Cytonn Q3’2025 Markets Review

By research team, Oct 5, 2025

Executive Summary

Global Markets Review

According to the World Bank the global economy is projected to grow at 2.3% in 2025, lower than the 2.7% growth recorded in 2024. This forecast marks a significant downward revision from earlier projection in January of 2.7%, reflecting anticipated economic downturn, particularly due to rising international trade disputes and policy uncertainties. The World Bank’s growth projection of 2.3% is 0.5% points lower than the IMF’s 2025 forecast of 3.0%, which was also revised from the April 2025 projection of 2.8%. In their last Global Economic Prospects Report in June 2025, the World Bank revised their global growth forecasts downward due to weakening global trade, largely driven by rising U.S. tariffs and the resulting trade tensions, which disrupted global supply chains and slowed cross-border economic activity. Notably, advanced economies are expected to record a 1.2% growth in 2025, down from the 1.7% expansion recorded in 2024. Additionally, emerging markets and developing economies are projected to expand by 3.8% in 2025, down from the 4.2% expansion recorded in 2024. On the other hand, the IMF revised their projection upwards to 3.0% from the April 2025 projection of 2.8% due to faster-than-expected early activity ahead of anticipated tariffs, lower actual U.S. tariff rates than initially announced, improved financial conditions helped by a weaker dollar, and fiscal expansion spending in key economies

Sub-Saharan Africa Regional Review

According to the World Bank, the Sub-Saharan economy is projected to grow at a moderate rate of 3.7% in 2025, which is 0.2% points higher than the 3.5% growth recorded in 2024, but a downward revision from the January 2025 projection of 4.1%. The downward revision is mainly due to the rising trade barriers coupled with the weakened global investor confidence. The expected recovery from 2024 is primarily driven by global economic stability, and easing of monetary policy rates in the region, which is expected to boost private consumption and investment. However, most countries face the risk of increased inflation due to increased food prices resulting from drought, prompting them to increase or hold off on further easing of the rates. Nevertheless, the risk of debt distress remains high with more than half of countries facing unsustainable debt burdens. Public debt is expected to remain high due to increased debt servicing costs as a result of high interest rates in developed economies and a reduction in donor support;

Kenya Macroeconomic Review

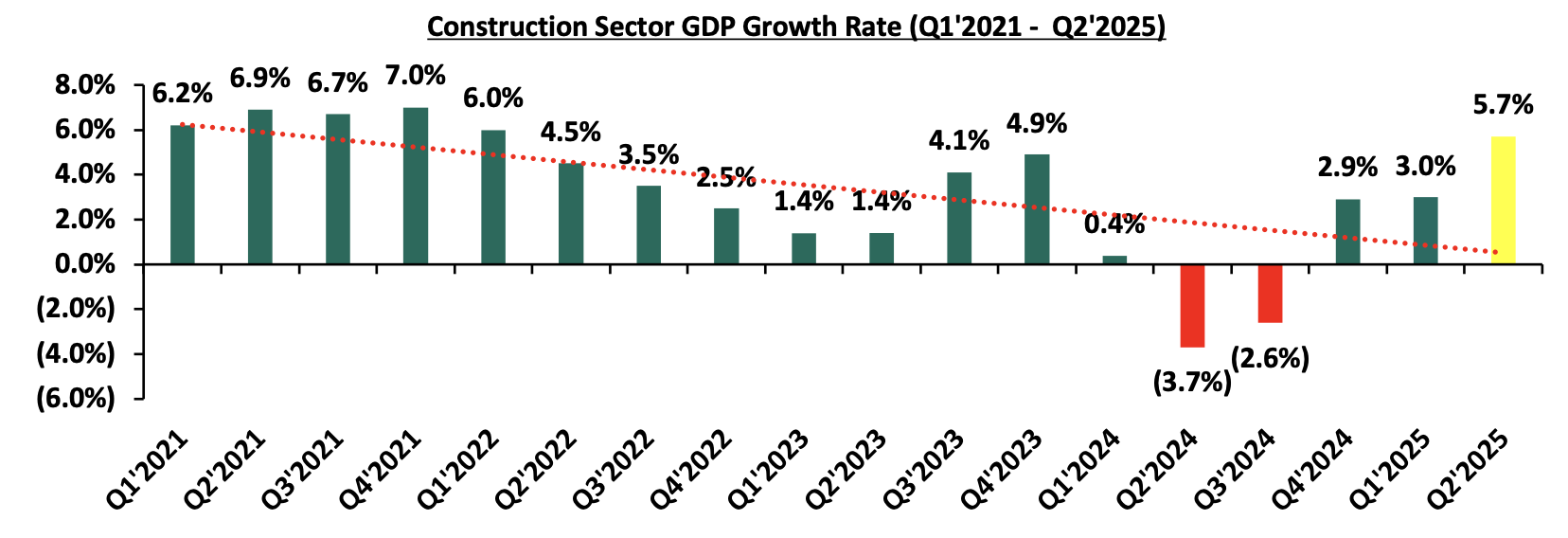

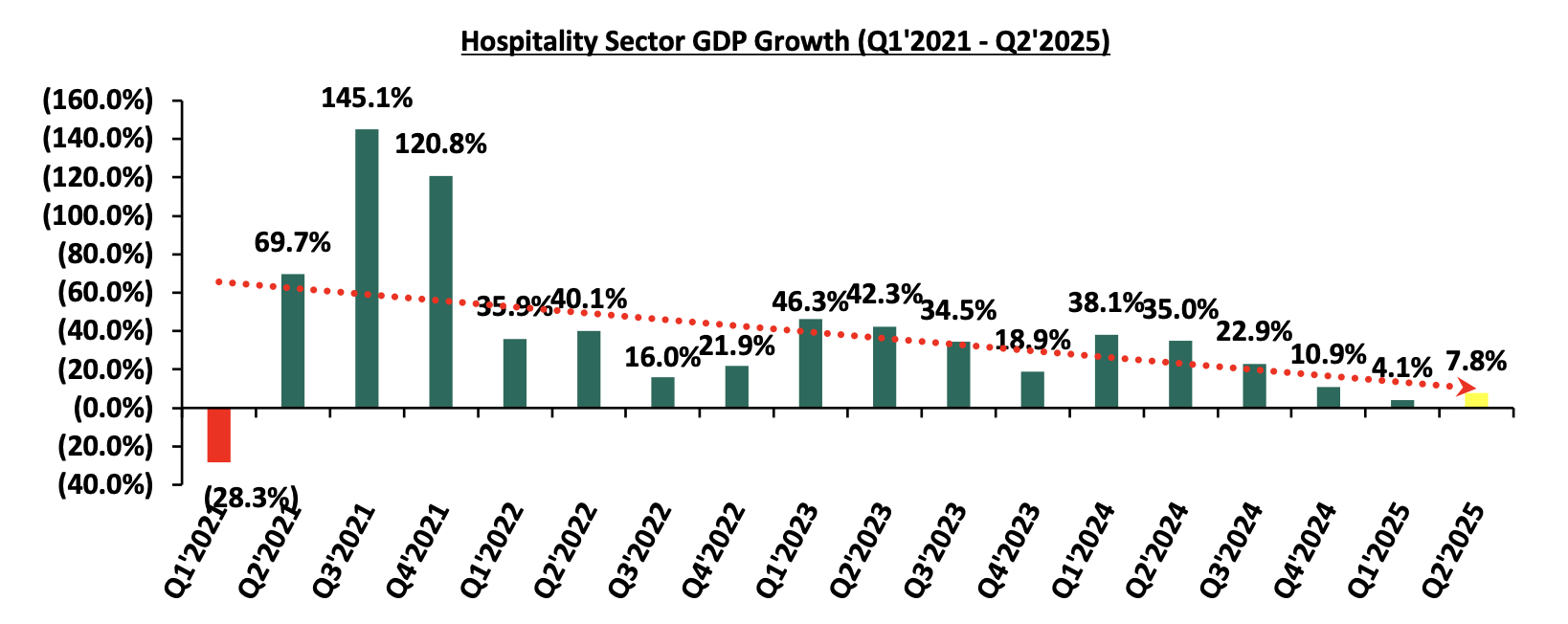

According to the Kenya National Bureau of Statistics (KNBS) Q2'2025 Quarterly GDP Report, the Kenyan economy recorded a 5.0% growth in Q2’2025, 0.4% points higher from the 4.6% growth rate recorded in Q2’2024. The main contributor to Kenyan GDP remains the Agriculture, Fishing and Forestry sector which grew by 4.4% in Q2’2025, lower than the 4.5% expansion recorded in Q2’2024. All sectors in Q2’2025 recorded positive growths, with varying magnitudes across activities. Most sectors recorded contraction in growth rates compared to Q2’2024 with Accommodation & Food Services, Financial Services Indirectly Measured and Other services recording growth rate declines of 27.2%, 8.9% and 3.4% points to 7.8%, 1.4% and 1.4% from 35.0%, 10.3% and 4.8% respectively. Other sectors recorded an expansion in growth rates, from what was recorded in Q2’2024, with Mining and Quarrying, Construction and Electricity and Water Supply recording the highest growths in rates of 20.8%, 9.4% and 4.5% points, to 15.3%, 5.7% and 5.7% from (5.5%), (3.7%) and 1.2% respectively. Notably, the overall economic performance highlighted modest growth despite a slowdown in several key sectors, reflecting the mixed performance across industries amid a challenging operating environment;

During the week, Stanbic Bank released its monthly Purchasing Managers’ Index (PMI) showing that business conditions in the private sector improved in September 2025, marking the first expansion since April. The headline PMI rose to 51.9 in September, up from 49.4 in August, moving above the neutral 50.0 threshold and signaling a renewed upturn in private sector activity. The improvement followed months of protest-related disruptions and subdued sales, reflecting early signs of demand stabilization. On a year-to-year basis the index has recorded a 4.4% increase to 51.9 in September 2025 from the 49.7 posted in September 2024, highlighting relatively stronger conditions compared to the same period last year.

The year-on-year inflation in September 2025 rose slightly to 4.6%, up from 4.5% recorded in August 2025. This was in line with our projection of an increase to within the range of 4.1% - 4.6% where our decision was mainly driven by the easing in the Central Bank Rate (CBR) to 9.50% in August 2025 and a slight depreciation of the Kenya Shilling against the US Dollar. The headline inflation was primarily driven by price increases in the following categories: Food & Non-Alcoholic Beverages at 8.4%, Transport at 4.0%, and Housing, Water, Electricity, Gas and Other Fuels at 1.4%. The month-on-month inflation rate stood at 0.2% in September 2025.

Fixed Income

During Q3’2025, T-bills were oversubscribed, with the overall subscription rate coming in at 110.6%, up from 109.4% in Q3’2024. Investors’ preference for the 91-day paper persisted with the paper receiving bids worth Kshs 90.8 bn against the offered Kshs 52.0 bn, translating to an oversubscription rate of 174.6%, albeit lower than the oversubscription rate of 338.3% recorded in Q3’2024. Overall subscription rates for the 364-day papers came in at 136.1% which was higher than the 49.6% recorded in Q3’ 2024 while that for 182-day papers came in 59.6% which was lower than the 77.6% recorded in Q3’2024. The average yields on the 364-day, 182-day and 91-day papers decreased by 7.2%, 8.5% and 7.8% points to 9.6%, 8.2% and 8.0% in Q3’2025, respectively, from 16.9%, 16.7% and 15.9%, respectively, in Q3’2024. The downward trajectory in yields is primarily driven by improved investor confidence, stemming from reduced credit risk in the country and relatively eased inflationary pressures. This has lowered the risk premium demanded by investors. Despite the government's sustained domestic borrowing, strong demand for government securities has supported the decline in yields. During the period, the acceptance rate stood at 89.5%, down from 88.3% in Q3’2024, with the government accepting Kshs 308.9 billion out of the Kshs 345.1 billion worth of bids received;

This week, T-bills were undersubscribed for the third consecutive week, with the overall subscription rate coming in at 63.1%, slightly higher than the subscription rate of 62.9% recorded the previous week. Investors’ preference for the shorter 91-day paper waned, with the paper receiving bids worth Kshs 1.6 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 40.4%, lower than the subscription rate of 40.5%, recorded the previous week. The subscription rates for the 182-day paper increased to 61.3% from the 19.4% recorded the previous week, while that of the 364-day paper decreased to 73.8% from the 115.3% recorded the previous week. The government accepted a total of Kshs 15.1 bn worth of bids out of Kshs 15.1 bn bids received, translating to an acceptance rate of 99.9%. The yields on the government papers registered a mixed performance with the yields on the 91-day paper increasing the most by 1.0 bps to 7.92% from the 7.91% recorded the previous week and the 364-day paper increased by 0.8 bps to 9.54% from 9.53% recorded the previous week while the yields on the 182-day papers decreased by 0.02 bps to 7.98% from 7.99% recorded the previous week;

During the week, the Kenya National Bureau of Statistics (KNBS) released the Q2’2025 Quarterly Gross Domestic Product Report, highlighting that the Kenyan economy recorded a 5.0% growth in Q2’2025, higher than the 4.6% growth recorded in Q2’2024;

During the week, KNBS released the Q2’2025 Kenya Quarterly Balance of Payment Report, where Kenya’s balance of payments position deteriorated significantly by 86.6% in Q2’2025, with a deficit of Kshs 157.0 bn, from a deficit of Kshs 84.1 bn in Q2’2024;

During the week, Kenya announced its plan to invite eligible holders of its outstanding USD 1.0 bn notes, at a purchase price of USD 1,037.50 per USD 1,000.0 in principal amount of notes accepted for purchase. The maturity date for the notes is 28thFebruary 2028. The offer began on 2nd October 2025 and will expire on 9th October 2025, unless extended, re-opened, amended or terminated by the Republic of Kenya;

Equities

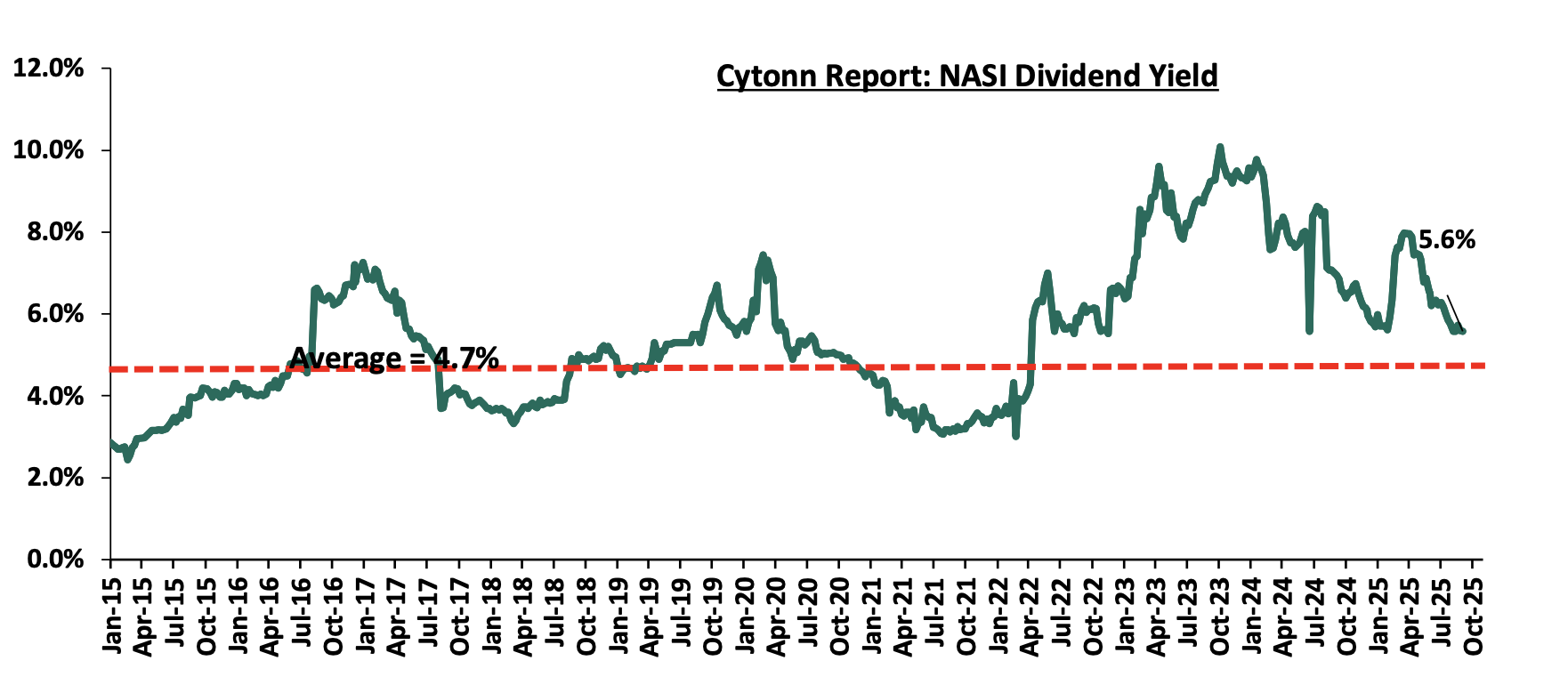

During Q3’2025, the equities market was on an upward trajectory, with NSE 20, NSE 10, NSE 25, and NASI gaining by 21.8%, 17.6%, 17.4%, and 15.2%, respectively. The equities market performance during the quarter was driven by gains recorded by large caps such as DTB, KCB, and Cooperative Bank of 35.3%, 21.8%, and 19.6% respectively. The gains were however weighed down by losses recorded by large cap stocks such as SCBK of 5.3%;

During Q3’2025, in the regional equities market, the East African Exchanges 20 (EAE 20) share index declined by 0.1% , attributable to losses recorded by large cap stocks such as Tanzania Breweries, Tanzania Cigarette Company and MTN Rwandacell of 24.7%, 13.4% and 3.9% respectively. The performance was however supported by gains recorded by large cap stocks such as CRDB Bank, Tanga Cement and Quality Chemicals Industry Limited of 53.5%, 37.2% and 36.3%

During the week, the equities market was on an upward trajectory, with NSE 20, NSE 25, NASI and NSE 10 gaining by 1.8%, 0.7%, 0.3%, and 0.1%, respectively, taking the YTD performance to gains of 47.2%, 42.4%, 35.0% and 34.9% for NSE 20, NASI, NSE 25, and NSE 10 respectively. The equities market performance was mainly driven by gains recorded by large-cap stocks such as Stanbic Bank, Absa, and NCBA of 7.8%, 7.0%, and 2.5%, respectively. The gains were however weighed down by losses recorded by large cap stocks such as Cooperative Bank, Safaricom and EABL of 2.1%, 1.7% and 0.9% respectively;

Additionally, in the regional equities market, the East African Exchanges 20 (EAE 20) share index declined by 0.2%, attributable to losses recorded by large cap stocks such as Tanga Cement, MTN Rwandacell and Safaricom Plc of 4.2%, 1.7% and 1.5% respectively. The performance was however supported by gains recorded by large cap stocks such as Absa Bank Kenya, Co-operative Bank and Bank of Baroda Uganda of 5.6%, 5.1% and 5.0% respective

During the week, the Nairobi Securities Exchange (NSE) launched the NSE Banking Sector Share Index (NSE BSI) on 1stOctober 2025 to track the performance of all listed commercial banks in Kenya. This index provides investors with a transparent benchmark to measure the performance of banking stocks and serves as a basis for structured products and investment strategies.

