Cytonn Monthly - January 2019

By Cytonn Research Team, Feb 3, 2019

Executive Summary

Fixed Income

During the month of January, T-bill auctions recorded an oversubscription, with the overall subscription rate coming in at 187.7%, an increase from 60.9%, recorded in December. The subscription rates for the 91-day, 182-day and 364-day papers came in at 173.0%, 141.0% and 240.2%, from 112.3%, 39.7% and 61.6%, in the previous month, respectively. The yields on the 91-day and 182-day papers both declined by 0.2% points, to 7.1% and 8.8% from 7.3% and 9.0%, respectively, while yields on the 364-day declined by 0.1% points to 9.9% from 10.0%, recorded in December. The Monetary Policy Committee (MPC) met in January to review the prevailing macroeconomic conditions and give direction on the Central Bank Rate (CBR). Consequently, the MPC maintained the CBR at 9.0%, citing well-anchored inflation expectations within the target range and that the economy was operating close to its potential. This was despite low private sector credit growth that came in at 2.4% in the 12 months to December 2018, slower than the 3.0% recorded in the 12 months to November 2018;

Equities

During the month of January, the equities market was on an upward trend with NSE 20, NASI and NSE 25 all gaining by 4.4%, 7.1%, and 9.1%, respectively. During the month we witnessed increased consolidation in the banking sector with the recently announced merger between tier 1 lender Commercial Bank of Africa (CBA) and listed tier 2 lender NIC Group taking center stage;

Private Equity

During the month of January, there was private equity activity in the financial services, education, and hospitality sectors, as well as a number of fundraising announcements. In the financial services sector, Britam Asset Managers bought a 40.0% stake worth Kshs 1.4 bn in a local electricity producer, Gulf Energy, through a New York-based energy investment vehicle Everstrong Capital. In the education sector, Dubai based GEMS Education, an international education company owned by a consortium of institutional investors, including Varkey Group and American private equity firm Blackstone Group, is set to acquire 100% stake in Hillcrest International Schools from its current owners, Fanisi Capital and businessman Anthony Wahome, for Kshs 2.6 bn. In hospitality, US private equity fund Emerging Capital Partners (ECP) has acquired a majority stake in Nairobi-based hospitality chain ArtCaffé Group for an undisclosed amount. In fundraising, Branch International, a mobile-based microfinance institution headquartered in California with operations in Kenya, Tanzania and Nigeria, raised a further Kshs 500.0 mn (USD 4.9 mn) in capital investment based on its third commercial paper in the Kenyan market;

Real Estate

During the month of January, the real estate sector recorded increased activity across various themes as follows: (i) In the residential sector, Erdemann Properties launched their residential development in Ngara dubbed “River Estate’’ on approximately 5.6-acres (costs undisclosed) that will comprise of one and two-bedroom apartments with price points of Kshs 6.0 mn and Kshs 8.5 mn, respectively, and Cytonn Real Estate launched its Kshs 2.5 bn gated community development dubbed “Applewood”, located in Miotoni, Karen. This signature development shall comprise luxury homes, each sitting on 1/2 acre, and, (ii) In the commercial sector, American-based fast-food restaurant Burger King and Quickmart Supermarket opened shops at Shell Fuel Station on James Gichuru Road in Lavington and Westfield Mall in Lavington, respectively, while Cleanshelf Supermarkets announced plans to open its 10th outlet at Shujaa Mall in Komarock.

- Are you looking for the perfect Valentine gift? Reserve a unit at The Alma in Ruaka and get your loved one a fully fitted kitchen with modern appliances and accessories. Having delivered Amara Ridge in 2018, we are delivering The Alma in 2019. To book a unit, visit: https://the-alma.com/introduction/FB;

- Cytonn Real Estate and Avic International wish to inform you that The Alma site will be closed from Monday, 4th February 2019, for the Chinese Spring Festival, and works will resume on Thursday, 7th February 2019;

- Following the recent approval by Retirement Benefits Authority (RBA), for Cytonn Asset Managers to manage pension funds, we are looking for business development consultants and agents with networks in the pensions industry to build our pensions business at very attractive commissions. If interested in being an agent or know someone who can be an agent, kindly contact us at pensions@cytonn.com;

- Following the completion and handover of Amara Ridge in Karen, we have now launched our next Karen project, dubbed Applewood, a Kshs 2.5 bn residential development located in Miotoni, Karen. This signature development shall comprise luxury homes, each sitting on 1/2 acre. We invite you to the exhibition of Applewood which is ongoing at the Amara Ridge Clubhouse (Location pin: https://goo.gl/maps/B3GVnu8pHyn) from 9:00 am to 5:00 pm daily and will end on 28th Feb 2019. Call 0709 101 000 or email resales@cytonn.com to reserve a villa! See Video here;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our returns on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects;

- We continue to beef up the team with ongoing hires for Financial and Real Estate Advisors for our offices in Nairobi, Nakuru, Kisumu, and Nyeri. Visit the Careers Section on our website to apply.

T-Bills & T-Bonds Primary Auction:

During the month of January, T-bill auctions recorded an oversubscription, with the overall subscription rate coming in at 187.7%, an increase from 60.9%, recorded in December. The subscription rates for the 91-day, 182-day and 364-day papers came in at 173.0%, 141.0% and 240.2%, from 112.3%, 39.7% and 61.6%, in the previous month, respectively. The yields on the 91-day and 182-day papers both declined by 0.2% points, to 7.1% and 8.8% from 7.3% and 9.0%, respectively, while yields on the 364-day declined by 0.1% points to 9.9% from 10.0%, recorded in December. The T-bills acceptance rate came in at 66.8% during the month, compared to 87.4% recorded in December with the government accepting a total of Kshs 120.4 bn of the Kshs 180.2 bn worth of bids received. The Central Bank of Kenya (CBK) remained disciplined in rejecting expensive bids in order to ensure stability of interest rates.

During the week, T-bills remained oversubscribed, with the overall subscription rate coming in at 167.4%, down from 170.2% recorded the previous week. The high subscription was attributed to a favorable liquidity condition in the market. The yields on the 91-day, 182-day, and 364-day papers declined by 0.6% points, 0.5% points and 0.5% points, to 7.1%, 8.8%, and 9.9%, respectively. The acceptance rate rose to 80.5% from 65.0% recorded the previous week, with the government accepting Kshs 32.3 bn of the Kshs 40.2 bn worth of bids received, higher than its weekly quantum of Kshs 24.0 bn. The subscription rate for the 91-day and 182-day declined to 59.7% and 81.0% from 123.8% and 107.3%, respectively, while the subscription rate for the 364-day paper improved to 296.9% from 251.7%, recorded the previous week, as the paper offers better risk-adjusted returns to investors.

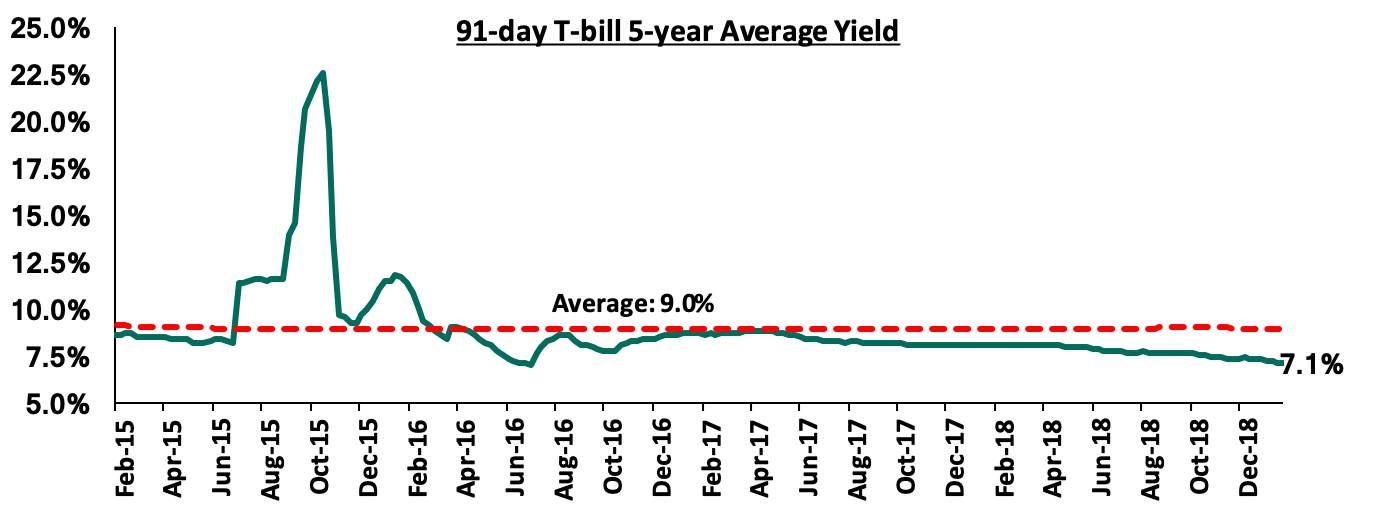

The 91-day T-bill is currently trading at a yield of 7.1%, which is below its 5-year average of 9.0%. The lower yield on the 91-day paper is mainly attributable to the low interest rate environment that has persisted since the passing of the law capping interest rates. We expect this to continue in the short-term, given:

- The discipline of the CBK in stabilizing interest rates in the auction market by rejecting aggressive bids that are priced above market, for both T-bills and T-bonds, and,

- The maintaining of the Central Bank Rate at 9.0% by the Monetary Policy Committee in their January meeting.

