncertainty. Additionally, while select currencies such as the Ghanaian Cedi and Zambian Kwacha registered strong appreciations in 2025, others such as the Tanzanian Shilling weakened, underscoring the uneven resilience of regional economies. The continued reliance on external borrowing, coupled with rising debt servicing costs, is expected to increase perceived risks in the region, thereby dampening investor confidence. Nevertheless, easing monetary policy rates, declining inflation in several economies, and improved foreign exchange reserves provide cautious optimism that targeted reforms and prudent fiscal management could gradually restore stability and support sustainable growth in the medium term.

Economic Growth:

According to the Kenya National Bureau of Statistics (KNBS) Q2’2025 Quarterly Gross Domestic Product Report, the Kenyan economy recorded a 5.0% growth in Q2’20250.4% points higher from the 4.6% growth rate recorded in Q2’2024. The main contributor to Kenyan GDP remains the Agriculture, Fishing and Forestry sector which grew by 4.4% in Q2’2025, lower than the 4.5% expansion recorded in Q2’2024. All sectors in Q2’2025 recorded positive growths, with varying magnitudes across activities. Most sectors recorded contraction in growth rates compared to Q2’2024 with Accommodation & Food Services, Financial Services Indirectly Measured and Other services recording growth rate declines of 27.2%, 8.9% and 3.4% points to 7.8%, 1.4% and 1.4% from 35.0%, 10.3% and 4.8% respectively. Other sectors recorded an expansion in growth rates, from what was recorded in Q2’2024, with Mining and Quarrying, Construction and Electricity and Water Supply recording the highest growths in rates of 20.8%, 9.4% and 4.5% points, to 15.3%, 5.7% and 5.7% from (5.5%), (3.7%) and 1.2% respectively. Notably, the overall economic performance highlighted modest growth despite a slowdown in several key sectors, reflecting the mixed performance across industries amid a challenging operating environment. The Kenyan Economy is projected to grow at an average of 5.0% in 2025 according to various organizations as shown below:

|

Cytonn Report: Kenya 2025 Growth Projections |

||

|

No. |

Organization |

2025 GDP Projections |

|

1 |

International Monetary Fund |

4.8% |

|

2 |

National Treasury |

5.3% |

|

3 |

World Bank |

4.5% |

|

4 |

Fitch Solutions |

5.1% |

|

5 |

Cytonn Investments Management PLC |

5.4% |

|

Average |

5.0% |

|

Source: Cytonn Research

In 2025, the Kenyan economy is projected to grow at an average of 5.0%, up from 4.7% in 2024. The faster expected growth is supported by easing monetary policy, accommodative financial conditions, and a rebound in key sectors, particularly agriculture which has benefited from favorable weather conditions after previous droughts. The economic environment has been bolstered by several positive macroeconomic indicators, including inflation within the Central Bank's target range, a stable exchange rate, and foreign exchange reserves at record highs. The services sector, including tourism and financial services, is also expected to contribute positively to growth. Additionally, improved business sentiment and gradually recovering consumer demand are supporting economic expansion. However, growth remains constrained by fiscal consolidation efforts as the government works to address budget deficits and manage elevated public debt levels, alongside higher taxation measures that have weighed on disposable incomes, private consumption, and overall business activity.

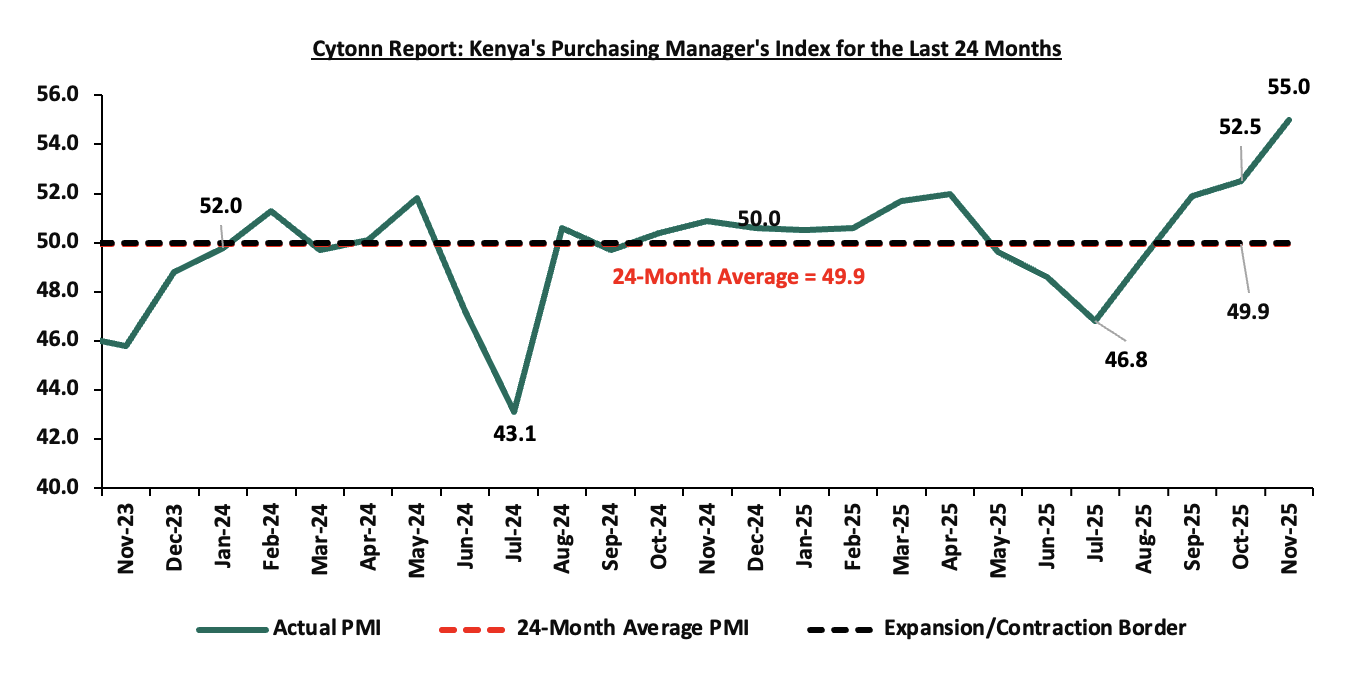

Business conditions in the Kenyan private sector recorded an improvement during the year, with the average Stanbic Bank Monthly Purchasing Managers’ Index (PMI) for the first eleven months averaging at 50.8, 1.3 points higher than the average of 49.5 recorded during a similar period in 2024. Similarly, PMI for the month of November 2025 came in at 55.0, up from 52.5 in October 2025 signaling an uptick of the business environment and for the third consecutive month. The improvement was largely driven by a faster pace of growth in output and new orders, as firms benefited from robust demand, promotional pricing and new product launches. Input prices rose marginally, with inflation rate decreasing marginally by 0.1% points to 4.5% in November 2025 from 4.6% as of October 2025 and improved supply chain efficiency, while output charges increased modestly as firms sought to maintain competitiveness and support sales. The chart below shows the trend of Kenya’s Purchasing Managers index for the last 24 months:

Source: Stanbic PMI

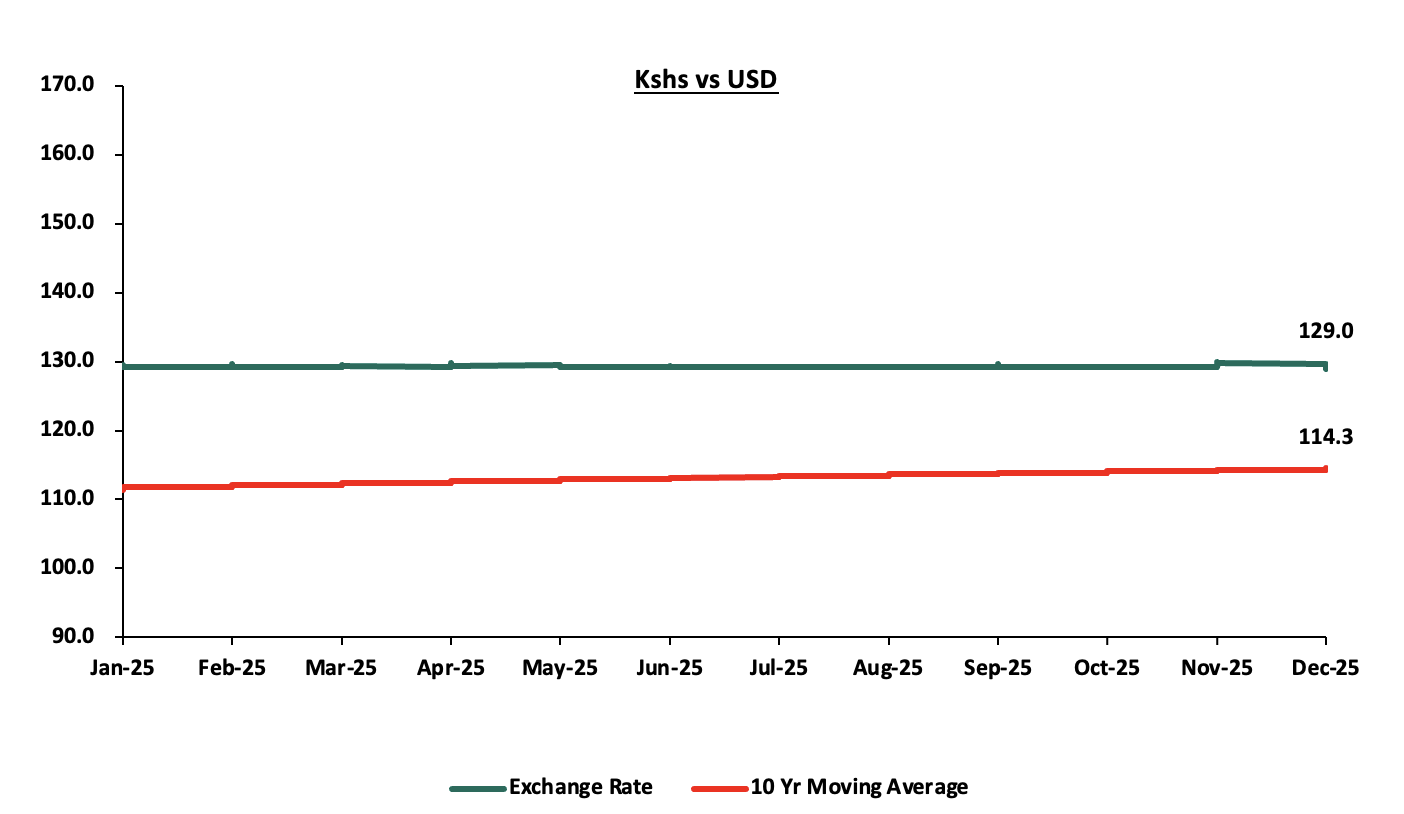

Kenyan Shilling:

The Kenya Shilling appreciated by 0.2% against the US Dollar to close the year at Kshs 129.0 in 2025, compared to Kshs 129.3 at the end of 2024, a significant moderation from the 17.4% appreciation recorded in 2024. The chart below highlights the performance of the Kenyan Shilling against the US Dollar in 2025:

Source: Central Bank of Kenya

The appreciation of the Kenyan shilling in 2025 was driven by;