Real Estate

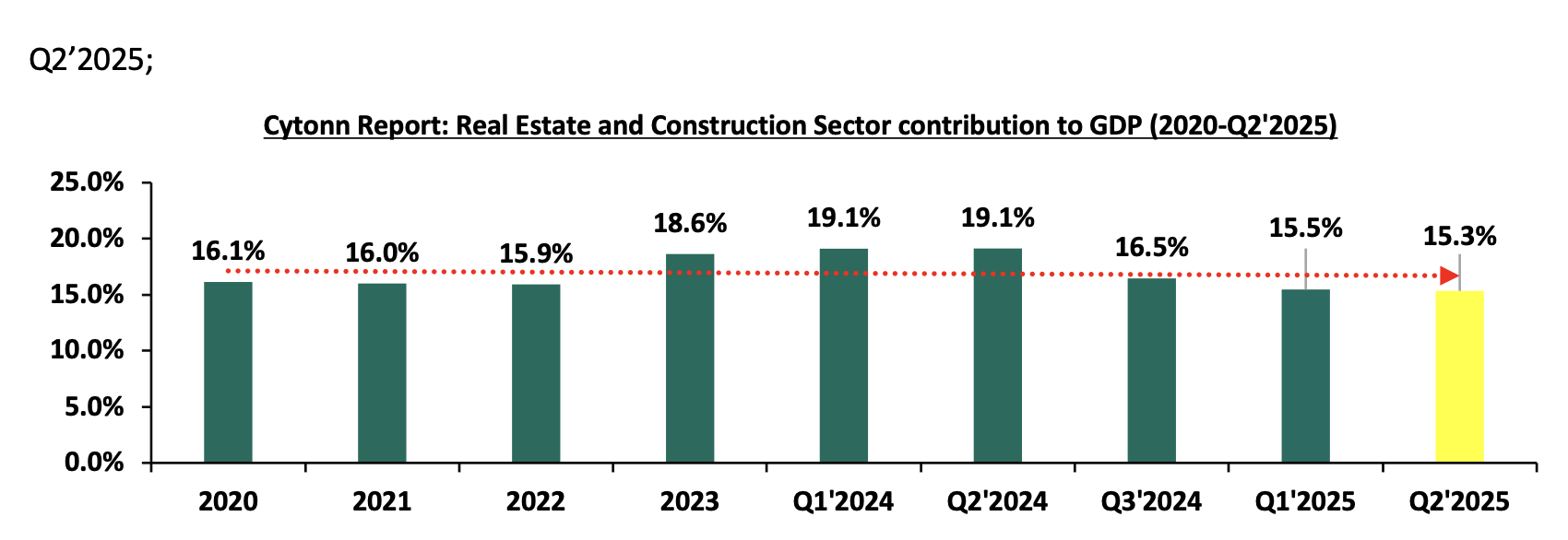

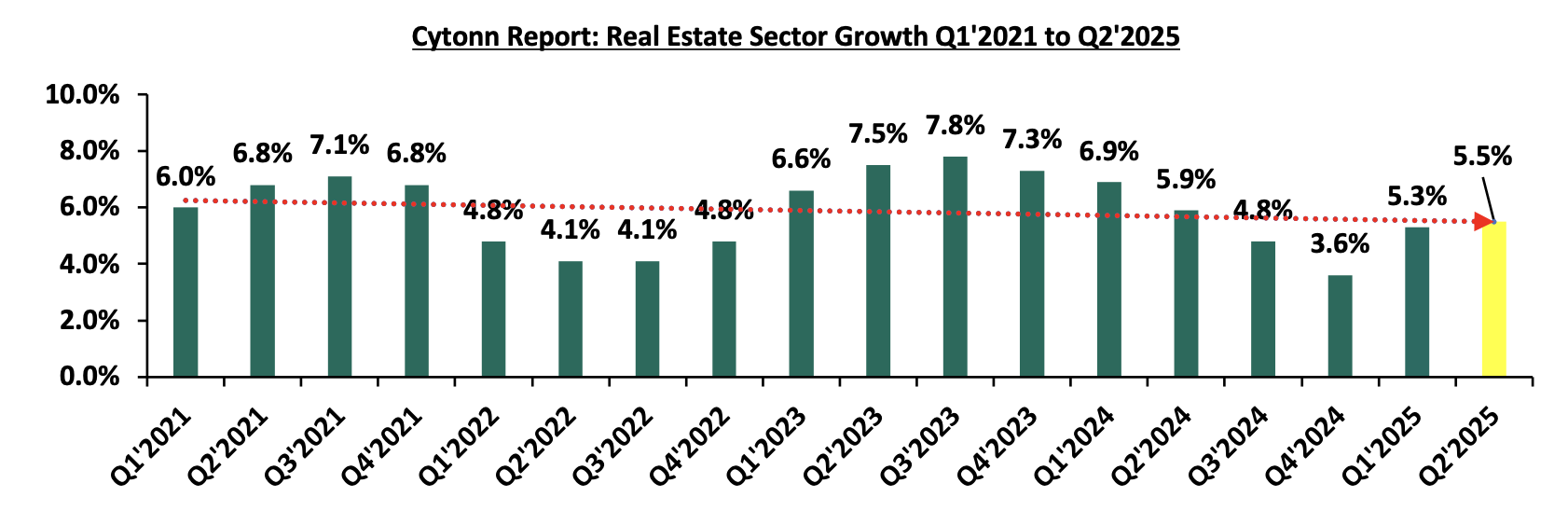

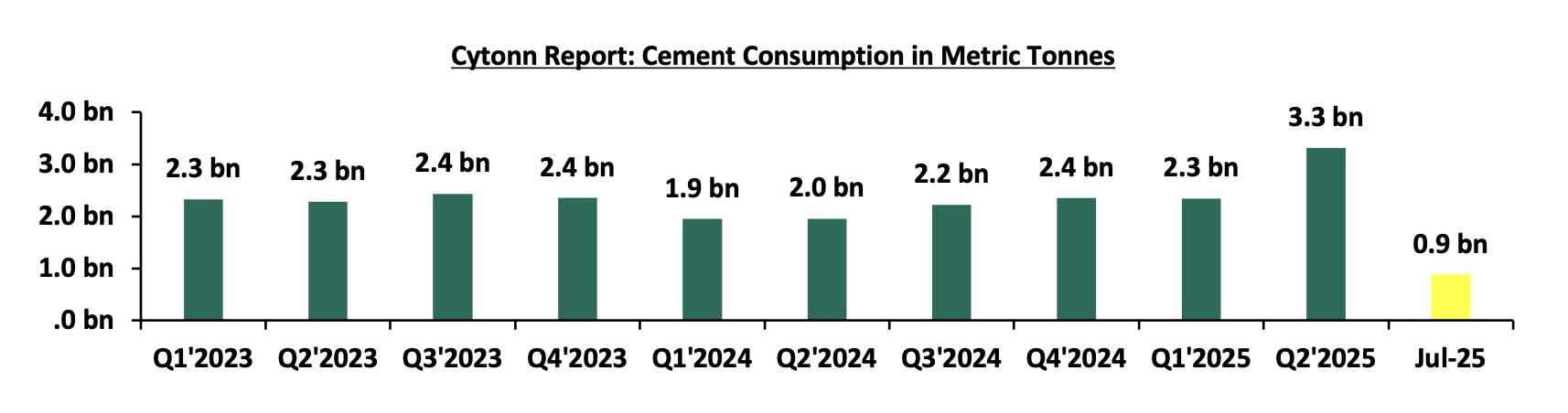

In Q3’2025, the general Real Estate sector continued to witness considerable growth in activity in terms of property transactionsand development activities. Consequently, the sector’s activity contribution to Gross Domestic Product (GDP) grew by 5.5% toKshs 364.6 bn in Q2’2025, from Kshs 339.2 bn recorded during the same period in 2024. In addition, the sector contributed 8.1% to the country’s GDP, to remain relatively unchanged from the 8.1% recorded in Q1’2025. Cumulatively, the Real Estateand construction sectors contributed 15.3% to GDP, 3.8% points decrease from 19.1% in Q2’2024, attributable to decline in construction contribution to GDP by 3.7% points, to 5.0% in Q2’2025, from 8.7% recorded in Q2’2024;

During the week, the Kenya National Bureau of Statistics (KNBS) released the Quarterly Gross Domestic Product Report that outlined the performance of various sectors to the GDP;

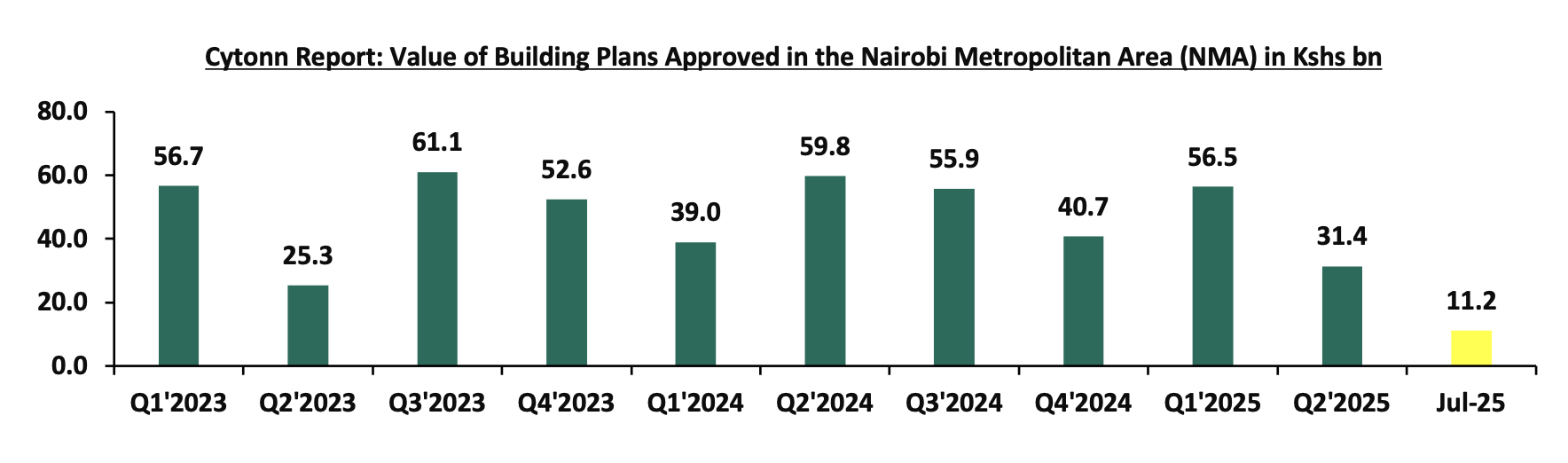

During the week, the Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) July 2025Reports, which highlighted the performance of major economic indicators;

During the week, the Court of Appeal delivered a landmark ruling on the long-running zoning dispute concerning Rhapta Road. The judgment provided much-needed clarity by confirming that the area falls under Zone 3C, which allows development of up to 20 storeys. This decision has positive far-reaching implications for property developers, residents, and the Nairobi City County government in terms of providing clarity and predictability.

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 26.7 and Kshs 22.9 per unit, respectively, as per the last updated data on 26th September 2025. The performance represented a 33.4% and 14.5% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 26th September 2025, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 1.2 mn shares for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015;

Investment Updates:

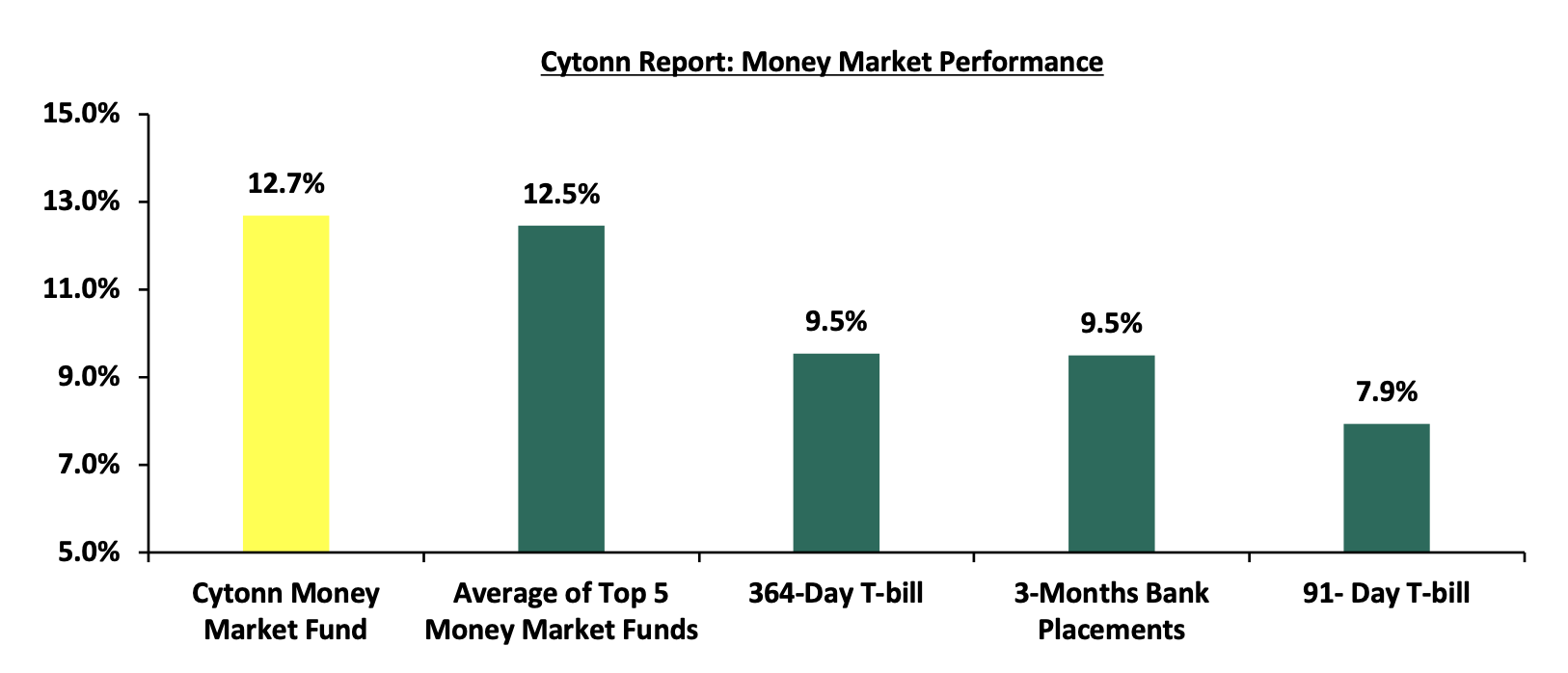

- Weekly Rates: Cytonn Money Market Fund closed the week at a yield of 12.7% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Tuesday, from 7:00 pm to 8:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Global Economic Growth:

According to the World Bank the global economy is projected to grow at 2.3% in 2025, lower than the 2.7% growth recorded in 2024. This forecast marks a significant downward revision from earlier projection in January of 2.7%, reflecting anticipated economic downturn, particularly due to rising international trade disputes and policy uncertainties. The World Bank’s growth projection of 2.3% is 0.5% points lower than the IMF’s 2025 forecast of 3.0%, which was also revised from the April 2025 projection of 2.8%. In their last Global Economic Prospects Report in June 2025, the World Bank revised their global growth forecasts downward due to weakening global trade, largely driven by rising U.S. tariffs and the resulting trade tensions, which disrupted global supply chains and slowed cross-border economic activity. Notably, advanced economies are expected to record a 1.2% growth in 2025, down from the 1.7% expansion recorded in 2024. Additionally, emerging markets and developing economies are projected to expand by 3.8% in 2025, down from the 4.2% expansion recorded in 2024. On the other hand, the IMF revised their projection upwards to 3.0% from the April 2025 projection of 2.8% due to faster-than-expected early activity ahead of anticipated tariffs, lower actual U.S. tariff rates than initially announced, improved financial conditions helped by a weaker dollar, and fiscal expansion spending in key economies.

The downturn in global economic growth in 2025 as compared to 2024 is majorly attributable to;

- Heightened trade tensions and rising U.S. tariffs. Escalating U.S. tariffs, particularly on imports from China and key trading partners have disrupted global supply chains and increased the cost of goods. This has led to the slowdown in international trade volumes and weakened export-driven growth in the emerging markets and developing economies. However, if the major economies settle their trade disputes, it could ease global economic pressures, and,

- Trade policy uncertainty. The global economic landscape in 2025 is clouded by unpredictable trade policies, especially from major economies such as the United States, China and the European Union. Sudden tariff hikes, retaliatory measures and inconsistent enforcement have created a volatile environment for global trade. Developing countries, particularly those reliant on exports are facing reduced trading volumes and lower commodity prices.

The global economy is expected to remain subdued in 2025, mainly as a result of rising global trade tensions as well as volatile and unclear trade policies, which are expected to slow down economic growth.

Global Commodities Market Performance:

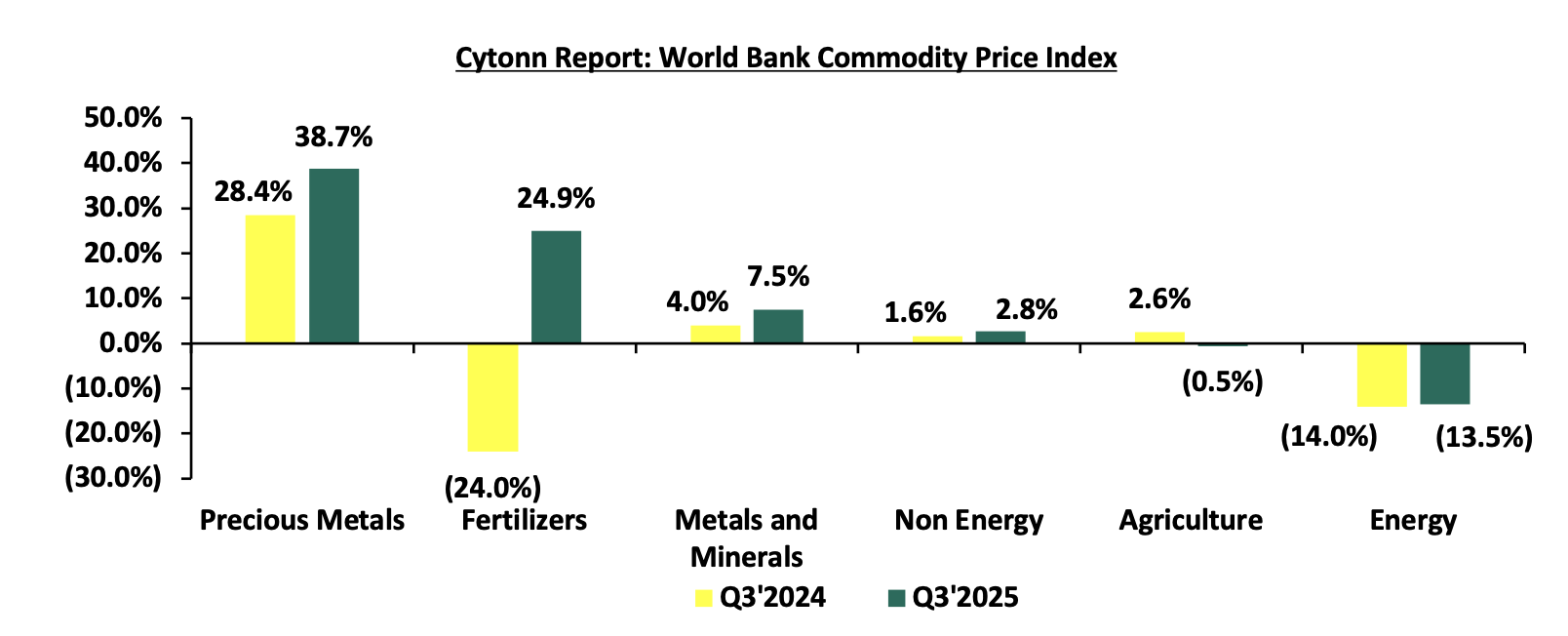

Global commodity prices registered mixed performance in Q3’2025, with prices of energy declining by 13.5%, compared to the 14.0% decrease recorded in Q3’2024, mainly as a result of due to a surge in oil and gas supply outpacing slowing demand growth, with renewable energy expansion further intensifying the oversupply and downward pressure. Additionally, prices of agriculture declined by 0.5% compared to the 2.6% increase recorded in Q3’2024 due to reduced demand and purchase orders. On the other hand, prices of precious metals increased by 38.7% in Q3’2025, compared to the 28.4% growth recorded in Q3’2024, mainly due to ongoing geopolitical tensions, a weakening U.S. dollar, and strong demand from both retail investors and central banks. Prices of Fertilizers, Metals and Minerals, and Non-Energy increased by 24.9%, 7.5% and 2.8% respectively, on the back of geopolitical tensions (especially in the Middle East), extreme weather impacting crop yields, rising input costs for fertilizers, and strong demand from clean-energy sectors. Tariffs and supply disruptions have further fueled these increases. Below is a summary performance of various commodities;

Source: World Bank

Global Equities Market Performance:

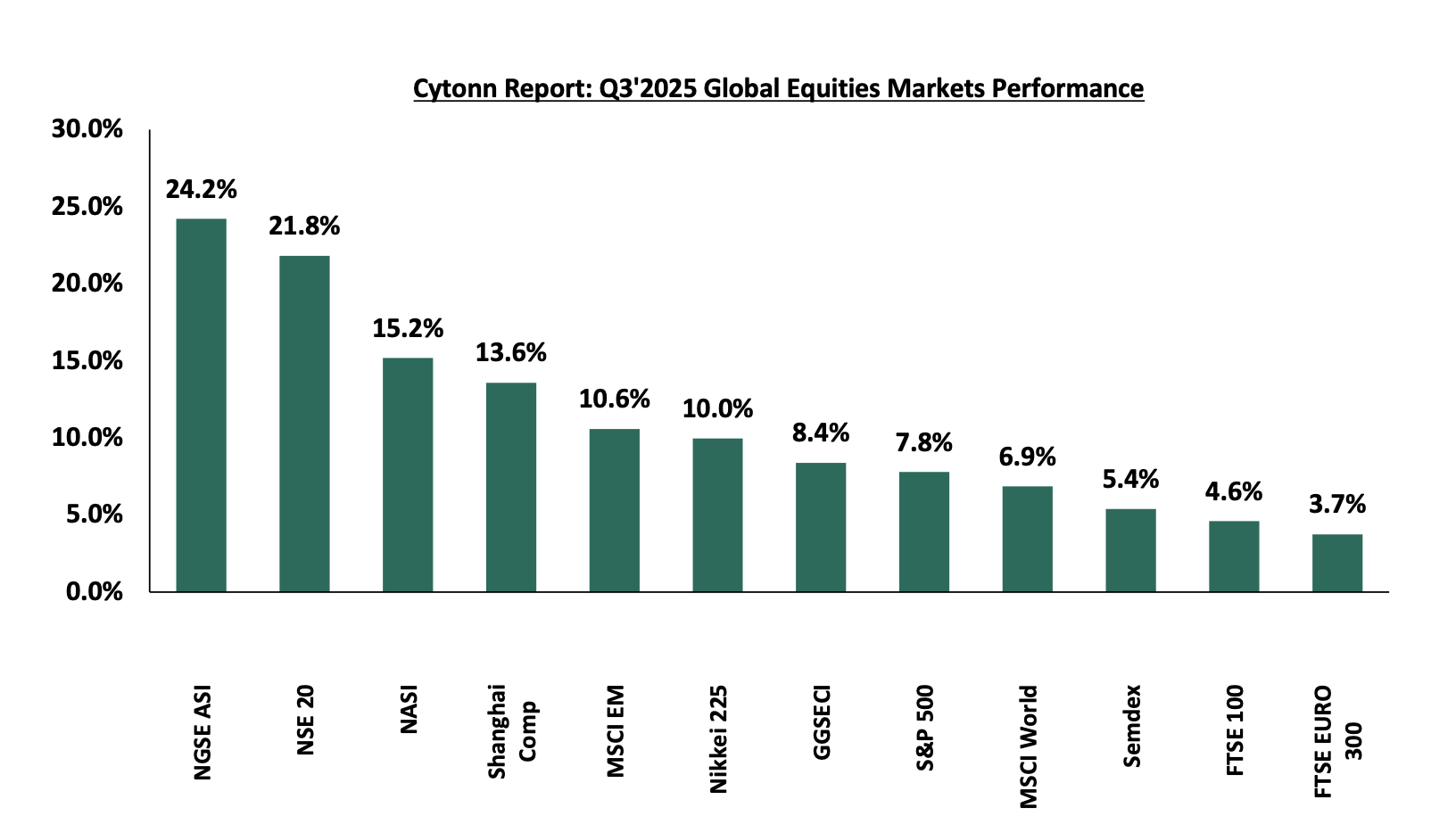

The global stock market was on an upward trajectory in Q3’2025, with most indices recording gains during the period, largely attributable to strong dividend growth, a weaker U.S. dollar boosting multinational earnings, resilient consumer spending, and rising investor confidence. Additionally, geopolitical tensions like tariff threats temporarily subsided and investors rotated into undervalued European and emerging markets. Notably, NGSEASI was the best performer during the period, recording a gain at 24.2% in Q3’2025 largely driven by gains in the large-cap stocks such as BUA Foods, Dangote Cement and MTN Nigeria gaining by 37.2%, 19.3% and 18.3% respectively, following improved earnings during the period, supported by easing inflation. Below is a summary of the performance of key indices as at the end of Q3’2025:

*Dollarized performance

According to the World Bank, the Sub-Saharan economy is projected to grow at a moderate rate of 3.7% in 2025, which is 0.2% points higher than the 3.5% growth recorded in 2024, and a downward revision from the January 2025 projection of 4.1%. The downward revision is mainly due to the rising trade barriers coupled with the weakened global investor confidence. The expected recovery from 2024 is primarily driven by global economic stability, and easing of monetary policy rates in the region, which is expected to boost private consumption and investment. However, most countries face the risk of increased inflation due to increased food prices resulting from drought, prompting them to increase or hold off on further easing of the rates. Nevertheless, the risk of debt distress remains high with more than half of countries facing unsustainable debt burdens. The public debt is expected to remain high due to increased debt servicing costs as a result of high interest rates in developed economies and a reduction in donor support.

Currency Performance:

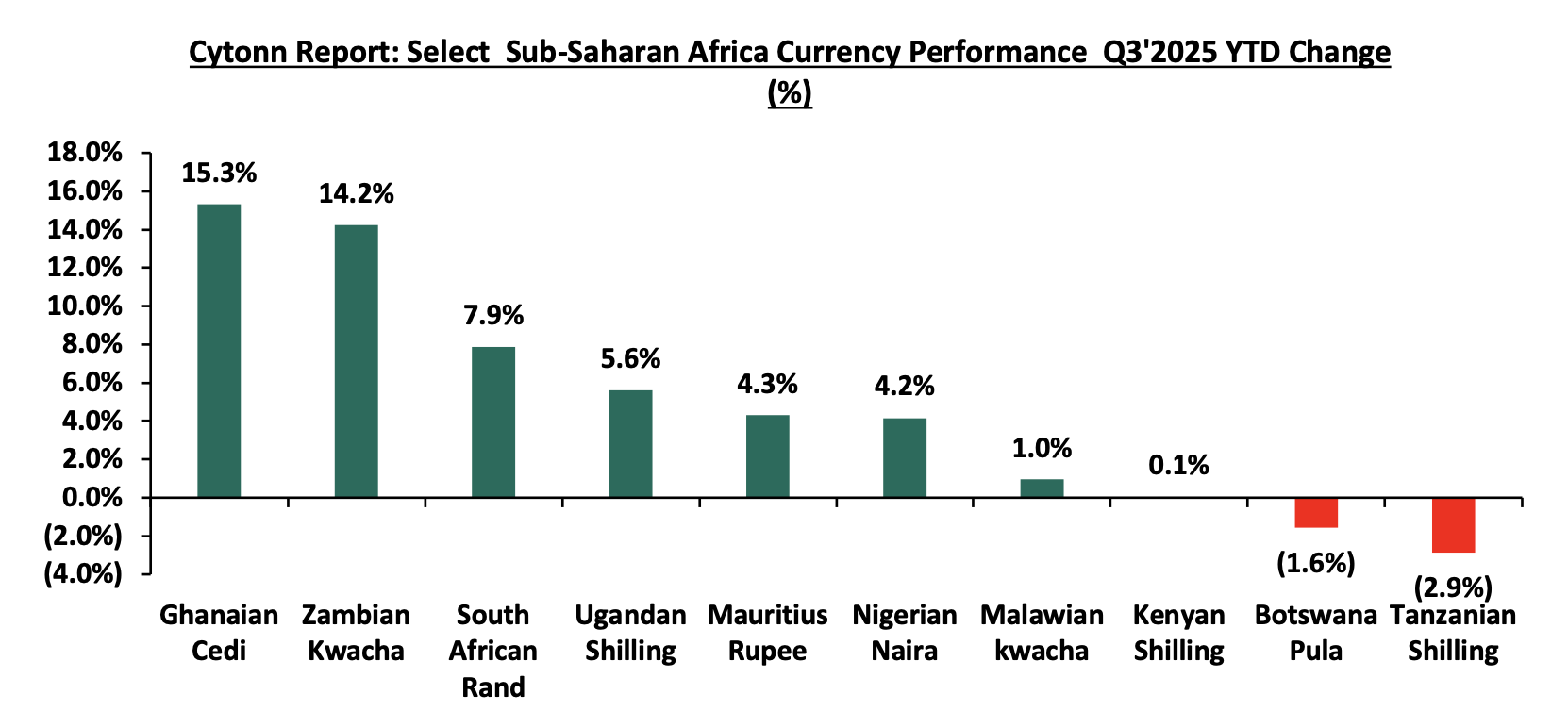

In Q3’2025, most of the select Sub-Saharan currencies appreciated against the US Dollar, primarily due to the respective central bank efforts, increased foreign currency inflows and debt-restructuring and policy reforms which have improved forex reserves. Notably, the Ghanaian Cedi emerged as the best performer among the selected currencies, appreciating by 15.3% against the USD on a year-to-date basis, closing Q3'2025 at GHS 12.5, from GHS 14.7 at the beginning of the year. The Ghanaian Cedi’s performance is majorly attributable to improved monetary policies, reduced inflation, and strong export earnings from gold and cocoa. Below is a table showing the performance of select African currencies against the US Dollar:

|

Cytonn Report: Select Sub-Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Sep-24 |

Jan-25 |

Sep-25 |

Last 12 months |

YTD change (%) |

|

Ghanaian Cedi |

15.8 |

14.7 |

12.5 |

21.2% |

15.3% |

|

Zambian Kwacha |

26.4 |

27.9 |

23.9 |

9.3% |

14.2% |

|

South African Rand |

17.3 |

18.8 |

17.3 |

(0.1%) |

7.9% |

|

Ugandan Shilling |

3768.0 |

3,697.6 |

3490.2 |

7.4% |

5.6% |

|

Mauritius Rupee |

45.9 |

47.7 |

45.66 |

0.5% |

4.3% |

|

Nigerian Naira |

1,669.0 |

1,540.7 |

1,476.62 |

11.5% |

4.2% |

|

Malawian kwacha |

1,733.7 |

1,750.3 |

1,733.7 |

0.0% |

1.0% |

|

Kenyan Shilling |

129.2 |

129.3 |

129.2404 |

(0.0%) |

0.1% |

|

Botswana Pula |

13.0 |

14.0 |

14.2 |

(8.7%) |

(1.6%) |

|

Tanzanian Shilling |

2,730.0 |

2,374.7 |

2,442.8 |

10.5% |

(2.9%) |

Source: Yahoo Finance, Central Banks

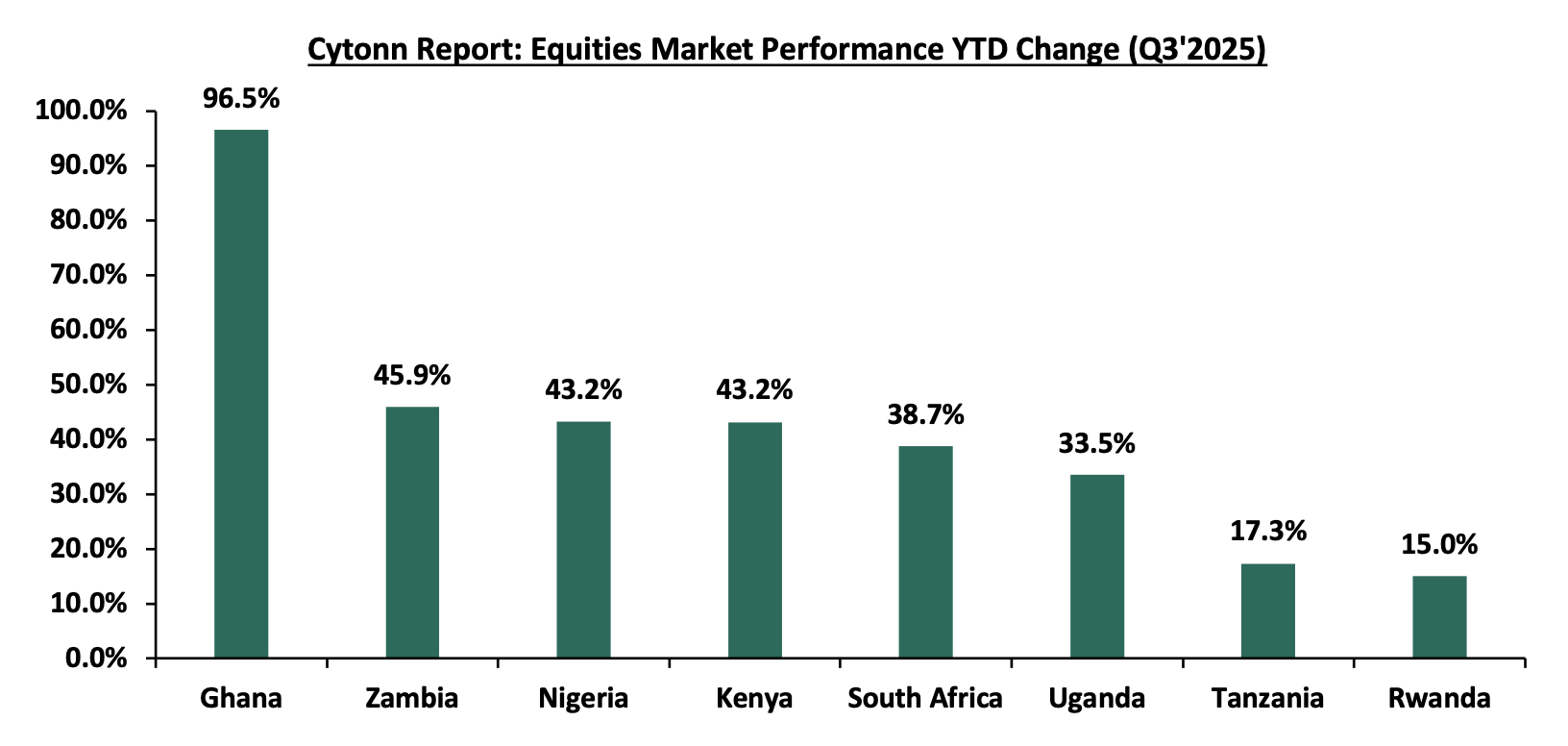

The chart below shows the year-to-date performance of different sub-Saharan African countries in Q3’2025;

Source: Yahoo Finance

Key take outs from the above table and chart include:

- The Ghanaian Cedi was the largest gainer against the USD Dollar, gaining by 15.3% year to date to close at GHS 12.5 as at the end of September from the GHS 15.8 recorded at the beginning of the year. The Cedi’s strength has been supported by several factors, including improved monetary policies, lower inflation, robust export revenues from gold and cocoa, and economic recovery that attracted global investors. and,

- The Tanzanian Shilling was the worst performing currency in Q3’2025, depreciating by 2.9%, mainly as a result of the country’s heavy dependence on imports, underperforming export sectors, and limited foreign exchange inflows to support the currency.

African Eurobonds:

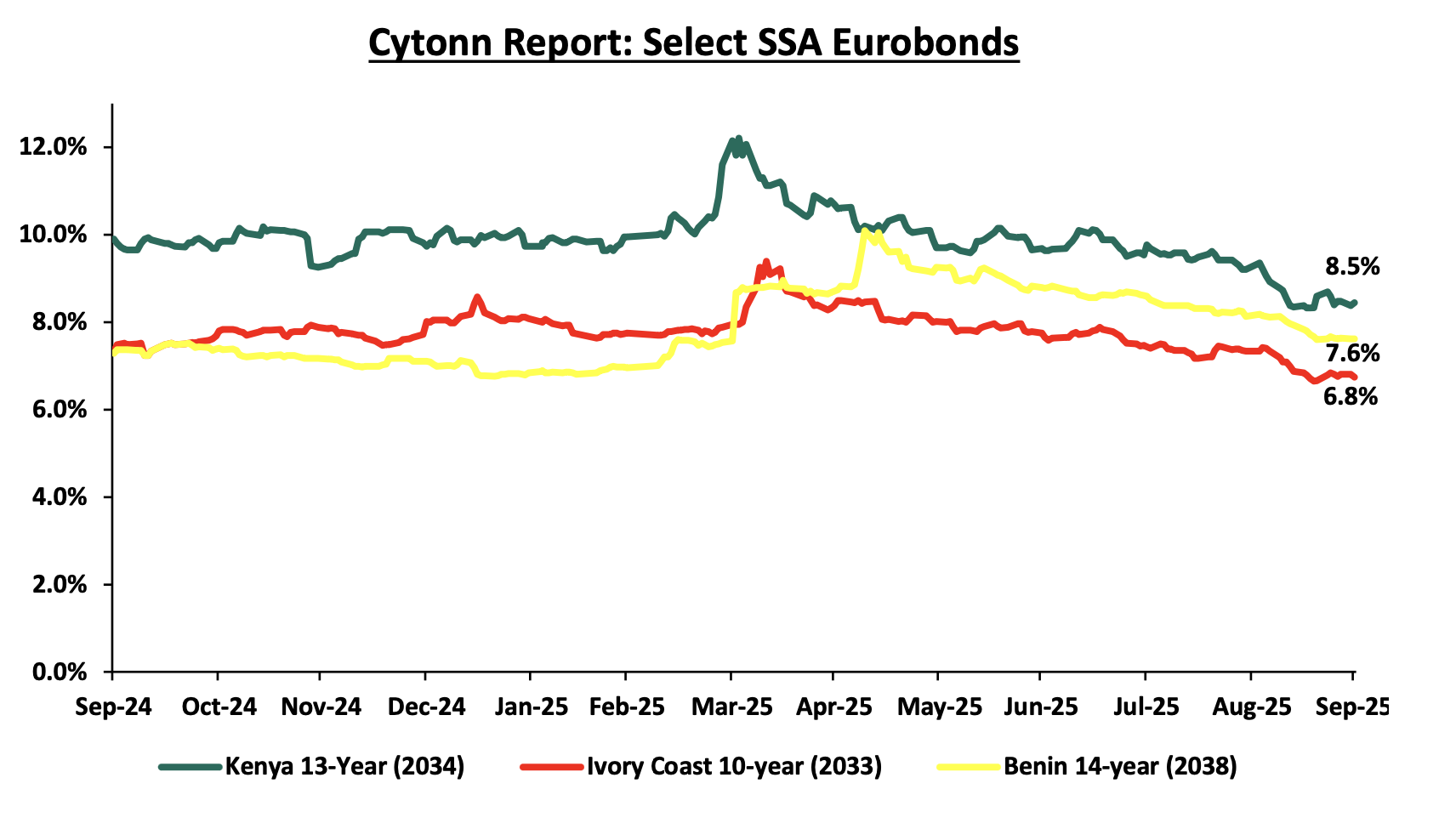

Africa’s appetite for foreign-denominated debt has increased in recent times with the latest issuers during the nine months to end of Q3’2025 being being Ivory Coast and Benin raising a total of USD 1.8 bn and USD 0.5 bn respectively in March 2025 and January 2025 respectively. Additionally, 2024 issuers were Ivory Coast, Benin, Kenya, Senegal and Cameroon raising a total of USD 2.6 bn, USD 0.8 bn, USD 1.5 bn, USD 0.8 bn and USD 0.6 bn respectively. Notably, all the bonds were oversubscribed with the high support being driven by the yield hungry investors and also the outlook of positive recovery in the regional economies. It is good to note that there was a general decline in the yields of the various bonds from most countries due to general improvement in investor sentiment as the economy recovers and the easing inflationary pressures in the region. The Yields of the Kenya’s 13-year Eurobond maturing in 2034 decreased by 1.4% points to 8.5% as at the end of September 2025 from 9.9% in September 2024. Similarly, the yields for Benin’s 14-year and Ivory Coast’s 10-year Eurobonds maturing in 2038 and 2033 respectively decreased by 0.3% points and 0.6% points to 7.6% and 6.7% respectively at the end of September 2025, down from 7.3% each in September 2024. Below is a graph showing the Eurobond secondary market performance of select Eurobonds issued by the respective countries:

Source: Bloomberg, CBK

Equities Market Performance:

Sub-Saharan Africa (SSA) stock markets were on an upward trajectory in Q3’2025, with Ghana’s stock market (GSECI) being the best performing market gaining by 96.5% YTD attributable to gains in the large-cap stocks such as MTN Ghana, Ecobank and Total Energies gaining by 48.5%, 37.9% and 34.5% respectively following improved earnings and growing investor interest in telecom stocks offering attractive dividend payouts. Below is a summary of the performance of key indices:

|

Cytonn Report: Equities Market Performance Q3'2025(Dollarized*) |

||||||

|

Country |

Index |

Sep-24 |

Jan-25 |

Sep-25 |

Last 12 months |

YTD Change |

|

Ghana |

GSECI |

277.6 |

333.8 |

656.1 |

136.3% |

96.5% |

|

Zambia |

LASILZ |

626.5 |

578.8 |

844.4 |

34.8% |

45.9% |

|

Kenya |

NASI |

0.8 |

1.0 |

1.4 |

65.0% |

43.2% |

|

South Africa |

JALSH |

5,015.1 |

4,502.1 |

6,246.1 |

24.5% |

38.7% |

|

Nigeria |

NGEASI |

59.1 |

67.5 |

96.6 |

63.7% |

43.2% |

|

Uganda |

USEASI |

0.3 |

0.3 |

0.4 |

44.9% |

33.5% |

|

Tanzania |

DARSDEI |

0.8 |

0.9 |

1.0 |

31.6% |

17.3% |

|

Rwanda |

RSEASI |

0.1 |

0.1 |

0.1 |

13.7% |

15.0% |

|

*The index values are dollarized for ease of comparison |

||||||

Source: Cytonn Research, Kwayisi, Yahoo Finance

The chart below shows the YTD Performance of the sub-Saharan Equities Market;

Dollarized performance

GDP growth in the Sub-Saharan Africa region is expected to improve, in contrast with the rest of the global economy. Additionally, public debt continues to be a major headwind, with high debt levels experienced in the region on the back of continued weakening of local currencies, which will make debt servicing costlier, making the region less attractive to foreign capital.