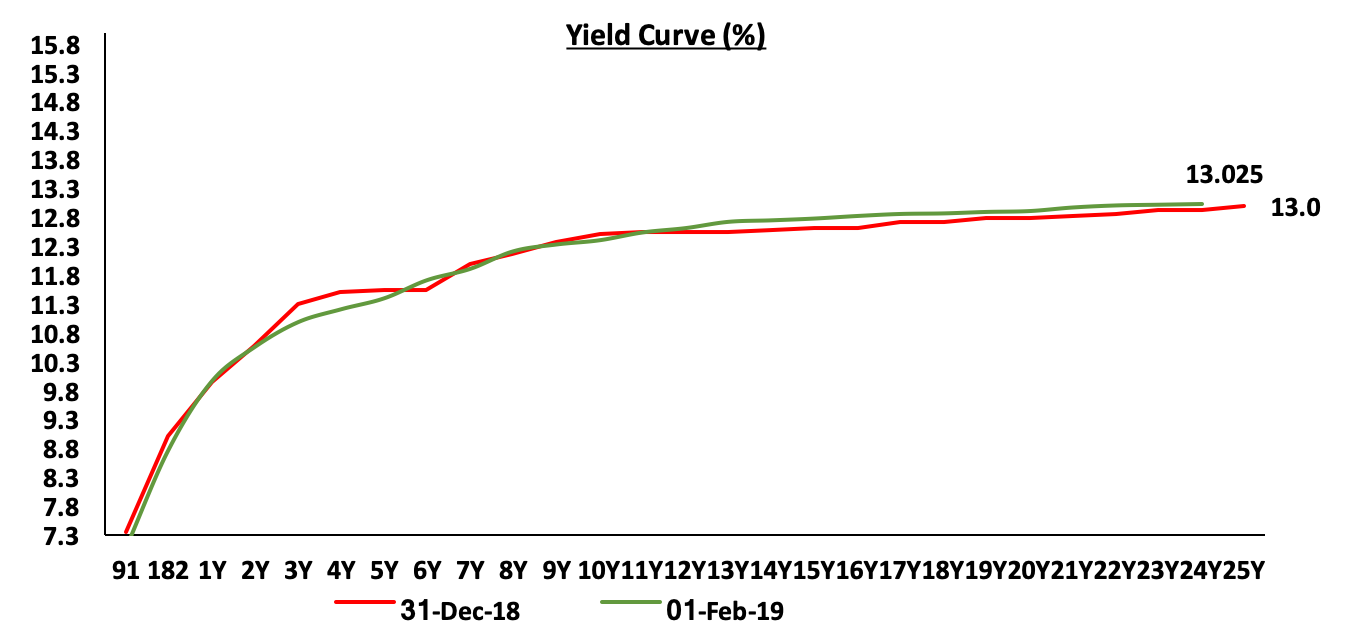

During the month of January, the Kenyan Government issued two bonds; issue number FXD 1/2019/2 and issue number FXD 1/2019/15, with tenors of 2.0-year and 15.0-year, both with market determined coupon rates. The government was seeking to raise Kshs 40.0 bn from the two bonds for budgetary support. The two bond issues were over-subscribed with an overall subscription rate of 254.9% with bids worth Kshs 102.0 bn received against the Kshs 40.0 bn on offer. The 2-year bond had a better performance with total bids of Kshs 76.9 bn compared to Kshs 25.1 bn worth of bids for the 15-year bond, an indication of the high demand in the shorter-end of the yield curve. The government accepted Kshs 38.5 bn out of the Kshs 102.0 bn worth of bids received against Kshs 40.0 bn on offer, translating to an acceptance rate of 37.7%, indicating that bids were largely not within ranges the Central Bank of Kenya (CBK) deemed acceptable. The average accepted yield for the 2-year and 15-year issue came in at 10.7% and 12.9%, respectively. This was within target of our expectation of between 10.7% - 10.9% and 12.6% - 12.9% for the 2-year and 15-year bonds, respectively. The Government has re-opened the two bonds with the coupon rates set at 10.7% and 12.9% for the 2-year and 15-year bond, respectively, in a bid to raise Kshs 15.0 bn. Treasury bonds with the same tenor (2.0-years and 15.0-years) are currently trading at a yield of 10.6% and 12.7%, respectively. We expect bids to come in at between 10.6% - 10.8% and 12.7% - 12.9% for the 2-year and 15-year bonds, respectively.

Despite the Government’s effort of issuing longer-term bonds in a bid to lengthen the debt maturity profile and reduce the potential rollover risks in the medium term, it is evident that there is low appetite for the long-dated papers. This is attributed to the saturation of long-end offers, leading to a relatively flat yield curve on the long-end, making Treasury rely on the short-term treasury bills to meet its domestic borrowing target. We are of the view that the Government will need to offer more incentives for the long-term bonds by increasing the yields to attract investors.

Secondary Bond Market:

The yields on government securities in the secondary market remained relatively stable during the month of January as the Central Bank of Kenya continued to reject expensive bids in the primary market. According to the FTSE NSE Bond Index, Treasury bonds listed at the Nairobi Securities Exchange (NSE) gained by 0.2% during the month, bringing the YTD performance to 0.2%.

Liquidity:

The average interbank rate dropped to 3.5% during the month of January from 8.0% in December, pointing to improved liquidity during the month, supported by government payments and debt redemptions.

During the week, the average interbank rate rose to 4.6%, from 3.2% the previous week, while the average volumes traded in the interbank market declined by 83.2% to Kshs 2.5 bn from Kshs 14.8 bn the previous week. Despite the rise in the interbank rate, the money market remained relatively liquid with commercial banks recording excess reserves of Kshs 23.9 bn in relation to the 5.25% cash reserves requirements (CRR) supported by government payments.

Kenya Eurobonds:

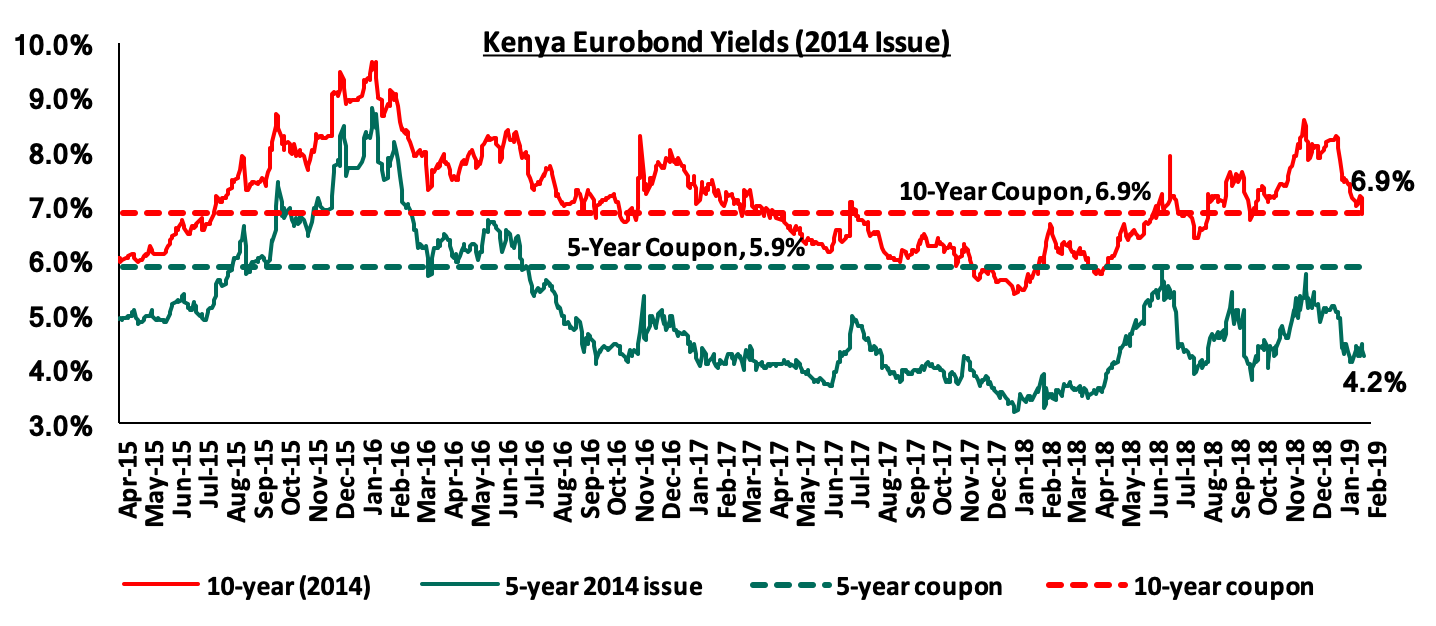

According to Bloomberg, the yield on the 5-year and 10-Year Eurobonds issued in June 2014 declined by 0.8% points and 1.4% points to 4.2% and 6.9% in January, from 5.0% and 8.3% in December, respectively. During the week, the yields on the 5-year Eurobond issued in 2014 declined by 0.2% points to 4.2% from 4.4%, while the 10-year Eurobond issued in the same year declined by 0.1% points to 6.9% from 7.0% the previous week. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 4.6% points and 2.8% points for the 5-year and 10-year Eurobonds, respectively, an indication of the relatively stable macroeconomic conditions in the country.