-

Diaspora remittances standing at a cumulative USD 5,046.6 mn in the twelve months to November 2025, 3.6% higher than the USD 4,872.2 mn recorded over the same period in 2024. This has continued to cushion the shilling against further depreciation. In the November 2025 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 60.6% in the period,

-

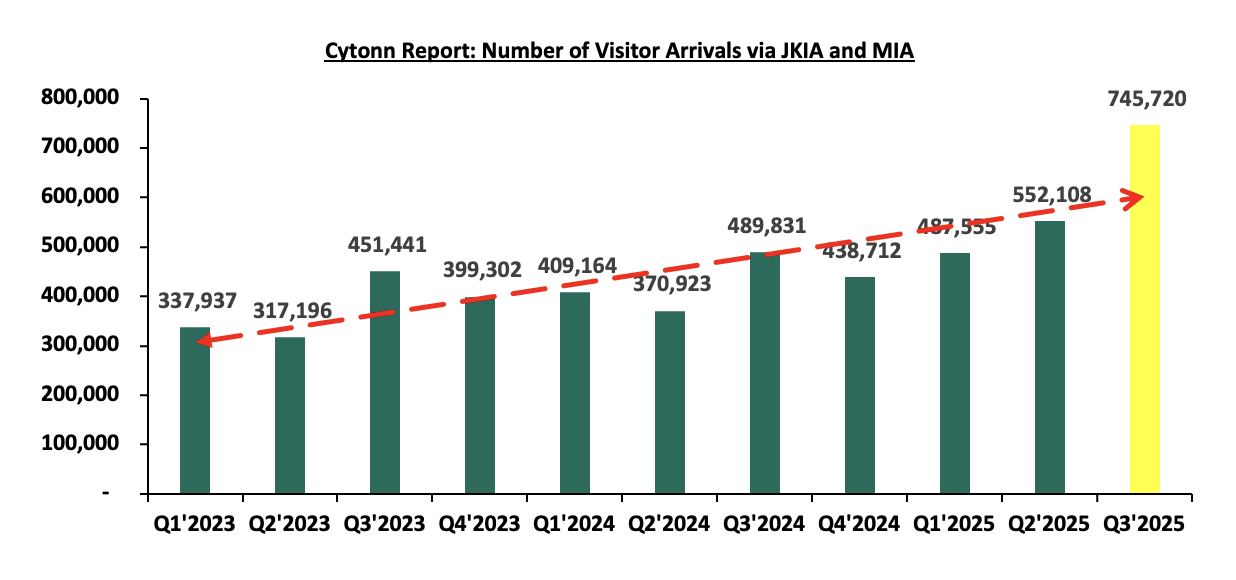

Tourism inflow receipts which are projected by the Ministry of Tourism to reach Ksh 560.0 bn in 2025, up from Ksh 452.2 bn in 2024, representing a 23.9% increase. Furthermore, according to the Kenya National Bureau of Statistics’ Leading Economic Indicators report for September 2025, arrivals through Jomo Kenyatta International Airport (JKIA) and Moi International Airport (MIA) rose by 52.2% to 745,720 visitors in Q3’2025, up from 489,831 visitors in Q3’2024, and,

-

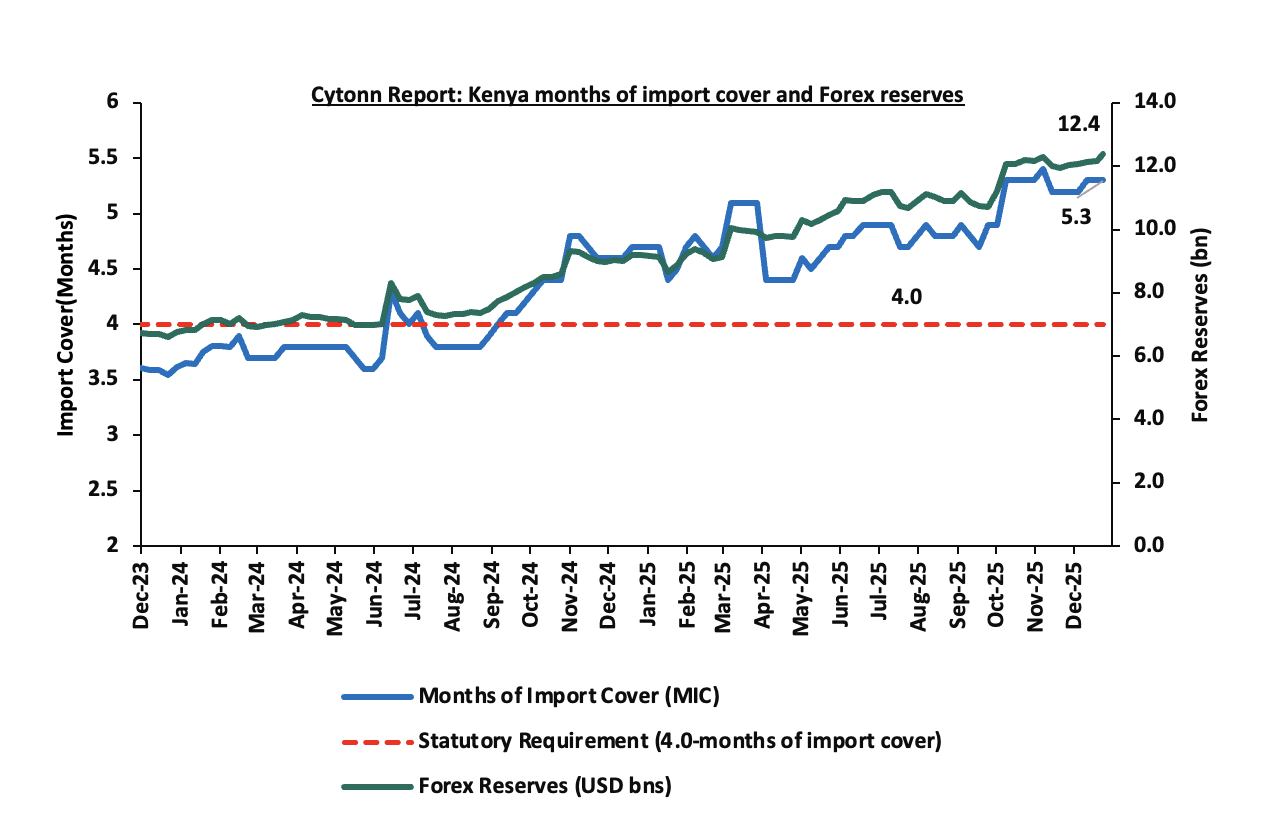

Improved forex reserves currently at USD 12.4 bn (equivalent to 5.3-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.5-months of import cover. The following is a graph showing Kenya months of import cover and forex reserves for the last two years;

Source: Central Bank of Kenya

The shilling was however weighed down by:

-

An ever-present current account deficit which came at 2.9% of GDP in Q2’2025 from 1.7% recorded in a similar period last year. Key to note, the current account deficit widened by 76.6% to Kshs 83.7 bn from Kshs 47.4 bn in Q2’2024. The y/y widening of the current account was brought about by the widening of the merchandise trade account deficit (the value of import goods exceeds the value of export goods, resulting in a negative net foreign investment) by 11.7% to Kshs 348.4 bn in Q2’2025, from Kshs 311.8 bn recorded in Q2’2024 coupled with a 7.5% decline in the services trade balance to a surplus of Kshs 65.5 bn from a surplus of Kshs 70.8 bn in Q2’2024, and,

-

The need for government debt servicing, continues to put pressure on forex reserves given that 59.7% of Kenya’s external debt is US Dollar-denominated as of June 2025.

The Kenyan shilling gained by 0.2% in 2025 to close the year at Kshs 129.0. We expected the shilling to remain within a range of Kshs 134.4 and Kshs 140.5 against the USD by the end of 2025 with a bias towards a 4.6% depreciation by the end of the year. The currency has averaged Kshs 129.3 in 2025, supported in part by the Central Bank of Kenya’s crawling-peg–like approach, which has allowed for gradual and controlled exchange rate adjustments in response to inflation dynamics and external sector conditions. Read on our outlook on Performance of Kenya Currency. Looking ahead, we expect the currency to continue to remain steady in the short term with CBK's interventions and favorable foreign exchange inflows likely to play a crucial role in mitigating excessive volatility.

Inflation:

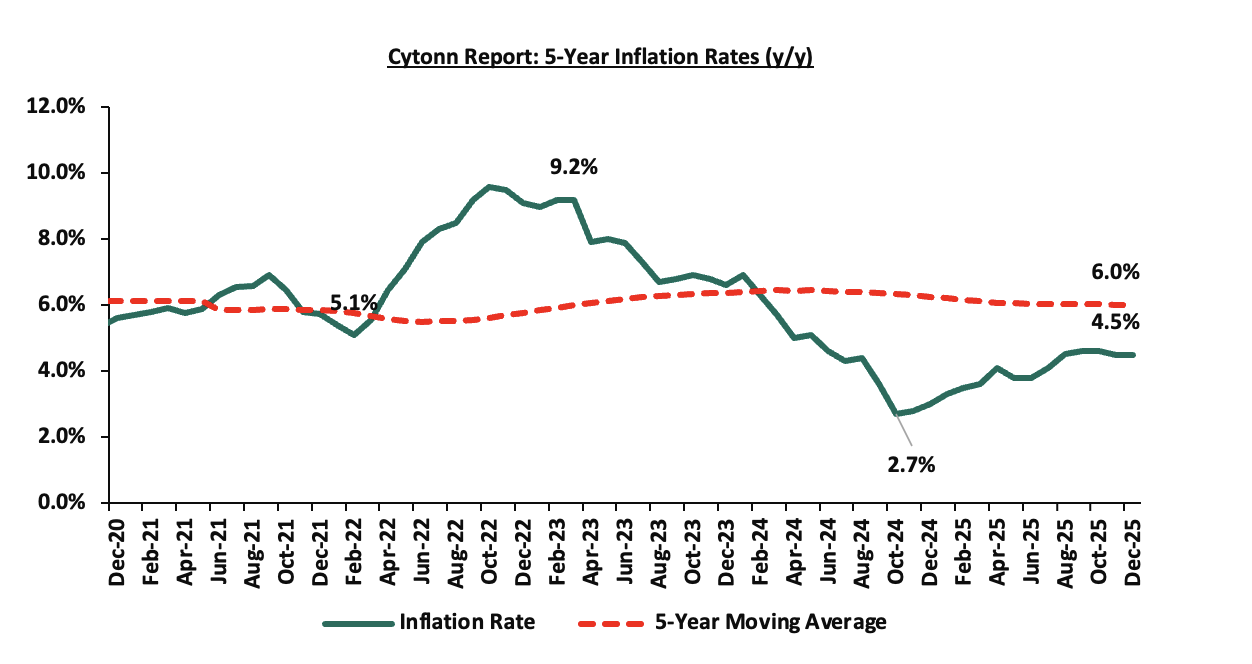

The inflation rate for the year 2025 averaged at 4.1%, compared to 4.5% recorded in 2024. Notably, the y/y inflation in December 2025 remained unchanged from the 4.5% recorded in November 2025. The headline inflation in December 2025 was majorly driven by increases in prices of commodities in the following categories; Food & Non-Alcoholic Beverages, Transport sector and Housing, Water, Electricity, Gas & other fuels by 7.8%, 5.2% and 1.6% respectively. Below is a chart showing the inflation trend for the last five years:

For the last 30 months, Kenya’s inflation has persistently remained within the Central Bank of Kenya (CBK) target range of 2.5% - 7.5%, owing to a stronger Shilling and stable fuel. With the continued easing of monetary policy following the MPC’s observation that its earlier measures had stabilized the Shilling and anchored inflation, the focus has now shifted to lowering borrowing costs, supporting the private sector, and promoting economic growth. As a result, we expect this to exert upward pressure on inflation. The Monetary Policy Committee (MPC) has lowered the Central Bank Rate (CBR) by cumulative of 225.0 bps to 9.00% in December 2025 from 11.25% in December 2024. Going forward, we still expect the inflationary pressures to remain within the CBK’s preferred target range of 2.5% - 7.5%.