According to the Kenya National Bureau of Statistics (KNBS) Q2'2025 Quarterly GDP Report, the Kenyan economy recorded a 5.0% growth in Q2’2025, 0.4% points higher from the 4.6% growth rate recorded in Q2’2024. The main contributor to Kenyan GDP remains to be the Agriculture, Fishing and Forestry sector which grew by 4.4% in Q2’2025, lower than the 4.5% expansion recorded in Q2’2024. All sectors in Q2’2025 recorded positive growths, with varying magnitudes across activities. Most sectors recorded contraction in growth rates compared to Q2’2024 with Accommodation & Food Services, Financial Services Indirectly Measured and Other services recording growth rate declines of 27.2%, 8.9% and 3.4% points to 7.8%, 1.4% and 1.4% from 35.0%, 10.3% and 4.8% respectively. Other sectors recorded an expansion in growth rates, from what was recorded in Q2’2024, with Mining and Quarrying, Construction and Electricity and water supply recording the highest growths in rates of 20.8%, 9.4% and 4.5% points, to 15.3%, 5.7% and 5.7% from (5.5%), (3.7%) and 1.2% respectively. Notably, the overall economic performance highlighted modest growth despite a slowdown in several key sectors, reflecting the mixed performance across industries amid a challenging operating environment. In 2025, the Kenyan economy is expected to rebound, returning to its growth path, with the average projected growth estimated at 5.0% by various organizations as outlined below:

|

Cytonn Report: Kenya 2025 Growth Projections |

||

|

No. |

Organization |

2025 GDP Projections |

|

1 |

International Monetary Fund |

4.8% |

|

2 |

National Treasury |

5.2% |

|

3 |

World Bank |

4.5% |

|

4 |

Fitch Solutions |

5.1% |

|

5 |

Cytonn Investments Management PLC |

5.4% |

|

Average |

5.0% |

|

Source: Cytonn Research

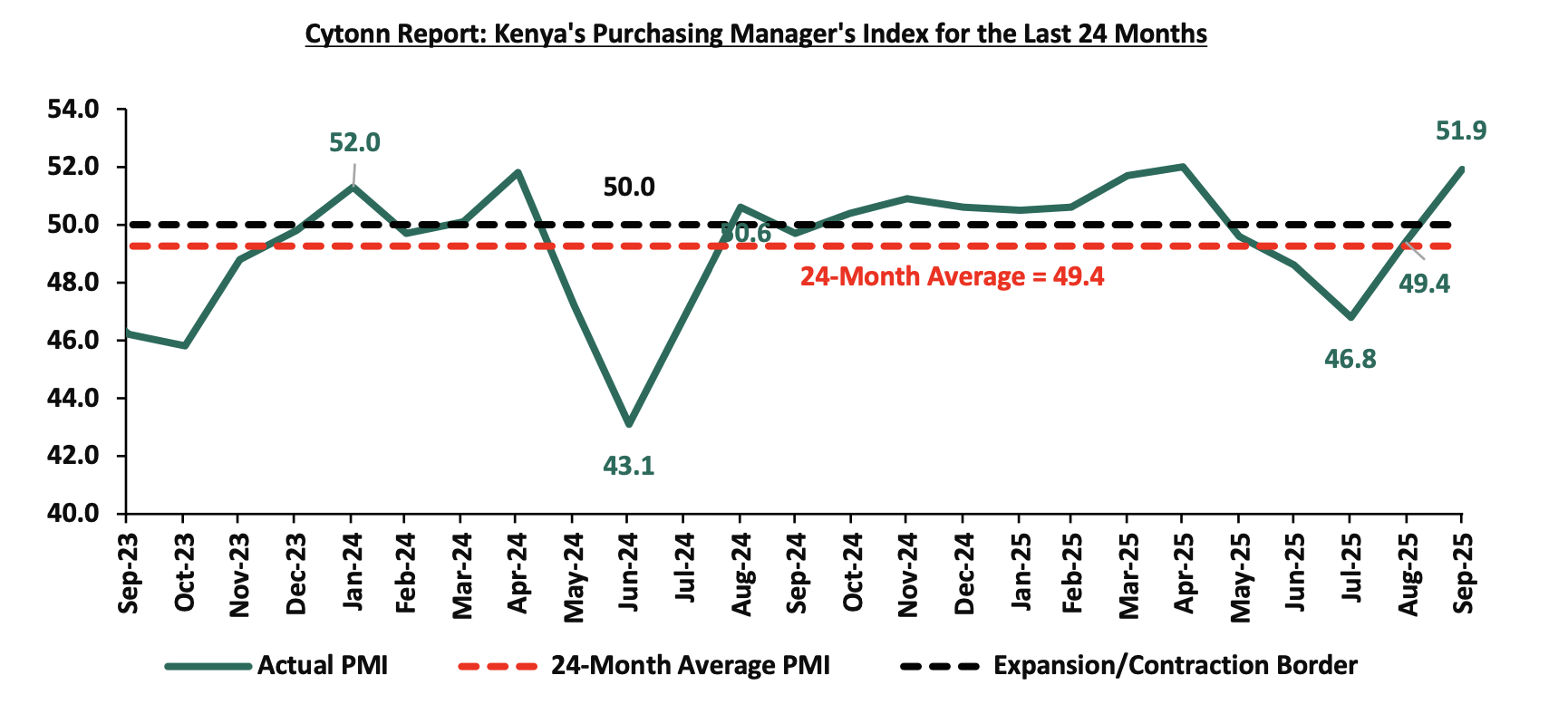

Key to note, Kenya’s general business environment improved slightly in Q3’2025, with the average Purchasing Manager’s Index for the quarter coming at 49.4, compared to 46.9 recorded in a similar period in 2024. The improvement was mainly on the back of a stronger and stable Shilling, despite the slight increase in inflation averaging at 4.4% in Q3’2025, 0.3% points higher than the 4.1% average rate for Q3’2024. Additionally, the easing monetary policy stance is expected to continue to reduce the cost of borrowing and increase spending therefore supporting business activity. The chart below summarizes the evolution of PMI over the last 24 months. (A reading above 50.0 signals an improvement in business conditions, while readings below 50.0 indicate a deterioration):

Stanbic Bank’s September 2025 Purchasing Manager’s Index (PMI)

During the week, Stanbic Bank released its monthly Purchasing Managers’ Index (PMI) showing that business conditions in the private sector improved in September 2025, marking the first expansion since April. The headline PMI rose to 51.9 in September, up from 49.4 in August, moving above the neutral 50.0 threshold and signaling a renewed upturn in private sector activity. The improvement followed months of protest-related disruptions and subdued sales, reflecting early signs of demand stabilization. On a year-to-year basis, additionally, the index has recorded a 4.4% increase to 51.9 in September 2025 from the 49.7 posted in September 2024, highlighting relatively stronger conditions compared to the same period last year.

Business output returned to growth, ending a four-month sequence of contraction. The rebound was supported by expansions in manufacturing, wholesale & retail, and services, which outweighed persistent weakness in construction. Similarly, new orders registered solid growth, snapping four consecutive months of decline as improved political stability and marketing efforts boosted demand. Roughly a third of surveyed firms reported higher output, while only 23.0% recorded a decline.

On the employment front, hiring activity strengthened further, with job creation reaching its fastest pace since May 2023. The rise in staffing helped firms reduce backlogs for the fourth consecutive month, pointing to improved capacity. Nevertheless, purchasing activity remained in negative territory, with firms cautious about committing to higher input volumes after months of weak sales. Despite this, inventories increased as some firms resumed procurement in anticipation of stronger demand. Supplier performance also improved markedly, with average delivery times shortening at the fastest pace in four years, reflecting easing supply-side pressures and stronger vendor competition. On prices, Kenyan companies continued to face cost pressures, though the rate of input cost inflation moderated for a second consecutive month. Firms cited higher taxes and commodity prices, especially fuel and food items, as key drivers. Selling prices, meanwhile, rose modestly, partly reflecting cost pass-through but also higher sales volumes.

Overall, while the private sector still faces headwinds from elevated taxes, higher commodity costs, and soft consumer demand, the September PMI reading highlights a tentative recovery in operating conditions. Business confidence remained strong, though below historical averages, as firms pinned hopes on product diversification, marketing strategies, and outlet expansion to sustain growth. The private sector outlook is expected to benefit from easing supply-side pressures, improving political stability, and a more accommodative monetary policy stance, all of which should help anchor a gradual recovery in activity.

Going forward, we expect the private sector to continue experiencing a fragile recovery, supported by easing supply-side bottlenecks, improved political stability, and a more accommodative monetary policy stance by the CBK. However, structural challenges such as elevated fuel prices, rising taxation, and subdued consumer purchasing power will likely constrain the pace of recovery. As such, while short-term improvements are evident, a sustained upturn in business conditions will depend heavily on continued policy support, effective inflation management, and stronger domestic demand.

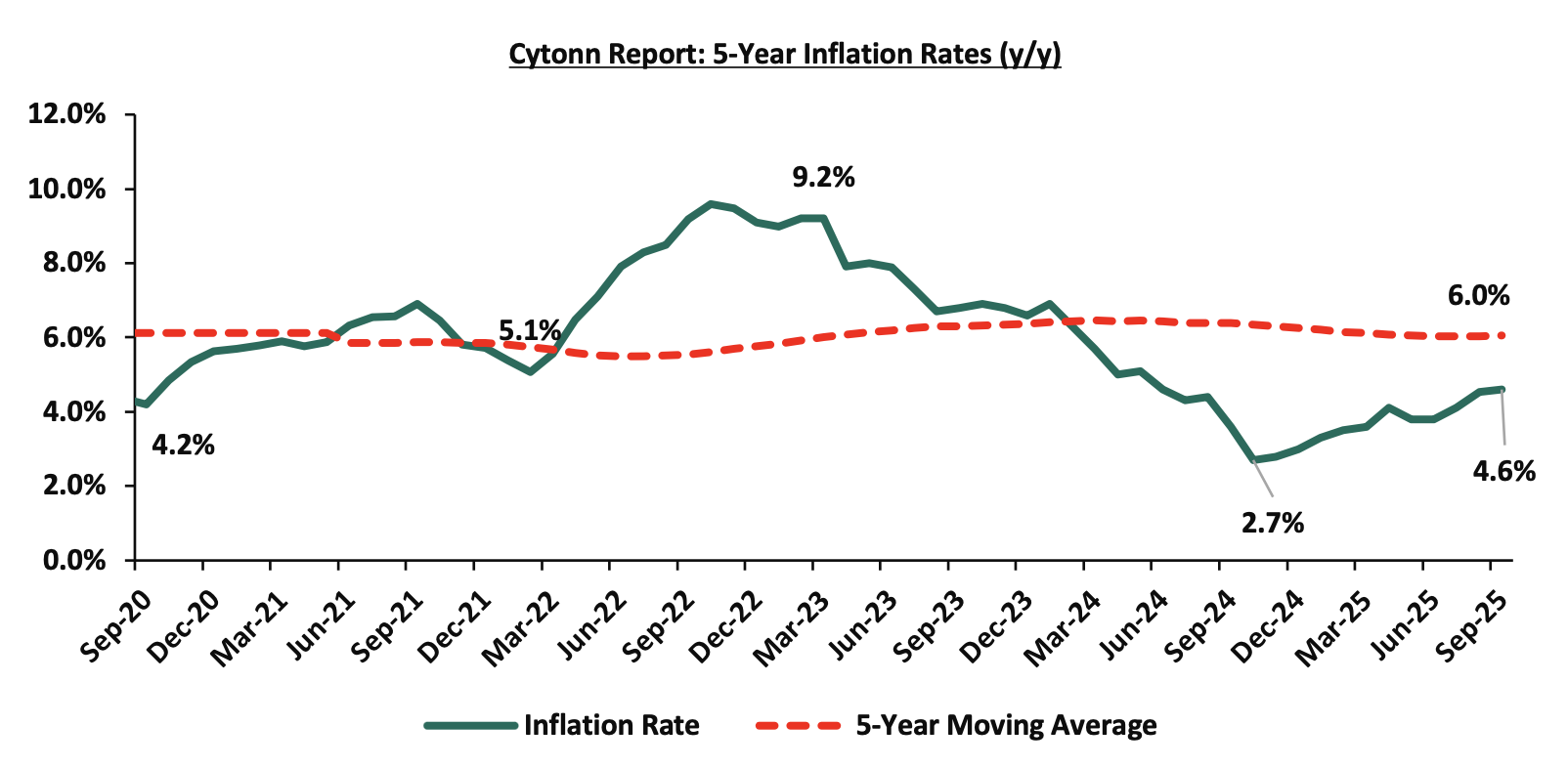

Inflation:

The average inflation rate increased to 4.4% in Q3’2025, compared to 4.1% in Q3’2024, attributable to a stronger and stable Shilling, leading to reduced fuel prices. Notably, fuel prices of Super petrol, Diesel, and Kerosene decreased by 0.4%, 0.1% and 0.5% in September 2025 to Kshs 184.5 Kshs 171.5 and Kshs 154.8, from Kshs 185.3, Kshs 171.6, and Kshs 155.6 per litre in August 2025 respectively. Inflation for the month of September 2025 rose slightly by 0.1% point to 4.6% up from 4.5% recorded in August 2025, mainly driven by an 8.4% increase in the food and non-alcoholic beverages index, a 4.0% increase in transport costs and a 1.4% rise in housing, water, electricity, gas and other fuels. Below is a chart showing the inflation trend for the last five years:

For the last 27 months, Kenya’s inflation has persistently remained within the Central Bank of Kenya (CBK) target range of 2.5% - 7.5%, owing to a stronger Shilling, reduced fuel and electricity prices. With the continued easing of monetary policy following the MPC’s observation that its earlier measures had stabilized the Shilling and anchored inflation, the focus has now shifted to lowering borrowing costs, supporting the private sector, and promoting economic growth. As a result, we expect this to exert upward pressure on inflation. The Monetary Policy Committee (MPC) has lowered the Central Bank Rate (CBR) by cumulative of 350 bps since August 2024, to 9.50% in August 2025 from 13.00%, in 2024. Going forward, we still expect the inflationary pressures to remain within the CBK’s preferred target range of 2.5% - 7.5%.

September 2025 Inflation

The year-on-year inflation in September 2025 rose slightly to 4.6%, up from 4.5% recorded in August 2025. This was in line with our projection of an increase to within the range of 4.1%- 4.6% where our decision was mainly driven by the easing in the Central Bank Rate (CBR) to 9.50% in August 2025 and a slight depreciation of the Kenya Shilling against the US Dollar. The headline inflation was primarily driven by price increases in the following categories: Food & Non-Alcoholic Beverages at 8.4%, Transport at 4.0%, and Housing, Water, Electricity, Gas and Other Fuels at 1.4%. The month-on-month inflation rate stood at 0.2% in September 2025. The table below summarizes the performance of commodity indices both on a year-on-year and month-on-month basis:

|

Cytonn Report: Major Inflation Changes – September 2025 |

|||

|

Broad Commodity Group |

Price change m/m (September-2025/ August -2025) |

Price change y/y (September-2025/September-2024) |

Reason |

|

Food and non- alcoholic beverages |

0.5% |

8.4% |

The m/m increase was mainly driven by the increase in prices of fruits and vegetables such as Oranges, Mangoes, Cabbages, potatoes and tomatoes by 5.6%, 3.0%, 2.7%, 2.6% and 1.2% respectively. However, the increase was weighed down by decrease in prices of Sifted Maize flour, Fortified Maize flour, Spinach and Sukuma Wiki of 3.0%, 2.2%, 1.8% and 1.0% respectively |

|

Transport |

(0.3%) |

4.0% |

The transport index recorded a slight m/m decrease mainly due to a decrease in prices of passenger transport costs with the bus/matatu fare for travel between towns dropped by 0.5%. Prices of Diesel and Petrol declined by 0.1% and 0.4%, to retail at Kshs 172.6 and Kshs 185.6 respectively. |

|

Housing, water, electricity, gas and other fuels |

0.5% |

1.4% |

The m/m increase was mainly driven by an increase in prices of 50kWh electricity and 200kWh electricity by 1.1% and 1.0% respectively. while single room house rent recorded an increase of 0.2%. However, the increase was weighed down by the decrease in prices of Kerosene and gas/LPG by 0.5% and 0.2% respectively. |

|

Overall Inflation |

0.2% |

4.6% |

The m/m increase was mainly attributable to the 0.5% increase in food and non-alcoholic beverages. |

In September 2025, overall inflation rose slightly to 4.6% on a y/y basis, up from 4.5% in August 2025, signaling mild upward price pressure in key sectors. Despite this, the inflation rate remained within the Central Bank of Kenya’s preferred range of 2.5%–7.5% for the twenty-seventh consecutive month, underscoring ongoing macroeconomic stability. The increase was primarily driven by an 8.4% y/y rise in food and non-alcoholic beverage prices, a 4.0% increase in transport costs and a 1.4% rise in housing, water, electricity, gas and other fuels. On a month-to-month basis, inflation was marginal at 0.2%, indicating relative price stability. Prices for Super Petrol, Diesel and Kerosene decreased by 0.4%, 0.1% and 0.5% respectively. Despite diesel, super petrol and kerosene prices decreasing, prices are still high, resulting in high production costs and high costs of goods and services. Additionally, the recent reduction in the Central Bank Rate to 9.50% from 9.75% is expected to stimulate credit uptake and increase money supply, which could gradually exert upward pressure on inflation in the coming months as monetary easing transmits through the broader economy. Meanwhile, the Kenya Shilling maintained stability, recording a 0.2 bps month-to-date appreciation as of 30th September 2025 to remain relatively unchanged from the Kshs 129.2 recorded at the end of August and a 5.1 bps year-to-date gain to Kshs 129.2 as of 3rd October, 2025, from the Kshs 129.3 recorded at the beginning of the year. This stabilization in the exchange rate, combined with manageable fuel price increases, continues to anchor inflation expectations within the CBK’s target range.

Going forward, we expect inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a stable currency and stable fuel prices. Additionally, favourable weather conditions will also contribute to stabilizing food prices, further supporting stable inflation rates. The risk, however, lies in the fuel prices which despite their stability, still remain elevated compared to historical levels. Additionally, the Monetary Policy Committee cut the Central Bank Rate by 25.0 bps to 9.50% from 9.75% in its August 2025 meeting, with the aim of easing the monetary policy, while maintaining exchange rate stability, and will meet again in October 2025. This cut in the Central Bank Rate is likely to elevate inflationary pressures gradually as consumer spending rises from increased money supply. The committee is expected to adopt a more cautious approach to rate adjustments in the coming meetings in a bid to continue supporting the private sector, while also keeping an eye on the effect on the inflation and exchange rate.