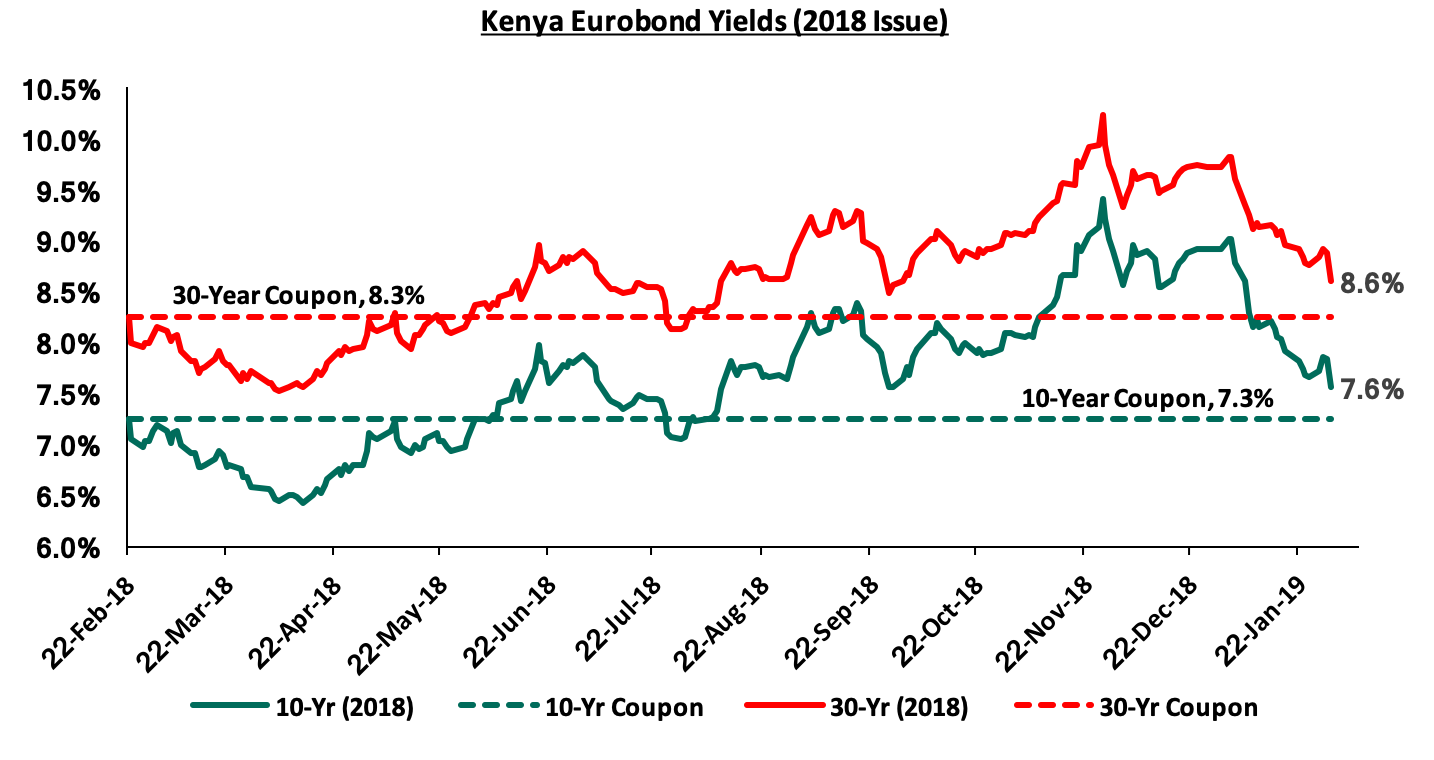

During the month, the yields on the 10-year and 30-year Eurobond issued in February 2018 declined by 1.4% points and 1.2% points to 7.6% and 8.6% from 9.0% and 9.8% in December, respectively. During the week, the yields on the 10-year and 30-year Eurobonds declined by 0.1% points and 0.2% points, to 7.6% and 8.6% from 8.7% and 8.8% recorded the previous week, respectively. Since the issue date, the yields on the 10-year Eurobond and 30-year Eurobond have both increased by 0.3%.

The declining yields on all the Eurobonds during the month signals improving country risk perception by investors, which was partly attributed to bullish expectations of improved economic growth in 2019 as well as increased Eurobond demand in emerging markets with a similar trend observed in other Sub-Saharan African Eurobonds, driving the prices up and effectively the yields down.

The Kenya Shilling:

The Kenya Shilling appreciated by 0.9% against the US Dollar during the month of January to Kshs 100.9 from Kshs 101.8 at the end of December. This was driven by hard currency inflows from diaspora remittances and offshore investors buying government debt, coupled with thin end month dollar-demand from oil importers. During the week, the Kenya Shilling appreciated by 0.5% against the US Dollar to close at Kshs 100.6 from Kshs 101.1 in the previous week, anchored by dollar inflows from diaspora remittances and portfolio investors buying government debt amid reduced dollar demand from the energy and manufacturing sector. On an YTD basis, the shilling has appreciated by 1.2% against the US Dollar. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit to 5.1% in the 12-months to November 2018, from 6.5% in November 2017, attributed to improved agriculture exports, increased diaspora remittances, strong receipts from tourism, and lower food and SGR-related equipment relative to 2017,

- Improving diaspora remittances, which increased by 38.6% in 2018 to USD 2.7 bn, from USD 1.9 bn recorded in 2017. The rise is due to;

- increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and

- new partnerships between international money remittance providers and local commercial banks making the process more convenient,

- CBK’s activities in the money market, such as repurchase agreements and selling of dollars, and,

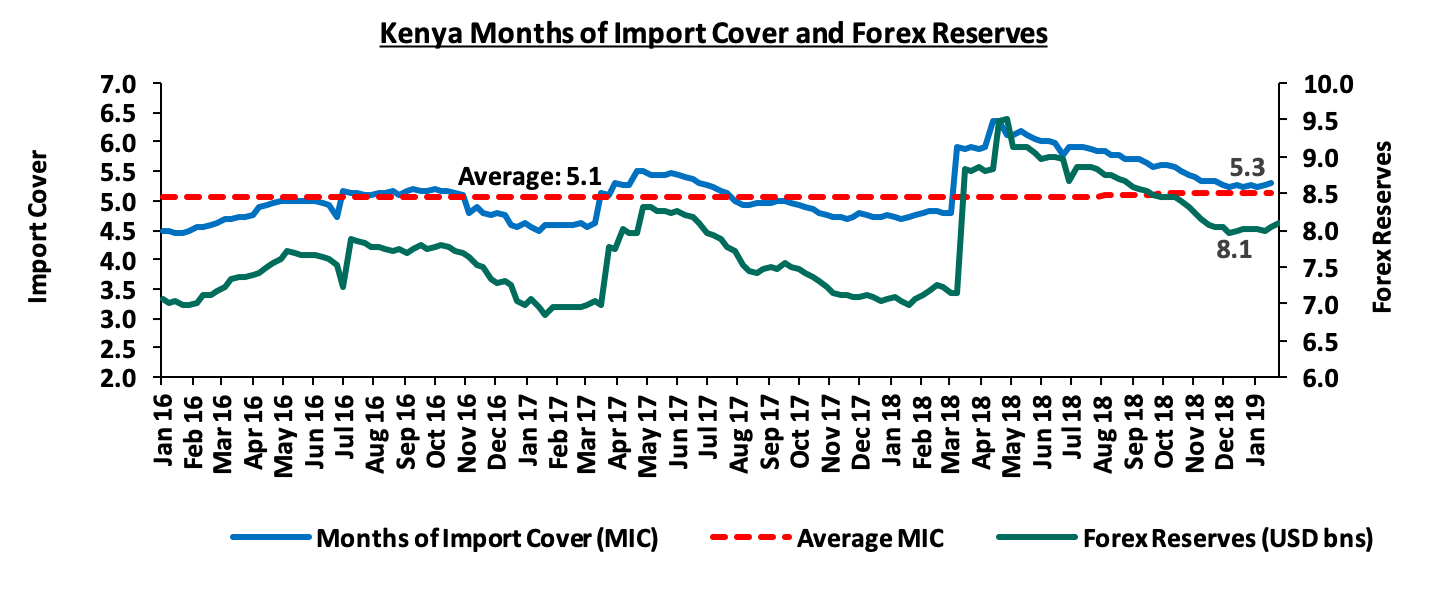

- High levels of forex reserves, currently at USD 8.1 bn, equivalent to 5.3-months of import cover, compared to the one-year average of 5.1 months, as highlighted below:

Inflation:

The Y/Y inflation rate for the month of January declined to 4.7% from 5.7% recorded in December. This was not in line with our projections of 3.8% - 4.2%, as highlighted our Cytonn Weekly Report #04/2019. The variance was due to a 0.8% rise in the food and non-alcoholic drinks’ index, which has a weighting of 36.0%, against our expectations of a marginal decline of 0.3%. The Y/Y decline was mainly due to the base effect. M/M inflation however rose by 0.4%, attributed to the 0.8% rise in the food and non-alcoholic beverages index coupled with a 0.2% rise in the housing, water, electricity, gas and other fuels index due to higher cost of house rents and cooking fuels. The rise was also partly due to increased prices of domestic electricity consumption for 50 Kwh as well as for 200 KWh, which rose by 1.7% and 1.2%, respectively, attributed to the increase in foreign and inflation adjustment charges. Inflation, however, was mitigated by the 1.4% decline in the transport index attributable to a decline in pump prices of petrol and diesel. Below is a summary of key changes in the Consumer Price Index (CPI) in November:

|

Major Inflation Changes in the Month of January 2019 |

|||

|

Broad Commodity Group |

Price change m/m (Jan-19/Dec-18) |

Price change y/y (Jan-19/Jan-18) |

Reason |

|

Food & Non-Alcoholic Beverages |

0.8% |

1.6% |

This was on account of a decline in prices of several foodstuffs in January 2019 compared to the previous year. Prices of other foodstuffs also increased at a faster rate than the price decreases |

|

Transport Cost |

(1.4%) |

11.1% |

This was on account of a decline in pump prices of petrol and diesel |

|

Housing, Water, Electricity, Gas and other Fuels |

0.2% |

12.7% |

This was on account of higher cost of house rents and cooking fuels, coupled with increased prices of domestic electricity consumption due to increase in foreign and inflation adjustment charges |

|

Overall Inflation |

0.4% |

4.7% |

The m/m increment was due to a 0.8% increase in the food index which has CPI weight of 36.0% |