December 2025 Inflation

The year-on-year inflation in December 2025 remained unchanged from the 4.5% recorded in November 2025. This was in line with our projection to a range of 4.3% to 4.5%, where our projection was mainly driven by the appreciation of the Kenya Shilling against the USD coupled with the stability of fuel prices. The price increase was primarily driven by a rise in prices of items in the Food and Non-Alcoholic Beverages (7.8 %), Transport (5.2 %), and Housing, Water, Electricity, Gas and other fuels (1.6%) over the one-year period. The month-on-month inflation rate stood at 0.6% in December 2025. The table below summarizes the performance of commodity indices both on a year-on-year and month-on-month basis:

|

Cytonn Report: Major Inflation Changes – December 2025 |

|||

|

Broad Commodity Group |

Price change m/m (December-2025/ November -2025) |

Price change y/y December-2025/December-2024) |

Reason |

|

Food and non- alcoholic beverages |

0.8% |

7.8% |

The m/m increase was mainly driven by the rise in prices of maize flour loose, kale/sukuma wiki, and potatoes by 5.1%, 4.7% and 2.9% respectively. However, the increase was weighed down by a decline in prices of mangoes, sugar and cooking oil of 1.6%, 1.5% and 0.7% respectively |

|

Transport |

1.9% |

5.2% |

The m/m increase was driven by the 5.3% increase in country bus and matatu fares for travel between towns coupled with the 14.4% increase in the prices of international flights due to effect of festive seasons. |

|

Housing, water, electricity, gas and other fuels |

(0.1%) |

1.6% |

The m/m decline was mainly due to a fall in electricity prices, with 50 kWh and 200 kWh decreasing by 2.8% and 2.6% respectively. However, the decline was partially offset by a 0.4% increase in the price of gas/LPG. |

|

Overall Inflation |

0.6% |

4.5% |

The m/m increase was mainly attributable to the 1.9% increase in transport |

In December 2025, overall inflation remained unchanged at 4.5% recorded in November 2025 on a y/y basis, signaling continued moderation in price pressures across major categories. Additionally, the inflation rate remained within the Central Bank of Kenya’s preferred range of 2.5%–7.5% for the thirtieth consecutive month, reflecting sustained macroeconomic stability. The increase was mainly driven by a 7.8% y/y rise in food and non-alcoholic beverage prices, a 5.2% increase in transport costs, and a 1.6% rise in housing, water, electricity, gas and other fuels. On a month-to-month basis, inflation remained modest at 0.6%, indicating relative price stability. Prices for Super Petrol and Diesel remained unchanged at Kshs 184.5 and Kshs 171.5 per litre respectively. Electricity costs eased during the month, with 50 kWh and 200 kWh declining by 2.8% and 2.6%, respectively. Meanwhile, the Kenya Shilling appreciated by 0.6% m/m against the US Dollar, to Kshs 129.0 from Kshs 129.8 recorded at the end of November and a 0.2% year-to-date appreciation to Kshs 129.0 as of 31st December 2025, from the Kshs 129.3 recorded at the beginning of the year.

Going forward, we expect inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a stable currency and stable fuel prices. Additionally, favorable weather conditions will also contribute to stabilizing food prices, further supporting stable inflation rates. The risk, however, lies in the fuel prices which despite their stability still remain elevated compared to historical levels. Additionally, the Monetary Policy Committee cut the Central Bank Rate by 25.0 bps to 9.0% from 9.25% in its December 2025 meeting, with the aim of easing the monetary policy, while maintaining exchange rate stability, and will meet again in February 2026. This cut in the Central Bank Rate is likely to elevate inflationary pressures gradually as consumer spending rises from increased money supply. The committee is expected to adopt a more cautious approach to rate adjustments in the coming meetings in a bid to continue supporting the private sector, while also keeping an eye on the effect on the inflation and exchange rate.

Monetary Policy:

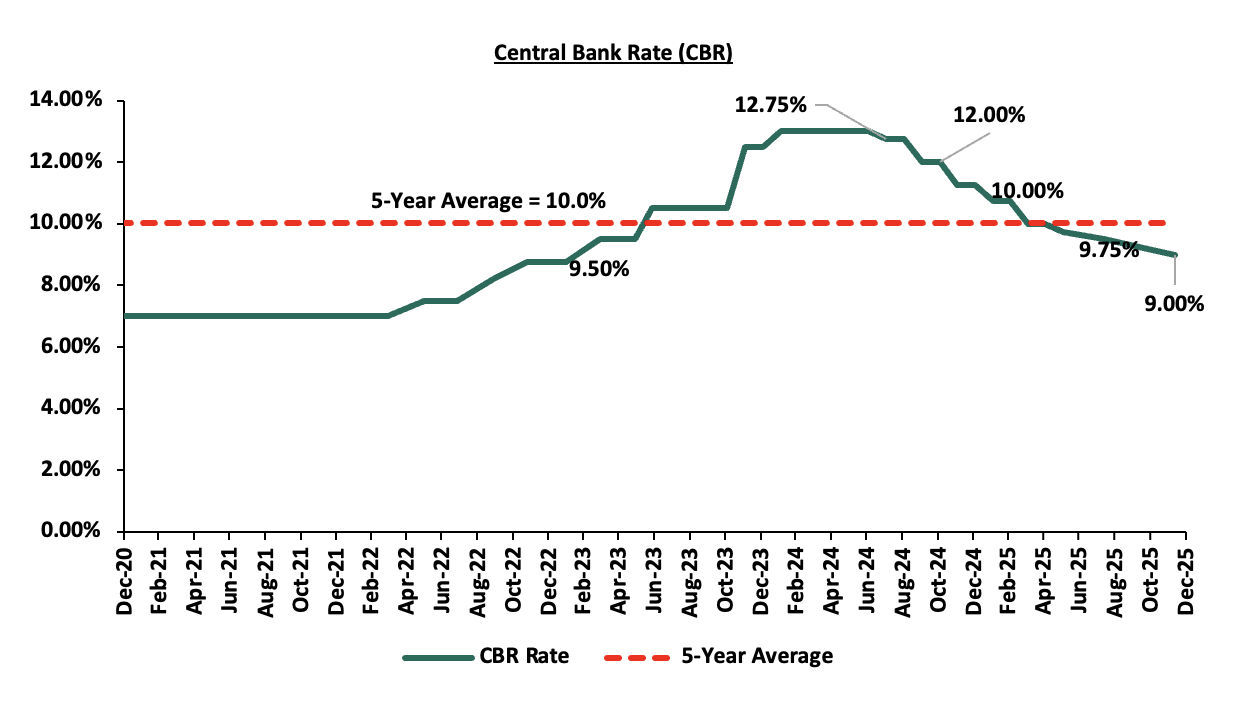

During the year, the Monetary Policy Committee (MPC) met six times and progressively eased monetary policy, lowering the Central Bank Rate (CBR) by a total of 225.0 bps, to 9.00% in December 2025 to 11.25% in December 2025. The reductions were aimed at stabilizing the exchange rate and anchoring inflation expectations, supported by a strengthened and stable currency and inflation remaining within the Central Bank of Kenya’s (CBK) target range of 2.5%–7.5%. In its latest meeting held in December 2025, the MPC lowered the CBR by another 25.0 basis points to 9.00%, in line with our expectations, on the back of accommodative policy trends in major economies, anchored inflationary pressures, and the need to support economic growth through lower financing costs. Overall, the MPC cut the CBR by a cumulative 175 bps from 10.75% in February 2025 to 9.00% in December 2025. We expect the MPC to continue lowering the rates in the short to medium term therefore lowering borrowing costs, leading to increased spending and an uptick in the business environment as well as reduced debt servicing costs for the government, and anchoring private sector credit growth, noting that its previous measures have successfully reduced overall inflation to below the mid-point of the target range of 2.5% - 7.5%, stabilized the exchange rate, and anchored inflationary expectations. The following is a graph highlighting the Central Bank Rate for the last 5 years.

Source: Central Bank of Kenya

2025 Key Highlights:

-

FY’2025/2026 National Budget

On 12th June 2025, the National Treasury presented Kenya’s FY’2025/2026 National Budget to the National Assembly highlighting that the total budget estimates for FY’2025/26 increased by 7.1% to Kshs 4.3 tn from the Kshs 4.0 tn in FY’2024/2025 while the total revenue inclusive of grants increased by 8.0% to Kshs 3.4 tn from the Kshs 3.1 tn in FY’2024/2025. The increase is mainly due to an 6.7% increase in ordinary revenue to Kshs 2.8 tn for FY’2025/2026, from the Kshs 2.6 tn in FY’2024/25. For more information, please read our Budget Review Note.

-

Credit Facilities Extended to Kenya

-

In 2025, Kenya recorded no disbursements from the International Monetary Fund, marking a sharp break from the post-Covid period when IMF support flowed consistently. The Fund terminated Kenya’s 2021 Extended Fund Facility (EFF) and Extended Credit Facility (ECF) programme in March 2025 after the country failed to meet key performance benchmarks, resulting in the loss of Kshs 109.7 bn in expected financing. By the time of termination, Kenya had received USD 2.8 bn of the total USD 3.6 bn expected under the programme. Kenya missed 11 out of 16 programme conditions, including restructuring Kenya Airways, enforcing fiscal consolidation, strengthening revenue mobilisation, and safeguarding the fuel stabilisation fund. Discussions are ongoing for a new IMF programme, with talks expected to resume in early 2026, though disagreements persist around exchange rate management and the classification of securitised debt, issues that may delay fresh funding.

-

Similarly, the World Bank did not disburse any funds to Kenya in 2025, having frozen Kshs 96.7 bn under its Development Policy Operations (DPO) programme due to stalled reforms. While Kenya enacted a Conflict-of-Interest law, the Bank maintains that 11 prior actions, including amendments to the Competition Act, implementation of the Treasury Single Account, e-procurement reforms, and sector-specific regulatory frameworks, remain outstanding. The National Treasury has prioritised unlocking the DPO facility, citing its relatively flexible structure and budgetary support role, with efforts underway to fast-track approval and disbursement. However, as at end-2025, World Bank financing remained on hold, underscoring continued reform slippage and execution risks.