The Kenyan Shilling:

The Kenyan Shilling remained stable against the US Dollar, appreciating slightly by 0.2 bps in Q3’2025, to remain relatively unchanged from the Kshs 129.2 recorded at the beginning of the quarter, mainly attributable to the improved forex reserves during the period which increased by 33.7% to USD 10.7 bn as of 25th September 2025 from USD 8.0 bn recorded in September 2024. Additionally, the Eurobond buyback program of the USD 900.0mn tranche maturing in 2027 in February 2025 alleviated the credit risk on the country, increasing dollar supply in the market. Additionally, during the week, the Kenya Shilling appreciated slightly against the US Dollar by 1.7 bps to close at 129.2 from 129.3 recorded the previous week.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 5,078.8 mn in the twelve months to August 2025, 9.4% higher than the USD 4,644.5 mn recorded over the same period in 2024. These has continued to cushion the shilling against further depreciation. In the August 2025 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 60.6% in the period,

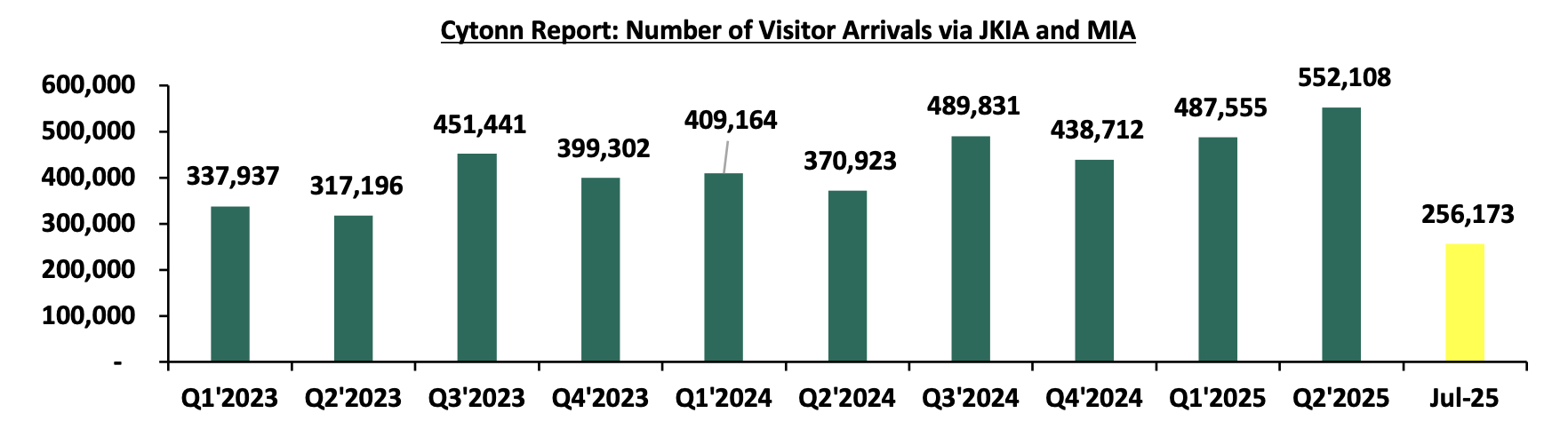

- The tourism inflow receipts which came in at Kshs 452.2 bn in 2024, a 19.8% increase from Kshs 377.5 bn inflow receipts recorded in 2023, and owing to tourist arrivals that improved by 9.9% to 2,424,382 in the 12 months to June 2025 from 2,206,469 in the 12 months to June 2024, and,

- Improved forex reserves currently at USD 10.7 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.0-months of import cover.

The shilling is however expected to remain under pressure in 2025 as a result of:

- An ever-present current account deficit which came at 1.6% of GDP in the twelve months to June 2025, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 61.4% of Kenya’s external debt is US Dollar-denominated as of March 2025.

Monetary Policy:

The Monetary Policy Committee (MPC) met once in Q3’2025 and lowered the CBR rate by 25.0 bps to 9.50%, from 9.75% in August 2025 against a backdrop of elevated uncertainties to the global outlook for growth, lower but sticky inflation in advanced economies heightened trade tensions as well as persistent geopolitical tensions. Below are some of the key highlights from the August 2025 meeting:

- The overall inflation increased by 0.3% points to 4.1% in July 2025, from 3.8% in June 2025, remaining below the mid-point of the preferred CBK range of 2.5%-7.5%. Core inflation increased to 3.1% in July 2025, from 3.0% in June, reflecting increasing demand pressures in the economy. This increase was largely attributed to higher prices of processed foods, particularly sugar and maize flour. Additionally, non-core inflation rose to 7.2% in July 2025, from 6.2 % in June, driven by higher energy prices. Lower energy and utilities costs, including reduced electricity and fuel prices, continued to help moderate non-core inflation. Overall inflation is expected to stay below the mid-point of the target range in the near term, supported by low food prices, stable energy prices, and a stable exchange rate.

- The recently released Quarterly Gross Domestic Product Report, for Q1’2025 showed a resilience in the performance of the Kenyan economy, with real GDP growing by 4.9%, compared to the similar growth recorded in Q1’2024. This was attributable to expansion in growth in agriculture and industrial sectors of the economy. The economy is expected to continue to strengthen in 2025 with real GDP growth projected at 5.2%, from the 4.7% growth recorded in 2024 supported by resilient services sector and agriculture, expected recovery in the industrial sector. However, this positive outlook is tempered by geopolitical tensions and trade policy uncertainties.

- The Kenya National Bureau of Statistics (KNBS) updated the balance of payments data to better capture cross-border transactions, especially those involving petroleum imports and re-exports under government-to-government deals. The revisions also include the use of alternative data sources to enhance accuracy in reporting international trade in services, notably travel and financial services. These adjustments refine the recording of regional oil product re-exports and international travel earnings.

- Based on the revised balance of payments data goods exports increased by 7.7% in the 12 months to June 2025, compared to 2024, reflecting a rise in exports of agricultural commodities, especially horticulture, coffee, vegetable oil and clothing accessories. Goods imports rose by 9.9% reflecting increases in intermediate and capital goods imports. Additionally, services receipts increased by 12.5%, driven by increased receipts from transport and travel services, while diaspora remittances increased by 12.1%. The current account deficit in 12 months to June 2025 is estimated at 1.6% of GDP, down from 1.8% in similar period in 2024. For 2025, the current account deficit is projected at 1.5% of GDP, up from 1.3% in 2024 and is expected to be fully financed by capital and financial inflows, yielding a balance of payments surplus of USD 673.0 mn.

- The CBK foreign exchange reserves, which currently stand at USD 10,966.0 representing 4.8 months of import cover, which is above the statutory requirement of maintaining at least 4.0-months of import cover, continue to provide adequate cover and a buffer against any short-term shocks in the foreign exchange market,

- The banking sector remains stable and resilient, with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans (NPLs) to gross loans remained unchanged in June 2025 from the 17.6% recorded in April 2025. Decreases in NPLs were noted in the building and construction, personal and household, and manufacturing sectors while increases were recorded in trade and tourism, restaurant and hotel sectors. Banks have continued to make adequate provisions for the NPLs,

- The CEOs Survey and Market Perceptions Survey conducted ahead of the MPC meeting in July 2025 revealed sustained optimism about business activity and economic growth prospects for the next 12 months. The optimism was attributed to the stable macroeconomic environment reflected in the low inflation rate and stability in the exchange rate, decline in interest rates, expansion in the digital economy and favorable weather conditions supporting agriculture. Nevertheless, respondents expressed concerns about high cost of doing business, subdued consumer demand and increased global uncertainties due to increased tariffs and geopolitical tensions,

- The Survey of the Agriculture Sector for July 2025 revealed an expectation for decline in food prices, on account of favourable weather conditions and the beginning of the harvest season for key crops, especially maize,

- Global economic growth showed steady recovery in 2024 coming in at 3.3%. However, the outlook for 2025 is projected to decline to 3.0%, an upward revision from 2.8% particularly from revisions in the growth in United States and China, due to lower tariffs on trade and global financial conditions. However, uncertainties from trade policies and tariffs as well as escalating geopolitical risks, particularly ongoing conflicts in the Middle East and the Russia-Ukraine war, continue to threaten global growth prospects,

- Global headline inflation is expected to decline, due to decreased energy prices and reduced global demand. Central banks in advanced economies have continued to cut interest rates, albeit cautiously. International oil prices have declined amid higher production and weak demand, yet volatility risks remain elevated due to trade tensions and ongoing geopolitical conflicts. Food inflation has tightened, largely due to high prices of edible oil prices, although inflation in cereals and sugar remain low.

- The Committee was informed on the proposed revised banking sector Risk-Based Credit Pricing (RBCP) model. The model aims to facilitate monetary policy decisions such as setting interest rates, which will effectively influence the lending rates by commercial banks.

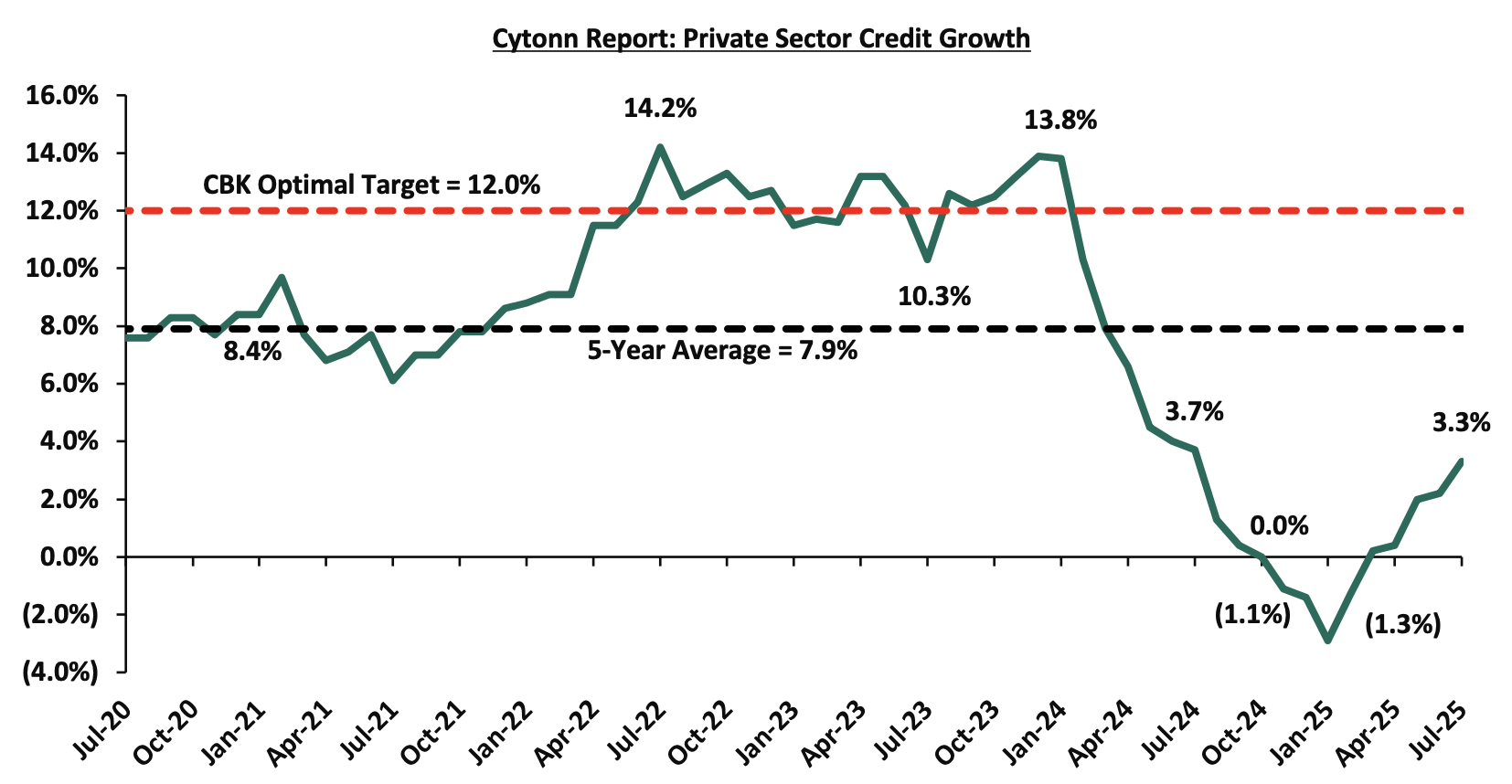

- Growth in private sector credit grew by 3.3% in July 2025 from 2.2% in June and a contraction of 2.9% in January 2025, mainly attributed increased demand attributable to declining lending interest rates. Notably, the growth in credit was recorded in key sectors such as manufacturing, trade, building and construction, and consumer durables since the last MPC meeting in June. Average commercial banks’ lending rates declined to 15.2% in July from 15.3% in June 2025 and 17.2% in November 2024. The chart below shows growth in private sector growth over the last five years:

- The Committee acknowledged the outcome of the implementation of the FY’2024/25 Budget and the Budget for FY’2025/26. These measures are anticipated to further support fiscal consolidation, which should reduce debt vulnerabilities in the medium-term.

The MPC noted that overall inflation is expected to remain below the midpoint of the 2.5%-5.0% target range in the near term, supported by low food prices, stable energy prices, and exchange rate stability. Additionally, central banks in major economies have continued to lower interest rates at a cautious pace. The Committee also noted that the recent economic developments, created room for further easing of monetary policy to support economic activity while maintaining exchange rate stability. The MPC noted that it will continue to monitor the effects of these policy measures, as well as global and domestic economic developments, and will remain ready to take additional action if necessary. Going forward, we expect the MPC to adopt a more cautious approach to rate adjustments in the coming meetings in a bid to continue supporting the private sector, while also keeping an eye on the effect on the inflation and exchange rate. The next MPC meeting is scheduled for 7th October 2025.

Fiscal Policy:

The total Kenyan budget for the FY’2025/2026 National Budget increased by 7.1% to Kshs 4.3 tn from the Kshs 4.0 tn in FY’2024/2025 while the total revenue inclusive of grants increased by 8.0% to Kshs 3.4 tn from the Kshs 3.1 tn in FY’2024/2025. The expenditure will be funded by revenue collections of Kshs 3.4 tn and borrowings amounting to Kshs 923.2 bn. Of the Kshs 923.2 bn total borrowing, Kshs 635.5 bn is estimated to be domestic while Kshs 287.7 bn is estimated to be net foreign borrowing.

The increase in revenues is mainly due to an 6.7% increase in ordinary revenue to Kshs 2.8 tn for FY’2025/2026, from the Kshs 2.6 tn in FY’2024/2025 with the increase largely dependent on the effectiveness of the Kenya Revenue Authority in collecting taxes as well as an increase in some of the existing taxes to meet its revenue target. The government’s efforts have seemingly resulted in improved revenue collection as evidenced by 97.4% of the revenue targets in FY’2024/25, and having attained 97.4% of the prorated revenue numbers for FY’2024/25 as of end June 2025. However, there are still concerns about the government's ability to meet its revenue collection targets in FY’2025/2026 mainly on the back of the current operating environment with the high cost of living and heightened political climate.

The table below summarizes the key buckets and the projected changes:

|

Amounts in Kshs billions unless stated otherwise |

|||

|

Cytonn Report: Comparison between FY’2024/2025 and FY’2025/2026 Budgets Estimates |

|||

|

Item |

FY'2024/25 Supplementary Budget II |

FY'2025/26 Estimates |

Change y/y (%) |

|

Ordinary Revenue |

2,580.9 |

2,754.7 |

6.7% |

|

Ministerial Appropriation-in-Aid |

486.8 |

567.0 |

16.5% |

|

Total grants |

52.6 |

46.9 |

(10.8%) |

|

Total Revenue & Grants |

3,120.3 |

3,368.6 |

8.0% |

|

Recurrent expenditure |

1,705.7 |

1,805.0 |

5.8% |

|

Recurrent Consolidated Funds Services (CFS) |

1,242.7 |

1,337.3 |

7.6% |

|

Development expenditure |

624.7 |

693.2 |

13.0% |

|

County Transfer & Contingencies |

445.6 |

474.9 |

6.6% |

|

Total expenditure |

4,007.5 |

4,291.9 |

7.1% |

|

Fiscal deficit inclusive of grants |

(887.2) |

(923.3) |

4.1% |

|

Projected Deficit as % of GDP |

(5.1%) |

(4.8%) |

(0.3%) pts |

|

Net foreign borrowing |

281.5 |

287.4 |

2.2% |

|

Net domestic borrowing |

605.7 |

634.8 |

4.9% |

|

Total borrowing |

887.2 |

923.2 |

4.1% |

Source: National Treasury of Kenya, www.parliament.go.ke

For the FY’2024/2025, the government was not able to meet the revenue collection targets having collected Kshs 2,430.1 bn, equivalent to 97.4% of the revised estimates III of Kshs 2,496.2 bn for FY’2024/2025 and 97.4% of the prorated estimates of Kshs 2,496.2 bn in the twelve months of FY’2024/2025. Notably, the total expenditure amounted to Kshs 3,519.2 bn, equivalent to 78.6% of the revised estimates of Kshs 4,474.9 bn, and 85.8% of the prorated expenditure estimates of Kshs 4,102.0 bn, an indication of modest spending by the government. The total borrowings as at the end of June 2025 amounted to Kshs 1,558.6 bn, equivalent to 91.6% of the revised estimates of Kshs 1,702.2 bn and 91.6% of the prorated estimates of Kshs 1,702.2 bn.

Going forward, we believe that the persistent fiscal deficit owing to lower revenues relative to expenditure will force the government to borrow more. We therefore expect the government to cut on its expenditure, mostly the development expenditure, in order to finance the growing debt maturities and the ballooning recurrent expenditure.

Money Markets, T-Bills Primary Auction:

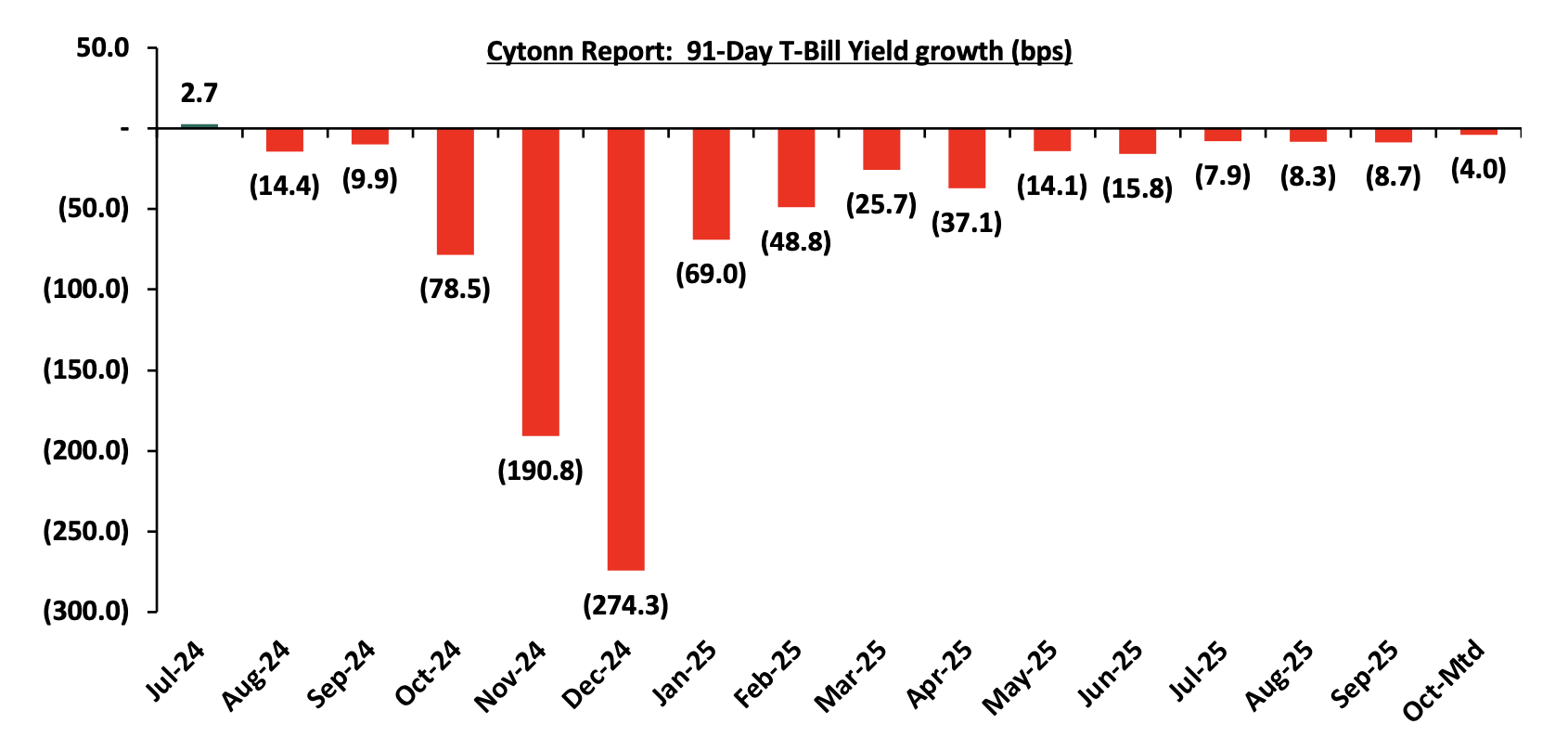

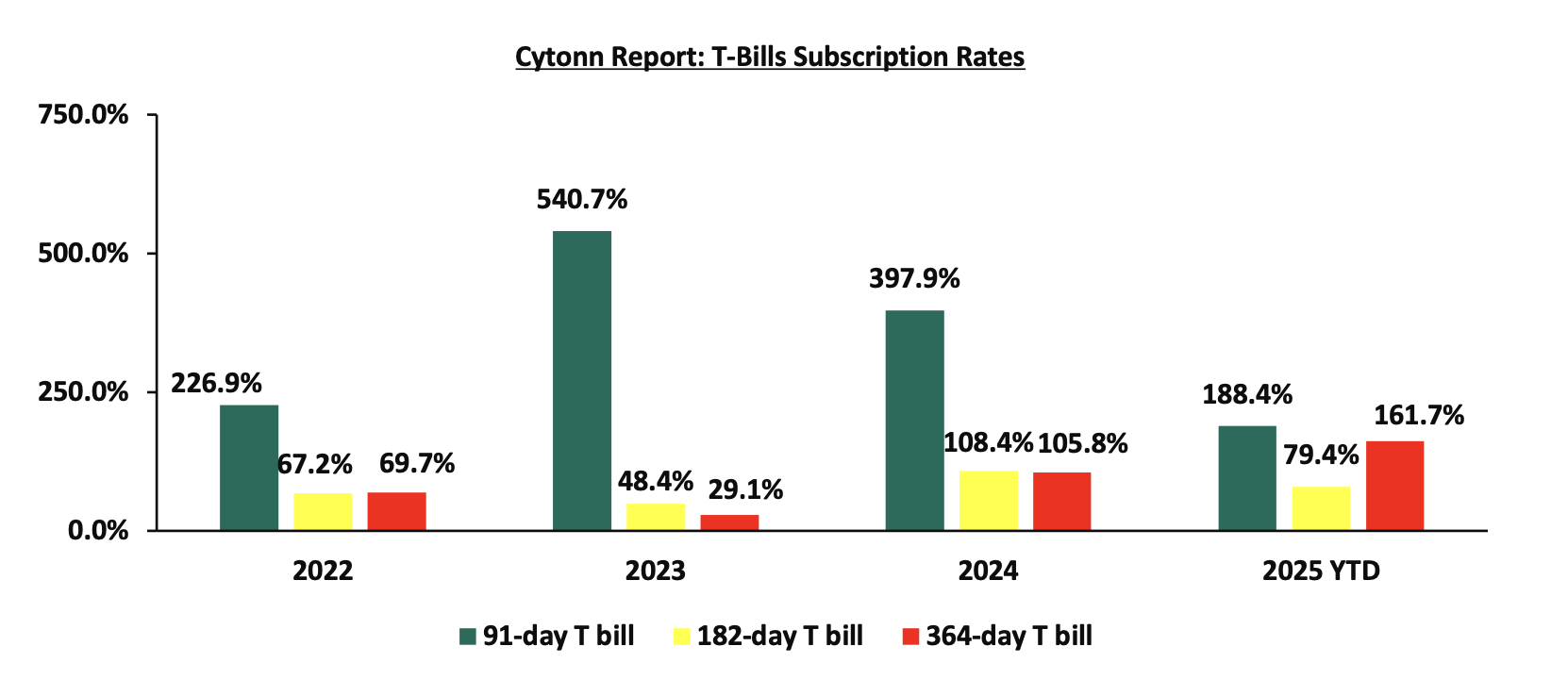

During Q3’2025, T-bills were oversubscribed, with the overall subscription rate coming in at 110.6%, up from 109.4% in Q3’2024. Investors’ preference for the 91-day paper persisted with the paper receiving bids worth Kshs 90.8 bn against the offered Kshs 52.0 bn, translating to an oversubscription rate of 174.6%, albeit lower than the oversubscription rate of 338.3% recorded in Q3’2024. Overall subscription rates for the 364-day papers came in at 136.1% which was higher than the 49.6% recorded in Q3’ 2024 while that for 182-day papers came in 59.6% which was lower than the 77.6% recorded in Q3’2024. The average yields on the 364-day, 182-day and 91-day papers decreased by 7.2%, 8.5% and 7.8% points to 9.6%, 8.2% and 8.0% in Q3’2025, respectively, from 16.9%, 16.7% and 15.9%, respectively, in Q3’2024. The downward trajectory in yields is primarily driven by improved investor confidence, stemming from reduced credit risk in the country and relatively eased inflationary pressures. This has lowered the risk premium demanded by investors. Despite the government's sustained domestic borrowing, strong demand for government securities has supported the decline in yields. During the period, the acceptance rate stood at 89.5%, down from 88.3% in Q3’2024, with the government accepting Kshs 308.9 billion out of the Kshs 345.1 billion worth of bids received. The chart below shows the yield growth rate for the 91-day paper during the year:

During the week, T-bills were undersubscribed for the third consecutive week, with the overall subscription rate coming in at 63.1%, slightly higher than the subscription rate of 62.9% recorded the previous week. Investors’ preference for the shorter 91-day paper waned, with the paper receiving bids worth Kshs 1.6 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 40.4%, lower than the subscription rate of 40.5%, recorded the previous week. The subscription rates for the 182-day paper increased to 61.3% from the 19.4% recorded the previous week, while that of the 364-day paper decreased to 73.8% from the 115.3% recorded the previous week. The government accepted a total of Kshs 15.1 bn worth of bids out of Kshs 15.1 bn bids received, translating to an acceptance rate of 99.9%. The yields on the government papers registered a mixed performance with the yields on the 91-day paper increasing the most by 1.0 bps to 7.92% from the 7.91% recorded the previous week and the 364-day paper increased by 0.8 bps to 9.54% from 9.53% recorded the previous week while the yields on the 182-day papers decreased by 0.02 bps to 7.98% from 7.99% recorded the previous week.

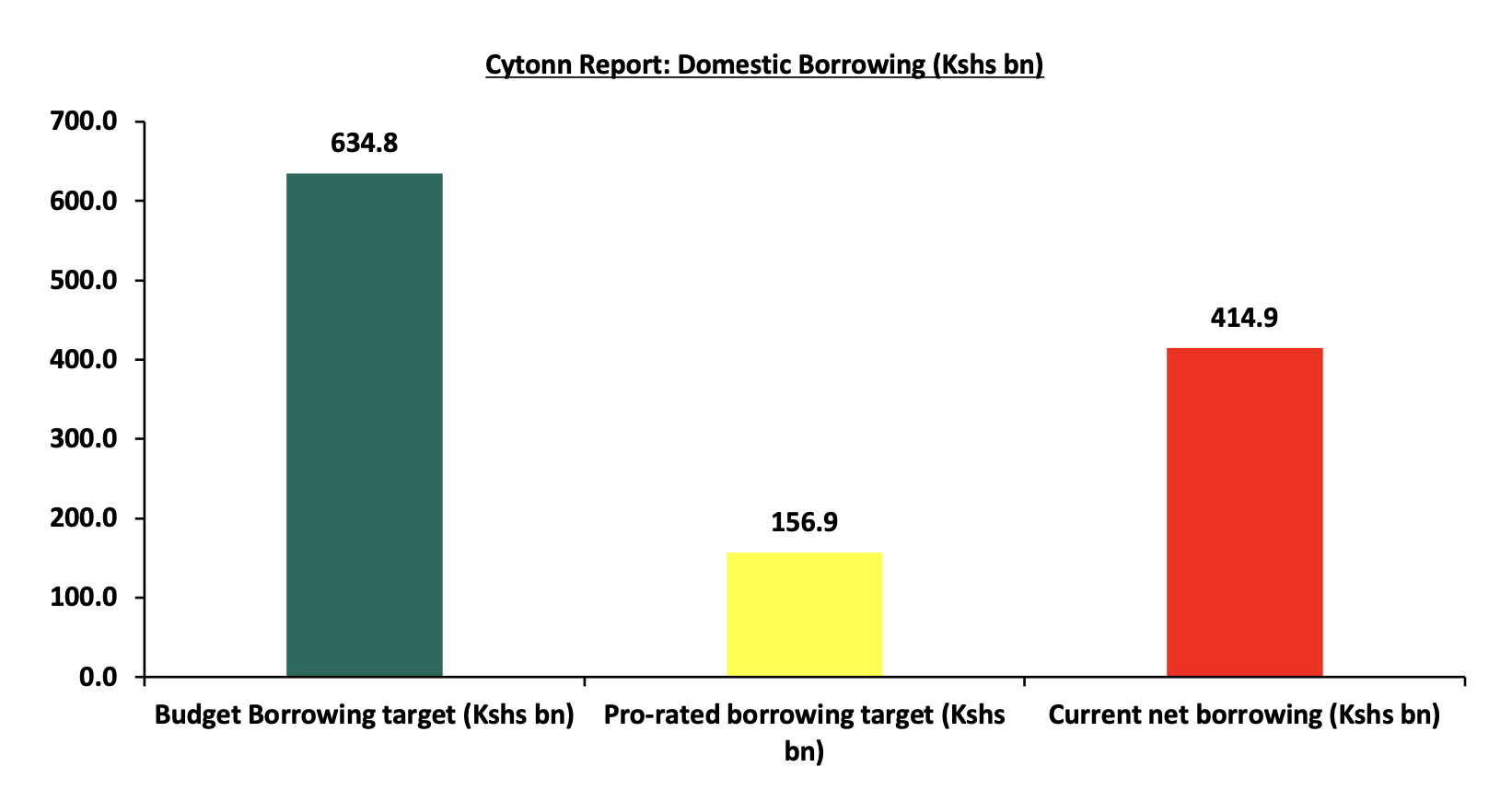

So far in the FY’2025/26, having advertised government securities totalling Kshs 586.0 bn. The government accepted bids worth Kshs 729.3 bn, of which Kshs 324.0 bn treasury bills and Kshs 405.3 bn were bonds. Total redemptions in FY’2025/26 amounted to Kshs 314.4 bn, with treasury bills accounting for Kshs 314.4 bn. As a result, currently, the government has a domestic borrowing surplus of Kshs 414.9 bn, which is 65.4% of the total net domestic borrowing target of Kshs 634.8 bn. The chart below shows the government’s current domestic borrowing:

The chart below compares the overall average T-bills subscription rates obtained in 2022, 2023, 2024 and 2025 Year to Date (YTD):

Primary T-Bond Auctions in Q3’2025

During Q3’2025, the Government reopened six, and issued two bonds on tap-sale, seeking to raise Kshs 250.0 bn. The bonds were generally oversubscribed, receiving total bids worth Kshs 713.1 bn translating to an overall subscription rate of 285.3%.Importantly, there was a notable shift towards offering longer-dated bonds, aligning with the government’s objective of lengthening the maturity profile of public debt and reducing refinancing risk. The government rejected expensive bids and only accepted bids worth Kshs 405.3 bn, out of the Kshs 713.1 bn of bids received, translating to an acceptance rate of 56.8%. The table below provides more details on the bonds issued during the period:

|

Cytonn Report: Bond Issuances in Q3’ 2025 |

|

||||||||||

|

Issue Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount offered (Kshs bn) |

Actual Amount Raised/Accepted (Kshs bn) |

Total bids received (Subscription) |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

|

|

9/22/2025 |

FXD1/2018/020-Reopened |

12.5 |

13.2% |

40.0 |

23.5 |

33.4 |

13.6% |

243.2% |

70.4% |

|

|

|

FXD1/2022/025-Reopened |

22.2 |

14.2% |

37.9 |

63.9 |

14.1% |

59.4% |

|

||||

|

9/8/2025 |

SDB1/2011/030-Reopened |

15.5 |

12.0% |

20.0 |

2.4 |

8.1 |

14.0% |

40.3% |

59.4% |

|

|

|

8/25/2025 |

IFB1/2018/015-Tapsale |

7.6 |

12.5% |

50.0 |

128.0 |

130.3 |

13.0% |

414.9% |

98.2% |

||

|

IFB1/2022/019-Tapsale |

15.6 |

13.0% |

51.8 |

77.1 |

14.0% |

67.2% |

|||||

|

8/18/2025 |

IFB1/2018/015-Reopened |

7.6 |

12.5% |

90.0 |

50.7 |

215.9 |

13.0% |

359.4% |

23.5% |

||

|

IFB1/2022/019-Reopened |

15.6 |

13.0% |

44.4 |

107.5 |

14.0% |

41.3% |

|||||

|

7/14/2025 |

FXD1/2018/020-Reopened |

12.8 |

13.2% |

50.0 |

30.6 |

33.1 |

13.9% |

153.8% |

92.4% |

||

|

FXD1/2018/025-Reopened |

18.0 |

13.4% |

36.1 |

43.8 |

14.3% |

82.3% |

|||||

|

Q3’2025 Total |

|

|

250.0 |

405.3 |

713.1 |

|

|

|

|

||

|

Q3’2024 Total |

|

|

145.0 |

150.3 |

199.3 |

|

|

|

|

||

|

Q3’2025 Average |

14.6 |

13.1% |

|

|

|

13.8% |

285.3% |

56.8% |

|

||

|

Q3’2024 Average |

9.4 |

15.5% |

|

|

|

17.5% |

144.5% |

80.5% |

|

||

In the primary bond market, the government is looking to raise Kshs 50.0 bn through the reopened bonds; FXD1/2018/015 and FXD1/2021/020 with fixed coupon rates of 12.7% and 13.4% respectively and tenors to maturity of 7.7 years, and 15.9 years respectively. The period of sale for the two bonds opened on Friday, 26th September 2025 will close on 15th October 2025. Our recommended bidding ranges for FXD1/2018/015 and FXD1/2021/020 are 12.75%-13.50% and 13.50%-14.50% respectively.

Secondary Bond Market Activity:

- Bond Turnover:

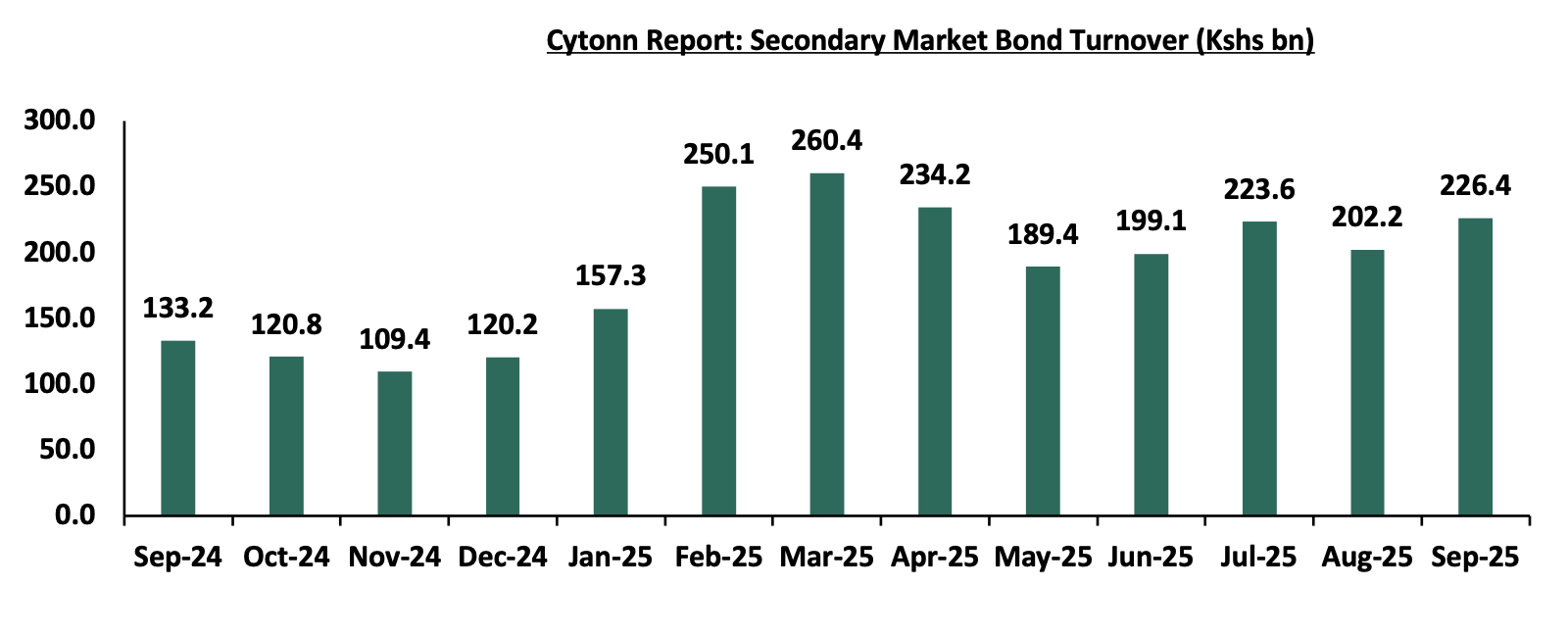

The secondary bond market recorded increased activity, with the total bond turnover increasing by 68.4% to Kshs 652.2 bn from Kshs 387.4 bn in Q3’2024, pointing towards increased activities by commercial banks in the secondary bond market. Similarly, on a year-on-year basis, the bond turnover increased significantly by 70.0% to Kshs 226.4 in September 2025, from Kshs 133.2 bn worth of treasury bonds transacted over a similar period last year. The chart below shows the bond turnover over the past 12 months;

- Yield Curve:

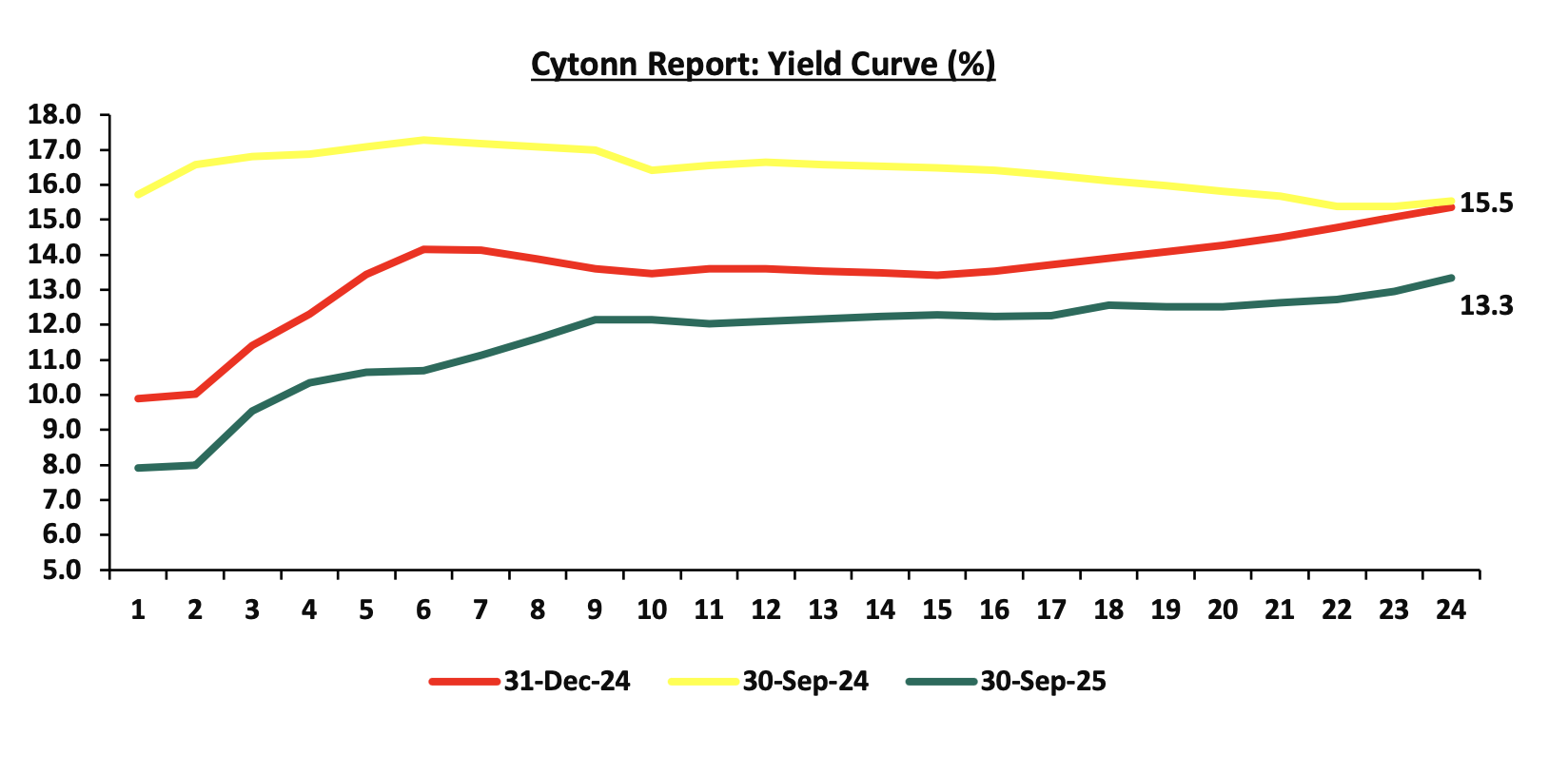

During Q3’2025, yields on the government securities were on a downward trajectory compared to the same period in 2024. This was primarily driven by continued effort by the government to reject highly priced bids, local currency stabilization, and relatively eased inflation. These factors reduced the need for investors to demand higher yields as compensation for inflation and currency depreciation risks, resulting in an overall decline across the yield curve. Notably, the yield curve has adjusted from a humped yield curve observed in 2023 and most part of 2024, towards a normal upward sloping curve, with long-term bonds registering highest yields. The shift in sentiment indicates increased confidence in the economic landscape. The chart below shows the yield curve movement during the period:

Money Market Performance

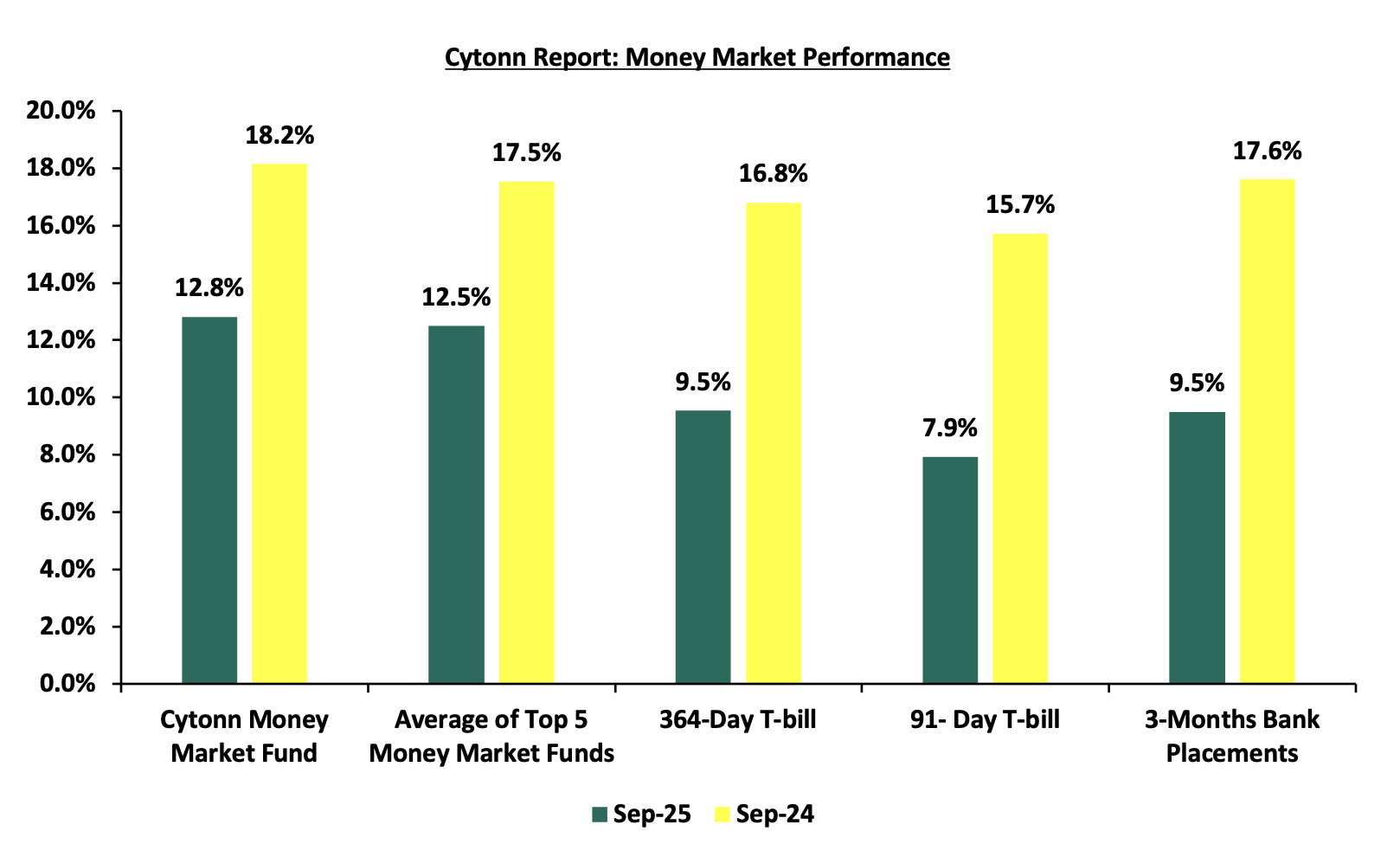

The 3-month bank placements recorded 9.5% at the end of Q3’2025, 8.1% points lower than the 17.6% recorded at the end of Q3’2024 (based on what we have been offered by various banks). The 364-day and 91-day T-bill rate decreased by 7.3% and 7.8% points to 9.5% and 7.9% at the end of Q3’2025 from 16.8% and 15.7% at the end of Q3’2024 respectively, and the average Top 5 Money Market Funds decreased by 5.0% points to 12.5%, from 17.5% at the end of Q3’2024. The yield on the Cytonn Money Market (CMMF) decreased by 5.4% points to 12.8% at the end of Q3’2025, from 18.2% recorded at the end of Q3’2024.

During the week, in the money markets, 3-month bank placements ended the week at 9.5% (based on what we have been offered by various banks), and the yields on the government papers registered a mixed performance with the yields on the 91-day paper increasing the most by 1.0 bps to 7.92% from the 7.91% recorded the previous week and the 364-day paper increased by 0.8 bps to 9.54% from 9.53% recorded the previous week while the yields on the 182-day papers decreased by 0.02 bps to 7.98% from 7.99% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 3rd October 2025:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 3rd October 2025 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1. |

Ndovu Money Market Fund |

13.1% |

|

2. |

Cytonn Money Market Fund ( Dial *809# or download Cytonn App) |

12.7% |

|

3. |

Nabo Africa Money Market Fund |

12.3% |

|

4. |

Gulfcap Money Market Fund |

12.2% |

|

5. |

Etica Money Market Fund |

12.1% |

|

6. |

Lofty-Corban Money Market Fund |

12.0% |

|

7. |

Kuza Money Market fund |

11.2% |

|

8. |

Enwealth Money Market Fund |

11.1% |

|

9 |

Arvocap Money Market Fund |

11.1% |

|

10. |

British-American Money Market Fund |

10.9% |

|

11. |

Orient Kasha Money Market Fund |

10.8% |

|

12. |

Jubilee Money Market Fund |

10.8% |

|

13. |

GenAfrica Money Market Fund |

10.8% |

|

14. |

Madison Money Market Fund |

10.6% |

|

15. |

Old Mutual Money Market Fund |

10.6% |

|

16. |

Apollo Money Market Fund |

10.0% |

|

17. |

Faulu Money Market Fund |

10.0% |

|

18. |

Dry Associates Money Market Fund |

9.9% |

|

19. |

Sanlam Money Market Fund |

9.5% |

|

20. |

Mali Money Market Fund |

9.4% |

|

21. |

CPF Money Market Fund |

9.1% |

|

22. |

KCB Money Market Fund |

9.0% |

|

23. |

ICEA Lion Money Market Fund |

8.9% |

|

24. |

Co-op Money Market Fund |

8.9% |

|

25. |

CIC Money Market Fund |

8.5% |

|

26. |

Genghis Money Market Fund |

8.5% |

|

27. |

Mayfair Money Market Fund |

8.4% |

|

28. |

Absa Shilling Money Market Fund |

8.1% |

|

29. |

AA Kenya Shillings Fund |

7.5% |

|

30. |

Stanbic Money Market Fund |

6.4% |

|

31. |

Ziidi Money Market Fund |

6.2% |

|

32. |

Equity Money Market Fund |

5.0% |

Source: Business Daily

Liquidity:

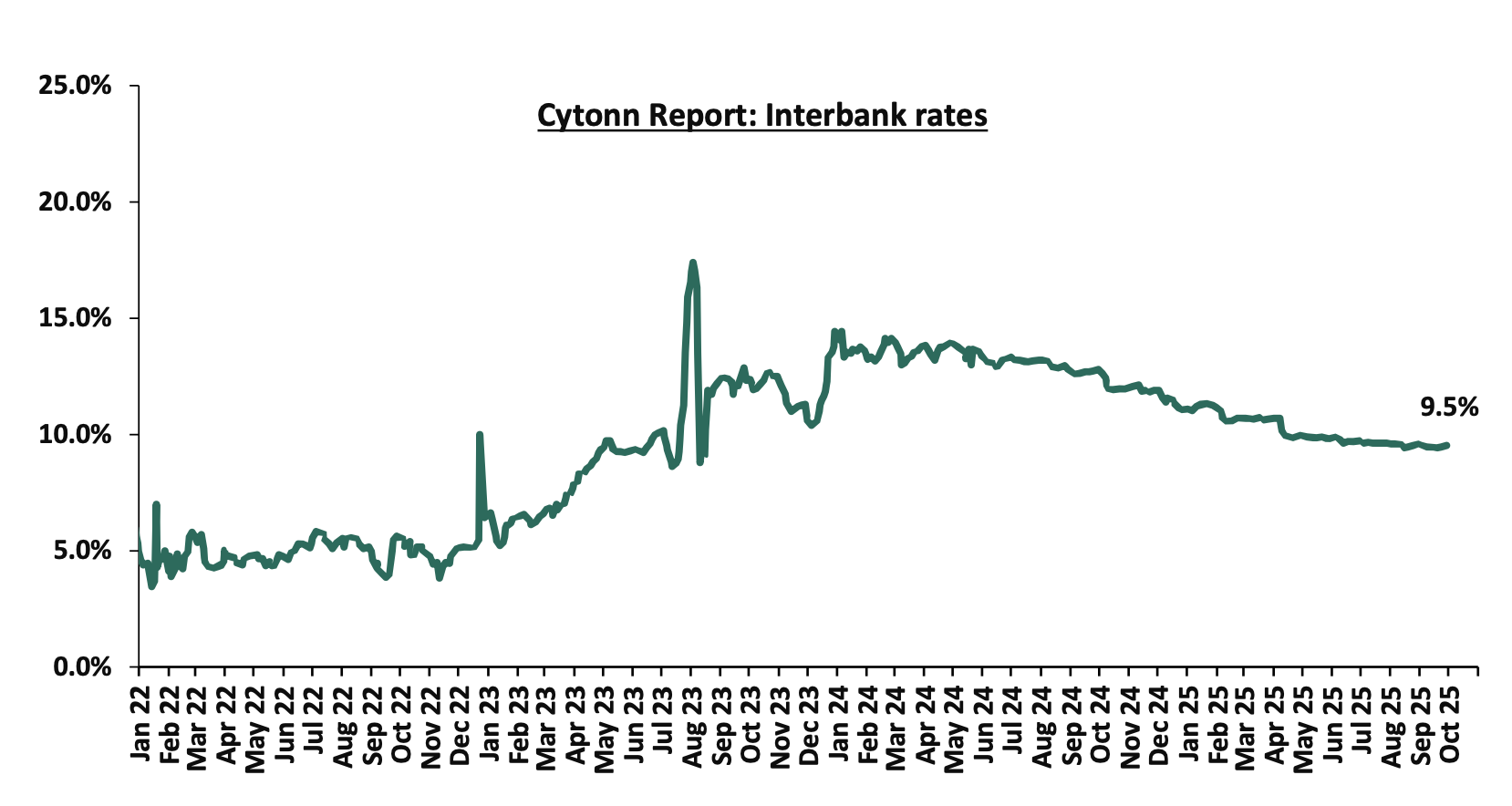

In Q3’2025, liquidity in the money markets eased, as evidenced by the decrease in the interbank rate to 9.6%, from 13.0% in Q3’2024, partly attributable to government payments that offset tax remittances. Additionally, the average volumes traded in the interbank market decreased by 52.2% to Kshs 12.4 bn, from Kshs 26.0 bn recorded in Q3’2024.

During the week, liquidity in the money markets marginally tightened, with the average interbank rate increasing by 3.9 bps to remain relatively unchanged from the 9.5% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded decreased by 12.6% to Kshs 15.1 bn from Kshs 17.2 bn recorded the previous week. The chart below shows the interbank rates in the market over the years

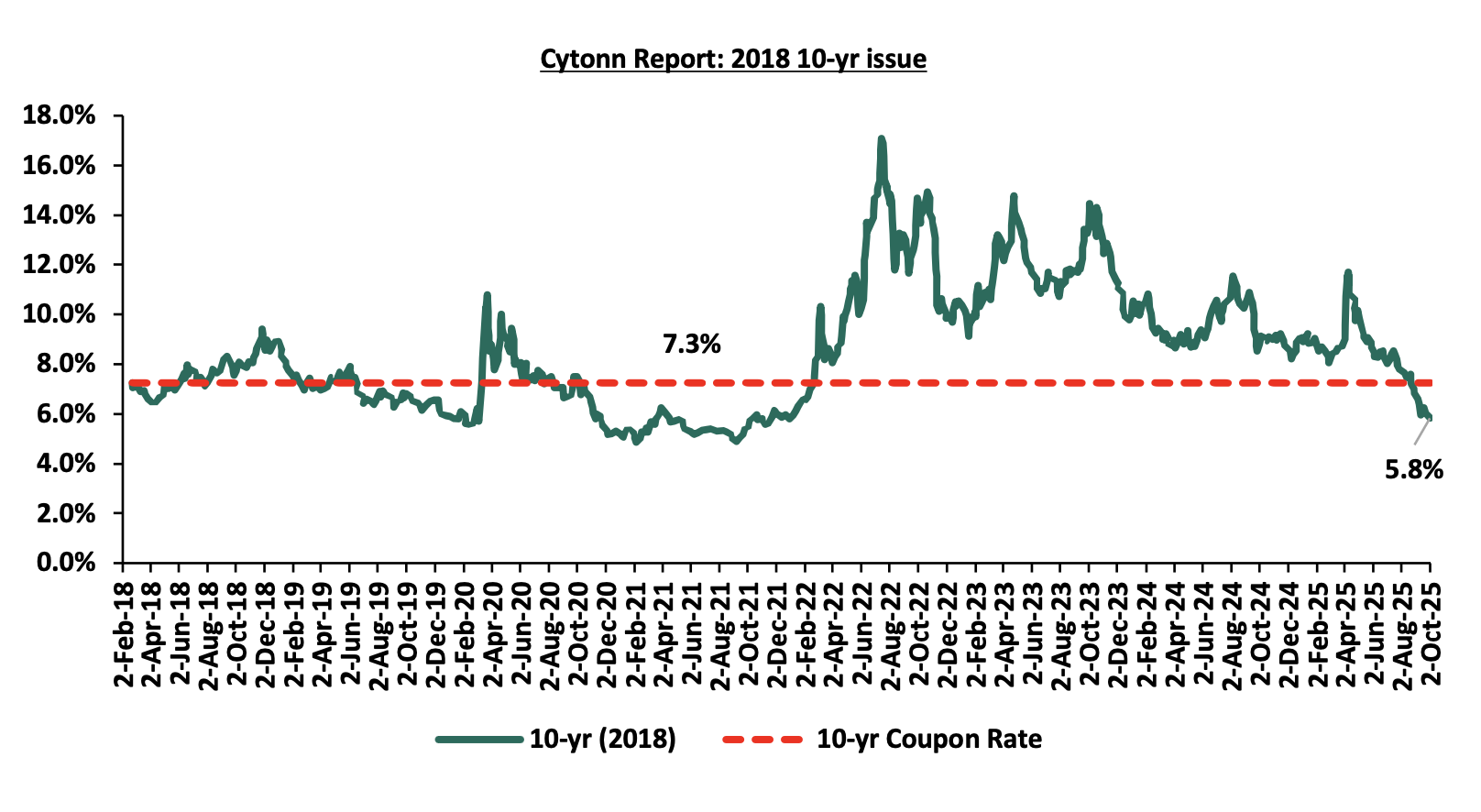

Kenya Eurobonds:

During Q3’2025, the yields on Eurobonds were on a downward trajectory, with the yield on the 10-Year Eurobond issued in 2018 decreasing the most by 2.0% points to 6.0% from 8.0% recorded at the beginning of the quarter. On a year-to-date basis, the yields on all Eurobonds were on a downward trajectory, with the yield on the 10-year Eurobond issued in 2018 declining the most by 3.2% points to 5.8% from 9.1% recorded at the start of the year.

During the week, the yields on Eurobonds were on a downward trajectory, with the yield on the 10-Year Eurobond issued in 2018 decreasing the most by 23.4 bps to 5.8% from 6.1% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 2nd October 2025;

|

Cytonn Report: Kenya Eurobond Performance |

|||||||

|

|

2018 |

2019 |

2021 |

2024 |

2025 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

11-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

1.5 bn |

|

Years to Maturity |

2.4 |

22.4 |

1.6 |

6.6 |

8.7 |

5.4 |

10.4 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

9.9% |

|

2-Jan-25 |

9.1% |

10.3% |

8.5% |

10.1% |

10.1% |

10.1% |

|

|

1-Jul-25 |

8.0% |

10.3% |

- |

9.4% |

9.7% |

9.3% |

|

|

25-Sep-25 |

6.1% |

9.3% |

- |

8.2% |

8.5% |

8.0% |

|

|

26-Sep-25 |

6.0% |

9.2% |

- |

8.1% |

8.4% |

7.8% |

|

|

29-Sep-25 |

6.1% |

9.3% |

- |

8.1% |

8.5% |

7.9% |

|

|

30-Sep-25 |

6.0% |

9.2% |

- |

8.1% |

8.4% |

7.9% |

|

|

1-Oct-25 |

5.8% |

9.3% |

- |

8.1% |

8.4% |

7.9% |

10.5% |

|

2-Oct-25 |

5.8% |

9.3% |

- |

8.1% |

8.4% |

7.9% |

|

|

Weekly Change |

(0.2%) |

0.0% |

- |

0.0% |

0.0% |

0.0% |

|

|

QTD Change |

(2.0%) |

(1.1%) |

- |

(1.3%) |

(1.2%) |

(1.4%) |

|

|

YTD Change |

(3.2%) |

(1.0%) |

- |

(1.9%) |

(1.7%) |

(2.2%) |

|

Source: Central Bank of Kenya (CBK)

Weekly Highlights.