Monetary Policy:

The Monetary Policy Committee (MPC) met on Monday 28th January 2018 to review the prevailing macroeconomic conditions and give direction on the Central Bank Rate (CBR). The MPC maintained the CBR at 9.0%, in line with our expectations as detailed in our MPC Note, citing that inflation expectations were still well anchored within the target range and that the economy was operating close to its potential, as evidenced by:

- Month-on-month overall inflation remained within the target range in November and December 2018, largely due to lower food prices following favorable weather conditions, reduction in electricity tariffs, decline in fuel prices and limited demand-driven inflationary pressures. The MPC noted that the inflation rate fell to 5.6% in December from 5.7% in November, following decreases in food prices, which offset the increase in energy prices and transport costs following the implementation of VAT on petroleum products in September 2018,

- The foreign exchange market remained stable, supported by balanced flows, and the narrowing current account deficit to 5.1% in the 12 months to November 2018 compared to 6.5% in November 2017. The narrowing of the current account deficit is largely due to strong growth in diaspora remittances and tourism receipts, higher tea and horticultural exports, slower growth in imports due to lower food and SGR–related equipment imports and the decline in international oil prices,

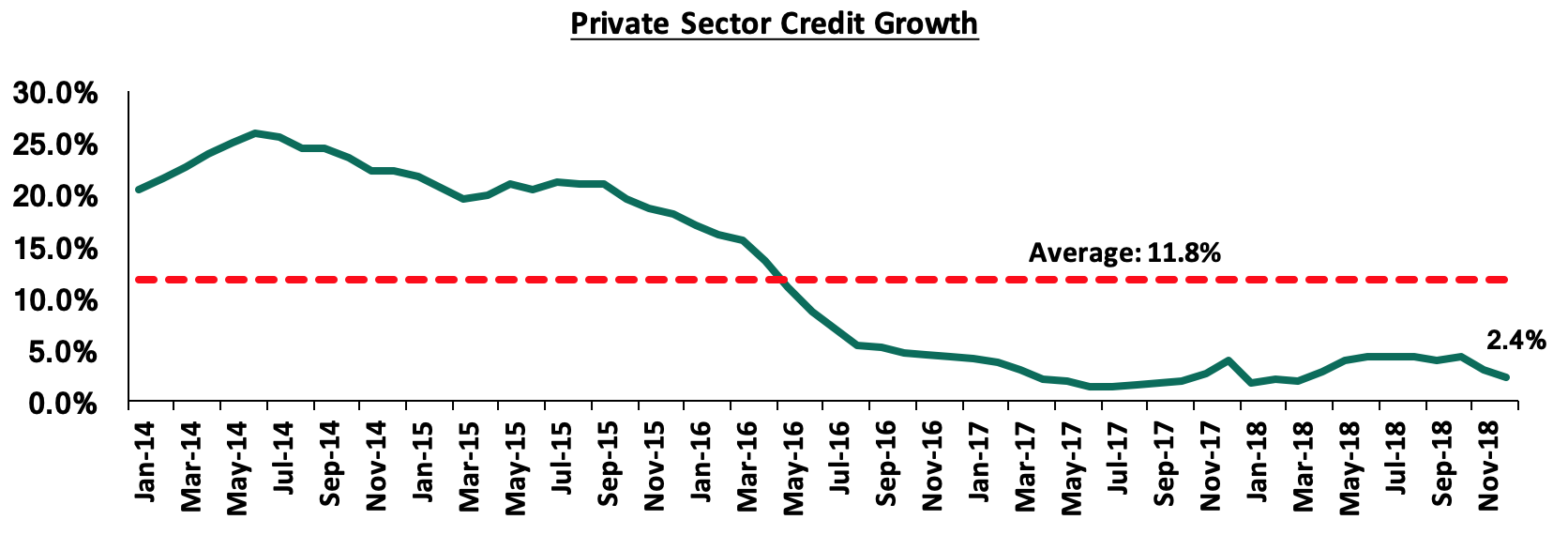

- Private sector credit growth, which grew by 2.4% in the 12 months to December 2018, slower than the 3.0% recorded in the 12 months to November 2018, largely due to successful recovery efforts and loan repayments. Strong growth in private sector credit was observed in the following sectors: credit to the finance and insurance sector grew by 17.5%, while credit extension to the consumer durables sector expanded by 11.0%. Similarly, credit extension to the business services segment grew by 8.0%, whereas credit to private households expanded by 6.8%. Growth in private sector credit is expected to strengthen in 2019 relative to 2018, owing to the anticipated higher economic activity and easing credit risk, and,

- Strong pickup of the economy as per data for the third quarter of 2018, with real GDP growth averaging 6.0% in the first 3 quarters of 2018 compared to 4.7% in a similar period in 2017. This outcome was due to a strong recovery in the agricultural activity due to improved weather conditions, continued recovery of the manufacturing sector, and resilient performance of the service sector particularly trade, tourism, information and communication, transport, and real estate.

The MPC noted that the current policy was still appropriate, but it would continue monitoring any perverse response to its previous decisions as well as developments in the global and domestic economy to take additional measures as necessary. See the CBK Release.

The Federal Reserve Bank of the U.S, through its Federal Open Market Committee (FOMC) has maintained its benchmark policy rate within a band 2.25% - 2.5%. The Fed also discarded earlier promises it had made on further gradual rate increases, saying it would exercise patience before making any further moves. The decision rides on the back of fears of a global economic slowdown, despite a robust U.S economy evidenced by the creation of 304,000 jobs in December 2018. In our view, the slowdown in rate hikes by the Fed may bring to a halt the recent foreign capital flight from emerging markets and allow for a recovery in asset prices.

Rates in the fixed income market have remained stable as the government rejects expensive bids despite being 9.4% behind its domestic borrowing target for the current financial year, having borrowed Kshs 167.2 bn against a pro-rated target of Kshs 184.5 bn. However, a budget deficit that is likely to result from depressed revenue collection creates uncertainty in the interest rate environment as any additional borrowing from the domestic market goes to plug the deficit. Despite this, we do not expect upward pressure on interest rates due to increased demand on government securities, driven by improved liquidity in the market owing to the relatively high debt maturities. Our view is that investors should be biased towards medium-term fixed income instruments to reduce duration risk associated with long-term debt, coupled with the relatively flat yield curve on the long-end due to saturation of long-term bonds.

Market Performance

During the month of January, the equities market was an upward trend with the NSE 20, NASI and NSE 25 all gaining by 4.4%, 7.1% and 9.1%, respectively. The performance recorded during the month was driven by large cap stocks with EABL leading with month-on-month gains of 21.9%, and gains in the banking sector which saw NIC Group, Equity Group, Co-operative Bank, KCB Group and Barclays Bank all gaining by 21.4%, 17.4%, 12.6%, 8.7%, and 5.5%, respectively.

Equities turnover increased by 85.5% during the month to USD 149.4 mn, from USD 80.7 mn in December 2018. Foreign investors remained net sellers for the month, with a net selling position of USD 13.4 mn, which is a 15.7% decrease from December’s net selling position of USD 15.9 mn.

During the week, equities turnover increased by 83.3% to USD 60.3 mn, from USD 32.9 mn the previous week, bringing the year to date (YTD) turnover to USD 157.0 mn. Foreign investors remained net sellers for the week, with a net selling position of USD 7.6 mn, which is 2298.9% increase from last week’s net selling position of USD 0.3 mn.