-

-

FY’2024/2025 KRA Revenue Performance

In July 2025, the Kenya Revenue Authority (KRA) released the annual revenue performance for FY’2024/25, highlighting that revenue mobilization for the period grew by a notable 6.8% down from 11.1% growth in the previous financial year, after KRA collected Kshs 2.6 tn compared to Kshs 2.4 tn in the previous financial year. This translates to a performance rate of 100.6% against the target of Kshs 2.6 tn; Please see our Cytonn Monthly – July 2025,

Kenya National Bureau of Statistics released the Q2’2025 Balance of Payment Report, noting that Kenya’s balance of payments position deteriorated significantly by 86.6% in Q2’2025, to a deficit of Kshs 157.0 bn, from a deficit of Kshs 84.1 bn in Q2’2024. The y/y negative performance in BoP was mainly driven by a significant 282.8% increase in financial account deficit to Kshs 136.5 bn from a deficit of Kshs 35.7 bn in Q2’2024. Please see our Cytonn Weekly 43/2025,

-

Current account

Kenya’s current account deficit widened by 76.6% to Kshs 83.7 bn in Q2’2025 from the Kshs 47.4 bn deficit recorded in Q2’2024. The y/y expansion registered was driven by the widening of the merchandise trade account deficit (the value of import goods exceeds the value of export goods, resulting in a negative net foreign investment) by 11.7% to Kshs 348.4 bn in Q2’2025, from Kshs 311.8 bn recorded in Q2’2024, a 59.1% improvement in the secondary trade balance to a surplus of Kshs 43.6 bn from a surplus of Kshs 27.4 bn in Q2’2023, and, the narrowing of the primary income deficit (the earnings that residents of a country receive from their investments abroad and the compensation they receive for providing labour to foreign entities) by 3.1% to Kshs 43.8 bn in Q2’2024, from Kshs 45.2 bn recorded in Q2’2024.

-

Credit Ratings

-

On January 24th 2025, the global ratings agency, Moody’s announced its revision of Kenya’s credit outlook to positive from negative, while maintaining the credit rating at Caa1, on the back of a likelihood of an ease in liquidity risks and improved debt affordability. The improved debt affordability is largely attributable to the reduction in domestic borrowing costs, evident in the sharp decline of yields for short-dated papers. Given the low inflation rates in the country, the stability of the exchange rate, and the ease in the monetary policy stance, domestic borrowing costs are expected to continue decreasing over the short-medium term. Please see our Cytonn Weekly 04/2025.

-

On 25th July 2025, the global ratings agency, Fitch Ratings affirmed Kenya’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at B-, while maintaining the Stable outlook. The affirmation reflects Fitch’s view that Kenya’s medium-term economic growth prospects remain robust, supported by a relatively diversified economy, sustained multilateral and bilateral creditor support, and moderate progress on fiscal consolidation. Please see our Cytonn Monthly- July, and,

-

On 22nd August 2025, S&P Global Ratings raised Kenya’s long-term sovereign credit rating to ‘B’ from ‘B-’, with a stable outlook, while affirming the short-term sovereign credit rating at ‘B’. At the same time, the agency revised Kenya’s transfer and convertibility assessment upward to ‘B+’ from ‘B’, reflecting the country’s improved external liquidity buffers and relatively resilient economic fundamentals compared to peers. This development marks a notable turnaround in Kenya’s sovereign risk profile, coming only a year after the same agency downgraded the country in August 2024 in the wake of fiscal setbacks following the repeal of the Finance Bill 2024. For more information, see our, Cytonn H1'2025 Markets Review. Below is a summary of the credit rating on Kenya by various rating agencies;

|

Cytonn Report: Kenya’s Credit Ratings |

||||||

|

Rating Agency |

Previous Rating |

Previous Outlook |

Current Rating |

Current Outlook |

Meaning |

Date Released |

|

Moody's Rating |

Caa1 |

Negative |

Caa1 |

Positive |

Substantial credit risks |

24th January, 2025 |

|

Fitch Ratings |

B- |

Stable |

B- |

Stable |

Highly Speculative |

25th July 2025 |

|

S&P Global |

B- |

Stable |

B |

Stable |

Extremely high risk, very vulnerable to default |

22rd August 2025 |

Source: Fitch Ratings, S&P Global, Moody’s

2025 Returns by Various Asset Classes:

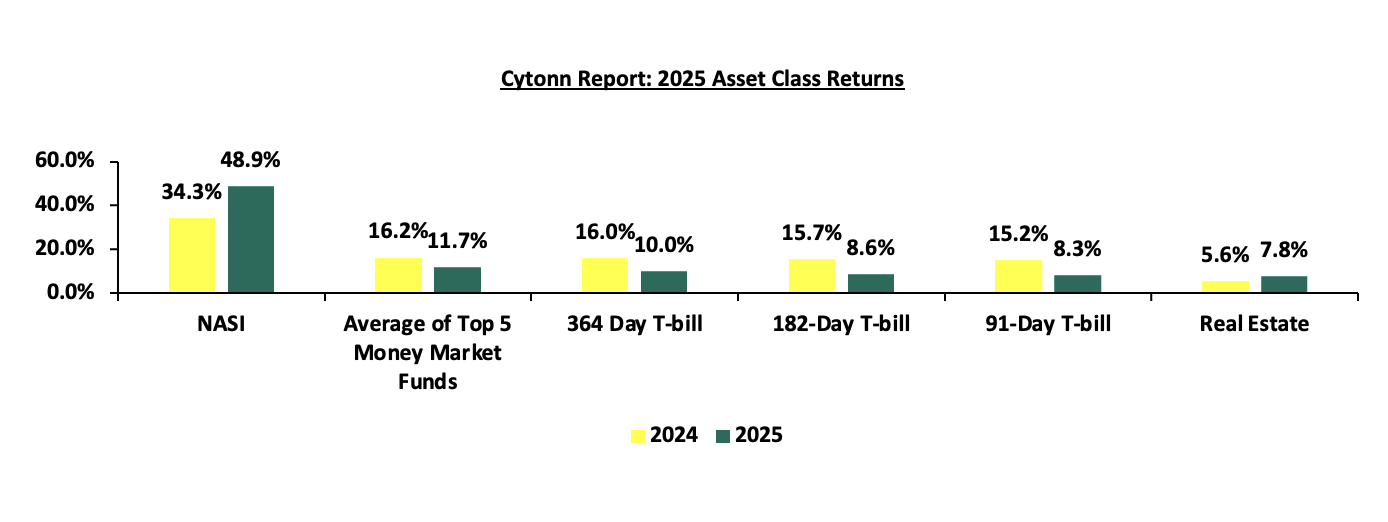

The returns by the various asset classes recorded mixed performances in 2025, in comparison to a similar period last year, with the NASI and real estate, being on upward trajectories. For the equities class, NASI registered a 48.9% gain in 2025, an improvement from the 34.3% gain recorded in 2024, as the average of top 5 MMFs recorded a yield of 11.7%, 4.5% points lower than the 16.2% average recorded in 2024. Additionally, the 364-day, 182-day and 91-day Government papers recorded average yields of 10.0%, 8.6% and 8.3%, respectively, lower than the average yields of 16.0%, 15.7% and 15.2%, respectively recorded in 2024, while the average Real Estate yield increased by 2.2% points to 7.8% in 2025, from 5.6% recorded in 2024. The graph below shows the summary of returns by various asset classes (Average top 5 MMF, Fixed Income, Real Estate and Equities).

The table below shows the macro-economic indicators that we track, indicating our expectations for each variable at the beginning of 2025 versus the experience;

|

Cytonn Report: Macro-Economic & Business Environment Outlook |

||||

|

Macro-Economic Indicators |

2025 Outlook |

Effect |

2025 Experience |

Effect |

|

Government Borrowing |

|

Negative |

|

Negative |

|

Exchange Rate |

|

Neutral |

|

Positive |

|

Interest Rates |

|

Positive |

|

Positive |

|

Inflation |

|

Neutral |

|

Positive |

|

GDP |

|

Neutral |

|

Neutral |

|

Investor Sentiment |

|

Positive |

|

Positive |

|

Security |

|

Negative |

|

Negative |

Since the beginning of the year, notable improvements were observed in two of the seven key macroeconomic metrics tracked, namely the exchange rate and inflation. At the start of the year, interest rates and investor sentiment were assessed as positive, exchange rate, inflation, and GDP (economic growth) were assessed as neutral, while government borrowing and security were assessed as negative. By the end of the year, interest rates, investor sentiment, exchange rate, and inflation were assessed as positive, GDP (economic growth) remained neutral, and government borrowing and security remained negative, indicating that overall macroeconomic performance improved relative to initial expectations. Notably, government borrowing remained negative, reflecting continued fiscal pressures, while economic growth remained neutral, broadly in line with expectations. Interest rates and investor sentiment remained positive throughout the year, supported by easing monetary policy and sustained market confidence, while security conditions remained negative, weighed down by persistent political tensions. In conclusion, macroeconomic fundamentals exhibited mixed but improving performance during the year, with most metrics trending positively. This was underpinned by the Kenyan shilling’s modest appreciation, inflation remaining well within the 2.5%–7.5% target range for the thirtieth consecutive month, and sustained investor confidence. Looking ahead, we expect a modest recovery in 2026, supported by continued GDP growth momentum, a stable exchange rate, and improving business conditions, underpinned by proactive fiscal and monetary policy measures implemented during the year.

T-Bills & T-Bonds Primary Auction:

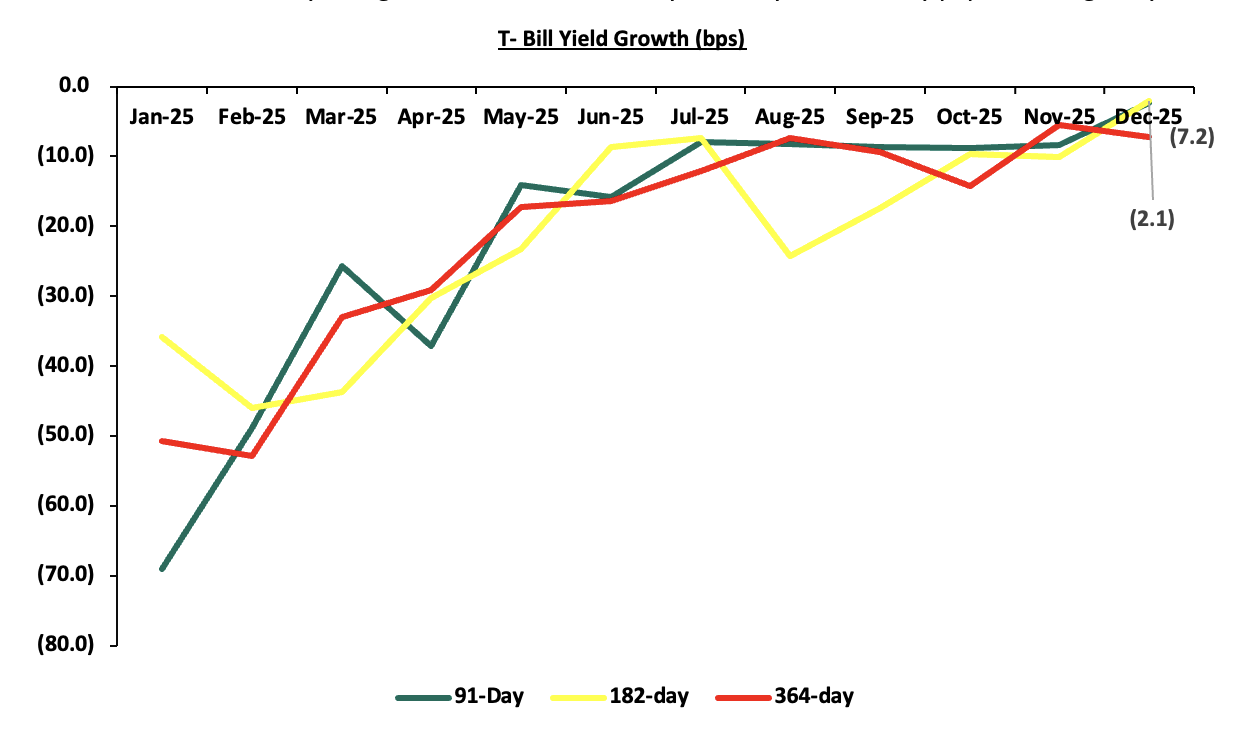

During the year, T-bills were oversubscribed, with the overall subscription rate coming in at 135.6%, down from 153.3% in FY’2024. Investors’ preference for the 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 423.5 bn against the offered Kshs 208.0 bn, translating to an oversubscription rate of 203.6%, albeit lower than the oversubscription rate of 399.7% recorded in FY’2024. Overall subscription rates for the 364-day paper came in at 175.0% higher than the 103.0% recorded in FY’2024 while that of the 182-day papers came in 69.1%, lower than the 104.9%, recorded in FY’2024. The average yields on the 364-day, 182-day, and 91-day papers were on a downward trajectory with the 182-day yields decreasing the most by 7.2% points to 8.6%, from 15.7% in 2024, while the 91-day and 364-day decreased by 6.9% points and 6.1% points bps to 8.3% and 10.0% in 2025, from 15.2% and 16.0% in 2024, respectively. Additionally, on y/y basis, the yields on the government papers registered significant decline in 2024 with the 182-day paper decreasing the most by 222.2 bps to close the year at 7.8% from the 10.0% recorded at the close of FY’2024, while the yields on the 364-day and 91-day decreased by 219.9 bps and 216.7 bps to close the year at 9.2% and 7.7%, from the 11.4% and 9.9%, respectively, recorded at the end of FY’2024. The year-on-year decline in yields is primarily driven by investors perceiving lower risks due to eased inflation, currency appreciation, and improved liquidity positions. As a result, there is less demand for higher returns to compensate for potential losses. The average acceptance rate during the period came in at 88.7%, higher than the 77.3% recorded in FY’2024, with the government accepting a total of Kshs 1,501.8 bn out of the Kshs 1,692.7 bn worth of bids received. Notably, the decline in the government papers yields continued in December 2025, with the yields on the 91-day paper decreasing by 2.4 bps, compared to 8.4 bps decline that was recorded in November 2025, as the government manages the borrowing costs amid budgetary pressures. The chart below shows the yields growth rate for the 91-day, 182-day and 365-day papers during the year.

During the week, T-bills were oversubscribed for the first time in three weeks, with the overall subscription rate coming in at 108.0%, higher than the subscription rate of 22.5% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 6.3 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 158.2%, significantly higher than the subscription rate of 60.4%, recorded the previous week. The subscription rate for the 182-day paper increased to 112.9% from the 7.1% recorded the previous week, while that of the 364-day papers increased to 83.0% from 22.8% recorded the previous week. The government accepted a total of Kshs 25.91 bn worth of bids out of Kshs 25.92 bn bids received, translating to an acceptance rate of 99.97%. The yields on the government papers showed mixed performance with the yield on the 182-day paper remaining unchanged at the 7.8% recorded the previous week, while the yield on the 91-day paper increased by 0.1 bps to remain relatively unchanged at the 7.7% recorded the previous week. The yield on the 364-day paper decreased by 0.1 bps to remain relatively unchanged at the 9.2% recorded the previous week.

The chart below compares the overall average T- bills subscription rates obtained in 2022, 2023, 2024 and 2025;

Primary T-Bond Auctions in FY’2025

Primary T-bond auctions in 2025 were generally oversubscribed, with bonds receiving bids worth Kshs 1,691.7 bn against the offered Kshs 755.0 bn, translating to an oversubscription rate of 224.1%, higher than the oversubscription rate of 171.1% recorded in 2024. The government accepted Kshs 1,109.3 bn of the Kshs 1,691.7 bn worth of bids received, translating to an acceptance rate of 65.6%;

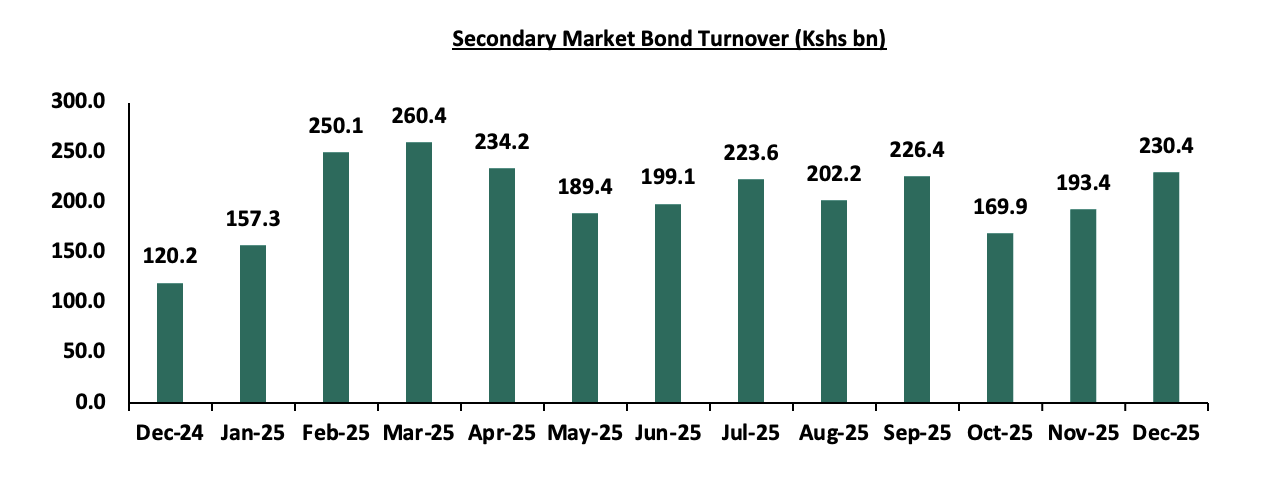

Secondary Bond Market Activity:

The secondary bond turnover increased by 19.2% to Kshs 230.4 bn in December 2025, from Kshs 193.4 bn recorded in November 2025, pointing towards increased activities by commercial banks in the secondary bonds market for the month of December. Similarly, on a year-on-year basis, the bond turnover increased by 91.8% from Kshs 120.2 bn worth of treasury bonds transacted over a similar period last year. The chart below shows the bond turnover over the past 12 months to December 2025;

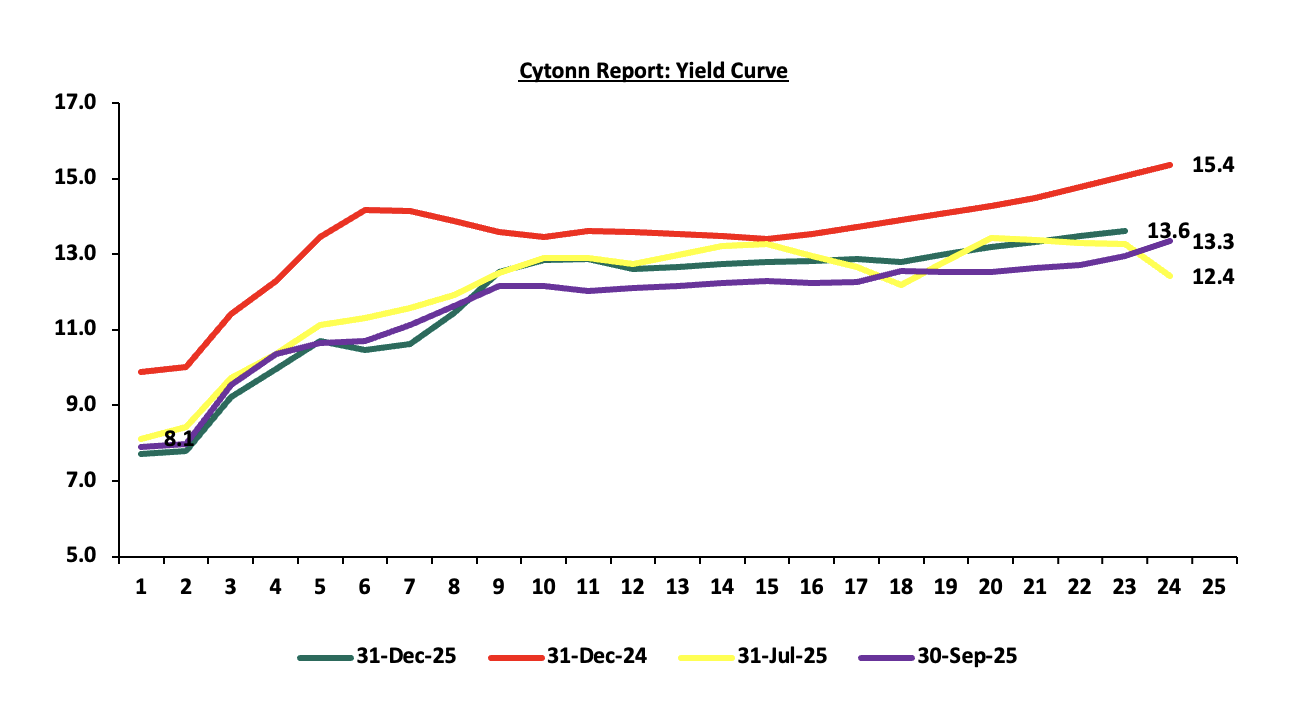

In 2025, the yield curve experienced a downward adjustment compared to 2024, primarily driven by continued effort by the government to reject highly priced bids, local currency stabilization and relatively eased inflation. These factors reduced the need for investors to demand higher yields as compensation for inflation and currency depreciation risks, resulting in an overall decline across the yield curve. Notably, the yield curve has adjusted towards a normal upward sloping curve, with long-term bonds registering highest yields. The chart below is the yield curve movement during the period;

Money Market Performance:

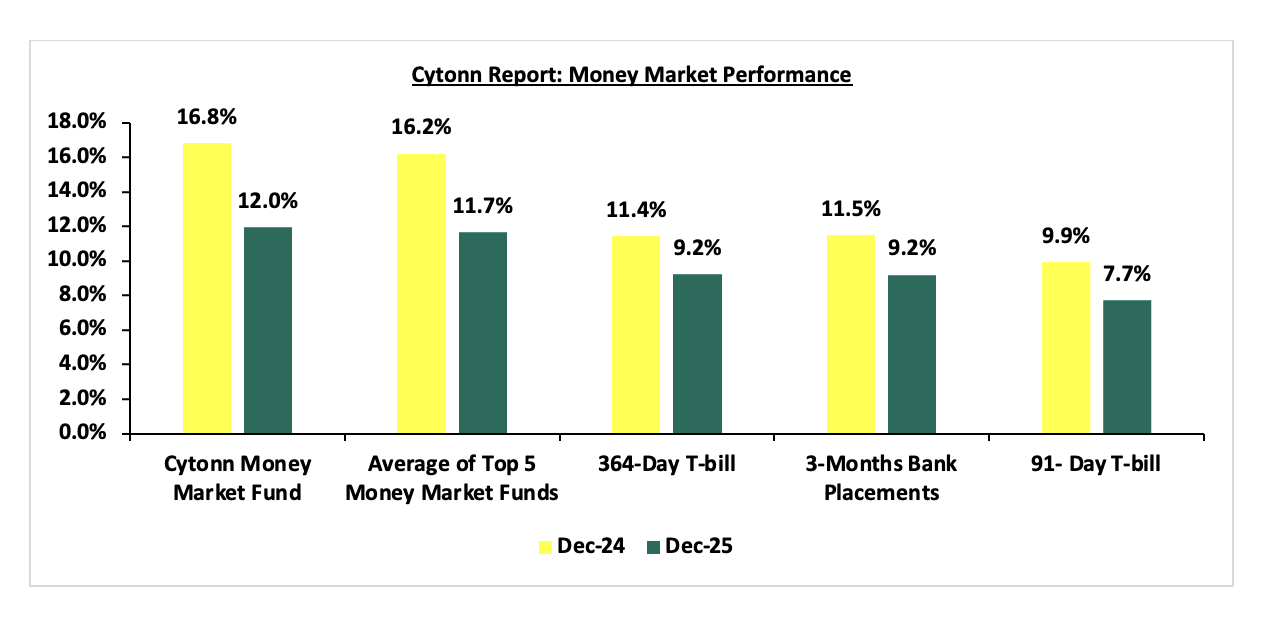

The 3-month bank placements recorded 9.2% at the end of FY’2025, 2.3% points lower than the 11.5% recorded at the end of FY’2024 (based on what we have been offered by various banks). The 364-and 91-day papers both decreased by 2.2% points to close the year at 9.2% and 7.7%, from the 11.4% and 9.9%, respectively, recorded at the end of FY’2024, while the average Top 5 Money Market Funds decreased by 4.5% points to 11.7%, from 16.2% at the end of FY’2024. The yield on the Cytonn Money Market (CMMF) decreased by 4.8% points from 16.8% at the end of FY’2024, to 12.0% recorded at the end of FY’2025.

During the week, 3-month bank placements ended the week at 9.2% (based on what we have been offered by various banks), and yields on the government papers decreased, with the yields on the 364-day and 91-day papers decreased by 0.1 bps to remain relatively unchanged at 7.7% and 9.2% respectively recorded the previous week. The yield on the Cytonn Money Market Fund increased by 5.0 bps to 11.96% from the 11.91% recorded the previous week, while the average yields on the Top 5 Money Market Funds remained unchanged at 11.7% recorded the previous week. The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 1st January 2026:

|

Money Market Fund Yield for Fund Managers as published on 1st January 2026 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Arvocap Money Market Fund |

12.2% |

|

2 |

Cytonn Money Market Fund ( Dial *809# or download Cytonn App) |

12.0% |

|

3 |

Nabo Africa Money Market Fund |

11.8% |

|

4 |

Etica Money Market Fund |

11.4% |

|

5 |

Lofty-Corban Money Market Fund |

11.1% |

|

6 |

Ndovu Money Market Fund |

11.1% |

|

7 |

Enwealth Money Market Fund |

11.0% |

|

8 |

Gulfcap Money Market Fund |

10.8% |

|

9 |

Kuza Money Market fund |

10.6% |

|

10 |

Jubilee Money Market Fund |

10.6% |

|

11 |

Old Mutual Money Market Fund |

10.5% |

|

12 |

Orient Kasha Money Market Fund |

10.0% |

|

13 |

Madison Money Market Fund |

9.9% |

|

14 |

British-American Money Market Fund |

9.8% |

|

15 |

Dry Associates Money Market Fund |

9.6% |

|

16 |

Apollo Money Market Fund |

9.5% |

|

17 |

KCB Money Market Fund |

9.5% |

|

18 |

SanlamAllianz Money Market Fund |

9.4% |

|

19 |

Faulu Money Market Fund |

9.2% |

|

20 |

GenAfrica Money Market Fund |

9.1% |

|

21 |

Genghis Money Market Fund |

8.9% |

|

22 |

CIC Money Market Fund |

8.5% |

|

23 |

ICEA Lion Money Market Fund |

8.4% |

|

24 |

CPF Money Market Fund |

8.3% |

|

25 |

Co-op Money Market Fund |

8.2% |

|

26 |

Mali Money Market Fund |

8.1% |

|

27 |

Absa Shilling Money Market Fund |

7.5% |

|

28 |

Mayfair Money Market Fund |

6.9% |

|

29 |

AA Kenya Shillings Fund |

6.8% |

|

30 |

Ziidi Money Market Fund |

6.1% |

|

31 |

Stanbic Money Market Fund |

5.2% |

|

32 |

Equity Money Market Fund |

4.7% |

Source: Business Daily

Liquidity:

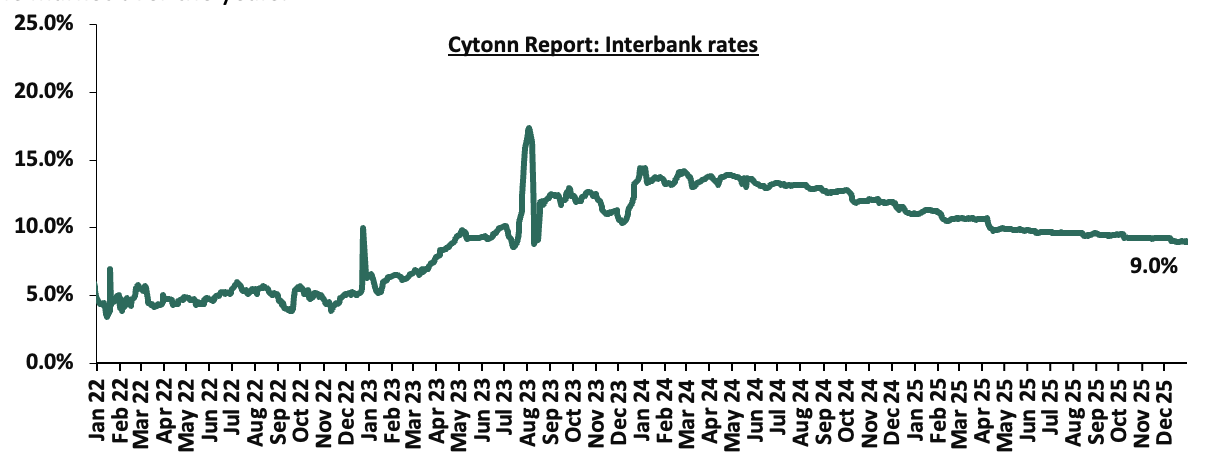

During the year, liquidity levels eased as evidenced by the decrease in the average interbank rate by 3.1% points to 9.9%, from 13.0% in 2024. The eased liquidity is partly due to government payments that offset tax remittances. Similarly, the average volumes traded in the interbank market decreased by 48.2% to Kshs 13.8 bn in 2025, from Kshs 26.7 bn recorded in 2024.

During the week, liquidity in the money markets eased, with the average interbank rate decreasing marginally by 0.03 bps, to remain relatively unchanged at 9.0% recorded the previous week, partly attributable to government payments that offset tax remittances. The average interbank volumes traded decreased by 4.0% to Kshs 9.6 bn from Kshs 10.1 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

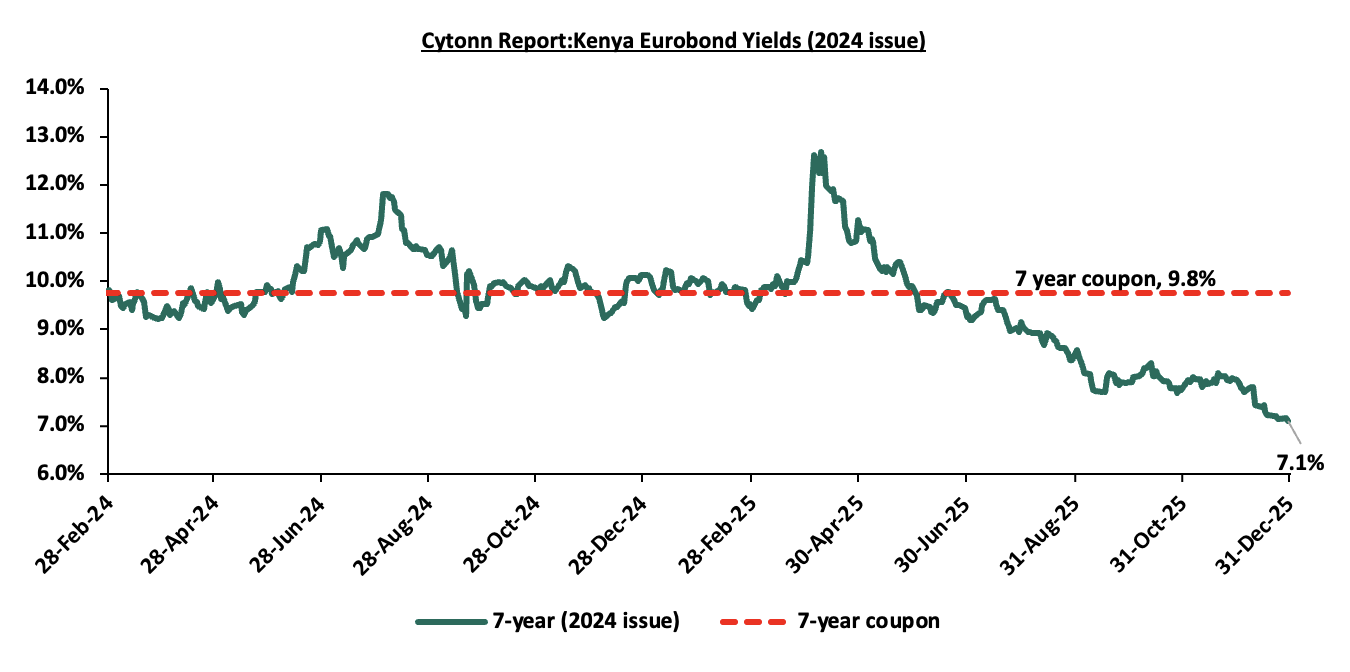

Yields on the 7-Year Eurobond issued in 2024, set to mature in 2031, decreased by 3.0% points to close the year at 7.1%, from 10.1% recorded at the beginning of 2025.