- Kenya Q2’ 2025 GDP Growth Highlight

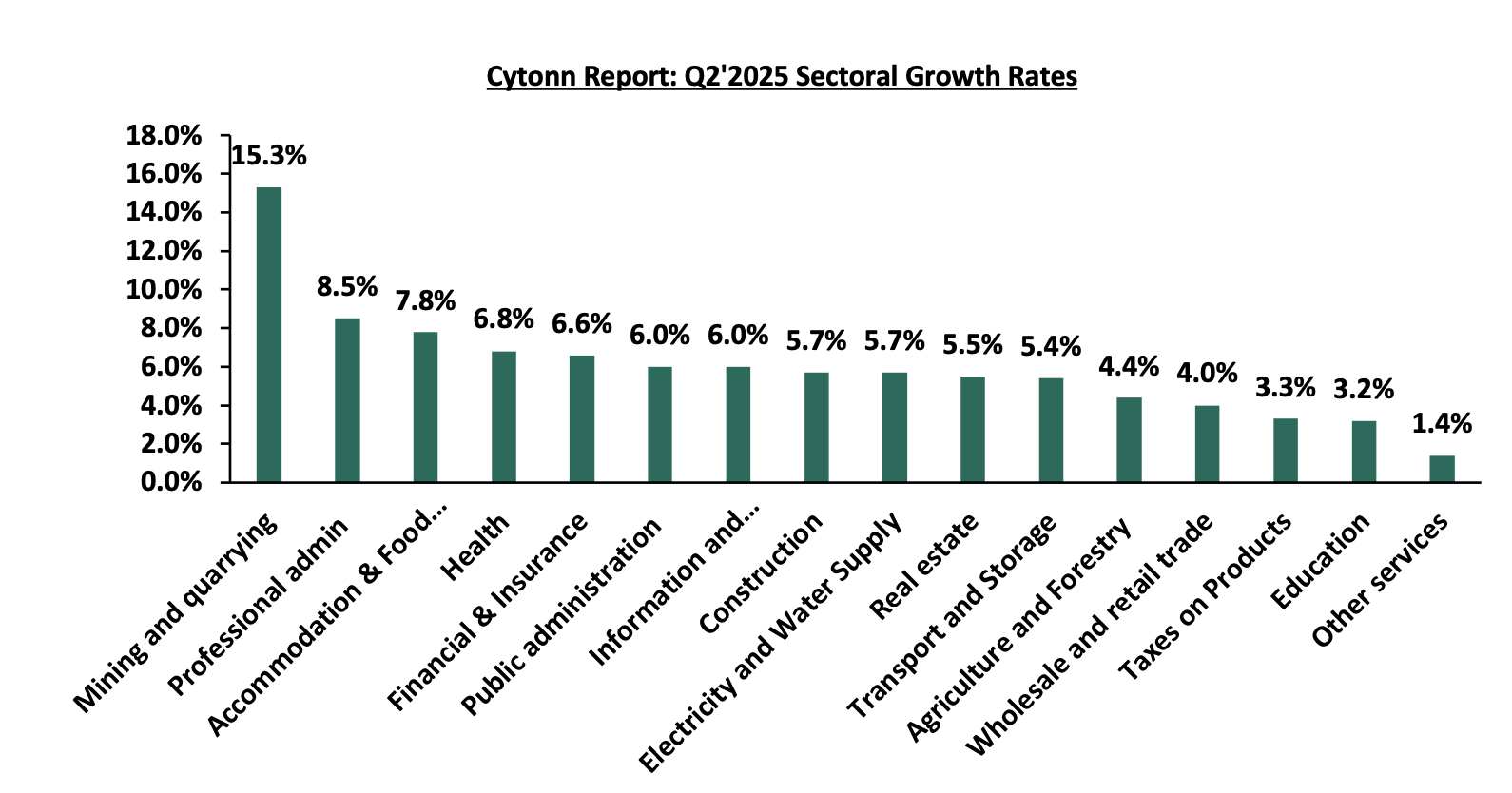

The Kenya National Bureau of Statistics (KNBS) released the Q2’2025 Quarterly Gross Domestic Product Report, highlighting that the Kenyan economy recorded a 5.0% growth in Q2’2025, higher than the 4.6% growth recorded in Q2’2024. The main contributor to Kenyan GDP remains to be the Agriculture, forestry and fishing sector which grew by 4.4% in Q2’2025, lower than the 4.5% expansion recorded in Q2’2024. All sectors in Q2’2025 recorded positive growths, with varying magnitudes across activities. However, most sectors recorded contraction in growth rates compared to Q2’2024 with Accommodation & Food Services, Financial Services Indirectly Measured and Public Administration sectors recording growth rate declines of 27.2%, 8.9% and 3.0% points to 7.8%, 1.4% and 6.0% from 35.0%, 10.3% and 9.0% respectively. Other sectors recorded an expansion in growth rates, from what was recorded in Q2’2024, with Mining and Quarrying, Construction and Electricity & Water Supply recording the highest growths in rates of 20.8%, 9.4% and 4.5% points, to 15.3%, 5.7% and 5.7% from (5.5%), (3.7%) and 1.2% respectively.

The key take-outs from the report include;

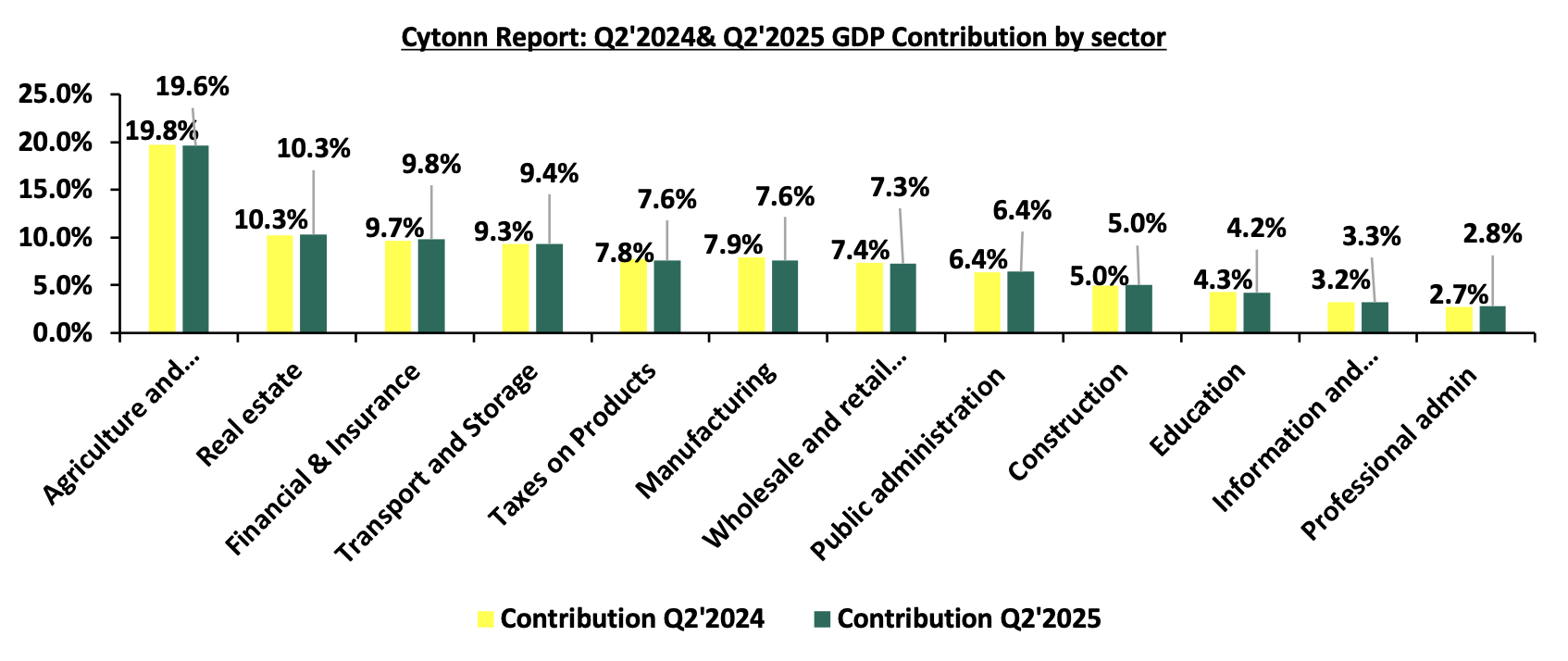

- Sectoral Contribution to Growth - The biggest gainer in terms of sectoral contribution to GDP was the Financial and Insurance sector, increasing by 0.1% points to 9.8% in Q2’2025 from 9.7% in Q2’2024, while the Agriculture and Forestry was the biggest loser, declining by 0.2% points to 19.6% in Q2’2025, from 19.8% in Q2’2024. Agriculture and Forestry remains the major contributor to GDP, with the sectoral contribution to GDP marginally decreasing by 0.2% to 19.6% in Q2’2025, from 19.8% recorded in Q2’2024 while Real Estate was the second largest contributor to GDP at 10.3% in Q2’2025, remaining constant from Q2’2024, indicating sustained growth. Mining and quarrying sector recorded the highest growth rate in Q2’2025 growing by 15.3%, a reversal from the 5.5% decline recorded in Q2’2024.

- The chart below shows the top contributors to GDP by sector in Q2’2025:

Source: KNBS Q2’2024 and Q2’2025 GDP Report

Source: KNBS Q2’2024 and Q2’2025 GDP Report - Slowed growth in the Agricultural Sector : Agriculture and Forestry recorded a growth of 4.4% in Q2’2025. The performance was a decrease of 0.1% points, from the expansion of 4.5% recorded in Q2’2024. Additionally, the sector remains the major contributor to GDP, with the sectoral contribution to GDP marginally decreasing by 0.2% to 19.6% in Q2’2025, from 19.8% recorded in Q2’2024.The positive growth recorded during the quarter was mainly attributable to favorable weather conditions. Notably, during the quarter, production of key food crops and cash crops increased with a significant increase in the production of Milk and coffee exports during the period under review. However, the performance was weighed down by decline in tea production.

- Reduced growth in the Financial and Insurance Services Sector: The Financial and Insurance sector growth rate slowed down by 0.3% points to 3.8% in Q1’2025 compared to the 4.1% in Q1’2024, attributable to the rise in cost of credit during the period. Additionally, the contribution to GDP increased by 0.01% points to remain relatively unchanged from the 9.0% recorded in Q1’2024. Some of the notable improvements include:

- The number of shares traded in the Nairobi Securities Exchange increased significantly by 107.9% to 580.0 mn in June 2025 from 279.0 million in June 2024. Similarly, the total value of traded shares increased significantly by 140.0% in June 2025 to 12.0 billion from 5.0 billion in June 2024

- The NSE 20 Share Index rose by 47.3% to 2,440.3 points in June 2025 from 1,656.5 points in June 2024, signaling improved performance in the equity market.

- Acccelerated growth in the electricity supply sector - The Electricity and Water Supply sector recorded an accelerated growth of 5.7% in Q2’2025 compared to a 1.2% growth in a similar period of review in 2024, with the sectoral contribution to GDP increasing by 0.1% to 2.3%, from the 2.2% recorded in Q2’2024. Notably, total electricity generated increased by 15.2% to 3,054.9 million-kilowatt hour (KWh) in Q2’2025, from 2,650.7 million KWh in Q2’2024.

- Reduced growth in the Accommodation and Food Service sector Accommodation and Food Services sector recorded double digit decline in growth Q2’2025, having expanded by 7.8%, significantly slower than the 35.0% recorded in Q2’2024. Additionally, the contribution to GDP remained relatively unchanged from the 1.6% recorded in Q2’2024.

- Continued growth in the Information and Communication sector: The Information and Communication sector recorded an expansion rate of 6.0% in Q2’2025 albeit slower than the 6.7% growth recorded in the same period last year. Similarly, the contribution to GDP increased by 0.1% points, to 3.3% in Q2’2025, from the 3.3% registered in Q2’2024.

The chart below shows the different sectoral GDP growth rates for Q2’2025:

Source: KNBS Q2’2025 GDP Report

In 2025, Kenya's economy is projected to grow at a faster pace, estimated between 5.2%-5.4%. This optimistic outlook is attributed to improved business activity, supported by a stronger and more stable Kenyan Shilling, reduced borrowing costs, and the relatively lower inflation rates. However, the growth trajectory faces challenges from a tough business environment characterized by increasing taxes and a high cost of living. Despite these hurdles, recent economic developments provide a more favorable outlook. The Central Bank of Kenya (CBK) made a significant policy move in August 2025 by lowering the Central Bank Rate (CBR) by 25 basis points to 9.50%, marking the seventh consecutive rate cut, lowering by 350 basis points from 13.0% in February 2024. This accommodative monetary policy stance aims to stimulate private sector lending and boost economic activity. Inflation, while still within the CBK's target range of 2.5% to 7.5%, has been on an upward trend. In September 2025, the year-on-year inflation rate rose slightly to 4.6%, up from 4.5% recorded in August 2025. This rise is primarily driven by higher food prices, particularly in the food and non-alcoholic beverages category. Despite the gradual rise, inflation remains well within the CBK's target range, providing some assurance for economic stability. The CBK's accommodative monetary policy is expected to alleviate some pressure on the cost of credit, thereby improving access to affordable borrowing. This environment is conducive to increased investment spending by both individuals and businesses, contributing positively to economic activity. The agricultural sector, Kenya's largest contributor to GDP, is anticipated to continue supporting growth due to favorable rainfall. While risks of rising fuel prices persist due to global geopolitical tensions, the overall inflation outlook is more favorable, bolstering optimism for the economic outlook.

For a more detailed analysis, please see our Kenya’s Q2’ GDP Growth Note

- Kenya Q2'2025 Balance of Payments Highlight

According to the Q2’2025 Kenya Quarterly Balance of Payment Report released by the Kenya National Bureau of Statistics (KNBS), Kenya’s balance of payments position deteriorated significantly by 86.6% in Q2’2025, with a deficit of Kshs 157.0 bn, from a deficit of Kshs 84.1 bn in Q2’2024.

Balance of Payments

Kenya’s balance of payment (BoP) position deteriorated significantly by 86.6% in Q2’2025, to a deficit of Kshs 157.0 bn, from a deficit of Kshs 84.1 bn in Q2’2024. The y/y negative performance in BoP was mainly driven by a significant 282.8% increase in financial account deficit to Kshs 136.5 bn from a deficit of Kshs 35.7 bn in Q2’2024. The performance was, however, supported by a significant 118.9% improvement in the capital account balance to a surplus of Kshs 17.6 bn from a surplus of Kshs 8.0 bn in Q2’2024. The table below shows the breakdown of the various balance of payments components, comparing Q2’2025 and Q2’2024:

|

Item |

Q2'2024 |

Q2'2025 |

Y/Y % Change |

|

Current Account Balance |

(47.4) |

(83.7) |

76.6% |

|

Capital Account Balance |

8.0 |

17.6 |

118.9% |

|

Financial Account Balance |

(35.7) |

(136.5) |

282.8% |

|

Net Errors and Omissions |

87.8 |

86.6 |

(1.4%) |

|

Balance of Payments |

(84.1) |

(157.0) |

86.6% |

All values in Kshs bns

Key take-outs from the table include;

- The current account deficit (value of goods and services imported exceeds the value of those exported) widened by 76.6% to Kshs 83.7 bn from Kshs 47.4 bn in Q2’2024. The y/y widening of the current account was brought about by the 11.7% widening in the merchandise trade account deficit to Kshs 348.4 bn from Kshs 311.8 bn in Q2’2024, coupled with a 7.4% decrease in services trade balance to Kshs 65.5 bn from Kshs 70.8 bn in Q2’2024,

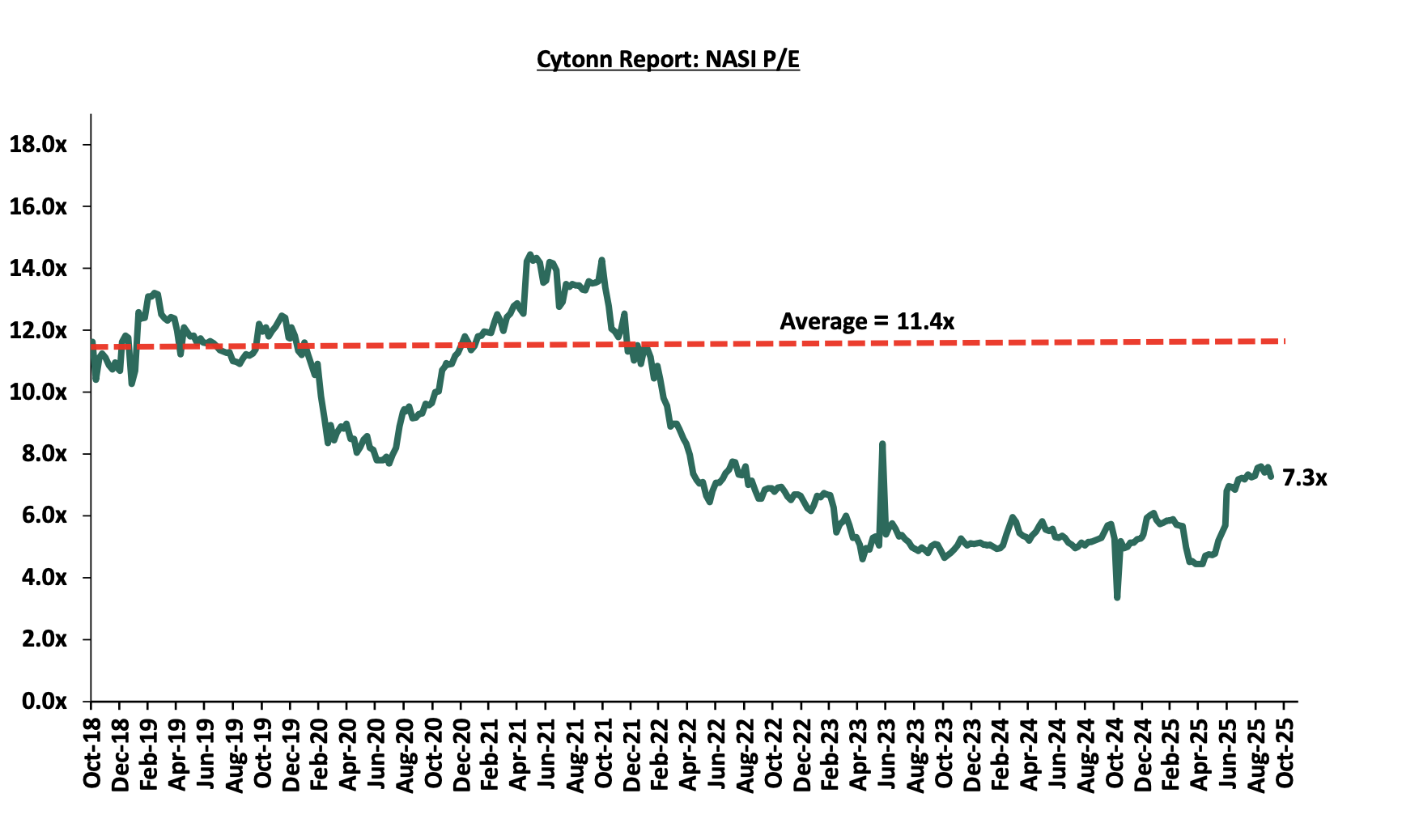

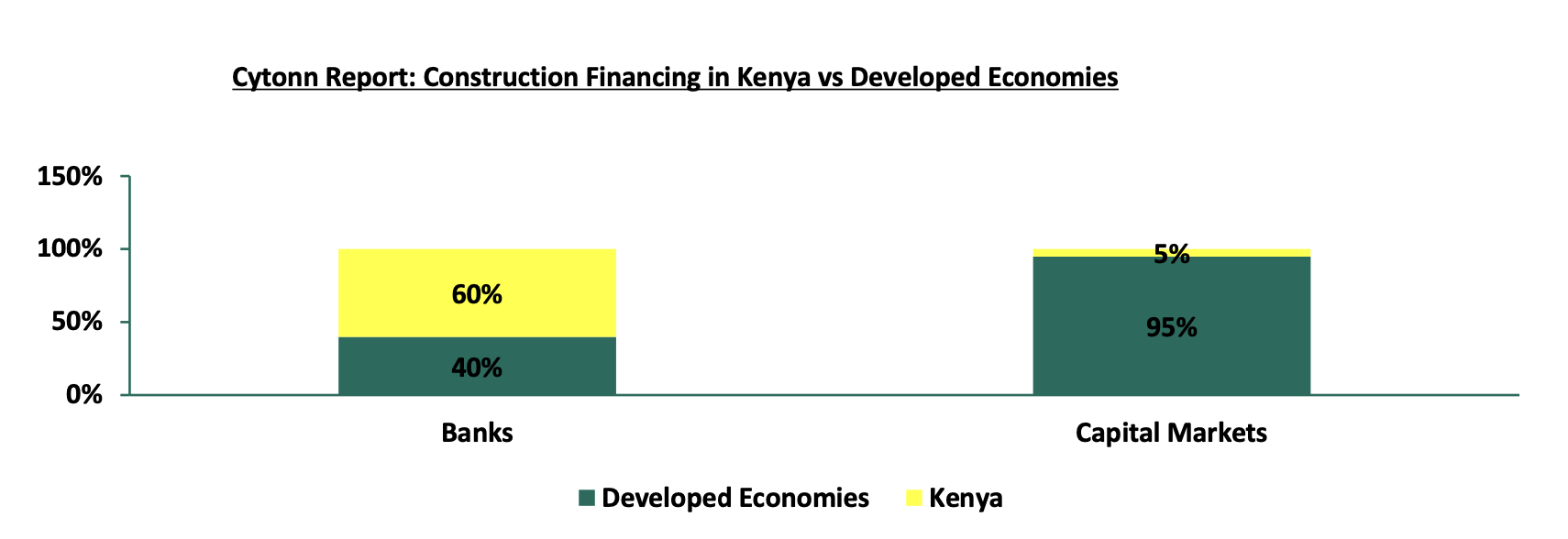

- The capital account balance (shows capital transfers receivable and payable between residents and non-residents, including the acquisition and disposal of non-produced non-financial items), which includes foreign direct investments (FDIs), increased by 118.9% to a surplus Kshs 17.6 bn in Q2’2025, up from a surplus of Kshs 8.0 bn in Q2’2024,