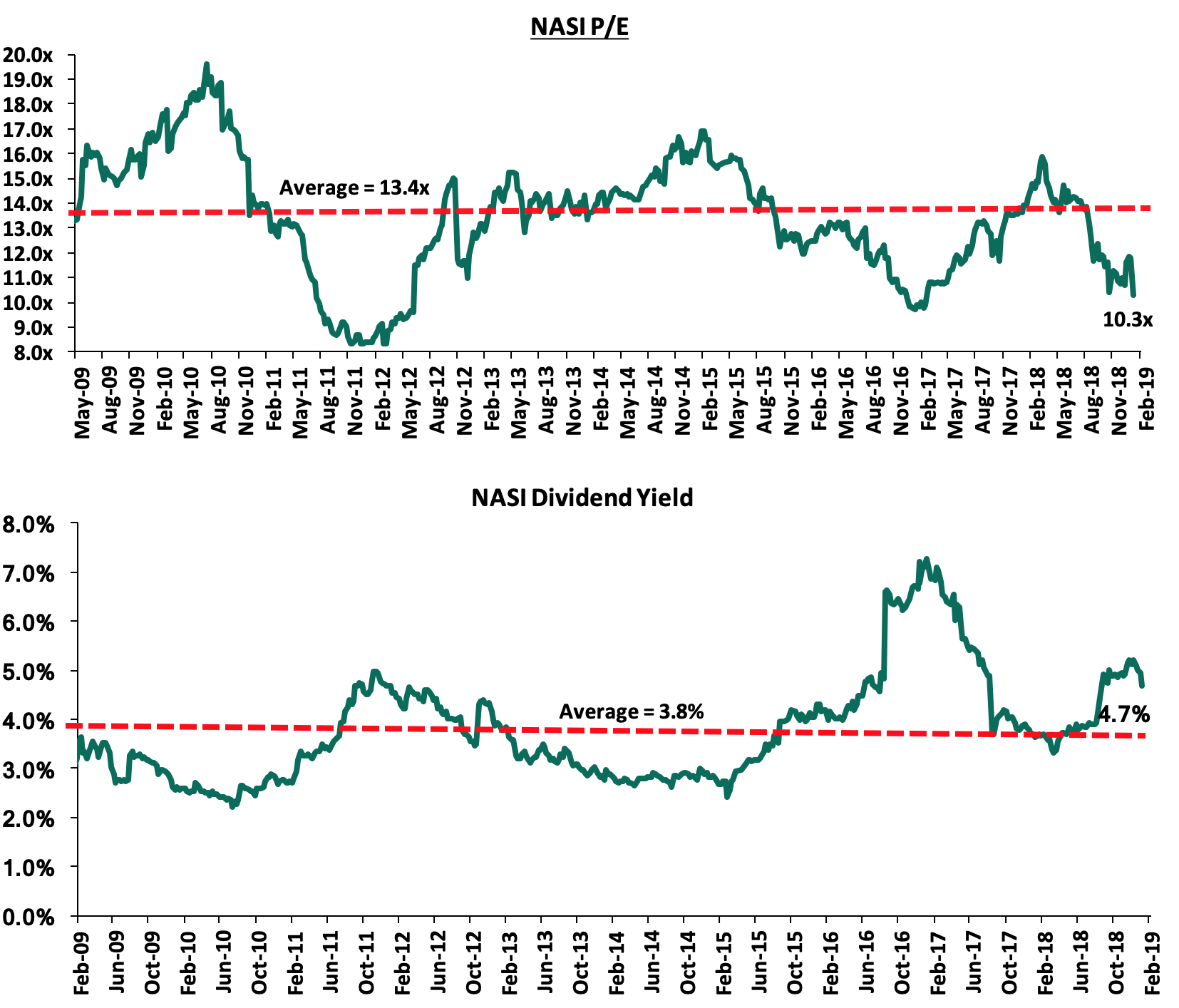

The market is currently trading at a price to earnings ratio (P/E) of 10.3x, 30.2% below the historical average of 13.4x, and a dividend yield of 4.7%, above the historical average of 3.8%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 10.3x is 6.0% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 23.7% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Monthly Highlights

The amendment to the Income Tax Act, included in the Finance Act 2018, was made public. The amendment introduced a requirement for Kenyan firms to pay a 30.0% tax on dividends received from their subsidiaries, and are redistributed to shareholders. This was a significant alteration to previous legislation in which a holding company would receive dividends from its subsidiary, without paying the withholding tax, if its ownership in the subsidiary exceeded 12.5%. We analysed the implications of this ammendement as follows;

- Companies distributing the tax-exempt dividends from subsidiaries to their holding companies would not be exempted from the withholding tax even if the holding company owns more than 12.5% of the subsidiary, and effectively, in our view, creating a higher tax expense. This undoes the provisions of the previous legislation, which protected such holding companies (owning more than 12.5% of the subsidiary) from these taxes.

- It would also mean that there would be double taxation, given that dividends are obtained from after-tax income, and redistribution of the same, does not change the fact the income had undergone taxation.

- When enforced, it may also lead to a downgrade of the country’s investment attractiveness, given the relatively stricter tax profile that would effectively reduce the absolute dividend income received by investors.

A proposal was tabled by Mr. Moses Kuria, the Member of Parliament for Gatundu South, to amend the Banking (Amendment) Act 2015, to allow credit consumers negotiate for interest rates on loans, depending on their risk profile, with an upper limit of up to 6.0% above the existing interest rate cap levels, currently at 13.0%. This proposal, if passed, will see borrowers be able to access credit at rates of a maximum of 19.0% per annum. The move comes in a bid to try and improve credit extension to the private sector, comprised largely of the Micro, Small and Medium Enterprises (MSMEs), as private sector credit growth (highlighted in the chart below) averaged 3.3% in 2018, way below the 5 year average of 11.8%. The Central Bank of Kenya echoed this sentiment and lauded the members of parliament for acknowledging the negative effect of interest rate capping on the economy. Despite recognizing the proposal as a commendable course of action, CBK Governor Dr. Patrick Njoroge still maintains his stance that the law should be completely overhauled to encompass a system that allows banks to adopt a risk-based lending approach.

Commercial Bank of Africa (CBA) issued a cash buy-out offer of Kshs 1.4 bn to Jamii Bora bank. The Kshs 1.4 bn buyout represents a steep discount from the Kshs 3.4 bn book value as at Q1’2018. This implies the transaction, if the offer is accepted and no further injections made, would happen at a Price to Book ratio (P/Bv) of 0.4x, significantly lower than the average P/B ratio of 1.6x of recent transactions in the banking sector. Analysis of this transaction was covered in our CBA Acquisition Note. See table below on banking sector transaction multiples.

In another transaction involving CBA and following the initial announcement of negotiations in December 2018, the respective Boards of Directors of CBA and NIC Group have proposed to recommend the merger of NIC and CBA to their shareholders. Pending fulfilment of a certain set of conditions, customary to transactions of this nature, the merger agreement is to be transacted as highlighted below:

- The merger agreement will be executed through share exchange and asset transfers,

- Consideration for the same will be in the form of a share swap in the ratio of 53% : 47% between CBA and NIC shareholders, respectively; this means that current CBA shareholders will own 53% of the combined entity and current NIC shareholders will hold 47% of the combined entity,

- NIC Group Plc, which will be the holding company for the merged businesses and which shall remain a publicly listed company quoted on the Nairobi Securities Exchange, will create new publically listed shares for the CBA Shareholders,

- Shareholder and regulatory approvals are expected to be finalised by Q1’2019 and Q2‘2019, respectively and the combined entity is expected to be operational by Q3’ 2019.

Some key issues that are yet to be addressed include the following:

- How will board seats be shared? We think the boards seats will be shared similar to the ownership, which is close to 50 / 50. Both and CBA and NIC currently have 10 board members each. We expect to see about 5 members fall off the board from each side and the combined board shall comprise of 10 members as is the average for Kenyan listed banks,

- Who will run the combined entity? We look at two things to make an informed guess, age and experience. With the age of the CBA Group MD at 61 years, while the NIC Group MD is 50 years old, we think the board is likely to choose young talent. Secondly, when you look at experience, John Gachora’s global markets experience spanning wallstreet investment banking, South Africa and then NIC seems better suited to drive the growth of the combined bank. So in our view, it may not be immediate but we see John Gachora as the Group MD of the combined entity.

For a detailed analysis of the transaction, see our NIC-CBA Merger Note.

Private Equity firms AfricInvest, which is based in Tunisia, and Catalyst Principal Partners, based in Kenya, acquired 24.2% stake in Prime Bank Kenya. The stake was valued at Kshs 5.1 bn, with the capital injection targeted to carry out strategic plans including expanding locally and into the region. The investment was carried out through a special purpose vehicle, AfricInvest Azure, formed jointly by AfricInvest and Catalyst, on terms which were not disclosed. As at Prime Bank’s last reporting in Q3’2018, the bank had a book value of Kshs 21.2 bn. As such, the transaction was carried out at a price-to-book value (P/Bv) of 1.0x, which was a 23.6% discount to the market’s trading valuation of 1.3x P/Bv for listed Kenyan banks at the time. For more details on the transaction, please see our Prime bank acquisition note.

Consolidation activity in the banking sector picked up pace in the month of January and we continue to track these transactions as highlighted in the table below;