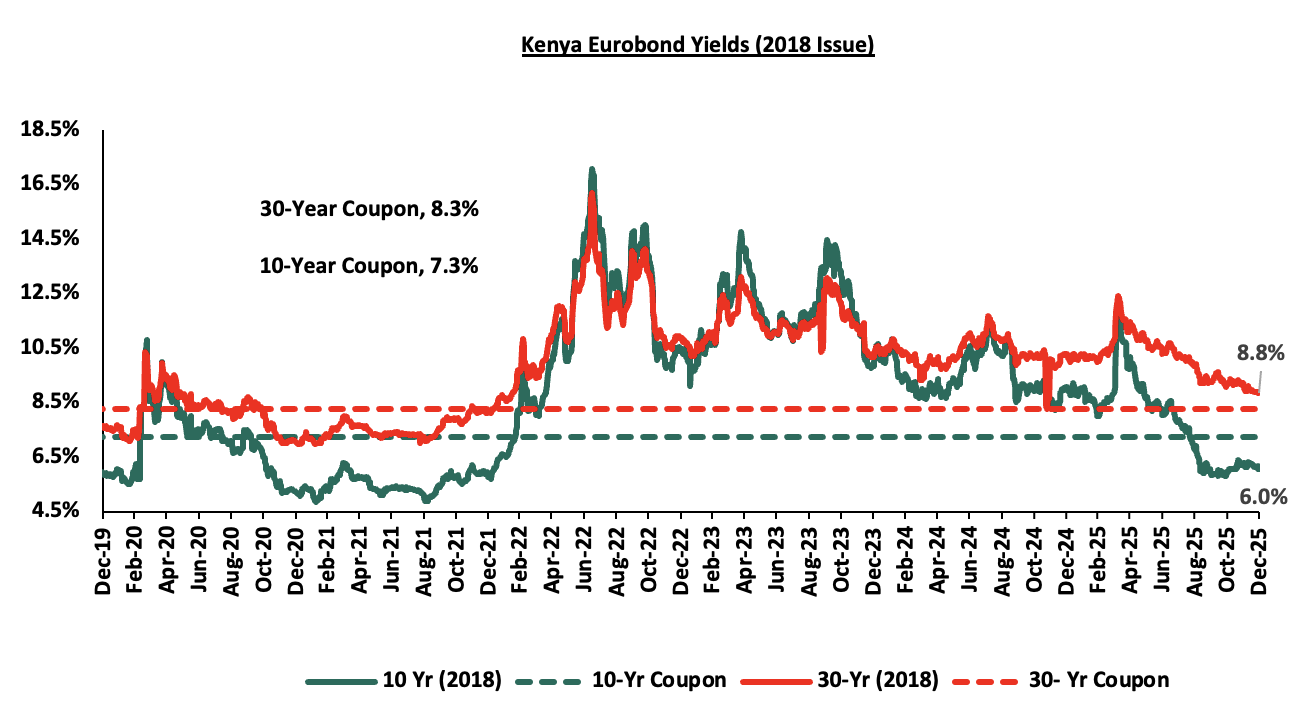

For the 2018 Eurobond issue, the yields on the 10-year Eurobond decreased by 3.1% points to close the year at 6.0% from 9.1% recorded at the start of 2025, while the yields on the 30-year Eurobond increased by 1.5% points to close the year at 8.8% from 10.3% recorded at the beginning of 2025.

For the 2019 Eurobond issue, the yields on the 12-year Eurobond increased by 2.9% points, to close the year at 7.2% from 10.1% at the beginning of 2025.

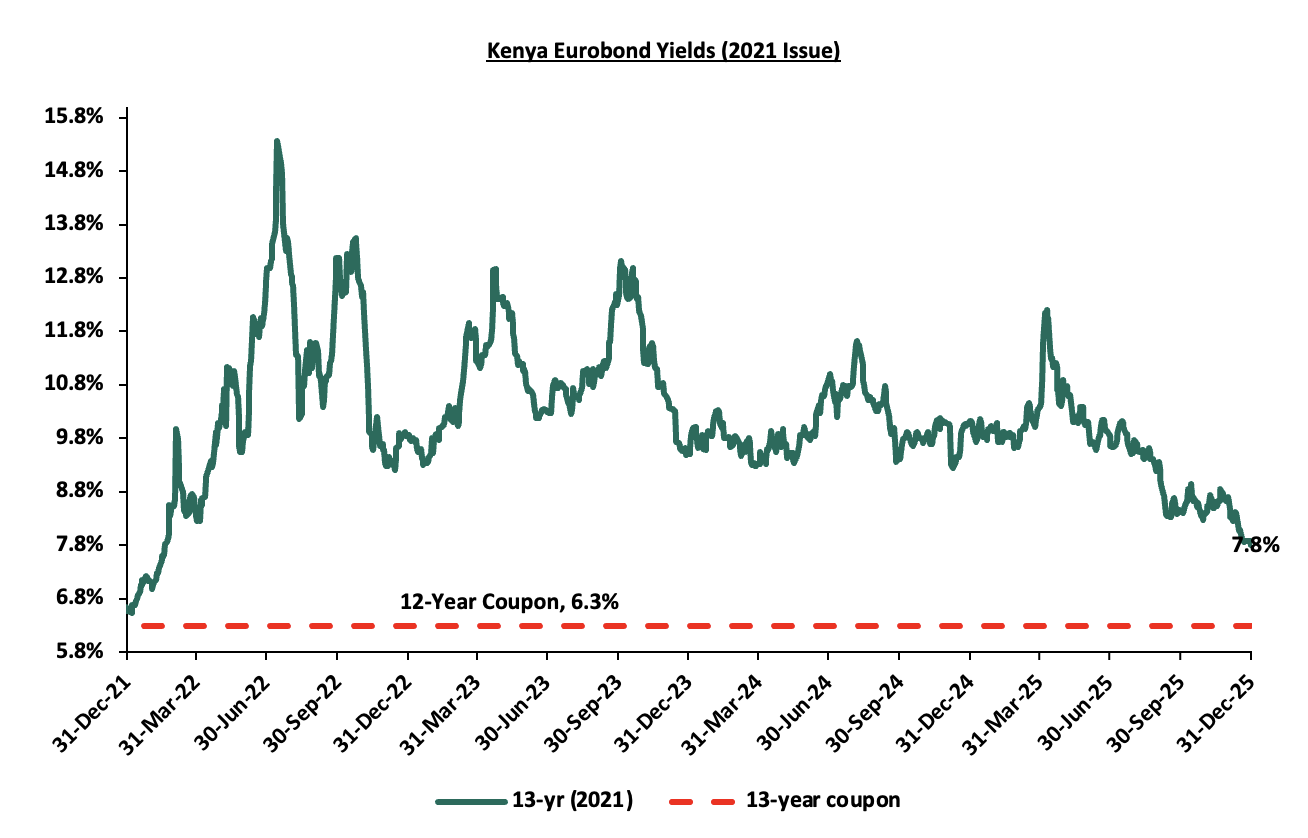

The yields on the 12-Year Eurobond issued in 2021, set to mature in 2033, decreased by 2.4% points to close the year at 7.8% from 9.5% recorded at the start of the year;

During the year, the yields on Eurobonds were on a downward trajectory, with the yields on the 13-year Eurobond issued in 2021 decreasing the most by 301.2 bps to 6.0% from 9.1% recorded at the start of the year.

Similarly, during the week, the yields on Eurobonds were on a downward trajectory, with the yields on the 7-year Eurobond issued in 2024 decreasing the most by 10.9 bps, to 7.1% from 7.2% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 31st December 2025:

|

Cytonn Report: Kenya Eurobond Performance |

|||||||||||

|

|

2018 |

2019 |

2021 |

2024 |

2025 |

||||||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

11-year issue |

||||

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

1.5 bn |

||||

|

Years to Maturity |

2.5 |

22.5 |

1.7 |

6.7 |

8.8 |

5.5 |

10.5 |

||||

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

9.9% |

||||

|

2-Jan-25 |

9.1% |

10.3% |

8.5% |

10.1% |

10.1% |

10.1% |

|

||||

|

4-Dec-25 |

6.2% |

9.1% |

- |

8.1% |

8.6% |

7.9% |

|

||||

|

23-Dec-25 |

6.1% |

8.9% |

- |

7.3% |

7.9% |

7.2% |

|

||||

|

24-Dec-25 |

6.2% |

8.9% |

|

7.3% |

7.9% |

7.2% |

|

||||

|

29-Dec-25 |

6.1% |

8.9% |

- |

7.3% |

7.9% |

7.1% |

10.0% |

||||

|

30-Dec-25 |

6.2% |

8.9% |

|

7.2% |

7.9% |

7.2% |

|

||||

|

31-Dec-25 |

6.0% |

8.8% |

- |

7.2% |

7.8% |

7.1% |

|

||||

|

Weekly Change |

(0.1%) |

0.0% |

- |

(0.1%) |

(0.1%) |

(0.1%) |

0.0% |

||||

|

MTD Change |

(0.2%) |

(0.3%) |

- |

(0.9%) |

(0.8%) |

(0.8%) |

0.0% |

||||

|

YTD Change |

(3.0%) |

(1.4%) |

- |

(2.9%) |

(2.3%) |

(3.0%) |

0.0% |

||||

Source: Central Bank of Kenya (CBK)

Rates in the Fixed Income market have been on a downward trend due to high liquidity in the money market which allowed the government to front load most of its borrowing. The government is 106.2% ahead of its prorated net domestic borrowing target of Kshs 327.8 bn, having a net borrowing position of Kshs 676.0 bn (inclusive of T-bills). However, we expect a stabilization of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to stabilize in the short to medium-term and hence investors are expected to shift towards the long-term papers to lock in the high returns

Market Performance

In 2025, the Kenyan equities market was on an upward trajectory, with NSE 20 gaining the most by 52.5%, while NASI, NSE 10 and NSE 25 gained by 48.9%, 48.0% and 47.4% respectively. Below is a summary of the 2025 annual performance of some of the large-cap stocks in the Kenyan stock market:

|

Cytonn Report: Kenya Equities Performance - Large Cap Gainers and Losers 2025 |

||

|

No |

Company |

Share Price Performance 2025 |

|

1 |

DTBK |

71.5% |

|

2 |

SCOM |

64.8% |

|

3 |

NCBA |

64.7% |

|

4 |

KCB |

55.1% |

|

5 |

EABL |

49.9% |

|

6 |

STANBIC |

41.5% |

|

7 |

EQTY |

39.1% |

|

8 |

COOP |

37.2% |

|

9 |

ABSA |

31.0% |

|

10 |

BAT |

22.0% |

|

11 |

SCBK |

4.2% |

|

12 |

BAMB |

(1.8%) |

Source: Cytonn Research

During the week, the Kenyan equities market was on an upward trajectory, with NSE 10 gaining the most by 2.3%, while NSE 25, NASI and NSE 20 gained by 2.1%, 1.8% and 1.3% respectively. The equities market performance was driven by gains recorded by large-cap stocks such as ABSA, KCB and NCBA of 8.0%, 5.2% and 2.4% respectively. The performance was, however, weighed down by losses by large-cap stocks such EABL, Standard Chartered and BAT of 0.4%, 0.1% and 0.1% respectively.

During the week, the banking sector index gained by 2.6% to 204.4 from 199.3 recorded the previous week. This is attributable to gains recorded by stocks such as Absa, KCB and NCBA of 8.0%, 5.2% and 2.4% respectively. The performance was, however, weighed down by losses recorded by large cap stocks such as Standard Chartered of 0.1%.

During the year, equities turnover increased by 40.6% to close the year at USD 1.1 bn, from USD 0.8 bn recorded in 2024. Foreign investors remained net sellers, with a net outflow of USD 92.9 mn, compared to net outflows of USD 16.9 mn recorded in 2024.

During the week, equities turnover decreased by 30.8% to USD 8.2 mn from USD 11.8 mn recorded the previous week. Additionally, foreign investors became net buyers for the first time in two weeks, with a net buying position of USD 0.1 mn, from a net selling position of USD 0.5 mn recorded the previous week.