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs bns) |

Transaction Stake |

Transaction Value (Kshs bns) |

P/Bv Multiple |

Date |

|

CBA Group |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

19-Jan* |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

19-Jan |

|

CBA Group |

NIC Group |

33.5** |

53:47*** |

Undisclosed |

N/A |

19-Jan* |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

18-Dec |

|

SBM Bank Kenya |

Chase Bank ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

18-Aug |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

17-Mar |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

16-Nov |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

16-Jun |

|

I&M Holdings |

Giro Commercial Bank |

3 |

100.0% |

5 |

1.7x |

16-Jun |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

15-Mar |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

14-Jul |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

13-Nov |

|

Average |

|

|

76.10% |

|

1.6x |

|

|

* Announcement date |

||||||

|

** Book Value as of the announcement date |

||||||

|

*** Shareholder swap ratio between CBA and NIC, respectively |

||||||

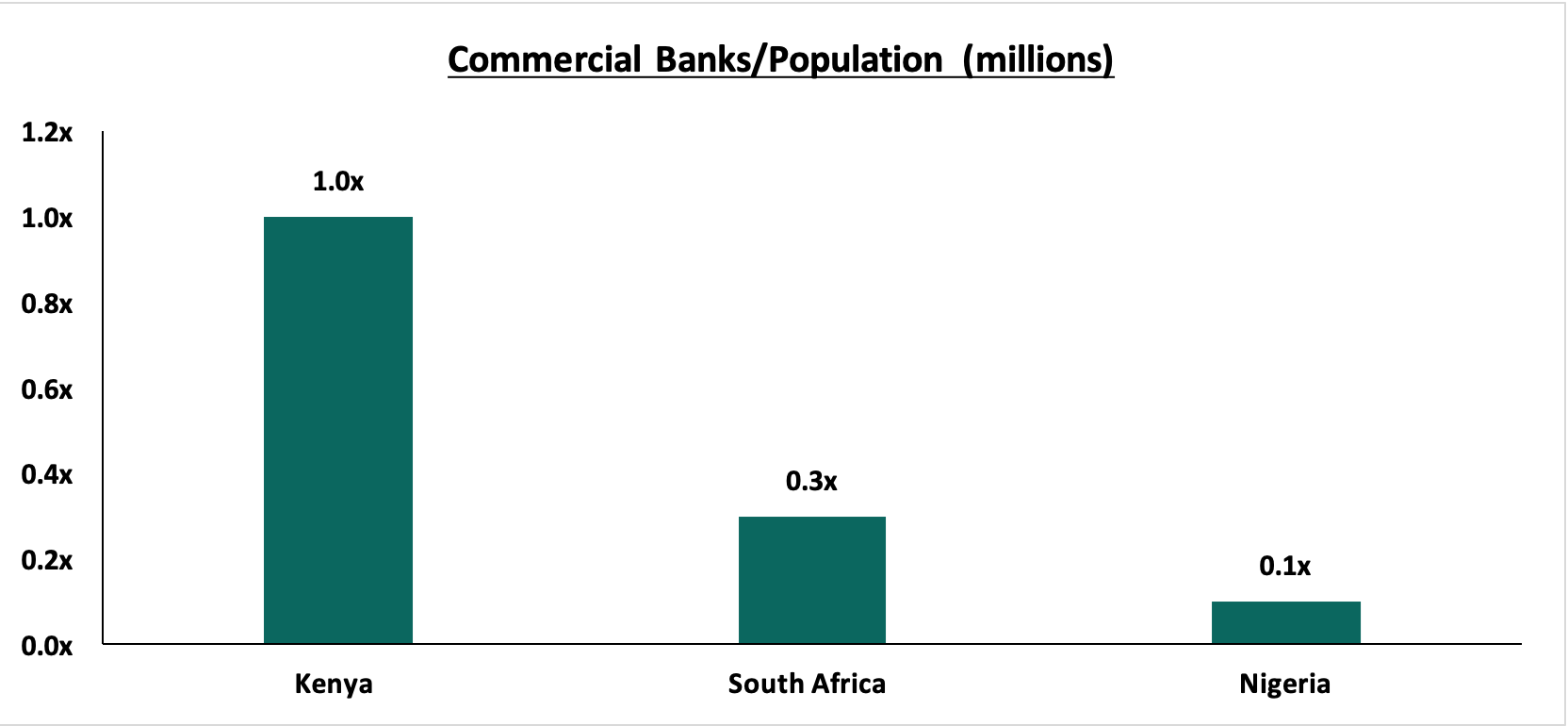

We expect consolidation in Kenya’s banking sector to continue as banks merge to form strategic partnerships, and struggling banks especially those that do not serve a niche, are acquired. This is an important and compelling trend given that the Kenyan banking sector is overbanked, relative to other markets. This will lead to a more stable and safer banking sector.

Universe of Coverage

Below is our universe of coverage table;

|

Banks |

Price as at 31.1.19 |

Price as at 31.12.18 |

m/m change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

|

Diamond Trust Bank |

149.3 |

156.5 |

(4.6%) |

(5.8%) |

283.7 |

1.7% |

90.9% |

0.9x |

|

Ghana Commercial Bank*** |

4.4 |

4.6 |

(4.6%) |

(10.9%) |

7.7 |

8.4% |

80.0% |

1.1x |

|

Access Bank |

5.8 |

6.8 |

(15.4%) |

(11.8%) |

9.5 |

7.1% |

76.8% |

0.4x |

|

NIC Group |

33.8 |

27.8 |

21.4% |

25.0% |

48.8 |

3.4% |

68.0% |

0.8x |

|

Zenith Bank*** |

22.5 |

23.1 |

(2.4%) |

(0.7%) |

33.3 |

12.6% |

67.5% |

1.0x |

|

KCB Group |

40.7 |

37.5 |

8.7% |

8.7% |

61.3 |

7.7% |

65.7% |

1.2x |

|

CAL Bank |

0.9 |

7.7 |

(8.2%) |

(8.2%) |

1.4 |

0.0% |

60.9% |

0.7x |

|

CRDB |

135.0 |

85.0 |

(10.0%) |

(10.0%) |

207.7 |

0.0% |

53.9% |

0.5x |

|

UBA Bank |

6.8 |

14.3 |

(11.7%) |

(7.1%) |

10.7 |

11.0% |

50.0% |

0.5x |

|

I&M Holdings |

95.0 |

150.0 |

11.8% |

11.8% |

138.6 |

3.7% |

49.6% |

1.0x |

|

Ecobank |

7.5 |

34.9 |

(0.1%) |

(0.1%) |

10.7 |

0.0% |

49.0% |

1.6x |

|

Equity Group |

40.9 |

7.5 |

17.4% |

17.4% |

56.2 |

5.0% |

45.7% |

1.9x |

|

Co-operative Bank |

16.1 |

1.0 |

12.6% |

10.1% |

19.9 |

5.3% |

36.6% |

1.3x |

|

Union Bank Plc |

6.3 |

31.0 |

11.6% |

11.6% |

8.2 |

0.0% |

32.5% |

0.6x |

|

Stanbic Bank Uganda |

30.0 |

34.5 |

(3.2%) |

(3.2%) |

36.3 |

3.9% |

24.8% |

2.1x |

|

Barclays Bank |

11.5 |

5.6 |

5.0% |

5.0% |

12.5 |

8.8% |

18.9% |

1.5x |

|

Guaranty Trust Bank |

33.5 |

5.5 |

(2.9%) |

(2.2%) |

37.1 |

7.0% |

14.5% |

2.2x |

|

HF Group |

6.9 |

11.0 |

25.3% |

18.8% |

6.6 |

5.7% |

13.6% |

0.2x |

|

Bank of Kigali |

278.0 |

6.0 |

(7.3%) |

(7.3%) |

299.9 |

5.0% |

12.9% |

1.5x |

|

SBM Holdings |

6.0 |

300.0 |

0.7% |

0.7% |

6.6 |

4.9% |

12.5% |

0.9x |

|

Standard Chartered |

194.8 |

194.5 |

0.1% |

0.3% |

196.3 |

6.4% |

7.5% |

1.6x |

|

Stanbic Holdings |

90.0 |

90.8 |

(0.8%) |

0.6% |

92.6 |

2.4% |

3.1% |

0.9x |

|

Bank of Baroda |

134.0 |

140.0 |

(4.3%) |

(4.3%) |

130.6 |

1.9% |

(1.4%) |

1.2x |

|

National Bank |

6.0 |

8.0 |

12.0% |

12.8% |

4.9 |

0.0% |

(7.2%) |

0.4x |

|

Standard Chartered |

21.1 |

21.0 |

0.4% |

0.4% |

19.5 |

0.0% |

(9.1%) |

2.7x |

|

FBN Holdings |

7.3 |

5.3 |

(8.2%) |

(7.5%) |

6.6 |

3.3% |

(10.1%) |

0.4x |

|

Stanbic IBTC Holdings |

45.2 |

48.0 |

(5.7%) |

(5.5%) |

37 |

1.3% |

(20.0%) |

2.4x |

|

Ecobank Transnational |

14.0 |

17.0 |

(17.6%) |

(17.4%) |

9.3 |

0.0% |

(38.1%) |

0.5x |

|

*Target Price as per Cytonn Analyst estimates |

||||||||

We are “Positive” on equities for investors as the sustained price declines has seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

During the month of January, there was private equity activity in the financial services, education, hospitality and fundraising sectors.

Financial Services Sector:

- Britam Asset Managers bought a 40.0% stake worth Kshs 1.4 bn in a local electricity producer, Gulf Energy, through a New York-based energy investment vehicle Everstrong Capital as the company seeks to diversify its investments beyond traditional investments. According to the Chief Executive Officer, Kenneth Kaniu, the investment will help achieve diversification of returns across asset classes, as well as currency, hence mitigating exchange rate risks. This is because returns from the power plant will be in the form of hard foreign currency, and Kenya’s cost of power is priced in US Dollars, due to the existence of the foreign exchange levy in electricity bills sent to homes and businesses. For more information, see our Cytonn Weekly #04/2019.

Education:

- Dubai based GEMS Education, an international education company owned by a consortium of institutional investors, including Varkey Group and American private equity firm Blackstone Group, plans to put up five middle-range schools in Nairobi at a cost of USD 20.0 mn (Kshs 2.0 bn). The investment will continue the Dubai based company’s initiative to expand in the Kenyan market. For more information, see our Cytonn Weekly #03/2019,

- GEMS Education is also set to acquire 100% stake of Hillcrest International Schools from its current owners, Fanisi Capital and businessman Anthony Wahome, for Kshs 2.6 bn. The transaction details are as below;

- Fanisi owns 55.0% stake in the school, while Mr. Wahome owns 45.0%,

- The amounts paid in consideration for the combined stake is Kshs 2.6 bn, and,

- Fanisi Capital and Mr. Wahome acquired 100% of Hillcrest from Barclays Bank of Kenya, the family of Kenneth Matiba and other creditors in 2011, for a total of Kshs 1.8 bn. The exiting parties stand to realize a profit of Kshs 0.8 bn on the seven-year investment at an IRR of 5.4%, excluding profits or losses for the period of investment.

The increased investments in the education sector is an indication of investor’s interest in the education sector in Sub-Saharan Africa, which is motivated by; (i) increasing demand for quality and affordable education, according to The Business of Education in Africa report by Caerus Capital, the Gross Enrolment Ratio (GER) has doubled over the last ten years, from 4.5% in 2006 to 8.5% in 2016, and (ii) support such as ease of approvals, offered to investors in the education sector by governments looking to meet Sustainable Development Goals (SDGs) targets of universal access to education. For more information, see our Cytonn 2019 Markets Outlook,

- The Ministry of Education has announced plans to give loans at subsidized interest rates and other innovative funding initiatives, including the introduction of education bonds to entrepreneurs to build schools and plug the capacity shortfalls coming from reduced State funding. The Ministry is also proposing to float sovereign bonds to support the funding of the education sector. These are some of the proposals that were tabled in the National Assembly in December 2018 on Reforming Education and Training for Sustainable Development by the Ministry of Education. The proposal tabled in the National Assembly will enhance access to quality education and provide investment opportunities to investors through the access of loans at a subsidized rate. We are of the view that the government should encourage Public-Private Partnerships (PPP) to help reduce levels of government financing and enable the government to obtain greater value for their investments in the education sector. For more information, see our Cytonn Weekly #03/2019.

Fundraising:

- Andela, a Silicon Valley corporation launched in 2014 to identify and train software developers in Africa, has concluded a USD 100.0 mn (Kshs 10.3 bn) Series D funding, raising the firm’s venture funding to USD 180.0 mn (Kshs 18.1 bn). Generation Investment Management led the round, with input from existing funders including the Chan Zuckerberg Initiative, GV, Spark Capital, and CRE Venture Capital. Andela, which identifies and moulds engineering expertise, has since hired 1,100 developers worldwide and integrated them into key companies such as Safaricom. The funds will be used to expand Andela’s performance by accelerating the growth of its trade in technology through talent development. For more information, see our Cytonn Weekly #04/2019,

- Branch International, a mobile-based microfinance institution headquartered in California with operations in Kenya, Tanzania and Nigeria, raised a further Kshs 500.0 mn (USD 4.9 mn) in capital investment based on its third issued commercial paper in the Kenyan market. The Silicon Valley start-up, founded in 2015, processes loans ranging from Kshs 250 to Kshs 70,000 daily and applies machine learning to create an algorithmic approach to determine credit worthiness via customers' smartphones. The commercial paper was arranged by Barium Capital, a capital–raising advisory firm owned by Centum Investments. The investment is expected to expand Branch’s business in Kenya. For more information, see our Cytonn Weekly #03/2019,

- Dutch impact investor Goodwell Investments has made a USD 2.0 mn (Kshs 203.0 mn) investment in Nairobi-based consumer goods catalogue and delivery service Copia for an undisclosed stake. Copia, a Silicon Valley start-up launched in Kenya in 2013, uses technology and a network of more than 3,000 local agents to deliver goods and services to about 40,000 “underserved consumers” in rural Kenya. Copia enables households to access goods that would otherwise be difficult to obtain without travelling to a major city. Pre-paid orders made through the firm take on average two to three days to be delivered. Copia has grown tremendously since 2013, with 3,000 agents and executing 80,000 orders a month. It serves 40,000 customers, translating to a 28.0% market share in Kenya. For more information, see our Cytonn Weekly #04/2019.

Hospitality:

- US private equity fund Emerging Capital Partners (ECP) has acquired a majority stake in Nairobi-based hospitality chain ArtCaffé Group. The transaction, whose value is undisclosed, but is estimated at Kshs 3.5 bn, will see Washington-based Emerging Capital Partners (ECP) acquire 100.0% stake in the business after the Competition Authority of Kenya (CAK) authorized the proposed acquisition. ArtCaffé started in 2008 and currently operates 20 full-service bakeries, coffee shops, and bar and casual dining restaurant outlets around Nairobi. ECP, started in 2000, is a Pan-African focused private equity firm that has raised over USD 2.0 bn invested in consumer goods, financial services, telecommunications, and infrastructure sectors. It has previously invested in rubber and sugar companies, restaurant chains, power and water utilities, banks, telecoms towers and PayTV and has made over 60 investments covering more than 40 African countries. In 2017, ECP sold its 90.0% stake in another Kenyan coffee chain, Java House to Dubai-based private equity firm Abraaj Group as highlighted in Cytonn Weekly #27/2017. In March 2018, South-African based private equity fund Uqalo invested Kshs 404.0 mn (USD 4.0 mn) to acquire an undisclosed stake in Kenyan fast food chain Big Square. For more information, see our Cytonn Weekly #10/2018

There is a great opportunity in Eastern Africa for casual dining concepts especially in Kenya, which has led to increased expansion of coffee shops to tap the country’s emerging coffee drinking culture and demand for snacks and meals. The investments are an indication of investors’ interest in the casual dining concept in Kenya, which is motivated by:

- Demand for international cuisine which has seen increase in global brands in the country such as Yum Brands Inc’s KFC and Pizza Hut, and,

- Population growth - Nairobi is one of the fastest growing cities in Africa at a rate of 4.0% annually, primarily due to high birth rates and immigrants that come to Nairobi searching for employment opportunities and is a home to a growing middle class and large expatriate population.

Despite the recent slowdown in growth, we maintain a “Positive” outlook on private equity investments in Africa, as evidenced by the increasing investor interest, which is attributed to; (i) economic growth, which is projected to improve in Africa’s most developed PE markets, (ii) attractive valuations in Sub-Saharan Africa’s private markets compared to its public markets, and (iii) attractive valuations in Sub-Saharan Africa’s markets compared to global markets. Going forward, the increasing investor interest, stable macro-economic and political environment will continue to boost deal flow into African markets.

During the month of January, the real estate sector recorded an increase in activity driven by; (i) intensified efforts by the Kenyan Government, international bodies and the private sector, to bridge the housing deficit in the country, which stands at 2.0 mn units and is growing at an annual rate of 10%, equal to 200,000 units, according to National Housing Corporation, (ii) positive demographics such as a high population growth rate of 2.5%, 1.3% points higher than the global average of 1.2% and a high rate of urbanization of 4.3%, compared to the global average of 2.0% as at 2017 as per the World Bank, which has created sustained demand for housing and commercial real estate across the country, and (iii) a stable macroeconomic environment, with GDP growth averaging at 5.1% over the last 5-years, and we expect growth to come in at 5.8% in 2019.

In this report, we have highlighted industry reports that were released during the month, and then delved into the review of the residential, commercial, hospitality and listed real estate sectors activities during the month.

- Industry Reports:

Three reports released during the month of January underlined the performance of the real estate sector as explained in the table below:

|

Industry Reports Released in January 2019 |

||

|

Coverage |

Report |

Key Take Outs |

|

Residential |

|

|

|

Land |

|

|

During the week, JLL, a professional services firm that specializes in real estate and investment management, released their Nairobi City Report 2019 highlighting the performance and outlook on the real estate investment market with a focus on the office, retail and hospitality sectors. The following were the key take-outs;

- The Office Sector is expected to show only marginal improvement in office demand and rental growth in 2019 due to expected economic growth. However, this will be affected by the current office space over-supply in the market, which has resulted to 25.0% vacancy rates. Optimism in the market remains much longer term on a three to five-year horizon,

- The Retail Sector currently records rental yields of 9.0% p.a. with rental charges ranging from Kshs 30,000 – 45,000/SQM/annum (equivalent to Kshs 232.3 – 348.5/SQFT/month). In 2019, demand is expected to increase, driven by:

- Increased penetration of foreign retailers such as Choppies, Game, Shoprite and Carrefour into Kenya’s consumer market, which is likely to dominate retail demand in 2019, and the expansion of local retailers such as Tuskys Supermarket, and

- The upward trend in household consumption, with wholesale and retail trade GDP growing by 6.8% in Q3’2018, 7% in Q2’2018 and 6.2% in Q1’2018, from 5.8% in 2017, giving retailers confidence to commit to leases in the years ahead.

- In the Hotels and Hospitality Sector,

- Renewed optimism in the Kenyan tourism industry resulted in a 9.8% increase in arrivals in 2017 and 37.3% increase in 2018 to over 2 mn international arrivals,

- In 2018, the hotels recorded an average annual occupancy rates of 54.0%, 11.7% increase from 2017. This trend is expected to continue in 2019 backed by stability in the tourism sector and new air routes that will drive demand into 2019,

- RevPAR increased by 6.7% despite occupancy growth of 11.7% (YTD Nov 2018). In 2019 the performance is forecast for gradual short-term growth with strong long-term fundamentals, and,

- The current pipeline of approximately 2,000 rooms is expected to place pressure on room rates as occupancy is expected to remain at around 55.0% for the market.

The report is in line with Cytonn 2019 Market Outlook, where we forecasted subdued performance in the office sector due to surplus supply in the market with the Nairobi region having an oversupply of 5.3 mn SQFT in 2018 that is forecasted to increase to 5.7 mn SQFT in 2019. For the retail sector, we have a neutral outlook due to increased supply leading to a decline in yields to 9.0% in 2018 from 9.6% in 2017, and projected decline to 8.7% in 2019. However, we expect the entry and expansion of international and local retailers to cushion the market. In the hospitality sector, we have a positive outlook given the country’s political stability, the continued marketing of Kenya as an experience destination, and the improved air transport with several airlines that have increased their flight frequencies in and out of the country.

- Residential Sector:

During the month, activity in the residential sector was mostly focused on the affordable housing initiative under the Big 4 Agenda and the high-end segment as shown below;

- The Kenyan Government invited private developers to file bids for Lot 1A, Lot 1B and Lot 1C, which refer to flagship projects, social housing projects and county projects in order to participate in the affordable housing initiative, by redeveloping government single dwelling estates to high-rise complexes, For more information please see Cytonn Weekly #03/2019,

- Following the signed deal between the Kenyan Government and United Nations Project Services (UNOPS) in 2018, in which the UN subsidiary is set to deliver 100,000 low-cost homes across Kenya at an estimated cost of Kshs 64.7 bn, the organization kick started the initiative during the month by injecting Kshs 1.0 bn into the project and vowing to seek the remaining Kshs 63.7 bn from other organizations. For more information, please see Cytonn Weekly #04/2019,

- The Government of Kenya announced relaxation of affordable housing regulations to include high income-earners of Kshs 100,000 and above. With these new regulations, income-earners of Kshs 100,000 and above, who as per KNBS data make up approximately 2.9% of the formal working population in Kenya will be able to take up affordable housing units through the Housing Fund and government-availed mortgages to be repaid in 15-years at 7.0% p.a., whereas low-income earners will acquire the houses through tenant purchase schemes. For more information, please see Cytonn Weekly #04/2019,