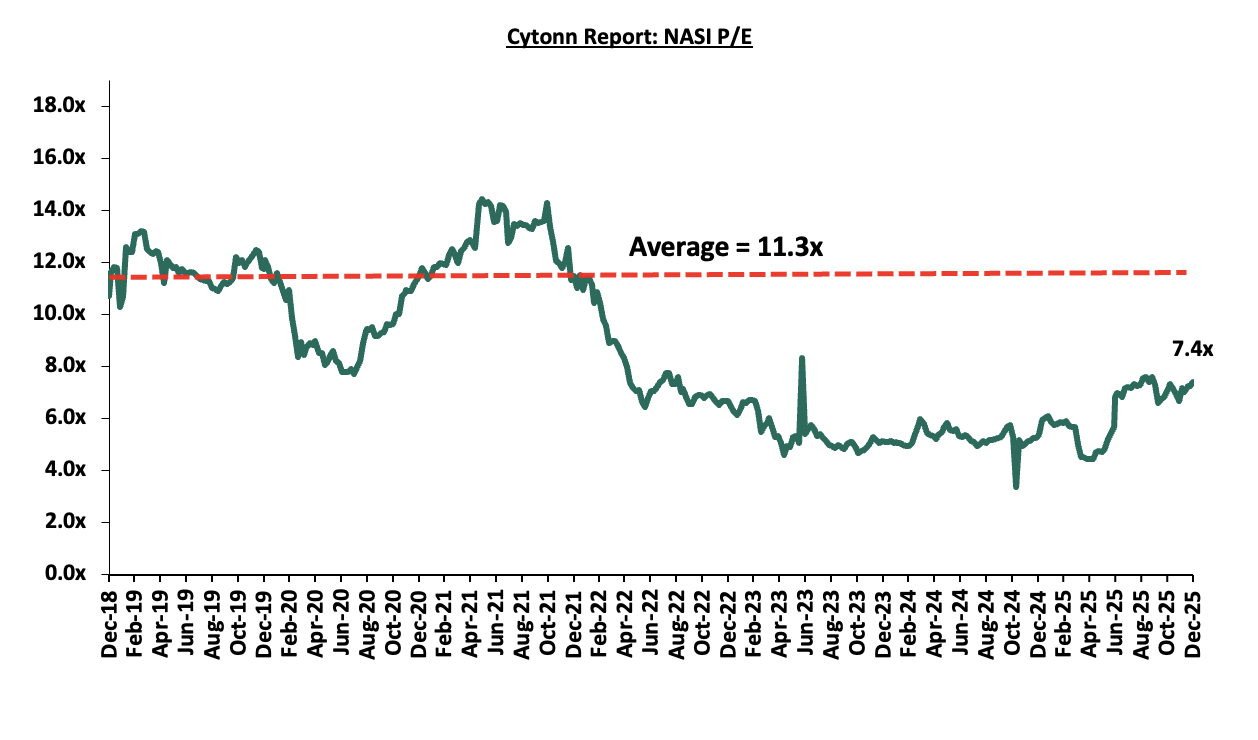

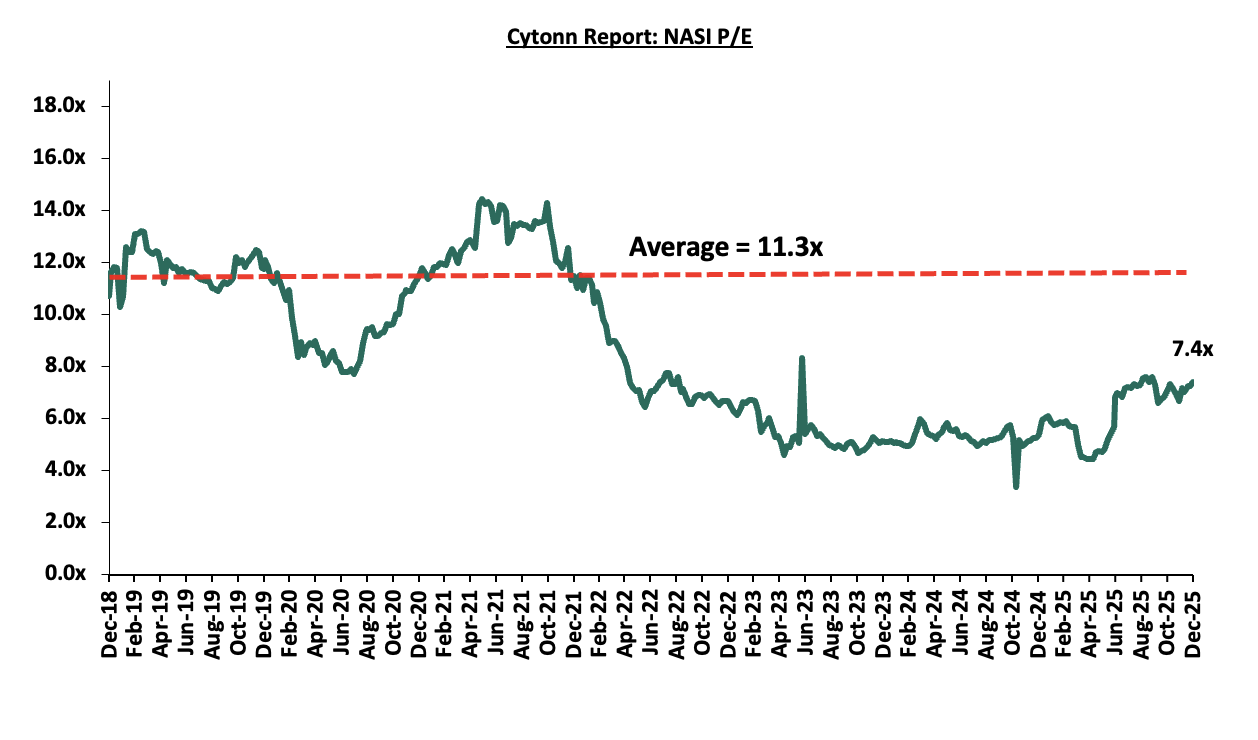

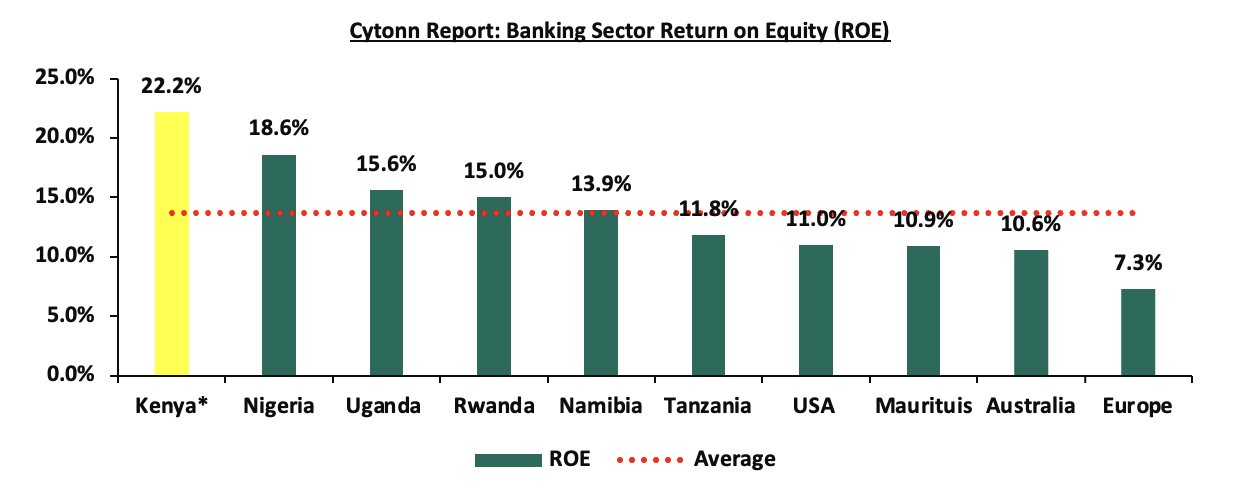

The market is currently trading at a price-to-earnings ratio (P/E) of 7.4x higher than 5.3x recorded at the end of 2024, and is 34.8% below the 15-year historical average of 11.3x. NASI’s P/E ratio remained boosted for the majority of the year, mainly attributable to a rise in price of large-cap stocks such as Safaricom whose price rose by 64.8% during the year. Safaricom continues to be a key part of Kenyan equities portfolios, accounting for 39.1% of Nairobi Stock Exchange (NSE’s) market capitalization and has dominated both the market turnover and determines the direction of the market given its weight and liquidity in the Nairobi Securities Exchange. On the other hand, the dividend yield is currently at 5.3%, 0.6% points above the historical average of 4.7%.

Key to note, NASI’s PEG ratio currently stands at 0.9x, an indication that the market is slightly undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the market’s historical P/E and dividend yield:

2025 Key Highlights

-

Banking Sector Earnings

According to the Q3’2025 banking results core earnings per share (EPS) for the listed banks recorded a weighted growth of 7.6% in Q3’2025, compared to a weighted growth of 24.6% recorded in Q3’2024, an indication of deteriorated performance mainly on the back of a 3.3% decline in non-funded income in Q3’2025, compared to a growth of 14.5% in Q3’2024, despite an improvement in loan book expansion. The table below highlights the performance of the banking sector, showing the performance using several metrics, and the key take-outs of the performance.

|

Cytonn Report: Kenyan Listed Banks Performance Q3’2025 |

|||||||||||||||

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

COF |

YIEA |

|

Equity Group |

32.7% |

2.9% |

(20.7%) |

16.1% |

7.9% |

2.5% |

40.1% |

7.6% |

2.2% |

19.9% |

63.9% |

7.5% |

24.5% |

3.7% |

11.3% |

|

I&M Group |

24.2% |

0.6% |

(23.1%) |

21.1% |

8.3% |

17.9% |

26.0% |

15.7% |

10.2% |

65.2% |

66.2% |

7.3% |

19.2% |

5.3% |

13.1% |

|

Absa Bank Kenya |

14.7% |

(9.6%) |

(21.9%) |

(4.6%) |

9.6% |

11.2% |

29.2% |

16.3% |

9.2% |

71.1% |

80.6% |

(0.6%) |

26.8% |

3.8% |

12.9% |

|

Diamond Trust Bank |

12.3% |

0.9% |

(14.6%) |

17.9% |

6.2% |

(5.8%) |

26.7% |

10.7% |

15.5% |

22.9% |

58.1% |

7.8% |

11.2% |

5.5% |

11.7% |

|

Co-operative Bank |

12.3% |

10.0% |

(9.0%) |

22.8% |

8.7% |

(0.8%) |

32.8% |

1.6% |

6.7% |

20.7% |

74.1% |

6.6% |

18.8% |

5.4% |

13.4% |

|

NCBA Group |

8.5% |

(11.8%) |

(42.3%) |

27.4% |

7.3% |

(1.9%) |

40.0% |

2.5% |

(5.3%) |

3.0% |

60.0% |

(3.5%) |

21.0% |

5.3% |

12.1% |

|

KCB Group |

0.7% |

1.1% |

(17.6%) |

12.4% |

8.4% |

(10.1%) |

30.2% |

(1.5%) |

(0.8%) |