- Transport, Housing and Infrastructure Cabinet Secretary James Macharia on 29th January 2019, stated that the government had reached an agreement with the workers’ union, which will pave the way for an end to court injunctions that had stopped the deduction of the 1.5% housing levy pay cut from formal employees’ basic salary. The 1.5% levy is, therefore, expected to be effected starting March 1st, 2019. This however comes at a point where the Federation of Kenya Employers (FKE) has obtained orders stopping the ministry from proceeding with the planned appointment of members to the Housing Fund Advisory Board and the case is to be heard on February 26. In our view, the National Housing Development Fund is a good initiative, but it needs clear and transparent guidelines on management of the fund as well as to educate the public on its importance and functionality in order to win public trust to ensure the achievement of the affordable housing initiative,

- The government launched the bomayangu.go.ke portal, which will allow citizens to register and apply for affordable housing units online. The portal will capture details of where registered users prefer living and therefore guide the plan on affordable housing program based on needs and data submitted via the portal. This portal also aims to ensure transparency in house allocation so that only legitimate people in need of housing access these affordable houses and thus a commendable move by the government,

- Erdemann Properties launched their residential development in Ngara on approximately 5.6-acres (costs undisclosed). The project dubbed “River Estate’’ will have eight 34-storey blocks of one and two-bedroom apartments with price points of Kshs 6.0 mn, and Kshs 8.5 mn, respectively. With 340 units on each block, the project aims to house 2,720 residents as well as the rehabilitation of key roads in Ngara Estate such as Jadongo Road. For more information, please see Cytonn Weekly #04/2019, and,

- Kenya-based international company, iBuild, rolled out a mobile-enabled construction platform in efforts to implement the housing agenda by enabling workers track their work history, homeowners and contractors find projects, place bids, hire workers, manage project details and make and receive payments, highlighting the continued incorporation of technology to enhance efficiency in real estate.

With the continued government support of the affordable housing initiative, we expect to see increased activities towards provision of more housing for the lower-middle and low-income section of the population.

In the high-end residential segment, Cytonn Real Estate launched its Kshs 2.5 bn gated community development dubbed “Applewood”, located in Miotoni, Karen. This signature development shall comprise luxury homes, each sitting on 1/2 acre. The development consist of eighteen, five-bedroom luxury villas.

- Commercial Sector:

In the retail sector, we saw increased uptake of retail space by both global and local retailers expanding their operations. In our view, the expansion of retailers is on the account of:

- Stable economic growth, with Kenya’s GDP growth averaging at 5.1% over the last five-years, and set to come in at 5.8% in 2019, according to Cytonn Research, thus, creating an enabling environment for the retailers to make desirable profits,

- Increased disposable income with the expanding middle class creating demand for retail products,

- Kenya’s growing position as a regional and continental hub, hence witnessing an increase in multinationals operating in the country,

- A positive demographic dividend, with a population growth rate of approximately 2.5% p.a. and a rapid urbanization rate of 4.3%, in comparison to the global average rates of 1.2% and 2.0%, respectively, and,

- The huge opportunity, with Kenya having a formal retail penetration of 35% according to Oxford Business Group, compared to markets such as South Africa with a penetration of 60%.

The table below shows the various stores and their newly opened shops and expansion plans:

|

Table Showing Retailers and their Expansion Activities in January 2019 |

|||||

|

Name |

Country of Origin |

Type of Store |

Stores opened or announced during the month |

No of Stores in Kenya |

Location of Stores in Kenya |

|

Burger King |

United States |

Fast Food |

1 opened at Shell Fuel Station on James Gichuru Road in Lavington |

5 |

Thika Road Mall, Two Rivers mall, Nextgen Mall, The Hub and Shell Fuel Station on James Gichuru Road in Lavington |

|

Quickmart |

Kenya |

Supermarket |

1 opened at Westfield Mall in Lavington |

10 |

Nakuru, Kahawa Sukari, Waithaka, Eastern Bypass, Ruaka, Ruai, Thindigua on Kiambu Road and Lavington |

|

Cleanshelf |

Kenya |

Supermarket |

1 planned for opening at Shujaa Mall |

10 |

Langata road, Ruaka, Kiambu, Magadi road, Kilimani, Komarock – Shujaa mall |

Source: Cytonn Research

We expect the continued entry of international retailers and expansion of local retailers to continue cushioning the retail real estate sector performance through increased occupancy rates.

- The Hospitality Sector:

During the month of January, Kenya Airways and Silverstone Airlines, announced plans to introduce daily direct flights from Nairobi to Seychelles, and from Nairobi to Lodwar, respectively. This follows the improvement of air transport operations recorded in 2018, with several airlines increasing flight frequency in and out of the country. For instance, Ethiopian Airlines increased their weekly frequencies from Addis Ababa to Mombasa from 7 to 14 per week. In our view, the improving air transport operations, political stability and continued marketing of Kenya as an experience destination, will result in increased tourist arrivals, which according to Kenya National Bureau of Statistics (KNBS), recorded a 39.8% increase from 1.4 mn in 2017 to 2.0 mn in 2018, and we expect the numbers to grow by 30.0% y/y to 2.6 mn in 2019. As a result, we expect continued demand for hospitality services, with serviced apartments expected to record relatively high occupancies of above 80.0% in 2019, according to our Cytonn 2019 Markets Outlook.

- Listed Real Estate:

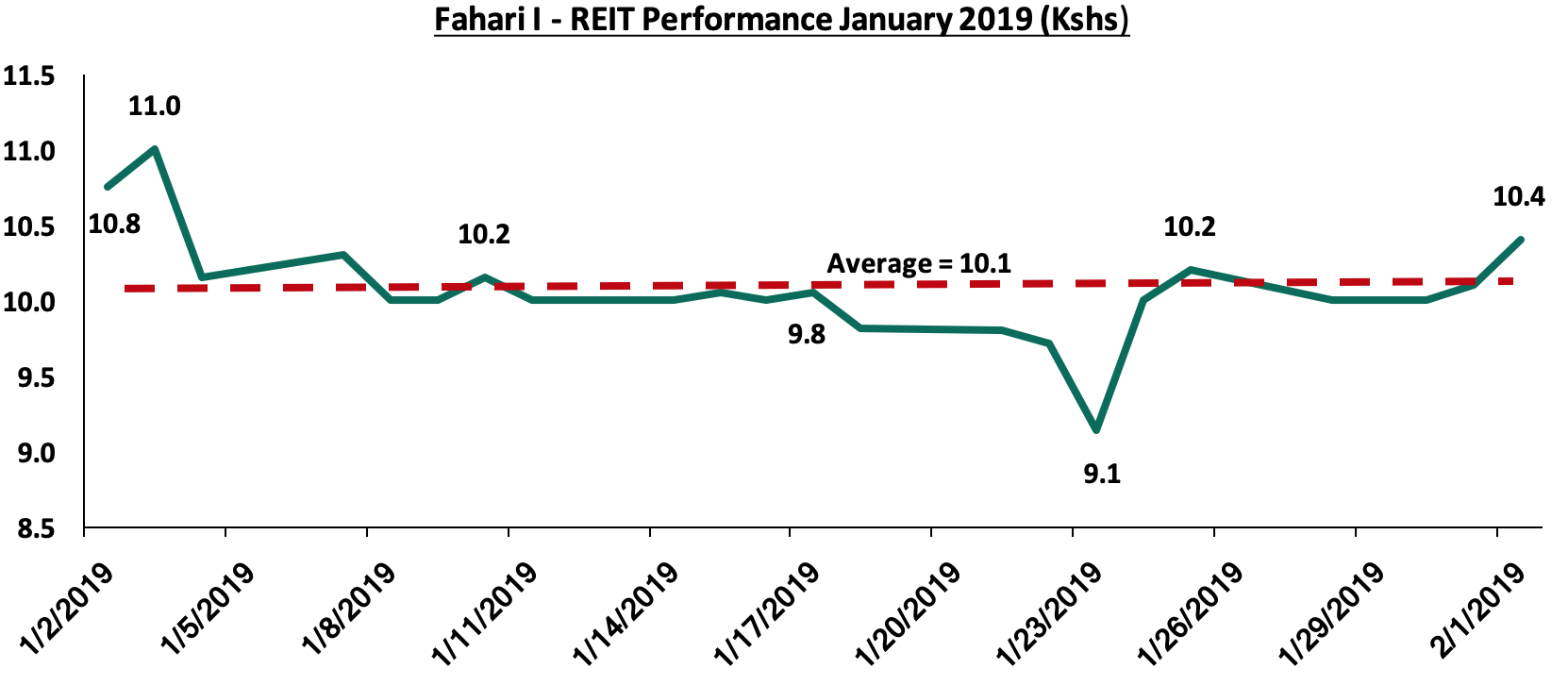

During the month, Stanlib’s Fahari I-REIT saw a decrease of 7.8%, closing at Kshs 10.1 per share from Kshs 11.0 per share at the end of December 2018. On average, the REIT traded at an average of Kshs 10.1 per share, a 1.0% drop from an average of Kshs 10.2 per share in December 2018. The prices for the instrument have remained low largely due to; (i) Fahari I – REIT performing poorly with a dividend yield of 5.7% as opposed to brick and mortar retail and office in Nairobi with 8.1% and 9.0%, respectively, (ii) inadequate investor knowledge, and (iii) lack of institutional support for REIT’s. We expect the REIT to continue trading at low prices and in low volumes.

We expect the real estate sector in Kenya to continue on an upward trajectory given (i) continued National Government support on affordable housing initiative, (ii) expansion by global retailers into the country, (iii) expanding middle-class, and hence growing disposable incomes, and (iv) positive demographics necessitating the need for adequate housing.

Disclaimer: The Cytonn Weekly is a market commentary published by Cytonn Asset Managers Limited, “CAML”, which is regulated by the Capital Markets Authority, CMA and the Retirement Benefits Authority, RBA. However, the views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only, and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.